saveyourassetsfirst3 |

- China uses paper gold smashes to drain London market, Maguire says

- Feds Falling out of Love with JP Morgan?

- Ruth Crowell to be named London Bullion Market Group CEO

- Gold Investors Weekly Review – November 1st

- Insiders Are Buying MAG Silver

- UR-Energy: A World-Class Junior Uranium Producer Right Here In The USA With Huge Potential

- SD Weekly Metals & Markets: Finland Says Up To 50% Of Gold Leased Out!

- WEEKEND REPORT: DOLLAR SURGE

- Jim Rickards: After “Currency Wars” Comes “The Death of Money”

- Jim Rickards: After “Currency Wars” Comes “The Death of Money”

- Three King World News Blogs

- Gold Eagle Bullion Sales Recover, Silver Eagles Approach Record

- Mexico mining tax approved, but hits political roadblock

- Alasdair Macleod: Finland admits leasing its gold, and maybe it's in Asia now

- South African mine strikes doing little to lift platinum

- India forced to take its eyes off gold

- Lawrence Williams: China imports another 109 tonnes of gold in September

- My big idea… let’s create an Essential Goods Index

- Monex precious metals review: Gold falls $39 Oz, Silver $0.72

- The Dollar Has Game

- Indirect Exchange : The Gold Standard

- Gold And Silver – Fundamentals Do Not Matter

- Insiders Are Selling Synnex

- Comex Deliverable Gold Falls to 658,443 Ounces

- SD Weekly Metals & Markets: Finland Says Up To 50% Of Gold Leased Out!

- Silver author David Morgan says new Fed chief Janet Yellen is great news for silver prices

- Silver Tutorial With David Morgan

- Top TSX gold companies swing back hard

- Why gold prices don't reflect fundamentals - Phillips Part 4

- A huge adjustment at comex causes total dealer gold to fall to 20.48 tonnes/The big three dealers in gold hold only 16.425 tonnes/GLD loses a monstrous 5.7 tonnes of physical gold from its vaults/

- West distorts bullish Chinese gold news, Kaye tells KWN

- Jim Willie’s Stunning Claim: The Game is Over. King Dollar is Dead! – Gold to $7,000 Silver to $250+!

- US Mint Alerts Primary Dealers Silver Eagle Production to Be Halted for 4 Weeks!

- China imports another 109 tonnes of gold in September

- Porter Stansberry: What you really need to know about Ben Bernanke and the next Fed chair

- Gold market report: Gold and Silver Prices Move Sideways

- John Butler: The Real Earthquake In Financial Markets Is Yet To Come

- Gold: The Medium-Term Outlook

- What Is Gold Really Worth

- Did The Wall Street Journal Publish Blatant Lies About The Gold Market?

- China’s Appetite for Gold: “Waning” or Surging?

- Don’t Worry – The Government Says That The Inflation You See Is Just Your Imagination

- Gold Very Strong In November - Returned 4.93% On Average In Last 10 Years

- Alasdair Macleod: Finland admits leasing its gold, and maybe its in Asia now

- Get Ready for Phase Two…

- China Imports 0.7% Less Gold Than August, Bloombergs Says Slowdown

- Gold starts November at two-week low

- Gold very strong in November: Returned 4.93% on average in last 10 years

- Important Charts On Gold & Silver Eagle Sales

- Gold demand at Indian festival seen dropping on import curb

| China uses paper gold smashes to drain London market, Maguire says Posted: 02 Nov 2013 12:31 PM PDT GATA | |||||||||||||||||||||

| Feds Falling out of Love with JP Morgan? Posted: 02 Nov 2013 10:35 AM PDT The following story ( click to read the article) caught my eye this morning for reasons that many in the gold community will easily understand. Ask most of those who believe that the feds closely monitor the price of gold and work to tame any price rallies when the metal is in a bullish uptrend, just who are the agents employed to actively short the metal at the Comex and you will always get two names, Goldman Sachs and JP Morgan. I find the following article both interesting and revealing therefore as it introduces something which I have not heard from any who adhere to this view - namely an apparent falling out between the political authorities and the latter of these two banks, J P Morgan. I also find it interesting, and have remarked about this many times of late, that the largest stopper of gold during the Comex delivery process in recent times has been JP Morgan for their HOUSE account. In other words, they are LONG gold at the Comex in order to take delivery of the physical metal ( I explained this when I was attempting to debunk the silly notion of bullion bank caused "FLASH CRASHES" that is currently circulating through the halls of the gold community edifice. It sure does make one wonder does it not what is going on behind the scenes when Morgan is being targeted by federal power? Have the feds lost one of their purported allies in the gold suppression scheme? Either way it is very interesting reading and certainly lays bare the methodology employed by the current administration which uses tactics of intimidation against all those who dare defy it. You know that this is brazenly arrogant when even Barney Frank seems to be taken aback by this concerted federal effort being used to harass J P Morgan. Those of you who have been reading my comments for many years know full well that there is no love lost between myself and either of these two megabanks. I have seen enough of their antics in the commodity markets over the years to have lost any sympathy for what might happen to either or both of them. Still there is something very unseemly in this episode which smacks more of a government shakedown rather than a pursuit of unbiased justice and fair play. http://dailycaller.com/2013/11/01/are-the-feds-targeting-jpmorgan-for-criticizing-obama/ | |||||||||||||||||||||

| Ruth Crowell to be named London Bullion Market Group CEO Posted: 02 Nov 2013 10:04 AM PDT Crowell has been the LBMA's deputy chief executive since June 2012 and was recently responsible the group's regulatory work | |||||||||||||||||||||

| Gold Investors Weekly Review – November 1st Posted: 02 Nov 2013 09:52 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week’s strengths, weaknesses, opportunities and threats in the gold market. The price of the yellow metal went lower after two consecutive weeks of gains. Gold closed the week at $1,316.20 which is $34.6 per ounce higher (2.5%). The NYSE Arca Gold Miners Index went 8.15% higher. Gold Market StrengthsSell-side analysts and traders' commentaries have highlighted a noticeable pickup in generalist and fundamental accounts buying large cap gold names in recent days. According to Macquarie, the move appears to be motivated by the fact that a lot of the bad news is already out there, and it's likely for companies to surprise to the upside rather than perform negatively. Barrick Gold reported earnings this week showing a noticeable improvement on the bottom line, with earnings per share of $0.58 versus the analysts' consensus of $0.51. Both gold and copper operations beat their operational targets, but the most significant improvement came on the cost side, where Barrick reported an 85 percent completion of its corporate downsizing program. Gold Market WeaknessesA recent International Monetary Fund (IMF) report shows that the gold holdings in Russia's Central Bank fell for the first time since August 2012, decreasing 0.4 tonnes in September. However, Russia has added more than 50 tonnes to its gold reserves this year alone and about 600 tonnes since 2007. It is expected that gold purchases by central banks will decrease to 350 tonnes this year from 544 tonnes in 2012. Despite the decrease, analysts agree that central banks will remain substantial net buyers of gold in years to come. The spot gold price on the Shanghai Gold Exchange dropped below the London price this week, signaling that demand may be waning in the world's second-largest gold market. Bloomberg reports that gold was selling at a 54.14 percent discount to the London price on Wednesday on very low volume in the Shanghai Gold Exchange. Gold Market OpportunitiesJeffrey Currie, an analyst with Goldman Sachs, suggested just under a month ago that gold miners should hedge their output and lock current prices. In his opinion, gold would be the next big short trade. Other analysts, including Tom Kendall of Credit Suisse, also followed with negative commentary on the gold market, adding their names to the short-selling list. It's interesting that this group dares to recommend that investors do the exact opposite of what asset allocation studies show: adding gold and gold stocks to a portfolio can add alpha without a significant increase to risk. Not only are these analysts ignoring proven academic research, they seem to be ignoring reality. BCA Research published a report at the end of last week highlighting that gold prices have failed to rise in recent months in spite of a weak dollar, adding that a catch-up is likely. BCA argues that gold is oversold on a technical basis, as seen in the following chart, which in itself could be enough to drive a gold rally above the $1,500 per ounce threshold. Mineweb contributor Dorothy Kosich reports that in a rare show of bipartisanship, Congressional Democrats and Republicans introduced a comprehensive bill aimed at fostering and facilitating the domestic growth of critical minerals to prevent future supply shocks. This highlights the urgent need to facilitate the development of American mineral deposits. The ultimate purpose of the bill is to ensure that officials are required to set, and adhere to, timelines and schedules for completion of reviews as well as for inspection and enforcement activities in the mining sector. According to Hal Quinn, CEO of the National Mining Association, the slow and inefficient permitting system in the U.S. is the largest impediment to unlocking the full value of American minerals, adding that the U.S. relies on foreign countries such as China to supply many of these critical minerals. This week, RBC Capital Markets published the fifth part of its study on capital and operating cost expectations in the gold market. In the report, RBC underlines that capital costs have stabilized while all-in sustaining costs could fall by $150 per ounce in 2014 alone. RBC argues that since prices have fallen by a larger extent than all-in costs, this should discredit gold producers' efforts to maintain or increase their returns on capital. After rising by 60 percent over the past three years, it appears 2014 may actually be a good time to build projects given the availability of engineering and equipment. Those companies that learned the importance of protecting balance sheet integrity and returns on capital will be the biggest beneficiaries of this new stage in capital costs, at the expense of those who were growing for the sake of growing. Gold Market ThreatsAlan Greenspan published his new book "The Map and the Territory" in which he warns, among other things, that the "Spectacle of American central bankers trying to press the inflation rate higher in the aftermath of the 2008 crisis is virtually without precedent." He follows up by commenting that this type of policy could easily trigger double-digit inflation. In light of this, David Rosenberg of Gluskin Sheff proposed a new mantra for the Federal Reserve: "Bring on inflation!" However, Rosenberg followed up by criticizing the Fed's optimistic sentiment that inflation is good for economic growth, in which there is no widely accepted evidence or studies to support the assertion. For those who still believe in the Fed's optimism after Wednesday's meeting, consider Rosenberg's list of market facts that show financial asset overheating:

The list is simply too long to continue, but the point comes across easily. David Zervos of Jefferies wrote quite an entertaining and ironic takedown on Janet Yellen's nomination to the Federal Reserve Chairmanship. According to Zervos, the most exciting part about having Yellen in the seat is her inherent mistrust of market prices and her belief in irrational behavior processes. Zervos adds that there likely will be a day in 2016 when unemployment is still well above Yellen's estimate and the headline inflation rate is above 4 percent, in which the Fed's models will still show a big output gap and lots of slack. This way, Yellen could continue talking down inflation risks. In fact, Zervos argues that Yellen's obsession with filling the output gap makes for a very real chance of policy mistakes down the road, similar to those resulting from an obsession with Keynesian mis-measuring of the output gap during the 1970s. | |||||||||||||||||||||

| Insiders Are Buying MAG Silver Posted: 02 Nov 2013 09:41 AM PDT In this article, I will feature one mining company that has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

MAG Silver Corp. (MVG) engages in the acquisition, exploration, and development of mineral properties in the Mexican silver belt. (click to enlarge) Insider buying during the last 30 days Here is a table of MAG Silver's insider-trading activity during the last 30 days by insider.

| |||||||||||||||||||||

| UR-Energy: A World-Class Junior Uranium Producer Right Here In The USA With Huge Potential Posted: 02 Nov 2013 08:50 AM PDT Finding value is getting harder and harder as the equity indexes reach new highs. Most sectors are definitely overbought. However, there are those sectors in the beat up commodity based equity world that are certainly not near the overbought zone and have been really beaten up for some time now. One of these is the Uranium mining sector. Some background on the sector The following 3-year chart of the URA ETF (which is a relatively good representation of the global uranium mining sector) shows the ugliness of the uranium mining industry's share price performance over the last three years: The downtrend in the sector began immediately after the Fukushima Daiichi nuclear plant meltdown in Japan in early 2011. The failure of this plant was as a result of a 55 foot Tsunami rather than a systemic failure of the plant itself. The massive waves knocked out the plant's redundant power | |||||||||||||||||||||

| SD Weekly Metals & Markets: Finland Says Up To 50% Of Gold Leased Out! Posted: 02 Nov 2013 07:51 AM PDT

On this week's Metals & Markets Wrap we'll cover:

Click here for the latest SD Weekly Metals & Markets Wrap with The Doc & Eric Dubin: This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||

| Posted: 02 Nov 2013 06:53 AM PDT Dollar: A rather interesting development occurred on Friday, and one that I wasn't really expecting. The dollar sliced right through its intermediate trend line on its first attempt. I thought for sure we would see some kind of pullback from that trend line before a break. In my opinion this signals that there are a lot of people caught on the wrong side of this market. If we take a look at the euro chart we can see that the daily euro cycle is only on day 12. That implies it still has another 8-13 days before finding its next daily cycle bottom. The dollar should have those same 8-13 days to rally before this daily cycle tops. Originally I thought we might see a test of the 200 day moving average over the next 4-6 weeks. But the explosive nature of the first five days, and taking into account this daily cycle still has another 8-13 days to go before topping, we could see a test and break of the 200 day moving average over the next 1-2 weeks. I think we would then have at least one more daily cycle higher before the intermediate cycle tops. Two daily cycles of this kind of behavior could definitely send the dollar back up to test the upper megaphone trend line over the next 2 months. I'm starting to get the feeling that this rally out of the yearly cycle low is going to be a lot more powerful then almost anyone is expecting, including me. In order to turn this back down it may require a fundamental change in the market such as an increase in QE. I don't believe that is politically feasible at the moment unless the stock market really starts to tank in front of the Christmas holidays. For the rest of the report and to learn how I think this will affect the gold market click here to try a one week subscription to the premium SMT newsletter. | |||||||||||||||||||||

| Jim Rickards: After “Currency Wars” Comes “The Death of Money” Posted: 02 Nov 2013 05:42 AM PDT "But one day it won't. We just don't know which day that will be." ¤ Yesterday In Gold & SilverThe gold price didn't do much in Far East trading on their Friday, and was actually up three or four bucks about half an hour before the London open. Then the high-frequency traders showed up, and that was it until the London p.m. gold fix. The low of the day came at that point, but the subsequent rally got sold down beginning at 12:45 p.m. EDT. After that, the gold price chopped sideways on very light volume into the 5:15 p.m. electronic close in New York. The CME recorded the high and low as $1,327.30 and $1,305.60 in the December contract. Gold finished the Friday session at $1,315.80 spot, which was down $6.90 from Thursday's close. Net volume was pretty light at 126,000 contracts. The silver price traded in a 25 cent range for most of Friday. It got sold down a bit starting at the London open, and then rallied off it's 9:30 a.m. GMT low, right up to its New York high at 9:15 a.m. EDT. After that, silver didn't do much of anything for the rest of the day. The CME reported silver's high and low as $21.995 and $21.705 in the December contract. Silver finished the day at $21.865 spot, down 4 cents from Thursday's close. Net volume was around 33,000 contracts. Both platinum and palladium got sold off a bit during the Friday session, but both recovered into the close and finished in positive territory. Here are the charts. The dollar index closed on Thursday in New York at 80.24, and the proceeded to trade more or less sideways until just before the 8 a.m. GMT London open. The bulk of the subsequent rally was in by the London p.m. gold fix, and the index traded sideways from there into the close, finishing the Friday trading session up another 48 basis points to 80.72. The gold stocks gapped down over 2% at the open, not helped by the horrific news out of Barrick. And, with the exception of a small counter-rally between 11:15 and 12:45 p.m. when the gold price rallied after the p.m. fix, it was all down hill from there. The HUI finished down 4.04%, which was barely off its low tick of the day. Nick Laird's Silver Sentiment Index turned in a slightly better performance, as it closed down only 2.81%. The CME's Daily Delivery Report showed that zero gold and 3 silver contracts were posted for delivery on Tuesday within the Comex-approved depositories. There was another withdrawal from GLD yesterday, this time an authorized participant took out 183,362 troy ounces. And as of 9:59 p.m. EDT Friday evening, there were no reported changes in SLV. The U.S. Mint had a smallish sales report for the first day of November. They reported selling 3,000 ounces of gold eagles, and that was it. For the month of October, the mint reported selling 48,500 troy ounces of gold eagles; 18,000 one-ounce 24K gold buffaloes; and 3,087,000 silver eagles. Based on these sales figures, the silver/gold ratio for the month worked out to 46 to 1. I have a very comprehensive story about October U.S. Mint bullion sales in the Critical Reads section further down. For the fourth day in a row there was no reported in/out movement in gold at the Comex-approved depositories on Thursday. Once again it was another big day for silver, as these same depositories reported receiving 1,116,963 troy ounces, and shipped out 603,063 troy ounces. All the activity was at JPMorgan Chase and Canada's Bank of Nova Scotia. The link to that activity is here. Well, the CFTC had a new Commitment of Traders Report [for positions held at the close of trading on October 22] loaded up on their Web site at 3:30 p.m. yesterday afternoon when I checked the site, and the changes I said would occur, were exactly as I predicted in both gold and silver. And as Ted Butler said on the phone yesterday, when you can predict with certainty what the report will say in advance, it's just more proof that the markets are managed by just a few traders. Here's what I said in The Wrap yesterday: "If you check the 30-day gold and silver charts posted just above the Critical Reads section above, you will note that both metals rallied [nearly] every day in the October 16-22 reporting period that today's possible COT Report will cover. It's a given it will show that the tech funds and small traders dumped their just-acquired short positions and maybe put some long contracts on as well. On the other side of the equation, its a certainty that JPMorgan et al were doing the exact opposite, and getting set up for the next engineered price decline, which may have started at 2 p.m. on Wednesday with the FOMC news. Aren't rigged markets just grand?" In silver, this COT Report showed that the rally during the reporting week was driven by technical funds going long, and covering short positions. In the process they added 3,323 long contracts and reduced their short position by 2,289 contracts. In total, that's a swing of 5,612 contracts. Of course, in lock-step against them the Commercial traders [JPMorgan et al] increased their net short position by the same 5,612 contracts, which is 28.1 million ounces. They did this by selling 1,856 of their own long contracts and by buying 3,756 short contracts that were being offered for sale by the technical funds and small traders. Ted says that JPMorgan's short position in silver [up to October 22] has now blown out to about 18,000 contracts, and they hold just under 18% of the short position in silver on the Comex futures market on a net basis. What would the closing price of silver have been if JPMorgan et al hadn't stepped in as short sellers of last resort? There's no law that says they have to trade exactly opposite the other two categories, but they do it in order to cap the price. If they just stood idly by with their hands in their pockets instead, the technical funds and small traders would have to bid up the price to find a free-market short seller, or someone to sell them a long position. If that ever happened, the silver price would be some rather large 3-digit number within a few hours. We would experience a market-clearing event that would make your eyes water. And that's precisely what JPMorgan et al are in the futures market for; to subvert the free-market pricing mechanism. Because if they weren't there, the new prices of all four precious metals [plus every other commodity on Planet Earth] would be over the moon in just a few days, if that. Some would say that JPMorgan et al provide "much needed liquidity" to the precious metal markets. That's the biggest pile of b.s. imaginable. They have inserted themselves in the chain of events to control the price, nothing more. They do that, plus make a profit on the side by skinning these brain-dead technical funds as "prices" rise and fall. What a scam! But, I digress. The rally in gold during the October 16-22 reporting week showed that the technical funds and small traders bought 8,678 long contracts and sold 8,646 short contracts. This combination of buying and selling by the brain-dead technical funds [for the most part] is what cause the rally during the reporting week. But standing in the Commercial category right beside them, JPMorgan et al happily sold them the longs they wanted and bought all the short contracts offered for sale. By inserting themselves as "sellers of last resort" they control the price that the technical funds buy and sell at, and thus the "free market" price in the process. As I said about silver, the mind boggles at what the real "free market" price of gold would be if JPMorgan et al weren't providing "badly needed liquidity." Ted said that, based on his calculation, JPMorgan Chase is long about 72,000 Comex contracts, or 7.2 million ounces as of the cut-off for the October 22 COT Report. All 10,000 contracts that they bought from the technical funds and small traders during the prior week's engineered price decline, were sold back to them at a profit during this last reporting week as prices "rallied." Ted figures they made a cool $50 million on that trade, and that JPM is net long about 22% of the entire Comex futures market in gold. Here's Nick Laird's "Days of World Production to Cover Short Positions" for all physical commodities traded on the Comex updated with the COT data as of October 22. Of the green and red bars for silver, JPMorgan's share of the short position is 43 days of world production. It's my opinion that about 90% of the rest of those bars are made up of HSBC USA, Citigroup and Canada's Scotiabank, and the same amount, if not more, can be said about the platinum and palladium short positions. I have a decent number of stories for you today, some of which I've been saving for today's column. ¤ Critical ReadsJPMorgan Discloses Eight DOJ Probes From Asia to MadoffThe largest U.S. bank disclosed for the first time in a filing yesterday that the Justice Department is examining its energy-trading practices, which were subject to a $410 million civil settlement with the Federal Energy Regulatory Commission in July. Investigations are also focusing on mortgage-bond sales, interest-rate rigging, the credit-derivatives market, and the bank’s trading loss last year, according to the filing. U.S. Attorney General Eric Holder has said that it’s a priority for his department and for President Barack Obama to hold banks accountable. Chief Executive Officer Jamie Dimon visited Holder in September to try to negotiate a settlement of mortgage-related cases against the bank. “The scope and breadth of risky practices at JPMorgan are mind-boggling,” said Mark Williams, a former Federal Reserve bank examiner who teaches risk management at Boston University. “Some of these probes are criminal, they’re not even just civil anymore, and I think it’s very telling about the broad risk-taking culture that was allowed under. What else is new when it comes to JPMorgan? This Bloomberg story was posted on their website on Friday, and I thank Manitoba reader Ulrike Marx for her first offering in today's column. Doug Noland: The May/June Dynamic The conventional view holds that massive QE has not caused inflation because the Fed’s monetary fuel has remained unused as “reserves” on bank balance sheets. From this viewpoint, inflation risks lurk somewhere out in the future: when the banks eventually lend these “reserves” and the monetary fuel finally makes its way into the real economy. Moreover, the optimistic view holds that the Fed has the tools to adeptly manage any future inflation issue. Doug's Credit Bubble Bulletin is must read this week...and was posted on the prudentbear.com Internet site yesterday evening...and I thank reader U.D. for sending it along. As stimulus tab rises for Fed, worries grow it may require a bailoutThe Federal Reserve has taken unprecedented steps to stimulate the economic recovery from the Great Recession, but the tab has risen to such tremendous proportions — fast approaching $4 trillion — that some worry the central bank ultimately could require its own taxpayer rescue. The Fed's total assets on its balance sheet have more than quadrupled to $3.8 trillion since 2008 amid a massive bond-buying effort. And there are few signs that the growth will stop any time soon. That could put the finances of the world's most powerful central bank at risk if historically low interest rates were to rise sharply — something top Fed officials said they do not expect but that critics warn is very possible. "It's really pretty cut-and-dried as far as the arithmetic goes: If you buy bonds and interest rates go up, you're going to take a capital loss on those bonds," said James D. Hamilton, an economics professor at UC San Diego. "The more they buy, the bigger their balance sheet, the bigger the loss they're going to face." Yes, dear reader, Mr. Hamilton has it exactly right. This article was posted on the L.A. Times website very early Tuesday morning...and it's worth reading. I thank West Virginia reader Elliot Simon for his first offering in today's column. Obama halted NSA spying on IMF and World Bank headquartersPresident Barack Obama has ordered the National Security Agency to stop eavesdropping on the headquarters of the International Monetary Fund and World Bank as part of a review of intelligence gathering activities, according to a U.S. official familiar with the matter. The order is the latest move by the White House to demonstrate that it is willing to curb at least some surveillance in the wake of leaks by former NSA contractor Edward Snowden of programs that collect huge quantities of data on U.S. allies and adversaries, and American citizens. The NSA's surveillance of the Washington-based IMF and World Bank has not previously been disclosed. Details of such spy programs are usually highly classified. This Reuters piece appeared on their website early on Thursday evening EDT...and I thank Elliot Simon for sharing it with us. NSA FILES: DECODED...and what the revelations mean for youWhen Edward Snowden met journalists in his cramped room in Hong Kong's Mira hotel in June, his mission was ambitious. Amid the clutter of laundry, meal trays and his four laptops, he wanted to start a debate about mass surveillance. He succeeded beyond anything the journalists or Snowden himself ever imagined. His disclosures about the NSA resonated with Americans from day one. But they also exploded round the world. For some, like Congresswoman Zoe Lofgren, it is a vitally important issue, one of the biggest of our time: nothing less than the defence of democracy in the digital age. This incredible audio/visual "essay" is very long, but you can spend as much or as little time as you want with each commentator. Just run your cursor over their respective photos, and their comments begin automatically. This was posted in The Guardian yesterday...and it's worth spending a bit of time on if these NSA revelations interest you, which they should. I thank U.K. reader Tariq Khan for being the first reader through the door with it. Barclays Said to Suspend Chief FX Dealer Ashton Amid ProbeBarclays Plc has suspended three currency traders, including a chief dealer in London, amid a probe into potential foreign-exchange manipulation, according to a person with knowledge of the decision. Chris Ashton, who was identified as global head of voice spot trading in a Barclays e-mail last month, and spot currency traders Jack Murray and Mark Clark were suspended, said the person, who asked not to be identified because they aren’t authorized to speak publicly about the matter. None of the three has been accused of any wrongdoing, said the person. Ashton didn’t respond to messages left on his work or mobile telephones, and didn’t reply to an e-mail seeking comment. Murray and Clark didn’t return messages left on their work telephones or reply to e-mails. Barclays, one of the four biggest currency traders in the world, is reviewing trading over several years and is cooperating with regulators’ requests for information, according to a statement. This news item, filed from London, was posted on the Bloomberg website yesterday morning Denver time...and I found it embedded in a GATA release. RBS avoids break-up with 38 billion pounds 'internal bad bank'Royal Bank of Scotland is to create an internal "bad bank" to fence off its riskiest asse | |||||||||||||||||||||

| Jim Rickards: After “Currency Wars” Comes “The Death of Money” Posted: 02 Nov 2013 05:42 AM PDT In Currency Wars, Rickards concluded that a dangerous global financial crisis was not only in the making, but that it was inevitable. Based on that financial war game inside a top-secret facility at the APL’s Warfare Analysis Laboratory, a historical analysis of international monetary policy in the twentieth century, as well as his assessment of the events leading to and adopted after the financial debacle of 2008, Rickards laid out the endgame that would result from the global financial chaos of the first currency war of this century; the collapse of the U.S. dollar and the eventual replacement of fiat money with a return to the gold standard. “The world is getting closer to that end game every day,” warns Rickards, who just finished writing the sequel to Currency Wars, titled The Death of Money, The Coming Collapse of the International Monetary System. Due out in bookstores next April 2014, The Death of Money picks up on the disturbing predictions outlined in Currency Wars and carries the analysis further into how the international monetary system might collapse and what new system will replace it. This very excellent article was posted on the trumanfactor.com Internet site on Thursday...and certainly falls into the must read category. I thank reader Harold Jacobsen for digging it up on our behalf. | |||||||||||||||||||||

| Posted: 02 Nov 2013 05:42 AM PDT 1. Keith Barron: "Staggering Q.E. in the West...and the Ultimate Collapse". 2. William Kaye: "People's Worst Nightmares Coming - Have a Survival Strategy". 3. Andrew Maguire: "Big Banks in Trouble as Major LBMA Default Nears". [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] | |||||||||||||||||||||

| Gold Eagle Bullion Sales Recover, Silver Eagles Approach Record Posted: 02 Nov 2013 05:42 AM PDT After two months of weakness, the American Gold Eagle bullion coins achieved stronger sales during the month of October. Silver Eagle bullion sales exceeded three million coins for the month, with the all time annual sales total quickly approaching. For the month of October 2013, Gold Eagle bullion sales reached 48,500 troy ounces across all options. The most popular seller by both units and total weight was the one ounce size at 41,000 pieces. The latest monthly sales total breaks the streak of two uncharacteristically weak months. In August, sales were 11,500 ounces, followed by sales of 13,000 ounces in September. The total for August had marked a six year low for monthly sales. This short but fact-filled commentary was posted on the coinupdate.com Internet site yesterday...and is certainly worth skimming. The only statistic that this commentary doesn't mention is the fact that the U.S. Mint will use between 15 and 20 percent more silver than the U.S. will mine in all of 2013. It's another contribution from Elliot Simon. | |||||||||||||||||||||

| Mexico mining tax approved, but hits political roadblock Posted: 02 Nov 2013 05:42 AM PDT Mexico's senate approved by 73 votes to 50 the broad outline of a package of tax reforms, which included a debated 7.5% charge on resource companies, and as much as 8% for gold, silver and platinum. The lawmakers, however, decided to set aside scores of divisive sections to be processed later. Members of the National Action Party, the main opposition party, expressed their discontent with the decision by abandoning the session as the Senate began to work through the reservations. Despite the senate tensions, the tax package was expected to be finalized later Wednesday or at some point today. Following senate approval the reforms only need to be enacted by President Enrique Peña Nieto to become a law. This short story was posted on the mining.com Internet site on Thursday and is certainly worth the read. I thank Ted Butler for pointing it out. | |||||||||||||||||||||

| Alasdair Macleod: Finland admits leasing its gold, and maybe it's in Asia now Posted: 02 Nov 2013 05:42 AM PDT GoldMoney research director Alasdair Macleod reports today that Finland's central bank has admitted leasing much of its gold, most likely through the Bank of England. Finland's admission, Macleod writes, adds to the evidence that much of the gold heading to Asia has been coming from Western central banks, suppressing the metal's price. Macleod's commentary is headlined "Finland's Gold" and it was posted on GoldMoney's Internet site on Friday. | |||||||||||||||||||||

| South African mine strikes doing little to lift platinum Posted: 02 Nov 2013 05:42 AM PDT Given that South Africa is the source of 75 percent of the world's platinum supply, the fact that prices have responded so little to strike action there this year has surprised investors. Prices barely reacted to news on Thursday that the hardline AMCU union had declared a wage dispute with Lonmin, raising the possibility of an industry-wide strike that could hit half of global output. Five years ago, the threat of production cuts in South Africa was the primary force driving platinum prices to record highs at $2,290 an ounce. Well, dear reader, JPMorgan et al didn't have a monster short position in either metal back then, but they sure do now...and like silver and gold, they are totally in the driver's seat as far as price is concerned. Check out Nick Laird's "Days to Cover" chart further up in this column to see how bad it really is. Also check out the platinum and palladium's charts from the Bank Participation Report in last Saturday's column. They tell all. This Reuters news item was posted on the mineweb.com Internet site...and is worth skimming. I thank Ulrike Marx for her final offering in today's column. | |||||||||||||||||||||

| India forced to take its eyes off gold Posted: 02 Nov 2013 05:42 AM PDT "You can bet that with the current state of the economy, Indians will be buying less gold and looking for alternative gifting options this Diwali season," says Arvind Panagariya, professor of economics at Columbia University and India observer. So if Indians aren't buying gold, what are they buying? According to the local merchants in New Delhi and Mumbai—silver. It might not carry the same prestige and status, but it is cheaper and thus a good alternative. Silver shares trade at $22 an ounce, while gold shares are trading north of $1,300. This short story was posted on the CNBC website yesterday afternoon just after the markets closed in New York...and it's the final offering of the day from Elliot Simon. | |||||||||||||||||||||

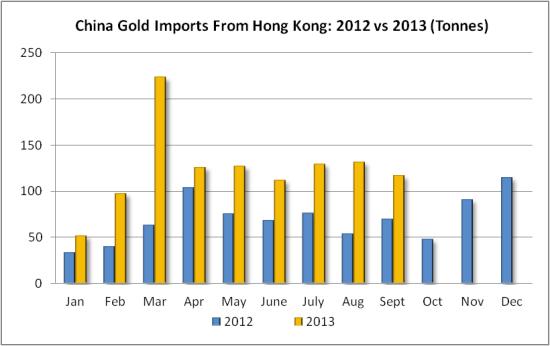

| Lawrence Williams: China imports another 109 tonnes of gold in September Posted: 02 Nov 2013 05:42 AM PDT There has been a fair amount of speculation in the press that Chinese gold demand may be slowing from its record levels recorded so far this year. Well we can report that the speculation is correct – marginally! Reading he latest Bloomberg headline relating to the newly released September figures out of Hong Kong “China Gold Imports From Hong Kong Fall on Premium, Slow Demand” one could be forgiven for thinking that the tide has indeed turned, yet, in reality, the September total for net gold imports from Hong Kong into mainland China at 109.4 tonnes remains the fifth highest month’s imports on record and although a full 0.8 tonnes below the previous month’s figure this hardly shows any kind of appreciable slowdown so far. Indeed Chinese imports by this route over the first nine months of the year are more than double those of last year. This must read commentary by Lawrie was posted on the mineweb.com Internet site yesterday. | |||||||||||||||||||||

| My big idea… let’s create an Essential Goods Index Posted: 02 Nov 2013 05:00 AM PDT Ed Miliband has a point. When this country toppled into crisis in 2007-08, it was widely feared that the financial collapse would lead to mass unemployment on a scale that dwarfed the recession of the early 1980s. And it hasn't happened, or not quite. Yes, unemployment is really bad. Yes, the statistics are manipulated. And yes, the absence of attractive jobs will scar an entire generation. But those features of the 1980s recession – entire industries disappearing, whole towns out of work – haven't recurred. What has happened, however, is a catastrophic loss of output, capital expenditures and savings far worse than in any post-war recession. In fact some would argue that this is a full-blown economic depression (I'm among their number). Since something has to give, average earnings are, in real terms, now at the levels they were a decade ago. Since taxation is now generally higher, as are pension contributions in the public sector, that statistic actually under-represents the injury to living standards. If we throw in the number of people working part-time, when they would prefer to be working full-time, or self-employed out of necessity rather than choice, you are looking at an economic disaster on an unprecedented scale. Miliband likes to draw attention to these problems by flourishing a statistic of his own: that in 38 out of 39 months under the Coalition Government, real wages have fallen. He's cleverly made that fact the central plank of his quest for election in 2015. I think he's right to do so. Real wages are determined in part by such things as productivity, exports, investment, and the general health of the British economy. Since British firms do badly in these respects, and since the export climate is dour, there's not much help to be expected from the "real economy". But that's only half of it. The other half is monetary policy, which has been kept absurdly slack from the very start of the crisis – and indeed years earlier too. The Bank of England has consistently overshot its inflation targets and responds by pumping yet more invented money into the hands of a disbelieving banking sector. Too much money chasing too few goods can have only one result. Fuel prices up. Transport prices up. Food prices up. Water up. Housing up. If you're a student, then the cost of education has screamed upwards. Oh, and if you think that booze or fags would be there to console you in your poverty, then alas those comforts have gone up in price more than almost anything. These things haven't simply escalated in price, they've gone up by more than "average inflation". And, as you may have noticed, you can't easily get by without food, water, fuel or housing. Miliband's solution comes straight from the Old Labour playbook. Squeeze the rich. Price controls. Blame big business. Tunes last popular when flares were big and the Bee Gees were at the height of their careers. Trust me. Real Change, really Ed? And the tunes are stupid. Take Miliband's Big Idea: a price freeze on energy companies. This is a policy so bad, it's actually hard to count the errors. But here are a few. One, energy companies don't actually make excess profits. SSE, for example, earns a net margin of just 1.7 per cent. The Economist estimates that across Europe power companies have lost more value than the entire banking sector. This is emphatically not an industry that's growing rich on the back of consumers. Two, Britain faces a coming power crunch, the result of recent under-investment. If you want more private power generating capacity, you have to let the private sector earn a return on its investment. Miliband's scheme threatens that. Three, it doesn't just threaten it for the 20 months of a price freeze. By creating an uncertain regulatory climate, the deterrent starts now and doesn't end until Miliband retracts the policy in full. Four, focusing on power ignores all those other things that form part of the problem. Five, by focusing on big companies, Miliband ignores the truth, which is that quantitative easing and terrible government planning form the real heart of the problem. So although Labour has identified the right problem, its "solution" is terrible. But there is a Big Idea available here, and any party could seize upon it. What we need is for the Office for National Statistics to draw up an Essential Goods Index, which would be just like the regular retail price index, except that its basket of goods should reflect purchases and living costs only by those on average incomes or below. Because the index would reflect all the basic goods that ordinary families depend on such as housing costs, bread, chicken and the cost of energy, politicians couldn't game the system. As policies go, it's brilliant. It's virtually costless. It's honest. It focuses attention on the true victims of this recession. Such an index wouldn't be hard to construct – they're my personal sphere of expertise (in 2001 I created the LEBA Power index, which remains the industry benchmark because it is incapable of being manipulated). If Miliband would like to pick my brains on creating an Essential Goods Index, I'd be happy to help. Best of all, the only way for politicians to respond to the new index would be with policies that actually worked. Abolishing the insanity of quantitive easing, which only serves to inflate asset bubbles and prices. Encouraging housing supply without encouraging unsustainable demand. Increasing power generating capacity in affordable ways. Improving public transport without huge vanity projects (HS2, I'm looking at you). An Essential Goods Index is so clearly necessary it's bewildering it doesn't already exist … except that politicians are no doubt nervous of the truths it would make plain. QE doesn't work. Inflating property bubbles is stupid. Fostering a banking industry whose giants are still too big to fail and which continue to lend too little to British business is even stupider. Solve those problems, Ed Miliband, and you've got my vote. | |||||||||||||||||||||

| Monex precious metals review: Gold falls $39 Oz, Silver $0.72 Posted: 02 Nov 2013 05:00 AM PDT Monex spot gold prices opened the week at $1,352 . . . traded as high as $1,361 on Monday and as low as $1,306 on Friday . . . and the Monex AM settlement price on Friday was $1,313, down $39 for the week | |||||||||||||||||||||

| Posted: 02 Nov 2013 05:00 AM PDT It appeared the US dollar was bottoming in the first half of October. We had noted the possibility of head and shoulders reversal patterns in sterling and the Swiss franc. These proved for naught, and yet, it still appears the dollar is carving out a bottom. The technical tone for the greenback has improved in recent days. There has also been a shift in the fundamental focus toward somewhat better news from the US and somewhat poorer news from Europe. There is mounting speculation that the European Central Bank will have to have some sort of policy response to the continued decline in private lending, weak growth in money supply, and near record low inflation. The Dollar Index, which despite the fact that it is not reflective of US trade flows (two of the US' 4 largest trading partners, China and Mexico, are not included, and it is | |||||||||||||||||||||

| Indirect Exchange : The Gold Standard Posted: 02 Nov 2013 04:30 AM PDT Mises.org | |||||||||||||||||||||

| Gold And Silver – Fundamentals Do Not Matter Posted: 02 Nov 2013 01:29 AM PDT If fundamentals mattered, gold and silver prices would be substantially higher. They are not, and for a reason. It is not hard to define what factors are influencing price, for they are political, even criminal under normal circumstances. These factors are, in two words: central bankers. The money changers still have a stranglehold on the financial system, and nowhere it is more evident than in the price of gold. Will it end? Yes, but as has been the biggest mystery, no one knows when?! While the golden grip continues, it is inexorably loosening. The United States, and by extension, the United Kingdom, is fast becoming more and more isolated. First, it was the natural opposition, Russia, China, morphing into the BRICS. Unable to sustain their no longer warranted arrogance, the Western alliances are now falling apart. Note the cover from Die Zeit, symbolic of the growing attitude of the rest of the world toward the US:

It was not enough to give the stiff arm to Germany when its representatives came to inspect its own gold, purportedly held in New York. "Nein, nein, Sie konnen nicht es sehen." "You cannot see it, but not to worry, we will deliver half your gold in seven years," the Germans were told, after the insulting rebuke. This is evidence of the growing in- fighting going on, and the revelation of NSA spying has driven a wedge even further. It is paramount for Western central bankers to keep the façade of owning tonnes of gold alive, for once it gives way, all control is lost. The unilateral actions on the part of the US ensures the eventual collapse of the existing fragile unity. Of course, the core reason lies in the massive creation of digital "dollars" that are now being rejected en masse by the largest creditors holding Federal Reserve [soon to be junk] bonds. The world is finally rejecting the US exporting its destructive inflation, via the Federal Reserve "dollar." Continuing stories of one country or another increasing its gold imports has not been of significance, relative to the current price of gold. It may make for attention-grabbing articles, but the impact is nil. The direction for price is solely in the diminishing control of the New World Order via Basel down through the IMF and then central banks. If ever a picture were worth a thousand words, it is this one of the dwindling registered gold stocks, the top graph, and the clincher graph below it showing the number of claims, almost 56 paper "owners" laying claim for each ounce of gold. This Gordian Knot cannot be resolved. It does not require much imagination to guess what will happen when 56 claims are made for each ounce. If ever you want to see a simple graphic of supply v demand, this one encapsulates it all.

However unrealistic one may view the charts of the bogus paper pricing mechanism viewed on the COMEX, they still function as a loose barometer for the current direction of gold and silver, and by default, they will act as the weather vane until displaced by some other basis of reality. No matter how bullishly one reads the ample news, in support of the demand for gold, it is not being translated into higher prices, as evidenced by the charts. This is why we see little value in parroting the same kinds of positive developments in the news. What is not being recognized sufficiently is the reality of the central banks maintaining control, even as it slips away, little by little. October paints a more positive picture in the fight to rally price higher. After an attempt to decline under August and September, a rally did ensue. The negative aspect to the last bar is how sellers kept the range relatively small, proof that buyers are not able to wrest control away. The ability to sustain the October performance is tenuous, going into November. Bulls have another month to demonstrate that the demand factors are going to translate into higher prices. The takeaway from last week's negative outside range bar is that buyers have a few weeks to defend the swing low, at 2, and then create a higher swing high, above 1, and change the trend to the upside. Buyers are still not meeting this burden, but points 1 and 2 are a show of effort. D/S = Demand over Supply on the rally bar attended by the highest green volume bar since mid-August. This is the kind of bar you will see buyers defend, on a retest. Three TDs later, [Trading Days], there was another relatively strong rally bar, and the low of that bar is minor support. It also coincides with a half-way retracement of the October swing low to late October swing high. Friday's close was mid-range the bar, indicating balance between buys and sellers. Given that Friday was the third day of decline, it is a minor plus that buyers showed up to keep price from declining any further. What is common to all three charts is the necessity for buyers to meet the burden of proof in shifting the trend from down to up. There is a degree of effort seen in the daily chart by virtue of a sideways trend. This is a first step in stopping a down trend that could possibly lead to an up trend. Time and price will tell. The relatively smaller range of October, combined with a neutral close and following a decline month for September, fits into the context of the strong, wide range rally of August, making the last two months a weak retest of that rally. Again, fundamental news is not driving price directionally for PMs. The fact that India is on track to purchase 6,000 tonnes of silver, this year, compared to just 2,000 tonnes for all of 2012, is a clear sign that overtly bullish news is not impacting the market, at least not for now. Ultimately, it will, but for now, the charts ain't buying it. For as long as the sideways TR, shown in the box, remains intact, holding above the TR at the lows from June/July, this has bullish connotations. That may be all well and good, for the present, but buyers need to step up their game. It is that simple. What matters on the daily chart are the last three bars. We already know price is languishing at these lower levels. What is to happen for the near term, moving forward? Price has been in a TR since early September. 23.50 is the upper bound, 20.50 is the lower bound. Wednesday's rally, 3rd bar from the end, was on high volume, ostensibly bullish as price rallied into recent high ground for October. Next day, price opened much lower, erasing the positive volume, and actually making it negative, for it trapped all those who were on the buy side of that volume. Thursday's bar, 2nd from end, was even wider range down with a poor close and on equally high volume. Clearly, sellers took control, but in a trading range, it may not be as meaningful. How to read Friday's small range bar? On the one hand, what happened to the sellers' momentum carrying price lower? It stopped, cold. On the other hand, the small range at the lower end of the bar tells us buyers were unable to rally price and extend the range higher, beyond the positive aspect of stopping the selling activity. The mid-range close on the bar, and just about unchanged from the previous close, tells us buys and sellers were in balance. That gives a tenuous edge to buyers for showing an ability to halt the sell-off. No one knows how it will develop by Monday's opening, but we know if buyers do not show up, sellers will have another easy time pushing price lower. The entire discussion has been focused on paper futures. We always add that continual buying of the physical metals should be an ongoing habit. It is impossible to know when instability will take over and align price with the reality of well known demand factors. When that does occur, the availability, not just of these great prices but for the metals themselves, may disappear overnight, for some period of time. Keep accumulating physical gold and silver, and make sure you maintain physical control, as well. Do not, under any circumstances, trust banks, and for sure, not safety deposit boxes. | |||||||||||||||||||||

| Posted: 02 Nov 2013 12:12 AM PDT In this article, I will feature one business services company that has seen intensive insider selling during the last 30 days. Intensive insider selling can be defined by the following three criteria:

Synnex Corporation (SNX) provides distribution and business process outsourcing services to resellers, retailers, and original equipment manufacturers primarily in North America. (click to enlarge) Insider selling during the last 30 days Here is a table of Synnex' insider-trading activity during the last 30 days.

| |||||||||||||||||||||

| Comex Deliverable Gold Falls to 658,443 Ounces Posted: 01 Nov 2013 11:01 PM PDT Le Cafe Américain | |||||||||||||||||||||

| SD Weekly Metals & Markets: Finland Says Up To 50% Of Gold Leased Out! Posted: 01 Nov 2013 10:38 PM PDT

On this week’s Metals & Markets Wrap we’ll cover: US Mint halting the sale of silver eagles for 4 weeks- premiums already rising Blatant gold and silver bombing this week surrounding release of FOMC minutes Silver market trends: look for premiums to continue to rise Finland’s bombshell: Bank of Finland reveals 50% of gold reserves [...] The post SD Weekly Metals & Markets: Finland Says Up To 50% Of Gold Leased Out! appeared first on Silver Doctors. This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||

| Silver author David Morgan says new Fed chief Janet Yellen is great news for silver prices Posted: 01 Nov 2013 08:26 PM PDT Silver author David Morgan from the Morgan Report chats with Cambridge House Live’s Vanessa Collette about Janet Yellen’s arrival at the US Federal Reserve and what her appointment will mean for the price of silver. China and India are boosting gold demand to record levels and this will also boost silver in the long run. Mr. Morgan was a very early buyer of silver and has already racked up some enormous profits from silver investing. But the best is yet to come… | |||||||||||||||||||||

| Silver Tutorial With David Morgan Posted: 01 Nov 2013 05:30 PM PDT Andy Hoffman joins David Morgan to discuss gold and silver, tapering, China, Ben Bernanke, the new Fed Chairman Janet Yellen. They discuss the cost and production of gold and silver and the demand. To listen to the podcast, please click the link below: Silver Tutorial With David Morgan Similar Posts: | |||||||||||||||||||||

| Top TSX gold companies swing back hard Posted: 01 Nov 2013 04:37 PM PDT See which gold companies did better and worse in a hard week for the price of gold. We tabulate a week of decline. | |||||||||||||||||||||

| Why gold prices don't reflect fundamentals - Phillips Part 4 Posted: 01 Nov 2013 03:37 PM PDT Gold markets are inefficient, unreflective of fundamentals & understate the metal's market value, writes Julian Phillips. | |||||||||||||||||||||

| Posted: 01 Nov 2013 03:13 PM PDT | |||||||||||||||||||||

| West distorts bullish Chinese gold news, Kaye tells KWN Posted: 01 Nov 2013 03:03 PM PDT GATA | |||||||||||||||||||||

| Posted: 01 Nov 2013 02:54 PM PDT

Many analyst writers choose the Black Swan analogy to describe deeply ominous events in progress, with little forward notice. The analogy simply does not fit anymore, as an armada of black swans is more appropriate, spotted on regular and frequent sightings. The US financial fortress died in September 2008. The Grand Paradigm Shift is in [...] The post Jim Willie’s Stunning Claim: The Game is Over. King Dollar is Dead! – Gold to $7,000 Silver to $250+! appeared first on Silver Doctors. | |||||||||||||||||||||

| US Mint Alerts Primary Dealers Silver Eagle Production to Be Halted for 4 Weeks! Posted: 01 Nov 2013 02:00 PM PDT

SDBullion has learned from industry contacts that the US Mint alerted its Primary Dealers Thursday that The Mint is halting its weekly allocation of 2013 Silver Eagles, and will be suspending all sales of ASEs for 4 weeks! *Updated 2:30pm EST: Silver Eagle shortage already underway as primary dealer wholesalers have taken the rare step [...] The post US Mint Alerts Primary Dealers Silver Eagle Production to Be Halted for 4 Weeks! appeared first on Silver Doctors. | |||||||||||||||||||||

| China imports another 109 tonnes of gold in September Posted: 01 Nov 2013 01:43 PM PDT China is maintaining its high gold import levels via Hong Kong with another 109 tonnes via this route recorded in September, 0.8 tonnes down on the August figure. But is this all the gold it imports? | |||||||||||||||||||||

| Porter Stansberry: What you really need to know about Ben Bernanke and the next Fed chair Posted: 01 Nov 2013 01:23 PM PDT From Porter Stansberry in Stansberry's Investment Advisory: Last month, we lost a great friend – Ben Bernanke. No other Federal Reserve chairman in history did so much to improve the fortunes of this newsletter or its founder. What could have inspired more Americans to turn to a hard-money, alternative source of financial insight, than a Fed chairman dedicated to destroying the purchasing power and savings of his fellow citizens? And who, besides that priceless naïf with his printing press, could have done more to provide easier, safer, and more obvious ways of increasing my personal wealth? Bernanke permitted and encouraged the largest housing bubble in history. Its inevitable collapse allowed me to buy rental real estate paying yields in excess of 20% and trophy properties in Miami Beach for prices last seen 15 years ago. In his first major policy speech after joining the Federal Reserve Board of Governors in 2002, Bernanke spelled out that an enormous inflation was on the horizon, as it was the only sensible solution to our country's massive debt load. If the Treasury issued debt to purchase private assets and the Fed then purchased an equal amount of Treasury debt with newly created money, the whole operation would be the economic equivalent of direct open-market operations in private assets... essentially equivalent to Milton Freidman's famous "helicopter drop" of money. Bernanke's speeches allowed anyone with ears and gray matter between them to lever up into hard assets, like gold, silver, oil, and farmland – trades that have been unbelievably profitable. And for the very, very rich... Bernanke did even more, God bless him. Bernanke dropped real interest rates well into negative territory. That allowed the world's wealthiest capitalists – like renowned investor Warren Buffett and Stephen Schwartzman, head of the private-equity firm Blackstone Group – access to unprecedented amounts of capital at rates of interest that literally paid them to borrow. They did the only logical thing... they responded with a wave of leveraged buyouts that dwarfed every other private-capital cycle in history. Immediately following Bernanke's ascension to the Fed chairman's seat in February 2006, U.S. private-equity firms bought out 654 U.S. companies, spending $375 billion (of mostly borrowed money) in just over a year. To give you some idea of the scale of this Bernanke-led boom, this series of deals involved 18 times more money than all of the private-equity deals done in 2003. This was a massive aggregation of wealth. Almost none of these deals would have been possible without Ben Bernanke's policies. And he was as good as his word. When the debt bubble finally burst, Ben did exactly as he promised he would. He matched the Treasury's deficit spending with newly created money and bought more than $3 trillion worth of Treasury bonds and mortgage bonds. At the end, Ben's policies had grown so completely out of control, it was possible for Brazilian entrepreneurs to borrow immense sums at such low rates that they began buying out iconic American brands, literally our country's greatest businesses – like Budweiser and later Heinz. The Chinese, powered by the same wave of Bernanke dollars, opted to begin buying out our oilfields. Soon, we believe, they will begin buying private homes. Yes, for rich people all around the world, Ben has been a living saint. Thank you, Ben! We couldn't have done it without you! None of us ever thought we'd be quite this rich... or end up owning all of those incredible assets. That's why, on my plane, we say a simple prayer to Ben before every flight. Dear Ben, thank you so much for providing us with nearly limitless risk-free ways of growing our capital. Please, never for a minute doubt your ability to "help the economy" by printing more money, thereby making us so, so much wealthier. Never consider whether or not it's fair or proper for the government to impoverish millions so that the very privileged few can gain so generously. And never worry that what you've done will someday lead to a massive inflation and a collapse of the whole paper money system. While gas prices are making it more expensive to fly this jet, we understand the need to do our part. You can count on us, dear Ben. Amen. Meanwhile, the people whom Ben fleeced – the workers, the savers, the few Americans left with simple industry and thrift, the kind of folks who would never have believed the government would actively try to hurt them – have been wiped out. They've seen the real value of their wages, savings, and standard of living decline by huge amounts. We doubt the validity of the U.S. government's various measures of inflation. They've been "adjusted" so many times over the years that they're nearly meaningless. But consider the following graphic of indicators, which are real and "unadjusted." They show in simple, stark terms exactly what Bernanke did to our economy. Most of our indicators are self-explanatory. They show how much the price of some basic goods have risen since Bernanke took over as Fed chairman. And for comparison... we've also included how much the U.S. government's total obligations ("Fed Debt") have swollen. And we've included the increase in the Federal Reserve's balance sheet – our economy's monetary base. It's clear... as the number of dollars increased, each one bought less and less…  And our assets are worth less, too... Now look at a few other indicators. The "S&P in Gold" is the change in the value of one share of the S&P 500, if you measured the stock index in gold ounces rather than dollars. We believe this is a better measure of the actual value of U.S. corporate assets because it measures their value in a sound currency (gold) rather than in paper. And we included the share price of Citigroup. As head of the Federal Reserve, Bernanke's primary regulatory duty was to police the large banks and to protect their depositors. We think the near total destruction in equity value of what was the largest U.S. bank when he took over at the Fed speaks volumes about how well Bernanke did his job.  Bernanke gutted the dollar. He gutted the middle class. He gutted the savings of millions. And he greatly impoverished our country. And yet... despite it all... Ben Bernanke is still being proclaimed a hero of the Republic. "When faced with potential global economic meltdown, he has displayed tremendous courage and creativity," said Barack Obama at a White House news conference this week. "He took bold action that was needed to avert another Depression." The USA Today newspaper added "Bernanke, a shy and self-effacing former Princeton professor, boldly led the U.S. economy through the worst financial crisis since the Great Depression." And because there's nothing genuinely good to say about the guy, as is typical with worthless government officials leaving the scene... the plaudits quickly spill over into maudlin absurdity: "Guiding the economy was like brain surgery, and you needed an expert to do it," claimed Michael Gertler, a New York University professor of economics. We know what to expect from the Federal Reserve. Its policies will continue to support and promote the incredible profligacy of our country's government. These policies will, in the end, cause unbelievable harm to millions of Americans. They will devastate the average standard of living in our country and leave a great many people in abject poverty. We can only warn you about what is happening and what it really means. Crux note: Porter will soon share the secrets of how to use Ben Bernanke's absurd policies to grow incredibly wealthy in a first-ever LIVE event. It's unlike anything we've ever done before in the history of S&A… and unlike any event you've attended before. Think of the very best TED talks, the Value Investors Conference, Berkshire Hathaway's Annual Shareholder Meeting, the Jim Grant Conference and so much more… all rolled into one blow-your-mind-away "mega-event." Porter and his personal advisors, S&A analysts and editors, big-name outside entertainers, master sportsmen, and other surprise guests are all converging on Miami, Florida this February. And now you have a chance to join them... The exclusive event will be limited to the first 1,000 people who respond. If you'd like to learn more about how to use Ben Bernanke's warped policies to radically improve your life and increase your wealth - from Porter Stansberry himself - click here now. More from Porter: | |||||||||||||||||||||

| Gold market report: Gold and Silver Prices Move Sideways Posted: 01 Nov 2013 01:21 PM PDT The event of the week was the FOMC meeting on Wednesday, which actually said nothing of any substance. This was hardly surprising, given the impending change of chairmanship; however it triggered a rally in the US dollar as dollar bears rushed to close, and gold fell $20 from $1355 to $1335 in less than half an hour.The price continued to drift lower yesterday (Thursday) closing at $1323. The consensus now appears to expect tapering following the March FOMC meeting. However, for that to happen, the economy will have to recover, unemployment will have to fall and the Fed will have to revise its forward guidance on interest rates. Therefore, those that expect tapering must be reflecting optimism about economic prospects. There was little in the way of solid news this week, with gold being on the other side of the dollar trade: when high frequency traders and hedge funds see the dollar rallying, they sell gold, and vice-versa. The problem with this sort of trading is that it is essentially mechanistic, losing sight of deeper considerations of relative value. This is why new factors, even though they may not be very significant in themselves, can have a disproportionate effect on prices. It also explains why traders in the paper markets can ignore fundamental developments, such as the overwhelming demand for physical gold from China and Asia generally, for extended periods of time. Besides the independent direction of paper gold and silver markets relative to bullion demand, loose thinking over the tapering issue needs to be resolved. Expect commentators in the coming weeks to address the inconsistency between expectations over tapering and the Fed's longer-term commitments to low interest rates. This has to be put in the context of the economic outlook, which for the Fed's FOMC is still far from clear. Next week Monday. UK: Halifax House Price Index, Tuesday. Eurozone: PPI. Wednesday. Thursday. Japan: Leading Indicator. Friday. UK: Trade Balance (non-EU), Visible Trade Balance (World).

| |||||||||||||||||||||

| John Butler: The Real Earthquake In Financial Markets Is Yet To Come Posted: 01 Nov 2013 01:00 PM PDT

In part 1 of this supurb interview with Lars Schall, London based investment manager and author John Butler discussed how the dollar reserve equilibrium is breaking down as the world moves away from the US dollar as reserve currency, and towards gold and the yuan. In this MUST WATCH 2nd installment, Butler discusses the ongoing [...] The post John Butler: The Real Earthquake In Financial Markets Is Yet To Come appeared first on Silver Doctors. | |||||||||||||||||||||

| Posted: 01 Nov 2013 12:39 PM PDT Based on the October 31st, 2013 Premium Update. Visit our archives for more gold & silver articles.

In our previous essay we took a closer look at the situation in silver and mining stocks (precisely: SLV and GDX ETFs) and discussed how it may translate into the precious metals market. As we wrote in the summary:

(…) when we factor in the impact of (…) silver’s cyclical turning point, which is just around the corner, and the fact that the short-term resistance lines have already been reached in case of the GDX ETF, we can presume that the top of the recent upward move in the precious metals may be already in (or is very close to being in).

After that essay was published, silver moved slightly above the medium-term declining resistance line on an intra-day basis, but didn't manage to hold these gains. Therefore, it’s quite possible that we have already seen the impact of silver’s cyclical turning point on the white metal. Additionally, the GDX ETF quickly invalidated the breakout above the 50-day moving average and the 38.2% Fibonacci retracement level. When we take into account the recent price moves in both, we can conclude that our projections from the previous essay's summary remain in place.

These circumstances have encouraged us to focus on the most interesting asset – gold. Does it confirm the indications for silver and mining stocks? To see what we can expect in the gold market, let us move to the world of charts. Today, we will start with the yellow metal’s very long-term chart (charts courtesy by http://stockcharts.com.) Once again, we see that the situation hasn't changed much from this long-term perspective. It was bearish as gold had already broken below the long-term rising support line and this breakdown wasn't even close to being invalidated this week.

Please note that in 2008, when gold moved higher before plunging for the final time, there were several intra-week attempts to move higher after which gold finally declined. Therefore, a double top pattern should not surprise us here.

Actually, we've recently seen a similar pattern on a smaller scale. It's more visible on the short-term chart. Let's take a look. On the above chart we can see two things:

The first point has bearish short- and medium-term implications and the second one has bearish short-term implications.

Either way, the outlook remains bearish.

Before we summarize, let's take a look at the chart featuring gold's price from the non-USD perspective. Looking at the above chart, we see that from this perspective, the situation is quite unclear. On the one hand, we might see a post-double-bottom rally. However, on the other hand, a pullback might be nothing more than a confirmation of a breakdown that we saw begin in mid-September.

The non-USD gold price moved to its declining resistance line (similar to the USD gold price) and declined. In this case we are taking the weekly closing prices into account. Naturally, we could see a move up to 51 on the above chart and the medium-term outlook would remain bearish, but it's not that likely that we will see an additional rally.

Summing up, the medium-term outlook for gold remains bearish and, at this time, the short-term outlook is bearish as well. It seems that the precious metals sector reversed direction this week right after moving to the declining resistance lines. We can see this important event in gold, silver and mining stocks. From this point of view, it might be the case that the next major downleg has already begun and it seems likely that we will see at least a short-term downswing shortly.

To make sure that you are notified once the new features are implemented, and get immediate access to our free thoughts on the market, including information not available publicly, we urge you to sign up for our free gold newsletter. Sign up today and you’ll also get free, 7-day access to the Premium Sections on our website, including valuable tools and charts dedicated to serious Precious Metals Investors and Traders along with our 14 best gold investment practices. It’s free and you may unsubscribe at any time.

Thank you for reading. Have a great and profitable week!

Przemyslaw Radomski, CFA Founder, Editor-in-chief Gold Price Prediction Website – SunshineProfits.com * * * * * About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing. Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | |||||||||||||||||||||

| Posted: 01 Nov 2013 12:28 PM PDT Al Jazeera released a TV interview with Nick Barisheff, CEO of Toronto based Bullion Management Group and author of the book “$10,000 – Why gold’s inevitable rise is the investor’s safe haven” Bullion Management Group has close to 0.5 billion of dollars worth of assets. Barisheff explains why he thinks gold could go to $10,000 in this decade and what the real value is of gold. Coincidence or not, the video is not accessible in the US. That is why we are providing the transcript in this article of the most important elements of the interview. Gold is not paying any dividend or interest so what is the usefulness as an investment?

Is gold a commodity or a monetary asset?

Gold’s outlook: $10,000 gold or the inflation adjusted $720 per ounce?

Does the world need currencies linked to commodities?

Nick Barisheff was several times a guest on GoldSilverWorlds. Some excellent readings which fall in the “must read” category: | |||||||||||||||||||||

| Did The Wall Street Journal Publish Blatant Lies About The Gold Market? Posted: 01 Nov 2013 12:00 PM PDT

Over the past year or so there has been a very aggressive attempt by Wall Street and the financial media to discredit gold as both an investment and a store of value against the intentional devaluation of the U.S. dollar by the Federal Reserve and the Government. As a perfect example of this, the Wall [...] The post Did The Wall Street Journal Publish Blatant Lies About The Gold Market? appeared first on Silver Doctors. | |||||||||||||||||||||

| China’s Appetite for Gold: “Waning” or Surging? Posted: 01 Nov 2013 11:06 AM PDT Bloomberg's latest report on Chinese gold imports is a great illustration of a journalist's power to shape a message by extracting certain data points and ignoring others. Here's the article: