Gold World News Flash |

- So much for China concerns

- Williams, Fitzpatrick, Ing interviewed by King World News

- 3 Fantastic Charts Showing Gold & Silver To Continue Surge

- While Bernanke May Not Understand Gold, It Seems Gold Certainly Understands Bernanke

- The Ongoing War In The Gold Market Continues To Rage

- TIME TO SIT ON THE SIDELINES

- Media Gets It Wrong — Debt Ceiling Suspended (Permanently), Not Raised

- Central banks drop tightening talk as easy money goes on

- US Dollar Valued In Gold Since 1718

- A Giant I Told You So!

- John Manfreda - Gold Manipulation Is Over?

- A Tale of Two Charts: Are We 2007 America or 2006 Zimbabwe?

- Guest Post: The Growing Rift With Saudi Arabia Threatens To Severely Damage The Petrodollar

- Gold in India Sells for $100 or More Over Spot on Black Market (If You Can Find It)

- Head Of Fortress Recommends Investing In Bitcoin

- While Bernanke May Not Understand Gold, It Seems Gold Certainly Understands Bernanke

- Guest Post: Buying Stocks On Margin At The Top - They Never Learn

- Gold Prices Still Dependent On The US Dollar

- Silver and Gold Prices Rose with the Gold Price Closing at $1,350.20

- Silver and Gold Prices Rose with the Gold Price Closing at $1,350.20

- Are Gold Advocates Gold Bulls at Any Price?

- 3 Fantastic Charts Showing Gold & Silver To Continue Surge

- Gold Daily and Silver Weekly Charts - Straining at the Leash

- Gold Daily and Silver Weekly Charts - Straining at the Leash

- World Gold Council responds to Sprott's criticism of demand data

- US Dollar Valued In Gold Since 1718

- TF Metals Report: More deception at the Comex

- Technicians Turn "Gold Bulls" as SocGen's Edwards Warns of "Financial Bubbles"

- U.S. Hyperinflation and Cultural Insanity

- Staggering Physical Gold Demand Now Overrunning Shorts

- 2014: The Year the Chickens Come Home to Roost

- Cybersecurity: The NSA’s Big Budget Action Movie

- The Markets Are Rigged! How to Opt Out and Still Profit

- BofA/Merrill Lynch Turns Bullish On Gold

- Gold climbs over 1% after China manufacturing data

- The Daily Market Report

- Gold Stocks Continue Bottoming Pattern

- Gold Prices Still Dependent On The US Dollar

- Here Is The Surprising Reason Gold Is Soaring Again Today

- Gold Markets Are Not Efficient, Don't Reflect Fundamentals and Understate Gold's Market Value - Part V

- Why $110 is Like Kryptonite for the Oil Price

- Gold Stocks Continue Bottoming Pattern

- Gold jumps to new 5-week high of 1348.91 as dollar slumps to nearly 2-yr lows against euro. DX at 8-mo lows, threatening 79.00 level.

- The Investment Hidden By Layers of Chinese Smog

- Gold Analysts "Turn Bullish" as "Financial Bubble Signs Abound" Says SocGen, China's Money-Market Rates Jump

- Gold higher at 1348.00 (+16.10). Silver 22.76 (+0.213). Dollar slides. Euro higher. Stocks called higher. US 10yr 2.49 (-2 bps).

- Measured Against Gold, US Dollar Purchasing Power Drops By 99.9%

- Buying Gold as a Mouthguard

- Money Printing: Not What It Was

- Oversold Gold Does The Trick, Bulls Get The Treat

| Posted: 25 Oct 2013 12:30 AM PDT from Dan Norcini:

Talk about a change in sentiment in one day! Today the tone was set by more abysmal economic data coming out of the US. Factory activity showed the slowest gains in a year. |

| Williams, Fitzpatrick, Ing interviewed by King World News Posted: 24 Oct 2013 11:57 PM PDT 2p ICT Friday, October 25, 2013 Dear Friend of GATA and Gold: King World News today has gold-related interviews with Singapore fund manager Grant Williams -- http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/25_T... -- Citigroup analyst Tom Fitzpatrick -- http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/24_3... -- and Canadian market analyst John Ing: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/24_S... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| 3 Fantastic Charts Showing Gold & Silver To Continue Surge Posted: 24 Oct 2013 11:00 PM PDT from KingWorldNews:

It is already setting up a double-bottom which targets $24.40 and an overshoot of that area could take Silver towards $26 in the near-term. |

| While Bernanke May Not Understand Gold, It Seems Gold Certainly Understands Bernanke Posted: 24 Oct 2013 10:30 PM PDT from Zero Hedge:

Via UBS, In testimony in front of the Senate banking committee in July, Ben Bernanke made an unusual comment; ‘nobody really understands gold prices and I don't pretend to understand them either’. That’s a surprising admission, because, as head of the central bank that controls the word’s reserve currency, we think Bernanke should understand gold. Because gold, in our view, is a critical barometer of the state of global credit. Many clients have asked us whether gold is an inflation hedge. The chart below suggests not. |

| The Ongoing War In The Gold Market Continues To Rage Posted: 24 Oct 2013 10:29 PM PDT  Today one of the most highly respected fund managers in Singapore spoke with King World News about the ongoing war in the gold market which continues to rage. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, noted, "I think the Goldman Sachs 'Slam Dunk' sell call on gold was a crazy one at the time, and the subsequent price action in gold has left them with egg on their face." Williams also spoke about what to expect going forward in this timely and powerful interview below. Today one of the most highly respected fund managers in Singapore spoke with King World News about the ongoing war in the gold market which continues to rage. Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, noted, "I think the Goldman Sachs 'Slam Dunk' sell call on gold was a crazy one at the time, and the subsequent price action in gold has left them with egg on their face." Williams also spoke about what to expect going forward in this timely and powerful interview below.This posting includes an audio/video/photo media file: Download Now |

| Posted: 24 Oct 2013 10:07 PM PDT Stocks: My best guess continues to be that stocks will extend this consolidation on Friday and then deliver one more push higher into the FOMC meeting next week. I expect the Fed will confirm no tapering which will likely trigger a big rally and probably reversal as smart money traders sell into the emotional move. Barring an immediate Fed intervention, that should give us the drop down into the half cycle low. Dollar: We should be coming down to the final few days in this yearly cycle decline. As you can see in the following chart the dollar is rapidly approaching that major support zone we talked about between 78.90 and 78.60. Most bear markets will make one final test of the 200 day moving average before really starting to accelerate to the downside. I think this is probably what is in store for the dollar index over the next 4 to 6 weeks. A final counter trend move back up to test the underside of the 200 day moving average along with a resurgence of taper talk as traders try to rationalize some reason for the rally. Gold: I'm going to start off today by revisiting the one-year gold chart. As I have noted on the chart, there are several key levels where we saw blatant manipulation in the gold market. Back in late May and early June gold was clearly capped at the $1425 level to set up the final June crash. Not surprisingly this intermediate rally was also capped at that exact same level even though the dollar still had a long way to fall in its intermediate cycle low. The next blatant manipulation came almost immediately after the September FOMC meeting where it was confirmed that tapering was off the table for the rest of this year. With the dollar rapidly approaching an YCL, and gold chewing through a lot of days in this daily cycle I suspect we are going to see a concerted effort made to hold gold at or below that FOMC top over the next week. If one is holding long positions I think that is the level where I would sell. If it does continue, then great, it will confirm an intermediate cycle bottom occurred at $1250. But the buy point will still be at the next daily cycle low, which will likely be at about the same level as we're at today. I know it's hard for many people to sit on the sidelines, but there are times when that is the correct investment strategy. I suspect more money has been lost in the markets due to impatience than just anything else. With the multiple threats of the $1375 manipulation level, and impending dollar rally hanging over this market, I think it's important to not let emotions force one to make a mistake that one logically knows doesn't have to be made at this point. This market isn't going to runaway from us. Runaway moves occur during a third or fourth daily cycle, not a first. Sentiment is still too depressed during a first daily cycle to generate a runaway type move. And after the kind of bear market we've seen, the bears aren't going to roll over and die easily. They most certainly aren't ready to give up yet. I expect they are going to return in force at the $1375 level while at the same time a lot of savvy longs are going to take profit at that level. |

| Media Gets It Wrong — Debt Ceiling Suspended (Permanently), Not Raised Posted: 24 Oct 2013 10:00 PM PDT from Wealth Cycles:

1: A common misperception, which mainstream media editors carefully present (read any debt ceiling article over the past four weeks), and gold commentators quickly parrot, is that "the debt ceiling is raised." This is untrue. The debt ceiling is suspended, in our view, permanently. Those who understand U.S. legislative procedure are acquiring gold, and this is why monetary metals prices jumped one day after Credit Suisse's Tom Kendall opined that "when you've got other asset classes, equities in particular, doing so well, then it's hard to divert investments out of them and into something like gold, which is falling." So far Signal's Strong That Metals Bottom Is Here has proven out a grand opportunity for accumulation of precious metals and getting rid of excess dollar exposures, gold never returning near the dollar’s high, at $1,180 per troy ounce. |

| Central banks drop tightening talk as easy money goes on Posted: 24 Oct 2013 09:40 PM PDT By Simon Kennedy and Jeff Kearns http://www.bloomberg.com/news/2013-10-23/central-banks-drop-tightening-t... The era of easy money is shaping up to keep going into 2014. The Bank of Canada's dropping of language about the need for future interest-rate increases and today's decisions by central banks in Norway, Sweden, and the Philippines to leave their rates on hold unite them with counterparts in reinforcing rather than retracting loose monetary policy. The Federal Reserve delayed a pullback in asset purchases, while emerging markets from Hungary to Chile cut borrowing costs in the past two months. "We are at the cusp of another round of global monetary easing," said Joachim Fels, co-chief global economist at Morgan Stanley in London. ... Dispatch continues below ... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Policy makers are reacting to another cooling of global growth, led this time by weakening in developing nations while inflation and job growth remain stagnant in much of the industrial world. The risk is that continued stimulus will inflate asset bubbles central bankers will have to deal with later. Already talk of unsustainable home-price increases is spreading from Germany to New Zealand, while the MSCI World Index of developed-world stock markets is near its highest level since 2007. "We are undoubtedly seeing these central bankers go wild," said Richard Gilhooly, an interest-rate strategist at TD Securities Inc. in New York. They "are just pumping liquidity hand over fist and promising to keep rates down. It's not normal." Normal or not, that's been the environment now for five years after monetary authorities fought to protect the world economy from deflation and to hasten its recovery. In the advanced world, central banks drove interest rates close to zero and ballooned their balance sheets beyond $20 trillion through repeated rounds of bond purchases, a policy known as quantitative easing. The economic payoff has been limited. The International Monetary Fund this month lopped its forecast for global economic growth to 2.9 percent in 2013 and 3.6 percent in 2014, from July's projected rates of 3.1 percent this year and 3.8 percent next year. It also sees inflation across rich countries already short of the 2 percent rate favored by most central banks. Central bankers are on guard to keep low inflation from turning into deflation, a broad-based decline in prices that leads households to hold off purchases and companies to postpone investment and hiring. "There is a concern at central banks that what we're seeing is another false start in their economies," said Michala Marcussen, global head of economics at Societe Generale SA in London. "We now need to see two to three months of better numbers before they're willing to contemplate an exit again." After flirting for months with the idea of curtailing stimulus, the Fed said in September it would continue purchasing $85 billion of bonds a month, citing the need to see more evidence that the U.S. economy will improve. That came less than two weeks before a 16-day U.S. government shutdown that postponed releases of key data the Fed is relying on to guide its policy decisions. The Fed's strategy also took a hit from this week's news that employers added fewer workers to payrolls than projected in September. The Fed will wait until March before slowing the pace of its third round of quantitative easing, according to the median estimate of economists in an Oct. 17-18 Bloomberg survey. "If you look at where we are economically versus where we were a year ago, we're virtually in the exact same place," Gary D. Cohn, president of Goldman Sachs Group Inc., said yesterday in a Bloomberg Television interview with Stephanie Ruhle. "So if quantitative easing made sense a year ago, it probably still makes sense today." That leaves central banks elsewhere likely to maintain a bias toward easing. Moving to tighten before the Fed is ready to do so would drive up currencies against the dollar, to the detriment of exports, said Derek Holt, vice president of economics at Bank of Nova Scotia in Toronto. The Bank of Canada, citing "uncertain global and domestic economic conditions," yesterday omitted language it used in previous decisions referring to the expected "gradual normalization" of its benchmark rate, now at 1 percent. The Riksbank kept its rate at 1 percent today and said it sees it at 1.15 percent in the fourth quarter next year, versus 1.25 percent in September. "The repo rate needs to remain at this low level until economic activity is stronger and inflation rises," it said. Norway left its benchmark rate at 1.5 percent today, a month after signaling it will move toward tighter policy as house prices and consumer debt hover at record levels. The Philippines also held its rate at a record low 3.5 percent to support Southeast Asia's fastest growing economy as inflation stays within the central bank's targeted range. "There's an easy-money bias across global central banks that probably will persist until about March or April," said Holt. "The Fed's decisions complicated the exit strategies for a lot of central banks." If the Fed's delay extends the decline in the dollar, then the Bank of Japan and the European Central Bank also are more likely to add fresh stimulus, Fels said in an Oct. 20 report. The ECB is likely to offer banks another round of cheap, long-term loans in the first quarter, while the BOJ may ease more to offset a 2014 consumption tax increase, Citigroup Inc. economists said in a report yesterday. The dollar has declined 1.1 percent against a basket of 10 leading global currencies in the last month, according to the Bloomberg U.S. dollar index. Some central banks in emerging markets are already acting. Chile unexpectedly lowered its benchmark rate by a quarter point to 4.75 percent on Oct. 17, pointing to weaker growth, inflation and the global outlook. Israel surprised analysts on Sept. 23 when it cut its key rate a quarter point to 1 percent, the lowest in almost four years. "With the dollar much weaker in recent days and weeks, you'll see central banks that were reluctant to ease start to do that now," said Thierry Wizman, global interest rates and currencies strategist at Macquarie Group Ltd. in New York. "They can be less worried about capital flight if the Fed isn't tightening policy, and the strength in their currencies is probably imparting some disinflation into their economies, giving them a window to cut rates." Hungary, Latvia, Romania, Serbia, Sri Lanka, Egypt, and Mexico have also eased since the start of September although Indonesia, Pakistan, Uganda, and India tightened, with the latter softening the blow by relaxing liquidity curbs in the banking system at the same time. Chinese policy makers have also been draining cash from the financial system. Even those central banks with limited room to act are using so-called forward guidance to deter investors from betting on an imminent increase in rates. The ECB vows to keep its main rate at 0.5 percent for an "extended period" and the Bank of England is pledging to maintain its benchmark at the same level at least until unemployment falls to 7 percent, which it doesn't expect to happen for three years. The Bank of Japan is trying to expand its monetary base by 60 trillion to 70 trillion yen ($720 billion) to bring inflation up to 2 percent. The Fed also depends on forward guidance as a policy tool. Officials have repeated in every policy statement since December that their target interest rate will remain near zero "at least as long as" unemployment exceeds 6.5 percent, so long as the outlook for inflation is no higher than 2.5 percent. "It's hard to look around and see much changing on the rate front," said David Hensley, director of global economic coordination at JPMorgan Chase & Co. in New York, who forecasts the average interest rate in developed economies to hold close to the current 0.40 percent for another year. The cheap cash may come at a price that policy makers will have to pay later if it inflates asset bubbles. Germany's Bundesbank said this week that apartments in the country's largest cities may be overvalued by as much as 20 percent. In the U.K., Band of England officials are rebutting suggestions of a housing bubble. Asking prices in London jumped 10.2 percent in October from the prior month, Rightmove Plc said Oct. 21. Bank of England Governor Mark Carney today unveiled a revamp of the central bank's money-market operations to widen access and cut the cost of liquidity insurance to the financial system. The BOE will expand the range of collateral it accepts in its facilities and offer money for longer periods on cheaper terms, Carney said in a speech in London. Swedish and Norwegian property markets are also proving a concern to their central bankers, and policy makers in New Zealand and Singapore have already sought to cool demand. Meantime, U.S. stocks are heading toward the best year in a decade with about $4 trillion added to U.S. share values this year. "The bubble conditions are going to remain in place," Michael Ingram, a market strategist at BGC Partners LP in London, told Bloomberg Radio's Bob Moon yesterday. "We could well see further stimulus." For now, such concerns are being overridden by a need to enhance economic expansion. The U.S. unemployment rate, at 7.2 percent in September, is still only the lowest since November 2008 and joblessness is 12 percent in the 17-nation euro area. "Whatever their official mandates, central bankers are supposed to safeguard a nation's real income," Karen Ward, senior global economist at HSBC Holdings Plc in London, said in an Oct. 21 report. Labor markets from the U.S. to U.K. suggest "we shouldn't fear a rapid withdrawal of global liquidity any time soon.' Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| US Dollar Valued In Gold Since 1718 Posted: 24 Oct 2013 09:00 PM PDT Le Cafe Américain |

| Posted: 24 Oct 2013 08:00 PM PDT by Kerry Lutz, FinancialSurvivalNetwork.com:

It's what will happen next that needs your immediate attention and concern. If this were a normal situation and a normal administration, the program would be scrapped and/or delayed. Since it's not, you must prepare for utter chaos and a complete healthcare meltdown. |

| John Manfreda - Gold Manipulation Is Over? Posted: 24 Oct 2013 07:29 PM PDT John Manfreda, via Wall St For Main St, discusses: (1) How he believes that Gold Manipulation may be over (2) How the oil market may be rigged and sees oil around 95 (3) His views on Nat gas... [[ This is a content summary only. Visit http://goldbasics.blogspot.com or http://www.newsbooze.com or http://www.figanews.com for full links, other content, and more! ]] |

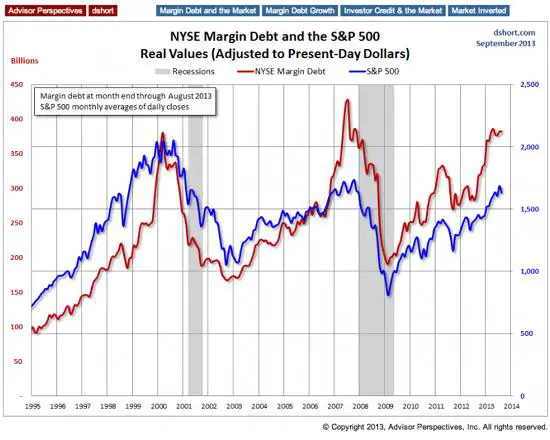

| A Tale of Two Charts: Are We 2007 America or 2006 Zimbabwe? Posted: 24 Oct 2013 07:11 PM PDT The US equity markets are back in record territory, at least in nominal terms. The last two times they spiked this way, the following year was pretty brutal. See the next chart, which tracks the S&P 500 and margin debt, the amount of money investors are borrowing against their shares of stock to buy more stock. The chart seems to show that when investors are optimistic enough to use leverage to invest in already-risky stocks, then the good times have pretty much run their course and something nasty is imminent. If recent history is our guide, it is now time to either take some money off the table or short the hell out of the big indexes – or whatever else you like to do when the market looks overbought. But this conclusion is only valid if we're in the same stage of the credit bubble as during those two previous sentiment peaks. In 2000 and 2007, to take just one measure of financial stability, the federal government's debt was $6 trillion and $8 trillion, respectively, versus $17 trillion today. Plenty of other leverage metrics are also way up, indicating that the US is much further down the path of currency debasement than it was just a few years ago. So the question becomes: at what point does a quantitative difference become qualitative? When does the phase change occur? The next chart shows why this question is more than academic. In the early stages of Zimbabwe's epic hyperinflation its stock market rose from 2,000 to over 40,000 in one year. Presumably a lot of indicators similar to margin debt were by then pointing to a blow-off top and screaming "sell" to students of history. Then the market proceeded to run up to 4,000,000. What happened? The country ran its printing press flat-out and inflated away its currency, so the price of pretty much every tangible asset, when measured in Zimbabwean dollars, went parabolic. Since equities represent part ownership of companies, and most non-financial companies own tangible assets, their value went up as well. Not enough to increase in real terms (versus gold, for instance) but enough to make shorting that market a really bad idea. So are we 2007 America or 2006 Zimbabwe? A lot is riding on the answer. |

| Guest Post: The Growing Rift With Saudi Arabia Threatens To Severely Damage The Petrodollar Posted: 24 Oct 2013 05:25 PM PDT Submitted by Michael Snyder of The Economic Collapse blog, The number one American export is U.S. dollars. It is paper currency that is backed up by absolutely nothing, but the rest of the world has been using it to trade with one another and so there is tremendous global demand for our dollars. The linchpin of this system is the petrodollar. For decades, if you have wanted to buy oil virtually anywhere in the world you have had to do so with U.S. dollars. But if one of the biggest oil exporters on the planet, such as Saudi Arabia, decided to start accepting other currencies as payment for oil, the petrodollar monopoly would disintegrate very rapidly. For years, everyone assumed that nothing like that would happen any time soon, but now Saudi officials are warning of a "major shift" in relations with the United States. In fact, the Saudis are so upset at the Obama administration that "all options" are reportedly "on the table". If it gets to the point where the Saudis decide to make a major move away from the petrodollar monopoly, it will be absolutely catastrophic for the U.S. economy. The biggest reason why having good relations with Saudi Arabia is so important to the United States is because the petrodollar monopoly will not work without them. For decades, Washington D.C. has gone to extraordinary lengths to keep the Saudis happy. But now the Saudis are becoming increasingly frustrated that the U.S. military is not being used to fight their wars for them. The following is from a recent Daily Mail report...

Saudi Arabia desperately wants the U.S. military to intervene in the Syrian civil war on the side of the "rebels". This has not happened yet, and the Saudis are very upset about that. Of course the Saudis could always go and fight their own war, but that is not the way that the Saudis do things. So since the Saudis are not getting their way, they are threatening to punish the U.S. for their inaction. According to Reuters, the Saudis are saying that "all options are on the table now"...

Sadly, most Americans have absolutely no idea how important all of this is. If the Saudis break the petrodollar monopoly, it would severely damage the U.S. economy. For those that do not fully understand the importance of the petrodollar, the following is a good summary of how the petrodollar works from an article by Christopher Doran...

This arrangement works out very well for the United States because we can wildly print money and run up gigantic amounts of debt and the rest of the world gobbles it all up. In 2012, the United States ran a trade deficit of about $540,000,000,000 with the rest of the planet. In other words, about half a trillion more dollars left the country than came into the country. These dollars represent the number one "product" that the U.S. exports. We make dollars and exchange them for the things that we need. Major exporting countries (such as Saudi Arabia) take many of those dollars and "invest" them in our debt at ultra-low interest rates. It is this system that makes our massively inflated standard of living possible. When this system ends, the era of cheap imports and super low interest rates will be over and the "adjustment" to our standard of living will be excruciatingly painful. And without a doubt, the day is rapidly approaching when the petrodollar monopoly will end. Today, Russia is the number one exporter of oil in the world. China is now the number one importer of oil in the world, and at this point they are actually importing more oil from Saudi Arabia than the United States is. So why should Russia, China and virtually everyone else continue to be forced to use U.S. dollars to trade oil? That is a very good question. In fact, China has been making a whole lot of noise recently about the fact that it is time to start becoming less dependent on the U.S. dollar. The following comes from a recent CNBC article authored by Michael Pento...

For much more on all of this, please see my previous article entitled "9 Signs That China Is Making A Move Against The U.S. Dollar". But you very rarely hear anything about this on the evening news, and most Americans do not understand these things at all. The fact that the U.S. produces the de facto reserve currency of the planet is an absolutely massive advantage for us. According to John Mauldin, this advantage allows us to consume far more wealth than we actually produce...

And as Mauldin went on to explain in that same article, a significant amount of the money that we ship out to the rest of the globe ends up getting reinvested in U.S. government debt...

Unfortunately, this system only works if the rest of the planet has faith in it, and right now the United States is systematically destroying the faith that the rest of the world has in our financial system. One way that this is being done is by our reckless accumulation of debt. The U.S. national debt is now 37 times larger than it was 40 years ago, and we are on pace to accumulate more new debt under the 8 years of the Obama administration than we did under all of the other presidents in U.S. history combined. The rest of the world is watching this and they are beginning to wonder if we are going to be able to pay them back the money that we owe them. Quantitative easing is another factor that is severely damaging worldwide faith in the U.S. financial system. The rest of the globe is watching as the Federal Reserve wildly prints up money and monetizes our debt. They are beginning to wonder why they should continue to loan us gobs of money at super low interest rates when we are beginning to resemble the Weimar Republic. The long-term damage that we are doing to the "U.S. brand" far, far outweighs any short-term benefits of quantitative easing. And as Richard Koo has brilliantly demonstrated, quantitative easing is going to cause long-term interest rates to eventually rise much higher than they normally should have. What all of this means is that the U.S. government and the Federal Reserve are systematically destroying the financial system that has enabled us to enjoy such a high standard of living for the past several decades. Yes, the U.S. economy is not doing well at the moment, but we haven't seen anything yet. When the monopoly of the petrodollar is broken, it is going to be absolutely devastating. And as I wrote about the other day, when the next great economic crisis strikes it is going to pull back the curtain and reveal the rot and decay that have been eating away at the social fabric of America for a very long time. Just check out what happened in Detroit recently. The new police chief was almost carjacked while he was sitting in a clearly marked police vehicle...

Isn't that crazy? These days, the criminals are not even afraid to go after the police while they are sitting in their own vehicles. And this is just the beginning. Things are going to get much, much worse than this. So let us hope that this period of relative stability that we are enjoying right now will last for as long as possible. The times ahead are going to be extremely challenging, and I hope that you are getting ready for them. |

| Gold in India Sells for $100 or More Over Spot on Black Market (If You Can Find It) Posted: 24 Oct 2013 05:00 PM PDT Global Economic Analysis |

| Head Of Fortress Recommends Investing In Bitcoin Posted: 24 Oct 2013 04:51 PM PDT At first glance, when the CIO of Fortress Investment Group says:

One might think, the firm that manages $54.6 billion is advocating the end of the USD as we know it... Or is this more muppetry at work?

However, color us a little skeptical at his advice... Given that Bitcoin may ultimately make firms like Fortress - that rely on fiat specie - redundant, then doesn't the endorsement of Bitcoin by one of the world's largest Private Equity firms reek of the ultimate failure of BTC as a monetary construct, and seem much more to be merely an attempt by the firm to herd even more momentum chasers into a trade (ostensibly one for Novogratz P.A.) that will be then unwound with Bitcoins ultimately converted into the same dollar they are supposed to replace? |

| While Bernanke May Not Understand Gold, It Seems Gold Certainly Understands Bernanke Posted: 24 Oct 2013 04:11 PM PDT "We see upside surprise risks on gold and silver in the years ahead," is how UBS commodity strategy team begins a deep dive into a multi-factor valuation perspective of the precious metals. The key to their expectation, intriguingly, that new regulation will put substantial pressure on banks to deleverage – raising the onus on the Fed to reflate much harder in 2014 than markets are pricing in. In this view UBS commodity team is also more cautious on US macro...

Via UBS, In testimony in front of the Senate banking committee in July, Ben Bernanke made an unusual comment; 'nobody really understands gold prices and I don’t pretend to understand them either'. That's a surprising admission, because, as head of the central bank that controls the word's reserve currency, we think Bernanke should understand gold. Because gold, in our view, is a critical barometer of the state of global credit. Many clients have asked us whether gold is an inflation hedge. The chart below suggests not.

But we believe that gold is in fact an inflation hedge - but the inflation it is hedging is not inflation as most people commonly understand it. Friedrich Hayek said that inflation is not a change in the consumer price index, it is an increase in money and credit. To this he added near money - any asset that could be quickly and easily swapped for traditional money or credit. (For ease of writing - I'll refer to money, near money and credit combined as 'credit'). For Hayek, neutral inflation was when credit expanded in line with the productive potential of the economy. Whether Hayek's inflation leads to traditional CPI inflation depends on the nature of the economy. If it is sclerotic - bound up by unions, capital controls and excessive state spending as it was in the 1970s - then you get CPI inflation. In a globalised world characterised by industrial overcapacity in China, a large global under-utilised workforce, and exceptionally low rates, the impact is asset price inflation. Hayek had a lot to say about an environment where 'inflation' or credit expanded too fast and asset prices rose. He argued that it accelerated growth, because there was a large incentive for companies that service or build assets (from estate agents and investment banks, to property developers) to expand, to build, and to transact more asset sales. Hayek's problem; this causes a major misallocation of capital - because the returns from servicing and building assets are available only when credit is expanding. When credit stops accelerating (not even declining) asset prices start to fall. Returns in these areas decline precipitously, and value is destroyed. When credit grows in line with the productive potential of the economy, a very different incentive structure emerges. Assets as a group tend to rise in line with incomes. So the incentive is to boost income and wealth through building businesses that create sustainable returns above the cost of capital. So how does gold fit into this? In commodity strategy, we see gold as a barometer of global credit inflation. The best way to understand this is to highlight the Bretton Woods II system of global capital flows that drove gold through a 12 year bull market up to 2011. We highlighted this mechanism in the note 'Reverse Bretton Woods' (3 September 2013) and depicted in Figure 3 below. It starts in the central oval with the Fed running easy money, and with the commercial banks expanding their balance sheets. In the 2000s and under QE1 and QE2, a key feature of this was the use of repo and the purchase of credit with CDS insurance. This balance sheet expansion neatly avoided raising risk weighted capital ratios - which allowed the banks to progress towards their Basle III targets. (More on the regulator backlash later).

This immediately suggests the first two things to track to measure the expansion of global money and credit - measure the change in the size of the Fed's balance sheet and the change in banks domestic lending. Those two neatly add up to M2 - notes and coins in circulation and deposits with commercial banks.

But that misses out 'near money' - assets that can be swapped for cash and used to buy more assets. The Treasury borrowing advisory committee have estimated this - at US$43trn at the start of the year. But the data is very slow coming out. One way to proxy developments is to follow the amount of liquid assets that the US banks hold that can be used for collateral in repo transactions. That's shown in the chart below.

That's not perfect, as it doesn't take account of rehypothecation - the reuse of capital (which is like the velocity of money in the repo market). We are not aware how we track this in a timely manner - but any suggestions, please get in touch. What we do know is that new regulations - notably central clearing rules, are sharply reducing the reuse of collateral for repo and other trades. But then there is the global aspect - the right side oval in figure 3 shows that when capital flows into emerging markets, central banks print their own currency to buy the incoming dollars. This sets off a chain reaction of credit growth - first deposits rise, then banks lend to consumers and corporates. That raises growth and inflation, lowering real rates and inducing more savings into the system (from consumers who need to save more to build a nest egg) and more demand for loans from corporates, and consumers who want to gear up speculate on property or fixed capital formation. Which causes even more credit expansion. So the initial capital flows into the rest of the world are multiplied up first by the emerging market central banks, and then by the commercial banks, and by the incentives that a combination of strong liquidity growth, rising inflation and sticky nominal rates then induce. Again, the data on this is slow and partial (as a chunk of emerging market lending occurs off balance sheet). So, out of expediency we take the change in foreign central bank treasury holdings held at the Fed, as a timely proxy, and we multiply it up five times - as a proxy of the impact of the fractional and shadow banking multiplier in emerging markets.

This gives us four metrics. Of these - we believe that a necessary condition for gold to rally is the expectation that 1) capital will flow into emerging markets, 2) the combination of the fed's balance sheet and the banks marketable securities holdings rises. The banks' vanilla lending at home in the US has little positive impact, and probably a negative impact on gold prices. Why? Because it doesn't deliver capital lows overseas, and it induces expectations of tightening monetary policy from the Fed. So we have created a weighted indicator made up of foreign central bank treasury holdings with the Fed, Fed balance sheet expansion and the US banks liquid security holdings.

It is potentially more revealing to show the change in liquidity vs the gold price.

In commodity strategy, our view is that US combined central bank and commercial bank asset purchases are the key driver of yield compression - which makes gold a relatively more attractive asset to hold - and the global reach for yield, that induces flows into emerging markets. Those flows then start a very bullish gold dynamic;

But when the Fed started QE3 last October, the improving growth outlook and rising stock market had gold anticipating the threat of tapering (first mentioned by the Fed three months later on Jan 4th), anticipating capital outflows from emerging markets (which began in Jan/February and which accelerated in May). And anticipating commercial bank liquid asset sales - which also began in May. All considered negative for gold. So while Bernanke may not understand gold, it would appear that gold certainly understands Bernanke. Perhaps the most significant aspect of the tapering debate was that the Fed became increasingly hawkish on tapering in 1H13, despite the fact that growth was modest and inflation subdued. Our interpretation of this was that the Fed started to become highly concerned about credit market overheating. Governer Jeremy Stein raised the issue in the December 2012 meeting, and his speech in February 2013 outlined research that showed not just tight spreads, but outsized low quality credit issuance - the classic signals of an overheated credit market, with the clear rider that this could lead to a bust. Soon after Stein presented his results, the tone from Bernanke et al became much more hawkish on QE. The most revealing aspect of the market reaction to Bernanke in 2013 is that it was the diametric opposite to the market reaction to Greenspan in 2004, even though their communication appeared identical. Back in February 2004, Greenspan stated that, if growth continued along the lines the Fed anticipated, then it would start to remove accommodation gradually. Greenspan then started raising rates by 25bps a meeting from June. Capital flowed into emerging markets, banks bought liquid assets, and the Bretton woods 2 system of flows kicked in so powerfully that treasury yields actually fell while rates rose. Something Greenspan dubbed 'a conundrum'.

Then Bernanke repeated the same communication procedure in 2013, announcing in June that, providing growth met the Fed's expectations, it would, in due course, gradually remove accommodation. The market response; capital flowed out of emerging markets, banks sold their liquid assets, treasury yields blew out 100 points and mortgage yields blew out more. In our view in commodity strategy, that is a clear expression of the fact that the global liquidity dynamic of the 2000s, and under QE1 & QE2 is now set to run in reverse. It is worth noting that Fig 12 shows that foreign treasury holdings have bounced since the Fed announced a delay to its tapering programme in September. EM currencies & equities have also jumped. We expect these trends to reverse as bank deleveraging takes hold, and as bullish positioning in broader risk assets unwinds. Asset price developments indicate that the pool of available liquidity has narrowed dramatically. The majority of major asset classes are well off their tops. None are confirming the near high in the S&P. Within the US market, banks have started to underperform.

And a narrowing group of stocks is driving the market - led by a group of growth/concept companies on largely triple digit multiples - Tesla, Netflix, Netsuite, 3D systems corp etc.. We have created a basket of these names in the chart below. We are using this index as an indicator for when a decline in liquidity reduces investors’ appetites for highly valued issues.

We've highlighted that regulation will now likely drive a new wave of deleveraging by the banks. What we're worried about is the interaction of several simultaneous strands of legislation - all acting to reduce liquidity – on the amount of money or near money available to buy assets. And the ease with which financial players can trade those assets. Before we go into the details, one of the main questions we get asked is why would the regulators continue with a process that seems to cause market dislocation? In our view it is because they believe in the morality of their actions - that banks that are too big to fail should shed assets or raise equity to the point where it's much harder for them to fail, to prevent a repeat of the financial crisis and the heavy burden on taxpayers that ensued. Fed Governor Jeremy Stein’s speech last week (‘Lean or clean?), and Governor Tarullo’s speech from May (Evaluating Progress in Regulatory Reforms to Promote Financial Stability) highlight that desire. That, in our view in commodity strategy, is a laudable aim. The difficulty, as the old joke has it, is that to get there, you don't want to start from here. Second, to many regulators, the banks have raised their exposure levels, and raised counterparty risk in the system, in order to raise net interest margin and equity value. So while the systemic banks reduced risk weighted assets by a third from the financial crisis, total leverage has risen 10%. This is precisely the opposite of what the regulators intended when they negotiated the Basle III capital requirements with the banks. The regulators apparently believe that the banks acted in bad faith. The regulators are now fighting back. The clearest comments on this were from Thomas Hoenig, deputy Chairman of FDIC, the US regulator. Third, the regulators believe that the fact that the markets have rallied for five years gives them scope to act without causing too much damage. And finally, regulators don't follow an Austrian view of the world. They may not perceive the degree to which credit markets have become overheated. And they are unlikely to recognise that the credit boom of the past five years has induced a massive misallocation of capital globally, and has created the potential for Hayek's 'recessionary symptoms' to show up as liquidity is drained from the system. So what are the key regulatory actions?

The problems with the regulation are fourfold.

And the problem with repo is that it is highly pro-cyclical. Rising values for high quality collateral used in repo reduce the amount of collateral you need to post to secure funding, and allow you to buy more assets. It can also reduce the haircuts for some lower quality collateral. And a point Jeremy Stein highlighted in his speech on 'credit overheating' was that the more the cost of capital falls as a result of banks expanding their repo operations, the more financial institutions are induced to reach for yield - further accelerating the Bretton Woods II liquidity cycle. But falling collateral values do the opposite. They reduce the capacity of firms to carry out repo and use the funds for credit transactions and for funding credit warehousing etc. and it reduces the tendency of financial companies to reach for yield. All this, in our view in commodity strategy, causes Bretton Woods II to go in reverse.

A key observation of the Bretton Woods II process of capital flows is that the risk free rate – the yield on 10-year treasuries – is no longer risk free. It is subject to a pro-cyclical and speculative expansion of leverage on the upside. The implication is that, when risk aversion rises, the normal safe haven bid for treasuries may be offset by selling from domestic commercial banks and foreign central banks. So yields may rise, or not fall as much as would be typical. This removes a natural stabilisation mechanism in markets. The higher cost of capital (than usual) may make the impact of risk aversion on markets and macro more severe than we are used to. And just as the Bretton Woods process was highly reflationary and bullish for all assets, reverse Bretton Woods is considered bearish for everything, except gold and silver. And that's because of the capital misallocation generated during the credit inflation will unwind, destroying value and precipitating what Hayek called 'recessionary symptoms'. Hayek said all it took to start the unwind was a deceleration in credit expansion. Our description of the impact of QE on growth is shown in the following two charts A rising cost of capital and shrinking liquidity, for any given rate of growth, does not only de-rate asset prices. It hurts growth in all the asset related businesses from financial services through to construction. And then it hurts growth via the reduced supply and higher cost of credit - which included from 2009-13 consumer spending (via mortgage refinancing, or cheap and plentiful car loans), or small companies (via tighter high yield spreads). So far, this set up appears very similar to 1937. Back then the US was into a fourth year of recovery from the depression. The Roosevelt administration scaled back deficit spending and the Fed raised reserve requirements (not thought of as a problem at the time, due to bank’s excess reserves) and started sterilising gold inflows. Manufacturing declined 37% & the Dow halved. The difference, though, is that this time the Fed is likely to move earlier. In our view in commodity strategy, as the private sector takes away leverage and reduces liquid asset holdings, the Fed will be forced into providing the heavy lifting to keep total asset purchases up. On that basis, the Fed will be doing much more QE in 2014 than the market anticipates. And with gold and silver acting as a barometer of whether the Fed will be reflationary or deflating the global economy in 6-12 months time, we anticipate hem to rally as soon as the deflationary process becomes visi |

| Guest Post: Buying Stocks On Margin At The Top - They Never Learn Posted: 24 Oct 2013 02:57 PM PDT Submitted by Jim Quinn of The Burning Platform blog, It’s like the movie Groundhog Day. Greed and hubris are the downfall of the mighty. Believing it is different this time is the mistake of the feeble minded. Watching the ensuing carnage will be a laugh riot. Seeing the blubbering of the bubble headed bimbos, pinhead pundits and Wall Street shysters when the inevitable collapse occurs will be worth the price of admission. If you think we're wrong, pony up to the trough, borrow some money and buy Twitter on IPO day. You can’t lose.

Of course, "this time is different..." |

| Gold Prices Still Dependent On The US Dollar Posted: 24 Oct 2013 02:47 PM PDT We are all aware that the world is in a chaotic state at the moment with a number of friction points that could spark and get of hand at any time. The debt ceiling has been raised in the United States paving the way for more government spending. Bond buying programs remain in place and currency creation by a number of governments continues unabated as each nation attempts to boost exports by debasing their own currency. The production of gold from mining activities is slowing. The demand, especially from China appears to be in overdrive. On a seasonality basis the fall is usually a time when gold does very well, but that is not happening this year, at least not just yet. The list of positive factors that support higher gold prices goes on and on, however, as the chart below shows, gold is now trading at around $1300/oz which is long way down from the heady days of $1900/oz, achieved in 2011. The Gold Chart

The gold chart shows that over the last 6 months gold has tried to rally and failed. The best it could do was a large jump on the news that 'tapering' had been deferred and that lasted for just two days before all those gains were lost. We would also draw your attention to the formation of a pattern of lower highs and lower lows which suggests weakness and further losses in value. Gold also has an inverse relationship with the US Dollar so it's important that we monitor the dollars progress and performance. The US Dollar Chart

The dollar has been sold off recently as evidenced by the US Dollar Index which depicts the dollar falling from '85' to '79' over the last 4 months. If the dollar can hold at this level then there is a possibility of a rally, which would in turn put a lid on gold's progress. A lot depends on the Feds assessment of the inflation and the employment figures, the latest of which were released earlier this week. The consensus was for around 180,000 new jobs so the figure of 148,000 is low but sufficient for the Fed to assume that they have in place the correct course of action. We doubt that we will see tapering this year and we expect the current level of QE to be maintained. This should have a negative impact on the dollar, although this level of stimulus is becoming the 'norm' and so the Law of Diminishing returns comes into play. Should QE be increased then the dollar would weaken and gold would be the beneficiary. Conclusion

Bob Kirtley, bob@gold-prices.biz www.skoptionstrading.com | www.gold-prices.biz |

| Silver and Gold Prices Rose with the Gold Price Closing at $1,350.20 Posted: 24 Oct 2013 02:44 PM PDT Gold Price Close Today : 1350.20 Change : 16.30 or 1.22% Silver Price Close Today : 22.786 Change : 0.204 or 0.90% Gold Silver Ratio Today : 59.256 Change : 0.187 or 0.32% Silver Gold Ratio Today : 0.01688 Change : -0.000053 or -0.31% Platinum Price Close Today : 1448.90 Change : -18.10 or -1.23% Palladium Price Close Today : 745.80 Change : -2.05 or -0.27% S&P 500 : 1,752.07 Change : 5.69 or 0.33% Dow In GOLD$ : $237.45 Change : $ (1.42) or -0.59% Dow in GOLD oz : 11.487 Change : -0.068 or -0.59% Dow in SILVER oz : 680.65 Change : -1.90 or -0.28% Dow Industrial : 15,509.21 Change : 95.88 or 0.62% US Dollar Index : 79.634 Change : -0.051 or -0.06% Franklin didn't post commentary today, if he posts later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. |

| Silver and Gold Prices Rose with the Gold Price Closing at $1,350.20 Posted: 24 Oct 2013 02:44 PM PDT Gold Price Close Today : 1350.20 Change : 16.30 or 1.22% Silver Price Close Today : 22.786 Change : 0.204 or 0.90% Gold Silver Ratio Today : 59.256 Change : 0.187 or 0.32% Silver Gold Ratio Today : 0.01688 Change : -0.000053 or -0.31% Platinum Price Close Today : 1448.90 Change : -18.10 or -1.23% Palladium Price Close Today : 745.80 Change : -2.05 or -0.27% S&P 500 : 1,752.07 Change : 5.69 or 0.33% Dow In GOLD$ : $237.45 Change : $ (1.42) or -0.59% Dow in GOLD oz : 11.487 Change : -0.068 or -0.59% Dow in SILVER oz : 680.65 Change : -1.90 or -0.28% Dow Industrial : 15,509.21 Change : 95.88 or 0.62% US Dollar Index : 79.634 Change : -0.051 or -0.06% Franklin didn't post commentary today, if he posts later it will be available here. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2011, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. |

| Are Gold Advocates Gold Bulls at Any Price? Posted: 24 Oct 2013 02:07 PM PDT Smart Knowledge U |

| 3 Fantastic Charts Showing Gold & Silver To Continue Surge Posted: 24 Oct 2013 01:52 PM PDT  On the heels of some wild trading in global markets and with gold and silver also on the move, today top Citi analyst Tom Fitzpatrick sent King World News 3 fantastic gold and silver charts, along with some tremendous commentary. Below is what Fitzpatrick had to say, along with 3 incredible charts: On the heels of some wild trading in global markets and with gold and silver also on the move, today top Citi analyst Tom Fitzpatrick sent King World News 3 fantastic gold and silver charts, along with some tremendous commentary. Below is what Fitzpatrick had to say, along with 3 incredible charts:This posting includes an audio/video/photo media file: Download Now |

| Gold Daily and Silver Weekly Charts - Straining at the Leash Posted: 24 Oct 2013 01:33 PM PDT |

| Gold Daily and Silver Weekly Charts - Straining at the Leash Posted: 24 Oct 2013 01:33 PM PDT |

| World Gold Council responds to Sprott's criticism of demand data Posted: 24 Oct 2013 12:42 PM PDT 2:40a ICT Friday, October 25, 2013 Dear Friend of GATA and Gold: Brendan Conway of Barron's reports today on what seems like a rather restrained response by the World Gold Council to the open letter from Sprott Asset Management CEO Eric Sprott criticizing the council's gold demand data: http://blogs.barrons.com/focusonfunds/2013/10/24/world-gold-council-stan... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Jim Sinclair Plans Seminar in Florida Gold mining entrepreneur and gold advocate Jim Sinclair plans to hold his next financial seminar in Kissimmee, Florida, near Orlando, on Saturday, November 2. Details can be found at his Internet site, JSMineSet, here: http://www.jsmineset.com/2013/10/22/florida-qa-session-announced/ Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| US Dollar Valued In Gold Since 1718 Posted: 24 Oct 2013 12:37 PM PDT How many ounces of gold can $1000 buy? The answer over time is instructive. Here is some knowledge about money. It is remarkable how few economists really understand this, and what it means, what it implies. |

| TF Metals Report: More deception at the Comex Posted: 24 Oct 2013 12:23 PM PDT 2:15a ICT Friday, October 25, 2013 Dear Friend of GATA and Gold: The TF Metals Report's Turd Ferguson notes this week that CME Group's most recent reports of deposits of gold to JPMorgan's vault of Comex-eligible gold add up to perfectly round numbers, which is virtually impossible given the small variations in weight of standard gold bars. Ferguson concludes that the JPMorgan gold deposit reports are "either completely fabricated and falsified or simple paper claims," part of a broad scheme of deception to conceal the vulnerability of the Comex gold market to a short squeeze. Ferguson's analysis is headlined "More Deception at the Comex" and it's posted at the TF Metals Report's Internet site here: http://www.tfmetalsreport.com/blog/5182/more-deception-comex CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Technicians Turn "Gold Bulls" as SocGen's Edwards Warns of "Financial Bubbles" Posted: 24 Oct 2013 12:15 PM PDT The PRICE of gold gained $10 per ounce in London trade Thursday morning, gaining 2.2% for the week so far to trade at $1346 as several analysts said they were "turning bullish". World stock markets ticked higher, while the Euro slipped from 2-year highs vs. the Dollar after weaker-than-expected PMI economic data, led by a sharp in services sector growth. |

| U.S. Hyperinflation and Cultural Insanity Posted: 24 Oct 2013 11:25 AM PDT Hyperinflation is an insidious, economic killer. It inevitably (but insanely) creeps up on its Victims in plain sight, before decimating them with an always unexpected ambush. How can one of the most-obvious of all economic phenomena always end up as a "surprise"? Because none of the Victims ever believe that hyperinflation is possible. Point out that the U.S. dollar has lost 98% of its value in the 100 years that the Federal Reserve has been responsible for preserving its value, and people will yawn – it's old news. But then assert that it is about to lose the last 2% of that value, and (amazingly) the response will be laughter and/or derision. Look at a chart showing a 98% decline in anything, and the expectation will be that the last 2% is also about to be lost. Or, in market vernacular; "the Trend is your friend." It is irrational, bordering on insane to expect such a chart to reverse itself, or even stabilize. Indeed, it is charts of this nature which spawned the expression "past the point of no return." Yet when people look at charts of currencies, in this case worthless paper currencies; the mere suggestion that a currency could go to zero is a concept literally beyond the comprehension of nearly all of our populations. If a person finds it impossible to conceptually conceive of lions, then a lion could simply walk up and eat that person. We will not/cannot protect ourselves from a "risk" which we do not believe to be within the realm of possibility. One does not take precautions to protect themselves from the "risk" of man-eating butterflies, or killer-bunnies. Thus is hyperinflation perceived by the masses: the Threat of the Killer-Bunnie. In less-extreme forms; the inability to acknowledge/accept (obvious) reality could be described as "normalcy bias". Because almost all Change (even large changes) is impossible to perceive in real-time; it is a common human intellectual flaw to expect tomorrow to be like today (or yesterday). A tomorrow which is not like either today or yesterday is not perceived to be within the realm of possibility. However, with respect to hyperinflation we are not dealing with mere Normalcy Bias, but rather its substantially more-extreme cousin: Cultural Insanity. There are several empirical reasons for reaching this more dramatic diagnosis. Obviously hyperinflation is not a Killer-Bunnie. There are numerous, documented historical examples of this economic killer. There is a very recent historical example (the Zimbabwe dollar), and there are several extremely obvious examples of hyperinflation currently in progress (Western, paper currencies). It is normal/sane not to believe in the existence of Killer-Bunnies, unless one has read about people being devoured by Killer-Bunnies, has watched Killer-Bunnies devouring people, and is watching Killer-Bunnies devouring people. In such a reality; it would be insane not to believe in something which can (easily) be empirically perceived. Regular readers have seen the chart below on the U.S. dollar on numerous occasions. It clearly and unequivocally depicts a hyperinflation-in-progress: a vertical line as supply (of U.S. dollars) goes to infinity. It is a fact of mathematics/economics that as the supply of anything goes to infinity its price must go to zero.

But readers will no longer see this chart in the future (unless one chooses to use an older version), because it no longer exists. Meet the new-and-improved version of this chart of the U.S. monetary base from the Federal Reserve. |

| Staggering Physical Gold Demand Now Overrunning Shorts Posted: 24 Oct 2013 11:19 AM PDT  On the heels of another surge in gold and silver, today Canadian legend John Ing told King World News that "staggering" physical gold demand is now overrunning shorts in the gold market. Ing, who has been in the business for 43 years, also spoke about the stunning demand for gold around the world, and the numbers involved will shock KWN readers around the world. On the heels of another surge in gold and silver, today Canadian legend John Ing told King World News that "staggering" physical gold demand is now overrunning shorts in the gold market. Ing, who has been in the business for 43 years, also spoke about the stunning demand for gold around the world, and the numbers involved will shock KWN readers around the world. This posting includes an audio/video/photo media file: Download Now |