saveyourassetsfirst3 |

- News, Charts & Premium Samples

- CFTC’s 5-year silver market probe ends with a whimper…

- Today’s Menu – A Propaganda and Manipulation Sandwich

- Thailand spot gold exchange mulled

- Will silicosis be SA gold's next big trial?

- Reminiscences Of A Stock Operator

- Gold Price: LBMA Gets Its Crystals Balls Out in Rome

- sept 26./another raid orchestrated by the bullion banks/Comex gold remain constant/Silver imports into India rise by 311%/

- US debt debate to drive the gold price

- Education After the Collapse – School When There Is No Classroom

- Gold 1350 Still Likely Resistance if Reached

- Gold shipment disappears from Air France flight to Zurich

- Gold and Silver price rally a repeat of 2008: Sunshine Profits

- A fact about inflation that will shock the average American

- Jim Rogers: Four surprising reasons to invest in China now

- Gold and silver prices: Mapping short term volatility

- Use Your Own Common Sense

- Can silver and palladium tell us more about the outlook for gold?

- Must-read: Ten reasons to quit your job right now, today

- This could slam a long-term floor under the price of gold

- The Smell of Collapse Is In The Air: Part 2

- India's gold bar imports plunged 68% year-on-year in August

- Precious metals driven by U.S. debt limit as countdown begins

- Bitcoin: As good as gold?

- Gold mining activity adversely affected by budget cuts: SNL MEG

- CFTC Silver Probe: See-no-Evil, Hear-no-Evil, Speak-no-Evil

- Max Keiser: We Are on a Gold Standard Now, Even Though it is Not Recognized

- U.S. 5 year silver market investigation ends: No Libor-style manipulation

- The Long-Running Silver Manipulation Case

- Another Piece of Economic Data - Another Reaction in Gold

- CIA and The Fed

- Gold and Silver still fighting to keep above 1300-1322

- Radio Appearance with John Stadtmiller of Republic National Broadcasting

- U.S. 5 Year Silver Market Investigation Ends - No LIBOR Style Manipulation

- Gold: Options Expiry Mouse Versus Asian Tiger

- Bad Bart

- Just How Much PM-Positive News Can Emerge? You Ain’t Seen Nothing Yet!

- U.S. 5 Year Silver Market Investigation Ends – No LIBOR Style Manipulation

- The Fat Lady Has Yet to Sing for Dimon and JP Morgan

- CFTC Can’t Stop Market Rigging When the U.S. Government Does It—It’s the Law

- Stunning LIBOR Fraud Admissions: "As For Kick Backs We Can Discuss That At Lunch" And Much More

- Behind ICAP case is an American push for global regulatory control

- Three King World News Blogs

- Rare gold coin from 1880 sells for $2.75M at auction

- Romania's Powder Keg: Mine Project Launches Protest Movement

- Russia Increases Gold Holdings With Kazakhstan for 11th Month

- China overtakes India as no. 1 gold buyer

- Thailand considers establishing spot gold exchange

- Eric Sprott: Manipulation, gold and the decline of the dollar

- CFTC Concludes Long-Running Silver Manipulation Investigation, Finds Nothing Wrong

| News, Charts & Premium Samples Posted: 26 Sep 2013 06:04 PM PDT In this update… - Links of the Week

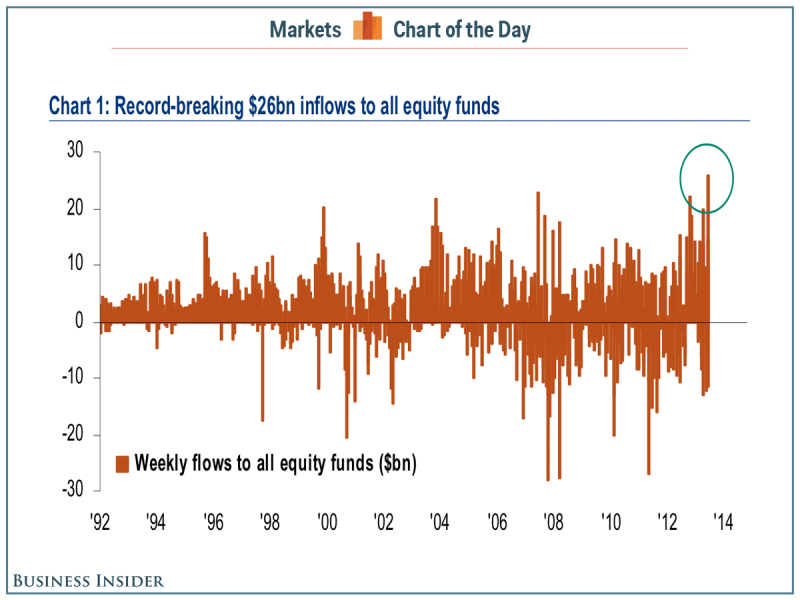

Generalist Fund Managers Interested in Gold & Silver Miners? Jim Rickards: Fed Knows Gold Has to Go Higher Gold Fundamentals Why B2 Gold’s Prospects are Up in an Era of Write-Downs Sponsor News… Corvus Gold Demonstrates Continuity w/ Continued Expansion of YJ Zone Balmoral Resources Outlines Large New IP Anomaly Premium Sample: Equity Fund Flows

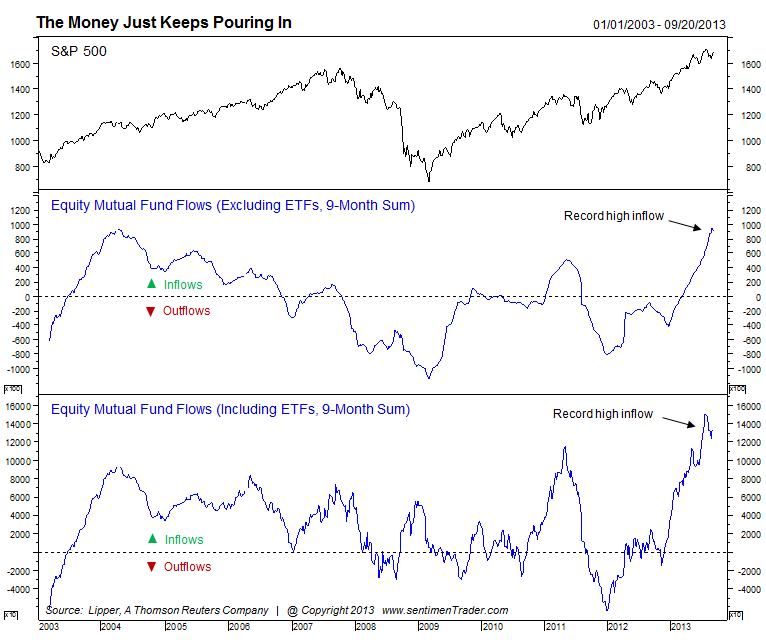

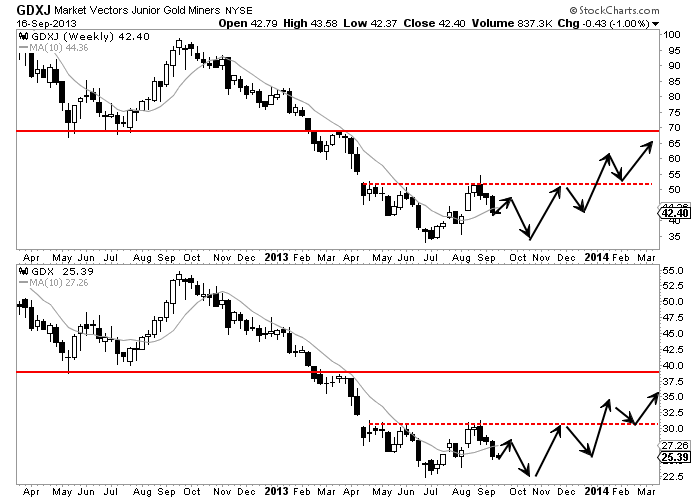

Premium Sample: We wrote last editorial (linked above) a few weeks ago. We had to change our views because the data had changed. The gold stocks veered off their recovery course and failed to hold the 50-day moving average. However, the good news is we don’t expect to see new lows (at least in GDXJ and the silver stocks). Both GDX and GDXJ have been in a bottoming pattern for 5 months. The charts below show the developing necklines. Upon breakout of the necklines we have targets of GDXJ $69 and GDX $39.  That seems like a huge move from a potential retest at GDX $22 and GDXJ $35. However, consider that the typical rebound in GDX can go 70% in five months. In the recent two-month recovery, GDX gained 39% while GDXJ gained 63%! Even the silver stocks were up 55% in only two months. If we do see a bottom in October/November then there is a good chance we could see a 100% rebound in GDXJ by next May. My friend Tiho Brkan emailed me recently and I wanted to share his near-term thoughts on precious metals with you. This is my view: - If Gold or Silver retest lows, its a buying opportunity. - If HUI breaks lower, its a buying opportunity. - If all three break lower… you guessed… its a buying opportunity. According to the charts above, over the coming months we will be or already have started forming a major bottom that is on par or even more meaningful than 2000/01 or 2008/09.

This week we’ve already put together a new report and updated another. We published a report covering our Top 2 Long-Term Speculations for this Bull Market. These are two speculations that we think have potential to be 20-baggers over the next four years. In addition, yesterday we published a new Macro-Market Report. Its 49 pages and covers the outlook for US equities, Emerging Markets, Bonds & Commodities. I’m quite proud of this report as I think it helps us see where the opportunities are and which areas should be avoided. Feedback from subscribers has been quite positive thus far. Get these two reports and much more! Wishing you good health and profits, -Jordan

|

| CFTC’s 5-year silver market probe ends with a whimper… Posted: 26 Sep 2013 05:36 PM PDT The CFTC said there is not "a viable basis to bring an enforcement action regarding complaints about alleged silver market manipulation." |

| Today’s Menu – A Propaganda and Manipulation Sandwich Posted: 26 Sep 2013 05:00 PM PDT I thought I had seen it all until today. However, in TPTB's relentless pursuit of preventing the inevitable economic collapse, they have gone ALL OUT to lie to – and steal from – the American public. Despite overnight news of European loans plunging at a RECORD pace – per the horrific chart below – PMs were attacked just after the 2:15 AM EST open of the London "pre-market" session for the 84th time in the past 93 days…

Just after the COMEX open, with gold and silver having recouped essentially all of the said losses – the final 2Q GDP estimate came in well below expectations; and would have been still lower if the BEA hadn't comically reduced the quarterly inflation "deflator" from 0.7% to 0.6%. However, not to be outdone by such miserable data, the BLS published "better than expected" jobless claims – that make not the slightest bit of sense. For the past two weeks, we have been told that low jobless claims readings were published because California and Nevada were updating their computer systems – and thus, hadn't submitted data. And now we're told those low readings were not reversed at all despite California and Nevada reporting in. And thus, despite the fact that continuing claims surged, jobless claims supposedly plunged. Huh? And this, just two weeks after a MISERABLE July/August NFP employment report. Frankly, I doubt we were told the whole story; but then again, are we EVER? Of course, gold and silver were immediately attacked; according to the MSM, "due to" the jobless claims data (please ignore the U.S. GDP and European loan data). They then recovered essentially all their losses again - and briefly went positive after the "pending home sales index" unexpectedly plunged nearly 2%. Clearly, rising interest rates are killing the supposed housing "recovery"; and thus, such a reading only solidifies the case for no QE "tapering." FYI, neither stocks nor bonds even budged on the data; just PMs, which somehow find a way to "react" violently to any and all government data, no matter how useless it has become. And then, for the coup de grace – as gold rose to +$1/oz. for the day, and silver nearly $0.15/oz.; in the form of one of the most disingenuous – and worthless – pieces of information the government has ever published. That is, just two weeks after its July 2013 NFP report was revised downward by a whopping 36%, it claims a "benchmark revision" of the 12 months ending March 2013 is adding 345,000 jobs. Never mind the quality of such jobs, or if they even exist; as frankly, the only reason such drivel was published was for the purpose of political PROPAGANDA, and to give the Cartel an excuse to attack PAPER PMs again; which is exactly what they did when it was issued at 10:09 AM EST – i.e, nine minutes after "KEY ATTACK TIME #1." And what do you know, for the third time in the past four days, gold is back under the Cartel's current "line in the sand" at the ROUND NUMBER of $1,330/oz…

Adding insult to injury – just one day after the CFTC announced its five-year investigation into COMEX silver manipulation ended with no charges; Attorney General Eric Holder is meeting with none other than JP Morgan's management as he LIES to America that those who manipulate markets will be held "accountable"…

LBMA conferences have a tradition of everyone guessing the gold price one year hence, and the average being offered back as some kind of guide to professional sentiment, writes Adrian Ash at BullionVault. You know the idea. Anyone trying to guess how many sweeties there are in a jar – or inflated balloons squashed inside a car, say – will likely be wrong. But average out everyone's guesses, and your answer can prove weirdly right. Forecasting the future then, this wisdom of crowds might help as well. Especially if the guesses are made by industry players, taking a punt at where they see – for instance – the gold or silver price sitting one year from now. But no... Where's the wisdom? And who's been making these guesses? The London Bullion Market Association is a loose grouping of bankers, brokers, miners, refiners, assayers, mints and vault operators with one common interest: Keeping the wholesale gold and silver markets they work in running efficiently. The LBMA's staff are thus charged with setting and maintaining the Good Delivery standards of the London market's large wholesale bars (1000-ounce silver, 400-ounce gold). These standards have been developed over 250 years and more, since the Bank of England – then as now sitting at the heart of the world's physical bullion trade – began to tell brokers what it would and would not accept into its vaults. To achieve these standards – and again picking up where the Bank of England began – the handful of people on the LBMA's executive team, plus the slightly bigger handful of volunteer committee members, set and maintain the Good Delivery list of bullion refiners. These refiners know the value of Good Delivery status. So they're happy to be poked, prodded and then approved (and spot-checked again from then on) for the production of gold or silver bars meeting the Good Delivery rules. Those rules, which the LBMA sets on behalf of its members, cover weight, shape, markings and of course purity or "fineness". And that, in truth, is it. The LBMA exists for no other purpose, and its members (such as BullionVault, as well as those bankers, brokers, miners and so on) expect it to do no more. The LBMA runs no vaults, and trades no metal. It might represent the bullion industry's interests to government (see Dodd-Frank and Conflict Gold, for instance, again addressed through the Association's refining standards ). But its annual accounts, in fact, show this global association doing its job for less money than your local tennis club probably turns over. Bankers, brokers and the rest however are a clubbable sort, those based in no less than the LBMA's growing membership worldwide, and especially in China. So the odd get-together gives these people, serving precious-metal buyers and sellers wholesale, the chance to talk shop, gossip even, and start new deals and business relationships over a beer or three. Hence Rome 2013, the LBMA's fourteenth annual conference. As cover perhaps for the dinners (and travel – Lima next year, anyone?) two days of expert seminars give the conference a focus. Keynote speakers then add a little spice – Marc Faber at LBMA 2012 in Hong Kong for instance, or Pierre Lassonde in Montreal 2011. Plus, this gathering of 700+ industry players gets chance to voice its collective guess on where prices are heading. It says more about sentiment, however, than direction. The gap between this crowd's "wisdom" and reality 12 months later has long stood out. "Perhaps a sobering thought for those of us," as Rhona O'Connell of GFMS said in 2009, "who profess to have crystal balls." After lagging the gold price so badly through the global financial crisis, the wholesale gold and silver world finally raised its targets, just in time for the price to turn lower. "This year I sensed that the bullishness has moderated and there is less conviction," said Tom Kendall, head of Credit Suisse's precious metals research, when he summarized the Hong Kong conference last year. Yet once more, the crowd's average guess was amiss – this time by being too keen. To see what this year's forecasts are as they come in, follow Bullionvault on Twitter and keep up-to-date with GoldNews, live from the conference floor. Watch also for news and views from the bullion market's premier event as well. Because if nothing else, LBMA Rome 2013's collective gold price forecast might suggest how fast prices are heading in the other direction. |

| Posted: 26 Sep 2013 03:22 PM PDT |

| US debt debate to drive the gold price Posted: 26 Sep 2013 03:15 PM PDT Analysts at ANZ Bank say they expect headlines around the US debt debate "to drive" the gold price and other precious metals. |

| Education After the Collapse – School When There Is No Classroom Posted: 26 Sep 2013 03:00 PM PDT Shtfplan |

| Gold 1350 Still Likely Resistance if Reached Posted: 26 Sep 2013 02:09 PM PDT |

| Gold shipment disappears from Air France flight to Zurich Posted: 26 Sep 2013 02:00 PM PDT

Some 44 kilograms of gold bars from an overall cargo of 300 kg of precious metal have mysteriously disappeared from a flight bound to Zurich. An insider operation could be to blame for a €1.5 million heist at Paris' Charles de Gaulle airport. France's national aviation police (GTA) is now investigating how and by whom [...] The post Gold shipment disappears from Air France flight to Zurich appeared first on Silver Doctors. |

| Gold and Silver price rally a repeat of 2008: Sunshine Profits Posted: 26 Sep 2013 01:11 PM PDT According to Radomski, a comparison of prices of silver and palladium gives sufficient clues about weakness in gold market too. For Silver the drop below 20 day moving average is not at all encouraging for silver bulls who saw prices again falling below $21 per ounce levels.However, the breakdown in palladium prices weren't validated and it did show some positive movements in recent days and weeks. |

| A fact about inflation that will shock the average American Posted: 26 Sep 2013 01:09 PM PDT From The Project to Restore America: The 100th anniversary of one of the most important economic events in world history is approaching, on December 23, 2013. A hundred years ago, on December 23, 1913, President Woodrow Wilson signed the Federal Reserve Act into law. That was the birth of the Fed. The Federal Reserve was sold as, among other things, a way to manage the United States dollar. The Fed’s currency management record is very clear, and no matter what your politics, this record speaks for itself... Here’s the short version: Since President Wilson signed the Fed into lawful existence, the U.S. dollar has lost approximately 96% of its value. A 1913 $1.00 is now worth just $0.04. What cost $1.00 in 1913, costs around $23.00 today. What happened before the Fed took over the management of our currency? Well, in the 100 years prior to the Fed’s creation... More on inflation: |

| Jim Rogers: Four surprising reasons to invest in China now Posted: 26 Sep 2013 01:09 PM PDT From Mining.com: A number of emerging markets have entered rough economic waters but there's still plenty of opportunity to go around, particularly in China... Rogers warned investors not to be flaky – to try to understand Chinese development in historical context: "In the 19th century in America, we had 15 depressions, with a 'd', and yet we became the most exciting and successful country in the 20th century." "China's gonna have a lot of problems. I don't know what or when or why, but I know it's coming. But when they happen, take advantage of the opportunity, don't throw up your hands and say 'oh gosh, now I'm going to Denmark to learn Danish' or something." Rogers highlighted four Chinese industries worth looking at in depth... Crux note: Like our colleague Porter Stansberry, investment legend Jim Rogers believes the government's inflationary policies will end in disaster for most Americans. But you don't have to be one of them. Jim recently published a "blueprint" detailing how almost anyone can "escape" America... without leaving home. Click here to discover how you can get your very own copy, absolutely free... More from Jim Rogers: |

| Gold and silver prices: Mapping short term volatility Posted: 26 Sep 2013 12:40 PM PDT After years of paying attention to the price action and not the mainstream market commentary — thanks in large part to Ted Butler and GATA — here are some of the dominate forces that currently seem to be determining price movements in the precious metals: |

| Posted: 26 Sep 2013 12:00 PM PDT You may have noticed yesterday that Walmart announced that they will be cutting orders because inventories are piling up. Only the most minimal thought is needed to understand what this means, Americans are shopped out. If Walmart’s sales have slowed it can only mean that the sales nationwide have slowed. This is not Saks 5th Avenue or Brooks Brothers announcing slow sales, this is Walmart where the average person goes to get anything and everything they need (or want). It is also interesting how CNBC handled this news yesterday. They spun it and twisted the news the best that they could, they even backtracked to say that the news was misunderstood. Look, slower sales should not be a shock to anyone. What should be a shock is that when you add up the sales of various stores or the actual sales by state of real estate or private polls of employment…they rarely if ever add up to and equal the “official” numbers released. They should but they rarely do. Back in the late 1800′s or early 1900′s, Vanderbilt, Carnegie and JP Morgan (as well as anyone else) could just look out their window at the smokestacks to see how business was doing. Then from the 1920′s until maybe 1990 or so you could track General Motors sales to gauge national business activity. Now all you need to do is look at Walmart…and they have spoken for anyone willing to listen. So why do I bring this up? Because there is supposedly a debate going on as to whether or not the Fed needs to taper, not taper or even monetize more. Looking at Walmart (the condition of Main St.) things are not going so well. Looking at the façade of Wall St., the markets are up. One is not confirming the other. Is this a surprise? Does anything today confirm anything else? We wake up every morning and are “told” what “is and isn’t.” Not that it makes any sense but it is…because it “is.” None of what I’ve written so far is breaking news or even great commentary but I have a point here. We are now 2 years into gold and silver correcting in price with the last 12 months becoming “harsh.” Some have told me or written to me that I should just stop writing. That I write because I have an ax to grind or I am talking my book. I’ve been told that “I am saying the same things I said last year yet gold and silver are significantly lower now than then.” First, for any reason or any amount of money “Bill Holter” will never write or say anything that he does not believe in. Second, yes, gold and silver are down. Do I believe that they should trade at these levels now with huge international demand and in the case of silver…below the global cost of production? Of course not. Can I or any of the other hard money advocate “make” the metals trade higher? Again, no. The only thing that we can do is to tell you the truth or at least the truth as we see it. Could we foresee 50% of the world’s silver production being sold on an Asian exchange during the thinnest trading of the week on a Sunday night? No, but, we can tell you that it is not natural, normal or even in the best interest of the seller…if that seller wanted the best price for what they sold. Unless of course there are ulterior motives. These “ulterior motives” want and need a lower than “true” market price for the metals. The only thing to do when someone offers you a product for less than what it costs to produce AND at price levels that were arrived at fraudulently…is to buy as much of it as you can afford! I/we can only try to tell you the truth as we see it. No one can or has faulted, proven faulty or even tried to attack “Austrian logic.” The ONLY thing that has been done is to “point” at price. They can point to the price of the Dow Jones or point to the price of silver and gold and say…”see you are wrong.” Well yes, for now. While business conditions suck, unemployment runs rampant, inflation runs 5% over official reports, cash money gets laundered into real estate and metals prices drop while proven and confirmed demand increases and supply decreases…we are wrong. I will say this, if something doesn’t make “common sense” and unless it is truly rocket science or brain surgery…then it is most probably wrong. Take advantage now of precious metals pricing that has been manufactured by paper markets rather than true supply and demand. Will you “make money” within 3 months, 6 months or a year? Who knows, what I do know is that our Treasury and Federal Reserve are broke and their Ponzi schemes are in the very late stages. I also know that when the day comes, you will wish that you had more ounces. Until then, we await some sort of statement from “good cop” Bart Chilton. Again, common sense tells us that the CFTC could in no way “indict” what has clearly been an “official” operation.Similar Posts: |

| Can silver and palladium tell us more about the outlook for gold? Posted: 26 Sep 2013 11:52 AM PDT It is usually the case that the most important price moves are seen simultaneously in all precious metals, so by comparing different metals' performance we could spot some confirmations or invalidations of the above. |

| Must-read: Ten reasons to quit your job right now, today Posted: 26 Sep 2013 11:50 AM PDT From James Altucher in The Altucher Confidential: The other day I met a guy who had worked for 38 years at GM. He wasn't in the union and he wasn't a high level executive. So consequently, when the rock of corporate safety in America over the past century went bankrupt he got nothing. No pension, no insurance, no savings. The unions got their money. The high level execs got their golden parachutes. the 30,000 in the middle got nothing. "I thought it was safe," he told me. "I thought nothing could touch me." The American religion wants you to believe that corporate safety is here, that its going to protect you and your white picket fence and your framed college degree. But its a lie. The government doesn't care about you. Your bosses don't care about you. And when the desert that rises up to claim you back into its dust, you'll disappear and nobody will wonder about your accomplishments and the things you are most proud of. Even when I had the best job ever, the job that was the best time in my life, I still had to consider: how am I going to escape this. Most people need to begin their exit strategy RIGHT NOW. So here's the 10 reasons you need to quit your job right now. And below that I have the methods for doing it. 1) Safety. We used to think you get a corporate job, you rise up, you get promoted, maybe you move horizontally to another division or a similar company, you get promoted again, and eventually you retire with enough savings in your IRA. That's all gone. That myth disappeared in 2008. It really never existed but now we know it's a myth. Corporate CEOs kept their billion dollar salaries and laid off about 20 million people and sent the jobs to China. Fine, don't complain or blame other people. But your job is not safe. 2) Home. Everyone thinks they need a safe job so they can save up to buy a home and also qualify for a mortgage. Mortgage lenders at the banks like people who are like them – other people locked in cubicle prison. Well now you don't need to worry about that. Here's why you should never own a home in the first place. Save yourself the stress. 3) College. Everyone thinks they need to save up to send their kids to college. Depending on how many kids you have and where you want them to go to college it could cost millions. Well now we know you don't need to send your kid to college. So you don't need to stress about that money anymore. 4) Their boss. Most people don't like their boss. Its like any relationship. Most of the time you get into a relationship for the wrong reasons. Eventually you're unhappy. And if you don't get out, you become miserable and scarred for life. 5) Their coworkers. See above. 6) Fear. We have such a high unemployment rate, people are afraid if they leave the job they are miserable at, they won't be able to get a job. This is true if you just walk into your boss's office and pee on his desk and get fired. But its not true if you prepare well. More on that in a bit. 7) The Work. Most people don't like the work they do. They spend 4 years going to college, another few years in graduate school, and then they think they have to use that law degree, business degree, architecture degree and then guess what? They hate it. But they don't want to admit it. They feel guilty. They are in debt. No problem. Read on. 8) Bad things happen. All the stuff I mention in the post "10 Reasons You Need to Quit Your Job" start to happen. And it gets worse and worse. You don't want to look back at your life and say, "man, those were the worst 45 years of my life." That wouldn't feel good. 9) The economy is about to boom. I don't care if you believe this or not. Stop reading the newspaper so much. The newspapers are trying to scare you. Bernanke just printed up a trillion dollars and airlifted it onto the US economy. Who is going to scoop that up. You in your cubicle? Think again. 10) Your job has clamped your creativity. You do the same thing every day. You want to be jolted, refreshed, rejuvenated. Note: Some people love their jobs. This is not for them, but the 90% who don't. So: Henry and Aaron asked a good question: You still need to support yourself, you still need to support your family, you can't just walk into your boss's office and quit. Good point. You need to prepare. Its like training for the Olympics if you feel now is the time to move on from your job. You need to be physically ready, emotionally (don't quit your job and get divorced on the same day for instance), mentally (get your idea muscle in shape) and spirituall all ready. The posts that will help you quit your job. To quit, at least follow the ideas in the first post: How to be the luckiest man alive in 4 easy steps What to do if you were fired today The 100 rules for being an entrepreneur In the above link, it's not about starting a business. It's about finding what your frontier is, how to explore it, how to test the waters and move beyond it. I'm not saying I can do this. I've hit my boundary so many times and bounced off that I have six broken noses to show for it. Some notes on this post: Note #1: I get a lot of criticisms from anonymous people in the Yahoo message boards. Claudia begs me, "Don't look at the message boards unless you talk to me first." Because she knows I'm an addict. I tell her 'ok' but I know I'm going to look. Because that's what addicts do. Note #2: Sometimes people criticize the "list" format in these posts. "10 reasons" for this. "10 reasons" for that. About 20% of my posts are lists. Not so much. Read "The Power of Hypnosis" or "The Tooth" for two recent non-list posts. And Charlton Heston clearly didn't mind lists when he came down from Mt. Sinai with "The 10 Commandments", the very first blog post. 3500 years later and still getting clicks. I don't mind when people critique me when they've lost, quit, or have been fired from as many jobs as I have. Or lost a home. Tried to raise two kids with almost nothing. Been as desperately unhappy as sometimes I've been. This doesn't qualify me for anything, of course. Maybe it disqualifies me. Who cares? A lot of people have had much worse than me. And I've been very blessed as well. Sometimes you can build back up. And sometimes you just think, "How the hell did this happen to me again". You can criticize me on Yahoo message boards. You can critique lists if you think you have some better way of helping people. My goal in these posts is to help people maybe think for a split second they can reduce some stress in their lives, they don't have to go through what I went through, they can throw themselves into experience and still come back alive, and at the end of the day, they can use some of these ideas to live a better and more fulfilling life. I've had that experience and I like to write about it. Later tonight I'm going to give my two daughters, nine and twelve years old, two choices and ONLY two choices. Either they watch "Star Wars" with me or they watch "Schindler's List". And if they don't like either choice then maybe I'll just sit by the TV with some ice cream and watch all by myself. Crux note: If you enjoyed this post from our friend James Altucher, you cannot afford to miss his new book, Choose Yourself. S&A founder Porter Stansberry calls it "the first and only 'self-help' book I've ever recommended in my life." Click here to see why. More on jobs: |

| This could slam a long-term floor under the price of gold Posted: 26 Sep 2013 11:50 AM PDT From Pierce Points: Low gold prices are starting to cure low gold prices it appears. The first signs of meaningful production cuts for the industry emerged this week, in Ghana. Ben Aryee, head of the state Minerals Commission, told reporters that Ghana’s gold output may drop as much as 18% this year. Aryee reported that the nation’s production in the second quarter fell 6.4%, to 1.021 million ounces. He singled out the low gold price as the direct cause of falling output, saying that gold production "will definitely decline" as "companies are scaling down operations." Such sweeping cuts from a top-ten producing nation are a sign of the times. As the chart below shows, the latest numbers from... More on gold: |

| The Smell of Collapse Is In The Air: Part 2 Posted: 26 Sep 2013 11:30 AM PDT

CAUTION! Before you continue… If you believe that total government debt can grow FOREVER and more rapidly than the underlying economy, this article is NOT for you. If you believe that governmental deficit spending, QE, and bond monetization can continue FOREVER without major consequences, this article is NOT for you. But if you are sane [...] The post The Smell of Collapse Is In The Air: Part 2 appeared first on Silver Doctors. |

| India's gold bar imports plunged 68% year-on-year in August Posted: 26 Sep 2013 11:26 AM PDT The Gems and Jewelry Export Promotion Council (GJEPC) has released the latest data for imports of raw materials for gems and jewelry. According to the data, the gold bar imports by the country witnessed a huge fall of 67.61% in August over the year. |

| Precious metals driven by U.S. debt limit as countdown begins Posted: 26 Sep 2013 11:17 AM PDT Analysts at ANZ Bank said in a note today that they expect headlines around the U.S. debt debate "to drive" the gold price and other precious metals. |

| Posted: 26 Sep 2013 11:04 AM PDT What is Bitcoin in the game as? It is clearly a medium of exchange, after all, many sites now accept it as a means of payment. But is it in the game as the new sound money? Is it the new gold? |

| Gold mining activity adversely affected by budget cuts: SNL MEG Posted: 26 Sep 2013 10:50 AM PDT Among factors adversely affecting mining are ongoing financing pressures on the junior exploration sector and budget cuts by major and intermediate producers. |

| CFTC Silver Probe: See-no-Evil, Hear-no-Evil, Speak-no-Evil Posted: 26 Sep 2013 10:43 AM PDT When the world's largest commodity futures "regulator" releases the results of a five-year probe; one expects to see a detailed, thorough, and well-reasoned analysis. What we see instead is a pathetic exercise in pseudo-logic – which could have been written in its entirety in a single afternoon. "Shallow" cannot begin to describe the lack of depth in this probe. Indeed, one would not even attempt such a vacuous non-response to the question/issue of silver manipulation unless they were absolutely certain that their findings would not be questioned in the slightest – as poking holes in this drivel is proverbial "child's play." Thus in releasing such a farcical probe, this directly implies a totally corrupt (Corporate) media – one which only parrots, never questions. Fortunately the CFTC has been kind of enough to place all of its pseudo-reasoning in bullet-point form, saving readers precious minutes of their lives which they would have otherwise wasted in going through its drivel line-by-line in order to expose this Big Lie. This makes the task of analysis simple: list these bogus arguments, expose the gigantic, unstated assumption (and omitted facts) upon which these "reasons" are based – and then translate them back into the Real World. 1) Silver cash and futures prices have risen dramatically between 2005 and 2007, with silver outperforming the gold, platinum and palladium markets, suggesting that silver futures prices are not depressed relative to other metals prices. 2) NYMEX silver futures prices tend to track closely the price of physical silver. 3) Concentration levels for the top four short futures traders in the silver market are comparable to those observed in the gold and copper futures markets, and generally are lower than the levels seen in the platinum and palladium futures markets. 4) The composition of the traders comprising the top four short futures traders, in terms of net positions, change over time. These traders represent a diverse group, and their futures positions are driven by an even more diverse group of customers. 5) There is no observable relationship between short-futures-trader concentration levels and silver prices. 6) There is a slightly positive relationship between the total net position of the large short futures traders and silver prices; this suggests that larger short futures positions are associated with higher, not lower prices. All of this report is totally and completely predicated upon one, single assumption, with the exception of arguments (2), (3) and (4), which (because of their specific nature) are also based upon separate, false assumptions and missing facts. The huge assumption upon which the entire CFTC report rests is that the silver market was "normal" at the time it commenced its sham-analysis, a market with supply and demand in balance, and prices in equilibrium. We know that this is an assumption in all of the CFTC's reasoning, because never once does it attempt to address how its analysis would differ if one did not assume a market in perfect balance. In fact, at the time the CFTC commenced its examination of the silver market; the silver market represented the most-tortured, perverted commodity market in the history of human commerce: prices near multi-century lows, inventories totally collapsed, near-complete genocide in the silver mining industry. These fundamentals are so extreme that no "regulator" could possibly fail to be aware of them. Indeed, the CFTC deliberately, cynically chose the absolute lowest point of this multi-century silver trough as the "norm" upon which it bases its entire pseudo-analysis. |

| Max Keiser: We Are on a Gold Standard Now, Even Though it is Not Recognized Posted: 26 Sep 2013 10:00 AM PDT

If you believe that gold no longer plays a role, think again. In effect, if you know what to look for, the world is on a gold standard now. 2013 Gold Eagles As Low As $51.49 Over Spot at SDBullion! Originally posted on RT.com In 1971 the US 'closed the gold window' starting an era [...] The post Max Keiser: We Are on a Gold Standard Now, Even Though it is Not Recognized appeared first on Silver Doctors. |

| U.S. 5 year silver market investigation ends: No Libor-style manipulation Posted: 26 Sep 2013 09:35 AM PDT The Division of Enforcement is not recommending charges to the CFTC in the silver investigation. Despite the five year investigation, no report of the investigation or its findings is being released to the public. |

| The Long-Running Silver Manipulation Case Posted: 26 Sep 2013 08:45 AM PDT We are getting ready to leave for Florida next Monday. Lot's to do to get things organized here before we turn our house over to our caretaker, who moves in and watches over things when we are out of town. I will be cutting back on my personal comments until the middle of next week and start back up from Miami. Today I have gathered a few must-read articles together for you that cover the most important event(s) on Wednesday. The key news was that the CFTC let JPMorgan off the hook in the long-running silver manipulation case. Bill Holter wrote a great article on this. Don't miss it. It's Bill at his best! I had a discussion with a friend about when he expects gold to finally turn up? His information is usually pretty accurate. He said, "Gold will bottom soon and then turn much higher. The bottom in 2000 was in November and the bottom in 2008 occurred in October with near double bottom in November. I expect the same timing to repeat this year. Be patient. The gold market is setting up for an excellent year in 2014 and the move will come before Thanksgiving." Let's start today's daily with the following important interview with GATA's Chris Powell that discusses why the CFTC can't stop market rigging when U.S. government does it – it's the law.

Also, on the same topic, Chris Powell is interviewed on King World News and discusses the same event… Another must see interview!

Similar Posts: |

| Another Piece of Economic Data - Another Reaction in Gold Posted: 26 Sep 2013 08:30 AM PDT The drama remains exactly the same as it has for some time now....a piece of economic news is released and it either confirms or dispels ideas of Fed tapering of bond buying. This time it was the jobless claims number which came in at 305,00 first time claims versus market expectations of 330,000. The news was interpreted as a jobs market improvement or more accurately, a job market that is not deteriorating as bad as some expected and therefore bolstered Fed tapering ideas. Up goes the US Dollar and down goes gold as a result. Get used to this - every single economic data release is going to be dissected and examined for "clues" to our monetary masters' next move. This is the tragic state to which our once proud financial market system has been reduced. As stated many times here before, go and grab a Daisy and start plucking the pedals as you recite the phrases, "She loves me; she loves me not" and you pretty much have the modern trading algorithm. If you have noticed, even the bond market has been reduced to playing this infernal game as it has lower today, with interest rates subsequently moving back up again. Up and down, up and down.... The only major markets seemingly unaffected by this were the equity markets which rose on the news. Then again, they rise on any news these days, whether bad or good. What else can be expected here in the land of perpetual bull markets in equities where bear markets have been rendered an obsolete concept from days gone by. From a technical analysis perspective, gold is having trouble maintaining its footing above key resistance centered between $1330 - $1335. Rallies are attracting selling and dips towards $1300 are attracting buying. It is still in a range until it proves which way it wants to go. Weakness in the gold mining shares would seem to indicate that it wants to break lower but thus far that has not been the case. In other words, I have no idea where this thing is headed in the short term. I have included the RSI or Relative Strength Indicator to show you the range trade and lack of clear direction. Notice that for the better part of three weeks, this indicator has been mostly confined between 60 on the top and 20 on the bottom; not a particularly friendly reading. We did get that sharp spike on the day of the FOMC statement which took the RSI through the top of this range and looked as if more promising things were ahead for the metal but it quickly surrendered its gains with the indicator reverting back to its previous pattern. On this time frame, the RSI would need to clear at least 65 for me to get the least bit excited about the metal but more importantly, it would have to push past the previous price peak made the day of and the day after the FOMC statement. At this point, that does not appear to be in the cards WITHOUT ANOTHER CATALYST coming from somewhere. After all, if gold cannot sustain a rally with a clear statement coming from the Fed that the economy is too weak for them to consider tapering at this time, then what in the world is it going to take to push this metal higher? My answer to that is the same - a LOSS OF CONFIDENCE in the currency and with the Dollar refusing to break down significantly right now, we are not seeing any signs of that. Perhaps the upcoming federal debt ceiling will change some minds in that regards but the jury is still out on that. The problem for gold remains the same thing I have been saying for weeks now - speculative money is not interested in chasing prices higher. Money inflows are simply not there and without them, this market cannot sustain any rallies. Something is going to have to change in investor/trader sentiment to bring this hot money back into the gold market, and the silver market, for that matter. Until it does, it looks to me like the bears still have the advantage until proven otherwise. |

| Posted: 26 Sep 2013 08:30 AM PDT

Within a millisecond of the 2pm release of the September 18, 2013 FOMC Meeting Announcement, the stock market exploded, trading nearly $400 Million worth of stock in a tenth of a second (a blink of an eye is 3 times longer), and almost $1 Billion worth in 2 seconds. Over in Chicago, futures trading also [...] The post CIA and The Fed appeared first on Silver Doctors. |

| Gold and Silver still fighting to keep above 1300-1322 Posted: 26 Sep 2013 08:07 AM PDT Commodity Trader |

| Radio Appearance with John Stadtmiller of Republic National Broadcasting Posted: 26 Sep 2013 07:45 AM PDT Andy Hoffman joins John Stadtmiller of the Republic Broadcasting Network to discuss Syria, housing, Obamacare, unemployment and gold. Republic Broadcasting Network – September 24, 2013 – Andy HoffmanSimilar Posts: |

| U.S. 5 Year Silver Market Investigation Ends - No LIBOR Style Manipulation Posted: 26 Sep 2013 07:02 AM PDT gold.ie |

| Gold: Options Expiry Mouse Versus Asian Tiger Posted: 26 Sep 2013 07:00 AM PDT

The gold price continues to decline, albeit modestly. Many gold investors are rightfully frustrated, after watching gold stocks give up all their "no taper" rally gains. The key issue causing this situation is comex gold options. Gold expiration day was yesterday, September 25. Gold often tends to decline as options expiry approaches, and I think [...] The post Gold: Options Expiry Mouse Versus Asian Tiger appeared first on Silver Doctors. |

| Posted: 26 Sep 2013 06:45 AM PDT Now that I have a daughter, I'm watching Sesame Street for the first time since I was a child. Much has changed, including the set, the cast, and the fact that the most popular character is no longer the Cookie Monster, but Elmo. I have many fond memories of the show, and look forward to watching it on Sprout for the next few years. Back in the early 1970s, I distinctly remember a Sesame Street Muppet named Bad Bart, idolized here on You Tube. Bad Bart was a good guy mistaken for a Western outlaw. People (Muppets) feared him like Jesse James; but in reality, he was just misunderstood. In other words, the polar opposite of Bart Chilton, who for years I have called "Good Cop" Chilton; i.e., a wolf in sheep's clothing. Sure, he facilitated GATA's participation in the March 2010 CFTC hearing on COMEX metals position limits; and yes, he actually stated in October 2010 that he believed silver was in fact manipulated. In his words:

However, aside from these two outbursts of humanity, he has largely proved to be a figurehead; clearly ordered to maintain the illusion of an investigation when in fact there NEVER was one. As I have stated for years, there's not a chance the government's PM suppression scheme – you know, the core of their ability to maintain a status quo in which they maintain wealth and power – would end at their own hand. The markets will ultimately overwhelm them; but in the meantime, government agencies like the CFTC are charged with not suppressing, but supporting their nefarious manipulations. The same goes for the SEC in the stock market; and for that matter, any and all regulatory framework – including the still not completed Dodd-Frank Act. To that end, just as the five-year statute of limitations on the investigation into the 2008 PAPER silver attacks was about to end, the CFTC – not surprisingly – concluded absolutely nothing prosecutable occurred. Chaired by a former Goldman Sachs partner – Gary Gensler – the investigation never had a chance, despite DAILY actions so obvious, a reasonably intelligent fifth-grader could spot it. I have dedicated my second career – as have GATA and others – to pointing such criminality each and every day; and despite the CFTC's decision, I expect more and more scrutiny as the ENTIRE WORLD wakes up to suppression of the "linchpin" of the global monetary system – i.e., REAL MONEY. The population in general may be dumbed down to unprecedented levels, but they are finally starting to doubt government PROPAGANDA that flies in the face of the REALITY of a dramatically weakening economy. Just ask Wal-Mart – America's LARGEST CORPORATION – what they are currently seeing; or heck, the ENTIRE CONTINENT of Asia…

…which by the way – per this email today from one of my Asian readers – is buying gold like it's going out of style…

Well, maybe not out of style; but certainly, it will shortly be out of stock - as the inevitable run on REAL MONEY approaches. And when it arrives like a financial tsunami – which frankly, could be catalyzed by any number of issues, at any time – you better have purchased it already; as by then, it will be too late to PROTECT yourself.Similar Posts: |

| Just How Much PM-Positive News Can Emerge? You Ain’t Seen Nothing Yet! Posted: 26 Sep 2013 06:00 AM PDT Usually, I tackle big picture – often abstract – issues in my writing. And we know, there are plenty to report on. However, sometimes the mosaic created by reporting on the myriad "small stuff" is just as effective in conveying my point; i.e., the entire GLOBAL economy is on the brink of irreversible decline due to the damage created by four decades of unfettered MONEY PRINTING. The world's BIG MONEY knows it; Eric Sprott knows it – and is visibly ticked off discussing it. Generally speaking, anyone that can think for themselves – and is willing to do so – knows it; and pretty soon, the ENTIRE WORLD will as well. Sadly, by the time the masses overcome the "groupthink" that prevents them from acting on such information, it will be too late. Each day, the "evil Troika" of Washington, Wall Street, and the MSM tell us a new "hurdle" must be cleared to reach the promised land of "recovery." Regarding anything economic, the outcome is ALWAYS assumed to be positive – despite years of evidence to the contrary. Conversely, they'll tell you such hurdles are insurmountable for Precious Metals – despite a 12+ year bull market, and textbook conditions for further price appreciation. Over time, relentless misinformation wears one down as much mentally as financially; as holding gold is contrary to a lifetime of PROPAGANDA denigrating it as a "barbarous relic" – despite it having outperformed ALL mainstream assets for the past decade. First and foremost, we are told gold and silver – despite having already been taken well below their respective costs of production – should fear "tapering" of the most aggressive MONEY PRINTING experiment of all time; i.e., the Ponzi scheme unfolding before our eyes in Treasury and Mortgage-Backed Securities – as I wrote of yesterday. Of course, tapering and halting are two different things entirely; and even if the Fed were to halt QE, it wouldn't have the slightest impact on the government's CATASTROPHIC financial condition. In fact, it would only make things worse; as if just the hint of tapering caused such damage to the bond market, think of what the impact of actually halting QE – let alone, unwinding the Fed's $3.4 trillion bond portfolio – would be. What's left of the economy would implode; deficits would soar; and the dollar would collapse. To wit, below is a table depicting what the government itself claims are "improved deficits"; ignoring, of course, what I wrote yesterday of the "extraordinary measures" utilized to conjure them out of thin air. Does this look like an improvement to you; particularly when higher "revenues" are due to pure accounting chicanery – like collecting "dividends" from the insolvent, off-balance sheet housing entities Fannie Mae and Freddie Mac? And what would this chart look like if the Fed stopped buying bonds entirely, causing interest rates to rise? Not only would said "dividends" from Fannie and Freddie create monstrous financial vacuums, but deficits would explode because each 1% rate increase adds roughly $200 BILLION to annual debt service costs. And as NO ONE is buying Treasuries but the Fed, how fast do you imagine said rates will rise?

Then, of course, you have the preface behind the Fed's June 19th statement; you know, when it said it may moderate the pace of purchases later in 2013 if the economy improves. Well I don't know about you, but I'm a bit puzzled as to how ANYONE can say the economy is improving; certainly not since June, when rates have surged and everything from durable goods orders to retail sales to mortgage applications, housing starts, and consumer confidence have tumbled. Not to mention, the July and August NFP employment reports were utter disasters – in the latter case, featuring a 30+ year low in the Labor Participation Rate. There's a reason the majority of Fed governors say tapering is not even a consideration; as each day, the economic data tanks further. This week alone, we've seen an "unexpected" PMI Manufacturing decline, a plunging Richmond Manufacturing Index, a four-month low in consumer confidence, terminally weak durable goods orders, and yet another Wall Street vulture exiting the materially declining housing market. Not to mention, surging Treasury bonds – indicating heightened confidence that tapering is off the table; as the benchmark 10-year yield is down from 2.90% when the FOMC statement was issued last week – covert "turboQEing" efforts not withstanding – to just 2.64% today. We're also told to ignore the fact that House Republicans are threatening to SHUT DOWN the government when the next fiscal year commences on Tuesday. Either way, this will be the fifth straight year the world's largest economy has no budget; and accounting shenanigans or not, a gaping budget deficit that promises to worsen over time – especially if rates cannot be held near their all-time lows. If Congress fails to agree on a new Omnibus spending bill this week; particularly if the already passed – and Republican approved – Obamacare is cited as the stumbling block, we may well see S&P turn tail again, and revise America's financial "outlook" to NEGATIVE. Not to mention, debt-ceiling "D-Day" has now been set at October 17th; which ironically, could make the budget discussion moot. In other words, a 2011-like CATASTROPHE could be awaiting us in the very near future; and if the debt ceiling is eliminated, 2013's epic Precious Metals suppression could come to an abrupt end. Meanwhile, we're told an easing "Syria crisis" was a big reason gold and silver prices declined, when in fact 90% of their recent gains were made before the alleged August 19th chemical attack – which to this day, no one has any concrete evidence regarding the perpetrators. A supposedly "historic" agreement last week with the Russians has already been all but nullified; and frankly, America's actions depict a nation HELL-BENT on invasion. Heck, if you listened to Obama's U.N. speech yesterday, you'd think he was Israel's Benjamin Netanyahu – that is, "champing at the bit" to bomb IRAN. The ENTIRE GLOBAL ECONOMY is collapsing; and no matter how much governments LIE about it – from China to Greece – their actions speak louder than their words. Simultaneously, the level of "fascist fraud" is rising exponentially – as "TBTF" banks like JP Morgan run roughshod over what was once a world-renowned regulatory landscape. Even Central banks are on to the PM suppression ruse; including two that joined the "repatriation parade" this month – Poland and Finland. And thus, as we watch the "DEATH THROES OF A DYING CARTEL" – including this week's three straight 2:15 AM EST attacks at EXACTLY the ROUND NUMBER of $1,330/oz (all of which have been repelled); keep in mind the amount of PM-positive news is just getting started…

Reality ALWAYS wins the day, and this will be no different. Only this time, when it does, the END GAME of the failed four-decade fiat currency regime will have commenced. And when it does, you better have already purchased your PHYSICAL gold and silver; as likely, you won't get another chance. And to conclude, here is the first-ever live interview I have seen with the PM crusader Andrew Maguire; fittingly, on the Max Keiser show – as Max, too (like myself) is a former Wall Street insider that fled the criminality to pursue TRUTH and JUSTICE. When Andrew first came onto the scene in early 2010, I was skeptical of his motives. However, after spending a week with him and his wife at GATA's London conference in August 2011, I changed my mind completely. It is people like him that inspire me to be the best person I can be; and listening to him speak of what I have written of for years – from the standpoint of a long-time LBMA metals trader – is as empowering as anything I could possibly write.Similar Posts: |

| U.S. 5 Year Silver Market Investigation Ends – No LIBOR Style Manipulation Posted: 26 Sep 2013 04:20 AM PDT We continue to believe silver will rise to its real record high or inflation adjusted high of $140/oz in the coming years. It remains an important diversification for all looking to protect their wealth from "bail-ins" or deposit confiscation and currency devaluations. Today's AM fix was USD 1,332.50, EUR 987.92 and GBP 830.22 per ounce. Gold rose $10.60 or 0.8% yesterday, closing at $1,333.10/oz. Silver gained $0.11 or 0.51%, closing at $21.76. Platinum rose $4.19 or 0.3% to $1,422.49/oz, while palladium climbed $3.22 or 0.4% to $720.22/oz. Gold and silver have consolidated on yesterday's gains and silver is up nearly 1% to $22/oz. Both rose yesterday for the first time in four sessions on fears that U.S. budget negotiations have stalled, increasing the risk of a U.S. government shutdown. While a shutdown is unlikely, the politicians are likely to again raise the U.S. debt ceiling to close to $18 trillion, storing up much greater problems for the U.S. and global economy in the long term.

Silver's support is at $20/oz and a fall below that level could see silver test the next level of support at $18.40/oz mark. Resistance is at $25/oz and a breach above resistance should see silver quickly test the next level of resistance at $35/oz (see chart above). Expectedly, the Commodity Futures Trading Commission (CFTC) has closed the investigation that was publicly confirmed five years ago, in September 2008, concerning silver manipulation by Wall Street banks. The Division of Enforcement is not recommending charges to the CFTC in the silver investigation. Despite the five year investigation, no report of the investigation or its findings is being released to the public. The CFTC statement said that "based upon the law and evidence as they exist at this time, there is not a viable basis to bring an enforcement action with respect to any firm or its employees related to our investigation of silver markets". In September 2008, the CFTC confirmed that it was investigating complaints of misconduct in the silver market. At that time the Commission had received complaints regarding silver prices. These complaints were focused on whether the silver futures contracts traded on the COMEX were being manipulated. By reference to publicly available information concerning large traders with short open positions in the silver futures contracts, the complaints alleged that the concentrated large shorts in the silver market were responsible for manipulating silver futures prices. The decision may highlight the great difficulty that U.S. regulators face in proving a case of market manipulation, even after the CFTC was given greater powers to crack down on trading malfeasance after the 2010 Dodd-Frank financial reforms. Incredibly, only once in its 36 year history has it successfully concluded a manipulation prosecution. This was a 1998 case concerning electricity futures prices. Occasionally, the CFTC has levied heavy fines for trading rule violations. The closing of the probe was a rare bright spot for Wall Street commodities players and banks during a year in which the U.S. power market regulator has leveled record fines against two big banks, and the Federal Reserve is considering whether to rein in Wall Street’s ability to operate in physical metal and wider commodity markets.

Democrat commissioner Bart Chilton, who had championed the silver inquiry, said he was disappointed. “For me, there’s not been a more frustrating nor disappointing non-policy-related matter at the CFTC,” he said in a statement after the agency’s announcement. The Gold Anti-Trust Action Committee, an advocacy group that believes the Federal Reserve and banks are colluding to keep gold and silver prices artificially low, said it was not surprised by the CFTC decision. “We believe that the U.S. government is part of the trading operation. In essence, you are not going to have the CFTC turn against its own government,” GATA Chairman Bill Murphy said. “We are not even slightly surprised and had expected this.” A JP Morgan spokesperson declined to comment. The CFTC findings that there has been no manipulation of the silver market came a day after the Federal Reserve itself had expressed concerns about 'suspicious' trading in the gold market and a day after there were further revelations and developments regarding LIBOR interest rate market manipulation and rigging. The world’s largest interdealer broker, ICAP, has been fined $87 million (€64.4m) by U.S. and UK regulators over its role in the Libor rate rigging scandal. The CFTC and UK Financial Conduct Authority (FCA) ordered ICAP to pay $65m and £14m respectively to settle allegations of wrongdoing. The scandal, which has laid bare market manipulation and the failings of regulators and bank bosses, has already seen three banks fined $2.6 billion, four individuals charged, scores of institutions and traders grilled and a spate of lawsuits launched. Banks and brokers have faced allegations that their employees actively colluded with traders seeking to fix rates for personal gain – and were handsomely rewarded.

Silver's fundamentals remain very sound, with a very small finite supply of above ground, investment grade silver coins and bars and robust and increasing industrial and store of value demand – particularly in Asia. We continue to believe silver will rise to its real record high or inflation adjusted high of $140/oz in the coming years. It remains an important diversification for all looking to protect their wealth from "bail-ins" or deposit confiscation and currency devaluations. |

| The Fat Lady Has Yet to Sing for Dimon and JP Morgan Posted: 26 Sep 2013 02:49 AM PDT I thought I was late to write about JP Morgan’s $920 million multi-regulator settlement last week on the London Whale, but breathless news of a possible $11 billion settlement of mortgage-related liabilities has pushed the bank and its chief back under the hot lights. Let’s go in reverse chronological order. The $11 billion settlement, if it comes together, is less of a hit than it seems. JP Morgan’s stock traded up 2.7% when the news broke. First, the $11 billion is really more like $7 billion, which is the cash component. The remaining $4 billion is various forms of borrower relief. If this settlement bears any resemblance to the mortgage settlements of 2011 and 2012, these are junk credits, with the bank being allowed to claim relief for things it would have done anyhow. If the economic value of bona fide borrower relief gets to be as much as 10% of nominal value, that would be a large by historical standards. The reason the numbers being bandied about are large is that the total includes FHFA putback claims, which the Wall Street Journal puts at $6 billion out of the total. FHFA suits against all the banks were pencilled out as carrying a price tag of as much as $200 billion. But that estimate likely based the total on the value if the agency litigated and prevailed (which frankly was pretty likely, the GSEs have well-defined rights). The Department of Justice is leading the negotiations and the New York state is also a participant. In addition to an apparently large bid-asked spread (the Morgan bank proposed a mere $3 billion versus the $11 billion bruited as the sought-after figure) and the fact that the bank wants a global settlement for all mortgage-related liability (the DoJ is reluctant to settle criminal liability), another potential sticking point is an admission of wrongdoing. But in many ways, the $920 million London Whale settlement last week is a much bigger deal. It’s been remarkable to see how much confused or deliberately misleading commentary has been published about the pact. To wit: Jonathan Weil reveals he does not understand that SEC rules implement legislation. Ouch. And Matt Levine wrote such an absurd piece that I don’t need to do a takedown. If he keeps this sort of thing up, he’ll have a great future at the Onion. I’ll probably have more to say about this in future posts, so let me stick to a few big issue: JP Morgan is not out of the woods on the Whale matter. This settlement was for the SEC, the FSA, and the OCC. Given how Senate testimony the degree to which JP Morgan flat out lied to the OCC and the severity of the control failures, I’m surprised the dollar value wasn’t bigger. One small consolation is that the CFTC was not part of the deal, and its settlement is likely to be 50% of what JP Morgan has already agreed to pay. And it’s important to understand how world class terrible JP Morgan’s oversight of the CIO was. The SEC order makes for juicy reading. One of the stunners is that Dimon lied to his audit committee. Some executives were loath to sign valuations that were important components of the CFO’s and Dimon’s certifications of financial statements. And we have this remarkable tidbit:

One person responsible for price testing of a major portfolio? That’s all you need to know that JP Morgan’s controls were utter rubbish. The Globe and Mail adds:

An admission of how grossly deficient they were comes in how much the bank is spending to bring them up to snuff. From Reuters:

Now even though we agree with the Bloomberg editors, who deem the Whale settlement to be too small, why do we still think it’s hugely significant? Dimon screwed Corporate America. Did you notice the howling about the $920 million settlement from much of the financial media? They may be upset about the precedent set by JP Morgan admitting to wrongdoing. But far more significant is something that the SEC perversely did not play up, which is that JP Morgan ‘fessed up to Sarbanes Oxley violations. And that means that the normal fig leaf of having a complaint auditor say everything was fine is no protection. Remember, heretofore Sarbanes Oxley has been a dead letter, at least from an enforcement perspective. To my knowledge, there were only two previous times the SEC tried using it: in HealthSouth, where it lost in court (not necessarily a meaningful indicator, since Richard Scrushy had huge home court advantage with an Alabama jury [he went to considerable lengths to taint the juror pool by large donations to and regular appearances in black churches]) and against Angelo Mozilo, where the SEC lost a ruling that seemed to put it off trying to use Sarbox (discussed at length in this post). The reason that this is a big deal is Sarbanes Oxley was designed expressly to get past the “I’m the CEO and I have no idea what happened” defense. Sarbanes Oxley requires corporate executives, which generally is at least the CEO and the CFO, to certify the adequacy of internal controls. And for a big bank, that includes risk controls. You can’t pretend to have adequate controls when, as the SEC describes, management is shocked to learn that your counterparties are demanding hundreds of millions in collateral because everyone in the market (as well as your own investment bank!) is marking positions differently than your biggest trading unit in the bank. Dimon is not out of the woods. The SEC only settled liability with the bank; it is still looking into charging individuals. The Wall Street Journal reported:

A compliance expert e-mailed to say that Dimon met all the conditions for a criminal prosecution under Sarbanes Oxley. So it’s the reluctance of the regulators to take on a TBTF CEO (particularly one that has no credible successor in the wings) that is keeping him safe for now. But remember, the CFTC’s investigation and resulting order may provide additional damning information. And recall the FBI and the Southern District of New York are trying to extradite two Whale traders. One is likely to be beyond their reach, but the other may not be. If he turns useful state’s evidence, the desire among the officialdom to Do Something About Dimon could change. I was hearing concerns voiced about Dimon over two years ago. Among other things, he’d browbeaten Ben Bernanke and Mark Carney, then the head of the Bank of Canada, within a span of week (Carney kept his cool and issued what everyone recognized was a dressing down within 24 hours). The concern was that either Dimon was becoming more erratic, or the bank was actually in trouble of some sort, and Dimon was going on the offense to divert attention from his problems. And worse, even though all TBTF are systemically dangerous, if anything JP Morgan is more so by virtue of its massive tri-party repo operation. Now even if more damning fact emerge about Dimon, they’d have to be awfully damning for him to be the target of litigation. But I could see the threat of litigation to be used to get JP Morgan to clean up its corporate governance act. At a minimum, the bank needs to split its CEO and Chairman roles (Dimon threatened to quit over that, but that was before the Whale shoes started to drop and analyst Josh Rosner released his rap sheet against JP Morgan, cataloguing the astonishing range and costs of regulatory sanctions) and force Dimon to have a real successor lined up, not some candidates who are clearly years away from being ready to take the helm. It’s way too early to tell how meaningful these actions against JP Morgan will prove to be. One robin does not make a spring. But they are at least an improvement over the abject regulatory dereliction of duty we’ve seen by regulators in the wake of the crisis, and if we are lucky, may represent them re-learning how to use their muscle. |