saveyourassetsfirst3 |

- Why is is the gold market so focused on tapering? Other factors are more important

- Crucial China support for gold may fade

- The Silk Road Redux: gold's journey East

- Silver beats gold as Asian demands eases

- Silver Miners Analyst Watch: October Edition

- Gold and the Unemployment Rate

- The U.S. Treasury just made a shocking "End of America" admission

- Must-read: Porter Stansberry predicts a massive new bankruptcy

- Why gold prices don't reflect fundamentals - Phillips Part 2

- Indian jewellers hoping to mobilise idle gold through new scheme

- Another Big Step For Randgold

- Jim Willie: US T-Bond Market: The Greatest Asset Bubble in Human History Nears the Cliff

- $100 Silver and the dirty secret of Silver monetary demand

- Brett Arends: Why Uncle Sam is hoarding gold

- Friday Humor: Bart Chilton: If You Don’t Want Consumers Protected, Fire Us All!

- Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO)

- Flash Sale! Sunshine Mint Silver Eagles .89 Over Spot Any Qty!

- Gold and silver: Physical reality in an increasingly alternative universe

- The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013

- Volatile times ahead for silver

- Gold ETP outflows see major decline in Q3, drops 78% q/q to $4.17 billion

- Silver beats gold as Asian demand eases

- The Great Chinese Gold Rush: The Infographic

- Silver prices to average $17 Oz in 2014, $18 in 2015: Natixis

- Jim Willie: US T-Bond Market: The Greatest Asset Bubble in Human History Nears the Cliff

- Spot Gold may fall to $1180.71, Silver to 18.19: Reuters analyst

- Keiser Report: JP Morgan’s Financial Herpes

- Friday gold puzzle – can you crack it?

- U.S. Treasury Says They Will Not Sell Gold As To Do So Would: “Undercut Confidence in the U.S.”

- Emperors with no clothes: From Nero to Nixon to Obama

- Gensler to Step Down as CFTC Chairman

- Gold traders bullish a third week on U.S. stalemate

- Emperors With No Clothes - From Nero To Nixon To Obama

- Central banks hold on to their gold despite weak sentiments

- Gold vs S and P negative correlation intact, precious metals in long bottoming process

- Emperors With No Clothes – From Nero To Nixon To Obama

- Silver Forecast October 4, 2013, Technical Analysis

- Gold Churning before Next Drop?

- Gold Price Analysis- Oct. 4, 2013

- Gold May Test 2013 Low on Head and Shoulders: Technical Analysis

- Gold Double Bottom Signals Rally to $1,425: Technical Analysis

- Jim Rickards: This is the Next Sub-Prime Crisis

- Four King World News Blogs

- Interest Rate Observer's Grant: Central Bank Folly Will Lift Gold

- Jim Rickards: Fed Should End QE: Gold will ultimately hit $5,000 - $7,000

- Russia's Gold output rises sharply in January-July

- U.A.E Precious Metals Hub Seen Growing as Location Feeds Demand

- China Gold Association leader notes Fed's manipulation of the gold market

- Ross Norman: Gold -- the Silk Road Redux

- Lawrence Williams: GATA's once-fringe views are mainstream now

| Why is is the gold market so focused on tapering? Other factors are more important Posted: 04 Oct 2013 05:13 PM PDT There are other basic underlying factors out there that are far more important for the future of gold than whether the U.S. Fed tapers or not. |

| Crucial China support for gold may fade Posted: 04 Oct 2013 03:47 PM PDT While China has been a stabilising influence on the gold price this year, few believe it will be able to drive the price higher on a sustained basis. |

| The Silk Road Redux: gold's journey East Posted: 04 Oct 2013 03:39 PM PDT All things bullion will have their epicentre in Asia, writes Sharps Pixley's Ross Norman, adding, Its less of an 'if' than a 'when' |

| Silver beats gold as Asian demands eases Posted: 04 Oct 2013 02:27 PM PDT Silver tracked and extended the moves in gold, first dipping to a loss of 2.7% for the week and then recovering to last Friday's finish at $21.80. |

| Silver Miners Analyst Watch: October Edition Posted: 04 Oct 2013 12:50 PM PDT Another month, another analyst watch summary for silver miners from your humble scribe. We are finding it hard to fathom that October has started, and with that the last quarter of this year is already upon us. As in previous installments we are summarizing our observations of analysts' price targets for primary silver mining companies as published on Yahoo.com. In this October instalment comparisons will be made to the data given in our September edition. As in previous reports we included the following silver miners in alphabetical order: Coeur Mining (CDE), Endeavour Silver (EXK), First Majestic Silver (AG), Fortuna Silver Mines (FSM), Hecla Mining (HL), Pan American Silver (PAAS), Silver Standard (SSRI), Silvercorp Metals (SVM) and SilverCrest Mines (SVLC). We duly note that most companies considered for this article are covered by more analysts than reported in our table. This article only considers analyst reports available through Yahoo.com |

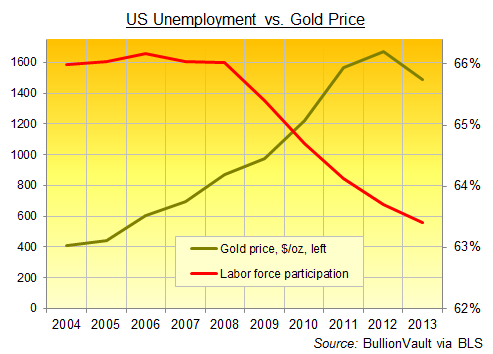

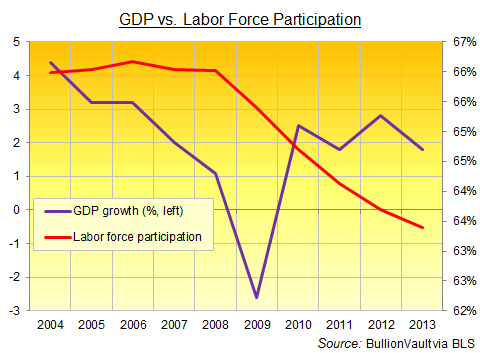

| Gold and the Unemployment Rate Posted: 04 Oct 2013 12:40 PM PDT Labor Force Participation tells a different story about gold and US joblessness... The GOLD PRICE tells us just like any other indicator what is going on in our country, or economy, writes Miguel Perez-Santalla at BullionVault. The most important part of an economy is simply employment. To ignore or sideline the importance of unemployment statistics is foolish. Including when you are considering the gold price. The unemployment statistic is one of the most important numbers being studied by the Federal Reserve Bank. Their attempt to influence growth in the economy can only be proven out by growth in employment. This is because a growing economy means the need to produce more and in all cases increase hiring. But all the liquidity that is being added by the Federal Reserve Bank, even though it has plainly worked to boost the gold price over time, has had little effect on unemployment. Because most of the money is not reaching the economy, or the people in the private sector. Often times we read that the unemployment rate has dropped. But unfortunately it is the Labor Force Participation Rate that has dropped at a greater rate. So the real unemployment rate is higher than what is reported. Because the participation rate is the barometer that shows how many people looking for work have lost faith that they can find full-time employment. There also seems to be a growth of part-time workforce. This is believed to be caused by the burden that Obamacare will have on small business enterprises. So to avoid the financial burden many smaller firms, instead of hiring full-time employees and paying benefits, prefer to hire part-time employees and avoid participating in the Obamacare scheme. Also related to Obamacare is the increase in expenses to a family of four which apparently will represent $766 per annum basis current studies. This will represent a loss of spendable income. This will in turn slow production and hurt the growth of the economy. In the end, less spending money means less buying which means less employment. But that's not all, if you take a look at our indicators you would see that the trend has not reversed. The trend looks dismal at best. People talk about an improving US economy and I hope that they are right. Unfortunately I believe the disparity between the haves and have-nots is growing. Even those that are able to find jobs are accepting positions beneath their education and experience. What does all this mean to the college graduates who spend anywhere from $50,000-$150,000 for a four-year degree? It means that not only is the college expense not worth the investment but that they are now in a whole that will be difficult to dig out of. If our young and well-educated are not able to find employment at reasonable levels then again we have built a top-heavy pyramid much like our mortgage crisis. Plenty of spending without the future of income to pay the debts will create another crisis. I know many don't want to hear this, but a college degree should not be for everyone. The education lobby in the United States has had a hold over our government for decades. We need skilled and intelligent laborers at many levels that can earn a reasonable living. Not all people should go into debt to find employment, but sadly this is the vision that our government has accepted as a solution to our woes.  If you look at the graph representing the gold price and the Labor Force Participation Rate you will see that though the rate has continued lower since 2012, gold drifted lower opposed to the norm. That I believe is due to an acceptance or numbing to the current climate, and a false understanding of the unemployment data of late creating a false confidence in the situation. Then take a look at the graph of the participation rate versus the Gross Domestic Product. You can see that the decrease of the participation rate properly signals the direction of the GDP.  The lack of growth in the Labor Force Participation Rate indicates that the economy is still a long way off from getting on its feet. This means the gold price has upward mobility on the back of the poor economic environment. Taking into consideration the expected negative factors of Obamacare, the government shutdown and the impending negotiations on the US debt ceiling it behooves the wise investor to consider their position in gold relative to the current market price. |

| The U.S. Treasury just made a shocking "End of America" admission Posted: 04 Oct 2013 12:24 PM PDT From SHTFplan: The next time someone tells you that the U.S. government is operating in a fiscally sustainable manner and that our economy is growing strongly... point them to the latest report from the U.S. Treasury Department. According to the new report released yesterday all of our worst fears may soon be realized should the United States default on its obligations to creditors, employees, and recipients of state-sponsored benefits. The report details the consequences of Congress failing to raise the debt ceiling so that the government can borrow more money. The political impasse will likely be resolved in the 11th hour just as it has been during prior showdowns. But, the report has much broader implications. This is nothing short of an official admission and confirmation of the decades' long woeful mismanagement of U.S. economic, fiscal, and monetary policy. Here's what you can expect to happen on that fateful day when our government is no longer extended the credit it needs to cover its trillion dollar commitments... More on the "End of America": |

| Must-read: Porter Stansberry predicts a massive new bankruptcy Posted: 04 Oct 2013 12:24 PM PDT From The S&A Digest: In March 2007, S&A founder Porter Stansberry published the first in his series of satirical letters from the "chairman" of General Motors. These letters accurately warned that General Motors was heading for bankruptcy. These detailed analyses laid bare the company's precarious financial situation – information that GM's official quarterly letters sought to hide. Our quarterly letters proved to be so prescient that many subscribers thought they were actually written by General Motors Chairman and CEO Rick Wagoner. Over time, we got more positive feedback on our Letters from the Chairman of General Motors than almost anything else we'd ever published. But as popular as these letters eventually became… they initially generated a massive amount of hate mail – even death threats. It's hard to remember now. But when these letters first appeared, many readers considered it nonsense to suggest America could suffer a massive economic collapse and the world's largest industrial concern would fail. Today, he's writing about GM again. In this Friday Digest, we're deviating from our usual fare. Instead, we're presenting Porter's new essay on the iconic American carmaker… and how it's once again careening toward a financial crisis. A Letter from the Chairman of General Motors Dear shareholders, Moody's Investors Service last week upgraded General Motors' rating. The major credit-rating agency bumped our rating from Ba1 to Baa3 – its lowest tier of "investment grade" credit. Nobody was more surprised than me. Let me tell you plainly, I do not believe our company is an investment-grade credit. Nor are our operations likely to improve in a way that would have led any reasonable analyst to conclude such. That is why all of the other major ratings houses (S&P, Fitch, Egan Jones) continue to rate our corporate obligations as "junk" – speculative debts that have a significant risk of default. I now understand what Bill Gross means when he says investors shouldn't trust Moody's ratings because the company has become a de facto arm of the U.S. government. Or as he put it this week: Moody's and the U.S. Treasury are just one big "happy family." Gross manages hundreds of billions of dollars in private capital for the investment management firm PIMCO. So he has the luxury of being able to say whatever he wants in public. I don't have that luxury. I'm the chairman of a publicly owned corporation, whose debts are soaring, whose margins are collapsing, and whose capital structure is still controlled by the government and our unions. So when the reporters called me to ask about the Moody's upgrade, I said: "Good things happen when you build great cars and trucks and deliver strong financial results." It's a great line. It still makes me chuckle. Read it carefully. You'll notice… I didn't say anything about GM. What I couldn't say is that our business is already beginning to collapse, again. Look at our core automotive operating profits. In the first six months of 2012, we generated $2.8 billion in automotive operating profits. In the first six months of this year, we made a little more than $2.1 billion. Thus, our core, global automotive business has seen its operating profits decline substantially… by more than 24%. We are approaching another crisis at GM, one that has its roots in the bailout of 2008/2009. The faulty bankruptcy process caused this crisis by failing to address our largest obligations (pensions and retired employee health care). And the crisis results from the motivations of our government owners – motivations that do not square with capitalism. Like my predecessor, Rick Wagoner, did… I plan to write to you from time to time, privately, here in these pages. I will tell you what is actually happening with our great company – an institution that was once the largest privately financed endeavor in human history. You'll get the truth here, even if I'm not allowed to say it anywhere else… What's happening with GM is a microcosm of what's happening with the rest of our society. Where once we sought only a fair opportunity for greatness, now we seek the false security of collectivism. I see it happening right in front of me every day. I believe an honest discussion of what's happening with our business could help educate the public about the failure that's inevitable when resources – like our capital, plants, and people – are governed by politics rather than by markets. At GM, we abandoned capitalism in 2010 when we emerged from bankruptcy. Instead of treating all of our creditors fairly, we gave the lion's share of the company's assets to the federal government and the UAW health care trust. Meanwhile, we didn't do anything to mitigate our enormous pension liability, which today stands at $26 billion. At the end of the bankruptcy process, none of our 400,000 retired workers lost a nickel. On the other hand, our shareholders, creditors, and many of our suppliers were wiped out. That's not the way capitalism is supposed to work. And still today, GM isn't really privately owned. Instead, the company is a kind of public-private "partnership," where actual control rests with the government. Today, GM is more like a Ponzi scheme than a real business. How so? Ponzi schemes don't generate any actual profits. They require greater and greater sums of money to work. Sooner or later, there simply isn't enough capital available to maintain the mirage of a functioning business. That's exactly what's happening at GM. Don't take my word for it. Consider the facts below. Then, decide for yourself. Is GM a real business, owned by capitalists, driven to create real profits, to be shared by its owners as they see fit? Or is it a kind of elaborate, government-sanctioned scheme, meant to enrich a few chosen, special interests? PART I: Who Are the Real Owners? All of Our Profits… and More… Are Going to Retired Workers Since GM emerged from bankruptcy protection in mid-2010… we've done great. The last few years are the best years in the history of our company. We've never built better cars. The market research firm JD Power says GM has the highest-quality cars of any major carmaker. Our trucks, it says, compete with Porsche for the highest-quality vehicles made anywhere in the world. We've never generated more revenue. In total, we've made about $26 billion in operating cash flow – what our main business generated before paying capital expenses and similar costs – since we emerged from bankruptcy. It all sounds good, I know. The bad news is that our business requires massive amounts of capital to sustain its operations. These so-called capital expenditures consumed roughly $20 billion of those operating profits. That left us with roughly $6 billion-$7 billion in actual cash that we could, in theory, return to our true owners (our shareholders) or re-invest into profitable lines of business. So where did this money – the so-called free cash flow – go? All the money – and a lot more – went to retired workers, unions, and the government. In total, we've sent around $18 billion in cash to these interests – far more than we've been able to earn. These payments started with $3.9 billion in dividends on special "preferred" shares the union, the U.S. Treasury, and the Canadian government got during the bankruptcy process. Keep in mind, our creditors got none of these shares, and we've never paid a cash dividend to regular, common stockholders. Another $8.5 billion went to repay debts to the U.S. Treasury and the union, obligations that we were saddled with in bankruptcy. And that's not all. In 2012, we announced with great fanfare that our operating results were so good, we were going to begin buying back shares. Normally, that's great for common shareholders. But in this case, the $5.1 billion worth of stock we bought back ALL came from the U.S. Treasury. No former creditor or any other public shareholder was able to sell to us. That's not all… We paid a $2-per-share premium to the actual market price of our stock. We simply gave the U.S. Treasury another $400 million "gift" for allowing us to buy back the shares it held. Remember… private investors didn't have a chance to sell their shares to GM at a $2 premium. That deal was nothing less than a crime. It was the U.S. Treasury stealing $400 million from the shareholders. If any other business in the country did something like this, it would get hit with a hundred lawsuits overnight. But when GM did it? The press cheered. How can you explain that? So we continue to owe far more to unions and governments than we're earning. If that were our only problem, perhaps we could envision a light at the end of the tunnel. But these obligations are only the beginning… That $26 billion in operating cash flow already accounted for about $8.8 billion in cash payments we made to support our pension plan and other retirement benefits. Without those obligations… our number would have looked even better, with operating cash flow of nearly $35 billion. That anchor around our neck isn't going anywhere. In addition to the cash, we contributed in 2011 60 million shares of stock (worth $2 billion) to the pension plan. No, that wasn't a cash expense. But believe me, shareholders should wish it was, as the expense will end up coming out of their pockets, instead of ours. Just think about what that means… Instead of the workers supporting the shareholders… at GM, the shareholders are supporting the workers. Sounds a little bit like communism, doesn't it? Well, just wait. The nonsense is only getting started… In 2012, we announced a big deal to eliminate our entire legacy, white-collar-salary pension obligations. We paid the Prudential insurance firm around $3.5 billion to manage $25 billion worth of our pension liabilities, taking them off our books. Don't forget… we also gave Prudential $25 billion from the pension fund to manage. Think about that for a little while. When is the last time you had to pay your broker 14% of your assets upfront to manage your account? Hedge funds normally charge 2%. They're considered expensive. Paying 14% sounds a little steep, doesn't it? No one ever explained it to me, either. My guess is a lot of that fee ended up in union offices or political piggy banks. Whatever happened, all of the money is gone. In the three years after bankruptcy, we made roughly $6 billion-$7 billion in "free cash flow." Somehow, that cash was supposed to cover $18 billion in obligations… including almost $1 billion a year in preferred-stock dividends to the union's health care trust and the Canadian government. That also includes the $400 million "gift" to the U.S. Treasury and the $5.1 billion worth shares we bought from it. And for our common shareholders, our real owners? We haven't paid a cent. So who really benefits from our brands… our research and development… our decades of investment… and the tens of billions of capital we have at stake? Is it our shareholders? No, it isn't. It's the union. It's the retired workers. And it's the government. Is any of this likely to change any time soon? No, it's going to get worse… a lot worse. Look at our preferred shares. They were created to make sure the union got most of the value out of our remaining assets. (Our bondholders didn't get any of these preferred shares.) The shares pay a 9% annual dividend. Try to find any other preferred stock issued by a major corporation that pays a coupon that large. You won't find another example. We were simply hijacked by the bankruptcy court and the Obama administration. And we have to pay this dividend before we pay anything else. If we don't, these obligations accrue, a situation that would rapidly warp our entire capital structure, placing the whole company in the union's control. So one of my most important jobs is to buy back these securities as quickly as I can. The problem is, they're extremely expensive. I've just negotiated a deal to buy back 120 million preferred shares at $27 each from the union's medical trust. That's $3.25 billion. Believe it or not, the medical trust will still own 140 million of these preferred shares. The Canadian government also owns a few of these shares (16 million). We can redeem all of these remaining shares in 2014, but it will cost us almost $4 billion – in cash. To pay off the union then, we'll have to borrow money… billions. Now, you know the real reason why Moody's just raised our credit ratings. I'm sure the government told Moody's to help GM raise the money so we can pay off the unions. Shall I feign indignation that the country's most politically powerful union is able to manipulate Moody's credit ratings? PART II: Since Government Can't Let Automakers Fail, Overcapacity Is Getting Worse and Worse I'm proud of GM's cars. As I mentioned, we've made huge strides in increasing the quality of our vehicles. But guess what? So has every other carmaker in the world. The competition makes it harder and harder to make a profit. Just look at our actual numbers. In the first six months of 2012, we sold $74.5 billion worth of cars around the world (automotive revenues). We made an operating profit of $2.8 billion. That's a minuscule operating profit margin of 3.8%. The situation is getting worse. In first half of 2013, we sold $74.6 billion worth of cars around the world, fractionally more revenue. But we earned a lot less, only $2.1 billion. Our costs rose, and we could not pass these costs on to our customers. Our operating margin declined to less than 3%. These are razor-thin margins. Margins this small are dangerous to operating companies, like ours, that have huge volumes. If anything were to happen to consumer demand – for example, if the economy were hit with a recession or we were unable to finance our customers (more about this below) – these puny margins would disappear overnight. The result would be sudden, large losses. You should know: An "accident" like this is inevitable. It's going to happen. And it's going to happen soon. The auto industry suffers from a tremendous glut of capacity. According to different sources, 20%-30% of global production isn't profitable. My counterpart at Nissan, Carlos Ghosn, is one of the few senior executives who has spoken honestly about this major problem. At a recent car show in Geneva, he said, "All of the car manufacturers have capacity problems – all of them." Sergio Marchionne, the chief executive of Chrysler and Fiat and the president of the European Automobile Manufacturers' Association, estimates the auto industry needs to cut capacity in Europe by 20%. Automakers employ or support 2.3 million people in Europe. Just like in the United States, the auto industry is too politically powerful to be allowed to fail. It's the same thing, all around the globe. So how likely is it that any automaker, anywhere, will be able to significantly reduce production? Capitalists making tough, but realistic, decisions no longer control this industry. Instead all of the capital-allocation decisions are being driven by politics. Whether you call it "welfare," "socialism," or "communism" doesn't matter. As long as this continues, it's inevitable that GM's operating margins will continue to deteriorate. And that means, it's only a matter of time before we're dealing with huge quarterly losses. Bernd Bohr is the head of the automotive group at Bosch, the privately held German company that's the world's largest manufacturer of car parts. He explains the current problems by pointing out that none of the major carmakers was allowed to fail in 2008/2009. "It was a peculiarity of the 2008-09 crisis," Bohr said, "that practically no capacity was taken out of the market due to state intervention…" While hard to fix, the problem is easy to understand. As long as no carmakers are allowed to fail, the ability of the entire industry to earn a profit will be greatly compromised. GM is the largest car company in the world (roughly tied with Toyota). It has the highest labor costs. It is heavily burdened by its pension obligations. It has, despite my best efforts, several weak brands. In this scenario, GM is extremely vulnerable, the most vulnerable large carmaker in the world. My advice? Don't pay attention to our revenue figures. Watch our margins. It's overcapacity that will kill us this time, not quality or a lack of demand. PART III: We're Doing It Again: Selling Cars to Unqualified Buyers Think about the dead-end GM faces strategically. We can't compete on brand. No one under 40 years old would rather drive a Cadillac than a BMW. Almost no one at any age would rather have a Chevy Malibu than a Honda Accord. And even though our trucks are great, Ford's are just as good (if I'm being honest). We can't compete on price because we don't have the cheapest costs. Instead, we have the highest. And no matter how much money we make, all of it (and more) will end up being siphoned off to either the union's health care trust or the pension fund. What would you do in this scenario? I've thought about this question every single day for three years. There's only one answer. And it's a lousy one. GM will have to compete on credit. We'll have to work out a deal with Wall Street to borrow billions and billions and funnel the money to car buyers who the other makers won't lend to. Our only chance is to, once again, become too big to fail. In the fall of 2010, we acquired a financial business, now called GM Financial. It exists to provide financing to buyers of our cars in dealer showrooms. You might recall that our company's last foray into finance didn't end well… huge losses at our former finance subsidiary were one of the primary reasons our company spiraled into bankruptcy back in 2008. We're doing it all again. As our margins have declined, we've attempted to grow by making more and more loans. Our loan book has ballooned to $11.5 billion. We made about 75% of these loans to borrowers with FICO scores lower than 600. Unbelievably, we're ev |

| Why gold prices don't reflect fundamentals - Phillips Part 2 Posted: 04 Oct 2013 12:22 PM PDT Gold markets are inefficient, unreflective of fundamentals & understate the metal's market value, writes Julian Phillips. |

| Indian jewellers hoping to mobilise idle gold through new scheme Posted: 04 Oct 2013 12:21 PM PDT In a show of solidarity with the government, Indian jewellers unveil plans to unlock idle gold across households. |

| Posted: 04 Oct 2013 12:16 PM PDT Randgold's (GOLD) CEO Mark Bristow spent several minutes of his speaking time at the September 2013 Denver Gold Forum reading the industry his version of the riot act best summarized in the following two quotes:

He went on to compare the performance of the company he has been heading since incorporation with the performance of gold and the peers within the gold mining industry. The chart below replicates the corresponding slide in Mr Bristow's presentation. The picture does not really change whether we use a 10-year time frame as shown below, or some other period. Randgold has managed to outperform peers dramatically and |

| Jim Willie: US T-Bond Market: The Greatest Asset Bubble in Human History Nears the Cliff Posted: 04 Oct 2013 11:31 AM PDT

The great global Paradigm Shift involves far more than wealth migrating from West to East in the form of Gold bullion. The corruption among the Wall Street bankers, the Chicago pit commodity traders, and the London bankers is all playing out in the COMEX & LBMA fall from grace. This article should add a good [...] The post Jim Willie: US T-Bond Market: The Greatest Asset Bubble in Human History Nears the Cliff appeared first on Silver Doctors. |

| $100 Silver and the dirty secret of Silver monetary demand Posted: 04 Oct 2013 11:02 AM PDT Paper price discovery is a nebulous construct calculated by using the futures price in a market where investment banks have primary influence (or where they rig the price). The result is that the price of silver (and Gold) is not derived by its physical demand or supply, but rather by the speculative positions standing long or short on the commodity exchange like any other traded commodity, stock or currency. |

| Brett Arends: Why Uncle Sam is hoarding gold Posted: 04 Oct 2013 11:01 AM PDT GATA |

| Friday Humor: Bart Chilton: If You Don’t Want Consumers Protected, Fire Us All! Posted: 04 Oct 2013 11:00 AM PDT

Bart Chilton provided Friday humor a little early yesterday on Bloomberg: “If you don’t want consumers protected, fine, fire us all, shut us down. If you want the markets safe, secure, efficient, and effective, that helps markets and consumers, you’ve got to keep us on the job.” Chilton’s full Bloomberg interview on why strong regulators [...] The post Friday Humor: Bart Chilton: If You Don’t Want Consumers Protected, Fire Us All! appeared first on Silver Doctors. |

| Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO) Posted: 04 Oct 2013 10:30 AM PDT

The metals have not gone nuts because of the extreme intervention by the Fed and the BOE and probably the BOJ. The intervention now is the most extreme that it’s been in 13 years. But the end is near. Silver Bullet Silver Shield Collection at SDBullion! From Truth in Gold: 90-95% of the American [...] The post Is Gold Money? Well, Do You Trust Ben Shalom Bernanke? (Yes and NO) appeared first on Silver Doctors. |

| Flash Sale! Sunshine Mint Silver Eagles .89 Over Spot Any Qty! Posted: 04 Oct 2013 10:05 AM PDT

Sunshine Mint Silver Eagle rounds only .89 over spot! Until 4pm EST only while supplies last! The post Flash Sale! Sunshine Mint Silver Eagles .89 Over Spot Any Qty! appeared first on Silver Doctors. |

| Gold and silver: Physical reality in an increasingly alternative universe Posted: 04 Oct 2013 09:52 AM PDT We live in a time of great illusion in terms of money, wealth, and justice. Investment banking and finance continue to attract the greatest minds. Fraud of the greatest degree goes practically unpunished. |

| The Amazing Disappearing Gold Bullion: Major Precious Metal Inventory Changes in 2013 Posted: 04 Oct 2013 09:30 AM PDT Le Cafe Américain |

| Volatile times ahead for silver Posted: 04 Oct 2013 09:24 AM PDT Silver has given up recent gains and is trading below $22 once again. We didn't expect silver to show significant strength. Will silver decline further? Or maybe the white metal will rebound in the near future? |

| Gold ETP outflows see major decline in Q3, drops 78% q/q to $4.17 billion Posted: 04 Oct 2013 09:18 AM PDT The physical outflows from gold Exchange Traded Products (ETPs) totaled $4.17 billion in the third quarter, declining sharply from the Q2 outflows of $18.54 billion. The gold ETP outflows have fallen by 78% over the quarter. |

| Silver beats gold as Asian demand eases Posted: 04 Oct 2013 09:13 AM PDT Wholesale gold rallied from a one-day low of $1,310 per ounce lunchtime Friday in London, but was still trading 1.4% down from last week while European stock markets also reversed earlier losses. |

| The Great Chinese Gold Rush: The Infographic Posted: 04 Oct 2013 09:00 AM PDT

Tracing the Great Chinese Gold Rush. China is taking over the world one gold bar at a time as this new world superpower reacts to years of being on the receiving end of the US dollar and Fed money printing. In the MUST SEE infographic below, learn how in the space of a few decades, [...] The post The Great Chinese Gold Rush: The Infographic appeared first on Silver Doctors. |

| Silver prices to average $17 Oz in 2014, $18 in 2015: Natixis Posted: 04 Oct 2013 08:33 AM PDT Although silver prices have dropped by 8% more than gold, the price could have been much lower had investors resorted to selling silver held in physically backed ETPs. |

| Jim Willie: US T-Bond Market: The Greatest Asset Bubble in Human History Nears the Cliff Posted: 04 Oct 2013 08:32 AM PDT

The climax blow will be the conversion of USTBonds and EuroBonds and UKGilts and JapGovtBonds into Gold bullion that kills the current system and opens the door to the new system. With great disruption, the new Paradigm Shift is in progress, unstoppable, but offering hope for a better day, a better system, a more fair system, with participants and savers given a just system. For three decades, Gold has had a nemesis in the USTreasury Bond. The USTBond is dying, a wreck in progress. As the old pillars fall and the new pillars rise, The Price of Gold will be set free. |

| Spot Gold may fall to $1180.71, Silver to 18.19: Reuters analyst Posted: 04 Oct 2013 08:02 AM PDT Silver is riding on a firm downtrend which is against the preceding uptrend that developed from the 1993 low of $3.53 and ended at the April 11, 2008 high of $49.51, he said. |

| Keiser Report: JP Morgan’s Financial Herpes Posted: 04 Oct 2013 08:00 AM PDT

In the latest Keiser Report, Max Keiser and Stacy Herbert discuss the Lilliputian view on fraud and theft and how this applies to the chief banking knaves at JPMorgan. In the second half, Max interviews Marc Armstrong of PublicBanking.org about turning depositors into shareholders as a fraud recipe shared amongst the Too-Big-To-Fail banks. With public [...] The post Keiser Report: JP Morgan's Financial Herpes appeared first on Silver Doctors. |

| Friday gold puzzle – can you crack it? Posted: 04 Oct 2013 07:58 AM PDT Here's a little gold puzzle for you to ponder as you're getting ready for the weekend. See if you can figure it out. |

| U.S. Treasury Says They Will Not Sell Gold As To Do So Would: “Undercut Confidence in the U.S.” Posted: 04 Oct 2013 07:44 AM PDT US Treasury Will Not Sell Any Gold in Event of Default

|

| Emperors with no clothes: From Nero to Nixon to Obama Posted: 04 Oct 2013 07:43 AM PDT One of the biggest laughs of the LBMA conference came when Smith presented the slide, 'Emperor … With No Clothes' which compared how the value of the Roman denarius, silver coin and the U.S. paper dollar have fared during periods of currency debasement. |

| Gensler to Step Down as CFTC Chairman Posted: 04 Oct 2013 07:00 AM PDT

The WSJ is reporting that Goldmanite Gary Gensler has declined an invitation from President Obama to serve a second term as CFTC Chairman, and will leave the CFTC by the end of the year. Apparently Goldman no longer needs their man at the CFTC now that the agency’s 5 year “investigation” into silver market manipulation [...] The post Gensler to Step Down as CFTC Chairman appeared first on Silver Doctors. |

| Gold traders bullish a third week on U.S. stalemate Posted: 04 Oct 2013 06:32 AM PDT Gold analysts are bullish for a third consecutive week on speculation that the first U.S. government shutdown in 17 years and a standoff over raising the country's debt limit will spur demand for the metal as a haven. |

| Emperors With No Clothes - From Nero To Nixon To Obama Posted: 04 Oct 2013 06:01 AM PDT gold.ie |

| Central banks hold on to their gold despite weak sentiments Posted: 04 Oct 2013 06:01 AM PDT The continuous decline in holdings reflects a further weakening in gold sentiment. The ones who beg to differ are the central bankers who have either held on or added to their gold reserves this year, viewing gold as an important diversifier. |

| Gold vs S and P negative correlation intact, precious metals in long bottoming process Posted: 04 Oct 2013 05:55 AM PDT Gold vs S&P negative correlation intact, precious metals in long bottoming process |

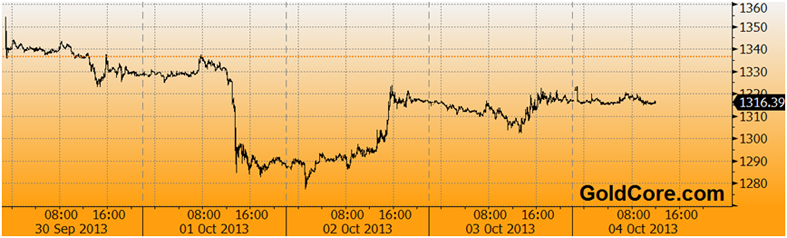

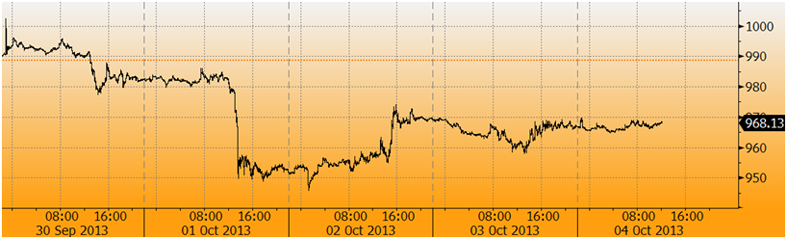

| Emperors With No Clothes – From Nero To Nixon To Obama Posted: 04 Oct 2013 05:20 AM PDT The hyperinflation of Weimar Germany in the 1920's is coming Today's AM fix was USD 1,316.00, EUR 967.01 and GBP 817.04 per ounce. Gold inched up $1.40 or 0.11% yesterday, closing at $1,317.40/oz. Silver remained unchanged closing at $21.70. Platinum climbed $10.10 or .74% to $1,372.40/oz, while palladium climbed $3.47 or 0.5% to $700.47/oz. Gold traded up marginally in London as investors digested the U.S. government shutdown and the debt ceiling deadline.

Gold is being supported by the U.S. government shutdown and potential October 17th default that threatens to hurt fragile U.S. and global economic growth, increasing bullion’s safe haven appeal. Some buyers are allocating to gold prior to the deadline in order to hedge potential market turmoil.Gold’s 1.2% loss for the week so far is largely due to a single massive Comex futures sell order on Tuesday that quickly sent the price below $1,300 an ounce, but it quickly recovered as the budget impasse in Washington dragged on. The COMEX paper speculators hold sway for now but physical supply and demand, the psychology of the investment public, and gold buyers internationally will dominate again soon. With Chinese markets closed for the National Day holiday through Monday and no major U.S. data expected due to the shutdown, gold was vulnerable to another sell off last night, but it did not; rather it kept in a tight range during Asian hours and in early European trading. Many federal agencies have stopped collecting and publishing data after Congress failed to agree on a spending bill. Federal Reserve officials said this week that the lack of data was making it difficult to read the economy and the Fed might have to keep monetary policy easy for longer to help offset the harm caused by the political fighting in Washington.

The shutdown of the U.S. government appears likely to drag on for another week and possibly longer. There are growing fears in financial markets about the more significant mid-October deadline to raise the U.S. debt ceiling. The very bad state of the debt-ceiling negotiations is leading to a re-evaluation of U.S default risk. While still unlikely, it is not now completely impossible given the degree of political tension, bickering and fighting amongst U.S. politicians. Platinum gained more than 1% to $1,379.24% due to a strike at Anglo American Platinum’s South African operations. The miner said it was losing an average of 3,100 ounces of production a day. Platinum gains may also be due to the fact that South Africa cut water supply to platinum mines in the North West province to half their usual quota, Business Day reported. Mines operated by Anglo American Platinum Ltd., Impala Platinum Holdings Ltd. and Lonmin Plc in the Rustenburg area produce 73% of global platinum output, the Johannesburg-based newspaper said. The North West province has been declared drought-stricken under the Disaster Management Act. A spokesman for Impala said the government had asked mines to cut back water consumption by only 10%, according to Business Day. Macquarie says in a report today that the Amplats strike affects about 20% of world platinum output. Global platinum mine production is about 15,000 oz a day while Amplats is losing 3,100 ounces of platinum production a day due to the strike. LBMA 2013, the gold industry's flagship annual international conference was held in Rome this year and was a great success with a near record attendance with over 800 delegates and 316 organisations. This included precious metal refineries, government mints, banks, central banks, pension funds, regulators, exchanges, bullion dealers, financial media and other industry participants. We live tweeted speeches including some photos of excellent slides from the event and they can be seen on Twitter at @GoldCore and @MarkTOByrne and at hashtag #LBMA. The key conclusions of the two and a half day event were that central banks continue to view gold as an important diversification and that while gold may weaken in the short term, the medium and long term gold fundamentalsare very sound.

There was a consensus that gold would go higher in the medium and long term and prices over $2,000/oz were cited as a strong possibility. Central banks and many participants emphasised that gold’s importance was as a store of value and vital diversification in a foreign exchange, savings and investment portfolio. The final session on Tuesday host by Brian Lucey of Trinity College Dublin was one of the most enjoyable and informative of the sessions. In it, Jeremy East of Standard Chartered Bank, Philip Klapwijk of Precious Metals Insights, Marwan Shakarchi of MKS and Andy Smith, an independent analyst gave their perspectives. Marwan Shakarchi of MKS said that he was bearish in the short term as he thinks that the Fed may start tapering soon. After this, the bull market will recommence. The world is in a mess and governments are in a mess. China is still an emerging market and China will consume easily double to about 2000 tonnes in 2 to 3 years time – up from 1,000 tonnes today. So, physical market demand will come back. In the long term, it is the people in the souk and the man and woman in the street in Asia that will decide the price. So, in the long term, price will be much higher. Silver will follow gold higher and may outperform but it is more volatile. Silver coin buyers are buying silver and putting it in the vault and they will not sell until silver rises to over $200/oz or $300/oz. Jeremy East of Standard Chartered Bank is bearish in the short term. However, he said that people would continue to buy gold. He sees a relocation in the market with demand and influence on price moving from the West to the East. China is slowly becoming the price setter. Asian markets are largely physical markets and people buy it for investment and as a store of value unlike the West where speculation remains more common. China would continue its demand going into the next year. India will start soon. So, prices would rebound after seeing a correction in the short term. Fundamentals are more supportive to platinum and palladium than gold today. Philip Klapwijk, Precious Metals Insights said that gold has further room to fall, before it stabilises. There was a large surplus of 2151 tonnes in 2012 and net demand from private sector has slumped, which is roughly estimated at 650 tonnes. Physical demand has increased although a bit. He believes that $1,000 – 1,100/oz could be a level that gold falls to. Perhaps most importantly, Klapwijk who has often been bearish on gold in recent years said that in the long run physical buyers of gold will be seen as wise. Analyst Andy Smith was very bullish and he gave the most interesting, thought provoking and entertaining of the presentations. There were one or two "death by powerpoint" presentations and his presentation was in marked contract and he thus won the 'Best Speaker' category at the LBMA 2013. In his words, "there are ruins all around us" as he juxtaposed images of ancient Rome and today's Detroit. Defaulting recently on $600 million of debt due for repayment, Smith noted that Detroit only has "half the debt per head of the US national average.” He said that the US Federal Reserve’s vote last week not to “taper” its current $85 billion of government purchases each month was very gold bullish. Referring to the US purchases of its own debt he said, “can you imagine what would happen if the Fed sold what it’s bought?” As the Fed’s Treasury bond holdings come due, said Smith, “It will be called one arm of government forgiving another. But it will in fact be one giant step close to Weimar [hyperinflation].” - The hyperinflation of Weimar Germany in the 1920's in coming - Gold will be the only saviour – from a financial perspective - Gold is a psychological market - Retail gold investors are far more intelligent than is assumed - Inflation is neither a necessary nor sufficient conditions to push gold prices much, much higher. - All that is necessary is a change in people's psychology regarding the value of paper money - India is a role model for the west when it comes to household savings into gold. That is the only social security system which will protect people in the coming years. - The Indians are wise as they are right not to trust governments or banks to protect their wealth - Silver will not be as valuable as gold in a hyperinflationary environment - Government is clever enough to call wealth confiscation other names – say redistribution, welfare etc. - Asset confiscation or 'outright theft' by desperate governments - including of deposits and pensions is coming

One of the biggest laughs of the conference came when Smith presented the slide, 'Emperor … With No Clothes' which compared how the value of the Roman denarius, silver coin and the U.S. paper dollar have fared during periods of currency debasement. The chart (see above) shows the silver denarius since Nero and the dollar since Nixon and looked at the level of debasement during the reign of each Roman Emperor and the term of each Presidency. President Obama, the current incumbent, is shown in Roman Emperor style with the laurel wreath, a crown, which signified the Emperor's divinity, on his head. Interestingly, the chart shows that President Obama's presidency has not been the worst in terms of currency debasement with President Reagan and President Bush II being much more detrimental to the U.S. currency. In fairness to Obama too, the debasement of the U.S. currency is due to the U.S going off the Gold Standard in 1933 and the Gold Exchange Standard under Nixon in 1971 and the ultra loose monetary policies of recent years. Currency devaluations and debasement are set to continue in the coming years. Owning physical gold, silver, platinum and palladium – either in one's possession or secure allocated storage will protect people, companies and institutions in the coming years. |

| Silver Forecast October 4, 2013, Technical Analysis Posted: 04 Oct 2013 05:06 AM PDT fxempire |

| Gold Churning before Next Drop? Posted: 04 Oct 2013 05:06 AM PDT dailyfx |

| Gold Price Analysis- Oct. 4, 2013 Posted: 04 Oct 2013 05:06 AM PDT dailyforex |

| Gold May Test 2013 Low on Head and Shoulders: Technical Analysis Posted: 04 Oct 2013 05:06 AM PDT bloomberg |

| Gold Double Bottom Signals Rally to $1,425: Technical Analysis Posted: 04 Oct 2013 05:06 AM PDT risingcapitalzone |

| Jim Rickards: This is the Next Sub-Prime Crisis Posted: 04 Oct 2013 02:35 AM PDT In this short 2:40 minute video, Jim Rickards, senior managing director at Tangent Capital and author of Currency Wars: The Making of the Next Global Crisis and the upcoming Death of Money: The Coming Collapse of the International Monetary System, calls the student loan debt load the “next sub-prime crisis.” Rickards makes his case based in part on the size of the debt and the nature of its underwriting. The super-smart and super-sexy Lauren Lyster did the honours over at the finance.yahoo.com Internet site early yesterday morning...and I thank Harold Jacobsen for sharing it with us. |

| Posted: 04 Oct 2013 02:35 AM PDT 1. Investors Intelligence report: "This Key Chart Shows Why the Stock Market is Set to Crater". 2. Keith Barron: "The U.S. is Going to See a Monster Collapse - One For the Ages". 3. Tom Fitzpatrick: "Stocks Are Now Set to Experience a Massive 22% Plunge". 4. Rick Rule: "I'm a Terrified Observer as I Watch the End Game Unfolding". [Although I post all of Eric King's interviews, I wish to go on the record as saying that I don't necessarily agree with everything that's said by some of his guests. - Ed] |

| Interest Rate Observer's Grant: Central Bank Folly Will Lift Gold Posted: 04 Oct 2013 02:35 AM PDT James Grant, editor of Grant's Interest Rate Observer, expects gold prices to rise as a result of the flawed easing policies of central banks around the world. |

| Jim Rickards: Fed Should End QE: Gold will ultimately hit $5,000 - $7,000 Posted: 04 Oct 2013 02:35 AM PDT The Federal Reserve should drop its quantitative easing (QE) and just focus on controlling inflation, says James Rickards, a partner at Tangent Capital Partners. |

| Russia's Gold output rises sharply in January-July Posted: 04 Oct 2013 02:35 AM PDT Russia gold output advanced sharply by 12.2% year-on-year to 122.041metric tons in the first seven months of this year, as per the latest figures released by the Union of Russian Gold Producers. |

| U.A.E Precious Metals Hub Seen Growing as Location Feeds Demand Posted: 04 Oct 2013 02:35 AM PDT The United Arab Emirates will grow as a precious-metals trading hub as more overseas companies turn to the country because of its location near consuming nations, according to the Dubai Multi Commodities Centre. Dubai accounts for about 25 percent of global physical gold trade, Gautam Sashittal, chief operating officer of government-owned DMCC, said in a Sept. 30 interview at the London Bullion Market Association’s annual conference in Rome. Gold trade in the country totaled $45 billion in the first half of this year, compared with $70 billion in all of 2012, he said. The DMCC is the U.A.E.’s largest free zone offering more than 7,300 companies, a number of them in the precious metals industry, tax-free status, Sashittal said. While gold is heading for the first annual decline in 13 years as some investors lost faith in the metal as a store of value, the plunge to a 34-month low in June boosted purchases of jewelry, bars and coins in Asia. India and China are the biggest gold consumers. This Bloomberg story, filed from London, was posted on their Internet site in the wee hours of yesterday morning MDT...and I thank Ulrike Marx for her second and final offering in today's column. |

| China Gold Association leader notes Fed's manipulation of the gold market Posted: 04 Oct 2013 02:35 AM PDT In a review of the gold market in China for The Real Asset Co. in London, Jan Skoyles and Koos Jansen quote a leader of the China Gold Association, Zhang Jie, about the U.S. Federal Reserve's manipulation of the gold market: "For the Fed, it is crucial that the dollar dominates the world and so the Fed will store gold reserves from countries all over the world to control the gold settlement system." The Skoyles-Jansen report is headlined "Uncovering China's Rush for Gold" and it's posted at The Real Asset Co.'s Internet site. I yanked this story from a GATA release that Chris Powell filed from Hong Kong earlier today. |

| Ross Norman: Gold -- the Silk Road Redux Posted: 04 Oct 2013 02:35 AM PDT The West does not have much to thank Marco Polo for. In his chronicles about trade along the Silk Road in 1271, he reported gold flowing East, while exotic luxury goods such as spices and silks flowed West. He also brought from the palace of Kublai Khan the concept of fiat currencies. 750 years later and gold is once again flowing eastwards – and with a vengeance – with paper money partly to blame. |

| Lawrence Williams: GATA's once-fringe views are mainstream now Posted: 04 Oct 2013 02:35 AM PDT The mineweb's Lawrence Williams' new commentary, "Gold Trading or Gold Hoarding -- Which Will Win Out?," acknowledges growing recognition that GATA has been right all along about central bank efforts to suppress the price of gold. Williams writes: "For years scorn was heaped on the GATA ideas, despite some substantial evidence being produced to support them. But, of late, given some increasingly strange gold market movements flying in the face of political and financial events which would at any other time have had the effect of leading to an upward run on gold, GATA's views, and those of a number of others on the fringe, are becoming mainstream -- particularly as these adverse price movements in gold appear to have been orchestrated by massive 'sales' of paper metal in volumes that have absolutely no relation to the amounts of gold being mined or available to the markets in physical form. 'There are no markets anymore, only interventions,' says Chris Powell, GATA's secretary, perhaps at last coming round to the observation that gold is not unique in being manipulated by the big financial players." Well, not quite "at last" for GATA, since that observation about every market being manipulated was made more than five years and almost 7,000 dispatches ago. [That it was, dear reader, as I've been overusing that quote ever since Chris introduced it in a speech at GATA's Washington conference in April of 2008. - Ed] |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment