saveyourassetsfirst3 |

- Alacer Gold focus squarely Turkey

- A top 2012 gold-copper discovery gets first resource

- Sibanye mulls solar plant to combat rising power prices

- Shanghai gold hits discount to London on ‘money market’ fall-out

- Gold miners reduce hedge book in Q2, more cuts seen

- Australian Dollar Slide Continues After Glenn Stevens' Warning

- USD/CAD - Rangebound As U.S. Key Releases Falter

- Peter Schiff: Fed Will Do The Opposite Of Tapering – More Money Printing!

- Inflated premiums tend to incite gold smuggling to India: WGC

- Shanghai gold hits discount to London on money market fall-out

- Screen traded fiat gold could get a violent wake-up call

- Corvus Gold Extends High-Grade Yellowjacket Zone Strike Length to 650 metres with 125 metre North Stepout,

- Guest Post: Western Financial System Default is Underway NOW!

- A Formal Response from Andrew Maguire

- A Formal Response from Andrew Maguire

- Gold falls from five-week high as dollar gains before Fed meets

- Marc Faber: “We Have A Lot Of Bearish Commentaries About Gold, But The Fact Is…It’s Bottoming-Out Here”

- Gold Will Hold Its Value

- Embry surprised West lets its gold go; Turk says Asia sees undervaluation

- Chris Duane on Why Silver Has Not Gone Up

- Ron Paul: A Welcome US/Saudi Reset

- Dollar index bounces off its lows for 2013 – but for how long?

- Attacks on Maguire aim to defend paper charade in gold market, Kaye says

- 90% Silver $1.49 Over Spot, Any Qty!

- Is Housing Headed For Another Bust?

- Screen Traded Fiat Gold Could Get a Violent Wake-Up Call

- “Screen Traded Fiat Gold Could Get a Violent Wake-Up Call”

- Gold price back to flat for the week after rallying 8% from the lows two weeks ago

- Gold price back to flat for the week after rallying 8% from the lows two weeks ago

- Do You Trust Politicians Or Do You Protect Your Hard Earned Wealth?

- Gold: India’s Capital Asset through History

- Gold Price Analysis- Oct. 29, 2013

- Gold shines on Dollar weakness, physical shortage

- John Dizard: “Screen-Traded Fiat Gold Could Get a Violent Wake-Up Call”

- Detroit Pensioners Face Miserable 16 Cent on the Dollar Recovery

- U.S. Trojan horse: NSA scandal shows Europe would be better off without Britain

- The beginning of the end for the 'petrodollar'?

- Should the Sultanate drop rial peg to dollar?

- BIS sees risk of 1998-style Asian crisis as Chinese dollar debt soars

- Nine King World News Blogs/Audio Interviews

- With more exports, Indian gold traders drive up domestic prices

- Egon von Greyerz: Hyperinflation and Gold's parabolic rise

- In London's Financial Times, John Dizard notes potential strain on paper gold

- Mike Kosares: Screen-traded fiat gold could get violent wake-up call

- US Dollar Attempting Recovery as SPX 500 Keeps Pushing Higher

- Gold: When Will It Crash Again?

- Technical Trading: Minor Daily Uptrend Seen For Comex Gold Futures

- Gold and Silver technical analysis: XAU/USD and XAG/USD below last week’s highs

- TECHNICAL Gold Upside Momentum Slowing above 1350

- Gold and Silver

| Alacer Gold focus squarely Turkey Posted: 29 Oct 2013 06:47 PM PDT Alacer - Australia behind it, Turkey very much in its cross hairs, and not just in terms of production. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A top 2012 gold-copper discovery gets first resource Posted: 29 Oct 2013 05:58 PM PDT Goldquest puts together first Romero resource, and Brent Cook of Exploration Insights weighs in with some thoughts on high grade deposit core. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sibanye mulls solar plant to combat rising power prices Posted: 29 Oct 2013 05:02 PM PDT Sibanye's electricity costs have risen 60% since 2007, even as the gold mining company used 16% less power, says CEO Neal Froneman. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shanghai gold hits discount to London on ‘money market’ fall-out Posted: 29 Oct 2013 04:08 PM PDT Prices on the Shanghai Gold Exchange stood at a $7 premium to London settlement last week, peaking $30 above that international benchmark. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold miners reduce hedge book in Q2, more cuts seen Posted: 29 Oct 2013 03:58 PM PDT The outstanding volume of gold delta-hedged against producers' hedge contracts fell by 529,000 ounces in Q2, says SocGen and GFMS. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Australian Dollar Slide Continues After Glenn Stevens' Warning Posted: 29 Oct 2013 01:02 PM PDT By Kenny Fisher AUD/USD has lost ground in Tuesday trading. The pair has dropped below the 0.95 line in Tuesday's North American session. The Aussie lost ground after RBA Governor Glenn Stevens warned that the currency is overvalued and due for a correction. In economic news, it was another disappointing day in the US as PPI, Retail Sales and CB Consumer Confidence all missed their estimates. Core Retail Sales was the lone bright spot, as it matched the forecast. As well, the Federal Reserve meets for a two-day policy meeting which begins on Tuesday. If RBA Governor Glenn Stevens was looking to scare the markets with some negative comments about the Australian dollar, he appears to have succeeded, at least temporarily. Stevens stated that the high level of the currency was not supported by the costs and productivity in the economy, and urged investors to tread carefully in the foreign | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| USD/CAD - Rangebound As U.S. Key Releases Falter Posted: 29 Oct 2013 12:57 PM PDT By Kenny Fisher The Canadian dollar is almost unchanged in Tuesday trading. The pair continues to trade in the mid-1.04 range in the Tuesday's North American session. In economic news, it was another rough day for US releases, as PPI, Retail Sales and CB Consumer Confidence all missed their estimates. Core Retail Sales was the lone bright spot, as it matched the forecast. As well, the Federal Reserve meets for a two-day policy meeting which begins on Tuesday. In Canada, inflation indicators continue to look weak, as both the Raw Materials Price Index and Industrial Product Price Index posted declines in September. Later on Tuesday, BOC Governor Stephen Poloz testifies before the House of Commons Standing Committee in Ottawa. In the US, the grim readings continued on Tuesday. PPI and Retail Sales both declined by 0.1%, missing the estimate of 0.2%. CB Consumer Confidence dropped sharply, from 79.7 to 71.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Schiff: Fed Will Do The Opposite Of Tapering – More Money Printing! Posted: 29 Oct 2013 11:30 AM PDT

Peter Schiff joins BNN’s The Street to discuss the Fed’s monetary policy ahead of this week’s October FOMC meeting, and the fact that the taper discussion is irrelevant- the Fed will be forced to do the opposite, and announce MOAR QE! Schiff, one of the few economists to correctly state the Fed would continue with [...] The post Peter Schiff: Fed Will Do The Opposite Of Tapering – More Money Printing! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Inflated premiums tend to incite gold smuggling to India: WGC Posted: 29 Oct 2013 11:10 AM PDT The Indian gold premiums are currently ruling at $120 to $150 per ounce over London prices. According to P R Somasundaram, Managing Director, World Gold Council-India, the exorbitant gold premiums in India have encouraged gold smugglers. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shanghai gold hits discount to London on money market fall-out Posted: 29 Oct 2013 11:05 AM PDT The price of London settled gold bounced to $1,348 per ounce Tuesday morning, halving an earlier 0.9% drop after China's most active gold contract closed below that world benchmark for the first time in 2013. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Screen traded fiat gold could get a violent wake-up call Posted: 29 Oct 2013 10:50 AM PDT In the Financial Times, veteran financial journalist and gold watcher, John Dizard noted the increasing strain in the physical gold market and detailed how that should lead to much higher gold prices. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

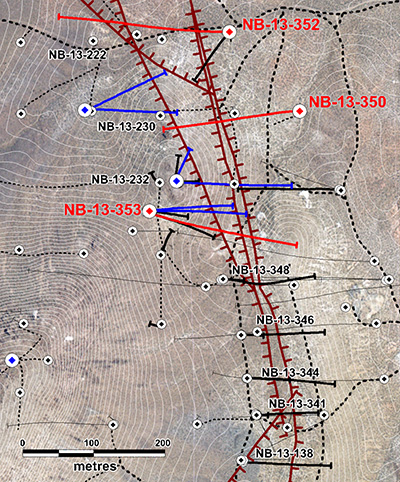

| Posted: 29 Oct 2013 10:35 AM PDT Vancouver, B.C……..Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces initial assay results from new core hole NB-13-352 and additional assays from hole NB-13-353 which was partially released previously (NR13-22, September 18, 2013). Hole NB-13-352 encountered 270 metres of continuous mineralization, which included four separate zones of quartz veining. One zone of quartz veining returned 1.2 metres @ 3.07 g/t gold and 8.00 g/t silver and another returned 2.4 metres @ 7.57 g/t gold and 6.90 g/t silver. Hole NB-13-352 has now intercepted high-grade vein mineralization for a distance of nearly 650 metres, which mineralization remains open on all directions (Figure 1). Complete assays from NB-13-353 show that, in addition to the main vein (7.9 metres @ 10.36 g/t gold and 105.61 g/t silver), there are multiple zones of veining that extend the entire length of the hole (Table 1). These veined intervals occur in a variety of lithologies and, together with NB-13-350 (1.8 metres @ 2.35 g/t gold and 6.62 g/t silver), indicate that the corridor between the main Yellowjacket structures has the potential to host multiple new high-grade vein zones (Figure 1). Jeff Pontius, Chief Executive Officer, stated: "The extension of the Yellowjacket system several hundred metres to the north, as shown by holes NB-13-350 & 352, dramatically expands this high-grade portion of the North Bullfrog deposit. In addition, the multiple new vein zones identified in hole 352 and the recently announced new vein zone discoveries in RC holes to the west are outlining the potential for continued expansion of high-grade vein system to the west and north. When put in the context of the greater North Bullfrog District potential and the fact that Sierra Blanca is only the first of several high priority targets to be explored, the overall potential of the Company's North Bullfrog property is demonstrably significant. This multimillion ounce potential, linked with the excellent project infrastructure, secure mining friendly jurisdiction, projected simple oxide gold recovery and currently estimated low development cost, highlights the exceptional asset controlled by the Company." Table 1: Significant intercepts* from recent core holes at Yellowjacket.

*Intercepts calculated with 0.1 g/t gold cutoff and up to 3 metres of internal waste. Additional Vein Zone and Expansion of Deep Mineralized Zone Drill hole NB-13-352 was drilled approximately 150 metres north of NB-13-350, where the first eastern quartz veins were discovered. The silver to gold ratio in both holes suggests that the high-grade veins are part of the overall Yellowjacket system. The upper intercept in NB-13-352 is in the same structural position as the veining in NB-13-350, indicating a likely continuity of veining. The second high-grade intercept in NB-13-352 is in a new position and may represent yet another new vein zone. In addition to the quartz veining, mineralization in the bottom of NB-13-352 (23 metres @ 0.79 g/t gold) is associated with broad pyrite veining/replacement style of mineralization similar to that observed in the bottom of NB-13-350 (42.7 metres @ 0.76 g/t gold), as well as holes NB-13-230 (26 metres @ 1.2 g/t gold, NR-13-20 Sept 5, 2013), NB-13-232 (12.2 metres @ 0.97 g/t gold, NR-13-22 Sept 18, 2013) and NB-13-222 (53.3 metres @ 0.86 g/t gold, NR-13-18 August 7, 2013). This shows that this mineralization style occurs over a strike length of at least 250 metres, is over 100 metres wide and is open in all directions, particularly at depth. This new style of mineralization could represent a large new zone of gold mineralization that still remains within potentially open pit mining depths. Figure 1: Location of Yellowjacket drill holes. Red collars and traces indicate holes reported in this press release. Blue indicates holes for which assays are pending. Black indicates previously released results. Significant mineralized faults are shown in dark red. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 68 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada and Alaska, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% controlled Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Cautionary Note Regarding Forward-Looking Statements | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Western Financial System Default is Underway NOW! Posted: 29 Oct 2013 10:00 AM PDT

The reason that every one in the west in involved in currency debasement/ currency manipulation is this: THE ENTIRE WESTERN BANKING SYSTEM IS DEFAULTING!! Yes you read that correctly, the west can no longer pay the piper and now they are going to debase their currencies in order to walk away form their debt obligations, [...] The post Guest Post: Western Financial System Default is Underway NOW! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Formal Response from Andrew Maguire Posted: 29 Oct 2013 09:08 AM PDT

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A Formal Response from Andrew Maguire Posted: 29 Oct 2013 09:03 AM PDT

Last week, an attempted attack on me was made based upon unreliable and misinformation. The most important question to ask from it is why? This is extremely easy to answer. I am exposing the imminent default of the LBMA unallocated bullion banking system. Ever since Jeffrey Christian of CPM Group made the mistake of admitting [...] The post A Formal Response from Andrew Maguire appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold falls from five-week high as dollar gains before Fed meets Posted: 29 Oct 2013 08:05 AM PDT Gold futures declined from a five-week high as the dollar's rally curbed demand for the metal as an alternative investment before Federal Reserve policy makers meet on U.S. monetary policy. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Oct 2013 08:00 AM PDT

In a recent interview with Barron's Roundtable, Marc Faber noted that: "We have a lot of bearish sentiment, [and] a lot of bearish commentaries about gold, but the fact is that some countries are actually accumulating gold, notably China. They will buy this year at a rate of something like 2600 tons, which is more [...] The post Marc Faber: "We Have A Lot Of Bearish Commentaries About Gold, But The Fact Is…It's Bottoming-Out Here" appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Oct 2013 07:45 AM PDT On Sunday, I wrote an email to Jim Sinclair. He published it along with his reply on Monday. For those of you who didn't catch it, here is my email and Jim's response below. I will follow it up with my further thoughts on the subject – and Andy Hoffman and Bill Holter's too.

I agree that there will be a reset and the price of gold will be adjusted at some reasonable value to the replacement currency, but I do not believe that price is reflected at the current manipulated price of $1,350. In many instances, that is too low to profitably support mining operations. I have read that if gold were not manipulated, it would probably sell somewhere around $2,300. So, if there is a re-set vs. debt/mortgages, etc., I would expect the price of gold to be substantially higher than it is now. Of course I don't expect to repay a $50,000 mortgage with one ounce of gold, but I would be surprised if it took more than 20 ounces, as valued in the "Reset" currency. Today it would take 37 ounces. In a worst-case scenario, gold will at least hold its value while those whose assets are dollar-denominated will lose a substantial portion of their wealth. Own things – high quality real estate, precious metals, and quality collectables. They will hold their value, in Sinclair's "Great Reset." My personal preference for gold and silver is based on their liquidity. You can convert them into the currency of the realm immediately at a given or fixed value. Not so with most other non-paper assets. That is not to be taken lightly. Here is what Andy Hoffman wrote about this topic over a year ago…

I spoke to Bill Holter about this and I believe he will write about it on Tuesday as well. Germany's stealth bomber and the Atomic Bomb. Did you know that Goering made it perfectly clear that Germany would have an Atomic Bomb by 1946? They also were close to development of the Horton 16, a long-range stealth bomber that was so fast and so difficult for radar to detect, it could have delivered its payload on NYC or Washington DC with impunity. Think about that when you consider the consequences of a nuclear Iran. Here is a must watch video: Greatest Mysteries of WWII: Hitler Stealth Fighter 720P Here is an article from Fox News:

Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Embry surprised West lets its gold go; Turk says Asia sees undervaluation Posted: 29 Oct 2013 07:31 AM PDT GATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chris Duane on Why Silver Has Not Gone Up Posted: 29 Oct 2013 07:22 AM PDT

In his latest update, Silver Bullet Silver Shield’s Chris Duane responds to questions on why silver has traded down over the past year and a half since May 2011, and whether it is time to follow many precious metals analysts, and sell their metals. Duane responds by discussing silver’s Giffen good status, market sentiment, and [...] The post Chris Duane on Why Silver Has Not Gone Up appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ron Paul: A Welcome US/Saudi Reset Posted: 29 Oct 2013 07:00 AM PDT

Last week it was reported that Saudi Arabia decided to make a "major shift" away from its 80 years of close cooperation with the United States. The Saudi leadership is angry that the Obama administration did not attack Syria last month, and that it has not delivered heavy weapons to the Syrian rebels fighting to [...] The post Ron Paul: A Welcome US/Saudi Reset appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollar index bounces off its lows for 2013 – but for how long? Posted: 29 Oct 2013 06:52 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Attacks on Maguire aim to defend paper charade in gold market, Kaye says Posted: 29 Oct 2013 06:31 AM PDT GATA | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% Silver $1.49 Over Spot, Any Qty! Posted: 29 Oct 2013 06:29 AM PDT

1 Day Only! 90% Silver Only $1.49/oz over spot, Any Qty! Click or call 614.300.1094! The post 90% Silver $1.49 Over Spot, Any Qty! appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Is Housing Headed For Another Bust? Posted: 29 Oct 2013 06:28 AM PDT Andy Hoffman joins Kerry Lutz of the Financial Survival Network to discuss how housing sales are falling off the cliff, new rules are coming down from the Consumer Financial Protection Bureau, the Fed. To listen to the interview, please click on the link below: Andy Hoffman – Is Housing Headed For Another Bust?

Similar Posts: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Screen Traded Fiat Gold Could Get a Violent Wake-Up Call Posted: 29 Oct 2013 06:17 AM PDT

Veteran financial journalist and gold watcher, John Dizard noted the increasing strain in the physical gold market and detailed how that should lead to much higher gold prices. "Something is unsettling the animals in the forest of the gold market. Usually there is a chorus of chirrups and squeaks that are significant, momentarily, for one [...] The post Screen Traded Fiat Gold Could Get a Violent Wake-Up Call appeared first on Silver Doctors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Screen Traded Fiat Gold Could Get a Violent Wake-Up Call” Posted: 29 Oct 2013 05:48 AM PDT Already more prudent hedge fund, investment and pension fund managers have liquidated their ETF positions in favour of allocated physical bullion. We would expect that trend to accelerate as prudent investors rightly seek to avoid the high level of counterparty and systemic risk associated with exchange traded gold and other forms of unallocated gold and paper gold. Today's AM fix was USD 1,346.75, EUR 978.81 and GBP 837.06 per ounce. Gold climbed $1.50 or 0.11% yesterday, closing at $1,353.00/oz. Silver slipped $0.05 or 0.22% closing at $22.47. Platinum rose $9.20 or 0.7% to $1,382.00/oz, while palladium climbed $6.50 or 0.9% to $707/oz. Gold for immediate delivery gained as much as 0.6% to $1,360.76/oz, prior to a sharp bout of concentrated selling just before European markets opened at 0800 GMT, that saw gold fall to just above $1,340/oz . Gold had been near the highest level in five weeks after U.S. economic data showed how weak the U.S. economy remains leading to concerns that the Fed will continue with ultra loose monetary policies.

Gold is currently 1.3% higher in October. Gold fell into the middle of the month (see chart below) and then as U.S. lawmakers wrangled over the nation's budget and debt ceiling, triggering a 16-day partial government shutdown, gold began to recover and is now nearly $100 above the low seen mid October at $1,252/oz. U.S. factory output trailed forecasts in September, while pending sales of previously owned homes fell the most in three years, separate reports showed yesterday.

In the Financial Times, veteran financial journalist and gold watcher, John Dizard noted the increasing strain in the physical gold market and detailed how that should lead to much higher "Something is unsettling the animals in the forest of the gold market. Usually there is a chorus of chirrups and squeaks that are significant, momentarily, for one species or another, such as a few cents of arbitrage between Zurich and London, or a dollar-an-ounce rise in India caused by a dealer’s near insolvency. Then the noise settles down to the murmur of wind through the trees However, the continuing high level of premiums for physical gold over the kinds you can trade on a screen suggests that the next move in the major gold indices or the various exchange traded funds could be discontinuous and dramatic. It would be much better for the financial world if gold were just bumping along, with only enough volatility and liquidity to keep a few dealers’ lights on. That would mean electronic or paper assets have retained their essential credibility with the public …" "This could turn into a very violent wake-up call for [screen-traded gold]. People talk about 'fiat currencies', but we also have 'fiat gold.' Volatility is too cheap right now." Taken together, this collection of persistent microeconomic signals in gold could flag macro trouble to come. These noises worried me in August. They worry me more now. Dizard's article, 'Strange gofo cry heralds trouble for gold' in the Financial Times can be read here. He has previously warned that ETF gold holdings and central bank gold reserves may be being lent to bullion banks, who then re lend that gold into the market. Owners of gold exchange traded funds (ETFs) would be surprised and worried to discover that certain banks might be lending out gold that they have bought and believe that they own. The leading gold ETF, GLD has been criticised by many analysts for its extremely complex structure and prospectus. There have also been warnings about the possible conflict of interest and overall lack of transparency. If as has been suggested, banks are lending gold into the market that has come from exchange traded funds then this would validate the many concerns raised about the gold ETF market. Questions would again be asked as to whether many of the ETFs are fully backed by the gold that they claim to own in trust on behalf of clients.

Already more prudent hedge fund, investment and pension fund managers have liquidated their ETF positions in favour of allocated physical bullion. We would expect that trend to accelerate as prudent investors rightly seek to avoid the high level of counterparty and systemic risk associated with exchange traded gold and other forms of unallocated gold and paper gold. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold price back to flat for the week after rallying 8% from the lows two weeks ago Posted: 29 Oct 2013 04:24 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold price back to flat for the week after rallying 8% from the lows two weeks ago Posted: 29 Oct 2013 04:21 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Do You Trust Politicians Or Do You Protect Your Hard Earned Wealth? Posted: 29 Oct 2013 04:05 AM PDT Gold prices have extended last weeks' gain as investors continue to accumulate the physical metal. The price of the yellow metal gained by almost 3% last week as the dollar trended lower against most other major currencies after the release of soft initial jobless benefit claims data out of the US and some upbeat manufacturing data out of China. Macroeconomic data released last week, strengthened hopes the Federal Reserve will continue with its quantitative easing program for the near future which augurs well for gold prices. In economic news from the US, the Labour Department said initial jobless claims dropped to 350,000 in the week ended October 19, a decrease of 12,000 from the previous weeks revised figure of 362,000. Economists expected claims to fall to 340,000 from the 358,000 originally reported for the previous week. In a separate report, the US Commerce Department showed the US trade deficit in August ticked up to USD38.8 billion from a revised USD38.6 billion in July. Economists expected a wider deficit of USD40.0 billion from the USD39.1 billion originally reported for the previous month. The value of imports were virtually unchanged at USD228.0 billion, while the value of exports edged down to USD189.2 billion from USD189.3 billion. China’s manufacturing growth hit a seven-month high in October, with the flash manufacturing Purchasing Managers’ Index rising more-than-expected to 50.9 from 50.2 in September, a survey by HSBC and Markit Economics showed Thursday. From the Eurozone, reports showed that the Eurozone, PMI manufacturing index increased to 51.3 in October, slightly below expectations of 51.4. And, the Eurozone PMI services unexpectedly dropped to 50.9. German PMI manufacturing was up to 51.5 versus market expectations of 51.4. French PMI manufacturing is still below 50 at 49.5, versus expectations of 50.1. Germany’s private sector economy expanded at the slowest pace in three months during October, as the slowdown in services growth offset improvement in manufacturing, preliminary data from Markit Economics showed. The flash composite output index dropped to a three-month low of 52.6 from 53.2 in September The precious metal made impressive gains during the week after the weak jobs data renewed speculation that the Federal Reserve will maintain its bond-buying stimulus program — rather than taper it. “Gold’s ascent above $1350, to one-month highs, has been driven by investor interest,” says a note from Barclays Capital, pointing to the “largest daily increase” in exchange-traded gold funds, which give investors exposure to the metal’s price without them taking physical ownership, since January. For many years I have been very vocal about the liars, deception, and outright theft committed by politicians around the world. Most of them have no interest in the improvement of their citizens and merely use their positions to enrich themselves. And, while they may proclaim that holders of offshore bank accounts are hiding billions from the tax payers, the governments themselves are the true thieves of wealth. They have looted billions from tax payers and are immune to the same type of prosecution imposed on law abiding individuals. The entire system is corrupt. Only now, it has become evident that the NSA has been spying on its allies in Europe. Recently, European leaders attended a summit which was overshadowed by reports of widespread US spying on its allies, allegations German Chancellor Angela Merkel said had shattered trust in the Obama administration and undermined the crucial trans-Atlantic relationship. France, which also vocally objected to allies spying on each other, asked that the issue of reinforcing Europeans’ privacy in the digital age be added to the agenda of the two-day summit. After summit talks on Thursday that lasted until after midnight, Herman Van Rompuy, European Council president, announced at a news conference that France and Germany were seeking bilateral talks with the US to resolve the dispute over “secret services” electronic spying by the end of this year. “What is at stake is preserving our relations with the United States,” French President Francois Hollande told reporters at his own early-morning news conference. “They should not be changed because of what has happened. But trust has to be restored and reinforced.” “It’s become clear that for the future, something must change, and significantly,” Merkel said. “We will put all efforts into forging a joint understanding by the end of the year for the cooperation of the [intelligence] agencies between Germany and the US, and France and the US, to create a framework for the cooperation.” An endless stream of disclosures has pushed Washington into an inextricably awkward predicament. Fresh reports in Britain's Guardian newspaper, the first to have published Snowden's leaks, suggest the telephones of 35 world leaders have been monitored by the NSA. The bugging of Chancellor Angela Merkel's mobile phone is particularly embarrassing. Friends don't do this sort of thing, Berlin says, while the US has been desperately emphasising the importance of its friendship with Germany.

And, while governments coerce individuals to comply with these absurd restrictions, banks have also been lying and cheating their own customers. While many banks have been involved in this, JPMorgan Chase, one of America's largest and most highly regarded banks, has now had to pay out several billion dollars to settle lawsuits from consumers and regulators. In the past few years, JPMorgan Chase has been party to a series of very expensive legal settlements. In many recent quarters, as it rang up big profits, the bank was forced to set aside hundreds of millions of dollars to deal with litigation. Joshua Rosner, a financial analyst and co-author of Reckless Endangerment, in March estimated that the company's litigation expenses since 2009 have totalled $16 billion! And it's not over yet. Along with a current investigation as to whether it failed to alert authorities to suspicions about Ponzi scheme Bernie Madoff, The New York Times reported that at least eight federal agencies are currently investigating the bank. A few of the cases include the following: In 2011 JPMorgan was one of several banks called out in a class-action lawsuit for over charging or wrongfully foreclosing on active-duty US military personnel. The company apologized, paid out $27 million in cash, cut interest rates on home loans and returned houses that were wrongfully foreclosed upon. In the same year, The Securities and Exchange Commission sued JP Morgan for misleading buyers by allegedly failing to inform investors that a hedge fund assisted in picking and betting against securities in a collateralized debt obligation JPMorgan had sold in 2007. In 2012, after being sued by pension funds and investors for investing their funds in a risky structured investment vehicle that failed at the height of the global financial crisis in 2008, JPMorgan settled the suit without admitting wrongdoing. And, again in the same year, the Securities and Exchange Commission charged JPMorgan with misleading investors about the quality of mortgages that underlay mortgage-backed securities it sold. The bank settled the charges without admitting or denying guilt. During this, year, JPMorgan Chase agreed to return $546 million to former customers of MF Global Holdings, the investment firm run by former New Jersey governor Jon Corzine that collapsed in 2011. While it did not admit wrongdoing, JPMorgan had been threatened with a lawsuit if it didn't return the cash that had been transferred from MF Global during the firm's chaotic final days. In South Africa, the situation is just as dire. Politicians have enriched themselves through swindling tenders and abusing tax payers' money. Ever since the ANC came in to power, the level of corruption and theft has escalated to new unimaginable new heights. Practically, every minister and senior public official in all spheres of government has abused tax payers' money. They have bought expensive cars, enjoyed a lavish life style and spent money on personal belongings while amassing small fortunes for themselves. As these government officials looted the nations' wealth, services in the public sector declined dramatically. But, finally, on Wednesday, Finance Minister, Pravin Gordhan, announced far-reaching cuts to these perks. Mr Gordhan said that the cost-cutting measures would come into effect by December 1. He said these measures would affect officials including members of the national executive, provincial governments and local municipalities. The cost of cars is to be standardised, although the brands could be selected, and Mr Gordhan said the maximum amount would be the equivalent of a BMW 530 saloon. He also said the government would consider bulk buying of cars, although security features would be considered.

Even more bad news for many government office bearers is that the Cabinet has imposed an immediate ban on the serving of alcohol at most official functions, while official credit cards are to be withdrawn. The markets are now watching the US central bank which begins a two-day meeting on Tuesday, announcing its monetary policy on Wednesday. Many analysts now expect it to stick with $85 billion of monthly quantitative easing.

While I maintain that one of the key driving forces behind higher gold prices will be the loss of confidence in the current global monetary system, in the medium term, gold will also be supported by cyclical events. The price of gold tends to do well between October and the end of the year due to greater physical demand on account of the Indian wedding season, holiday seasons in U.S. and a lot of other countries resulting in ramped up demand for gold jewellery. Ownership of gold is more important than trying to use the precious metal as means to obtain a high return on one's investment. It is a hedge against the declining value of currencies and is an insurance against the corrupt global monetary system. Not only are we seeing money printed on an unprecedented scale, politicians and bankers lie, cheat and steal on an unprecedented level. And, if you believe that your government or banker has your interest at heart, you may as well believe in the tooth fairy. The deterioration of our society is directly attributable to those people who we would usually rely on for order and leadership. You can choose to acknowledge the overwhelming evidence and reduce your exposure to these bankrupt western countries that will make every effort to lie, cheat, and steal whatever they can from you… just to keep the party going a little while longer. You can choose to trust these politicians and central bankers to do the right thing or alternatively, you can choose to take action yourself to protect your hard earned wealth buy owing physical gold. You only have yourself to rely on. Not the system. Not the government. And, for sure, you certainly cannot trust the bankers. Technical picture

Gold prices are now hovering around the $1350/oz. level, and have pierced through the 50 day MA. I expect to see a further move to the upside and a re-test of $1400/oz. in the medium-term.

About the author: David Levenstein is a leading expert on investing in precious metals . Although he began trading silver through the LME in 1980, over the years he has dealt with gold, silver, platinum and palladium. He has traded and invested in bullion, bullion coins, mining shares, exchange traded funds, as well as futures for his personal account as well as for clients. For more information go to www.lakeshoretrading.co.za | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: India’s Capital Asset through History Posted: 29 Oct 2013 03:58 AM PDT Mises.org | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Analysis- Oct. 29, 2013 Posted: 29 Oct 2013 03:45 AM PDT dailyforex | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold shines on Dollar weakness, physical shortage Posted: 29 Oct 2013 03:08 AM PDT Gold has performed strongly, as it seems clear the fact the US debt issue has only been postponed and central bank stimulus is likely to be required for a prolonger period. Such concerns appear to the accelerating central bank's and private investors search for alternatives to the US dollar as a reserve asset. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Dizard: “Screen-Traded Fiat Gold Could Get a Violent Wake-Up Call” Posted: 29 Oct 2013 02:43 AM PDT "All the stars are aligned for a massive move to the upside in gold and silver" ¤ Yesterday In Gold & SilverThe gold price did nothing in Far East or morning trading in London on their respective Mondays, but once the London p.m. fix was in at 10 a.m. EDT, the gold price rallied smartly. But it all came to and end just minutes after London trading ended, as the usual not-for-profit sellers put in an appearance. By noon in New York the gold price was back to unchanged from Friday's close, and didn't do much after that. Gold's low was printed at the 8 a.m. GMT London open, and the high was a very few minutes after 11 a.m. in New York. The CME recorded those two prices as $1,346.10 and $1,361.80 in the December contract. Gold finished the Monday trading session at $1,353.20 spot, which was up a whole 30 cents from Friday's close. Volume, which had been pretty light for most of the day, jumped quite a bit as the trading day wore on in New York, so it was obvious that JPMorgan et al had to throw a fair number of contracts at the gold price to keep it from taking off. Volume, net of October and November, ended up at a pretty decent 130,000 contracts. Silver didn't do much at all. It traded mostly in a 25 cent range the entire day. The high tick [$22.715] in the December contract was printed sometime after 9:30 a.m. GMT in London yesterday morning. Silver finished the Monday trading day at $22.51 spot, down 8.5 cents from Friday. Volume, net of October and November, was pretty light at only 28,500 contracts. Platinum rallied from the open in London until just before 11 a.m. in New York, and then it chopped sideways into the close. Palladium rallied a bit in New York, but got sold off after 1 p.m. EDT. Here are the charts. The dollar index closed on Friday afternoon in New York at 79.21, and then traded sideways until noon in London. From there it rallied about 15 basis points by 9:30 a.m. EDT, before chopping sideways into the close. The index closed at 79.34; up 13 basis points from the previous Friday. Here's the chart from the 6 p.m. start of trading in New York on Sunday evening. The gold stocks spent the first 30 minutes of the Monday session in the red, before vaulting higher with the gold price at the p.m. fix. This rally ran out of gas shortly before 11:30 EDT, and at that point, some of the gains disappeared. But, despite that, the stocks somehow managed to close in the black, as the HUI finished up 1.17%. The price pattern in silver stocks was about the same, but they couldn't hold their gains. Nick Laird's Intraday Silver Sentiment Index closed down 0.67%. The CME's Daily Delivery Report for Monday showed that 19 gold and 10 silver contracts were posted for delivery within the Comex-approved depositories on Tuesday. The link to that activity is here. There were no reported changes in GLD yesterday, but a decent chunk of silver was deposited in SLV. This time it was 1,926,884 troy ounces. In less than a week there have been 4.34 million ounces of silver deposited in SLV. However, during the first three weeks of October, 8.52 million ounces were reported withdrawn. All of this will be accounted for when Joshua Gibbons updates the SLV bar list on his Web site on Thursday. Since yesterday was a Monday, the U.S. Mint had a sales report. They sold 2,000 troy ounces of gold eagles; 2,000 one-ounce 24K gold buffaloes; and 506,500 silver eagles. Over at the Comex-approved depositories on Friday, there was little activity in gold, as only 499 troy ounces were reported shipped out. The link to that tiny activity is here. Of course it was much busier in silver, as 600,207 troy ounces were received, and 721,390 troy ounces were shipped out the door. The link to that action is here. I noted that the CFTC has issued another Commitment of Traders Report, the second in as many days as they get caught up from the government shut down, this one for the week ending Tuesday, October 8. During that reporting week, gold surged by about fifty bucks, and silver rallied by about $1.50. The tech funds and small traders bought longs and sold short positions, which is what caused the rally; and JPMorgan et al as sellers of last resort did the opposite, and capped it before it could get very far. In silver, the Commercial net short position increased by a chunky 4,621 contracts, or 23.1 million ounces, and in gold the Commercial net short position blew out by 12,288 contracts, or 1.23 million ounces. It was the same old, same old trading pattern during that reporting week. Nothing has changed. Since today is Tuesday, I have a fairly decent number of stories for you, so I hope you can find the time for the ones that interest you. ¤ Critical ReadsIn Fed and Out, Many Now Think Inflation Helps Inflation is widely reviled as a kind of tax on modern life, but as Federal Reserve policy makers prepare to meet this week, there is growing concern inside and outside the Fed that inflation is not rising fast enough. JPMorgan Faces Possible Penalty in Madoff CaseFederal authorities are preparing to take action in a criminal investigation of JPMorgan Chase, suspecting that the bank turned a blind eye to Bernard L. Madoff’s Ponzi scheme. The Madoff case, coming on the heels of a tentative $13 billion settlement over JPMorgan’s mortgage practices, poses another major threat to the reputation of the nation’s largest bank. Reflecting the magnitude of the investigation, prosecutors and JPMorgan have held preliminary discussions about a so-called deferred prosecution agreement, people briefed on the inquiry said. Such an arrangement would suspend criminal charges against JPMorgan in exchange for a fine, certain other concessions and an acknowledgment that the bank will face charges if it fails to behave. Prosecutors may also require JPMorgan, which has repeatedly said that “all personnel acted in good faith” in the Madoff matter, to hire an independent monitor. This is another story from The New York Times...this one from last Wednesday. Jon Stewart Skewers CNBC and FOX anchors for defending JPMorgan ChaseJon lets it all hang out in this 11:20 minute youtube.com rant. You'll absolutely love it, and it will be the best 11:20 minutes of your day! It's incredible to watch these so-called news anchors prostitute themselves to JPMorgan. It's a must watch...and most of the naughty bits have been "beeped" out. I thank Ted Butler for being the first one through the door with it, as it was linked in his Saturday commentary. Detroit Pensioners Face Miserable 16 Cent on the Dollar RecoveryIf there is ever a case study about people who built up their reputation and then squandered it for first being right for all the wrong reasons, and then being wrong for the right ones, then Meredith Whitney certainly heads the list of eligible candidates. After "predicting" the great financial crisis back in 2007 by looking at some deteriorating credit trends at Citigroup, a process that many had engaged beforehand and had come to a far more dire -and just as correct - conclusion, Whitney rose to stardom for merely regurgitating a well-known meme, however since her trumpeted call was the one closest to the Lehman-Day event when it all came crashing down, it afforded her a 5 year very lucrative stint as an advisor. Said stint has now been shuttered. The main reason for the shuttering, of course, is that in 2010 she also called an imminent "muni" cataclysm, staking her reputation once again not only on what is fundamentally obvious, but locking in a time frame: 2011. Alas, this time her "timing" luck ran out and her call was dead wrong, leading people to question her abilities, and ultimately to give up on her "advisory" services altogether. Which in some ways is a shame because Whitney was and is quite correct about the municipal default tidal wave, as Detroit and ever more municipalities have shown, and the only question is the timing. It is the same kind of violent and anguished repricing that all unsecured creditors in the coming wave of heretofore "denialed" municipal bankruptcy filings will have to undergo. Starting with Detroit, where as Reuters reports, the recovery to pensioners, retirees and all other unsecured creditors will be.... 16 cents on the dollar!... or less than what Greek bondholders got in the country's latest (and certainly not final) bankruptcy. This story was posted on the Zero Hedge website late on Sunday morning EDT...and my thanks go out to Nick Giambruno, the Senior Editor over at the InternationalMan.com Internet site, for sending it our way. Jim Puplava Interviews Kyle Bass This 19-minute audio interview was posted on the financialsense.com Internet site on Saturday...and I thank U.A.E. reader Laurent-Patrick Gally for bringing it to my attention late Saturday afternoon. I listened to it on the weekend, and it's worth your while. U.S. on Spying Scandal: 'Allies Aren't Always Friends' Many commentators in the US see surveillance like the NSA's alleged tapping of Chancellor Merkel's phone as a necessary fact of life. The White House is trying to limit the damage -- but the snooping will go on. The main ones are: What did President Barack Obama know? How can the crisis of confidence in the trans-Atlantic alliance be repaired? And what will really change in the end? This article was posted on the German website spiegel.de yesterday afternoon Europe time...and it's the first contribution of the day from Roy Stephens. Appearances and Reality: Merkel Balks at E.U. Privacy PushChancellor Merkel has put on a good show of being outraged by American spying. But, at the same time, she has impeded efforts to strengthen data security. Does she really want more privacy, or is she more interested in being accepted into the exclusive group of info-sharing countries known as the 'Five Eyes' club? One particular point of clarification was especially important to Angela Merkel during the EU summit in Brussels last week. When she complained about the NSA's alleged tapping of her cellphone, the German chancellor made clear that her concern was not for herself, but for the "telephones of millions of EU citizens," whose privacy she said was compromised by US spying. Yet at a working dinner with fellow EU heads of state on Thursday, where the agenda included a proposed law to bolster data protection, Merkel's fighting spirit on behalf of the EU's citizens seemed to have dissipated. In fact, internal documents show that Germany applied the brakes when it came to speedy passage of such a reform. Although a number of EU member states -- including France, Italy and Poland -- were pushing for the creation of a Europe-wide modern data protection framework before European Parliament elections take place in May 2014, the issue ended up tabled until 2015. This short, but eye-opening article was posted on the spiegel.de website very early yesterday evening Europe time...and is worth reading. It's also courtesy of Roy Stephens. U.S. Trojan horse: NSA scandal shows Europe would be better off without BritainLike the curious incident of the dog that didn’t bark in the nighttime in the classic Sherlock Holmes story Silver Blaze, the most revealing thing about the latest NSA spying revelations which made world headlines last week was the non-barking of the UK. While leading politicians of other European countries and officers of the EU itself were keen to express their concern over the latest revelations of US spying on its allies – the President of the European Parliament Martin Schulz said that US secret services were ‘out of control’ – British Prime Minister David Cameron has only said that he thought that the EU statement on the matter was ‘good and sensible’ and that he agreed with it. German Chancellor Angela Merkel said Cameron ‘silently acquiesced” to the statement. At a press conference, Cameron refused to comment about the recent NSA revelations. The muted British reaction to what is a truly outrageous scandal, is proof, if indeed any further proof were needed, of what Britain's main role in the EU is: to act as a Trojan horse to defend and further the interests of the government of the United States of America. The great French leader Charles de Gaulle twice vetoed Britain's application to join the EEC (European Economic Community), (the forerunner to today’s EU) not because he was anti-British but because he feared that allowing Britain to join would tantamount to letting America in. In January 1963, he famously declared that allowing Britain to join would lead to a “colossal Atlantic community dependent on and led by America, which would soon absorb the European Community.” Ain't it the truth! This very excellent op-ed piece showed up on the Russia Today website yesterday morning Moscow time...and is well worth your time. But it's a must read for all students of the New Great Game. I thank South African reader Bob Visser for sharing it with us. NSA Fallout: Swiss cabinet to tighten phone securityIn the wake of revelations that the National Security Agency (NSA) spied on European politicians through their mobile phones, Swiss President Ueli Maurer has said that new phone security measures will be soon introduced for the cabinet. While Maurer did not go into detail about the new measures, telling the Schweiz am Sonntag newspaper that the details would be made public soon, he said certain safeguards had already been in place to make sure Swiss government business stayed private. This article appeared on the swissinfo.ch Internet site on Sunday...and it's the second offering in a row from Bob Visser. Swiss bankers stay home amid U.S. global tax evasion manhuntAs a US hunt for tax evaders and their accomplices gains momentum, many Swiss bankers are afraid to go abroad for fear of arrest, one business leader said. “In my opinion, some 1,000 Swiss bankers no longer dare to go to the United States, or even travel abroad,” Martin Naville, the head of the Swiss-American Chamber of Commerce, was quoted as saying by Swiss weekly Le Matin Dimanche on Sunday. Swiss banks and industry representatives are increasingly cautioning bankers who have worked with US cl | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Detroit Pensioners Face Miserable 16 Cent on the Dollar Recovery Posted: 29 Oct 2013 02:43 AM PDT If there is ever a case study about people who built up their reputation and then squandered it for first being right for all the wrong reasons, and then being wrong for the right ones, then Meredith Whitney certainly heads the list of eligible candidates. After "predicting" the great financial crisis back in 2007 by looking at some deteriorating credit trends at Citigroup, a process that many had engaged beforehand and had come to a far more dire -and just as correct - conclusion, Whitney rose to stardom for merely regurgitating a well-known meme, however since her trumpeted call was the one closest to the Lehman-Day event when it all came crashing down, it afforded her a 5 year very lucrative stint as an advisor. Said stint has now been shuttered. The main reason for the shuttering, of course, is that in 2010 she also called an imminent "muni" cataclysm, staking her reputation once again not only on what is fundamentally obvious, but locking in a time frame: 2011. Alas, this time her "timing" luck ran out and her call was dead wrong, leading people to question her abilities, and ultimately to give up on her "advisory" services altogether. Which in some ways is a shame because Whitney was and is quite correct about the municipal default tidal wave, as Detroit and ever more municipalities have shown, and the only question is the timing. It is the same kind of violent and anguished repricing that all unsecured creditors in the coming wave of heretofore "denialed" municipal bankruptcy filings will have to undergo. Starting with Detroit, where as Reuters reports, the recovery to pensioners, retirees and all other unsecured creditors will be.... 16 cents on the dollar!... or less than what Greek bondholders got in the country's latest (and certainly not final) bankruptcy. This story was posted on the Zero Hedge website late on Sunday morning EDT...and my thanks go out to Nick Giambruno, the Senior Editor over at the InternationalMan.com Internet site, for sending it our way. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Trojan horse: NSA scandal shows Europe would be better off without Britain Posted: 29 Oct 2013 02:43 AM PDT Like the curious incident of the dog that didn’t bark in the nighttime in the classic Sherlock Holmes story Silver Blaze, the most revealing thing about the latest NSA spying revelations which made world headlines last week was the non-barking of the UK. While leading politicians of other European countries and officers of the EU itself were keen to express their concern over the latest revelations of US spying on its allies – the President of the European Parliament Martin Schulz said that US secret services were ‘out of control’ – British Prime Minister David Cameron has only said that he thought that the EU statement on the matter was ‘good and sensible’ and that he agreed with it. German Chancellor Angela Merkel said Cameron ‘silently acquiesced” to the statement. At a press conference, Cameron refused to comment about the recent NSA revelations. The muted British reaction to what is a truly outrageous scandal, is proof, if indeed any further proof were needed, of what Britain's main role in the EU is: to act as a Trojan horse to defend and further the interests of the government of the United States of America. The great French leader Charles de Gaulle twice vetoed Britain's application to join the EEC (European Economic Community), (the forerunner to today’s EU) not because he was anti-British but because he feared that allowing Britain to join would tantamount to letting America in. In January 1963, he famously declared that allowing Britain to join would lead to a “colossal Atlantic community dependent on and led by America, which would soon absorb the European Community.” Ain't it the truth! This very excellent op-ed piece showed up on the Russia Today website yesterday morning Moscow time...and is well worth your time. But it's a must read for all students of the New Great Game. I thank South African reader Bob Visser for sharing it with us. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The beginning of the end for the 'petrodollar'? Posted: 29 Oct 2013 02:43 AM PDT The US dollar owes its privileged status in the global financial system to the Persian Gulf oil producers who sell their oil for dollars and then "recycle" the proceeds by buying US Treasury bonds. Economists coined a special term for the money involved in this scheme: "petrodollars." The latest developments in the Middle East signal that the era of "petrodollars" may be coming to an end. Numerous reports point out that Saudi Arabia has been one of the main forces pushing the US for a military intervention in Syria. Prince Bandar bin Sultan, the chief or Saudi intelligence, has offered to pay Washington for all expenses incurred during the intervention and some reports claim that he has threatened Vladimir Putin with terror attacks if Russia doesn't give up supporting Bashar al-Assad. After the plans for the intervention failed, the Saudis made considerable efforts to show Washington their anger and disappointment. The Daily Mail reports that "upset at President Barack Obama's policies on Iran and Syria, members of Saudi Arabia's ruling family are threatening a rift with the United States that could take the alliance between Washington and the kingdom to its lowest point in years. Saudi Arabia's intelligence chief is vowing that the kingdom will make a 'major shift' in relations with the United States to protest perceived American inaction over Syria's civil war as well as recent U.S. overtures to Iran, a source close to Saudi policy said on Tuesday." This short article was posted on the voiceofrussia.com Internet site on Sunday afternoon Moscow time...and I found it in a GATA release yesterday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Should the Sultanate drop rial peg to dollar? Posted: 29 Oct 2013 02:43 AM PDT The rial peg to the dollar was a sensible decision taken four decades ago as the United States was driving the global economy but its floundering finances and internal political bickering is forcing the once mighty nation to lose its grip on the treasury. This short article was posted on the Times of Oman website early Sunday morning local time...and is another story I found embedded in a GATA release yesterday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BIS sees risk of 1998-style Asian crisis as Chinese dollar debt soars Posted: 29 Oct 2013 02:43 AM PDT Foreign loans to companies and banks in China have tripled over the last five years to almost $900bn and may now be large enough to set off financial tremors in the West, and above all Britain, the world’s banking watchdog has warned. “Dollar and foreign currency loans have been growing very rapidly,” said the Bank for International Settlements in a new report. “They have more than tripled in four years, rising from $270 billion to a conservatively estimated $880 billion in March 2013. Foreign currency credit may give rise to substantial financial stability risks associated with dollar funding,” it said. China’s reserve body SAFE said 81pc of foreign debt under its supervision is in dollars, 6pc in euros, and 6pc in yen. This is the second commentary in a row from Ambrose Evans-Pritchard. It was posted on The Telegraph's website late on Sunday evening BST...and it's certainly worth reading if you have the time. My thanks to Roy Stephens once again. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nine King World News Blogs/Audio Interviews Posted: 29 Oct 2013 02:43 AM PDT 1. Robert Fitzwilson: "U.S. Collapse to Make Weimar Germany Look Like Child's Play". 2. James Turk: "40-Year Market Veteran Says Gold and Silver Will Super-Charge". 3. Eric Sprott: "Historic End Game - "A Collapse to End All Collapses"". 4. William Kaye: "LBMA Collapse, Gold and the Greatest Short Squeeze in History". 5. KWN Commentary: "Two Scary Charts That Issue a Dire Warning For Investors". 6. Dr. Paul Craig Roberts: "Former U.S. Treasury Official - America's Ultimate Collapse". 7. Michael Pento: "The United States is Now Set Up For a Devastating Crash". 8. The first audio interview is with Dr. Paul Craig Roberts...and the second audio interview is with Andrew Maguire/Eric Sprott". [Please direct any questions or comments about what is said in these interviews by either Eric King or his guests, to them, and not to me. Thank you. - Ed] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| With more exports, Indian gold traders drive up domestic prices Posted: 29 Oct 2013 02:43 AM PDT Gold traders and some big exporters seem to have come up together to form a cartel to keep domestic market gold prices artificially higher. They ensure this by diverting more gold for exports and domestic market continue to starve of gold amidst control on imports. This has resulted in premiums for physical delivery of yellow metal quoting as high as $100 per ounce which works out to Rs.1800-2000 per 10 gram. While spot gold is quoting at $1350 per ounce in international market, in Indian market gold including taxes is sold at around $1600 per ounce. Premiums so charged are taken by the bullion dealer who sells gold and importing banks. The premium a month ago was around $40 per ounce. The premiums are calculated over landed cost of imports. Industry sources said that in last two quarters, exports of gold jewellery in quantity has been in the range of 35-40 tons per quarter. However, in last quarter that is in July to September quarter official imports of gold was 62 tons. If out of this 35 tons is the exports. “At a time when gold imports are drying up, diverting it only for exports will aggravate the situation further,” said a Mumbai based jeweler. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Egon von Greyerz: Hyperinflation and Gold's parabolic rise Posted: 29 Oct 2013 02:43 AM PDT There is a ridiculous amount of time spent on what the Fed will do or won’t do or analysing the latest economic figures. Very few people use their own brain to figure out the obvious. And the obvious is that debt which has been growing exponentially in the last 40 years, started its parabolic phase in 2006 when Bernanke became chairman of the Fed. So we don’t have to ask what central banks will do. Because it is guaranteed that they will soon start unlimited money printing to complete the debt parabola. That means we are now starting the hyperinflationary phase in the USA and many other countries. And this will all start in 2014. What will be the trigger? The answer is simple – the fall of the US dollar. Hyperinflation is a currency event. It does not arise as a result of increase in demand but as the inevitable consequence of a collapsing currency. When a country for an extended period lives above its means and prints money which it can never pay back, the rest of the world will punish the country and its currency. It took the US over 200 years to reach a debt of US$8 trillion. Since Bernanke became chairman of the Fed in 2006, US debt has more than doubled to $17 trillion. That is an incredible ‘achievement’ and the beginning of the parabolic rise of US debt not by tens of trillions but by 100 of trillions of dollars. This is no different to the Weimar Republic or Zimbabwe and a completely natural consequence of what is happening now. This commentary was posted on the goldswitzerland.com Internet site on Sunday...and it's definitely worth reading. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| In London's Financial Times, John Dizard notes potential strain on paper gold Posted: 29 Oct 2013 02:43 AM PDT Something is unsettling the animals in the forest of the gold market. Usually there is a chorus of chirrups and squeaks that are significant, momentarily, for one species or another, such as a few cents of arbitrage between Zurich and London, or a dollar-an-ounce rise in India caused by a dealer's near insolvency. Then the noise settles down to the murmur of wind through the trees However, the continuing high level of premiums for physical gold over the kinds you can trade on a screen suggests that the next move in the major gold indices or the various exchange traded funds could be discontinuous and dramatic. It would be much better for the financial world if gold were just bumping along, with only enough volatility and liquidity to keep a few dealers' lights on. That would mean electronic or paper assets have retained their essential credibility with the public. Taken together, this collection of persistent microeconomic signals [I spoke of in gold] could flag macro trouble to come. These noises worried me in August. They worry me more now. This must read commentary by John Dizard in the FT last Friday was posted in the clear over at the gata.org Internet site on Saturday. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mike Kosares: Screen-traded fiat gold could get violent wake-up call Posted: 29 Oct 2013 02:43 AM PDT “This could turn into a very violent wake-up call for [screen-traded gold]. People talk about ‘fiat currencies’, but we also have ‘fiat gold.’ Volatility is too cheap right now.” — Gold refiner quoted by John Dizard in his Financial Times column this weekend. John Dizard’s column in this weekend’s Financial Times explores the unsettling developments in the physical gold market and what problems they might impose on the paper gold market. Though the column itself is a very positive one for gold’s prospects, it runs under a negative headline that has little to do with the content: Cry of negative gofo heralds trouble for gold. The words “paper traders” should have been added to end of the headline, because that is clearly the point Dizard is making. One more point of interest before I put this piece of the China analysis to rest: HSBC, the multinational bank headquartered in London, is the chief storage facility for the largest gold ETFs. As mentioned in my previous article, much of the gold transferred to Switzerland by HSBC came out of the ETFs. In addition, HSBC is an important trading member in the daily London Gold Market Fixings. Founded by Sir Thomas Sutherland in the British colony of Hong Kong in 1865, HSBC stands for the Hong Kong Shanghai Banking Corporation. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar Attempting Recovery as SPX 500 Keeps Pushing Higher Posted: 29 Oct 2013 02:40 AM PDT dailyfx | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold: When Will It Crash Again? Posted: 29 Oct 2013 02:40 AM PDT seekingalpha | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Technical Trading: Minor Daily Uptrend Seen For Comex Gold Futures Posted: 29 Oct 2013 02:40 AM PDT forbes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver technical analysis: XAU/USD and XAG/USD below last week’s highs Posted: 29 Oct 2013 02:40 AM PDT invezz | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICAL Gold Upside Momentum Slowing above 1350 Posted: 29 Oct 2013 02:40 AM PDT dailyfx | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 29 Oct 2013 12:00 AM PDT The Silver GoldSpot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment