Gold World News Flash |

- Obamacare LIES, Economic COLLAPSE & the Fukushima NIGHTMARE – Michael Snyder

- The 10 US Cities With LESS THAN 10 Days of Cash on Hand

- Silver Expert Jeffrey Christian Proves Illegal COMEX Price Setting

- David Morgan Discusses The Gold & Silver Markets

- GLD inventory remains firm/Silver rises/Gold and Silver whacked prior to first day notice for November

- 10 Signs That Obamacare Is Going To Wreck The U.S. Economy

- U.S. Dollar Long-term View

- Michael Pettis Cautions China's Hidden Debt Must Still Be Repaid

- Ambrose Evans-Pritchard: JPM sees 'most extreme excess' of global liquidity ever

- Andrew Maguire: Christian attacked me to defend the paper gold system

- The Silver and Gold Price Uptrend Remains in Force

- The Silver and Gold Price Uptrend Remains in Force

- How to set-up a gold IRA or 401(k) rollover from your current plan

- How to set-up a gold IRA or 401(k) rollover from your current plan

- The Top 10 Biggest Gold Producing Countries in the World

- Placeholder Gold vs Physical Gold – Spot The Massive Disparity

- Silver and Mining Stocks

- Gold Daily and Silver Weekly Charts - Day After Option Expiry and FOMC Tomorrow

- Gold Daily and Silver Weekly Charts - Day After Option Expiry and FOMC Tomorrow

- Gold Market Recap Report

- The Daily Market Report: Gold Pulls-Back Modestly, but Impetus Remains to Upside

- Ron Paul Talks About Economic Collapse and Lack of Federal Reserve Transparency

- Gold’s Gift on the Eve of Zero Hour

- Gold falls as prices hit ‘technical crossroads’

- A Cyclical ‘Mini-Me’ to a Big Secular Event?

- A top 2012 gold-copper discovery gets first resource

- Sibanye mulls solar plant to combat rising power prices

- Shanghai gold hits discount to London on ‘money market’ fall-out

- Gold miners reduce hedge book in Q2, more cuts seen

- Gold prices to stay volatile despite beginnings of new positive trend – Levenstein

- The Wall Street Journal Published Blatant Lies About The Gold Market

- The Wall Street Journal Published Blatant Lies About The Gold Market

- Paper Gold Versus Physical Gold

- Paper Gold Versus Physical Gold

- Celente - Get Ready, Capital Controls Coming To US & Europe

- Inflation Attacks the Dollar Menu

- Surrounded by D.C. Zombies

- Surrounded by D.C. Zombies

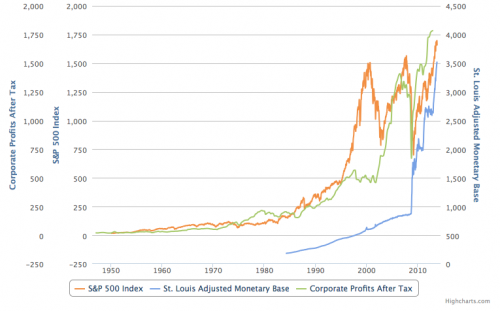

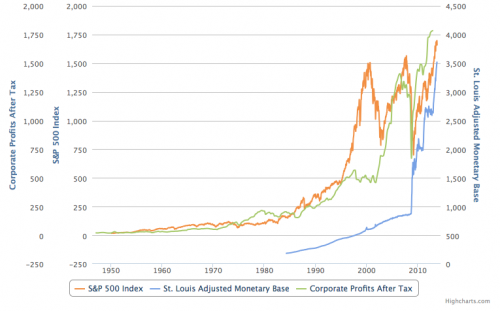

- Stockmarket Bubble On Borrowed Time

- Stockmarket Bubble On Borrowed Time

- Lars Schall's Matterhorn Interview with John Butler On Gold

- Lars Schall's Matterhorn Interview with John Butler On Gold

- Gold Price in China Drops Below London 1st Time in 2013, India Raises Key Interest Rate Ahead of Diwali

- Gold Hits Shanghai Discount to London on "Money Market" Fall-Out

- Gold Holds Near 5-Week High, Fed Stimulus Seen Ongoing

- Gold Falls From 5-Week High as Dollar Gains Before Fed Meeting

- Gold and the Permanent Portfolio in Australia

- Intraday Elliott Wave Analysis For GOLD and E-Mini SP500

- Gold lower at 1346.50 (-6.10). Silver 22.44 (-0.04). Dollar higher. Euro lower. Stocks called higher. US 10yr 2.52% (-1 bp).

- PART TWO: The Real Earthquake In Financial Markets Is Yet To Come – John Butler

| Obamacare LIES, Economic COLLAPSE & the Fukushima NIGHTMARE – Michael Snyder Posted: 29 Oct 2013 08:10 PM PDT

Do you know that 1 out of every 4 Americans has a job that pays $10 per hour or less? Do you know that today 47 MILLION Americans are on food stamps? That’s up 50% from the day Obama took office. Do you realize that Obamacare is a Trojan horse designed to wreck the US economy? Do you realize that something is killing sea life all over the Pacific Ocean? Do you know 300 tons of highly radioactive water is being dumped into the Ocean each day? Do you care that the U.S. military is being taught to treat Christians as “extremists” and “potential terrorists”? These ARE the signs of the collapse, and sadly, this is just the tip of the iceberg. Michael Snyder from the Economic Collapse Blog joins me to discuss all of the latest. |

| The 10 US Cities With LESS THAN 10 Days of Cash on Hand Posted: 29 Oct 2013 07:39 PM PDT from Zero Hedge:

|

| Silver Expert Jeffrey Christian Proves Illegal COMEX Price Setting Posted: 29 Oct 2013 07:25 PM PDT OPEN LETTER TO THE CFTC by Bix Weir, Road to Roota:

In a stunning admission last week at The Silver Summit in Spokane, Washington, CPM Group’s President Jeffrey Christian, a long time opponent of silver market rigging claims, admitted that the price of silver was being illegally set on the COMEX trading floor. This admission came during his attempt to prove that there was no silver market manipulation taking place. Christian’s assertion was that the wild swings in the price of silver were not being caused by rogue market riggers but by multiple computer algorithms and High Frequency Trading programs firing at the same time in the COMEX silver exchange based on the same program triggers. Christian claims that the simultaneous nature of these trades spring from all trading houses using the same algorithms they learned in the same colleges. Trading volumes on the COMEX supports this assertion as the COMEX is on track to trade over 80B equivalent ounces of silver derivatives in 2013 which is 1,800x the amount of Registered Physical Silver in the COMEX inventories(44M oz).

Unfortunately for Christian and the CME, what he describes is an artificial price setting mechanism for silver in an exchange that is specifically regulated such that it does not “set” silver prices but rather is a “price discovery” exchange. What Christian describes is ILLEGAL and the CME Group who owns the COMEX should immediately shut down all HFT’s and computer trading programs stopping this continued distortion of silver prices. Regulating the futures and options markets such that they DO NOT set an artificial price of a commodity is specifically why the CFTC hires Economists to oversee the Silver derivative markets(futures and options are derivatives). Weighing the stable supply/demand dynamics of the silver industry(0-5% annual volatility range) against the volatile COMEX trading activity and price fluctuations(over 100% annual volatility swings) is the proof that the price of silver is being artificially determined by derivatives as Christian suggests. The legal concept is fairly simple, the trading of futures and options should not be the overriding price influence in setting the price of any commodity as it does not reflect the true supply/demand dynamics of the underlying commodity being traded. Jeffrey Christian is the leading authority on commodity derivatives with experience in advising the largest players in the paper/electronic silver space such as the IMF, World Gold Council, Central Banks, Bullion Banks and Global Mining Companies. Before CPM Group spun off from Goldman Sachs in the 1980′s, Christian worked with Robert Rubin who advocated and developed Gold Leasing Programs for Central Banks and National Treasuries(although Germany is still trying to unwind their leased gold). In the 1990′s Christian advised companies on how to properly hedge their gold production(although massive Billion dollar write downs were taken as the price of gold rose in the 2000′s). Christian is currently leading the charge to restart miner hedging programs as he advocates hedging once again to offset the price volatility on the COMEX… WAIT! This silver price volatility is caused, according to Christian, by multiple computer algorithms and High Frequency Trading programs firing at the same time and is NOT a freely traded price of silver! Any hedging on false COMEX price discovery is an accident waiting to happen…AGAIN! It is imperative that the CFTC investigate and stop such illegal price influencing actions on the COMEX as it is destroying the true price discovery mechanism for silver. Companies and individuals are making bad decisions based on faulty price data originating out of the COMEX. Silver investors should demand an explanation from the CFTC and the CME as to Jeffrey Christian’s claim that price fluctuations in silver are being initiated and caused by computer driven trading that artificially influences the “Fair Market Value” of silver. I want to thank Jeffrey Christian for bringing this to the attention of all who attended the Silver Summit as it explains WHY the price of silver is so volatile in an underlying industry that should, by all accounts present at the Summit, be stable and predictable. Sincerely, Bix Weir |

| David Morgan Discusses The Gold & Silver Markets Posted: 29 Oct 2013 07:00 PM PDT from silver investor.com: |

| Posted: 29 Oct 2013 06:56 PM PDT by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed down $6.80 cents to $1345.20 (comex closing time ). Silver was down 4 cents at $22.45. In the access market today at 5:15 pm tonight here are the final prices: gold: $1344.30 I wrote this to you last night: “We are now ready to move into the November comex month. The November month is non active for both silver and gold. As options expiry has already passed, expect the bankers to whack silver and gold to persuade the holders of these contracts from taking delivery.” |

| 10 Signs That Obamacare Is Going To Wreck The U.S. Economy Posted: 29 Oct 2013 06:51 PM PDT by Michael Snyder, Economic Collapse Blog:

It is almost as if Obamacare was specifically designed to wreck the U.S. economy. Not that what we had before Obamacare was great. In fact, I have long argued that the U.S. health care system is a complete and total train wreck. But now Obamacare is making everything that was bad about our system much, much worse. |

| Posted: 29 Oct 2013 06:46 PM PDT I finally had to look at the monthly chart on the Dollar to get a handle on its position. I identified the Dollar being in a triangle pattern prior to the low in 2011. At that time, I surmised that we were looking at an Intermediate Wave (E). It was an easy mistake to make, since it had escaped the lower trendline as it typical of a Wave (E). However, having turned back at both the top and bottom trendline subsequently gave me pause. Looking at the long-term pattern suggests that the triangle may just be ending now with a second break of the lower trendline for Wave (E). |

| Michael Pettis Cautions China's Hidden Debt Must Still Be Repaid Posted: 29 Oct 2013 06:44 PM PDT Debt always matters because it must always be paid for by someone - even if the borrower defaults, of course, the debt is simply “paid” by the lender. As China Financial Markets' Michael Pettis notes, this is why the fact that debt in China seems to be growing much faster than debt-servicing capacity implies slower growth in the future. The author of "Avoiding The Fall", explains that if the debt cannot be fully serviced by the increase in productivity created by the investment that the debt funded, unless it is funded by liquidating state sector assets it must cause a reduction in demand elsewhere, most probably in household consumption. Therefore, in spite of all the hope among global stock-buying hope-mongers, this reduction in demand implies slower growth in the future and, of course, a more difficult rebalancing process.

Via Michael Pettis of China Financial Markets, Five or six years ago, a few skeptics first started pointing out that the credit dynamics underlying Chinese growth was creating an unsustainable increase in debt. This, they warned, would ultimately undermine the banking system and cause growth to collapse if it were not addressed in time. There were three standard rejoinders to the warnings. First, analysts argued that investment was not being misallocated, and because credit growth poured mostly into investment, it did not therefore follow, as the skeptics argued, that debt was rising faster than debt servicing capacity. Although I think few analysts still support this argument, there remain some analysts who do not think China has an overinvestment problem. For example my Carnegie colleague Yukon Huang, who has argued, for example in one of the FT blogs that China is actually underinvested:

Because I have addressed this issue many times before in my newsletters, especially the common and distressingly ahistorical fallacy that one can determine whether a very poor country like China is over- or under-invested by comparing its capital stock per capita to more advanced countries with much higher levels of social capital and the consequent ability to absorb investment efficiently, I will not do so again. Needless to say, I think that the evidence of investment misallocation has continued to rise, and in the past two years the number of analysts that are not worried about a systematic tendency for debt to rise faster than debt-servicing capacity has dropped significantly. I have no doubt that their refusal to accept the consensus on the subject is useful in that it helps sharpen the debate, but this is a losing battle and, like the capital stock argument, distressingly ahistorical. The second rejoinder, which has also largely faded away as an argument over the past few years, is that debt in China doesn’t matter. Sometimes, these analysts argue, it doesn’t matter because it is funded domestically. Sometimes it doesn’t matter because the banks are implicitly guaranteed by the central government. Sometimes it doesn’t matter because China was able to resolve its last debt crisis, 10-15 years ago, in an environment of rapid growth and at no cost, and so of course it can do so again. Again I have addressed all of these arguments as to why debt doesn’t matter in China many times before and it is pretty easy to show that all of these claims are fairly nonsensical, and this is especially obvious from the very wide range of historical precedents. Debt always matters. Either it must be repaid out of the proceeds of the investment that was funded by the debt, or – if the debt funded consumption or was misallocated into insufficiently productive investments – it must be repaid by transfers from some other sector of the economy, and these transfers reduce growth by reducing real demand. The third rejoinder should have been, in principle, the easiest to refute, and for a while it looked like it had been refuted to everyone’s satisfaction, but in the past year I have seen a revival. China doesn’t have to worry about rising bad debts in its banking sector, according to this argument, because the PBoC’s extensive reserves will make it easy to recapitalize the banks. Ray Chan, of the South China Morning Post, for example, had an interesting article last Saturday that made this point. He starts off the article by warning that the rapid growth in credit in China has uneasy parallels with rapid credit growth in the US before the 2007 crisis:

Debt and reserves The article does a good job of listing many of the problems that have emerged in the past few years, but then quotes a number of analysts who argue that China’s problems is very different from that of the US and it is unlikely to suffer the same kind of crisis. The article continues:

I agree that China is in a very different position than the US, but this isn’t necessarily a good thing. The main relevant difference is that because all the banks are perceived to be guaranteed by the central government, and Chinese households have a limited number of ways to save outside the banking system, it is unlikely that China will experience a system-wide bank run as long as the credibility of the guarantee survives, and runs on individual banks can be resolved by regulatory fiat (banks that receive deposits will be forced to lend to banks that lose deposits). We are not likely to see a Lehman-style crisis. We are also not likely to see, however, the advantages of a Lehman-style crisis, and these are a relatively quick adjustment in the process of investment misallocation. I have always said that the resolution of the Chinese banking problems is far more likely to resemble that of Japan than the US, and instead of three of four chaotic years as the system adjusts quickly, and at times violently, we are more likely to see a decade or more of a slow grinding-away of the debt excesses. The net economic cost is likely to be higher in a Japanese-style rebalancing, but American-style rebalancing is risky except in countries with very flexible institutions – financial as well as political. But I do disagree very strongly with Mervyn Davies’ claim that because the PBoC is “very rich in reserves” it will not be much of a challenge to recapitalize the banks. China’s reserves only matter to its credit position if China faced a problem of external debt. It doesn’t, and so the amount of reserves are almost wholly irrelevant, because this argument seems to be reviving, it makes sense, I think, to repeat why central bank reserves cannot in any way help China resolve the crisis. I will leave aside the problems of whether the reserves are transferred in the form of foreign currency, in which case it does little to satisfy domestic RMB-denominated funding needs, or in RMB, in which case the PBoC must stop buying dollars in order to hold down the value of the RMB and in fact must sell dollars, which would cause the value of the RMB to soar, thereby wiping out the export sector in China. A much more important objection is that the idea that reserves can be used to clean up the banks (or anything else, for that matter) is based on a misunderstanding about how the reserves were accumulated in the first place. There seems to be a still-widespread perception that PBoC reserves represent a hoard of unencumbered savings that the PBoC has somehow managed to collect. But of course they are not. The PBoC has been forced to buy the reserves as a function of its intervention to manage the value of the RMB. And as they were forced to buy the reserves, the PBoC had to fund the purchases, which it did by borrowing RMB in the domestic market. This means that the foreign currency reserves are simply the asset side of a balance sheet against which there are liabilities. What is more, remember that the RMB has appreciated by more than 30% since July, 2005, so that the value of the assets has dropped in RMB terms even as the value of the liabilities has remained the same, and this has been exacerbated by the lower interest rate the PBoC currently earns on its assets than the interest rate it pays on much of its liabilities. In fact there have been rumors for years that the PBoC would be insolvent if its assets and liabilities were correctly marked, but whether or not this is true, any transfer of foreign currency reserves to bail out Chinese banks would simply represent a reduction of PBoC assets with no corresponding reduction in liabilities. The net liabilities of the PBoC, in other words, would rise by exactly the amount of the transfer. Because the liabilities of the PBoC are presumed to be the liabilities of the central government, the net effect of using the reserves to recapitalize the banks is identical to having the central government borrow money to recapitalize the banks. This is the point. Any government that is able to borrow money can borrow money to recapitalize its banks, whether or not it has large amounts of foreign currency reserves. The amount of central bank reserves that China or any other country has is wholly irrelevant, except perhaps to the extent that without those reserves the central government would lack the credibility to borrow domestically, which hardly seems to be a concern in China’s case. Bailing out the banks, it turns out, is conceptually no different than transferring debt from the banks to the central government. China can handle bad debts in the banking system, in other words, by transferring the net obligations from the banks to the central government, and the large hoard of reserves held by the PBoC does not make it any easier for China can resolve any future debt problems. In fact if anything it should remind us that when we are trying to calculate the total amount of debt the central government owes, the total should include any net liabilities of the PBoC, and that these net liabilities will increase by 1% of GDP every time the RMB strengthens against the dollar by 2%. Does hidden debt matter? Before finishing on this topic, I want to address another related fallacy that pops up a surprisingly large number of times when I discuss the net liabilities of the central bank. I am often told that because these liabilities are hidden in the central bank books, and so no one really knows how much debt the PBoC adds to the central government’s debt burden, they really shouldn’t matter in our calculations. The central bank will presumably never default because its obligations are guaranteed by the central government, and the its net liability position is hidden, so why bother even consider the PBoC’s balance sheet when assessing China’s debt position? Even those who do not understand why this reasoning is incorrect should know that it must obviously be incorrect. If it weren’t, any country could solve all of its debt problems merely by borrowing in a non-transparent way through the central bank. As the Greeks and the Italians most recently showed us, non-transparent borrowing may cause us to recognize a problems later than we otherwise would have, but it cannot solve the problem. The reason is because in any case debt must either be serviced or the borrower must default. If the assets which were funded by the debt do not create enough wealth with which to service the debt, and if the borrower does not default, then by definition there must have been a transfer from some other entity to cover the difference between the debt servicing cost and the returns on the asset. Typically this other entity, in China and elsewhere, has been the household sector, and in the case of China the transfer occurred primarily in the hidden form of severely repressed interest rates. Whether the transfer is from the household sector, however, of from other sector, this is where the problem of debt lies for China. If the central bank (or the commercial banks or any other borrower whose obligations are covered by the central government) is unable to service its debt – and remember that the “economic” debt servicing cost is not the coupon, which is repressed by policymakers, but consists of whatever the “natural” interest rate would have been – the difference will be paid for by someone else, and the economy will suffer slower growth because of the reduction in demand caused by the transfer payment. So who is likely to cover the cost of NPLs in Chinese banks? This isn’t an easy question to answer. If the household sector continues to pay, either in the hidden form of repressed interest rates, or in the more explicit form of taxes, the existence of bad debt in the Chinese banking system must act to repress future household consumption growth. The transfers from the household sector to pay what may turn out to be a huge NPL bill will significantly lower the household income share of GDP, making it very unlikely that the household consumption share of GDP will rise. If however the state sector covers the difference (perhaps by privatizing state assets and using the proceeds to pay down debt), we are left with the very difficult political problems, which China currently faces, of assigning the costs to different sectors or groups that control the state sector in China. The potentially very large cost of cleaning up NPLs must be assigned to groups that are likely to be both powerful and reluctant to pay the cost. Debt always matters because it must always be paid for by someone –even if the borrower defaults, of course, the debt is simply “paid” by the lender. This is why the fact that debt in China seems to be growing much faster than debt-servicing capacity implies slower growth in the future. If the debt cannot be fully serviced by the increase in productivity created by the investment that the debt funded, unless it is funded by liquidating state sector assets it must cause a reduction in demand elsewhere, most probably in household consumption. This reduction in demand implies slower growth in the future and, of course, a more difficult rebalancing process. |

| Ambrose Evans-Pritchard: JPM sees 'most extreme excess' of global liquidity ever Posted: 29 Oct 2013 05:09 PM PDT By Ambrose Evans-Pritchard http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100025974/jp... If you think there is far too much money sloshing through the global financial system and causing unstable asset booms, you are not alone. A new report by JP Morgan says the bank's measure of excess global money supply has reached an all-time high. "The current episode of excess liquidity, which began in May 2012, appears to have been the most extreme ever in terms of its magnitude," said the report, written by Nikolaos Panigirtzoglu and Matthew Lehmann from the bank's global asset allocation team. They said the latest surge is far beyond anything seen in the last three episodes of excess liquidity: 1993-1995, 2001-2006, and during the Lehman emergency response from October 2008 to September 2010, all of which set off a blistering rise in asset prices. ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata This is not a problem right now. The bank says there is enough juice to keep the boom going for several more months, but it stores up bigger problems for later. "It could be a warning if fundamentals are out of whack. Markets could be vulnerable next year if that liquidity starts to disappear," said Mr Panigirtzoglu. My own view on all this is somewhat different, so I pass on the report's findings for readers to make their own judgment. They are argue that the global M2 money supply has risen by $3 trillion this year, up 4.6 percent in just nine months to $66 trillion. Roughly $1 trillion is showing up in the G4 bloc of the US, eurozone, Japan, and the UK. Most, some $2 trillion, is showing up in emerging markets where credit continued to surge at $170 billion a month in July and August despite the Fed taper scare earlier that hit the Fragile Five (Brazil, India, Indonesia, South Africa, and Turkey). Mr Panigirtzoglu said there is an internal credit boom in emerging markets that is running in parallel to QE in the West. My guess is that China has accounted for a fair chunk of the latest growth since it has reverted to excess credit yet again, shoveling loans at the state behemoths, hoping to squeeze a lit more juice out of that exhausted catch-up model. I also think that this $2 trillion jump is linked to QE by the Fed, Bank of England, the Bank of Japan, and to the ECB's back-door support for Club Med bonds. Money has been pushed out into Asia, Latin America, and Africa, but this can be overstated. Determining levels of excess money is no easy task. The devil is in the detail. JP Morgan measures "broad liquidity" held by firms, pension funds, and households (etc.) as well as banks. They say correctly (a crucial point often missed) that QE bond purchases from banks do not necessarily boost the broad money supply. You have to buy outside the banks. In very crude terms, excess liquidity is the gap between "money demand and money supply." When confidence returns, demand for money falls, so it finds a home elsewhere in stocks, property, and such. If JP Morgan is right, you can see why the BIS, the IMF, and Fed hawks are biting their fingernails worrying about the next train wreck. There is clearly a huge problem with the way QE has been conducted. The wash of money has set off another asset boom, yet the world economy has failed to achieve "escape velocity," and is arguably still in a contained depression. Global trade volumes contracted by 0.8 percent in August. (It would have been a lot worse without QE, of course, though we can never prove it.) If we ever need more QE it should go straight into the veins of the economy by direct deficit financing of big investment projects (fiscal dominance) and damn the torpedoes, and the taboos. Just print money to build houses for the poor and solve two problems at once. Remember, I said "if," before you Austro-liquidationists and coupon rentiers all scream abuse at once. Interestingly, JP Morgan also said that Norway's sovereign wealth fund ($800 billion) stopped buying equities in the third quarter, becoming net sellers. It is currently 63.6 percent invested in equities, above its 60 percent target. This implies more selling. Other such funds are likely to be in the same position. Interpret that as you want. Sounds to me like there is now a sovereign wealth fund "call" on global equities markets. They will sell into the rallies. Join GATA here: Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Andrew Maguire: Christian attacked me to defend the paper gold system Posted: 29 Oct 2013 04:41 PM PDT By Andrew Maguire Last week an attack was made on me based on misinformation. The most important question to ask about it is: Why? This is easy to answer. I am exposing the imminent default of the London Bullion Market Association's unallocated bullion banking system. Ever since Jeffrey Christian of CPM Group made the mistake of admitting that 100-1 leverage was routinely employed by the LBMA bullion banks -- -- it would appear that his credibility with his industry peers was brought into question by his exposing the default vulnerability of the LMBA's unallocated bullion banking system. My work publicizing this has put Christian on the defensive and has caused him to disparage my successful trading career. ... Dispatch continues below ... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. It mystifies me as to why my 35 years of trading and banking history are of such importance when I am recognized by my peers as an international and respected trade and investment adviser providing more than 20 years of service to institutions and accredited investors. I am recognized as a metal trading specialist and a U.S. Commodity Futures Trading Commission "whistleblower" and I want to make the following information clear. I have never said I worked for Goldman Sachs. The commodity trading firm J. Aron, for which I briefly worked, was taken over by Goldman Sachs and I suspect that this is how people have wrongly concluded that I worked at Goldman Sachs. With regard to my tenure at J. Aron, this was a very short-term junior position 41 years ago, coinciding with my first emigration to Canada, and I do not attribute any of my trading experience or skill set to the firm. My full-time institutional banking career started in Canada in 1972 at Associates Capital International, a division of Gulf and Western, prior to its acquisition by Citigroup, where I fulfilled numerous senior management roles in both Canada and later in the UK, specializing in derivatives trading. I left ACI in 1982 to become an independent trader specializing in the precious metals markets while pursuing several other business opportunities. False information was recently distributed that one of my companies, Custom Lease Capital, had failed and had been my sole business interest. I received an entrepreneur award in 1992 for excellence with this company and it was sold in good legal standing: http://ethnobc.org/uploads/Pass_Winners.pdf Alongside my experience as an independent trader, I have had directorships in several highly successful companies, including VSE-listed Guilderand Mining in 1992: www.northernminer.com/news/people--guilderand-mining/1000131933 Recent misinformation relating to a 1998 trading account's supposedly having "dismal performance" actually relates to a former wife's retail equity trading account, which indeed underperformed and was closed by me. It is not a prerequisite to have worked at Goldman Sachs of JPMorganChase to be an accredited trader. Many successful traders have worked for these companies. But I do have very good contacts at both of these banks. Not being given the opportunity to rebut misinformation before it is published creates unnecessary confusion. Despite claims to the contrary, I was never directly given the opportunity to rebut the recent charges before they were published. In summary, attempts to discredit my work by focusing on my credentials 40 years ago, using unreliable sources, confirm that I am exposing the risk of a potential LBMA default. This information obviously strikes fear in those who try to discredit me, or else why would I matter? These attacks tell me I am succeeding and I am very encouraged to continue the pursuit of the truth exposing a very opaque and protected cabal of banks that increasingly are being caught manipulating world markets. In providing this response, it is not my intention to perpetuate a distracting exercise and so I do not plan to make further comments on this matter. Join GATA here: Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| The Silver and Gold Price Uptrend Remains in Force Posted: 29 Oct 2013 04:21 PM PDT Gold Price Close Today : 1345.20 Change : -6.80 or -0.50% Silver Price Close Today : 22.452 Change : -0.046 or -0.20% Gold Silver Ratio Today : 59.914 Change : -0.180 or -0.30% Silver Gold Ratio Today : 0.01669 Change : 0.000050 or 0.30% Platinum Price Close Today : 1459.10 Change : -11.00 or -0.75% Palladium Price Close Today : 746.05 Change : -3.40 or -0.45% S&P 500 : 1,771.95 Change : 984.00 or 124.88% Dow In GOLD$ : $240.96 Change : $ 2.92 or 1.22% Dow in GOLD oz : 11.656 Change : 0.141 or 1.22% Dow in SILVER oz : 698.39 Change : 6.38 or 0.92% Dow Industrial : 15,680.35 Change : 111.42 or 0.72% US Dollar Index : 79.631 Change : 0.287 or 0.36% Silver and GOLD PRICES are languishing. Well, maybe the NGM have them languishing, since the Nice Government Men could hardly want silver and gold busting the roof when they announce they mean to keep on depreciating the dollar. The uptrend in the SILVER and GOLD PRICES that began 16 October remains in force. Those blasted Federal Open Market Committee meetings cast a pall over everything. Today stocks shot up on the theory that the FOMC tomorrow will announce that it's buying more monetary liquor for the party, i.e., not slowing down Quantitative Easing. This, they believe, will work wonders for the stock market. Anyhow, we are back to the proverb, "Buy the rumor, sell the news." Tomorrow comes the "news" and that may crack the stock market's back for this short term move. Dow Jones Industrial Average made a new high today at 15,680.35 vs. the 18 September high at 15,676.94. Hubba-hubba. Dow rose 111.42 or 0.72%. S&P500 rose 9.84 (0.5%) to 1,771.95. It has risen 9 of the last 10 days. Folks, I'm nothing but a natural born fool from Tennessee who only wears shoes half the year, but even I know that this is NOT normal and will not go on forever. This doesn't even take into consideration that the whole stock market is floating on a massive wave of newly created money. But shucks! Who am I, hick and ridge-runner, to put my conclusions up against the opinion of hundreds of shark-skin suit and pointy-toe shoe wearing Wall Streeters who hawk stocks for a living? Why, they're bound to be objective, right? After all, they're government regulated! Dow in gold and Dow in silver rose a little today. DiG rose 1.22% to 11.656 oz (G$240.91 gold dollars). DiS added 6.38 oz (0.92%) to 698.39. Both remain comfortably within their downtrends, although both rose slightly above their 20 day moving averages today. Do y'all ever think about what a sham, Potemkin world y'all live in? Everything is manipulated -- markets, media, politics -- to create an illusion of stability, prosperity, and participatory democracy. Do any of y'all really believe that hogwash? Talk is getting around on the Internet about the "Mystery Seller" coming in to the light trading hours of silver and gold futures selling two thousand or more contracts at a lick. No profit- maximizing seller in his right mind would do that. Therefore, the finger points to? Well, who has a motive to deceive? US dollar index has been gaining this week. This is the sort of move that drives the rational mind to gibber and drool. All the news expected from the FOMC is that they will continue to create $85 billion of new money a month, which can only sepreciate the dollar, and in the teeth of that the dollar RISES? Well, it did. 28.7 basis points (0.37%) today to 79.631. Y'all can buy them nasty dollars if you want, but you're just picking your own pocket. Dollar strength is almost as enduring as Hollywood chastity. Continuing the offense against reason, the Euro fell 0.31% today to $1.3744, obviously expecting dollar strength -- from alien tourists, I suppose. Yen dropped 0.56% to 101.85 cents/Y100, for what reason I haven't a clue. I've stopped trying to parse why the Japanese do anything. At the rate their population is declining, who knows how long the yen will continue to be traded. Various reports say more adult diapers are being sold than children's in Japan. What does that mean? I've already voiced my suspicions as to why silver and gold have slacked off this week. Today silver pared off 4.6 cents to 2245.2 while gold lost $6.80 to $1,345.20. That takes silver barely below its 2252c 50 DMA. I don't like that, but it's a near thing. MACD, RSI, and Rate of Change are all positive for silver. Ditto for gold, but its 50 DMA stands at $1,342.30. I reckon we simply have to endure this until the silly FOMC cloud passes. Tonight I'll appear on a webinar with Jason Matyas, who is working on the documentary, "Beyond Off the Grid." At http://www.beyondoffgrid.com/webinars/how-to-build-your-local-economy-webinar/ you can sign up for the webinar. Starts at 8:00 Central time. We'll be talking about why a US government default is inevitable, and how to rebuild your local economy. Or, y'all could wax cultural and watch rasslin' instead. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Silver and Gold Price Uptrend Remains in Force Posted: 29 Oct 2013 04:21 PM PDT Gold Price Close Today : 1345.20 Change : -6.80 or -0.50% Silver Price Close Today : 22.452 Change : -0.046 or -0.20% Gold Silver Ratio Today : 59.914 Change : -0.180 or -0.30% Silver Gold Ratio Today : 0.01669 Change : 0.000050 or 0.30% Platinum Price Close Today : 1459.10 Change : -11.00 or -0.75% Palladium Price Close Today : 746.05 Change : -3.40 or -0.45% S&P 500 : 1,771.95 Change : 984.00 or 124.88% Dow In GOLD$ : $240.96 Change : $ 2.92 or 1.22% Dow in GOLD oz : 11.656 Change : 0.141 or 1.22% Dow in SILVER oz : 698.39 Change : 6.38 or 0.92% Dow Industrial : 15,680.35 Change : 111.42 or 0.72% US Dollar Index : 79.631 Change : 0.287 or 0.36% Silver and GOLD PRICES are languishing. Well, maybe the NGM have them languishing, since the Nice Government Men could hardly want silver and gold busting the roof when they announce they mean to keep on depreciating the dollar. The uptrend in the SILVER and GOLD PRICES that began 16 October remains in force. Those blasted Federal Open Market Committee meetings cast a pall over everything. Today stocks shot up on the theory that the FOMC tomorrow will announce that it's buying more monetary liquor for the party, i.e., not slowing down Quantitative Easing. This, they believe, will work wonders for the stock market. Anyhow, we are back to the proverb, "Buy the rumor, sell the news." Tomorrow comes the "news" and that may crack the stock market's back for this short term move. Dow Jones Industrial Average made a new high today at 15,680.35 vs. the 18 September high at 15,676.94. Hubba-hubba. Dow rose 111.42 or 0.72%. S&P500 rose 9.84 (0.5%) to 1,771.95. It has risen 9 of the last 10 days. Folks, I'm nothing but a natural born fool from Tennessee who only wears shoes half the year, but even I know that this is NOT normal and will not go on forever. This doesn't even take into consideration that the whole stock market is floating on a massive wave of newly created money. But shucks! Who am I, hick and ridge-runner, to put my conclusions up against the opinion of hundreds of shark-skin suit and pointy-toe shoe wearing Wall Streeters who hawk stocks for a living? Why, they're bound to be objective, right? After all, they're government regulated! Dow in gold and Dow in silver rose a little today. DiG rose 1.22% to 11.656 oz (G$240.91 gold dollars). DiS added 6.38 oz (0.92%) to 698.39. Both remain comfortably within their downtrends, although both rose slightly above their 20 day moving averages today. Do y'all ever think about what a sham, Potemkin world y'all live in? Everything is manipulated -- markets, media, politics -- to create an illusion of stability, prosperity, and participatory democracy. Do any of y'all really believe that hogwash? Talk is getting around on the Internet about the "Mystery Seller" coming in to the light trading hours of silver and gold futures selling two thousand or more contracts at a lick. No profit- maximizing seller in his right mind would do that. Therefore, the finger points to? Well, who has a motive to deceive? US dollar index has been gaining this week. This is the sort of move that drives the rational mind to gibber and drool. All the news expected from the FOMC is that they will continue to create $85 billion of new money a month, which can only sepreciate the dollar, and in the teeth of that the dollar RISES? Well, it did. 28.7 basis points (0.37%) today to 79.631. Y'all can buy them nasty dollars if you want, but you're just picking your own pocket. Dollar strength is almost as enduring as Hollywood chastity. Continuing the offense against reason, the Euro fell 0.31% today to $1.3744, obviously expecting dollar strength -- from alien tourists, I suppose. Yen dropped 0.56% to 101.85 cents/Y100, for what reason I haven't a clue. I've stopped trying to parse why the Japanese do anything. At the rate their population is declining, who knows how long the yen will continue to be traded. Various reports say more adult diapers are being sold than children's in Japan. What does that mean? I've already voiced my suspicions as to why silver and gold have slacked off this week. Today silver pared off 4.6 cents to 2245.2 while gold lost $6.80 to $1,345.20. That takes silver barely below its 2252c 50 DMA. I don't like that, but it's a near thing. MACD, RSI, and Rate of Change are all positive for silver. Ditto for gold, but its 50 DMA stands at $1,342.30. I reckon we simply have to endure this until the silly FOMC cloud passes. Tonight I'll appear on a webinar with Jason Matyas, who is working on the documentary, "Beyond Off the Grid." At http://www.beyondoffgrid.com/webinars/how-to-build-your-local-economy-webinar/ you can sign up for the webinar. Starts at 8:00 Central time. We'll be talking about why a US government default is inevitable, and how to rebuild your local economy. Or, y'all could wax cultural and watch rasslin' instead. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| How to set-up a gold IRA or 401(k) rollover from your current plan Posted: 29 Oct 2013 02:30 PM PDT

Where you will find a quick introduction to anchoring your retirement fund with some heavy metal — gold and silver. . . . . . . We get a steady stream of phone inquiries on the subject. We designed this page to address some of the initial questions people ask on the subject. If you would like to learn more, or set up a rollover, please call George Cooper at 1-800-869-5115 He has many years experience helping people establish and maintain precious metals’ retirement plans. |

| How to set-up a gold IRA or 401(k) rollover from your current plan Posted: 29 Oct 2013 02:29 PM PDT

Where you will find a quick introduction to anchoring your retirement fund with some heavy metal — gold and silver. . . . . . . We get a steady stream of phone inquiries on the subject. We designed this page to address some of the initial questions people ask on the subject. If you would like to learn more, or set up a rollover, please call George Cooper at 1-800-869-5115 He has many years experience helping people establish and maintain precious metals’ retirement plans. |

| The Top 10 Biggest Gold Producing Countries in the World Posted: 29 Oct 2013 01:52 PM PDT The Perth Mint presents a neat infographic on the world's top 10 gold producing countries. China, which loves gold more than anything, came in as the number one producer with annual output of 370 metric tons. According to the latest official numbers from the IMF, China holds the world's fifth largest reserves of gold with [...] |

| Placeholder Gold vs Physical Gold – Spot The Massive Disparity Posted: 29 Oct 2013 01:41 PM PDT In his latest edition of Things That Make You Go Hmm (subscription is highly recommended), Grant Williams explains how he has been watching several gold market trends unfolding throughout this past year. Many of the figures do not add up, he explains. Despite clear evidence of massive demand for physical gold, “The Gold Price” has continued to trade poorly. However, the longer this situation persists, the more definitely it will resolve itself; and it’s very hard to see how that resolution ends in anything but higher prices. Demand levels from Asia continue to soar while production increases just a couple of percent each year; and leaving aside Indian festivals and increasing central bank purchases, the fiat alternative to gold bullion — the US dollar — is coming under renewed pressure in the wake of the Taper That Never Was and the appointment of Janet Yellen as Ben Bernanke’s successor. The following is an excerpt from Grant Williams his latest report, in particular his analysis on the gold market: East vs West, physical gold vs “placeholder” gold. Westerners aren’t used to the kind of inflation levels, government confiscation, and currency volatility so common in places like India; and so the need to own gold as protection isn’t fully appreciated in the West. Westerners pay lip service to gold’s being “an inflation hedge” or “a currency” or “a safe asset”, but these terms are used in an extremely abstract way by the vast majority of the investing public, who see gold as mostly just another trading vehicle. Yes, there are Western investors who have a deeper understanding of the reasons for owning physical gold, but they are a tiny minority. Perhaps the simplest way to illustrate this point is to look at trading volumes in gold ETFs — a simple, effective way of renting gold for the short term for punters investors — to see how Western and Eastern volumes compare. For the purposes of this exercise, there’s nowhere better to go than the heavyweight champion of the gold ETF world, GLD: Source: Bloomberg As you can see from this chart, the average daily turnover of GLD on the NYSE is a little shy of 11 million shares. At current prices, that is roughly US$1,419,127,163 or $1.4 billion. Every day. Fortunately, the GLD ETF is also listed on the Tokyo, Hong Kong, and Singapore stock exchanges; so a comparison is extremely straightforward. What do the volumes in Asian trading of paper shares offering “ownership” of gold custodied in the London vault of HSBC look like? Well, they look like this: Source: Bloomberg Now, eagle-eyed readers will have noticed that I didn’t include the average lines for the three Asian exchanges. The reason for that is simple: they are so close to the X axis as to be almost invisible. To provide a clear picture of the contrast between GLD volumes on the Western and Eastern exchanges, what I will do instead is show the average daily turnover on all four exchanges as dollar figures on the same chart (below). I actually had to delete the line that demarcated the X axis, because, with a 1pt stroke on it in Adobe Illustrator, it became too difficult to see the bars for Japan, Hong Kong, and Singapore; so the chart looks a little strange. What’s that? The Asian exchange volumes are a little difficult to make out? Ah… well, in that case, let me clarify it for you: The volume on the NYSE is approximately 700x that of both Tokyo and Hong Kong and a mere 350x that of Singapore. In short, Asians like their gold to be heavy, shiny, and made of … well, gold. Source: Bloomberg This massive disparity in appetite for “placeholder gold” is just one side of the coin, however; and India is just one of the Eastern countries that has been soaking up copious amounts of physical gold in recent months. Why? Well, I’ll hand it back to S. again, as he finishes his article with something of a flourish: The economic establishment wails that gold does not obey its policies. Gold defies government policies because of the disconnect between the policies and the people. Indians revere, not simply love, gold. But the State policies are founded on the economic theories of the West which treat gold like any other commodity for trade and profit. It is no surprise that the theories, which work in the West but not here, project gold as India’s villain. Yet, gold has emerged as the winner in economics — successfully hedging inflation and beating the stocks and banks. With the unalterable basic facts about gold in India known, the real challenge is how to frame a practical and workable policy for gold and how to ensure that gold imports do not affect the macro economy. Gold buying by Indians is seen as weakening India. But buying is economic power as well — in fact, the ultimate economic power is a nation’s market. Yet, surprisingly, India has not put to use its enormous power as one quarter of the world’s retail market for gold. India has to strategise and use its huge market to overcome the weakness of its people for gold. How to do it is the challenge and a topic by itself. Indeed. How do you get the gold out of Indian citizens’ hands and into government coffers? I can think of one way, but I wouldn’t advocate trying it. The evidence of physical gold’s being sucked ever more violently from West to East grew hugely this past week when figures were released for gold exports to Switzerland through London:

Extraordinary. Now, we don’t know with absolute certainty where that gold is ultimately bound — but we know it isn’t Switzerland. If we throw into the mix the widely covered movement of gold into China through HK, a picture begins to emerge of an incredible wave of physical metal heading from West to East, even as the price continues to languish. One of the primary sources of supply in this steady transfer of physical bullion has been the GLD warehouse. I’ve touched on the subject of the incredible vanishing ETF gold holdings before, but it’s worth revisiting the phenomenon and reminding readers of a chart I included in the July 16th edition of Things That Make You Go Hmmm…, entitled “What If?“: Source: TTMYGH/Bloomberg/COT This chart shows the precipitous drop-off in both ETF holdings and gold stored in the COMEX warehouses. The gold in London is heading somewhere — and it’s heading there via Switzerland, by the looks of it. Taking that chart a step further, we find yet more evidence of a major disconnect between the two biggest precious metals ETFs, GLD and SLV. As you can see from the first chart below, the prices of both “monetary metal” ETFs have performed pretty badly so far this calendar year, with GLD falling a chunky 20%: Source: Bloomberg The extent of this decline is cited by mainstream commentators as the reason for the hollowing out of the amount of metal held in custody on behalf of the GLD ETF. The silver ETF has fared even more poorly, with its customary volatility pushing it 27.5% lower year-to-date. Tough times to be a precious metals bull, to be sure. Now, however, take a look at the total reported physical metal holdings of all precious metals ETFs. (These figures extend wider than simply GLD and SLV and take into account all the major competing products.) Source: Bloomberg Notice anything? Yes… holdings of silver in ETFs have actually increased as the price has fallen nearly 30%, while gold bullion in custody has plummeted. Now, if there’s anybody out there who can explain this phenomenon to me, I am genuinely interested in hearing any and all plausible explanations. I said “plausible”, folks. This draining of physical metal was always going to cause stresses somewhere in the machinery at some point — it was only a matter of time — and the Indian central bank’s “war on gold” seems to have been the final straw. As the RBI’s working group so neatly summarized on page 9 of their 224-page paper: ”Demand for gold is not strictly amenable to policy changes and also is price inelastic due to varied reasons.” Of course, despite the fact that gold isn’t “strictly amenable to policy changes,” nor does it have any price elasticity, the Indian government went ahead and made a raft of policy changes designed to curb gold buying. The upshot?

Those final ten words are the key. There now exists something of a perfect storm in the physical gold market as we move deeper into the Indian festival season. Demand at this time of the year in the subcontinent is “inelastic” (as the geniuses at the RBI eventually surmised). The GLD ETF has already lost nearly 35% of its bullion this year; China has been hoovering up as much physical gold as it possibly can (through Hong Kong and, most likely, Switzerland); and we are now set to move into what has been, for the last 40 years, the strongest part of the year with regard to the price performance of gold (driven largely by that Indian festival season). |

| Posted: 29 Oct 2013 01:34 PM PDT In our previous commentary we discussed the implications that the most recent moves in the USD Index and the general stock market are likely to have on the precious metals market. Today, we will briefly discuss two parts of the PM market. Read More... |

| Gold Daily and Silver Weekly Charts - Day After Option Expiry and FOMC Tomorrow Posted: 29 Oct 2013 01:15 PM PDT |

| Gold Daily and Silver Weekly Charts - Day After Option Expiry and FOMC Tomorrow Posted: 29 Oct 2013 01:15 PM PDT |

| Posted: 29 Oct 2013 01:06 PM PDT 29-Oct (CMEGroup) — Gold showed vulnerable action on Tuesday as prices failed to reverse a recent pattern of lower highs and prices also failed to hold above this week’s initial lows. Clearly a much sharper than expected rally in the Dollar served to shift sentiment in gold away from the recent bull track as the market’s attention was at least temporarily diverted away from the hope of further US easing. In fact, even with reports of a criminal investigation into manipulation of the Dollar reportedly behind the sharp rally in the Greenback, gold and other physical commodity markets were just not able to discount the negative influence of the currency market action on gold prices. The gold market did show some minor recovery action in the wake of soft US conference board readings and therefore the gold market at times is able to benefit from evidence of soft US data. Unfortunately the gold market focus has been extremely fickle over the last two weeks and therefore it could take a definitively dovish Fed statement to rekindle the bull track that dominated gold from October 15th to October 28th. With reports of an increase in gold de-hedging circulating Tuesday afternoon that could have been responsible for a portion of the October rally but producers aren’t like to implement hedges until prices off a more reasonable profit margin. Another issue that might be capable of lending support to gold prices in the weeks ahead is predictions that extreme premiums for gold inside India might result in a significant jump in smuggled gold and that in turn could boost demand in neighboring areas like Dubai and Singapore. [source] |

| The Daily Market Report: Gold Pulls-Back Modestly, but Impetus Remains to Upside Posted: 29 Oct 2013 12:40 PM PDT

This morning’s U.S. economic data were just the latest indications that the economy is foundering. Retail sales missed expectations, falling 0.1% in September. PPI for September came in at -0.1%, also below expectations, but it was the annual pace of producer price appreciation that really caught me off guard; PPI was just 0.3% y/y in September, versus 1.4% y/y in August. We talked about the absence of “official” inflation in Friday’s DMR and today’s PPI print has to be very troubling to the Fed. With inflation running well below the Fed’s own target of 2%, there is little chance they would contribute to disinflation or deflation risks by commencing a taper. The FOMC is widely expected to hold steady on policy tomorrow, but FedWatchers will be combing through the verbiage of the policy statement for any subtle hints on timing for a possible taper at some point down the road. While the Fed might be inclined to give taper advocates a little glimmer of hope, if for nothing else to keep markets a bit off guard, the Fed is in reality remains unlikely to taper until 2015ish. You may recall that when they first gave their 6.5% unemployment target, the Fed’s central tendencies didn’t forecast a such a jobless rate until 2015. Since then, the unemployment rate has been coming down more as a result of labor force participation that true job growth. Chairman Bernanke has acknowledged this troubling trend and hinted that even 6.5% unemployment may not be enough to start tapering. As investors begin to recognize that the taper is a distant possibility, the underlying long-term uptrend in gold should continue to re-exert itself. Long-time gold watcher Gene Arensberg views the $1350 to $1375 zone as a “technical crossroads”. Arensberg believes a rise above this level would confirm a new bull-market leg, “which would invite participation by momentum traders in larger numbers." |

| Ron Paul Talks About Economic Collapse and Lack of Federal Reserve Transparency Posted: 29 Oct 2013 12:10 PM PDT In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed. Senator Rand Paul has introduced legislation for an "Audit the Fed" bill which [...] |

| Gold’s Gift on the Eve of Zero Hour Posted: 29 Oct 2013 12:02 PM PDT While the price of gold has been range-bound between $1,290–1,420 since late July, we remain on watch for evidence of what we've labeled "Zero Hour." That's the moment when a major commodities exchange runs out of gold to settle a contract and settles in cash instead — a default. At that moment, the price of physical gold in your hand runs away from "paper gold." As we go to press, signs of stress are in the system — especially in GLD, the giant ETF that's a proxy for the price of gold. We've never much liked GLD. It has too much "counterparty risk" — the risk that whomever you're doing business with won't, or can't, live up to their promises. Among those promises is that heavy-duty moneybags investors can exchange their GLD shares for actual metal — an option not available to you, the retail investor. But now even the big boys can't trade in their shares for the real thing. "People have tried to get their gold out of that ETF," says John Hathaway, manager of the Tocqueville Gold Fund, "and you just can't get it." Hathaway's account is confirmed by Grant Williams, a Singapore-based hedge fund adviser. The problem? The massive imbalance between futures contracts on the New York Comex and the actual metal inventory the Comex has on hand for delivery. Williams reckons there are 55 ounces of "paper gold" for every ounce of the real thing. "We've seen the gold being drained out of the Comex almost nonstop this year," Williams recently told radio host Eric King, "certainly since the Bundesbank repatriation request. It hasn't had any noticeable effect just yet, but it really is a spring that is continually being coiled, and at some point it is going to snap back. And when it does, with all of these disparate claims on each ounce of gold, there is going to be some fireworks, no doubt about it." From the start of 2013 through mid-September, Comex gold inventories plunged 36% — from 11.059 million ounces to 7.034 million. This is the West-to-East flow of gold we've been documenting all year in the daily 5 Min. Forecast. The gold being drained from the vaults in New York has moved to China, where both the central bank and ordinary people are loading up at prices last seen in 2010. The drop in Comex inventory "is worth $9.66 billion at today's prices," writes Mark O'Byrne of the Irish gold dealer GoldCore, "meaning that a handful of billionaires or just one powerful creditor nation-state with large foreign exchange reserves, such as Russia, could corner the Comex gold market and cause a default." Zero Hour approacheth. Here's another wrinkle uncovered by the aforementioned Grant Williams. Nearby is a chart of the gold price going back three years — annotated with two specific dates. The first one was when Venezuela's late caudillo Hugo Chavez demanded the repatriation of 160 metric tons of gold held abroad, mostly at the Bank of England. The second was when Germany's central bank asked for the return of 674 tons of gold from the New York Fed and the Banque de France — for which the Germans were told they'd have to wait seven years. In both cases, "an initial move higher quickly morphed into a concerted move lower" in the gold price, writes Williams. And because Germany was asking for more than four times as much bullion as Venezuela, the move down was that much greater. What gives? Williams is in agreement with Eric Sprott, the Canadian fund manager who helped us develop the Zero Hour scenario last February. The Western central banks have leased their gold to large commercial banks at interest rates of less than 1%, and the commercial banks have sold that gold (mostly to China), plowing the proceeds into assets earning more than 1%. "I think the central banks have been leasing their gold out for decades to the bullion banks," Mr. Williams writes in his free newsletter Things That Make You Go Hmmm… "and now find themselves in the rather precarious position of needing to reclaim that which they are supposed to own before the shortfall is exposed." The smash in the paper gold price "was specifically designed to shake out loose holders," Williams goes on, "and it has worked to a degree, but only amongst the weaker holders of the ETFs, who tend to 'rent' gold rather than own it. "I think the stronger hands have been getting their gold out of the official warehouses as fast as they can; and central banks in places like China, Russia and all over the rest of Asia and South America have been trying to buy and, crucially, to take delivery of physical gold while they still can." Zero Hour approacheth. Mr. Sprott himself would agree. "The supply of gold has not gone up," he recently told an interviewer at Mineweb. "In fact, it was down last year, I'm sure it will be down this year, I'm sure it will be down next year. So how can we have these new entrants coming into the market and buying that much gold, and the price goes down? "It's always been my contention that the demand for gold is well in excess of mine supply, that the Western central banks continue to supply that gold. "I think the decline in gold was engineered here to try to spring some physical gold out of the market, which the GLD and other ETFs responded to in huge proportion. There was a dump of about 700 tons of physical gold in a six-month period. Well, that's almost 1,400 tons a year, annualized. That's about two-thirds of the mine production ex China, ex Russia that hit the market on an annualized basis, and yet was consumed, I might point out." Consider it a gift as Zero Hour approaches. You can buy metal in 2013 at 2010 prices. Regards, Addison Wiggin Ed. Note: In today’s Daily Reckoning email edition, Addison revealed his two favorite ways to buy and hold real physical gold… and offered readers a rare chance to get in on one of them right away. Offers like this are packed in every single issue of The Daily Reckoning email edition. If you’re not getting it, you’re missing out. It’s completely free to sign up, it comes with no obligation and it takes about 30 seconds. So if you’ve got half a minute to spare, you might want to use it to sign up for FREE, right here. |

| Gold falls as prices hit ‘technical crossroads’ Posted: 29 Oct 2013 11:44 AM PDT 29-Oct (MarketWatch) — Gold futures fell below $1,350 an ounce Tuesday, a key technical level, as traders studied a spate of U.S. economic data releases, including a bigger-than-expected drop in consumer confidence, for their potential impact on the Federal Reserve's monetary-policy decision this week. December gold GCZ3 -0.54% shed $6.10, or 0.5%, to $1,346.10 an ounce on the Comex division of the New York Mercantile Exchange. The gold market reached a "pretty important technical crossroads with gold in the $1,350s," said Gene Arensberg, editor of the Got Gold Report. "Between $1,350 and $1,375 is (an unknown but almost certain) point of transition where the 'maybe new bull-market leg' becomes a 'confirmed new bull-market leg', which would invite participation by momentum traders in larger numbers." [source] |

| A Cyclical ‘Mini-Me’ to a Big Secular Event? Posted: 29 Oct 2013 11:17 AM PDT Ever since the current (final wave 5?) leg in the now 4 year, 7 month old US stock bull market generated in November of 2012, NFTRH has tried to make the point that there is no new secular bull market in US stocks. Indeed, there is a maturing cyclical bull market that has another 5 (+/-) months to live if it is to match the two previous cycles. The bubble leader, Russell 2000 does after all have a measured target of 1350 (Kisses Goodbye). Why do we call the US cyclical stock bull a bubble you ask? Because of this chart (courtesy of SlopeCharts), variations of which NFTRH subscribers have been repeatedly hit over the head with just to make sure that we know what we are dealing with. The orange line (S&P 500) shows the first hump was the ending bubble phase of the secular bull market, when stocks just had to be owned by the public even as they separated from all rational measures of value, including corporate profits (green line). The second hump was in line with corporate profits as the Greenspan-instigated credit bubble served to pump the economy temporarily. The third hump goes hand in hand with corporate profits and with a more honest official inflation (as policy) as the Monetary Base hockey stick (blue) sees to it that corporate profits and the S&P 500 keep right on rising. The two previous humps lasted about 5 years each. T minus… Today’s cyclical stock bull is likely a bubble because reverence toward policy makers and the efficacy of policy making is likely a bubble. Remember how well reviled Ben Bernanke was in 2011? Pitchfork wielding mobs and all? Bill Gross very publicly went bearish against long-term Treasury bonds due to the inflation that “Helicopter Ben” had promoted? “How you like me now, suckas?” thinks Ben. The macro backdrop is currently a compressed and oh so noisy ‘mini-me’ version of the the big changes that occurred in 2000. The difference is secular vs. cyclical. So what does this mean for the gold stock sector? Chart courtesy of Savehaven.com Well for one thing it means that gold stocks are back on the counter cycle where they belong after spending 8 years (shaded area) mostly in positive correlation to the US stock market. The gold stock bull market was birthed on a counter cycle as the great secular stock bull market ended in 2000. If symmetry holds and we are right to call the S&P 500′s bull market a cyclical one with termination measured in months, not years, then we may also be right in looking for a strong rally at least and new cyclical bull market at best, in the absolutely torn to shreds gold mining sector. If you look at the big picture chart above you see a series of higher highs and higher lows intact on the HUI during the secular phase from 2000 to present. What is a bull market? It is a series of higher highs and higher lows. The cyclical bear of the last two years has required infinite risk management but let me ask you this; how many stock market bulls are thinking about risk management right now? The same proportion that were doing so in 2000 maybe? Conversely, how many strong gold stock bulls are left out there? The same proportion as in 2000 maybe? The current cycle has from several vantage points (macro fundamental and technical) the potential to be a mini-me version of the big changes that occurred in 2000. Best of all, few are expecting it. Next best of all, in the event this analysis is incorrect and a new, enduring era of economic plenty has actually been manufactured by policy, gold will fail again and the gold stock sector will probably fail the blue dotted line above, which can be considered a close proximity ‘stop loss’ to this plan. But if the plan is correct, it is a long way up to another higher high on the HUI (though it is best to manage lower, shorter term targets and resistance points for now). Meanwhile, expect grind and noise as emotional markets play out their respective roles with policy makers front and center both in the media (jawboning) and through official policy statements (FOMC comin’ at ya tomorrow at 2PM US Eastern). Note: This originally appeared over at Safehaven.com P.S. The Daily Reckoning email edition is full of great insights, wisdom and advice for the savvy investor. Learn how to profit from today's big market moves by subscribing today. Just click here. |

| A top 2012 gold-copper discovery gets first resource Posted: 29 Oct 2013 10:36 AM PDT Goldquest puts together first Romero resource, and Brent Cook of Exploration Insights weighs in with some thoughts on high grade deposit core. |

| Sibanye mulls solar plant to combat rising power prices Posted: 29 Oct 2013 10:36 AM PDT Sibanye's electricity costs have risen 60% since 2007, even as the gold mining company used 16% less power, says CEO Neal Froneman. |

| Shanghai gold hits discount to London on ‘money market’ fall-out Posted: 29 Oct 2013 10:36 AM PDT Prices on the Shanghai Gold Exchange stood at a $7 premium to London settlement last week, peaking $30 above that international benchmark. |

| Gold miners reduce hedge book in Q2, more cuts seen Posted: 29 Oct 2013 10:36 AM PDT The outstanding volume of gold delta-hedged against producers’ hedge contracts fell by 529,000 ounces in Q2, says SocGen and GFMS. |

| Gold prices to stay volatile despite beginnings of new positive trend – Levenstein Posted: 29 Oct 2013 10:36 AM PDT From a technical perspective, David Levenstein argues, now that gold seems to have broken its down trend, the yellow metal has its best chance to outperform towards the end to the year. |