Gold World News Flash |

- U.S. Dollar's Breakdown, Stocks' Breakout and Implications for Gold

- The Inevitable Market Deleveraging Will Occur, Whether the Fed Wants It or Not

- China's Gold Reserves At Least 2.5 Times Higher Than Reported, ‘De-Americanisation’ Continues

- Gold Best Week in 11 for on US Short-Covering

- Gold Markets are not Efficient, Don’t Reflect Fundamentals & Understate Gold’s Market Value (part 5)

- Gold, Trust & Independence, Part 3

- Gold, Trust & Independence, Part 3

- Gold, Trust & Independence, Part 3

- GATA hero Maguire is no metals trading expert – CPM’s Christian

- The Ongoing War In The Gold Market Continues To Rage

- Is A Massive Chinese Order Causing a Silver Shortage in Europe?!

- Gold pops back into positive territory on US consumer sentiment miss. Currently trading 1348.00.

- Gold, Stock Market Investors Time to Sit on the Sidelines

- China's Gold Reserves At Least 2.5 Times Higher Than Reported, ‘De-Americanisation’ Continues

- Silver in a Deflationary Crash

- Silver and Gold - Lone Options in an Exponential WorldÂ

- Gold — Driven by American Politics and Monetary-Policy Expectations

- Staggering Physical Gold Demand Now Overrunning Shorts

- How to Make $15.6 Million, Risk-Free

- Gold Falls From Three-Week High as Demand May Slow After Rally

- Securing a Life Raft Amid the U.S. Dollar Hurricane

- Gold Prices Get Best Week in 11 on "Short-Covering" and "Diwali Demand"

- Elliott Wave Analysis For USDCAD - Three Wave Rally

- Gold lower at 1339.80 (-6.50). Silver 22.35 (-0.36). Dollar bounces. Euro lower. Stocks called better. US 10yr 2.52% (unch).

- The Collapse of the U.S. Dollar is Unavoidable! Here’s Why

- 12 Reasons Why Gold Price Will Rebound and Make New Highs in 2014

- Precious Metals: Gold, Silver and Miners Are Trapped

| U.S. Dollar's Breakdown, Stocks' Breakout and Implications for Gold Posted: 25 Oct 2013 10:51 AM PDT After 12 years of gains, gold has fallen nearly 20% this year. The price of gold has been pressured for much of this year by the view that the Fed would end its stimulus program soon because of strength in the U.S. economy. However, some recent (weaker than expected) economic data, along with the 16-day U.S. government shutdown, have suggested that the central bank may keep its bond purchase in place for longer and increased gold's safe-haven appeal. What impact did these circumstances have on the yellow metal? |

| The Inevitable Market Deleveraging Will Occur, Whether the Fed Wants It or Not Posted: 25 Oct 2013 10:43 AM PDT

By engaging in QE, the Fed alters the very structure of risk in the financial system. Traders on Wall Street, knowing full well that the Fed would be soaking up Treasuries, rushed into new debt issuance with the intention of flipping over these assets to the Fed in the near future.

This became a self-fulfilling prophecy as the “front-running the Fed” trade became a dominant theme for Wall Street. By piling into bonds, traders forced prices higher and yields lower: precisely what the Fed wanted.

It is critical to note that a significant percentage of these investors had no interest in actually owning US debt as an asset class in the long run. They were simply looking for an easy trade that made money. As a result, interest rates were driven even lower by the “investment herd”.

All risk in the financial world ultimately traces its pricing back the yield on US Treasuries. US Treasuries are considered to be “risk free” because they are backed by the full faith and credit of the US Government.

All other, riskier assets (corporate bonds, municipal bonds, emerging markets bonds, then stocks and emerging market stocks) trade based on their perceived riskiness relative to Treasuries yields. By manipulating interest rates lower, both directly (cutting rates) and indirectly (by broadcasting its intention in buying Treasuries, thereby incentivizing traders to front run it) the Fed altered the capital market landscape in ways that few investors understand.

By maintaining artificially low interest rates, the Fed was hoping to drive investors away from bonds and into stocks and other, more risky assets. The Crash of 2008, combined with a retiring or soon to retire Baby Boomer population that is more interested in income than capital gains, resulted in a mass exodus away from stocks in the 2009-2013 period.

By keeping interest rates near zero, the Fed has been hoping to push investors into the stock market. The hope here was that as stock prices rose, investors would feel wealthier (the “wealth effect”) and would be more inclined to start spending more, thereby jump-starting the economy.

This has not been the case. Instead the entire capital market structure has become mispriced.

Individual investors have been fleeing stocks for the perceived safety (and more consistent returns) of bonds. Since 2007, investors have pulled over $405 billion out of stock based mutual funds. The pace did not slow throughout this period either with investors pulling $90 billion out of stock based mutual funds in 2012: the largest withdrawal since 2008.

In contrast, over the same time period, investors have put over $1.14 trillion into bond funds. They brought in $317 billion in 2012, the most since 20008.

This had the effect of pushing yields even lower (precisely what the Fed wanted).

As you can see, today rates are the lowest they’ve been in over fifty years. This is not a sustainable trajectory. Real estate and all other assets that have been financed via cheap debt have been pushed higher due to excess leverage. This includes GDP.

In the 1960s every new $1 in debt bought nearly $1 in GDP growth. In the 70s it began to fall as the debt climbed. By the time we hit the ‘80s and ‘90s, each new $1 in debt bought only $0.30-$0.50 in GDP growth. And today, each new $1 in debt buys only $0.10 in GDP growth at best.

Put another way, the growth of the last three decades, but especially of the last 5-10 years, has been driven by a greater and greater amount of debt. This is why the Fed has been so concerned about interest rates. It’s also why ultimately the Fed’s efforts to reflate the system will fail on some level with the inevitable market deleveraging occurring one way or another.

Be prepared.

For a FREE Special Report outlining how to protect your portfolio a market collapse, swing by: http://phoenixcapitalmarketing.com/special-reports.html

Best Phoenix Capital Research

|

| China's Gold Reserves At Least 2.5 Times Higher Than Reported, ‘De-Americanisation’ Continues Posted: 25 Oct 2013 10:35 AM PDT Today's AM fix was USD 1,341.75, EUR 971.79 and GBP 827.58 per ounce. Gold climbed $12.10 or 0.91% yesterday, closing at $1,345.40/oz. Silver inched up $0.11 or 0.49% closing at $22.67. Platinum rose $15.45 or 1.1% to $1,445.75/oz, while palladium fell $0.53 or 0.1% to $743.47/oz. Gold Krugerrands (1 oz) are trading at $1,406.48 or premiums between 4.75% and 5.5% and Gold Kilo Bars (1 kilo) are trading at $44,451.89 or premiums between 3% and 3.5%. Premiums are steady.

Gold dipped below its three-week high in London on profit taking after a 2% gain this week, which put gold on course for a second week of higher prices. Gold closed above the 50-day moving average and this in conjunction with two weekly higher closes is bullish technically. Gold's gains yesterday came due to increasing concerns that the Federal Reserve will maintain the pace of unprecedented monetary stimulus and debasement. Gold is on track for its first yearly drop in over 13 years, as speculators sold gold on the COMEX and some investors became nervous of the recent price falls. The call is interesting as CPM have been notoriously bearish on gold in recent years - throughout much of the 11 year bull market. Gold may jump 7.5% or $100 to $1,450/oz by year end if prices break out of a pennant formation, according to technical analysis by Paul Kavanaugh of Future Path Trading as seen on Bloomberg. The chart above shows gold trading in a "pennant flag," when the upper and lower trend lines for prices meet to form a triangle. The lower level is $1,251, and the upper is $1,434, Kavanaugh said. "Prices are clearly trying to move higher, and a close above the 50-day moving average means we could see some strength," Kavanaugh said. Comments from state backed Xinhua that call for a "de-Americanised world" and a proposal to consider a new international reserve currency to replace the dollar mark a key event for gold prices. The official Xinhua News Agency and the voice of the Chinese government, offered a not so subtle, highly critical commentary on October 14 regarding the U.S.' appalling fiscal, monetary and political situation as it stands today. While the Chinese echoed the notion of a "super-sovereign reserve currency" before, their statement is more important as the U.S. continues to struggle to reach agreements on debt ceiling talks and future monetary policy actions. "It is perhaps a good time for the befuddled world to start considering building a de-Americanised world" said the important op-ed.

Key among its proposals: the creation of a new international reserve currency to replace the present reliance on the U.S. dollar as reserve currency. The article suggested that this is a necessary step to prevent American bumbling and profligacy from further afflicting the world. "The world is still crawling its way out of an economic disaster thanks to the voracious Wall Street elites." "The cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising the debt ceiling has again left many nations' tremendous dollar assets in jeopardy and the international community highly agonized," says Xinhua. The Chinese have for a long number of years expressed concerns about the direction Washington, led by Wall Street, is leading the world financial system and the global economy. In March 2009, the governor of the People's Bank of China, Zhou Xiaochuan, called for the creation of a new reserve currency, albeit in less forthright language. The world needs a new "super-sovereign reserve currency" to replace the current reliance on the dollar, Zhou wrote in a paper published on the People's Bank of China's website. Zhou Xiaochuan is still China's central bank governor. The goal is to "create an international reserve currency that is disconnected from individual nations and is able to remain stable in the long run." This sounds like he may be referring to gold, as gold is an "international reserve currency that is disconnected from individual nations" and has remained "stable in the long run." Along with a greater role for developing-market economies in both the World Bank and International Monetary Fund, "the authority of the United Nations in handling global hot-spot issues has to be recognized. That means no one has the right to wage any form of military action against others without a UN mandate." "A self-serving Washington has abused its superpower status and introduced even more chaos into the world by shifting financial risks overseas, instigating regional tensions amid territorial disputes, and fighting unwarranted wars under the cover of outright lies," the commentary continues. "Such alarming days when the destinies of others are in the hands of a hypocritical nation have to be terminated, and a new world order should be put in place, according to which all nations, big or small, poor or rich, can have their key interests respected and protected on an equal footing." Since the early 2000s, those positive on gold have rightly suggested that excessive money printing by the Federal Reserve would lead to a devaluation of the world's reserve currency as inflation picks up and hampers the currency. Those more concerned about the dollar's fate has warned of a currency collapse and serious inflation. While the notion of the dollar losing its status as the world's reserve currency had appeared muted for some time given the lack of alternatives, it is now gaining credence. A deeper look into China's gold holdings warrants attention (see charts). Its last reported gold holdings in April 2009 were 1,054 metric tons. After adjusting for net imports from Hong Kong and domestic output, the figure is closer to 5,086 metric tons. If one were to take away gold uses for jewelry, industrial, and other categories and only add implied bar demand to central bank holdings, the figure is likely closer to 2,710 metric tons according to Bloomberg Industries' Andrew Cosgrove and Kenneth Hoffman. In just 10 years, China's gold holdings could catch up to the U.S., based on adjusted Chinese consumption for jewelry, industrial and other uses and using implied bar demand as the primary driver of incremental central bank additions (see chart).

At current run rates, China is on pace to add 622 metric tons of bars to its central bank holdings this year (380 mt in 2012). Given the low gold price, growing reserves in 2014 above this year's levels appears achievable. Gold will benefit from the continuing move away from the dollar as the world's reserve currency as some form of a gold-backed currency emerges. China's call for "de-Americanization" is likely just a posturing maneuver. A large-scale sale of China's U.S. Treasury holdings would likely cause a dramatic decline in the dollar, while increasing rates. This would cripple the U.S. economy and dent export demand for Chinese products. This therefore, is the "nuclear option" for the Chinese government and one that they will be keen to avoid. They will only adopt this position if forced to in extreme circumstances, such as a U.S. default or extreme debasement of the dollar. Already, the Chinese have stopped accumulating dollars - preferring safer currencies, infrastructure, hard assets and commodities and of course gold. Even a small amount of Chinese selling could lead to substantial dollar weakness and much higher bond yields plummeting the U.S. into another recession. The smart money, including the Chinese people and the People's Bank of China, is concerned about currency debasement and continue to accumulate physical gold for the long term. The dumb money continues to not understand the ramifications of dollar currency debasement and the De-Americanising world and continues to see gold as a trade or a mere speculation rather than the essential safe haven asset that it is. Gold is heading for the first annual decline since 2000. The Chinese have lustily greeted gold's 19% drop this year by continuing to buy record amounts of gold. They know the price drop has created a gift for physical buyers globally. |

| Gold Best Week in 11 for on US Short-Covering Posted: 25 Oct 2013 10:31 AM PDT The PRICE of wholesale gold slipped but held near 1-month highs Friday morning in London, heading for the strongest week-on-week gain since mid-August at $1343 per ounce. Rising 1.7% from last Friday's finish, gold prices lagged silver – up 2.3% for the week – as European stock markets held flat and Asian stock markets fell hard. |

| Gold Markets are not Efficient, Don’t Reflect Fundamentals & Understate Gold’s Market Value (part 5) Posted: 25 Oct 2013 10:30 AM PDT by Julian D. W. Phillips, Gold Seek:

Why? There's no doubt that if the Indian gov't could harness locally owned gold (total around 25,000 tonnes). The currency would then be the best backed currency in the world and shouldn't suffer declines if its gold were used as collateral for its foreign currency needs. The trouble is the Indian people would be furious and the gov't would most likely lose the next election (because of the feelings the Indian people have towards gold). So, with elections due next year, they're currently exploring ways to achieve this without creating uproar. Hence temple gold, where there are around 2,000 tonnes of gold held by them overall. |

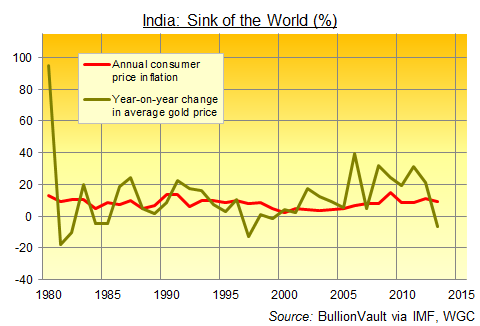

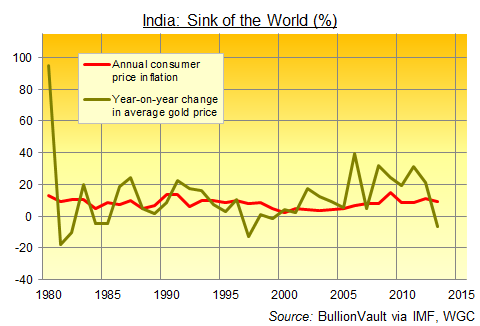

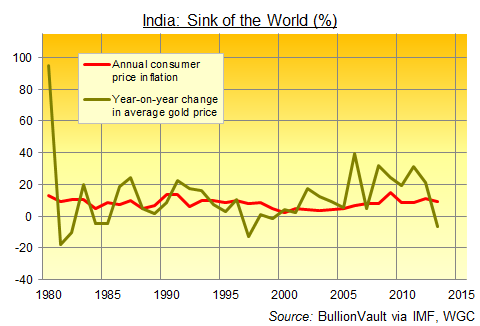

| Gold, Trust & Independence, Part 3 Posted: 25 Oct 2013 10:01 AM PDT India needs gold, wants it, loves it. But where to find it with imports banned...? WHERE were we? Oh yes, trust and independence, writes Adrian Ash at BullionVault – the key themes at this year's LBMA/LPPM precious metals conference. Indian temples and Italy's central bank have lots in common when it comes to gold. Both are sitting on plenty (3,500 if not 8,000 tonnes or more in the former, and 2,451 tonnes for the Banca). Both have found their governments wanting to "use" that gold to smooth out trouble in the wider economy (Hindu temples today, Italy in 2009). Both have – to date – declined to help. And for India's temples as for the Banca d'Italia, keeping hold of that gold speaks to two key issues: trust and independence. Gold is "unique amongst safe assets," said the Bank of Italy's director general, Salvatore Rossi, at the top of the LBMA's conference in Rome this month. Because it is not "issued" by anyone. So it cannot be devalued or controlled by government, not in the way that, say, paper money can be exploited to boost the economy's output but at the cost of rising inflation. Rossi's speech was note-perfect as an example of central-bank speak. But so diplomatic as to lack all controversy, the Bank of Italy chief actually made a statement so loud no one could hear it. Or so we thought. Italy's central-bank gold is what keeps it independent of politicians. Gold acts as the bedrock of that trust which the public must put in the central bank – unelected, and so untainted by politics – to avoid creating inflation by fearing it. Too philosophical a reading? Perhaps. But contrast the trust and independence issues for India's temples. Just like Indian households, they're finding that the government's 2013 ban on gold imports – imposed to try and cut the country's huge trade deficit – will see them short of the new gold they'd normally expect this festive season. Peaking next week with Dhanteras, the first day of Diwali, gift-giving has run into a historic gold shortage. There simply isn't enough gold flowing into the world's heaviest buyer to meet seasonal demand. Good, says the government. "India, as we all know, already wastes far too high a proportion of her resources in the needless accumulation of the precious metals," as a certain economist, John Maynard Keynes, wrote in his first policy paper 100 years ago. That argument hasn't changed, but Keynes was in truth repeating a view running from ancient Rome's Pliny the Elder to Karl Marx and Victorian economist William Stanley Jevons, who also called India "the sink of the world" for silver and gold. Keynes in 1913 said India needed to quit this "uncivilized and wasteful habit". Rajiv Takru, India's financial services secretary today, called buying gold "wasteful expenditure" in June 2013. So why do Indian households buy (and gift) so much of the stuff? Because they've got to do something...  Incredibly, and despite being the biggest topic of sober conversation at the conference hotel, dinners and drinks, the government clampdown on gold imports (banning credit, banning coins, hiking duty to 10%, forcing re-export of 20% of all new shipments) went almost entirely undiscussed on the podium in Rome at this year's LBMA shindig. Yes, C.K.Venkataraman, CEO of the giant Titan Industries, shared insights and examples from marketing jewelry to Indian households. But out of 57 speakers, and with the global bullion market facing a shutdown by its #1 consumer, only Shekhar Bhandari – executive vice president of Kotak Mahindra Bank – addressed the issue head on, and from the inside. Bhandari, like the mass of refiners, brokers and secure transport providers making up the 700-strong LBMA delegates this year, clearly won't make much from India's gold love if the entire trade goes underground. Which it will, only too quickly, if the government persists with the imports ban as it is. But unlike the Western attendees, however, India's formal banking and bullion industry can at least recoup some of the revenues lost to smugglers if it helps unlock – or "mobilize" – all that gold already inside the country. Which totals perhaps 16,000 if not 20,000 tonnes on best estimates. Which is at least 10% of all the gold ever mined in history. Because like Pliny the Elder said, India's been sucking the stuff in for a very long time. "The biggest avenue the government has to monetise gold," Bhandari told Reuters a month before the LBMA conference, "is the gold deposit scheme." It would see households (or perhaps temples) put their gold items on deposit, in return for a rate of interest. "That has the maximum potential and [would encourage] recurring behaviour." But what about trust? Indians buy gold because they don't trust their government not to damage their best interests, most notably through the persistently weak Rupee. To retain financial independence, Indians buy gold today just as they have throughout history. Because whilst its price can be volatile, it tends to beat official inflation. It can't be inflated like the all-too paper Rupee. And it can of course be hidden – hung around a wrist or ankle here, stuffed under a floorboard there – to escape the government's ever-eager taxation of wealth. India's rich Hindu temples offer an alternative. Because if private citizens won't help the nation, perhaps the largest private institution will instead? Clearly this is being discussed, between banks and government if not with the temples themselves. Kotak's Bhandari told the LBMA conference that temple gold, if mobilized through a government-guaranteed deposit scheme, could meet India's domestic consumer demand for a decade. But again, there are big issues of trust and independence to fix first. Bhandari separately told one speaker that could be achieved in 3 years. But getting India's faithful to allow their local temples to offer the gold gifts it's received...and getting those holy items smelted and recast into kilobars for jewelers to rework into bangles and bracelets...looks a might big task. Meantime, that 10% import duty on gold – even if legal inflows do pick up at some point – offers a huge incentive to smugglers all around India's borders. And even with the big crash of 2013, gold prices remain high by historical standards. How high has also become a key theme for the precious metals market in 2013. Trust and independence loom largest there, perhaps, as we'll see in our fourth and final part next week... |

| Gold, Trust & Independence, Part 3 Posted: 25 Oct 2013 10:01 AM PDT India needs gold, wants it, loves it. But where to find it with imports banned...? WHERE were we? Oh yes, trust and independence, writes Adrian Ash at BullionVault – the key themes at this year's LBMA/LPPM precious metals conference. Indian temples and Italy's central bank have lots in common when it comes to gold. Both are sitting on plenty (3,500 if not 8,000 tonnes or more in the former, and 2,451 tonnes for the Banca). Both have found their governments wanting to "use" that gold to smooth out trouble in the wider economy (Hindu temples today, Italy in 2009). Both have – to date – declined to help. And for India's temples as for the Banca d'Italia, keeping hold of that gold speaks to two key issues: trust and independence. Gold is "unique amongst safe assets," said the Bank of Italy's director general, Salvatore Rossi, at the top of the LBMA's conference in Rome this month. Because it is not "issued" by anyone. So it cannot be devalued or controlled by government, not in the way that, say, paper money can be exploited to boost the economy's output but at the cost of rising inflation. Rossi's speech was note-perfect as an example of central-bank speak. But so diplomatic as to lack all controversy, the Bank of Italy chief actually made a statement so loud no one could hear it. Or so we thought. Italy's central-bank gold is what keeps it independent of politicians. Gold acts as the bedrock of that trust which the public must put in the central bank – unelected, and so untainted by politics – to avoid creating inflation by fearing it. Too philosophical a reading? Perhaps. But contrast the trust and independence issues for India's temples. Just like Indian households, they're finding that the government's 2013 ban on gold imports – imposed to try and cut the country's huge trade deficit – will see them short of the new gold they'd normally expect this festive season. Peaking next week with Dhanteras, the first day of Diwali, gift-giving has run into a historic gold shortage. There simply isn't enough gold flowing into the world's heaviest buyer to meet seasonal demand. Good, says the government. "India, as we all know, already wastes far too high a proportion of her resources in the needless accumulation of the precious metals," as a certain economist, John Maynard Keynes, wrote in his first policy paper 100 years ago. That argument hasn't changed, but Keynes was in truth repeating a view running from ancient Rome's Pliny the Elder to Karl Marx and Victorian economist William Stanley Jevons, who also called India "the sink of the world" for silver and gold. Keynes in 1913 said India needed to quit this "uncivilized and wasteful habit". Rajiv Takru, India's financial services secretary today, called buying gold "wasteful expenditure" in June 2013. So why do Indian households buy (and gift) so much of the stuff? Because they've got to do something...  Incredibly, and despite being the biggest topic of sober conversation at the conference hotel, dinners and drinks, the government clampdown on gold imports (banning credit, banning coins, hiking duty to 10%, forcing re-export of 20% of all new shipments) went almost entirely undiscussed on the podium in Rome at this year's LBMA shindig. Yes, C.K.Venkataraman, CEO of the giant Titan Industries, shared insights and examples from marketing jewelry to Indian households. But out of 57 speakers, and with the global bullion market facing a shutdown by its #1 consumer, only Shekhar Bhandari – executive vice president of Kotak Mahindra Bank – addressed the issue head on, and from the inside. Bhandari, like the mass of refiners, brokers and secure transport providers making up the 700-strong LBMA delegates this year, clearly won't make much from India's gold love if the entire trade goes underground. Which it will, only too quickly, if the government persists with the imports ban as it is. But unlike the Western attendees, however, India's formal banking and bullion industry can at least recoup some of the revenues lost to smugglers if it helps unlock – or "mobilize" – all that gold already inside the country. Which totals perhaps 16,000 if not 20,000 tonnes on best estimates. Which is at least 10% of all the gold ever mined in history. Because like Pliny the Elder said, India's been sucking the stuff in for a very long time. "The biggest avenue the government has to monetise gold," Bhandari told Reuters a month before the LBMA conference, "is the gold deposit scheme." It would see households (or perhaps temples) put their gold items on deposit, in return for a rate of interest. "That has the maximum potential and [would encourage] recurring behaviour." But what about trust? Indians buy gold because they don't trust their government not to damage their best interests, most notably through the persistently weak Rupee. To retain financial independence, Indians buy gold today just as they have throughout history. Because whilst its price can be volatile, it tends to beat official inflation. It can't be inflated like the all-too paper Rupee. And it can of course be hidden – hung around a wrist or ankle here, stuffed under a floorboard there – to escape the government's ever-eager taxation of wealth. India's rich Hindu temples offer an alternative. Because if private citizens won't help the nation, perhaps the largest private institution will instead? Clearly this is being discussed, between banks and government if not with the temples themselves. Kotak's Bhandari told the LBMA conference that temple gold, if mobilized through a government-guaranteed deposit scheme, could meet India's domestic consumer demand for a decade. But again, there are big issues of trust and independence to fix first. Bhandari separately told one speaker that could be achieved in 3 years. But getting India's faithful to allow their local temples to offer the gold gifts it's received...and getting those holy items smelted and recast into kilobars for jewelers to rework into bangles and bracelets...looks a might big task. Meantime, that 10% import duty on gold – even if legal inflows do pick up at some point – offers a huge incentive to smugglers all around India's borders. And even with the big crash of 2013, gold prices remain high by historical standards. How high has also become a key theme for the precious metals market in 2013. Trust and independence loom largest there, perhaps, as we'll see in our fourth and final part next week... |

| Gold, Trust & Independence, Part 3 Posted: 25 Oct 2013 10:01 AM PDT India needs gold, wants it, loves it. But where to find it with imports banned...? WHERE were we? Oh yes, trust and independence, writes Adrian Ash at BullionVault – the key themes at this year's LBMA/LPPM precious metals conference. Indian temples and Italy's central bank have lots in common when it comes to gold. Both are sitting on plenty (3,500 if not 8,000 tonnes or more in the former, and 2,451 tonnes for the Banca). Both have found their governments wanting to "use" that gold to smooth out trouble in the wider economy (Hindu temples today, Italy in 2009). Both have – to date – declined to help. And for India's temples as for the Banca d'Italia, keeping hold of that gold speaks to two key issues: trust and independence. Gold is "unique amongst safe assets," said the Bank of Italy's director general, Salvatore Rossi, at the top of the LBMA's conference in Rome this month. Because it is not "issued" by anyone. So it cannot be devalued or controlled by government, not in the way that, say, paper money can be exploited to boost the economy's output but at the cost of rising inflation. Rossi's speech was note-perfect as an example of central-bank speak. But so diplomatic as to lack all controversy, the Bank of Italy chief actually made a statement so loud no one could hear it. Or so we thought. Italy's central-bank gold is what keeps it independent of politicians. Gold acts as the bedrock of that trust which the public must put in the central bank – unelected, and so untainted by politics – to avoid creating inflation by fearing it. Too philosophical a reading? Perhaps. But contrast the trust and independence issues for India's temples. Just like Indian households, they're finding that the government's 2013 ban on gold imports – imposed to try and cut the country's huge trade deficit – will see them short of the new gold they'd normally expect this festive season. Peaking next week with Dhanteras, the first day of Diwali, gift-giving has run into a historic gold shortage. There simply isn't enough gold flowing into the world's heaviest buyer to meet seasonal demand. Good, says the government. "India, as we all know, already wastes far too high a proportion of her resources in the needless accumulation of the precious metals," as a certain economist, John Maynard Keynes, wrote in his first policy paper 100 years ago. That argument hasn't changed, but Keynes was in truth repeating a view running from ancient Rome's Pliny the Elder to Karl Marx and Victorian economist William Stanley Jevons, who also called India "the sink of the world" for silver and gold. Keynes in 1913 said India needed to quit this "uncivilized and wasteful habit". Rajiv Takru, India's financial services secretary today, called buying gold "wasteful expenditure" in June 2013. So why do Indian households buy (and gift) so much of the stuff? Because they've got to do something...  Incredibly, and despite being the biggest topic of sober conversation at the conference hotel, dinners and drinks, the government clampdown on gold imports (banning credit, banning coins, hiking duty to 10%, forcing re-export of 20% of all new shipments) went almost entirely undiscussed on the podium in Rome at this year's LBMA shindig. Yes, C.K.Venkataraman, CEO of the giant Titan Industries, shared insights and examples from marketing jewelry to Indian households. But out of 57 speakers, and with the global bullion market facing a shutdown by its #1 consumer, only Shekhar Bhandari – executive vice president of Kotak Mahindra Bank – addressed the issue head on, and from the inside. Bhandari, like the mass of refiners, brokers and secure transport providers making up the 700-strong LBMA delegates this year, clearly won't make much from India's gold love if the entire trade goes underground. Which it will, only too quickly, if the government persists with the imports ban as it is. But unlike the Western attendees, however, India's formal banking and bullion industry can at least recoup some of the revenues lost to smugglers if it helps unlock – or "mobilize" – all that gold already inside the country. Which totals perhaps 16,000 if not 20,000 tonnes on best estimates. Which is at least 10% of all the gold ever mined in history. Because like Pliny the Elder said, India's been sucking the stuff in for a very long time. "The biggest avenue the government has to monetise gold," Bhandari told Reuters a month before the LBMA conference, "is the gold deposit scheme." It would see households (or perhaps temples) put their gold items on deposit, in return for a rate of interest. "That has the maximum potential and [would encourage] recurring behaviour." But what about trust? Indians buy gold because they don't trust their government not to damage their best interests, most notably through the persistently weak Rupee. To retain financial independence, Indians buy gold today just as they have throughout history. Because whilst its price can be volatile, it tends to beat official inflation. It can't be inflated like the all-too paper Rupee. And it can of course be hidden – hung around a wrist or ankle here, stuffed under a floorboard there – to escape the government's ever-eager taxation of wealth. India's rich Hindu temples offer an alternative. Because if private citizens won't help the nation, perhaps the largest private institution will instead? Clearly this is being discussed, between banks and government if not with the temples themselves. Kotak's Bhandari told the LBMA conference that temple gold, if mobilized through a government-guaranteed deposit scheme, could meet India's domestic consumer demand for a decade. But again, there are big issues of trust and independence to fix first. Bhandari separately told one speaker that could be achieved in 3 years. But getting India's faithful to allow their local temples to offer the gold gifts it's received...and getting those holy items smelted and recast into kilobars for jewelers to rework into bangles and bracelets...looks a might big task. Meantime, that 10% import duty on gold – even if legal inflows do pick up at some point – offers a huge incentive to smugglers all around India's borders. And even with the big crash of 2013, gold prices remain high by historical standards. How high has also become a key theme for the precious metals market in 2013. Trust and independence loom largest there, perhaps, as we'll see in our fourth and final part next week... |

| GATA hero Maguire is no metals trading expert – CPM’s Christian Posted: 25 Oct 2013 09:45 AM PDT "How many times does someone have to lie to you before you stop believing him," CPM Managing Director Jeff Christian asked attendees at Cambridge House's Silver Summit 2013. by Dorothy Kosich, MineWeb.com

During a talk to the Silver Summit in Spokane, Washington, Thursday, Christian revealed that Andrew Maguire–who has been frequently portrayed by GATA as a heroic, whistleblower metals trader with more than three decades of experience in metals trading– actually has a background in auto sales and leasing. |

| The Ongoing War In The Gold Market Continues To Rage Posted: 25 Oct 2013 09:00 AM PDT from KingWorldNews:

"Eric Sprott has done some phenomenal work on this in the last week or so. He's put out a couple of pieces, including an open letter to the World Gold Council that runs through the numbers and demonstrates very clearly that there is a significant supply/demand imbalance in the gold market. |

| Is A Massive Chinese Order Causing a Silver Shortage in Europe?! Posted: 25 Oct 2013 08:30 AM PDT from Silver Doctors:

On Wednesday, he attempted to source a ton of silver (32,000 oz), from the three main Swiss refiners. Two of them refused to take the order entirely, and the third refiner stated delivery would take 2 weeks. The refiners claimed they had been very busy during the last month trying to fulfill an "enormous" Chinese order. |

| Gold pops back into positive territory on US consumer sentiment miss. Currently trading 1348.00. Posted: 25 Oct 2013 07:22 AM PDT |

| Gold, Stock Market Investors Time to Sit on the Sidelines Posted: 25 Oct 2013 06:59 AM PDT My best guess continues to be that stocks will extend this consolidation on Friday and then deliver one more push higher into the FOMC meeting next week. I expect the Fed will confirm no tapering which will likely trigger a big rally and probably reversal as smart money traders sell into the emotional move. Barring an immediate Fed intervention, that should give us the drop down into the half cycle low. |

| China's Gold Reserves At Least 2.5 Times Higher Than Reported, ‘De-Americanisation’ Continues Posted: 25 Oct 2013 06:46 AM PDT Today’s AM fix was USD 1,341.75, EUR 971.79 and GBP 827.58 per ounce. Yesterday’s AM fix was USD 1,336.25, EUR 968.79 and GBP 825.76 per ounce. Gold climbed $12.10 or 0.91% yesterday, closing at $1,345.40/oz. Silver inched up $0.11 or 0.49% closing at $22.67. Platinum rose $15.45 or 1.1% to $1,445.75/oz, while palladium fell $0.53 or 0.1% to $743.47/oz. |

| Silver in a Deflationary Crash Posted: 25 Oct 2013 06:40 AM PDT Silver may be the good news metal, but it's about to have a serious retest of its “bad news” capacity. The 1970’s It's been a long while since we've witnessed visible inflation. |

| Silver and Gold - Lone Options in an Exponential World Posted: 25 Oct 2013 06:37 AM PDT Monetary inflation, by whatever euphemism and at multiple stages in its cycle, has clear benefits to some but major disadvantages for the majority. Sadly, the impact of the final leg of the century- long monetary experiment may be far uglier than many would like to imagine. |

| Gold — Driven by American Politics and Monetary-Policy Expectations Posted: 25 Oct 2013 06:30 AM PDT Nichols on Gold |

| Staggering Physical Gold Demand Now Overrunning Shorts Posted: 25 Oct 2013 06:27 AM PDT 25-Oct (KingWorldNews) — Eric King interviews John Ing, CEO of Maison Placements Canada Inc. They discuss the “staggering” demand for physical gold in in Asia. Ing notes that the Chinese have “sopped up virtually the entire world's gold production. If you add in another 1,000 tons of gold being imported into India, you are now talking well above the entire world's annual production of gold.” Ing believes the low for gold is in: “I have told you for some time that we have seen the lows in gold, and I will say it again, the lows are behind us. People need to get rid of their bearish mentality and understand that we have now entered another bullish phase inside of this secular bull market in gold.” [source] |

| How to Make $15.6 Million, Risk-Free Posted: 25 Oct 2013 06:27 AM PDT Dear Reader, Dan Steinhart here, filling in for David Galland. What if I told you about a foolproof investment that's a guaranteed winner? One that will pay you $15.6 million, with exactly zero risk of loss? It's true. And you don't even need to give Prince Abogaye your bank account information. You just need to be a Wall Streeter. A questionable moral compass helps, too. Here's how. Earlier this year, the Blackstone Group, the world's largest private equity firm, loaned $100 million to a small, struggling European company called Codere. Blackstone included an odd stipulation in the loan agreement: that Codere must not pay the interest due on a separate, unrelated loan. If Codere didn't comply, its $100 million loan from Blackstone would become due immediately. Codere, struggling to survive amidst six running quarters of losses, needed Blackstone's cash. So when the August 15 interest payment came due, it obeyed Blackstone and did not pay. Nor did it pay within the 30-day grace period, even though it had the money to. Instead, Codere purposefully triggered a default by waiting to make the interest payment until the grace period was over. By now you should be asking at least two questions. Why on earth would Blackstone coax its debtor into defaulting? And more importantly, how did it make money doing so? Follow the MoneyHere's the missing puzzle piece: earlier this year, Blackstone purchased Credit Default Swaps (CDSs) on Codere's debt. A CDS, if you're not familiar, is basically an insurance contract. If you own a McDonald's corporate bond and you're worried you might not get your money back, you can pay a counterparty to assume that risk. Then, if McDonald's defaults, the counterparty must pay you for your losses. Or, if you're really adventurous, you can buy CDSs without owning the underlying bond, which is essentially a speculation that McDonald's will default on that bond. Unless, of course, you have influence over the fast-food giant's management. Then it's not a speculation at all. It's a can't-lose trade. That's what Blackstone did. It took out an insurance policy on Codere, persuaded it to default, then collected $15.6 million in payouts. There was never a chance Blackstone would lose money on this arrangement. It was literally a risk-free trade. Now, I'm no lawyer, but that sure sounds like fraud to me. If I took out an insurance policy on my neighbor's house, then convinced him to burn it down, the police would want to have a word with me. But apparently, this is neither fraudulent nor illegal, because both Codere and Blackstone agreed on the terms. Curiously, the party that most certainly would not have agreed to the terms—the underwriter of the CDS insurance policy—isn't mentioned in any of the reports on this young story. Blackstone's gambit cost that unnamed company at least $15.6 million, and probably a lot more, since other parties also held CDSs on Codere's debt. I would have liked to be a fly on the wall when Blackstone lawyers had their eureka moment. I picture a team of suited professionals proudly explaining this loophole to Blackstone's investment officer and enjoying his reaction: "Wait a minute… you're saying we can screw someone out of $15.6 million, with zero risk to us, and it's completely legal? Where do I sign?" Again, I can't help but draw parallels to the real world. What Blackstone did is tantamount to someone purposely totaling their car to collect on insurance. Obviously there are clauses in GEICO contracts that define such actions as fraud and protect the insurer from having to pay out on bogus claims. But apparently, CDSs lack that clause. Or at least this particular CDS did. Investment implications? If you're going to invest, make sure you truly understand what you're doing. I don't imagine many readers of this missive trade CDSs. But the lesson applies equally to retail investors. Just last week, on a company-wide call about the state of the markets, Casey Research Chief Economist Bud Conrad shared the following chart. It looks like a heat map, but it's actually an incredibly granular look at action in the gold market over a ten-minute period on October 11, when an anonymous seller dumped a massive sell order on the market. Usually, when a seller wants to unload a large position, it sells a little bit at a time, so as not to depress the price. Entering the entire order as one big trade is akin to flushing money down the toilet. Yet that's exactly what this eager seller did, dropping 5,000 gold contracts all at once, knocking the price down $20 in a matter of seconds. This wouldn't matter to you, unless of course you had set a stop-loss order on gold anywhere above $1,264. In which case you sold your gold to someone at an awful price. I'm not qualified to weigh in on the "is gold manipulated" debate, other than to say that this piece of evidence points strongly to the affirmative. If the seller's plan was to knock the price of gold down so it could buy it back at a lower price, it appears to have worked quite well. As I write, the price of gold is $1,348/oz. Meaning anyone who was stopped out at around $1,270 missed out on a 6%+ gain in the past two weeks. And what's worse, there's a good chance they donated those gains to someone who had a better grasp on the inner workings of the gold market than they did. I'll end the conversation on gold here because Bud Conrad, who most certainly is qualified to weigh in on the gold debate, is hard at work assembling data for a comprehensive analysis of those inner workings of the gold market. In the upcoming edition of The Casey Report, he'll quantify just how much influence the biggest banks hold over the price of gold. If you're at all familiar with Bud's work, you know he'll leave no stone unturned and no data unanalyzed in his quest for the truth. If you'd like to get your hands on Bud's analysis hot off the press on November 14, click here to sign up for a risk-free trial to The Casey Report. It comes with a 90-day, no-questions-asked money-back guarantee, so you literally have nothing to lose. I'll now pass the reins over to Robert Ross, my friend and a senior analyst for Mauldin Economics, to explain China's unique and cautious approach to liberalizing its economy. Capitalism Finds a Way: China’s New Special Economic ZoneRobert Ross, Senior Analyst, Mauldin Economics Those living in developed countries take many benefits for granted. Whether it's clean water, a stable electrical grid, or grocery stores chock full of anything your palate desires, most people in developed countries are pretty well off. Especially compared to the average person in an emerging-market economy. But one facet that many investors take for granted is that in a developed, capitalist economy, most businesses play by the same rules. That's not the case in the People's Republic of China, where the government allows certain districts to play by their own set of guidelines, in the name of economic development. Known as "special economic zones" or "free trade zones," these areas of the country have certain perks, such as market interest rates and lower export taxes. Though the idea may sound strange to outsiders, these zones employ free-market principles to help liberalize certain sectors of the economy. The newest such zone, which opened in Shanghai's Pudong province in September, aims to help modernize the country's service industry, particularly the financial sector. China has used this approach to economic development since the 1980s, when the country first established special economic zones in certain areas of Guangdong Province, Fujian Province, and Shenzhen. These original zones were geared towards modernizing the country's manufacturing sector, particularly the export of processed goods, by permitting the investment of foreign capital. Now that the country's manufacturing sector has become a dominant global force, the Chinese government has decided to refocus its efforts on opening up its inefficient, costly services sector—particularly the financial industry. By granting the newest zone perks unavailable to the rest of China—such as letting the market (rather than regulators) set interest rates, allowing firms to convert foreign currencies to yuan, and letting businesses freely move money overseas—the Chinese government seems ready to revamp its financial sector through a healthy injection of free-market principles. Big Economy, Small ChangesNewly appointed Premier Li Keqiang has touted the ambitious project, which began on September 29, as a symbol of China's commitment to economic change. He's following in the footsteps of Deng Xiaoping, who nudged China towards a market economy using special economic zones starting in the 1980s. After the death of Mao Zedong, Deng set up the first special economic zone in Shenzhen, essentially walling off the city north of Hong Kong from the rest of the country and allowing foreign manufacturing firms to capitalize on low-cost Chinese labor. It was a monumental success and is often cited as a major factor that turned China into one of the world's largest trading powers. Although this approach to economic liberalization may seem odd to Westerners, it fits with China's economic narrative, which historically avoids big, bold changes. It minimizes risks by letting experienced local officials experiment with reforms inside a tightly sealed zone. Policies that don't work can be contained within the area. On the flip side, reforms that do work can be rolled out to the rest of Mainland China. But since the Chinese government has been intentionally vague on certain rules and regulations, an air of uncertainty hangs over Pudong's potential success. For instance, the Politburo hasn't addressed how it will keep ordinary Chinese citizens living outside Pudong from gaining access to the attractive interest rates offered by zone-specific banks. Also, since firms in the zone can convert large amounts of yuan into dollars for use abroad, there is bound to be pressure from outside the zone for similar privileges. This isn't the first time such issues have come to the forefront. When Chinese regulators turned a blind eye to banks offering "wealth-management products" that paid a higher rate of return than bank deposits, cash that was meant to stay contained in a special economic zone ended up bloating the shadow-banking sector. That hot money eventually made its way into large real estate and infrastructure projects, contributing to China's numerous "ghost cities." It also made the country more vulnerable to financial shocks, as many of the banks making these risky loans are leveraged to the hilt. Give Me Golf Courses or Give Me Death!Though the government is relaxing restrictions, there are signs that the Politburo isn't very keen on ceding all control. As a part of the deal with Pudong, the Chinese government included a "negative list" of sectors in which foreigners cannot invest. The list cites several vices like guns, drugs, and pornography, which shouldn't be an issue. But it contains over 1,000 banned items, including an odd assortment of activities like news portals, golf courses, and "traditional Chinese tea processing techniques." Importantly, access to an uncensored Internet—which many touted as a surefire bet—was also left off the table. "This is a place-holder for real reform," said Derek Scissors, a resident scholar at the American Enterprise Institute. "It guarantees nothing, with at least a chance that something useful is going to come out of it." Avoiding the Middle-Income TrapThe Chinese government may not have a choice but to do everything in its power to make sure the zone succeeds. Soaring wages and an ageing workforce have aroused fears that the country could fall into what's known as the "middle income trap," a phenomenon characterized by plateauing growth after a country reaches middle-income levels. To avoid the "trap," an economy must transition from cheap labor-driven growth to growth based on high productivity and innovation. Since the establishment of this new economic zone aims to improve the financial sector, and thus provide smaller Chinese with access to bank financing, it could be a crucial step towards a stable growth model. But in order to attract major investors, China will need stable regulation, and the government will have to step outside of its comfort zone and let the reforms that work trickle out into the broader economy. That's the only way to foster innovation throughout all of China. The Chinese government has demonstrated an inability to loosen its grip on the economy in the past. We'll see if it can relinquish control and allow the economy to flourish in the near future. Robert Ross is a senior analyst at Mauldin Economics. A native of Cleveland, OH, he graduated top of his class from Loyola University New Orleans College of Business with a degree in economics. He currently works on numerous Mauldin publications, including Bull's Eye Investor, Yield Shark, and Transformational Technologies. Dan again. I have one more article for you today. Did you know that 30 of what were the 50 largest banks in the US in 1980 are now part of Bank of America, Wells Fargo, and JPMorgan Chase? These behemoths loom over the financial industry, more interconnected than ever. Doug French has more on the astounding consolidation of the US banking system, a phenomenon that all but ensures that when the next crisis comes, these "Way Too Big to Fail" banks will once again have the leverage to hold the US hostage for bailouts, subsidies, and other goodies. Bigger Banks, Bigger ProblemsWarren Buffett says banks are in better shape than at any time he can remember. US banks have "built up capital, loan losses are down, portfolios are in good shape," the legendary investor claims. "The problem is they have more money around than they'd like." That's one man's opinion from the outside looking in. But maybe things aren't so rosy. Richard Parsons was a banker with Bank of America and is the author of Broke: America's Banking System. The ex-banker has his doubts. In a piece for the Wall Street Journal, Parson writes about the comments of FDIC head man Martin Gruenberg who said recently, "Prior to the recent crisis, the major national authorities here and abroad did not envision that these large, systemically important financial institutions (SIFIs) could fail, and thus little thought was devoted to their resolution." Parsons takes Gruenberg to task for his lack of historical perspective. Indeed, during every rash of bank failures, big banks go down along with the small ones. As economist Murray Rothbard pointed out years ago, there is no other line of business where so many firms fail at the first sign of trouble. In our fractionalized banking system, one person's deposits are loaned out to another, giving two people title to the same asset simultaneously. This is the fundamental reason that the banking system repeatedly fails in mass. In an attempt to stave off repeated crises, the banking industry has enlisted plenty of help from the government. The Federal Reserve was created one hundred years ago to stand ready as the lender of last resort. The Federal Deposit Insurance Corporation, created by FDR, provides deposit insurance to quash any bank run. Still, a run on only 8% of deposits put Washington Mutual, a huge mortgage lender, on the ropes. The banking system melts down every couple of decades. Parsons points out that six of the top 50 banks failed in the banking crisis of the late '80s and early '90s. While many were allowed to fail, Parsons quotes former FDIC Chairman Irvine Sprague who identified Continental Bank as "too big to fail," and wrote "scores of large and small institutions—perhaps hundreds—would have been in serious jeopardy if Continental could not have met its commitments." Creating MonstersBank of America stepped in to aid regulators by acquiring two large failed Texas banks in 1988 and continued to buy failing banks over the next seven years. One of the banks was BoA's massive California competitor, Security Pacific. Amazingly, BoA paid over three times book value for a bank circling the drain. SP shareholders received the equivalent of $41 per share in 1992. Without the buyout, SP CEO Robert Smith estimates the bank's stock would have traded for $4 a share... probably on the way to zero. As bailed-out institutions live on and grow larger, rescue operations balloon beyond the government's ability to handle alone. The bailed-out become the bailers-out. Bank of America stepped up again in the 2008 crisis and purchased the failing Merrill Lynch for $50 billion, and a teetering Countrywide Financial for $4.1 billion. The purchase of these bad apples continues to cost the company money. Besides Bank of America, banking authorities asked Wells Fargo and JPMorgan to buy Wachovia, Washington Mutual, and Bear Stearns. With these transactions, Wells and Morgan grew into behemoths that cannot be allowed to fail. Parsons' most salient point is, "Thirty of what were the 50 largest banks in the country in 1980 are now part of Bank of America, Wells Fargo, and JPMorgan Chase." By the end of last year, the top ten banks in the US now control 56% of banking assets. At the same time, the top 70 banks or 1% of the industry controlled 86% of deposits. How on earth could stitching a bunch of bad banks together make bigger, safer banks? It can't, no matter what Warren Buffett thinks. Banks made $43 billion in the second quarter only because of a quirk in bank accounting rules that says banks don't have to count the $51 billion they lost in their bond portfolios. Parsons points out this country has seen 3,000 banks fail over the past three decades and more than 12,000 over the past century. As Rothbard explained years ago, the banking business is unstable and is doomed to repeat a series of booms and busts. Because of that, the financial system would be much safer if its assets were disbursed over as many banks as possible. Instead, at regulators' insistence, the problems and bad assets of many banks have been combined into a few. Instead of many small problems, we now have a few huge ones. Systemic risk in the financial system has increased, not decreased. As a result, whenever the next banking crisis hits, it will be a doozy. |

| Gold Falls From Three-Week High as Demand May Slow After Rally Posted: 25 Oct 2013 06:21 AM PDT 25-Oct (Bloomberg) — Gold fell from a three-week high in New York on speculation physical demand may slow after prices rallied on bets for prolonged U.S. stimulus and a weaker dollar. Bullion futures reached $1,352.30 an ounce yesterday, the highest since Sept. 30, and climbed as much as 8.1 percent since Oct. 15. The Bloomberg U.S. Dollar Index, a measure versus 10 currencies, was little changed near an eight-month low after data showed yesterday more Americans than forecast filed jobless-benefit claims and manufacturing growth slowed. …"Gold has been benefiting from a weaker dollar and the reassessment of U.S. monetary policy expectations in light of softer data and continued political and fiscal uncertainty," Joni Teves, an analyst at UBS AG in London, wrote today in a report. In the physical market, the "rally from the lows printed this month has meant that participants here are likely stepping back a bit," she said. [source] |

| Securing a Life Raft Amid the U.S. Dollar Hurricane Posted: 25 Oct 2013 06:00 AM PDT There was a joke flying around the water cooler yesterday. It went something like this… "What if the government were to print a TRILLION dollars a year in stimulus? That'd be crazy, right!" One trillion. Bigger than 2008's "shock and awe" bailout, and powerful enough to lift any ailing boat in the economy, eh? Ready for the punch line? After a quick scratch of the head and carrying of the one, you'll realize the government IS ALREADY printing a trillion dollars a year in stimulus! [The joke spawned when someone misfired a quote from Dr. Marc Faber, editor of the Gloom Boom & Doom report, who postulated the case where the Fed prints a trillion dollars A MONTH in stimulus. Nah, the stimulus isn't a trillion a month. Not yet however.] Sometimes misunderstandings are funny – in this case the throwing around of "a trillion dollars" is downright scary. Jokes aside, the Fed's loose money policy is having a direct effect on the markets we trade every day. After all, you can't just keep printing dollars without recourse, right? A quick look at the vitals – four important charts I highlighted earlier this month – and you'll see the greenback is in trouble and the financial markets are continuing an epic move higher. (We'll save crude and gold for another discussion, of course there's much to talk about there, too!) Let's talk greenback… Other economies around the globe are starting to pick up. Strip it all down and the U.S. dollar isn't as strong in comparison. The U.S. dollar has been trending higher since mid-2011. Whaaat? Uptrending dollar? With all the quantitative easing (QE) and loose monetary policy the Fed has been throwing at it, your editor is amazed by the strength of the U.S. buck. The current status of the U.S. dollar is almost like imagining an island economy that runs on seashells. But every month "hurricane Bernanke" washes ashore and dumps billions of the dead crustaceans about the island. How can a seashell hold its value, at that rate!? But, the dollar has been doing just that! That's the power of a crappy global economy. When compared the other alternatives the U.S. dollar was the clear winner. What, would you rather own Yuan, Yen or Euros? No way! Not only was the U.S. dollar the clear winner in the global race to safety, the U.S. economy is actually quite bustling! Surprise surprise, when a country gets unexpected, valuable raw materials (shale oil and gas) from beneath its soil and manufacturing can use that raw material to an advantage, it certainly favors the economy. And in that respect it also supports the dollar. So in the past two years, even in the face of QE, we've got a "better than the rest" currency and an economy that's really starting to make strides – it's all been very positive for the dollar. Unfortunately, for the U.S. dollar, the flow of beneficial factors is ebbing. Other economies around the globe are starting to pick up. Strip it all down and the U.S. dollar isn't as strong in comparison. That said, the dollar is starting to feel the overwhelming pressure of the Fed's loose monetary policy. Fact is, I can't see how we get out of this scenario without unforgiving levels of inflation. The Fed isn't worried about inflation, by the way. Instead the Chairman and his predecessor are more interested in making sure the strings they pull actually make the puppet dance. The dollar will dance alright. Dance to the downside. Meanwhile, at the clip of $1 trillion a year, Fed stimulus is having a direct effect on financial markets. A look at the S&P 500 and you'll see that the Fed's action, combined with a positive economic outlook, has spurred the market barometer to new highs. The market has been screaming higher for years now. And although you can chalk some of the froth up to an economic comeback a lot of it gets back to "hurricane Bernanke." The market is either going up because of the expectations of stimulus or because the stimulus itself is already inflating prices. Either way as long as the stimulus continues the market will churn higher. And as far as the eye can see, the stimulus in one form or another will keep coming. What's the takeaway? There's not much more to be said today other than the fact that the U.S. dollar is finally feeling some pressure. The government keeps on spending and to keep its debt in check it's going to have to keep on printing. That also means good things for the commodities and hard assets we talk about on a daily basis. It's always hurricane season on this island! Keep your boots muddy, Matt Insley P.S. Starting today, add another $23 billion to the pile! It's all part of a "secret" budget that congress already passed… Not only is this "secret" budget not affected by the recent shutdown circus, it's presenting a more immediate opportunity for in-the-know readers, like you. In yesterday’s Daily Resource Hunter email edition, I gave readers a chance learn about one opportunity that could let them cash-in on the government’s best-kept secret. It’s all part of being a free member of the Daily Resource Hunter. Sign up for free right here to ensure you never miss another opportunity like this one. Original article posted on Daily Resource Hunter |

| Gold Prices Get Best Week in 11 on "Short-Covering" and "Diwali Demand" Posted: 25 Oct 2013 05:59 AM PDT GOLD PRICES slipped but held near 1-month highs Friday morning in London, heading for the strongest week-on-week gain since mid-August at $1343 per ounce. Rising 1.7% from last Friday's finish, gold prices lagged silver – up 2.3% for the week – as European stock markets held flat and Asian stock markets fell hard. Japan's Nikkei share index closed Friday more than 4% down for the week, as money-market rates in neighboring China held at multi-month highs. Beijing today announced a new benchmark lending rate, aimed at letting market forces set key levels more transparently. Shanghai gold prices meantime slipped on Friday, cutting the premium over and above international benchmarks to $2 per ounce. In US Dollar terms, "Gold prices have now breached key resistance at the 50-day moving average," says a note from brokers INTL FCStone. "We have also noticed that open interest [in the gold futures market] is rising in line with higher prices, indicative of fresh longs [ie, bullish traders] entering the market." Catching up after the US government shutdown, futures regulator the CFTC will release commitment of traders data from 3 weeks ago today. More recent figures will follow next week, it said. "Clearly," says global bank and bullion market-maker HSBC in a note, "gold prices [on Thursday] received a boost from a combination of weak US data, a slump in the Dollar and positive Chinese economic data. "The confluence of the three events is gold-bullish and helped trigger a wave of short covering," it says, with traders betting that gold prices would fall forced to close their positions at a loss. "Much of this recent strength we've seen in gold prices," agrees Mark Keenan of French investment bank SocGen's Cross Commodity Research team "has been a result of short-covering in the futures markets." That said, November also marks the "peak gold-buying period" in India, Keenan reminded CNBC this morning, with the festival season culminating with Diwali a week-on-Sunday. Gold prices in India today hit new record highs above the world's London benchmark, with premiums to international prices reaching $130 per ounce according to Reuters, up from $100 a week ago. "The supply issues in India are even more acute right now," says a note from Swiss investment bank and London market-maker UBS, "given the fast-approaching festive season of Diwali." The reality, says UBS, is that the Indian government's anti-gold import rules mean "the supply chain is currently too slow to keep up" with Diwali demand. Illegal inflows "may help" the note goes on, but "Internal gold supply satisfies only a small portion of demand, and the sense is that scrap sales [for recycling into new product] have actually stalled." This week saw several new reports of large black-market gold seizures, while the government this week repeated its commitment to restricting Indian gold coin and bullion imports regardless. |

| Elliott Wave Analysis For USDCAD - Three Wave Rally Posted: 25 Oct 2013 05:45 AM PDT Canadian Dollar (Forex: USDCAD) is at new high after very sharp reversal from 1.0267 swing low. We have reworked out previous bearish Elliott wave count for USDCAD. We are tracking a new count now which still shows a three wave rise from 1.0180. Read More... |

| Posted: 25 Oct 2013 05:28 AM PDT |

| The Collapse of the U.S. Dollar is Unavoidable! Here’s Why Posted: 25 Oct 2013 03:45 AM PDT The mother of all collapses is still in front of us. Below are my reasons why that is So says Peter Schiff, CEO and Chief Global Strategist of Euro Pacific Capital in edited excerpts from an interview* he had recently with Taki Tsaklanos (goldsilverworlds.com) entitled Peter Schiff: The Collapse Of The Dollar Is Unavoidable. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Tsaklanos’ article goes on to say in further edited excerpts: The collapse of the U.S. dollar is unavoidable [While] the current economic problems in the Western world (excessive debt levels and too many promises by governments in untenable social welfare states) are shared by most countries…the U.S. is suffering the most from this disease… [Says Schiff:] “Because of the privilege of the U.S. having the dollar as the world reserve currency, the U.S. economy has been able to evolve in a way that no other nation could. Like no other country in the world, the U.S. is dependent on debt, cheap money, artificially low interest rates, and imports…When all this comes to an end, the U.S. economy will suffer like no other. Maybe it will be a wake-up call to other countries in what the U.S. did wrong in terms of the destruction of the country."When the dollar became the world reserve currency in 1944 the U.S. was a fundamentally different country than it is today. At that time, the dollar was backed by gold. Everyone holding dollars could exchange it for gold at a pre-set rate. Gold was available on demand, so the dollar was as good as gold. In that period of time, the U.S. was the world's biggest creditor nation. It had a huge trade surplus which it invested in the rest of the world. The fact that the U.S. once was so great, however, does not mean it still is. None of the attributes that made…it deserving of the world's reserve currency exist today. [Says Schiff:] "America is now its mirror image of its former self. We are the world's biggest debtor, with the biggest trade deficit, and the dollar is backed by nothing. We have mountains of debt. If the U.S. dollar was not the reserve currency today, nobody would accept it to become the reserve currency."Schiff's fundamental concerns are related to politicians who are not doing the right thing. [Says Schiff:] "Looking at the fiasco of the debt ceiling, we are not doing the right thing. For the time being, the right thing is wrongly considered to be more debt and reckless spending. Any restraint on debt is seen as a problem. The type of 'problem' the U.S. is solving currently is the limitation on debt, not the decrease of debt levels.The conventional wisdom, mainly in Washington, is so wrong that only a complete implosion can impose discipline. An externally driven crisis will finally force the government to take the right action. It will be a currency crisis. Right now, the dollar is weakening somewhat, but that is nothing compared to what is coming…” What will the dollar be replaced with once it falls? Schiff believes the world cannot use the euro or the yen as the world reserve currency because they are nearly as bad as the U.S. dollar. At the end of the day, those are all fiat currencies backed by nothing but promises…[So what could be done to] stabilize the dollar and recreate confidence [in other currencies]? Gold… and the U.S. has 90% of its reserves in gold. Gold was the international reserve before the dollar hegemony. Going back to the gold standard would result in one of the two things:

Schiff believes that it is much easier to adjust the price of one thing up instead of the price of every other asset down so his expectation is that the gold price will go much higher from here… [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://goldsilverworlds.com/economy/peter-schiff-collapse-of-dollar-unavoidable/ (© 2013 Gold Silver Worlds) Related Articles: 1. Which Is the World's Safest Major Currency – You'll Be Surprised

The term 'safe fiat currency’ is as intellectually disingenuous as terms like 'fair tax' or 'government innovation' but, as we've been exploring recently why modern central banking is completely dysfunctional, it does beg the question– is any currency 'safe'? Let's look at the numbers for some data-driven analysis. Words: 575 Read More » 2. Gold Standard Should Replace "Exorbitant Privilege" of USD Reserve Currency Status – Here's Why  The least imperfect monetary system by which civilized nations can conduct their business is the classical gold standard – a system in which every major nation defines its currency as a weight unit of gold. [Let me explain.] Words: 890 Read More » 3. Dollar's Days As Reserve Currency To End In 2 Years (10 Years Latest) – Here's Why The American dollar will be overthrown…in as short a period as 5 to 10 years says one analyst while another believes it will happen as early as 2015, 2016 latest. Here’s why. Read More » China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. Read More »

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More » 6. Now Available: Debit Cards Backed By Actual Gold & Silver! Precious metals have historically been excellent ways to preserve one's purchasing power over the long term. However, in today's world, they do not act well as a medium of exchange. To solve this problem Peter Schiff and his teams worldwide have worked out a totally new service: the first Gold and Silver Debit cards that gives bank customers access to their gold and silver holdings. The post The Collapse of the U.S. Dollar is Unavoidable! Here’s Why appeared first on munKNEE dot.com. |

| 12 Reasons Why Gold Price Will Rebound and Make New Highs in 2014 Posted: 25 Oct 2013 12:24 AM PDT Investor sentiment towards precious metals is at the lowest level in over a decade. Many analysts believe the bull market is over and are calling for sub-$1,000 gold in 2014. Even diehard gold bugs are losing faith, as the correction has been longer and more severe than most had anticipated. So, is it time to throw in the towel? Is the bull market in precious metals really over? |

| Precious Metals: Gold, Silver and Miners Are Trapped Posted: 25 Oct 2013 12:14 AM PDT The precious metal market has been stuck in a strong down trend since 2012. But the recent chart, volume and technical analysis is starting to show some signs that a bottom may have already taken place. This report focused on the weekly and monthly charts which allow us to see the bigger picture of where the precious metals sector stands in terms of its trend. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

We feel it important to raise this topic once more in this series because Societe Generale, the French bank has stated that if the Indian government does not handle this matter well there could be a run on the Indian Rupee.

We feel it important to raise this topic once more in this series because Societe Generale, the French bank has stated that if the Indian government does not handle this matter well there could be a run on the Indian Rupee.

The long-running debate between the Gold-Anti Trust Action (GATA) committee and CPM Managing Director Jeff Christian over alleged manipulation of gold and silver prices may have escalated as Christian revealed Thursday that GATA may have failed to do its homework or been hoodwinked in researching the background of so-called metals trader Andrew Maguire.

The long-running debate between the Gold-Anti Trust Action (GATA) committee and CPM Managing Director Jeff Christian over alleged manipulation of gold and silver prices may have escalated as Christian revealed Thursday that GATA may have failed to do its homework or been hoodwinked in researching the background of so-called metals trader Andrew Maguire. Williams: "I'm keenly focused on the price action in gold. We are now beginning to see to see some very interesting and positive developments in the gold price from a technical perspective. We have also seen some staggering gold exports from the UK, through Switzerland. This gold likely went into China….

Williams: "I'm keenly focused on the price action in gold. We are now beginning to see to see some very interesting and positive developments in the gold price from a technical perspective. We have also seen some staggering gold exports from the UK, through Switzerland. This gold likely went into China….  One of my contacts with one of the largest European precious metals brokers told me this morning that they could not find any silver. All the refiners they contacted could not take their orders and could not give any delay. "Call us next next month", they said. This is the first time that such an event has occurred.

One of my contacts with one of the largest European precious metals brokers told me this morning that they could not find any silver. All the refiners they contacted could not take their orders and could not give any delay. "Call us next next month", they said. This is the first time that such an event has occurred.

No comments:

Post a Comment