saveyourassetsfirst3 |

- Gold trading or gold hoarding – which will win out?

- It remains a mystery what caused gold’s Tuesday collapse

- Gold Fields third-quarter output increase 10%

- The process of selling silver - Endeavour

- Who would trade a pawn shop for a payday pariah?

- AngloGold plans to cut 400 jobs at Ghana mine

- Where Are Gold Prices Going?

- Corvus Gold: More Great Results From Yellow Jacket

- India's October gold imports to zoom 176% m/m to 30 tonnes

- Currency strength and central bank’s activity: Got gold?

- Volatile Times Ahead for Silver

- Obamacare law creates “Data Services Hub” and tracks “social and behavioral” data

- Volatility rising in precious as U.S. shutdown cancels nonfarm Friday

- Uncovering China’s rush for gold

- Insiders Are Buying Sandstorm Metals & Energy: Should You?

- Gold Up 2.4% on government shutdown and U.S. default risk on Oct. 17

- David Morgan-Massive Debt Problem-Were Getting Very Close to the Edge

- Corvus Gold Drills 19 m @ 11 g/t Gold (including 11 metres of 18.0 g/t Gold) at Yellowjacket High-Grade Zone

- 8 Reasons Why I Expect Molycorp Shares To Double In 1Q 2014

- Balance Sheet Liquefaction and the Race for Precious Metals

- Case for Gold vs. the Case for Treasuries; Is Bill Gross Talking His Book or Talking Reality?

- COMEX Delivery Month Smash: The Pattern Re-Emerges

- COMEX Delivery Month Smash: The Pattern Re-Emerges

- Gold Miners Analyst Watch: October Edition

- Uncovering China’s Gold Rush

- PEAK GOVERNMENT- THE EROI OF FIAT

- How would a U.S. debt default impact the U.S. dollar?

- Gold grinding sideways under 1322 resistance

- Silver Forecast October 3, 2013, Technical Analysis

- Gold Prices October 3, 2013, Technical Analysis

- Gold Has Crashed Lower And Hit The Med Term 61.8%

- Gold Price Analysis- Oct. 3, 2013

- Gold Double Bottom Signals Rally to $1,425: Technical Analysis

- Gold prices could fall to $1170 in 6 12 months: Natixis

- Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17

- Volatility Rising in Precious as US Shutdown Cancels Non-Farm Friday

- GATA secretary interviewed on CNBC Asia about gold market manipulation

- Outlook for Gold favourable on weakness in dollar system: Sunshine Profits

- Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17

- Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17

- ObamaCare and the Devolution of the Relationship of Citizen to Government

- Mind Blowing Silver Manipulation Proof for Good Cop Chilton

- LBMA Consensus: Outlook for Gold Positive Despite Short Term Nervousness

- Dollar Seen as Shutdown Loser as Growth Hit Spurs QE

- Soros: European Union Remains at Risk of Collapse

- Four King World News Blogs/Audio Interviews

- Endeavour Silver Corp: Selling Silver

- Michael J. Kosares: Golden Gut Check 2013

- Iamgold CEO Committed to Low-Grade Gold

- No delivery allowed in Malaysia's first gold futures contract

| Gold trading or gold hoarding – which will win out? Posted: 03 Oct 2013 05:19 PM PDT "The old order changeth yielding place to new"- Tennyson. As the West relinquishes its gold through manipulative trading and China picks it up, the global financial order will likely move East. | |||||||||||||||||||||||||||||||||||||||||||||||||

| It remains a mystery what caused gold’s Tuesday collapse Posted: 03 Oct 2013 05:02 PM PDT Tuesday's sudden $40 drop in gold – made inside 1 hour – happened right at the start of US trade and has many puzzled. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Fields third-quarter output increase 10% Posted: 03 Oct 2013 04:50 PM PDT The bullion miner says it is on track to reach its full-year production target, helped by a 10% increase in third-quarter output. | |||||||||||||||||||||||||||||||||||||||||||||||||

| The process of selling silver - Endeavour Posted: 03 Oct 2013 02:12 PM PDT Endeavour Silver, has produced its latest informational video on Selling Silver detailing the stages involved from mine output of concentrate or doré through to eventual sale. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Who would trade a pawn shop for a payday pariah? Posted: 03 Oct 2013 12:11 PM PDT Gold is suffering and instead we have loans made at extortionate interest rates, says Joan Bakewell This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||

| AngloGold plans to cut 400 jobs at Ghana mine Posted: 03 Oct 2013 11:42 AM PDT AngloGold plans to cut 400 jobs at its Obuasi mine by year end to rein in costs as the decline in the price of bullion has eroded profit. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Oct 2013 11:18 AM PDT I take a long view of precious metals investing and find little meaning in the day-to-day fluctuations in the market. Major corrections—like those we’ve endured this year—are a different story. They clearly have an impact, leaving investors either anxious about their portfolios or excited about the new buying opportunity. So it’s no surprise that the question I’ve been asked most often in the past few months has been, “Where are prices going?” In the short term, prices cannot be predicted with any real accuracy. But if one takes a longer view, there are factors that can and should be considered. We all know the arguments about inflation and quantitative easing, but let’s take a look at a more basic price driver: the supply of physical gold.

When supply and demand are considered, particularly in the media, the focus is almost always on demand. When participating in media interviews, I am frequently asked about demand coming from Asia. Rarely am I asked about supply. That’s a big oversight. Large miners (defined as publicly traded miners with a market cap in excess of $5 billion) account for 30% of annual global gold supply. The statistic is similar for silver. At current prices, the majority of large miners are losing serious money. The following chart shows the interplay between supply, demand, and prices over the last several quarters.

Large miners are trimming costs, but once SG&A expenses (selling, general, and administrative expenses, including all management salaries, indirect production, marketing, and general corporate expenses) are reduced to the bone, the only way miners can continue to reduce their expenses in a meaningful way is by reducing operations. They will be forced to either shut down or sell mines with the highest operating costs. Those actions will result in a decrease in supply, which should place upward pressure on the price of physical metal. If prices do not move up on their own with in the next 12 months, we expect that miners will drastically cut production in order to conserve cash. Many (but not all) of the small to medium-sized miners are sitting on piles of cash and—unlike most large miners—could weather a longer period of suppressed prices. But they won’t be able to make up the shortfall in production. Nor would they want to: they stand to benefit most when prices increase. Based on our initial research, we believe a long-term basement price for gold is in excess of $1,300 per ounce. This does not take in to account all the other reasons we like to invest in precious metals. This price is strictly based on supply and demand. To be clear, this assumes that demand for physical gold remains relatively constant. Here’s a chart showing gold demand for the past ten years, excluding ETFs. The chart ends in 2012. So far, demand in 2013 is well above that during the same period in 2012.

Clearly, if demand drops, prices could fall from today’s levels, but that’s where the other demand drivers of precious metals come in. Those demand drivers remain as strong as ever.

The World Gold Council released its demand figures for the second quarter of 2013 a few months ago. But be sure to dig deeper than the numbers. What you’ll find is that gold ETFs are included in the demand figures. ETFs have seen massive outflows as traders, hedge funds, and institutions pull out—many of them forced to do so due to margin calls. What I find interesting—and what I’ve known given my vantage point at the Hard Assets Alliance—is that the second quarter saw record demand for gold coins and bars, and demand for jewelry also increased. Keep an eye on supply in the physical market. Author: Ed D’Agostino, General Manager, Hard Assets Alliance

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Corvus Gold: More Great Results From Yellow Jacket Posted: 03 Oct 2013 11:11 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||

| India's October gold imports to zoom 176% m/m to 30 tonnes Posted: 03 Oct 2013 10:31 AM PDT The most recent import figures suggest that gold imports by India during the month of September has almost doubled over the month. The country imported 7.24 tonnes of gold in September as compared to August's 3.38 tonnes. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Currency strength and central bank’s activity: Got gold? Posted: 03 Oct 2013 10:21 AM PDT The crucial story for gold investors is not the pure inflation rate of the dollar, but something much deeper. When you focus on gold, you should sharpen the focus of your lens on the dollar system. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Volatile Times Ahead for Silver Posted: 03 Oct 2013 10:04 AM PDT SunshineProfits | |||||||||||||||||||||||||||||||||||||||||||||||||

| Obamacare law creates “Data Services Hub” and tracks “social and behavioral” data Posted: 03 Oct 2013 10:00 AM PDT

Stop worrying about the IRS or the NSA stealing your information. From now on we will hand it over to the government voluntarily. If the IRS or NSA scandals involving misuse of private data were troubling, consider the implications of the new information databases created in the name of health care. The newly-launched Affordable Care [...] The post Obamacare law creates "Data Services Hub" and tracks "social and behavioral" data appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Volatility rising in precious as U.S. shutdown cancels nonfarm Friday Posted: 03 Oct 2013 09:39 AM PDT Precious metals fell back Thursday morning in London, with gold reversing $20 of yesterday's near-$50 rally to trade 2.6% lower for the week so far. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Uncovering China’s rush for gold Posted: 03 Oct 2013 09:13 AM PDT The Chinese government acknowledged gold as a strategic asset in 2000, when it included the establishment of an open gold market in its five year economic plan. Since then China has come to play a significant role in the international gold market as it strives to develop and advance all... | |||||||||||||||||||||||||||||||||||||||||||||||||

| Insiders Are Buying Sandstorm Metals & Energy: Should You? Posted: 03 Oct 2013 09:06 AM PDT There is perhaps no stock out there that has been as disappointing as Sandstorm Metals and Energy (STTYF.PK). The company was founded in December of 2010 by the same management team that started up Sandstorm Gold (SAND), a gold streaming, mine financing company that has provided investors with a return of 70 percent since inception (and at one point in October of 2012, up over 340 percent). Several key management at Sandstorm came over from Silver Wheaton (SLW), where they came to love the streaming model and helped Silver Wheaton grow into the company it is today. Therefore, a lot is expected from this management team. To sum of Sandstorm Metals business model briefly, the company gives an upfront cash payment to mining companies looking to build a mine. What they get is the right to purchase a fixed amount of a commodity, such as silver or copper, for the | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Up 2.4% on government shutdown and U.S. default risk on Oct. 17 Posted: 03 Oct 2013 09:02 AM PDT Gold recouped much of Tuesday's peculiar flash crash losses and rose by 2.4% yesterday rebounding some $40 from a two month low at $1,278.24/oz earlier in the session. | |||||||||||||||||||||||||||||||||||||||||||||||||

| David Morgan-Massive Debt Problem-Were Getting Very Close to the Edge Posted: 03 Oct 2013 09:00 AM PDT

Precious metals expert David Morgan says, "You cannot print yourself out of this mess that we are in. We have a massive debt problem, and the only solution they can come up with is 'add to the debt.' That will not fix the problem." Morgan goes on to say, "The problem is the money will [...] The post David Morgan-Massive Debt Problem-Were Getting Very Close to the Edge appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

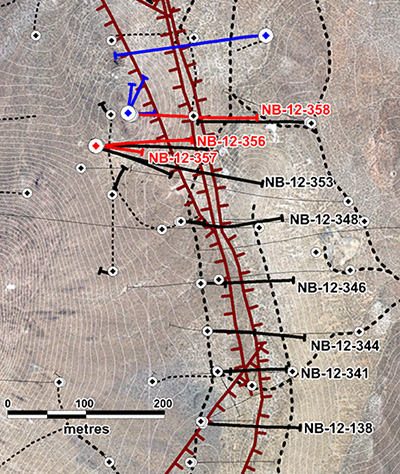

| Posted: 03 Oct 2013 08:59 AM PDT Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces initial assay results from three core holes along the northern extension of the Yellowjacket Zone at the North Bullfrog Project, Nevada. The high-grade intercept in NB-13-356 (11.0m @ 18.0 g/t gold) is 50 metres down dip from the previously reported intersection in NB-13-355 (11.7m @ 9.5 g/t gold, NR13-22, Sept 18, 2013) and hole NB-13-358 (1.3m @ 11.6 g/t gold) is 50 metres to the north of the intersection in NB-13-355 (Figure 1, Table 1). As in previous results, gold and silver occur in these intersections as very fine grains of electrum, native gold and acanthite, a cyanide soluble silver sulfide. Metallic screen assays for gold show that in most samples more than 80% of the gold reports to the minus 100 micron fraction. Corvus now has results from 50 metre spaced drill fences for over 400 metres of strike length, in an area 50 – 100 metres wide to a depth of 150 – 200 metres of the high-grade Yellowjacket system. By the conclusion of the 2013 drill program, 600 metres of strike will have been tested for potential inclusion in the project's new resource calculation, presently scheduled for early 2014. These new results, and the prior results contained in the September 18, 2013 news release, represent the main vein stockwork zone over widths of 20 to 40 metres with results from the surrounding 50 to 100 metre wide mineralized alteration zone still pending. These latest drill results continue to demonstrate the continuity and expansion potential of this major new Nevada high-grade vein system discovery. A similar style of vein mineralization has been encountered in additional holes to the north with assays pending (Figure 1). These results continue to highlight the potential expansion of this high-grade system to the west and to the north, which may, in turn, add significantly to the area of the proposed higher grade starter pit. Even more important is the fact that this vein is completely blind at the surface so other similarly hidden veins may exist elsewhere on the property. Hole NB-13-357 intersected a fault zone at the anticipated vein location which may have either displaced the vein or precluded good vein development. Wall rocks to the fault do host the typical disseminated type of lower grade mineralization. Jeff Pontius, Chief Executive Officer, states: "These latest results not only demonstrate the continuity of the Yellowjacket vein system but also its expansion potential for a large, at surface, high-grade, open pit deposit which could offer attractive mining economics. This information linked with the intersection of other broad stockwork vein zones having grades in excess of 1 g/t gold in our ongoing bulk tonnage development drilling program, suggest that the Sierra Blanca deposit and the North Bullfrog District as a whole, has high potential to develop into a major new Nevada high-grade discovery." Table 1: Significant intercepts* from recent core holes at Yellowjacket.

*Intercepts calculated with 0.1g/t gold cutoff and up to 1metre of internal waste. ** Silver assays are pending

About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 70 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company's independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in June, 2013. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated oxidized Indicated Resource of 36.7 Mt at an average grade of 0.26 g/t gold for 308,000 ounces of gold and an oxidized Inferred Resource of 220.4 Mt at 0.18 g/t gold for 1,289,000 ounces of gold (both at a 0.1 g/t gold cutoff), with appreciable silver credits. Unoxidized Inferred mineral resources are 221.6 Mt at 0.19 g/t for 1,361,000 ounces of gold (at a 0.1 g/t gold cutoff). Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website athttp://www.corvusgold.com/ Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada and Alaska, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% controlled Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the potential for any additional high-grade mineralization to be discovered to the west and to the north and south, thereby potentially significantly enhancing and expanding the possible "starter pit" area of the deposit; the potential for the Yellowjacket zone to be or become a large, at surface, high-grade, open pit deposit which could offer attractive mining economics, the possible impact of additional high grade mineralization in a starter pit to affect the economics of the project; the discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate, the potential for there to be additional high-grade mineralization within and below the current oxide deposit; the potential for any mining or production at North Bullfrog, the potential for the existence or location of additional high-grade veins and/or mineralization, whether at Yellowjacket or elsewhere, the potential for the Company to secure or receive any royalties in the future, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates and the preliminary economic analysis thereof also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered, and the results of mining it, if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially and adversely from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, the Company’s inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company's 2013 Annual Information Form filed with certain securities commissions in Canada. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties. Cautionary Note Regarding References to Resources and Reserves National Instrument 43 101 – Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM. United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Caution Regarding Adjacent or Similar Mineral Properties This news release contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the US Securities and Exchange Commission (the "SEC") set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7") strictly prohibit information of this type in documents filed with the SEC. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not indicative of mineral deposits on the Company's properties or the potential production from, or cost or economics of, any future mining of any of the Company's mineral properties. This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States. | |||||||||||||||||||||||||||||||||||||||||||||||||

| 8 Reasons Why I Expect Molycorp Shares To Double In 1Q 2014 Posted: 03 Oct 2013 08:02 AM PDT Molycorp, Inc. (MCP) mines and sells rare earth chemicals and oxides and rare metal materials and products in the U.S. and globally. Rare earth elements are used in number of important applications, such as clean energy technologies, defense technologies, automotive technologies, consumer electronics, Aerospace technologies, healthcare technologies and many more. Molycorp operates 26 locations in 11 countries and has more than 2700 employees. Molycorp also operates a subsidiary, Molycorp Magnequench, that develops and sells powerful and permanent rare earth magnets and materials to build those magnets. Since 2011, the share price has ranged from over $80 to just under $5 per share and currently sits at $7.36. A glut of rare earth materials on the world market, collapse of rare earth prices due to the glut, high capex, high production costs, construction cost overruns and delays, increased debt and dilution have all contributed to the price collapse from | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance Sheet Liquefaction and the Race for Precious Metals Posted: 03 Oct 2013 08:00 AM PDT

The ultimate scramble for precious metals lies just below the thin ice of US Treasuries. 2013 Silver Philharmonics As Low As $1.99 Over Spot at SDBullion! By Dr. Jeffrey Lewis, Silver-Coin-Investor: The Fed seems to be stuck because of housing market weakness and its associated mortgage backed securities. The repo market appears to be where [...] The post Balance Sheet Liquefaction and the Race for Precious Metals appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Case for Gold vs. the Case for Treasuries; Is Bill Gross Talking His Book or Talking Reality? Posted: 03 Oct 2013 07:33 AM PDT Global Economic Analysis | |||||||||||||||||||||||||||||||||||||||||||||||||

| COMEX Delivery Month Smash: The Pattern Re-Emerges Posted: 03 Oct 2013 07:31 AM PDT

February, April and June were Comex delivery months that saw the price of gold get hammered. August was a delivery month that saw the price of gold rally. October is a delivery month and gold is getting hammered again. What’s the difference? I think at this point it’s safe to say that we’re onto something. [...] The post COMEX Delivery Month Smash: The Pattern Re-Emerges appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

| COMEX Delivery Month Smash: The Pattern Re-Emerges Posted: 03 Oct 2013 07:26 AM PDT

Click here for more on the re-emerging pattern of gold smashes during COMEX delivery months: | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Miners Analyst Watch: October Edition Posted: 03 Oct 2013 07:18 AM PDT October is upon us and it is time again for an update on price targets for gold miners provided by analysts and available from Yahoo.com. As in previous installments we will be noting price targets and target changes in comparison with results published in our last edition in this series. We would like to stress that many companies mentioned in this article may have more analysts following their progress than considered in our data base. This difference is explained by the fact that not all analysts release their predictions to Yahoo.com. Instead, in many cases analyst data is considered as proprietary information only available to subscribers of the analysts' services. We continue to consider the following stocks (in alphabetical order): Agnico Eagle (AEM), Alamos Gold (AGI), Allied Nevada (ANV), AngloGold Ashanti (AU), AuRico Gold (AUQ), Barrick Gold (ABX), Eldorado Gold (EGO), Gold Fields (GFI), Goldcorp (GG), Harmony Gold | |||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 03 Oct 2013 07:08 AM PDT

The Chinese government acknowledged gold as a strategic asset in 2000, when it included the establishment of an open gold market in its five year economic plan. Since then China has come to play a significant role in the international gold market as it strives to develop and advance all aspects of the industry and gold's role in the domestic market. Why it has decided to focus on building and developing the gold industry from both a supply and demand perspective is a question that requires further investigation. In the coming weeks Koos Jansen and myself will reveal the cogs of China's gold market as we work to reach a conclusion as to why gold is such a high priority for China's economic development. This week we provide an overview of the major elements of the marketplace in an attempt to unveil the strategy of the State Council.

| |||||||||||||||||||||||||||||||||||||||||||||||||

| PEAK GOVERNMENT- THE EROI OF FIAT Posted: 03 Oct 2013 07:00 AM PDT

There was a time when $1 of government stimulus money would boost the GDP by $16. Now we talk daily about it taking $3.8 trillion to run the Federal Government and for each dollar of stimulus the GDP grows 8 Cents. This equation of how much it takes to run the government and the results [...] The post PEAK GOVERNMENT- THE EROI OF FIAT appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

| How would a U.S. debt default impact the U.S. dollar? Posted: 03 Oct 2013 06:59 AM PDT The political impasse in Washington and wrangles over the U.S. debt ceiling, which is leading to a gradual shutdown of the US government, is yet to seriously rattle market sentiment, but the longer it carries on the greater the risk of extreme market volatility. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold grinding sideways under 1322 resistance Posted: 03 Oct 2013 06:52 AM PDT fxstreet | |||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Forecast October 3, 2013, Technical Analysis Posted: 03 Oct 2013 06:52 AM PDT fxempire | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Prices October 3, 2013, Technical Analysis Posted: 03 Oct 2013 06:52 AM PDT fxempire | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Has Crashed Lower And Hit The Med Term 61.8% Posted: 03 Oct 2013 06:52 AM PDT forexspace | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Analysis- Oct. 3, 2013 Posted: 03 Oct 2013 06:52 AM PDT dailyforex | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Double Bottom Signals Rally to $1,425: Technical Analysis Posted: 03 Oct 2013 06:52 AM PDT bloomberg | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold prices could fall to $1170 in 6 12 months: Natixis Posted: 03 Oct 2013 06:36 AM PDT In light of the weakness of developing country economies in recent months and the accompanying weakness in their currencies, central bank demand for gold may beaffected by the decline in holdings of foreign exchange reserves as central banks draw down their reserves in an effort to support their currencies. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17 Posted: 03 Oct 2013 06:03 AM PDT

The partial government shutdown in Washington has entered a third day, adding to concerns over how soon a political compromise would be reached. Congress must also agree to raise the debt limit in just two weeks on October 17th or risk a default that will likely cause turmoil in global markets. Gold recouped much of [...] The post Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17 appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Volatility Rising in Precious as US Shutdown Cancels Non-Farm Friday Posted: 03 Oct 2013 06:00 AM PDT Bullion Vault | |||||||||||||||||||||||||||||||||||||||||||||||||

| GATA secretary interviewed on CNBC Asia about gold market manipulation Posted: 03 Oct 2013 05:33 AM PDT GATA | |||||||||||||||||||||||||||||||||||||||||||||||||

| Outlook for Gold favourable on weakness in dollar system: Sunshine Profits Posted: 03 Oct 2013 05:27 AM PDT The easiest way to look at the dollar is to compare it as a currency against all the other currencies. This, in fact, was the best way to assess the dollar from 2002-3, when it started to lose its value against other currencies and gold began its long and spectacular upward climb | |||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17 Posted: 03 Oct 2013 04:33 AM PDT gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||

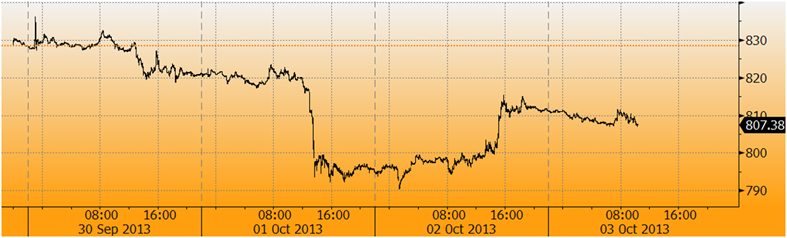

| Gold Up 2.4% On Government Shutdown and U.S. Default Risk On October 17 Posted: 03 Oct 2013 03:52 AM PDT The U.S. government is essentially bankrupt with a national debt of nearly $17 trillion and unfunded liabilities of between $100 trillion and $220 trillion . This will lead to a lower dollar and much higher gold and silver prices in the coming months and years. Today's AM fix was USD 1,309.00, EUR 961.58 and GBP 806.63 per ounce. Gold climbed $26.10 or 2.02% yesterday, closing at $1,316/oz. Silver rose $0.52 or 2.46%, closing at $21.70. Platinum inched up $13.65 or 1% to $1,388.25/oz, while palladium climbed $2.38 or 0.3% to $717.38/oz.

Gold recouped much of Tuesday’s peculiar flash crash losses and rose by 2.4% yesterday rebounding some $40 from a two month low at $1,278.24/oz earlier in the session. Deepening concerns about the government shutdown, poor jobs data and the growing risk of a U.S. default led to dollar weakness and a fall in equities.

The partial government shutdown in Washington has entered a third day, adding to concerns over how soon a political compromise would be reached. Congress must also agree to raise the debt limit in just two weeks on October 17th or risk a default that will likely cause turmoil in global markets. In a reversal of Tuesday’s market, the S&P 500 index fell while safe havens such as U.S. Treasuries and gold rose and has consolidated on those gains overnight in Asia and in Europe. Importantly, volume was higher than the previous day when prices fell sharply and volume was about 5% above its 30-day average, preliminary Reuters data showed. Gold’s inflation hedge appeal was boosted after the European Central Bank’s chief, Mario Draghi, said the ECB is watching moves in market interest rates closely and is ready to do "whatever is needed." On Tuesday, gold futures posted their biggest daily percentage drop in more than two weeks, following a big Comex sell order and technical selling once prices fell below $1,300 an ounce.

The flash crash on Tuesday led to renewed market talk of manipulation on the COMEX. CFTC regulator, Bart Chilton, implied that manipulation may have been the cause of the sharp sell off which came out of the blue, with no data released or news flow and without corresponding moves in other markets. One theory put forward was that it was forced liquidation by a distressed commodities fund and selling related to a fund rebalancing on the first day of the fourth quarter, although the speculation could not be confirmed by Reuters. While the U.S. government has had shutdowns before, including one 17 years ago during the Clinton administration, never before has the U.S. been in such an appalling fiscal state. The U.S. government is essentially bankrupt with a national debt of nearly $17 trillion and unfunded liabilities of between $100 trillion and $220 trillion. This will lead to a lower dollar and much higher gold and silver prices in the coming months and years. | |||||||||||||||||||||||||||||||||||||||||||||||||

| ObamaCare and the Devolution of the Relationship of Citizen to Government Posted: 03 Oct 2013 03:15 AM PDT By Lambert Strether of Corrente. Yves has written a number of posts on devolution, starting with Welcome to the World Where Things Don't Work Well. Naturally, one thinks at once of ObamaCare:

In some ways ObamaCare can be seen as a case study for devolution. I’m going to look at devolution in the context of what ObamaCare shows about the relation of citizen to government. (And at this point I’m going to freely admit this won’t be the longest post in the world, or as full of linky goodness as I’d like; I’m a bit behind the eight-ball partly because of the site review, and also from other stressors.) So, devolution of the relationship between government and citizen.** To begin with, ObamaCare often speaks of consumers, rather than citizens. From the healthcare.gov*** blog:

In fact, the only places on healthcare.gov where “citizen” occurs concern immigration status and privacy. Contrast Social Security, whose very card seems to be built around the concept of citizenship:

Why does this matter? Well, let’s do a thought experiment. Let’s suppose that instead of “Senior Citizens,” we had “Senior Consumers.” How would Senior Consumers “manage” their retirements, in the course of their working lives? I’m guessing they would have gone onto Marketplaces [Exchanges], maybe assisted by Navigators, and… Well, let’s just go ahead and adapt ObamaCare’s glossary definition for “Health Insurance Marketplace”:

And one more:

Got the picture? Once you start looking at ObamaCare as a paradigm, rather than a program, or a political battle — indeed, as a change in the Constitutional order — your perspective might change. (One can also imagine “Marketplaces” for public education, police protection, etc. The possibilities — and the rents — are limitless!) I’ll admit I’m taking for granted that a transition from citizen to consumer is a devolution; see Frederick Pohl’s The Space Merchants on this point. Readers can hash that question out in comments! Next, if the actual purpose of ObamaCare is not to devolve people’s expectations of government, the administration and its defenders are certainly achieving that as a side effect. When I was growing up, the space program — ludicrous now in retrospect considering climate change — was a central symbol of the power of the state and, when you think about it, a pretty amazing and successful project, in its own terms. (And I remember, a mere fifteen years into the neo-liberal dispensation, when the Hubble telescope’s distorted mirror was discovered, saying: “Eesh. Can’t we do anything right?”) The space program was of course not flawless, and had mistakes and casualties. Nevertheless, one did not hear, as with ObamaCare today: “Oh, the launch date is really a soft launch! Just wait a few months!” Or “Why so critical? A space rocket is really complicated to engineer. Expect glitches!” Or “Relax! The payload for the rocket was a lot greater than we expected, and that’s why the rocket never left the launching pad!” Or “We did great because we got 26 million miles toward the moon, even if the moon is 47 million miles away!” And one did not hear the same lame, weak, and above all disempowering excuses from the President on down to thousands of Obots. The ObamaCare exchange project had three years; by contrast, LBJ rolled out Medicare for all over-65s in one year. And at launch, even after a series of requirements were ruthlessly triaged (with some triaged in defiance of the law), the ObamaCare exchanges were unusable for large numbers of people in many states (including me). Why should government performance like that be acceptable? Many of those vigorously defending the ObamaCare rollout are users of Apple products, like iPhones and iPads. If Apple has launched a product like this, the twitter would be aflame, and Apple’s stock price would have vaporized. Why are ObamaCare’s apologists not demanding of their government, as citizens, that it deliver a quality product on time, instead of rationalizing failure and shifting blame? If they were evaluating their cell phones, instead of the largest domestic initiative since LBJ, they’d be asking why the Exchanges weren’t designed by Jony Ives, instead of looking like they were thrown together by a body shop using some cheap e-commerce library. Don’t the American people deserve the best? To put this another way, if President Romney had launched RomneyCare, instead of President Obama launching RomneyCare, the Obots would be comparing the ObamaCare launch to Project Orca. NOTE * I’m going to use the term ObamaCare, rather than ACA or PPACA since that’s the term most people use. Obama says it’s fine. NOTE ** There could be an implicit teleology here; Graeber makes the argument somewhere that for the average Roman, being a peasant was better than being a slave, so the collapse of the Roman Empire was, for the average European, a step up. NOTE *** The very URL http://www.healthcare.gov is Orwellian, since, as a child of six knows, health insurance, which is what the exchanges deliver, is not the same as health care, which the exchanges, like the equally parasitical insurance companies, do not deliver. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Mind Blowing Silver Manipulation Proof for Good Cop Chilton Posted: 03 Oct 2013 03:00 AM PDT Miles Franklin | |||||||||||||||||||||||||||||||||||||||||||||||||

| LBMA Consensus: Outlook for Gold Positive Despite Short Term Nervousness Posted: 03 Oct 2013 02:32 AM PDT "Silver wasn't allowed to close above the $22 spot price mark for the eighth day in a row" ¤ Yesterday In Gold & SilverAs I pointed out in The Wrap in yesterday's column, gold got hit for about ten bucks shortly after 8 a.m. in Hong Kong on their Wednesday morning, but had recovered all of that loss within a couple of hours. After that, the gold price began to trade with a slight positive bias which lasted right into the Comex open. After popping above the $1,300 spot price mark, gold traded more or less sideways until the London p.m. gold fix was in. Then a rally began that either ran out of gas, or got capped, shortly before the London close at 11 a.m. EDT. The high tick at that point was recorded by Kitco at $1,325.10 spot. The price got sold down about ten bucks from there, before trading sideways for the rest of the New York trading session. Gold closed at $1,316.30 spot, which was up $28.80 from Tuesday's close, but well of its high. Net volume was pretty chunky as well at 181,000 contracts. The price pattern for silver was similar to gold's but with a bit more 'volatility', and the rally at the London p.m. gold fix got capped both times that it attempted to break above the $22 price mark. After that, the silver price got sold down in fits and starts into the 5:15 p.m. electronic close. Kitco recorded the high tick as $22.14 spot. Like gold, silver got sold down well of its high, and every rally attempt after that met with the usual seller of last resort. Silver finished the New York session on Wednesday at $21.73 spot, up 56.5 cents from Tuesday, but more than 2% below its high tick. Net volume was pretty decent at 43,000 contracts. Here's the New York Spot [Bid] chart on its own so you can see the price action during the Comex and the New York Access Market in more detail. Neither platinum or palladium prices did much of anything yesterday, as it was strictly a gold and silver show. Here are the charts. The dollar index closed on Tuesday afternoon in New York at 80.18, and its high tick of 80.27 came around 8:30 a.m. Hong Kong time on their Wednesday morning. From there it chopped a bit lower until 8:30 a.m. EDT in New York. 40 minutes later the index was down to 79.81. It recovered a bit from there, but closed below the magic 80.00 mark at 79.916, which was down about 25 basis points from Tuesday's close. There was no correlation between the dollar index and gold and silver yesterday either, as the rallies in both metals occurred long after the index hit its low tick of the day. Of course this currency action had no impact on either platinum or palladium. The gold equities rallied smartly into gold's high tick, which came a few minutes before the London close at 11 a.m. EDT. It was all down hill from there, and the HUI could manage a gain of only 0.46% by the close. I would guess that some entity such as a precious metal mutual fund was force to unload some shares yesterday. However that's pure speculation on my part. The silver shares did even worse, and despite the solid gain in the metal price itself, quite a few of them actually closed down on the day, as did Nick Laird's Intraday Silver Sentiment Index, which finished in the red to the tune of 0.06%. After a quiet "Day 2" delivery day from the CME on Tuesday, the Daily Delivery Report for "Day 3" yesterday made up for it, as 1,664 gold and 192 silver contracts were posted for delivery within the Comex-approved depositories on Friday. In gold, the big short/issuer was Deutsche Bank out of its in-house [proprietary] trading account. In far distant #2 position was Barclays with 101 contracts issued. The biggest long/stopper was HSBC USA with 1,172 contracts, followed by JPMorgan Chase with 335 contracts in it's in-house [proprietary] trading account, and 137 contracts for its client account. In silver, the one and only short/issuer was Jefferies. JPMorgan stopped/received 157 of those contracts; 117 for it's proprietary trading account and the other 40 for its client account. The link to yesterday's Issuers and Stoppers Report is here, and it's worth a quick look. An authorized participant withdrew 135,154 troy ounces from GLD yesterday. Over at SLV, a smallish 145,142 troy ounces was also withdrawn, which probably represented a fee payment of some kind. The U.S. Mint also had a small sales report yesterday, it's third in as many days. They sold 3,000 ounces of gold eagles and 1,000 one-ounce 24K gold buffaloes, but no silver eagles. Over at the Comex-approved depositories on Tuesday, they reported receiving 31,841 troy ounces of gold, all of it into HSBC USA. The link to that activity is here. As it almost always the case, there was much more activity in silver, as they reported receiving 576,912 troy ounces and shipped out 174,491 troy ounces. The link to that action is here. Yesterday in this space I posted a couple of concentration charts for both platinum and palladium, and promised the same charts for gold and silver in today's column, and here they are. In the gold chart below, you can see back in the early years of this century, the Big 4 and Big 8 Comex futures traders did not have an overly large number of days of world gold production held short. The maximum was around 35 days and the minimums were less than 20 days. As you can tell, that began to change as the bear market in gold came to an end. At their peak in the last few months of 2010, the Big 4 and Big 8 were short 100 days and about 135 days of world production in gold. Since then, they've been whittling it down, and as of last week's COT Report, the Big 4 and Big 8 largest traders are short 45 and 59 days of world production respectively. The rapid fall-off in the last twelve months was due to the fact that JPMorgan Chase switched from a short-side corner to their current long-side corner, which Ted Butler places around 7 million ounces as of this writing. Not surprisingly, the silver concentration of the Big 4 and Big 8 looks totally different from the other three precious metals. There have been few days over the last thirteen years where they, collectively, have been short less than 100 days of world silver production between them, and most of the big spikes show cumulative short positions of more than 180 days [6+ months] of world silver production. As the chart points out, the days of world production that the Big 4 and Big 8 hold as of last week's Commitment of Traders Report shows that they are short 86 and 120 days of world silver production respectively. Only recently have platinum and palladium joined silver at these obscene "Days to Cover Short Positions" levels. These are obviously the U.S. bullion banks and New York investment houses [along with Canada's Bank of Nova Scotia] going short against all comers in the Comex futures market in order to prevent the prices of these three precious metals from blowing sky high, which is exactly what they would do the moment they withdrew from the market, or tried to cover these short positions. I've decided to include the platinum and palladium charts as well, so you can compare all four at once. It's just too bad that there won't be a Commitment of Traders Report or a Bank Participation Report from the CFTC tomorrow, as it would show the current short positions of the Big 4 and Big 8 in all four precious metals, along with the short and long position of the U.S. bullion banks broken out separately in the BPR. I don't have that many stories today, but the final edit is up to you. ¤ Critical ReadsU.S. shutdown 'risk to global economy', says DraghiA protracted U.S. government shutdown would threaten the global economy, European Central Bank president Mario Draghi has said. Although Mr Draghi said he did not see the prospect of a US government default, he added: "The US budget shutdown is a risk if protracted. "At the present time the impression one has is that it will not be so, but if it were to be protracted it's a risk to the US and the world economy we have to have this present in our minds." Today's first story was posted on the telegraph.co.uk Internet site yesterday afternoon BST...and it's courtesy of Roy Stephens. Dollar Seen as Shutdown Loser as Growth Hit Spurs QEThe first U.S. government shutdown in 17 years is stoking speculation that the longer it lasts, the more likely the Federal Reserve will delay reducing its monetary stimulus program, boosting emerging-market currencies at the expense of the dollar. The Fed’s stimulus programs have weighed on the greenback, with the Bloomberg Dollar Index falling 0.9 percent since Sept. 17. That was the day before the central bank decided to keep printing cash to buy $85 billion of bonds a month because it has yet to see signs of sustained economic growth. The Bloomberg JPMorgan Asia Dollar Index is up 0.3 percent in that period. “If the fiscal issue drags on, the Fed is likely to be less willing to reduce stimulus in the economy. The dollar will suffer if that is the case,” James Kwok, the London-based head of currency management at Amundi, which oversees an equivalent of $1 trillion, said yesterday in a phone interview. Amundi has reduced bets the dollar will rise, according to Kwok. This Bloomberg story appeared on their Internet site early yesterday morning MDT...and I thank West Virginia reader Elliot Simon for finding it for us. Pimco's Gross: Low interest rates may persist for decadesGross wrote in his October investment outlook that investors should "bet against" expectations that the federal funds rate - the U.S. Federal Reserve's benchmark short-term borrowing rate - will rise by one percentage point by late 2015. "The U.S. (and global economy) may have to get used to financially repressive - and therefore low policy rates - for decades to come," wrote Gross, a co-founder and co-chief investment officer at Pimco, whose flagship Pimco Total Return Fund has roughly $250 billion in assets. "Right now the market (and the Fed forecasts) expects fed funds to be 1 percent higher by late 2015 and 1 percent higher still by December 2016. Bet against that," he wrote in the letter entitled "Survival of the Fittest?" This is not a surprise, dear reader, as governments cannot afford higher rates...as their deficits grow larger by the day. Japan is the template for all nations now. Bill isn't saying anything that most well-informed readers haven't figured out on their own already. This Reuters piece was posted on their website yesterday afternoon EDT...and I thank Manitoba reader Ulrike Marx for sharing it with us. 'Vampire' foreclosures are what's keeping bank inventory high, analyst saysAs if rising mortgage rates aren’t scary enough, analysts have identified a lurking threat to housing: “vampire” properties. These “vampire” properties are bank-owned foreclosed homes in which prior owners continue to live, as defined by RealtyTrac, an online foreclosure marketplace. Former owners live in 47% of U.S. bank-owned properties, according to RealtyTrac. These properties are “sucking the life out of the housing market,” said Daren Blomquist, vice president at RealtyTrac, an online foreclosure marketplace. If you have any interest in residential real estate at all, this marketwatch.com news item certainly falls into the must read category. My thanks go out to Roy Stephens for his second offering in today's column. Talking Jamie Dimon With Sam Seder of 'The Majority Report' Yesterday, I had the pleasure of joining old friend Sam Seder on The Majority Report. Among other topics, we talked about the surreal exchange between CNBC dingbat Maria Bartiromo and Salon's amazed and incredulous Alex Pareene about Chase CEO Jamie Dimon. Pareene hilariously told the CNBC panel that anybody could do Jamie Dimon's job as badly as he's done it, offered himself in half-seriousness as an option and made the absolutely accurate point that any other boss in any other industry who had overseen the regulatory problems that took place at Chase under Dimon would be looking for work. Australia Broadcasting Corporation: Extended interview with James RickardsThis interview with Jim was conducted on Monday in Australia, which was Sunday here in North America. It was posted on the abc.net.au Internet site the following evening AEST. It runs for 10:37 minutes...and he's always worth listening to. I thank Harold Jacobsen for sending it along. Greenwald: 'The objective of the NSA is literally the elimination of global privacy'Glenn Greenwald of the UK’s Guardian answered questions on Tuesday about the ongoing NSA leaks and his source, the now notorious former intelligence contractor Edward Snowden, during an online question-and-answer session held Tuesday on the website Reddit. Asked by a participant during the Reddit “Ask Me Anything” segment to explain what he thought was the single most shocking revelation to come from Snowden’s leaks, Greenwald responded that the actual abilities of the NSA as detailed through those disclosures was what he considered to personally be the biggest takeaway. “The general revelation that the objective of the NSA is literally the elimination of global privacy: ensuring that every form of human electronic communication - not just those of The Terrorists™ - is collected, stored, analyzed and monitored,” he said. This very interesting news item was posted on the Russia Today website early Monday evening Moscow time...and it should come as no surprise to you. It's another contribution to today's column from Roy Stephens. Pulitzer winner Seymour Hersh: Bin Laden raid 'one big lie'Seymour Hersh, a Pulitzer Prize-winning journalist, said all the details surrounding the U.S. raid on Osama bin Laden’s compound that resulted in the terrorist leader’s death are completely false. That whole story of U.S. success is “one big lie,” he said in The Guardian. “Not one word of it is true,” he said, referring to the narrative put forth by the Obama administration about the bin Laden mission and about the al Qaeda leader’s 2011 death. I posted a story about this in my Saturday column, I believe, but it's been given new life in an article posted over at The Washington Times on Monday. Of course, for anyone with an open mind, the events of 9/11 also fall into this same 'one big lie' category. I found this story on their website yesterday. Soros: European Union Remains at Risk of Collapse The euro crisis may be over, but Europe is still in a precarious state, says hedge fund legend George Soros, chairman of Soros Fund Management. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar Seen as Shutdown Loser as Growth Hit Spurs QE Posted: 03 Oct 2013 02:32 AM PDT The first U.S. government shutdown in 17 years is stoking speculation that the longer it lasts, the more likely the Federal Reserve will delay reducing its monetary stimulus program, boosting emerging-market currencies at the expense of the dollar. The Fed’s stimulus programs have weighed on the greenback, with the Bloomberg Dollar Index falling 0.9 percent since Sept. 17. That was the day before the central bank decided to keep printing cash to buy $85 billion of bonds a month because it has yet to see signs of sustained economic growth. The Bloomberg JPMorgan Asia Dollar Index is up 0.3 percent in that period. “If the fiscal issue drags on, the Fed is likely to be less willing to reduce stimulus in the economy. The dollar will suffer if that is the case,” James Kwok, the London-based head of currency management at Amundi, which oversees an equivalent of $1 trillion, said yesterday in a phone interview. Amundi has reduced bets the dollar will rise, according to Kwok. This Bloomberg story appeared on their Internet site early yesterday morning MDT...and I thank West Virginia reader Elliot Simon for finding it for us. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Soros: European Union Remains at Risk of Collapse Posted: 03 Oct 2013 02:32 AM PDT The euro crisis may be over, but Europe is still in a precarious state, says hedge fund legend George Soros, chairman of Soros Fund Management. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Four King World News Blogs/Audio Interviews Posted: 03 Oct 2013 02:32 AM PDT 1. Dr. Stephen Leeb: "Stunning - China to Accumulate Another 5,000 Tons of Gold". 2. John Ing: "Failed U.S. Government Intervention Causing Panic Into Gold". 3. Louise Yamada: "Two Fantastic Gold, Silver and Mining Charts". 4. The audio interview is with Robin Griffiths. [Although I post all of Eric King's interviews, I wish to go on the record as saying that I don't necessarily agree with everything that's said by some of his guests. - Ed] | |||||||||||||||||||||||||||||||||||||||||||||||||

| Endeavour Silver Corp: Selling Silver Posted: 03 Oct 2013 02:32 AM PDT This 5-minute video clip explains how Endeavour Silver sells its mine production on the open market. The process is pretty much identical for all silver/gold miners. I'm more than familiar with this process, but for some it will be educational...which is the whole point of the video. Of course they never mention the fact that they hate to sell silver in a managed market, but I know for a fact that everyone at EDR/EXK knows what's really going on with JPMorgan's price management scheme. And like every other silver/gold producer, they'd never mention it in public. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Michael J. Kosares: Golden Gut Check 2013 Posted: 03 Oct 2013 02:32 AM PDT This issue we team up with the charting research services, Macrotrends.net and Thechartstore.com, to bring you a grouping of highly illuminating charts on the gold and silver markets. Though we are a full five years from the genesis of the 2008-2009 financial crisis, its aftershocks still influence (in fact, dominate) economic policy as well as activity in the financial markets, including gold. Every once in a awhile, it pays to revisit the fundamental drivers of gold demand -- particularly investment demand -- in order to determine whether or not the secular bull market is still on course. If nothing else, it helps to clear the synapses of excessive media wash and re-establish why gold remains vitally important to the contemporary investment portfolio. For some, these charts will serve as an affirmation; for others a revelation -- a golden gut check of sorts. As you are about to see, the price of gold may have changed over the past year, but the fundamental monetary forces driving it have not. This commentary, with some excellent charts, was posted on the usagold.com Internet site yesterday...and it's worth your time. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Iamgold CEO Committed to Low-Grade Gold Posted: 03 Oct 2013 02:32 AM PDT Stephen Letwin is a man of conviction. The chief executive of mid-tier gold miner Iamgold Corp believes low-grade deposits are the future, whether the industry is ready or not. With prices down and higher costs cutting into margins - already slim at many low-grade mines - explorers that once boasted about the size of their deposits are now wooing investors with tales of high-grade zones. But Letwin, who was touting low-grade gold last year, before spot prices dropped more than 20 percent, sees no reason to change his tune. "I don't care who you are - we are all migrating to lower grade," he said in an interview. "It's just a fact of life." Yes, it is, dear reader. It's not that the world is running out of gold, but at these "Made in the USA" prices courtesy of JPMorgan et al, there's little left that can be economically mined. A lot of ore bodies will require much higher prices to bring on stream, and that's why that some mines are being forced to high-grade their current mines, which shortens their mine life. It's a lose-lose situation at these prices. This news item appeared on The New York Times website just after the markets closed yesterday...and I thank Phil Barlett for bringing it to our attention. | |||||||||||||||||||||||||||||||||||||||||||||||||

| No delivery allowed in Malaysia's first gold futures contract Posted: 03 Oct 2013 02:32 AM PDT Malaysia's first gold futures contract will start trading on Oct. 7 to meet investor demand, according to the head of the country's derivatives exchange. Gold prices will continue to be volatile and the 100-gram, ringgit-denominated contract will allow investors to trade without worrying about currency fluctuations, Chong Kim Seng, chief executive officer of Bursa Malaysia Derivatives Bhd., said in an interview. Bullion for delivery up to one year will be cash-settled and bench-marked against the London fixing, he said. “The small contract size means retail customers, big or small, can be involved and traders who want to do hedging can just do multiples,” said Chong. “The issues that’s facing the U.S., the government shutdown and the tapering policy, have an impact on the U.S. dollar and interest rates, so it’s important that people consider gold as part of their portfolio.” This Bloomberg story, filed from Singapore early on Thursday morning local time, was posted on their website in the wee hours of this morning Denver time. I found this news item in a GATA release just before I hit the 'send' button on today's column. | |||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment