saveyourassetsfirst3 |

- “Stay away” from gold, says investment bank Morgan Stanley

- Why gold prices don't reflect fundamentals - Phillips Part 3

- Insiders Are Buying AuRico Gold

- Gold bullion market's big issues, part I

- Festival demand soars, India gold premiums go through the roof

- Stay away from gold Says Morgan Stanley as India doubles silver imports

- Ann Barnhardt: OBAMA DESTROYING DOLLAR, CHINA to TAKE U.S. LAND for Debt

- Yellen does nothing for gold

- U.S. Treasury “firm believers in gold," will not sell even to avoid default

- Trust, not price the concern of central banks - Ash

- Obama Orders Federal Workers To “Make Life As Difficult For People As We Can”

- No Detour For Detour Gold

- Many junior miners won’t survive this fall - McCoach

- Corvus Gold Drills 34m @ 5.4 g/t Gold at Yellowjacket High-Grade Zone

- Jim Sinclair: Default Drama Will See Global Investors Shun Treasuries in 2014

- Precious Metals Markets: The New Wild, Wild West

- Precious Metals Markets: The New Wild, Wild West

- Gold struggles in Frankenstein economy

- Countdown to Panic

- Will The Real Goldman Sachs View On Gold Please Stand Up

- U.S. Treasury “Firm Believers In Gold”, Will Not Sell Even To Avoid Default

- But, What If We Couldn’t Borrow Anymore?

- Silver Industrial Conference to focus on new uses of Silver: Silver Institute

- Gold attractive for long term buyers: Jeff Nichols

- U.S. Treasury “Firm Believers In Gold”, Will Not Sell Even To Avoid Default

- U.S. Treasury “Firm Believers In Gold", Will Not Sell Even To Avoid Default

- Morgan Stanley joins Goldman in the ‘slam-dunk’ call for lower gold prices – will be found to be TOTALLY wrong… again

- India’s Gold Refineries Shutting Bulk Operations

- Like an Offshore Paradise: Vatican Moves to Close Dirty Accounts

- Three King World News Blogs

- Commodity Prices Wrong as Often as 27% of Time for Traders

- Peter Grandich discusses gold market manipulation with Wall Street for Main Street

- Pierre Lassonde must not know the right central bankers

- Race to Debase: 2000 to 2013 Q3 - Fiat Currencies vs. Silver and Gold

- India's Gold refineries shutting bulk operations

- Will China’s Gambit to Undermine the Trans-Pacific Partnership Succeed?

- Gold Price Analysis- Oct. 10, 2013

- Gold challenging significant support level

- TECHNICAL ANALYSIS : Gold

- Gold and silver: Technical analysis

- Silver Forecast October 10, 2013, Technical Analysis

- TheDailyGold Interviewed by Palisade Radio

- Yellen’s Fed News Fails to Shake Gold’s “Lethargy” as Goldman Targets $1050

- Gold and silver: Consolidation continues

- Calling on Yellen: Time for a Modest, Dull Fed

- The Gold Dollar

- Hong Kong gold imports surge to highest ever on record, more than monthly global gold production

- Grandich discusses gold market manipulation with Wall Street for Main Street

- Whose right on the gold price: Goldman Sachs or the financial newsletters?

- Kyle Bass on US Default Risk: “There Is No Way To Protect Yourself If US Treasuries Default!”

| “Stay away” from gold, says investment bank Morgan Stanley Posted: 10 Oct 2013 04:47 PM PDT "We recommend staying away from gold," said Morgan Stanley analyst Joel Crane overnight, repeating the bank's 2014 average forecast of $1,313/oz. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why gold prices don't reflect fundamentals - Phillips Part 3 Posted: 10 Oct 2013 02:04 PM PDT Gold markets are inefficient, unreflective of fundamentals & understate the metal's market value, writes Julian Phillips. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Insiders Are Buying AuRico Gold Posted: 10 Oct 2013 11:59 AM PDT In this article, I will feature one gold miner that has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

AuRico Gold (AUQ) operates as a gold producer with mines and projects in North America. Insider buying during the last 30 days Here is a table of AuRico Gold's insider-trading activity during the last 30 days by insider.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold bullion market's big issues, part I Posted: 10 Oct 2013 11:51 AM PDT Central banks tend to sell gold when it's cheap, and buy or hold when it's not. "This," as Blackrock's Terence Keeley rightly noted to the LBMA conference, "is no way to diversify your portfolio." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Festival demand soars, India gold premiums go through the roof Posted: 10 Oct 2013 11:15 AM PDT Festival and marriage season demand have spiked up significantly, taking gold premiums to new heights. Indian retailers are seen willing to pay up to $50 more on a troy ounce of the precious metal. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stay away from gold Says Morgan Stanley as India doubles silver imports Posted: 10 Oct 2013 11:13 AM PDT Wholesale prices in Asia and London for physical gold slipped again Thursday morning, dipping back below $1,300 per ounce as politicians in Washington mulled a short-term fix to avoid the $17 trillion debt ceiling triggering a government default in one week's time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ann Barnhardt: OBAMA DESTROYING DOLLAR, CHINA to TAKE U.S. LAND for Debt Posted: 10 Oct 2013 11:10 AM PDT

In this interview with Elijah Johnson, Ann Barnhardt of the former Barnhardt Capital discusses the end game of Obama’s destruction of the US dollar (an event that has been in progress for 100 years since The Fed was created in 1913), which Barnhardt claims will see China taking not just the US’ gold in exchange [...] The post Ann Barnhardt: OBAMA DESTROYING DOLLAR, CHINA to TAKE U.S. LAND for Debt appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 11:09 AM PDT Many were surprised at gold's fall given Yellen's appointment is expected to be a bullish underlying factor for most markets, including the precious metals. Market speculators are clearly convinced Democrats and Republicans will meet some kind of resolution by Oct. 17. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury “firm believers in gold," will not sell even to avoid default Posted: 10 Oct 2013 11:07 AM PDT An important, little noticed article published over the weekend pointed out that the United States Treasury "remain firm believers in gold." | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trust, not price the concern of central banks - Ash Posted: 10 Oct 2013 11:05 AM PDT When it comes to gold and silver, argues Adrian Ash, trust and independence were the issues most on the tongues of those that gathered in Rome for the latest LBMA conference. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Obama Orders Federal Workers To “Make Life As Difficult For People As We Can” Posted: 10 Oct 2013 11:00 AM PDT

Why would the president of the United States try to purposely hurt the American people? Well, in 2013 this is done in order to score political points and force the opposition in to doing what you want them to do. A few days ago, an angry Park Service ranger publicly admitted that he and his [...] The post Obama Orders Federal Workers To "Make Life As Difficult For People As We Can" appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 10:46 AM PDT Q3 Update Detour Gold (DRGDF.PK) has released a quarterly update on its Detour Lake project, so it's an excellent moment to provide an update after my earlier article on this company. The third quarter of this year is the first quarter wherein Detour Gold has reached the commercial production status, so Q3 was quite pivotal as now Detour Gold can record gold sales as revenues instead of offsetting it against development expenses. Detour produced 75,672 ounces of gold in Q3 (which is a 31% increase compared to Q2) thanks to an increased availability rate of the mill and a higher throughput per day (on average 53,800 tonnes per operating day). The company has also started to pre-strip the so called Domain 2-zone which holds higher grade ore and should be beneficial for the company's production profile in the near term. My view on this update I'm optimistic about | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Many junior miners won’t survive this fall - McCoach Posted: 10 Oct 2013 10:30 AM PDT Greg McCoach says things are not going to get better at least until 2014 and a lot of juniors are going to go out of business. An interview with The Gold Report. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

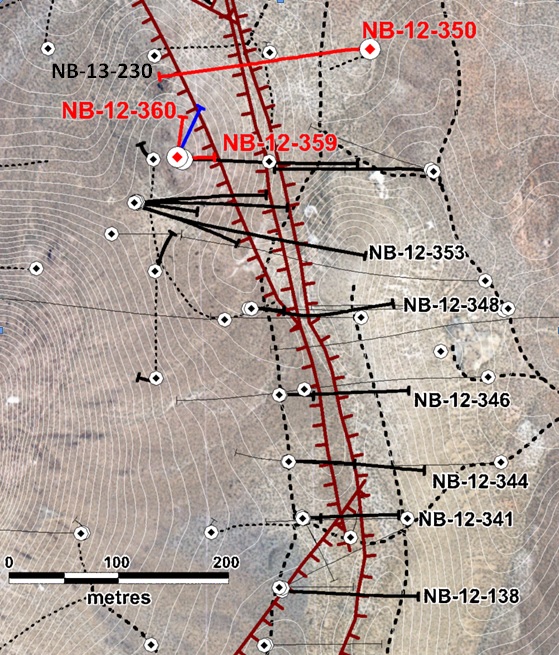

| Corvus Gold Drills 34m @ 5.4 g/t Gold at Yellowjacket High-Grade Zone Posted: 10 Oct 2013 10:15 AM PDT Vancouver, B.C., Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces initial assay results from an additional three core holes along the northern extension of the Yellowjacket Zone at the North Bullfrog Project, Nevada. The high-grade intercept NB-13-359 returned 34.4 metres @ 5.4 g/t gold and is 50 metres along strike from the previously reported intersection NB-13-356 (19.2 metres @ 10.97 g/t gold, NR-13-24, Oct 3, 2013). These new intercepts, like others released over the past few weeks, come only from holes in the core vein zones. Results for the reverse circulation holes in the surrounding stockwork zones, which zones are typically lower grade but can extend for 30 to 50 metres around the high grade vein zones, are still pending. Assay results from NB-13-360, located 50 metres along strike to the north of NB-13-359, returned 61 metres @ 1.5 g/t gold (including 5.2 metres @ 9.3 g/t gold) (Figure 1, Table 1). Gold and silver continue to occur in these intersections as very fine grains of electrum, native gold and acanthite, a leachable silver sulfide. Corvus has now reported results from within the high-grade Yellowjacket zone at 50 metre spaced drill fences over a current strike length of 450 metres, within a structural zone ranging from 100-150 metres in width and to a depth of about 150 metres. The system remains open in all directions and indications from RC grid drilling to the west and northeast suggest additional vein zones may be present in those areas. Drill hole NB-13-350 was drilled approximately 100 metres east of the known Yellowjacket Zone and angled towards Yellowjacket and North Sierra Blanca. The hole intercepted a completely new quartz vein stockwork structure which returned 7.1 metres @ 0.98 g/t gold (Figure 1, Table 1). This new structure has the same style of quartz-sulphide veining as the other Yellowjacket veins and currently appears to have a similar north-south trend, which strengthens the Company's belief that more covered high-grade structures should exist on the project. In addition, the hole encountered a different, thick zone of possible replacement style of mineralization at depth (42.7 metres @ 0.8 g/t gold) extending to the bottom of the hole. This new style of massive, moderate grade, mineralization correlates with a similar zone in previously reported hole NB-13-230 (26 metres @ 1.2 g/t gold, NR-13-20 Sept 5, 2013) and could represent a large new target at depth in the greater Sierra Blanca deposit area. Follow up core drilling is being planned to further define this new zone and assess its depth extent. Jeff Pontius, Chief Executive Officer, stated: "Identifying yet another fault strand with the potential to host significant high-grade vein related mineralization emphasizes once again the high-grade potential of the North Bullfrog area. The possible expansion of this new high-grade potential starter pit zone is emerging as a major component of a possible new mine plan. In addition, the discovery of a new, potentially large, body at depth at the bottom of holes NB-13-350 and 230 could significantly increase the scale of the project. This information, linked with the numerous similar high-grade targets indicated by the geophysics, illustrates the potential for the district to emerge as a major new large Nevada gold system." Table 1: Significant intercepts* from recent core holes at Yellowjacket.

*Intercepts calculated with 0.1g/t gold cutoff and up to 1 metre of internal waste.

About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 70 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold Corporation. The property package is made up of a number of leased patented federal mining claims and 758 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company's independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in June 2013. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated oxidized Indicated Resource of 36.7 Mt at an average grade of 0.26 g/t gold for 308,000 ounces of gold and an oxidized Inferred Resource of 220.4 Mt at 0.18 g/t gold for 1,289,000 ounces of gold (both at a 0.1 g/t gold cutoff), with appreciable silver credits. Unoxidized Inferred mineral resources are 221.6 Mt at 0.19 g/t for 1,361,000 ounces of gold (at a 0.1 g/t gold cutoff). A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website athttp://www.corvusgold.com/ Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada and Alaska, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% controlled Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: Ryan Ko Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the anticipated content, commencement and cost of exploration programs, anticipated exploration program results, the potential for there to be one or more additional vein zone(s) to the west and northeast of the current Yellowjacket high grade zone; the potential for any additional high-grade mineralization to be discovered, thereby potentially significantly enhancing and expanding the possible "starter pit" area of the deposit; the possible impact of additional high grade mineralization in a starter pit to affect the economics of the project; the discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate, the potential for there to be additional high-grade mineralization within and below the current oxide deposit; the potential for there to be a potentially large body at depth at the bottom of holes NB-13-350 and 230 and for any such body to significantly increase the scale of the project; there to be the potential for any mining or production at North Bullfrog, the potential for the existence or location of additional high-grade veins and/or mineralization, whether at Yellowjacket or elsewhere, the potential for the North Bullfrog district to emerge as a major new large Nevada gold system; the potential for the Company to secure or receive any royalties in the future, business and financing plans and business trends, are forward-looking statements. Information concerning mineral resource estimates and the preliminary economic analysis thereof also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered, and the results of mining it, if a mineral deposit were developed and mined. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially and adversely from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, the Company’s inability to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company's 2013 Annual Information Form filed with certain securities commissions in Canada. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties. Cautionary Note Regarding References to Resources and Reserves National Instrument 43 101 – Standards of Disclosure for Mineral Projects ("NI 43-101") is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the "CIM Standards") as they may be amended from time to time by the CIM. United States shareholders are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology of the SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7"). Accordingly, the Company's disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms "mineral resources", "inferred mineral resources", "indicated mineral resources" and "measured mineral resources" are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant "reserves" as in-place tonnage and grade without reference to unit amounts. The term "contained ounces" is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a "reserve" differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, and a "final" or "bankable" feasibility study is required to report reserves, the three-year historical price is used in any reserve or cash flow analysis of designated reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Caution Regarding Adjacent or Similar Mineral Properties This news release contains information with respect to adjacent or similar | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jim Sinclair: Default Drama Will See Global Investors Shun Treasuries in 2014 Posted: 10 Oct 2013 09:30 AM PDT

In an email alert to subscribers, legendary gold trader Jim Sinclair warns of a consequence to the debt ceiling/ US default drama that the financial MSM has not even contemplated much less discussed. Sinclair points out the fact that the US has come so close to the edge of an outright default (which would result [...] The post Jim Sinclair: Default Drama Will See Global Investors Shun Treasuries in 2014 appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Markets: The New Wild, Wild West Posted: 10 Oct 2013 08:34 AM PDT

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Precious Metals Markets: The New Wild, Wild West Posted: 10 Oct 2013 08:00 AM PDT

Precious metals markets are now the Wild West: a lawless territory where the Judges are bought and paid for, and where brutal and rapacious men are allowed to pillage the populace at will, unchecked by the rule of law. The Sheriff is too cowardly to emerge from his office, let alone do anything to go [...] The post Precious Metals Markets: The New Wild, Wild West appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold struggles in Frankenstein economy Posted: 10 Oct 2013 07:38 AM PDT Central bank interventions in the economy are nothing new.The consequences of them, however, are a man-made economy that behaves and looks rather weird, a Frankenstein economy if you will. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 07:30 AM PDT I'm still steamed about the blatancy of this morning's Cartel attack; not only on "FOMC Minutes Day," but as the White House announces "uber-dove" Janet Yellen will likely be running the Federal Reserve. In fact, just as I'm writing at EXACTLY 10:00 AM EST – i.e, "Key Attack Time #1"; this is what they just did, with the Dow sitting at the same unchanged level it's been at all morning – and the following headline coming across the tape; "Fed's Evans says current situation in the U.S, with high jobless rate and low inflation, calls for accommodative policies." And FYI, for those that still believe there's a chance in hell of a "tapering" announcement at the October 29th FOMC meeting, recall that the Fed now considers this decision "data dependent"; with absolutely ZERO data being published due to the government "shutdown"…

By the way, notice how on Monday (blue line), the day's gains were capped at EXACTLY 1%, at EXACTLY the KEY ROUND NUMBER of $1,325/oz, at EXACTLY 10:00 AM EST. On Tuesday, yet another Cartel Herald was utilized to stop gold's gains at EXACTLY 10:00 AM EST – i.e., the second the global PHYSICAL market closes; at EXACTLY the KEY ROUND NUMBER of $1,330/oz. that has served as the Cartel's "line in the sand" for the past month. As for silver – which as I wrote about last week, it has been attacked for at least a 2% intraday decline on 45% of ALL trading days this year. To wit, what more can I say than that the Cartel's "line in the sand" for the past month has clearly been the KEY ROUND NUMBER of $22/oz?

At least Zero Hedge is finally understanding what I told them two years ago. However, to act as if such "market action" – with the CFTC closed due to the government "shutdown" – is any different than when it was open over the past decade, is just plain RIDICULOUS…

Aside from getting this travesty off my chest, I feel the need to continue reporting it to empower you to understand PAPER gold and silver markets are but an illusion – en route to the ultimate END GAME of fiat currency collapse. Watching the sheer lunacy of the Cartel's attacks this year, there is but one conclusion a reasonable person can make. That is, TPTB are terrified of the impending, inevitable loss of confidence in the unbacked fiat trash they are hyper-inflating; from the dollar, to the Euro, to the Yen, Pound, and ALL other currencies. In other words, they are panicking – particularly in the United States of Deterioration, whose economy peaked at the turn of the century; and today, represents the epicenter of financial fraud. As for the MSM, it acts as head economic cheerleader the vast majority of the time. However, to its managers, readership remains more important than propaganda. Thus, they are just as happy to print sensationalistic negative headlines when markets are down as fluff pieces, no matter how misleading the content. In this case, the headlines are in fact foreboding; but considering we are supposedly amidst a "recovery," we have been taught – by the result of years of market manipulation – to consider events like government shutdowns and debt ceiling debates "trivial." After all, the government has already "shut down" 17 times since 1976, while the debt ceiling has been raised 76 times since 1962. In other words, while the nation's issues are MANY, we have been brainwashed not to fear these particular red herrings. That said, it's difficult to ignore the fact that this time around, markets are acting particularly ominously. Forget the "whopping" 6% decline in the PPT-supported Dow Jones Propaganda Average; heaven forbid, pushing it below its 200 DMA for the first time this year. No, I'm referring to the fact U.S. Treasury volatility is now greater than not only some of the worst PIIGS, but soon-to-be bankrupt J.C. Penney. Moreover, as "economic confidence" – according to a recent Gallup Poll – collapses at its greatest rate since the Lehman bankruptcy, T-bill rates have risen to their highest level since that fateful 2008 day. In other words, early signs of market panic; notwithstanding official efforts – 24 hours per day, seven days per week – to "calm" them with heightened MONEY PRINTING, MARKET MANIPULATION, and PROPAGANDA. Let's be honest, such signs – though highly unpropitious – are not that scary. After all, polls are known for their volatility, and with the Fed "turboQEing" everything in sight, it wouldn't be unprecedented for T-bill rates to plunge anew (in and of itself, a foreboding development). However, market participants are clearly starting to worry about America's fate; not to mention, it's "stock" – the U.S. dollar. Such panic is just in its preliminary stages. However, the same could have been said when markets started turning down in early 2000 and mid-2008. And don't forget, the cumulative issues then pale in comparison to what the world is dealing with now. Don't believe me? Than pray tell, why has the Fed since ballooned the (published) money supply by 6x…

…and its own balance sheet by the same. As for the market manipulation described above, is there ANYONE on the planet who could objectively look upon these charts and conclude gold and silver prices are significantly LOWER than a year ago?

Moreover, such panic is far more advanced overseas; as the average currency is down an incredible 10% in the past six months, and 20% in the past two years. The European PIIGS are nearing financial collapse, the "fragile five" nations have experienced dramatic inflation and social unrest, and the Bank of Japan is en route to doubling its money supply in just two years; while in the United States of Money Printing, the list of "worst since Lehman" issues grows longer each day. "Panic" – like "sentiment" – can be a very fickle thing. In other words, one day it can be non-existent; and the next, as virulent and pandemic as Ebola. Government attempts to delay the inevitable, GLOBAL fear of fiat currency collapse have indeed been powerful; and no doubt, will expand as the trapped rats run for cover. However, the status quo of "modest" inflation, steady financial markets, and the perception of government control will eventually succumb to REALITY – just as they always do. When this occurs; which frankly, could be ANY DAY given the horrific issues confronting both America and the global economy at large – today's "panic" will give way to all-out, 2008-style PANIC. Only this time around, Central banks won't have the "ammo" to fight back the tide with new MONEY PRINTING. Oh, they'll certainly try; but this time, all it will foster is HYPERINFLATION. And thus, I could not be more vociferous in my decade-long call to PROTECT YOURSELF from what's coming. The how and when may still be in question; but the what certainly isn't. In other words, the GLOBAL economy is on a collision course with collapse; led by its "ringleader of destruction" – the U.S. dollar. Only PHYSICAL Precious Metals are guaranteed to maintain their purchasing power when all is said and done; and when the REAL panic begins, I suspect their supply will dry up as quickly as ice cream in July. Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will The Real Goldman Sachs View On Gold Please Stand Up Posted: 10 Oct 2013 07:00 AM PDT

The head of Goldman Sachs’ commodities research area yesterday announced in headline-grabbing fashion that gold was a “slam dunk” sell. What’s truly stunning about this is that during the 2nd quarter this year, Goldman Sachs revealed in an SEC 13-F filing that it had accumulated over 4 million shares of GLD (that’s half a billion [...] The post Will The Real Goldman Sachs View On Gold Please Stand Up appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury “Firm Believers In Gold”, Will Not Sell Even To Avoid Default Posted: 10 Oct 2013 06:37 AM PDT

Brett Arends of the Wall Street Journal and Marketwatch asked the U.S. Treasury if they would consider selling some of the country's gold reserves to pay the bills if the budget crisis escalates later this month. Their response? Not a chance! The Treasury has considered that option, among the many others, and rejected it. "Selling gold would undercut [...] The post U.S. Treasury "Firm Believers In Gold”, Will Not Sell Even To Avoid Default appeared first on Silver Doctors. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| But, What If We Couldn’t Borrow Anymore? Posted: 10 Oct 2013 06:30 AM PDT Not that it will happen over the next 10 days but I wondered what would happen if the Treasury “really” couldn’t borrow any more money? Magically Zero Hedge put out an article yesterday that illustrates the immediate effects. Between Oct. 18th and Nov. 15th the Treasury has $441 billion worth of bonds to “redeem.” We don’t really redeem them, we simply borrow the same amount of funds due (plus interest?) and magically “rollover” the old debt into new debt…and all is well. I am sure you recall the 1980 movie aptly named “Rollover” where the financial world stood at the abyss and was at the mercy of whether the Saudis would “rollover” their debt. This is exactly where we are today with a small caveat. The caveat being “this is where we were” last year some 18 months ago wondering if the Chinese would continue to purchase our debt. The answer as it turns out was “no,” they stopped making purchases and actually started to liquidate which has caused interest rates to rise. This brings us to where we are today. The Federal Reserve is THE only buyer able to purchase what is needed to “sell” by the Treasury to raise new debt AND payoff old debt. This is pure and simply an insolvency of the first degree. Just because “we” pretend that it’s not so makes no difference. Just because the global financial system “pretends” that it’s not so makes no difference either. It is what it is and at some point in time as it always happens, “the crowd” (which even includes Americans) will realize this. Many of you have heard Jim Sinclair’s “GOTS” (get out of the system). If you cannot do this entirely you absolutely MUST do this to some extent for the simple reason of your own survival. When the day comes that we either cannot “rollover” our debt OR the “masses” understand the Ponzi nature and panic…everything will close. So you have $3 million in muni bonds and are comfortable…”you’re all set?” Really? Will the municipality actually pay? Where will you cash your check? Or even deposit it? The majority has not even thought past the first or second “move” to what is coming. In the event that the Treasury cannot borrow whether it is because of Congressional/Executive office sabre rattling or because the market itself shuts them down, everything will close. “Everything” in this case means EVERYTHING! If you cannot bring yourself to “get out of the system” and if you are willing to do ONLY one thing to help yourself then I would suggest that you buy some silver. Silver is wealth. It will not evaporate or be bailed in. It most probably will not even be considered for confiscation and most importantly “it will spend.” After some very brief period of time, “dollars” won’t spend…silver will. Eric Sprott and several others have said that silver will be THE best investment of this decade, I don’t doubt them in any way. In fact I agree with them but that is not why you must own silver. As I said above, owning “some” silver means that you have something “outside” of the system that represents wealth AND will spend. If it turns out to be so, that silver is THE best investment of the decade then you made a good investment. If (when) it turns out that the system shuts down and the banks and brokers “bail in” some of your assets, then you will have something that is spendable at the very moment that it’s needed most. How long could we see a financial system closure? Your guess is as good as mine. Hopefully not long. Some will say “there he goes again fear mongering.” I would remind everyone that the FDIC (also Canada and Europe) have written laws that provide for “bail ins.” Do you really believe that any law is written “not to be used?” This whole thing has been systematically set up, they know that failure is coming and have (are) prepared for it. Without going over the edge here I will ask you one more question, for what possible reason could there be a need for 2 billion rounds of ammunition? “They” know that it’s coming, so do you if you’re willing to admit it to yourself.Similar Posts: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Industrial Conference to focus on new uses of Silver: Silver Institute Posted: 10 Oct 2013 05:22 AM PDT The conference will focus on new uses of silver and the expanding opportunities in the global marketplace. It will also provide expert insight into the developments and practices within the largest industrial sectors of silver demand, given that the industrial uses of silver account for over 50 percent of overall demand. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold attractive for long term buyers: Jeff Nichols Posted: 10 Oct 2013 05:18 AM PDT Gold prices could witness a significant rise in the next 3-5 years when large traders in futures market who have sold reently resume buying. Hundres of tons of bullion bars have travelled from depositories in New York, London and western vaults to Hong Kong, Shanghai and East Asian region. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury “Firm Believers In Gold”, Will Not Sell Even To Avoid Default Posted: 10 Oct 2013 04:17 AM PDT “The federal government has about 8,100 metric tonnes of gold, held in places like Fort Knox. At current prices that's worth about $340 billion. That would only keep the government going for about a month, which tells you how little gold we really have in relation to our commitments,” writes Brett Arends of the Wall Street Journal. Today's AM fix was USD 1,298.00, EUR 959.56 and GBP 814.51 per ounce. Gold fell $13.10 or 0.99% yesterday, closing at $1,306.30/oz. Silver slipped $0.45 or 2.02% closing at $21.85. Platinum dropped $16.50 or 1.2% to $1,379.10/oz, while palladium fell $11.28 or 1.6% to $700.72/oz.

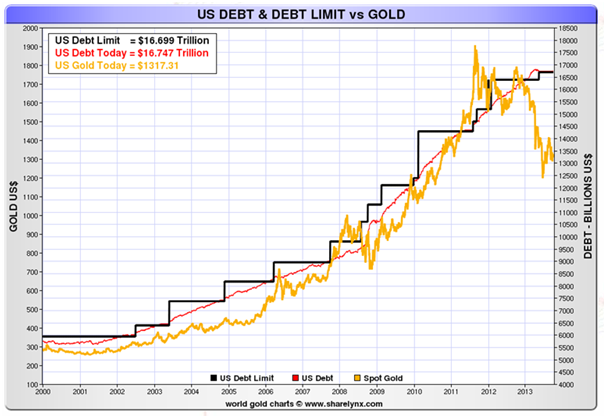

Gold edged off, falling beneath $1,300/oz in London as the dollar bounced from an eight-month low on hopes that the considerable risks due to the U.S. government shutdown and debt ceiling are addressed. COMEX selling continues to pressurise the price despite robust demand especially from China and India. Premiums in India were at $50 per ounce overnight and on the Shanghai Gold Exchange premiums were at $21 per ounce overnight. President Barack Obama launched a series of White House meetings with lawmakers yesterday to search for a way to end a government shutdown and raise the debt limit. Congressional aides from both parties noted U.S. lawmakers are not opposed to a short term increase in the debt ceiling limit. The U.S. will almost certainly raise the debt ceiling again, as it has done dozens of times since 1960, and this will be very bullish for gold as it has been in the last 10 years (see chart). Gold fell despite monetary dove, Janet Yellen, being nominated as the next chief of the U.S. central bank. Her appointment is positive for gold and will be supportive. Central banks remains net buyers and gold sales remain nearly non existent. Gold sales under the Central Bank Gold Agreement in the year to September 26 were the lowest of any year since the first version of the pact came into force in 1999, World Gold Council shows.

China is on pace to consume a record amount of gold again this year, which may be partly due to the central bank diversifying its foreign-exchange reserves. The People’s Bank of China is likely continuing to quietly accumulate gold. They will announce it when they are ready as China does not want sharp price rises to effect their stealth gold diversification programme.

The Chinese government and central bank realises, like the U.S. Treasury and Bundesbank that gold is an important store of value and diversification which protects against currency devaluations and systemic risks and a systemic crash. An important, little noticed article published over the weekend pointed out that the United States Treasury “remain firm believers in gold”. Brett Arends of the Wall Street Journal and Marketwatch asked the U.S. Treasury if they would consider selling some of the country's gold reserves to pay the bills if the budget crisis escalates later this month. Their response? Not a chance. The Treasury has considered that option, among the many others, and rejected it. "Selling gold would undercut confidence in the U.S. both here and abroad," a spokeswoman said, "and would be destabilizing to the world financial system." She was quoting an official position laid out last year in a letter to Senator Orrin Hatch, but so far apparently little noticed on Wall Street. The Treasury's position is, in a word, extraordinary. We hear all this skepticism these days about gold. Yet the Treasury itself considers U.S. gold holdings to be a key element in maintaining confidence in the country's soundness—and the stability of the international financial system. In other words, according to the official position of the U.S. Treasury, the promises and commitments of the government, and its "full faith and credit," are actually worth less than gold. They'd rather default than lose their bullion. The federal government has about 8,100 metric tonnes of gold, held in places like Fort Knox. At current prices that's worth about $340 billion. That would only keep the government going for about a month, which tells you how little gold we really have in relation to our commitments. I confess I am a gold agnostic—neither a confirmed skeptic, nor a true believer. I try to keep an open mind. (I do see some value in owning it, since in the past it has often tended to do well when other assets, such as stocks and bonds, have done badly.) But the Treasury's comment is really remarkable. The Treasury suspects that if the government just sold its gold, all those "gold skeptics" who run the financial markets would panic. What does that tell you? The full article can be read here.

A buy and hold strategy, while difficult in recent months, will continue to reward the prudent. In these uncertain times, all owners of gold and those considering owning gold should acquaint themselves with the most appropriate storage options for their own particular circumstances. GoldCore's ebook How To Store Gold Bullion- The Seven Key Must Haves is a must read in this regard Download here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. Treasury “Firm Believers In Gold", Will Not Sell Even To Avoid Default Posted: 10 Oct 2013 04:01 AM PDT gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 03:39 AM PDT | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India’s Gold Refineries Shutting Bulk Operations Posted: 10 Oct 2013 02:26 AM PDT "Needless to say, our mining companies won't say a word in protest." ¤ Yesterday In Gold & SilverAs you're already aware, the gold price didn't do much during the Far East trading session on their Wednesday, and volumes weren't overly heavy. This pattern continued in London until shortly after 9 a.m. BST. At that point, gold spiked up a bit, and you can tell from chart that it ran into "resistance." Then at 10 a.m. BST right on the button, the high-frequency traders arrived, and they worked the gold price lower until the London p.m. gold fix, which occurred minutes after 10 a.m. EDT in New York. The subsequent rally developed some real legs around the 1:30 p.m. Comex close, and gold was up 12 bucks in no time until the usual seller of last resort put in an appearance, and from 2:30 p.m. EDT onwards, the gold price chopped sideways into the close of electronic trading. According to the CME Group, December's high and low price ticks were $1,294.60 and $1,323.30. Gold closed at $1,307.00 spot, down $11.90 on the day. Net volume, mostly of the HFT variety, was pretty decent at 164,000 contracts. The silver price action was very similar to gold's, so I shan't dwell on it much. The low of the day came at 10:15 a.m. in New York, and the rally that began moments before the Comex close also met the same fate as gold's rally that occurred at that point. The CME's high and low ticks in silver for the December contract were $22.41 and $21.75, which was a 3% intraday move, a nearly daily occurrence in this metal. Silver closed at $21.89 spot, down 40 cents from Tuesday's close, and comfortably back under the $22 spot price once again. Net volume was pretty decent as well, around 41,500 contracts. It was the same chart pattern for platinum, and the palladium price had a mini version of it as well. Here are the charts. The dollar index closed at 79.99 on Tuesday afternoon in New York, fell to its low tick [79.88] in very early Far East trading yesterday. From there, it rallied up until 9:30 a.m. EDT, before selling off a hair into the close. The index finished the Wednesday session at 80.37, up 38 basis points. It's a real stretch to associate yesterday's price action in the precious metals to what happen in the currencies, as the dollar index rally was pretty long in the tooth before gold and silver "reacted" to that fact. The gold stocks gapped down a bit at the open, before selling off to their lows of the day at the London p.m. gold fix. The rally after that was rather lackluster, but the gold equities popped into positive territory on the back of gold's rally that began shortly after the Comex close. The HUI almost closed in positive territory, but finished down 0.01%. The selloff into the silver's 10:15 a.m. EDT low tick was far more severe, as the silver stocks were down about 3.5% at their lows. The stocks popped into positive territory very briefly, but couldn't hold those gains, and Nick Laird's Intraday Silver Sentiment Index closed down 0.87%. I'm not sure whether it was the good guys or bad guys buying the shares yesterday. The CME's Daily Delivery Report showed that 21 gold and two silver contracts were posted for delivery on Friday within the Comex-approved depositories. The link to yesterday's Issuers and Stoppers Report is here. There were no reported changes in GLD yesterday, and as of 9:35 p.m. EDT last evening, there were no reported changes in SLV, either. The folks over at the shortsqueeze.com updated their Web site with the data for the last couple of weeks of August. In GLD, the short position declined from 2.53 million ounces down to 2.20 million ounces, a drop of 12.79% from the mid-August report. The short position in GLD declined by 30% over the entire month. But the short report for silver was the big surprise. It actually increased by 5.84%. Based on the price action since the middle of August, along with the fact that 4.1 million ounces of silver were deposited during the reporting period, I was expecting a rather decent decline in SLV's short position, and it didn't happen. I don't know what to make of it. I'm sure that Ted Butler will have something to say about it when I talk to him tomorrow, and I'll borrow what I can from the conversation and stick it in Friday's column. There was no sales report from the U.S. Mint. Over at the Comex-approved depositories on Tuesday, they reported that 31,953 troy ounces of gold were deposited, all of it into HSBC USA. The link to that activity is here. As per usual, there was big activity in silver. A smallish 15,070 troy ounces were deposited, but a very chunky 911,616 troy ounces were shipped out of the Bank of Nova Scotia's vault for parts unknown. The link to that action is here. From feast to famine, as I don't have very many stories for you today, and I hope you like some of the articles in the few presented below. ¤ Critical ReadsRejoice: the Yellen Fed will print money forever to create jobsWe now know where we stand. Janet Yellen is to take over the US Federal Reserve, the world's monetary hegemon, the master of all our lives. The Fed will be looser for longer. The FOMC will continue to print money until the US economy creates enough jobs to reignite wage pressures and inflation, regardless of asset bubbles, or collateral damage along the way. No Fed chief in history has been better qualified. She is a glaring contrast to Alan Greenspan, a political speech writer for Richard Nixon, who never earned a real PhD (it was honorary) or penned an economic paper of depth. Ambrose Evans-Pritchard serves up Janet Yellen on a platter in this blog that showed up on the telegraph.co.uk Internet site sometime yesterday BST...and I thank Roy Stephens for today's first story. Brazil's Second Largest Oil Company on Verge of Latin America's Biggest Corporate Bankruptcy FilingWhen on October 1, fallen billionaire Eike Batista's OGX Petroleo & Gas, missed a $45 million bond coupon payment, some were surprised but most had seen the writing on the wall. After all, Brazil's second largest oil company after Petrobras, and the crowning jewel of Batista's EBX Group, had been under the microscope of investors and certainly creditors (and if it wasn't it certainly should have been) after oil deposits that Batista had valued at $1 trillion turned out to be commercial failures. And so the countdown to the inevitable bankruptcy filing began. Overnight, Bloomberg reports that the wait should not be long (in fact it may coincide with the default of that other insolvent mega-creditor: the United States), and will mostly certainly take place before the end of the month, following the retention of bankruptcy specialist law firm Quinn Emanuel. This Zero Hedge piece from yesterday, along with the embedded Bloomberg story, is certainly worth skimming...and my thanks go out to reader M.A. for sending it our way. RBS Said to Pass Currency Trader Chats to FCA Amid ProbeRoyal Bank of Scotland Group Plc has handed over records of instant messages to U.K. regulators after concluding a former currency trader’s communications with counterparts at other firms may have been inappropriate, according to two people with knowledge of the matter. The messages related to the dealer’s trading positions, said the people, who asked not to be identified because they weren’t authorized to speak publicly. The trader had left the Edinburgh-based bank before the investigation, and his departure was unrelated to the probe, the people said. Stewart Todd, a spokesman for the U.K.’s Financial Conduct Authority, declined to comment on the communications. RBS, Britain’s biggest publicly owned lender, uncovered the chats after opening an internal probe following a Bloomberg News report in June that traders at some of the world’s biggest banks may have sought to manipulate benchmark rates in the $5.3 trillion-a-day foreign-exchange market. The FCA said in June it was reviewing the allegations. This Bloomberg story, filed from London, was posted on their website early yesterday morning Denver time...and my thanks go out to Manitoba reader Ulrike Marx. Like an Offshore Paradise: Vatican Moves to Close Dirty AccountsMore than 1,000 customers who have no business holding accounts at the Vatican Bank have parked more than 300 million euros there, money the institution's officials suspect is illicit. They are now calling for the funds to be removed. The church-state has sought the aid of a consulting firm as part of a change in strategy in which it is moving away from secrecy and toward more integrity and transparency. In fact, the Vatican has been troubled by affairs surrounding its bank ever since the Commission for Works of Charity was established in 1887. This served to protect church assets from the Italian state's appetite for expropriation. Over the decades, this financial institution, which was later rechristened as the Institute for Religious Works (IOR), appears to have been involved in a number of shady deals: There have been allegations of Sicilian mafia money laundering, stock market manipulation and illegal transactions worth billions funneled through the bank. The Vatican Bank also played a key role in the 1982 collapse of Milan's Banco Ambrosiano, the largest bank crash in Italian history. Shortly thereafter, the bank's chairman was found hanging from a London bridge. It turns out he was murdered. In the 1990s, Italian industrialists used the church's spin-off to launder huge bribes for politicians. The scandalous reports surrounding the financial institute reached their latest peak in May 2012, when church officials suddenly ousted then-bank head Ettore Gotti Tedeschi in the midst of a money laundering investigation by Italian justice officials and the Vatileaks scandal. Now that the investigation against Gotti Tedeschi has been closed without any charges being pressed, there are growing suspicions that he had to leave for other reasons. In his struggle to implement international standards at the institution, the bank president had evidently had a falling out with other powerful Vatican officials. This absolute must read essay definitely falls into the "you can't make this stuff up" category. It was posted on the German website spiegel.de yesterday afternoon Europe time...and it's the second contribution to today's column from Roy Stephens. How the U.S. raid on al-Shabaab in Somalia went wrongNavy seals launched a daring night-time raid in Barawe, but were forced to retreat an hour later without their target – why? As a mother of young children, Fadumo Sheikh is used to rising early. Last Saturday she was due to prepare their breakfasts before they went to the local madrasa. But the day started earlier than ever when, at around 2am, she was woken by the sound of sporadic gunfire. Within sight of Sheikh's home in Barawe, Somalia, crack American navy Seals had launched a lightning amphibious assault on the Islamist militant group al-Shabaab. Less an hour later they would be forced to retreat, their mission far from accomplished. Based on interviews with witnesses and members of al-Shabaab, as well as official statements and media reports, the Guardian can present the most comprehensive picture yet of the daring pre-dawn raid – and where it went wrong. The Americans' target was an innocuous two storey beach-side house in Barawe, a fishing town of about 200,000 people that was a crucial slave trade port in the colonial era. In particular, they had planned the delicate operation of capturing, not killing, Abdulkadir Mohamed Abdulkadir, a Kenyan of Somali origin and senior commander of al-Shabaab who was linked to a number of terrorist plots. This very interesting story was posted on theguardian.com Internet site early yesterday afternoon BST...and it's courtesy of South African reader Bob Visser. Three King World News Blogs 1. Dr. Stephen Leeb: "Despite Correction, Silver is Set Up to Super-Surge to $110". 2. Rick Rule: "Why I Am a Terrified As I Watch the End Game Unfolding". 3. Keith Barron: "Chilling Truth About What Will Happen When the U.S. Implodes". Commodity Prices Wrong as Often as 27% of Time for TradersIn a Bloomberg News survey conducted during the past eight weeks, 85 traders and analysts said they have little confidence in the assessed prices of crude, metals and iron ore. Regulators, including European Union Competition Commissioner Joaquin Almunia, may examine commodities markets, having already increased investigations of manipulation of benchmarks for interest rates, derivatives, foreign exchange and oil. Five years after the global credit crisis prompted more regulation of banks, benchmark prices for hundreds of commodities are determined through surveys of anonymous traders who may have a stake in the outcome of the assessments. Unlike stock prices, available in real time at regulated exchanges for all investors to see, many raw materials that go into food, clothing and power are bought and sold in private. “There will be growing pressure for more regulation,” David Wilson, director of metals research and strategy at Citigroup Inc. in London, said by phone Sept. 3. “Commodities markets have traditionally been a backwater that only specialists would have been involved with. Clearly these markets haven’t changed with the times.” This long and somewhat involved commentary on commodities was posted on the Bloomberg website about an hour before the equity markets opened yesterday. A comment on gold price manipulation by Mark O'Bryne of GoldCore Ltd. appears in the very last section. I thank reader Ken Hurt for bringing this news item to our attention. Peter Grandich discusses gold market manipulation with Wall Street for Main StreetMarket analyst and mining company consultant Peter Grandich discusses gold market manipulation with Wall Street for Main Street's John Manfreda in a 19-minute interview posted on the youtube.com Internet site yesterday. I found this clip embedded in a GATA release that Chris Powell filed from Taiwan early this morning local time. Pierre Lassonde must not know the right central bankersMarket analyst and mining company consultant Peter Grandich discusses gold market manipulation with Wall Street for Main Street's John Manfreda in a 19-minute interview posted on the youtube.com Internet site yesterday. I found this clip embedded in a GATA release that Chris Powell filed from Taiwan early this morning local time. Pierre Lassonde must not know the right central bankersGold mining entrepreneur Pierre Lassonde, a former chairman of the World Gold Council, this week told MineWeb's Geoff Candy that central bankers hardly ever think about gold, much less think about the manipulation of its price. "When I was chairman of the World Gold Council," Lassonde says, "one of my goals was to get closer to the central bankers and I tried to understand what goes on in their heads and try to help them with the management of their gold reserves, or their lack of reserves. ... I made many trips to China, to Beijing, to talk to the chief central banker there. ... Ninety-nine point nine percent of the central bankers I know don't even know they have gold in their vault. They don't spend one millisecond thinking about gold during the day. It's not on their agenda, so to think that they try to manipulate gold to suppress the gold price -- forget it. They don't even think about it." Of course maybe the central bankers known to Lassonde are not the ones known to staff members of the International Monetary Fund, who surveyed central bankers in 1999 and, in a secret report to the IMF board, reported that the central | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Like an Offshore Paradise: Vatican Moves to Close Dirty Accounts Posted: 10 Oct 2013 02:26 AM PDT More than 1,000 customers who have no business holding accounts at the Vatican Bank have parked more than 300 million euros there, money the institution's officials suspect is illicit. They are now calling for the funds to be removed. The church-state has sought the aid of a consulting firm as part of a change in strategy in which it is moving away from secrecy and toward more integrity and transparency. In fact, the Vatican has been troubled by affairs surrounding its bank ever since the Commission for Works of Charity was established in 1887. This served to protect church assets from the Italian state's appetite for expropriation. Over the decades, this financial institution, which was later rechristened as the Institute for Religious Works (IOR), appears to have been involved in a number of shady deals: There have been allegations of Sicilian mafia money laundering, stock market manipulation and illegal transactions worth billions funneled through the bank. The Vatican Bank also played a key role in the 1982 collapse of Milan's Banco Ambrosiano, the largest bank crash in Italian history. Shortly thereafter, the bank's chairman was found hanging from a London bridge. It turns out he was murdered. In the 1990s, Italian industrialists used the church's spin-off to launder huge bribes for politicians. The scandalous reports surrounding the financial institute reached their latest peak in May 2012, when church officials suddenly ousted then-bank head Ettore Gotti Tedeschi in the midst of a money laundering investigation by Italian justice officials and the Vatileaks scandal. Now that the investigation against Gotti Tedeschi has been closed without any charges being pressed, there are growing suspicions that he had to leave for other reasons. In his struggle to implement international standards at the institution, the bank president had evidently had a falling out with other powerful Vatican officials. This absolute must read essay definitely falls into the "you can't make this stuff up" category. It was posted on the German website spiegel.de yesterday afternoon Europe time...and it's the second contribution to today's column from Roy Stephens. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 02:26 AM PDT 1. Dr. Stephen Leeb: "Despite Correction, Silver is Set Up to Super-Surge to $110". 2. Rick Rule: "Why I Am a Terrified As I Watch the End Game Unfolding". 3. Keith Barron: "Chilling Truth About What Will Happen When the U.S. Implodes". | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commodity Prices Wrong as Often as 27% of Time for Traders Posted: 10 Oct 2013 02:26 AM PDT In a Bloomberg News survey conducted during the past eight weeks, 85 traders and analysts said they have little confidence in the assessed prices of crude, metals and iron ore. Regulators, including European Union Competition Commissioner Joaquin Almunia, may examine commodities markets, having already increased investigations of manipulation of benchmarks for interest rates, derivatives, foreign exchange and oil. Five years after the global credit crisis prompted more regulation of banks, benchmark prices for hundreds of commodities are determined through surveys of anonymous traders who may have a stake in the outcome of the assessments. Unlike stock prices, available in real time at regulated exchanges for all investors to see, many raw materials that go into food, clothing and power are bought and sold in private. “There will be growing pressure for more regulation,” David Wilson, director of metals research and strategy at Citigroup Inc. in London, said by phone Sept. 3. “Commodities markets have traditionally been a backwater that only specialists would have been involved with. Clearly these markets haven’t changed with the times.” This long and somewhat involved commentary on commodities was posted on the Bloomberg website about an hour before the equity markets opened yesterday. A comment on gold price manipulation by Mark O'Bryne of GoldCore Ltd. appears in the very last section. I thank reader Ken Hurt for bringing this news item to our attention. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Peter Grandich discusses gold market manipulation with Wall Street for Main Street Posted: 10 Oct 2013 02:26 AM PDT Market analyst and mining company consultant Peter Grandich discusses gold market manipulation with Wall Street for Main Street's John Manfreda in a 19-minute interview posted on the youtube.com Internet site yesterday. I found this clip embedded in a GATA release that Chris Powell filed from Taiwan early this morning local time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pierre Lassonde must not know the right central bankers Posted: 10 Oct 2013 02:26 AM PDT Market analyst and mining company consultant Peter Grandich discusses gold market manipulation with Wall Street for Main Street's John Manfreda in a 19-minute interview posted on the youtube.com Internet site yesterday. I found this clip embedded in a GATA release that Chris Powell filed from Taiwan early this morning local time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

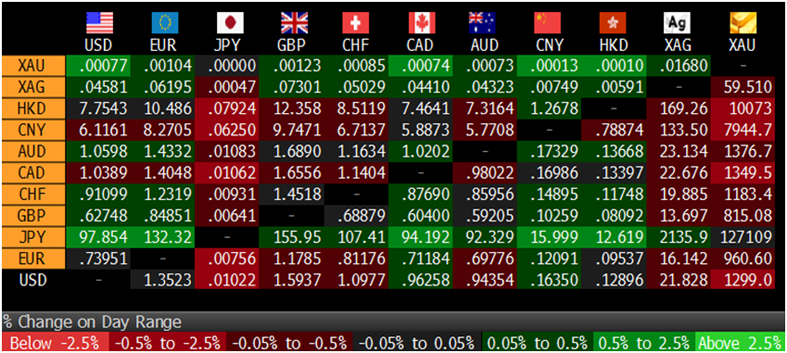

| Race to Debase: 2000 to 2013 Q3 - Fiat Currencies vs. Silver and Gold Posted: 10 Oct 2013 02:26 AM PDT So far in the 21st century, fiat currencies have lost an average of 78% of their value against silver, and 81% of their value compared to gold. Mike Maloney over at goldsilver.com has posted a table of numbers showing the loss of purchasing power of each of the world's fiat currencies against these metals from the beginning of 2000, up to and including the 3rd quarter of this year. It's an interesting read, and won't take much of your time. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| India's Gold refineries shutting bulk operations Posted: 10 Oct 2013 02:26 AM PDT India’s gold refineries are operating, says the trade, at only 25 per cent of installed capacity due to acute shortage of used jewellery. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will China’s Gambit to Undermine the Trans-Pacific Partnership Succeed? Posted: 10 Oct 2013 02:08 AM PDT This is Naked Capitalism fundraising week. 493 donors have already invested in our efforts to shed light on the dark and seamy corners of finance. Join us and participate via our Tip Jar or another credit card portal, WePay in the right column, or read about why we’re doing this fundraiser and other ways to donate, such as by check, as well as our current goal, on our kickoff post. And read about our current target here While eyes in the US have remained focused on the budget cliffhanger in Washington, in Bali, two sets of meetings were taking place. The first was the latest set of Trans-Pacific Partnership negotiations. The US, led by John Kerry (Obama was supposed to make an appearance but the budget drama kept him away) met with representatives of the 12 nations it is pressing to agree to this deliberately mis-branded “trade deal”. The reason the label is misleading is that trade is already substantially liberalized; the real point of the TPP and its cousin, the pending EU-US trade agreement, is to weaken the power of nations to regulate, which will allow multinationals to lead a race to the bottom on product and environmental safety. As we wrote earlier this year:

Back to the current post. The second meeting in Bali this week was for Asia-Pacific Economic Cooperation (APEC). And the two intersected in intriguing ways. Remember, the terms of the TPP are shrouded in secrecy that is utterly inconsistent with the notion of democratic rule. Draft chapters have not been released. In the US, the US Trade Representative has given briefings on the general terms of the pact’s chapters, but as anyone who has worked on contracts or legislation, reading the detailed terms is critical to understanding an agreement, and those are being kept firmly secret. Consider this stunner from the Japan Times in August (emphasis ours)

Not only has the US been pushing remarkably hard on the secrecy front, it’s being remarkably aggressive on timing. It got a commitment from the prospective signatories in Bali for the pact to be finalized by year end, when a State Department briefing immediately afterward met with skeptical questions (if you have time, you really should read the session in full. The obstinacy and disingenuousness of the State Department mouthpiece is way too obvious). For instance:

Forbes is also skeptical that the deal can get done so quickly:

In fairness, the Forbes article points out that one set of issues that was seen as a major stumbling block for Japan, that of five types of agricultural products it wanted held out of the deal, may not be such a problem after all because the Japanese Prime Minister Abe, who talked up the deal this week, looks to be able to play the sellout of domestic farmers so as to disadvantage an LDP rival. However, the US has been ruffling the potential signatories. For instance:

And the State Department Q&A also indicated that Indonesia, which was also hosting the APEC leaders’ meeting, had the US trying to upstage that session. Now bruised official egos are likely not enough in and of themselves to derail a trade deal. But the Asian nations are also playing a careful balancing act between the current hegemon, the US, and its presumed successor, at least in the region, if not globally, China. Now remember, the whole point of the TPP is that it is an “everybody but China” deal. So what did China do at the APEC summit when Obama was detained in Washington? Step up its efforts to undermine the TPP. From Agence France-Presse:

It’s not clear that China’s efforts to throw sand in the TPP gears will work. But the year end timetable looks like a bizarre Administration fantasy (why push for an empty commitment to a deadline that clearly can’t be met?). And the parallel ASEAN trade talks could give countries that wanted to drag their feet on the TPP an excuse to do so (note that one country being reluctant is likely to be insufficient to derail the deal, but two or three could change the equation. Reporters in the State Department briefing were making comparisons to the failed Doha round). A final factor that could work against the TPP is a continuation of a destabilizing budget battle. As we’ll discuss in our accompanying post today, there was progress of sorts Wednesday, in at least the two sides have agreed to talk. But they aren’t even at the stage of discussing terms, beyond a vague idea of putting the debt ceiling on hold while the two parties work out a bigger budget deal, with deficit cutting measures included. The problem is given the failure to reach a | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Analysis- Oct. 10, 2013 Posted: 10 Oct 2013 01:40 AM PDT dailyforex | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold challenging significant support level Posted: 10 Oct 2013 01:35 AM PDT alpari | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 10 Oct 2013 01:25 AM PDT dailyfx | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and silver: Technical analysis Posted: 10 Oct 2013 01:25 AM PDT invezz | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Forecast October 10, 2013, Technical Analysis Posted: 10 Oct 2013 01:05 AM PDT fxempire | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TheDailyGold Interviewed by Palisade Radio Posted: 10 Oct 2013 12:56 AM PDT Palisade Radio asks us about our thoughts on precious metals, gold stocks, the S&P 500 and more….

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yellen’s Fed News Fails to Shake Gold’s “Lethargy” as Goldman Targets $1050 Posted: 10 Oct 2013 12:50 AM PDT

The WHOLESALE price of gold gave back this week’s 1.4% gains Wednesday morning in London, dropping below $1310 per ounce as European shares recovered earlier losses.

Commodities ticked lower, as did non-US government bonds, while silver followed gold lower, but retained a 1.0% gain for the week so far.

US stock futures pointed higher despite Washington’s current impasse over the debt ceiling moving within 8 days of a possible debt default.

The US Dollar meantime rose sharply after the New York Times reported that current Federal Reserve vice-chair Janet Yellen – a renowned “dove” on low interest rates and stronger quantitative easing – will today be confirmed as President Obama’s choice to succeed Ben Bernanke as the central bank’s chief.

“Sentiment has changed. People don’t seem to be flocking to gold, even in times of distress,” said Jim Iuorio, managing director of TJM Institutional Services in Chicago to CNBC on Tuesday.

“[Gold prices] continue to hang in limbo,” says a Singapore trading desk, “unable to rally yet does not want to give up $1300 handle.”

“The closer the US comes to reaching its debt ceiling,” say commodity analysts at Commerzbank in Germany, “and the more the risk of insolvency grows as a result, the more gold should be in demand as a safe haven in the west…which should be reflected in a climbing gold price.

“Perhaps gold will be shaken out of its lethargy when the Fed minutes are published this evening,” says the bank, asking if the delay in ‘QE tapering’ last month was due to the US central bank’s fears over a drop in government spending.

But “once we get past this stalemate in Washington, precious metals are a slam dunk to sell,” reckoned investment bank Goldman Sach’s head of commodities research Jeffery Currie, speaking Tuesday at Commodities Week here in London.

Selling gold is his top raw materials trade for 2014, a view agreed Tuesday by Swiss investment and bullion bank Credit Suisse’s research chief Ric Deverell.

“You have to argue that with significant recovery in the US,” said Currie, “tapering of QE should put downward pressure on gold.”

Economic growth in the UK is set to outstrip the US in 2013, the International Monetary Fund said Tuesday, adding that it was “pleasantly surprised” by Britain’s ‘austerity’ policies failing to hurt growth as the IMF warned in April.

UK manufacturing and industrial output today showed a sharp drop for August, defying analyst forecasts of strong growth.

The Pound fell hard after the news, dropping to a 2-week low beneath $1.60. That buoyed gold for UK investors above £820 per ounce, some 0.8% below an earlier spike to 1-week highs.

Gold priced in Euros also eased back, touching last week’s closing level at €967 per ounce as the single currency fell despite much stronger-than-expected German industrial output data for August.

Currie at Goldman Sachs now sees his target for year-end 2014 at $1050 per ounce – a “key gold level” according to panellists speaking last week at the London Bullion Market Association’s conference in Rome.

Adrian Ash

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can fully allocated bullion already vaulted in your choice of London, New York, Singapore, Toronto or Zurich for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and silver: Consolidation continues Posted: 10 Oct 2013 12:45 AM PDT invezz | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||