Gold World News Flash |

- Silver and Gold Prices Both Closed Lower with the Gold Price Closing at $1,307.20

- Figures Don’t Lie, but Liars Figure

- Grandich discusses gold market manipulation with Wall Street for Main Street

- Chilling Truth About What Will Happen When The US Implodes

- Gold and its direct economic impact

- Kyle Bass Warns: “There Is No Way To Protect Yourself If US Treasuries Default”

- Silver and Gold Prices Both Closed Lower with the Gold Price Closing at $1,307.20

- Ron Paul Redux: "The End Of Dollar Hegemony"

- The Rise Of The C-Note "And" The Cashless Economy?

- Pierre Lassonde must not know the right central bankers

- Kyle Bass Warns "There Is No Way To Protect Yourself If US Treasuries Default"

- Obamacare: I’ve Started So I’ll Finish

- The Bullion Market's Big Issues, Part I

- Who Wants to Be a Millionaire? Who Wouldn’t! Here’s How

- Why I Am A Terrified As I Watch The End Game Unfolding

- Gold Daily and Silver Weekly Charts - G20 Central Bank/Finance Meeting in Washington Tomorrow

- Gold Daily and Silver Weekly Charts - G20 Central Bank/Finance Meeting in Washington Tomorrow

- Figures Don’t Lie, but Liars Figure

- Gold, Trust & Independence, Part I

- Gold, Trust & Independence, Part I

- Gold, Trust & Independence, Part I

- Gold Drops Most in a Week as Stronger Dollar Damps Metal Demand

- The Daily Market Report

- Do Not Express The Value Of Gold In Monopoly Money

- Gold Stock Investors Keep the Best and Dump the Rest

- Market Monitor – October 9th

- Despite Correction, Silver Is Set Up To Super-Surge To $110

- Will The Real Goldman Sachs View On Gold Please Stand Up

- Nearing first gold pour, Carpathian short of cash, considering sale

- Yellen’s Fed news fails to shake gold’s "lethargy"

- Kyrgyz leader rejects calls to nationalise Centerra mine

- Gold likely to consolidate as debt ceiling issues continue to hover

- U.S., Switzerland Export Largest Ever Amounts Of Gold To Hong Kong And Investors Should Take Note

- Gold Bullion Continues to Drain Out of COMEX

- Created Currencies ... Are Not Gold! (Financial Prepping 101)

- A Paradigm Shift in Latin American Stocks

- Rust Belt Boom: Oil Investing for the Next 100 Years

- SILVER Elliott Wave Technical Analysis

- Gold Declines in New York as Investors Assess Stimulus, Debt

- Gold lower at 1304.50 (-15.40). Silver 21.87 (-0.47). Dollar jumps. Euro lower. Stocks called better. US 10yr 2.64% (+1 bp).

- Gold Prices Flirt with $1300 as Yellen Moves to Chair US Fed

- Fiat Paper Currencies are NOT Gold!

- Yellen's Fed News Fails to Shake Gold's Lethargy, Goldman Targets $1050

- Why We Own Gold

- Why We Own Gold

- TF Metals Report: Goldman buys gold after panicking speculators to sell

- Von Greyerz: Money printing will destroy currencies without helping economies

- Latest World Official Gold Reserves

- Changes in World Gold Official Reserves

- Latest sales under the third Central Bank Gold Agreement (CBGA3)

| Silver and Gold Prices Both Closed Lower with the Gold Price Closing at $1,307.20 Posted: 10 Oct 2013 12:33 AM PDT Gold Price Close Today : 1,307.20 Change : -17.40 or -1.31% Silver Price Close Today : 21.89 Change : -0.55 or -2.46% Gold Silver Ratio Today : 59.71 Change : 0.69 or 1.17% Franklin is travelling this week, but he wanted y'all to receive today's prices, below. God willing, Franklin will return on Monday, 14 October 2013. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Figures Don’t Lie, but Liars Figure Posted: 09 Oct 2013 11:00 PM PDT by Frank Holmes, Daily Reckoning.com.au:

September's correction only adds to the negative sentiment toward the precious metal. The assumption from many market pundits is that gold is no longer attractive as an investment. With rising rates and continuing low inflation, U.S. investors believe they have a solid case for selling their holdings. |

| Grandich discusses gold market manipulation with Wall Street for Main Street Posted: 09 Oct 2013 09:38 PM PDT 12:36p ChST Thursday, October 10, 2013 Dear Friend of GATA and Gold: Market analyst and mining company consultant Peter Grandich discusses gold market manipulation with Wall Street for Main Street's John Manfreda in a 19-minute interview posted at YouTube yesterday: http://www.youtube.com/watch?v=Zy_vq3oI8u4&feature=youtu.bef CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Don't Let Cyprus Happen to You Depositors at the Bank of Cyprus lost 47.5 percent of their savings. So to preserve your wealth, get some of it outside the banking system into physical gold and silver. Worldwide Precious Metals (Canada) Ltd., established in 2001, specializes in physical gold, silver, platinum, and palladium. We offer delivery or secure and fully insured storage outside the banking system in Brinks vaults. We have access to gold and silver from trusted worldwide refineries and suppliers. And when you have an account with us you have immediate access to it for buying and selling your stored bullion. For information on owning physical precious metals in your portfolio, visit us at: www.wwpmc.com. Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: |

| Chilling Truth About What Will Happen When The US Implodes Posted: 09 Oct 2013 09:01 PM PDT  Today a man who has lived in 18 countries around the world, and witnessed collapses in many of these countries firsthand, told King World News, "What shocks the people is how quickly things can flip. One day everything seems to be alright, and the next day there is panic." Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about some of the astonishing firsthand accounts of what he witnessed. Below is what Barron had to say. Today a man who has lived in 18 countries around the world, and witnessed collapses in many of these countries firsthand, told King World News, "What shocks the people is how quickly things can flip. One day everything seems to be alright, and the next day there is panic." Keith Barron, who consults with major companies around the world and is responsible for one of the largest gold discoveries in the last quarter century, also spoke about some of the astonishing firsthand accounts of what he witnessed. Below is what Barron had to say.This posting includes an audio/video/photo media file: Download Now |

| Gold and its direct economic impact Posted: 09 Oct 2013 08:00 PM PDT by Jan Skoyles, TheRealAsset.co.uk

The report is designed to set the baseline in future discussion around the value the gold industry brings to both the national and international economic scene. - In total, the WGC report states that in 2012 the gold industry generated over $210 billion in to the world's economy in 2012. This is the equivalent GDP to the city of Beijing or the Republic of Ireland. |

| Kyle Bass Warns: “There Is No Way To Protect Yourself If US Treasuries Default” Posted: 09 Oct 2013 07:55 PM PDT from Zero Hedge:

|

| Silver and Gold Prices Both Closed Lower with the Gold Price Closing at $1,307.20 Posted: 09 Oct 2013 07:32 PM PDT Gold Price Close Today : 1,307.20 Change : -17.40 or -1.31% Silver Price Close Today : 21.89 Change : -0.55 or -2.46% Gold Silver Ratio Today : 59.71 Change : 0.69 or 1.17% Franklin is travelling this week, but he wanted y'all to receive today's prices, below. God willing, Franklin will return on Monday, 14 October 2013. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com © 2013, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold or 18 ounces of silver. or 18 ounces of silver. US $ and US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. |

| Ron Paul Redux: "The End Of Dollar Hegemony" Posted: 09 Oct 2013 07:12 PM PDT In a little-known 2006 speech (in the US, though widely known around the world), entitled "The End of Dollar Hegemony," Ron Paul discusses the breakdown of the Bretton Woods system - which most people know about - and the de-facto system that replaced it - which most people do not know about. As Casey Research's Nick Giambruno notes it is a must listen with the most important part of the speech where Paul discusses the petrodollar system, a primary factor in maintaining the dollar's role as the world's premier currency after the breakdown of Bretton Woods. The End of Dollar Hegemony Part 1

The End of Dollar Hegemony Part 2

The End of Dollar Hegemony Part 3

Via Nick Giambruno of Casey Research, The speech is an absolute must-listen... ... The most important part of the speech is where Paul discusses the petrodollar system, a primary factor in maintaining the dollar's role as the world's premier currency after the breakdown of Bretton Woods.

Ron Paul told me that although this speech is relatively unknown in the US, it was widely received around the world. As we discussed the implications of these issues, Paul said that the premise of this speech still applies today. I believe that once the dollar loses its status as the world's premier reserve, the US will start to implement the destructive measures we frequently discuss: capital controls, people controls, price controls, currency devaluations, confiscations, nationalizing pensions, etc. Such things have happened recently in Poland, Cyprus, Iceland, Argentina, Zimbabwe, Venezuela, and a number of other countries. Take a glance at history and you will quickly notice these measures are the norm when a government gets into serious fiscal trouble. Many nations have made the mistake of thinking they were somehow "exceptional" and that these kinds of things couldn't happen to them. There is no question the US is and will continue to be in serious fiscal trouble unless it implements drastic (and politically impossible) changes. The only saving grace for the US has been its ability to print the world's reserve currency. But once that special privilege is lost, it will revert to the measures all other governments throughout history have taken. You absolutely want to be internationalized before the US dollar loses its status as the world's premier reserve currency. I truly believe the window opportunity to take protective action will slam shut at that time. You can find our specific guidance on how to do that here. |

| The Rise Of The C-Note "And" The Cashless Economy? Posted: 09 Oct 2013 06:40 PM PDT Even as Washington stares into a fiscal abyss of its own construction, there is one bright spot: the ongoing global popularity of the $100 bill. The U.S. Treasury/Federal Reserve launched their latest version of the venerable C-Note just this week, printing $350 billion worth over the last 12 months to meet anticipated robust worldwide demand. This came on the heels of the 2012FY, when the Treasury printed 3.0 billion such notes. Given that $100 bills last about 15 years in circulation, ConvergEx's Nick Colas notes that these record amounts seem to indicate very strong worldwide demand for hard currency rather just replacing old stock. In the US, by contrast, the 'Cashless economy' is coming hard and fast. Dollar bill production in 2013FY was just $1.8 billion, the lowest amount since 1980. The value of all currency printed, excluding $100 bills, was $27 billion – less than half the run rate of just a decade ago and the lowest since 1981.

Via ConvergEx's Nick Colas, The ongoing news coverage about the U.S. debt limit and budget debates has crowded out some pretty juicy stories in the past week, such as the mysterious $27 billion cash hoard sitting in a Moscow airport warehouse. According to the Russian tabloid press (so take this all with a grain of salt), it arrived six years ago in 200 pallets of plastic-wrapped cash, with no forwarding address. Since then Russian authorities have kept the money under armed guard, waiting for someone to claim it. Some say it belongs to a fallen Middle East dictator. Others suspect it is Iranian oil money. The strangest bit of the story, true or not, is that that the cash is all in 100 euro notes. It is theoretically possible for such a trove to exist, for the European Central Bank printed some 129 billion euros worth of these bills from 2002 to 2008. If 16% of them are sitting in Moscow, that would be a large chunk of the outstanding, to be sure. How one person or institution could amass so much of the relatively new currency without drawing attention is the real question. That anecdote neatly explains why the U.S. $100 note is still the world's king of physical currency, rather than the euro. Over the same seven-year period the U.S. Treasury printed $589 billion of C-notes, so anyone looking to store $27 billion in cash would need just 4.5% of the issuance to construct their nest egg. And, of course, the U.S. government was printing $100 bills long before the euro was even a twinkle in Brussels' eye, so the supply is actually much larger than that. The fact that the U.S. Treasury just redesigned the $100 bill, launching the latest iteration today, should tell you that physical notes are still an important part of what makes the U.S. dollar a global "Reserve" currency. The new notes have upgraded anti-counterfeiting measures such as three-dimensional ribbon imbedded in the bill and a color-changing bell in an inkwell. Everyone from Hezbollah to North Korea has famously tried to counterfeit the U.S. $100 bill over the years, with varying levels of success. The latest enhancements are merely the latest move in a long game of cat and mouse between forgers and the U.S. government. What is more intriguing is the explosive increase in demand for $100 bills since the Financial Crisis. Prior to 2007, the U.S. Treasury typically printed about 630 million C-notes (the average from 2001 – 2006). From 2007 to the recent end of the 2013 government fiscal year, that average is 1,894 million, or three times the old run rate. A few points here:

Who uses the $100, and to what purpose? That's where things get a little difficult. It's not like this is an efficient way to move money around. One million dollars just about fits in a standard Halliburton 5" aluminum briefcase, but it weighs about 22 pounds. The $100 bill is widely accepted, to be sure, but if you move around with more than a few million dollars you'd better have a bodyguard or five. A piece of the incremental demand over the last decade is obviously conflict-related. When I travelled in Afghanistan earlier this year it was clear that the U.S. dollar was the preferred currency, and the whole place seems to run on wads of $100 bills. As countries in the region – Syria, Libya, Lebanon, and Egypt, for example – go through political and economic upheaval, their demand for physical currency likely grows. The dollar still has an edge over the euro here, if only because of its longer history. Back inside the U.S., however, paper currency is quickly sliding into the same history as electric typewriters and land line telephones. We've got a lot of data on this in chart form after this note, but here are the highlights:

In summary, technology – debit cards, online bill paying, gift cards, etc – is quickly making physical currency a niche product rather than a mainstay of the domestic American economy. The most profitable 'Niche' from an issuer's perspective is the high-denomination $100 bill, and this fits neatly with the needs of many people who want a reliable and physically compact currency – especially offshore. For everyday transactions, the "Cashless economy" is clearly on its way. |

| Pierre Lassonde must not know the right central bankers Posted: 09 Oct 2013 05:15 PM PDT 8:21a ChST Thursday, October 10, 2013 Dear Friend of GATA and Gold: Gold mining entrepreneur Pierre Lassonde, a former chairman of the World Gold Council, this week told MineWeb's Geoff Candy that central bankers hardly ever think about gold, much less think about the manipulation of its price. "When I was chairman of the World Gold Council," Lassonde says, "one of my goals was to get closer to the central bankers and I tried to understand what goes on in their heads and try to help them with the management of their gold reserves, or their lack of reserves. ... I made many trips to China, to Beijing, to talk to the chief central banker there. ... Ninety-nine point nine percent of the central bankers I know don't even know they have gold in their vault. They don't spend one millisecond thinking about gold during the day. It's not on their agenda, so to think that they try to manipulate gold to suppress the gold price -- forget it. They don't even think about it." MineWeb's interview with Lassonde is here: http://www.mineweb.com/mineweb/content/en/mineweb-gold-analysis?oid=2081... Of course maybe the central bankers known to Lassonde are not the ones known to staff members of the International Monetary Fund, who surveyed central bankers in 1999 and, in a secret report to the IMF board, reported that the central bankers were desperate to conceal their gold swaps and leases lest transparency about their gold reserves impair their surreptitious interventions in the gold and currency markets: http://www.gata.org/node/12016 Meanwhile this week fund manager and geopolitical strategist James G. Rickards, author of the recent book "Currency Wars," who has held U.S. government security clearance, told the Canadian Broadcasting Corp.'s "The Lang and O'Leary Exchange" program that central bankers do think very much about gold. Rickards said "fine art" is a good investment these days because it "behaves the way gold would behave if central banks didn't intervene, because central banks don't care about fine art." The interview with Rickards is six minutes long and is posted at the CBC Internet site here: http://www.cbc.ca/player/News/Business/Lang+%26+O%27Leary+Exchange/ID/24... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Buy metals at GoldMoney and enjoy international storage GoldMoney was established in 2001 by James and Geoff Turk and is safeguarding more than $1.7 billion in metals and currencies. Buy gold, silver, platinum, and palladium from GoldMoney over the Internet and store them in vaults in Canada, Hong Kong, Singapore, Switzerland, and the United Kingdom, taking advantage of GoldMoney's low storage rates, among the most competitive in the industry. GoldMoney also offers delivery of 100-gram and 1-kilogram gold bars and 1-kilogram silver bars. To learn more, please visit: http://www.goldmoney.com/?gmrefcode=gata Join GATA here: Louis Boulanger Now Seminar http://www.gata.org/files/GATAInNewZealand.pdf Gold Investment Symposium 2013 The Silver Summit http://www.cambridgehouse.com/event/silver-summit-2013 Mines and Money Australia New Orleans Investment Conference https://jeffersoncompanies.com/landing/speakers?IDPromotion=613011610080... * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT How to profit with silver -- Future Money Trends is offering a special 16-page silver report with our forecast for 2013 that includes profiles of nine companies and technical analysis of their stock performance. Six of the companies have market capitalizations of less than $800 million and one company has a market cap of only $30 million. The most exciting of these companies will begin production in a few weeks and has a market cap of just $150 million. Half of all proceeds from the sale of this report will be donated to the Gold Anti-Trust Action Committee to support its efforts exposing manipulation and fraud in the gold and silver markets. To learn about this report, please visit: http://www.futuremoneytrends.com/index.php?option=com_content&id=376&tmp... |

| Kyle Bass Warns "There Is No Way To Protect Yourself If US Treasuries Default" Posted: 09 Oct 2013 04:54 PM PDT "If the politicians lead us into a 'prioritization of payments' situation for Treasury Secretary Lew or an actual missed payment, there is nothing you can do to protect yourself from that!" are the ominous words that Kyle Bass uses to describe the farce that is rapidly approaching (and for now being ignored by stocks). Bass went on to pull no punches in his "disappointment" in JCPenney's performance (and dilution) coming as close as he can to saying "sell." But his piece de resistance was a dismal destruction of any silver lining for Puerto Rico and the significant implications that will have on Muni bonds in general.

On Default risk and "Un-hedgeable" implications:

On JCPenney - "Disappointed" - "didn't belive they needed to raise the capital... and now they have diluted us over 30%"

On Puerto Rico and the threat to the entire Muni market - "you look at their finances and you can only say - I have no clue how this can exist for very much longer" |

| Obamacare: I’ve Started So I’ll Finish Posted: 09 Oct 2013 04:24 PM PDT There are people that are like magnates when it comes to raking in the millions and there are some that have an even stronger pull than usual where finances are concerned. As Warren Buffet openly states that he believes that a default on US debt will be catastrophic and that lawmakers in Congress need to get their act together and get the federal government back to work by passing the budget we might well wonder if it's just for show or if he really believes that. Why would someone who made $10 billion out of the lifelines that he threw to the failing companies after the financial crisis of 2008 want to forego making even more than that this time round? Buffet on ShutdownWarren Buffet has recently asked the politicians of the US to stop using the debt limit as some sort of weapon to win the policy debates. But, we had better hope that he's not talking about weapons of mass destruction (as they never existed the last time that word was banded about in the country). We should be asking though whether Buffet is really eyeing the best interests of the country. The man made $10 billion out of the loans that were granted to failing companies and banks five years ago. Yes, he had the money to shore them up then and no money lender is philanthropic enough to do it for free of charge and with no interest; but we should wonder if he will be "fearful when others are greedy or greedy when others are fearful" (to quote his favorite saying) this time around. Through Berkshire Hathaway Inc. Buffet has so far made $10 billion and he still hasn't got the entire return on his investments back. Maybe he'll be using the money he has made when the stock market drops this time round. He might even turn out to be the lender of last resort for the US administration. Who knows?

National DebtWhen Lehman Brothers collapsed it brought the stock market to its knees and the market lost 50% of its value in the aftermath. Then we were only talking about a measly $517 billion for Lehman. The US has $12 trillion in debt that is outstanding. Even when we are told that the Chinese and the Japanese own the US debt the answer comes back from some that it doesn't matter. There are some that are even under the delusion that it's acceptable to have so much debt in the US since Japan is in a worse state of affairs. Japan may have almost double the national debt of the US in terms of a percentage of Gross Domestic Product, but that doesn't make things any better for the US to carry on willy-nilly with the frenzied spending and it certainly doesn't mean that they can go on spending as they have done in the past. Is it because the guy round the corner does it that I can do it. Stop looking over the garden fence Uncle Sam and start looking in your own back yard.

At least that was how things stood today when the national debt clocks were checked. That's already out of date right now, however. It was old news as soon as it was written. Sometimes we might wonder whether it would actually be better for the whole world to collapse and those that believe that there needs to be a rethink of how the economies of the world actually act and react together. Some believe that it might be a good think for there to be an implosion that will bring the banks down, kill off the money-makers and the buck reapers and get rid of those that started the printing presses rolling the greenbacks out. Granted, we all might go under but we could all start from scratch in a brand new world and just probably end up doing the self-same thing since we never learn from our mistakes. It will never happen, but a few might get hurt along the way as we enter day 9 of the shutdown and the debt ceiling deadline is just a week away. Come on policymakers, carry on and keep knocking of 0.5% from the growth rate of the USA and spiral us into not just recession, but depression. We will need to invent a new word for the effects on the world and that word might well beObamacaression that will be on the tips of the tongues of the American people. That's where it all stemmed from. They voted a man into office so the ideal that all Americans might have healthcare coverage one day could see the light of day in a new world that then changed tack when the chips were down and went on to believe that meritocracy should be the order of the day. Obamacare was the ideal that was the start of all of this and Obamacare will be the caress of death of the US.Obamacaression. It was the start of this and it will be the finish of it too. The US may not default, but it will do a damn good job of destroying what has been built up over the past five years. Obamacare: I've started so I'll finish. You don't have to be Mastermind to know what will happen next. Maybe that's not such a bad idea. We need to restructure the way the economies work, don't we?Originally posted: Obamacare: I've Started So I'll Finish You might also enjoy: USA: Uncle Sam is Dead Where Washington Should Go for Money: Havens | Sugar Rush is on | Human Capital: Switzerland or Yemen? | Wonderful President of USA and Munchkins | Last One to Leave Turn Out the Lights | Crisis is Literal Kiss of Death | Qatar's Slave Trade Death Toll | Lew's Illusions | Wal-Mart: Unpatriotic or Lying Through Their Teeth? | Food: Walking the Breadline | Obama NOT Worst President in reply to Obama: Worst President in US History? | Obama's Corporate Grand Bargain Death of the Dollar | Joseph Stiglitz was Right: Suicide | China Injects Cash in Bid to Improve Liquidity Technical Analysis: Bear Expanding Triangle | Bull Expanding Triangle | Bull Falling Wedge | Bear Rising Wedge | High & Tight Flag

|

| The Bullion Market's Big Issues, Part I Posted: 09 Oct 2013 02:48 PM PDT Price action isn't the big players' big concern in gold and silver right now. "Faith and Religion," said Edel Tully of UBS, the Swiss investment and bullion bank. "Those were key themes," she said, summing up this year's LBMA ... Read More... |

| Who Wants to Be a Millionaire? Who Wouldn’t! Here’s How Posted: 09 Oct 2013 01:43 PM PDT Here are some ways you can reach millionaire status but… it's going to take some patience. Few things of value happen overnight. So writes Gina Monaco (loop.ca) in edited excerpts from her original article* entitled Money lessons from the rich. The following is presented by Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com and www.munKNEE.com and the FREE Market Intelligence Report newsletter (sample here – register here). The excerpts may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.Monaco goes on to say in further edited excerpts: In a study commissioned by BMO, almost half of Canada's millionaires are new immigrants or first generation Canadians and two-thirds of them were self-made, with only 20 per cent getting a part of their wealth from an inheritance. That gives the rest of us some hope. 1. Keep learning Keep investing in your education, even if you have a degree. Read success books and attend motivational and other seminars to keep your momentum going. Try reading biographies of successful people – even millionaire Donald Trump! The more you read about the path to success of others, the more motivated you will be to pursue your own dreams. 2. Discipline yourself Don't spend money on luxury items you can't afford. If you want to earn yourself into a millionaire then you need to live a disciplined life. Think Zen! 3. Follow your bliss Do what you love and the money will follow. I know, it might sound corny, but if you're doing what you love, whether it's your job or hobby or side business, means you will stick it out during the ups and downs [and have a much greater chance of becoming a millionaire]. Again, think Zen! 4. Save, save, save Did I mention save? To live within your means is the hardest thing to do in a society of instant gratification. You have to move beyond the paycheque to paycheque mentality. Millionaires pay themselves first. 5. Reduce personal debts All debt is bad, but some debt is not as bad as others. Mortgages, business loans and student loans are not so bad but high-interest credit cards and lines of credit will stand in your way to becoming a millionaire. Pay them off. 6. Invest Financial markets yield good returns whether you're a conservative or an aggressive investor. Long-term investing usually yields better returns and is less risky than short-term investing. Start with companies you know…. like banks, yeah banks! 7. Invest long-term money Only invest what you can afford to lose. Don't use the money you need for your day-to-day living. How to free up cash? See items four and five – pay off debts and save. Don't incur debt by using your credit facilities to invest. 8. Own your home A person's home is their castle – and it can be as valuable as one. Homes appreciate in value over time and are a good investment. According to MSN Money Central, 95 percent of all millionaires own a home. 9. Open a retirement savings account As soon as possible – the earlier the better! Retirement accounts use compound interest, which means you continually earn interest on your interest. The earlier you start contributing to your retirement account, the more money you can accumulate because you have more time to take advantage of compound interest. [It makes becoming a millionaire that much easier.] 10. Don't put all your eggs in one basket Millionaires believe in diversification, meaning multiple streams of income so read up and learn the many ways you can diversify your millionaire portfolio. [Editor's Note: The author's views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]*http://www.theloop.ca/living/money/the-next-step/photo-gallery/-/p/6641/Money-lessons-from-the-rich/2545945 (© Bell Media 2013 All rights reserved) Related Articles: 1. Are You a Millionaire? 10 Reasons You May Not Be and What to do About It The reason you are not a millionaire (or even on your way to becoming one) is really quite simple. You probably assume it's because you aren't earning enough money but the truth is that, for most people, it does not matter how much money you make… [but, rather,] the way you treat money in your daily life. [Let me explain.] Words: 866 2. More Reasons You May Not be a Millionaire – Yet Many people assume they aren't rich because they don't earn enough money. If I only earned a little more, I could save and invest better, they say. The problem with that theory is they were probably making exactly the same argument before their last several raises. Becoming a millionaire has less to do with how much you make, it's how you treat money in your daily life. The list of reasons you may not be rich doesn't end at 10. [Here are 10 more.] Words: 842 3. Do You Have What It Takes to Become Filthy Rich? Saving money isn't all about whether or not you know how to score screaming bargains. It has more to do with your attitude toward money. Many millionaires, in fact, have frugal ways and understanding how personal traits can influence your finances is an essential ingredient for building wealth. Do you have the 10 key traits to become rich let alone very, very rich? Words: 815 4. Manage Your Money Without Breaking A Sweat – Here's How If you want more free time, or are just plain lazy, here are some easy ways to manage your money. I promise you won't break into a sweat… Read More » 5. 10 Money Ideas That WILL Change Your Life Personal finance isn't nuclear physics – just spend less than you earn, save and invest the rest – but knowing what should be done and actually doing it, however, are two different things. Here are 10 money lessons I wish I had known when I was 20 which have the power to change your life if you are willing to embrace them. Words: 1340 6. American Grads: Here's a Great Guide to Personal Finance Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don't need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out. 7. "Put More Cash in Your Wallet: Turn What You Know into Dough" – A Book by Loral Langemeier You too can live comfortably and buy the things you want without worrying about how to stretch your income even further — you can even pay off your old bills in the process! Get out there and start making money! Words: 911 8. Here's the Smart (Easy) Way to Profit from a "Gold Party" Have you ever wanted to host a gold party but didn't know how to get started? Wondered who to call or even how much money you could make?…[We] make the process very simple for you and alleviate the costs of hosting traditional gold parties Read More » Visit wsj.com – HERE – to find their calculator which shows where your household income stands compared to others in the U.S.. $506,000 puts you in the top 1%; the much talked about $250,00 in the top 6%; $200,000 in the top 10% while an annual salary of $43,000 puts you in the top/bottom 50%. Where do you stand? The post Who Wants to Be a Millionaire? Who Wouldn't! Here’s How appeared first on munKNEE dot.com. |

| Why I Am A Terrified As I Watch The End Game Unfolding Posted: 09 Oct 2013 01:31 PM PDT  As the modern world seems to move directly from one crisis to another, today one of the wealthiest people in the financial world spoke with King World News about why he told KWN very recently, "I am a terrified observer as I watch the end game drawing to a close." Rick Rule, who is business partners with billionaire Eric Sprott, also warned that Western central planners may not be able to halt a 2008-style collapse a second time around. Below is what he had to say in this candid and powerful interview. As the modern world seems to move directly from one crisis to another, today one of the wealthiest people in the financial world spoke with King World News about why he told KWN very recently, "I am a terrified observer as I watch the end game drawing to a close." Rick Rule, who is business partners with billionaire Eric Sprott, also warned that Western central planners may not be able to halt a 2008-style collapse a second time around. Below is what he had to say in this candid and powerful interview.This posting includes an audio/video/photo media file: Download Now |

| Gold Daily and Silver Weekly Charts - G20 Central Bank/Finance Meeting in Washington Tomorrow Posted: 09 Oct 2013 01:25 PM PDT |

| Gold Daily and Silver Weekly Charts - G20 Central Bank/Finance Meeting in Washington Tomorrow Posted: 09 Oct 2013 01:25 PM PDT |

| Figures Don’t Lie, but Liars Figure Posted: 09 Oct 2013 12:35 PM PDT Gold took quite a beating in September, bucking its seasonal average monthly return of 2.3%. The political battle between President Barack Obama and Congress, China's Golden Week, and India's gold import restrictions likely weighed on the metal. September's correction only adds to the negative sentiment toward the precious metal. The assumption from many market pundits is that gold is no longer attractive as an investment. With rising rates and continuing low inflation, U.S. investors believe they have a solid case for selling their holdings. However, this could be a premature assessment, causing these bears to potentially lose out on a lucrative position. Allow me to use an ice cube to explain. One of the strongest drivers of the "fear trade" is real interest rates. Whenever a country has negative-to-low real rates of return, which means the inflationary rate (CPI) is greater than the current interest rate, gold tends to rise in that country's currency. And our model tells us that the tipping point for gold is when real interest rates go above the 2-percent mark. Consider the ice cube, which shows how new equilibriums can have significant effects. At 31 degrees, H2O is a solid chunk, but when the temperature increases, the mass slowly begins to turn into a liquid. Above 32 degrees, ice changes form from solid to liquid, but it's still made of hydrogen and oxygen. Because money is like water, when many other economic dynamics, such as population growth, urbanization rates and changes in government policies, reach their tipping point, the velocity of money tends to be altered. As global investors, we watch for changes in these trends to know how to invest in commodities and markets, find new opportunities and adjust for risk. So, how close to gold's tipping point are we? In other words, what is the real interest rate today? As you can see below, Treasury investors continue to lose money, as the 5-year bill yields 1.41 percent and inflation sits at 1.5 percent. This is nowhere near the 2 percent mark.

I would be worried about gold if real interest rates solidly crossed the 2 percent threshold for an extended amount of time, because it would have a dramatic effect on gold as an asset class. In a high interest rate environment, gold and silver lose their attraction as a store of value. In order for that tipping point to happen, rates would need to continue rising above inflation, and inflation would need to remain low. These are the forecasts made by many gold sellers today; however I wouldn't get too trigger happy just yet, as recent data challenges these assumptions. Take the monthly unemployment figure, which is one of the primary indicators the Federal Reserve studies when evaluating the economy. But depending on the definition of an unemployed person, the numbers reveal different results. The official U3 unemployment rate, the exact figure Ben Bernanke uses, tracks the total unemployed as a percent of the civilian labor force. The broadest gauge calculated by the Bureau of Labor Statistics (BLS) is the U6 unemployment rate. For this number, the BLS adds in all those people who are marginally attached to the labor force, plus people working part-time but want to work full-time. What does "marginally attached to the labor force" mean? These people are neither working nor looking for work but indicate they want a job, are available to work and have worked during some period in the last 12 months. These marginally attached people also include discouraged workers who are not looking for work because of some job-market related reason. Then there's a measure of the labor market the BLS tracked prior to 1994. This is the seasonally-adjusted alternate unemployment rate that statistician John Williams continued to calculate. It's basically the U6 plus long-term discouraged workers. While the figures closely followed one another from 1994 through 2009, there's recently been a shift. U3 and U6 have been trending downward over the past few years, whereas Williams' ShadowStats unemployment rate shows a noticeably upward trajectory. Perhaps the official unemployment figure overstates the health of the economy? Based on the jobs market, a limited housing recovery and regulations that have been slowing down the flow of money, the Fed may have no choice but to raise rates very gradually to keep stimulating the economy. Then there's the suggestion of inflation manipulation. Even though the U.S. has been reporting a low inflation number, things feel more expensive to many Americans. Disposable income has been growing less than inflation in recent years; perhaps that's why many people feel "squeezed." Also consider Williams' chart below. It shows monthly inflation data going back for more than a century. The blue and grey shaded areas represent BLS' historical Consumer Price Index (CPI). You can clearly see the wild swings of inflation and deflation, especially during World War I, the Great Depression, and World War II, as well as the stagflation of the 1970s and early 1980s. However, shortly after disco, bell bottoms, and episodes of "All in the Family" faded from memory, the U.S. adjusted CPI, not once but twice, first in the early 1980s and again in the mid-1990s. If you use the pre-1982 calculation, you end up with a much different inflation picture. This is the area shaded in red. Way back in 1889, statistician Carroll D. Wright, in addressing the Convention of Commissioners of Bureaus of Statistics of Labor, talked about the impartial and fearless presentation of its data, using the above play on words. He said: "The old saying is that 'figures will not lie,' but a new saying is 'liars will figure.' It is our duty, as practical statisticians, to prevent the liar from figuring; in other words, to prevent him from preverting the truth, in the interest of some theory he wishes to establish." Wright's speech seems particularly relevant today. For patient, long-term investors looking for a great portfolio diversifier, a moderate weighting in gold and gold stocks may be just the answer. And, today, when looking across the gold mining industry, you'll find plenty of companies that have paid attractive dividends, many higher than the 5-year government yield. Regards, Frank Holmes |

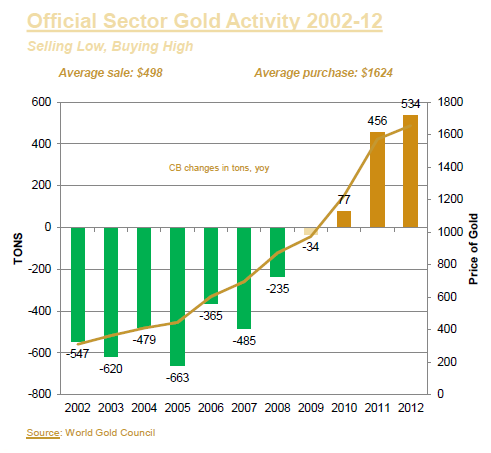

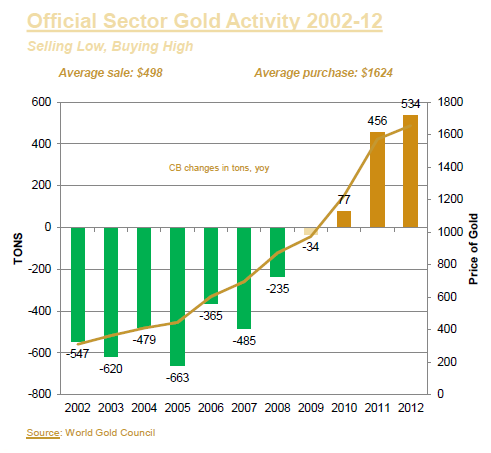

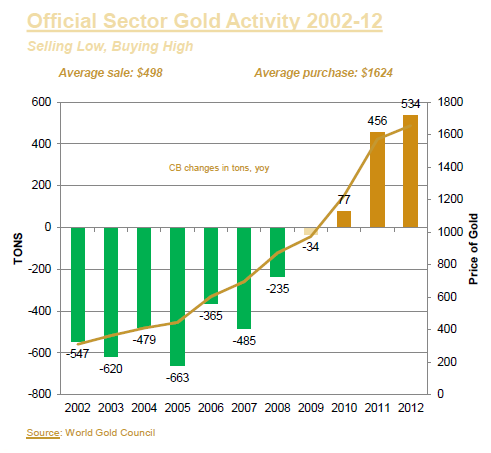

| Gold, Trust & Independence, Part I Posted: 09 Oct 2013 12:26 PM PDT Why do central banks hold gold? Because of the trust and independence it provides... "FAITH and RELIGION," said Edel Tully of UBS, the Swiss investment and bullion bank. "Those were key themes," she said, summing up this year's LBMA conference last Tuesday evening, writes Adrian Ash at BullionVault. We could hardly ignore those issues, meeting in the hills just west of Rome with 700 other delegates for the London Bullion Market Association's annual jolly. From Monday night's dinner on top of Monte Mario, the dome of St.Peter's dominated the view. And any asset which doesn't pay an income, and which has fallen in price for more than two years, must look like a "hold-n-hope" investment based more on prayer than cold logic. Instead of "faith and religion" however, we had already scribbled down "trust and independence" as the LBMA conference's key themes. Because where Dr.Tully heard whispers of eternal beliefs – here in God (or gods), there in gold – we nearly had to cover our ears from all-too worldly shouting over safety and sovereignty, confidence and freedom. Gold forms a triangle with these ideas throughout history. Trust and independence met gold again last week in Rome. Because today's oh-so-modern mob of taxpayers, government officials, lenders, traders, high priests and the rest still need to trust each other but also demand independence as they skip through the forum. And as the oh-so-sociable LBMA conference showed, the way that gold and silver are treated speaks to people's trust in each other, and their freedom to act as they choose. Take central bankers. They tend to sell gold when it's cheap, and buy or hold when it's not. "This," as Blackrock's Terence Keeley rightly noted to the LBMA conference, "is no way to diversify your portfolio."  But central-bank gold is about much more than smoothing returns or improving your efficient frontier. It's about independence, even if that independence puts the central bank's trust in other institutions in doubt. Institutions such as, say, the monetary union you're publicly working to deepen and develop. Not that any of the six current or former central bankers addressing the LBMA conference last week dared say any such thing. Nothing too blatant was given away. But you didn't need rolling translation to hear what was said. "Trust is a central bank's most valuable asset," announced keynote speaker Salvatore Rossi of the Banca d'Italia. Only just behind that, he seemed to suggest, gold came a close second. And given Italy's recent history with gold, it certainly seems to support the central bank's trust amongst the general public. Because as Rossi said, gold so plainly supports the bank's independence from government. "I don't need to remind you of gold's unique role in central bank reserves," said Rossi, nevertheless reminding the 700-odd delegates to the LBMA's two-day meeting in Rome that gold is "unique amongst risk assets" because it is not "issued" by anyone. So it carries no liability and needs no counterparty for its inherent value. Just as importantly, the central bank of Italy's director general also pointed to "psychological reasons" for gold's key role. So did Clemens Werner of the Bundesbank, the world's second-heaviest gold owner behind the United States. More than 40 years after the final gasp of the Gold Standard and eight decades after that monetary system really hit the skids, he named "confidence" and "precaution" as the big reasons for continuing to hold gold. Because as Italy's Rossi went on in his speech, gold "enhances resilience" in the central bank's reserves overall, typically rising when other risk assets plunge. More notably, gold "underpins the independence of the central bank" from government. Quite how, Rossi didn't say. But with Silvio Berlusconi trying to destroy Italy's government just a few minutes cab-ride away, the point was plain enough if you knew the history. Il Cavaliere came after the Banca d'Italia's gold in 2009. He was told where to go. The central bank's big friends at the European Central Bank then told Berlusconi where to go, too. Trying to tax the central bank's unrealized profits on gold was illegal under the Euro treaty, breaching line after line of the critical "independence" from government which national central banks must retain. Italian central-bank governor Mario Draghi has since moved into the job of ECB chief. So his stand against Berlusconi's failed gold bullion tax grab looks a good template for how the ECB, and the biggest gold-owning central banks of the Eurosystem, might view their gold reserves today. Most definitely, none of Germany or Italy's gold is up for sale this year. Alexandre Gautier said the same of France's hoard. But then again, the Banque de France said that in the late 1990s, only to break ranks and take advantage of rising prices in the early Noughties. Gautier also spoke last week about trading and lending (this was a business conference, after all), but only to say the former is now very limited, while the latter is off the table. Not until gold borrowers come up with collateral. Which is unlikely but necessary now that – compared with 10 or 15 years ago, when lending European central-bank gold was all the rage (as was selling it, at least outside Rome and Frankfurt) – "the environment is totally different. I'm not sure it could be acceptable for a 1-year loan without collateral." Which brings us back to trust...to be continued in Part II |

| Gold, Trust & Independence, Part I Posted: 09 Oct 2013 12:26 PM PDT Why do central banks hold gold? Because of the trust and independence it provides... "FAITH and RELIGION," said Edel Tully of UBS, the Swiss investment and bullion bank. "Those were key themes," she said, summing up this year's LBMA conference last Tuesday evening, writes Adrian Ash at BullionVault. We could hardly ignore those issues, meeting in the hills just west of Rome with 700 other delegates for the London Bullion Market Association's annual jolly. From Monday night's dinner on top of Monte Mario, the dome of St.Peter's dominated the view. And any asset which doesn't pay an income, and which has fallen in price for more than two years, must look like a "hold-n-hope" investment based more on prayer than cold logic. Instead of "faith and religion" however, we had already scribbled down "trust and independence" as the LBMA conference's key themes. Because where Dr.Tully heard whispers of eternal beliefs – here in God (or gods), there in gold – we nearly had to cover our ears from all-too worldly shouting over safety and sovereignty, confidence and freedom. Gold forms a triangle with these ideas throughout history. Trust and independence met gold again last week in Rome. Because today's oh-so-modern mob of taxpayers, government officials, lenders, traders, high priests and the rest still need to trust each other but also demand independence as they skip through the forum. And as the oh-so-sociable LBMA conference showed, the way that gold and silver are treated speaks to people's trust in each other, and their freedom to act as they choose. Take central bankers. They tend to sell gold when it's cheap, and buy or hold when it's not. "This," as Blackrock's Terence Keeley rightly noted to the LBMA conference, "is no way to diversify your portfolio."  But central-bank gold is about much more than smoothing returns or improving your efficient frontier. It's about independence, even if that independence puts the central bank's trust in other institutions in doubt. Institutions such as, say, the monetary union you're publicly working to deepen and develop. Not that any of the six current or former central bankers addressing the LBMA conference last week dared say any such thing. Nothing too blatant was given away. But you didn't need rolling translation to hear what was said. "Trust is a central bank's most valuable asset," announced keynote speaker Salvatore Rossi of the Banca d'Italia. Only just behind that, he seemed to suggest, gold came a close second. And given Italy's recent history with gold, it certainly seems to support the central bank's trust amongst the general public. Because as Rossi said, gold so plainly supports the bank's independence from government. "I don't need to remind you of gold's unique role in central bank reserves," said Rossi, nevertheless reminding the 700-odd delegates to the LBMA's two-day meeting in Rome that gold is "unique amongst risk assets" because it is not "issued" by anyone. So it carries no liability and needs no counterparty for its inherent value. Just as importantly, the central bank of Italy's director general also pointed to "psychological reasons" for gold's key role. So did Clemens Werner of the Bundesbank, the world's second-heaviest gold owner behind the United States. More than 40 years after the final gasp of the Gold Standard and eight decades after that monetary system really hit the skids, he named "confidence" and "precaution" as the big reasons for continuing to hold gold. Because as Italy's Rossi went on in his speech, gold "enhances resilience" in the central bank's reserves overall, typically rising when other risk assets plunge. More notably, gold "underpins the independence of the central bank" from government. Quite how, Rossi didn't say. But with Silvio Berlusconi trying to destroy Italy's government just a few minutes cab-ride away, the point was plain enough if you knew the history. Il Cavaliere came after the Banca d'Italia's gold in 2009. He was told where to go. The central bank's big friends at the European Central Bank then told Berlusconi where to go, too. Trying to tax the central bank's unrealized profits on gold was illegal under the Euro treaty, breaching line after line of the critical "independence" from government which national central banks must retain. Italian central-bank governor Mario Draghi has since moved into the job of ECB chief. So his stand against Berlusconi's failed gold bullion tax grab looks a good template for how the ECB, and the biggest gold-owning central banks of the Eurosystem, might view their gold reserves today. Most definitely, none of Germany or Italy's gold is up for sale this year. Alexandre Gautier said the same of France's hoard. But then again, the Banque de France said that in the late 1990s, only to break ranks and take advantage of rising prices in the early Noughties. Gautier also spoke last week about trading and lending (this was a business conference, after all), but only to say the former is now very limited, while the latter is off the table. Not until gold borrowers come up with collateral. Which is unlikely but necessary now that – compared with 10 or 15 years ago, when lending European central-bank gold was all the rage (as was selling it, at least outside Rome and Frankfurt) – "the environment is totally different. I'm not sure it could be acceptable for a 1-year loan without collateral." Which brings us back to trust...to be continued in Part II |

| Gold, Trust & Independence, Part I Posted: 09 Oct 2013 12:26 PM PDT Why do central banks hold gold? Because of the trust and independence it provides... "FAITH and RELIGION," said Edel Tully of UBS, the Swiss investment and bullion bank. "Those were key themes," she said, summing up this year's LBMA conference last Tuesday evening, writes Adrian Ash at BullionVault. We could hardly ignore those issues, meeting in the hills just west of Rome with 700 other delegates for the London Bullion Market Association's annual jolly. From Monday night's dinner on top of Monte Mario, the dome of St.Peter's dominated the view. And any asset which doesn't pay an income, and which has fallen in price for more than two years, must look like a "hold-n-hope" investment based more on prayer than cold logic. Instead of "faith and religion" however, we had already scribbled down "trust and independence" as the LBMA conference's key themes. Because where Dr.Tully heard whispers of eternal beliefs – here in God (or gods), there in gold – we nearly had to cover our ears from all-too worldly shouting over safety and sovereignty, confidence and freedom. Gold forms a triangle with these ideas throughout history. Trust and independence met gold again last week in Rome. Because today's oh-so-modern mob of taxpayers, government officials, lenders, traders, high priests and the rest still need to trust each other but also demand independence as they skip through the forum. And as the oh-so-sociable LBMA conference showed, the way that gold and silver are treated speaks to people's trust in each other, and their freedom to act as they choose. Take central bankers. They tend to sell gold when it's cheap, and buy or hold when it's not. "This," as Blackrock's Terence Keeley rightly noted to the LBMA conference, "is no way to diversify your portfolio."  But central-bank gold is about much more than smoothing returns or improving your efficient frontier. It's about independence, even if that independence puts the central bank's trust in other institutions in doubt. Institutions such as, say, the monetary union you're publicly working to deepen and develop. Not that any of the six current or former central bankers addressing the LBMA conference last week dared say any such thing. Nothing too blatant was given away. But you didn't need rolling translation to hear what was said. "Trust is a central bank's most valuable asset," announced keynote speaker Salvatore Rossi of the Banca d'Italia. Only just behind that, he seemed to suggest, gold came a close second. And given Italy's recent history with gold, it certainly seems to support the central bank's trust amongst the general public. Because as Rossi said, gold so plainly supports the bank's independence from government. "I don't need to remind you of gold's unique role in central bank reserves," said Rossi, nevertheless reminding the 700-odd delegates to the LBMA's two-day meeting in Rome that gold is "unique amongst risk assets" because it is not "issued" by anyone. So it carries no liability and needs no counterparty for its inherent value. Just as importantly, the central bank of Italy's director general also pointed to "psychological reasons" for gold's key role. So did Clemens Werner of the Bundesbank, the world's second-heaviest gold owner behind the United States. More than 40 years after the final gasp of the Gold Standard and eight decades after that monetary system really hit the skids, he named "confidence" and "precaution" as the big reasons for continuing to hold gold. Because as Italy's Rossi went on in his speech, gold "enhances resilience" in the central bank's reserves overall, typically rising when other risk assets plunge. More notably, gold "underpins the independence of the central bank" from government. Quite how, Rossi didn't say. But with Silvio Berlusconi trying to destroy Italy's government just a few minutes cab-ride away, the point was plain enough if you knew the history. Il Cavaliere came after the Banca d'Italia's gold in 2009. He was told where to go. The central bank's big friends at the European Central Bank then told Berlusconi where to go, too. Trying to tax the central bank's unrealized profits on gold was illegal under the Euro treaty, breaching line after line of the critical "independence" from government which national central banks must retain. Italian central-bank governor Mario Draghi has since moved into the job of ECB chief. So his stand against Berlusconi's failed gold bullion tax grab looks a good template for how the ECB, and the biggest gold-owning central banks of the Eurosystem, might view their gold reserves today. Most definitely, none of Germany or Italy's gold is up for sale this year. Alexandre Gautier said the same of France's hoard. But then again, the Banque de France said that in the late 1990s, only to break ranks and take advantage of rising prices in the early Noughties. Gautier also spoke last week about trading and lending (this was a business conference, after all), but only to say the former is now very limited, while the latter is off the table. Not until gold borrowers come up with collateral. Which is unlikely but necessary now that – compared with 10 or 15 years ago, when lending European central-bank gold was all the rage (as was selling it, at least outside Rome and Frankfurt) – "the environment is totally different. I'm not sure it could be acceptable for a 1-year loan without collateral." Which brings us back to trust...to be continued in Part II |

| Gold Drops Most in a Week as Stronger Dollar Damps Metal Demand Posted: 09 Oct 2013 09:34 AM PDT 09-Oct (Bloomberg) — Gold fell the most in a week after the dollar extended gains and as imports slumped in India, the world's biggest consumer. The Bloomberg U.S. Dollar Index, a gauge against 10 major trading partners, rose to a one-week high, curbing demand for the precious metal as an alternative asset. Purchases of gold and silver by India were worth $800 million in September compared with $4.6 billion a year earlier, the Commerce Ministry said today. "The dollar is the winner today," Phil Streible, a senior commodity broker at R.J. O'Brien & Associates in Chicago, said in a telephone interview. "Prices are under pressure as physical demand has taken a hit." [source] |

| Posted: 09 Oct 2013 09:28 AM PDT Gold Falls as One Point of Uncertainty Resolved

The dollar index popped to a two week high and remains fairly well bid at this point, which is keeping the yellow metal under pressure. However, the equity rally has fizzled and U.S. stocks are in negative territory as investors continue to fret over the government shutdown and risks associated with a potential sovereign default. Those two factors should continue to provide some underpinnings to the gold market as well as we continue to tick ever-closer to the point where the federal government can no longer borrow. Already there is much speculation about actions Bernanke might take on his way out the door, and actions Yellen might take on her way in. Most of that speculation centers on tapering. Suffice to say though that Yellen is every-bit as dovish as Bernanke and perhaps even more so; more aligned with noted doves Evans, Dudley and Rosengren. Jim Rickards of Tangent Capital Partners and the best selling author of Currency Wars tweeted this today:

Chicago Fed President Charles Evans spoke today at an IMF panel discussion and said that continued accommodative policy is necessary given the high jobless rate and low inflation. He noted that the U.S. has faced fiscal headwinds for several years and the current situation — presumably referring to the government shutdown and debt ceiling debate — “gives me great pause in looking at things.” I’m sure this whole fiasco is giving ‘great pause’ to even the hawks on the FOMC. We’ll get a clearer picture of just how tight the deliberations were at the last FOMC meeting when the minutes are released later today. The article late on Monday by WSJ Fed watcher Jon Hilsenrath suggested that negotiations inside the Fed were “tense” and produced “muddled” signals to the market. I would suggest that muddled signals may have in fact been the intent, taking a page from the playbook of Alan Greenspan. Keeping the market on its heels, wondering will they or won’t they is a way to prevent big bets in either direction. However, when all is said and done, the sluggish economy, stubbornly high unemployment and tepid inflation (at least by official measures) likely means the Fed won’t be tapering any time soon. That’s actually probably more true under Yellen’s leadership and amid expectations that more short-term solutions for the budget and debt ceiling are in the offing. Once the market reconciles this reality, that the fiscal headwinds courtesy of Congress and über-accommodative Fed policy are here to stay, gold should attract renewed buying interest. Certainly the safe-haven appeal of the yellow metal is heightened the closer we get to default without some kind of deal. |

| Do Not Express The Value Of Gold In Monopoly Money Posted: 09 Oct 2013 09:23 AM PDT In his latest article, Richard Geene explains that the main reason that the masses ignore the inevitable failure of fiat money systems, such as that which is employed by the US and virtually the rest of the world today, is because just prior to their demise, they have more recently been remembered for generating a widespread period of prosperity that has enriched its supporters, if not the masses as well. The fundamental flaw in a fiat money system can be summed up as human nature. When the going gets rough, the rough start printing. (source: Thunder Capital Management) This is nothing new. Monetary history shows that as soon “a country went to a fiat currency there was a period, as long or longer than 30 years, in which it thrived even more. However, during that period of prosperity on a fiat currency, excesses began to build. Once they have built up to extreme levels, it is a very dangerous time. When levels of debt become too excessive, an increasing amount of the rewards of production; profits, must go to servicing debt. When the servicing of debt consumes all of the profits of production, it finally consumes production itself. This is the real culprit for the loss of jobs domestically. As more of the economy shifts from real production of goods, to the pushing of various forms of paper, citizens lose jobs and live in more dangerous times. We have reached that time.” Paper currencies seem normal. They seem natural. We are told they are necessary. Paper currencies with no intrinsic value are used everywhere – we pretend they are valuable. If we don't look closely, or remember the world of 60 years ago, they seem like a good idea. Monopoly money. Euros. Dollars. What is the essential difference? Paper, with no intrinsic value, is accepted only because we have confidence in the issuer of the currency and/or because we have no other choice. Monopoly money can buy hotels on Park Place. Unbacked paper dollars can buy hotels in Manhattan. The hundreds of unbacked paper currencies that have become worthless during the last century can buy NOTHING. If I am playing Monopoly and I change the rules to allow me, and only me, to add $85,000 to my stack of money, it seems likely I will "win" and own more property. Eventually, no one will want to play with me because I created $85,000 of fraudulent Monopoly money. If I am a central banker and I create $85,000,000,000 every month to buy bonds, I will own lots of bonds in a few years. People will eventually realize my $85,000,000,000 per month gives me and my friends an unfair advantage and most others will refuse to play with me except when necessary, and they will certainly seek other "games" that are more fair and less slanted toward the player who can create boatloads of currency from nothing. From Richard Russell: (link)

Should we trust our central bankers? They largely control our financial lives. Inflation, deflation, depression, prosperity, booms, and busts are strongly influenced by banking policies, interest rates, and the availability of currency and credit, all of which are influenced by central banks. Jim Grant: (link)

The world is overloaded with debt. As Bill Bonner said, "To solve the debt problem they added debt! The genius of this plan was, we admit, not immediately obvious." We think it is progressively more obvious that creating a massive quantity of currency each month – say $85,000,000,000 – is helping few outside the financial community and will eventually cause considerable harm to the economy and the purchasing power of the dollar. We all know that:

What are the "solutions" to our massive and unpayable debt conundrum? 1) Increase taxes and pay off the national debt. This will not happen. 2) The "nuclear" option: Default on much of the debt, force most individuals, businesses, and governments into some form of bankruptcy, and thereby liquidate most of the debt and the related paper assets. Politicians will avoid this option. 3) Create a massive inflation and thereby reduce the debt burden. Descriptive words that come to mind are: ugly, dangerous, social upheaval, food riots, bread lines, suicide, tears, anger, homelessness, denial, repression, martial law, and chaos. This is probably the only choice remaining. Hugo Salinas Price: (link)

"The Powers-That-Be" appear to prefer a distracted populace, slowly rising prices, a strong dollar, weak gold prices, and minimal restrictions on their ability to accumulate assets and power. There will be trauma if currencies collapse, gold prices skyrocket, and inflation flies out of control. We can reasonably expect that the governments of the world will "do something" that unfortunately will NOT solve the problems of collapsing currencies and out of control inflation. Michael Noonan: (link)

When paper assets are overvalued, gold and silver prices are likely to be undervalued. How much are paper assets and unbacked paper currencies truly worth? That is a huge question. Consider:

SRSrocco Report: (link)

Will all this economic nonsense – unbacked paper currencies, massive printing (QE) of currencies, gold price manipulation, unregulated derivatives, out-of-control deficit spending, creating more debt to solve an excess debt problem, and so on – work out well for anyone except the financial and political elite? Jim Grant: (link)

So what do we do to prepare – to "prep" for the coming paper currency disaster? Arabian Money: (link)

SO OUR SUGGESTIONS ARE:

Read more: TANSTAAFL, Butter and Silver, The Reality of Gold and the Nightmare of Paper GE Christenson | The Deviant Investor |

| Gold Stock Investors Keep the Best and Dump the Rest Posted: 09 Oct 2013 09:14 AM PDT Greg McCoach, publisher of Mining Speculator newsletter, is not ashamed to admit he has taken a big hit in juniors in the last couple of years. What he has done in response is what he advises all investors to do in this interview with The Gold Report: Get rid of the also-rans and keep and build positions in those companies that have what it takes to gain in multiples when the market recovers. And he suggests six companies that could do just that. The Gold Report: You wrote recently, "The 2008 crisis will pale in comparison to what is now on the horizon." Given that the 2008 crisis nearly destroyed the world economy, how bad will the next crisis be? |

| Posted: 09 Oct 2013 09:10 AM PDT Top Market Stories For October 9th, 2013: Why The Debt Ceiling Is Impossible - It's A Delusion - Mike Maloney Welcome to the Third World, Part 10: Suddenly, Being a Politician is Hard - John Rubino Yesterday's top story: Looming gold & silver 'production cliff' now accelerating - NBF - Mineweb COMEX Gold Inventories Steady Overall With 40,000 Ounces Moved Out of Deliverable Category - Jesse's Café OPEC Is In Big |

| Despite Correction, Silver Is Set Up To Super-Surge To $110 Posted: 09 Oct 2013 09:09 AM PDT  With continued volatility in the gold and silver markets, today acclaimed money manager Stephen Leeb told King World News that despite weakness, silver is now set up to "super-surge" to $110. Leeb discussed the surprising reason for the coming surge, as well as how the mainstream media will be used to explain it. With continued volatility in the gold and silver markets, today acclaimed money manager Stephen Leeb told King World News that despite weakness, silver is now set up to "super-surge" to $110. Leeb discussed the surprising reason for the coming surge, as well as how the mainstream media will be used to explain it.This posting includes an audio/video/photo media file: Download Now |

| Will The Real Goldman Sachs View On Gold Please Stand Up Posted: 09 Oct 2013 09:09 AM PDT The head of Goldman Sachs' commodities research area yesterday announced in headline-grabbing fashion that gold was a "slam dunk" sell. What's truly stunning about this is that during the 2nd quarter this year, Goldman Sachs revealed in an SEC 13-F filing that it had accumulated over 4 million shares of GLD (that's half a billion dollars worth) of GLD to become the 6th largest holder. True to its historical track record, Goldman often says one thing through its research reports but does the exact opposite with its capital. I've written an article published by Seeking Alpha which compares the Goldman's "sell" report, which has no basis in factual analysis, with a list of fundamental factors that point to the reasons that Goldman is saying one thing but doing the exact opposite with its capital. You can read my article here: Follow The Money But before you read that, consider this accounting from www.goldcore.com of the last time Goldman issued a highly publicized "sell" on gold back in 2007: It is worth remembering that Goldman, to much fanfare and media attention, "told clients" in November 2007, to sell gold. On November 29, 2007, Goldman recommended that investors sell gold in 2008 and it named the strategy as one of its 'Top 10 Tips' for the year. Gold subsequently rose nearly 6.4% in December 2007 alone - from $783.75/oz to $833.92/oz. Gold then rose another 5.8% in 2008 - from $833.92/oz at the close on December 31, 2007, to close at $882.05/oz on December 31, 2008. Gold rose 12.2% in the 13 months after Goldman's sell gold call. Gold then rose 23.4% in 2009, 27.1% in 2010, 10.1% in 2011 and 7% in 2012. Thus, proving Goldman's 'Top Tip' prediction absolutely wrong and costing their clients and many of the unsuspecting public a lot of money in the process. At the time, Goldman cut its gold forecast to $740/oz from $810/oz on a 12 month basis. One year later, gold closed at $882.05/oz - more than 19% above Goldman's 'forecast'. The crystal ball gazing of Wall Street banks and hedge funds and others who have suggested gold is a bubble in recent years has cost many of the investment public dearly. As ever, it remains wise to ignore the considerable noise that emanates from Wall Street and maintain a healthy, long term allocation to physical gold. |

| Nearing first gold pour, Carpathian short of cash, considering sale Posted: 09 Oct 2013 08:55 AM PDT Carpathian shares crumbled Wednesday as it outlined financial woes and mine commissioning delay. |

| Yellen’s Fed news fails to shake gold’s "lethargy" Posted: 09 Oct 2013 08:55 AM PDT The gold price lost this week’s 1.4% gains on Wednesday morning, dropping below $1,310 as European shares recovered earlier losses. |

| Kyrgyz leader rejects calls to nationalise Centerra mine Posted: 09 Oct 2013 08:55 AM PDT Kyrgyzstan’s president has rejected opposition calls to nationalise the Kumtor gold mine as violent riots over its ownership flared up again this week. |

| Gold likely to consolidate as debt ceiling issues continue to hover Posted: 09 Oct 2013 08:55 AM PDT What is clear to Asia, if not to the U.S. is that gold is needed in the transition period away from a US dominated currency world, argues Julian Phillips. |

| U.S., Switzerland Export Largest Ever Amounts Of Gold To Hong Kong And Investors Should Take Note Posted: 09 Oct 2013 08:09 AM PDT 09-Oct (SeekingAlpha) — Chinese gold import data have just been released for August, and it shows that imports are still very strong. But what investors should really take note of is that imports into Hong Kong were close to 300 tonnes in August – which would put them on pace to suck up all of global mine supply. [source] |

| Gold Bullion Continues to Drain Out of COMEX Posted: 09 Oct 2013 07:56 AM PDT It was announced this evening that President Obama will nominate Janet Yellen as the new Fed Chairman tomorrow, having been denied his first choice of Larry Summers by popular outrage. There were big adjustments in the registered (dealer) gold inventories at JPM and HSBC yesterday as a total of over 40,000 ounces of gold bullion moved back to the customer storage category. |

| Created Currencies ... Are Not Gold! (Financial Prepping 101) Posted: 09 Oct 2013 07:12 AM PDT Paper currencies seem normal. They seem natural. We are told they are necessary. Paper currencies with no intrinsic value are used everywhere - we pretend they are valuable. If we don't look closely, or remember the world of 60 years ago ... Read More... |