saveyourassetsfirst3 |

- Bullish on gold and equities despite dearth of exploration - Lassonde

- “Over-delivering” Centamin well on track to exceed 2013 gold target

- Nearing first gold pour, Carpathian short of cash, considering sale

- Yellen's Fed news fails to shake gold's "lethargy"

- Gold, Trust & Independence, Part I

- Wave Of The Future Investment From The Ground Up: Byron King

- Jim Sinclair: Hold Your Gold & Get Out of the System!

- Did gold stop to respond to the U.S. dollar price moves?

- Gold challenging significant support level

- Silver price climbs to two-week highs, ETF inflows and coin sales remain robust

- Yellen's Fed news fails to shake gold's lethargy as Goldman targets $1,050

- India’s near-record silver demand

- Rick Rule: Eric Sprott Believes His Portfolio Will See 15 to 20 Baggers in the Next 12 Months

- Goldman tells clients to sell gold; did same in November 2007, gold then rose 12%

- Do Not Express The Value Of Gold In Monopoly Money

- Losing My Head

- Has ANYONE Actually Been Able To Successfully Sign Up For Obamacare Yet?

- Did Gold Stop Responding to the U.S. Dollar Price Moves?

- Where’s the fire fueling gold?

- Former Assistant Treasury Secretary: Obama Will Seize Total Power to Prevent US Default

- Final Nail in the Hyperinflation Coffin

- Stewart Thomson: Silver Leads Gold Higher

- Goldman Tell Clients To Sell Gold - Did Same In Nov 2007, Gold Then Rose 12%

- TF Metals Report: Goldman buys gold after panicking speculators to sell

- COMEX Gold Inventories Steady Overall With 40,000 Ounces Moved Out of Deliverable Category

- Think Twice Before Burying Your Gold In The Back Yard

- Goldman Tell Clients To Sell Gold – Did Same In Nov 2007, Gold Then Rose 12%

- Gold may recover if stalemate continues in debt negotations: ETFS

- As Budget Stalemate Hostilities Escalate, Obama Starts to Brandish Default Threat

- China Imports 110 Tonnes of Gold Through Hong Kong in August

- Largest Collapse in Economic Confidence Since Lehman

- IMF sours on BRICs and doubts eurozone recovery claims

- China's gold imports from Hong Kong remain above 100 tonnes in August

- China’s unstoppable gold imports continue virtually unchecked

- India's gold demand to rise by 15% in Q4 2013 to up to 300 tonnes: WGC

- Luxury-focused Indians swing for gold

- Sprott's Thoughts: India Will Dominate the Silver Market in 2013

- Starved of gold, Indians may import record volumes of silver

- Goldman Says Gold "Slam Dunk" Sell, Ready To Buy All Its Clients Have To Offer

- Looming gold and silver ‘production cliff’ now accelerating: NBF

- Direct economic impact of gold mining $210 billion plus globally

- Peak Gold, Easier to Model than Peak Oil? - Part I

- Gold Trading at Falling Resistance from August

- Gold Forecast October 9, 2013, Technical Analysis

- Dollar Stuck at June Low as SPX 500 Marks Critical Break

- Silver Forecast October 9, 2013, Technical Analysis

- Gold Responds to Well-Defined Trendline Resistance

- Gold Support and Resistance Levels Investors Need to Watch

- CHARTS - Gold and silver ascending

- Silver ETF: Cup And Handle Potential

| Bullish on gold and equities despite dearth of exploration - Lassonde Posted: 09 Oct 2013 05:58 PM PDT Franco Nevada Chair, Pierre Lassonde, says, In his 35 year career, he has never seen gold operating companies so cheap |

| “Over-delivering” Centamin well on track to exceed 2013 gold target Posted: 09 Oct 2013 04:58 PM PDT Centamin, with its rapidly growing Sukari Gold mine in Egypt, is well on track to exceed its 2013 gold production guidance of 320,00 ounces with further expansion ahead. |

| Nearing first gold pour, Carpathian short of cash, considering sale Posted: 09 Oct 2013 04:54 PM PDT Carpathian shares crumbled Wednesday as it outlined financial woes and mine commissioning delay. |

| Yellen's Fed news fails to shake gold's "lethargy" Posted: 09 Oct 2013 03:40 PM PDT The gold price lost this week's 1.4% gains on Wednesday morning, dropping below $1,310 as European shares recovered earlier losses. |

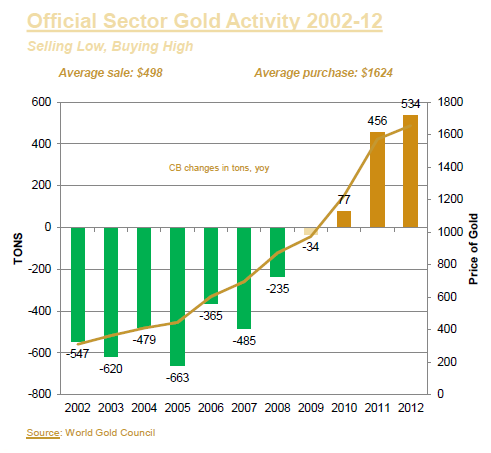

| Gold, Trust & Independence, Part I Posted: 09 Oct 2013 12:26 PM PDT Why do central banks hold gold? Because of the trust and independence it provides... "FAITH and RELIGION," said Edel Tully of UBS, the Swiss investment and bullion bank. "Those were key themes," she said, summing up this year's LBMA conference last Tuesday evening, writes Adrian Ash at BullionVault. We could hardly ignore those issues, meeting in the hills just west of Rome with 700 other delegates for the London Bullion Market Association's annual jolly. From Monday night's dinner on top of Monte Mario, the dome of St.Peter's dominated the view. And any asset which doesn't pay an income, and which has fallen in price for more than two years, must look like a "hold-n-hope" investment based more on prayer than cold logic. Instead of "faith and religion" however, we had already scribbled down "trust and independence" as the LBMA conference's key themes. Because where Dr.Tully heard whispers of eternal beliefs – here in God (or gods), there in gold – we nearly had to cover our ears from all-too worldly shouting over safety and sovereignty, confidence and freedom. Gold forms a triangle with these ideas throughout history. Trust and independence met gold again last week in Rome. Because today's oh-so-modern mob of taxpayers, government officials, lenders, traders, high priests and the rest still need to trust each other but also demand independence as they skip through the forum. And as the oh-so-sociable LBMA conference showed, the way that gold and silver are treated speaks to people's trust in each other, and their freedom to act as they choose. Take central bankers. They tend to sell gold when it's cheap, and buy or hold when it's not. "This," as Blackrock's Terence Keeley rightly noted to the LBMA conference, "is no way to diversify your portfolio."  But central-bank gold is about much more than smoothing returns or improving your efficient frontier. It's about independence, even if that independence puts the central bank's trust in other institutions in doubt. Institutions such as, say, the monetary union you're publicly working to deepen and develop. Not that any of the six current or former central bankers addressing the LBMA conference last week dared say any such thing. Nothing too blatant was given away. But you didn't need rolling translation to hear what was said. "Trust is a central bank's most valuable asset," announced keynote speaker Salvatore Rossi of the Banca d'Italia. Only just behind that, he seemed to suggest, gold came a close second. And given Italy's recent history with gold, it certainly seems to support the central bank's trust amongst the general public. Because as Rossi said, gold so plainly supports the bank's independence from government. "I don't need to remind you of gold's unique role in central bank reserves," said Rossi, nevertheless reminding the 700-odd delegates to the LBMA's two-day meeting in Rome that gold is "unique amongst risk assets" because it is not "issued" by anyone. So it carries no liability and needs no counterparty for its inherent value. Just as importantly, the central bank of Italy's director general also pointed to "psychological reasons" for gold's key role. So did Clemens Werner of the Bundesbank, the world's second-heaviest gold owner behind the United States. More than 40 years after the final gasp of the Gold Standard and eight decades after that monetary system really hit the skids, he named "confidence" and "precaution" as the big reasons for continuing to hold gold. Because as Italy's Rossi went on in his speech, gold "enhances resilience" in the central bank's reserves overall, typically rising when other risk assets plunge. More notably, gold "underpins the independence of the central bank" from government. Quite how, Rossi didn't say. But with Silvio Berlusconi trying to destroy Italy's government just a few minutes cab-ride away, the point was plain enough if you knew the history. Il Cavaliere came after the Banca d'Italia's gold in 2009. He was told where to go. The central bank's big friends at the European Central Bank then told Berlusconi where to go, too. Trying to tax the central bank's unrealized profits on gold was illegal under the Euro treaty, breaching line after line of the critical "independence" from government which national central banks must retain. Italian central-bank governor Mario Draghi has since moved into the job of ECB chief. So his stand against Berlusconi's failed gold bullion tax grab looks a good template for how the ECB, and the biggest gold-owning central banks of the Eurosystem, might view their gold reserves today. Most definitely, none of Germany or Italy's gold is up for sale this year. Alexandre Gautier said the same of France's hoard. But then again, the Banque de France said that in the late 1990s, only to break ranks and take advantage of rising prices in the early Noughties. Gautier also spoke last week about trading and lending (this was a business conference, after all), but only to say the former is now very limited, while the latter is off the table. Not until gold borrowers come up with collateral. Which is unlikely but necessary now that – compared with 10 or 15 years ago, when lending European central-bank gold was all the rage (as was selling it, at least outside Rome and Frankfurt) – "the environment is totally different. I'm not sure it could be acceptable for a 1-year loan without collateral." Which brings us back to trust...to be continued in Part II |

| Wave Of The Future Investment From The Ground Up: Byron King Posted: 09 Oct 2013 11:50 AM PDT An increasingly high-tech world is on the horizon, but technological revolution can't take place without the right materials, especially graphite and platinum group metals. This is where mining, one of the oldest industries in human history, comes in. In this interview with The Metals Report, Byron King, editor of the Energy & Scarcity Investor and Outstanding Investments newsletters, profiles companies poised to deliver graphite and platinum group metals to tech companies working to change the way we communicate, travel and harness energy. The Metals Report: Byron, you recently visited Lawrence Livermore National Lab in California. What did you see there that could affect our lives in the next decade? Byron King: The focus of my visit was a massive physics experimental project known as the National Ignition Facility, or NIF. It uses laser beams to simulate the effects of almost incomprehensibly powerful phenomena like |

| Jim Sinclair: Hold Your Gold & Get Out of the System! Posted: 09 Oct 2013 11:30 AM PDT

With an official US debt default growing closer by the hour, Jim Sinclair has sent yet another email alert to subscribers warning them to hold on to their gold bullion, and to get out of the banking system NOW. Sinclair states that gold is a unique currency that becomes money when fiat money fails, and [...] The post Jim Sinclair: Hold Your Gold & Get Out of the System! appeared first on Silver Doctors. |

| Did gold stop to respond to the U.S. dollar price moves? Posted: 09 Oct 2013 11:02 AM PDT Some investors buy gold as a safe haven or alternative to the U.S. dollar. However, looking at a chart of gold, it seems that these circumstances have had a limited effect on the gold market. |

| Gold challenging significant support level Posted: 09 Oct 2013 11:00 AM PDT alpari |

| Silver price climbs to two-week highs, ETF inflows and coin sales remain robust Posted: 09 Oct 2013 10:40 AM PDT Silver prices rallied to their highest value in more than two weeks. The value of silver exchange-traded fund too has surged since August. |

| Yellen's Fed news fails to shake gold's lethargy as Goldman targets $1,050 Posted: 09 Oct 2013 10:30 AM PDT The wholesale price of gold gave back this week's 1.4% gains Wednesday morning in London, dropping below $1.310 per ounce as European shares recovered earlier losses. Commodities ticked lower, as did non-U.S. government bonds, while silver followed gold lower, but retained a 1.0% gain for the week so far. |

| India’s near-record silver demand Posted: 09 Oct 2013 10:19 AM PDT According to GFMS India imported 4,073 tonnes of silver, in the first seven months of the year. This was double 2012′s total but has not topped the record 5,048 tonnes in 2008. |

| Rick Rule: Eric Sprott Believes His Portfolio Will See 15 to 20 Baggers in the Next 12 Months Posted: 09 Oct 2013 10:00 AM PDT

Rick Rule: "Eric Sprott…is as aggressive as I have seen him since the year 2000…he is as is his style, the style that has made him a billionaire, very aggressively going into the marginal junior producers…companies that barely make money at $1400, but would be making $800 or $900 an ounce if the gold price [...] The post Rick Rule: Eric Sprott Believes His Portfolio Will See 15 to 20 Baggers in the Next 12 Months appeared first on Silver Doctors. |

| Goldman tells clients to sell gold; did same in November 2007, gold then rose 12% Posted: 09 Oct 2013 09:43 AM PDT Gold is a "slam dunk" sell for next year because the U.S. economy will extend its recovery after lawmakers resolve stalemates over the nation's budget and debt ceiling, Goldman Sachs Group Inc.'s Jeffrey Currie said yesterday on a panel in London. |

| Do Not Express The Value Of Gold In Monopoly Money Posted: 09 Oct 2013 09:23 AM PDT In his latest article, Richard Geene explains that the main reason that the masses ignore the inevitable failure of fiat money systems, such as that which is employed by the US and virtually the rest of the world today, is because just prior to their demise, they have more recently been remembered for generating a widespread period of prosperity that has enriched its supporters, if not the masses as well. The fundamental flaw in a fiat money system can be summed up as human nature. When the going gets rough, the rough start printing. (source: Thunder Capital Management) This is nothing new. Monetary history shows that as soon “a country went to a fiat currency there was a period, as long or longer than 30 years, in which it thrived even more. However, during that period of prosperity on a fiat currency, excesses began to build. Once they have built up to extreme levels, it is a very dangerous time. When levels of debt become too excessive, an increasing amount of the rewards of production; profits, must go to servicing debt. When the servicing of debt consumes all of the profits of production, it finally consumes production itself. This is the real culprit for the loss of jobs domestically. As more of the economy shifts from real production of goods, to the pushing of various forms of paper, citizens lose jobs and live in more dangerous times. We have reached that time.” Paper currencies seem normal. They seem natural. We are told they are necessary. Paper currencies with no intrinsic value are used everywhere – we pretend they are valuable. If we don't look closely, or remember the world of 60 years ago, they seem like a good idea. Monopoly money. Euros. Dollars. What is the essential difference? Paper, with no intrinsic value, is accepted only because we have confidence in the issuer of the currency and/or because we have no other choice. Monopoly money can buy hotels on Park Place. Unbacked paper dollars can buy hotels in Manhattan. The hundreds of unbacked paper currencies that have become worthless during the last century can buy NOTHING. If I am playing Monopoly and I change the rules to allow me, and only me, to add $85,000 to my stack of money, it seems likely I will "win" and own more property. Eventually, no one will want to play with me because I created $85,000 of fraudulent Monopoly money. If I am a central banker and I create $85,000,000,000 every month to buy bonds, I will own lots of bonds in a few years. People will eventually realize my $85,000,000,000 per month gives me and my friends an unfair advantage and most others will refuse to play with me except when necessary, and they will certainly seek other "games" that are more fair and less slanted toward the player who can create boatloads of currency from nothing. From Richard Russell: (link)

Should we trust our central bankers? They largely control our financial lives. Inflation, deflation, depression, prosperity, booms, and busts are strongly influenced by banking policies, interest rates, and the availability of currency and credit, all of which are influenced by central banks. Jim Grant: (link)

The world is overloaded with debt. As Bill Bonner said, "To solve the debt problem they added debt! The genius of this plan was, we admit, not immediately obvious." We think it is progressively more obvious that creating a massive quantity of currency each month – say $85,000,000,000 – is helping few outside the financial community and will eventually cause considerable harm to the economy and the purchasing power of the dollar. We all know that:

What are the "solutions" to our massive and unpayable debt conundrum? 1) Increase taxes and pay off the national debt. This will not happen. 2) The "nuclear" option: Default on much of the debt, force most individuals, businesses, and governments into some form of bankruptcy, and thereby liquidate most of the debt and the related paper assets. Politicians will avoid this option. 3) Create a massive inflation and thereby reduce the debt burden. Descriptive words that come to mind are: ugly, dangerous, social upheaval, food riots, bread lines, suicide, tears, anger, homelessness, denial, repression, martial law, and chaos. This is probably the only choice remaining. Hugo Salinas Price: (link)

"The Powers-That-Be" appear to prefer a distracted populace, slowly rising prices, a strong dollar, weak gold prices, and minimal restrictions on their ability to accumulate assets and power. There will be trauma if currencies collapse, gold prices skyrocket, and inflation flies out of control. We can reasonably expect that the governments of the world will "do something" that unfortunately will NOT solve the problems of collapsing currencies and out of control inflation. Michael Noonan: (link)

When paper assets are overvalued, gold and silver prices are likely to be undervalued. How much are paper assets and unbacked paper currencies truly worth? That is a huge question. Consider:

SRSrocco Report: (link)

Will all this economic nonsense – unbacked paper currencies, massive printing (QE) of currencies, gold price manipulation, unregulated derivatives, out-of-control deficit spending, creating more debt to solve an excess debt problem, and so on – work out well for anyone except the financial and political elite? Jim Grant: (link)

So what do we do to prepare – to "prep" for the coming paper currency disaster? Arabian Money: (link)

SO OUR SUGGESTIONS ARE:

Read more: TANSTAAFL, Butter and Silver, The Reality of Gold and the Nightmare of Paper GE Christenson | The Deviant Investor |

| Posted: 09 Oct 2013 09:17 AM PDT It's so stuffed up that losing my head doesn't seem like such a bad idea right now. Regardless, it's not me I'm worried about. The whole world is losing it's head and the near-term future is uncertain. (What a great metaphorical screen shot. Just like "the world", Kathy looks to be puking up her gold!) |

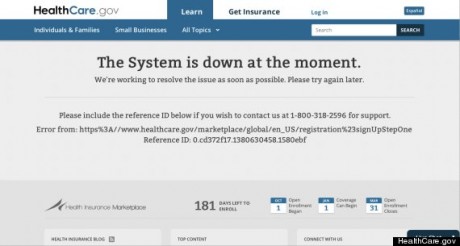

| Has ANYONE Actually Been Able To Successfully Sign Up For Obamacare Yet? Posted: 09 Oct 2013 09:05 AM PDT

Do you know anyone that has been able to get past all of the glitches and sign up for health insurance using one of the Obamacare websites? Thousands of applications have been "started", but the mainstream media has been desperately searching for someone that has actually been able to successfully get enrolled and so far [...] The post Has ANYONE Actually Been Able To Successfully Sign Up For Obamacare Yet? appeared first on Silver Doctors. |

| Did Gold Stop Responding to the U.S. Dollar Price Moves? Posted: 09 Oct 2013 08:36 AM PDT SunshineProfits |

| Where’s the fire fueling gold? Posted: 09 Oct 2013 07:58 AM PDT Gold took quite a beating in September, bucking its seasonal average monthly return of 2.3%. The political battle between President Barack Obama and Congress, China's Golden Week, and India's gold import restrictions likely weighed on the metal. |

| Former Assistant Treasury Secretary: Obama Will Seize Total Power to Prevent US Default Posted: 09 Oct 2013 07:45 AM PDT

You can forget about any default in the debt ceiling crisis. Former Assistant Treasury Secretary Dr. Paul Craig Roberts says, "The debt ceiling will be raised. No government wants to lose its power or lose its ability to borrow. So, if they don't raise the debt ceiling, it is just a way of Washington committing [...] The post Former Assistant Treasury Secretary: Obama Will Seize Total Power to Prevent US Default appeared first on Silver Doctors. |

| Final Nail in the Hyperinflation Coffin Posted: 09 Oct 2013 07:43 AM PDT It's Wednesday morning, and I may have to be carted out to the loony bin! Last night, at roughly 9:00 PM EST, it was reported Janet Yellen will in fact be nominated to be the next Federal Reserve Chairman. This was possibly the most widely expected – and nation-destroying – decision since Obama was given the Democratic nomination for re-election in 2012. However, the MSM acts as if it was a big surprise! Amazingly, Kitco has the gall to spin this decision as good for the dollar; which happens to be up a whopping 0.4%, to 80.37 (how many times have I told you that no KEY ROUND NUMBER is defended more than 80 on the "dollar index?). And this, despite top MSM lackeys Yahoo! Finance and Bloomberg both posting stories (in the former case, its "top story" clearly calling out Yellen for the uber-dove she is – with quotes such as this…

As for me, I have written endlessly of how Yellen is infamous for suggesting the Fed temporarily abandon its "dual mandate" of controlling inflation and unemployment rate – in order to focus solely on the latter for as long as it takes. Yet, Kitco – the supposed PM advocate, has as its own "top story" the most foolish headline of all time; "Gold dips as Yellen lifts dollar; US shutdown underpins." Yes, gold "dipped" by nearly $11/oz. this morning – with no other market budging – but not until 5:00 AM EST – nine hours after the announcement – when it suddenly WATERFALL DECLINED in London PAPER trading for no reason; followed by another $6/oz. WATERFALL DECLINE at 6:00 AM EST, just before the COMEX open. Again, whilst no other market budged. And how about silver falling 1.5% in just two minutes – for the millionth time this month, pushing it below the Cartel's current "line in the sand" at $22/oz. Oh yes, "free market trading" at its best, yet as easy to predict as rain in Seattle; given the HUI was inconspicuously hammered for 3% yesterday; whilst gold and silver were unchanged…

Apparently, government fear of Precious Metals has reached supernatural proportions; as just last month – when it was announced that supposed inflation "hawk" Larry Summers withdrew his Fed Chairmanship candidacy – gold was smashed as well; also just after the London PAPER opening, as the Cartel's now six-week long "line in the sand" at $1,330/oz was about to be breached. To wit, such blatant attacks belie the fact that Janet Yellen's nomination solidifies the Fed's commitment to "QE to Infinity" – which, by the way, will likely be validated this afternoon when the September 18th FOMC minutes are released (remember, gold has been attacked on essentially EVERY FOMC minutes release date this year, despite the fact the Fed continues with QE4 in full force). In choosing Yellen, the nation has indeed hammered the FINAL NAIL into the HYPERINFLATION COFFIN; as given her background as the ultimate banker lackey, there is literally NOTHING she won't do to maintain the status quo of UNLIMITED MONEY PRINTING. Given such information – and historically low prices, well below the cost of production – how on Earth can one not act now to PROTECT THEMSELVES with the historically-proven track record of PHYSICAL Precious Metals?Similar Posts: |

| Stewart Thomson: Silver Leads Gold Higher Posted: 09 Oct 2013 07:00 AM PDT

At this stage in the super-crisis, rising bond prices are bullish for gold. That should change, but not for several years. Demand for silver could be even stronger than for gold, and the most recent price action shown by gold’s "little brother" is superb. Submitted by Stewart Thomson: Chinese investors should be back on the [...] The post Stewart Thomson: Silver Leads Gold Higher appeared first on Silver Doctors. |

| Goldman Tell Clients To Sell Gold - Did Same In Nov 2007, Gold Then Rose 12% Posted: 09 Oct 2013 06:01 AM PDT gold.ie |

| TF Metals Report: Goldman buys gold after panicking speculators to sell Posted: 09 Oct 2013 06:01 AM PDT GATA |

| COMEX Gold Inventories Steady Overall With 40,000 Ounces Moved Out of Deliverable Category Posted: 09 Oct 2013 06:00 AM PDT Le Cafe Américain |

| Think Twice Before Burying Your Gold In The Back Yard Posted: 09 Oct 2013 05:44 AM PDT You may own your home, but unlike Uncle Jed Clampett you probably don’t own the ground underneath it… D. R. Horton owns your vector gold. You get to keep the “swimming pools… movie stars” but they get the gold, oil and gas plus you will need to buy the groundwater from them to fill up your pool. |

| Goldman Tell Clients To Sell Gold – Did Same In Nov 2007, Gold Then Rose 12% Posted: 09 Oct 2013 05:09 AM PDT The crystal ball gazing of Wall Street banks and hedge funds and others who have suggested gold is a bubble in recent years has cost many of the investment public dearly. As ever, it remains wise to ignore the considerable noise that emanates from Wall Street and maintain a healthy, long term allocation to physical gold. Today's AM fix was USD 1,309.50, EUR 968.28 and GBP 819.77 per ounce. Gold fell $3.00 or 0.23% yesterday, closing at $1,319.40/oz. Silver inched down $0.03 or 13% closing at $22.30. Platinum climbed $7.69 or 0.6% to $1,399.99/oz, while palladium rose $9.37 or 1.3% to $710.37/oz.

Gold ticked lower today as the U.S. budget impasse dragged on for a second week and threatened to spill over to talks about raising the U.S. debt ceiling, boosting the metal’s safe-haven appeal. President Obama, Republican and Democrat politicians remain intransigent and President Obama said yesterday he would negotiate on budget issues only if they agree to re-open the federal government and raise the debt limit with no conditions. Today, Obama will announce his intent to nominate Federal Reserve Vice Chairwoman, Janet Yellen, to be the next head of the U.S. central bank, a White House official said. Yellen is extremely dovish and will continue to debase the dollar which will be very positive for gold. Indian silver imports are on pace to hit a record high this year as the wedding and festival season drives up buying of the precious metal instead of traditional gold, made scarcer and dearer by misguided punitive taxes and quasi capital controls aimed at preventing Indian people from buying gold to protect from the devaluation of the rupee. Despite these punitive taxes, India’s gold demand could rise as much as 15% this quarter to 300 tonnes as pent-up demand following a good monsoon keeps the country on track for yearly demand estimated at 1,000 tonnes. Gold is a "slam dunk" sell for next year because the U.S. economy will extend its recovery after lawmakers resolve stalemates over the nation's budget and debt ceiling, Goldman Sachs Group Inc.'s Jeffrey Currie said yesterday on a panel in London. "The bank has a target for gold prices next year at $1,050 an ounce," said Currie, Goldman Sachs's head of commodities research..

It is worth remembering that Goldman, to much fanfare and media attention, "told clients" in November 2007, to sell gold. On November 29, 2007, Goldman recommended that investors sell gold in 2008 and it named the strategy as one of its 'Top 10 Tips' for the year. Gold subsequently rose nearly 6.4% in December 2007 alone – from $783.75/oz to $833.92/oz. Gold then rose another 5.8% in 2008 – from $833.92/oz at the close on December 31, 2007, to close at $882.05/oz on December 31, 2008. Gold rose 12.2% in the 13 months after Goldman’s sell gold call. Gold then rose 23.4% in 2009, 27.1% in 2010, 10.1% in 2011 and 7% in 2012. Thus, proving Goldman's 'Top Tip' prediction absolutely wrong and costing their clients and many of the unsuspecting public a lot of money in the process. At the time, Goldman cut its gold forecast to $740/oz from $810/oz on a 12 month basis. One year later, gold closed at $882.05/oz – more than 19% above Goldman's 'forecast'. The crystal ball gazing of Wall Street banks and hedge funds and others who have suggested gold is a bubble in recent years has cost many of the investment public dearly. As ever, it remains wise to ignore the considerable noise that emanates from Wall Street and maintain a healthy, long term allocation to physical gold.

A buy and hold strategy, while difficult in recent months, will continue to reward the prudent. In these uncertain times, all owners of gold and those considering owning gold should acquaint themselves with the most appropriate storage options for their own particular circumstances. GoldCore's ebook How To Store Gold Bullion - The Seven Key Must Haves is a must read in this regard Download here. |

| Gold may recover if stalemate continues in debt negotations: ETFS Posted: 09 Oct 2013 05:06 AM PDT The gold price fell last week despite the US government shutdown, a weaker dollar, and generally weaker than expected US economic data, indicating that short term investors continue to engage in “buy the rumor, sell the fact†gold trading activity. |

| As Budget Stalemate Hostilities Escalate, Obama Starts to Brandish Default Threat Posted: 09 Oct 2013 02:32 AM PDT This is Naked Capitalism fundraising week. 419 donors have already invested in our efforts to shed light on the dark and seamy corners of finance. Join us and participate via our Tip Jar or another credit card portal, WePay in the right column, or read about why we’re doing this fundraiser and other ways to donate, such as by check, as well as our current goal, on our kickoff post. And read about our current target here The confrontation underway in Washington DC isn’t as deadly as the Cuban Missile crisis. But in many ways, a misstep could be would produce collateral damage is hard to estimate but would unquestionably be large. So given the stakes, it’s remarkable to see Obama prove his manhood by telling those Republicans he isn’t not intimidated by the possibility of default; it may be presented in “no drama Obama” lecturing, but his message remains that he’s not going to be the one to steer out of this game of chicken. From the Financial Times:

And Politico tells us that, as we anticipated, both sides are simply digging in harder in their entrenched positions:

As this stalemate progresses, the ugly truth is becoming more and more obvious: there is no bargaining space where the two sides’ interests overlap, short term or long term. On the

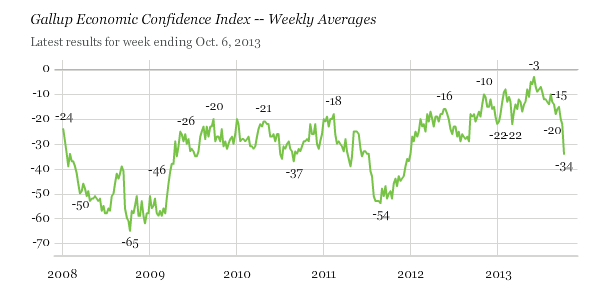

Paul Krugman recaps the views of various camps in the right-wing punditocracy, but they are variants of two themes: that either the damage done by a default (which might mean a default on Social Security payments rather than Treasuries) is being exaggerated by the Democrats, and that those profligates need to have that government tit taken away from them (this from representatives in red states that are net financial beneficiaries of Federal taxation and spending). The latter position is dressed up in proper Peterson Institute “we need to live within our means” packaging, but it’s an intellectually respectable cover for the apocalyptically-minded among the Republican base. As we’ve stressed, both the evangelicals and the Tea Partiers see government (and society generally) as corrupt, and if they can’t get their way, they believe they will do better if they wreck the entire system. So even if the doomsters are right and Obama were unsuccessful in escaping a Treasury default, many would say that a global financial meltdown would be a survivable event and would cleanse the system. They’ve got no idea what they are asking for. We are already seeing damage from the first week of the Federal shutdown. Gallup tells us Weekly Drop in U.S. Economic Confidence Largest Since ’08

And mind you, this poll is as of the end of last week. There is no way were are going to have a resolution of this impasse this week; we’ll be lucky if there’s one by the end of next week. And even though the Republicans are caucusing internally, they aren’t agreed on how to proceed, so the lack of cohesiveness is a further impediment to dealmaking. I could well be proven wrong, but I don’t see Boehner conceding to Obama and letting his 20 or so moderate Republicans join the House Democrats to pass a continuing resolution and/or a deficit ceiling extension while the to-ing and fro-ing is still in process (meetings are scheduled for Wednesday, but the internal fissures seem so large that any agreement within the party is likely to take longer to hammer out). My guess continues to be he needs the excuse of a market upheaval or more evidence (economic or political) that the shutdown is doing damage before he’d pull that ripcord. Note that Obama is still trying to get a short-term extension with the carrot of a Great Betrayal (which is framed as a bigger but yet to be determined deficit-cutting deal). But even if the Republicans get out of their own way and seek to exit the corner they’ve gotten themselves into, I don’t see how we get to a deal in four to six weeks. As much as Obama really really really wants his Great Betrayal, he also wants his tax increase fig leaf and won’t budge on Obamacare. And the Democrats are also likely to want lower cuts than were on the table last year, given how deficit levels were falling over the course of the year. So even if Even though the stock market and gold did not react all that much today, it would be a mistake to think that investors aren’t getting rattled. MacroBusiness pointed out that the VIX rose to 20% and short-duration Treasuries have also suffered a wild ride. And while the markets continue to discount that the folks in DC would be so deranged as to default, pundits are pointing out how even getting this close to the brink will have long-term consequences. And let us not forget that if this impasse goes past October 17, which looking more and more likely, that the consequences of cutting off government spending and services even more radically to preserve the ability to ability to service debt will be tantamount to suddenly signing on to an IMF austerity program. If you thought the shutdown was ugly, you ain’t seen nuthin’ yet. Now the Administration might plan to alleviate the severity of debt-ceiling inflicted spending limits by having the Fed use its “unusual and exigent circumstances” authority to monetize debt (I’m assuming Obama and Bernanke would wait for the deus ex machina of market upset to provide air cover). But even austerity lite would be ugly on top of the partial shutdown spending reductions. And a final thought: Obama and the Democrats are confident that the Republicans will lose seats in the House if they keep refusing to blink on budget brinksmanship. But what happens if the game of chicken continues and we get a deeper economic downdraft as a result? Bill Clinton’s explained his 1992 campaign as “It’s the economy, stupid.” If the economy takes a hit next year, which seems certain, and the fact set is more complicated than just a Republican-induced showdown, I’m not certain the Democrats will escape blame. The incumbent Administration is generally seen as responsible for the state of the economy. If voters come to see the wrangle in “a pox on both their houses” terms, it could take more out of the Democrats than they now anticipate. |

| China Imports 110 Tonnes of Gold Through Hong Kong in August Posted: 09 Oct 2013 02:22 AM PDT "This situation is being allowed to persist until China has all the gold they want/need" ¤ Yesterday In Gold & SilverThe gold price chopped sideways in a tight range during Far East trading, but once London opened, the high-frequency traders swung into action and the low tick of the day came shortly after the 8:20 a.m. EDT Comex open. From that point the price rallied to its high at the London p.m. gold fix. The price got capped at that point, and then got sold down to its afternoon low just minutes after 3 p.m. in electronic trading. After that it traded sideways into the close. The CME recorded the low and high price ticks in the December contract as $1,315.40 and $1,330.80 respectively. Gold closed in New York at $1,318.90 spot, down $3.50 on the day, which was obviously well off its high. Volume was about a third higher on Tuesday than it was on Wednesday at 132,000 contracts vs. 99,000 contracts. It was pretty much the same for silver, with the low tick coming at, or minutes after, the 8:20 a.m. Comex open in New York. The subsequent rally ran into a not-for-profit seller at 9 a.m. as the price went vertical. The high came just minutes before the London close and, like gold, it was all down hill from there. The CME lows and highs for the December contract were $22.11 and $22.525 respectively. Silver closed at $22.29 spot, down 6 cents from Monday's close. Net volume was around 34,000 contracts, and only a hair higher than Monday's volume. Here's the New York Spot Silver [Bid] chart on its own, so you can see the price action in more detail. Platinum didn't do much yesterday, but palladium went on a bit of tear, but it was as equally obvious that the price was being capped at the $715.00 spot price point. Here are the charts. The dollar index closed late Monday afternoon at 79.92, and spent the day trying to get above, and stay above, the 80.00 mark. It just about made it, closing the Tuesday session at 79.99, up a whole 7 basis points. Once again there no relationship between the currency moves and the price action in both gold and silver. The gold stocks opened unchanged, and then began a long, slow slide that gathered steam after 2:30 p.m. in New York. The stocks finished the Tuesday trading session just off their lows. The HUI closed lower by 2.97%, giving back all of Monday's gains, plus another percent on top of that. The silver stocks got crushed, as Nick Laird's Intraday Silver Sentiment Index closed down a whopping 3.88%, giving up all of Monday's gains, plus another 2.2 percentage points on top of that. The CME's Daily Delivery Report for Tuesday is hardly worth mentioning, as only 2 gold and 1 silver contract were posted for delivery on Thursday. Nothing to see here. There was another withdrawal from GLD yesterday. This time it was 57,920 troy ounces. And as of 10:02 p.m. EDT yesterday evening, there were no reported changes in SLV. The U.S. Mint had another sales report yesterday. They sold 1,000 ounces of gold eagles and another 194,500 silver eagles. There wasn't much in/out activity in gold over at the Comex-approved depositories on Monday. They reported receiving 7,417 troy ounces, and shipped 780 troy ounces out the door. The link to that activity is here. And there was more big activity in silver on Monday, as these same depositories received 742,722 troy ounces and shipped out 898,202 troy ounces. The link to that action is here. The big news yesterday were the August gold import numbers for China. Here are the updated charts courtesy of Nick Laird over at sharelynx.com. The first one shows the monthly import data, and the second one is the yearly import data, with the bar for 2013 representing year-to-date imports. If they keep up this pace, China will import around 1,200 tonnes of gold through Hong Kong in 2013, which represents about half of all the gold that will be mined this year. And those are the gold imports we know about, plus they absorb the 400+ tonnes a year of their own mine production on top of that. Along with Indian imports, these two countries on their own will absorb about 90% of world mine production this year. This prima facie data begs the question: What central bank vaults are providing the physical gold demanded by every other country on Planet Earth this year? I have somewhat fewer stories for you today, but a lot of must read precious metal stories, so I hope you can find the time to read the ones that interest you. ¤ Critical ReadsLargest Collapse in Economic Confidence Since LehmanU.S. economic confidence plunged more in the past week than in any week since the collapse of Lehman Brothers on September 15, 2008 — the catalyst for the financial crisis and U.S. recession. Gallup's Economic Confidence Index fell 12 points to -34 last week thanks to the government shutdown. Fiscal brinksmanship has been a major drain on economic confidence in the past. This short commentary was posted on the businessinsider.com Internet site yesterday morning EDT...and today's first story is courtesy of Roy Stephens. Rydex Ratio in the Danger ZoneThe Rydex Ratio has reached a level where it is telling us that sentiment is too bullish, and that stock prices are vulnerable. The Rydex Ratio gives a view of sentiment extremes using using the totals of assets in Rydex mutual funds. It is calculated by dividing Money Market Assets plus Bear Funds Assets by Bull Funds Assets. We display the indicator with the scale reversed so that interpretation can be more intuitive. The unique feature of the Ratio is that it measures sentiment based upon where people are actually deploying real money, not just an opinion poll. Currently, the Ratio has reached the top of the normal extreme range, and at this level we should be looking for a price decline. But wait, there already has been a price decline from the September top, and the Ratio has moved even higher during the price pullback. This is not a rational response by investors, and suggests there will be a stronger downside reaction when investors decide that buying into a decline isn't working. This tiny commentary by Carl Swenlin was posted on the financialsense.com Internet site last Friday, and the chart alone is worth the trip. I thank reader U.D. for sending it our way. Billions in Debt, Detroit Faces Millions in Bills for BankruptcyThis city is learning that it is expensive to go broke. Even as it wrestles with the $18 billion of debt that has overwhelmed it, Detroit has already been billed more than $19.1 million by firms hired to sort through that debt, search for ways to restructure it, and now guide the city through court. That does not include more costs that the city is expected to bear for the support staff for its state-appointed emergency manager, and for another set of lawyers and consultants to represent city retirees. “It’s just ridiculous,” Edward L. McNeil, an official with the local council of the American Federation of State, County and Municipal Employees, said of the mounting costs. “The only thing that’s getting done is that these people are getting paid big-time while the citizens of Detroit are getting ripped off.” This New York Times story from Monday is courtesy of Phil Barlett. He slid it into my in-box in the wee hours of yesterday morning, but I was already full up in my Tuesday column, so here it is now. Obama Will Nominate Janet Yellen For Fed Chair TodayAssuming she is confirmed (which should be easy) the post will make Yellen the most powerful woman in American history, as the Fed has tremendous independence and influence on the US and world economies. Obama will announce her nomination Wednesday at 3 p.m. during an event in the East Room of the White House, the official said. It doesn't matter who they pick, the entire economic, financial and monetary system is done for anyway. This news item was posted on the businessinsider.com Internet site early yesterday evening EDT...and it's the second story of the day from Roy Stephens. NSA's Utah Spy Supercenter Crippled By Power Surges Long before Edward Snowden's whistle-blowing revelations hit the world and the Obama administration's approval ratings like a ton of bricks, we ran a story in March 2012 which exposed the NSA's unprecedented domestic espionage project, codenamed Stellar Wind, and specifically the $1.4+ billion data center spy facility located in Bluffdale, Utah, which spans more than one million square feet, uses 65 megawatts of energy (enough to power a city of more than 20,000), and can store exabytes or even zettabytes of data (a zettabyte is 100 million times larger than all the printed material in the Library of Congress), consisting of every single electronic communication in the world, whether captured with a warrant or not. Worsening Debt Crisis Threatens Puerto RicoWhile Detroit has preoccupied Americans with its record-breaking municipal bankruptcy, another public finance crisis on a potentially greater scale has been developing off most Americans’ radar screens, in Puerto Rico. Puerto Rico has been effectively shut out of the bond market and is now financing its operations with bank credit and other short-term measures that are unsustainable in the long run. The biggest concern is that the territory, which has bonds that are widely held by mutual funds, will need some sort of federal lifeline, an action for which there is no precedent. Puerto Rico, with 3.7 million residents, has about $87 billion of debt, counting pensions, or $23,000 for every man woman and child. That compares with about $18 billion of debt for Detroit, with a little more than 700,000 people, or about $25,000 for every person in the city. Detroit and Puerto Rico have been rapidly losing population, leaving a smaller, and poorer, group behind to shoulder the burden. This news item, filed from San Juan, was posted on The New York Times website on Monday evening...and it's definitely worth reading. It's the second offering of the day from Phil Barlett. IMF Cuts Global Growth Forecast, Warns of Prolonged StuporThe International Monetary Fund expressed guarded optimism about the state of the global economy on Tuesday, even as it trimmed its forecasts for output and warned about the catastrophic impact of a potential U.S. debt default. In its latest global economic snapshot, the IMF cut its world growth forecasts for the sixth straight time in less than two years, saying a stronger performance in most advanced economies would fail to make up for a more sluggish expansion in the developing world. Prospects for emerging markets, long the engine of the global recovery, have dimmed somewhat with both structural and cyclical factors at play, the IMF said. This news item, filed from Washington, was posted on The New York Times website early yesterday afternoon EDT...and is certainly worth the read. It's the third and final offering of the day from Phil Barlett. The story now has a much friendlier headline, as it has been changed to read "IMF Says Global Economy Healthier, but Still Weak". IMF sours on BRICs and doubts eurozone recovery claimsThe International Monetary Fund has thrown in the towel on emerging markets. After years of talking up the BRICS club of Brazil, Russia, India, China, and South Africa, it now admits that these countries have either exhausted their catch-up growth models, or run into the time-honoured problems of supply bottlenecks and bad government. The Fund has cut its forecast for the developing economies by 0.5pc to 4.5pc this year in its latest World Economic Outlook, and by 0.4pc to 5.1pc next year. The 2013 estimates have been slashed by 1.8pc for India, for Mexico by 1.7pc, and 1pc in Russia, compared to forecasts made in April. Similar damage is expected for Turkey, Indonesia, Ukraine, and others with big trade deficits as details are fleshed out. The IMF was caught off guard by the ferocity of the emerging market rout when the Fed began to talk tough in May, threatening to turn down the spigot of dollar liquidity that has fuelled the booms -- and masked the woes -- in Asia, Latin America, and Africa. In what amounts to a mea culpa, the IMF hinted that it had for long been blind to festering problems in the BRICS and mini-BRICs. This is the same IMF story as discussed in the NYT article above it, but stripped naked by Ambrose Evans-Pritchard, as he pulls no punches here. This article was posted on the telegraph.co.uk Internet site early yesterday evening BST...and I thank Ulrike Marx for bringing it to our attention. It's definitely worth reading. U.S. moves Marines to Italy as situation in Libya becomes tenseTwo hundred United States Marines are being mobilized from a base in Spain to an Italian site neighboring Libya where an Army raid over the weekend resulted in the capture of suspected Al-Qaeda terrorist, Abu Anas al-Libi. CNN reported early Tuesday that a US military official confirmed the repositioning of 200 heavily armed Marines to the naval base at Sigonella, Italy, a Sicilian fort south of Catania that sits on the opposite side of the Mediterranean from Libya. This news story was posted on the Russia Today website yesterday afternoon Moscow time, which was about 8 a.m. in New York. My thanks to Roy Stephens for sending it along. Three King World News Blogs1. John Embry: "U.S. Propaganda is a "Smokescreen" For a Catastrophic Problem". 2. Dr. Paul Craig Roberts: "Former U.S. Treasury Official - President to Seize Total Power". 3. Egon von Greyerz: "Governments Will Start Panicking as Chaos and Crisis Accelerate". [Although I post all of Eric King's interviews, I wish to go on the record as saying that I don't necessarily agree with everything that's said by some of his guests. - Ed] China's gold imports from Hong Kong remain above 100 tonnes in AugustChina's net gold purchases from Hong Kong fell 5 percent in August from the previous month, but were sti |

| Largest Collapse in Economic Confidence Since Lehman Posted: 09 Oct 2013 02:22 AM PDT U.S. economic confidence plunged more in the past week than in any week since the collapse of Lehman Brothers on September 15, 2008 — the catalyst for the financial crisis and U.S. recession. Gallup's Economic Confidence Index fell 12 points to -34 last week thanks to the government shutdown. Fiscal brinksmanship has been a major drain on economic confidence in the past. This short commentary was posted on the businessinsider.com Internet site yesterday morning EDT...and today's first story is courtesy of Roy Stephens. |

| IMF sours on BRICs and doubts eurozone recovery claims Posted: 09 Oct 2013 02:22 AM PDT The International Monetary Fund has thrown in the towel on emerging markets. After years of talking up the BRICS club of Brazil, Russia, India, China, and South Africa, it now admits that these countries have either exhausted their catch-up growth models, or run into the time-honoured problems of supply bottlenecks and bad government. The Fund has cut its forecast for the developing economies by 0.5pc to 4.5pc this year in its latest World Economic Outlook, and by 0.4pc to 5.1pc next year. The 2013 estimates have been slashed by 1.8pc for India, for Mexico by 1.7pc, and 1pc in Russia, compared to forecasts made in April. Similar damage is expected for Turkey, Indonesia, Ukraine, and others with big trade deficits as details are fleshed out. The IMF was caught off guard by the ferocity of the emerging market rout when the Fed began to talk tough in May, threatening to turn down the spigot of dollar liquidity that has fuelled the booms -- and masked the woes -- in Asia, Latin America, and Africa. In what amounts to a mea culpa, the IMF hinted that it had for long been blind to festering problems in the BRICS and mini-BRICs. This is the same IMF story as discussed in the NYT article above it, but stripped naked by Ambrose Evans-Pritchard, as he pulls no punches here. This article was posted on the telegraph.co.uk Internet site early yesterday evening BST...and I thank Ulrike Marx for bringing it to our attention. It's definitely worth reading. |

| China's gold imports from Hong Kong remain above 100 tonnes in August Posted: 09 Oct 2013 02:22 AM PDT China's net gold purchases from Hong Kong fell 5 percent in August from the previous month, but were still above 100 tonnes for a fourth straight month, as strong demand for jewellery and bars persisted in the world's second-biggest bullion consumer. Net gold flows into China - excluding imports by Hong Kong from China - hit 110.505 tonnes in August, compared with 116.385 tonnes in July, data from the Hong Kong Census and Statistics Department showed. China's net gold imports from Hong Kong have totalled 744.818 tonnes for the first eight months of the year, while India's purchases as of August stand at a little less than 600 tonnes. |

| China’s unstoppable gold imports continue virtually unchecked Posted: 09 Oct 2013 02:22 AM PDT People have been predicting that imports of gold into China would slow down – well August figures suggest they may have, but only by a minute 3 tonnes compared with a month earlier, and the country remains on track to comfortably exceed 1,000 tonnes of known net gold imports for the year, with a total of 723 tonnes imported via Hong Kong for the first eight months. Extrapolating this over the full year would give a total import figure (via Hong Kong alone) of 1,084.5 tonnes. On the evidence of the past six months’ import figures, the full year total could be quite a bit higher if recent momentum is sustained – and there’s no real sign of it slowing down, at least not yet – it seems more likely that the full year figure could well end up at more like 1,150 tonnes. Certainly, in past years, imports have tended to rise as the year progresses, which means that even this number could be a conservative estimate. This must read commentary by Lawrence Williams was posted on the mineweb.com Internet site early yesterday morning BST...and once again I thank Ulrike Marx for finding it. |

| India's gold demand to rise by 15% in Q4 2013 to up to 300 tonnes: WGC Posted: 09 Oct 2013 02:22 AM PDT India's gold demand is likely to increase by over 15 per cent during the last quarter of this year to up to 300 tonne from last year on account of good monsoon and 20 per cent more auspicious days this festival season, the World Gold Council (WGC) said today. |

| Luxury-focused Indians swing for gold Posted: 09 Oct 2013 02:22 AM PDT Demand for luxury items in the country is akin to India's insatiable appetite for gold. A new report has identified that India was the most dynamic luxury market from 2008 to 2013, and is forecast to grow by a further 86% in constant value terms over the next five years to 2018, followed by China at 72%. Though China is whetting the emerging market appetite of the world’s leading luxury goods companies, India has turned out to be the fastest growing market and is predicted to grow by a massive 163% in constant value terms between 2012 and 2017, to reach a value of $7 billion, according to a new Euromonitor study. As far as product categories are concerned, jewellery has recorded the fastest growth trend across both nations. The must read stories from Ulrike Marx just keep on coming. This one, also filed from Mumbai, was posted on the mineweb.com Internet site yesterday. |

| Sprott's Thoughts: India Will Dominate the Silver Market in 2013 Posted: 09 Oct 2013 02:22 AM PDT With silver falling by 26% so far this calendar year, even factoring in the recent surge, you’d be excused for presuming there were negative fundamentals developing in the market for the white metal. Indeed the fundamentals have been changing, but they all favour the price of silver. Unfortunately for investors, this has not yet been reflected in the price. The most recent import data from the Indian government confirms reports that Indians are importing significant quantities of silver. The latest data, provided to us by Nikos Kavalis from Metals Focus Ltd., shows that India imported US$1.78 billion worth of silver during Q2 – a 311% increase over the same period last year. This equates to 3,015 tonnes of silver in the first half of 2013, putting Indians on track to import more than 6,030 tonnes of silver this year. If this trend continues through the rest of 2013, we would see the highest silver imports in the past five years. As we examined the Indian import data in more detail we saw that silver is coming to India from all corners of the earth to satiate demand. The most notable sources have been the UK, Switzerland and China. Many countries that had not previously shipped the metal to India are also making their first shipments this year. The Indians have become an enormous new buyer of silver, sopping up bullion supply from around the world. Putting these numbers into perspective, according to the Silver Institute, the world produced 24,478 tonnes of silver in 2012, meaning the Indians are currently on track to import 25% of the world’s mined silver supply. And, believe it or not, this number could increase given the forecasts for monsoon season. This commentary by David Franklin was posted on the sprottgroup.com Internet site yesterday and it, too, is a must read. |

| Starved of gold, Indians may import record volumes of silver Posted: 09 Oct 2013 02:22 AM PDT Indian silver imports are on pace to hit a record high this year as the wedding and festival season drives up buying of the precious metal instead of the traditional gold, made scarcer and dearer by official measures aimed at cutting the trade gap. Higher silver demand in the world's biggest buyer may help support prices, which have fallen almost 30 percent this year on the international market and are on track for their biggest annual drop in almost three decades. The increase in buying is unlikely to spark a fresh policy response from authorities, as in the case of gold, since the value of silver that is imported is far lower than that of gold and therefore not critical to the trade balance. This Reuters story, filed from Mumbai, was posted on their website late yesterday afternoon EDT...and I found it embedded in a GATA release. Put this on your must read pile as well |

| Goldman Says Gold "Slam Dunk" Sell, Ready To Buy All Its Clients Have To Offer Posted: 09 Oct 2013 02:22 AM PDT Goldman, which is the hedge fund best known for originating prop order flow in the opposite direction of what its sell-side "research" team tells its clients to do, has never been clearer on gold: "Gold is slam dunk sell for next year because the U.S. economy will extend its recovery after lawmakers resolve stalemates over the nation’s budget and debt ceiling, Goldman Sachs Group Inc.’s Jeffrey Currie said." |

| Looming gold and silver ‘production cliff’ now accelerating: NBF Posted: 09 Oct 2013 02:22 AM PDT In their analysis, NBF suggests a “Production Cliff thesis was looming, now accelerating.” “Production Cliff” is a term used by NBF mining analysts for mining company production profiles that are set to undergo a material contraction that is both rapid and without adequate development projects to offset the decline. “We generally reserve the term for senior producers since this condition applies to most of them as it is a symptom of a landscape where geology presents natural barriers to reserve replacement. A declining discovery rate for very large deposits (+5mn oz.) together with increasingly difficult development logistics where companies explore further afield present nearly insurmountable challenges to simply replace reserves let alone grow production,” said the analysts. NBF predicts that the Production Cliff is likely to occur in 2015, “but, now, with a move to raise cut-off grades we could see an acceleration of this thesis starting in 2014 prior to the market drop-off in 2017+.” The above three paragraphs are the most salient from this commentary posted on the mineweb.com Internet site yesterday...and it's also courtesy of Ulrike Marx. |

| Direct economic impact of gold mining $210 billion plus globally Posted: 09 Oct 2013 02:22 AM PDT A Price Waterhouse Coopers study, commissioned by the World Gold Council (WGC), puts the direct global financial impact of gold mining at some $210 billion – more than the GDP of most countries – yet this could well understate the true impact on the global economy due to restrictions in the terms of reference of the report and if indirect impact is taken into account. Speaking at the global launch of the report this morning in London, Terry Heymann, Director of Gold for Development at the WGC, noted that a significant gold mining industry has the potential to transform the economies of emerging nations in particular. While its impact on the economies of some major countries like China and the U.S.A, the world’s top and No. 3 producers is important, the overall economic impact is less significant because of those countries’ mega economies, but on gold producers with much smaller GDPs, like Papua New Guinea, Ghana and Tanzania the direct contribution of gold mining to the national GDP is very significant indeed at 15%, 8% and 6% respectively. For some of other important gold producers that were analysed in detail but that fall outside the top 15 producing nations (which produce over three quarters of the world’s gold) like Mali, Burkina Faso, Surinam etc. the impact on their economies could be even greater. One can only fantasize about the true economic impact of both gold and silver mining on the world's economy if these metals were allowed to trade at their free-market prices, instead of their current "Made in the U.S.A. by JPMorgan Chase et al" prices they're selling for right now. Gold would be priced out of reach of all but the super rich...and silver would be the new gold. This commentary by Lawrie Williams was posted on the mineweb.com Internet site early yesterday morning BST, and it's worth reading. And if you don't want to read it, then you should at least look at the embedded chart. I thank Ulrike Marx for her final offering in today's column. |

| Peak Gold, Easier to Model than Peak Oil? - Part I Posted: 09 Oct 2013 02:00 AM PDT The Oil Drum |

| Gold Trading at Falling Resistance from August Posted: 09 Oct 2013 01:35 AM PDT fxtimes |

| Gold Forecast October 9, 2013, Technical Analysis Posted: 09 Oct 2013 01:35 AM PDT fxempire |

| Dollar Stuck at June Low as SPX 500 Marks Critical Break Posted: 09 Oct 2013 01:15 AM PDT dailyfx |

| Silver Forecast October 9, 2013, Technical Analysis Posted: 09 Oct 2013 01:10 AM PDT fxempire |

| Gold Responds to Well-Defined Trendline Resistance Posted: 09 Oct 2013 01:05 AM PDT dailyfx |

| Gold Support and Resistance Levels Investors Need to Watch Posted: 09 Oct 2013 01:00 AM PDT minyanville |

| CHARTS - Gold and silver ascending Posted: 09 Oct 2013 01:00 AM PDT invezz |

| Silver ETF: Cup And Handle Potential Posted: 09 Oct 2013 12:45 AM PDT etftrends |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment