Gold World News Flash |

- U.S. debt ceiling is more than raised -- it is entirely suspended until Feb. 7

- China Leads Campaign to Replace the Dollar as Reserve Currency

- Lurching gold prices mystify traders -- and Reuters

- The Jim Rogers view on gold

- Gold Spikes 3% After Debt Ceiling Rises & U.S. Downgrade

- “Stimulate and Hope”: Empire at a Turning Point

- Gold Resurrection from Financial Disaster

- The Frightening Reality About What Is Happening In The US

- Guessing game starts on timing of Venezuela's next devaluation

- GoldSeek Radio interviews GATA Chairman Murphy

- Join GATA next week at the Silver Summit in Spokane

- 2 Tailwinds

- What the Republican Civil War Means For Gold

- The Scary Chart That Has Everyone In Washington Terrified

- Precious Metals: Today's Similarities with 1976

- You've Been PUNK'D - What Are You Gonna Do About It?

- Draghi On Gold "I Never Thought It Wise To Sell"

- The Hidden Secrets Of Money Part 4: The Biggest Scam In The History Of Mankind (In 7 Easy Steps)

- Barron, Griffiths, Pento, and Ing comment at King World News

- Guest Post: America The Reckless

- Today the Gold Price Closed Above it's 20 DMA at $1,322.70

- Today the Gold Price Closed Above it's 20 DMA at $1,322.70

- The Mother of Central Banks Warns Markets To Respect Independence

- You Either Believe In Magic Or You Believe In Math

- The Frightening Reality About What Is Happening In The US

- Silver’s Summer Rally Fizzles Out

- Markets Pop On Weak Dollar Events

- Chinese Credit Agency Downgrades U.S. Debt (Again)

- Gold Daily and Silver Weekly Charts - Blow the Man Down

- Gold Daily and Silver Weekly Charts - Blow the Man Down

- The Jim Rogers View On Gold

- “There Is No Question This Will End In Disaster”

- Ted Butler: JP Morgan’s Perfect Silver Manipulation Cannot Last Forever

- Matières à Réflexion for Thursday, 17 October - Larry Summers Flinches At Gold Question

- Matières à Réflexion for Thursday, 17 October - Larry Summers Flinches At Gold Question

- QUEST UPDATE

- In The News Today

- Hydro-Fracking Grows a Set of Billion-Dollar Balls

- Was There Gold on Columbus Santa Maria? - Kitco News

- The Daily Market Report

- Complete Collapse & Economic Meltdown Will Shock The World

- Gold Resurrection From Financial Disaster, Gold Trade Settlement $7000

- U.S. Debt Deal Reached, Republicans Got Nothing, Now 90 Days Until Next Crisis

- China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate

- Is U.S. Dollar Decline Going To Spike Gold and Silver Prices?

- Update: ECB Chief Mario Draghi On Central Bank Gold Reserves

- Gold Price Forecast to Hit $2,500 Before End of 2014

- Big Money in the Beer Can Sector

- Palladium, the Other Precious Metal Can Double Your Money Now

- Gold Prices Jump to $1320 on US Debt-Ceiling Deal as Foreign Creditors "Review Dollar Diversification"

| U.S. debt ceiling is more than raised -- it is entirely suspended until Feb. 7 Posted: 18 Oct 2013 01:13 AM PDT There's No Actual Debt Ceiling Right Now By Alex Pappas http://dailycaller.com/2013/10/17/theres-no-actual-debt-ceiling-right-no... There's no actual debt ceiling right now. The fiscal deal passed by Congress on Wednesday evening to re-open the government and get around the $16.4 trillion limit on borrowing doesn't actually increase the debt limit. It just temporarily suspends enforcement of it. That means Americans have no idea how much debt their government is going to rack up between now and Feb. 7, when the limits are supposed to go back into place and will have to be raised. ... Dispatch continues below ... ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... There is no dollar amount set for how much debt the government can accumulate between now and then. The suspension strategy was employed first earlier this year during previous fiscal battles in Congress. Such tactics infuriate anti-government waste groups. "Suspending the debt ceiling without a dollar amount is further proof that Congress is taking a major step backward in fiscal responsibility," David Williams, the president of the Taxpayers Protection Alliance, told TheDC on Thursday. "A real dollar figure is a constant reminder to taxpayers and Congress that the country is broke. This was done to hide the real debt from taxpayers." To critics, lawmakers have gotten away with allowing the country to rack up more debt and avoid the threat of default without actually voting for debt limit increase. The conservative Heritage Foundation has criticized the practice as a "smokescreen." "Suspending the debt ceiling is less transparent to the American people. It allows members of Congress to avoid debate on the specific dollar amount increase in the debt limit, making their vote politically much easier to cast," the organization wrote in October. "A calendar date is not nearly as scary to constituents as a figure in the trillions of dollars." Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| China Leads Campaign to Replace the Dollar as Reserve Currency Posted: 18 Oct 2013 01:00 AM PDT by Sasha Cekerevac, Investment Contrarians:

In my view, the commentary was intended to voice the opinion of Chinese leaders that they are fed up with the political fighting in Washington, leaving China's trillions of dollars in U.S. debt in the hands of ineffective leaders. |

| Lurching gold prices mystify traders -- and Reuters Posted: 18 Oct 2013 12:56 AM PDT As usual the news agency questions nearly everyone except the biggest participants in the gold market, central banks. * * * Lurching Gold Prices Mystify Traders, Undermine Confidence By Frank Tang NEW YORK -- In the early hours of the New York morning on Thursday, when scarcely a few hundred lots of gold futures are usually traded, a wave of buy orders worth over $2.3 billion surged into the market. Prices soared 3 percent in just 10 minutes, setting the tone for the next 12 hours of trade -- and puzzling many traders and investors who have been rattled by a series of similarly abrupt, and largely unexplained, trade surges over the past two weeks. ... A few suggested darker causes: the deliberate gaming of the market, whether by a rogue trader or a computer-driven algorithm that seeks to maximize market impact by overwhelming the system with a large number of orders in milliseconds. Whatever the cause, the trades risk undermining confidence at a time when electronic trading glitches and flash crashes have roiled other U.S. financial markets in recent years and will fuel concerns that algorithmic trading systems have undue influence over prices. "Clearly, whoever is out to sell is looking for high impact. It's somebody who is either running a big short position or would like to see a lower gold price for other reasons," said Ross Norman, Chief Executive Officer of London-based bullion broker Sharps Pixley, referring to an abrupt $30 drop on Oct 11. For the complete story: http://www.reuters.com/article/2013/10/18/us-gold-tumble-analysis-idUSBR... ADVERTISEMENT You Don't Have to Wait for Your Monetary Metal: Many investors lately report having to wait weeks and even months for delivery of their precious metal orders. All Pro Gold works with the largest wholesalers that have inventory "live" -- ready to go. All Pro Gold can ship these "live" gold and silver products as soon as payment funds clear. All Pro Gold can provide immediate delivery of 100-ounce Johnson Matthey silver bars, bags of 90 percent junk silver coins, and 1-ounce silver Austrian Philharmonics. All Pro Gold can deliver silver Canadian maple leafs with a two-day delay and 1-ounce U.S. silver eagles with a 15-day delay. Traditional 1-ounce gold bullion coins and mint-state generic gold double eagles are also available for immediate delivery. All Pro Gold has competitive pricing, and its proprietors, longtime GATA supporters Fred Goldstein and Tim Murphy, are glad to answer any questions or concerns of buyers about the acquisition of precious metals and numismatic coins. Learn more at www.allprogold.com or email info@allprogold.com or telephone All Pro Gold toll-free at 1-855-377-4653. Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Posted: 18 Oct 2013 12:43 AM PDT Clif Droke |

| Gold Spikes 3% After Debt Ceiling Rises & U.S. Downgrade Posted: 18 Oct 2013 12:42 AM PDT Today's AM fix was USD 1,308.50, EUR 959.87 and GBP 813.09 per ounce. Gold fell $1.80 or 0.14% yesterday, closing at $1,279.50/oz. Silver slid $0.06 or 0.28% closing at $21.27. Platinum climbed $14.80 or 0% to $1,395.20/oz, while palladium rose $7.25 or 1% to $712.55/oz. Gold prices jumped $36 in 15 minutes and it surged as high as $1,321 per ounce or as much as 3.6% at one stage. Silver jumped by an even greater margin, by 5.1%, and rose as high as $22.18/oz. Gold rose for the first time in four days after U.S. lawmakers reached an agreement to increase the debt ceiling and increasingly important Chinese credit ratings agency, Dagong Global Credit Rating Co. cut its credit rating for the U.S. This led to short covering and some safe haven demand for gold as the dollar fell against all major currencies.

The smart money is scooping gold bullion up at these depressed levels. Gold is down 23% this year despite robust demand from central banks and especially from India and China. Global sales of bullion bars and coins gained 78% in the second quarter, according to the World Gold Council, showing that demand actually accelerated. The U.S. government has avoided default but remains essentially insolvent and its appalling fiscal state has deteriorated once again due to the debt ceiling being raised above $16.7 trillion. Although the U.S. national debt has already surged well above that and as of writing, the U.S. National Debt is actually nearly $16.97 trillion and rising at roughly $1 trillion every year. It is worrying that the recent debate has again been superficial and revolves around the theatre and political chicanery of the Republicans versus the Democrats and the usual partisan support for opposing 'teams' rather than the substantive issue of America's likely insolvency and the fact that the actual national debt is actually between $100 trillion and $200 trillion and there is little sign of political or economic will to tackle this fundamentally important issue. The U.S. is engaged in fiscal and monetary policies that are akin to a Banana Republic. In addition to electronically creating out of nothing $85 billion every month to buy its own debt in the form of bonds, the U.S. is also borrowing more money than it is authorized to borrow, from itself again. The extra $264 billion or so in borrowing — the difference between the actual real time $16.964 trillion national debt and the $16.7 trillion debt limit — was lent to themselves - by one section of government to another - in recent weeks. Treasury Secretary, Jack Lew, ex COO of Citigroup Bank, has been using "extraordinary measures" since the U.S. ran out of money a few months ago and has been using government retirement programmes to make up the difference. This is a form of shell game or confidence trick used to perpetrate what is a dangerous accounting practice that tends to end in tears.

These unusual, some would say fraudulent, accounting practices and the fact that the U.S. is borderline insolvent, contrary to copious amounts of denial globally, are extremely dollar bearish and gold and silver bullish. The risks posed to the dollar, but also to the pound, euro, yen and other electronic and fiat currencies is why we remain confident that both precious metals will reach real (inflation adjusted) record highs in the coming months. Silver will likely continue to outperform after its most recent period of under performance. JP Morgan Chase has issued letters to its business account holders notifying them that as of November 17 the bank will limit all cash transactions, including deposits, withdrawals and ATM usage, to $50,000 per month, and will prohibit all outgoing international bank wires. Chase Bank has moved to limit cash withdrawals while banning business customers from sending international wire transfers. This has caused speculation that the bank is preparing for a looming financial crisis in the United States by imposing capital controls. Some have suggested the drastic measures were designed to push business clients into more costly premium business accounts. Bank officials confirmed yesterday that the new capital limits apply to all business account holders but could not say why the measures came about and whether they were bank driven, due to profit motives or government regulations.

The bank will stop processing any outgoing international bank wire, and that any monthly cash transactions in excess of the new $50,000 limit will be subject to penalties and fees. JP Morgan is embattled after a series of scandals including allegations of manipulation in many markets including LIBOR, foreign exchange, oil and energy markets and of course in the gold and silver markets. It has received some enormous 'slap on the wrist' fines as it attempts to clear up the mess created by the London Whale trading scandal. The bank will pay $100 million to the U.S. Commodity Futures Trading Commission (CFTC), conceding "reckless" behavior led to the trading debacle that generated about $6 billion in losses. There remains the real risk of capital controls and it will be important to own gold bullion in the event of capital controls. GoldCore's 10th Anniversary Gold Sovereign & Storage Offer Click For Details: Gold Sovereigns |

| “Stimulate and Hope”: Empire at a Turning Point Posted: 18 Oct 2013 12:30 AM PDT by Greg Canavan, Daily Reckoning.com.au:

But the Internet bubble and bust marked an important turning point. It coincided with the birth of the euro, a competing reserve currency that no doubt encouraged capital to flow back out of the world's greatest economic empire. Before the euro come about, the U.S. enjoyed unrivaled capital inflows. It pushed up the value of the ("King") dollar and inflated equity markets to historic levels. |

| Gold Resurrection from Financial Disaster Posted: 18 Oct 2013 12:00 AM PDT by Jim Willie, SilverBearCafe.com:

Take a whirlwind tour with graphics and photos. Absorb the images. They are profound, broad, and ugly. CENTRAL BANKS AS MATRIX No Plan B is on the table. The central bank is stuck in a destructive cycle with no viable workable exit strategy. |

| The Frightening Reality About What Is Happening In The US Posted: 17 Oct 2013 10:30 PM PDT from KingWorldNews:

Barron: "Gold is soaring today as a result of the chaos which has been taking place in Washington, but mostly because of the Chinese downgrading the United States. The Chinese know that all the US did was defer this crisis and not solve anything.” |

| Guessing game starts on timing of Venezuela's next devaluation Posted: 17 Oct 2013 09:58 PM PDT By Andres Schipani and Robin Wigglesworth http://www.ft.com/intl/cms/s/0/f1976846-372e-11e3-9603-00144feab7de.html... Beauty pageants are to Venezuela what football is to Argentina or baseball to Cuba -- a spectacle that allows people to forget their everyday woes. Yet at the Miss Venezuela competition last week, even the contestant from the capital Caracas had a gritty message for the audience, saying she wanted her country "to fight in the face of adversity." Not even under the lights could the brunette model dodge the reality that Venezuelans are battling an economic crisis that threatens the legacy of Hugo Chavez and his "Bolivarian revolution" and which is coming to the boil as the overvalued exchange rate drains foreign reserves. ... Dispatch continues below ... ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. "The big warning sign for Venezuela is its plummeting foreign exchange reserves," says Michael Riddell, a bond fund manager at M&G Investments in London. The OPEC nation's $95 billion of annual oil revenues mean default on its more than $45 billion of foreign debt remains improbable. Nonetheless, analysts say the country could face financing issues, as only a small percentage of its foreign reserves are liquid. Headline foreign reserves have fallen to $21 billion from $30 billion at the start of the year; furthermore, because of large gold holdings, only some $2 billion of that is fully liquid. Still, after including off-budget funds, such as a development fund that is partially Chinese financed and the foreign currency account of PDVSA, the state oil company, total available reserves are approximately $48 billion, analysts estimate. "Venezuela is not broke,"" says Efrain Velazquez, president of the National Economic Council, a government watchdog. Instead, the country "has had inappropriate international reserves management." That mismanagement is now flaring up, however, ahead of municipal elections on December 8 -- a poll widely seen as a referendum on the popularity of Nicolas Maduro, the president. Central to the economic problems he faces is the exchange rate, officially fixed at 6.3 bolivars to the US dollar but trading on the black market at close to 50 bolivars. That widening gap has led to a flourishing arbitrage by insiders who have access to dollars at the official rate and can then sell them at the street rate, pocketing the difference. Currency restrictions have also exacerbated shortages of essential goods, fuelling inflation running at almost 50 per cent a year. Toyota announced that it will this month shut its Venezuelan plant for two weeks because of delays in getting dollars needed to buy materials. Investors outside the country have been watching worriedly. The yield on Venezuela's benchmark 2027 dollar bond has risen to more than 12 per cent from under 9 per cent at the start of the year. The annual cost of insuring $10 million of Venezuelan debt against default for five years, as measured by credit default swaps, has also risen to $983,000 versus $600,000 in January. Nonetheless, Francisco Rodríguez, Venezuela economist at Bank of America Merrill Lynch, shrugs off the market concerns, saying total foreign reserves of $48 billion can cover some 10 months of imports and four years of debt service. "The excessive focus on the country's short-term liquidity situation runs the risk of missing the forest for the trees," he wrote in a recent note to investors. While $2 billion cash reserves might seem little, "this is not an abnormal number by Venezuelan standards -- it is near the average for the past four years -- making it hard to understand recent concerns with liquidity levels." One reason for that concern is lack of action by Mr Maduro's administration to face up to problems. Behind the scenes, his ruling Socialist party faces internecine fights between radical ideologues and pragmatists, a tug of war that has led to a stalemate which has only worsened the economic situation. A devaluation, for example, would boost the local currency value of Venezuela's dollar oil receipts -- the country's time-honoured solution to closing a fiscal deficit -- and remove the need for currency restrictions. But doing so before the December 8 elections would damage Mr Maduro, who has to decide whether his administration "wants to be politically popular or economically sustainable," as Stratfor, the risk consultancy, puts it. "We see little scope for President Maduro to re-engineer a new path for the economy of Venezuela," says Paolo Batori, Morgan Stanley's global head of sovereign strategy. He has "little flexibility for any diversion from the populist oil-financed government spending policies of his predecessor." Nonetheless, analysts agree a large devaluation seems all but inevitable at some point. Indeed, planning minister Jorge Giordani recently said Mr Maduro would outline changes to macroeconomic policy at "an appropriate moment." In the meantime, or at least until after the election, Mr Maduro has taken to blaming Venezuela's problems on corruption, sabotage, speculation, and hoarding, and has asked lawmakers for decree powers to fight graft and an "economic war." Co-incidentally, when his mentor Chávez presided over maxi-devaluations in 2002 and 2010, the government also claimed that the country's foreign exchange and broader economic problems were due to economic sabotage. Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| GoldSeek Radio interviews GATA Chairman Murphy Posted: 17 Oct 2013 09:48 PM PDT 3:46p AEST Friday, October 18, 2013 Dear Friend of GATA and Gold: GoldSeek Radio's Chris Waltzek today interviews GATA Chairman Bill Murphy about the wild week in the monetary metals market. The interview is not quite 8 minutes long and can be heard at GoldSeek Radio here: http://radio.goldseek.com/nuggets/murphy.10.17.13.mp3 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Join GATA next week at the Silver Summit in Spokane Posted: 17 Oct 2013 09:44 PM PDT 3:34p AEST Friday, October 18, 2013 Dear Friend of GATA and Gold: Metals consultancy CPM Group Managing Director Jeff Christian plans to tell the Silver Summit next week that everything GATA says is a lie and that there is no manipulation in the gold and silver markets, according to a press release from the conference. GATA Chairman Bill Murphy will be present to disagree and to note that if the gold and silver markets are not manipulated, they may be the only such markets these days. The conference's press release is posted at GoldSeek here: http://news.goldseek.com/FeaturedPR/1381928520.php The conference, to be held Thursday and Friday, October 24 and 25, at the Davenport Hotel in Spokane, Washington, also will feature presentations by GATA favorites Jeff Berwick of The Dollar Vigilante letter, GoldSeek and SilverSeek proprietor Peter Spina, and Bix Weir of the Road to Roota letter. Dozens of mining companies will be exhibiting. The conference's Internet site is here: http://www.cambridgehouse.com/event/silver-summit-2013 CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Posted: 17 Oct 2013 09:40 PM PDT by Bill Holter, MilesFranklin.com:

The gold "very positive" event is the onset of capital controls announced yesterday by Chase bank and then seconded by Citi. |

| What the Republican Civil War Means For Gold Posted: 17 Oct 2013 09:03 PM PDT In one sense, the past couple of weeks' debt ceiling debate was just one more in a long line of annoying-but-otherwise-pointless pieces of bad political theater. But in another sense it was a turning point, one that may have put the democrats completely in charge. Consider: In a system with two viable parties, each side has to pretend to be more reasonable than it really is in order to attract just enough moderate votes to win the next election. So democrats pay lip service to fiscal responsibility and deficits – occasionally even signing bills like welfare reform that they find repugnant – when they'd much rather spend their days indiscriminately tossing other people's money at new entitlement programs. Republicans, meanwhile, pretend to empathize with people they privately view as prey when they'd rather be cutting taxes and invading places that have oil. We only rarely get to see the major parties' true selves because the 20% of voters in the middle are turned off by displays of naked avarice, and in a two-party system elections go to whoever carries a majority of that block. That's why the latest debt ceiling debacle is such a big deal. Government shutdowns and related turmoil have become a standard bargaining chip lately, without affecting the make-up of either party. But this time the main conflict was not between republicans and democrats, but between mainstream, log-rolling, back-scratching, career-politician republicans and a handful of representatives and senators elected with Tea Party – i.e., highly ideological – support. The latter have no interest in raising the debt ceiling under any circumstances and see a government shutdown as a positive end in itself. Defunding Obamacare was just the excuse. They got rolled, of course, as regular republicans chose to raise the debt ceiling without condition (as everyone always knew they would). But the cost of reopening the government is a republican civil war with only two likely outcomes: 1) The two groups stay in the big tent but challenge each other in primaries and intrigue over committee seats, etc., making a united, coherent policy front impossible and handing the next few elections to the democrats. 2) The Tea Party/libertarian republicans leave and either join the existing libertarian party or start one of their own, siphoning just enough votes from republicans in future elections to keep the democrats in charge. Already, it has started. See this from today's Bloomberg:

Once the civil war costs the republicans control of the House of Representatives (November 4, 2014), the democrats will be relieved of the need to fool the middle about their commitment to fiscal sanity. The incoming Clinton administration and its congressional majorities will ramp up domestic spending and finance it with higher taxes, more borrowing and way more money printing. Janet Yellen (the perfect Fed chair for this transition) will expand QE and make it permanent. The Fed's balance sheet will grow in trillion-dollar chunks as it buys up all the bonds issued by the government and the mortgage packagers and pretty much anybody else with paper to sell. The resulting tidal wave of hot money will swamp emerging markets and drive Europe and Japan crazy, but the democrats won't care because they'll be favored by 20 points in the polls and in any event will be too busy hiring more staff to handle the upcoming legislative season to listen to non-believers. Oh, and they’ll counter any dissent with capital controls and stepped-up surveillance. Could there be a better environment for gold? Not at first glance. But then almost the same could have been said two years ago when the Fed started buying $85 billion of bonds each month and bubbles began to form in stocks and houses. Some of that cash certainly should have found its way into precious metals. Instead the result was an epic correction. So logic isn't necessarily our best guide here. Still, the republican implosion/democrat ascendance comes after a two-year precious metals correction (during which China, India, and Russia bought something like 4,000 tons of gold, an amount greater than Germany's entire gold reserves). So coming when it does, the combination of democrat dominance, an even more accommodating Fed and a growing shortage of Western gold to be shipped East…well, at the risk of being wrong again, this really does look like precious metals paradise. |

| The Scary Chart That Has Everyone In Washington Terrified Posted: 17 Oct 2013 09:01 PM PDT  On the heels of some wild trading in global markets, and the Chinese downgrading the US, today top Citi analyst Tom Fitzpatrick sent King World News the scary chart that has everyone in Washington terrified. Fitzpatrick also discusses an incredible price target for gold, along with 3 incredible gold and silver charts he sent KWN. On the heels of some wild trading in global markets, and the Chinese downgrading the US, today top Citi analyst Tom Fitzpatrick sent King World News the scary chart that has everyone in Washington terrified. Fitzpatrick also discusses an incredible price target for gold, along with 3 incredible gold and silver charts he sent KWN.This posting includes an audio/video/photo media file: Download Now |

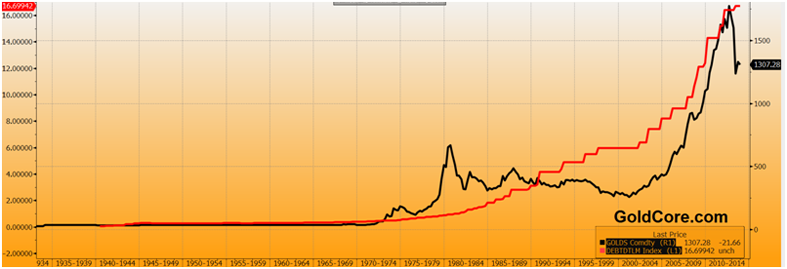

| Precious Metals: Today's Similarities with 1976 Posted: 17 Oct 2013 08:56 PM PDT From 1974 to 1976 the Barron's Gold Mining Index declined 67%. From 2011 to 2013, the HUI Gold Bugs Index declined 66%. The chart below is an updated chart of all of the worst cyclical bear markets in gold stocks, dating back to 1938. Read More... |

| You've Been PUNK'D - What Are You Gonna Do About It? Posted: 17 Oct 2013 07:01 PM PDT The Urban Dictionary defines punked as a way to describe someone humiliating you, tricking you, and ripping you off. At the subversive and deceptive hands of those issuing the world reserve currency aka the fiat "dollar," individual Americans and ... Read More... |

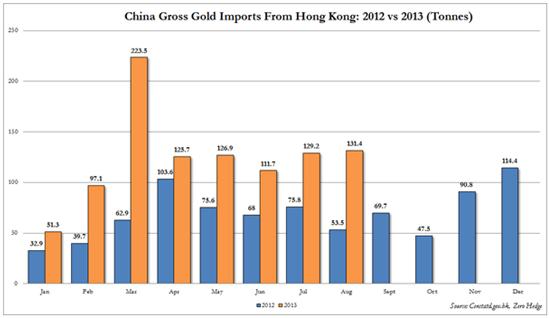

| Draghi On Gold "I Never Thought It Wise To Sell" Posted: 17 Oct 2013 06:37 PM PDT While Ben Bernanke would prefer not to discuss the barbarous relic, having noted in the past that "nobody really understands gold prices," it would seem his European brother-in-arms has a different opinion. When asked this week, by the ironically named Tekoa Da Silva, his thoughts on precious metals as reserve assets (and central banks around the world increasing their allocations), none other than the ECB head himself Mario Draghi explained "I never thought it wise to sell [gold], because for Central Banks this is a reserve of safety." But Draghi did not stop there, and perhaps enlightened by the farce in Washington this week, the unusually truthful central banker explained, "in the case of non-USD countries, it gives you good protection against fluctuations of the USD." Perhaps that is why China continues to import gold at a record pace? Oh, and don't fight the ECB...

|

| The Hidden Secrets Of Money Part 4: The Biggest Scam In The History Of Mankind (In 7 Easy Steps) Posted: 17 Oct 2013 05:22 PM PDT From the seven stages of empire to the dollar crisis (and golden opportunity) Mike Maloney moves on to expose the system that is ultimately responsible for most of the inequality in the world today. As Mike explains, most people can feel deep down that something isn't quite right with the world economy, but few know what it is. Gone are the days where a family can survive on just one paycheck...every day it seems that things are more and more out of control, yet only one in a million understand why. The powers that be DO NOT want you to know about this, as this system is what has kept them at the top of the financial food-chain for the last 100 years... Learning this will change your life, because it will change the choices that you make. If enough people learn it, it will change the world...because it will change the system . For this is the biggest Hidden Secret Of Money. Never in human history have so many been plundered by so few, and it's all accomplished through this...The Biggest Scam In The History Of Mankind.

|

| Barron, Griffiths, Pento, and Ing comment at King World News Posted: 17 Oct 2013 04:47 PM PDT 10:45a AEST Friday, October 18, 2013 Dear Friend of GATA and Gold: King World News has collected gold-related reaction to the temporary resolution of the debt ceiling issue in Washington. From mining entrepreneur Keith Barron: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/17_T... From Cazenove Capital's Robin Griffiths: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/17_T... From market analyst Michael Pento: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/17_C... And from John Ing of Maison Placements in Toronto: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/10/17_C... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... Join GATA here: The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata |

| Guest Post: America The Reckless Posted: 17 Oct 2013 04:43 PM PDT Authored by Michael Spence, originally posted at Project Syndicate, The world’s developed countries face growth and employment shortfalls, while developing countries are confronting huge challenges in adapting to increasingly volatile capital flows while adjusting their growth patterns to sustain economic development. And yet America’s political dysfunction has come to marginalize these (and other) crucial issues. It is all very difficult to fathom. The threat of a default on US sovereign debt has been lifted – for now – but the deeper problem persists: For America’s Republicans and Democrats, negotiating a fiscal grand compromise appears to carry higher costs than playing a game of brinkmanship, even at the risk of default. Surely this involves a collective miscalculation of the longer-term costs. Setting aside the external impact on the global economy, the damage to domestic stability and growth from anything other than a short-term technical default would be so severe that the political system (and both parties with it) could not withstand the backlash. Domestic and foreign holders of US Treasury bills would regard a deliberate, unforced default as a betrayal of trust. Some are reassured by this fact, because it suggests that a real default will not happen. And that means that the fragile global economy, dependent (for now) on a single country for its main reserve currency, can withstand America’s political shenanigans. That may be true, and it may be the only practical choice in the short run. But the US pattern of decision-making (or non-decision-making) has already created additional risk. It will surely be reflected in upward pressure on interest rates, at which point the Federal Reserve will enter the picture. Far from tapering its monthly purchases of long-term assets, one can easily imagine a scenario in which the Fed’s already substantial balance sheet would have to expand even more quickly to counter the negative economic effects of an unplanned – and rapid – rise in borrowing costs. And this comes at a time when many (including me) believe that strengthening US economic growth makes an orderly withdrawal from policy-assisted growth the wise course, both domestically and internationally. Outside the US, even a technical default would have profound effects. The eurozone still faces rebalancing and structural challenges, but it has managed to create a window of stability in sovereign-debt markets. In the case of a US default, however, it would start to attract capital inflows, causing the euro to rise, adding to already-substantial headwinds to growth and employment, and making recovery in its damaged peripheral economies nearly impossible. Measures to counter “excessive” capital inflows – of the type introduced in Brazil and Malaysia – might be needed. China and other sovereign holders of US debt face capital losses over and above those implied by the inevitable appreciation of their currency. One is reminded of the external consternation expressed during the 2008 crisis at the possibility of a default on debt carrying an implicit government guarantee. In March 2009, Zhou Xiaochuan, the governor of the People’s Bank of China, argued that the dollar’s role as the main international reserve currency was not in the interest of the global economy or of the US itself. In an expanding global economy, the supplier of the reserve currency is pushed to run current-account deficits – and hence toward a leveraged-growth model that systematically erodes its strength and independence as it becomes increasingly reliant on foreign capital and foreign asset ownership. Now we can see that the global economy is dependent not only on the strength of the reserve-currency country, but also on its values – particularly, on its continued willingness to put critical international commitments ahead of domestic disputes. America’s governance crisis has called this into question. The long-run effects of the US default threat will be overwhelmingly negative. For starters, it will reinforce the notion that policies and policy disputes are to be conducted with a view to domestic issues and interests, independent of the systemic global effects – even as those effects grow larger. Indeed, some factions within the US political system do not appear to understand the large adverse feedback effects on the domestic economy from a disruption in the global financial system. Second, external holders of US sovereign debt will almost certainly begin to view Treasuries as risky assets and, where possible, to diversify away from them. That is not necessarily bad – wholesale dumping of US sovereign debt is highly unlikely, as that would be self-destructive for many countries, including China – but the transitions could be bumpy. Third, the willingness to hold America’s creditworthiness hostage for domestic political purposes will almost surely accelerate the decline of US influence in global economic governance and management. In the short to medium term, that decline may create a vacuum and lead to volatility and heightened risk, because, as many have noted, there are few candidates to replace the US. To be fair, the trend toward diminished US influence – and, ultimately, shared responsibility for global economic governance and stability – was already underway, and in a sense is inevitable. The hope was that the transitions would be gradual and stable, with the US playing a leadership role as it has in most of the postwar period. Finally, the US default risk may revive Zhou’s 2009 agenda (perhaps premature at the time) and accelerate the search for a workable alternative to the single-country reserve-currency model, which has outlived its usefulness. In the end, no one wants the global system to be vulnerable to a single country’s domestic political fights. The global economy faces tremendous trials in the coming years: growth, employment, and distributional challenges in many advanced and developing countries; far-reaching institutional reform in Europe; the complex middle-income transition in China; and the continuing need to reduce poverty worldwide. Managing them effectively requires designing a system of global governance in which one country’s internal politics cannot jeopardize all countries’ prospects. The immediate threat is gone. But this is no time for a sigh of relief and business as usual. |

| Today the Gold Price Closed Above it's 20 DMA at $1,322.70 Posted: 17 Oct 2013 04:10 PM PDT Gold Price Close Today : 1322.70 Change : 40.70 or 3.17% Silver Price Close Today : 21.903 Change : 0.583 or 2.73% Gold Silver Ratio Today : 60.389 Change : 0.258 or 0.43% Silver Gold Ratio Today : 0.01656 Change : -0.000071 or -0.43% Platinum Price Close Today : 1431.90 Change : 36.70 or 2.63% Palladium Price Close Today : 736.80 Change : 24.25 or 3.40% S&P 500 : 1,733.15 Change : 11.61 or 0.67% Dow In GOLD$ : $240.24 Change : $ (7.66) or -3.09% Dow in GOLD oz : 11.621 Change : -0.371 or -3.09% Dow in SILVER oz : 701.81 Change : -19.29 or -2.68% Dow Industrial : 15,371.65 Change : -2.18 or -0.01% US Dollar Index : 79.613 Change : -0.855 or -1.06% Oh, I want to crow really hard, but I'm choking it back. In the aftermath of the debt-ceiling deal, the GOLD PRICE jumped $40.70 (3.2%) to $1,322.70. That leaves the impression that the $1,251 intraday low on Tuesday was THE low for this move and the start of a new rally. That needs to be confirmed by gold closing over $1,330.80, the October high, followed by more higher prices. The GOLD PRICE did more. Today it closed above its 20 DMA at 1,309.33. 50 DMA hovers above at $1,342.76. A close above $1,375 will send the bears scurrying for their dens and the security of a government lunch. For the time being, absent a close below $1,272, today's movement confirms that the upside down head and shoulders we've been watching really is at work. The gold price will hit the overhead neckline about $1,410. A breakout through that point turns all forces in gold's favor. Here's a little more icing: on the weekly chart, gold closed today above its 18 week moving average (1,318.32). Barely, but above. That upside-down HandS targets $1,675. Blast! I nearly forgot. Gold also broke out of its falling wedge formation. That bullish formation, remember, usually resolves with an upside breakout. The SILVER PRICE proved that EoD chart key reversal on Tuesday by jumping 2.7% today or 58.3 cents to 2190.3 -- comfortably above the 20 DMA at 21.70, and within clipping distance of the 50 DMA at 22.42. Silver also escaped its falling wedge. The neckline of silver's upside down HandS stands about 2490c, and it could make that jump lightning fast. Unless we see closes below $1,272 and 2090c, silver and GOLD PRICES have again begun rallying. In the next few days they need to advance sharply to confirm that. The debt-ceiling farce forespoke the future loud and clear: spending by inflation will continue and grow. Reform is impossible and default inevitable, whether outright or by inflation. I asked a friend today why people can't understand that. He answered, "Because the consequences are too devastating." Too devastating for most people even to ponder. Let him who has ears to hear, hear. Y'all ever been around a married couple who were always contradicting each other? She no more than opens her mouth to say something than he corrects her. He starts to say something and she nay-says it. Doesn't take much of that to make you start looking for the exits, because this is gonna end in a scrap and maybe even a cutting. So it is when markets that ought to agree -- "confirm" -- instead gainsay. Behold, that happened loudly in stocks today when the S&P500 closed at a new all-time-since-the-cosmos- was-formed high at $1,733.15 (up 11.61 or 0.67%) but the Dow closed d-o-w-n 2.18 (0.01%) at 15,371.65, below its 18 September 2013 all-time high by 305.29. This is not the stuff from which beautiful marriages --or rallies -- are built. But shucks, what do I know? I'm just a natural born fool from Tennessee. Today's big jumps in silver and gold brought down the Dow in Gold and Dow in Silver once again. Both stand a gnat's eyebrow from falling through their 20 DMAs. Dow in gold today closed down 3.09% at 11.621 oz (20 DMA is 11.60 oz). Dow in silver lost 2.68% or 19.29 oz and closed at 701.81 oz. 20 DMA standeth at 699.85 oz. Relative Strength Index and MACD have also turned down. Unless the DiG and DiS suddenly reverse and shoot sunward, this lower peak of the last 10 days confirms the reversal downward in June. S&P500 today hit and slightly punctured its overhead trendline. It gained 0.67% or 11.61 for a 1,733.15 close. Dow closed down 2.18 at 15,371.65, nowhere near its last high. It appears the debt-ceiling driven rally yesterday was a classic case of "sell the news." US dollar index slammed down 1.1% or 85.5 basis points to 79.613. To give you an idea what that means, the last low was 79.72. If the dollar falls past that mark, it could flutter through the air all the way to 73. Euro finally worked up enough courage to close unequivocally higher. It gapped up and ended at $1.3676, 1.07% higher. Minimum target is probably at least $1.3710, the last high. Yen gapped up, too, but not as enthusiastically. Oh, it was enough to jump over the 20 and 50 DMA's, but just to the middle of the last nine weeks trading range. Ended at 102.15, up 0.88%. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Today the Gold Price Closed Above it's 20 DMA at $1,322.70 Posted: 17 Oct 2013 04:10 PM PDT Gold Price Close Today : 1322.70 Change : 40.70 or 3.17% Silver Price Close Today : 21.903 Change : 0.583 or 2.73% Gold Silver Ratio Today : 60.389 Change : 0.258 or 0.43% Silver Gold Ratio Today : 0.01656 Change : -0.000071 or -0.43% Platinum Price Close Today : 1431.90 Change : 36.70 or 2.63% Palladium Price Close Today : 736.80 Change : 24.25 or 3.40% S&P 500 : 1,733.15 Change : 11.61 or 0.67% Dow In GOLD$ : $240.24 Change : $ (7.66) or -3.09% Dow in GOLD oz : 11.621 Change : -0.371 or -3.09% Dow in SILVER oz : 701.81 Change : -19.29 or -2.68% Dow Industrial : 15,371.65 Change : -2.18 or -0.01% US Dollar Index : 79.613 Change : -0.855 or -1.06% Oh, I want to crow really hard, but I'm choking it back. In the aftermath of the debt-ceiling deal, the GOLD PRICE jumped $40.70 (3.2%) to $1,322.70. That leaves the impression that the $1,251 intraday low on Tuesday was THE low for this move and the start of a new rally. That needs to be confirmed by gold closing over $1,330.80, the October high, followed by more higher prices. The GOLD PRICE did more. Today it closed above its 20 DMA at 1,309.33. 50 DMA hovers above at $1,342.76. A close above $1,375 will send the bears scurrying for their dens and the security of a government lunch. For the time being, absent a close below $1,272, today's movement confirms that the upside down head and shoulders we've been watching really is at work. The gold price will hit the overhead neckline about $1,410. A breakout through that point turns all forces in gold's favor. Here's a little more icing: on the weekly chart, gold closed today above its 18 week moving average (1,318.32). Barely, but above. That upside-down HandS targets $1,675. Blast! I nearly forgot. Gold also broke out of its falling wedge formation. That bullish formation, remember, usually resolves with an upside breakout. The SILVER PRICE proved that EoD chart key reversal on Tuesday by jumping 2.7% today or 58.3 cents to 2190.3 -- comfortably above the 20 DMA at 21.70, and within clipping distance of the 50 DMA at 22.42. Silver also escaped its falling wedge. The neckline of silver's upside down HandS stands about 2490c, and it could make that jump lightning fast. Unless we see closes below $1,272 and 2090c, silver and GOLD PRICES have again begun rallying. In the next few days they need to advance sharply to confirm that. The debt-ceiling farce forespoke the future loud and clear: spending by inflation will continue and grow. Reform is impossible and default inevitable, whether outright or by inflation. I asked a friend today why people can't understand that. He answered, "Because the consequences are too devastating." Too devastating for most people even to ponder. Let him who has ears to hear, hear. Y'all ever been around a married couple who were always contradicting each other? She no more than opens her mouth to say something than he corrects her. He starts to say something and she nay-says it. Doesn't take much of that to make you start looking for the exits, because this is gonna end in a scrap and maybe even a cutting. So it is when markets that ought to agree -- "confirm" -- instead gainsay. Behold, that happened loudly in stocks today when the S&P500 closed at a new all-time-since-the-cosmos- was-formed high at $1,733.15 (up 11.61 or 0.67%) but the Dow closed d-o-w-n 2.18 (0.01%) at 15,371.65, below its 18 September 2013 all-time high by 305.29. This is not the stuff from which beautiful marriages --or rallies -- are built. But shucks, what do I know? I'm just a natural born fool from Tennessee. Today's big jumps in silver and gold brought down the Dow in Gold and Dow in Silver once again. Both stand a gnat's eyebrow from falling through their 20 DMAs. Dow in gold today closed down 3.09% at 11.621 oz (20 DMA is 11.60 oz). Dow in silver lost 2.68% or 19.29 oz and closed at 701.81 oz. 20 DMA standeth at 699.85 oz. Relative Strength Index and MACD have also turned down. Unless the DiG and DiS suddenly reverse and shoot sunward, this lower peak of the last 10 days confirms the reversal downward in June. S&P500 today hit and slightly punctured its overhead trendline. It gained 0.67% or 11.61 for a 1,733.15 close. Dow closed down 2.18 at 15,371.65, nowhere near its last high. It appears the debt-ceiling driven rally yesterday was a classic case of "sell the news." US dollar index slammed down 1.1% or 85.5 basis points to 79.613. To give you an idea what that means, the last low was 79.72. If the dollar falls past that mark, it could flutter through the air all the way to 73. Euro finally worked up enough courage to close unequivocally higher. It gapped up and ended at $1.3676, 1.07% higher. Minimum target is probably at least $1.3710, the last high. Yen gapped up, too, but not as enthusiastically. Oh, it was enough to jump over the 20 and 50 DMA's, but just to the middle of the last nine weeks trading range. Ended at 102.15, up 0.88%. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| The Mother of Central Banks Warns Markets To Respect Independence Posted: 17 Oct 2013 03:39 PM PDT In a speech given earlier this week in Mexico, Mr Jaime Caruana who is the General Manager of the Bank of International Settlements (BIS) talked about the increasing pressure from the market on central banks. In fact, it was more of a plea to get more independence to unwind the massive monetary expansion and normalize interest rates.

The General Manager continued by explaining that he believes those measures were a “success” as they did contain the crisis and soften the recession. But, clearly, even the mother of central banks is aware that the limitations of monetary policy are increasingly being questioned. Or, in our own words, the question is being asked if indeed those policies have been a “success” or rather a “failure.”

The General Manager goes to the heart of the problem, i.e. unsustainable debt levels, but unfotunately only slightly touches the issue. He points out that “The relentless rise in total debt is not reassuring. Since the end of 2007, the total debt of the G20 non-financial sector, both private and public, has risen by almost $35 trillion dollars.” Clearly, the BIS is not willing to see the elephant in the room. The institution is performing non-stop research and has access to all possible data. Yet, there is no sign of questioning their own policy. The following chart (source: Debt Bear Market In 50 charts) shows that every incremental unit of debt (measured in dollar, but you can replace the dollar with any currency) is creating 0.08 dollar in economic value. Or, the other way around, to achieve one dollar of economic growth, one needs 12.5 dollar of debt. In half a century ago, the effectiveness of debt has decreased with a factor 50 ! Unfortunately, this is not one of their charts.

Although admitting that “in some cases, central banks are now seen as the marginal buyer of longer-term bonds,” a basic level of self criticism would have been suitable. By contrast, the vision of the BIS is that markets must allow independent central bank decision making.

The return to normal monetary conditions (“normalization”) has not started yet; there was only a slight caution of a potential upcoming minimal decrease in June of this year by the US Fed which caused a panic sell of in a matter of days. Stocks went quickly down, bond rates exploded higher, gold got sold off with a deflationary fear. The warning signs were loud and clear. Our view is that the tragedy of this story is the central bank “ivory tower” attitude. They behave like if they have some sort of special rights for a free lunch. Anybody with a sound logic knew that their measures would not come without consequence. Moreover, when this monetary experiment got out of hand, what central banks in essence did was trying to solve a solvency problem by creating even more debt (which was the initial problem). Also, there was no empirical evidence in history that such measures would solve the problem. With the absence of results from their policies, they wonder why the pressure to exit is so high. |

| You Either Believe In Magic Or You Believe In Math Posted: 17 Oct 2013 03:22 PM PDT While Santiago Capital's Brent Johnson believes "anything is possible," he warns "there's a catch." While it may be true for the individual (climb Everest, win a gold medal, walk on the moon), it is not true for the world at large because, as he so eloquently notes in this brief presentation, "the best thing we can learn from history is... that the world does not learn from history." And there is indeed plenty that is occurring once again - in oh-so-predictable cycles - that we have seen time and time again... and apparently choose to ignore the conclusion. As Johnson concludes, "you either believe in magic, or you believe in math."

Something here for everyone... 4th Turnings, Kondratieff Waves, Dalio's beautiful deleveraging, the unsustainable nature of the current cycle and the pulling forward of our demand... "you either believe in magic... or you believe in math"

|

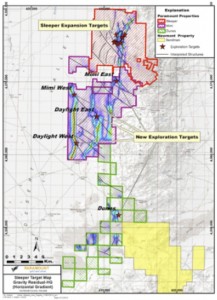

| The Frightening Reality About What Is Happening In The US Posted: 17 Oct 2013 03:17 PM PDT  Today a man who has lived in 18 countries around the world, and witnessed collapses in many of these countries firsthand, spoke with King World News about the frightening reality of what is really happening in the United States. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke with KWN about what people should expect to see in the United States going forward, and it wasn't pretty. Below is what Barron had to say. Today a man who has lived in 18 countries around the world, and witnessed collapses in many of these countries firsthand, spoke with King World News about the frightening reality of what is really happening in the United States. Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke with KWN about what people should expect to see in the United States going forward, and it wasn't pretty. Below is what Barron had to say.This posting includes an audio/video/photo media file: Download Now |

| Silver’s Summer Rally Fizzles Out Posted: 17 Oct 2013 01:46 PM PDT The euphoria that heralded the summer rally in silver prices has now dissipated and is as good as dead as silver prices drift lower. Silver made a valiant attempt to breach the $25.00 level in August but could not maintain its momentum and has since drifted lower to trade at around $21.00/oz today. Its big sister, gold, has also ran out of steam having peaked at around $1420/oz, it is now struggling to get above $1300/oz level.

Since the heady days of almost $50.00/oz, silver has suffered through a number of false dawns with this summer's effort now sadly joining that list of failed attempts to rally and challenge old highs. We are aware that the demand for physical silver is alive and well and needed for such industrial purposes as solar panels and that various mints around the world are from time to time sold out of their offerings of silver bars and coins for investment purposes. We are also aware of the paper market, as represented by the COMEX, frequently suffers from sellers who dump large amounts of paper contracts at odd times throughout the trading day, thus sending prices lower. We can shout about this situation all day long but we do not have the power to change it and investing against it has been a disaster for some. As gold and silver bulls we need to recognize that nothing goes up in a straight line and that there are bumps along the way. This current bull market in the precious metals sector is going through a downturn, a bear phase within a bull market if you wish. This year alone silver has fallen from around $30/oz at the beginning of 2013 to around $21/oz today, that's a 30% loss in value, so silver now requires a 50% increase in the price to get it back to the $30/oz level. This is not impossible, but at the moment it is a big ask for any commodity. So you have a choice; you can fight it or recognize that the trend is your friend and go with the flow. There will come a time when this bear phase exhausts itself and we can hit the acquisition trail with some gusto, so we must remain vigilant and look for those indicators that will alert us to a future change of direction. Until you are confident about silvers direction, keeping a fair amount of cash on the side-lines is not such a bad idea, after all the US Dollar started the year at around 80.5 on the US Dollar Index, which is where it stands today, so those dollars will buy you a lot more silver now than they would have in January 2013. Taking a quick look at the chart we can see that the summer rally has fizzled out with silver looking as though it will re-visit its summer lows. The trend is still downward despite the physical demand being buoyant. The MACD, RSI and the STO are more or less neutral, suggesting that silver could go either way. For what it is worth we think that silver will trade in the teens before we see a resumption of the rally in silver prices or their associated stocks, so go gently out there.

Bob Kirtley (bob@gold-prices.biz) www.skoptionstrading.com | www.silver-prices.net |

| Markets Pop On Weak Dollar Events Posted: 17 Oct 2013 01:46 PM PDT Global trade has an enormous impact on both the financial markets and worldwide economy. Therefore, when the currency that serves as the guidepost for valuing assets drops 1%, it impacts investor decisions across all asset classes. Read More... |

| Chinese Credit Agency Downgrades U.S. Debt (Again) Posted: 17 Oct 2013 01:46 PM PDT China's Dagong Global Credit Rating just downgraded the U.S.'s credit rating from A to A-minus, according to Zero Hedge. Dagong pulled no punches in its announcement this morning. "Since the outbreak of the U.S. debt crisis in 2008, the deviation between the federal government’s sources of debt repayments and the country's real wealth creation capacity has been constantly broadened," they grumbled. "The huge amount of government debts that lack the basis of repayment always stands on the brink of default, and this situation is difficult to change in the long term." American-based Fitch still rates U.S. sovereign debt at AAA… they did, however, downgrade the outlook to negative, following the horn-locking in Congress. Fitch's explanation explicitly blamed political problems and the recent risk of default. Perhaps the most interesting element is that Dagong doesn't lay the same blame at the feet of the recent debt ceiling debacle and government shutdown. Instead, it indicated that the recent congressional pandemonium "highlights the deterioration of the government's solvency, pushing the sovereign debts into a crisis status." China holds a boatload of U.S. Treasury securities: about $1.3 trillion, at last check. It is certainly getting squeamish about the money it holds. Dagong now estimates that the "depreciation of the U.S. dollar caused a loss of $628.5 billion on foreign creditors over the years of 2008-2012." With U.S. ratings agencies held in the grip of vengeful government regulators and in the cross hairs of the Justice Department, Dagong is the only noteworthy ratings agency remaining that might produce some sort of realistic assessment of the U.S. credit situation. That can was just kicked to January, when it will assuredly be kicked again. And again. If there's one thing Congress works hard it, it is insolvency. P.S. We've been covering the slow-burn collapse of the American dream for several years now. While the media have been laser-focused on the drama in Congress, what they're not telling you is that the first stage of a massive new crisis has already begun. In fact, America has been in a state of perpetual crisis for the past six years, and it is gradually worsening by the day. To get the real story behind the flashy headlines, subscribe to The Daily Reckoning by clicking here. |

| Gold Daily and Silver Weekly Charts - Blow the Man Down Posted: 17 Oct 2013 01:21 PM PDT |

| Gold Daily and Silver Weekly Charts - Blow the Man Down Posted: 17 Oct 2013 01:21 PM PDT |

| Posted: 17 Oct 2013 01:05 PM PDT If October has held any surprises for anyone so far, it has to be the bears. While volatility has been in evidence, the crash that some analysts were predicting has so far failed to materialize. Read More... |

| “There Is No Question This Will End In Disaster” Posted: 17 Oct 2013 11:43 AM PDT  On the heels of the Chinese downgrading the United States, the US Dollar Index has plunged back below the key psychological level of 80, and the gold market has soared. Today one of the top strategists in the world told King World News that "there is no question this will end in disaster." Cazenove Capital is the appointed stockbroker to Her Majesty The Queen, and their acclaimed strategist, Robin Griffiths, also warned that global stock markets may now be set to plunge. Below is what Griffiths had to say in his timely and powerful interview. On the heels of the Chinese downgrading the United States, the US Dollar Index has plunged back below the key psychological level of 80, and the gold market has soared. Today one of the top strategists in the world told King World News that "there is no question this will end in disaster." Cazenove Capital is the appointed stockbroker to Her Majesty The Queen, and their acclaimed strategist, Robin Griffiths, also warned that global stock markets may now be set to plunge. Below is what Griffiths had to say in his timely and powerful interview. This posting includes an audio/video/photo media file: Download Now |

| Ted Butler: JP Morgan’s Perfect Silver Manipulation Cannot Last Forever Posted: 17 Oct 2013 11:36 AM PDT Silver manipulation – a lot has been written about the subject, not many have grasped how it works exactly. The age of algorhythm trading (best known as High Frequency Trading, or HFT) allows for manipulative tricks to be rolled out in a very clever way. The “intuitive” way to manipulate the price of a commodity to the downside is to go short when prices are rising. Not so with JP Morgan. It is no coincidence that their manipulation strategy is so clever that most do not understand the mechanics; it is a perfect manipulation. This article brings clarity in the precise mechanics of JP Morgan’s silver price manipulation. It goes to the heart of the manipulative tricks. The author is obviously Ted Butler, with four decades of experience in the precious metals markets, specialized in the paper (futures) market. The mechanics described in this article have rarely before been explained. It makes it a must read for precious metals enthusiasts, but also for professional and individual investors because the ongoing manipulation must come to an end resulting in much higher prices. I think the most important comparison of the London Whale case to the COMEX silver manipulation is in the differences. In basic terms, JPM's London Whale manipulation was a simple price rig in extremely complex securities. In silver, JPMorgan's price rig is complex in a simple commodity. Let me try to explain. The London Whale manipulation was simple in that it followed the rigid blueprint of every previous manipulation, including the Hunt Brothers silver manipulation and the Sumitomo copper case, in that positions were added continuously which moved the price to the manipulators' advantage. Then, because the resultant prices became so out of line with what normal supply and demand forces would dictate, the whole thing collapsed leaving the manipulators with great losses and exposing the manipulative attempt. In COMEX silver, JPMorgan has behaved differently. Instead of selling short silver at declining prices, as it did in the London Whale case, JPMorgan has only sold short additional quantities of silver on increasing prices. After these additional short sales have satiated all new buying interest, JPMorgan then causes prices to decline (through the manipulative device of HFT) and buys back its short sales at lower prices and great profit. While the key to the silver manipulation is JPMorgan's dominant market share or market corner on the short side (same as in the London Whale case), there have been some important outside factors that have contributed to the silver price-rigging. The most important have been in the modern mechanics of trading, from HFT to the presence of technical traders and funds which mechanically and consistently buy and sell on price signals; buying as prices move higher and selling and selling short as prices decline. These technical funds are the enablers which allow JPMorgan to sell high and buy low in silver. These technical funds and traders are important contributors to the perfect market manipulation. I realize that every time the price of silver and gold get smashed down, the intuitive reaction is that JPMorgan or other commercial traders are bombing the market lower by selling thousands of contracts. But that's only partially true. Yes, JPMorgan rigs the price lower on those big down days, but not by selling enormous quantities of COMEX silver contracts short. JPM does get the price snowball rolling down the hill by selling a small quantity of contracts short at critical times and prices with the intent of inducing the technical funds to sell much larger quantities of contracts short (which JPM and other commercials then buy). This is an important feature of the perfect market manipulation in silver and the reason it has lasted so long; JPMorgan can always proclaim it was a net buyer of silver (and gold) on the big down days as is consistently proven in COT reports. By itself, it is a significant defense against allegations that JPMorgan is manipulating the price of silver, as how the heck can you be accused of manipulation if you buy on big down days? More than any other factor, this has been the prime impediment to ending the silver manipulation. But it doesn't tell the whole story.