Gold World News Flash |

- Gold Daily and Silver Weekly Charts – Appearance Versus Reality

- Hong Kong radio interviews GATA secretary

- Ross Norman: Gold -- the Silk Road redux

- Buying Silver Was The Stupidest Move I Ever Made!

- The US Is Going To See A Monster Collapse – One For The Ages

- Uncovering China’s Rush for Gold

- I Am A Terrified Observer As I Watch The End Game Unfolding

- Volatile Times Ahead for Silver

- “SILVER IS A TICKING TIME BOMB” — Jan Skoyles

- Gold Ratio Charts

- The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013

- The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013

- Government Shutdown? 36 Facts Which Prove That Almost Everything Is Still Running

- Wall Street Headhunter: "I Haven't Seen Morale This Bad Since The Titanic"

- Gold: The Portfolio Insurance

- Guest Post: The Rise And Fall Of Monetary Policy Coordination

- Louise Yamada - 2 Fantastic Gold, Silver & Mining Charts

- Silver and Gold Prices Both Fell Today — the Gold Price Closed at $1,317.40

- Silver and Gold Prices Both Fell Today — the Gold Price Closed at $1,317.40

- Financial Collapse Begins

- Laurence Williams: GATA's once-fringe views are mainstream now

- Higher interest rates bullish for gold as they signify inflation, Barron says

- China Gold Association leader notes Fed's manipulation of the gold market

- Ronald Stoeferle: Gold Bubble or Bargain?

- Gold Daily and Silver Weekly Charts - Appearance Versus Reality

- Gold Daily and Silver Weekly Charts - Appearance Versus Reality

- Volatile Times Ahead for Silver Price

- Latest newsletter now available and we think you will gain much from it

- Latest newsletter now available and we think you will gain much from it

- Euro's October Seasonals and Gold Shutdown

- NAV Premiums of Certain Precious Metal Trusts and Funds - The Odd Situation in Gold Bullion Inventories

- NAV Premiums of Certain Precious Metal Trusts and Funds - The Odd Situation in Gold Bullion Inventories

- Gold Markets Are Not Efficient, Don't Reflect Fundamentals

- Who would trade a pawn shop for a payday pariah?

- Where Are Gold Prices Going?

- Where Are Gold Prices Going?

- The US Is Going To See A Monster Collapse - One For The Ages

- Volatile Times Ahead for Silver

- The Daily Market Report

- The Fed’s $700 Billion Magic Trick

- Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO)

- Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO)

- Gold Markets are not Efficient, Don?t Reflect Fundamentals & Understate Gold?s Market Value (part 2)

- The process of selling silver – Endeavour

- Gold trading or gold hoarding – which will win out?

- AngloGold plans to cut 400 jobs at Ghana mine

- Gold below $1,300 proves too tempting to resist

- Gold Markets Are Not Efficient, Don't Reflect Fundamentals and Understate Gold's Market Value - Part II

- Gold drops on U.S. govt shutdown uncertainty, low demand

- Gold prices rebound; jewellers stocking up for festivals

| Gold Daily and Silver Weekly Charts – Appearance Versus Reality Posted: 03 Oct 2013 11:30 PM PDT from Jesse’s Café Américain:

I have not yet figured out what is causing this, and I may never find it out. But it does seem to suggest that if gold should break out and run higher there is going to be a grabasstic rush to stake out all the deliverable and allocated bullion that you can find. YTD the gold bullion inventories are down in excess of 700 tonnes, but we see no decline in silver, platinum or palladium inventories across a broad spectrum of publicly disclosing entities. |

| Hong Kong radio interviews GATA secretary Posted: 03 Oct 2013 10:58 PM PDT 1:53p HKT Friday, October 4, 2013 Dear Friend of GATA and Gold: Your secretary/treasurer was interviewed for a few minutes today by Bryan Curtis of the daily "Money for Nothing" program on Radio/Television Hong Kong's Radio 3 station. The segment can be heard by activating the link at the bottom of the "Money for Nothing" program's page at the RTHK Internet site here: http://programme.rthk.hk/channel/radio/programme.php?name=radio3/money_f... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ross Norman: Gold -- the Silk Road redux Posted: 03 Oct 2013 10:47 PM PDT 1:44p HKT Friday, October 4, 2013 Dear Friend of GATA and Gold: Ross Norman of the Sharps Pixley gold brokerage in London has published a pretty scholarly and fascinating study of gold's centuries-long journey from the West to the East, a journey that has been hastened greatly in recent years. The study is headlined "Gold: The Silk Road Redux" and it's posted at the Sharps Pixley Internet site here: http://www.sharpspixley.com/uploads/COMMNOWARTICLESEPLBMA_2013.pdf CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Buying Silver Was The Stupidest Move I Ever Made! Posted: 03 Oct 2013 09:35 PM PDT from TruthNeverTold: |

| The US Is Going To See A Monster Collapse – One For The Ages Posted: 03 Oct 2013 09:20 PM PDT from KingWorldNews:

We will eventually head over the cliff — it's inevitable. What we have already started to see in the 3rd world countries are the inflation rates and interest rates going up. These countries are finding it harder to borrow money. This is a harbinger for what is going to happen in the West. |

| Uncovering China’s Rush for Gold Posted: 03 Oct 2013 09:08 PM PDT by Jan Skoyles, TheRealAsset.co.uk

The Chinese government acknowledged gold as a strategic asset in 2000, when it included the establishment of an open gold market in its five year economic plan. Since then China has come to play a significant role in the international gold market as it strives to develop and advance all aspects of the industry and gold's role in the domestic market. |

| I Am A Terrified Observer As I Watch The End Game Unfolding Posted: 03 Oct 2013 09:01 PM PDT  As the modern world seems to move directly from one crisis to another, today one of the wealthiest people in the financial world stunned King World News when he said, "I am a terrified observer as I watch the end game drawing to a close." Rick Rule, who is business partners with billionaire Eric Sprott, also spoke what is at stake for humanity, what we are doing to our children and grandchildren, and what this all means for investors in major markets, including gold and silver. Below is what he had to say in this candid and powerful interview. As the modern world seems to move directly from one crisis to another, today one of the wealthiest people in the financial world stunned King World News when he said, "I am a terrified observer as I watch the end game drawing to a close." Rick Rule, who is business partners with billionaire Eric Sprott, also spoke what is at stake for humanity, what we are doing to our children and grandchildren, and what this all means for investors in major markets, including gold and silver. Below is what he had to say in this candid and powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Volatile Times Ahead for Silver Posted: 03 Oct 2013 08:40 PM PDT by Przemyslaw Radomski, Silver Seek:

Despite this temporary increase, silver has since given up the gains and is trading below $22 once again. We didn't expect silver to show significant strenght – as we emphasized in our previous essay on the gold price on October 2013, the medium-term trend for the precious metals market remains down. |

| “SILVER IS A TICKING TIME BOMB” — Jan Skoyles Posted: 03 Oct 2013 08:24 PM PDT

This is a fun one, we visit with the one and only Jan Skoyles, writer and researcher for TheRealAsset.co.uk. Jan has a degree in International Business and Economics, and she’s got a great sense of humor – which is a great asset indeed in these trying times. Jan tells us the issues with the CFTC and the manipulation in the silver market just make silver even more of a “ticking time bomb.” Jan says her personal allocation for silver and gold is 50/50, “That’s how much faith I have in silver.” And if you miss Jan at the Pub, you can always catch her right here at SGT Report, or daily over at The Real Asset Company. |

| Posted: 03 Oct 2013 07:07 PM PDT It was only recently that I looked at the Dow Jones Industrials/Gold ratio (DJI/Gold ratio). I wanted now to add another ratio that is often overlooked but is equally important. The Gold/Bonds ratio. The ratio in this case is the ... Read More... |

| The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013 Posted: 03 Oct 2013 06:15 PM PDT |

| The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013 Posted: 03 Oct 2013 06:15 PM PDT |

| Government Shutdown? 36 Facts Which Prove That Almost Everything Is Still Running Posted: 03 Oct 2013 05:40 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, All of this whining and crying about a "government shutdown" is a total joke. You see, there really is very little reason why this "government shutdown" cannot continue indefinitely because almost everything is still running. 63 percent of all federal workers are still working, and 85 percent of all government activities are still being funded during this "shutdown". Yes, the Obama administration has been making a big show of taking down government websites and blocking off the World War II Memorial, but overall business in Washington D.C. is being conducted pretty much as usual. It turns out that the definition of "essential personnel" has expanded so much over the years that almost everyone is considered "essential" at this point. In fact, this shutdown is such a non-event that even referring to it as a "partial government shutdown" would really be overstating what is actually happening. The following are 36 facts which prove that almost everything is still running during this government shutdown... #1 According to U.S. Senator Rand Paul, 85 percent of all government activities are actually being funded during this "government shutdown". #2 Approximately 1,350,000 "essential" federal employees will continue to work during this "government shutdown". #3 Overall, 63 percent of the federal workforce will continue to work during this "government shutdown". #4 The U.S. Postal Service will continue to deliver our mail. #5 U.S. military personnel will remain on duty and will continue to get paid. #6 Social Security recipients will continue to get their benefits. #7 Medicare recipients will continue to get their benefits. #8 Medicaid recipients will continue to get their benefits. #9 Food stamp recipients will continue to get their benefits. #10 Those on unemployment will continue to get their benefits. #11 Federal retirees will continue to get their pensions. #12 The federal school lunch program has enough money to go through at least the end of this month. #13 Public schools all over the country will continue to stay open. #14 Almost all federal law enforcement officials will continue working. #15 The Federal Reserve will remain "completely functional". #16 The Supreme Court will continue to operate normally and federal courts have enough money to keep going for at least two weeks. #17 TSA employees will continue to molest travelers at our airports. #18 Air traffic controllers will continue to monitor traffic at our airports. #19 Hopelessly outmanned border patrol agents will continue to try to stem the tide of illegal immigration. #20 Visas and passports will continue to be issued by the State Department. #21 The Veterans Administration will continue to offer substandard medical services, and it will be able to continue processing benefit payments at least for now. #22 The Obama administration apparently has plenty of money to spend on closing open-air memorials that are usually open to the public 24 hours a day. #23 The Department of Defense announced the awarding of 94 new contracts worth a combined total of more than 5 billion dollars on September 30th - the day right before the "government shutdown". #24 The "government shutdown" has not prevented the new two billion dollar NSA spy center from opening up. #25 Federal prisons will continue to operate normally. #26 Amtrak trains will continue to run. #27 The Patent and Trademark Office will be open. #28 The Consumer Product Safety Commission will continue to issue product recalls if the products "create an immediate threat to the safety of human life". #29 The National Weather Service and the National Hurricane Center will continue to track weather patterns. #30 If the federal government needs to respond to a natural disaster, this "shutdown" will not affect that. #31 NASA will continue to support the Mars Rover and the two American astronauts up on the International Space Station. #32 All city employees of the D.C. government have been deemed "essential" and will continue to go to work. #33 Even though the Obamacare exchanges are not working properly, people will still be able to access them. #34 The IRS will continue to collect taxes, but it will be suspending punitive audits of conservative organizations. #35 Barack Obama will continue to get paid for the full duration of this "shutdown". #36 The U.S. Congress will continue to get paid for the full duration of this "shutdown". Of course not everything is operating normally during this government shutdown. Government parks are closed. The EPA and the Department of Energy have almost totally closed up shop. But overall, most Americans are not going to notice much of a difference. And perhaps now is a good time for the American people to evaluate whether or not they actually need a gigantic federal government that wastes enormous mountains of our money. For example, our federal government recently spent $98,670 to construct a single outhouse in Alaska. That is more than a lot of Americans pay for their entire houses. For many more examples like this, please see my previous article entitled "The Waste List: 66 Crazy Ways That The U.S. Government Is Wasting Your Hard-Earned Money". It is about time that Washington D.C. started experiencing some of the "belt-tightening" that the rest of the country has been going through. For far too long, the fatcats in D.C. have been living in an alternate reality where they have been able to live the high life at our expense. A recent blog post by Daniel Greenfield discussed how this shutdown is going to affect the alternate reality that the Obamas have been living in...

Oh the humanity! Will Michelle Obama ever tweet again? And how will the White House continue to function without at least one projectionist on duty at the White House 24 hours a day? No wonder Barack Obama is so upset about this shutdown. In the end, this shutdown could turn out to be very good for America. We have a government that is wildly out of control and that desperately needs to be reigned in. During the Obama administration, federal debt held by the public has risen by 90 percent, and overall federal government spending has risen by a whopping 317 percent since 1990. So is it really a bad thing that the federal government has been forced to cut back for a little while? Our politicians can whine and cry all they want. They won't be getting any sympathy from me. |

| Wall Street Headhunter: "I Haven't Seen Morale This Bad Since The Titanic" Posted: 03 Oct 2013 05:04 PM PDT Say what you will about the quality of financial earnings in 2013 (and we have said quite a bit, making it very clear over the past three quarters that a substantial portion of financial "earnings" has been accounting gimmickry such as loan-loss reserve releases and other "one-time" addbacks which mysteriously end up becoming quite recurring), but one thing that is indisputable is that of the nearly $52 in non-GAAP, adjusted S&P500 EPS so far in 2013, over 20% is attributable to financials. This can be seen on the charts below, showing the breakdown of S&P component industries to the S&P500's bottom line, as follows: Q1: And Q2: In other words nearly $11/share of the $52 in S&P500 EPS in the first half of 2013 is due to financial companies. While we don't have the industry breakdown by sector for third quarter expectations handy, it is once again roughly in the 20% range. Which may be a problem. As we reported first in July (and again on subsequent occasions), one of the most dramatic events to take place in Q3 as a result in the blowout of rates on Tapering fears, was the sudden and precipitous collapse in the value of unrealized gains (or rather losses) on available for sale securities held by banks due to soaring yields and plunging fixed income prices. But while this major adverse impact to bank capitalization was immune from also hitting the bank income statement due to the special treatment of Available for Sale Securities courtesy of FAS115, something else did impact the income statement. As we also reported first two weeks ago, the unprecedented plunge in fixed income profit in Q3 as indicated by early reporter Jefferies, foreshadowed something very bad is coming. The revenue collapse, according to CEO Dick Handler, was due to "rising-rate environment, spread widening, redemptions experienced by its client base which "heavily muted trading," and related mark-to-market write downs." In other words: a perfect storm. Days later, first Citi, and then virtually all other major banks warned that they too will suffer comparable drops in fixed-income revenues and profits. As in Jefferies' case this is due to pushing writedowns through the P&L, to a plunge trading volumes, to an illiquid market, to client redemptions and due to demand for mortgage originations and refinancings grinding to a halt. In some cases, like JPMorgan, the pain will only be magnified as banks have to take massive legal reserves, which will further crush actual earnings, although bank analysts will surely bless these as "non-recurring" as usual (even if they are now about the most recurring component of JPM's quaterly performance), and thus allow them to be excluded from Non-GAAP bottom lines. However, one thing is now abundantly clear: 2013 is now one big scratch for bankers who were expecting that this year bonuses would finally pick up from the prior several years mediocre performance and catch up to the record days of 2009 (just after the biggest wholesale bank bailout in history). The WSJ summarizes the situation best:

And if bankers are not happy, nobody else will be (here's looking at you dear perpetual banker bailout ATM known as US taxpayers).

They may not be good with non-taxpayer funded numbers, but bankers are always quick when it comes to turning a phrase:

In previous years there was always at least one product group that was making money. This year: everyone is suffering.

Naturally, since everyone wants out and to find a job at a competitor, it is suddenly the biggest buyer's market out there. It also means axes will be flying in 2013 coming bonus time, or rather, just before.

And we are not talking selected surgial layoffs here and there. The mortgage industry: that bread and butter of banking Net Interest Margin-based operations, is about to be nuked from orbit.

Finally, since a dropping bonus check tide will reduce all compensation packages across all levels, it means more disgruntled bankers, less discretionary income for the wealthiest, even less taxes paid into city, state and Federal coffers, less consumption and more saving, and an end to America's deficit-cutting miracle and certainly and end to the days of barely even stall speed GDP. As for what it means for second half S&P500 EPS of which financials represent 20%, and for the hopes and prayers of discredted "the recovery is here" chatterbox pundits (and central bankers) everywhere, we are confident, no pun intended, readers can figure that out on their own. |

| Posted: 03 Oct 2013 04:55 PM PDT Chairman Ben Bernanke was expected to announce a reduction in the Fed's asset purchase program which is running at $85 billion a month, but a 9:1 vote put off a decision in a move that came as... [[ This is a content summary only. Visit http://goldbasics.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

| Guest Post: The Rise And Fall Of Monetary Policy Coordination Posted: 03 Oct 2013 04:41 PM PDT Authored by Harold James, originally posted at Project Syndicate, The US Federal Reserve’s recent surprise announcement that it would maintain the current pace of its monetary stimulus reflects the ongoing debate about the desirability of cooperation among central banks. While the Fed’s decision to continue its massive purchases of long-term assets (so-called quantitative easing) was motivated largely by domestic economic uncertainty, fears that an exit would trigger interest-rate spikes in emerging economies – especially Brazil, India, Indonesia, South Africa, and Turkey – added significant pressure. But should central banks’ decision-making account for monetary policy’s spillover effects? Discussion of central-bank cooperation has often centered on a single historical case, in which cooperation initially seemed promising, but turned out to be catastrophic. Like most of our modern cautionary tales, it comes from the Great Depression. In the latter half of the 1920’s, there was almost constant transatlantic tension, as US monetary policy drove up borrowing costs and weakened GDP growth in Europe. In 1927, at a secret meeting on New York’s Long Island, Europe’s leading central banks convinced the Fed to cut its discount rate. Although the move helped to stabilize European credit conditions in the short term, it also fueled the speculative bubble that would collapse in 1929. Cooperation in the 1920’s was both novel and fragile, based as it was on the friendship between Bank of England Governor Montagu Norman and Benjamin Strong, Governor of the Federal Reserve Bank of New York, and, to a lesser degree, their ties with the president of Germany’s Reichsbank, Hjalmar Schacht. The oddly intimate and affectionate relationship between Strong and Norman included regular visits, telephone conversations (a novelty at the time), and an extensive and bizarre correspondence, in which they discussed personal matters as much as monetary issues. Strong once wrote, “You are a dear queer old duck, and one of my duties seems to be to lecture you now and then.” By the late 1920’s, though, Strong was dying of tuberculosis and Norman was experiencing successive nervous breakdowns. Their legacy of cooperation would soon crumble, too, with most observers concluding after the Great Depression that central banks should be subject to strict national controls to block future efforts at collaboration. Central-bank cooperation in the aftermath of the 2008 financial crisis has unfolded in a remarkably similar manner. Initially, increased cooperation seemed to be just what the doctor ordered, with six major advanced-country central banks lowering their policy rates dramatically on October 8, 2008 – three weeks after the collapse of US investment bank Lehman Brothers – in a coordinated effort to stabilize plunging asset markets. They subsequently pumped huge amounts of liquidity into the banking system, thereby averting a total collapse. Now, as the Fed contemplates its next move, emerging-market central bankers are becoming increasingly concerned about the destabilizing effects of monetary tightening on their economies. At September’s G-20 summit in Saint Petersburg, between discussions of the security challenge posed by Syria, world leaders attempted to tackle the issue by creating a formula for international monetary cooperation. But their limited efforts resulted in a fundamentally meaningless appeal. The modern view is that the Fed’s mandate requires it to act according to inflation and employment outcomes in the US, leaving it up to other countries to combat any spillover effects. This means that other countries must devise appropriate tools to limit capital inflows when US interest rates are low and to block outflows when the Fed tightens monetary policy. But emerging economies missed their chance to limit inflows, and impeding outflows at this point would require draconian measures that would contradict the principles of an integrated global economy. Moreover, unanticipated shifts in market expectations make it extremely difficult to anticipate the need for such tools. In this sense, the recent G-20 injunction that advanced-country central banks “carefully calibrate and clearly communicate” monetary-policy changes is unhelpful. Given how difficult it is to communicate coming policy changes accurately, markets tend to be skeptical about long-term forward guidance. This highlights a fundamental difference between central-bank cooperation in the 1920’s and today. Back then, monetary policy was viewed as an “art” practiced by a “brotherhood” of central banks. Modern central bankers, recognizing the limits of such personal ties, often attempt to formulate official rules and procedures. But adhering to rules can be difficult when policymakers are confronted with the conflicting goals of preserving stable employment and GDP growth at home and ensuring that international capital movements are sustainable. When things go wrong (as they almost inevitably do), there is a political backlash against central bankers who failed to follow the rules – and against the cooperative strategies in which they engaged. We are thus left with a paradox: While crises increase demand for central-bank cooperation to deliver the global public good of financial stability, they also dramatically increase the costs of cooperation, especially the fiscal costs associated with stability-enhancing interventions. As a result, in the wake of a crisis, the world often becomes disenchanted with the role of central banks – and central-bank cooperation is, yet again, associated with disaster. |

| Louise Yamada - 2 Fantastic Gold, Silver & Mining Charts Posted: 03 Oct 2013 04:32 PM PDT With continued volatility in key global markets, today King World News is pleased to share a piece of legendary technical analyst Louise Yamada’s “Technical Perspectives” report. Yamada is without question one of the greatest technical analysts Wall Street has ever seen. This information is not available to the public and we are grateful to Louise for sharing her incredible work with KWN readers globally. The portion below has two incredibly important charts that cover the metals and mining share markets |

| Silver and Gold Prices Both Fell Today — the Gold Price Closed at $1,317.40 Posted: 03 Oct 2013 03:54 PM PDT Gold Price Close Today : 1317.40 Change : -3.20 or -0.24% Silver Price Close Today : 21.739 Change : -0.107 or -0.49% Gold Silver Ratio Today : 60.601 Change : 0.443 or 0.74% Silver Gold Ratio Today : 0.01650 Change : -0.000122 or -0.73% Platinum Price Close Today : 1369.50 Change : 8.10 or 0.59% Palladium Price Close Today : 699.20 Change : 2.30 or 0.33% S&P 500 : 1,678.64 Change : -136.60 or -7.53% Dow In GOLD$ : $235.32 Change : $ -1.49 or -0.63% Dow in GOLD oz : 11.383 Change : -0.072 or -0.63% Dow in SILVER oz : 689.84 Change : 0.70 or 0.10% Dow Industrial : 14,996.54 Change : -58.56 or -0.39% US Dollar Index : 79.763 Change : -0.153 or -0.19% Silver and GOLD PRICES both fell back today, but not through any meaningful support. Gold peeled off 3.20 to wind up at $1,317.40. Silver scraped off 10.7 cents to 2173.9. This sounds more respectable when you discover that the GOLD PRICE traded as low at $1,302.84, then leapt from $1,309 to $1,317 in a single bound. That whispers that abundant buyers await any decline to buy more, building a floor under the market. The SILVER PRICE traded much the same, falling about 9:00 to 2143, but recovering two hours later to 2165c. Of course, all of this is on a razor thin margin of stability. Push either metal much past the recent trading range and they'll jump a long way. What intrigues me more, however, are the falling wedges both silver and gold have traced. They don't measure to much gain, but would take them back to the August highs at least. This is a waiting game. It will eventually work out to silver and gold's advantage, but it will wear your nerves down to nubbins in the meantime. Be patient. Here's a quote from Sara Hoyt, "There are two types of people in the world. Those who want to tell everyone what to do and how to do it, and those who have fond fantasies of holding them underwater until bubbles stop coming up." This slow market has been going on too long. I fell to watching paint dry on my office wall today and caught myself thinking, "This is the most excitement I've had in days." This government shutdown wrestling match is hurting stocks worse than anything else, although it's liable to infect bonds soon. Dow fell 0.9% (136.60 points) to end the day below 15,000 at 14,996.54. S&P500 caught up with the Dow today by closing below its 50 DMA (1,679.84). It lost 0.9% (15.23) and ended at 1,678.64. A rising support line will catch the S&P500 around 1,660. Analogous support on the Dow chart intersects about 14,850. Both flashed SELL signals several days ago. Once the sparring in Washington ends, stocks should turn up again for one last hurrah. Dow in Gold and Dow in Silver both fell further today. Dow in Silver is perched on its 20 day moving average, ready to fall through. Dow in Gold has already fallen through. Appears to be the end of any upward motion for some time, and the major trend remains gravity-ward. US dollar index keeps edging closer and closer to the cliff. Low came at 79.627, but it recovered enough to close at 79.763, down only 15.3 basis points (0.2%). A close below 79.50 is, technically, a fall off the cliff with no net below. Euro gained 0.28% to $1.3620 and appears to be pulling away from that top channel line. If so, it might hit $1.3700. If currency markets moved on supply and demand instead of politics, I'd say the euro could move to $1.4400. However, we know currency markets have all the integrity of Gunsmoke's Miss Kitty, and a euro at that height would mean a US dollar at 75.00, alerting the whole world that the end is not only near, but scant minutes away. Plus a euro that high would crucify the European economy. So 'twon't happen. Yen has been rallying and today hit 102.79. Sounds encouraging, but it ain't. Looks to be sketching a rising wedge, which climbs then disappoints by breaking down earthward. On 3 October 1776 the Continental Congress borrowed $5 million to halt the rapid depreciation of paper money in the Colonies. It didn't. Nothing ever changes with fiat money. It always goes bad, whatever country it infects. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Silver and Gold Prices Both Fell Today — the Gold Price Closed at $1,317.40 Posted: 03 Oct 2013 03:54 PM PDT Gold Price Close Today : 1317.40 Change : -3.20 or -0.24% Silver Price Close Today : 21.739 Change : -0.107 or -0.49% Gold Silver Ratio Today : 60.601 Change : 0.443 or 0.74% Silver Gold Ratio Today : 0.01650 Change : -0.000122 or -0.73% Platinum Price Close Today : 1369.50 Change : 8.10 or 0.59% Palladium Price Close Today : 699.20 Change : 2.30 or 0.33% S&P 500 : 1,678.64 Change : -136.60 or -7.53% Dow In GOLD$ : $235.32 Change : $ -1.49 or -0.63% Dow in GOLD oz : 11.383 Change : -0.072 or -0.63% Dow in SILVER oz : 689.84 Change : 0.70 or 0.10% Dow Industrial : 14,996.54 Change : -58.56 or -0.39% US Dollar Index : 79.763 Change : -0.153 or -0.19% Silver and GOLD PRICES both fell back today, but not through any meaningful support. Gold peeled off 3.20 to wind up at $1,317.40. Silver scraped off 10.7 cents to 2173.9. This sounds more respectable when you discover that the GOLD PRICE traded as low at $1,302.84, then leapt from $1,309 to $1,317 in a single bound. That whispers that abundant buyers await any decline to buy more, building a floor under the market. The SILVER PRICE traded much the same, falling about 9:00 to 2143, but recovering two hours later to 2165c. Of course, all of this is on a razor thin margin of stability. Push either metal much past the recent trading range and they'll jump a long way. What intrigues me more, however, are the falling wedges both silver and gold have traced. They don't measure to much gain, but would take them back to the August highs at least. This is a waiting game. It will eventually work out to silver and gold's advantage, but it will wear your nerves down to nubbins in the meantime. Be patient. Here's a quote from Sara Hoyt, "There are two types of people in the world. Those who want to tell everyone what to do and how to do it, and those who have fond fantasies of holding them underwater until bubbles stop coming up." This slow market has been going on too long. I fell to watching paint dry on my office wall today and caught myself thinking, "This is the most excitement I've had in days." This government shutdown wrestling match is hurting stocks worse than anything else, although it's liable to infect bonds soon. Dow fell 0.9% (136.60 points) to end the day below 15,000 at 14,996.54. S&P500 caught up with the Dow today by closing below its 50 DMA (1,679.84). It lost 0.9% (15.23) and ended at 1,678.64. A rising support line will catch the S&P500 around 1,660. Analogous support on the Dow chart intersects about 14,850. Both flashed SELL signals several days ago. Once the sparring in Washington ends, stocks should turn up again for one last hurrah. Dow in Gold and Dow in Silver both fell further today. Dow in Silver is perched on its 20 day moving average, ready to fall through. Dow in Gold has already fallen through. Appears to be the end of any upward motion for some time, and the major trend remains gravity-ward. US dollar index keeps edging closer and closer to the cliff. Low came at 79.627, but it recovered enough to close at 79.763, down only 15.3 basis points (0.2%). A close below 79.50 is, technically, a fall off the cliff with no net below. Euro gained 0.28% to $1.3620 and appears to be pulling away from that top channel line. If so, it might hit $1.3700. If currency markets moved on supply and demand instead of politics, I'd say the euro could move to $1.4400. However, we know currency markets have all the integrity of Gunsmoke's Miss Kitty, and a euro at that height would mean a US dollar at 75.00, alerting the whole world that the end is not only near, but scant minutes away. Plus a euro that high would crucify the European economy. So 'twon't happen. Yen has been rallying and today hit 102.79. Sounds encouraging, but it ain't. Looks to be sketching a rising wedge, which climbs then disappoints by breaking down earthward. On 3 October 1776 the Continental Congress borrowed $5 million to halt the rapid depreciation of paper money in the Colonies. It didn't. Nothing ever changes with fiat money. It always goes bad, whatever country it infects. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Posted: 03 Oct 2013 03:43 PM PDT This month Gordon explains the current markets as a "Crack Up Boom" and further tells us what to expect in the future from "An 'Echo Boom' Ahead". He also takes input from John Rubino as they discuss what "Spooked the Fed" and ... Read More... |

| Laurence Williams: GATA's once-fringe views are mainstream now Posted: 03 Oct 2013 03:39 PM PDT 6:37a HKT Friday, October 4, 2013 Dear Friend of GATA and Gold: MineWeb's Laurence Williams' new commentary, "Gold Trading or Gold Hoarding -- Which Will Win Out?," acknowledges growing recognition that GATA has been right all along about central bank efforts to suppress the price of gold. Williams writes: "For years scorn was heaped on the GATA ideas, despite some substantial evidence being produced to support them. But, of late, given some increasingly strange gold market movements flying in the face of political and financial events which would at any other time have had the effect of leading to an upward run on gold, GATA's views, and those of a number of others on the fringe, are becoming mainstream -- particularly as these adverse price movements in gold appear to have been orchestrated by massive 'sales' of paper metal in volumes that have absolutely no relation to the amounts of gold being mined or available to the markets in physical form. 'There are no markets anymore, only interventions,' says Chris Powell, GATA's secretary, perhaps at last coming round to the observation that gold is not unique in being manipulated by the big financial players." Well, not quite "at last" for GATA, since that observation about every market being manipulated was made more than five years and almost 7,000 dispatches ago: Williams' commentary is posted at MineWeb here: http://www.mineweb.com/mineweb/content/en/mineweb-whats-new?oid=207314&s... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Higher interest rates bullish for gold as they signify inflation, Barron says Posted: 03 Oct 2013 03:19 PM PDT 6:13a HKT Friday, October 4, 2013 Dear Friend of GATA and Gold: Gold mining entrepreneur Keith Barron tells King World News that higher interest rates are bullish, not bearish, for gold insofar as they signify higher inflation: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/3_Th... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| China Gold Association leader notes Fed's manipulation of the gold market Posted: 03 Oct 2013 03:12 PM PDT 6:10a HKT Friday, October 4, 2013 Dear Friend of GATA and Gold: In a review of the gold market in China for The Real Asset Co. in London, Jan Skoyles and Koos Jansen quote a leader of the China Gold Association, Zhang Jie, about the U.S. Federal Reserve's manipulation of the gold market: "For the Fed, it is crucial that the dollar dominates the world and so the Fed will store gold reserves from countries all over the world to control the gold settlement system." The Skoyles-Jansen report is headlined "Uncovering China's Rush for Gold" and it's posted at The Real Asset Co.'s Internet site here: http://therealasset.co.uk/china-rush-gold/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Ronald Stoeferle: Gold Bubble or Bargain? Posted: 03 Oct 2013 02:55 PM PDT In this one hour presentation for ABC Bullion, Ronald Stoeferle from Incrementum Liechtenstein explains in much detail why he believes gold is a bargain and debt a bubble. This article provides the highlights of the presentation and the rationale for Stoeferle’s key premise. The difference between the Keynesian economist and Austrian economist (explained by a comparison with a doctor):

A comparison between today’s corrective phase and the one in the 70′s:

Why the gold bull market is not over:

Structural over-indebtedness is the key problem in our economy:

Clear signs of a debt bubble:

The big bubble is not in gold; it is in bonds. Stoeferle asks a question to the audience:

What to expect going forward?

Further reading from Incrementum Liechtenstein: In Gold We Trust 2013 – Long Term Gold Price Target $2,230 |

| Gold Daily and Silver Weekly Charts - Appearance Versus Reality Posted: 03 Oct 2013 01:24 PM PDT |

| Gold Daily and Silver Weekly Charts - Appearance Versus Reality Posted: 03 Oct 2013 01:24 PM PDT |

| Volatile Times Ahead for Silver Price Posted: 03 Oct 2013 12:58 PM PDT On Wednesday, silver gained almost 2.7% and reached $22 as a weak dollar boosted commodities priced in the greenback. The US currency was under selling pressure as a U.S. government shutdown entered a second day with no end in sight. The white metal was supported by weak U.S. economic data, which raised hopes the Federal Reserve would stick to its commodity-friendly stimulus for longer. |

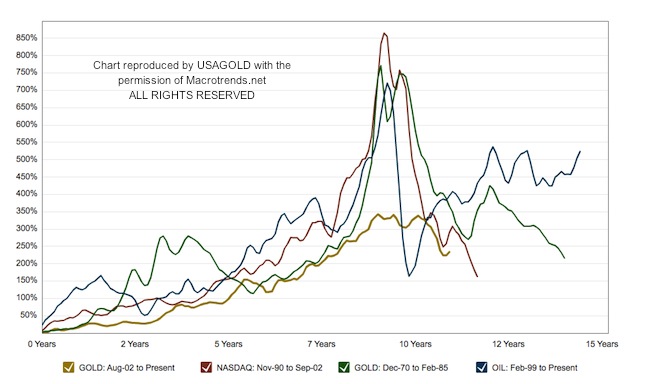

| Latest newsletter now available and we think you will gain much from it Posted: 03 Oct 2013 12:48 PM PDT In the current issue of our Review & Outlook newsletter, we explore whether or not gold’s bull market is still on course. A series of charts on the long-term relationship between gold and monetary policy tell an interesting and timely story. We invite you to visit our special report: Golden Gut Check 2013 Sneak preview: “This issue we team up with the charting research services, Macrotrends.net and Thechartstore.com, to bring you a grouping of highly illuminating charts on the gold and silver markets. Though we are a full five years from the genesis of the 2008-2009 financial crisis, its aftershocks still influence (in fact, dominate) economic policy as well as activity in the financial markets, including gold. Every once in a awhile, it pays to revisit the fundamental drivers of gold demand — particularly investment demand — in order to determine whether or not the secular bull market is still on course. If nothing else, it helps to clear the synapses of excessive media wash and re-establish why gold remains vitally important to the contemporary investment portfolio. For some, these charts will serve as an affirmation; for others a revelation — a golden gut check of sorts. As you are about to see, the price of gold may have changed over the past year, but the fundamental monetary forces driving it have not.” Chart sneak preview:

This chart is posted in the “What bubble?” section. As you can see, gold’s early 21st century uptrend does not match up with the three biggest bubbles since we went off the gold standard in 1971. The rounded top is suggestive of a correction within a primary bull market trend, rather than a blow-off top. This is just one of five interesting charts in the latest newsletter. Secular bull or bear markets evolve over very long periods of time — fifteen to twenty five years. We are now in year 11 of gold’s secular by most accounts including the one by Macrotrends in the chart above. By the way, we invite you to visit Macrotrends.net for some interesting charts. |

| Latest newsletter now available and we think you will gain much from it Posted: 03 Oct 2013 12:47 PM PDT In the current issue of our Review & Outlook newsletter, we explore whether or not gold’s bull market is still on course. A series of charts on the long-term relationship between gold and monetary policy tell an interesting and timely story. We invite you to visit our special report: Golden Gut Check 2013 Sneak preview: “This issue we team up with the charting research services, Macrotrends.net and Thechartstore.com, to bring you a grouping of highly illuminating charts on the gold and silver markets. Though we are a full five years from the genesis of the 2008-2009 financial crisis, its aftershocks still influence (in fact, dominate) economic policy as well as activity in the financial markets, including gold. Every once in a awhile, it pays to revisit the fundamental drivers of gold demand — particularly investment demand — in order to determine whether or not the secular bull market is still on course. If nothing else, it helps to clear the synapses of excessive media wash and re-establish why gold remains vitally important to the contemporary investment portfolio. For some, these charts will serve as an affirmation; for others a revelation — a golden gut check of sorts. As you are about to see, the price of gold may have changed over the past year, but the fundamental monetary forces driving it have not.” Chart sneak preview:

This chart is posted in the “What bubble?” section. As you can see, gold’s early 21st century uptrend does not match up with the three biggest bubbles since we went off the gold standard in 1971. The rounded top is suggestive of a correction within a primary bull market trend, rather than a blow-off top. This is just one of five interesting charts in the latest newsletter. Secular bull or bear markets evolve over very long periods of time — fifteen to twenty five years. We are now in year 11 of gold’s secular by most accounts including the one by Macrotrends in the chart above. By the way, we invite you to visit Macrotrends.net for some interesting charts. |

| Euro's October Seasonals and Gold Shutdown Posted: 03 Oct 2013 12:44 PM PDT Euro rallies across the board on breaking political and monetary news as: Italian PM Letta wins a confidence vote in the Senate following Berlusconi's U-turn to support the incumbent government after 25 dissidents from his party gave Letta's government the numbers he needed for maintaining majority. |

| Posted: 03 Oct 2013 12:31 PM PDT |

| Posted: 03 Oct 2013 12:31 PM PDT |

| Gold Markets Are Not Efficient, Don't Reflect Fundamentals Posted: 03 Oct 2013 12:28 PM PDT Hedging One of the biggest problems facing a miner, a refiner, a jewelry maker and anyone forced to hold gold for a period of time, when his business is not speculating on the gold price, is avoiding the price risk inherent in owning gold for such a time. Just the act of holding it for that time is a speculation. So what can these risk-averse gold holders do to get rid of the risk? The answer is that they hedge their gold. |

| Who would trade a pawn shop for a payday pariah? Posted: 03 Oct 2013 12:11 PM PDT Gold is suffering and instead we have loans made at extortionate interest rates, says Joan Bakewell This posting includes an audio/video/photo media file: Download Now |

| Posted: 03 Oct 2013 11:21 AM PDT Where Are Gold Prices Going? By Ed D’Agostino By Ed D’Agostino, General Manager, Hard Assets Alliance I take a long view of precious metals investing and find little meaning in the day-to-day fluctuations in the market. Major corrections—like those we’ve endured this year—are a different story. They clearly have an impact, leaving investors either anxious […] |

| Posted: 03 Oct 2013 11:18 AM PDT I take a long view of precious metals investing and find little meaning in the day-to-day fluctuations in the market. Major corrections—like those we’ve endured this year—are a different story. They clearly have an impact, leaving investors either anxious about their portfolios or excited about the new buying opportunity. So it’s no surprise that the question I’ve been asked most often in the past few months has been, “Where are prices going?” In the short term, prices cannot be predicted with any real accuracy. But if one takes a longer view, there are factors that can and should be considered. We all know the arguments about inflation and quantitative easing, but let’s take a look at a more basic price driver: the supply of physical gold.

When supply and demand are considered, particularly in the media, the focus is almost always on demand. When participating in media interviews, I am frequently asked about demand coming from Asia. Rarely am I asked about supply. That’s a big oversight. Large miners (defined as publicly traded miners with a market cap in excess of $5 billion) account for 30% of annual global gold supply. The statistic is similar for silver. At current prices, the majority of large miners are losing serious money. The following chart shows the interplay between supply, demand, and prices over the last several quarters.

Large miners are trimming costs, but once SG&A expenses (selling, general, and administrative expenses, including all management salaries, indirect production, marketing, and general corporate expenses) are reduced to the bone, the only way miners can continue to reduce their expenses in a meaningful way is by reducing operations. They will be forced to either shut down or sell mines with the highest operating costs. Those actions will result in a decrease in supply, which should place upward pressure on the price of physical metal. If prices do not move up on their own with in the next 12 months, we expect that miners will drastically cut production in order to conserve cash. Many (but not all) of the small to medium-sized miners are sitting on piles of cash and—unlike most large miners—could weather a longer period of suppressed prices. But they won’t be able to make up the shortfall in production. Nor would they want to: they stand to benefit most when prices increase. Based on our initial research, we believe a long-term basement price for gold is in excess of $1,300 per ounce. This does not take in to account all the other reasons we like to invest in precious metals. This price is strictly based on supply and demand. To be clear, this assumes that demand for physical gold remains relatively constant. Here’s a chart showing gold demand for the past ten years, excluding ETFs. The chart ends in 2012. So far, demand in 2013 is well above that during the same period in 2012.

Clearly, if demand drops, prices could fall from today’s levels, but that’s where the other demand drivers of precious metals come in. Those demand drivers remain as strong as ever.

The World Gold Council released its demand figures for the second quarter of 2013 a few months ago. But be sure to dig deeper than the numbers. What you’ll find is that gold ETFs are included in the demand figures. ETFs have seen massive outflows as traders, hedge funds, and institutions pull out—many of them forced to do so due to margin calls. What I find interesting—and what I’ve known given my vantage point at the Hard Assets Alliance—is that the second quarter saw record demand for gold coins and bars, and demand for jewelry also increased. Keep an eye on supply in the physical market. Author: Ed D’Agostino, General Manager, Hard Assets Alliance

|

| The US Is Going To See A Monster Collapse - One For The Ages Posted: 03 Oct 2013 11:10 AM PDT  With stocks struggling once again, today one of the legends in the business warned King World News that the U.S. is going to see a "monster collapse." This man has lived in 18 countries around the world, and he witnessed collapses in many of these countries, but today he issued this ominous warning, "This collapse will be one for the ages." Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about how this will impact key markets such as gold. Below is what Barron had to say in this powerful interview. With stocks struggling once again, today one of the legends in the business warned King World News that the U.S. is going to see a "monster collapse." This man has lived in 18 countries around the world, and he witnessed collapses in many of these countries, but today he issued this ominous warning, "This collapse will be one for the ages." Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about how this will impact key markets such as gold. Below is what Barron had to say in this powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Volatile Times Ahead for Silver Posted: 03 Oct 2013 10:43 AM PDT On Wednesday, silver gained almost 2.7% and reached $22 as a weak dollar boosted commodities priced in the greenback. The US currency was under selling pressure as a U.S. government shutdown entered a second day with no end in sight. Read More... |

| Posted: 03 Oct 2013 10:12 AM PDT Gold Choppy Amid Uncertainty

The government shutdown, the looming collision with the debt ceiling, a weak economy and ongoing worries about Fed tapering are all contributing to a broad sense of uncertainty. The DJIA has fallen back below 15,000 as investors take more defensive positions. Huddling with Congressional leaders yesterday, President Obama reiterated that he will not negotiate over the CR, nor the debt ceiling. After that meeting, the White House released the following statement: “The president made clear to the leaders that he is not going to negotiate over the need for Congress to act to reopen the government or to raise the debt limit to pay the bills Congress has already incurred.” The President remains hopeful that “common sense will prevail,” the White House added. If we’re counting on “common sense” to prevail in Washington, hunkering down to ride out a protracted storm seems like a pretty good idea. Safe-haven demand is helping underpin gold. With both sides digging in their heels, one has to wonder when the major credit rating agencies are going to take notice. A potential technical default on top of a government shutdown seems worthy of some notice. Credit analyst Gary Jenkins, of Swordfish Research, worries that the U.S. may become “a little like Argentina, threatening to default every couple of years.” That hardly seems worthy of a AAA rating (Moody’s and Fitch), or even AA+ (S&P) for that matter. The services ISM print for September was terrible this morning, dropping to 54.4, well below expectations. The employment component plunged to 52.7, versus 57.0 in August, its biggest drop since 2009. Shortly thereafter, the BLS announced that the September jobs report would not be released tomorrow, due to the government shutdown. Call me conspiratorial, but I’d wager they’d find a way to get the report out if it were going to be a good number. It probably wasn’t going to be. Median expectations were running about 180k, but yesterday’s ADP survey miss perhaps suggested some downside risk, as did the ISM report. The jobless rate was expected to hold steady at 7.3%. |

| The Fed’s $700 Billion Magic Trick Posted: 03 Oct 2013 10:00 AM PDT We're closing in on the five year anniversary of the most severe market drop in recent history. From the last week of September 2008 through the beginning of October 2008 the Dow shed over 2,000 points – representing an overall market drop of more than 23%. $700B is a lot of money, but it pales in comparison to what's being spent TODAY. Those were the bad old days. The early innings of a market drop that saw the DOW cut in half. With this epic anniversary in mind, let's not miss the opportunity to take a look in the rearview and measure just what happened in response this 2008's epic market collapse. As usual, we'll also discuss a way to play what we've learned… Back in 2008 and early 2009 when the sky was falling the "stupid-big" number (so big it's stupid) was $700 billion. Back then we were told that a shock and awe bailout would cure the market's woes… after all it was $700 billion! That's a lotta dough! Flash forward five years and that $700B was only the tip of the iceberg. The dough has been rolling for five years and counting. In fact, right now we're about a year into the Fed's third round of quantitative easing (QE) or as we like to call it QE "Infinity." Point being when the latest installment of the Feds’ fix started it was meant to be short-lived. After all, spending $85 billion a month can only last so long, right? Wrongo! Here we are nearly 12 months into QE infinity and we've spent nearly a trillion dollars! It's the government's stealth QE. The one that keeps on taking! Ah and all from the humble beginnings of a $700B bailout. Let's do a little "billions" math…

Needless to say, $700B is a lot of money, but it pales in comparison to what's being spent TODAY. Think of it like this… The Fed could be fixing up 42 Colorado towns a month, building anywhere from 17 to 85 power plants a month, cleaning up a gulf spill PLUS a hurricane disaster per month, or cover two years of Exxon's budget per month. But, alas, the Fed isn't doing anything "real" by my count. Instead the $85B per month goes towards buying bonds and mortgage-backed securities. Okay you get the point. When it comes to "billions" math, the government is spending an ENORMOUS amount of money per month. (At the 5 year anniversary of the market collapse and almost the year anniversary of QE infinity, it's VERY important to take note.) The printed cash is flowing into a black abyss. You and I won't see it, but we're told it's single-handedly helping prop up the economy. I've got to come clean. I did make one error above. The point is, you can't combat the Fed's agenda with rationality. I mistakenly brought forth the idea that Fed spending (if it's to happen at all) could be used more productively. But that was the wrong logic. That is, you can't expect the Fed to do something productive with all of the cash it's printing. Instead that money is quickly being funneled into other government programs and the balance sheet of America's largest banks. It's a grand cover-up. While the market continues to churn the Fed is simply trying to buy more time. They need to get more money to cover up a bunch of big bank's bad decisions (dating back to 2007 and before.) With enough time the Fed's "magic" will indeed work… But at what price does this "magic" come? Oh, what's that? The big banks underwrote a zillion bad loans back in 2007? Wow, and they were all subprime borrowers that never had a chance in hell of paying off their debt? Hmmmm. And here we are five years later still trying to cover over those bad bets – keeping interest rates low to spur the housing market, while also funneling billions directly into mortgage-backed securities. With enough time the Fed's "magic" will indeed work. At some point all of the bad bets that banks made will be a distant memory. Their balance sheets won't be bleeding red and the housing market will be somewhat back to normal. But at what price does this "magic" come? I'm glad you're still with me, because here's the kicker… the price is what any run of the mill contractor would charge – heck it's the same billing philosophy if you're getting new drywall installed in your basement: time and money or T&M for short. It's our T, because here we are five years later and we're still watching the Fed print billions. And it's our M. If you're paying taxes or trying to save your modest wealth, you're on the hook. The great cover up continues and so does the Fed's war on savers. In fact, if there's one takeaway from the last 5 months of Fed Theatre, it's that you can expect the easing to continue – in some form – well into the future. Luckily there are a few conclusions we can make during this battle of attrition.

That said, many of our favorite investments have a bright future ahead. I'm talking about energy and mining plays. Momentum is rolling higher for oil and gas shares – we're truly in the early innings of a massive earth-changing revolution. As U.S. shale plays continue to ramp higher these profitable assets, I say, should hold a strong position in your portfolio. As the Fed prints, producers profit! Momentum isn't as strong for our friends in the mining sector, but don't count the golden age over just yet! Last week while slightly tuning in to a CNBC broadcast I heard the talking heads ask a simple question: which price will an ounce of gold fetch first (from its current price) $1,000 or $2,000? It's a loaded question to be sure. But I don't much care about the short-term answer. So instead of answering which will hit first, I'd pose another question: will gold hit $2,000 in the long-term? The answer is a resounding YES. So whether that happens in the next year or the next five, holding on to your favorite, well-run mining plays will pay off. The five year anniversary of the subprime market meltdown lends us an important lesson: you can't trust your financial future to the Fed. As the Fed Theatre continues to play out – and the printing press hums along – look to your favorite energy and mining plays for profit. (Many of which you'll find right here in these pages!) Keep your boots muddy, Matt Insley P.S. What's funny, while the Fed continues to print there is one little-known government sector that will continue to profit! Recently a leaked set of government documents all but guarantees that one sector will absolutely soar. And if you’re a Daily Reckoning subscriber, you had a chance to learn just what sector and, more importantly, what companies stand to make huge gains because of these documents. Don’t miss out on this and other incredible opportunities delivered straight to your inbox every day. Sign up for The Daily Reckoning right here. |

| Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO) Posted: 03 Oct 2013 09:10 AM PDT The metals have not gone nuts because of the extreme intervention by the Fed and the BOE and probably the BOJ. The intervention now is the most extreme that it's been in 13 years. But the end is near. 90-95% of the American public - by design - will never have the chance to buy gold or silver - it will move higher in price too quickly and retail investing patterns suggest they will refuse to chase the price. And given that 76% of the public lives from paycheck to paycheck they don't have money to buy gold/silver anyway - that's my prediction. My comment above was in response to a discussion I was having with a colleague about the fact that most people in this country are completely clueless about what is really happening in this country in terms of the indisputable fact the U.S. is in a state of political and economic collapse. The extreme corruption and massive ongoing theft of wealth by corporate America - in collusion with the Federal Government - is symptomatic of this collapse. Unfortunately, Karl Marx predicted this about America back in the mid-1870's - a fact that I hate yo acknowledge because I despise socialism/communism. So I thought it would be interesting to present the differing view on what gold is and what it represents between non-U.S. Central bank officials and our wonderful B.S. Bernanke. The following is an excerpt from the keynote speech given by the Director General of Italy's Central Bank to the audience at a London Bullion Marketing Association conference recently held in Italy (the Bank of Italy has the 4th largest gold reserve in the world - that is, if you assume the U.S. really has possession and legal claim to the gold it reports as owning): During Banca d'Italia's keynote address Salvatore Rossi the director general told delegates how gold plays a key role in the central bank reserves:Now compare that statement to the remarks by BS Bernanke a couple years ago when he was being questioned by then Congressman Ron Paul while under oath - I've transcribed the salient section: Ron Paul: Do you think gold is money? I don't know about anyone else, but I think it's quite fitting that the first two initials of Bernanke's full name are "B" and "S." I can't believe nobody has flagged that in 7 years of his Fed Chairmanship - because, if anything, Bernanke is certainly full of BullShit. |

| Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO) Posted: 03 Oct 2013 09:10 AM PDT The metals have not gone nuts because of the extreme intervention by the Fed and the BOE and probably the BOJ. The intervention now is the most extreme that it's been in 13 years. But the end is near. 90-95% of the American public - by design - will never have the chance to buy gold or silver - it will move higher in price too quickly and retail investing patterns suggest they will refuse to chase the price. And given that 76% of the public lives from paycheck to paycheck they don't have money to buy gold/silver anyway - that's my prediction. My comment above was in response to a discussion I was having with a colleague about the fact that most people in this country are completely clueless about what is really happening in this country in terms of the indisputable fact the U.S. is in a state of political and economic collapse. The extreme corruption and massive ongoing theft of wealth by corporate America - in collusion with the Federal Government - is symptomatic of this collapse. Unfortunately, Karl Marx predicted this about America back in the mid-1870's - a fact that I hate yo acknowledge because I despise socialism/communism. So I thought it would be interesting to present the differing view on what gold is and what it represents between non-U.S. Central bank officials and our wonderful B.S. Bernanke. The following is an excerpt from the keynote speech given by the Director General of Italy's Central Bank to the audience at a London Bullion Marketing Association conference recently held in Italy (the Bank of Italy has the 4th largest gold reserve in the world - that is, if you assume the U.S. really has possession and legal claim to the gold it reports as owning): During Banca d'Italia's keynote address Salvatore Rossi the director general told delegates how gold plays a key role in the central bank reserves:Now compare that statement to the remarks by BS Bernanke a couple years ago when he was being questioned by then Congressman Ron Paul while under oath - I've transcribed the salient section: Ron Paul: Do you think gold is money? I don't know about anyone else, but I think it's quite fitting that the first two initials of Bernanke's full name are "B" and "S." I can't believe nobody has flagged that in 7 years of his Fed Chairmanship - because, if anything, Bernanke is certainly full of BullShit. |

| Gold Markets are not Efficient, Don?t Reflect Fundamentals & Understate Gold?s Market Value (part 2) Posted: 03 Oct 2013 09:00 AM PDT Gold Forecaster |

| The process of selling silver – Endeavour Posted: 03 Oct 2013 08:49 AM PDT Endeavour Silver, has produced its latest informational video on Selling Silver detailing the stages involved from mine output of concentrate or doré through to eventual sale. |

| Gold trading or gold hoarding – which will win out? Posted: 03 Oct 2013 08:49 AM PDT "The old order changeth yielding place to new"- Tennyson. As the West relinquishes its gold through manipulative trading and China picks it up, the global financial order will likely move East. |

| AngloGold plans to cut 400 jobs at Ghana mine Posted: 03 Oct 2013 08:49 AM PDT AngloGold plans to cut 400 jobs at its Obuasi mine by year end to rein in costs as the decline in the price of bullion has eroded profit. |

| Gold below $1,300 proves too tempting to resist Posted: 03 Oct 2013 08:49 AM PDT The bounce back in the gold price was quick and vigorous as prices below $1,300 proved too tempting for buyers to ignore, says Julian Phillips. |

| Posted: 03 Oct 2013 06:43 AM PDT One of the biggest problems facing a miner, a refiner, a jewelry maker and anyone forced to hold gold for a period of time, when his business is not speculating on the gold price, is avoiding the price risk inherent in owning gold for such a time. Read More... |