saveyourassetsfirst3 |

- 2013’s best read stories: Physical gold, manipulation and forecasting

- Cheaper gold brings new customers to Dubai in droves

- 4 Dividend Growth Stocks For 2014 And Beyond

- The Case for a Crash in 2014

- GBP/USD - Post-Christmas Rally Continues As Pound Soars

- For Those Who Proclaim that Gold is All About the Dollar

- Evidence Suggests China Arranged April Gold Crash!

- Evidence Suggests China Arranged April Gold Crash!

- Aluminum heads for biggest gain in five months as dollar weakens

- Investor psychology can trump market fundamentals

- COMEX, LBMA on the Precipice

- Why Advice From Highly Successful People Is Misleading (& Potentially Harmful)

- Rob Kirby: This Ends When China Doesn’t Get Its Gold!

- Holiday Cheer To Our Faithful Followers

- Silver Eagles $3.29 Over Spot With $4.99 S/h- Any Qty!

- Playing gold’s uncertain 2014 with options

- Finance Ghosts of Christmas Present

- Angry Bart Chilton takes his parting shot

- Jim Rickards: Gold Set Up For an Epic Short Squeeze in 2014

- Corruption Scandal Is Edging Near Turkish Premier

- Metals Seen Rallying With Crops After Record Tumble: Commodities

- Platinum Jumps Most in 10 Weeks on Economy Bets

- Investors Expected to Continue Absorbing Silver

- Gold Rises on Physical Buying as South Sudan Violence Escalates

- After a year, Bundesbank repatriates only 37 of 700 tonnes of gold

- Gold becoming scarce in Mexico too

- Minor blemishes aside, gold shone for Indians in 2013

- India mulls relaxing import duty on gold doré

- Koos Jansen: Did China goose March gold imports to prepare for April smash?

- Jim Rickards: Gold Set Up for an Epic Short Squeeze in 2014

- The Money Bubble

- Happy Boxing Day: My Train Set, Devolution, and Evolution

- La Bourse de Tokyo enregistre sa plus forte hausse depuis 40 ans

- Leading Indicators from the Superstars of Resource Investing

- What’s hottest in alternative investment stocks for 2014

- Traders say gold is now a great opportunity for a rebound in 2014 as action moves from India to Dubai

- Michael Hoexter: Malign Confusion about Growth, Economic Growth or “Degrowth”: Which Way Forward? – Pt 3

- Jim Willie: Return of the Gold Standard is Near!

- Mercenary Links Dec 26th: Blindsided

- Koos Jansen: Did China goose March gold imports to prepare for April smash?

- India mulls relaxing import duty on gold dore

- The Stock Market Has Officially Entered Crazytown Territory

- Centerra Gold drafts deal with Kyrgyzstan on Kumtor mine

- dec 26/GLD loses 1.5 tonnes of but and SLV loses 4.187 million oz/comex gold holds steady/gold and silver rise as London is basically shut/

- The NSA is Coming to Town!

- Nary an Intellect Stirring

- Why Economics Will Never Be a Legitimate Science

- Another Bubble Looking for a Pin

- 15 Quotes About The Duck Dynasty Controversy That Every American Should See

- Jim Willie: Return of the Gold Standard is Near!

| 2013’s best read stories: Physical gold, manipulation and forecasting Posted: 27 Dec 2013 04:31 PM PST This year's top-10 best read stories on Mineweb were, unsurprisingly, dominated by gold, given the metal's poor performance through the year. |

| Cheaper gold brings new customers to Dubai in droves Posted: 27 Dec 2013 04:18 PM PST Lower gold prices are driving massive sales in the Gulf region, with younger customers flocking stores |

| 4 Dividend Growth Stocks For 2014 And Beyond Posted: 27 Dec 2013 12:06 PM PST As 2013 comes to a close and investors seek new ideas for next year, these 4 stocks offer great options for any Dividend Growth Portfolio. All 4 stocks have grown dividends in the past, and have management that is willing to continue growing them. With low payout ratios and high growth rates, these stocks future dividend growth rates will likely double, triple, or even quadruple the rate of inflation for years to come. Family Dollar Stores, Inc. ( FDO ) The first stock on my list is Family Dollar Stores, Inc. Family Dollar operates a chain of low cost retail stored spanning 46 states with 8,000 locations. It sells a variety of products ranging from household supplies, to children's and adult's clothing. With its lower price point it attracts a great deal of customers trying to conserve money, but most of the items that Family Dollar sells are everyday necessities, |

| Posted: 27 Dec 2013 10:30 AM PST

With the 2013 Santa stock market rally in full euphoric swing, any discussion of a crash in 2014 strikes a note of cognitive dissonance. With the Fed promising to keep interest rates at zero until 2099 (or whatever date signifies “forever”), the prospects of ever-higher prices in every asset class never seemed brighter. But the [...] The post The Case for a Crash in 2014 appeared first on Silver Doctors. |

| GBP/USD - Post-Christmas Rally Continues As Pound Soars Posted: 27 Dec 2013 10:24 AM PST By Kenny Fisher GBP/USD continues to impress with a late-week rally and has gained around 140 points on Friday, as the pair trades in the mid-1.65 range in the European session. It's another light schedule for releases, with no UK events for the third straight day. In the US, today's highlight is Crude Oil Inventories. The British pound continues to soar against the retreating US dollar. The pound has gained close to two cents since Wednesday, as low liquidity due to the holiday has resulted in sharp movements from the pair over the past two days. These are the highest levels we've seen from GBP/USD since May 2011. US Unemployment Claims dropped sharply on Thursday. The indicator fell to 338 thousand, down from 379 thousand in the previous release. The estimate stood at 346 thousand. The sharp reading was a dramatic reversal from numbers over the past two weeks, which |

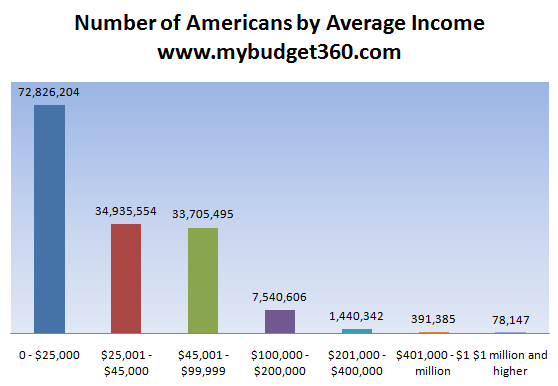

| For Those Who Proclaim that Gold is All About the Dollar Posted: 27 Dec 2013 10:11 AM PST Source: MyBudget360.com It's 8:45 and the US Dollar is DOWN big-time, 0.54 to 79.96 but gold is only UP $0.70. For those who proclaim that gold is all about the dollar, this action says otherwise. Personally, at this point, it's all about the Gold Cartel manipulation (led by JPM) and the willingness to blindly follow the "painted" charts to the short side. Sooner or later, Sinclair will be right and gold will be a mirror image of the dollar's plunge to the low 70s – and lower. But short-term, as in today's action, the dollar is not causing a move in gold. Let's see what happens for the rest of this short week. Similar Posts: |

| Evidence Suggests China Arranged April Gold Crash! Posted: 27 Dec 2013 08:53 AM PST

|

| Evidence Suggests China Arranged April Gold Crash! Posted: 27 Dec 2013 08:45 AM PST

There was a huge spike in gold exports from Hong Kong to the mainland in March. As if someone knew there was going to be immense demand for physical in April in the mainland. But why would anybody import expensive gold in March to sell it for bottom prices in April? In between April 22nd and [...] The post Evidence Suggests China Arranged April Gold Crash! appeared first on Silver Doctors. |

| Aluminum heads for biggest gain in five months as dollar weakens Posted: 27 Dec 2013 08:27 AM PST Aluminum headed for the biggest gain since July, pacing gains in industrial metals, as the dollar weakened. |

| Investor psychology can trump market fundamentals Posted: 27 Dec 2013 08:19 AM PST With gold and silver equities markets as volatile as ever and assets of many miners valued at pennies on the dollar, Eric Muschinski, editor of the Gold Investment Letter, believes being on the right side of the emotional curve when investing is critical. |

| Posted: 27 Dec 2013 08:15 AM PST Andy Hoffman speaks to Harvey Organ from harveyorgan.blogspot.com on his weekly podcast to discuss the COMEX, JP Morgan, bond market, U.S. economy, Obamacare, gold and silver, tapering and QE. To listen to the interview, please click below: COMEX, LBMA on the Precipice Similar Posts: |

| Why Advice From Highly Successful People Is Misleading (& Potentially Harmful) Posted: 27 Dec 2013 08:00 AM PST

Nobody asks the 99% who fail to make it big what they did, or try to analyze what they did that prevented their success. The average man cannot ever hope to win with “investments” (or the world of finance in general), but must be content with savings. Unfortunately, in the absence of sound money, we [...] The post Why Advice From Highly Successful People Is Misleading (& Potentially Harmful) appeared first on Silver Doctors. |

| Rob Kirby: This Ends When China Doesn’t Get Its Gold! Posted: 27 Dec 2013 07:00 AM PST

Financial analyst Rob Kirby says, "There is colossal fraud and price control going on. There are no free markets." Kirby goes on to say, "What we've seen over the last six months is a ramp-up in interest rate swaps to the tune of $12 trillion . . . . What the build in these interest [...] The post Rob Kirby: This Ends When China Doesn’t Get Its Gold! appeared first on Silver Doctors. |

| Holiday Cheer To Our Faithful Followers Posted: 27 Dec 2013 06:44 AM PST Andy Hoffman joins Kerry Lutz of the Financial Survival Network to discuss mining closures, silver price in China, gold premiums in India, Federal Reserve, COMEX, physical gold and silver, interest rates and tapering. To download the audio, please click on the link below: Andrew Hoffman – Holiday Cheer To Our Faithful Followers Similar Posts: |

| Silver Eagles $3.29 Over Spot With $4.99 S/h- Any Qty! Posted: 27 Dec 2013 06:33 AM PST

Year End Small Stacker Day! 2013 Silver Eagles Only $3.29 Over Spot + $4.99 s/h- ANY QTY at SDBullion! *While Supplies Last! Click or call 614-300-1094 to order- limited quantities available! The post Silver Eagles $3.29 Over Spot With $4.99 S/h- Any Qty! appeared first on Silver Doctors. |

| Playing gold’s uncertain 2014 with options Posted: 27 Dec 2013 06:11 AM PST With gold set to post negative year-over-year returns for the first time in 13 years, many traders are positioning themselves for an uncertain 2014. Amidst such volatility a trader must be very conscious of risk, and options are a vehicle to do that. |

| Finance Ghosts of Christmas Present Posted: 27 Dec 2013 05:27 AM PST The Return of the 1875 Peru “Gold” Bond Scam: Guano-Crazy Earlier this week I spoke to an "investor" in a trust backed by a $1,000 Peru “gold” bond of 1875, also known as guano bonds. According to this scam, only three of the bonds in existence are redeemable, and you have one of the lucky three! The bonds are worth hundreds of millions, no trillions, because the much lower number that bond math gives doesn't matter when you make phony claims about worthless bonds. The con artists claim late and ex-presidents have all successfully monetized these bonds, because using big names is a way to provide false social proof to those desperate to believe in phantoms. Some outfit will authenticate the certificate; yes really, it is indeed a piece of paper. "Lawyers" will cite "various scholastic and private documents" and intentionally misinterpret "available SEC documents," and make statements such as "evidence indicates" your bonds are redeemable. If you raise any objections, the DNA of the guano mutates, and the guano grows like The Blob. Scams on these worthless securities has been making the rounds for decades. Bank Bailout Risk Is Back in a Big Way Bank bailout risk is back due to enormous tail-risk trades, among other reasons. If you missed my latest post on this topic, you can read about it here. While you are there, if you live in the U.S., U.K. or Canada and are a member of Goodreads, enter to win one of my business books in a contest ending January 27, 2014. For example, Structured Finance retails for $150 from my publisher, John Wiley & Sons, or currently over $83 on Amazon. but you have a chance to win an autographed copy, or a copy of any or all of my five books, on Goodreads. |

| Angry Bart Chilton takes his parting shot Posted: 27 Dec 2013 04:58 AM PST After almost 30 years in Washington, Bart Chilton will soon be taking his leave. For the past 6 1/2 years he has been an outspoken member of the Commodity Futures Trading Commission, one of the financial industry's most important regulators. Chilton leaves behind a sobering message: As we long suspected, Wall Street continues to use every trick in its playbook to do whatever it can to eviscerate numerous post-financial-crisis rules. The arsenal includes high-powered lobbyists who outnumber lawmakers 10-1; $1,000-an-hour letter-writing lawyers who gain strength from negotiating over arcana; and the occasional hoodwinking of a president whose knowledge of the ways of finance are close to nil. In a recent interview Chilton said that, despite years of hard work by financial regulators to put the 2010 Dodd-Frank law into force (witness the 882 pages required to explain a 71-page Volcker Rule), their efforts will be futile in the face of Wall Street's money and power. "The lesson for me is: The financial sector is so powerful that they will roll things back over time," Chilton says. "The Wall Street firms have tremendous influence, and they can impact policy to a greater degree than any one regulator or a small group of regulators can." |

| Jim Rickards: Gold Set Up For an Epic Short Squeeze in 2014 Posted: 27 Dec 2013 04:58 AM PST "JPMorgan et al were standing at the ready to cap the prices" ¤ Yesterday In Gold & SilverWith a lot of the markets in the West still closed on December 26 for the Boxing Day holiday, it was very quiet in Far East and London trading yesterday, as the gold price traded in a tight range either side of the $1,200 spot price mark. But once trading began in New York at 8:20 a.m. EST yesterday morning, a rally began that either ran out of gas or got capped in pretty short order. The high of the day came at, or just before, the London p.m. gold fix---and gold got sold down quietly for the rest of the day from that point onward. The CME recorded the low and high ticks in New York as $1,200.50 and $1,215.40 in the February contract. The gold price closed at $1,211.20 spot, up $5.90 on the day. And you can add the December 24 gain of $6.90 to that as well. Not surprisingly, net volume yesterday was very light at around 62,000 contracts. The rally in silver was similar. The only differences were that the rally began about 20 minutes before the Comex open---and the rally obviously got capped at the 9:30 a.m. EST open of the equity markets as it broke above the $20 spot price mark. After that it, too, got sold down as the Thursday trading session wore on, closing safely back below twenty bucks once again. The low and highs were recorded as $19.415 and $20.03 in the March contract. Silver finished the Thursday session in New York at $19.80 spot, which was up 30.5 cents from Tuesday's close. Tuesday's gain was 3.5 cents. Silver's net volume was pretty close to 19,500 contracts which, although light, wasn't that light, so it's obvious that the not-for-profit sellers had to dump a fair amount of paper silver into the Comex futures market to cap the rally. The platinum and palladium prices popped at the Comex open as well, but met the same price fate as gold and silver---and at the same times. Here are the charts. Here's the three-day dollar index chart---which I wouldn't read a thing into. And yesterday's rally in all four precious metals at the 8:20 a.m. EST Comex open had zero to do with the currencies. The index closed at 80.51---which was down about eight basis points from Tuesday's close. Naturally enough, the gold stocks gapped up at the open, but the party ended once the HUI broke through the 200 mark at the 10 a.m. EST London p.m. gold "fix"---and that was it for the day. The stocks struggled to stay in positive territory at times, but did manage to close in the black, as the HUI finished up a meager 0.42%. But not to be forgotten is the fact that the HUI closed up 3.03% on Tuesday. It was pretty much the same for the silver equities, as they turned in a slightly better performance, but just barely, as Nick Laird's Intraday Silver Sentiment Indicator closed up 0.83% on Thursday. On Tuesday, Nick's indicator was up 2.27%. The CME Daily Delivery Report for Tuesday, December 24 showed considerable activity in gold, as 506 contracts were posted for delivery for sometime today. The short/issuers of note were Jefferies and Canada's Bank of Nova Scotia with 322 and 101 contracts respectively. Not surprisingly, the report also showed that JPMorgan Chase was the stopper on 501 of those contracts, all in its in-house [proprietary] trading account. There were only six silver contracts posted for delivery---and JPM stopped four of them. The CME's Daily Delivery Report for yesterday, showed that nine gold and 33 silver contracts were posted for delivery on Monday. JPMorgan stopped all nine gold contracts---and 20 of the silver contract---all in its in-house [proprietary] trading account. The link to yesterday's Issuers and Stoppers Report is here. With the exception of a handful of contracts, that should just about do it for the December delivery month in both gold and silver. First Day Notice for the January delivery month is upon us already---and the numbers will be posted on the CME's website late on Monday evening EST. January is not an overly big delivery month in either metal. There were no reported changes in GLD on the day before Christmas, but an eye-watering 4,187,436 troy ounces of silver were withdrawn from SLV. That's an awful big withdrawal to be of the "plain vanilla" liquidation variety---and I'll be interested in what Ted B. has to say about it in his Saturday column. But there was a withdrawal from GLD on Thursday, as an authorized participant took out 48,222 troy ounces. And as of 6:13 p.m. EST yesterday evening, there were no reported changes in SLV. Joshua Gibbons, the "Guru of the SLV Bar List" had this to say in his weekly update for SLV: "Analysis of the 25 December 2013 bar list, and comparison to the previous week's list---No silver was added, removed, or had a serial number change. As of the time that the bar list was produced, it was overallocated 734.0 oz. 4,187,436.4 troy ounces were removed on Tuesday, but not yet reflected on the bar list." The link to Joshua's website is here. The good folks over at the shortsqueeze.com Internet site updated their short interest numbers for both SLV and GLD as of mid-December---and here's what they had to report. The short interest in SLV rose by 10.58% since the first of the month---and now stands at 20,376,400 shares/troy ounces. That works out to just under 634 metric tonnes of the stuff. That's 10 days of world silver production that should be on deposit with SLV, but isn't. About 6.1% of all SLV shares outstanding have been sold short. The percentage sold short in GLD over the same period of time increased by 7.03%. The short interest in GLD now stands at 23,236,900 shares, or 2.32 million troy ounces, or a bit over 72 tonnes. About 8.7% of all GLD shares outstanding have been sold short, which is outrageous. As Ted Butler says, because of their very nature, no precious metal fund should ever allow its shares to be shorted. Not one of these shorted shares in either SLV or GLD have any metal backing them at all. The U.S. Mint had a smallish sales report since Monday. They sold 4,000 troy ounces of gold buffaloes---and that was all. I don't have the in/out activity for Monday at the Comex-approved depositories in either gold or silver. There's no historical data---and the previous day's numbers are overwritten with the current day's data---and I didn't write anything down. And, not surprisingly, there wasn't much in/out activity in gold on Tuesday. The Comex-approved depositories only reported receiving 8,005 troy ounces off the stuff---and nothing was shipped out. There was no in/out activity at all in silver. Because of the holidays, I don't have that many stories for you today, so I hope you can find time to skim them all. ¤ Critical ReadsAngry Bart Chilton takes his parting shotAfter almost 30 years in Washington, Bart Chilton will soon be taking his leave. For the past 6 1/2 years he has been an outspoken member of the Commodity Futures Trading Commission, one of the financial industry's most important regulators. Chilton leaves behind a sobering message: As we long suspected, Wall Street continues to use every trick in its playbook to do whatever it can to eviscerate numerous post-financial-crisis rules. The arsenal includes high-powered lobbyists who outnumber lawmakers 10-1; $1,000-an-hour letter-writing lawyers who gain strength from negotiating over arcana; and the occasional hoodwinking of a president whose knowledge of the ways of finance are close to nil. In a recent interview Chilton said that, despite years of hard work by financial regulators to put the 2010 Dodd-Frank law into force (witness the 882 pages required to explain a 71-page Volcker Rule), their efforts will be futile in the face of Wall Street's money and power. "The lesson for me is: The financial sector is so powerful that they will roll things back over time," Chilton says. "The Wall Street firms have tremendous influence, and they can impact policy to a greater degree than any one regulator or a small group of regulators can." U.S. Mortgage Applications Drop to 13-Year LowThe average number of mortgage applications slipped 6.3% to a 13-year low on a seasonally adjusted basis as interest rates rose from the previous week, the Mortgage Bankers Association said Tuesday. “Following the Federal Reserve‘s taper announcement, mortgage application volume dropped again last week, with rates increasing and refinance application volume falling to its lowest level since November 2008,” said Mike Fratantoni, MBA’s vice president of research and economics On an unadjusted basis, MBA said the market composite index fell 7% from the previous week. The refinance index dropped 8% from the prior week, while the seasonally adjusted purchase index eased 4%. This commentary was posted on The Wall Street Journal's blog site late on Tuesday morning...and it's something I found in yesterday's edition of the King Report. 'Tracked everywhere you go': Snowden delivers Xmas message on govt spyingNSA whistleblower Edward Snowden has delivered his ‘Alternative Christmas Message’ via a British TV channel. The whistleblower called for an end to mass spying by governments, stating that a child born today will have "no conception of privacy." Snowden’s address aired by the UK’s Channel 4 comes as an alternative to the Queen’s traditional Christmas speech, which is shown by the country’s other leading broadcasters. Filmed in Russia, the address is the first TV appearance of the whistleblower since his arrival in the country, where he was granted temporary asylum in August. As a former US Central Intelligence Agency employee, US National Security Agency contractor, and the person behind the biggest security leak in US history, Snowden gives his assessment of the classic bogey model of the Orwellian state as “nothing compared” to today's surveillance methods. This article was posted on the Russia Today website late on Christmas Eve Moscow time...and I thank South African reader B.V. for sharing it with us. Italian Families' Spent 11% Less on Christmas Gifts in 2013According to pundits, 2012 was the worst year for the Eurozone's peripheral economies, only worse than the just as tumultuous 2011, while 2013 was - if only listens to Europe's propaganda masters - a year of recovery thanks to the ECB's "whatever it takes" mentality. Which fails to explain why families in recession-battered Italy spent 11.4% less on gifts this Christmas than last year and one in five households did without presents completely, according to the consumers' group Federconsumatori estimated on Thursday. ANSA said the Italian households spent an average of 131 euros each on gifts for a total of 3.35 billion euros. Another consumers' association, Codacons, said overall Christmas spending, including expenditure on food and drink as well as gifts, was down 8% this year with respect to 2012. According to Codacons' data, spending on gifts was 15% down on last year. This commentary was embedded in a short story posted on the Zero Hedge website yesterday morning...and I thank reader 'David in California' for bringing it to our attention. Corruption Scandal Is Edging Near Turkish PremierA corruption investigation that has encircled the Turkish government moved an ominous step closer to Prime Minister Recep Tayyip Erdogan on Wednesday, as three top ministers whose sons have been implicated abruptly resigned — and one of them, on his way out the door, said Mr. Erdogan should step down as well. The resignations, coming only hours after the ministers welcomed Mr. Erdogan at the Ankara airport as he returned from Pakistan late on Tuesday, were enough to inspire new talk of a deepening crisis, which Mr. Erdogan has repeatedly denounced as a foreign plot. But the words from one of the departing ministers were considered stunning, coming from a political party known for silencing dissent. That instantly raised the significance of the entire inquiry and left members of the Turkish public wondering if they were witnessing the collapse of their Islamist-rooted government of the last decade. This 2-page story, filed from Istanbul, was posted on The New York Times website on Christmas Day...and I thank Roy Stephens for his first offering of the day. It's worth reading, at least in my opinion. There's also a story on this issue posted on the france24.com Internet site. It's a bit more current, but not as in-depth. It's also courtesy of Roy Stephens---and the link to that is here. Egypt declares Muslim Brotherhood a terrorist groupEgypt's military-backed government declared the Muslim Brotherhood movement of ousted president Mohammed Morsi a "terrorist" group Wednesday, banning all its activities, including demonstrations, ministers said after a cabinet meeting. Deputy prime minister Hossam Eissa said the movement has been declared a "terrorist" group and social solidarity minister Ahmed al-Borei said the government would ban all its activities, including "protests." Eissa added that the implications of the declaration punish those who belong to the group, finance it and promote the group’s activities. This news item was posted on the france24.com Internet site on Christmas Day...and it also courtesy of Roy Stephens. China eases immediate cash crunch but policy still tighteningShort-term rates plummeted in China after the central bank injected fresh liquidity to alleviate extreme stress in the money markets, but key borrowing costs remain worryingly high as the authorities try to rein in the world's biggest credit bubble. Seven-day 'Shibor' rates in Shanghai fell 265 basis points to 6.20pc, reversing the sharp spike over recent days caused as banks hoarded funds and built up buffers against potential defaults and counter-party losses. The closely-watched 7-day repurchase rate fell by the most in almost three years to 5.55pc after the central bank added $4.8bn in liquidity early on Tuesday through open market operations. The year-end jitters have been the worst since the cash squeeze in June, an episode that briefly span out of control and left lingering doubts about the ability of the Communist authorities to manage the credit system. This must read commentary by Ambrose Evans-Pritchard was posted on the telegraph.co.uk Internet site during the Tuesday lunch hour in London...and it's the final offering of the day from Roy. Japan's P.M. sparks tension in Asia with visit to WWII shrineChina and South Korea both reacted with fury after Shinzo Abe became the first Japanese prime minister to visit the contentious Yakusuni shrine in seven years. The Chinese foreign ministry described relations between the two sides as "already grim" and added that the visit was "absolutely intolerable". Among the 2.5 million war dead buried at Yakusuni are several "class A" war criminals, the Japanese leaders who were responsible for starting and waging the war in Asia. China estimates that some 21 million Chinese were killed by Japanese aggression and has accused Japan of denying the full extent of its war crimes. Nothing like rubbing salt into an old wound. Despite his protestations to the contrary, Abe's actions did nothing but further inflame the situation that exists between Japan, China and Korea. This story was posted on the telegraph.co.uk Internet site yesterday morning GMT. |

| Corruption Scandal Is Edging Near Turkish Premier Posted: 27 Dec 2013 04:58 AM PST A corruption investigation that has encircled the Turkish government moved an ominous step closer to Prime Minister Recep Tayyip Erdogan on Wednesday, as three top ministers whose sons have been implicated abruptly resigned — and one of them, on his way out the door, said Mr. Erdogan should step down as well. The resignations, coming only hours after the ministers welcomed Mr. Erdogan at the Ankara airport as he returned from Pakistan late on Tuesday, were enough to inspire new talk of a deepening crisis, which Mr. Erdogan has repeatedly denounced as a foreign plot. But the words from one of the departing ministers were considered stunning, coming from a political party known for silencing dissent. That instantly raised the significance of the entire inquiry and left members of the Turkish public wondering if they were witnessing the collapse of their Islamist-rooted government of the last decade. This 2-page story, filed from Istanbul, was posted on The New York Times website on Christmas Day...and I thank Roy Stephens for his first offering of the day. It's worth reading, at least in my opinion. There's also a story on this issue posted on the france24.com Internet site. It's a bit more current, but not as in-depth. It's also courtesy of Roy Stephens---and the link to that is here. |

| Metals Seen Rallying With Crops After Record Tumble: Commodities Posted: 27 Dec 2013 04:58 AM PST Metal and crop prices are poised to rebound in 2014 as accelerating economic growth boosts demand, helping to staunch this year’s record retreat for investments in commodity-focused funds. Average annual prices for 15 of 23 non-energy commodities from aluminum to sugar will be higher than now, according to estimates from as many as 26 analysts compiled by Bloomberg. Corn may rise as much as 20 percent, platinum 23 percent and nickel 19 percent, based on the median of trader and investor forecasts in a survey that asked as many as 59 respondents to predict next year’s peak price for each of 15 raw materials. Corn, silver and gold dropped the most in 2013, and five more raw materials tumbled into bear markets as output rose and investors shifted to equities. Commodity-fund investments fell by a record $88 billion to $332 billion in the first 11 months, almost all of it in metals and agriculture, Barclays Plc says. While Goldman Sachs Group Inc. says supplies are mostly ample and Bank of America Corp. expects more losses, global manufacturing is the strongest since April 2011 and the International Monetary Fund says world growth will quicken. Well, dear reader, I don't know what to make of this article. It looks like something that the columnists just dumped on the Bloomberg website [without editing] before they left for the holidays. I'll leave it up to you as to its believability. Reader Ken Hurt sent us this article which was posted on their website on Tuesday afternoon Denver time. |

| Platinum Jumps Most in 10 Weeks on Economy Bets Posted: 27 Dec 2013 04:58 AM PST Platinum futures jumped the most in 10 weeks on speculation that a global economic rebound will boost demand for the metal used for pollution-control devices in cars. Gold also rose. Platinum jumped as much as 3.8% to a two-week high at 8:20 a.m. New York time in the most-active trading of the session. The price will rally to $1,650 an ounce in 2014 as consumption surpasses output, a Bloomberg survey showed. Demand exceeded supply this year by the most since 1999, according to Johnson Matthey Plc. “There’s a deficit in platinum, and people probably have just realized how cheap it is,” Dominic Schnider, the head of commodity research at UBS AG’s wealth-management unit in Singapore, said in a telephone interview. “Unlike gold, platinum benefits from a global economic recovery.” This Bloomberg news item showed up on their Internet site very early yesterday afternoon MST...and my thanks go out to reader Ken Hurt for his second contribution in a row to today's column. |

| Investors Expected to Continue Absorbing Silver Posted: 27 Dec 2013 04:58 AM PST Investment demand will remain a key factor for the silver market in 2014, as there will likely be little slowdown in buyers’ appetite for the metal. Industrial demand should pick up as the global economy grows, particularly in the U.S., although how much this will affect silver is up for debate. However, continued growth in mine supply and a lackluster outlook for gold will keep silver tethered. Low prices didn’t stop investors from keeping silver in their portfolios. The largest silver exchange-traded fund, iShares Silver Trust (SLV), as of Dec. 17 has 10,139.78 metric tons of silver, slightly more than what it had to start the year, 10,084.96 tons, and not far off the high set on Jan 16 of 10,734.99. By contrast, holdings in the largest gold ETF, the SPDR Gold Shares (GLD) are down nearly 40%. This 2-page Kitco News story was picked up by Forbes during the New York lunch hour on December 24...and its courtesy of West Virginia reader Elliot Simon. It's worth reading. |

| Gold Rises on Physical Buying as South Sudan Violence Escalates Posted: 27 Dec 2013 04:58 AM PST Gold gained for the second time in three sessions on speculation that this month’s price drop may spur more physical buying and as violence escalated in South Sudan. Bullion closed at $1,193.60 an ounce on Dec. 19, the lowest settlement since August 2010, after the Federal Reserve said it will reduce economic stimulus. Prices are down 3.8 percent in December, heading for the fourth straight monthly decline. Trading today was 69 percent lower than the average for the past 100 days for this time of day, according to data compiled by Bloomberg. Fighting in South Sudan has killed at least 500 people. “Expectations of some physical demand after the huge drop is helping prices on this very thinly traded day,” Frank McGhee, the head dealer at Integrated Brokerage Services in Chicago, said in a telephone interview. “Also, the violence in Sudan is supportive,” boosting demand for the metal as an investment hedge, he said. I doubt very much if the violence in Sudan had anything to do with what the gold price did going into the Christmas break---however, it does make for a good headline. The photo in this Bloomberg piece from late Tuesday morning MST, makes it worth a quick look. It's the third and final offering of the day from Ken Hurt. |

| After a year, Bundesbank repatriates only 37 of 700 tonnes of gold Posted: 27 Dec 2013 04:58 AM PST While Germany's Bundesbank announced a year ago that it would repatriate most of the 700 tonnes of gold it has vaulted with foreign central banks, the Berlin newspaper Bild reported yesterday that only 37 tonnes have been repatriated so far. Even that much repatriation was to involve only 20 percent of the German gold reserves held at the Federal Reserve Bank of New York, and repatriating even that small fraction was going to require seven years. Zero Hedge notes the Bild report with some acerbic commentary today. The pace of the Bundesbank's gold repatriation, Zero Hedge says, "would make a snail proud." This Zero Hedge story is embedded in this GATA release from Tuesday morning...and it falls into the must read category for sure. |

| Gold becoming scarce in Mexico too Posted: 27 Dec 2013 04:58 AM PST Hugo Salinas Price, president of the Mexican Civic Association for Silver, reports that the Mexican Mint has run out of gold for minting coins as the metal flows in ever-increasing amounts from West to East. His report is posted at the association's Internet site, plata.com.mx. This tiny article is a must read as well...and is a commentary I found posted on the gata.org Internet site on Christmas Day. |

| Minor blemishes aside, gold shone for Indians in 2013 Posted: 27 Dec 2013 04:58 AM PST The World Bank and the International Monetary Fund may have written off gold as an investment option but the yellow metal shows no sign of losing its sheen in India. In 2013 not only did gold prices witness an upward march to touch Rs 34,600 per 10 grams, the demand also remained somewhat intact. "Gold will always remain an asset class in India. It will never fetch any negative return. Temporarily, there can be some reverses but in the long term it cannot fade away," Bachharaj Bamalwa, director of the All India Gems and Jewellery Trade Federation, told the Indo-Asian News Service. This very interesting news item, filed from New Delhi, was posted on the India Today website late Christmas morning IST...and it's another article that I extracted from a GATA release on December 25. |

| India mulls relaxing import duty on gold doré Posted: 27 Dec 2013 04:58 AM PST In a bid to kick-start India’s flagging gold refineries, which have been operating at only 25% of installed capacity, the government is looking to relax some of the conditions currently imposed on the import of gold doré by refiners, finance ministry officials told members of the media. According to official sources, with India's current account deficit compressed significantly, this can be seen as a first step in reducing the import duty on gold in a calibrated manner,. The import of gold doré is permitted only against a licence issued by the Directorate General of Foreign Trade. This story, filed from Mumbai, was posted on the mineweb.com Internet site yesterday. |

| Koos Jansen: Did China goose March gold imports to prepare for April smash? Posted: 27 Dec 2013 04:58 AM PST Gold researcher and GATA consultant Koos Jansen, perhaps the foremost expert on China's gold market, reports data suggesting, as GATA's secretary/treasurer speculated a month ago to King World News that China helped arrange April's gold price smash down so that it could get a lot of gold a lot cheaper. Jansen discloses that there was "a huge spike" in gold imports by China from Hong Kong in March, "as if someone knew there was going to be immense demand for physical in April on the mainland." Jansen writes: Why would anybody import expensive gold in March to sell it for bottom prices in April? The answer: Chinese importing doesn't have to work like that. This longish, but very interesting read, is well worth your time. There's lot to digest here, so read it slowly. I found it buried in a GATA release from yesterday evening. |

| Jim Rickards: Gold Set Up for an Epic Short Squeeze in 2014 Posted: 27 Dec 2013 04:58 AM PST This 32:30 minute audio interview with Jim is a must listen in my opinion. The conversation turns to gold around the 21:15 minute mark...and it's all about gold after that. But the entire interview is worth your time...and I urge you to listen to the whole thing, especially the last six or seven minutes. It was posted on the physicalgoldfund.com Internet site on Monday...and I thank Harold Jacobsen for today's final story. |

| Posted: 27 Dec 2013 03:00 AM PST In testimony before Congress in 1912, J.P. Morgan, the leading financier of his day, declared: andldquo;Money is gold, nothing else.andrdquo; A century later a diametrically opposing view was taken by |

| Happy Boxing Day: My Train Set, Devolution, and Evolution Posted: 27 Dec 2013 02:55 AM PST By Lambert Strether of Corrente But such a form as Grecian goldsmiths make When I was 8 or 10 years old, my parents gave me an A.C. Gilbert “American Flyer” S-gauge train set for Christmas. That was a big deal for me then, and I’ve come to realize (many years later) that it was an even bigger deal than I thought.

All the time, of course, I was learning lessons: I could mow lawns or shelve books in the library to make money to buy trains (and kits and buildings and balsa wood and glue and paint); I could solder and saw and cut and drill and wire stuff up; I could imagine a world much like our own, but mine; and even more importantly, I could build a system. This last may be that’s why former model railroaders are so heavily represented in the technical community. From Steven Levy’s Hackers, which describes the seminal role the Tech Model Railroad Club played in the computer revolution that’s going to end by talking all our jobs away so we can live by plucking food from edible forests in our home towns except not because free markets:

Peter Samson fell in love with the wiring, and I suppose if I had done that, I would have become a real software engineer, instead of the somewhat competent coder that I am today. What I did fall in love with, though I wasn’t aware of this until years later, was a magazine that my parents got me a subscription to: Model Railroader. From Model Railroader, and its editor, Linn Westcott, I learned, all unawares, how to structure a publication into departments; that errors, from typos on up, were not to be tolerated and should be acknowledged; that reviews were there to serve the reader, not the manufacturer, and so That Model Railroader had the air of a technical publication was also important — and here we’re getting into the [de|e]volution part — because the highest expression of a model builder’s art was, arguably, “scratch building” a detailed replica of a steam locomotive in brass or nickel silver, while actually fabricating all the components oneself; at that time, in the late ’50s to mid-60s, we could actually build stuff, and there was story after story about men — Westcott unashamedly used “men,” or, informally, “fellows” — actually building tiny machine tools to construct wheels, boilers, cylinders, valve gear, and so forth. The layout were important, although “picture-book perfection” (see at right) is not very much like modeling when it comes to issues of scale and scope, of a railroad instead of a locomotive, but the miniature machinist was at the pinnacle. Fast forward forty years, and all that is gone, evolved or devolved I am not sure. Then, before the neo-liberal dispensation had begun walk out of the station, in the mid-70s, and now, when it’s heading, at top speed, who knows where, but probably to ruin. One thing that is evident to me now, that I could not see as a child, is how class intersects with the hobby: One must achieve a certain station in life to have permanent housing with the space for a large layout, and the money to spend on lots and lots of locomotives and rolling stock.** A big layout can take a decade to build; the hobby is not one for the downwardly mobile! And now, with wealth, one can even buy a museum grade layout from any of a number of builders; such a thing was unheard of when I was a child. Another change, which may also express class (“…nothing more, and nothing less, than groups of friends…”) is open expressions of friendship between men; where Westcott fictionalized friendships in the “Bull Session” Department**, today, friendships are openly expressed: Men build models for each other as gifts, exchange rolling stock, set up interchanges between their (fictional) railroads, create space for model railroaders who’ve had to downsize their homes, and so forth. Bonding, in other words. And third aspect of class is that we, in this country, are privileged to purchase models with absolutely fantastic detail — eye candy of a near-pornographic glaze — all “factory applied” by tiny fingers somewhere in Asia. (When I was a teenager, “detail” was synonymous with brass locomotives, scratch built, but also constructed in Asia, but in Japan, and then brought to this country by “Pacific Fast Mail.” Mail! Can you imagine!) So, as far as the locomotives and the rolling stock — surely the essentials of a railroad — what we once could make for ourselves is now made for us. Is that devolution? Or simply the workings of comparative advantage? What we do today, and brilliantly, is model the entire railroad: We actually fill out the paper forms and “operate” the railroad more or less prototypically, even — here we find class again — modeling (reproducing) the social relations that make the General Code of Operating Rules come alive (leaving out the Jay Goulds and Jim Fisks, of course). And we model the landscape (the “scenery”) infinitely better today than we did forty years ago, although we model the contours of the land by carving pink slabs of (petroleum-based) styrofoam, spraying electrostatic (petroleum-based) model grasses, gluing down the track with caulking guns like Martha Stewart, instead of using metal spikes for pity’s sake…. And yet, for all the power of the illusion, especially the photographed illusion, I can’t help but be reminded, when I think of today’s scenery building techniques***, of the styrofoam pediments in the McMansions we built during the housing bubble before the 2008 crash; the houses were fake, because they were cogs in a giant machine of accounting control fraud. Isn’t there something fake about these techniques? Sometimes, when I see structures with too much detail — especially “pre-built” structures — I’m reminded of the horrifically sentimental Thomas Kinkade, “painter of light.” I hate having my heartstrings tugged, which strikes me as another kind of fraud. Back to the timeline: The changes I’ve been describing encompass the neo-liberal revolution book-ended by Nixon and Obama. Somewhere along the line, we traded our ability to fabricate metal for the ability to fabricate a scene. Is that evolution or devolution? I’m not sure. If I had a son, I’m not sure I’d give him trains today. Oh, and there was no such thing as “sponsored content” in the world of Lynn Westcott. He wouldn’t have stood for an “innovation” like that. Nowadays, I guess, we’re easier, more corrupt; and surely, in that aspect, devolved. MR doesn’t do sponsored content, fortunately, proving that the old way still linger and culture can be strong. NOTE * A useful set of skills and attitudes if one wishes to end up blogging for Naked Capitalism! NOTE ** I did not know that Westcott was an operator on John Allen’s Gorre & Daphetid (see image above); as an editor, he had effaced himself, another valuable lesson that vandals like Tina Brown would have done well to learn. NOTE *** For his brilliant Miami Spur, Lance Mindheim will photograph a building’s wall, catching all its weathering, coloring, and detail, and then laminate the image onto a model building and voila! In the old days, the wall would have been built, detailed, and weathered manually. Mindheim’s layouts are beautiful, but again, I can’t help but think that a better crafted illusion has devolved the modeling skill. |

| La Bourse de Tokyo enregistre sa plus forte hausse depuis 40 ans Posted: 27 Dec 2013 02:08 AM PST Si la baisse de plus de 17% de la devise japonaise face au dollar et à l'euro n'a pas entraîné de bond des exportations en volumes, comme le gouvernement de Shinzo Abe l'avait espéré, elle a dopé en termes comptables les montants des profits réalisés à l'étranger... Lire |

| Leading Indicators from the Superstars of Resource Investing Posted: 27 Dec 2013 12:00 AM PST |

| What’s hottest in alternative investment stocks for 2014 Posted: 26 Dec 2013 09:33 PM PST It’s the season for hot New Year investment tips from the experts. The ArabianMoney investment newsletter (subscribe here) will have its top tips for the New Year in our January edition. CNBC discusses the best alternative investment stocks for 2014, with Jack Rivkin, Altegris, and Frank Holmes of US Global Investors. Mr. Rivkin thinks with risks to the upside, cyclical stocks will do well in 2014 while Mr. Holmes still has his eye on gold… |

| Posted: 26 Dec 2013 09:12 PM PST There are too many bears in the wood for gold. The downside from these levels is limited. Laying down positive future positions makes sense. The contrarians signals for gold are looking good for 2014. Dr. Copper is showing the way. Alan Knuckman of Trading Advantage and George Gero of RBC Wealth Management, discuss the dismal year gold had and the possibility of a golden rebound. They speak on Bloomberg Television’s ‘Market Makers’… |

| Posted: 26 Dec 2013 08:55 PM PST By Michael Hoexter, a policy analyst and marketing consultant on green issues, climate change, clean and renewable energy, and energy efficiency. Originally published at New Economic Perspectives. Variation in Fossil Fuel Dependency Among Developed Countries and Degrowth As action is required today and in the near future, though, it is reasonable to assume that production will be organized via some form of a capitalist organization of firms and the motivation of economic actors to achieve monetary profits/savings. In the period of transition to a new energy economy, the government sector and budget will play an enlarged and leading role in financing and regulating the transition. Targeting net degrowth over a period of years, perhaps a decade, might or might not inhibit the development of the "greener" sectors of the energy and transport economy exactly because these sectors have to play "catch-up" in the area of infrastructure. The most secure way to build out these sectors in terms of minimizing technology risk, is to deploy renewable energy generators, some on a vast scale, heavy and light electric rail infrastructure, electric road and other grid-tied systems not dependent on advances in battery technology or availability of moderately scarce elements like lithium. These systems require as construction materials emissions-intensive steel and concrete on a very large scale. Innovations may cut these emissions substantially though in the foreseeable future not completely. Various commercial interests are claiming they have a breakthrough on the energy storage or generation side which would diminish the need for these investments but currently there is no certain alternative to the creation of some massive earthworks. Anderson and Bows' degrowth agenda takes the risk of stifling the growth of the greener sectors of the economy with initial embedded emissions costs, for the sake of what is hoped to be early and dramatic emissions reductions in the developed world and allowing some of the remaining atmospheric resources to be taken up by emissions from developing countries. To avoid social collapse, Anderson and Bows' degrowth perspective would require that a fossil fuel-independent basic community and transport infrastructure is in place in those countries that embark on a radical degrowth program. They also assume, I believe, a robustly unified polity and sacrifice-ready members of the top 10-20% in wealth, who would assent to degrowth targeted at their consumption, with much sacrifice required of people of more modest incomes and wealth. The countries where it would be easier but by no means easy to institute a degrowth program would include the densely populated countries of the British Isles, Western, Northern, and Central Europe that still have extensive rail and public transport networks, though have become dependent on fossil-fueled trucking for freight and fossil fueled personal transport for convenience. Not only do these regions possess these potentially zero- or low-carbon networks but they also have from pre-capitalist times, structures of urban and community life which pre-date the fossil fuel age. By contrast, the United States, Canada, Russia, Australia, and much of Latin America do not have a low- to zero-carbon potential infrastructure already built. In many areas of these countries, commerce and community hinge upon the ready access to fossil fuels, as urban planning and more recent economic development, were predicated upon automobility and far-flung supply chains for goods and services. Some of these nations have had oil deposits and a large oil industry presence in their political and economic systems. So in some of the Annex I countries, UN-speak for the most developed countries, as well as other highly fossil fuel dependent countries, a degrowth-first strategy has a high probability of attenuating the communication, commerce, and social support networks that are vital in the initial and longer-term in combating climate change. Much of the radical conservation measures that Anderson and Bows are counting on require a unified polity and community integrity in order to make the proposed degrowth bearable for ordinary folk. The choice is easier for Western, Northern and Central Europe, which in many countries enjoys an overall quality of life at fractions of the per unit GDP carbon emissions than other countries in both the developing world and in non-European and Eastern European Annex I nations (US, Canada, Russia, Ukraine, etc.). Besides the density of population and choice of transportation services in these more fortunate Annex I countries, they can export their emissions by relying, increasingly on manufacturing and emissions-intensive resource extraction from other nations with laxer environmental standards or reserves of fossil energy. As also mentioned above, they benefit from some of the highest levels of state-funded public services in the world, which, one assumes and rightly would remain largely in place as a degrowth program was put into action. By contrast, the more recently built and sparsely populated parts of the world both in Annex I and outside it, a sudden reduction in emissions from degrowth without a massive countervailing program of social integration will lead to social and commercial disintegration rather than a path to a more sustainable society. The effort to address climate change will involve in these countries, a simultaneous effort to reconstitute society, a society that is more resilient, future-oriented, nature-aware, and community-oriented. While European countries fractured by austerity, the rise of right-wing anti-immigrant parties, and neoliberalism could also benefit from such a program of social integration, they are not as dependent upon large scale infrastructure projects to "green" their common spaces. Clearing the Field: It's Between "Green" Growth and Degrowth We have over the past several years been living in a period of malign, toxic confusion about economic growth and how it is achieved. This has been spurred on by the deficit hysteria/austerity campaign that has served only a small fraction of the elite in our financialized economy yet has dominated discourse in Washington and many other capitals. The deficit hysteria campaign has capitalized on the deep flaws in academic economics and economics education to distort the understandings of politicians and lay people about how our capitalist economy works, in particular the functions of government spending and overall demand in regulating the rate of economic activity and growth. Claiming to support growth, the austerity campaign has undermined it, yet continues to convince lawmakers otherwise, continuing to lead them or have them lead us, into an emissions-intensive economic abyss. The political and economic predators who have pushed deficit hysteria have politically capitalized on sincere concerns that some individuals and political leaders have had about lax financial standards in the private credit industry, debt-fueled consumption and overconsumption more generally. They have misattributed the private debt-fueled consumption boom of the last decade to government, exonerating the role of private lenders eager to profit via offers of credit from people's wish to consume essential or luxury goods and services. They have politically capitalized on the confusion of laypeople and many economists between financial and real resources especially as regards government finance, treating conservation of a limited pool of financial resources as equivalent in virtue to conserving the finite resources of the earth. A critical casualty of the deficit hysteria campaign is the instrument of government itself, a necessary institution for the process of transforming our energy and transport systems to face the challenge of climate change. In pursuing their perverse campaign for political power, the policy space for government has been hemmed in by false accusations and notions about money and the role of government. An honest discussion about the standards according to which we might organize and regulate our economies must exclude the false notion that there exists for a monetarily-sovereign national government a limited pool of financial resources even though we are fast approaching real limits in the planet's ability to absorb the effects of our economic activity. The difficulty of this mental and political feat in an era where we have two versions of the austerity narrative, a reluctant "Left" or "liberal" one and an enthusiastic, sadistic right-wing one, is quadrupled: not only do listeners need to distinguish between the two but a sham political conflict between the two flavors of deficit hysteric can further confuse. It is no progress to content oneself with the sympathetic version of deficit phobia that laments that government does not have the financial resources to address the existential social and environmental threats facing us. This leaves among the tripartite choice offered in the title of this piece between the current "malign confusion", growth and degrowth, only the latter two as options to be taken seriously. Of course confusion about growth, stoked by our ambivalence about consumption, remains the dominant political-economic discourse, so to have this serious discussion about the choice between growth and degrowth requires considerable focus, mental effort and research. A government's growth orientation, once disentangled from the ideological morass of neoclassical economics, neoliberalism, and the deficit hysteria campaign, however faces some real rather than financial constraints as well as real constraints that will become financial constraints. In the former category, as discussed above, economic growth as currently conceived is predicated upon a diminishment and in many cases destruction of the non-human biosphere, most sharply and critically by fossil fuel use. With climate change that destruction is not merely a passive deformation and diminishment of non-human nature and that nature growing more scarce as a resource for humans but rather a rebound by climate forces that will destroy large parts of human civilization. In the area of financial constraints, the fossil resources required for growth in our current technological regime are not unlimited in supply, contrary to industry propaganda and government complicity with the industry; increases in demand for fossil energy lead to increases in prices and puts pressure on supply. These shortages and price rises in turn put a damper on growth, yielding a negative feedback loop. The only currently feasible and realistic growth orientation then would mobilize available resources upon the task of freeing society from the scourge of fossil fuel dependence, even as some of the activities involved in that process will inevitably use substantial amounts of fossil fuels for at least a decade and a half. As my Pedal to the Metal Plan demands, as well as other "Green New Deal" proposals, copious government spending with or without compensatory tax increases are required to build infrastructure, fund innovation, and subsidize nascent industries. Taxes, the "degrowth" side of the economy, would need to target those activities that yield high emissions with some exemptions for those activities that are life-essential or on a path to zero net emissions during operation. Another orientation that we have considered as serious is a degrowth orientation, which attempts to front-load emissions savings by strict conservation and small-scale energy efficiency measures that themselves do not represent large emissions investments. Degrowth advocates seek to engineer a controlled economic recession that would guarantee yearly emissions reductions. As currently understood, these efforts would in developed countries leave some of the nascent green industries or infrastructure projects in a state of limbo as well as have negative employment effects unless counteracted by something like a job guarantee program, itself with a low emissions profile. Instituting a degrowth politics and strategy would require an extraordinary commitment on the part of a large swath of the population to break with the economic and social status quo, as well as experience some forms of deprivation. The role of state support and leadership, while critical in the Pedal to the Metal Plan, becomes even more central in an economy that would degrow over the period of perhaps a decade. Managing Growth and Degrowth under Threat of Climate Apocalypse Ultimately, if economics is to become a relevant and realistic discipline, it must confront the real physical world which economies have transformed but economics has not measured or accounted for in relevant physical aspects like carbon emissions and other dimensions of ecological footprint. An exclusive focus on growth or degrowth as "good" or "bad" or vice-versa will lead to mismanagement of an economy, even one that is attempting a crash-course in emissions reductions. The management of growth will depend critically upon carbon emissions incurred during production and consumption of goods and services, which currently are known in estimates but often not in detail or in measured reality. If we take the Pedal to the Metal Plan as a model, the exact timing and prioritization of elements of that plan may depend on engineering analysis and real world data collection regarding actual emissions required to provide certain economic services in the present and results in future emissions reductions. The interaction between those emission expenditures and economic benefits will feed into an iterative process whereby incentives and subsidies can be adjusted to lower emissions and/or increase economic output per unit emissions. The focus on projects that reduce overall consumption, such as energy efficiency and conservation projects, would seem an intuitive place to start. |

| Jim Willie: Return of the Gold Standard is Near! Posted: 26 Dec 2013 08:29 PM PST

The next year will feature many powerful new effects. The Indirect Exchange will become a prominent fixture, its channel filled. It will direct many $billions in USTreasury Bonds from large scale asset acquisitions by Eastern and BRICS players, sent back to New York and London. The payments for the asset purchases will be done in [...] The post Jim Willie: Return of the Gold Standard is Near! appeared first on Silver Doctors. |

| Mercenary Links Dec 26th: Blindsided Posted: 26 Dec 2013 06:37 PM PST Mercenary Links Dec 26th: UPS blindsided by e-commerce surge… S&P 500 hits 42nd record close… Turkey in crisis… Nikkei 16,000, libertarian ‘seasteads,’ and more.

~~~

~~~

~~~

~~~ ~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

~~~

Recent Mercenary Links (scroll for archives) |

| Koos Jansen: Did China goose March gold imports to prepare for April smash? Posted: 26 Dec 2013 05:31 PM PST GATA |

| India mulls relaxing import duty on gold dore Posted: 26 Dec 2013 03:46 PM PST According to finance ministery officials, the government is looking to relax some of the conditions currently imposed on the import of gold dore by refiners |

| The Stock Market Has Officially Entered Crazytown Territory Posted: 26 Dec 2013 03:06 PM PST

It is almost as if Wall Street has not learned any lessons from the last two major stock market crashes at all. Just look at Twitter. At the current price, Twitter is supposedly worth 40.7 BILLION dollars. But Twitter is not profitable. It is a seven-year-old company that has never made a single dollar of profit. Not one single dollar. In fact, Twitter actually lost 64.6 million dollars last quarter alone. And Twitter is expected to continue losing money for all of 2015 as well. But Twitter stock is up 82 percent over the last 30 days, and nobody can really give a rational reason for why this is happening. Overall, the Dow is up more than 25 percent so far this year. Unless something really weird happens over the next few days, it will be the best year for the Dow since 1996. It has been a wonderful run for Wall Street. Unfortunately, there are a whole host of signs that we have entered very dangerous territory. The median price-to-earnings ratio on the S&P 500 has reached an all-time record high, and margin debt at the New York Stock Exchange has reached a level that we have never seen before. In other words, stocks are massively overpriced and people have been borrowing huge amounts of money to buy stocks. These are behaviors that we also saw just before the last two stock market bubbles burst. And of course the most troubling sign is that even as the stock market soars to unprecedented heights, the state of the overall U.S. economy is actually getting worse... -During the last full week before Christmas, U.S. store visits were 21 percent lower than a year earlier and retail sales were 3.1 percent lower than a year earlier. -The number of mortgage applications just hit a new 13 year low. -The yield on 10 year U.S. Treasuries just hit 3 percent. For many more signs like this, please see my previous article entitled "37 Reasons Why 'The Economic Recovery Of 2013' Is A Giant Lie". And most Americans don't realize this, but the U.S. financial system and the overall U.S. economy are now in much weaker condition than they were the last time we had a major financial crash back in 2008. Employment is at a much lower level than it was back then and our banking system is much more vulnerable than it was back then. Just before the last financial crash, the U.S. national debt was sitting at about 10 trillion dollars, but today it has risen to more than 17.2 trillion dollars. The following excerpt from a recent article posted on thedailycrux.com contains even more facts and figures which show how our "balance sheet numbers" continue to get even worse...

So don't be fooled by this irrational stock market bubble. Just because a bunch of half-crazed investors are going into massive amounts of debt in a desperate attempt to make a quick buck does not mean that the overall economy is in good shape. In fact, much of the country is in such rough shape that "reverse shopping" has become a huge trend. Even big corporations such as McDonald's are urging their employees to return their Christmas gifts in order to bring in some much needed money...

This irrational stock market bubble is not going to last for too much longer. And a lot of top financial experts are now warning their clients to prepare for the worst. For example, David John Marotta of Marotta Wealth Management recently told his clients that they should all have a "bug-out bag" that contains food, a gun and some ammunition...

So what do you think is coming in 2014? Please feel free to share your thoughts by posting a comment below... |

| Centerra Gold drafts deal with Kyrgyzstan on Kumtor mine Posted: 26 Dec 2013 03:05 PM PST Centerra Gold says it has agreed to swap the govenrment's 32.7% stake in the Canadian miner for half the Kumtor mine. |

| Posted: 26 Dec 2013 03:04 PM PST |

| Posted: 26 Dec 2013 03:00 PM PST

The American Civil Liberties Union has put a lump of coal in the stocking of the National Security Agency with the release of "The NSA is Coming to Town," a two-minute parody video set to the classic Christmas song. You better watch out, you better not Skype! You better log out yeah you better not [...] The post The NSA is Coming to Town! appeared first on Silver Doctors. |

| Posted: 26 Dec 2013 02:08 PM PST I'm writing this Christmas morning, at 5:00 AM; and I thought I'd get a few things off my chest. Given the utter torture chamber TPTB have made 2013 into, I'm looking forward to the calendar turning. But then again, sometimes one must be careful what they wish for. After all, the Fed has not only created an equity bubble rivaling that of the late 1990s; but via unprecedented money creation, has done the same thing in markets ranging from bonds to real estate, to art, diamonds, and even Bitcoins. Despite the Fed's "deflation" propaganda, U.S. gasoline prices have never been higher in late December than today; while just last week, both beef and chicken prices hit new all-time highs. Obamacare is set to increase health insurance policies by 50%+ in 2014 and beyond; not to mention, yield widespread job layoffs, as employers desperately attempt to offset onerous healthcare mandates. And with another 1.3 million people set to leave the labor force this weekend – as their unemployment benefits expire; the "war against poverty wages" rages on, given the nation's largest growing "employment segment" is the minimum wage, part-time category. This is why U.S. entitlement spending is going parabolic; and why it was reported Monday that the savings rate plunged to multi-year lows last month, below 4%. Charts such as these demonstrate just how weak the REAL U.S. economy actually is; and again, even we are in awe of the high-pitched "recovery" propaganda amidst easily, the worst holiday retail season since the post-2008 financial crisis. Meanwhile, as miniscule rate increases (in the context of long-term averages) have caused new mortgage applications to plunge to 13-year lows, housing affordability has never been lower. The Fed's free money, coupled with venture capital from its Wall Street partners in crime, have created a real estate bubble that – despite showing early signs of rolling over – still remains at nose bleed levels. In 2014, a tsunami of home equity rate resets will commence, from ill-advised loans made at the mid-2000s bubble peak; and thus, without further, MASSIVE Fed stimulus, another 2008 is unquestionably around the corner. Hence, what Peter Schiff deems Fed "Open Mouth Operations" will likely fail in short order; as in our view, "QE5" is far more likely than actual "tapering." Last week, we proved tapering is but a mirage to start with; and next year, our guess is the rest of the world will realize this, too. Source: Zero Hedge In fact, the entire world is irreversibly addicted to ultra-low interest rates; and thus, it won't be long before the battle that was a seeming Fed victory last week will become an all-out loss in the war to stave off reality. The Chinese repo rate surges noted below are but a symptom of this disease, and now that the all-important U.S. 10-year Treasury yield is on the verge of achieving multi-year highs above 3%, it won't be long before a potentially cataclysmic impact will be felt across the world's four corners. Source: Zero Hedge Remember, global economic activity is in far worse shape than even the bogus, manipulated American situation; and thus, any negative factor experienced here will unquestionably be more virulent there. Already, we are seeing currencies of the so-called "Fragile Five" nations collapsing anew; and with major elections upcoming in India and Europe during 2014, it's entirely possible that the "next 2008" is right around the corner; only this time, Central banks no longer have the same "monetary ammo" to counter it with. Quietly, Standard & Poor's stripped the European Union of its ill-deserved triple-A rating last week; while simultaneously, Italy's President warned of the strong possibility of a violent, widespread public insurrection in the coming months, as weak economies and surging inflation become impossible to ignore. But why listen to facts such as this, when it's much easier to focus on rising stock markets – benefiting no more than 1% of the population – care of hyper-inflating Central banks? We still rank the PIIGS – or PIFIGS, if one rightly includes France – as very high on the list of "crisis catalysts"; and frankly, Greece and Spain still top our list of "potential black swans." And speaking of crisis catalysts, there's always the ever-widening gap between paper and physical PM prices. As COMEX registered gold inventory has plunged 85% to just 463,000 ounces – with the possibility of another 300,000+ ounces being withdrawn when the December contract closes in six days – Indian premiums have surged to an all-time high above 25%. Per an article from LibertyBlitzkrieg.com, Indian gold smuggling is going parabolic; in what, in time, will likely be viewed as the most suicidal government policy in Indian history.

However, said "gold rush" is not just occurring in India, but EVERYWHERE. Even the U.S. Mint set a record for silver Eagle sales this year; and in fact, closed last week for two weeks – in what can only be described as the year's second silver shortage.

In China, just the published amount of gold imports will end the year at more than double 2012's record level; and while the COMEX reveals – in spades – that it is purely a speculative, manipulated, Cartel PAPER tool, the Shanghai Exchange is rapidly rising to prominence as the world's leading PHYSICAL market. In our view, it won't be long before "price discovery" is nearly entirely made in China; and frankly, 2014 may well signal its coming out party. Can you imagine waking up each day to NOT the typical 2:15 AM smashes, but inexorably higher prices? Well get used to the thought, as it's no doubt coming. Source: InGoldWeTrust.ch As an article from Zero Hedge notes, "gold fever" – or better put, fiat currency fears – are spreading like wildfire; and following this week's BOMBSHELL news that the Bundesbank has only repatriated 37 of the 700 tonnes of gold demanded a year ago from the Fed and the Bank of France, such realization of the utter emptiness of Western vaults may well go "viral" a lot sooner than anticipated. Yes, record physical demand has been offset this year by unprecedented naked shorting; yielding gold and silver prices well below the cost of production, and thus, the likelihood of massive supply shortages in the coming years. Not to mention, record low Western precious metal sentiment; which we assure you, can't last much longer.

We hope you enjoy your holidays to the fullest; but at the same time, gird up for the likely horrific ramifications of the hyperinflationary, global monster the Fed, BOJ, ECB, and other major central banks have created. "Rome is burning" – perhaps, literally – and for this likely brief, historic moment, nary an intellect appears to be stirring.

PROTECT YOURSELF, and do it NOW! Call Miles Franklin at 800-822-8080, and talk to one of our brokers. Through industry-leading customer service and competitive pricing, we aim to EARN your business. Similar Posts: |

| Why Economics Will Never Be a Legitimate Science Posted: 26 Dec 2013 01:45 PM PST

The competitive (game-like) nature of economics means that the usual incremental accumulation of knowledge that applies in natural science is impossible. To succeed in the market, I need to have better information and/or interpretation than at least one other trading opponent (oops, I almost said “trading partner”!) There are two ways for me to have [...] The post Why Economics Will Never Be a Legitimate Science appeared first on Silver Doctors. |

| Another Bubble Looking for a Pin Posted: 26 Dec 2013 12:01 PM PST Gold Scents |

| 15 Quotes About The Duck Dynasty Controversy That Every American Should See Posted: 26 Dec 2013 12:00 PM PST

What is being done to Phil Robertson shows just how far America has fallen. The thought police are waging an all-out campaign to take down one of the biggest names in the United States, and if they are successful none of us will ever be safe again. We are becoming a nation that is governed [...] The post 15 Quotes About The Duck Dynasty Controversy That Every American Should See appeared first on Silver Doctors. |

| Jim Willie: Return of the Gold Standard is Near! Posted: 26 Dec 2013 10:44 AM PST

|

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment