Gold World News Flash |

- Society is ripe for collapse! – Greg McCoach Interview

- GOLD, SILVER & BITCOIN: A Rebel’s Portfolio?

- Maguire – Gold War Heats Up As Stunning Events Taking Place

- Guest Post: Yellenomics – Or The Coming Tragedy of Errors

- The dead end of interventionism

- Ebay Expands Accepted Digital Currencies, Says PayPal May One Day Incorporate BitCoin

- Buying Time In A Brought-Forward World... And Why There Is No Plan B

- Guest Post: Finland's Gold

- Three Dimensions of the Investment Climate

- The Macro Analytics: A Technical Update

- Large Forex Speculators Were Bearish on US Dollar Into Late October Bottom, COT Report

- Maguire - Gold War Heats Up As Stunning Events Taking Place

- Disappearing Deliverable Comex Gold Bullion

- Gold? What Gold? The Great 56:1 Imbalance

- Easy Money Is Again Leading To Bubbles – Courtesy Of Central Banks

- Coming Clean, Dr. Joseph Farrell – Covert Wars & The Mysterious Strength of the US Dollar

- Probes into forex trading spread across globe

- Much of West's gold is oversubscribed and unrecoverable, von Greyerz says

- LBMA Collapse To Expose US, Europe & BIS Gold Is Gone

- Weekend Report: Dollar Surge

- Gold Investors Weekly Review – November 1st

- This Past Week in Gold

- China uses paper gold smashes to drain London market, Maguire says

- Conspiracy And The Threat To Democracy

- U.S. Dollar Surge Implications

- Entire Fiat Money System is Bankrupt: Demise of the Global US Fiat Dollar Reserve Currency

- Gold And Silver - Fundamentals Do Not Matter

- Does the U.S. Dollar Have a Future?

- WEEKEND REPORT: DOLLAR SURGE

- Gold And Silver Price – Fundamentals Do Not Matter

- Gold And Silver – Fundamentals Do Not Matter

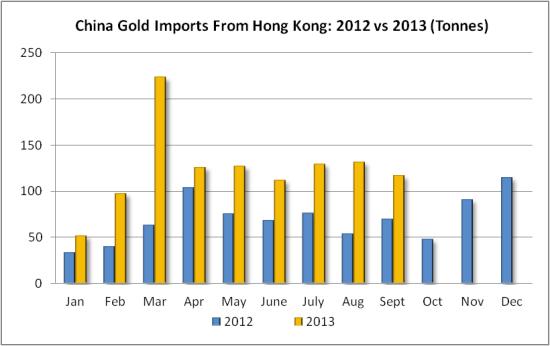

- Chinas Appetite for Gold: Waning or Surging?

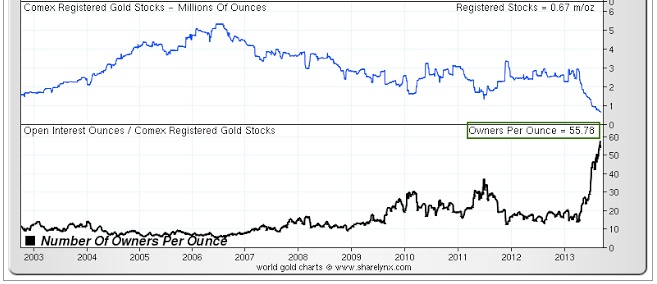

- Comex Deliverable Gold Falls to 658,443 Ounces, Claims Per Deliverable Ounce at 55

- Comex Deliverable Gold Falls to 658,443 Ounces, Claims Per Deliverable Ounce at 55

- China's Appetite for Gold: 'Waning' or Surging?

- Both Silver and Gold Prices Closed Lower this Week

- Both Silver and Gold Prices Closed Lower this Week

- FDIC, BoE brew ‘bail-in’ plan for banks, depositors

- Maguire - Big Banks In Trouble As Major LBMA Default Nears

- Gold Daily and Silver Weekly Charts - All Saints

- Gold Daily and Silver Weekly Charts - All Saints

- GATA Chairman Murphy interviewed by Kitco News

- 12 Reasons Why Gold Should Bounce Sharply Higher in 2014

- What Is Gold Really Worth

- Euro heads for worst week in 16 months on ECB bets

- West distorts bullish Chinese gold news, Kaye tells KWN

- Barclays said to suspend chief FX dealer, two others amid probe

- The Daily Market Report: Gold Slumps as Dollar Gains Mount

- China’s Appetite for Gold: “Waning” or Surging?

- Huge Cracks In US Financial Fortress, Petro-Dollar Final Death Throes

| Society is ripe for collapse! – Greg McCoach Interview Posted: 04 Nov 2013 12:00 AM PST from cambridgehouseintl: | ||||||||||||||||||||||||

| GOLD, SILVER & BITCOIN: A Rebel’s Portfolio? Posted: 03 Nov 2013 08:45 PM PST

Physical gold and physical silver are precious tangible assets, and both of these monetary metals have been treated to a rough patch in price over the past couple of years. Sure, this makes them an even better buy, but the real salt in the wound for silver & gold bugs is the price action in the crypto currency Bitcoin, which has skyrocketed from around $9 to a current price of around $200 this year alone. That’s the price action we ought to have seen in silver if it traded as freely as Bitcoin. In this interview with Justin O’Connell from GoldSilverBotcoin.com we try to get to the bottom of what’s causing Bitcoin to rise so high, and ask the fundamental question: Should Bitcoin be a part of a monetary rebel’s portfolio? | ||||||||||||||||||||||||

| Maguire – Gold War Heats Up As Stunning Events Taking Place Posted: 03 Nov 2013 08:00 PM PST from KingWorldNews:

Obviously when you get price discounts like this, wholesale demand rapidly increases. I think that we would see sovereign and central bank demand certainly coming in in the low $1,300s here — anticipating that this might be a possible bottom. If there was any breach of $1,300, it would be short-lived. As we've discussed before, central bank and sovereign buying ramps up exponentially once we ever cross that line. | ||||||||||||||||||||||||

| Guest Post: Yellenomics – Or The Coming Tragedy of Errors Posted: 03 Nov 2013 05:35 PM PST Submitted by Pater Tenebrarum of Acting-Man blog, Keynesian Paradigm to Be RevivedWe have come across a recent article at Bloomberg that discusses the philosophical roots of Janet Yellen's economics voodoo. This seems in many ways even more appalling than the Bernanke paradigm (which in turn is based on Bernanke's erroneous interpretation of what caused the Great Depression, which he obtained in essence from Milton Friedman). Janet Yellen, so Bloomberg informs us, was a student of the Keynesian James Tobin at Yale, the economist whose main claim to fame these days is that a tax is named after him. Tobin, like other Keynesians, was an apologist for central economic planning, which made him eligible for the central bank-sponsored Nobel Prize in Economics. He was undoubtedly a man after the heart of the ruling class. It is therefore not a big surprise that one of his students gets to run the Federal Reserve, which is one of the main agencies, if not the main agency, by which the rule of money power and central economic planning are perpetuated. It should be noted that the inflationist who runs the central bank of Argentina, Mercedes Marco del Pont, was also trained in Yale. Marcos del Pont once asserted sotto voce in a speech that the enormous ongoing plunge in the purchasing power of the Argentine peso was not a result of her incessant massive money printing. Since she didn't deign to explain what actually causes it then (foreign speculators perhaps? Just guessing here…), it presumably is just a case of 'sh*t happens'. This just as a hint as to what can be expected from economists trained at Yale. From the Bloomberg article:

(emphasis added) Naturally, the Bloomberg article neglects to mention that Tobin's toxic advice to Kennedy laid the foundation for the later Nixon gold default and the roaring 'stagflation' of the 1970s. What is not surprising though is that one of the witch doctors advising Shinzo Abe on his hoary inflationist policies also turns out to be a Yalie indoctrinated by Tobin. The only good thing we have to say about this particular circumstance is that it will accelerate the inevitable collapse in Japan, and thus perhaps bring forward the moment in time when unsound debt and malinvestments in Japan are finally liquidated. Unfortunately it is to be expected that this will involve massive theft from Japan's savers and bring misery and misfortune to millions, as the statists will no doubt try everything to save the present system. The eventual confiscation of the citizenry's wealth is undoubtedly high on their agenda for dealing with 'fiscal emergencies' (for proof, see the recent proposals by the IMF, which are more than just idle thought experiments. They are the blueprint for what we must expect to happen down the road).

Keynesian economist James Tobin – he looks harmless enough, but was a wolf in sheep's clothing. There is no government intervention in the economy he didn't like or recommend. His work was directly responsible for the catastrophic 'stagflation' of the 1970s. (Photo via AFP / Author unknown)

The Economic Illiteracy of the PlannersBloomberg also brings us a brief excerpt from a speech Ms. Yellen delivered on occasion of a reunion of the Yale economics department. The excerpt perfectly encapsulates her and the department's philosophy (which is thoroughly Keynesian and downright scary):

(emphasis added) She couldn't be more wrong if she tried. We cannot even call someone like that an 'economist', because the above is in our opinion an example of utter economic illiteracy. First of all, the premise she proposes is completely mistaken. The unhampered market economy is the only economic system that can guarantee maximum employment. Only in an economy where there is no intervention in prices and wages at all will all those who want to work actually find work. It is precisely because the state intervenes in the economy and fixes wages and prices that perpetual institutional unemployment exists. In other words, she has things exactly the wrong way around. Of course, we may concede that in a complete command economy, unemployment can be made to disappear as well – along with all traces of freedom, human dignity and wealth. There was no unemployment under Stalin, but we doubt that his army of slave laborers such as that he forced into digging the Baltic-White Sea canal was particularly happy. Of course Ms. Yellen's contention that the class of philosopher kings to which she belongs “has the knowledge and ability to improve macroeconomic outcomes rather than make matters worse”, must be answered with a resounding 'No'! The historical record of interventionism speaks for itself: it is a history of constant, recurring failure, that quite possibly has thrown back economic and technological progress by decades, perhaps even centuries. It can not be otherwise; if it were otherwise, then socialism would work, but socialism demonstrably cannot work. The same problem that makes socialism a literal impossibility – the calculation problem identified by Mises in 1920 – applies in variations to all attempts at economic planning. Central banks are a special case of the socialist calculation problem as it pertains to the modern financial and monetary system (see also J.H. De Soto's work on this point). Similar to the planners of a putative socialist economy in which the means of production have been nationalized and where therefore prices for the means of production no longer exist, the interventionists populating central banks cannot 'calculate'. They cannot gauge the opportunity costs involved in their actions and compare them to the outcomes, as they are not subject to the market test - the categories of profit and loss have no meaning for them. There is in fact nothing on which such a calculation could be based. It is an absolute certainty that their interventions will result in precisely what Yellen asserts will not happen: they will “make matters worse”. It is simply not possible for a central economic planning agency to 'improve' on a market-derived outcome. The Federal Reserve's handful of board members cannot 'know' what the ideal level of interest rates for the entire market economy is. Only the market itself can determine the state of society-wide time preference, and thereby establish the natural interest rate. The interventions of the central bank are intended to impose an interest rate that deviates from the natural rate, on the absurd theory that a gaggle of bureaucrats 'knows more' than the entire market! The reality of what they know and don't know is amply demonstrated by the outcomes of their policies: the recurring booms and busts that have consistently damaged the economy structurally, and which have finally led to a situation where the economy found itself actually worse off when the last boom ended than it was on the eve of the boom. This demonstrates a rare gift for destruction, as normally credit booms cannot crimp the progress of capitalist economies completely. With the Fed at the helm, it has however apparently become possible now to actually enter a cycle of economic regression. Not only are we worse off than we would have been otherwise, we are now worse off in absolute terms as well. These people know less than nothing, which is to say, they do possess knowledge, but it is in a sense negative knowledge, due to the destruction it brings. Here is Ms Yellen at a post 2008 bust hearing – from a report in the NYT that was dug up by Zerohedge a while ago (here is a link to the audio recording):

(emphasis added) Robert Wenzel among others already reported on Ms. Yellen's absolutely dismal forecasting record. The reason why we are bringing this point up is that it has to be contrasted with the picture painted of her in the mainstream press, where she is regularly portrayed as a veritable Cassandra who foresaw the crash taking before anyone else did – but curiously did absolutely nothing about it, in spite of her position as a Fed governor. For another excellent and very detailed deconstruction of the myth that Ms. Yellen ever knew what she was doing, here is a video by Peter Schiff, who has dug into all the evidence (these days it is luckily very easy to fact-check and expose the lies the media want us to believe). Note that although Schiff is obviously philosophically opposed to Ms. Yellen and everything she stands for, his assessment is very fair. Even so, it is utterly damning:

Peter Schiff on the myth that Ms. Yellen has 'forecast the crisis'. She forecast absolutely nada.

What To ExpectIt will probably be best to prepare the funeral rites for the US economy. The seemingly inexorable lurch toward socialism is going to be taken up another notch with Ms. Yellen's nomination to Fed chair. From the Bloomberg article we learn that Anglo-Saxon central banking socialism is indeed going global these days – and that Ms. Yellen is one of its foremost proponents:

| ||||||||||||||||||||||||

| The dead end of interventionism Posted: 03 Nov 2013 04:55 PM PST "Government Exits Health Care Market" says a headline we'll never see. Nancy "Are you serious?"/"pass the bill" Pelosi and her allies could tell us why. Their statements about the poor and uninsurable notwithstanding, the whole point of the law was not to solve a problem, but to get a bill passed in the name of that problem. Laws rarely if ever achieve the stated aims of the lawmakers, but once a law is on the books it becomes another foot in the door of the economy. Even if it produces spectacular havoc and failure, the intervention itself will not be surrendered. Why? The people who championed ObamaCare are people for whom government is their raison d'etre. To surrender the intervention would be to surrender power, and that kind of thinking has not produced the massive state we live under. Besides, if the people who support government-mandated health care were serious about solving a problem they would not turn it over to the world's number one problem-creator. ObamaCare is already showcasing the inevitable effects of bureaucracy and interventionism. If its level of incompetence is anything like FEMA's Americans will fear routine health checkups more than they do Cat 5 storms. You'll recall it was Hurricane Katrina that launched FEMA from the pages of Catch-22 as we read about rescue personnel diverted to Atlanta for two days so they could be given classes in sexual harassment and FEMA history while people were dying in New Orleans and the U.S. president was telling FEMA head Michael Brown he was doing "a heck of a job." To satirize government one need only report on it, as we saw last year when first-responder FEMA made a first response to a nor'easter by closing its offices. ObamaCare of course is government's answer to government failure. As an intervention, ObamaCare is the suppression of certain voluntary acts and the compulsion of other acts. It's one more area where other people, not you, are in control of your life. The key to the advancement of interventionism is how each stage is publicly perceived. When interventions bring on a crisis, it's critical for interventionists that the free market take the blame. Blame speculators, blame greed, blame Original Sin, blame the other party, but don't blame the government unless you're reprimanding regulators while calling for more or better regulation. The reasoning behind this is straight-forward: If the free market is allowed to breathe, what would it do to the careers of people like Nancy Pelosi, Hillary Clinton, and Kathleen Sebelius - for that matter, any politician or bureaucrat? Thomas DiLorenzo cites a 1992 study by Milton Friedman in which Friedman concluded that the problems in the American health care system are entirely due to government intervention. DiLorenzo writes: Friedman documented how, at the beginning of the 20th century, about 90% of all American hospitals were private, for-profit enterprises. State and local governments then began taking over the hospital industry. So, by the early 1990s only about 10% of all American hospitals were private, for-profit enterprises. Socialism characterizes at least 90% of all hospitals. Many other hospitals have received government subsidies, and with the subsidies come reams of regulation, making them fascist by definition. The effect of this vast government takeover of the hospital industry, Friedman documented, is what any student of the economics of bureaucracy should expect: the more that is spent on hospital care, the worse the quality and quantity of care become, thanks to the effects of governmental bureaucratization. According to Friedman, as governments took over an ever-larger share of the hospital industry (being exempt from antitrust laws), hospital personnel per occupied hospital bed quintupled, as cost per bed rose tenfold. Friedman concluded that "Gammon's Law," named after British physician Max Gammon, "has been in full operation for U.S. hospitals since the end of World War II." Gammon's Law states that "In a bureaucratic system, increases in expenditure will be matched by a fall in production.… Such systems will act rather like 'black holes' in the economic universe, simultaneously sucking in resources, and shrinking in terms of … production." Dr. Gammon surely knew what he was talking about, having spent his career in the British National Health Service. Intervention, because it's always coordinated by political entrepreneurs, preys upon the ignorance of the public. Murray Rothbard, who is still unknown to most of the public, explains how this developed: Orthodox historians have always treated the Progressive period (roughly 1900–1916) as a time when free-market capitalism was becoming increasingly "monopolistic"; in reaction to this reign of monopoly and big business, so the story runs, altruistic intellectuals and far-seeing politicians turned to intervention by the government to reform and to regulate these evils. [Gabriel] Kolko's great work [The Triumph of Conservatism] demonstrates that the reality was almost precisely the opposite of this myth. Despite the wave of mergers and trusts formed around the turn of the century, Kolko reveals, the forces of competition on the free market rapidly vitiated and dissolved these attempts at stabilizing and perpetuating the economic power of big business interests. It was precisely in reaction to their impending defeat at the hands of the competitive storms of the market that big business turned, increasingly after the 1900s, to the federal government for aid and protection. [p. 38; emphasis added] With this understanding it's hardly surprising to find that health care industry lobbyists influenced and wrote the health care law. What blessings does intervention bestow? It keeps headline writers busy. Today it's ObamaCare's website and the cronyism behind its creation (health care intervention), yesterday and today it was and is NSA spying (privacy intervention), before that it was Putin trumping Obama over Syria (foreign intervention), sometime earlier it was IRS targeting of liberty nonprofits (economic intervention), then we have the pseudo-austerity of budget sequestration, the czars, Fast and Furious, Benghazi, the ongoing wars, student debt - youth unemployment, etc. ad infinitum throughout American history. Government meddling also produces government debt, both official and unofficial, which according to economist Laurence Kotlikoff reached $222 trillion in 2011, an increase of $11 trillion from 2010. But the headline writers don't talk about this. Since 1913, a large part of the funding for an expanding government has been brought to us by the monopoly money producer of the U.S., the Federal Reserve, along with its partner in coerced wealth extraction, the Internal Revenue Service. Since their creations both agencies have fine-tuned their craft, with the IRS benefiting from a war to get permanent tax withholding, and the Fed benefiting from a depression it inaugurated when FDR made it a felony for American citizens to own gold money. Taxes, inflation, and debt do not profit most taxpayers. For now the pain is tolerable for most. But there will be a time when it isn't, and they will need an understanding of free markets if they are not to be conned into a new system of economic enslavement to replace the one that goes belly up. | ||||||||||||||||||||||||

| Ebay Expands Accepted Digital Currencies, Says PayPal May One Day Incorporate BitCoin Posted: 03 Nov 2013 04:36 PM PST First it was China hinting that where Silk Road failed in monetizing, pardon the pun, BitCoin, the world's most populous nation could soon take the lead. Then, none other than private equity titan Fortress said it had great expectations for the digital currency. Now, it is eBay's turn to announce that it is preparing to expand the range of digital currencies it accepts, adding that "its payment unit PayPal may one day incorporate BitCoin." But not just yet. FT reports that according to eBay CEO John Donahoe, "digital currency is going to be a very powerful thing."

While traditional retailers have so far balked at even the vaguest idea of considering allowing BitCoin as a viable payment method, all that would take to start a seismic shift in perception would be one angel idea "investor" to show that it can be done. That someone may well be eBay, which in a radical attempt to curry favor with "fringe" buyers and sellers, could open up its ecommerce platform, which started as an auction side for small traders, but may well become something far bigger.

Paradoxically, the more accepted BitCoin becomes in the conventional marketplace, the more subject to various forms of mandatory regulation, supervision and enforcement it, its purchases, and its users will be. So will BitCoin ultimately become a victim of its own success? That remains to be seen, although what we do know is that neither eBay nor anyone else tightly embedded within the monetary fiat framework, is even close to contemplating expanding the Petrodollar cycle to include gold or other precious metals as viable legal (or illegal) tender. | ||||||||||||||||||||||||

| Buying Time In A Brought-Forward World... And Why There Is No Plan B Posted: 03 Nov 2013 03:45 PM PST Here we go again, creating another asset bubble for the third time in a decade and a half, is how Monument Securities' Paul Mylchreest begins his latest must-read Thunder Road report. As Eckhard Tolle once wrote, “the primary cause of unhappiness is never the situation but your thoughts about it," and that seems apt right now. After Lehman, policy makers went “all-in” on bailouts/ZIRP/QE etc. This avoided an “all-out” collapse and bought time in which a self-sustaining recovery could materialise. The Fed’s tapering threat showed that, five years on from Lehman, the recovery was still not self-sustaining. Mylchreest's study of long-wave (Kondratieff) cycles, however, leaves us concerned as to whether it ever will be. More commentators are having doubts; and the problem looming into view is that we might need a new "plan." The (rhetorical) question then is "Have we really got to the point where it's just about more and more QE, corralling more and more flow into the equity market until it becomes (unsustainably) 'top-heavy'?"

Policy makers are pushing monetary systems and experimental policies to their limit, so shouldn’t we consider the possibility of correspondingly extreme outcomes in financial markets in due course... cause and effect?

No Plan B? After Lehman, policy makers went “all-in” on bailouts/ZIRP/QE etc. This avoided an “all-out” collapse and bought time in which a self-sustaining recovery could materialise. The Fed’s tapering threat showed that, five years on from Lehman, the recovery was still not self-sustaining. Our study of long-wave (Kondratieff) cycles, however, leaves us concerned as to whether it ever will be. More commentators are having doubts, e.g. Andrew Law of Caxton in the recent FT interview. The problem looming into view is that we might need a new “plan.” Does the incoming Fed Chairwoman have a new plan and, more importantly, one which could work? We have our doubts, the default strategy being continued reliance on liquidity-driven asset bubbles, while hoping for the best in terms of traction with the real economy. Our colleague, Andy Ash, commented last week.

If the US is locked into low growth for the foreseeable future, should the S&P 500 be trading on a 12-month forward earnings multiple of 16.2x, slightly higher than the 15.5x long-term average? Let’s not forget that Europe appears to be stuck in an even lower growth scenario and China’s growth rate is moderating. Moreover, corporate margins are close to an all-time high and earnings forecasts are being progressively downgraded. So higher and higher valuations for more distant, and (arguably) increasingly uncertain, cash flows. With the temporary deal agreed in Washington, QE looks set to continue running at US$85bn until March 2014, maybe longer. We’ve written about the QE/repo linkage a lot in recent months and it’s our opinion that the collateralisation of excess deposits created by QE has positively impacted equities via shadow banking conduits, e.g. repos.

Even the US Treasury (Treasury Borrowing Advisory Committee report for Q2 2013) noted the correlation between weeks when QE exceeded US$5bn and strength in the S&P 500.

Have we really got to the point where it’s just about more and more QE, corralling more and more flow into the equity market until it becomes (unsustainably) “top-heavy”? ... Trying to Make Sense of Bubbles If we are in a centrally-planned bubble (and it feels like it to us), we are reliant on second guessing policymakers, trying to gauge flows (positive for equities right now) and utilising any indicators which seem to be showing good correlations. An example of the latter is the Summation Index. This is a measure of market breadth, being a running total of Advance minus Decline values of the McClellan Oscillator. A pattern of declining peaks had formed since the correction in late-May, but this reversed with the recent upward move.

We are still in the biggest debt crisis in history and the banking sector will remain at the centre of its ebbs and flows. The divergence of the sector’s performance from the broader market pre-empted the Lehman collapse in 2008. In the US, we are keeping a close eye on the breakdown in the BKX.

In such extreme circumstances, we should also keep an idea of “crash patterns” in the back of our minds in case. These often play out as a peak followed by a failure to make a new high and a subsequent break of support. Here are some notable examples.

... A final word on equity market indicators. In our reports since May, we’ve been “road-testing” a model for the US equity market (using the DJIA which has a longer history). It is based on cycles, not economic indicators, but cycles in time. It is created from the interaction of 18 cycles in US equities. These vary in length from just under 3 months to more than 30 years. Most of these cycles were discovered by the Foundation for the Study of Cycles (FSC), which has published a vast body of work during the last 70 years. We’d like to make contact with any readers who’ve also looked into this type of work, as trying to incorporate it into our research is very much work in progress. While in its very early days, the model has been a reasonably good predictor of market direction since the beginning of 2009 (having also picked out most of the market peaks and troughs since 1905). We are slightly alarmed because it’s predicting that the Dow should be rolling over now into the first part of 2014.

Buying time in a brought forward world Manipulating the Time Horizon We’ve been reflecting on the idea that using unconventional monetary policies, i.e. QE at the long end of the yield curve, central banks have “bought time” in a profound sense by manipulating the time horizon. This leads to longer-term cash flows associated with financial assets being discounted at artificially low rates. It has been crossing our minds as to how much equity investors have really considered this issue, even if (like us) they are believers in equities overcoming bonds in the inflationary endgame (see “Inflationary Deflation” report from December 2012? Fixed income investors are acutely aware that QE has forced them to extend duration. That comes with the scary knowledge that they might all rush for the exit at the same time. While many financial assets have long duration, equities have very long “duration,” often reflecting theoretical cash flows to infinity. Equity investors typically make detailed estimates for corporate cash flows, e.g. for 7-10 years. Beyond that, cash flows to infinity are capitalised (using long-term growth rate assumptions, ROIC fades, etc) in the form of terminal values...or until analysts predict that the deposit/reservoir will be depleted in the case of mining/energy stocks. QE obviously keeps rates lower than they would otherwise be and increases the value of these capitalised cash flows - especially more distant ones. When we think about long-term economic cycles, one of (if not) the biggest single driver is the growth in debt (and, problematically, its eventual reduction at the end of the cycle). If we consider the US economy, the huge increase in debt has brought forward consumption over an extended period of several decades. That process has become increasingly “long in the tooth”, so it’s hardly surprising that credit and consumption growth is currently subdued. When so much consumption has already been “brought forward”, it might seem counter-intuitive that the valuation of distant cash flows is being inflated via PEs above their historic average AND artificially suppressed interest rates. When you also consider that corporate margins are close to a historic peak, the market takes on the appearance of an athlete that is expected to continue performing at peak level almost indefinitely. Hmmm, as Grant (“Things That Make You Go Hmmm”) Williams might say. It Should Work Both Ways In a world of US$85bn per month QE, the corollary of the discussion above should be that the valuation of long duration financial assets should be unusually sensitive on the downside to anything that threatens this current “buying time” and “brought forward” model for long-term financial assets. The obvious candidates are:

The market turmoil induced by Bernanke and his colleagues with the taper threat (quickly watered down and subsequently canned) seems entirely fitting in this light. The consequence is that the Fed’s ability to taper looks ever more serious with regard to asset prices. This is the two-way version of the “Stockholm syndrome” between the Fed and markets we’ve highlighted before. Boxed in?

Full Thunder Road Report below: | ||||||||||||||||||||||||

| Posted: 03 Nov 2013 02:49 PM PST Submitted by Alasdair Macleod of GoldMoney.com, On Wednesday Finland gave in to public pressure and revealed where she stores her gold reserves. The statement followed a press release by the Bank of Sweden on similar lines released on Monday.The totals (in tonnes) for these two Scandinavian countries are as follows:

So far, so good. But then the Head of Communications for the Bank of Finland added some more information in Finnish in a blog run on the Bank's website. It is not available in English, so I asked her for a translation, but I am still waiting. Instead, a Finnish reader of my own blog and a Finnish journalist who has been following this topic have independently given me an English translation of a highly relevant and interesting paragraph, three from the end. This is the journalist's:

And my reader's translation:

Half Finland's gold is stored at the Bank of England, and "no more than half" is "invested". If any "investment" is to take place it would be in London. It is not immediately clear what is meant by invested, but presumably this is a result of translation of what has happened from English into Finnish plus explanation for a non-specialist readership. However if it has been invested, then by definition it is no longer in the possession of the Bank of Finland, and will most probably have been sold into the market in return for a promise to redeliver at a later date. This follows the Austrian National Bank's admission to a parliamentary committee a year ago that it had earned EUR300m by leasing its gold through London. The evidence is mounting that Western central banks through the Bank of England have been feeding monetary gold into the market through leasing operations. Indeed, the Finnish blog says as much: "Gold investment activities are common for central banks". This explains in part how the voracious appetite for gold by China, India and South-East Asia is being satisfied, without the gold price rising to reflect this demand. It is also consistent with my disclosure earlier this year of the discrepancy of up to 1,300 tonnes between the gold in custody as recorded in the Bank of England's Annual Report, dated 28th February 2013 and the amount recorded on the virtual tour on the Bank's website the following June.

| ||||||||||||||||||||||||

| Three Dimensions of the Investment Climate Posted: 03 Nov 2013 02:31 PM PST There are three dimensions to the broader investment climate: the trajectory of Fed tapering, the ECB's response to the draining of excess liquidity and threat of deflation, and Chinese reforms to be unveiled at the Third Plenary session of the Central Committee of the Communist Party.

There has been increased speculation that the Federal Reserve can begin tapering in December. The FOMC statement dropped the reference to tighter financial conditions and the manufacturing ISM was stronger than expected, as was September industrial production.

For the same reasons we did not think it very likely in September, we are skeptical of a December tapering. First, the impact of the government shutdown will distort much of the data in the coming weeks, including the October employment report on November 8 (for which the ADP data was disappointing). There has been a trend slowing of non-farm payroll growth, illustrated by the fact that the 3-month average is below the 6-month average, which is below the 12-month average.

Second, measured inflation remains low. The core PCE deflator for September will be released on November 8 as well and may tick up to 1.3%, after reaching two-year lows in July just above 1.1%. As we have noted before, the core PCE deflator, the Fed's preferred inflation measure, is lower now than in the early 2000s, when the then-Fed Governor Bernanke recognized the risk of deflation.

Third, when the Fed revised lower its growth forecasts in September, it did not cut sufficiently, especially in light of the government shutdown. It seems unreasonable to expect the Fed to taper at the same time as it reduces its growth forecasts. The effectiveness of the Fed's communication has again been questioned in light of its decision in September not to taper.

Fourth, and while perhaps the least appreciated, it is also among the most compelling reasons for the Fed not to taper in December. The credibility of the institution is clear better served by maximizing the degrees of freedom for the next Federal Reserve Chair. Tapering in December would needlessly tie the hands of Bernanke's successor and any anti-inflation chits to be earned would be wasted on the ongoing Bernanke, who will go down in history for the unorthodox policies adopted upon reaching the zero bound of nominal interest rates.

This is particularly important because the Federal Reserve sits on the cusp of among the largest changes in personnel in the Fed's history. Consider there are two vacancies already on the Board of Governors and that is before a successor to Yellen is found, assuming her nomination is approved by the Senate. Another Governor's term expires at the end of January. Another governor may choose to return to the university from which he is on leave.

In addition, in the coming months, another governor may chose to leave, having long served on the Board and amid reports of philosophical (personal?) differences with Yellen. Lastly, note that the fine print of Dodd-Frank also calls for the Board to have a second vice-chair to oversee the Fed's regulatory duties.

We think there is a strong possibility that Bernanke steps down early. While the Senate Banking Committee might be able to vote on Yellen's nomination later this month or early December, there may be some delay tactics when it comes to the entire Senate vote. Recall Bernanke's nomination for a second term by Obama (Bernanke was initially appointed by Bush-the-Lesser) passed the Senate by a 70-30 margin. Yellen needs 60 votes to over-ride a filibuster than has been threatened.

In any event, shortly after Yellen is confirmed, it is reasonable to expect Bernanke to resign. It serves no one's interest to have two Federal Reserve Chairs. That means Yellen is most likely to Chair the late Jan 2014 FOMC meeting that most expect to be Bernanke's last. What this implies too, is that our March tapering call does not require Yellen to announce such at her first meeting, but rather, the second she chairs.

II

Europe seems poised to snatch defeat from the jaws of victory. It has been a particularly good year for EMU. After initially blowing it, European officials managed to address the Cypriot crisis and although it retains capital controls, it remains in every other way a member of the monetary union. The six quarter contraction ended. Italian and Spanish stocks and bonds have rallied strongly, helping to ease their debt servicing costs and rebuilding investor confidence. Target 2 imbalances have been reduced and banks have returned nearly 40% of the LTRO borrowings.

Yet the repayment of the LTRO funds has seen the excess liquidity in the system fall. Excess liquidity has fallen by about 470 bln euros to stand just below 150 bln. Nearly 380 bln euros of LTRO borrowing has been returned, including what was announced before the weekend. The remainder of the decline in excess reserves (~90 bln euros) is due to what the ECB calls autonomous factors. Without getting bogged down in the minutia, autonomous factors include items such as bank notes in circulation, government deposits) and the point is that they are not a function of the ECB itself.

At the same time that excess liquidity is falling money supply growth is weak (M3 is up 2.1% year-over-year) and lending to businesses and households continues to shrink. Many observers were still surprised to learn that EMU CPI fell to 0.7% in Oct from a year ago, drawing nearer the record low of 0.5% in 2009.

With the traditional medicine of devaluation denied by the monetary union, the path of adjustment toward increased competitiveness requires inflation to be lower than Germany's. Germany's ordo-liberalism requires low inflation. This forces other countries to undershoot Germany's low target. The surprise to many is that they are doing it. Using EU harmonized calculations, German CPI stood at 1.3% in October. Italy's October CPI was 0.7% and Spain's was -0.1%. France's September reading was 1.0%, while Greece's was -1.0%.

In order to respond to the tightening of financial conditions in the euro area and the increasing risk of deflation, the ECB needs to do something as bold as the OMT announced in mid-2012. Consider the limitation of its options. Many observers are talking about a repo rate cut as early as this week. Yet such a move would be ineffective. In the current environment, the key rate is the deposit rate, which is set at zero. Overnight rates (EONIA) trade closer to the deposit rate than the repo rate (50 bp).

The ECB says that it is technically prepared to cut the deposit rate below zero, but it is obviously reluctant to do so and for good reason. No major central bank has done this and the issue is not only intended and unintended consequences but also foreseeable and unforeseeable effects. It could further harm the fragile financial institutions. It could unsettle the global capital markets.

Many observers expect the ECB to provide another LTRO later this year or early next year. We had thought so as well. However, it has become clearer, and seems only right, that in stress testing banks, those that rely on ECB funds, should be penalized in some fashion. This means that while the ECB may offer another LTRO, it may not meet widespread demand, and, there may in fact be a stigma attached to its use.

The ECB is continues to sterilize the sovereign bonds purchased under Trichet's SMP program. In theory, the ECB could refrain from doing so and thereby ease liquidity conditions. Yet this would not doubt raise the hackles of the Bundesbank, which may still be hoping for a Constitutional Court ruling that finds elements of the OMT program to go against the Germany's Constitution. Remember, the former Bundesbank President and a German member of the Governing Council both resigned over the SMP program.

Further dilution liberalization of collateral rules is beside the point, though incentives to strengthen the asset-backed securities market, may be a way to cope with the reluctance of banks to lend. If the ECB is going to lean against the deflationary forces and address tightening of monetary conditions, it does not have as many choices as it may appear. One way to increase excess liquidity is to reduce the required liquidity (reserves). A refi rate cut in conjunction would send a stronger signal. While the sooner the better, given that the ECB had foreseen base effects and the decline in energy prices, so the low inflation number may not have been too surprising, December looks like a more likely time frame than this week's meeting.

It goes without saying, one would have thought, that Draghi will strike a dovish tone at the press conference following this week's ECB meeting. The real data has lagged behind the survey data that Draghi had previously pointed to and what had appeared to be improvements in the labor markets have been revised away. Austerity among the debtors has not been offset by stimulus among the creditors. Although the citation of Germany in the US Treasury report on the foreign exchange market raised some eyebrows, got some chins wagging and keyboards clicking, there can be little doubt of the unspoken agreement throughout much of Europe.

III

At the end of next week (Nov 9-12), the Central Committee of the Chinese Communist Party holds its Third Plenary session. The Third Plenary session has in the past been the platform from which important changes have been announced. This one is similarly being promoted as having wide-ranging and substantial reforms.

Chinese officials appear to recognize that reforms are needed or risk the middle-income trap, in which a country exhausts it resources in achieving middle income status. There are three broad areas that reform is likely to be focused on: improving the functioning of the market (including unified market for land), transform government by reducing red-tape and providing a basic social safety net for Chinese citizens, and fostering new private businesses and more competition. The key take away point is that it is not a status quo government, but reformist.

To be sure, despite being reform minded, the new Chinese government has shown little interest in addressing the contradiction that goes largely unspoken yet is ever present, between a modernizing and flexible economy and the archaic and rigid political superstructure. Political reform and competition in that space is most unlikely to be forthcoming from the Third Plenary Session.

The outcome of the session is unlikely to have much immediate impact on the global capital markets. Nevertheless, investors have a vested interest in the strategy of the world's second largest economy. The rise of China since 1978 stands alongside the fall of a little more than a decade later as the two most important geopolitical events since the end of the World War.

China has taken significant measures toward giving greater market influence over some interest rates. It has removed the floor for lending rates, re-opened bond futures and introduced a prime rate. This new prime rate is a weighted average of 9 domestic commercial banks lending rates to their best customers. This supplements and, perhaps, will eventually supplant the PBOC's current benchmark (1-year benchmark has been set at 6% since July 2012, last week the prime rate was 5.71%). Further financial liberalization is expected in the coming months. There are reports suggesting the Plenary Session may also take up calls for national deposit insurance.

Chinese officials also appear to be preparing people for slower growth. The emphasis is shifting toward quality of growth, which seems to emerge only as the quantity has slackened, even according to official data. Although China's manufacturing PMI improved, forward looking new orders and export orders were softer, keeping the near-term outlook less certain at best.

The yuan has been resilient this year and rising to multi-year highs into late October, it spent last week on the defensive, as the US dollar rallied broadly. If our constructive technical outlook for the dollar is correct, it suggest further gains against the yuan as well. The CNY6.12 area may offer a near-term cap. It denotes not only the Oct high but also the 100-day moving average. Above there, the CNY6.15 area is also interesting. It corresponds to a retracement objective of this year's dollar decline and the 200-day moving average.  | ||||||||||||||||||||||||

| The Macro Analytics: A Technical Update Posted: 03 Nov 2013 12:17 PM PST The Technical Analysis of the SP 500, key Currency Cross Drivers, Gold and Oil are discussed in this comprehensive 30 minute video presentation with 42 updated supporting graphics. Read More... | ||||||||||||||||||||||||

| Large Forex Speculators Were Bearish on US Dollar Into Late October Bottom, COT Report Posted: 03 Nov 2013 10:02 AM PST The latest data for the weekly Commitments of Traders (COT) report was released on Friday by the Commodity Futures Trading Commission (CFTC) and showed that large futures speculators turned bearish on the US dollar on October 8th and then registered three straight weeks of bearish positions through October 22nd. Non-commercial large futures traders, including hedge funds and large International Monetary Market speculators, had an overall US dollar short position totaling $-3.64 billion as of Tuesday October 22nd. This was a weekly change of $-2.4 billion from the total position of $-1.24 billion that was registered on October 15th, according to data from Reuters that calculates this amount by the total of US dollar contracts against the combined contracts of the euro, British pound, Japanese yen, Australian dollar, Canadian dollar and the Swiss franc. | ||||||||||||||||||||||||

| Maguire - Gold War Heats Up As Stunning Events Taking Place Posted: 03 Nov 2013 09:53 AM PST  On the heels of some wild trading action last week, London metals trader Andrew Maguire spoke with KWN about the stunning events taking place as the gold war heats up, as well as some extraordinary information about what to expect in the gold market going forward. Below is what Maguire had to say in this tremendous interview. On the heels of some wild trading action last week, London metals trader Andrew Maguire spoke with KWN about the stunning events taking place as the gold war heats up, as well as some extraordinary information about what to expect in the gold market going forward. Below is what Maguire had to say in this tremendous interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| Disappearing Deliverable Comex Gold Bullion Posted: 03 Nov 2013 09:48 AM PST There was a change in status of 48,652 ounces of gold bullion in the JPM warehouse which were withdrawn from the registered to the eligible category. Apparently someone had a change of heart. Big change of heart. About one and half tonnes worth. The claims per ounce of deliverable gold stand at 55. As I have explained before, this is a metric, a way of measuring inventory against potential ownership. | ||||||||||||||||||||||||

| Gold? What Gold? The Great 56:1 Imbalance Posted: 03 Nov 2013 06:03 AM PST So you think you own some gold because you own a gold ETF. Right? Think again! At By Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). It should come as no surprise to anyone that the gold that is claimed to exist in Fort Knox or any of the other gold depositories around the world does not exist to the extent claimed. Why? Because when Germany’s representatives came to New York and politely asked (and I paraphrase): “We would like to physically see our gold before making arrangements to have it returned.” they were rebuffed with the reply, “Sorry, no one is allowed access to the vaults to inspect/verify their holdings. As for having it returned, no problem. We are prepared to return 50% of it to you over the next 7 years. We realize that you are one of the major economic powers in the world with major political clout and major financial resources at your disposal but, sorry, that’s the best we can do.” If that is not enough to convince you that your paper gold holdings, supposedly backed up with an equivalent amount of physical gold, do not exist then take a look at the 2 graphs below which clearly show the discrepancy – a 56 to 1 discrepancy – between what is purported to be in the coffers of COMEX and the actual number of owners per troy ounce. The bottom line is that you do NOT own much, if any, gold if you own paper gold in the form of a gold ETF. You only really own gold if you have it in your physical personal possession. Got gold? Really?? Related Articles: 1. Where Does Your Country Rank in Gold Reserves per Person?

The country with the biggest reserves in the world is, not surprisingly, America, with 8,134 tonnes but, expressed in terms of reserves per person, the picture looks very different. Take a look. You’ll be surprised. Read More » 2. United States Gold Bullion Depository: Fort Knox or Fort NOT? If you believe the government routinely lies or covers up its actions, we can't simply laugh off the idea that there's no gold in Fort Knox. Until an audit is done, the facts provide more questions than answers. [This article explores the situation, implications and possible ramifications.] Words: 892 Read More » 3. 10 Largest Gold Reserves By Country Gold definitely has caught the public's attention; for proof, just look at the number of cash for gold ads. Gold has been rising since 2001 and its near vertical rise over the last two years helps explain some of the recent fascination, but political actions have helped as well. In the United States, Rep. Ron Paul and others have called for a return to the gold standard. Elsewhere, Venezuelan President Hugo Chávez recently nationalized his country's gold industries, and some analysts have said countries should dip into their gold reserves to alleviate the sovereign debt crisis. With all these recent stories, we wanted to see which countries actually have the most gold in their reserves, based on information from the World Gold Council. [Take a look at the list below.] Words: 565 Read More » 4. A "Troy" Ounce of Gold is 10% Greater Than a Regular Ounce – True or False? When the price of gold is mentioned as costing "x dollars per troy ounce" do you fully appreciate the significance of the term "troy"? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 "karat" gold and another item stamped 18 "karat" gold (other than that it is much more expensive)? Let me explain. Words: 587 Read More » 5. So Little Gold: Why So Cheap? Gold, the precious metal most often thought of as money, is in short supply. In fact, the existing above ground horde is so small one has to question whether it is realistic to think of it as having a serious role as money in the future. The fact is there just isn't enough of it and – once institutional and private investors realize that the supply is so disarmingly and alarmingly insignificant – prices are likely to go parabolic. Words: 1119 Read More » The post Gold? What Gold? The Great 56:1 Imbalance appeared first on munKNEE dot.com. | ||||||||||||||||||||||||

| Easy Money Is Again Leading To Bubbles – Courtesy Of Central Banks Posted: 03 Nov 2013 02:15 AM PST In this week’s commentary, John Mauldin looks at two highly relevant concepts: easy money (call it QE, money printing, helicopter money, or whatever the term) and economic bubbles (based on his latest book, Code Red, which he launched last week). Obviously the two are linked to each other. Although in the minds of central bankers there is not necessarily a direct effect between both, we simple human beings all know that the inherent risks are huge. You would not be reading this article if you believed otherwise. We know that this is going to end badly, as explained in We Created The Conditions For Catastrophic Failure and in 2013 – Start of Seismic Shifts in Money, Metals, Markets (among many other articles). They key in the thinking of central banks is that policy makers believe they can “manage” the effects of their monetary policies. It is somehow comparable with driving a car; even in a risky situation, the driver can adjust the rest of the drive to get back home safely. This assumes they can somehow decide on the driving conditions, even if the remainder of the trip is on an ice road. This “blindness” is reflected in the first chart of Mauldin’s article.

This is the most interesting chart we have seen in a while. Mind how the world works from the eyes from central planners. They truly believe they can exponentially inflate something and then manage it back to normal levels. So here is the question: what if things do not work that way in the real world? Anyway, two other bubble signs that were spotted by Mauldin:

Easy Money Will Lead to BubblesThe causal effect between easy money and economic bubbles is so intuitive that one could ask the question who in this world is not able to see it. After all, wasn’t it the monetary policy of the US Central Bank who paved the way for the housing bubble which catastrophically popped in 2008? Shouldn’t we have learned meantime what the risks are of market interventions? Look at this video from Peter Schiff to learn the ivory tower in which central banking policy makers are living. John Mauldin puts easy money in some recent context:

Excessive Monetary Liquidity Creates BubblesMauldin explains that the corporate bond market is looking particularly bubbly. He says: “Investors are barely being compensated for the risks they're taking. In 2007, a three-month certificate of deposit yielded more than junk bonds do today. Average yields on investment-grade debt worldwide dropped to a record low 2.45 percent as we write this from 3.4 percent a year ago, according to Bank of America Merrill Lynch's Global Corporate Index. Veteran investors in high-yield bonds and bank debt see a bubble forming. Wilbur L. Ross Jr., chairman and CEO of WL Ross & Co. has pointed to a "ticking time bomb" in the debt markets. Ross noted that one third of first-time issuers had CCC or lower credit ratings and in the past year more than 60 percent of the high-yield bonds were refinancings. None of the capital was to be used for expansion or working capital, just refinancing balance sheets.” Now here is the key which all of us understand intuitively:

As we have re-iterated several times, debt is the biggest bubble.

Mauldin goes on to explain that agricultural is another bubble which is developing in many places in the United States although agriculture in other countries can be found at compelling values.

Finally, looking at the history of economic activity, it appears that boom and bust are going hand in hand in a centrally planned monetary world. Excess liquidity finds its way in the economy and affects asset prices in a way that is (a) unavoidable and (b) hard or impossible to turn back. That is the key to boom and bust.

| ||||||||||||||||||||||||

| Coming Clean, Dr. Joseph Farrell – Covert Wars & The Mysterious Strength of the US Dollar Posted: 02 Nov 2013 06:00 PM PDT | ||||||||||||||||||||||||

| Probes into forex trading spread across globe Posted: 02 Nov 2013 03:59 PM PDT By Daniel Schäfer and Caroline Binham http://www.ft.com/intl/cms/s/0/1d20d216-431b-11e3-9d3c-00144feabdc0.html A global probe into the manipulation of foreign exchange markets escalated dramatically on Friday when it emerged that Barclays had suspended six traders and two of the largest US banks revealed they had become embroiled in the investigation. Revelations that Barclays had suspended six staff, including its chief currencies trader in London, capped a torrid week for some of the world's largest banks with signs that a wave of new regulatory probes across three continents poses a growing threat to earnings. With more and more banks becoming ensnared and senior figures being put on leave, bankers and investors said the affair increasingly resembled the Libor rigging scandal. The Libor probe has so far led to the dismissal of many dozens of traders, while four banks and one interdealer broker have paid a total of $3.5 billion in fines. ... Dispatch continues below ... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Authorities including those in Switzerland, the UK, Hong Kong, and the US have opened preliminary investigations into whether some of the biggest banks in the world rigged the foreign exchange market, which has daily volumes of $5.3 trillionn and is used by millions of companies, institutional funds and retail investors. Crucial benchmark rates in the mostly unregulated market are set based on transactions made during short windows of 60 seconds for the largest currencies. Regulators are investigating if traders colluded to move these benchmarks, although none has been formally accused of wrongdoing. After a series of high-level suspensions this week, there are now at least a dozen traders across six banks on leave. They include several of the most senior traders in the market such as Barclays' Chris Ashton, who oversees the bank's voice-spot trading around the world. At least six of the leading banks in the foreign exchange market -- where everything from the leading reserve currency, the US dollar, to smaller currencies such as the Hungarian forint are being traded -- have now confirmed they have received requests from regulators. Citigroup and JPMorgan on Friday became the latest banks to confirm they were co-operating with regulators on the investigations, joining Barclays, UBS, Deutsche Bank, and Royal Bank of Scotland. US investment bank Goldman Sachs has also started to look internally for any signs of wrongdoing, as has HSBC, according to people familiar with the situation. All the banks mentioned declined to comment. Credit Suisse is also looking into the matter, it said in an earlier statement. Authorities around the world are also examining whether other benchmark rates, including oil-spot markets, have been manipulated. "This [litigation] risk is by far the one that worries me the most," said the global head of trading at a large investment bank. "It is like banks don't have an immune system any longer. A cold can kill you these days." In the UK, Sir Philip Hampton, chairman of the majority state-owned RBS, played down the chances of the taxpayer ever receiving a profit on its L45 billion investment, partly because of the mounting costs of litigation and customer compensation. He said that more than half of the L45 billion that was pumped into the bank had been eroded by "irrecoverable" losses -- including its bill for mis-sold payment protection insurance, interest rate swaps, and Libor charges. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||

| Much of West's gold is oversubscribed and unrecoverable, von Greyerz says Posted: 02 Nov 2013 03:29 PM PDT 6:21p ET Saturday, November 2, 2013 Dear Friend of GATA and Gold: Interviewed by King World News, Swiss gold fund manager Egon von Greyerz notes disclosures by Sweden, Finland, France, and Austria that much of their gold reserves is not in their direct custody but rather almost certainly "leased" and thus probably way oversubscribed. Von Greyerz says: "How much of the West's supposed 23,000 tons of gold is still in the vaults? Nobody knows, but I would be surprised if it's more than half. We have a system where physical gold is owned many times over, and we also have a system where the paper gold market is 100 times the size of the physical gold market, with absolutely no chance whatsoever for people who hold paper gold to receive physical delivery. "With this extremely fragile and precarious situation you wonder why anybody with a sound mind would hold paper gold or physical gold in a bank. There is only one way for investors to hold gold, which is in physical form and outside the banking system." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/2_LB... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Seminar in Florida Gold mining entrepreneur and gold advocate Jim Sinclair plans to hold his next financial seminar in Kissimmee, Florida, near Orlando, on Saturday, November 2. Details can be found at his Internet site, JSMineSet, here: http://www.jsmineset.com/2013/10/22/florida-qa-session-announced/ Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||

| LBMA Collapse To Expose US, Europe & BIS Gold Is Gone Posted: 02 Nov 2013 12:27 PM PDT  On the heels of some wild trading action this week, today the 42-year market veteran, who correctly predicted that the Fed would not taper, warned King World News that as the LBMA system implodes, it will expose that the gold belong to the US, Europe, and the BIS is largely gone. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this fascinating interview. On the heels of some wild trading action this week, today the 42-year market veteran, who correctly predicted that the Fed would not taper, warned King World News that as the LBMA system implodes, it will expose that the gold belong to the US, Europe, and the BIS is largely gone. Below is what Egon von Greyerz, who is founder of Matterhorn Asset Management out of Switzerland, had to say in this fascinating interview.This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| Posted: 02 Nov 2013 09:59 AM PDT A rather interesting development occurred on Friday, and one that I wasn't really expecting. The dollar sliced right through its intermediate trend line on its first attempt. I thought for sure we would see some kind of pullback from ... Read More... | ||||||||||||||||||||||||

| Gold Investors Weekly Review – November 1st Posted: 02 Nov 2013 09:52 AM PDT In his weekly market review, Frank Holmes of the USFunds.com nicely summarizes for gold investors this week’s strengths, weaknesses, opportunities and threats in the gold market. The price of the yellow metal went lower after two consecutive weeks of gains. Gold closed the week at $1,316.20 which is $34.6 per ounce higher (2.5%). The NYSE Arca Gold Miners Index went 8.15% higher. Gold Market StrengthsSell-side analysts and traders' commentaries have highlighted a noticeable pickup in generalist and fundamental accounts buying large cap gold names in recent days. According to Macquarie, the move appears to be motivated by the fact that a lot of the bad news is already out there, and it's likely for companies to surprise to the upside rather than perform negatively. Barrick Gold reported earnings this week showing a noticeable improvement on the bottom line, with earnings per share of $0.58 versus the analysts' consensus of $0.51. Both gold and copper operations beat their operational targets, but the most significant improvement came on the cost side, where Barrick reported an 85 percent completion of its corporate downsizing program. Gold Market WeaknessesA recent International Monetary Fund (IMF) report shows that the gold holdings in Russia's Central Bank fell for the first time since August 2012, decreasing 0.4 tonnes in September. However, Russia has added more than 50 tonnes to its gold reserves this year alone and about 600 tonnes since 2007. It is expected that gold purchases by central banks will decrease to 350 tonnes this year from 544 tonnes in 2012. Despite the decrease, analysts agree that central banks will remain substantial net buyers of gold in years to come. The spot gold price on the Shanghai Gold Exchange dropped below the London price this week, signaling that demand may be waning in the world's second-largest gold market. Bloomberg reports that gold was selling at a 54.14 percent discount to the London price on Wednesday on very low volume in the Shanghai Gold Exchange. Gold Market OpportunitiesJeffrey Currie, an analyst with Goldman Sachs, suggested just under a month ago that gold miners should hedge their output and lock current prices. In his opinion, gold would be the next big short trade. Other analysts, including Tom Kendall of Credit Suisse, also followed with negative commentary on the gold market, adding their names to the short-selling list. It's interesting that this group dares to recommend that investors do the exact opposite of what asset allocation studies show: adding gold and gold stocks to a portfolio can add alpha without a significant increase to risk. Not only are these analysts ignoring proven academic research, they seem to be ignoring reality. BCA Research published a report at the end of last week highlighting that gold prices have failed to rise in recent months in spite of a weak dollar, adding that a catch-up is likely. BCA argues that gold is oversold on a technical basis, as seen in the following chart, which in itself could be enough to drive a gold rally above the $1,500 per ounce threshold. Mineweb contributor Dorothy Kosich reports that in a rare show of bipartisanship, Congressional Democrats and Republicans introduced a comprehensive bill aimed at fostering and facilitating the domestic growth of critical minerals to prevent future supply shocks. This highlights the urgent need to facilitate the development of American mineral deposits. The ultimate purpose of the bill is to ensure that officials are required to set, and adhere to, timelines and schedules for completion of reviews as well as for inspection and enforcement activities in the mining sector. According to Hal Quinn, CEO of the National Mining Association, the slow and inefficient permitting system in the U.S. is the largest impediment to unlocking the full value of American minerals, adding that the U.S. relies on foreign countries such as China to supply many of these critical minerals. This week, RBC Capital Markets published the fifth part of its study on capital and operating cost expectations in the gold market. In the report, RBC underlines that capital costs have stabilized while all-in sustaining costs could fall by $150 per ounce in 2014 alone. RBC argues that since prices have fallen by a larger extent than all-in costs, this should discredit gold producers' efforts to maintain or increase their returns on capital. After rising by 60 percent over the past three years, it appears 2014 may actually be a good time to build projects given the availability of engineering and equipment. Those companies that learned the importance of protecting balance sheet integrity and returns on capital will be the biggest beneficiaries of this new stage in capital costs, at the expense of those who were growing for the sake of growing. Gold Market ThreatsAlan Greenspan published his new book "The Map and the Territory" in which he warns, among other things, that the "Spectacle of American central bankers trying to press the inflation rate higher in the aftermath of the 2008 crisis is virtually without precedent." He follows up by commenting that this type of policy could easily trigger double-digit inflation. In light of this, David Rosenberg of Gluskin Sheff proposed a new mantra for the Federal Reserve: "Bring on inflation!" However, Rosenberg followed up by criticizing the Fed's optimistic sentiment that inflation is good for economic growth, in which there is no widely accepted evidence or studies to support the assertion. For those who still believe in the Fed's optimism after Wednesday's meeting, consider Rosenberg's list of market facts that show financial asset overheating:

The list is simply too long to continue, but the point comes across easily. David Zervos of Jefferies wrote quite an entertaining and ironic takedown on Janet Yellen's nomination to the Federal Reserve Chairmanship. According to Zervos, the most exciting part about having Yellen in the seat is her inherent mistrust of market prices and her belief in irrational behavior processes. Zervos adds that there likely will be a day in 2016 when unemployment is still well above Yellen's estimate and the headline inflation rate is above 4 percent, in which the Fed's models will still show a big output gap and lots of slack. This way, Yellen could continue talking down inflation risks. In fact, Zervos argues that Yellen's obsession with filling the output gap makes for a very real chance of policy mistakes down the road, similar to those resulting from an obsession with Keynesian mis-measuring of the output gap during the 1970s. | ||||||||||||||||||||||||

| Posted: 02 Nov 2013 09:52 AM PDT Summary: Long term - on major sell signal since Mar 2012. Short term - on buy signals but no set ups yet. Gold sector cycle - up as of 10/25. Read More... | ||||||||||||||||||||||||

| China uses paper gold smashes to drain London market, Maguire says Posted: 02 Nov 2013 08:42 AM PDT 8:35a PT Saturday, November 2, 2013 Dear Friend of GATA and Gold: London metals trader Andrew Maguire tells King World News that the London gold market is in danger of default because of Chinese purchases of real metal when the Federal Reserve and its bullion bank agents smash the price of paper gold. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/1_Ma... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||

| Conspiracy And The Threat To Democracy Posted: 02 Nov 2013 08:29 AM PDT HYPOCRISY DEMOCRACY The deluge of news, views, opinions, theory and spin about everything from the weather – weather now means climate change – to why the price of gold is low and Facebook shares are high, or the outlook for economic growth in the US, Europe or Japan is what passes for 24/7 democratic open access information. Everybody has a right to too much bent information, but for the BBC's Brian Wheeler, October 26, the dark side of information – conspiracy theories – are destroying democracy. He says: | ||||||||||||||||||||||||

| U.S. Dollar Surge Implications Posted: 02 Nov 2013 08:22 AM PDT A rather interesting development occurred on Friday, and one that I wasn't really expecting. The dollar sliced right through its intermediate trend line on its first attempt. I thought for sure we would see some kind of pullback from that trend line before a break. In my opinion this signals that there are a lot of people caught on the wrong side of this market. | ||||||||||||||||||||||||

| Entire Fiat Money System is Bankrupt: Demise of the Global US Fiat Dollar Reserve Currency Posted: 02 Nov 2013 07:58 AM PDT Matthias Chang writes: It’s been a while since I last wrote an article on the on-going financial crisis. I don’t write for the sake of writing, as others do because they have to do so, on account of their subscribers who pay hefty subscription fees and demand their money’s worth. Major issues or trends do not change on a daily or even monthly basis. A trend may take a few years to run its course and unless there is a major factor that may affect the trend, there is hardly any need to comment any further on the trend or outcomes. | ||||||||||||||||||||||||

| Gold And Silver - Fundamentals Do Not Matter Posted: 02 Nov 2013 07:56 AM PDT If fundamentals mattered, gold and silver prices would be substantially higher. They are not, and for a reason. It is not hard to define what factors are influencing price, for they are political, even criminal under normal circumstances. Read More... | ||||||||||||||||||||||||

| Does the U.S. Dollar Have a Future? Posted: 02 Nov 2013 07:35 AM PDT “If the dollar does indeed lose its role as leading international currency, the cost to the United States would probably extend beyond the simple loss of seigniorage, narrowly defined. We would lose the privilege of playing banker to the world, accepting short-term deposits at low interest rates in return for long-term investments at high average rates of return. When combined with other political developments, it might even spell the end of economic and political hegemony.”– Economist Menzie Chinn, “Will the Dollar Remain the World’s Reserve Currency in Five Years?”, CounterPunch 2009 | ||||||||||||||||||||||||