Gold World News Flash |

- THE SIXTH STAGE OF COLLAPSE

- 1974 Meeting European Ministers Of Finance On Gold

- Delay in Fed Taper Sees Gold "At Key Juncture"

- Money Trees & the Lack of Inflation

- Money Trees & the Lack of Inflation

- Money Trees & the Lack of Inflation

- Strength in gold miners show belief that rise in gold is ‘real’: analyst

- Is the Silver Bull Market Over?

- Jim’s Mailbox

- Chaos Now Ready To Explode As The West Begins To Collapse

- Gold, Silver and the Debt Ceiling

- Gold Rallies to Near 5-Week High; US Mint Gold Bullion Coins Spike

- Industry Insider Reveals: What NOT to Do When Investing in Miners

- 3 Reasons Gold Could Scream Higher

- Eric Sprott’s Open Letter To The World Gold Council

- Another One Trillion Dollars ($1,000,000,000,000) In Debt

- Gold: Making New Highs

- Gold Investment Rallies in Largest ETF, Re-Opened in India, as US Jobs Data Pushes Fed Tapering "Back to March"

- Gold retreats from 4-week high as dollar steadies

- Gold lower at 1332.70 (-6.10). Silver 22.64 (-0.072). Dollar bounces. Euro lower. Stocks called lower. US 10yr 2.49% (-2 bps).

- THE HEALTH INSURANCE MARKETPLACE IS OPEN

- William Engdahl: China, gold prices, and U.S. default threats

- Gold Strategies for Success in a Flat Commodity Price Market

- Finance: Too Much Product

- Finance: Too Much Product

- Looking Beyond Flashy Drill Results

- Looking Beyond Flashy Drill Results

- China & the Dollar-Based Financial System

- China & the Dollar-Based Financial System

- What's Your Gold Plan for Getting Punched in the Mouth?

- The Miners That Made Haywood's Quarterly Cut: Kerry Smith

- The Miners That Made Haywood's Quarterly Cut: Kerry Smith

| Posted: 23 Oct 2013 11:20 AM PDT by Dmitry Orlov, The Burning Platform:

Ideally, it would start of with a global financial collapse triggered by a catastrophic loss of confidence in the tools of globalized finance. That would swiftly morph into commercial collapse, caused by global supply chain disruption and cross-contagion. As business activity grinds to a halt and tax revenues dwindle to zero, political collapse wipes most large-scale political entities off the map, allowing small groups of people to revert to various forms of anarchic, autonomous self-governance. Those groups that have sufficient social cohesion, direct access to natural resources, and enough cultural wealth (in the form of face-to-face relationships and oral traditions) would survive while the rest swiftly perish. |

| 1974 Meeting European Ministers Of Finance On Gold Posted: 23 Oct 2013 11:00 AM PDT by Koos Jansen, Koos Jansen

FOLLOWING IS TEXT OF STATEMENT MADE TO C-20 DEPUTIES’ MEETING ON MAY 7 BY DUTCH TREASURER-GENERAL OORT RE ZEIST MEETING OF EC FINANCE MINISTERS APRIL 22 AND 23 ON GOLD: I HAVE BEEN ASKED TO REPORT ON AN INFORMAL DIS- CUSSION – AND I EMPHASIZE THE WORD INFORMAL, REPEAT INFORMAL DISCUSSION – WHICH THE MINISTERS OF FINANCE OF THE EEC HAVE HELD ON APRIL 22 AND 23 AT ZEIST ON THE SUBJECT OF GOLD. |

| Delay in Fed Taper Sees Gold "At Key Juncture" Posted: 23 Oct 2013 10:54 AM PDT The PRICE of GOLD slipped 1.1% from yesterday's sudden 3-week high in London on Wednesday, holding above $1330 per ounce as the US Dollar rallied from new two-year lows on the currency market. Falling to $1.3790 per Euro, the Dollar had dropped almost 1% after September's US jobs data showed much weaker hiring than analysts forecast. |

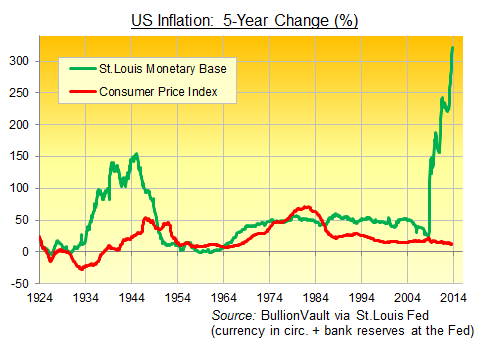

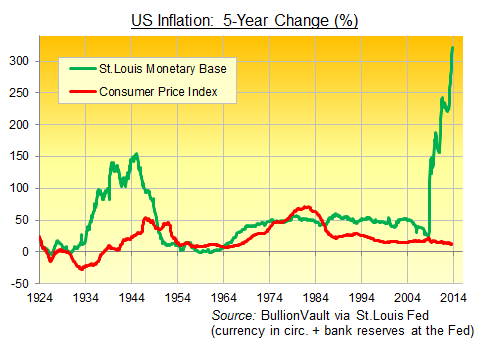

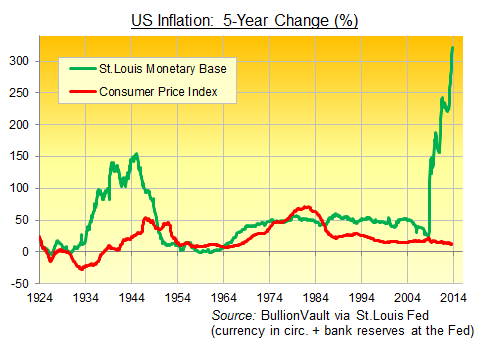

| Money Trees & the Lack of Inflation Posted: 23 Oct 2013 10:46 AM PDT Inflation has gone missing. Is digital money-printing to blame...? TEE-HEE! Money really does grow on trees according to headline writers everywhere today, writes Adrian Ash at BullionVault. Gold, no less, has been found in minute quantities in eucalyptus trees in Australia. Analyzing tree leaves and bark could now unearth gold deposits up to 30 metres below ground elsewhere in the world, geochemists say. Good news perhaps for the gold mining sector. But unearthing that ore won't be easy like picking a leaf. Making money is never cost-free. And not even money-printers are making as much profit as you might imagine right now. UK firm De La Rue today gave its second profits warning of the year. Weird as it sounds, there is over-capacity in money printing worldwide, it claims. That may seem hard to believe, what with quantitative easing still rolling ahead at record levels. But money printing isn't what it used to be, even in these most inflationary days. And De La Rue is lagging profit targets set back in 2010, when quantitative easing was hitting its stride. De La Rue Plc is the world's largest independent printer of banknotes. It has printed 150 different currencies over the last 5 years, designing two-fifths of all new banknotes issued anywhere in the world since 2008. You might think that was (ahem) a license to print money. But money-printing volumes actually fell this year, De La Rue says, down 10% in the first half of 2013. Surely quantitative easing means there's more money around? Near-zero interest rates are also bringing more credit and spending to the economy, right? And what about the rebirth of real estate inflation, most notably in UK house prices but also worrying German politicians as even Berlin rents soar? All that money, however, is electronic, not physical paper. Indeed, the central banks' printing presses are today an "electronic equivalent" as Ben Bernanke of the US Fed put it way back in 2002, urging the Japanese to debauch the Yen just as he's since attacked the Dollar. But it was paper money, not photons blinking on a bank-account balance, which fired inflation in the basket-case economy of Zimbabwe when Bernanke spoke a decade ago, nor in Argentina today. Digitized cash, in contrast, is now the real thing, as military strategist, historian and consultant Edward Luttwak notes in an aside on Italian gangsters. Starting in the 1990s, says Luttwak, the Calabrian family gangs pushing cocaine north into Europe as far as the new markets of the old Soviet states found their "Colombian [cocaine] suppliers refused to accept cash, because it was no good for investing in Miami real estate or local hotels or restaurants. The Calabrians needed real money: not bundles of paper but deposits in bank accounts that could be wired." Fact is, legitimate businesses cannot use cash. And worldwide, reckons Mastercard (with a vested interest, of course), business transactions now account for 89% of the value of payments. Consumers, meantime, are also moving away from cash (at least, outside the black economy they are; and those immoral earnings still need laundering into the "real money" of digitized bank databases in the end). As a proportion of retail transactions by number, cashless payments now make up 80% in the United States, 89% in the UK, and all but 7 in Belgium according to Mastercard. Even ignoring the plastic PR team, nearly half of UK consumer transactions are now done without cash, with currency payments sinking almost 10% by value in 2012 from the year before, according to the British Retail Consortium. The bulk of non-cash growth came from "alternative" methods, notably PayPal, with "new ways to pay and new ways to shop shaping the retail landscape like never before." Might this explain why consumer price inflation hasn't taken off in the developed West? Yes, there's lots more money around. Yes, people keep buying gold as protection. Because basic economics says this should push the general price level higher, as the value of each monetary unit is shrunk. But all this extra money sits on hard drives, servers and in the cloud, rather than in purses and wallets. That's where money is transacted too, in intangible code. Lacking a physical presence, perhaps this wall of money loses its impact.  There are lots of other reasons you could give for why inflation hasn't surged on quantitative easing. It's all locked up in banking reserves, for instance, instead of reaching the "real" economy. Increased spending power since 2008 has gone almost entirely to the top 1%, who use it to buy shares, property and fine art rather than Doritos and donuts. Or perhaps central bankers really have kept that credibility which they fought to attain after the 1970s' inflation. Western households are now sure that the cost of living will never be let loose again. But the birth of money back in ancient Greece changed our brains and our world. It made kings of anyone holding coin, with the "universal equivalent" marking the beginning of the end of feudal society just as it created an independent yard-stick for all values – mercantile, religious and personal. This is what the myth of King Midas is about, after all. The human brain and how it conceives of the world is being changed again by digitization today. Just ask a 20-year old (go on, ask them. Ask them anything, and see if they can answer without checking online. Ask a 45-year old come to that). Plenty of people worry that digitization is changing us for the worse, twiddling their fears about the internet by writing, of course, on the internet. Plenty of other idiots think the posthuman world will prove a new joy, with the internet's jibber-jabber of lies, confusion and stupidity taking us back to some forgotten Eden where everyone's views are equal. Like, y'know, in the way opinions were freely allowed to medieval peasants who couldn't read? Today's infotainment and readers' comments let knowledge morph and shift just like knowledge was shared and communal pre-Gutenberg. Who needs the Enlightenment?! Either way, perhaps our brave new digital world also revokes the iron law of money. Perhaps our flood of new cash will never end in higher living costs in the way it always has – and always has – in the past. Because money we cannot touch cannot in turn touch prices as surely as paper or metal did. Yeah right. And money really does grow on trees. |

| Money Trees & the Lack of Inflation Posted: 23 Oct 2013 10:46 AM PDT Inflation has gone missing. Is digital money-printing to blame...? TEE-HEE! Money really does grow on trees according to headline writers everywhere today, writes Adrian Ash at BullionVault. Gold, no less, has been found in minute quantities in eucalyptus trees in Australia. Analyzing tree leaves and bark could now unearth gold deposits up to 30 metres below ground elsewhere in the world, geochemists say. Good news perhaps for the gold mining sector. But unearthing that ore won't be easy like picking a leaf. Making money is never cost-free. And not even money-printers are making as much profit as you might imagine right now. UK firm De La Rue today gave its second profits warning of the year. Weird as it sounds, there is over-capacity in money printing worldwide, it claims. That may seem hard to believe, what with quantitative easing still rolling ahead at record levels. But money printing isn't what it used to be, even in these most inflationary days. And De La Rue is lagging profit targets set back in 2010, when quantitative easing was hitting its stride. De La Rue Plc is the world's largest independent printer of banknotes. It has printed 150 different currencies over the last 5 years, designing two-fifths of all new banknotes issued anywhere in the world since 2008. You might think that was (ahem) a license to print money. But money-printing volumes actually fell this year, De La Rue says, down 10% in the first half of 2013. Surely quantitative easing means there's more money around? Near-zero interest rates are also bringing more credit and spending to the economy, right? And what about the rebirth of real estate inflation, most notably in UK house prices but also worrying German politicians as even Berlin rents soar? All that money, however, is electronic, not physical paper. Indeed, the central banks' printing presses are today an "electronic equivalent" as Ben Bernanke of the US Fed put it way back in 2002, urging the Japanese to debauch the Yen just as he's since attacked the Dollar. But it was paper money, not photons blinking on a bank-account balance, which fired inflation in the basket-case economy of Zimbabwe when Bernanke spoke a decade ago, nor in Argentina today. Digitized cash, in contrast, is now the real thing, as military strategist, historian and consultant Edward Luttwak notes in an aside on Italian gangsters. Starting in the 1990s, says Luttwak, the Calabrian family gangs pushing cocaine north into Europe as far as the new markets of the old Soviet states found their "Colombian [cocaine] suppliers refused to accept cash, because it was no good for investing in Miami real estate or local hotels or restaurants. The Calabrians needed real money: not bundles of paper but deposits in bank accounts that could be wired." Fact is, legitimate businesses cannot use cash. And worldwide, reckons Mastercard (with a vested interest, of course), business transactions now account for 89% of the value of payments. Consumers, meantime, are also moving away from cash (at least, outside the black economy they are; and those immoral earnings still need laundering into the "real money" of digitized bank databases in the end). As a proportion of retail transactions by number, cashless payments now make up 80% in the United States, 89% in the UK, and all but 7 in Belgium according to Mastercard. Even ignoring the plastic PR team, nearly half of UK consumer transactions are now done without cash, with currency payments sinking almost 10% by value in 2012 from the year before, according to the British Retail Consortium. The bulk of non-cash growth came from "alternative" methods, notably PayPal, with "new ways to pay and new ways to shop shaping the retail landscape like never before." Might this explain why consumer price inflation hasn't taken off in the developed West? Yes, there's lots more money around. Yes, people keep buying gold as protection. Because basic economics says this should push the general price level higher, as the value of each monetary unit is shrunk. But all this extra money sits on hard drives, servers and in the cloud, rather than in purses and wallets. That's where money is transacted too, in intangible code. Lacking a physical presence, perhaps this wall of money loses its impact.  There are lots of other reasons you could give for why inflation hasn't surged on quantitative easing. It's all locked up in banking reserves, for instance, instead of reaching the "real" economy. Increased spending power since 2008 has gone almost entirely to the top 1%, who use it to buy shares, property and fine art rather than Doritos and donuts. Or perhaps central bankers really have kept that credibility which they fought to attain after the 1970s' inflation. Western households are now sure that the cost of living will never be let loose again. But the birth of money back in ancient Greece changed our brains and our world. It made kings of anyone holding coin, with the "universal equivalent" marking the beginning of the end of feudal society just as it created an independent yard-stick for all values – mercantile, religious and personal. This is what the myth of King Midas is about, after all. The human brain and how it conceives of the world is being changed again by digitization today. Just ask a 20-year old (go on, ask them. Ask them anything, and see if they can answer without checking online. Ask a 45-year old come to that). Plenty of people worry that digitization is changing us for the worse, twiddling their fears about the internet by writing, of course, on the internet. Plenty of other idiots think the posthuman world will prove a new joy, with the internet's jibber-jabber of lies, confusion and stupidity taking us back to some forgotten Eden where everyone's views are equal. Like, y'know, in the way opinions were freely allowed to medieval peasants who couldn't read? Today's infotainment and readers' comments let knowledge morph and shift just like knowledge was shared and communal pre-Gutenberg. Who needs the Enlightenment?! Either way, perhaps our brave new digital world also revokes the iron law of money. Perhaps our flood of new cash will never end in higher living costs in the way it always has – always has – in the past. Because money we cannot touch cannot in turn touch prices as surely as paper or metal did. Yeah right. And money really does grow on trees. |

| Money Trees & the Lack of Inflation Posted: 23 Oct 2013 10:46 AM PDT Inflation has gone missing. Is digital money-printing to blame...? TEE-HEE! Money really does grow on trees according to headline writers everywhere today, writes Adrian Ash at BullionVault. Gold, no less, has been found in minute quantities in eucalyptus trees in Australia. Analyzing tree leaves and bark could now unearth gold deposits up to 30 metres below ground elsewhere in the world, geochemists say. Good news perhaps for the gold mining sector. But unearthing that ore won't be easy like picking a leaf. Making money is never cost-free. And not even money-printers are making as much profit as you might imagine right now. UK firm De La Rue today gave its second profits warning of the year. Weird as it sounds, there is over-capacity in money printing worldwide, it claims. That may seem hard to believe, what with quantitative easing still rolling ahead at record levels. But money printing isn't what it used to be, even in these most inflationary days. And De La Rue is lagging profit targets set back in 2010, when quantitative easing was hitting its stride. De La Rue Plc is the world's largest independent printer of banknotes. It has printed 150 different currencies over the last 5 years, designing two-fifths of all new banknotes issued anywhere in the world since 2008. You might think that was (ahem) a license to print money. But money-printing volumes actually fell this year, De La Rue says, down 10% in the first half of 2013. Surely quantitative easing means there's more money around? Near-zero interest rates are also bringing more credit and spending to the economy, right? And what about the rebirth of real estate inflation, most notably in UK house prices but also worrying German politicians as even Berlin rents soar? All that money, however, is electronic, not physical paper. Indeed, the central banks' printing presses are today an "electronic equivalent" as Ben Bernanke of the US Fed put it way back in 2002, urging the Japanese to debauch the Yen just as he's since attacked the Dollar. But it was paper money, not photons blinking on a bank-account balance, which fired inflation in the basket-case economy of Zimbabwe when Bernanke spoke a decade ago, nor in Argentina today. Digitized cash, in contrast, is now the real thing, as military strategist, historian and consultant Edward Luttwak notes in an aside on Italian gangsters. Starting in the 1990s, says Luttwak, the Calabrian family gangs pushing cocaine north into Europe as far as the new markets of the old Soviet states found their "Colombian [cocaine] suppliers refused to accept cash, because it was no good for investing in Miami real estate or local hotels or restaurants. The Calabrians needed real money: not bundles of paper but deposits in bank accounts that could be wired." Fact is, legitimate businesses cannot use cash. And worldwide, reckons Mastercard (with a vested interest, of course), business transactions now account for 89% of the value of payments. Consumers, meantime, are also moving away from cash (at least, outside the black economy they are; and those immoral earnings still need laundering into the "real money" of digitized bank databases in the end). As a proportion of retail transactions by number, cashless payments now make up 80% in the United States, 89% in the UK, and all but 7 in Belgium according to Mastercard. Even ignoring the plastic PR team, nearly half of UK consumer transactions are now done without cash, with currency payments sinking almost 10% by value in 2012 from the year before, according to the British Retail Consortium. The bulk of non-cash growth came from "alternative" methods, notably PayPal, with "new ways to pay and new ways to shop shaping the retail landscape like never before." Might this explain why consumer price inflation hasn't taken off in the developed West? Yes, there's lots more money around. Yes, people keep buying gold as protection. Because basic economics says this should push the general price level higher, as the value of each monetary unit is shrunk. But all this extra money sits on hard drives, servers and in the cloud, rather than in purses and wallets. That's where money is transacted too, in intangible code. Lacking a physical presence, perhaps this wall of money loses its impact.  There are lots of other reasons you could give for why inflation hasn't surged on quantitative easing. It's all locked up in banking reserves, for instance, instead of reaching the "real" economy. Increased spending power since 2008 has gone almost entirely to the top 1%, who use it to buy shares, property and fine art rather than Doritos and donuts. Or perhaps central bankers really have kept that credibility which they fought to attain after the 1970s' inflation. Western households are now sure that the cost of living will never be let loose again. But the birth of money back in ancient Greece changed our brains and our world. It made kings of anyone holding coin, with the "universal equivalent" marking the beginning of the end of feudal society just as it created an independent yard-stick for all values – mercantile, religious and personal. This is what the myth of King Midas is about, after all. The human brain and how it conceives of the world is being changed again by digitization today. Just ask a 20-year old (go on, ask them. Ask them anything, and see if they can answer without checking online. Ask a 45-year old come to that). Plenty of people worry that digitization is changing us for the worse, twiddling their fears about the internet by writing, of course, on the internet. Plenty of other idiots think the posthuman world will prove a new joy, with the internet's jibber-jabber of lies, confusion and stupidity taking us back to some forgotten Eden where everyone's views are equal. Like, y'know, in the way opinions were freely allowed to medieval peasants who couldn't read? Today's infotainment and readers' comments let knowledge morph and shift just like knowledge was shared and communal pre-Gutenberg. Who needs the Enlightenment?! Either way, perhaps our brave new digital world also revokes the iron law of money. Perhaps our flood of new cash will never end in higher living costs in the way it always has – always has – in the past. Because money we cannot touch cannot in turn touch prices as surely as paper or metal did. Yeah right. And money really does grow on trees. |

| Strength in gold miners show belief that rise in gold is ‘real’: analyst Posted: 23 Oct 2013 10:00 AM PDT 23-Oct (MarketWatch) — After underperforming gold prices in recent months, gold mining stocks are finally scoring some impressive gains. "The rally in the miners is wholly due to the rally in gold," said Brien Lundin, editor of Gold Newsletter, pointing out that the gold mining indexes and gold put in "an interim bottom" on Oct. 11. …"That the miners have not only responded to gold's rebound but also provided leverage to the metal's move is a sign of a healthy rally and therefore encouraging to gold bulls," Lundin told MarketWatch. [source] |

| Is the Silver Bull Market Over? Posted: 23 Oct 2013 10:00 AM PDT by Peter Spina, Silver Seek:

As the price of silver did to the upside in 2009-2011, the downside since has been equally extreme in emotions, now a fear-dominated sentiment. The price reflecting this negative state with a sell-off low during the Summer, trading below $20/ounce. With the silver and gold markets having found an extreme selling capitulation in early Summer, prices have been able to consolidate higher over the past months, recovering some of its large losses. Unlike with the Gold ETF holdings, Silver ETF investments remained firm with strong investment demand following silver to its lows. |

| Posted: 23 Oct 2013 09:43 AM PDT Jim, Redefining metrics and scale. The new $1 is now $5 What next? The new quart is 24oz.? The new "footlong" sub is now 8 inches? Caution ahead regarding inflation! CIGA Wolfgang Rech McDonald's New ‘Dollar Menu’ Goes Up to $5 By Venessa Wong Since McDonald's (MCD) launched the Dollar Menu nationally in 2002,... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Chaos Now Ready To Explode As The West Begins To Collapse Posted: 23 Oct 2013 09:00 AM PDT from KingWorldNews:

Kaye: "Well, it's not good. Most end games don't end well, and certainly this one is destined to fall into that category as well. It's certainly not going to end well for the 99%. The unsustainable rally in stocks which is being fed with the cocaine being supplied by the Fed's disastrous QE policy, is destined to unravel…. "There has been talk of 'tapering.' Well, at some point they will need to withdraw the stimulus. It will either be a deliberate action on the part of central planners, or they will be forced to because they lose control of interest rates. There is a massive risk that it could end up being the latter of the two scenarios because foreign nations, particularly China, are increasingly uneasy with their exposure to US financial assets. |

| Gold, Silver and the Debt Ceiling Posted: 23 Oct 2013 08:50 AM PDT from Deviant Investor:

And back in the real world where people work and support their families, life goes on, few noticed the lack of government "services," and in three months we will be blessed with another episode of our "Congressional Reality Show." Gold, Silver, and National Debt: Examine the following graph. It is a graph of smoothed* annual gold and silver prices and the official U.S. national debt since 1971 when the dollar lost all gold backing and was "temporarily" allowed to float against all other unbacked debt based currencies. All values start at 1.0 in 1971. |

| Gold Rallies to Near 5-Week High; US Mint Gold Bullion Coins Spike Posted: 23 Oct 2013 07:46 AM PDT

…United States Mint gold bullion sales grew sharply Tuesday with advances across all four American Gold Eagle sizes. U.S. Mint distributors ordered 9,500 ounces on top of the 3,000 ounces from Monday. The two-day total of 12,500 ounces is higher than sales through all of August and is 500 ounces shy of matching sales from September. [source] PG View: With the debt ceiling hiked and QE seemingly here to stay for some time longer, savvy investors are building/bolstering their hedges. |

| Industry Insider Reveals: What NOT to Do When Investing in Miners Posted: 23 Oct 2013 07:43 AM PDT Precious metals miners are the most volatile stocks on earth. They're so volatile that investors often forget that underneath those whipsawing stock prices lie real businesses. Mining isn't an easy business, that's for sure. More miners fail than succeed. But some today are executing their business plans well, selling gold and silver for more than it costs them to extract it from the ground. Yet their stock prices remain in the doldrums. What should you do when you own stock in a business that's making good money, but the market doesn't seem to care? Well, the most famous investor in history, Warren Buffett, encountered a similar situation during the financial crisis in 2008/2009, when his Coca-Cola stock tanked by 39%. You don't need me to tell you that he didn't sell. He sat tight, content in knowing that the underlying business was strong no matter what value the market was ascribing to it. Coca-Coca has risen exactly 100% since then. There are a handful of Coca-Colas scattered around the precious metals industry today, trading at dirt cheap prices despite their strong business performance. You can find them by taking a peek at our BIG GOLD portfolio, which focuses on opportunities in large-cap miners. Simply sign up for a risk-free trial offer by clicking here. Today's article is from Eric Angeli, broker at Sprott Global Resources and protégé of our good friend Rick Rule. Eric has solid advice on investing successfully in precious metals miners. Without giving too much away, the key is to focus on the company itself and factors it can control… rather than things it cannot control, like where the price of gold may go over the next 3-6 months. Enjoy, and see you next week. Dan Steinhart |

| 3 Reasons Gold Could Scream Higher Posted: 23 Oct 2013 07:35 AM PDT Over the past week, gold has gone from zero to hero, breaking off an $80 run in just five trading days. I've been bearish on gold since earlier this year. But I think this move could have legs. In fact, gold stocks might even move significantly higher before we finish out the year. Here are the clues indicating gold might be undergoing a change of character: 1. Fakeouts lead to breakouts On Oct. 15, gold futures plummeted to a low of $1,251. This drop signaled a clear break below critical support at $1,275. That morning, it looked like the floor was about to drop out. I suspected gold futures would soon test their late June lows of $1,179… That's when buyers stepped in. Futures haven't looked back since. Here's where we stand now: After faking a move lower, gold futures have broken above resistance, posting the first higher low since early July. This could be a significant short-term bottom—especially since it was preceded by a false move lower. 2. Miners try for a double-bottom If you want to find an asset class performing worse than gold this year, look no further than gold miners. Investors have slammed these stocks all year. The group is down nearly 44% on the year. No one wants these stocks… However, the chart is beginnign to look constructive… The miner to metal ratio has been dismal all year. If this bottom holds, we could see miners snap back in a big way… 3. Sentiment is in the gutter Just 10 days ago, CNBC’s gold sentiment survey revealed 83% of those surveyed were expecting prices to fall. That's way too lopsided. Whenever you see sentiment get to these extremes, it's time to start looking for a big move in the opposite direction. So what happens next? I think gold (and miners) can move higher from here. It will be messy. There will be big down days mixed with the initial thrusts higher. But right now, gold appears to be setting up for a solid fourth quarter. I'm not ready to declare blue skies and new highs in gold's future just yet. But something is brewing right now that could spark a significant move. If you're nimble and you don't mind big swings in both directions, this is your time to trade… Regards, Greg Guenthner Ed. Note: As long-time readers of The Rude Awakening know… Greg is no gold bug. In fact, this is his first bullish gold prediction all year. So when he changes his tune, it’s time to stand up and take notice. And rest assured, he’ll be following this story very closely in the days to ahead. So you’ll want to get his analysis before anyone else. Sign up for The Rude Awakening, for FREE, right here, and stay one step ahead of the rest of the market. |

| Eric Sprott’s Open Letter To The World Gold Council Posted: 23 Oct 2013 07:12 AM PDT 22-Oct (ZeroHedge) — Authored by Eric Sprott of Sprott Global Resources, Dear World Gold Council Executives; As you very well know, the business environment for gold producers has been extremely challenging over the past few years. While demand for physical gold remains extremely strong, prices on the COMEX have fallen precipitously. This contradictory situation is the single most important obstacle to a healthy gold mining industry. In my opinion, the massive imbalance between supply and demand is not reflected in prices because available statistics are misleading. It is not the first time that GFMS (and World Gold Council) statistics come under pressure from the investment community. In his now celebrated "The 1998 Gold Book Annual", Frank Veneroso demonstrated the inconsistencies in GFMS gold demand data and proceeded to show how they grossly underestimated demand. The tremendous increase in the price of gold over the following years vindicated his conclusions. For very different reasons, we are now at a similar pivotal point for gold. Over the past few years, we have seen incredible incremental demand from emerging markets. Indeed, so much so that the People's Bank of China has announced that it is planning to increase the number of firms allowed to import and export gold and ease restrictions on individual buyers.1 In India, the government has been fighting a losing battle against gold imports by imposing import taxes and restrictions.2 Moreover, Non-Western Central Banks from around the world are replacing their U.S. dollar reserves by increasing their holdings of gold.3 But, demand statistics reported by the World Gold Council (WGC) consistently misrepresent reality, mostly with regard to demand from Asia. …The evidence presented here is clear, demand for physical gold is extremely strong and, in reality, without the massive outflows from ETFs (half of world mine supply), it is hard to imagine how this demand would have been met. Since ETFs have a finite size (about 1,900 tonnes left), these outflows cannot continue for much longer (see our article on the topic).7 All these observations point to a considerable imbalance between supply and demand (unless Western Central Banks decide to fill this void with what is left of their reserves)…The supply-demand imbalance is obvious to all. [source] |

| Another One Trillion Dollars ($1,000,000,000,000) In Debt Posted: 23 Oct 2013 07:04 AM PDT 22-Oct (ZeroHedge) — Did you know that the U.S. national debt has increased by more than a trillion dollars in just over 12 months? On September 30th, 2012 the U.S. national debt was sitting at $16,066,241,407,385.89. Today, it is up to $17,075,590,107,963.57. These numbers come directly from official U.S. government websites and can easily be verified. For a long time the national debt was stuck at just less than 16.7 trillion dollars because of the debt ceiling fight, but now that the debt ceiling crisis has been delayed for a few months the national debt is soaring once again. In fact, just one day after the deal in Congress was reached, the U.S. national debt rose by an astounding 328 billion dollars. In the blink of an eye we shattered the 17 trillion dollar mark with no end in sight. We are stealing about $100,000,000 from our children and our grandchildren every single hour of every single day. This goes on 24 hours a day, month after month, year after year without any interruption. [source] PG View: Clearly this pace of debt accumulation is unsustainable. When “stuff” hits the fan, you’re going to be thankful you have gold in your portfolio. |

| Posted: 23 Oct 2013 05:55 AM PDT Gold has broken the resistance at 1331. The short-term technical structure is positive as long as the support at 1310 holds. Resistances stand at 1354 and 1376. Another support can be found at 1290 (16/10/2013 high). Read More... |

| Posted: 23 Oct 2013 05:42 AM PDT GOLD INVESTMENT prices slipped 1.1% from yesterday's sudden 3-week high in London on Wednesday, holding above $1330 per ounce as the US Dollar rallied from new two-year lows on the currency market. Falling to $1.3790 per Euro, the Dollar had dropped almost 1% after September's US jobs data showed much weaker hiring than analysts forecast. "Although December remains a possibility" for the US Federal Reserve to start 'tapering' its $85 billion per month quantitative easing, "this report makes it more likely that the Fed pushes the first reduction in the pace of its asset purchases into 2014," say economists at investment bank Goldman Sachs. Tapering is now most likely to begin in March, they add, when current chairman Ben Bernanke is due to be replaced by Janet Yellen. "We are technically clearly at a key juncture for the development of the next medium-term trend," says investment analysis from Commerzbank in Germany, adding that its chart analysts are now "neutral" on gold prices short-term. "I still believe the upside is limited," says David Govett at brokers Marex, pointing to "the absence of any other positive factors" beyond the declining US Dollar. "We suspect that gold should continue to push higher," says a note from INTL FCStone, also pointing to the weakening US currency. But for the new trend to continue, gold investment and jewelry demand "do need to pick up." Gold investment through the giant SPDR Gold Trust, the world's largest exchange-traded gold fund (ticker: GLD) rose Tuesday for the first time in a month, and by the largest volume in 8 weeks. Adding 6.7 tonnes to the gold needed to back the GLD's shares, however, the trust's assets remained near 56-months lows at 878 tonnes. "We favour selling this rally in gold," says Australia's ANZ Bank, "as the fundamental demand from China seems to be wavering." Hitting $25 per ounce last week, Shanghai premiums for investment gold over and above London benchmarks slipped today to $7 from $8 on Tuesday. New data meantime showed China's biggest banks tripling the amount of bad loans they wrote off in the first half of this year. Forecasting a contraction in China's manufacturing activity for September – due for data release tonight in HSBC's monthly PMI index – "The slowdown is due to weak demand and rising interest rates," reckons chief China economist Zhiwei Zhang at investment bank and brokerage Nomura, speaking to CNBC. Meantime today in India – where finance minister P.Chidambaram repeated the ban on gold coin imports Tuesday – a major bullion-backed mutual fund was reopened to new business after a 3-month suspension, made as the government called for banks to cease promoting gold investment. The $300 million Reliance Gold Savings Trust likely waited for the summer's sharp drop in gold imports reported earlier this month before reopening, Reuters quotes Commtrendz Research director Gnanasekar Thiagarajan. "However, the biggest challenge will be to find gold supplies as it is not available in the market." Premiums on gold in India today held at record levels of up to $125 per ounce above London benchmarks, dealers said, as growing festival demand continued to meet a "drought" of supply amid the ongoing import restrictions. "A large part of jewelers and goldsmiths are on the verge of a closure due to non-availability of gold," says M.C.Jain, president of the All India Bullion & Jewellers Association, which met recently with government officials to discuss easing the gold import rules. |

| Gold retreats from 4-week high as dollar steadies Posted: 23 Oct 2013 05:40 AM PDT 23-Oct (Reuters) — Gold retreated from four-week highs on Wednesday as a slight recovery in the dollar prompted some investors to cash in gains, with a rally sparked by weaker-than-expected U.S. non-farm payrolls data running out of steam. The metal rose nearly 2 percent on Tuesday while the dollar index hit eight-month lows and stock markets rallied, after weak U.S. jobs data cemented expectations for the Federal Reserve to keep its stimulus measures in place until next year. …”This 1,330 level is an important technical point, and so far gold has managed to hold onto it,” he said. “A lot of investors are just waiting to see what the next move will be.” Technical analysts — who study past price patterns to determine the next likely direction of trade — at Commerzbank say gold’s rally on Tuesday had neutralised its bearish view on the metal, although it remains vulnerable to further losses. [source] |

| Posted: 23 Oct 2013 05:33 AM PDT |

| THE HEALTH INSURANCE MARKETPLACE IS OPEN Posted: 23 Oct 2013 04:23 AM PDT Sean Hackbarth has additional insight into the half-billion dollar website failure. http://directorblue.blogspot.com/ |

| William Engdahl: China, gold prices, and U.S. default threats Posted: 23 Oct 2013 04:17 AM PDT 6:15p ICT Wednesday, October 23, 2013 Dear Friend of GATA and Gold: Writing for Russia Today, geopolitical and market analyst William Engdahl outlines the interest of the U.S. government and Wall Street in suppressing the price of gold. Engdahl's commentary is headlined "China, Gold Prices, and U.S. Default Threats" and it's posted at RT here: http://rt.com/op-edge/us-debt-gold-price-threats-481/ CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Strategies for Success in a Flat Commodity Price Market Posted: 23 Oct 2013 02:23 AM PDT It could be 2017 before the commodity supercycle is evident again, but stormy weather in the mining space has a silver lining: It is encouraging miners to develop new, innovative approaches to their business. In this interview for the first edition of The Mining Report, John Kaiser of Kaiser Research Online outlines 10 strategies that are setting certain companies apart. Discover the companies that are redefining their business, as well as miners with the goods in the ground to continue come rain or shine. The Mining Report: John, you have characterized the current resource market as a bear market unlikely to have higher metal prices in the next year, with the possible exception of zinc. Why are you drawing a different conclusion than other analysts who believe we are in a resource supercycle? |

| Posted: 23 Oct 2013 01:43 AM PDT First Tony Dye, now Neil Woodford. Still the finance sector won't learn... This LAST WEEK has seen a confluence of events that suggests we may be reaching the terminal point of the financial markets merry-go-round, writes Tim Price on his blog, ThePriceOfEverything. This is the point just before the ride stops suddenly and, unexpectedly, the passengers are thrown from their seats. Having waited with increasing concern to see what might transpire from the gridlocked US political system, the market was rewarded with a few more months' grace before the next agonising debate about raising the US debt ceiling. There was widespread relief, if not outright jubilation. Stock markets rose, in some cases to all-time highs. But let there be no misunderstanding on this point: the US administration is hopelessly bankrupt. As are those of the UK, most of Western Europe, and Japan. The market preferred to sit tight on the ride, for the time being. Three professors were meanwhile awarded what was widely misreported as 'the Nobel prize in economics' for mutually contradictory research. What they actually received was the 'Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel', which is not quite the same thing. But then economics is not a science, and Eugene Fama's 'efficient market hypothesis' is not just empirically wrong, but dangerously so. History, it would seem, is clearing the decks. Perhaps the most intriguing development of the week was the news that Neil Woodford would soon be retiring from his role managing £33 billion of other people's money at Invesco Perpetual to start up his own business. It was widely reported that Mr.Woodford nursed growing frustration at the short-termism of the financial services industry. One of the sadder stories in the history of investment management is that of Mr.Tony Dye. The following extract is taken from his obituary in The Independent:

Neil Woodford's apparent concerns are well placed. There is a grotesque mismatch between the set-up of institutional asset managers and what is in the best interests of their end clients, the individual members of the public who pay their fees. The investment fund marketplace is grotesquely oversupplied. There is far too much, to use the dismal phrase, product. The problem is exacerbated by perhaps inevitable weaknesses in psychology – both on the part of the manager, and on the part of the investor. Stress points abound throughout the chain. The investment fund world is hopelessly balkanised, and brimming over with a degree of product specialisation utterly unwarranted by investors' real needs. The fund management industry is a perpetual production line of novelty, or rather an endless rehash of the same old ideas. The point of absurdity was reached and surpassed when there were more mutual funds listed on the New York Stock Exchange than there were common stocks with which to populate them. The industry is a monstrous hydra, busily consuming its own, and its investors', capital. New funds are launched daily. Failing older funds are quietly tidied away, merged, or destroyed. They are 'uninvented'. Alison Smith and Stephen Foley covered the news of Neil Woodford's resignation for the Financial Times. They cited the FT's own John Kay, who carried out a review of UK equity markets last year, and who said:

As they suggest, Neil Woodford's past success means that raising money for his new business is unlikely to be much of a struggle. "But imagine the hurdles in the way of a manager who would like to purse long-term strategies but is just starting out." In the words of Professor Kay:

We have not been immune to the demands of clients frustrated at the performance of diversified portfolios lagging the broader equity markets (although this explicit benchmarking against stocks was never a mandate to which we subscribed). We struggle, in some cases, to make sufficiently clear our concerns about broader market valuation, or just as importantly the gravity of the global financial situation (including a potential QE-driven currency crisis), which makes a wholehearted commitment to the stock market in late 2013 seem to us a risky strategy. So where, if anywhere, does the fault lie? Sometimes it is not just asset managers who should be accused of being short-termist, or of missing the big picture. Our thesis has been consistent for five years now. We believe we are at the tail end of a 40-years' and counting experiment in money and the constant expansion of credit. This experiment is not ending well. Because government money, unbacked and unchecked as it now is by anything of tangible value, can be created at will, it has been. What is extraordinary is that despite trillions of Dollars (and Pounds and Yen) of stimulus, there are few visible signs of what we would call inflation, in anything other than the prices of financial assets themselves. We are living through a historic period of global currency debasement. The neo-Keynesian money-printers who dominate the world's central banks have 'won' the debate, but are now scratching their heads, looking in vain for the economic recovery that they were expecting all those trillions to have bought. They will continue to look in vain, because money creation and true wealth creation are polar opposites. As portfolio manager Tony Deden has asked,

Those words were written four years ago. The printing presses have been run to exhaustion ever since. So far they have bought us an inflationary rally in the prices of financial assets, and not much else. It has been a lousy time for anyone focused on the disciplined and genuinely diversified pursuit of capital preservation in real terms (more recently, for anyone seeking to escape the inflationary insanity via the honest money that is gold). We have not, to any significant extent, participated in the 'phony rally'. But then we are playing a longer game than most of our peers. Round and round and round she goes; where she stops, nobody knows. Fund manager Sebastian Lyon recently quoted another celebrated fund manager, Jean-Marie Eveillard:

|

| Posted: 23 Oct 2013 01:43 AM PDT First Tony Dye, now Neil Woodford. Still the finance sector won't learn... This LAST WEEK has seen a confluence of events that suggests we may be reaching the terminal point of the financial markets merry-go-round, writes Tim Price on his blog, ThePriceOfEverything. This is the point just before the ride stops suddenly and, unexpectedly, the passengers are thrown from their seats. Having waited with increasing concern to see what might transpire from the gridlocked US political system, the market was rewarded with a few more months' grace before the next agonising debate about raising the US debt ceiling. There was widespread relief, if not outright jubilation. Stock markets rose, in some cases to all-time highs. But let there be no misunderstanding on this point: the US administration is hopelessly bankrupt. As are those of the UK, most of Western Europe, and Japan. The market preferred to sit tight on the ride, for the time being. Three professors were meanwhile awarded what was widely misreported as 'the Nobel prize in economics' for mutually contradictory research. What they actually received was the 'Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel', which is not quite the same thing. But then economics is not a science, and Eugene Fama's 'efficient market hypothesis' is not just empirically wrong, but dangerously so. History, it would seem, is clearing the decks. Perhaps the most intriguing development of the week was the news that Neil Woodford would soon be retiring from his role managing £33 billion of other people's money at Invesco Perpetual to start up his own business. It was widely reported that Mr.Woodford nursed growing frustration at the short-termism of the financial services industry. One of the sadder stories in the history of investment management is that of Mr.Tony Dye. The following extract is taken from his obituary in The Independent:

Neil Woodford's apparent concerns are well placed. There is a grotesque mismatch between the set-up of institutional asset managers and what is in the best interests of their end clients, the individual members of the public who pay their fees. The investment fund marketplace is grotesquely oversupplied. There is far too much, to use the dismal phrase, product. The problem is exacerbated by perhaps inevitable weaknesses in psychology – both on the part of the manager, and on the part of the investor. Stress points abound throughout the chain. The investment fund world is hopelessly balkanised, and brimming over with a degree of product specialisation utterly unwarranted by investors' real needs. The fund management industry is a perpetual production line of novelty, or rather an endless rehash of the same old ideas. The point of absurdity was reached and surpassed when there were more mutual funds listed on the New York Stock Exchange than there were common stocks with which to populate them. The industry is a monstrous hydra, busily consuming its own, and its investors', capital. New funds are launched daily. Failing older funds are quietly tidied away, merged, or destroyed. They are 'uninvented'. Alison Smith and Stephen Foley covered the news of Neil Woodford's resignation for the Financial Times. They cited the FT's own John Kay, who carried out a review of UK equity markets last year, and who said:

As they suggest, Neil Woodford's past success means that raising money for his new business is unlikely to be much of a struggle. "But imagine the hurdles in the way of a manager who would like to purse long-term strategies but is just starting out." In the words of Professor Kay:

We have not been immune to the demands of clients frustrated at the performance of diversified portfolios lagging the broader equity markets (although this explicit benchmarking against stocks was never a mandate to which we subscribed). We struggle, in some cases, to make sufficiently clear our concerns about broader market valuation, or just as importantly the gravity of the global financial situation (including a potential QE-driven currency crisis), which makes a wholehearted commitment to the stock market in late 2013 seem to us a risky strategy. So where, if anywhere, does the fault lie? Sometimes it is not just asset managers who should be accused of being short-termist, or of missing the big picture. Our thesis has been consistent for five years now. We believe we are at the tail end of a 40-years' and counting experiment in money and the constant expansion of credit. This experiment is not ending well. Because government money, unbacked and unchecked as it now is by anything of tangible value, can be created at will, it has been. What is extraordinary is that despite trillions of Dollars (and Pounds and Yen) of stimulus, there are few visible signs of what we would call inflation, in anything other than the prices of financial assets themselves. We are living through a historic period of global currency debasement. The neo-Keynesian money-printers who dominate the world's central banks have 'won' the debate, but are now scratching their heads, looking in vain for the economic recovery that they were expecting all those trillions to have bought. They will continue to look in vain, because money creation and true wealth creation are polar opposites. As portfolio manager Tony Deden has asked,

Those words were written four years ago. The printing presses have been run to exhaustion ever since. So far they have bought us an inflationary rally in the prices of financial assets, and not much else. It has been a lousy time for anyone focused on the disciplined and genuinely diversified pursuit of capital preservation in real terms (more recently, for anyone seeking to escape the inflationary insanity via the honest money that is gold). We have not, to any significant extent, participated in the 'phony rally'. But then we are playing a longer game than most of our peers. Round and round and round she goes; where she stops, nobody knows. Fund manager Sebastian Lyon recently quoted another celebrated fund manager, Jean-Marie Eveillard:

|

| Looking Beyond Flashy Drill Results Posted: 23 Oct 2013 01:35 AM PDT Trained metallurgist and mining analyst on spotting value in junior miners... DEREK MACPHERSON is a mining analyst at investment bank M Partners in Toronto, Canada. Before joining, he worked in mining research for a bank-owned investment dealer. And prior to entering capital markets, MacPherson spent six years working as a metallurgist. Now studying underappreciated companies, Derek Macpherson says they can be opportunities to buy, not sell. Don't be dazzled by flashy drill results, he advises in this interview with The Gold Report. Investors are better looking for junior explorers with long-term vision, high grades and simple operations in good jurisdictions. The Gold Report: Derek, when it comes to junior mining equities you're something like a shark cruising for prey, seeking an opportunity to strike. What common buying opportunities do you look for that other investors might overlook? Derek Macpherson: We seek out assets that have been underappreciated or unjustly tossed aside, companies whose stories are starting to change. That change might be an operations turnaround, a turnover in the management team or a revision to the capital structure. TGR: One of your recent research flashes reported on the Mexican government's consideration of imposing a royalty on Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) on companies that mine commodities in Mexico. Tell us about that. Derek Macpherson: Whenever that topic comes up, it puts pressure on Mexican producers and developers. We are seeing the potential of a royalty getting priced in to those companies, and priced in as a worst case scenario. Initial discussions centered on a 5% EBITDA royalty, which could affect company valuations significantly. However, Mexican mining companies are working with the government to find a more reasonable solution. If the proposal gets ratcheted down to a 2.5% EBITDA royalty or perhaps a 2% net smelter return, then company valuations could recover. In Mexico, you want to look for companies that have low all-in cash costs. They will be somewhat insulated from the royalty because their margins won't be as compressed as higher cost operations. TGR: What common events lead you to undervalued equities? Derek Macpherson: One of the most obvious is when management teams disappoint; the mining space is littered with those. In those instances, we look at the underlying value and whether the management team can turn the operation around. We ask ourselves if the selloff was excessive, potentially creating a buying opportunity if the damage is recoverable. TGR: Do you think management teams are being punished too harshly for performance shortcomings? Derek Macpherson: I think it's partly a function of the commodity price environment. In a rising gold price environment, there was more room for error and setback didn't have as large an impact on project economics. In a volatile price environment, investors have shown very little patience. If production results or a resource update aren't in line with projections or better, the market pushes the stock down. TGR: Do you watch for seasonal opportunities, or has seasonality become less predictable? Derek Macpherson: Seasonality has been a bit less predictable. It has been dampened, first, by gold being driven by macro events and, second, by it being technically traded. This year, in particular, investors should be looking at the season for tax-loss selling. I expect to see an accelerated selloff near the end of 2013, as investors try to capitalize on their tax losses. This should create a buying opportunity for a lot of good stocks. This is the time for investors to do their homework and find the stocks they want to pick up as they sell off later in the year. TGR: What types of stocks do you think will sell off more than others? Derek Macpherson: I think it will be a function of the company's year-to-date performance. Companies that had a tough time from January to October will be the most affected. That doesn't speak to the quality of their projects, which could create buying opportunities. TGR: News flow used to dry up in the summer and start to flow again in September with the publication of summer drill results. Does news flow still matter? Derek Macpherson: To a certain extent, yes. Drill results became a bit of a selling opportunity or a liquidity event this summer. However, we are seeing that abate, particularly in September. TGR: Haywood Securities produces a quarterly report on the junior exploration companies that looks out three months to forecast how the companies listed will perform quarter to quarter. Do you look for quarter-to-quarter performance or do you look more long term? Derek Macpherson: In the junior exploration space, you have to look a little bit longer term. It often takes time and money to determine the value of a deposit. We try to look through flashy drill results that might move the stock over the short term but don't necessarily indicate anything about a company's long-term economic viability. We try to hitch our wagon to companies that take a long-term approach to how they do their work and a long-term approach to driving value. TGR: Speaking to those of our readers who are new to the junior mining space, what are some effective approaches for novice investors? Derek Macpherson: You certainly need to account for commodity volatility. Pick companies that have lower risk and can withstand volatility. When it comes to projects, we look for one of two things: a project needs to have very high grade or it needs to be technically simple. Having one of those two features can reduce the risk of your investment. The next thing to be aware of is jurisdiction. In the current market, there is an increased discount for political or permitting risk, and for the additional capital expense (capex) needed to put infrastructure in a remote location. Consequently, we tend to focus on North America, Mexico and some South American jurisdictions. In South America we look for jurisdictions with an existing mining culture, which can mean focusing on a specific region or even town in a given country. Peru is a good example; mining is welcome in some areas and is more challenging in others. TGR: What about playing the volatility itself in metals prices? Derek Macpherson: That's very difficult to do because investors have to guess right on which way metal prices go that day. If investors want to play that volatility through equities, they have to get into more leveraged names, which tend to have a higher risk balance sheet. Playing the volatility can be very difficult and very expensive if you guess wrong. TGR: Your thesis seems to prefer companies with cash and those that can raise cash with low-cash projects. Is that accurate? Derek Macpherson: Yes. That is, in part, a function of the current market environment. TGR: Do you have any parting thought for our readers? Derek Macpherson: Even though markets are challenging for mining equities, some high-quality names have sold off, creating an opportunity for investors to get involved at a reasonable price. Despite the overhang that equity markets have put on the space, it will get better; it's just a matter of when. TGR: Derek, thanks for your time and insights. |

| Looking Beyond Flashy Drill Results Posted: 23 Oct 2013 01:35 AM PDT Trained metallurgist and mining analyst on spotting value in junior miners... DEREK MACPHERSON is a mining analyst at investment bank M Partners in Toronto, Canada. Before joining, he worked in mining research for a bank-owned investment dealer. And prior to entering capital markets, MacPherson spent six years working as a metallurgist. Now studying underappreciated companies, Derek Macpherson says they can be opportunities to buy, not sell. Don't be dazzled by flashy drill results, he advises in this interview with The Gold Report. Investors are better looking for junior explorers with long-term vision, high grades and simple operations in good jurisdictions. The Gold Report: Derek, when it comes to junior mining equities you're something like a shark cruising for prey, seeking an opportunity to strike. What common buying opportunities do you look for that other investors might overlook? Derek Macpherson: We seek out assets that have been underappreciated or unjustly tossed aside, companies whose stories are starting to change. That change might be an operations turnaround, a turnover in the management team or a revision to the capital structure. TGR: One of your recent research flashes reported on the Mexican government's consideration of imposing a royalty on Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) on companies that mine commodities in Mexico. Tell us about that. Derek Macpherson: Whenever that topic comes up, it puts pressure on Mexican producers and developers. We are seeing the potential of a royalty getting priced in to those companies, and priced in as a worst case scenario. Initial discussions centered on a 5% EBITDA royalty, which could affect company valuations significantly. However, Mexican mining companies are working with the government to find a more reasonable solution. If the proposal gets ratcheted down to a 2.5% EBITDA royalty or perhaps a 2% net smelter return, then company valuations could recover. In Mexico, you want to look for companies that have low all-in cash costs. They will be somewhat insulated from the royalty because their margins won't be as compressed as higher cost operations. TGR: What common events lead you to undervalued equities? Derek Macpherson: One of the most obvious is when management teams disappoint; the mining space is littered with those. In those instances, we look at the underlying value and whether the management team can turn the operation around. We ask ourselves if the selloff was excessive, potentially creating a buying opportunity if the damage is recoverable. TGR: Do you think management teams are being punished too harshly for performance shortcomings? Derek Macpherson: I think it's partly a function of the commodity price environment. In a rising gold price environment, there was more room for error and setback didn't have as large an impact on project economics. In a volatile price environment, investors have shown very little patience. If production results or a resource update aren't in line with projections or better, the market pushes the stock down. TGR: Do you watch for seasonal opportunities, or has seasonality become less predictable? Derek Macpherson: Seasonality has been a bit less predictable. It has been dampened, first, by gold being driven by macro events and, second, by it being technically traded. This year, in particular, investors should be looking at the season for tax-loss selling. I expect to see an accelerated selloff near the end of 2013, as investors try to capitalize on their tax losses. This should create a buying opportunity for a lot of good stocks. This is the time for investors to do their homework and find the stocks they want to pick up as they sell off later in the year. TGR: What types of stocks do you think will sell off more than others? Derek Macpherson: I think it will be a function of the company's year-to-date performance. Companies that had a tough time from January to October will be the most affected. That doesn't speak to the quality of their projects, which could create buying opportunities. TGR: News flow used to dry up in the summer and start to flow again in September with the publication of summer drill results. Does news flow still matter? Derek Macpherson: To a certain extent, yes. Drill results became a bit of a selling opportunity or a liquidity event this summer. However, we are seeing that abate, particularly in September. TGR: Haywood Securities produces a quarterly report on the junior exploration companies that looks out three months to forecast how the companies listed will perform quarter to quarter. Do you look for quarter-to-quarter performance or do you look more long term? Derek Macpherson: In the junior exploration space, you have to look a little bit longer term. It often takes time and money to determine the value of a deposit. We try to look through flashy drill results that might move the stock over the short term but don't necessarily indicate anything about a company's long-term economic viability. We try to hitch our wagon to companies that take a long-term approach to how they do their work and a long-term approach to driving value. TGR: Speaking to those of our readers who are new to the junior mining space, what are some effective approaches for novice investors? Derek Macpherson: You certainly need to account for commodity volatility. Pick companies that have lower risk and can withstand volatility. When it comes to projects, we look for one of two things: a project needs to have very high grade or it needs to be technically simple. Having one of those two features can reduce the risk of your investment. The next thing to be aware of is jurisdiction. In the current market, there is an increased discount for political or permitting risk, and for the additional capital expense (capex) needed to put infrastructure in a remote location. Consequently, we tend to focus on North America, Mexico and some South American jurisdictions. In South America we look for jurisdictions with an existing mining culture, which can mean focusing on a specific region or even town in a given country. Peru is a good example; mining is welcome in some areas and is more challenging in others. TGR: What about playing the volatility itself in metals prices? Derek Macpherson: That's very difficult to do because investors have to guess right on which way metal prices go that day. If investors want to play that volatility through equities, they have to get into more leveraged names, which tend to have a higher risk balance sheet. Playing the volatility can be very difficult and very expensive if you guess wrong. TGR: Your thesis seems to prefer companies with cash and those that can raise cash with low-cash projects. Is that accurate? Derek Macpherson: Yes. That is, in part, a function of the current market environment. TGR: Do you have any parting thought for our readers? Derek Macpherson: Even though markets are challenging for mining equities, some high-quality names have sold off, creating an opportunity for investors to get involved at a reasonable price. Despite the overhang that equity markets have put on the space, it will get better; it's just a matter of when. TGR: Derek, thanks for your time and insights. |

| China & the Dollar-Based Financial System Posted: 23 Oct 2013 01:29 AM PDT Japan can no longer help. China is trying to step out of supporting the Dollar... OUR THEME is the global financial system, writes Greg Canavan in The Daily Reckoning Australia. It's been around for 40-plus years in its current guise. That is, since 1971 when Richard Nixon reneged on the US government's promises to pay its debt in gold (or gold equivalent Dollars). However, abandoning gold didn't send the greenback down the toilet. That's because oil soon replaced gold as the 'foundation' of the US Dollar's strength. In 1973 US Secretary of State Henry Kissinger made a deal with Saudi Arabia. If the Saudis priced their oil in US Dollars and agreed to buy US Treasuries with the proceeds from the oil sales, the US would protect the House of Saud's interests in the region. The Saudis would pay for this military protection (and the infrastructure required to modernise its economy) with the interest from its rapidly increasing stash of Treasury bonds. Thus the petro-dollar came into existence. And the recycling of Dollars for oil back into the US economy provided vital support for the US Dollar and by extension for the global financial system. Saudi support sorted out the problem of the US oil and energy deficit. In the 1980s and '90s, Japanese support sorted out the problem of the US consumer goods deficit. Following the Saudis, Japan recycled its huge trade surpluses back into the US via the purchase of Treasury bonds. And it has done so pretty much ever since. But there's a looming problem. Abenomics. That's the term for the audacious efforts of Japanese PM Shinzo Abe in trying to engineer inflation in Japan's structurally deformed economy. His strategy makes the US Fed look prudent. Apparently it will pull Japan out of its multi-decade deflationary slump and Japan will once again be prosperous. So how's it going? It depends how you look at it. Monday, Japan announced a record trade deficit for September of US$9.5 billion, the 15th consecutive monthly deficit. In the first half of the Japanese fiscal year (which starts in April), the deficit came in at US$51 billion, also a record. The Yen has weakened significantly against the US Dollar over the past year, but it still managed to run a trade surplus with the US of US$5.4 billion for the month. However it's deficit with China nearly doubled to US$6.3 billion. What does all this mean and how does it fit in with the health or otherwise of the global financial system? Well, Japan was a major supporter of the system by buying US Treasuries with the proceeds of its trade surpluses. But it's no longer producing these surpluses. Thanks to a weaker Yen and increased energy importing needs after the Fukushima nuclear accident, Japan is now producing regular deficits. More importantly, its legendary current account surplus is shrinking. (The current account is basically the trade balance plus net income from foreign investments.) In August, Japan's current account surplus was just US$1.64 billion. In other words, its trade deficit is beginning to consume the income it receives from its vast holdings of foreign assets (including US Treasury bonds). If the trade deficit continues to grow, Japan may have to sell some of its foreign assets to fund it...or issue more debt, which may be difficult given its debt load is already the largest in the world. The point is that if Japan continues down the path of Abenomics it will no longer be able to fund the US government – as it has basically done for decades. That's another nail in the coffin for the US Dollar-based financial system. That will leave the Fed and China as the main buyers of US debt. We'll get a sense of whether China is still buying with the delayed release of Treasury International Capital (TIC) data tomorrow. But it's quite clear that while they are still supporting the system, they are also making moves to abandon it at some point in the future. They are importing record amounts of gold...and they are establishing bilateral swap lines with many of the world's central banks in order to bypass the US Dollar when conducting trade. They don't want the yuan to replace the US Dollar as the world's reserve currency; the Chinese economy doesn't have the depth or strength to fulfil that function. They simply want to build the infrastructure to allow the yuan to become a global trade based currency, while cutting out the US Dollar middleman. Right now, most global trade is settled in US Dollars. Trading between two nations usually involves buying and selling the US Dollar to facilitate the trade. This is what China is trying to get around. By removing the US Dollar from trade transactions, it removes an important leg of support (via foreign exchange trade) for the Dollar. But China has to tread carefully. Its economy is a basket case, courtesy of maintaining the yuan-Dollar peg for years at an artificially low rate. This fixing of exchange rates, along with crazy over-zealous central planning, created a huge asset and property price bubble along the lines of Japan in the 1980s. Then the central planners did more planning to correct the problems caused by previous planning. The latest debacle is the revelation that China's vast affordable housing plan is not really working out, because those it targets cannot afford it. So China finds itself helplessly bound up in the current US Dollar system. It knows it must get out but cannot do so without causing major global volatility. This goes against the whole vibe of the Chinese leadership, which is stability. This is why we suspect that China is rapidly accumulating physical gold, and encouraging its citizens to do likewise. They know the West has commoditised the 'price' of gold by throwing thousands of tonnes of paper supply at it. They also know that gold is a wealth reserve asset, not a commodity, and that it will trade as a wealth reserve asset when the current incarnation of the financial system morphs into something else. For China, gold is a way of preserving some of their savings and hedging against their nearly US$1.3 trillion in US Treasuries. How much more they are willing to absorb is impossible to tell. But they can't be happy with the news that US debt soared by US$328 billion in one day following the resolution of the debt crisis. Of course the US didn't just spend it all at once. It's been operating under 'extraordinary measures' for a while now, and the one-day increase represents a catch-up to normalise its debt needs. US debt now stands at $17.075 trillion and there is no limit on how much it can spend between now and February 7 when the next debt debate rolls around. The point we're getting at with all this is that the financial system is in the process of major change. The structures that have held it together for decades are changing and changing fast - in a relative sense. Right now we're getting a melt-up in asset prices as capital shifts from government debt to the private sector. This is leading to general complacency and the interpretation that 'things are getting better'. In the absence of strong fundamentals, confidence is levitating assets prices around the world. But confidence is fleeting. Confidence doesn't provide the investor with attractive prices. Instead, it distorts judgment and makes you think that a Semper Augustus is more than just a tulip. So you pay anything for it, secure in the knowledge that someone will come along at some point and pay even more to take it off your hands. |