Gold World News Flash |

- Silver : We are UNDER the cost of PRODUCTION ~ David Morgan

- A Trip Through The Bitcoin Mines

- Why are so many laws and rules being thrown out?

- Gold becoming scarce in Mexico too

- Minor blemishes aside, gold shone for Indians in 2013

- ANOTHER BUBBLE LOOKING FOR A PIN

- U.S. Economy - The ‘Real’ Goods on the Latest Durable Goods Data

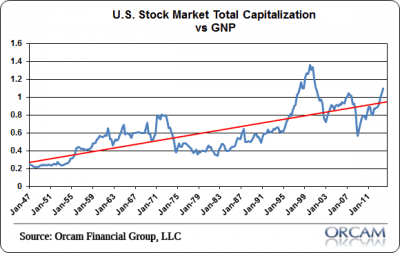

- Warren Buffett’s Favorite Valuation Metric Suggests Stock Market Is OVERvalued by 15%

- Leading Indicators from the Superstars of Resource Investing 2014

| Silver : We are UNDER the cost of PRODUCTION ~ David Morgan Posted: 25 Dec 2013 08:21 PM PST The Elite continues to manipulate PM's its prices will go lower and lower and lower. They do this to keep the masses away and invest in the already crashed Stock Market Bubble. SILVER is at a BARGIN... [[ This is a content summary only. Visit http://www.GoldSilverNewsBlog.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] | ||

| A Trip Through The Bitcoin Mines Posted: 25 Dec 2013 07:48 PM PST Once upon a time, money - in the form of precious metals - used to be literally dug out of the earth. Limitations on the amount that could be mined, and on how much growth could be borrowed from the future (all debt is, is future consumption denied), is why eventually the world's central bankers moved from money backed by precious metals, to "money" backed by "faith and credit", in the process diluting both. It was the unprecedented explosion in credit money creation that resulted once money could be "printed" out of thin air that nearly destroyed the western financial system. Which brings us to Bitcoin, where currency "mining" takes place not in the earth's crust, or in the basement of the Federal Reserve, but inside supercomputers. It is these supercomputers, that are the laborers of the virtual mines where Bitcoins are unearthed, that the NYT focuses on in a recent expose:

As the following chart shows, in addition to the surge in the price of Bitcoin, another explosion witnessed recently is in the processing power of the Bitcoin network: from non-existent a couple of years ago, the "mining" power dedicated to hashing, or the calculations used to extract new Bitcoins, has risen to nearly 10 quadrillion per second! So what do these supercomputer-populated mines look like? Below we look at two examples of just that. * * * First, we look at Hong Kong, where one of the largest Bitcoin mines in the world is located. In an industrial backwater near Hong Kong's massive port, one of Asia's largest Bitcoin mines is quietly turning raw computing power into digital currency. Located about eight miles from the city's finance hub, the entire facility is no larger than a two-bedroom apartment. Aside from a small bathroom, the mine offers no creature comforts. It is dominated by vertical racks that house hundreds of ASIC chips. Shorthand for application-specific integrated circuits, these chips are custom-built to mine bitcoins.

These racks house hundreds of ASIC chips used to mine bitcoins. Chinese investors have been enthusiastic early adopters, a trend amplified by a lack of more traditional investment vehicles in the country

The Kwai Chung mining facility is extremely quiet -- except for the whirr of computers Industrial bitcoin mines devote their massive amounts of computing power to working on the algorithm, and are rewarded with an equivalent share of bitcoins. Currently, a winner is rewarded with 25 bitcoins roughly every 10 minutes.

A closer look at the towers. Most of the facility is devoted to mining for an investor group in China. Miners are lured to Hong Kong because of its proximity to chipmakers in China and the city's permissive regulatory environment.

A bubbling liquid produced by 3M cools the ASIC chips. This mine was purpose-built by Allied Control for clients based in China. Kar-Wing Lau, Allied Control's vice president of operations, said the mine is cheaper to run and more efficient than many others because it uses a technology called immersion cooling. Heat sinks and fans are typically used to disperse the heat generated by massed ranks of computer chips, but this Hong Kong mine is liquid-cooled using a product developed by 3M. The processors used in the mine were build specifically for mining. They have no other function. "These ASIC chips, they can mine bitcoins and do nothing else," Lau said. "Given the pace of advancement, we need them to be constantly upgraded." These radiators, housed on a balcony outside the mine, help disperse heat produced by the chips. Immersion cooling allows Allied Control to leave less space between the chips, which saves money that would otherwise be spent on rent. The technology also cuts down on electricity use -- one of the other major costs associated with Bitcoin mining. Lau wouldn't reveal how much it cost to build the mine, but he said that electricity bills for a fully-operational mine of this size would typically exceed $50,000 per month. "The real question from a business perspective is how efficiently you can run your mining operation," Lau said.

The inside of the racks used to house the mining chips. Cooling, however, is only one of the key factors when determining Bitcoin "mine" placement. Another key one: access to cheap electricity, because those massive servers sure soak up a lot of electricity: electricity, whose costs can quickly add up once a parallel processing cluster gets big enough. * * * Which brings us to Bitcoin mega-mine #2 in Iceland. It is here that the NYT goes searching for digital excavators used to procure the digital currency.

Iceland's low electric bill and its effective infrastructure, may be a reason why the one country that rebelled against the banker syndicate and jailed some of its bankers, may become the place where the bulk of Bitcoin mining takes place:

No coins, but the cash miners get in exchange for BTC, especially if each Bitcoin continues to trade close to $1000, the mining can be quite lucrative. The flipside, however, is that the business is just as if not more capital intensive than running a gold mine for the same profit.

What is the upside of mining?

To be sure, like any industry in its infancy, there are numerous glitches, and mining for Bitcoins is no different:

Hopefully Bitcoin will still be around by then. * * * The future of Bitcoin mining is uncertain. There are a fixed number of bitcoins available -- and more than half have already been extracted. Kar-Wing Lau of the Hong Kong-based Allied Control, compared the explosion of professional mining operations to an arms race. For now, it appears to be a profitable endeavor. Lau said that Allied Control is currently exploring other mining platforms, including a mine built in a shipping container -- something that could prove useful if regulators crack down on the currency. | ||

| Why are so many laws and rules being thrown out? Posted: 25 Dec 2013 04:19 PM PST

The biggest problem facing investors today is that “the rules” of the game change almost every year.

What I mean is that any basic rule investors took for granted could be thrown out the window. Indeed, in the last five years we’ve seen:

1) Accounting standards at financial institutions suspended. 2) Capital requirements for banks (Basel III) postponed multiple times. 3) Fraud go unpunished. 4) Obvious insider trading amongst political officials and banking insiders. 5) Central bankers openly admit that they will lie to investors.

Why are so many laws and rules being thrown out?

The Powers That Be are committed to propping the system up by any means possible.

Consider Spain.

Spain’s banking system, by any reasonable analysis, is totally bankrupt.

The reason for this is that Spanish banks are all packed to the brim with garbage assets (mortgage loans and Spanish Government bonds… which aren’t worth the paper they’re printed on).

Consider the story of Bankia.

Bankia was formed by merging seven bankrupt regional Spanish banks in 2010.

The new bank was funded by Spain’s Government rescue fund… which received “preference shares” in return for over €4 billion (from taxpayers).

These preference shares were shares that a) yielded 7.75% and b) would get paid before ordinary investors if Bankia failed again. So right away, the Spanish Government was taking taxpayer money to give itself preferential treatment over ordinary investors.

Indeed, those investors who owned shares in the seven banks that merged to form Bankia lost their shirts. They were wiped out and lost everything.

Bankia was then taken public in 2011. Spanish investment bankers convinced the Spanish public that the bank was a fantastic investment. Over 98% of the shares were sold to Spanish investors.

One year later, Bankia was bankrupt again, and required the single largest bailout in Spain’s history: €19 billion. Spain took over the bank and Bankia shares were frozen on the market (meaning you couldn’t sell them if you wanted to).

When the bailout took place, Bankia shareholders were all but wiped out, forced to take huge losses as part of the deal. The vast majority of them were individual investors (the bank currently faces a lawsuit for over 140,000 claims of mis-selling shares).

So that’s two wipeouts in as many years.

The bank was taken public a year a second time later in May 2013. Once again Bankia shares promptly collapsed, losing 80% of their value in a matter of days. And once again, it was ordinary investors who got destroyed.

Indeed, things were so awful that a police officer stabbed a Bankia banker who sold him over €300,000 worth of shares (the banker had convinced him it was a great investment).

Which brings us to today.

Bankia remains completely bankrupt. But its executives and the Spanish Government continue to claim that things are improving and that the bank is on the up and up. Indeed, just a few weeks ago, the Wall Street Journal wrote an article titled “Investors Show Interest in Bankia.”

The story featured a quote from Spain’s Finance Minister that, “… it is logical. The perception of Spain has improved and Banki has improved a lot.”

Bear in mind, this is a bank that has wiped out investors THREE times in the last THREE YEARS. So that’s three different rounds of individual investors being told that Bankia was a great investment and losing everything.

Every single one of these wipeouts was preceded by both bankers and Spanish Government officials claiming that “everything had been fixed” and that Bankia was a success story.

And now the Spanish Government is trying to convince them to line up for a fourth round.

This kind of fraud and lawlessness is unbelievable to me. But it is indeed how the world works today. Those who have power will do anything they can to retain it. This includes, lying, cheating, and stealing.

And while certain items relating to this story are unique, the morals to Bankia’s tale can be broadly applied across the board to the economy/ financial today.

Those morals are:

1) Those in charge of regulating the system will lie, cheat and steal rather than be honest to those who they are meant to protect (individual investors) 2) Any financial problem that surfaces will be dealt with via fraud or lies rather than taking a hit. This will include short selling bans, stocks being frozen, bail-ins, and worse. 3) When the inevitable collapse finally does hit, it will be individual investors and the general public who get screwed.

For a FREE Special Report outlining how to profit from bear market crashes and bull market runs, swing by: http://phoenixcapitalmarketing.com/special-reports.html

Best Regards Phoenix Capital Research

| ||

| Gold becoming scarce in Mexico too Posted: 25 Dec 2013 11:43 AM PST 2:40p ET Wednesday, December 25, 2013 Dear Friend of GATA and Gold: Hugo Salinas Price, president of the Mexican Civic Association for Silver, reports that the Mexican Mint has run out of gold for minting coins as the metal flows in ever-increasing amounts from West to East. His report is posted at the association's Internet site, La Plata, here: http://www.plata.com.mx/mplata/articulos/articlesFilt.asp?fiidarticulo=2... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||

| Minor blemishes aside, gold shone for Indians in 2013 Posted: 25 Dec 2013 11:34 AM PST From Indo-Asian News Service http://businesstoday.intoday.in/story/year-2013-roundup-demand-for-gold-... The World Bank and the International Monetary Fund may have written off gold as an investment option but the yellow metal shows no sign of losing its sheen in India. In 2013 not only did gold prices witness an upward march to touch Rs 34,600 per 10 grams, the demand also remained somewhat intact. Steady demand, despite import restrictions, saw gold prices swaying between Rs 26,440 per 10 grams in April to Rs 34,600 per 10 grams in August. "Gold will always remain an asset class in India. It will never fetch any negative return. Temporarily, there can be some reverses but in the long term it cannot fade away," Bachharaj Bamalwa, director of the All India Gems and Jewellery Trade Federation, told the Indo-Asian News Service. ... Dispatch continues below ... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Last year India imported around 960 tonnes of gold. High gold imports strained India's current account deficit, which touched a high of 4.8 per cent of the country's gross domestic product in 2012-13. India, being the world's biggest buyer of bullion, imported a record 162 tonnes in May 2013. This shook the government, which was trying to rein in the huge current account deficit so as not to let the rupee depreciate any further. The government raised the import duty on gold to 15 pe cent. This rise in import duty somewhat stalled gold imports between end-July and mid-October. "This hiking of customs duty may help the economy in the short run but in the long run it does not because Indians will never stop buying gold. Thus the deficit in gold in the market, arising due to the hike in import duty, is filled by smuggled gold," economist Siddharth Shankar told IANS. "Though the current account deficit looks a little better in the short run, in the long run the parallel economy is booming due to smuggled gold," Shankar added. Somasundaram PR, managing director of the World Gold Council, said: "Gold is considered as a strong asset class and we believe policy direction should aim at easing the regulatory landscape for gold imports, viewing it as a strategic investment asset." He said demand for gold in India, whether in the form of jewellery or investment (bars and coins), is predominantly retail and is driven by millions of individuals across rural and urban India. "They invest in gold as part of their household savings. It is important to understand that jewellery is considered an investment -- not discretionary spending for consumption. It serves as a collateral for lending to a large class of borrowers in certain socio-economic segments," Somasundaram added. "Look at the wedding and festive season in last quarter of 2013. This suggests that the demand outlook remains strong and the long-term fundamentals of the gold market are intact." During April this year the price of gold fell to around Rs 26,440 per 10 grams. But later it again rose and now it is hovering around Rs 31,000 per 10 grams. "Over here, the 80-20 rule imposed by the government was a dampener for the industry," said Bamalwa, alluding to a government stipulation that 20 percent of gold imported by retailers must be exported. "Initially there was no clarification on this issue, which stalled gold import for some time. This led to a rise in smuggling of gold across the country," he said. As a result, Bamalwa said, 2013 was one of the worst years for the industry in terms of imports mainly due to restrictions on imports and the volatility in prices due to the steep depreciation of the rupee. Import duty on gold, which was 2 percent Jan 17, 2012 is now 15 percent. "This year even during Diwali or the festive season the business was not good," Vipul Shah, chairman of the Gems and Jewellery Export Promotion Council, said. But he conceded that the situation was far from justifying the alarm bells being sounded. Yet the industry expects that overall demand for gold in India for 2013 is likely to end at around 900-1,000 tonnes against 960 tonnes last year. Join GATA here: Vancouver Resource Investment Conference http://www.cambridgehouse.com/event/vancouver-resource-investment-confer... Mines and Money Hong Kong http://www.minesandmoney.com/hongkong/ * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||

| ANOTHER BUBBLE LOOKING FOR A PIN Posted: 25 Dec 2013 08:14 AM PST Well the Fed in it's infinite wisdom has gone and done it again. They've created another bubble. Arguably the 6th in the last 13 years (tech, real estate, credit, bond, oil, and now stocks again, and an echo bubble in housing). If one steps back far enough they can see what's really happening. The Fed has now manufactured a parabolic move in the stock market. Much more aggressive (and thus even more unsustainable) than either the 2000 or 2007 tops. Here's the problem; Parabola's always collapse. There are never any exceptions. And when this one goes it's going to take the global economy with it. At some point profit taking starts as nervous professionals fearing a regression to the mean event start to lock in profits. As the big institutional money starts to come out of the market the selling begins to accelerate and the losses quickly mount. The steeper the parabola the quicker the losses once the parabola breaks. It's not unusual to see 3-6 months of gains evaporate in the space of days when one of these collapses. I have a pretty good idea where this one is going to initially once the break begins (more on that in a minute). This all started in 2011. If the Fed had just allowed the market to correct naturally and drop down into it's 4 year cycle low in 2012 we would probably now be on a sustainable path into another secular bull market. Unfortunately the Fed made a catastrophic mistake. Instead of allowing the market to function naturally they began operation Twist, then LTRO, then QE3 and QE4. The result as you can see in the first chart is they've created a huge unsustainable parabolic move in the stock market. Try as they might to prevent corrections the longer they allow this to continue the more devastating the crash is going to be when the market breaks. Based on the extremely stretched nature of the current intermediate cycle (week 27) I'm looking for a top and the start of the collapse early next year. Possibly as we begin earnings season. Margin debt and money market funds are at levels indicating retail investors are now all in like they always are at market tops. Source: sentimentrader.com I expect we are going to see the market fall precipitously to test the previous bull market tops and erase most of last years gains in a matter of days or weeks. At that point Yellen will panic and all thoughts of tapering will vanish. As a matter of fact I expect the Fed will increase QE, maybe drastically, to try and reflate the parabola. At that point though the damage will already be done. All they will accomplish is a violent echo rally common to all collapsing parabolas. From there the bear market will have begun and the more QE they throw at the market, the more and faster the liquidity will leak into the commodity markets until inflation completely destroys the economy and the next recession gets underway. The Fed thinks they are creating a "wealth effect". All they've really done is sow the seeds of the next crash. | ||

| U.S. Economy - The ‘Real’ Goods on the Latest Durable Goods Data Posted: 25 Dec 2013 07:59 AM PST Earlier today I posted an update on the December Advance Report on November Durable Goods Orders. This Census Bureau series dates from 1992 and is not adjusted for either population growth or inflation. Let’s now review the same data with two adjustments. In the charts below the red line shows the goods orders divided by the Census Bureau’s monthly population data, giving us durable goods orders per capita. The blue line goes a step further and adjusts for inflation based on the Producer Price Index, chained in today’s dollar value. This gives us the “real” durable goods orders per capita. The snapshots below offer an alternate historical context in which to evaluate the standard reports on the nominal monthly data. | ||

| Warren Buffett’s Favorite Valuation Metric Suggests Stock Market Is OVERvalued by 15% Posted: 25 Dec 2013 07:44 AM PST Here's some perspective on the potential value of the U.S. equity market using Warren Buffett’s favorite valuation metric -  total stock market capitalization relative to GDP. total stock market capitalization relative to GDP.So says Cullen Roche (pragcap.com) in edited excerpts from his original article* entitled Updating Warren Buffett's Favorite Valuation Metric. [The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Cullen goes on to say in further edited excerpts: There's some natural upside bias in an indicator like this because the stock market is not the economy and, in fact, the total market cap of the U.S. equity market has tended to grow quite a bit faster than Gross National Product. Nevertheless, if we use a linear trendline we can better gauge where we are and, based on this perspective, the U.S. stock market is starting to looking a little expensive. At a level of 1.1 (using estimated Q4 GNP) the U.S. stock market is now about 15% above trend which would put our "fair value" for the S&P at about 1520 at present (all else equal). Obviously, this is a rather imprecise way of viewing things, but it does provide a bit of perspective on where we might be in the market cycle. Multiple expansion and paying more for less earnings appears to be the most obvious driver of the market at present. [As Katchum says in his article**, "according to the stock valuation chart below, the stock market is now crossing the 115% ratio of total market cap against GNP which means we are crossing the border from modestly overvalued into significantly overvalued territory.If global GDP weakens next year, a drop in the stock market will not be far off."] [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://pragcap.com/updating-warren-buffetts-favorite-valuation-metric#v4bZDm2siAL7KCQw.99 (Copyright © 2013 All Rights Reserved) **http://katchum.blogspot.ca/2013/12/stock-market-just-became-significantly.html Related Articles: 1. Global Stock Markets At Key Resistance Lines – Will They Break Out or Crash? Markets around the globe are all facing key resistance levels at the same time. Can they pull a "Great Escape" and bust through? Yes they can and if they do, it would be very bullish for equity markets around the world [and if they don't, then watch out below!]. Read More » 2. These Indicators Suggest Stock Market Returns Are "Too Good To Be True" Current macro conditions indicate that we are in a sweet spot for equity returns…that global growth is continuing and there is little or no tail risk in the immediate future. It's time to get long equities…but I have this nagging feeling that these market conditions are too good to be true. If you look, there are a number of technical and fundamental clouds on the horizon. Read More » 3. Don't Be Scared "Stockless"! There's No Fear Anymore – Anywhere! There's no fear anymore – anywhere – and I'm talking about the type of fear that overwhelms investors – and, in turn, the market. The surest indication of this can be found in the following chart. Read More » 4. Stocks to Continue to Soar & Gold to Continue to Fall in 2014 – Here's Why Each December we publish a list of investment themes that we feel are critical to the coming year. Below are our expectations for the U.S, Japanese and European stock markets, municipal bonds and gold. Read More » 5. Relax! Take Stock Market Bubble Warnings With a Grain of Salt – Here's Why Bubble predictions are headline-grabbing claims that are sure to attract reader/viewership and more than a few worried individuals who will be pushed to act but, like all forecasts, these bubble warnings should be taken with a grain of salt. 6. Bookmark This Article: The Stock Market Will Crash Within 6 Months! Until recently, I have not used the term "stock market crash". I do not take using this term lightly. It brings with it major repercussions. I am now breaking out this phrase because of the current state of the stock market. This stock market crash will occur within the next six months from today… The markets will fall within a combined day/few days a total of at least 20%. Bookmark this article. Read More » 7. Stock Market Bubble & Coming Recession? These Charts Say Otherwise The real value of the stock market is positively correlated, over time, with the amount of freight hauled by the nation's trucks (in other words, the physical size of the economy has a lot to do with the real, inflation-adjusted value of the economy) and the latest numbers (see chart) strongly suggest that we are not in a stock market bubble. Read More » 8. These 2 Stock Market Metrics Make Me Feel Uneasy – What About You? It's been an amazing run in the stock market but…I start to feel a bit uneasy about things when I see all news reported as good news, because it either means the economy is getting better or more QE is coming. The fact, though, is that the market is just driving higher on what looks like sheer optimism of continued QE and little else. You can see this optimism in two indicators you'll recognize. Read More » The post Warren Buffett's Favorite Valuation Metric Suggests Stock Market Is OVERvalued by 15% appeared first on munKNEE dot.com. | ||

| Leading Indicators from the Superstars of Resource Investing 2014 Posted: 25 Dec 2013 06:54 AM PST Knowledge is money in resource investing. That is why The Gold Report reaches out to the top experts in the sector all year long to bring you their best investing ideas. For this special year-end feature, we asked some of your favorite thought leaders about the tools they use to spot trends and make those important buy-sell decisions. What are the early indicators that gold will rise, plummet or coast sideways? Is it Federal Reserve bond buying? China's growth rate? Lipstick sales? You may be surprised by the answers. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment