Gold World News Flash |

- PA Food Bank Head Warns Demand Cannot be Met

- Gold vs. Wall Street Program Traders

- China – Gold – Financial Capital of the World

- Gold’s Role in a Portfolio

- Tracing The Great Chinese Gold Rush

- David Morgan Interview - Silver Summit Oct 2013 - Spokane

- That’s a Lot of Silver…

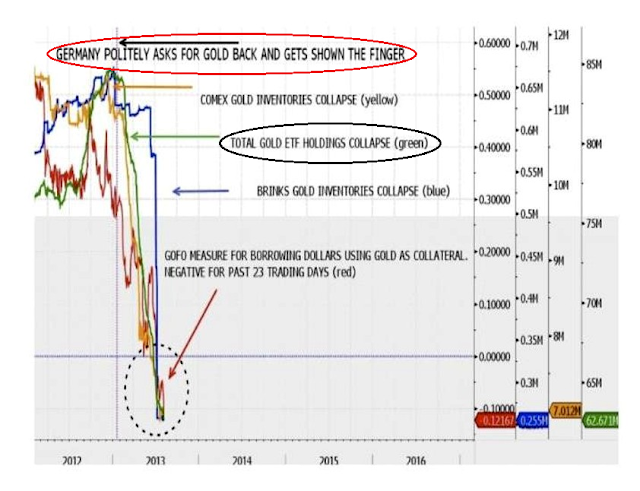

- The Massive Drawdown of Gold From the West Continues - Silver Comparison - the Abyss

- The Massive Drawdown of Gold From the West Continues - Silver Comparison - the Abyss

- Greek Companies Unable To Pay Taxes Explode From 182K To Over Half A Million In One Month

- Will Indians keep buying gold?

- Why Is An Epidemic Of Thievery Sweeping America?

- Silver and Gold Prices Gainsaid Each Other with the Gold Price Rising to $1,314.60

- Silver and Gold Prices Gainsaid Each Other with the Gold Price Rising to $1,314.60

- US Dollar Appears To Be Fundamentally Weak

- I Would Like To See No Reason To Own Gold

- American Silver Eagle Coin Sales On Verge of Record Shattering Year

- U.S. Mint Gold Coin Sales Soar 273% in October

- Gold market manipulation cited in Future Money Trends interview of Jay Taylor

- Gold Daily and Silver Weekly Charts - Ship of Fools

- Gold Daily and Silver Weekly Charts - Ship of Fools

- QE will increase but rates will rise anyway, Turk says

- The Mogambo Guru’s Lifetime Income Equation

- Strong euro poses risk to recovery, Fabrizio Saccomanni warns

- Gold vs. Wall Street's Program Traders

- Disappearance of Western central bank gold becomes clear, Embry says

- A Drone of Their Own: US Eyes China’s Drone Program

- Fate of Dollar is the Fate of U.S. Power-Dr. Paul Craig Roberts

- The Daily Market Report: Gold Rebounds From Two-Week Low

- Honest Politicians… And Other Oxymorons

- "Token demand" for new Hindu year leaves gold waiting on US data

- Can’t miss headlines: Gold eyes $1,300, Jaguar dilution looks massive & more

- Gold eases on talk ECB may loosen monetary policy

- Jim Sinclair’s $50,000 gold call – let’s hope it doesn’t happen

- China is Buying Up the World – Big Time! Take a Look

- Jim Rickards’ Newest Book: The Death Of Money

- The Biggest Fear in Retirement, and the Golden Solution

- How Much More Gold Can They Drain From GLD Before It Loses All Credibility?

- Weekend Report...The US Dollar and Oil...The Inflation / Deflation Battle Rages On

- Gold Gains From a Two-Week Low in New York; Platinum Increases

- Gold firms as investors await ECB, Fed policy moves

- Gold better at 1318.70 (+3.50 ). Silver 21.81 (-0.01). Dollar easier. Euro higher. Stocks called higher. US 10yr 2.61% (-2 bps).

- Can VIX Substitute Gold?

- Gold Prices Look to US Jobs Data After Diwali Demand "Goes Missing" in India

- Coming Clean, Dr. Joseph Farrell – Covert Wars & The Mysterious Strength of the US Dollar

- "Token Demand" for New Hindu Year Leaves Gold Waiting on US Data

- US Dollar and Crude Oil…The Inflation / Deflation Battle Rages On

- Gold price in a range of currencies since December 1978 XLS version

- The Visual Capitalist's Guide to Precious Metals Stock Picking

- The Visual Capitalist's Guide to Precious Metals Stock Picking

| PA Food Bank Head Warns Demand Cannot be Met Posted: 04 Nov 2013 09:40 PM PST by Paul Joseph Watson, InfoWars:

Joe Arthur of the Central Pennsylvania Food Bank "says the donor network for the food banks is already stretched too thin to quickly expand," according to an Associated Press report. From November 1st, $5 billion was wiped off the Supplemental Nutrition Assistance Program (SNAP) as a result of a planned stimulus withdrawal. Almost 50 million Americans who are supported by the program face an average loss of $36 dollars a month, which is a significant amount for those living near the poverty line. | ||||||||||||||||||||||||||||||||||||||||

| Gold vs. Wall Street Program Traders Posted: 04 Nov 2013 09:35 PM PST Gold ran into trouble last week after an encounter with its important 150-day (30-week) moving average. The 150-day MA, which is an important psychological resistance barrier that is programmed into many Wall Street trading algorithms, was touched by gold a few days ago and was unable to overcome it. I've long maintained that the 150-day moving average is a psychologically significant benchmark for the gold ETF, both as a line of support and resistance. GLD's performance in recent days has confirmed this observation. | ||||||||||||||||||||||||||||||||||||||||

| China – Gold – Financial Capital of the World Posted: 04 Nov 2013 08:40 PM PST from Armstrong Economics:

| ||||||||||||||||||||||||||||||||||||||||

| Posted: 04 Nov 2013 08:20 PM PST by David Schectman, MilesFranklin.com:

"Gold isn't an investment, it's an insurance policy," I said, "You may need it some day." He replied, "I don't need it for insurance. I'll never have to sell it. I'll leave it for my kids." I said, "Will you change your mind when gold is $3,000 or $5,000 an ounce? You bought it at $300 and it's up three to four times. That certainly beats any interest you would have earned over the last decade." | ||||||||||||||||||||||||||||||||||||||||

| Tracing The Great Chinese Gold Rush Posted: 04 Nov 2013 07:16 PM PST As we recently noted, China is taking over the world on gold bar at a time. This growing world super-power has, it would appear (by words and deeds) grown tired of being on the receiving end of the USDollar and Fed money printing. The Real Asset Company illustrates how, in the space of a few decades, China has opened up her huge gold market which is now hungrily devouring the world's physical gold.

(click image for large legible version) | ||||||||||||||||||||||||||||||||||||||||

| David Morgan Interview - Silver Summit Oct 2013 - Spokane Posted: 04 Nov 2013 07:16 PM PST In our mail bag this morning is this interview with David Morgan at the Cambridge House Silver Summit by Vanessa Collette, bought to us by First Majectic Silver Corporation. Silver expert David Morgan from the Morgan Report chats | ||||||||||||||||||||||||||||||||||||||||

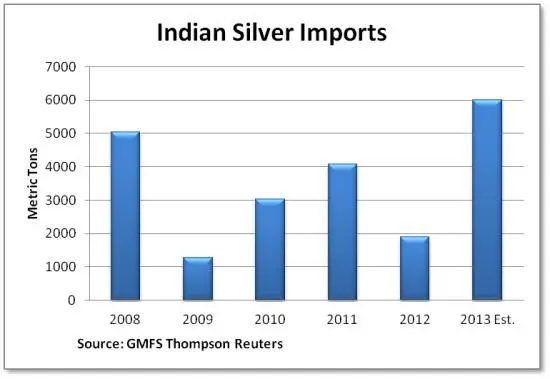

| Posted: 04 Nov 2013 07:01 PM PST The Indian government has restricted the importation of gold. So Indians have switched to silver:

Some thoughts There are about 32,000 ounces in a ton, so 6,000 tons is nearly 200 million ounces. The total annual supply of silver is a billion ounces (750 million ounces from mines, 250 million from recycling). So 200 million ounces is 20% of total global supply – a lot of silver for just one country. According to the Silver Institute, industrial users (including jewelry makers) absorb about 850 million ounces of silver each year, which leaves 150 million ounces for investors. But by importing 132 million more ounces this year than last, India is taking almost all of that surplus for itself, leaving the rest of the world's silver bugs to scramble for what little is left. Also interesting is the fact that silver is so cheap that a doubling of imports has a negligible impact on India's balance of trade and therefore probably won't attract the ire of regulators. So from a policy standpoint, restricting gold imports is working and will likely continue. That means the current level of silver demand might be sustained. Wonder where all the extra silver will come from? | ||||||||||||||||||||||||||||||||||||||||

| The Massive Drawdown of Gold From the West Continues - Silver Comparison - the Abyss Posted: 04 Nov 2013 05:26 PM PST | ||||||||||||||||||||||||||||||||||||||||

| The Massive Drawdown of Gold From the West Continues - Silver Comparison - the Abyss Posted: 04 Nov 2013 05:26 PM PST | ||||||||||||||||||||||||||||||||||||||||

| Greek Companies Unable To Pay Taxes Explode From 182K To Over Half A Million In One Month Posted: 04 Nov 2013 05:20 PM PST The US bug, whereby the worse the economy, the higher the stock market and bond prices must have shifted to Greece, because while the Greek stock market was the best performing "asset" class in October, and Greek bond yields are plunging just because the greater fool stock posse has now moved to the insolvent nation if only for a few months, the economic reality just gets worse by the minute. Case in point - Greek corporations, or what's left of them, and what Greece needs more than anything - taxes. Kathimerini reports, in what is now nail overkill on the Greek economic coffin, that "hundreds of thousands of enterprises are unable to fulfill their tax obligations, according to the data published on Monday by the Finance Ministry. Within just one month, from the end of August to end-September, the number of corporations that have fallen behind on their taxes soared from 182,785 to 526,477." No, you read that right: the number of companies that went in arrears on their tax obligations has tripled to over one million in one month. The same month in which the Grecovery was rumored to be in full swing and when John Paulson was buying every Greek stock he could find. It's a crazy pills world as Kathimerini reports.

There was a silver lining: with virtually nobody working officially, as unknown amounts have shifted to the gray economy, the taxpayer debt have plunged. Why? Simply because if one doesn't officially make money, a luxury corporations can't afford, one doesn't officially have to pay any taxes, hence no taxpayer debts.

Good luck collecting in current year debts when the unemployment hits fresh record highs, and thus the base of taxpaying individuals craters. As for corporations, our best advice is for Greece to tax the bankruptcy process. That's the only way the dying country can possibly collect any "owed" funds from what is left of the country's once thriving businesses. But at least the Greek economic skeleton still has its precious euro. Meanwhile, elsewhere in the same basket case country...

| ||||||||||||||||||||||||||||||||||||||||

| Will Indians keep buying gold? Posted: 04 Nov 2013 05:07 PM PST 8p ET Monday, November 4, 2013 Dear Friend of GATA and Gold: Premiums on gold in India will decline over time as smuggling the monetary metal past the government's heavy-handed import restrictions is institutionalized, according to an Indian analyst interviewed by Sprott Asset Management's Henry Bonner. Bonner's commentary is headlined "Will Indians Keep Buying Gold?" and it's posted at the Sprott Internet site here: http://sprottgroup.com/thoughts/articles/will-indians-keep-buying-gold/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| Why Is An Epidemic Of Thievery Sweeping America? Posted: 04 Nov 2013 05:05 PM PST Submitted by Michael Snyder of The Economic Collapse blog, Desperate people do desperate things, and it appears that Americans are rapidly becoming a lot more desperate. An epidemic of thievery is sweeping across America, and authorities are not quite sure what to make of it. Down in Texas, cattle thieves can get up to $1,500 per head of cattle, and cattle rustling was up nearly 40 percent last year. As you will read about below, cargo hijacking is becoming much more sophisticated, and it is being estimated that losses from cargo thefts will total about $216 million this year alone. And for some reason, Tide laundry detergent has become a very hot commodity among common criminals all across America. In fact, it is being reported that some grocery stores are "losing $10,000 to $15,000 a month" as a result of Tide thefts. So why is all of this happening? Well, as I have written about previously, crime is on the rise in the United States, and poverty is absolutely exploding. In fact, according to the latest numbers from the U.S. Census Bureau, 49.2 percent of all Americans are receiving benefits from at least one government program each month. Over the past five years, we have seen an unprecedented rise in the number of people that cannot take care of themselves without help from the government. Millions upon millions of Americans that have been forced into poverty are becoming increasingly angry, frustrated and desperate. And what we are watching right now is only just the beginning - all of this is going to get a whole lot worse. When people think of the "social decay" that is happening to America, most of the time Texas and Oklahoma would not be the first places that come to mind. But according to NPR, there was nearly a 40 percent rise in the theft of cows and horses down in that area of the country last year...

And this is happening even though the penalties for cattle rustling have gotten much stronger...

Another trend that is baffling law enforcement authorities is the huge wave of cargo hijackings that they have been seeing. According to a recent CBS News article, cargo thefts are becoming a lot more elaborate these days...

You may not think that stealing truckloads of walnuts or cheese is a big deal, but the truth is that the dollar values of some of these thefts are absolutely staggering...

And this is not just happening in a few isolated locations. We are literally seeing an epidemic of cargo theft that stretches from coast to coast...

Perhaps most fascinating of all is the wave of Tide thefts that is sweeping the nation. The following is an excerpt from a New York Magazine article from earlier this year...

So why are criminals so interested in Tide detergent? Well, apparently it is heavily used as currency in the drug trade...

We live at a time when an increasing number of Americans will do just about anything for money. Down in Florida, one mother was so desperate for money that she was actually prostituting her three teenage daughters. Two of them were under the age of 18...

But haven't you heard? Everything is just fine in America. Barack Obama and the mainstream media keep telling us that over and over, so it must be true. Right? I think that we got a glimpse into the true condition of America last month when a "technical glitch" caused the system that processes food stamp card payments to malfunction for a couple of hours. A Time Magazine article described what happened at one Wal-Mart in Louisiana...

And similar "mini-riots" happened in a bunch of other locations as well. For example, customers at one Wal-Mart in Mississippi just started taking groceries out of the store that they hadn't paid for when their food stamp cards were not accepted...

Keep in mind that all of this was caused by a "technical glitch" that only lasted for a few hours. What would happen if there was a problem that lasted for much longer? That is a sobering thing to think about. And as I wrote about recently, all 47 million Americans on food stamps just had their benefits reduced on November 1st. This is causing food banks all across the country to brace for a huge influx of needy people...

In fact, the president of the Food Bank for New York City says that members of her organization "are panicking"...

Purvis also told Salon.com that "when people cannot afford to eat food" it has the potential to start "riots"...

So will we see riots as a result of these food stamp cuts? No, I do not believe that we will see riots yet. But the volcano of anger, frustration and desperation that is simmering just below the surface of this country continues to get hotter. Someday it will explode. What will you do when that happens? | ||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Gainsaid Each Other with the Gold Price Rising to $1,314.60 Posted: 04 Nov 2013 04:34 PM PST Gold Price Close Today : 1314.60 Change : 1.50 or 0.11% Silver Price Close Today : 21.678 Change : -0.126 or -0.58% Gold Silver Ratio Today : 60.642 Change : 0.419 or 0.70% Silver Gold Ratio Today : 0.01649 Change : -0.000115 or -0.69% Platinum Price Close Today : 1453.90 Change : 18.00 or 1.25% Palladium Price Close Today : 748.95 Change : 2.45 or 0.33% S&P 500 : 1,767.93 Change : 6.29 or 0.36% Dow In GOLD$ : $245.92 Change : $ 0.09 or 0.04% Dow in GOLD oz : 11.896 Change : 0.004 or 0.04% Dow in SILVER oz : 721.43 Change : 5.25 or 0.73% Dow Industrial : 15,639.12 Change : 23.57 or 0.15% US Dollar Index : 80.574 Change : -0.148 or -0.18% Silver and GOLD PRICES gainsaid each other today. The gold price rose $1.50 to $1,314.60 while silver lost 12.6 cents and ended at 2167.8c. Let's review the facts, since they never lie -- you can't always parse what they're saying, but they never lie. The SILVER PRICE bottomed at 1817c on 27 June, traded as high as 2512 cents (end August) and sank back to a mid-October low at 2050c. That uptrend remains intact, and today the line hits about 2100c under the silver market. Relative Strength Indicator is pointing down, MACD just rolled over downside. Rate of change also turned down today, after rising since Mid-October. But the silver price has drawn a line in the sand, today's low at 2158c. Draw a line from the 2050 October low to that and you have and uptrend. If it breaks that 2060cent mark, it will sink toward 2100c. However, it if holds here silver will be turning in the teeth of all pessimism. GOLD PRICES are much the same, with an uptrend line from the June low at $1,179,.40 to the October low at $1,250. Today that uptrend offers support about $1,260. Friday's low was lower than today's, so there's also an uptrend from mid-October until now. Close below $1,312 tomorrow violates that support. Here's a little clue as to why and how so much industry -- and industrial jobs -- have been exported from the USA. In Bangladesh, the worlds second largest clothing exporter, garment workers have been striking because an April collapse of one garment factory killed more than 1,100 garment workers. A new government wage board has proposed wages be raised 77% to 5,300 taka ($68 or 78 taka=US$1) monthly, but factory bosses are holding out for 4200 taka ($54). If 5300 taka is a 77% rise, then the minimum wage now is about 3,000 taka ($54)/month, then the workers would be making about 22-1/3 cents an hour if they work (ha-ha) a 40 hour week. (3000/4.33 weeks/40/78) Now maybe some of y'all can explain how US garment factories paying $10 an hour plus a social security, insurance, tax-tax-tax load of say, 35%, above the hourly wage or $13.50 net cost per hour, can compete with a factory paying 22.3 cents an hour. Whoops -- they can't. Average monthly wage for Bangladeshi workers is about half that of its rivals Vietnam and Cambodia, and about one-fourth that of top exporter China. But after all, price is the only thing that counts when you buy clothes, right? And people wonder why these folks vote communist! Today's markets were subdued. Stocks rose a little, gold rose barely, US Dollar index gave back some of its preposterous gains from last week. Stock market smugness remains at all time highs, as does margin debt, P/Es, and dividend yields. It is scenario written by Daffy Duck, or maybe the Three Stooges. If Moe were around today, they'd make HIM the head of the federal reserve. Stocks barely moved today. Dow rose 23.57 (0.15%) to 15,63910 while the S&P500 rose 0.36% (6.29) to 1,767.93. S&P500 and other indices remain in a "thrown over" condition above their top channel lines. That might not mean much to y'all unless you know that when a market has been rising a long, long time the "throw-over" or trading above its upper trend line generally sounds a honking big alarm that the rise is over. Generally. Usually. Normally. Dow in gold and silver rose again today and is starting to bother me just a little. Dow in gold today closed 11.90 oz, up 0.23% and Dow in silver closed 722.53 oz, up 1.15%. Compare these against the June highs at 12.514 oz and 816.77 oz. Trend still down, but both indicators stand above their 20 day moving averages, pointing momentum up. US Dollar index broke a six day winning streak today by giving up 14.8 basis points (0.19%) to 80.574. Since it is close to its 50 dma (80.66), odds say it has turned up and will rally toward 81 (where it failed today) toward its 200 DMA at 81.77. Y'all tell me why it's rallying -- beats me. However, I am reporting to you what it is doing technically. Fundamentally, the US dollar has less value than all that gravel and fish dung at the bottom of your fish tank. Euro looks even sicker than the US dollar. Lo! How is the mighty euro fallen, from $1.3825 a few days ago, gapping down twice, to close today at $1.3514. Sitting above its $1.3494 50 day moving average. Euro was also enjoying a big, long (since mid-September) throw-over, but has now come back to the channel line. Drops could be dramatic from here, since the 200 DMA stands at $1.3229. Yen didn't wiggle today. Closed 101.43 cents/Y100, and going nowhere but sideways. It's in a crab race with the US dollar. Ominously for the dollar, that upside breakout of the 10 year treasury yield that took place in June and relented in September has now lifted its head again. Yes, the higher interest rate will attract buyers, but it will also cost the US treasury dearly AND it violates the Fed's Zero Interest Rate Policy. In other words, it squeezes the fed and suggests bond buyers aren't so sure the dollar is worth what they presently must pay for it. Just a little bird-chirp in the wind, but worth hearkening to. A friend today whom I know to be a successful trader told me he bought more metals because today marked a 60 year anniversary of 1953 lows. Maybe he knows something I don't know. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| Silver and Gold Prices Gainsaid Each Other with the Gold Price Rising to $1,314.60 Posted: 04 Nov 2013 04:34 PM PST Gold Price Close Today : 1314.60 Change : 1.50 or 0.11% Silver Price Close Today : 21.678 Change : -0.126 or -0.58% Gold Silver Ratio Today : 60.642 Change : 0.419 or 0.70% Silver Gold Ratio Today : 0.01649 Change : -0.000115 or -0.69% Platinum Price Close Today : 1453.90 Change : 18.00 or 1.25% Palladium Price Close Today : 748.95 Change : 2.45 or 0.33% S&P 500 : 1,767.93 Change : 6.29 or 0.36% Dow In GOLD$ : $245.92 Change : $ 0.09 or 0.04% Dow in GOLD oz : 11.896 Change : 0.004 or 0.04% Dow in SILVER oz : 721.43 Change : 5.25 or 0.73% Dow Industrial : 15,639.12 Change : 23.57 or 0.15% US Dollar Index : 80.574 Change : -0.148 or -0.18% Silver and GOLD PRICES gainsaid each other today. The gold price rose $1.50 to $1,314.60 while silver lost 12.6 cents and ended at 2167.8c. Let's review the facts, since they never lie -- you can't always parse what they're saying, but they never lie. The SILVER PRICE bottomed at 1817c on 27 June, traded as high as 2512 cents (end August) and sank back to a mid-October low at 2050c. That uptrend remains intact, and today the line hits about 2100c under the silver market. Relative Strength Indicator is pointing down, MACD just rolled over downside. Rate of change also turned down today, after rising since Mid-October. But the silver price has drawn a line in the sand, today's low at 2158c. Draw a line from the 2050 October low to that and you have and uptrend. If it breaks that 2060cent mark, it will sink toward 2100c. However, it if holds here silver will be turning in the teeth of all pessimism. GOLD PRICES are much the same, with an uptrend line from the June low at $1,179,.40 to the October low at $1,250. Today that uptrend offers support about $1,260. Friday's low was lower than today's, so there's also an uptrend from mid-October until now. Close below $1,312 tomorrow violates that support. Here's a little clue as to why and how so much industry -- and industrial jobs -- have been exported from the USA. In Bangladesh, the worlds second largest clothing exporter, garment workers have been striking because an April collapse of one garment factory killed more than 1,100 garment workers. A new government wage board has proposed wages be raised 77% to 5,300 taka ($68 or 78 taka=US$1) monthly, but factory bosses are holding out for 4200 taka ($54). If 5300 taka is a 77% rise, then the minimum wage now is about 3,000 taka ($54)/month, then the workers would be making about 22-1/3 cents an hour if they work (ha-ha) a 40 hour week. (3000/4.33 weeks/40/78) Now maybe some of y'all can explain how US garment factories paying $10 an hour plus a social security, insurance, tax-tax-tax load of say, 35%, above the hourly wage or $13.50 net cost per hour, can compete with a factory paying 22.3 cents an hour. Whoops -- they can't. Average monthly wage for Bangladeshi workers is about half that of its rivals Vietnam and Cambodia, and about one-fourth that of top exporter China. But after all, price is the only thing that counts when you buy clothes, right? And people wonder why these folks vote communist! Today's markets were subdued. Stocks rose a little, gold rose barely, US Dollar index gave back some of its preposterous gains from last week. Stock market smugness remains at all time highs, as does margin debt, P/Es, and dividend yields. It is scenario written by Daffy Duck, or maybe the Three Stooges. If Moe were around today, they'd make HIM the head of the federal reserve. Stocks barely moved today. Dow rose 23.57 (0.15%) to 15,63910 while the S&P500 rose 0.36% (6.29) to 1,767.93. S&P500 and other indices remain in a "thrown over" condition above their top channel lines. That might not mean much to y'all unless you know that when a market has been rising a long, long time the "throw-over" or trading above its upper trend line generally sounds a honking big alarm that the rise is over. Generally. Usually. Normally. Dow in gold and silver rose again today and is starting to bother me just a little. Dow in gold today closed 11.90 oz, up 0.23% and Dow in silver closed 722.53 oz, up 1.15%. Compare these against the June highs at 12.514 oz and 816.77 oz. Trend still down, but both indicators stand above their 20 day moving averages, pointing momentum up. US Dollar index broke a six day winning streak today by giving up 14.8 basis points (0.19%) to 80.574. Since it is close to its 50 dma (80.66), odds say it has turned up and will rally toward 81 (where it failed today) toward its 200 DMA at 81.77. Y'all tell me why it's rallying -- beats me. However, I am reporting to you what it is doing technically. Fundamentally, the US dollar has less value than all that gravel and fish dung at the bottom of your fish tank. Euro looks even sicker than the US dollar. Lo! How is the mighty euro fallen, from $1.3825 a few days ago, gapping down twice, to close today at $1.3514. Sitting above its $1.3494 50 day moving average. Euro was also enjoying a big, long (since mid-September) throw-over, but has now come back to the channel line. Drops could be dramatic from here, since the 200 DMA stands at $1.3229. Yen didn't wiggle today. Closed 101.43 cents/Y100, and going nowhere but sideways. It's in a crab race with the US dollar. Ominously for the dollar, that upside breakout of the 10 year treasury yield that took place in June and relented in September has now lifted its head again. Yes, the higher interest rate will attract buyers, but it will also cost the US treasury dearly AND it violates the Fed's Zero Interest Rate Policy. In other words, it squeezes the fed and suggests bond buyers aren't so sure the dollar is worth what they presently must pay for it. Just a little bird-chirp in the wind, but worth hearkening to. A friend today whom I know to be a successful trader told me he bought more metals because today marked a 60 year anniversary of 1953 lows. Maybe he knows something I don't know. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. | ||||||||||||||||||||||||||||||||||||||||

| US Dollar Appears To Be Fundamentally Weak Posted: 04 Nov 2013 04:19 PM PST The WGC published its latest report on gold and currencies. Based on the main premise that gold is playing an important role as a monetary asset, it reiterates its value as a fundamental store of wealth. The interesting chapter in the report is related to the evolving relationship between gold and the dollar. From “Trends into the future: gold's potential role in the monetary system and its evolving relationship with the dollar” (page 28), it appears that allocations of US dollars continue to fall, a trend that started in 2012. What’s more, plotted against several economic dimensions, the dollar appears to be fundamentally weak. Are these the first cracks of the end of the dollar hegemony? Only time will tell, but the data are supporting the evidence. From the report (source): The state of the US dollarThe purchasing power of US investors has eroded over the past four decades. In fact, they lost almost 80% of their purchasing power to inflation and another 30% to a protracted devaluation of the US dollar.7 And while the US dollar will continue to be one of the most (if not the most) relevant currencies, many economists expect the US dollar to be challenged in the longer term by EM currencies. Market consensus forecasts indicate US-dollar depreciation against 14 out of the 27 major currencies including the Chinese yuan, Australian dollar, Mexican peso, Singapore dollar and Korean won by 2016. More importantly, these bearish views are firmly supported by weak fundamentals. Traditional currency drivers indicate a bleak outlook for the US dollar (Chart 8). Relative GDP growth, current account deficits and short- and long-term interest rates suggest that the dollar is poised for a decline. The relatively lower US inflation rate is the only factor that appears to be in favour of dollar strength. These trends are likely to continue as deficit spending continues in the face of a low-rate, low-growth environment. While technical factors, including momentum and investment flows, drive the US dollar in the short term,10 fundamental factors have more influence over the long run. In light of these developments, reserve asset managers have decreased their US dollar allocation considerably, from 63% in 1999 to 53% in 2012. The emergence of other currenciesThe unprecedented growth of emerging markets, coupled with the decline in the US dollar over the past decade, has led many policy makers to consider whether EM currencies should play an increasing role in the global monetary system. In its paper, Gold, the renminbi and the multi-currency reserve system, the Official Monetary and Financial Institutions Forum (OMFIF) observed that the ongoing internationalisation of the renminbi will add an additional currency to the reserve system. As emerging markets continue to capture an increasing share of global trade, their currencies will likely acquire a bigger share of reserve portfolios. Over the past 15 years, the growth of emerging nations' international trade activity has translated into an increased use and liquidity in their currency (Chart 9a and 9b). The trend of internationalisation has also been seen in the gold market. With investment gold increasingly flowing towards the East, emerging markets are likely to overtake developed markets in their gold ownership in the not too distant future. Recent trends indicate that an increased proportion of gold demand is coming from developing economies and that trading hubs in Shanghai, Hong Kong, Singapore, Mumbai and Istanbul are drawing liquidity away from the traditional US dollar-dependent New York and London markets. For example, the Shanghai Gold Exchange has grown tremendously since its founding in 2002, expanding its trading volume at a 24% CAGR and increasing delivery volume at 38% CAGR in the past five years. As this trend develops, the direction and fluctuations of the Chinese yuan will likely have a material influence on gold prices in years to come. Gold’s role as a fiat currency hedgeAs the world moves towards a multi-currency reserve system, gold will play an important role as a foundation asset that diversifies risk. As more currencies are included in the reserve system, gold's relationship with other currencies will likely evolve. It is likely that gold will retain its generally negative relationship with the US dollar, but it will also serve as a hedge against all fiat currencies.11 Gold will retain its quality of being a hard asset without being anyone's liability, and it will remain a buffer against geopolitical uncertainty. | ||||||||||||||||||||||||||||||||||||||||

| I Would Like To See No Reason To Own Gold Posted: 04 Nov 2013 02:49 PM PST Interviewed by FutureMoneyTrends (click for the free newsletter service), Jay Taylor covers several topics related to the gold market. He reiterates the benefits of owning gold in a paper based money system, he gives an interesting view on “gold manipulation,” he explains the sentiment of gold investors, and gives his thoughts on the correction. How to survive and thrive in the greatest wealth transfer and extreme market manipulation:

What to think of the manipulation of the gold price:

Whether gold investors are getting tapped out after a two year gold and silver correction:

Thoughts on whether the gold correction is over:

Go to JayTaylorMedia.com and MiningStocks.com to learn more about the work of Jay Taylor. | ||||||||||||||||||||||||||||||||||||||||

| American Silver Eagle Coin Sales On Verge of Record Shattering Year Posted: 04 Nov 2013 02:28 PM PST The American public's love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on [...] | ||||||||||||||||||||||||||||||||||||||||

| U.S. Mint Gold Coin Sales Soar 273% in October Posted: 04 Nov 2013 01:51 PM PST Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing. From 2000 to 2007 the average yearly purchases of [...] | ||||||||||||||||||||||||||||||||||||||||

| Gold market manipulation cited in Future Money Trends interview of Jay Taylor Posted: 04 Nov 2013 01:45 PM PST 4:45p ET Monday, November 4, 2013 Dear Friend of GATA and Gold: Dan Ameduri of Future Money Trends today interviews financial letter writer Jay Taylor about the gold market and its manipulation. The interview is 18 minutes long and audio as well as a transcript are posted at the Future Money Trends Internet site here: http://www.futuremoneytrends.com/index.php/interviews/549-we-are-close-t... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Seminar in Florida Gold mining entrepreneur and gold advocate Jim Sinclair plans to hold his next financial seminar in Kissimmee, Florida, near Orlando, on Saturday, November 2. Details can be found at his Internet site, JSMineSet, here: http://www.jsmineset.com/2013/10/22/florida-qa-session-announced/ Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Ship of Fools Posted: 04 Nov 2013 01:25 PM PST | ||||||||||||||||||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts - Ship of Fools Posted: 04 Nov 2013 01:25 PM PST | ||||||||||||||||||||||||||||||||||||||||

| QE will increase but rates will rise anyway, Turk says Posted: 04 Nov 2013 12:47 PM PST 3:45p ET Monday, November 4, 2013 Dear Friend of GATA and Gold: The Federal Reserve will be increasing its bond monetization, not "tapering" it, GoldMoney founder James Turk predicts to King World News today. But interest rates are likely to rise anyway, Turk adds, as there will continue to be more general selling of government bonds than buying by the Fed. "It is extremely critical that investors understand that they should absolutely not be holding dollars or Treasury paper," Turk says. "They are incredibly overvalued and therefore they will be the ultimate losers here. Physical gold and silver are the place to be, and can continue to be picked up at prices that reflect severe undervaluation." An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/4_Wo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata | ||||||||||||||||||||||||||||||||||||||||

| The Mogambo Guru’s Lifetime Income Equation Posted: 04 Nov 2013 12:29 PM PST My mood is dark. I see, as usual, enemies everywhere, but have started filling my days, not with installing more defensive armaments in the Super Duper Mogambo Bunker (SDMB), but with making lists of all the people whom I blame for something, starting with the worst offender of them all, the absolutely satanic Alan Greenspan. It was Greenspan who was the horrid chairman of the Federal Reserve who started the ridiculous Keynesian insanity of creating all the mountains of cash and credit that allowed the bank bubble, the dot-com bubble, the housing bubble, the stock market bubble, the bond market bubble, the size-of-government bubble, the national debt bubble, and the staggering, incalculable derivatives bubble, to probably name but a few. On and on, the lengthy list of the damnably blameworthy continues, page after page, purple with rage, most recently including Jerry something-or-other, whom I had almost forgotten about. He was the kid who leapt up to catch the booming bomber I hit in a baseball game at recess in the fourth grade, which would have been a nice, long, juicy home run for me. "Now hear this! You and monetary policy in this country will now be ruled by me! Gold shall be money again, just like the Constitution requires!" I'd have been a hero to the lovely Suzanne, who was watching my every move and thinking to herself "Oh, wonderful Mogambo! My hero! I will be your devoted girlfriend until high school, when you will get a cool car and drive me around, and kiss me all the time, and we will live happily ever after!" Instead, thanks to Jerry just wildly throwing his arms up in a panicked lunge of doofus desperation, like some disjointed scarecrow, the ball miraculously landing right in his stupid glove, I am out. Out! Just another loser! Loser! Loser! And then, in the depths of my despair, to my horror, I saw my darling Suzanne turn up her pretty little nose in disgust, and leave without saying a word, which was (now that I think about it) the pivotal moment in my life that pretty much defined my relationships with women from then on. Thus Jerry, having ruined my whole love life with his stupid lucky catch, is on the list. Oh, yeah. He's on the list. Despite my foul mood, I laughed out loud at the cover of Barron's magazine. It concedes that over the next 20 years, the economy will slow, although they do not continue, perhaps in smaller print, to reveal the Ugly, Ugly Fact (UUF) that things always slow down before they stop, start rolling back down the hill, and after a short period gathering speed and highly-erratic behavior careening all over the road, soon crash over a cliff in a raging fireball, killing everybody in sight. You can relax, however, because that's just the theory. Just a theory! In practice, however, things never actually stop, because, at this late stage of disintegration, things tend to go from horrifically bad to tragically worse so quickly that things usually plunge randomly over cliffs in raging fireballs, killing everybody in sight, before they ever, you know, actually stop. Now, you would think that this "Ending in raging fireballs and killing everybody in sight" theory, which is my latest Profound Mogambo Insight (PMI) about the stupidity of Keynesian economic theory, would be worth a Nobel Prize or two, or maybe just a couple of millions of that luscious prize money, which would come in real handy right now. But nooOOOooo! In fact, NOJMR satirically posted the headline "Mogambo denied the Nobel Prize again" at his MogamboGuru.com website, which is pretty funny, especially since I have not done anything noteworthy, nor prize-worthy, in my whole worthless life, according to all my teachers, schoolmates, family, so-called friends, neighbors, co-workers, supervisors, bosses and shareholders, and did I mention wife and kids? Nevertheless, I would like to end that distasteful phase of my life by proposing my Mogambo Lifetime Income Hypothesis (MLIH), which postulates that, in the aggregate, people can never spend more in their lifetimes than their lifetime income. The proof is made by example: If you earned $10 million over your lifetime, but you spent $11 million, at the settlement of your estate, you would owe $1 million to someone who is now not going to be paid, and thus whose lifetime income will have been reduced by that $1 million. I even came up with a clever equation, to appeal to the Keynesians (who love this kind of thing): I = E. I assume you are impressed with the breathtaking elegance and cosmic simplicity of this profound mathematical identity, and are chanting "More! More Wisdom Of The Mogambo (WOTM)! Give him the damned Nobel Prize and the money, and then get on to more WOTM!" Okay! Here's my latest hot-stuff idea. How about tongs as an underdeveloped resource? I mean, tongs are not just for turning burgers on a grill! Imagine you are slouching comfortably on the couch, and some idiot put the remote control on the coffee table. Would you rather huff and puff to heave your ponderous bulk up (oof!) into a sitting position so you can lean over (oof, again!) and get it, or merely whip out a pair of tongs and get it with no muss, no fuss? Or, imagine if you had a pair of tongs when attacked by a guy with a gun who is robbing you because his little bit of currency is not enough to pay the increasing costs of energy, food and shelter necessary to support his family, which is because the evil Federal Reserve created so much currency and credit that the dollar's buying power went down and down because of the continual over-creation of currency and credit, which is experienced by people as "things always costing more and more dollars," but he doesn't have more dollars. A desperate man, but with tongs, you could use them to reach out and snatch that gun away, and smack him upside the head (bap!) with it! Or how about a pair of tongs that was big enough that you could reach into a window at the Federal Reserve and pluck that pinhead Bernanke up and out of his seat, and deposit him in the dumpster out back where he and his laughably asinine Keynesian policies belong, whereupon you could run inside, leap in to his recently-vacated seat, and take over! Grab the phone! Dial everybody up, and say, "Now hear this! You and monetary policy in this country will now be ruled by me! Gold shall be money again, just like the Constitution requires! Gold is not currently money because the horrid Supreme Court has infamously ruled that money does NOT have to be only of silver and gold, like the Constitution clearly says, and money can be anything a government official or a banker says it is, contrary to what the Constitution says." And if anybody objects to your bloodless coup to stop the mindless insanity of continuously increasing the money supply which causes inflation in prices, you could use tongs to pluck them out, too! So, are you probably starting to think to yourself "Hey! This idiot's right about the importance of tongs! Perhaps I should send him all my money to invest in his new hit comic book, titled 'Mogambo, Man of Tongs!', which he will sell to Stan Lee at Marvel comics for a billion dollars, and we'll all be rich, and have all the tongs we want!" I know you are, by this time, on your feet with rejoicing, happily chanting with so many others, "More! More! More Wisdom Of The Mogambo (WOTM) to enlighten us and show us how to make a lot of money by betting against the stupidity of Keynesian economic policy!" Flattered by such adoration, quickly relent, and say, "Okay! Saving the best for last, I offer this final Sublime Pearl Of Mogambo Wisdom (SPOMW), which is to buy gold and silver bullion with every dollar you can get your hands on. Buy gold and silver, I say with a haughty-yet-sneering arrogance born of the certainty of 2,500 years of experience! Buy gold and silver, no matter how much your ungrateful families whine about how they are sick of subsisting on silage-grade gruel ("Buy it by the ton and save!"), and how they complain about needing expensive vegetables, and expensive fruits, and expensive proteins, and prohibitively expensive medicines, and bandages, and expensive medical and dental care, and all of that other expensive crap that greatly interferes with your Mission From Mogambo (MFM) to acquire as much gold and silver as possible." And if you find some tongs made out of gold or silver, so much the better! Whee! Regards, The Mogambo Guru Ed. Note: After disappearing for more than two years, the Mogambo Guru has resurfaced, angrier and more vitriolic than ever. No one knows where he’s been, but whatever he witnessed on his trek was terrible enough to prompt his reemergence in The Daily Reckoning email edition. He’ll be making more appearances as the weeks go by. So to make sure you get your fill of Sublime Mogambo Wisdom (SMW), be sure to sign up for The Daily Reckoning, for FREE, right here. | ||||||||||||||||||||||||||||||||||||||||

| Strong euro poses risk to recovery, Fabrizio Saccomanni warns Posted: 04 Nov 2013 12:12 PM PST 04-Nov (Financial Times) — Italy's finance minister has warned of the risks of a strengthening euro to Europe's fragile recovery, urging the European Central Bank to ease monetary policy to help the continent's small and medium enterprises. The comments by Fabrizio Saccomanni come less than two weeks after the euro hit a two-year high against the dollar. The single currency has pared back some of its gains, but remains more than 2 per cent higher than at the beginning of the year. This week, the ECB's board will gather in Frankfurt but analysts do not expect any change in the policy rate, which has been stuck at 0.5 per cent, a record low, since last May. "The euro is now the strongest currency in the world, vis a vis the dollar the renminbi, the [British] pound, the Swiss franc," Mr Saccomanni told the Financial Times. [source] PG View: In a world embroiled in an ongoing currency war, it’s almost amusing how a currency setting a new high for the year can set off a panic among policymakers. To offer a measure of perspective: When EUR-USD set a nearly two-year high of 1.3832 last month, it was still nearly 16% off the cycle high set in July of 2008 at 1.6038. | ||||||||||||||||||||||||||||||||||||||||

| Gold vs. Wall Street's Program Traders Posted: 04 Nov 2013 10:53 AM PST Gold ran into trouble last week after an encounter with its important 150-day (30-week) moving average. The 150-day MA, which is an important psychological resistance barrier that is programmed into many Wall Street trading ... Read More... | ||||||||||||||||||||||||||||||||||||||||

| Disappearance of Western central bank gold becomes clear, Embry says Posted: 04 Nov 2013 10:48 AM PST 1:45p ET Monday, November 4, 2013 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry today tells King World News that the disappearance of Western central bank gold reserves through leasing is becoming clearer but that central bank propaganda about Western economies has reached totalitarian levels. An excerpt from the interview is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/11/4_Na... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... | ||||||||||||||||||||||||||||||||||||||||

| A Drone of Their Own: US Eyes China’s Drone Program Posted: 04 Nov 2013 10:30 AM PST Do you recall last month when Islamic terrorists took over a mall in Nairobi, Kenya? They shot the place up and killed 67 innocent people — butchering innumerable unfortunate souls among them. Then the Islamists held their ground and fought off the Kenyan army for several days. In the end, fighting set the mall on fire and the whole place burned down. You had better believe that governments and security agencies across the world took notice of what happened in Kenya. It’s bad enough that passing through airports has become an anti-terror drill. But if daily activities like going to a mall are now fatal, then the modern world is paddling pretty near the edge of the waterfall. Society could collapse in a hurry. Thus, it’s no surprise that just last week we have word that two of the top Islamist terror guys from the Nairobi attack met their fate in the course of a drone strike in Somalia. There’s no “official” U.S. confirmation on the details, but evidently, the terrorists’ Suzuki SUV had an encounter with a Hellfire missile. Kaboom. Chinese leadership is on a crash program to catch up with the rest of the world in terms of military capability. Now consider what happens as this kind of military technology spreads out across the world. And consider the moneymaking opportunities that savvy investors have in terms of this new domain of warfare. Imagine a remote region of central Asia. In a small village, Islamist militants are hard at work preparing an improvised explosive device (IED) based on a surprisingly sophisticated design. The perps are more or less relaxed, because they know that the nearest threat to their efforts is hundreds of miles away — at a Chinese army base. It’s way too far to be of any real concern to these bomb builders. Their plan is simple: In a week, their IED will be placed next to a Chinese government building and detonated remotely. The target is the regional governor and his entourage, including several high-ranking officials on a show-and-tell tour in the countryside. It’s a major target, and the groundwork for the attack has been all but laid. But then, without warning, the rude house that serves as the terrorists’ base of operations explodes — BOOM! — and the plot vaporizes with them. Villagers hear the explosion and see the fireball rising. Neighbors pour in from the fields to see what just happened. They look up into the sky, but nobody can see or hear the small black dot nearly 15,000 feet up. It’s the platform from whence came the missile that just streaked straight into the terrorists’ lair. But if the locals could discern that black dot, they’d see a red star on a red bar painted on the side of a drone — an unmanned aerial vehicle. But after a few minutes, it doesn’t matter anymore, because the aircraft has turned and begun to fly back to the Aksu Wensu air base, located in the Lanzhou Military Region of China. Actually, this scenario isn’t quite as far-fetched or as science fiction as you might think. China has the drone. No, China hasn’t used its drones for assassination attempts — yet, as far as we know — but it looks like China is headed in that direction. According to analysts who follow such things, China probably has the world’s second-largest fleet of military drones, numbering in the thousands. In fact, China’s drone fleet is second only to that of the U.S., which has at least 7,000 drones in military service. A recent report published by the Department of Defense’s Defense Science Board (DSB) noted that “in a worrisome trend, China has ramped up research in recent years faster than any other country.” And the Chinese are doing drones more cheaply than U.S. defense contractors could ever hope. For example, the General Atomics MQ-9 Reaper, the U.S. military’s main hunter-killer drone, costs about $17 million today, and that’s a price based on economies gained from late-stage production. By comparison, China’s “Wing Loong” drone — suspected of being a copy of the Reaper, and it certainly looks like one — costs the equivalent of about US$1 million. Now, it’s not the airframe or conventional propeller engines that account for the bulk the of Reaper’s price tag. Instead, it’s the cutting-edge electronics and optics onboard. And while it’s unlikely that China’s drones are as electronically sophisticated as ours (we can only hope), are they really 17 times less effective?! As Soviet Marshal Joseph Stalin supposedly once noted, “Quantity has a quality all its own.” The Chinese are certainly keen students of military technology. There are many reasons for this, but one main driver is a collective Chinese recognition of how far the nation fell behind the rest of the world during the Cultural Revolution of the 1960s. In fact, I recall a senior U.S. military officer relating a story about an official tour of China in the early 1980s. The Chinese still included horse-cavalry units in orders of battle planning. But not anymore. Today, Chinese leadership is on a crash program to catch up with the rest of the world in terms of military capability. They want the best, and they’ll go to any ends to get it and figure out how to make it work. The move toward drone warfare is part of China’s larger strategy to project power over the international waters to its east and south and over its small, weaker neighbors to the north and west. (Of course, one very underpopulated area north of China is Siberia — part of Russia.) Consider just one recent Chinese military exploit involving drones. Last month, on Sept. 9, a Chinese drone penetrated Japanese airspace near Okinawa for the first time. Japanese defense forces noted the intrusion and scrambled jets. The Chinese drone was escorted out of the area by Japanese air force F-15s. Then in response to the Chinese intrusion, in late October, the Japanese prime minister gave the Japanese military permission to engage and destroy future drone incursions. Looking ahead, this kind of cat-and-mouse drone game between Japan and China could be a flashpoint in the ongoing territorial tensions between the two countries. Of interest as well, in early October of this year, the U.S. and Japan renewed a mutual defense treaty and included new terms involving drones. Specially, the U.S. military will begin flying long-range drones — like Global Hawk — over the disputed Senkaku Islands in spring of 2014. So looking ahead, what would happen if U.S. and Chinese drones met in the skies over the East China Sea? According to current U.S. doctrine, American drones are not intended (nor designed, truth be told) to enter into contested or hostile air space. In essence, U.S. drones are not meant to fight aircraft to aircraft in any conflict with China or anyone else. So far, China’s drones apparently mimic American designs. Thus, the odds are even. Then again, countries can do things with drones they wouldn’t do with manned aircraft. And with technological breakthroughs, advances are occurring with stunning speed. Needless to say, China’s acquisition of drones on a massive scale is a major boost to its military and overall governmental capabilities, one to which the rest of the world will have to adapt. Regards, Byron King Ed. Note: Regardless of how you feel about it, the U.S. is not going to slow down military spending. Especially as China ramps up the production of its drone program. That means a few companies will benefit greatly from U.S. government contracts. And it also means a few savvy investors stand to make some tremendous gains in the process. In today’s Tomorrow in Review email edition, Byron gave readers a chance to discover this profit potential first hand, with access to a special video telling them just what to do. If you didn’t get it, you missed out. But not to worry… Byron will be back with a similar offer. Sign up for free, right here, and keep an eye on your email. | ||||||||||||||||||||||||||||||||||||||||

| Fate of Dollar is the Fate of U.S. Power-Dr. Paul Craig Roberts Posted: 04 Nov 2013 10:13 AM PST By Greg Hunter's USAWatchdog.com Dear CIGAs, Former Assistant Treasury Secretary Dr. Paul Craig Roberts says, "The fate of the dollar is the fate of United States Power." Dr. Roberts goes on to say, "The whole question of the dollar's longevity depends on the willingness of other countries to continue holding dollars and dollar denominated assets... Read more » The post Fate of Dollar is the Fate of U.S. Power-Dr. Paul Craig Roberts appeared first on Jim Sinclair's Mineset. | ||||||||||||||||||||||||||||||||||||||||

| The Daily Market Report: Gold Rebounds From Two-Week Low Posted: 04 Nov 2013 09:39 AM PST

While some think the ECB will cut the refi rate by 25 bps this week on growing signs of disinflation, such a cut seems more likely at the December 5 policy announcement. As for the Fed, it strikes me as rather unlikely that they would start tightening as the ECB moves to loosen. Nonetheless, the ECB easing scenario, along with the lingering Fed taper expectations has weighed on the euro and boosted the dollar. Recent dollar strength has put gold under pressure. St. Louis Fed President James Bullard said today that there is no hurry to start removing accommodations with inflation still well below target. He called the current pace of asset purchases “torrid” Bullard went on to say that he would like to exit QE, but he’d like to meet the Fed’s goals of full employment and stable prices as well. Bullard suggested there was room for further expansion of the Fed’s nearly $4 trillion balance sheet. He found justification in the fact that the central banks of Japan, Europe and the UK had balance sheets bigger than ours, relative to GDP, and hadn’t imploded yet. I suspect that, like me, you find little assurance there. If the ECB does cut rates this week, it will be just the latest in a long string of confirmations, that the age of easy money is here to stay. Easy money and the expansion of central bank balance sheets will continue to provide underpinnings for the gold market. | ||||||||||||||||||||||||||||||||||||||||

| Honest Politicians… And Other Oxymorons Posted: 04 Nov 2013 09:39 AM PST Can we at least agree that the American people deserve the truth? That governing ourselves requires getting accurate information from the people we elect? That their function is to represent us? And that they have no right to lie or mislead? Opposing mendacity ought to be a no-brainer. What I see instead is a mainstreaming of the notion that it isn’t a big deal for a political candidate, an elected official, or an appointee to lie or deliberately mislead. People in government mislead us so reliably that presuming the truth of their statements would be folly. President Obama knew that his rhetoric about the Affordable Care Act was misleading and that many people who bought insurance on the individual market would be forced to get new policies when Obamacare made their policies illegal. The Chicago Tribune’s Clarence Page thinks that Obama knowingly lied, but he isn’t that upset about it, because “that’s one of those political lies, you know.” Director of National Intelligence James Clapper lied to Congress about NSA surveillance while under oath. He was not forced to resign his post, let alone prosecuted, and in some circles more ire has been aimed at the man questioning him. Dick Cheney remains widely respected among Republicans despite repeatedly deceiving Americans about the threat Saddam Hussein’s Iraq posed to the United States. In interviews, mainstream media figures continue to give his words the same presumption of truth extended to people who’ve never misled as he did. Bill Clinton lied under oath and in a finger-wagging statement to the American people. He is, nevertheless, one of the most trusted political figures in the United States today. There are important ways in which every lie or misleading statement is not equal. If we look at the consequences of every Bush administration misdirection prior to the Iraq War — a multitrillion-dollar conflict that killed 5,000 Americans and tens of thousands of Iraqis — their deceit was orders of magnitude more damaging than, say, Clinton and his allies subverting a sexual-misconduct lawsuit while under oath. But there is one way in which all lies government officials tell are alike: To different degrees, they all subvert self-government by depriving Americans of accurate information as we make political judgments. They all diminish an almost depleted store of trust that’s needed for functional governance. Mendacity doesn’t imply the rightness of any particular response to it. I wouldn’t have supported impeaching Dick Cheney because of his statements on Iraq (his role in torture is another question), nor do I think the Clinton impeachment was prudent, though I’m glad he was stripped of his ability to practice law after he left the White House. I’d like to see Clapper fired and prosecuted for perjury. Other people have reached different judgments on all of these questions. Maybe they’re right. What I worry about are the world-weary pundits and partisan apologists who can’t even be bothered to condemn Obama-era falsehoods, deceitful Cheneyesque fear-mongering, or Clintonian parsing with any vigor or consistency. The biggest predictor of whether someone even complains about untruths is whether the deceit in question advances or impedes an end they favor. Getting upset in principle at lies told by political allies is a rarity. Almost no one regards proven liars as having shamed or discredited themselves. The attitude is, “It’s all in the game.” But necessity hasn’t actually forced this posture upon us. People in government mislead us so reliably that presuming the truth of their statements would be folly. Dogs steal food reliably too. We still summon our angry voice, retrieve ill-gotten gains, and put the dogs in the corner. If we stopped, if the cost of bad behavior decreased or disappeared, transgressions would only get more frequent and brazen. Journalists in particular are supposed to be champions of the truth. Our job is bringing it to the public. People in power who lie ought to be our sworn enemies, and we should resist at every opportunity a norm in which official lies are normalized. That doesn’t mean that all lies shouldn’t be reported on as if they are equally important. But neither should politicians be absolved so long as they’re perceived as being less untruthful than a predecessor or someone from another party. The ideal of full truthfulness is unattainable. It is still worth pursuing and retaining as a standard. History ought to remember Bill Clinton, in part, as a liar. History ought to remember the role Bush-era deception played in Iraq, torture, warrantless spying, and other policies besides. And if journalists belatedly pursue the most prudent course, tomorrow’s historians will remember the moment in 2013 when the media began to rebel against the egregiously misleading statements of the Obama era. Our ability to govern ourselves is undermined when Clapper lies about surveillance, when Gen. Keith Alexander misleads about NSA activities abroad, when Obama misleads in the course of defending his health care proposal, and when Sen. Dianne Feinstein suggests absurdly low-ball estimates of innocents killed in drone strikes. There are many more examples of objectionable lies, untruths, and propaganda efforts, but aren’t the ones listed enough to raise general alarm? Earlier this year, former Rep. Anthony Weiner, who resigned his seat in a sexting scandal, got caught in a lie about when his behavior stopped. The political press and the public hounded him relentlessly for his deceit. Every statement he made was parsed, journalists treated him as though he’d forfeited the presumption that anything he said was true, and he wound up as thoroughly disgraced as he had during the original crotch-shot news cycle. Wouldn’t America be better off if the fervor for truth and shaming of liars that characterizes our sex scandals were applied to surveillance, torture, kids killed by drones, landmark legislation affecting a fifth of the economy, and matters of similar importance? It wouldn’t keep politicians honest. But it would keep them more honest. Conor Friedersdorf Ed. Note: Politicians lie. That’s just what they do. And trying to keep them honest will be difficult, if not downright impossible. But that doesn’t matter… If you have all the facts and stay informed, you can cut through the political B.S. and protect yourself. That’s what the Laissez Faire Today email edition does for its nearly 100,000 readers every day. They’re staying ahead of the curve, and so should you. Sign up for FREE, right here, and find out what all the hype is about. Original article posted on Laissez Faire Today | ||||||||||||||||||||||||||||||||||||||||

| "Token demand" for new Hindu year leaves gold waiting on US data Posted: 04 Nov 2013 08:25 AM PST Despite the festival season in India, “support from this was missing” for gold in October, says, says the weekly note from Germany's Heraeus. | ||||||||||||||||||||||||||||||||||||||||

| Can’t miss headlines: Gold eyes $1,300, Jaguar dilution looks massive & more Posted: 04 Nov 2013 08:25 AM PST Gold steadies in the $1,310s in the past 24 hours while copper flirts with $3.30/pound. Las Bambas potential buyer list grows and Jaguar Mining’s massive dilution. | ||||||||||||||||||||||||||||||||||||||||

| Gold eases on talk ECB may loosen monetary policy Posted: 04 Nov 2013 08:25 AM PST Gold prices eased on Monday on talk that the European Central Bank may loosen monetary policy this week. | ||||||||||||||||||||||||||||||||||||||||

| Jim Sinclair’s $50,000 gold call – let’s hope it doesn’t happen Posted: 04 Nov 2013 08:25 AM PST Jim Sinclair who has a tremendous following within the gold investment community, has predicted in an interview that gold will reach $50,000, but this envisages currency collapse and hyperinflation. | ||||||||||||||||||||||||||||||||||||||||

| China is Buying Up the World – Big Time! Take a Look Posted: 04 Nov 2013 08:24 AM PST China is buying up the world – big time! Take a look. It’s all shown here in one map. So writes Tyler Falk (smartplanet.com) in edited excerpts from his original article* entitled China's massive foreign investment, in one map. Hat tip to SeniorD [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Falk’s article contains the following:  [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://www.smartplanet.com/blog/bulletin/chinas-massive-foreign-investment-in-one-map Related Articles: 1. China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate