saveyourassetsfirst3 |

- Apple Poised For A Strong December

- Silver Sky For Silver Wheaton

- Near Term US Dollar & Market Relationships

- Corvus Drills 48.7 m of 1.9 g/t Au at North Bullfrog

- Evil smackdown commencing

- houston coin show this week

- ECB : increase of oz753,21 in gold and gold receivables

- 2012 Silver Market Review

- Flash Crash in Gold – Whodunnit?

- Gold Price Forecast For 2013: Rising Value Amid More Global Uncertainty?

- The Gold Price Tumbles But Don't Worry

- New U.S. Sanctions To End "Turkeys Game Of Gold For Natural Gas"

- US Dollar and Market relationships near term

- New Sanctions to End 'Game of Gold for Natural Gas'

- NC’s Guess About a Sean Quinn-GT Group Connection Just Got a Bit More Solid (But a Bit More Ho-Hum, Too)

- Bullion at One-Week Low on Fiscal Cliff Concern

- Why It's Time To Look At European Utilities

- Will Better News from Europe & U.S. Derail Gold?

- Is The EUR Confined To Lame Duck Status?

- Germany ‘tied to a corpse’

- Silver: The Gorgeous Cup & Handle

- Yra Harris: Gold and Out of Control Inflation

- Gold and Silver Market morning, November 28, 2012

- Silver Update: Silver Saga 11.27.12

- Grant Williams: Gold Market Manipulation is More Than Plausible

- ETF Securities Launches Bullion Trackers in Hong Kong

| Apple Poised For A Strong December Posted: 28 Nov 2012 10:45 AM PST By Bret Jensen:

Judging from the market sell-off and increased volatility over the last few days, the politicians must be back in town. Oh well, it was nice while they were away for the Thanksgiving break and not on TV in campaign mode instead of meeting to resolve the "fiscal cliff". Looking for silver linings, Apple (AAPL) sure has had a nice run since its predicted bottom on November 16%. The stock has gone from $506 intra-day on the 16th to over $590 before its recent pullback to around $575 in this latest market downdraft and we should expect volatile trading sessions until the politicians decide to behave like adults and reach a deal. For those that did not pull the trigger or add to their position when Apple approached $500, this could be another Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 10:41 AM PST By PowerOptions: The long-term prospects for Silver Wheaton (SLW) appear bright, as the company is on track for its best year ever with a production forecast of 28 million silver equivalent ounces for this year - and the company is forecasting to grow production to 48 million ounces by 2016 - that's a lot of silverware. However, in Silver Wheaton's Q3 earnings results released on November 5, 2012, the company noted it produced 7.7 million silver equivalent ounces but only sold 5.1 million ounces. Due to the lower amount of silver sales and also due to lower silver prices, the company's revenues and operating cash flows were down year-over-year. And, since Silver Wheaton's dividend is tied to its cash flows, 20% of operating cash flows, its divided payment this quarter was also lower than in recent quarters. Silver Wheaton is in the mining business, but doesn't actually own any mines. Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Near Term US Dollar & Market Relationships Posted: 28 Nov 2012 10:33 AM PST The S&P 500 a nice run to 1409 and met resistance there. Expect a pullback to the 1384 area, if not a bit lower, in the coming days. The US dollar is likely to get a bounce which will also pull down precious metals along with stocks near term. | ||||||||||||||||||||||||||||||||||||||||||||||||||

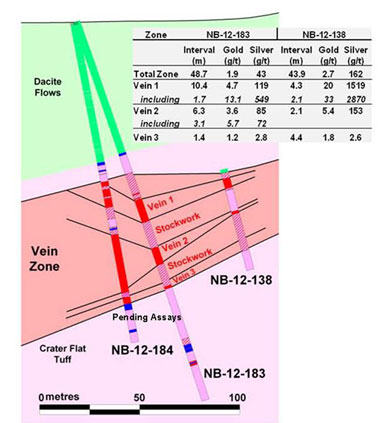

| Corvus Drills 48.7 m of 1.9 g/t Au at North Bullfrog Posted: 28 Nov 2012 10:07 AM PST

Vancouver, B.C., Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) announces the latest assays from the first hole of the 2012 Phase II Yellow Jacket drill program at the North Bullfrog Project, Nevada. The four hole program was designed to further identify and delineate the bonanza grade feeder system identified earlier in 2012 in hole NB-12-138 which returned 72.4 metres @ 1.74 g/t gold and 98.7 g/t silver including 4.3 metres @ 20 g/t gold and 1,519 g/t silver. The most recent results, Hole NB-12-183, intersected 49 metres @ 1.9 g/t gold and 43 g/t silver including 1.7m @ 13.1 g/t gold and 549 g/t silver (Table 1). The Yellow Jacket high-grade, fault controlled, gold and silver mineralization has been encountered over a strike length of approximately 700 metres and remains open. 3D IP imaging has highlighted a number of other structural zones with high-grade potential. Aggressive follow-up drilling at several other targets is expected to commence early 2013. During the most recent program, which commenced in early October, 780 metres of core were drilled in four holes. Three of the four holes hit significant vein mineralization, which remains open to the north and at depth. All vein intersections to date are within 150 metres of the surface (which could represent open pit mining depths) with quartz veins widening at depth (Figure 2) and have not been included in the current North Area resource. The silver to gold ratio of holes NB-12-138 & NB-12-183 is distinctly higher than that of the overall North Bullfrog resource estimate and could represent a major new silver discovery in the district which could benefit the overall project financing. Assays for the remainder of hole NB-12-183 and the other three holes are pending at this time. Table 1

*Intercepts are approximate true width and are calculated with 0.2 g/t gold cut-off Jeff Pontius, Corvus CEO stated: "As we continue with the planned development of the South area Mayflower deposit targeting gold production in late 2014, these new high-grade gold and silver intercepts in the North area open the door for a very exciting new Nevada high-grade discovery. The recent intercepts confirming and extending the spectacular mineralization found in hole NB-12-138 along with the substantial quartz vein thicknesses in the following three holes are giving shape to a significant new discovery that could dramatically change both the North Bullfrog project and the overall Corvus story." Yellow Jacket Vein System The Yellow Jacket vein system represents a completely blind discovery of a previously unrecognized style of mineralization in the North Bullfrog District (Figure 1). Prior drilling in this area was focussed to the east in an area of historic prospect pits along the Liberator and Yellow Jacket Faults with RC hole NB-10-63 intersecting 10.7 metres @ 7.5 g/t gold and 6.5 g/t silver and core hole NB-12-126 intersecting 11.4 metres @ 4.9 g/t gold and 7.0 g/t silver. Core hole NB-12-127 (7.7 metres @ 2.4 g/t gold and 11.31 g/t silver) was designed to follow up on an interesting intersection in RC hole NB-11-91 (9.1 metres @ 2.07 g/t gold and 2.32 g/t silver) which was the first time quartz vein related mineralization was encountered. These results were used to target the hotter boiling zone part of the quartz vein system which led to the Yellow Jacket discovery in hole NB-12-138 (72.4 metres @ 1.74 g/t gold and 98.7 g/t silver including 4.3 metres @ 20 g/t gold and 1,519 g/t silver). Structural analysis based on oriented core indicates that the mineralization in NB-12-138 is controlled by the intersection of the Blind and Mai Faults (Figure 1). Holes NB-12-183 and NB-12-184 were designed to drill perpendicular to the plunge of that intersection (Figure 2) and successfully hit the target which appears to have an expanding vein system at depth.

Figure 1: Plan of the Yellow Jacket zone showing the major structures and the drill

Figure 2: Drill section in the plane of NB-12-183 and NB-12-184 showing how In general the Yellow Jacket Zone of high-grade, fault controlled, gold and silver mineralization has been encountered over a strike length of approximately 700 metres and remains open. The mineralization is relatively shallow and could possibly be exploited as part of an expanded Sierra Blanca open pit, although to date this mineralization has not been included in the North Bullfrog resource estimate. The structural concepts developed and proven at Yellow Jacket are now being applied to generate targets on the rest of the North Bullfrog property. As part of this exploration program, Corvus is conducting an integrated high-grade targeting study that incorporates the new 3D IP geophysical data with new geological and structural mapping to further define and delineate these new targets. To date, the Company has defined three additional high-grade targets in the North Area that will be tested during the 2013 exploration program as well as the deep high-grade vein potential below the Mayflower deposit. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims owned by the Company. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company's independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012 (available atwww.sedar.com). The project currently includes numerous prospective gold targets, with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 contained ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 contained ounces of gold (both at a 0.2 g/t gold cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure, access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. About Corvus Gold Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production. On behalf of (signed) Jeffrey A. Pontius Contact Information: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 09:38 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 09:25 AM PST just giving a heads up, the money show is this week: http://themoneyshow.houstoncoinclub.org/ | ||||||||||||||||||||||||||||||||||||||||||||||||||

| ECB : increase of oz753,21 in gold and gold receivables Posted: 28 Nov 2012 08:20 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 08:07 AM PST LIVE Thursday November 29 – 9:00 AM Eastern This live audiocast, hosted by The Silver Institute, features Philip Klapwijk, Global Head of Metals Analytics for Thomson Reuters GFMS. Mr. Klapwijk will be commenting on the 2012 Silver Market Review which was prepared on behalf of The Silver Institute . Register for the audiocast at the link below.

For more see The Silver Institute at this address: http://www.silverinstitute.org/site/2012/11/20/2012-silver-market-review/ Tip of the hat to David Morgan for the heads up. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Flash Crash in Gold – Whodunnit? Posted: 28 Nov 2012 08:01 AM PST Gold saw a massive 24-tonne sell order (7,800 contracts) at 8:20 a.m. New York time – bang on the opening of the world's largest gold exchange – with a fall of 2.25% in the market price. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Price Forecast For 2013: Rising Value Amid More Global Uncertainty? Posted: 28 Nov 2012 07:46 AM PST By Timothy Woods: The "lost decade" continues to see much market volatility, leading economists to predict that the price of gold will remain high into 2013 and beyond, and possibly rise further. "The Lost Decade" The Eurozone, whose economy contracted 0.1% in 2012´s third quarter, continues to show little sign of recovery, with France now looking like it could be dragged toward the PIIGS´ mire too and Spain grappling with the possibility of Catalonian independence while also trying to kickstart their economy. What´s more Europe´s leaders failed to reach agreement yet again on how to assist Greece once more. In the United Kingdom, if the Euroskeptic Tories get their way, David Cameron may push Britain to "second-class membership" status of the EU before long, further weakening the bloc, amid difficult negotiations on the upcoming EU budget. Ben Bernanke and the Fed are content to print more money until the US economy shows Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| The Gold Price Tumbles But Don't Worry Posted: 28 Nov 2012 07:22 AM PST  By Tim Iacono: By Tim Iacono: Early morning trading in the gold market today is providing another reminder of how volatile the yellow metal can sometimes be as the gold price plunged nearly $20 an ounce in a matter of minutes and then continued lower as shown in this three-day chart from Kitco below. Most times, you never know what's behind a move like this, that is, other than the fact that there was a big mismatch in futures markets between the number and price of buy and sell orders, the latter winning out over the former. To be sure, today appears to be a "risk-off" day as the price of stocks and commodities are moving broadly lower as the U.S. dollar strengthens, no doubt due to growing uncertainty around the world about how nations are dealing with their massive debts. In Europe, traders appear less enamored with the Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| New U.S. Sanctions To End "Turkeys Game Of Gold For Natural Gas" Posted: 28 Nov 2012 07:06 AM PST gold.ie | ||||||||||||||||||||||||||||||||||||||||||||||||||

| US Dollar and Market relationships near term Posted: 28 Nov 2012 06:16 AM PST Nov 28th- David Banister- www.themarkettrendforecast.com The SP 500 is likely to pullback from a 66 point rally off the 1343 pivots. Those pivots were right at a Fibonacci fractal retracement of 61.8% of the Summer rally. That rally ran from 1267-1474 as we all know in hindsight, and the correction was a normal correction within a bull cycle. Near term, we had a nice run to 1409 and met resistance there. We would expect a pullback to the 1384 areas on the SP 500, if not a bit lower in the coming days. The US Dollar is likely to get a bounce which will also pull down Precious Metals along with stocks near term. We think this could be a opportunity to buy as we approach pivot pullback buy points, but of course we will monitor in the event the pullback becomes more dire than expected. Below are charts of the US Dollar and The SP 500 Index and potential near term movements to monitor. Over at our ATP trading service we closed out long positions in NUGT ETF with nice gains yesterday as well as stocks with trading profits while we watch the pullback action.

Consider joining our forecast service with a 33% coupon to get daily updates and keep you on the right side of the markets. Go to www.markettrendforecast.comto sign up for free weekly reports or the subscription discount. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| New Sanctions to End 'Game of Gold for Natural Gas' Posted: 28 Nov 2012 06:02 AM PST Gold remains unchanged on Wednesday and is likely being supported by the realization that the Greek bailout deal may not be the success it was hailed to be, and also the time is running out for negotiations on the US fiscal cliff. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 05:31 AM PST By Richard Smith Here are some big fat clues that my guess was right, from the International Consortium of Investigative Journalists (ICIJ), who are collaborating with The Guardian and the BBC in an investigative series on offshore companies, and here provide a list of billionaires and some of their companies and doings. Umm, let's include the ICIJ's cautious disclaimer, and part of their list, relating to a couple of likely lads: Sean Quinn and a Russian oligarch, Vladimir Antonov:

The words "Unitrust" and "Edward Petre-Mears" naturally leap out at any international company register enthusiast (now, there's a specialized enthusiasm). Edward Petre-Mears featured in our recent post about the GT Group affiliations of a small group of nominee directors. Unitrust formed companies used by both Quinn and Antonov. So now we have the beginnings of a Sean Quinn-Unitrust-Petre-Mears-GT Group connection, in the UK. The Opencorporates database has a few details of the London Unitrust here; we see from the ICIJ piece that it operates as a company incorporator. For some reason this particular UK company incorporator has directors with very Russian names; that's striking. One wonders how they acquired their expertise in UK company incorporation. On the same Opencorporates page, on the right, one notices that there's a New Zealand company with the same name, and lo, it too is a company incorporator. Its registered address is 334 Te Atatu Road, Te Atatu South, Auckland. The New Zealand Unitrust's founder director is none other than Edward Petre-Mears's wife, Sarah Louise Petre-Mears. She too features in NC's post yesterday highlighting a small group of nominee directors connected with the GT Group. The Guardian's investigated Sarah's other 1200 nominee directorships. So the Unitrust name, and the Petre-Mears name, both take us to 334 Te Atatu Road, Auckland, and thus, via the Petre-Mears' long and distinguished collaboration with the Taylor family, to GT Group. The globe-spanning coincidence of company names and maverick company registration activities are already too much to overlook, but there's more. We noticed that the UK's Unitrust has directors with Russian names. Does that pattern recur in New Zealand? Well, NZ's Unitrust shares its address, 334 Te Atatu Road, with another company incorporator, Bizoffice Company Formations Limited, which we also linked with GT Group. And in turn, Bizoffice Company Formations has a shareholder, Bizoffice Limited, that has Russian-looking names on its directors' roster; they look just as inconcongrous in New Zealand as they do in the UK. That's comforting incongruity, for the sleuth. Now, the styles of the Bizoffices and Unitrusts coincide, on opposite sides of the globe, right down to very specific and very offbeat preferences on director nationality. Combined with the fondness for the Petre-Mears family, I reckon that's far too many coincidences. It's a signature, and, looking at the NZ end of the empire, it appears to be a GT Group signature. So…that post of mine, still a guess, is now beginning to look much less wild. But I don't think I'll patting myself wholeheartedly on the back for that intuitive leap, if it gets some really rock-hard confirmation in due course. For in fact the new evidence turned up by the Guardian/ICIJ investigations makes my post look more like a remarkably unpersuasive statement of the bleeding obvious. With, for instance, 28 nominee directors running 21,500 offshore companies, the asset hiding business is a small world indeed. It would be much more surprising if Sean Quinn was not using GT Group services. The GT Group footprint, meanwhile, just gets ever more impressive. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Bullion at One-Week Low on Fiscal Cliff Concern Posted: 28 Nov 2012 05:27 AM PST The dollar gold price fell to a one-week low below $1,735 per ounce Wednesday, as stocks and commodities also edged lower while the dollar and US Treasuries gained despite ongoing uncertainty over how the US will address its deficit problems. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Why It's Time To Look At European Utilities Posted: 28 Nov 2012 05:01 AM PST By David Hunkar: The STOXX® Europe 600 Utilities Index can be considered as a proxy for the European utility sector. The index is comprised of 25 utilities from the continent. As of November 25, 2012, the index is down over 58% in the past five years in U.S. dollar terms. Since 2008, the index has been on a downtrend trend as shown in the chart below. The sector may be ready for a rebound from the current lows as extreme pessimism haunts European stocks. (click to enlarge) Source: STOXX How to invest in European Utilities? Unfortunately there is no European utility sector-specific ETF available on the U.S. markets for investing in European utilities. ETFs tracking the STOXX utilities index and trading on the European markets include the STOXX EUROPE 600 UTILITIES ETF by db X-Trackers, iShares STOXX Europe 600 Utilities, SPDR MSCI Europe Utilities ETF and Lyxor ETF Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Better News from Europe & U.S. Derail Gold? Posted: 28 Nov 2012 04:58 AM PST After touching a recent high of $1,755 on Nov. 23, Comex gold futures retreated about 0.7% to end at $1,742.30 on Tuesday. Year-to-date, the gold futures are up 11.20%, compared to the S&P 500 Index which is up 13.51%. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Is The EUR Confined To Lame Duck Status? Posted: 28 Nov 2012 04:24 AM PST By Dean Popplewell: Safe haven assets are once again the "flavor de jour" lifting the mighty dollar higher outright against the single unit while pushing global equities back into the red. U.S. fiscal cliff concerns continue to depress global risk appetite and boost the demand for the off the shelf, safer haven currencies. Asian and European bourses have been trading weaker, following in tandem yesterday's late session fall in U.S. equities in response to a comment from Senate Majority Leader Harry Reid that he was "disappointed" with "little progress" in talks about resolving the U.S. fiscal cliff. Time is running out as capital markets approach the year-end turn when supposed U.S. automatic tax hikes and spending cuts are being triggered. The U.S. economy currently does not have the growth bandwidth to sustain such an economic move. Global growth is so tentative that any such misalignment of new economic Complete Story » | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 28 Nov 2012 04:15 AM PST Silver has spent an impressive amount of time hanging above the $34.00 mark since the start of the week, in the face of "risk off" headwinds that have hurt the CRB Commodity Index as a ... | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver: The Gorgeous Cup & Handle Posted: 28 Nov 2012 03:13 AM PST I've been talking baout the formation of a Cup & Handle formation for a couple months now. Contrary to the scoffers, it is coming to fruition on the charts and is completing soon. Look for big moved in the metals by year's end. The only question will be the reason(s) for the big moves. from mrthriveandsurvive: ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Yra Harris: Gold and Out of Control Inflation Posted: 28 Nov 2012 03:03 AM PST Trading legend Yra Harris is afraid inflation could get out of control and says, "It's like being a little pregnant, you can't really control it. from usawatchdog: Nothing destroys democracy like inflation–end of story." If Democrats and Republicans can't reach a deal to avoid the so-called "fiscal cliff," then Harris contends, "Deflation . . . is bullish for gold because everybody knows what the central bank will do to answer the call . . . the Fed will become that much more aggressive." No matter what, Harris is betting that "gold will be higher by the end of the year." Join Greg Hunter as he goes One-on-One with trading legend Yra Harris. ~TVR | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold and Silver Market morning, November 28, 2012 Posted: 28 Nov 2012 03:00 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Update: Silver Saga 11.27.12 Posted: 28 Nov 2012 02:55 AM PST | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Grant Williams: Gold Market Manipulation is More Than Plausible Posted: 28 Nov 2012 02:39 AM PST ¤ Yesterday in Gold and SilverEven though the gold price began a long, slow decline starting around 1:00 p.m. Hong Kong time yesterday, I wouldn't read a whole heck of a lot into it. We're into the last day of trading in the December contract...and as I said in 'The Wrap' last night, I'm not expecting much dramatic price action until after the weekend is done. I don't consider Tuesday's price decline falling into the 'dramatic' category by any stretch of the imagination, as you've seen many examples of a JPMorgan-engineered waterfall price decline in the past. Gold closed at $1,741.80...down $7.60 on the day. Gross volume was an eye-watering 309,000 contracts...but net of all roll-overs, the volume was only around 88,000 contracts. It was much the same story in silver. It closed at $34.05 spot...down 13 cents from Monday. Gross volume was around 104,000 contracts...and net volume around 29,000 contracts. The dollar index started the Wednesday trading session at 80.13...and sat at that value until the 8:00 a.m. GMT London open. By 10:30 a.m. in New York, the index was at its zenith...up to 80.46...and gave back a small portion of that going into the close. The dollar index closed at 80.35...up 22 basis points on the day. I'd guess that some, but not all, of yesterday's price action in gold and silver was currency related. The gold stocks gapped down just about a percent at the open...and continued to slide as the day progressed. The HUI closed on its absolute low of the day...down 2.67%. The silver stocks appeared to have been hit even harder...and I only saw one green arrow in the group that I track. But Nick Laird's Silver Sentiment Index closed down only 1.57%. (Click on image to enlarge) The CME's Daily Delivery Report wasn't very exciting. It showed that only 6 gold contracts were posted for delivery tomorrow. The GLD ETF showed that an authorized participant deposited 116,252 troy ounces of gold...and there were no reported changes in SLV. Well, the new short interest numbers for both GLD and SLV were posted on the shortsqueeze.com Internet site late yesterday evening. There wasn't much change in SLV, as it showed a small decline of only 0.99% for the first half of November. There are now 13,139,800 shares/ounces sold short in SLV...or 412.8 tonnes. That represents 4.2% of the SLV ETF. But the short position in GLD jumped up 17.79% from the last report. GLD is now short 22,060,800 shares...or 2.21 million ounces of gold...68.6 tonnes. That's 5.1% of the GLD ETF sold short. One can only imagine how high the price of silver and gold might be if this amount of physical metal was purchased to cover these shorted shares that have no precious metals backing them. There was no sales report from the U.S. Mint. It was an exciting day over at the Comex-approved depositories on Monday. They only reported receiving 302,128 troy ounces of silver...but a whopping 2,368,812 troy ounces were shipped out the door. Most of the activity was at Brink's, Inc...and the link to that is here. I have the usual number of stories for a weekday column...and I hope you can find the time to run through the ones that interest you the most. My concern still lies in the obscene and grotesque short positions held by JPMorgan Chase and Scotia Mocatta in silver. Alasdair Macleod: Custody arrangements reduce security for GLD and SLV shareholders. Bob Bishop to speak at GATA fundraiser at Vancouver conference. Comex has monstrous 2.4 million ounce silver withdrawal from Brink's, Inc. ¤ Critical ReadsSubscribeO.E.C.D., Slashing Growth Outlook, Warns of Global RecessionThe Organization for Economic Cooperation and Development on Tuesday sharply cut its forecast for the world economy, warning that failure to end the euro crisis and avert a fiscal impasse in the United States could cause a global recession. The organization, based in Paris, predicted that gross domestic product in its 34 member countries, all of which have developed economies, would expand 1.4 percent in 2013, significantly below the forecast of 2.2 percent it made just six months ago. Even that forecast assumes that United States lawmakers reach a budget agreement to prevent billions of dollars in tax increases and automatic spending cuts from taking effect automatically at the end of the year. If the United States does not avoid that so-called fiscal cliff, "a large negative shock could bring the U.S. and the global economy into recession," according to the forecast, written by Pier Carlo Padoan, the organization's deputy secretary general and chief economist. This story showed up on The New York Times website yesterday sometime...and I thank Phil Barlett for the first story in today's column. The link is here.  Do You Live In A Death Spiral State?Thinking about buying a house? Or a municipal bond? Be careful where you put your capital. Don't put it in a state at high risk of a fiscal tailspin. Eleven states make our list of danger spots for investors. They can look forward to a rising tax burden, deteriorating state finances and an exodus of employers. The list includes California, New York, Illinois and Ohio, along with some smaller states like New Mexico and Hawaii. If your career takes you to Los Angeles or Chicago, don't buy a house. Rent. This story showed up in Forbes on Sunday...and I pulled this story from yesterday's edition of the King Report. The link is here...and I found the page a little slow to load.  Exodus From Stocks Grows: 'Investors Are Turning Tail'Fear of the "Fiscal Cliff" is causing the biggest exodus from U.S. stocks this year as investors essentially put their money under the mattress rather than trust Congress to come up with a compromise. U.S. equity stock funds had a net outflow of just over $9 billion in the week ended Nov. 21, the biggest outflow for a single week this year, according to research firm EPFR Global. The next biggest outflow was during the week ended Oct. 25, as fiscal cliff jitters rattled investors ahead of the election. "Investors are turning tail because we have the fiscal cliff," said Cameron Brandt, director of research at EPFR. "There are going to be people cashing in as we head into this period of uncertainty." This story appeared on the CNBC website early yesterday afternoon Eastern time...and I thank West Virginia reader Elliot Simon for sending it along. The link is here.  Student Debt Bubble Officially Pops as 90+ Day Delinquency Rate Goes ParabolicWe have already discussed the student loan bubble, and its popping previously. Yesterday, we got the Q3 consumer credit breakdown update courtesy of the NY Fed's quarterly credit breakdown. And it is quite ghastly. As of September 30, Federal (not total, just Federal) rose to a gargantuan $956 billion, an increase of $42 billion in the quarter - the biggest quarterly update since 2006. But this is no surprise to anyone who read our latest piece on the topic. What also shouldn't be a surprise, at least to our readers who read about it here first, but what will stun the general public are the two charts below, the first of which shows the amount of 90+ day student loan delinquencies, and the second shows the amount of newly delinquent 30+ day student loan balances. The charts speak for themselves. They certainly do! This is not a big read...but the charts are definitely worth the trip. I thank 'David in California' for sharing it with us...and the link to this Zero Hedge article is here.  Why $16 Trillion Only Hints at the True U.S. DebtA decade and a half ago, both of us served on President Clinton's Bipartisan Commission on Entitlement and Tax Reform, the forerunner to President Obama's recent National Commission on Fiscal Responsibility and Reform. In 1994 we predicted that, unless something was done to control runaway entitlement spending, Medicare and Social Security would eventually go bankrupt or confront severe benefit cuts. Eighteen years later, nothing has been done. Why? The usual reason is that entitlement reform is the third rail of American politics. That explanation presupposes voter demand for entitlements at any cost, even if it means bankrupting the nation. A better explanation is that the full extent of the problem has remained hidden from policy makers and the public because of less than transparent government financial statements. How else could responsible officials claim that Medicare and Social Security have the resources they need to fulfill their commitments for years to come? No surprises here for most readers...and the unfunded liabilities are many multiples of this number. This WSJ story was picked by the finance.yahoo.com Internet site on Tuesday...and I thank Manitoba reader Ulrike Marx for sending it along. The link is here.  Buffett: JPMorgan CEO Dimon Would Be Best Choice to Lead Treasury in CrisisJPMorgan Chase & Co. Chief Executive Officer Jamie Dimon would be the best person to lead the U.S. Treasury Department in a financial crisis, billionaire investor Warren Buffett said. "If we did run into problems in markets, I think he would actually be the best person you could have in the job," Buffett said, according to the transcript of an interview with Charlie Rose to be aired on PBS. "World leaders would have confidence in him." President Barack Obama is seeking to replace Treasury Secretary Timothy F. Geithner, who had said he planned to step down. Dimon, 56, testified before Congress and shuffled top managers this year after the bank disclosed a loss, now of more than $6.2 billion, stemming from a wrong-way bet on credit derivatives. Buffett has described Dimon's annual letter to shareholders as a must-read. If Dimon is as good at rigging other markets as he is at controlling precious metal prices, then he gets my vote...as you need a criminal of his stature to run things. This story showed up on the moneynews.com Internet site early on Tuesday morning Eastern time...and I thank Elliot Simon for his second offering in today's column. The link is here.  Bank of America CEO Brian Moynihan Apparently Can't Remember AnythingThank God for Bank of America CEO Brian Moynihan. If you're a court junkie, or have the misfortune (as some of us poor reporters do) of being forced professionally to spend a lot of time reading legal documents, the just-released Moynihan deposition in MBIA v. Bank of America, Countrywide, and a Buttload of Other Shameless Mortgage Fraudsters will go down as one of the great Nixonian-stonewalling efforts ever, and one of the more entertaining reads of the year. In this long-awaited interrogation – Bank of America has been fighting to keep Moynihan from being deposed in this case for some time – Moynihan does a full Star Trek special, boldly going where no deponent has ever gone before, breaking out the "I don't recall" line more often and perhaps more ridiculously than was previously thought possible. Moynihan seems to remember his own name, and perhaps his current job title, but beyond that, he'll have to get back to you. The MBIA v. Bank of America case is one of the bigger and weightier lawsuits hovering over the financial world. Prior to the crash, MBIA was, along with a company called Ambac, one of the two largest and most reputable names in what's called the "monoline" insurance business. Matt Taibbi tees Brian up and drives him down the fairway in this rather longish blog that was posted over at the Rolling Stone magazine website during the New York lunch hour yesterday. It's another contribution from Ulrike Marx...and the link is here.  Credit Rating Firms in EU to Face Sovereign/Debt LimitsCredit rating companies face curbs on when they can assess government debt and restrictions on their ownership under draft plans agreed on by European Union officials and legislators. Lawmakers from the European Parliament and Cyprus, which holds the rotating presidency of the EU, also agreed yesterday to let investors sue ratings companies if they lose money because of malpractice or gross negligence. "We have reached a good result," Michel Barnier, the EU's financial services chief, said in an e-mailed statement. "With this agreement, we are taking another important step towards financial stability." Barnier proposed the tougher ratings rules after warnings from nations including France and Germany that downgrades of sovereign debt had deepened the bloc's fiscal crisis. Barnier said last year that ratings companies were guilty of "serious mistakes" and shouldn't be allowed to "increase market volatility" through ill-timed or unjustified downgrades. The European Commission, the 27-nation EU's executive arm, has said that tougher regulation is needed to boost competition for the so-called big three ratings companies, Fitch Ratings Ltd., Moody's Investors Service Inc. and Standard & Poor's. Negotiators at yesterday's meeting brokered a draft deal on the rules, which must be formally approved by governments and by the full parliament before they can be implemented. It will be interesting to see if this libel chill will make any difference to the credit rating agencies going forward. This Bloomberg story...filed from Brussels...was posted on their Internet site early yesterday evening...and I thank Elliot Simon for digging it up on our behalf. The link is here.  ETF Securities Launches Bullion Trackers in Hong Kong Posted: 28 Nov 2012 02:39 AM PST  ETF Securities is launching three new commodity exchange-traded funds (ETFs) on the Hong Kong stock exchange as the firm builds out its footprint in Asia. The three ETFs will provide exposure to gold, silver and platinum via holdings in metals and other ETFs. The new funds will be listed on Wednesday 28 November. Fred Jheon, managing director and head of Asia Pacific at ETF Securities, told IndexUniverse.eu: "We are the first ETP provider to launch a suite of physically backed precious metal products on the Hong Kong exchange." "This listing is the culmination of a year's work of planning and working together with our business partners and regulators," said Jheon. | ||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment