Gold World News Flash |

- The Daily Market Report: Gold Weighed by Continued Firmness in Dollar

- Gold Price Lacks Direction as Private Investors Buy, Whilst Indian Consumers Switch to Silver

- Financial interests finally get rid of CFTC's Chilton

- Gold Standard: the Perfect Prescription

- The Last Honorable Bureaucrat? Bart Chilton Stepping Down from CFTC

- That’s a Lot of Silver…

- Why Silver Prices Could Easily Double from Here

- China’s Central Banker Leads Push to Overhaul Economy

- Gold, Tapering, and The Middle Class

- Europe's Not Fixed, China's Inflation, and Housing Bust 2.0

- Silver Summit & David Morgan-Stacking Silver

- Peter Schiff Predicts Gold Going To $2,000 Next Year

- A Closer Look At Bank Bail-Ins And The Black Hole Of Our System

- Gold edges to new 2-week low as euro comes under renewed pressure, pushing dollar back toward recent high.

- Gold at a Crossroads

- Finland’s Gold

- 24 Winners in the “Blue Sky” Market

- Gold prices ease as euro weakens ahead of ECB meeting

- GOLD AT A CROSSROADS

- That's a Lot of Silver...

- Gold better at 1317.00 (+2.00). Silver 21.71 (+0.07). Dollar easier. Euro higher. Stocks called higher. US 10yr 2.62% (+2 bps).

- Gold Prices Flat on "Tiny" Volume, "Lack Direction" as Western Investors Turn Bullish But Indian Households Switch to Silver

- Coming Clean, Dr. Joseph Farrell – Covert Wars & The Mysterious Strength of the US Dollar

- Appetite for gold rises to six-month high

- Gold Buying Yes, Selling No

- Gold Buying Yes, Selling No

- Gold vs. Wall Street’s Program Traders

| The Daily Market Report: Gold Weighed by Continued Firmness in Dollar Posted: 05 Nov 2013 10:21 AM PST

I think that’s nonsense. Economic data didn’t support tapering in September (when many were expecting it), the data didn’t support a taper in October and it is very unlikely that the data will sufficiently improve to warrant a tapering before year end. In fact, most of the recent FedSpeak — from the likes of Bullard and Rosengren — has been rather dovish. Additionally, CNBC reported this morning that research by the Fed’s own economists favor lowering the unemployment target from 6.5% to 6%, or even 5.5%. Goldman Sachs’ Jan Hatzius thinks such a revision to guidance may result in tapering sooner rather than later, but could push a potential rate hike out to 2017. Given that we hit the ‘zero-bound’ in December 2008, that about assures us our first “lost decade.” Hatzius believes the Fed funds rate could be below normal into “the early 2020s.” With Janet Yellen presumably taking over the reigns of the Fed early in 2014, and considering the market’s visceral reaction to hints of tapering earlier this year, I think the Fed might see how the markets react to the new guidance before messing with QE. If the ECB eases before year end, that may put the Fed under additional pressure to keep their foot on the monetary gas pedal. |

| Gold Price Lacks Direction as Private Investors Buy, Whilst Indian Consumers Switch to Silver Posted: 05 Nov 2013 09:51 AM PST LONDON wholesale gold was unchanged Tuesday lunchtime from yesterday or from last week's finish at $1317 per ounce, as European shares again defied a drop in Asian stock markets to tick higher. Major government bond prices edged back, and commodities rallied from multi-month lows. |

| Financial interests finally get rid of CFTC's Chilton Posted: 05 Nov 2013 09:51 AM PST 12:52p ET Tuesday, November 5, 2013 Dear Friend of GATA and Gold: Bart Chilton, the member of the U.S. Commodity Futures Trading Commission who long has complained about manipulation of the monetary metals markets and has vigorously advocated more restrictive position limits for commodity traders, announced today that he will retire from the commission soon: http://www.cftc.gov/PressRoom/SpeechesTestimony/chiltonstatement110513#s... In his formal statement presented at today's CFTC meeting, Childton said: "Early this morning I sent a letter to the president expressing my intent to leave the agency in the near future." ... Dispatch continues below ... ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Chilton's five-year term on the CFTC expired in April and he had said this year that he would like to be reappointed. His announcement today contradicting himself suggests that he has been told that President Obama would not be renominating him, which should be no surprise, given the enormous trouble Chilton has caused for the powerful financial interests that control the U.S. government. Because of his work on the CFTC Chilton came to be targeted by not only those financial interests but also by some people who have supported GATA's work for free and transparent markets in the monetary metals. Unlike most other CFTC commissioners, Chilton strove to answer his e-mail personally, and this responsiveness induced people dissatisfied with the commission's work to focus their dissatisfaction on him even as he sought to accomplish their objectives. No other commissioners would answer their mail reliably, so Chilton took the heat for all of them. Chilton was only one of the five CFTC commissioners and was never able to carry a majority in favor of improving competition in the commodity markets. But he raised hell about the issue and induced the commission to hold its March 25, 2010, hearing on the monetary metals markets and arranged for GATA Chairman Bill Murphy and board member Adrian Douglas to speak at the hearing, which turned out to strike a powerful blow against market manipulation. As his biography suggests -- http://www.cftc.gov/About/Commissioners/BartChilton/index.htm -- Chilton arose from the producing class, farmers. He represented the producing class well in its age-old struggle against the financial class. GATA and the whole country are enormously obliged to him. His departure from the CFTC will be a great loss. CHRIS POWELL, Secretary/Treasurer Join GATA here: New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Gold Standard: the Perfect Prescription Posted: 05 Nov 2013 09:47 AM PST Boiled down to the simplest terms; all economies must choose one of two "systems" in which to operate. They can choose a credit-based (i.e. debt-based) economy, or they can choose a "cash" (i.e. pay-as-you-go) economy. This is a simple tautology, and so beyond debate. This brings us to simple arithmetic. For any society which chooses the credit-based system; this necessarily implies the steady/relentless accumulation of debt. Any (so-called) "credit-based system" where there is no accumulation of debt is, in fact, just a cash-based system. In turn, the relentless accumulation of debt necessarily implies ever-increasing interest payments, to service all that debt. This brings us to the proposition of simple arithmetic: to make ever larger interest payments and maintain a constant rate of growth is only mathematically possible in an exponential-growth model. This is where simple arithmetic gives way to insanity. Again as a tautology; an exponential-growth economy is only possible in an infinite system. But we residents of the Planet Earth occupy a finite system – a very finite system. As we simultaneously confront shortages of oil, drinking water, arable land, and a host of other vital resources; the delusion that our (finite) planet is an infinite system goes from being irrational to insane. Put another way, pushing the accelerator pedal of an automobile to the floor when there is a brick wall directly ahead is merely "irrational" when that brick wall is 1,000 meters away. But it becomes insane to continue doing so when the brick wall is only 10 meters away. This describes Western economies of today perfectly: pedal-to-the-metal, with a brick wall 10 meters ahead. Western insolvency has become farcical. Many (most?) Western governments are already at the point where they can only avoid immediate debt-default (i.e. bankruptcy) by fraudulently maintaining interest rates near-zero: assigning near-zero "risk" to the debts of hopelessly insolvent debtors, even after one of those debtors (Greece) has already defaulted. Even that isn't enough for the U.S. and Europe's Deadbeat Debtors. They must also (pretend to) "buy" most of their own debt, with newly-printed paper, conjured out of thin air; backed by nothing – worth nothing – because there are no longer any legitimate buyers for all this bad debt. These economies are now open Ponzi-schemes, and as with all Ponzi-schemes they will soon implode. The time to discuss what sort of economies we should/must have after Debt Jubilee resets the economies of debt-bloated Western regimes is today. Even after these astronomical bond-debts are erased so that our economies once again become solvent (i.e. sane); we still face the choice of a debt-based or cash-based system. However, as previously illustrated; this decision amounts to a choice between a rational system (finite growth in a finite system) or an irrational system (attempting infinite growth in a finite system). If we once again choose an irrational system; we already know there is a brick wall looming ahead of us. But because we are already facing myriad "resource crises" today, we will arrive at that brick wall in much less time than was required in our last lemming-charge. Thus choosing to continue to attempt infinite growth in a finite system is no longer merely irrational, it is simply insane. |

| The Last Honorable Bureaucrat? Bart Chilton Stepping Down from CFTC Posted: 05 Nov 2013 09:47 AM PST from Silver Doctors:

Chilton's full statement on position limits & resigning from the CFTC is below:

hat tip: Bix Weir |

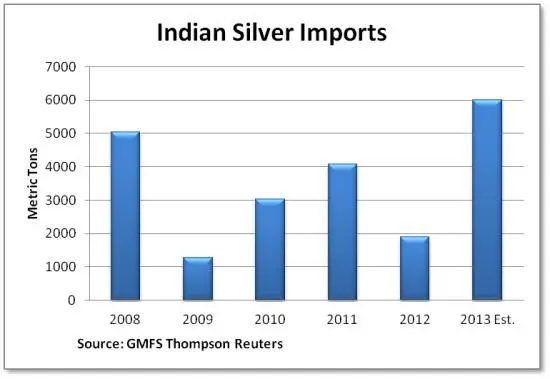

| Posted: 05 Nov 2013 09:45 AM PST by John Rubino, Dollar Collapse:

Here's a chart showing Indian silver imports since 2008. Note how they plunged in 2012, which might have had a bit to do with silver falling by over half from its $50 high. There are about 32,000 ounces in a ton, so India's projected 2013 imports of 6,000 tons is nearly 200 million ounces. The total annual supply of silver is a billion ounces (750 million ounces from mines, 250 million from recycling). So 200 million ounces is 20% of total global supply – a lot of silver for just one country. According to the Silver Institute, industrial users (including jewelry makers) absorb about 850 million ounces of silver each year, which leaves 150 million ounces for investors. But by importing 132 million more ounces this year than last, India is taking almost all of that surplus for itself, leaving the rest of the world's silver bugs to scramble for what little is left. |

| Why Silver Prices Could Easily Double from Here Posted: 05 Nov 2013 09:38 AM PST Michael Lombardi writes: In the first 10 months of this year, the U.S. Mint sold 39.2 million ounces of silver in coins. In the same period last year, the Mint only sold 28.94 million ounces of silver in coins. A general negativity by investors surrounding silver this year has not stopped people from buying silver coins. In fact, demand is up 35% so far in 2013. (Source: U.S. Mint web site, last accessed November 1, 2013.) |

| China’s Central Banker Leads Push to Overhaul Economy Posted: 05 Nov 2013 09:30 AM PST 05-Nov (The Wall Street Journal) — With mandatory retirement looming and little to lose politically, China’s central banker, Zhou Xiaochuan, used a Communist Party session last November to vent about the lethargic pace of economic reform. The gray-haired governor of the People’s Bank of China blasted those at the “top” of the government for failing to put forward specific plans to remake the financial sector, according to government officials with knowledge of the meeting. In the audience were the party officials in charge of finance and commerce. One year later, Mr. Zhou still has his job and may be more powerful than ever. In March, when he hit the retirement age of 65, China’s new leaders unexpectedly brought him back for a third five-year term. As new Communist Party chief Xi Jinping signed off on the reappointment, he called Mr. Zhou “a talent who can be counted on,” recalls an official involved in the party’s staffing decisions. Mr. Zhou’s reappointment signals that party leaders are likely to embrace at least some market-oriented reforms in an economic plan due to be released at a meeting of senior party officials scheduled to begin on Saturday. The central banker has long championed a more consumer-based economy in which ordinary people have more money to spend and more loans are available to private firms rather than state-owned behemoths. To that end, his priorities include creating deposit insurance for banks, making higher interest rates available to depositors, creating more privately owned banks and opening China more to foreign investors. [source] PG View: One thing that Chinese consumers like to spend their money on is gold; something that Zhou himself has encouraged. |

| Gold, Tapering, and The Middle Class Posted: 05 Nov 2013 09:04 AM PST Historically, gold futures prices often make an intermediate trend bottom around mid-November. Please click here now. This price chart from Dimitri Speck provides a good picture of average seasonal price action. Read More... |

| Europe's Not Fixed, China's Inflation, and Housing Bust 2.0 Posted: 05 Nov 2013 08:55 AM PST

Here’s the news worth knowing about today:

1) Europe is not fixed. The EU just announced record high unemployment with unemployment numbers rising nearly one million thus far in 2013.Greece, which was hoping to increase taxes or grow its way out its debt problems has just revealed that over 500,000 companies cannot pay their taxes (up from 182,000 last month). So much for the “Europe is fixed” theme.

We believe the crisis will re-emerge later in 2013 or early 2014. The key item to watch is the German Dax. Whenever it comes back to test the upper trendline in the chart below, things will start getting messy again.

2) China is engaging in the same taper/no-taper verbal interventions as the US. The Chinese premiere warned against loose monetary policy last night and China’s market dropped.

The People’s has a major problem on its hands (several actually). The primary one pertains to inflation. China has flooded its financial system with credit and easy money in ways that Ben Bernanke never dreamed of.

As a result of this inflation is rising, which leads to wage strikes, which erases profit differentials between China and other manufacturing centers, which leads to manufacturers pulling out of China, which results in a weaker Chinese economy, which results in the need for more credit to sustain growth and finance more projects.

This has resulted in a sideways Chinese stock market with every new flood of liquidity kicking off rallies and every talk or taper or tightening causing corrections. At some point this will break and we’ll either collapse or skyrocket depending on whether we see a debt deflationary collapse or a debt deflationary collapse accommodated by rampant monetization which would result in a Zimbabwe-esque stock market rally.

3) In the US, the housing market is definitively in a bubble. And it is once again popping.

Over 50% of all home purchases are cash only. In California, the amount of median income needed to buy a home is virtually identical to the Bubble Years of 2005-2006.

Mortgage applications are plunging and sales are stalling (we’ve been flat for two months but are down 27% since June). Be aware of this. Homebuilder stocks seem to be sensing something is amiss. We’ve been moving sideways since the peak in May 2013.

These are the trends to be away of.

Be prepared.

For a FREE Special Report outlining how to protect your portfolio a market collapse, swing by: http://phoenixcapitalmarketing.com/special-reports.html

Best Phoenix Capital Research

|

| Silver Summit & David Morgan-Stacking Silver Posted: 05 Nov 2013 08:45 AM PST from silver investor.com: |

| Peter Schiff Predicts Gold Going To $2,000 Next Year Posted: 05 Nov 2013 08:00 AM PST from United CPM:

There is nothing to be scared about when it comes to run-of-the-mill price corrections, as we've seen in gold and silver. Though gold still does not have the luster one would expect considering the Fed pace of bond buying, Peter Schiff is not afraid to predict the next leg up. In the meantime, however, and despite that the Federal Reserve has made it perfectly clear it plans to continue printing, there has been no change in the direction of the gold price, with gold sinking to $1,315 at the beginning of this week. |

| A Closer Look At Bank Bail-Ins And The Black Hole Of Our System Posted: 05 Nov 2013 07:52 AM PST The bank bail-in rumble is growing louder. After the events in Cyprus, a small country and potentially meaningless in the eyes of most people, it seems that bail-in idea has spread like a virus across the Western world. Only in the last week, we saw the following developments:

All these events come right after the IMF super tax proposal of 10% on savings accounts of households with a positive net worth in Europe (reported on this site) earlier this month. One could rightfully ask the question why this type of measures are considered in a world which is being flooded with liquidity on a scale that mankind has never seen before (whether one calls it money printing, quantitative easing, easy money, or helicopter money). The fact of the matter is that, even with excess liquidity, bank losses are still there, as evidenced in Europe (see Europe prepares to come clean on hidden bank losses by Reuters). Europeans are not not privileged on this matter. Recently, the Bank of International Settlements (say, the mother of all central banks) released a report in which they wrote the following: Only 30% of the large, international banks analysed is more easily able to fulfil a risk-based Tier 1 capital ratio of 8.5% (including the capital conservation buffer) than a 3% leverage ratio, which is the ratio the Basel Committee favours. This does not sound very encouraging, does it? Nor is the following comment from England's central bank chairman providing inspiration: "Systemic resilience depends on being able to resolve failing banks in a way that does not threaten the entire system. Fairness demands the end of a system that privatises gains but socialises losses." Mr. Carney told this during a speech about a week ago. Admittedely, Mr. Draghi has asked to delay the bank bail-in plans till the Europe-wide banking union is in place. But still, there are more than enough signs of a growing adoption of bank bail-ins. In order to get a better understanding on how it is possible that the banking system has a real need for bail-ins while having absorbed unprecedented liquidity from central banks, our staff reached out to Darryl Schoon, student of the Great Depression and author of Times of the Vulture. In his book, he correctly predicted the housing crisis back in 2007. Darryl Schoon took us to the heart of our monetary system. He explained how debt-based banking is the foundation of modern economies , a foundation that is inherently unstable and when stressed, it collapses. Banking is the cause of our problems, not the symptom. The causes of the banking crisis are systemic. While banks have paid-in capital, that capital has nothing to do with the business of borrowing and loaning, i.e. the credit business. Where does the money come from that a bank loans? It does not come from the paid-in capital, as the paid-in capital sits on a separate deposit in the books. Rather, the money comes out of thin air; it is nothing more than an electronic entry in a computer system. It has a relationship with demand deposits (money deposited on a bank account by a bank client), but the relationship is very low (in the order of 10 or 15 to 1). Basically, the mechanics of banking work as follows:

The money loaned is not the depositor's money; it is the total deposit base levered 10 to fifteen times the original amount. That amount is issued as credit in the form of loans. The bank is thus creating debt by offering credit. Because of the leverage, it has 10 to 15 times as much loans as it has on deposit. A bank can borrow money overnight in the repurchase market (repo market) from other banks, in case it needs to meet an obligation which it cannot with its own means. Conversely, a bank can loan its excesses out and get in return an interest payment. That is how a bank keeps its books in line. The take-away here is that our economic and monetary system is dependent solely on debt and the repayment of that debt. Now, here is the key: this debt based system must always expand. When it stops expanding, it risks becoming a black hole. In order to understand this statement, one should look at the two big risks inherently associated with this debt-based system:

From that point of view, it is important to realize that the huge amounts of money being "printed" by central banks is not money that is "sitting in the banking system"; it is merely "debt in motion." One could compare it with the 1930's during the Great Depression when people said that "money disappeared." Such a statement is not correct; it was credit that disappeared leaving only debt that could not be repaid. This is the best kept secret in our economic and monetary system. The real issue central banks are facing is the decade low velocity of money. It means that the unprecedented amounts of money being created (i.e. debt being created) are simply not moving. Bail-ins are not solving any issue on that matter; they only allow ailing banks to keep going. One could rightfully ask the question why bail-ins are only now coming front stage (and not earlier)? Darryl Schoon explains it by comparing today's situation with the one in the 1930's. Fundamentally, the system was the same back then. At that time, there were no bail-ins nor bail-outs; the debt-based banking system simply collapsed. Today, central planners are fighting tooth and nail to avoid a collapse. One final note. Central planners are very focused on reassuring people. It is mandatory that people feel safe or they will stop borrowing. In that respect, savings accounts cannot be removed or the illusion of safety is blown up. Large scale bank bail-ins are not very likely to occur, from that point of view. Central planners will likely print more money to replace any savings lost. |

| Posted: 05 Nov 2013 07:25 AM PST |

| Posted: 05 Nov 2013 07:05 AM PST At the moment gold is at a critical crossroads. If it can move above $1375 it will confirm that an intermediate degree bottom occurred last month at $1251, and start a pattern of higher highs. If however gold continues lower and breaks ... Read More... |

| Posted: 05 Nov 2013 07:00 AM PST Goldmoney |

| 24 Winners in the “Blue Sky” Market Posted: 05 Nov 2013 06:26 AM PST You won't hear much pessimism from me, these days. Other than the negative outlook on the U.S. dollar, pretty much everything else we see is surrounded with blue skies. The American shale boom is the poster child for this "blue sky" thesis. Over the past five years we've seen a massive turnaround in the American economy. Rack some of the market-based gains to inflation fluff, but a large portion of America's economic comeback sprouted roots from the energy boom. That said, it's only prudent to take a step back and wonder if a crash is, in fact, imminent… Remember we're not just resource hunters, here, we're also traders. A gain in the hand is worth two in the bush, eh? Any trader worth his salt knows how to play the ups and downs of the market – when the getting is good you "sell high" and when all hope is lost you step back in and "buy low." That's the most basic mantra of any good trader. Just as good traders know how to buy low and sell high, they also know how to "let the winners run." Today we’ll take a look at some of our favorite picks. We'll update where they've been since our first mention – plus, where they may be headed in the future. Fact is, with the gains I'm seeing out of this bunch, some traders may think it's time to take some money off the table. But as you'll see, that may not be the best plan with this raging bull… A little over a year ago I was kicking rocks in North Dakota's oil-rich prairie land. It's funny, sometimes there are so many good investment ideas they just start hitting you in the face. I passed a massive, brand new, oil storage container owned by Enbridge Energy Partners (EEP). I set foot on a rig owned and operated by Nabors Industries (NBR). I took pictures of hundreds of oil rail cars (owned by none other than BNSF — Warren Buffet's company) lining up to transport the freshly produced crude. Even when I went to put my hotel key in the door, after a long day of site visits, I look over the my left and see a contractor lugging a plethora or yellow cases – the trademark yellow containers carry Trimble Navigation (TRMB) geo-tracking equipment used by many a resource hunter. Enbridge, Nabors and Trimble, by the way, are posting solid double digit gains since that anecdotal message – 13%, 16% and 22% is nothing short of fantastic for off-the-cuff resource picks! But that's only part of the story. Here's a few other important takeaways to keep in mind: Midstream is a must! – The U.S. shale boom is creating tons of opportunities in oil and gas, not the least of which is through "midstream" companies. These are the companies that gather, process and transport oil and gas.

The rail boom chugs along! – Along with midstream players we're seeing a true resurgence in rail traffic. Whether trains are transporting standard goods or part of America's new oil bounty, rail players and terminal owners are burning up the tracks!

Fertilizer gains still growing! – With the use of America's cheap and abundant natural gas as a feedstock, nitrogen fertilizer makers are achieving a global advantage on costs. Some pay a nice dividend to boot!

The race is on to become the "Next Exxon" – Now that the dust is starting to settle in the shale patch, it's clear to see that "local" oil players are cashing in the most. These are the pure-play type companies that can cash in on sweet-spots and leverage efficiencies to turn a profit.

Keep an eye on "unconventional" gold and silver players! — Big gold producers have been a flop over the past few years – I'm looking at you Goldcorp, Barrick and Newmont! First they started diverging from the price of bullion – so even as the price of gold moved higher the big miners continued to fall! Second, after the price of gold pulled back earlier this year those big players fell even further. I'm not turning a blind eye to these losses – over the past two years many big miners shed nearly half their value – but it's important to note some of the other winning "unconventional" precious metals plays we've looked at…

Add it all up and some savvy readers could be sitting on a lot of winners. As I hinted above, a hot-streak like this will have some traders holding their hand right-close to the sell button. The market can only go up so far so fast – there's got to be a pullback or crash waiting in the wings, right? But just as good traders know how to buy low and sell high, they also know how to "let the winners run." Above, we've listed 24 winners, along with one company that's unchanged, Marathon Oil. All together the list is averaging a 33% annualize gain (accounting for the varied timeframes.) It easily outpaces the mainstream markets on a yearly basis. So do I think the market is going to crash? Is this list a little top-heavy? Nope! For starters I'm a firm believer in letting your winners run, especially when there is blue sky as far as the eye can see. Plus, as long as the Fed continues to spur the market along with more easy money – which analysts believe will happen all the way through March 2014 – then the companies listed above will have a stiff wind at their back. Add it all up and this run could be one for the ages. Keep up the good work! And don't forget to keep your boots muddy, Matt Insley Ed. Note: Finding winners in the current US energy boom is Matt’s specialty. And clearly, he’s good at it. But his colleague, Byron King has a few more tricks up his sleeve, and Matt relayed them to his Daily Resource Hunter email readers yesterday. If you didn’t get it, not to worry. You can sign up for FREE, right here, and start getting all of Matt’s incredible analysis (as well as several chances at real profit opportunities), every single day. Original article posted on Daily Resource Hunter |

| Gold prices ease as euro weakens ahead of ECB meeting Posted: 05 Nov 2013 06:01 AM PST 05-Nov (Reuters via CNBC) — Gold prices eased on Tuesday, pressured by a retreat in the euro ahead of a key European Central Bank meeting later this week, and as investors awaited more transparency on U.S. monetary policy. The euro fell against the dollar on Tuesday on speculation the ECB may signal easier monetary policy or even cut rates at a meeting on Thursday after a sharp moderation in headline euro zone flash inflation figures last week. A stronger dollar tends to weigh on gold, which is denominated in the U.S. unit. [source] PG View: Gold is actually a little higher now. |

| Posted: 05 Nov 2013 05:47 AM PST At the moment gold is at a critical crossroads. If it can move above $1375 it will confirm that an intermediate degree bottom occurred last month at $1251, and start a pattern of higher highs. If however gold continues lower and breaks below that $1251 level it will confirm that an intermediate degree decline is still in progress and the recent bounce was nothing more than another bull trap to work off the short-term oversold levels. Actually based on my cycles analysis I think we can even narrow the band a little tighter. If gold can move above the October 28 high at $1361 over the next several days it would confirm that this daily cycle has become right translated and complete a new pattern of higher highs and higher lows. If however gold moves below Friday's half cycle low of $1305 it would confirm that the daily cycle has topped in a left translated manner and the odds would then be very high that the October low at $1251 is going to be broken over the next 2-3 weeks. Until one of these lines in the sand get broken, there is just no compelling reason to place a directional trade in the precious metals market. More in last night's report. |

| Posted: 05 Nov 2013 05:34 AM PST The Indian government has restricted the importation of gold. So Indians have switched to silver ... Read More... |

| Posted: 05 Nov 2013 05:25 AM PST |

| Posted: 05 Nov 2013 05:23 AM PST GOLD PRICES were unchanged Tuesday lunchtime from yesterday or from last week's finish at $1317 per ounce, as European shares again defied a drop in Asian stock markets to tick higher. Major government bond prices edged back, and commodities rallied from multi-month lows. Silver prices today bounced from a near 3-week low at $21.58 per ounce, more than 6.5% below last Wednesday's 6-week high. The British Pound meantime rose to 1-week highs after the European Commission sharply revised its 2014 and 2015 growth forecasts for the UK higher. That pushed Sterling gold prices below £820 for the first time since October 22nd. "Yesterday was one of the quietest days I can remember for a while," said Marex Spectron's David Govett in a note Tuesday morning, "with tiny volumes and very narrow ranges." "Trading volume was very light," agrees brokerage INTL FCStone, adding that turnover in Comex gold futures was barely half its 1-month average, "among the weakest daily turnover" of 2013 to date. Open interest in US gold futures held flat on Monday, with the total number of contacts now live ending the day virtually unchanged from Friday below 389,000. The quantity of gold bullion needed to back shares in the giant SPDR Gold Trust, the world's biggest exchange-traded gold fund, was also unchanged, ending Monday at a 57-month low of 866 tonnes. Gold bullishness amongst private investors, in contrast, rose last month to the highest level since April reports the UK's Daily Telegraph, citing the latest Gold Investor Index from Bullionvault, "the world's largest online market for buying physical bullion." But amongst Indian consumers, the world's heaviest gold buyers, "Sales picked up only a couple of days before Diwali," says the Bombay Bullion Association's Harmesh Arora, commenting on last weekend's festival of lights – typically the biggest season for Indian household gold demand. "It was nowhere enough to match up with last year's level." Thanks to the Indian government's anti-gold import rules, "This time there were no stocks available," says All India Gem & Jewellery Trade Federation chairman Haresh Soni, also speaking to the Wall Street Journal. "There was also spending tightness due to overall liquidity crunch." "This Diwali was a disaster," the paper quotes one senior jewelry chainstore manager, claiming that pre-festive sales were 50% down on 2012. "I have never seen such bad festival sales in 20 years," says the director, Rajiv Popley. But while "there is less gold available...rural people will gradually move to silver," says Rajesh Khosla, managing director at the part-state owned refiner MMTC-Pamp – recently approved for production of Good Delivery wholesale silver by the London Bullion Market Association. Demand to buy silver in India has already doubled in 2013 from full-year 2012, Reuters notes today. The world's No.1 end-consumer of silver, as well as of gold, India could be set for a new annual record says a report from Japanese trading house Mitsui, overtaking the previous record of 2008 when India accounted for more than 15% of the world market. Over in neighboring Dubai, "Jewellery demand has been especially strong," reports French investment bank and London bullion market-maker Societe Generale, "as it has benefitted from the tourist trade, with the increasing restrictions in the Indian market encouraging Indians to make more purchases [overseas]." Back in the spot market, "There was no significant economic data...to provide any direction for the gold price," says Commerzbank's precious metals team, adding that silver continues to move "more or less in line" with gold. New data overnight showed Japan's monetary base – the total amount of currency in circulation, plus commercial bank holdings at the central bank – rose to a new record in October for the 8th month running. Reaching more than ¥186 trillion ($1.9trn), the monetary base stood 46% above October last year thanks to the Bank of Japan's newly aggressive quantitative easing program of bond and other investment purchases. Ahead of Wednesday's Bank of Japan policy decision, governor Haruhiko Kuroda said today the central bank "[is] ready to take appropriate policy adjustments without hesitation" to achieve its 2.0% per year target rate for consumer price inflation. Japanese consumer prices were flat year-on-year in September, after 15 years' deflation. Meantime in the United States, any "tapering" of the US central bank's $85 billion per month in quantitative easing "is a data-dependent program," said St.Louis Federal Reserve president James Bullard to CNBC. |

| Coming Clean, Dr. Joseph Farrell – Covert Wars & The Mysterious Strength of the US Dollar Posted: 05 Nov 2013 04:00 AM PST |

| Appetite for gold rises to six-month high Posted: 05 Nov 2013 03:40 AM PST Gold is on track for its first annual loss in 13 years, but demand from buyers rose last month This posting includes an audio/video/photo media file: Download Now |

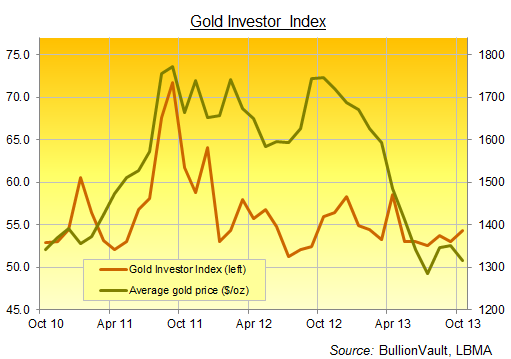

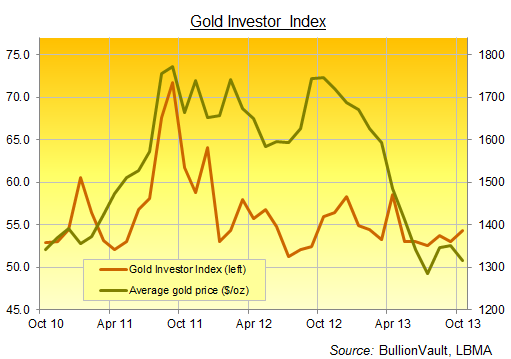

| Posted: 05 Nov 2013 01:02 AM PST Gold Investor Index shows investor selling retreating further as price steadies... The NUMBER of BullionVault users starting or adding to their gold holding increased slightly from September last month, writes Adrian Ash, head of research. But it was a 15% drop in the number of net sellers which pushed the Gold Investor Index higher in October, up to its highest level since April.  Overall, net gold buyers outnumbered sellers better than two-to-one on BullionVault in October. That took our index – which measures the balance of private investors adding to their gold holdings over those who reduce them on BullionVault, the world's biggest exchange for gold and silver online – up to a 6-month high of 54.3 from 53.0 in September. The Gold Investor Index peaked at 71.7 in September 2011. A reading of 50.0 would signal a perfect balance of net buyers and sellers. Of course, with world stock markets hitting 5-year highs, it should have been no surprise to gold prices edging lower. Average monthly gold prices have now fallen in 10 of the last 12 months – something not seen since the bull market began in early 2001. But Washington's short-term fix to the debt ceiling confirms there's no will to tackle spending or money printing long term. And with the insurance value of gold ownership being confirmed, October's drop in its price let savers build their insurance at lower cost. |

| Posted: 05 Nov 2013 01:02 AM PST Gold Investor Index shows investor selling retreating further as price steadies... The NUMBER of BullionVault users starting or adding to their gold holding increased slightly from September last month, writes Adrian Ash, head of research. But it was a 15% drop in the number of net sellers which pushed the Gold Investor Index higher in October, up to its highest level since April.  Overall, net gold buyers outnumbered sellers better than two-to-one on BullionVault in October. That took our index – which measures the balance of private investors adding to their gold holdings over those who reduce them on BullionVault, the world's biggest exchange for gold and silver online – up to a 6-month high of 54.3 from 53.0 in September. The Gold Investor Index peaked at 71.7 in September 2011. A reading of 50.0 would signal a perfect balance of net buyers and sellers. Of course, with world stock markets hitting 5-year highs, it should have been no surprise to gold prices edging lower. Average monthly gold prices have now fallen in 10 of the last 12 months – something not seen since the bull market began in early 2001. But Washington's short-term fix to the debt ceiling confirms there's no will to tackle spending or money printing long term. And with the insurance value of gold ownership being confirmed, October's drop in its price let savers build their insurance at lower cost. |

| Gold vs. Wall Street’s Program Traders Posted: 04 Nov 2013 04:00 PM PST |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Is it Mission Accomplished for the CFTC's "Good Cop"?

Is it Mission Accomplished for the CFTC's "Good Cop"? The Indian government has restricted the importation of gold. So Indians have switched to silver:

The Indian government has restricted the importation of gold. So Indians have switched to silver:

Unabashedly, Peter Schiff predicts that gold is going $2,000 in a recent interview with Bloomberg. It seems he is going out on a limb. But, I can't help but agree.

Unabashedly, Peter Schiff predicts that gold is going $2,000 in a recent interview with Bloomberg. It seems he is going out on a limb. But, I can't help but agree.

No comments:

Post a Comment