Gold World News Flash |

- Massive sell/buy orders create huge gold market instability

- Are Currency Controls Coming?

- Marine Le Pen: EU Will Collapse Like the Soviet Union

- Billionaire Sprott Says Gold & China To Dominate The World

- Gold as a FOREX Currency

- Billionaire Sprott Asks How Will People Survive What’s Coming?

- Gold market report: Gold breaks out of its short-term downtrend

- 9 Signs That China Is Making A Move Against The U.S. Dollar

- Paper gold will be dumped for real metal, Grant Williams tells KWN

- Silver and Gold Prices Rose 3.1 and 3.7 Percent Respectively this Week

- Silver and Gold Prices Rose 3.1 and 3.7 Percent Respectively this Week

- TF Metals Report: Bullion banks pillaging GLD for metal

- Mike Kosares: China's gold conduit from London, a financial coup d'etat

- Manipulated Markets Prospects: Gold, U.S. Dollar, Bonds, Equities & Interest Rates

- China’s London-Zurich-Hong Kong gold conduit — a major financial coup d’etat

- Vulgar Competition and Italian Gold

- All Hell Will Break Loose And It’s Going To Be “Pandemonium”

- The Daily Market Report

- In The News Today

- Alasdair Macleod: China and gold

- Jim’s Mailbox

- Gene Arensberg: Short-selling banks covering on gold?

- Gold Daily and Silver Weekly Charts - Big Moves In and Out of Comex Bullion Warehouses

- Gold Daily and Silver Weekly Charts - Big Moves In and Out of Comex Bullion Warehouses

- Maguire, Sprott interviewed at KWN

- Maguire Predicted Gold Surge – Now Says West Is Collapsing

- Theater Of The Absurd: Greenspan Writes Book On Economic Forecasting

- Western Credit-Rating Fraud Exposed -- Again

- Market Monitor – October 18th

- Gold-Mining Profits Fallacy

- Gold, Silver, Debt – Don’t Miss These Important Charts

- Billionaire Sprott Asks How Will People Survive What’s Coming?

- Attention Investors: The Blood is Now in the Streets

- The Budget/Debt Ceiling Bill Potentially Eliminates The Debt Ceiling Limit

- The Key Factor To Drive Gold and Silver Prices to Extreme Values

- Is the Rising Stock Market Bullish or Bearish News for Gold?

- Is Rising Stock Market Bullish or Bearish for Gold?

- Gold Is A Reserve Of Safety Says ECB President

- Gold only has one way to go, and that’s up – Hegarty

- Kyrgyz crowd attacks Australian gold miner’s office

- Gold shorts "wrongfooted" by US default swerve

- India’s Sept gold jewellery exports rise 16.5% – trade body

- Massive sell/buy orders create huge gold market instability

- Silver Prices and the Flow of Physical

- Maguire Predicted Gold Surge - Now Says West Is Collapsing

- What the Republican Civil War Means For Gold

- Why You Should Triple-Check the Ticker Before Buying That Stock

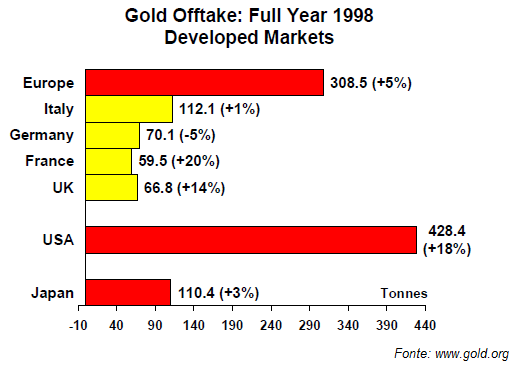

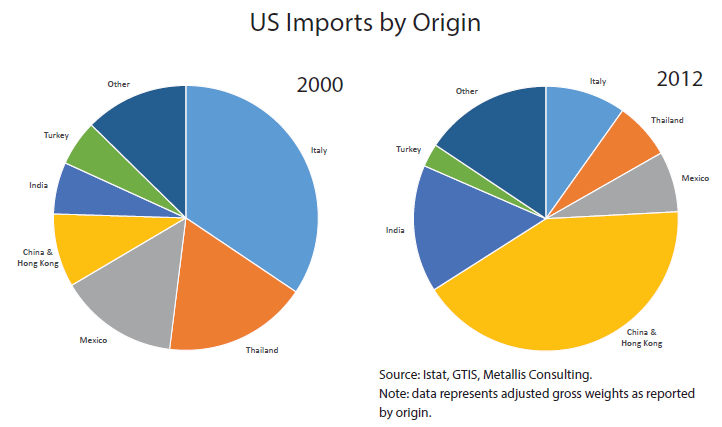

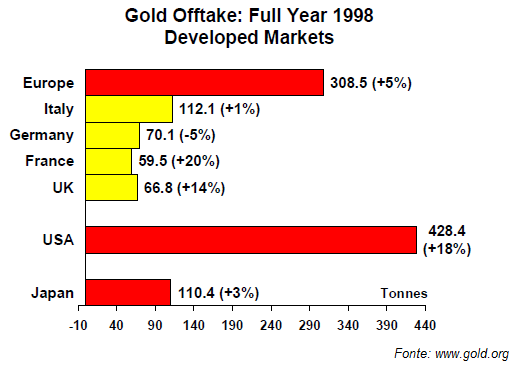

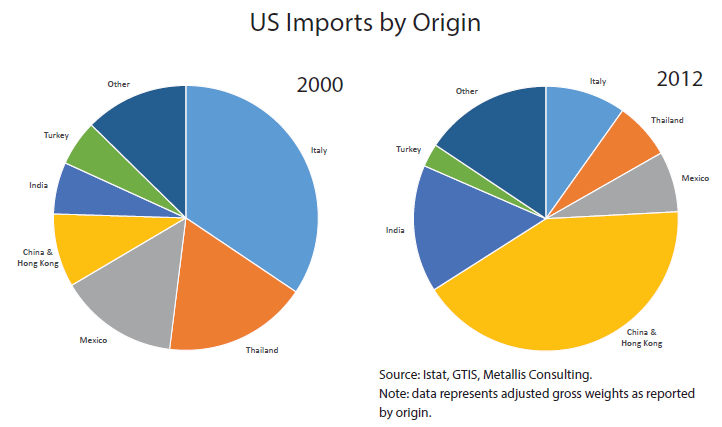

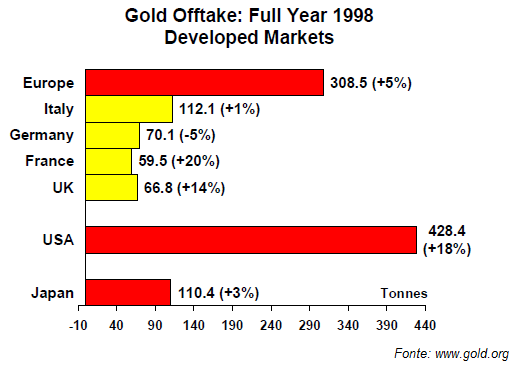

- Italy's Gold Sector: Decline & Fall

- Italy's Gold Sector: Decline & Fall

- Italy's Gold Sector: Decline & Fall

| Massive sell/buy orders create huge gold market instability Posted: 18 Oct 2013 10:30 PM PDT by Lawrence Williams, MineWeb.com

What is apparent from the graphic is that there seem to be massive, almost instantaneous trading volumes every day of over 5,000 contracts (5,000 contracts is half a million ounces) so far this month, all at about the same time and all seemingly designed to move the gold price up or down – with the real massive contract trades on October 1st, and 10th – both well over 20,000 contracts (well over 2 million ounces, or around $2.6 billion) traded – all in a matter of minutes (or less). |

| Posted: 18 Oct 2013 10:00 PM PDT by David Schectman, MilesFranklin.com:

It is prudent to get some of your assets off shore now, while you still can, and that includes gold and silver. Who knows what's coming in the precious meals arena? Jim Sinclair has been telling you to Get Out of the System for many months. Bail-ins are coming. Increased taxes are a certainty. The groundwork has been laid for wealth confiscation. And currency controls are being discussed to sell. We can thank our spineless politicians for putting another nail in the dollar's coffin. |

| Marine Le Pen: EU Will Collapse Like the Soviet Union Posted: 18 Oct 2013 09:20 PM PDT by Martin Banks, Henry Samuel and Alex Spillius, The Telegraph:

Marine Le Pen, buoyed by a weekend by-election triumph in southern France, criticised the EU as a "global anomaly" and pledged to return the bloc to a "cooperation of sovereign states". She said Europe's population had "no control" over their economy or currency, nor over the movement of people in their territory. |

| Billionaire Sprott Says Gold & China To Dominate The World Posted: 18 Oct 2013 09:02 PM PDT  In the aftermath of another wild week of trading in which the US Dollar Index closed below the key psychological level of 80, today billionaire Eric Sprott told King World News that gold and China will dominate the world going forward. The Canadian billionaire also told KWN that investors would be wise to follow the Chinese in their investments. Below is what Sprott, who is Chairman of Sprott Asset Management, had to say in part II of this remarkably powerful interview series. In the aftermath of another wild week of trading in which the US Dollar Index closed below the key psychological level of 80, today billionaire Eric Sprott told King World News that gold and China will dominate the world going forward. The Canadian billionaire also told KWN that investors would be wise to follow the Chinese in their investments. Below is what Sprott, who is Chairman of Sprott Asset Management, had to say in part II of this remarkably powerful interview series.This posting includes an audio/video/photo media file: Download Now |

| Posted: 18 Oct 2013 09:01 PM PDT Another gold writer emailed me the other day with a few questions about my take on the apparent disconnect between the gold price action this year and "physical gold's obvious fundamentals." I explained to him how the POG (price of gold) is thoroughly and utterly disconnected from the physical segment of the gold market today. I said that any increase in physical demand (due to physical gold's |

| Billionaire Sprott Asks How Will People Survive What’s Coming? Posted: 18 Oct 2013 08:20 PM PDT from KingWorldNews:

|

| Gold market report: Gold breaks out of its short-term downtrend Posted: 18 Oct 2013 08:00 PM PDT by Alasdair Macleod, Gold Money:

The debate now continues facilitated by the debt ceiling being temporarily abandoned until February, when presumably the game of chicken will be run for a second time if nothing has been agreed. Understandably gold, along with other markets, was victim to rumour and counter-rumour emanating from Washington with few traders prepared to commit themselves until Thursday morning. |

| 9 Signs That China Is Making A Move Against The U.S. Dollar Posted: 18 Oct 2013 05:09 PM PDT While 20-year highs for the CNY may be enough for many to question the USD's ongoing reserve status, it is clear that there are many other plans afoot that undermine the dominance of the greenback. Submitted by Michael Snyder of The Economic Collapse blog, On the global financial stage, China is playing chess while the U.S. is playing checkers, and the Chinese are now accelerating their long-term plan to dethrone the U.S. dollar. You see, the truth is that China does not plan to allow the U.S. financial system to dominate the world indefinitely. Right now, China is the number one exporter on the globe and China will have the largest economy on the planet at some point in the coming years. The Chinese would like to see global currency usage reflect this shift in global economic power. At the moment, most global trade is conducted in U.S. dollars and more than 60 percent of all global foreign exchange reserves are held in U.S. dollars. This gives the United States an enormous built-in advantage, but thanks to decades of incredibly bad decisions this advantage is starting to erode. And due to the recent political instability in Washington D.C., the Chinese sense vulnerability. China has begun to publicly mock the level of U.S. debt, Chinese officials have publicly threatened to stop buying any more U.S. debt, the Chinese have started to aggressively make currency swap agreements with other major global powers, and China has been accumulating unprecedented amounts of gold. All of these moves are setting up the moment in the future when China will completely pull the rug out from under the U.S. dollar. Today, the U.S. financial system is the core of the global financial system. Because nearly everybody uses the U.S. dollar to buy oil and to trade with one another, this creates a tremendous demand for U.S. dollars around the planet. So other nations are generally very happy to take our dollars in exchange for oil, cheap plastic gadgets and other things that U.S. consumers "need". Major exporting nations accumulate huge piles of our dollars, but instead of just letting all of that money sit there, they often invest large portions of their currency reserves into U.S. Treasury bonds which can easily be liquidated if needed. So if the U.S. financial system is the core of the global financial system, then U.S. debt is "the core of the core" as some people put it. U.S. Treasury bonds fuel the print, borrow, spend cycle that the global economy depends upon. That is why a U.S. debt default would be such a big deal. A default would cause interest rates to skyrocket and the entire global economic system to go haywire. Unfortunately for us, the U.S. debt spiral cannot go on indefinitely. Our debt is growing far, far more rapidly than our GDP is, and therefore our debt is completely and totally unsustainable. The Chinese understand what is going on, and when the dust settles they plan to be the last ones standing. In the aftermath of a U.S. collapse, China anticipates having the largest economy on the planet, more gold than anyone else, and a respected international currency that the rest of the globe will be able to use to conduct international trade. And China is not just going to sit back and wait for all of this to happen. In fact, they are already doing lots of things to get the ball moving. The following are 9 signs that China is making a move against the U.S. dollar... #1 Chinese credit rating agency Dagong has downgraded U.S. debt from A to A- and has indicated that further downgrades are possible. #2 China has just entered into a very large currency swap agreement with the eurozone that is considered a huge step toward establishing the yuan as a major world currency. This agreement will result in a lot less U.S. dollars being used in trade between China and Europe...

#3 Back in June, China signed a major currency swap agreement with the United Kingdom. This was another very important step toward internationalizing the yuan. #4 China currently owns about 1.3 trillion dollars of U.S. debt, and this enormous exposure to U.S. debt is starting to become a major political issue within China. #5 Mei Xinyu, Commerce Minister adviser to the Chinese government, warned this week that if the U.S. government ever does default that China may decide to completely stop buying U.S. Treasury bonds. #6 According to Yahoo News, China has already been looking for ways to diversify away from the U.S. dollar...

#7 Xinhua, the official news agency of China, called for a "de-Americanized world" this week, and also made the following statement about the political turmoil in Washington: "The cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations' tremendous dollar assets in jeopardy and the international community highly agonized." #8 Xinhua also said the following about the U.S. debt deal on Thursday: "[P]oliticians in Washington have done nothing substantial but postponing once again the final bankruptcy of global confidence in the U.S. financial system". The commentary in the government-run publication also declared that the debt deal "was no more than prolonging the fuse of the U.S. debt bomb one inch longer." #9 China is the largest producer of gold in the world, and it has also been importing an absolutely massive amount of gold from other nations. But instead of slowing down, the Chinese appear to be accelerating their gold buying. In fact, money manager Stephen Leeb says that his sources are telling him that China plans to buy another 5,000 tons of gold. There are many that are convinced that China eventually plans to back the yuan with gold and try to make it the number one alternative to the U.S. dollar. So exactly what would happen if the Chinese announced someday that they were going to back their currency with gold and would no longer be using the U.S. dollar in international trade? It would change the face of the global economy almost overnight. In a previous article, I described some of the things that we could expect to see happen...

The fact that we get to print up giant mountains of money and virtually everyone around the world uses it has been a huge boon for the U.S. economy. When that changes, the word "catastrophic" is not going to be nearly strong enough to describe what is going to happen. According to a Rasmussen Reports survey that was released this week, only 13 percent of all Americans believe that the country is on the right track. But the truth is that these are the good times. The American people haven't seen anything yet. Someday people will look back and desperately wish that they could go back to the "good old days" of 2012 and 2013. This is about as good as things are going to get, and it is only downhill from here.

|

| Paper gold will be dumped for real metal, Grant Williams tells KWN Posted: 18 Oct 2013 04:40 PM PDT 10:37a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: Singapore fund manager Grant Williams tells King World News that someday, maybe soon, paper gold is going to be dumped for the real thing: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/18_A... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Silver and Gold Prices Rose 3.1 and 3.7 Percent Respectively this Week Posted: 18 Oct 2013 04:35 PM PDT Gold Price Close Today : 1,314.40 Gold Price Close 11-Oct-13 : 1,268.00 Change : 46.40 or 3.7% Silver Price Close Today : 21.869 Silver Price Close 11-Oct-13 : 21.215 Change : 0.654 or 3.1% Gold Silver Ratio Today : 60.103 Gold Silver Ratio 11-Oct-13 : 59.769 Change : 0.33 or 0.6% Silver Gold Ratio : 0.01664 Silver Gold Ratio 11-Oct-13 : 0.01673 Change : -0.00009 or -0.6% Dow in Gold Dollars : $ 242.19 Dow in Gold Dollars 11-Oct-13 : $ 248.41 Change : -$6.21 or -2.5% Dow in Gold Ounces : 11.716 Dow in Gold Ounces 11-Oct-13 : 12.017 Change : -0.30 or -2.5% Dow in Silver Ounces : 704.18 Dow in Silver Ounces 11-Oct-13 : 718.22 Change : -14.05 or -2.0% Dow Industrial : 15,399.65 Dow Industrial 11-Oct-13 : 15,237.11 Change : 162.54 or 1.1% S&P 500 : 1,744.50 S&P 500 11-Oct-13 : 1,703.20 Change : 41.30 or 2.4% US Dollar Index : 79.634 US Dollar Index 11-Oct-13 : 80.426 Change : -0.792 or -1.0% Platinum Price Close Today : 1,434.80 Platinum Price Close 11-Oct-13 : 1,372.90 Change : 61.90 or 4.5% Palladium Price Close Today : 739.65 Palladium Price Close 11-Oct-13 : 713.05 Change : 26.60 or 3.7% The GOLD PRICE gave back $8.30 of yesterday's dramatic $40.70 gain and closed Comex at $1,314.40. Silver coughed up 3.4 cents of yesterday's 58.3 cent gain for a 2186.9c close. Still, yesterday's gains powerfully confirmed the Key Reversal on Tuesday and left both silver and GOLD PRICES above their 20 day moving averages, first tripwire of upward momentum. Behold, both silver and gold prices have also formed bullish falling wedge patterns, and yesterday's surge released them on their own recognizance ("broke them out") of that pattern. Unless contradicted by closes below 2090 and 1872, we have to assume that silver and gold prices are rallying. If they close below those points, both will revisit the June lows. Up above, for all its pep the SILVER PRICE has not been able to close above 2200c and stay there. Now silver must show its cards or fold, rising above 2200c and 2250c (50 DMA is at 2245c) in short order. Gold must confirm a rally by closing above $1,332 as the first step of an advance. 50 DMA awaits then at $1,343. Gold price rose 3.7% for the week, silver 3.1%. Respectable, but the weekly charts still show both below their 20 week moving averages. GOLD/SILVER RATIO is behaving by not rising, but I would like to see silver outpacing gold. Sure enough, when the cloud of the debt-ceiling kerfuffle passed over the market, stocks rose and the dollar fell. Surprising the Great and Mighty, silver and GOLD PRICES took that news quite well, thank you very much. By the way, the debt-ceiling deal changed nothing, reformed nothing, cured nothing. Federal government spending remains out of control, and federal debt has grown so large it will never be paid. Default is certain, only the date is uncertain. The yankee government will either repudiate the debt outright or inflate it away. Right now, they're inflating it away, and that will continue. If you think "This will never happen -- the dollar is the world's reserve currency!" or "America has the world's strongest economy," well, you just keep thinking that, and wait for reality to catch up with your error. Stocks indices argued yesterday but got in line today. Dow gained 28 (0.18%) for a 15,399.65 close. S&P500 rose 11.35 (0.65%) to 1,744.50. S&P500 gapped up and made another all -time high, punching barely through the overhead trend line. Dow remains 300 points below its overhead trendline. S&P500 could spurt further still, but odds are against much more rise here. It has formed a rising wedge from which it will most likely fall down. Right now it's going higher because -- its price is rising. In other words, it's a mania. I looked at Google today, which just rose above $1,000/share. It's price/earnings ratio is 29.15, another way of saying it would pay back your principle in 29.15 years. Or it pays a 0.25% return roughly. Whoa! That's not "dividend yield," because Google pays NO dividend. This is a greater fool market — "Buy because prices are rising." By the way, some folks believe that inflation will also help stocks. Constantino Bresciani-Turroni wrote The Economics of Inflation examining the German hyperinflation. He found that stocks did not keep pace with inflation. Dow in gold and Dow in silver both fell for the week, but rose a tiny bit today. Dow in silver ended the week at 704.18 oz, down 2% for the week. Dow in gold closed 11.716, down 2.5% this week. Both indicators are still locked in a downtrend, good news for silver and gold investors. Need to see them close below their 20 DMAs, now at 699.74 oz and 11.60. US dollar index is flirting with the 79.60-ish area that forms the lip of a cliff. Should it fall over that, it won't land before 73. Lost 0.7% today, 5.1 basis points, to 79.634. Euro rose slightly, 0.85 to $1.3687. Put yourself in the place of the European Nice Government Men, manipulating the euro. Would you really want your currency to rise against the dollar, pricing your goods out of markets around the world and opening the door to cheaper US goods? Maybe the deal's been struck with the US NGM to let the euro rise and dollar fall, but why? Sooner or later that tight shoe will begin to pinch. Yen rose 0.16 today to 102.32. Nipponese NGM doing their best to keep it steady, regardless what the dollar does. All this explains why I wouldn't buy any scrofulous fiat currencies even with y'all's money. Game is wholly rigged, and they're playing "competitive devaluation." I saw an internet dust-up today about JP Morgan Chase Bank informing its customers it would limit cash withdrawals to $50,000/month and limit overseas wires. Various voices found in this harbingers of exchange controls and other tyrannies. Might be, but I have to ask, Why would you leave your money in JPM anyway? Do you simply enjoy feeding your enemy? Why not put your money in a small bank you might be able to trust at least a little? And besides, why don't you have at least three months' cash needs in a safe place OUTside the banking system anyway? As Catherine Fitts says, "Come clean!" Stop leaving your money in the banks that are destroying you and your country. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Silver and Gold Prices Rose 3.1 and 3.7 Percent Respectively this Week Posted: 18 Oct 2013 04:35 PM PDT Gold Price Close Today : 1,314.40 Gold Price Close 11-Oct-13 : 1,268.00 Change : 46.40 or 3.7% Silver Price Close Today : 21.869 Silver Price Close 11-Oct-13 : 21.215 Change : 0.654 or 3.1% Gold Silver Ratio Today : 60.103 Gold Silver Ratio 11-Oct-13 : 59.769 Change : 0.33 or 0.6% Silver Gold Ratio : 0.01664 Silver Gold Ratio 11-Oct-13 : 0.01673 Change : -0.00009 or -0.6% Dow in Gold Dollars : $ 242.19 Dow in Gold Dollars 11-Oct-13 : $ 248.41 Change : -$6.21 or -2.5% Dow in Gold Ounces : 11.716 Dow in Gold Ounces 11-Oct-13 : 12.017 Change : -0.30 or -2.5% Dow in Silver Ounces : 704.18 Dow in Silver Ounces 11-Oct-13 : 718.22 Change : -14.05 or -2.0% Dow Industrial : 15,399.65 Dow Industrial 11-Oct-13 : 15,237.11 Change : 162.54 or 1.1% S&P 500 : 1,744.50 S&P 500 11-Oct-13 : 1,703.20 Change : 41.30 or 2.4% US Dollar Index : 79.634 US Dollar Index 11-Oct-13 : 80.426 Change : -0.792 or -1.0% Platinum Price Close Today : 1,434.80 Platinum Price Close 11-Oct-13 : 1,372.90 Change : 61.90 or 4.5% Palladium Price Close Today : 739.65 Palladium Price Close 11-Oct-13 : 713.05 Change : 26.60 or 3.7% The GOLD PRICE gave back $8.30 of yesterday's dramatic $40.70 gain and closed Comex at $1,314.40. Silver coughed up 3.4 cents of yesterday's 58.3 cent gain for a 2186.9c close. Still, yesterday's gains powerfully confirmed the Key Reversal on Tuesday and left both silver and GOLD PRICES above their 20 day moving averages, first tripwire of upward momentum. Behold, both silver and gold prices have also formed bullish falling wedge patterns, and yesterday's surge released them on their own recognizance ("broke them out") of that pattern. Unless contradicted by closes below 2090 and 1872, we have to assume that silver and gold prices are rallying. If they close below those points, both will revisit the June lows. Up above, for all its pep the SILVER PRICE has not been able to close above 2200c and stay there. Now silver must show its cards or fold, rising above 2200c and 2250c (50 DMA is at 2245c) in short order. Gold must confirm a rally by closing above $1,332 as the first step of an advance. 50 DMA awaits then at $1,343. Gold price rose 3.7% for the week, silver 3.1%. Respectable, but the weekly charts still show both below their 20 week moving averages. GOLD/SILVER RATIO is behaving by not rising, but I would like to see silver outpacing gold. Sure enough, when the cloud of the debt-ceiling kerfuffle passed over the market, stocks rose and the dollar fell. Surprising the Great and Mighty, silver and GOLD PRICES took that news quite well, thank you very much. By the way, the debt-ceiling deal changed nothing, reformed nothing, cured nothing. Federal government spending remains out of control, and federal debt has grown so large it will never be paid. Default is certain, only the date is uncertain. The yankee government will either repudiate the debt outright or inflate it away. Right now, they're inflating it away, and that will continue. If you think "This will never happen -- the dollar is the world's reserve currency!" or "America has the world's strongest economy," well, you just keep thinking that, and wait for reality to catch up with your error. Stocks indices argued yesterday but got in line today. Dow gained 28 (0.18%) for a 15,399.65 close. S&P500 rose 11.35 (0.65%) to 1,744.50. S&P500 gapped up and made another all -time high, punching barely through the overhead trend line. Dow remains 300 points below its overhead trendline. S&P500 could spurt further still, but odds are against much more rise here. It has formed a rising wedge from which it will most likely fall down. Right now it's going higher because -- its price is rising. In other words, it's a mania. I looked at Google today, which just rose above $1,000/share. It's price/earnings ratio is 29.15, another way of saying it would pay back your principle in 29.15 years. Or it pays a 0.25% return roughly. Whoa! That's not "dividend yield," because Google pays NO dividend. This is a greater fool market — "Buy because prices are rising." By the way, some folks believe that inflation will also help stocks. Constantino Bresciani-Turroni wrote The Economics of Inflation examining the German hyperinflation. He found that stocks did not keep pace with inflation. Dow in gold and Dow in silver both fell for the week, but rose a tiny bit today. Dow in silver ended the week at 704.18 oz, down 2% for the week. Dow in gold closed 11.716, down 2.5% this week. Both indicators are still locked in a downtrend, good news for silver and gold investors. Need to see them close below their 20 DMAs, now at 699.74 oz and 11.60. US dollar index is flirting with the 79.60-ish area that forms the lip of a cliff. Should it fall over that, it won't land before 73. Lost 0.7% today, 5.1 basis points, to 79.634. Euro rose slightly, 0.85 to $1.3687. Put yourself in the place of the European Nice Government Men, manipulating the euro. Would you really want your currency to rise against the dollar, pricing your goods out of markets around the world and opening the door to cheaper US goods? Maybe the deal's been struck with the US NGM to let the euro rise and dollar fall, but why? Sooner or later that tight shoe will begin to pinch. Yen rose 0.16 today to 102.32. Nipponese NGM doing their best to keep it steady, regardless what the dollar does. All this explains why I wouldn't buy any scrofulous fiat currencies even with y'all's money. Game is wholly rigged, and they're playing "competitive devaluation." I saw an internet dust-up today about JP Morgan Chase Bank informing its customers it would limit cash withdrawals to $50,000/month and limit overseas wires. Various voices found in this harbingers of exchange controls and other tyrannies. Might be, but I have to ask, Why would you leave your money in JPM anyway? Do you simply enjoy feeding your enemy? Why not put your money in a small bank you might be able to trust at least a little? And besides, why don't you have at least three months' cash needs in a safe place OUTside the banking system anyway? As Catherine Fitts says, "Come clean!" Stop leaving your money in the banks that are destroying you and your country. Y'all enjoy your weekend! Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| TF Metals Report: Bullion banks pillaging GLD for metal Posted: 18 Oct 2013 04:34 PM PDT 10:30a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: The TF Metal Report's Turd Ferguson today reports more evidence that the gold exchange-trade fund GLD is being pillaged by the major bullion banks to cover short positions in gold elsewhere: http://www.tfmetalsreport.com/blog/5167/pillaging-gld CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Mike Kosares: China's gold conduit from London, a financial coup d'etat Posted: 18 Oct 2013 04:23 PM PDT 10:19a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: Centennial Precious Metals proprietor Mike Kosares today reports documentation of huge gold flows from London through Switzerland to China. His commentary is headlined "China's London-Zurich-Hong Kong Gold Conduit -- A Major Financial Coup D'Etat" and it's posted at Centennial's Internet site, USAGold, here: http://www.usagold.com/cpmforum/2013/10/18/chinas-london-zurich-hong-kon... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... * * * Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Manipulated Markets Prospects: Gold, U.S. Dollar, Bonds, Equities & Interest Rates Posted: 18 Oct 2013 03:02 PM PDT Deepcaster |

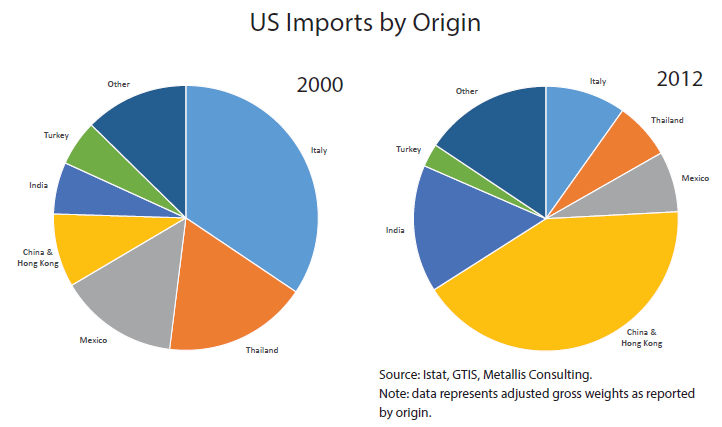

| China’s London-Zurich-Hong Kong gold conduit — a major financial coup d’etat Posted: 18 Oct 2013 02:57 PM PDT

United Kingdom gold exports to Switzerland jumped from 85 tonnes to 1,016 tonnes in the first eight months of 2013 — a twelve times rise. Some bullion market watchers attribute the huge increase to withdrawals or sales from ETFs — an explanation that covers only half the story…….if that. Switzerland, according to the Koos Jansen website, has exported nearly 500 tonnes of gold to Hong Kong through July, 2013. Hong Kong, in turn, has exported over 1200 tonnes of gold to the China mainland over the same period. Now, with this report of ramped-up exports from the United Kingdom, another piece of the puzzle falls into place and we begin to get a fairly clear picture what these gold mobilizations entail. Switzerland and Hong Kong are acting as a conduit of western gold on its way to China — and Chinese central bank reserves. To what extent this gold mobilization is the result of some yet to be identified external pressure on London’s bullion banks, or simply business as usual, remains to be determined, but gold movements of this size usually do not occur in a vacuum. Hedge funds have been in the gold ETF liquidation mode since April, at the behest, it seems, of certain bullion banks that have isused generalized ETF sell recommendations to their clientele (which includes the funds). The ETF selling has been blamed repeatedly for the rapid drop in price. If all of this has been a ploy to drive down the price on paper and channel substantial amounts of physical gold to China, who is the winner in this game and who is the loser? The gold market is forever and always opaque (no matter how diligent or persistent the arguments that it isn’t or that it should not be), and that is probably why so many are intrigued by it. Yet, at the same time, those who innocently own gold for asset preservation purposes can rest assured that they will never become collateral damage in these affairs as long as they do not allow themselves to lose patience or forget the reasons why they purchased gold in the first place. Gold is never sought by those who think all is right with the world. It is sought by those who believe that things could go wrong, or indeed, that things have already gone very badly. That true believer might be someone of incredible private wealth, as it was Bernard Baruch in the 1930s, or it might be a great nation state like Germany or China today. When the sitting secretary of the Treasury asked Bernard Baruch why he was buying so much gold, the reply came quickly that he “was commencing to have doubts about the currency.” China and Germany, no doubt, are acting on doubts of their own. Up until today, we were unaware of the degree to which those doubts had manifested themselves in the hidden corridors of the world gold market. . . .Now we know. In the first eight months of 2013, China produced 270 tonnes of gold from its mines, and almost four times that amount through its London – Zurich – Hong Kong gold conduit — a major financial coup d’etat. Link to Reuters article “Gold exports to Switzerland surge as investors sell ETFs” Also see related: Euro, yuan swap deal comes in under the radar, but log it for the future ____________ If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails. |

| Vulgar Competition and Italian Gold Posted: 18 Oct 2013 02:30 PM PDT "Italy accused of protectionism!" is hardly news. Wanting free competition in the airline market, IAG - the group formed from the UK's privatized British Airways and Spain's privatized Iberia in 2012 - has urged the European Commission ... Read More... |

| All Hell Will Break Loose And It’s Going To Be “Pandemonium” Posted: 18 Oct 2013 02:06 PM PDT  Today one of the most highly respected fund managers in Singapore warned King World News that investors around the world need to be prepared because the West is nearing that point where "all hell is going to break loose." Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that as the real financial chaos begins "it's going to look like pandemonium." Williams also spoke about what all of this will mean for investors in key markets such as gold and silver in his powerful interview below. Today one of the most highly respected fund managers in Singapore warned King World News that investors around the world need to be prepared because the West is nearing that point where "all hell is going to break loose." Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that as the real financial chaos begins "it's going to look like pandemonium." Williams also spoke about what all of this will mean for investors in key markets such as gold and silver in his powerful interview below.This posting includes an audio/video/photo media file: Download Now |

| Posted: 18 Oct 2013 02:00 PM PDT Gold Remains Firm After U.S. Can Kick

Mission accomplished. Can kicked. Crisis averted. At least for another several months… As we discussed in Thursday’s DMR, the market realizes that the debt ceiling is more a target than any real attempt to limit the amount of debt accumulated. Gold rallied smartly back in 2011 when that debt ceiling deal was struck as well. At this point we don’t even know what the new debt ceiling might be, the ceiling has simply been suspended until February 7. Treasury can borrow whatever it needs — unhindered for the time being by a pesky ceiling — putting us ever-deeper in debt and moving inexorably toward that as yet to be determined new debt “target”. The Fed of course has been the buyer of the majority of Treasury’s new debt issuance in recent years, and they will likely continue to step up to the plate. The prospects for tapering have dimmed even further. The day after the 2011 deal, our debt exploded by $238 bln. It was the largest one-day increase in the history of the United States, which took our debt/GDP ratio beyond 100% for the first time since World War II. S&P downgraded the U.S. a couple days after that. Although the threat of imminent default has been averted, China’s Danong ratings agency quickly downgraded U.S. sovereign debt to A- from A. In a press release Danong said: "The [U.S.] government is still approaching the verge of a default crisis, a situation that cannot be substantially alleviated in the foreseeable future." This move came days after China Daily ran an op-ed calling for China to “gradually reduce its current dollar holdings as a matter of financial prudence and steadily work with others toward a new global financial architecture.” In short, China would very much like to see an alternative to the dollar as the global reserve currency. The financial press is indeed rife with stories these days about the decline of dollar supremacy. Our mounting debt burden, our propensity to try and paper over our problems by printing ever-more dollars, along with persistent political intransigence are all to blame. Jim Grant of Grant’s Interest Rate Observer, summed it up on BloombergTV yesterday by saying “The U.S. government is persistently, chronically and abidingly cash flow negative. We can’t get along without more debt.” Indeed, the U.S. debt is expected to reach $23 trillion in the next five-years and if the economy takes another turn for the worse, I fear it could be much worse than that. There’s a requirement in the deal that calls on Congress to hammer out longer-term tax and spending policies for the next decade and report by December 13. We need look back no further than the so-called “super-committee” that begot the sequester to deduce the likely success of that endeavor. So, sometime early next year, this whole nonsense will begin all over again, further diminishing our already eroded standing as the global economic superpower and keeper of the world’s reserve currency. I’m not surprised in the least that the dollar has tumbled to a new eight-month low and gold is up nearly 3% today. In the aforementioned Bloomberg interview, Jim Grant said he still believes in gold “fundamentally and over the long-term as the legacy and final monetary asset.” It would seem I share more than a last name with Mr. Grant… |

| Posted: 18 Oct 2013 01:58 PM PDT Jim Sinclair’s Commentary This drama is far from over. As U.S. averts default, Japan and China brace for next dollar drama By Wayne Arnold and Leika Kihara HONG KONG/TOKYO (Reuters) – Deal or no deal, the U.S. Congress’ dance with default impressed policymakers and investors in China and Japan with just how vulnerable their own... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Alasdair Macleod: China and gold Posted: 18 Oct 2013 01:22 PM PDT 7:17a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: Frantically selling gold, the West is forfeiting economic power to China and other Eastern nations that appear to be buying more metal than annual mine production, GoldMoney research director Alasdair Macleod writes today. His commentary is headlined "China and Gold" and it's posted at GoldMoney's Internet site here: http://www.goldmoney.com/en-gb/news-and-analysis/news-and-analysis-archi... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 18 Oct 2013 01:22 PM PDT Jim, Four things come to mind: 1) JPM in desperate need of cash. A red flag. 2) China seeking alternatives to Treasuries for its USD holdings. 3) JPM deal with China regarding its inability to deliver gold. 4) Global turmoil on the horizon. Best to diversify locations. CIGA Name Withheld China’s Largest Conglomerate Buys The... Read more » The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Gene Arensberg: Short-selling banks covering on gold? Posted: 18 Oct 2013 01:10 PM PDT 7:07a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: Trading limits go out the window when somebody big wants to send a message in the gold market, the Got Gold Report's Gene Arensberg writes today. His commentary is headlined "Short-Selling Banks Covering on Gold?" and it's posted at the GGR here: http://www.gotgoldreport.com/2013/10/short-selling-banks-covering-on-gol... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Gold Daily and Silver Weekly Charts - Big Moves In and Out of Comex Bullion Warehouses Posted: 18 Oct 2013 01:10 PM PDT |

| Gold Daily and Silver Weekly Charts - Big Moves In and Out of Comex Bullion Warehouses Posted: 18 Oct 2013 01:10 PM PDT |

| Maguire, Sprott interviewed at KWN Posted: 18 Oct 2013 01:01 PM PDT 7a AEST Saturday, October 19, 2013 Dear Friend of GATA and Gold: At King World News, London metals trader Andrew Maguire describes the Federal Reserve's desperate intervention in the gold market to defend the U.S. dollar and China's steady acquisition of discounted metal: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/18_M... And Sprott Asset Management CEO Eric Sprott remarks on the catastrophic imbalance in the United States between production and consumption: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/18_B... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Maguire Predicted Gold Surge – Now Says West Is Collapsing Posted: 18 Oct 2013 12:59 PM PDT Dear CIGAs, On the heels of an explosive mid-week surge in the price of gold and continued weakness in the US dollar, today the man who predicted the massive spike mid-week spike in gold ahead of time warned King World News that the West is now collapsing. London metals trader Andrew Maguire also spoke with... Read more » The post Maguire Predicted Gold Surge – Now Says West Is Collapsing appeared first on Jim Sinclair's Mineset. |

| Theater Of The Absurd: Greenspan Writes Book On Economic Forecasting Posted: 18 Oct 2013 12:34 PM PDT Given his track record, Alan Greenspan's publication of a guide to economic forecasting will likely prove as successful as Lance Armstrong's guide to drug-free cycling. As Bloomberg reports, Greenspan's new book "The Map and the Territory" is about as credible as art history by Mr. Magoo; as it pretends to tackle the subject of forecasting while saying next to nothing about the author's historic failure to reduce the risks leading to the crisis, which he calls "almost universally unanticipated." Bloomberg's Daniel Akst sums it up best with his concluding sentence: "'The Map and the Territory' is an infuriating book, one that will leave readers wondering how its author could have come all this way and yet remain so hopelessly lost." Indeed...

|

| Western Credit-Rating Fraud Exposed -- Again Posted: 18 Oct 2013 12:09 PM PDT The "good news" is that the latest Act of "The U.S. Debt-Ceiling Farce" has mercifully ended, and the curtain has come down on this puppet-theater. The bad news is that it ended (absurdly) with a mere three-month reprieve – before we get literally an instant replay of this contrived posturing and puffery. Apart from the outrageous irresponsibility of the U.S.'s elected representatives staging these contrived "crises" (instead of doing their jobs); these quasi "shutdowns" of the U.S. government do serious short-term harm to the already-crippled U.S. economy – meaning medium- and long-term economic consequences from this staged theater. Yet as the dust settles from the latest Act; we see essentially zero reaction in the international financial community (with one, small exception). The world's largest economy, sitting with the largest debts and largest deficits in the History of the World openly "debates" whether or not to continue paying its bills, it ends up (supposedly) only hours away from official debt-default, and there is no reaction? Having regularly used words such as "drones" and "parrots" to characterize the ever-vigilant minions of the Western, Corporate Media; this one event alone provides absolute vindication. During the worst days of the "Euro Debt-Crisis" (so far); European governments received regular downgrades to their sovereign debt on only the flimsiest of pretexts, sometimes due to nothing more than the (fraudulent) manipulation of credit-default swap rates on that debt (i.e. the multi-trillion dollar bets made that these governments will default on that debt). The "insurance market" (credit default swaps) for the debt of many European debtors is greater than the actual debts themselves. The Tail does "wag the Dog" in our crime-ridden financial markets. And by fraudulently manipulating credit-default swap rates; Western banksters can (and do) manufacture downgrades on Euro economies (or vice versa) – and by doing so, they can drive interest rates to literally any number they desire…but they don't do this in the USA. With the U.S. government a mere hours away from debt-default, and sitting with (in actual fact) more than $200 trillion in debts/obligations; the U.S.'s Teflon, "AAA" credit rating remains intact. An economy which the Chairman of the Federal Reserve has now acknowledged is a Ponzi-scheme, retains a carved-in-stone "AAA" credit rating. The obvious question is: would/will the U.S. economy be "downgraded" at all after it defaults on its astronomical debts and liabilities? For those comatose members of the general public who still snicker whenever they see/hear the word "conspiracy"; spend just two minutes observing the Ultimate Accomplices of financial crime: the Western credit-rating agencies. Right up until (literally) the day after the made-in-Wall-Street U.S. housing bubble imploded; these credit rating Accomplices were rubber-stamping virtually all of the Bankster's "securitized" mortgage-fraud products "AAA". This was ratings fraud: ratings agencies selling these (bogus) "AAA" ratings to Wall Street – which those Banksters then used to lure-in chumps for $trillions in securities fraud. And there wasn't even any attempt made to hide the fraud. The ratings agencies openly acknowledged that they allowed their "clients" (the Wall Street Banksters) to tell them how to rate their fraud-products. Not only did these (so-called) "credit rating" agencies not even employ enough staff to thoroughly/properly examine all the "products" on which they issued ratings; they openly acknowledged that they didn't even understand some of the more convoluted Wall Street scams – and so they simply accepted the Bankster's own explanations, essentially allowing them to "rate" their own fraud-products. |

| Posted: 18 Oct 2013 11:58 AM PDT Top Market Stories For October 18th, 2013: The Biggest Scam In The History Of Mankind - Hidden Secrets of Money Episode 4 - Mike Maloney Historical Perspective: The Crisis Last Time - Jesse's Cafe What the Republican Civil War Means For Gold - John Rubino Make A Commitment To Your Finances - Money Talks Federal Reserve Policy Failures Are |

| Posted: 18 Oct 2013 11:30 AM PDT Gold miners' stocks have been brutalized this year, leaving them bleeding in the gutter as the most hated sector in all the markets. Plunging prices always lead to fear and excessive bearishness, unsustainable anomalous extremes ... Read More... |

| Gold, Silver, Debt – Don’t Miss These Important Charts Posted: 18 Oct 2013 11:30 AM PDT In this article, contributor Peter De Graaf shows in five charts the long and short term corrections of the gold and silver price. Precious metals remain within their rising trendline, despite the negative sentiment among investors and trader. Moreover, the seriousness of the debt situation and the impact on the dollar “paper currency” is shown in four charts. The debt ceiling in the US being pushed upward for the 79th time since 1960. Right after the last raise in 2011, the price of gold rose +17% between August 1st ($1620), and August 22nd ($1898) – that was +17% in just three weeks! A similar reaction by gold at this time could result in price rising quickly from $1281 to $1498. Gold Price CorrectionsThe current correction in gold started in August 2011 and has now gone on for 112 weeks – (it most likely bottomed on June 28th). This has been the longest correction since the current bull market started in 2002.

The expectation is for gold to advance by more than 50% as in 2006-2008, and more than 80% as in 2008-2011 during this next 'leg up', because of the depth of the current pullback. Because of blatant manipulation of the gold price by large traders dumping oversized lumps of futures contracts during hours when trading is usually sparse; the price of gold is starting this next rally below its normal starting point. This is likely to cause the price to act in slingshot fashion, and may very well surprise a lot of people. Here is the gold chart that records the beginning of the current bull market, along with three upside breakouts and the expectation for the next breakout, marked by arrows. (Charts courtesy www.stockcharts.com unless indicated).

The RSI (at top of chart) is ready to rise, the CCI (at upper bottom) is rising from oversold conditions, and the A/C line at the lower bottom is still in uptrend after merely leveling out. This chart courtesy Incrementum.li shows us that the current correction in the gold price is not unusual, if we accept the principle that the higher the price, the larger the pullback.

Featured is the daily gold chart. Price is carving out a rising channel that is anchored by two upside reversals (June 28th and Oct 15th). On Oct. 17th price broke out from beneath three months of resistance, with a target at the 200DMA. The three supporting indicators have all turned positive, including the Accumulation/Distribution line. The Gold Direction Indicator (for details www.pdegraaf.com), turned bullish at 55%, compared to 44% on Wednesday.

Debt Ceiling, Debt Per Capita, Dollar InflationThis chart courtesy Sharelynx.com shows a gap that has opened up between the US debt limit and the price of gold. Unless we expect the debt limit to be lowered, (how likely is that), we better prepare our portfolio for a rise in the price of gold, as the rubber band effect takes hold.

This chart courtesy BMGBullion.com shows the US Federal Debt on a per capita basis. This debt cannot be paid off – it will be inflated away. Gold and silver will be sought as protection against this inflation.

This chart courtesy Mark J. Lundeen shows the number of US dollar bills in circulation, compared to the number of ounces of gold supposedly stored at Fort Knox. (These gold ounces have not been audited since 1953).

Silver Price and Silver CorrectionsHere is the long-term chart for silver, along with the breakout points after a correction takes place, marked with arrows, including the expectation for the next breakout. The three supporting indicators are beginning to rise up from support levels.

Featured is the index that compares silver to gold. Since the second leg in the double bottoms of 2003 and 2008, the trend has favored silver over gold. The two supporting indicators are turning positive. The target for the current bounce is at the top of the blue channel.

Featured is the daily bar chart for TIP the bond fund that is indexed for inflation. Price dropped sharply in May and June when it was thought that the FED might reduce its bond purchases (TIPs are bonds after all). Recently however the people who buy TIPs are sniffing the first whiffs of price inflation, and the arrows point to breakouts while the supporting indicators are positive. Price inflation is the delayed result of monetary inflation and a source of energy for gold and silver to rise.

Peter Degraaf is an online stocks and bullion trader, with over 50 years of investing experience. He produces a daily report for his many subscribers, in 17 different countries. For a sample copy of a recent report contact him at itiswell@cogeco.net or visit his website www.pdegraaf.com. Please do your own due diligence. Peter Degraaf is not responsible for your trading decisions. |

| Billionaire Sprott Asks How Will People Survive What’s Coming? Posted: 18 Oct 2013 11:14 AM PDT  In the aftermath of the dollar plunge and the gold surge this week, today in his King World News interview billionaire Eric Sprott asked the chilling question, with the collapse that is coming, "as human beings, how is everyone going to survive?" He then stated, "It's a scary prospect." Below is what Sprott, who is Chairman of Sprott Asset Management, had to say in part I of this remarkably powerful interview series. In the aftermath of the dollar plunge and the gold surge this week, today in his King World News interview billionaire Eric Sprott asked the chilling question, with the collapse that is coming, "as human beings, how is everyone going to survive?" He then stated, "It's a scary prospect." Below is what Sprott, who is Chairman of Sprott Asset Management, had to say in part I of this remarkably powerful interview series.This posting includes an audio/video/photo media file: Download Now |

| Attention Investors: The Blood is Now in the Streets Posted: 18 Oct 2013 10:11 AM PDT This moment of financial uncertainty, like all those before it, is a golden opportunity for investors with vision to buy emerging disruptive technologies at truly bargain prices. I'm constantly amazed by the sort of sentiment I read in mainstream financial publications. When stocks are down, people decide they're going to sell off and look elsewhere for profits. The market "stinks," they say. Seriously, am I the only person who finds this sort of short-term thinking addled and absurd? After all, we've seen financial cycles since… forever. We know they happen. We know that the best time to buy is when markets are depressed. So why are so many people acting as if the markets are broken? Oh, wait. I know that one. It's because most people are driven more by herd psychology than higher-order thought processes. I've been reminded why I like the Austrian economist Joseph Schumpeter so much. One reason is that he considered big business cycles the inevitable consequence of innovation, as well as the resistance to innovative change that always exists within the old order. If you are waiting for policymakers to solve the market's problems, you're going to be waiting a long time. This view, that cycles cannot be eliminated due to the biological imperative of human nature, sets Schumpeter apart from other economists, even of his own Austrian School. In fact, many of my friends of the Austrian persuasion who adhere more strictly to the banking theories of Mises and Hayek tend to irritate me. They're. So. Whiny. They complain and complain about the stupid things that governments do and the fact that stupid people enable those stupid things… stupidly. So what? If you can't change it, accept it. And profit from it. By this point in history, given that we've suffered through far more serious injuries to our economic system, and more than recovered every time, it should be obvious that human nature is not "repairable." There's not ever going to be some sort of global — or even societal — awakening, in which the vast majority of people suddenly realize that government is basically incapable of improving on free markets to any significant degree. Societies do, however, respond to the pain caused by government-induced failures, just as B.F. Skinner's pigeons learned complex behaviors without ever understanding them. We are, in fact, well on the road to recovery, though I admit that more people are going to have to suffer negative reinforcement (pain) before we are ready to make up for lost time. But we will. I'm sure you know the Chinese curse, "May you live in interesting times." We do, in fact, live in very interesting times. More importantly, we are in a period of historic opportunity, which we may never see again. Stop listening to the whiners. The time to invest is when there's blood in the streets. When your stocks have been doing well for a while and every moron decides that it's time to buy equities, you'll be in positions to "sell high." You can't really do that, however, if you neglect to buy low because you got caught up in the pessimism and lost faith in human ingenuity. This is the same thing John Templeton did it back in 1939. Templeton started his investing career in 1939 by borrowing about $10,000, which was real money in those days. With war escalating in Europe and most investors in panicked despair, he didn't buy gold, nor did he put all his money in Treasuries or other "safe havens." He bought 100 shares in each of the 104 companies priced under a dollar on the New York and American stock exchanges. Almost all were innovative startups, and 34 were in bankruptcy. He then ignored his portfolio for four years. At that point, only four of the 104 were worthless, and he had quadrupled his money. It wasn't luck. Templeton was one of the few who understood portfolio mathematics. It is axiomatic that a diversified portfolio of truly innovative companies held for the long run will pay off big. This is based on the simple assumption that human progress will continue and things will get better. Most people forget that during the Great Depression, there was considerable growth in technological innovation. Necessity created a number of innovations that made our lives better and easier — the laundromat, copy machines, the car radio, the electric shaver and even the cotton tampon all came out of the 1930s. The first nylon material was introduced by DuPont. Improvements in existing technologies like the automobile and airplanes were constantly happening, even as the stock market flat-lined. So at a time when the mainstream was too busy running scared from markets and hiding their money (to the detriment of the rest of the economy), innovative investors like John Templeton were quietly investing in emerging technologies and, over time, making a fortune. Templeton didn't wait for the government or central banks to somehow stimulate us into success like most people then and now. If you are waiting for policymakers to solve the market's problems, you're going to be waiting a long time. There are two kinds of people the world should really be looking to for solutions — scientists and the investors who fund their innovations. Scientists might toil away for years, and investors might sit and wait patiently, but inevitably, as progress is made, there is a payoff — and that payoff can, in some cases, lead to revolutions in entire industries. Schumpeter is the most important economist to investors: He coined a term "creative destruction." If you really want to make money, look not for that which strikes at the margins and outputs of existing firms, but at their very foundations. We are looking for investments that leave ruins behind. Capitalism is the very perennial gale of creative destruction. So if we want to seek out and profit from the real innovations in society, we have to look for technologies that aren't just changing some things, but changing everything. Regards, Patrick Cox Ed. Note: The kind of investments Patrick refers to aren’t easy to identify. But they’re not impossible. And that’s where people like Patrick come in. They spend their lives poring over research and data trying to find just one gem out of thousands. And a few of these diligent investors are willing to share what they know, so that you can take a shortcut to amazing profits. That’s the kind of news we publish in The Daily Reckoning. That’s the kind of insight readers are provided. And that’s the reason over half a million people check it out every single day. You owe it to yourself to be one of them. Sign up for FREE, right here, and start getting all the info your missing. |

| The Budget/Debt Ceiling Bill Potentially Eliminates The Debt Ceiling Limit Posted: 18 Oct 2013 09:54 AM PDT Paper money eventually returns to its intrinsic value – zero. (Voltaire, 1694-1778)Often rather quickly, I might add to that nugget of wisdom. Unbeknown to most people in this country - and certainly not reported in the mainstream media - is a Provision buried within the Continuing Appropriations Act of 2014 that - in effect - gives the President the ability to unilaterally waive the debt ceiling limit. Although Congress can override the President's move to get lift the debt ceiling entirely, it would take a 2/3 majority in both Houses of Congress to block the action. That just would not be possible for all practical purposes. It looks to me, based on reading the Bill, that Harry Reid and Lisa Murkowski, who is on the Appropriations Committee, slipped the Provision into the legislation at a late stage in the game, when they realized that Boehner had caved in and the world was begging the Government to avoid default. I would bet a lot of money that probably 90% of the Congressmen who voted "yes" on the Bill didn't even know that the Provision was in there. I can guarantee that as fact. In essence, while most people feel a sense of relief over the passage of the Bill enabling to Government to pile on even more debt, the cold reality is that the legislation is a ticking time bomb for the U.S. dollar and it sets up the next stage of systemic collapse. I wrote an article for Seeking Alpha which lays out my analysis, which you can read here: LINK. The truth is, the U.S. political and economic system is now akin to a runaway freight train in which the brakes have failed and it's headed toward a gorge where the bridge has collapsed. |

| The Key Factor To Drive Gold and Silver Prices to Extreme Values Posted: 18 Oct 2013 09:50 AM PDT The precious metal investors are actually sitting on gold mine, and they don't even know the real reason why this is true. Many analysts are focusing on the huge amount of debt and fiat money in the system to be invested in gold and silver, but the fundamental root cause continues to go unnoticed. While the massive amount of debt, derivatives and fiat money are indeed excellent reasons to own the precious metals, they are the mere symptoms and not the disease itself. The advanced societies of the world were built on an economic system that can only survive if it continues to grow. Without growth, the $100's of trillions in derivatives and debts would implode -- along with it the Suburban Retail-Commercial-Housing economy. |

| Is the Rising Stock Market Bullish or Bearish News for Gold? Posted: 18 Oct 2013 09:47 AM PDT On Thursday, the S&P 500 closed at a new high and its intraday record of 1733.45 broke the all-time high set Sept. 19. Over 80 percent of stocks traded on the New York Stock Exchange rose. According to FactSet, companies in the ... Read More... |

| Is Rising Stock Market Bullish or Bearish for Gold? Posted: 18 Oct 2013 09:34 AM PDT On Thursday, the S&P 500 closed at a new high and its intraday record of 1733.45 broke the all-time high set Sept. 19. Over 80 percent of stocks traded on the New York Stock Exchange rose. According to FactSet, companies in the S&P 500 index are on track for third-quarter earnings growth of 1.1% from last year. Excluding J.P. Morgan Chase's loss, they would be on pace for 3.6% growth. Please note that at the beginning of earnings season, analysts expected earnings growth of 3%. |

| Gold Is A Reserve Of Safety Says ECB President Posted: 18 Oct 2013 09:20 AM PDT Today’s AM fix was USD 1,317.00, EUR 962.09 and GBP 813.16 per ounce. Yesterday’s AM fix was USD 1,308.50, EUR 959.87 and GBP 813.09 per ounce. Gold climbed $40.20 or 3.14% yesterday, closing at $1,319.70/oz. Silver rose $0.53 or 2.49% closing at $21.80. Platinum jumped $44.84 or 3.2% to $1,432.74/oz, while palladium soared $23.50 or 3.3% to $737.50 /oz. |

| Gold only has one way to go, and that’s up – Hegarty Posted: 18 Oct 2013 09:06 AM PDT Former Rio Tinto executive Owen Hegarty says there is only one way it will go and that is a "north easterly direction over time". |

| Kyrgyz crowd attacks Australian gold miner’s office Posted: 18 Oct 2013 09:06 AM PDT A crowd of about 200 people attacked Z-Explorer's local office on Friday, in what appeared to be another violent conflict over the privatisation of the country’s resources. |

| Gold shorts "wrongfooted" by US default swerve Posted: 18 Oct 2013 09:05 AM PDT “Gold shorts” who were positioned to profit if gold fell had to close their bets fast as the metal jumped this week, says Societe Generale's Robin Bhar. |

| India’s Sept gold jewellery exports rise 16.5% – trade body Posted: 18 Oct 2013 09:05 AM PDT Exports of gold jewellery from India rose 16.5% in value terms to $653.90 million in September, an industry body said Friday. |

| Massive sell/buy orders create huge gold market instability Posted: 18 Oct 2013 09:05 AM PDT Massive daily paper gold trades are responsible for moving the gold market upwards or downwards (mostly the latter) virtually every day now creating major instability in the gold markets. |

| Silver Prices and the Flow of Physical Posted: 18 Oct 2013 08:43 AM PDT The ultimate lynch pin for the silver market is the flow of physical metal to support ongoing price suppression. The flow of physical metal is mostly an illusion nearly equal to (and in some ways parallel with) the perceived strength of the paper currencies used to measure its value. Actual or threat of default in physical silver delivery to the COMEX could very likely lead to default across the asset spectrum. |