Gold World News Flash |

- New York is Drowning in Bribes and Corruption by Pam Martens

- People In Asia Are Staggered At What’s Happening In The West

- The Biggest Central Bank Gold Buying Spree Since 1964

- The Weekend Vigilante – Austrialiastan, Singapore and Cambodia

- "New York Is Drowning In Bribes And Corruption"

- Gold and Silver - Back Story v Charts; Charts Are Superior

- Bitcoin Climbs To Highest Since April, Led By Chinese Actions

- Ron Paul Knows "The Longer QE Lasts, The Worse It Will End"

- Silver Prices and the Flow of Physical

- When Hyman Minsky Runs For The Hills: Japan Central Bank To "Own" 100% Of GDP In 5 Years

- In The News Today

- Jim’s Mailbox

- Unlike America, China Is Embracing Bold Reform

- People In Asia Are Staggered At What’s Happening In The West

- China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate

- The Ongoing Depression Could Force A Return To The Gold Standard

- John Williams: Currency Markets Will Stop Politicians Kicking The Can

- The London - China Gold Conduit — A Major Financial Coup D’etat

- Manipulated Markets Prospects: Gold, U.S. Dollar, Bonds, Equities & Interest Rates

- Vulgar Competition and Italian Gold

- Gold Mining Stocks Profits Fallacy

- Gold, Silver and U.S. Debt

- China and gold

| New York is Drowning in Bribes and Corruption by Pam Martens Posted: 20 Oct 2013 12:30 AM PDT by Michael Krieger, Liberty Blitzkrieg:

- Preet Bharara, U.S. Attorney for the Southern District of New York (the district that has failed to rein in the serial crimes by Wall Street's biggest firms) It's no surprise to me that New York is exceedingly corrupt. It's a huge city, with a ton of wealth and massive income inequality. That's basically the primary breeding ground for wide-scale corruption. However, it also comes as no surprise to me that the situation has gotten a lot worse in recent years. After all, NYC is the headquarters of some of the largest financial institutions in the world. As such, some of the worst actors in the recent financial collapse call the city home. The whole world watched as these criminals and shysters not only evaded criminal charges, but were also rewarded trillions of dollars of public support for their efforts. |

| People In Asia Are Staggered At What’s Happening In The West Posted: 19 Oct 2013 10:30 PM PDT from KingWorldNews:

So they don't really understand what the West is doing, but they are very, very happy to pick up as much gold as they can, slowly and gradually, and then more aggressively into dips in the price. And that's going to continue. |

| The Biggest Central Bank Gold Buying Spree Since 1964 Posted: 19 Oct 2013 10:00 PM PDT by Mike Burnick, SilverBearCafe.com:

Overseas investors holding U.S. assets are also watching this nonsense, and they are voting with their wallets. Needless to say, it’s a vote of no-confidence. However, one asset class stands to benefit in the long term: gold. |

| The Weekend Vigilante – Austrialiastan, Singapore and Cambodia Posted: 19 Oct 2013 08:30 PM PDT by Jeff Berwick, Dollar Vigilante:

It’s been somewhat of a whirlwind week as I’ve been all over this region. The last time we spoke I was in Thailand and was not looking forward to entering into the fasco-communist nanny state of Australiastan. I showed up at Don Muang airport in Bangkok and the beautiful check-in girl for Air Asia squinted her eyes at the screen and told me I couldn’t go to Australia. I wasn’t entirely unhappy to hear this news but was curious as to why. She said, “you don’t have a visa.” I told her that I was flying under my Kanadian slave card (passport) and that both Kanada and Australiastan are still purported to be owned by the Queef of England and part of the Orwellian named, “Commonwealth” and in my dozens of trips to Australia in the past I’ve never needed a visa. |

| "New York Is Drowning In Bribes And Corruption" Posted: 19 Oct 2013 06:33 PM PDT Submitted by Miachel Krieger of Liberty Blitzkrieg blog, Public corruption, based on all the evidence, appears rampant. And the ranks of those convicted in office have swelled to absolutely unacceptable levels. State Senators as well as State Assemblymen; elected officials as well as party leaders; city council members as well as town mayors; Democrats as well as Republicans. - Preet Bharara, U.S. Attorney for the Southern District of New York (the district that has failed to rein in the serial crimes by Wall Street’s biggest firms)

It’s no surprise to me that New York is exceedingly corrupt. It’s a huge city, with a ton of wealth and massive income inequality. That’s basically the primary breeding ground for wide-scale corruption. However, it also comes as no surprise to me that the situation has gotten a lot worse in recent years. After all, NYC is the headquarters of some of the largest financial institutions in the world. As such, some of the worst actors in the recent financial collapse call the city home. The whole world watched as these criminals and shysters not only evaded criminal charges, but were also rewarded trillions of dollars of public support for their efforts. The example was set. Crime pays, and now the entire city seems to be following their lead. Pam Martens has written and excellent article about corruption within New York’s legal system. Some excerpts from Counter Punch are below:

A $15,000 bond for a woman throwing a shoe at her Wall Street ex-husband, and a $15,000 bond for a state Supreme Court judge for accepting bribes. That pretty much sums it up. Good thing Mayor Bloomberg is focused on arresting Banksy when the city’s legal system has become one giant cesspool of fraud and corruption. Full article here.

|

| Gold and Silver - Back Story v Charts; Charts Are Superior Posted: 19 Oct 2013 06:14 PM PDT Almost everybody wants a back story, some information to explain what is going on with gold and silver, mostly looking for some kind of psychological calm as prices decline, or a ray of hope to reinforce why price may reach the sun and the moon. Read More... |

| Bitcoin Climbs To Highest Since April, Led By Chinese Actions Posted: 19 Oct 2013 05:29 PM PDT Submitted by Jonathan Stacke via The Genesis Block, The last week has seen dramatic upwards price action in the bitcoin markets, driven by a series of macro and micro events across the globe. The fallout from Silk Road’s closure turned out to be but a blip in bitcoin’s price history, with significant gains since then. Turmoil in global financial markets and recent news of leading global websites accepting bitcoin may have bolstered enthusiasm for digital currency, but most interesting may be CNY’s definitive recent price leadership. Compared with prices before the brief Silk Road drop, bitcoin exchange rates have climbed 14% in the last two weeks. At $145/BTC on Bitstamp, bitcoin has reached a level not seen since late April, and the only time that level has been reached on more than three consecutive days was from April 3-11 during the bubble. Notably, the market has been significantly less volatile leading up to this level recently, compared with April. The 3DMA volatility leading into this level previously was between 13% and 22%, compared with just 4% currently. US EventsA number of factors may be driving the latest climb. For one, bitcoin price increases are known to often coincide with media coverage. Accordingly, even the Silk Road closure which highlighted bitcoin’s use for illicit purposes may have helped drive new participants into the market as a result of the exposure gained. The recent Money 2020 conference in Las Vegas may have similarly driven interest from a number of established financial players. The global macroeconomic environment may be playing a role as well. As we’ve noted previously, bitcoin shares a generally inverse relationship with USD, an asset that has been negatively impacted in recent weeks as a result of the US debt ceiling impasse. Chinese EventsPerhaps most important was the activity out of China. The Chinese government has recently been more vocal in its ongoing campaign to see the dollar removed from global reserve status. While such calls for an international reserve note are generally assumed to refer to Special Drawing Rights issued by the IMF, it may have bolstered enthusiasm for bitcoin’s apolitical nature. Also out of China was news that Baidu, the world’s fifth largest website, is now accepting bitcoin for certain services.

Perhaps not incidentally, CNY price movement has been a notable leader in the latest rally. Overlaying CNY/BTC and USD/BTC trading history, it becomes clear that USD/BTC trading has been largely responsive to the Chinese markets. The graph below shows bitcoin trading in CNY markets, as well as USD/BTC levels converted to CNY for comparison. Overlaid on top of them is the differential between their prices at any given time. The differential tends to normalize around 2-3% and spikes/sinks periodically with price movement. In reviewing this chart, a consistent pattern becomes clear: CNY price movement occurs first, increasing the differential, with USD catching up much later and eventually sending the differential back down towards 3%.

|

| Ron Paul Knows "The Longer QE Lasts, The Worse It Will End" Posted: 19 Oct 2013 03:19 PM PDT In this exclusive interview with Birch Gold Group, former Congressman Ron Paul shares his opinions on a number of topics, including investing in physical gold and silver, the future of the U.S. dollar and the role of the Federal Reserve.

Full audio if the following interview is available here.

Rachel Mills for Birch Gold Group (BGG): This is Rachel Mills for Birch Gold Group. I am speaking with Ron Paul today. How are you, Ron Paul? Ron Paul (RP): I am doing very well. Nice to talk to you Rachel. BGG: It’s good to talk to you again, and by the way of information for Birch’s audience, I was your last press secretary on Capitol Hill in Congress and I worked for you for the 5 years. So I may be cheating a little bit because a lot of your answers to my questions I maybe have a pretty good guess at what you might say. RP: Okay! BGG: But, just really quick – today with you I’d like to go over several things. But I’d like to ask your opinion on things like Janet Yellen as the next Fed Chair, about debt ceiling and shutdown issues. I want to get into, briefly, if you are still a buyer of gold even though it is so “expensive”. But first I wanted to introduce Birch Gold’s listeners to your background a little bit because I think it’s fascinating. In 1971, Nixon closed the gold window which led to the end of the Bretton Woods agreement. That was very important event for you, I know for sure, because you knew at the time that it would eventually destroy the currency, which we are still experiencing. And you said that that was what got you into politics to begin with. Had you been reading Austrian economists before that? RP: Yes, for a good while. As a matter of fact, it was 1971, there was confirmation of the Austrian economic writers who had been predicting that would happen as early as Henry Hazlitt said when the IMF was set up in 1945. He said it wouldn’t work and Bretton Woods would break down. And by the 50′s and the 60′s people were rejecting it and it was so artificial and it was fragile. So people did know that it was coming, and mainly it was coming because the governments pretended that the dollar would be as good as gold at $35 an ounce forever, yet they kept printing dollars and it was pretty simple logic to figure out there’ll be a limit. The governments worked real hard to convince the people that there was no problem, that the dollar would always be valued at $35 an ounce. But finally the market overwhelmed. The politicians and Congresses, and Central Banks can manipulate things for a while but eventually if they are out of sync with the market, the market will overwhelm. And even if the government won’t permit it legally to do it, it just drives the whole system into the underground economy. So fixed exchange rates and different things don’t work, they just hide the fact. But in 1971, it was confirmation that everything that the Austrians were saying as far back as the beginning of the Bretton Woods, that was true. And of course we’ve been suffering the consequences from that ever since. BGG: Yeah and I’ve heard people argue that the dollar is doing well against other currencies. But I know for Austrians and for people who understand gold, like you and me, that’s not much solace because it’s all on a race to the bottom. RP: Right and the ultimate measure of the value of the currency is what it purchases, so gold is a good indicator long term, I don’t think it’s a good indicator short term, because there are a lot of factors, just like in the 50′s and 60′s, they were able to hold gold at $35 an ounce when it should have been $235 an ounce! But anyway, overall in the long term it’s what the dollar will purchase. And even though our government tells us today there is no inflation, they are trying to get prices to rise at at least 2% a year, yet there are some things in our economy, the prices are soaring: the price of a bond, the price of education, the price of medical care – all of these things are going up. So there is a lot of price inflation, but that’s the ultimate tests. You can measure one currency against another, gold is a long-term indicator. But if none of the prices were affected by printing money, it would be no big deal. But they are and of course the major problem is not only the price increases, it’s the malinvestment, the overinvestment, the bubbles that form and the corrections that have to come. That’s where the real problem is, in addition to the cost of living going up and hurting the poor and the middle class, much more so than it will the wealthy. BGG: Right, which leads nicely to Janet Yellen as the next Fed Chair, as recently has been announced. What do you think of Janet Yellen? Do you think she’s going to solve all our problems? RP: No, she’ll make them worse. She’s inherited a mess, although she was a participant in the mess and she always argued for more inflation. One thing I find a little bit interesting is that she has a reputation for transparency. She wants to tell the markets exactly what their decisions are early on and let the markets know what they are doing. But if it comes true transparency, like allowing an audit of the Federal Reserve, and letting us know who they bail out and when they bail out and what they did in ’09 with their trillions of dollars, and all the international transactions, there’s no way that’s going to be permissible. Because that’s where all the power and control is accomplished, it’s behind the scenes with the Fed on international transactions.

But if anything, she takes a position, not only did she endorse what Bernanke was doing, she was always much more dovish on trying to prevent prices from going up and having, you know, price inflation. She was arguing the case for even more, so the odds of her having the guts or the wisdom to start backing off the purchase of debt, it’s slim to none. So that will certainly continue and it’s still working on the surface. The longer it lasts, the worse the correction will be when eventually people give up on our dollar and give up on our debt. BGG: So do you think Larry Summers would have been any better? He was rumored to be Obama’s preferred choice. What do you think? RP: No, the policies wouldn’t be all that different, even if he had been slightly more reserved in credit creation. He was also a person that would… there is a subjective factor in markets too – and he would have added as another subjective factor because people didn’t like him. And he might be just, you know, annoying the marketplaces because that is a factor, they might trust him less. But overall they’re very much the same – both of them. Anybody who can even be considered to be Chairman of the Federal Reserve will be an endorser of Keynesian economics, that the lender of last resort is crucial for the banks and all the currencies and Central Banks of the world. And they believe, though of course, the most important role for the Fed – and Congress never talks about it, but they secretly acknowledge it – without the Fed, who would buy the debt? And if somebody didn’t buy the debt, interest rates would soar. So even this big talk about all the arguments in Washington on the issues of war and spending and welfare and debt, they’re in total agreement with each other, and they all support the Fed’s role in being not only the lender but the printer of the last resort. Print what you need… but just common sense tells you that this can’t last.

BGG: Who would’ve you picked? RP: I would’ve picked nobody. I don’t think we should have a Fed, so I wouldn’t pick a Chairman. But even though in the Presidential campaign when they pushed me – “well, you’ll have to pick someone to unwind it” or something like that – I always threw out Jim Grant’s name. Because I’ve known him, he’s an Austrian economist, he knows that monetizing the debt is bad and if they were trying to work on a transition, somebody like that, you know, would move us in the right direction. But he wouldn’t last either because if he decided right now to only buy $75 billion worth of government debt per month, the markets would crash probably and then they would want to throw him out. So it’s a system that is very friable and unworkable and since they will not work out of it gracefully and deliberately, you know, we will probably go on to having a major crash of the dollar – that’s what I see happening. BGG: Yeah, scary. Moving on, I wanted to ask you about the debt ceiling. We are up against the debt ceiling again, as we always find ourselves every few months it seems. And so, we’ve had an impending crisis if they don’t raise the debt ceiling, which everyone expects they will find a way to raise it. But then, before you know it, we will be right up against it again. So what is the point of the debt ceiling anymore? RP: Well, it was intended to restrain government but some people don’t even like it, they want to get rid of it, just so the government never has to be hesitant in spending as much as they want. But you’re right: Once they raise it, they just go back to doing the same thing. The debt ceiling isn’t as necessary – this October 17th day isn’t as crucial as they pretend, because that’s an arbitrary date. They could have picked the 16th or the 20th or any date they wanted. Besides, the national debt hasn’t moved since May because they’re always taking money elsewhere and spending it and paying all the bills. So they can continue to do that for a week or a month or a year if they really wanted to. Just pay the bills as the money comes in and they could always pay the interest rates. And the other thing… if, say, we were in charge and we wanted to change things to work our way out of it and we wanted to deal with this national debt, just eliminate the debt we owe to the Federal Reserve. We pay a lot of interest to the Federal Reserve and they turn this money and they use this money for all kinds of things, so I would just wipe that debt off the books. But if we did that today, that means they would have a lot of room for more debt – that would lower the national debt by $2 trillion. BGG: Yeah but it wouldn’t solve the spending problems… RP: This government would spend more money if we got this freebie! But I would only think that would be worthwhile thinking about it is, you know, to tide this over and work our way out of it. But when the reforms are necessary when a crash comes and if we have to pay off the debt, you don’t have to pay the debt to the Federal Reserve if you are going to eliminate it or restore confidence and quit printing and quit monetizing debt – you could eliminate that. There is no moral obligation, there is really no legal obligation either because the institution isn’t even constitutional, you know… BGG: …institution to begin with, yeah. It seems like debt ceiling, the only purpose anymore is just to create an artificial crisis which Washington seems to thrive on. RP: Yeah they do and then they argue which authoritarian is going to run they show. And they don’t argue over the issue, it’s just the matter of which one, and then they are always talking about compromise, but they’re never talking about compromise between two authoritarians who want to manage the economy in different ways. They always want those who believe in limited government, the Constitution and freedom to give up so much of it, and then they call it, you know, a “good” thing to sacrifice liberty for the benefit of the authoritarians. But the authoritarians are in charge and I don’t think that people who don’t believe in that system should yield anything. I think that we all should stick to our guns and say that the rule of law is important, our privacy is important, our First Amendment is important, the way we go to war is important, and never give in. But right now these battles that we have when it comes down to shutting down government as a political stunt or the debt limit, it’s another stunt for the two variations of compulsion, you know, by government. They’re fighting over who has the power. And I think the American people are sick and tired of it, and rightfully so, but I don’t think they fully understand that it’s actually where the divisions are. They keep thinking that, you know, if those of us who believed in limited government would just give in and say, “Okay, go ahead and increase the national debt instead of by $1 trillion, increase it by $500 billion and worry about it next week”, and that’s supposed to be a good type of compromise. It solves nothing and makes our problems worse.

BGG: Yeah, and that’s why I appreciate Birch Gold trying to educate people and win on that front, I know it’s important to you. But I wanted to ask you: Are you still a buyer of gold? It has gotten so “expensive”, some people even say there is a gold bubble. Is it possible for gold to be in a bubble? RP: Well, it can get out of whack, people can buy… right now, of course gold is in a bit of a correction. So it’s different than a bubble that occurs when the interest rates are very low in the dollar system and then people overdo things and they overbuy. But markets aren’t always smooth, and the gold market isn’t smooth, so it goes up, it might go up too much, and at times too fast and then it makes a correction because the traders are in there and they have all kinds of motivation. If people look at it long-term, you know, from when the Fed started when it was $20 an ounce up to the time it went up $1,900 an ounce, you know, that’s more of the trend. Of course now it’s down. Instead of people arguing that it’s too “expensive”, I would think people who are in it for the long term, it looks to me like this would be a very good time to buy. BGG: I would think so. RP: So some people might say, “Oh well no, it’s too expensive, because it used to be $1,000 or $500 and I’ll wait for that.” No, I think this is a good time. I personally don’t get too much involved because I bought my insurance a few years ago at a different price. I look at gold as insurance and others will, you know, others might be just at a time where they can start buying their insurance against the dollar fiasco, and I would say this is as good time as any. BGG: Yeah, I have a family member, I won’t get too specific who, but a family member who is inquiring about gold. It’s interesting to me because this person is not someone who is typically into economics and the things that I talk about. But now she’s looking around and getting a little bit nervous and thinking that gold might be a good investment, but wondering if it’s too late to jump in. So… RP: Certainly if they thought it was too late that means that they must trust the government to balance the budget, and trust the Fed not to print any more money and that you’ll never see prices going up. And most people don’t buy into the government’s argument that the cost of living isn’t going up. People on fixed incomes… and this is one thing that conservatives and libertarians don’t give much credibility to, because we don’t like the setting of wages, you know, and pushing up minimum wages with the law… but the truth is, the cost of living has gone up much faster than the minimum wage. But that’s characteristic: Cost of living goes up much faster than Social Security benefits. But the fault there is the currency, not the fault of laws not matching up with the system and compelling businesspeople to pay a certain amount. But no, I think the cost of living – which isn’t inflation in the ordinary sense – is very, very serious and that’s why people are saying, “I need more money, send me more money on my Social Security check” or “Send me more money by another law, the minimum wage law.” And this misses the point because it really is the nature of money and deficits and what the Fed does. BGG: Right. Well, how is retirement treating you? Are you retired? RP: Not really. I’m retired from Congress and that is good. Not that I didn’t enjoy working there with my staff but… BGG: You have to say that! RP: I’m just glad I’m not going back and forth on airplanes, on John Boehner’s schedule. But I have a lot of activities going on: I’m working hard on homeschooling, I have a curriculum on homeschooling, which I like, and the Internet programming, I do some radio broadcasting and write a book now and then, so I’m very happy with my schedule. BGG: Yeah, I’ve looked into your homeschooling curriculum and I’m a subscriber to the Ron Paul Channel, so it’s all very exciting. RP: Wonderful. Hey, RonPaulChannel.com. BGG: Good! Well thank you so much for joining me today. I really enjoy talking to you. Again, my old boss, Congressman Ron Paul. Thank you so much. RP: Thank you Rachel. |

| Silver Prices and the Flow of Physical Posted: 19 Oct 2013 03:07 PM PDT Jeffrey Lewis |

| When Hyman Minsky Runs For The Hills: Japan Central Bank To "Own" 100% Of GDP In 5 Years Posted: 19 Oct 2013 12:03 PM PDT Over two years ago, in "Japan's WTF Chart" we showed where Japan lies on the sovereign debt-to-tax revenue continuum. The "where", with a WTF-inducing 1900% sovereign debt/revenue, was essentially off the chart as it was nearly 5 times greater than the first runner up: Greece, with 400%. Naturally, that ratio is absolutely unsustainable and the second rates begin creeping higher, all bets are off, however the day of reckoning could be delayed if as we said two years before Japan's insane QE was unveiled, the BOJ enter "hyprintspeed" and started monetizing debt at a pace that would make Hyman Minsky break out in a lunatic cackle. One look at the chart below, which shows JPM's estimate for various central bank holdings as a percent of host nation GDP, is enough to explain why that distant giggling is Hyman Minsky warming up... and he is running for the hills. The reason: while as a result of its recent decision to double its monetary base in (every) two years Japan's central bank now holds about 40% of local GDP on its books, it has precommited to seeing this percentage hit 60% over the next two years. But that's jst the beginning. As JPM's Mike Cembalest points out, the "contingent" line is where the BOJ's asset holdings as a % of GDP will rise to should Japan's 2% inflation goal prove elusive. Did we say "contingent" - we meant definite. And as the line shows, the Bank of Japan will, for the first time in history, "own" all of Japan's GDP on its balance sheet some time in 2018 when its "assets" as a percentage of GDP surpass 100%, and then proceed in linear fashion to add about 10% of GDP to its balance sheet with every passing year until everything inevitably comes crashing down. What is most ironic here is that we still assorted carnival barkers and trolling nobel prize winning op-ed writers working for cash burning media outlets, bitching and moaning about the 90% "unsustainable threshold" level of sovereign debt to GDP. Um, standalone sovereign debt in a world with central banks means nothing. A far more important question is what happens in a world in which the first official sovereign LBO by a central bank of a sovereign nation (remember those fringe bloggers who said in 2009 the So just what do Reinhort and Rogoff, or anyone else for that matter with 2 functioning neurons to rub together, think about a world in which a nation's central bank owns more assets, and has thus created more cash and reserves, than all the good and services for its host nation, which it has then effectively LBOed... with debt created out of thin air and collateralized by what can only be defined as funny money. We can't wait to find out, and neither can the aforementioned Mr. Minsky, who if not running for the hills, is certainly spinning in his grave. * * * Some more thoughts on that absolute, circus-like clusterfuck with zero regard for the future that is happening in a very irradiated Japan, which at this point knows quite well it's game over.

Yup: the proverbial Bernanke chopper warming up now, somewhere in Tokyo.

Since we've said all of this before, and frankly are tired of repeating ourselves, the only thing that needs clarification is what a 20-foot oarfish looks like. Here is the answer.

|

| Posted: 19 Oct 2013 11:50 AM PDT China's London-Zurich-Hong Kong gold conduit — a major financial coup d'etat Posted on October 18, 2013 by MK by Michael J. Kosares The United Kingdom's gold exports to Switzerland jumped from 85 tonnes to 1,016 tonnes in the first eight months of 2013 — a twelve times increase. Some bullion market watchers attribute... Read more » The post In The News Today appeared first on Jim Sinclair's Mineset. |

| Posted: 19 Oct 2013 11:48 AM PDT Dear Jim, Thought this video might interest you. Could this be another reason why China is buying so much gold? Regards, CIGA Bosko The post Jim’s Mailbox appeared first on Jim Sinclair's Mineset. |

| Unlike America, China Is Embracing Bold Reform Posted: 19 Oct 2013 10:30 AM PDT The contrast of the past week has been telling. In the U.S., you've had the yawn-fest otherwise known as the debt ceiling debate. All too predictably, the Republicans caved because their politicians will be up for re-election soon enough whereas Obama won't be (he can only serve two terms). It wasn't hard to work out the endgame in advance, despite all the hoopla, and the markets nailed it from day one. What's received far less attention is the rise of the Chinese yuan to a 20-year high versus the U.S. dollar. That's big news, comparable to the U.S. debt ceiling resolution. And it may have a hugely beneficial impact not only on China, but the rest of the world. The reason for this is that significant yuan undervaluation was one of the key drivers behind the 2008 financial crisis. It allowed China to become an exporting powerhouse. For that to happen though, China needed willing consumers for its exported goods and it found them in developed markets, particularly the U.S. Given stagnant real incomes, American consumers were only too happy to rack up debts to pay for these goods. And those debts eventually brought the U.S., and the world, unstuck. Now China is actively pursuing a strong yuan policy. The reason that it's doing this is because the country's exporters are strong enough to withstand a higher yuan. And more importantly, China knows that it needs to re-balance its economy, which has been over-reliant on exports at the expense of consumption. A stronger currency promotes consumption as it allows the Chinese to import cheaper foreign goods and enjoy less expensive overseas holidays. A rising yuan is not only good for China though. It also goes a long way to removing a central problem in global trade: that of a significant trade imbalance between China and America. Today I'm going to further explore why a rising yuan is such a big deal. But also why it isn't a cure-all for China's problems, or the world's for that matter. The development should be welcomed though as genuinely good news in an otherwise downbeat global economic environment. Economic fault lines Rajan is relevant to the discussion because of his book, Fault Lines, published in 2011. Reading through the book this week, it does a great job of outlining the underlying issues which caused the financial crisis and remain threats to the world economy today. For those that don't know, Rajan is famous for warning of impending economic problems at the glamorous (at least by economist standards) Jackson Hole conference in 2005. His speech went down like a lead balloon then as Alan Greenspan was still at the height of his powers and the world could seemingly do no wrong. Or at least that's what everyone thought, bar Rajan. Anyhow, the book details a number of the key threads from the 2005 speech. It suggests that there were four primary causes for the 2008 crisis:

The first cause is fascinating as it's one that few people have focused on. Rajan suggests that rising income inequality in America created the political pressure to push easy credit conditions. Everyone knows of the increasing inequality in the U.S. but Rajan has a unique take on it, placing the blame on a poor education system and inadequate social safety nets. Technological progress has meant that the labor force requires ever-greater skills which the U.S. education system has been unable to provide. That's resulted in stagnant paychecks for the middle class and growing job insecurity. Politicians have felt the pain of their constituents but fixing the education system is a long-term solution which they've been unwilling to promote. Instead, they've opted for short-term fixes. Namely, they created the conditions for easier credit so their constituents could afford things via debt which they couldn't afford via their own incomes. That ultimately contributed to the subprime and housing crisis. This brings us to the second cause for the 2008 meltdown: the export-led growth of several countries including China. Normally, debt-fueled consumption in the likes of the U.S. would push up prices and inflation there. Then the central bank would have to raise rates to stem the consumption. But what happened prior to 2008 was that increased U.S. household consumption was met by exporters from abroad. China, Japan and Germany needed other countries to consume their excess supply of goods and the U.S. came to the party. It was a win for the exporters and a win for the U.S. as it kept a lid on inflation. That is until high household indebtedness in the U.S. limited further demand growth and everything eventually unraveled. Rajan describes the third cause of the crisis as a "clash of systems". Here, he examines what pushed many developing countries towards export-oriented economic models. And he suggests the 1997 Asian crisis played a key role. Prior to the this crisis, Asian countries weren't net exporters. Yes, they produced exports sold overseas. But their strong growth entailed substantial investment in machinery and equipment, often imported from the likes of Germany. That meant they often ran trade deficits, having to partially fund their investments via borrowing from abroad. The financing for the investment mainly came from the developed world. Given the lack of transparency in many Asian countries, these financiers were only willing to lend on a short-term basis. When trouble hit, that short-term financing evaporated. And the Asian crisis ensued. Due to the crisis, Asian countries decided to cut back on debt-fueled investment. Instead, they focused on boosting exports by maintaining undervalued currencies. In other words, they went from being net importers to substantial net exporters, thereby creating the conditions for a global glut in goods. Finally to the fourth cause of the 2008 downturn. Rajan says U.S. central bank policy poured fuel on the flames. The bank pandered to politicians wishes by keeping interest rates too low for too long. They did this to maintain high employment, one of the bank's two central mandates. Note that keeping people in jobs was critical to assuage the masses given the stagnant incomes and inadequate social safety nets in the U.S. But low interest rates, ably aided by greedy financiers, helped create the credit bubble. Rajan believes the four underlying causes for the 2008 crisis are still with us today and they need to be addressed if we're to avoid further trouble. Let's now draw the discussion back to the significance of a rising yuan. The impact on China I've argued previously that China's 50% devaluation of the yuan in 1994 was a critical event in recent economic history. It was one of several devaluations and resulted in a significantly undervalued yuan. That undoubtedly aided in China becoming the world's largest exporter. The country's entry into the World Trade Organisation in 2001 also kicked things along. But an undervalued yuan created a long list of problems for China, including:

These issues haven't disappeared. Far from it. But the underlying issue - an undervalued yuan - is being addressed. Welcoming a rising yuan Chinese leaders are also in the process of addressing other related issues. You should to see more on this at a key meeting of Communist Party leaders next month. As I outlined in a previous post, likely reforms at this meeting include:

A stronger yuan and related reforms can help put China on a more sustainable economic path. But it can also assist the global economy. With China consuming more of its production, that may mean less goods being sent overseas. That could go some way to addressing the current oversupply in goods. In other words, it could remove a key impediment to a global economic recovery. More work to be done I'm not as optimistic as some commentators are that the transition to a new economic model will happen fast enough to prevent serious short-term pain for China. But I'm not as pessimistic as others who suggest China will go the way of Japan, which encountered similar issues as a dominant exporter in the 1980s but failed to re-balance its economy. It's likely that China still has some time to avoid the fate of Japan. And though a rising yuan reduces some of the global economic imbalances highlighted by Rajan, significant imbalances still remain. Japan is trying to export its way out of deflation by turning the yen into toilet paper. Germany is also committed to its export-oriented model. That means the global supply glut is unlikely to rapidly diminish, even if Chinese export growth slows from a higher yuan. At the other end of the spectrum, reform in the U.S. is as elusive as ever. Central bankers there seem determined to reflate debt-driven consumerism. The politicians are happy to go along with this as it placates disgruntled voters, whose real wages haven't risen over the past 20 years and worry about losing their jobs. The debt ceiling debate largely ignored these inconvenient truths. In sum, the world's economic problems remain acute but a stronger yuan is a welcome step forward. This post was originally published at Asia Confidential: |

| People In Asia Are Staggered At What’s Happening In The West Posted: 19 Oct 2013 10:13 AM PDT  Today one of the most highly respected fund managers in Singapore told King World News that "People in Asia are staggered at what's happening in the West." Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that when the system finally goes, "it's all going to go at once because the math is just going to fall like dominos." Williams also spoke about what all of this will mean for investors in key markets such as gold and silver in his powerful interview below. Today one of the most highly respected fund managers in Singapore told King World News that "People in Asia are staggered at what's happening in the West." Grant Williams, who is portfolio manager of the Vulpes Precious Metals Fund, also warned that when the system finally goes, "it's all going to go at once because the math is just going to fall like dominos." Williams also spoke about what all of this will mean for investors in key markets such as gold and silver in his powerful interview below.This posting includes an audio/video/photo media file: Download Now |

| China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate Posted: 19 Oct 2013 08:03 AM PDT China, Russia and other nations are exiting their dollar-denominated holdings in So says Jason Hamil (goldstockbull.com) in edited excerpts from his original article* entitled China Hints at Dumping U.S. Debt, Saying De-Americanized World is Needed. [The following article is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]Hamil goes on to say in further (and perhaps paraphrased in some places) excerpts: China's official news agency has published an op-ed commentary [see details at end of article] calling for the 'de-Americanising' of the world economy. They specifically mentioned the threat to nations with large amounts of dollar holdings, suggesting that one nation should not have the ability to impact the rest of the world economy so powerfully. In other words, one nation should not be able to print the world reserve currency or issue so much outstanding debt. China holds roughly $1.3 Trillion in U.S. treasury bonds, so if they decide to follow their words with action, we may see an accelerated selling of U.S. debt and dollars in the East. I don't foresee an outright dumping of debt as many are anticipating, but I would not be surprised to see China's treasury holdings cut in half within the next year or two.

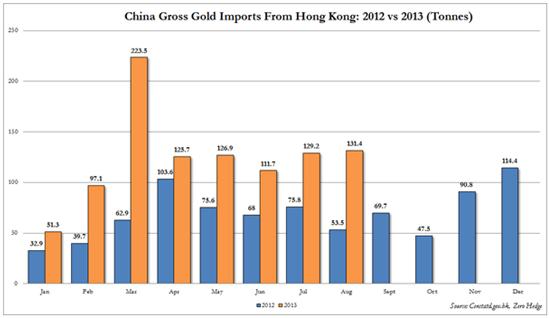

The Chinese move from U.S. dollars to gold has been very aggressive, yet under-reported by the mainstream media. At the current pace, Hong Kong will send, just to Mainland China, an amount of gold roughly equivalent to 50% of the rest of the world's mined supply. Gold imports from Hong Kong to mainland China are set to double the imports from 2012. Not only are exports from Hong Kong to mainland China skyrocketing, but Hong Kong itself will likely import over 2,000 tonnes for the year. Considering that global mined supply (excluding China) is only 2,400 tonnes, this leaves the rest of the world scrapping for the remaining 400 tonnes. [Editor's Note: The following chart shows that through August, China has imported 994 tons of gold through Hong Kong, versus 511 tons in the year-ago period - and that doesn't include the production of China's domestic gold mines (300 or so tons, all of which stays within the country) and whatever else finds its way in through other ports. Assume monthly imports for the rest of the year average 100 tons, add in domestic gold production, and China will have accumulated at least 1,700 tons of gold in one year.One then has to ask where all of the gold is coming from that enters Hong Kong. It is coming from Western nations at a staggering pace. In fact, some have estimated that the United States is exporting more than they produce, quietly selling gold reserves in order to keep a cap on the price. Inventories are down sharply on the COMEX, as can be seen in the chart below. Whatever the exact truth may be, it is evident that China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. They have also been busy buying up energy resources around the globe and expanding their own reserves. This slow transition out of dollars and into real assets makes sense and allows them to get a good price for the debt they are selling.

This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. The move out of U.S. dollars and debt is well underway, with a series of bilateral trade agreements being established in local currencies and the FED needing to step in and buy an increasing amount of government debt to stabilize the economy and avoid a default but the true panic has yet to set in, as many continue to have full faith in the ability of the U.S. government to service its debt. Greenspan famously said that the FED can guarantee cash benefits as far out as needed, but they can not guarantee their purchasing power. The same can be said of the U.S. servicing its debt, so long as the FED continues to assist. So while a standard default may not occur anytime soon, the slow eroding of the dollar's purchasing power amounts to a default nonetheless. It is simply occurring at a pace slow enough to keep investors and the masses placated or unaware. There are a number of factors that could cause this pace to quicken:

Conclusion Whatever the spark that ignites the fuse, I believe it is wise to have some insurance against the possibility of a panic out of dollars. Gold and silver are the best insurance for this type of event and they happen to be on fire sale right now with some of the lowest dealer premiums seen in years. From Xinhua: U.S. fiscal failure warrants a de-Americanized world As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world… Most recently, the cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations' tremendous dollar assets in jeopardy and the international community highly agonized. Such alarming days when the destinies of others are in the hands of a hypocritical nation have to be terminated, and a new world order should be put in place, according to which all nations, big or small, poor or rich, can have their key interests respected and protected on an equal footing. To that end, several corner stones should be laid to underpin a de-Americanized world.

Of course, the purpose of promoting these changes is not to completely toss the United States aside, which is also impossible. Rather, it is to encourage Washington to play a much more constructive role in addressing global affairs. And among all options, it is suggested that the beltway politicians first begin with ending the pernicious impasse. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*https://www.goldstockbull.com/articles/china-believes-de-americanized-world-needed/ (Copyright © 2013 Gold Stock Bull – All Rights Reserved; Become a Gold Stock Bull Premium Member and get my top-rated newsletter, instant access to the model portfolio and email alerts whenever I am buying or selling. Click here to get started for just $39!) Related Articles: 1. Noonan: Is Gold's Decline Being Caused By Fed Payback Time to China?

The manipulated raids in the gold market since last April may be hurting the Precious Metals game players, weakening their confidence and "disproving" gold's worth against a fiat currency, but they serve a greater purpose, as in Federal Reserve payback time to China. Here’s why. Read More » 2. Shift From U.S. Dollar As World Reserve Currency Underway – What Will This Mean for America?

Today, more than 60% of all foreign currency reserves in the world are in U.S. dollars – but there are big changes on the horizon…Some of the biggest economies on earth have been making agreements with each other to move away from using the U.S. dollar in international trade…[and this shift] is going to have massive implications for the U.S. economy. [Let me explain what is underway.] Words: 1583 Read More » 3. Continuing U.S. Dollar Strength Depends on Asia's Self-interests Continuing – Here's Why In an odd twist of fate the future of the U.S. dollar is in the hands of Asian governments [and particularly China and Japan. Let's hope they continue to put their own interests first.] Here's why. Read More » 4. Gold Standard Should Replace "Exorbitant Privilege" of USD Reserve Currency Status – Here's Why The least imperfect monetary system by which civilized nations can conduct their business is the classical gold standard – a system in which every major nation defines its currency as a weight unit of gold. [Let me explain.] Words: 890 Read More » 5. Dollar's Days As Reserve Currency To End In 2 Years (10 Years Latest) – Here's Why The American dollar will be overthrown…in as short a period as 5 to 10 years says one analyst while another believes it will happen as early as 2015, 2016 latest. Here’s why. Read More » 6. China Continues Buying Gold Like There Was No Tomorrow! Here Are the Impressive Numbers China continues to buy gold with both hands, keeping up all the gold they produce and importing even more! Imports were up 50% in October vs. the previous month; up 68% in November and up 74% in December. What will January bring given the continued weakness in the price of gold? Probably even more buying! Most Americans simply don’t understand that Russia and China have the power to collapse the U.S. economy by going to a gold for oil system. All they have to do is pull the trigger. Let me explain. Words: 1515 Read More » 8. The Decline in Gold & Silver Is Being Orchestrated By the Fed – Here's Why By its obvious and concerted attack on gold and silver, the U.S. government could not give any clearer warning that trouble is approaching. The values of the dollar and of financial assets denominated in dollars are in doubt. For Americans, financial and economic Armageddon might be close at hand…. The Ongoing Depression Could Force A Return To The Gold Standard Posted: 19 Oct 2013 06:55 AM PDT This is an excellent interview with Jim Rickards. He explains that we are in a depression currently. The answers to that problem from the US government and central bank will likely force them to impose monetary discipline through the return to a gold standard. The longer the dollar based monetary system is suppressed, the more likely that market forces will induce a dollar collapse. This piece provides deep insights in a complex matter, brought in an easy to understand way. Courtesy: Jim Rickards and FutureMoneyTrends. We are in a depression although it does not “look” or “feel” as such. First of all I’d say this depression started in 2007. 2008 was the panic and it was an emergency liquidity response to that, but the roots of this really go back to 2007. That’s when the sub-prime crisis erupted, that’s when the Bear Stearns hedge funds melted down. That’s when the Fed first started in to cut the discount rate and respond a little bit, even though they were way behind the curve and didn’t see it coming. So the depression started in 2007. It could be over tomorrow if we had the right policies, but we don’t have the right policies. It will continue indefinitely. We look like Japan. Japan has said, people talk about the lost decade, we’re in the third lost decade; it’s been over 20 years of depression, depressionary symptoms or depressionary economy in Japan. The U.S. is now in the same mode, it’s kind of ironic because for decades Bernanke and other scholars criticized the Japanese, saying, “What’s the matter with you guys, don’t you know how to run monetary policy, don’t you know how to get out of a depression?” Then they said, you know, in 2007, “We are going to avoid the mistakes of Japan.” But we’ve made every single mistake that Japan made. We should have shut down banks in 2008. We didn’t. We propped them up instead of shutting them down, which is exactly what the Japanese did. They locked the problems into place and financed them instead of writing them off, shutting them down, putting bankers in jail, closing the banks, breaking the mob, stripping out the bad assets, putting them under a rock in trust for the American people, sell them over 20 years or however long it takes. Then re-IPO the clean banks. They didn’t do that. Instead they did what the Japanese did, which is they propped up the system, they kept their buddies in place. There was no real prosecutorial effort, and so we shouldn’t be surprised that we have the same result as Japan, because we went down the same path structurally. Now we printed more money than the Japanese did, but that’s not the solution, so it’s not going to work. So having said all that, I just think that you will have this hyper-inflationary response at some point. Not right away, because it’s behavioral. The Fed needs to change behavior first. But when they change it, they may find it spins out of control, as it did in the ’70s. At that point the price of gold will soar or, if we go into a depression, the Fed may raise the price of gold as a way to create deflation. Either way, gold goes up in the end. The return to the gold standard – a deliberate choice by today’s political leaders or an imposed event driven by market forces? One is that we get to a gold standard by design. In other words, people look at the system and they say that it really is not sustainable, it really is based on confidence, but we’re in the process of eroding confidence. There is no exit from quantitative easing. We should say there’s no good exit. You can back away from it, but then you’ll implode the economy in a deflationary crash. Or you can keep going and eventually cause a loss of confidence in the dollar and then have a hyper-inflationary crash, so you have a crash either way. One looks like the Great Depression, one looks like the late ’70s but worse. Those are the only two paths, but there’s no other path. There’s no way we can just sort of taper, reduce it, finesse it, try to get growth on a self-sustaining path. The reason for that is we’re in a depression. And depressions are structural problems; they require structural solutions. You cannot use a liquidity solution for a structural problem. You need a structural solution. So there’s nothing the Fed can do to solve the depression or to change the structural problems in the U.S. economy. I mean, they’re assuming, they’re saying, “We’re gonna print money until unemployment gets to 6 and a half percent.” Who says there’s any relationship between printing money and unemployment? There’s no necessary relationship there. One’s monetary, one’s structural, so you need to do other things. So therefore they’re gonna keep going, but they think they’re right. I may be a critic and I may be able to point out why they’re wrong, why their models are wrong and why this says “No Good Exit,” but they think they’re right and they’re gonna keep going and kind of drive the bus over the cliff. Now, at that point, when the crisis emerges, they may have to go to a gold standard. They don’t want to, but they may have to, to restore confidence. But I’m very doubtful that they’ll do it as a matter of choice and say, “Look, we need to do this, let’s just do it now, let’s be honest, let’s be transparent, let’s be thoughtful.” You could do that but I think that’s very unlikely. Financial repression is here …. interest rates are suppressed by the Fed each time they want to move higher (signaling unrest) That’s what financial repression is. That’s what quantitative easing is. Every time the rates want to go up, the Fed can just buy more bonds. Of course, they buy bonds with printed money, but it just keeps the lid on rates. I’ve spoken to people in the primary dealer community. They’re completely relaxed because they’re just middle-men; they’re intermediaries between the Fed and the banks; the institutional investors. They buy bonds from the Treasury, they can finance them or sell them to the Fed or they can sell them to institutions. Now, the risk there is that they’ll get caught out. They’ve got long maturities, so they’ve got five-year notes or ten-year notes and they’re financing them overnight in the repo market. Well, what if the repo rate went up? All of a sudden the trade is profitable, it goes upside down, if the short-term rate gets above the long-term rate. Or if long-term rates go up they have capital losses on the bonds. It’s a very risky trade, but the Fed has told them, “We’ve got your back.” That’s what forward guidance is. When the Fed says “We’re not going to raise rates for two years or three years, etc., then you can do the overnight financing for three years and know that you’re going to be paying zero rates.” They’ve taken the risks out of the trade. So the primary dealers are relaxed, the Fed is going to keep the lid on the interest rates. If we follow the Japan scenario, and I expect we will, I can see ten-year no-rates coming down to 80 basis points. If they go from 250 to 80, that’s the greatest bond market rally in history. So everyone is worried about the bond bubble, but they’re focused on nominal rates. They’re not looking at real rates. Nominal rates could come down a lot more as a way of getting real rates lower, because inflation is low it may even dip into deflation. So we could be set up. But in the long run rates would go way up and the country would go bankrupt and we’ll all have hyper-inflation. That could be two or three or four years away. Over the course of the next year you can see a very strong bond market rally. Gold and silver are weak given the monetary context – how is that possible? There are a number of reasons. There’s certainly some Central Bank manipulation. There’s some fundamental reasons having to do with what we’ve been talking about, which is deflation. Gold should go down in a deflation environment initially. But if deflation gets bad enough, the government will make the price of gold go up because they get desperate to create inflation. If you’ve tried everything, if you want inflation, and you’ve tried everything to create it, so you tried money printing, cutting rates, currency wars, Operation Twist, QE, forward guidance, nominal GDP targeting, you’ve tried everything, you still didn’t get the inflation. There’s one thing that always works, which is devaluing your currency against gold. There could come a time when deflation gets so bad that the Fed and the treasury actually raise the price of gold, not to enrich gold investors, but to get close to generalized inflation. Because if gold goes up, silver and oil will go up along with it. It’s exactly what happened in 1933. That’s one path. But the other, perhaps more likely path, is that the Fed just keeps printing money and finally succeeds in changing behavior, velocity of the turnover money picks up and inflation goes up on its own. Then gold will race way ahead of that. That’ll just change the psychology. My advice for gold investors today is to kind of do what the Chinese do: just buy the dips. The Chinese bought a tonne, hundreds of tonnes of gold at the lows in July, July 2013. Now, again, we had that smash in April and gold went down over 20 percent between April and June. Well, right there at the end of June, the Chinese were buyers, so my advice to investors: don’t use leverage. Buy physical bullion. Don’t buy paper gold. Do what the Chinese do, which is buy the dips, put it away and don’t read the papers. So gold is volatile. You just have to get used to it. And if gold is down a lot, it’s because deflation has the upper hand. But nothing moves in isolation. If gold traders down to, let’s say, $800 an ounce, that is a highly deflationary world. That probably means the stock market’s crashing, other commodities are going down, so you might actually like your gold better in that environment, because even though it went down a nominal space, it can outperform these other asset classes and still preserve wealth. Of course, in the opposite case, if inflation takes off, we all know what’s going to happen: gold is going to go way up. China is one of the most important owner of US dollars (through US Treasuries). How can they exit those huge positions and de-Americanize the monetary system? China is actually reducing its purchases. They’re not dumping them. This idea that suddenly they’re going to dump two trillion dollars of treasury. That’s not going to happen. Because it would be too disruptive; they would shoot themselves in the foot. They would crash the market, the U.S. could actually freeze their treasury accounts. People don’t realize that, but the president has the legal authority to freeze the Chinese accounts. We wouldn’t have to steal their money, just say, “Hey, we’re freezing it. We’ll get back to you later about when you can collect.” You have to get back to them and make good behaviors, so to speak. And the Chinese know that, so they’re not gonna go there because the U.S. has very powerful tools to preserve its interests and preserve its markets. But at the margin, as they get more reserves, as they run a continuing current accounts surplus, they get direct foreign investments. They get their hands on more dollars. They don’t have to invest new dollars in treasuries. What they’re doing is swapping it for Euros, they’re investing very heavily in Europe, they’re buying direct assets, they’re buying mines, they’re buying companies, buying stocks, etc. So they’re not dumping what they have, but they’ve slowed down the purchases. They’re selling a little, and most importantly, at the margin they’re diversifying into other assets. That’s going to put a lot of pressure on U.S. interest rates, because in the past the Chinese have been buyers, so the question is: Who’s going to step in and fill the void, so to speak, as what’s called “the buyer of last resort” of treasury? Well, the answer, of course, is the Fed. |

| John Williams: Currency Markets Will Stop Politicians Kicking The Can Posted: 19 Oct 2013 04:14 AM PDT In this interview, John Williams from Shadowstats.com explains why his calculations show that hyperinflation is coming and that the first signs will be there in 2014. Courtesy: USAWatchDog.

He explains that the trigger for a dollar collapse will probably come from a loss in trust in this world reserve currency:

Gold is the most important way to protect against a hyperinflation. Rising gold prices would not reflect a benefit but rather a decline of the currency:

|

| The London - China Gold Conduit — A Major Financial Coup D’etat Posted: 19 Oct 2013 03:21 AM PDT The United Kingdom’s gold exports to Switzerland jumped from 85 tonnes to 1,016 tonnes in the first eight months of 2013 — a twelve times increase. Some bullion market watchers attribute the huge increase to withdrawals or sales from ETFs — an explanation that covers only half the story…….if that. |

| Manipulated Markets Prospects: Gold, U.S. Dollar, Bonds, Equities & Interest Rates Posted: 19 Oct 2013 03:16 AM PDT “Bank deposits are not safe which used to be safe. Money in Treasury bills is not 100 percent safe and there is inflation in the system and you would hardly get any interest. “Bonds are not very safe anymore because eventually interest rates will go up Equities in the U.S. are relatively expensive by any valuation matrix you may use. (The federal government is) “essentially wasting money left, right and center: Republicans on the military and the Democrats on buying votes with transfer payments and entitlements. The best you can hope for is that you have diversified your portfolio of different assets and they don’t all collapse at the same time.” “Marc Faber: Pray All Asset Classes Don’t Collapse at the Same Time,” John Morgan, moneynews.com, 10/15/2013 |

| Vulgar Competition and Italian Gold Posted: 19 Oct 2013 02:39 AM PDT Alessandra Pilloni writes: Vulgar competition needs to come to Italy's delicate jewelry business... "Italy accused of protectionism!" is hardly news. Wanting free competition in the airline market, IAG - the group formed from the UK's privatized British Airways and Spain's privatized Iberia in 2012 - has urged the European Commission to investigate and block the possible rescue of Italy's bankrupt Alitalia by the state-owned Italian Post Office. This tells a story all too familiar in Italy - the lack of a reality check, or any market discipline, for companies who are struggling to remain competitive in today's global economy. |

| Gold Mining Stocks Profits Fallacy Posted: 19 Oct 2013 02:27 AM PDT Gold miners’ stocks have been brutalized this year, leaving them bleeding in the gutter as the most hated sector in all the markets. Plunging prices always lead to fear and excessive bearishness, unsustainable anomalous extremes that investors desperately try to rationalize as righteous. Today the bears’ primary rationalization against gold miners is the notion they can’t earn any profits, which is a complete fallacy. Stock prices have always been the result of an endless tug-of-war between fundamentals and sentiment. Fundamentals measure how much any stock is worth based on its underlying company’s earning power. Naturally this only changes slowly, so stock prices would be very stable and gradual if fundamentals were their sole driver. Imagine a price chart with a largely-straight line, trending modestly higher or lower. |

| Posted: 19 Oct 2013 02:10 AM PDT Don’t Miss Out on These Important Charts. “The National Budget must be balanced. The Public Debt must be reduced; the arrogance of the authorities must be moderated and controlled. Payments to foreign governments must be reduced, if the Nation does not want to go bankrupt. People must again learn to work, instead of living on public assistance.” …..Marcus Tullius Cicero (+/- 55 BC). |

| Posted: 18 Oct 2013 04:00 PM PDT Finance and Eco. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Public corruption, based on all the evidence, appears rampant. And the ranks of those convicted in office have swelled to absolutely unacceptable levels. State Senators as well as State Assemblymen; elected officials as well as party leaders; city council members as well as town mayors; Democrats as well as Republicans.

Public corruption, based on all the evidence, appears rampant. And the ranks of those convicted in office have swelled to absolutely unacceptable levels. State Senators as well as State Assemblymen; elected officials as well as party leaders; city council members as well as town mayors; Democrats as well as Republicans. People in Asia are staggered at what's happening in the West. They are amazed at the prices on the Comex. They don't really understand them because they see what the gold price is supposed to be, and yet they go to the store and the price of gold is always higher.

People in Asia are staggered at what's happening in the West. They are amazed at the prices on the Comex. They don't really understand them because they see what the gold price is supposed to be, and yet they go to the store and the price of gold is always higher. The debt-ceiling drama and government shutdown that has been playing out in the U.S. for the past few weeks is an absolute embarrassment. Americans, regardless of political persuasion, are shaking their heads in shame at the three-ring circus going on in Washington.

The debt-ceiling drama and government shutdown that has been playing out in the U.S. for the past few weeks is an absolute embarrassment. Americans, regardless of political persuasion, are shaking their heads in shame at the three-ring circus going on in Washington. Hello from Phnom Penh, Cambodia,

Hello from Phnom Penh, Cambodia,

No comments:

Post a Comment