Gold World News Flash |

- Commodity Technical Analysis: Gold Plunges from Fibonacci Level

- Asian Metals Market Update

- Overnight Futures 'Fat-Finger' $750mm Notional In One Minute

- A “force majeure”? Oh Puulease!!!

- Richard Russell - Bursting Bubbles Will Make Things Far Worse

- “Whack-A-Mole” Job on Gold takes it Down

- International Monetary Fund “Reviewing” Capital Controls Policy

- Aiming to boost gold reserves, China sees 'fundamental market shortage'

- John Williams: Government Unemployment Manipulation & the Economic Collapse

- Royal Canadian Mint’s Tungsten Twostep?

- Exaggerations about silver

- Regular Forum Archives 1998-2001

- Rosen – Key Targets For Gold, Silver, Miners & Common Stocks

- How Do the Chinese View the Gold Market?

- The Top Ten 'Fiscal Cliff' To-Do List

- Gold Price Hammered As USA Heads Towards Financial Doomsday

- Sharp Gold Decline Blamed On Large Sell Order, Technicals, Softer Euro

- Guest Post: BRICS: The World's New Bankers?

- The Gold Price May Close Lower Tomorrow but Huge Buying Interest Lurks Around $1,705

- Is the Yen Doomed?

- Jim's Mail Box

- Will We Hold It Wednesday – Fiscal Cliff Fever Edition

- Profit taking, fat finger or take-down? – gold crashes again

- Goldman's Stolper Sets 'New' Four-Year FX Plan

- Surging Silver Investment

- Flash Crash in GOLD A Real Whodunit

- Gold and silver raid/silver's OI for December remains elevated/Open Europe comments on the Greek bailout/Spain must slash the balance sheet of nationalized banks by up to 60% for bailout cash

- Thursday gold tour of the NY Fed

- "Whack-A-Mole" Job on Gold takes it Down

- Germany ‘tied to a corpse’

| Commodity Technical Analysis: Gold Plunges from Fibonacci Level Posted: 29 Nov 2012 12:23 AM PST courtesy of DailyFX.com November 28, 2012 05:40 PM Daily Bars Chart Prepared by Jamie Saettele, CMT Commodity Analysis: I wrote yesterday that “weakness off of the 61.8% retracement demands respect but a drop below 11/20 high (1735.51) would create overlap and suggest that an important top is in place.” Gold didn’t just create overlap…the price nearly broke the 11/15 low. Viewed in light of the 3 wave advance from 1672.50, the trend is lower. Commodity Trading Strategy: Given market conditions lately, there is nothing at this point that would surprise me but a move back to former resistance at 1735 would present a short opportunity against the 11/23 high. LEVELS: 1673 1684 1705 1735 1745 1754... | ||

| Posted: 29 Nov 2012 12:02 AM PST Speculation that the US fiscal cliff issue could be resolved resulted in gold and silver paring most of their losses. There will be big moves like yesterday triggering all stop losses as long as the US fiscal issue is not formally resolved. Greece issue is now temporarily over. Focus will shift to the global economy for the next three weeks after which traders will go to Christmas vacations. | ||

| Overnight Futures 'Fat-Finger' $750mm Notional In One Minute Posted: 28 Nov 2012 10:41 PM PST First we saw some shenanigans in Gold and Silver this morning, followed by some very jerky moves in S&P 500 futures off the lows. Tonight while everything was gliding along quietly, someone in their infinite wisdom decided that 0005ET was the perfect time buy around 11,000 S&P 500 e-mini contracts (or around $750mm notional exposure); instantly devouring the entire stack of orders. This move was not in any way followed by any other asset class (EURJPY twitched a little at it) and as far as we can see there was/is absolutely no news to accompany the flash-smash. That is all...

The early evening Abe chatter had come and passed without event so this is unrelated to that. Surely noone left a resting buy-stop order at 1410 for 11,000 contracts?

Why not wait til Europe came in? Why not wait til the US came in? If you want buy $775mm notional exposure - wait for a pull back to VWAP? Or was it forced buybacks?

and a look at the tick-data tells the story - a totally human-looking trading pattern...NOT! looks like perfectly executed stop run...

Equity futures were alone in their exuberance...

Charts:Bloomberg | ||

| A “force majeure”? Oh Puulease!!! Posted: 28 Nov 2012 10:10 PM PST CME Declares Force Majeure at Manhattan Gold Depository by Bill Holter, MilesFranklin.com:

First off, they claim to have some 29,000 ounces of Gold and 33,000 ounces of palladium vaulted. I guess my first question would be… is this vault the size of a closet inside of a single wide trailer home? This is roughly 1 ton of each metal and would stack neatly inside of a closet. Secondly, the vault is flooded? …Still? Were they not able to have a sump pump shipped in from another state? Oh, no sump pumps? Why not call in a couple of scuba divers to go in and start "reclamation?" How hard would this be? These 2 tons represent less than the crust on a ham sandwich. Larry, Moe and Curly could move and ship all of this metal in less than an 8 hour day even after crashing the forklift 5 times and doing it all by hand! I don't get it, why even raise any eyebrows of non delivery and why not just have "other Gold" shipped from another institution since it is "so plentiful?" This really smells putrid to me and really have to wonder "What are they thinking?" | ||

| Richard Russell - Bursting Bubbles Will Make Things Far Worse Posted: 28 Nov 2012 10:01 PM PST  With gold, silver and stocks on the move, the Godfather of newsletter writers, Richard Russell, issued this warning in a note to subscribers: "I continue to believe that we are in a primary bear market, one that is, and has been, disguised by the Federal Reserve's series of QEs. Bernanke's theory is that if the Fed creates enough "money," then sooner or later deflation and sluggish growth must turn into inflation and faster growth." With gold, silver and stocks on the move, the Godfather of newsletter writers, Richard Russell, issued this warning in a note to subscribers: "I continue to believe that we are in a primary bear market, one that is, and has been, disguised by the Federal Reserve's series of QEs. Bernanke's theory is that if the Fed creates enough "money," then sooner or later deflation and sluggish growth must turn into inflation and faster growth." This posting includes an audio/video/photo media file: Download Now | ||

| “Whack-A-Mole” Job on Gold takes it Down Posted: 28 Nov 2012 10:00 PM PST by Dan Norcini:

It was that nasty, infamous "FAT FINGER" once again that was initially blamed for the smashing avalanche of sell orders that crushed the gold price lower early in today's session. Never mind the fact that the market did not immediately pop right back, which would have indeed been the case were there an actual trading error involved. The other annoying fact is that "fingers", fat or skinny or otherwise, have very little if anything to do with today's trading volume. | ||

| International Monetary Fund “Reviewing” Capital Controls Policy Posted: 28 Nov 2012 09:51 PM PST from Silver Vigilante:

IMF director Christine Lagarde said November 16: "Our position is very much based on the latest development that we are observing at the moment and will be settled very shortly, probably with a view to being more flexible than we have been historically," she said on a briefing as part of his two-day Manila visit. Her parlance is misleading, with the term "flexible" being used to explain the placement of restrictions. | ||

| Aiming to boost gold reserves, China sees 'fundamental market shortage' Posted: 28 Nov 2012 09:28 PM PST China 2015 Gold Output Likely 450 Tons: Ministry From MarketWatch.com http://www.marketwatch.com/story/china-2015-gold-output-likely-450-tons-... BEIJING -- China aims to have domestic gold production reach 450 metric tons by the end of 2015, a rise of around 25% from 2011, the Ministry of Industry and Information Technology said Monday. The ministry forecast rising domestic demand for gold and a "huge amount of room" for the industry's development due to gold's safe-haven and wealth-preserving properties, it said. Still, domestic consumption is likely to exceed 1,000 tons by the end of 2015, "widening the fundamental market shortage," the ministry noted. China has tried to speed up industry consolidation, aiming to reduce the number of gold producers in the country to 600 companies by the end of 2015 from 700 in the 2006-2010 period, the ministry said. The amount of gold produced by the top 10 gold companies will rise to 260 tons by the end of 2015 from 100 tons in 2010, it said. By the end of 2015, China is likely to have gold reserves of 8,000-9,000 tons, an increase of 20% from 2010, it said, without specifying if these were state reserves. ADVERTISEMENT Prophecy Platinum Intercepts Best Pt+Pd+Au Grades Yet Company Press Release VANCOUVER, British Columbia -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) announces more results of its 2012 drill program on the company's fully-owned Wellgreen platinum group metals, nickel, and copper project in southwestern Yukon Territory, Canada. Four surface holes and four underground holes all intercepted significant mineralized widths, ranging from 28.5 meters (WS12-201) and up to 459.5 metres (WS12-193). Highlights include WU12-540, which returned 8.9 metres of 5.36 grams per tonne platinum, palladium, and gold; 1.73 percent copper; and 1.01 percent nickel within 304.5 meters of 0.66 g/t platinum-palladium-gold, 0.20 percent copper, and 0.27 percent nickel. The surface drill program started in June and has completed 16 holes (assays pending for 12 holes) with two rigs now on site. The surface program continues to progress at a steady pace. Prophecy Chairman John Lee commented: "Wellgreen is a very large nickel, copper, and platinum group metals project with near-surface high-grade zones. High-grade intercepts will be incorporated into resource modeling and mine planning in the pre-feasibility study. We expect further positive drill results from Wellgreen shortly." Wellgreen features a low 2.59-to-1 strip ratio, is situated at an altitude of 1,300 meters, and is only 15 kilometers from the two-lane paved Alaska Highway. Those factors significantly minimize the project's indirect costs. For the complete company statement with full tabulation of the drilling results, please visit: http://prophecyplat.com/news_2012_sep11_prophecy_platinum_drill_results.... Join GATA here: Vancouver Resource Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT GoldMoney adds Toronto vaulting option In addition to its precious metals storage facilities in Hong Kong, Switzerland, and the United Kingdom, GoldMoney customers now can store their gold and silver in a high-security vault operated by Brink's in Toronto, Ontario, Canada. GoldMoney also has recently partnered with Rhenus Freight Logistics to offer another gold storage option in Switzerland. The Rhenus vault is in the secured zone of Zurich Airport and offers customers superb security as well as the ability to inspect their gold. Storage at the new vaults in Canada and Switzerland is available at GoldMoney's lowest fees. Customers can select their storage location when placing their buy order. GoldMoney customers can take delivery of any number of gold, silver, platinum, and palladium bars from any GoldMoney vault, as well as personally collect their bars stored in the Hong Kong, Switzerland, and U.K. vaults. It's easy to open an account, add funds, and liquidate your investment. For more information, visit: http://www.goldmoney.com/?gmrefcode=gata | ||

| John Williams: Government Unemployment Manipulation & the Economic Collapse Posted: 28 Nov 2012 09:18 PM PST "The President and Congress you have now is the one that will see hyperinflation, we will not have another election to fix this." – John Williams from FutureMoneyTrends:

| ||

| Royal Canadian Mint’s Tungsten Twostep? Posted: 28 Nov 2012 09:03 PM PST by Rob Kirby, via Silver Doctors:

In the end, we were all told that this loss was due to honest miscalculations and blunders, or in other words – LAX CONTROLS. Lax Internal Controls at the ISO 9001 accredited Royal Canadian Mint? Here's where we deduce why the Royal Canadian Mint circulated a "false, incredulous story" about how they lost $15 million worth of gold bullion: | ||

| Posted: 28 Nov 2012 08:59 PM PST from Alexiscom1: | ||

| Regular Forum Archives 1998-2001 Posted: 28 Nov 2012 08:13 PM PST Two years ago, Martijn went through roughly 1,200 days-worth of the regular USAGOLD discussion forum and compiled (most of *) the intermittent comments by ANOTHER and FOA, along with a few others, into a 436 page pdf. That pdf is available for download on Scribd here. But lately, the discussion forum archive on the USAGOLD website appears to be MIA. ANOTHER (THOUGHTS!) and The Gold Trail | ||

| Rosen – Key Targets For Gold, Silver, Miners & Common Stocks Posted: 28 Nov 2012 07:30 PM PST from KingWorldNews:

"On the S&P 500, the bear market began in the year 2000. There is a clear 'megaphone' pattern and the market has most likely seen its high for this leg (see chart below). Stocks may attempt to fight the trend for another 30 days, but once that period is over we are headed back down to the long-term trendline. This is the trendline that began at the 1982 bottom. If you look closely at the chart, which starts at 1982, you can see the 1987 crash reached the trendline near the early part of the chart. The next pattern down in the megaphone pattern will take us to that long-term trendline in the S&P 500 and the Dow. This will be a devastating drop for those who are positioned incorrectly…. | ||

| How Do the Chinese View the Gold Market? Posted: 28 Nov 2012 07:12 PM PST Via Jeff Clark of Casey Research, How Do the Chinese View the Gold Market?Have you ever wondered what the typical Chinese gold investor thinks about our Western ideas of gold? We read month after month about demand hitting record after record in their country – how do they view our buying habits? Since 2007, China's demand for gold has risen 27% per year. Its share of global demand doubled in the same time frame, from 10% to 21%. And this occurred while prices were rising. Americans are buying precious metals, no doubt. You'll see in a news item below that gold and silver ETF holdings just hit record levels. The US Mint believes that 2012 volumes will surpass those of 2011. But let's put the differences into perspective. This chart shows how much gold various countries are buying relative to their respective GDPs.

It's widely believed that the majority of the gold flowing into Hong Kong ends up in China, so its total is probably close to double what the chart reflects. Even if none of it went to China, coin and jewelry demand is 35 times greater than the US, based on GDP. The contrast between how our two nations can buy bullion is striking…

Some will point to cultural affinity to account for the differences. There's some truth to that, though this is a much greater factor in India. Even there, gold jewelry is not viewed as a decoration or an adornment; it's a store of value. It's financial insurance in a pretty bow. In India, gold can be used as collateral, regardless of its form. It's not just an investment that they're trying to make money from; it's more important than that. But certainly the differences can't all be attributed to culture… You've likely heard how government leaders in Beijing have been encouraging citizens to buy gold and silver. This would be akin to seeing your local Congressman or President Obama appearing on TV and imploring you to buy some gold and silver. (Utah made gold legal tender, but it was mostly a symbolic move.) Chinese radio and TV spots, along with newspaper ads, talk about "safeguarding your wealth" and putting "at least 5% of your savings" in precious metals. I haven't seen this here except from dealers on cable TV. Can you imagine Ben Bernanke appearing in a commercial during American Idol, encouraging you to buy gold Eagles? No, what I hear from politicians about precious metals is nothing but the sound of crickets chirping, save Ron Paul. And the mainstream continues to claim gold is in a bubble. We've pointed it out before, but in case any of them are reading, there are two criteria for a bubble: first, a massive price increase, such as the gold price doubling in less than 7 weeks like it did in 1979-'80... which, of course, hasn't occurred in this bull market. (Yet.) The second criterion is widespread participation on the part of the public. I don't hear celebrities and TV anchors bubbling on about the latest gold stocks. Most people I know outside Casey Research aren't talking about the great price they got on a silver Maple Leaf. Most investors I talk to say their friends, family, or co-workers aren't scrambling to snatch up gold Eagles. And the #1 reason we're not in a bubble is because Eva Longoria still hasn't asked me out on date – something she'd only do because I'm a gold analyst. And with apologies to those of you who do know history, I think the Chinese have studied history a little better than many of us. The lessons are right in front of us, though I don't hear this kind of data very much on CNBC…

What do we hear instead? That the country will drop into recession if current amounts of spending and outlay of benefits are reduced. I think it is quite the opposite; it will be worse if our leaders continue down this path of debt, deficit spending, and printing money. What I'd love to see on CNBC is a spot with Doug Casey saying this: "Anyone who thinks they have any measure of financial security without owning any gold – especially in the post-2008 world – is either ignorant, naïve, foolish, or all three." I bet that'd get the airwaves buzzing. It must seem strange to many Chinese that we continue to believe in our dollars, Treasuries, and bonds more than gold and silver. And it's not just China that would view our investing habits as peculiar. Indeed, as the above tables implies, our views on precious metals are in the minority. My fear is that regardless of what form the fallout takes, many of my friends will be caught off guard. Probably many of yours, too. As the value of dollars continues to decay and inflation creeps closer and closer and then higher and higher, many investors will feel blindsided. Many Chinese citizens will not. Given China's aggressive buying habits, my suspicion is that many of them will probably wonder why we didn't see what was happening all around us, why we didn't learn from history, and why we didn't better prepare.

Part of the reason why American dollars are losing value can be traced to Chinese actions as well: Realizing that the US government was not going to rein in its profligate spending, the Chinese have stopped investing in the US economy and are now dumping dollars. This, of course, simply adds to the US government's problems... but it provides ways for you to turn a tidy profit. | ||

| The Top Ten 'Fiscal Cliff' To-Do List Posted: 28 Nov 2012 06:26 PM PST The schizophrenia in US equity markets (and by correlation all risk markets) is nowhere better highlighted than the last 24 hours of 2% swings in the S&P 500 on nothing more than boiler-plate comments from DC. However, as BofAML's Ethan Harris notes, "the year-end fiscal challenges in the US are more like an 'obstacle course' than a 'cliff' - politicians must navigate about 10 major policy decisions before year-end." We continue to expect a messy multistage deal on the cliff - with some wishy-washy partial deal late December and more complete resolution (as it will be called) late Spring. We agree with BoFAML's view that until then, we suggest that investors fade the likely "press fakes" of an imminent deal, and brace for downside volatility. It seems to us that the negotiations remains stuck at square one. Via BofAML: Cliff Note: Stuck At Square One Obstacle course In our view, the year-end fiscal challenges in the US are more like an "obstacle course" than a "cliff"—politicians must navigate about 10 major policy decisions before year-end.

More than three weeks after the election and they are still stuck at the first obstacle: the role of taxes in any deficit reduction agreement. What is the hold-up here? Isn't there an easy deal that focuses on capping deductions? After all, both parties have been talking about this approach as a way to raise taxes on the wealthy without raising tax rates. We see three reasons why it is proving very hard to overcome this obstacle:

As we have been arguing for more than a year, we expect a messy multi-stage deal on the cliff, with a partial deal in late December and a full resolution only in the Spring. During this period, we suggest that investors fade the likely "press fakes" of an imminent deal, and brace for downside volatility. A big gap Any deal on the cliff requires an acceptance of the relative role of revenues and outlays in closing the budget gap. The official positions of the major players are miles apart. President Obama has proposed a roughly $4 trillion 10-year deficit reduction plan that is $1.5 trillion (or 40%) tax increases, mainly from allowing the Bush tax cuts to expire for upper income households. His plan has been roundly rejected by Republicans. They argue that most of the spending cuts are not real: his $4 trillion includes almost a trillion in savings that were already agreed to in the first part of the debt-ceiling agreement and almost another trillion in savings from the winding down of the war in Afghanistan. Stripping those items out, the tax increases become three-fourths of a $2 trillion deficit reduction plan. By contrast, the two main House Republicans, speaker Boehner and Budget Committee chairman Paul Ryan, have suggested that spending cuts should account for all or the vast majority of the cuts. In his negotiations with the President in 2011, Speaker Boehner was apparently close to agreeing in principle on $0.8 trillion in tax increases, or 20% of a $4 trillion dollar plan. However, that deal quickly fell apart once it began to be fleshed out and vetted with the rank and file members in Congress. Moreover, the plan's reliance on "dynamic scoring"- raising revenues by stimulating growth—has already been strongly rejected by Democrats. Paul Ryan has offered budgets in each of the last two years that include dramatic cuts in spending - including effectively eliminating all of non-defense discretionary spending - but no increase in taxes. To reach a deal, the two parties must not only bridge a huge gap in terms of the tax share—somewhere between 0% and 75% - they must also agree on the same accounting system. A big precedent The outcome in this initial round of negotiations could set the tone for future deals:

Members of both parties feel that their leaders have given too much ground in the past. Democrats were upset when President Obama agreed to extend all the Bush tax cuts. Republicans are upset about extending the payroll tax cut and extended unemployment benefits. For different reasons, neither party was happy with the outcome of the debt-ceiling debate: for some fiscal conservatives, any debt-ceiling increase was wrong and neither party liked the sequester. For Democrats, there will never be an easier time to raise upper-income tax rates, since they are set to go up automatically at year-end. This is why many liberal leaning politicians and analysts are arguing that it is better to let all the tax cuts expire—go over the cliff—and then offer to restore tax cuts for just low- and middle-income families. At the same time, if they raise revenues by closing loopholes, it will be harder to do comprehensive tax reform later. On Medicare, there are limits to how much payments to providers can be cut without seriously impairing service. Moreover, as we have seen with the "doc fix", if the cuts are too big, they simply become part of the annual mini-cliff. Beauty is skin deep On the surface, capping deductions seems like an easy compromise. It is less offensive to Republicans than raising tax rates. It is favored by Democrats because the vast majority of the revenue increase would come from the wealthy. And it avoids the politically messy business of identifying which deductions should be limited. Deal done. Let's move on. Unfortunately, there is no free lunch in deficit reduction - someone gets hurt. As former budget director Peter Orszag argues, the three most important deductions are mortgage interest, state and local taxes and charity1. Of the three, the most discretionary—or easiest to change—is charity. How hard is the hit to charities? Americans give about $300 billion (2% of GDP) to charities every year. Most studies suggest at least some loss of funding if the deduction is capped. Indeed, a recent literature review shows "some evidence" that limiting "the tax deductibility of individual charitable contributions would fall entirely on charities themselves: taxpayers would cut their gifts by roughly the increase in their tax bill, reducing charities by an equivalent amount." In other words, if the government collects an extra $10 billion by capping charitable deductions, charitable giving would drop by about $10 billion, or 3.3%. By contrast, a rise in tax rates for the wealthy might actually increase charitable giving. On the one hand, higher taxes would have a negative "income effect" on charitable giving, as people would have less income to devote to all kinds of spending. On the other hand, higher tax rates create a "substitution effect" where the cost of each dollar of giving is lower. Thus, if the tax rate is 40% instead of 30%, it costs 60 cents to give a dollar to your favorite charity rather than 70 cents. A cap on deductions creates other challenges. As we have noted before, it tends to hurt people in states that voted for President Obama. Looking at the electoral map, states with high taxes and high home prices—such as New York and California—tended to vote for Obama. Raising upper income taxes through tax rates has a uniform impact on high-income families across the country, while a cap tends to target states with higher-than-average deductions. Outlook The debate over deductions underscores many of our themes around the cliff:

The markets have vacillated between complacency and concern when it comes to the cliff. After the Fed easing in the fall, the markets seemed to run out of steam as they started to look ahead to year-end. After the election, there was a quick sell-off when the reality of continued split government sank in. The market then rallied Thanksgiving week, when politicians went home for a full week of vacation. And, in the latest week, they are again in worry mode. There could be a number of critical moments for the markets:

Finally, all this needs to be bundled into legislation. Vague agreements in principle will have to become specific. They will have to agree on the overall split between tax increases, spending cuts and "can kicking." If this "sticker shock" phase goes poorly, politicians could accidentally go over the cliff. In sum: Running an obstacle course along a cliff can be dangerous. | ||

| Gold Price Hammered As USA Heads Towards Financial Doomsday Posted: 28 Nov 2012 05:58 PM PST Didn't the CME lower margins on Gold and Silver last week? CME lowers gold, silver, copper, natgas margins | Reuters

December is the NUMBER ONE month for Gold and Silver deliveries annually. The "December" Gold and Silver contracts trade on the notably criminal COMEX in New York during the month of "November". November is "seasonally", on average, the first or second most bullish month for these two Precious Metals EVERY year. This year, from it's close on October 28, 2012 up to it's November high, the price of Gold was up 4.5%. On one 100 ounce NY COMEX Gold contract, a trader held a $7694 unrealized profit at the November high price, if he had purchased his contract at the close in October. The November high in Gold occurred at 11AM the morning of November 23, 2012. The November high price for Gold at that time was $1754 per ounce. This year, from it's close on October 28, 2012 up to it's November high, the price of Silver was up 11%. On one 5000 ounce NY COMEX Silver contract, a trader held a $16,950 unrealized profit at the November high price, if he had purchased his contract at the close in October. The November high in Silver occurred at 7PM October 26, 2012. The November high price for Silver at that time was $34.28 per ounce. With unrealized profits in the Precious Metals of this magnitude going into options expiration, it was imperative that the bullion banks do everything in their power to prevent delivery demands at great financial loss to the banks. Nov. 27 Comex December gold options expiry Nov. 27 Comex December silver options expiry Let the games begin! ___________________________________ CME Declares Force Majeure Due To "Operational Limitations" On NYC Gold DepositoryCME Group declared a force majeure at one of its New York precious metals depositories yesterday, run by bullion dealer and major coin dealer Manfra, Tordella and Brooks (MTB), due to "operational limitations" posed by Hurricane Sandy.MTB has "operational limitations" following Hurricane Sandy and can't load gold bullion, platinum bullion or palladium bullion, CME Group Inc., the parent of the Comex and New York Mercantile Exchange, said today in a statement. MTB must provide holders with metal at Brinks Inc. in New York to meet current outstanding warrants in relevant delivery periods with compensation for costs, Chicago-based CME said. The CME said that MTB will not be able to deliver metal as the lower Manhattan company deals with "operational limitations" almost a month after the arrival of Hurricane Sandy. MTB is one of five depositories licensed to deliver gold against CME's benchmark 100-troy ounce gold contract, held 29,276 troy ounces of gold and 33,000 troy ounces of palladium as of Nov. 23, according to data from CME subsidiary Comex. In a notice to customers on Monday, CME declared force majeure for the facility, a contract clause that frees parties from liability due to an event outside of their control. CME said that individuals holding MTB warrants or certificates for a specific lot of metal stored in the depository, may receive gold delivered from Brinks Co. (BCO) in New York. MTB is responsible for any additional costs incurred by customers receiving metal from Brinks, CME said. "This shouldn't have a material impact on the way market participants are doing business," a CME spokesman said. "They'll still contact MTB if they want to take delivery on contracts," and MTB will arrange for delivery through Brinks according to Dow Jones Newswires. In a notice posted to its website dated Nov. 12, MTB said the firm "sustained substantial damages" following Hurricane Sandy's arrival in New York City on Oct. 29, and had curtailed its operations. The force majeure will remain in effect until further notice from the exchange, the CME said. The delivery period for CME's December-delivery precious metals futures begins on Friday. ___________________________________ Doesn't ANYBODY find it the least bit alarming that MTB has conveniently used a natural disaster to hide the fact [assumed] that it DOES NOT HAVE THE METAL AVAILABLE to meet December Gold delivery demands? Seriously, this storm hit New York almost one month ago, and now with just two days before "first notice delivery" they have encountered "operational limitations" preventing them from making good on delivery demand of Gold via December Gold contracts sold through their depository? Seriously? This is OUTRAGEOUS! Jim Richard outdoes himself in this report. Now they are calling it a roll over that was executed not as a spread but as an outright sale. That was such a bold manipulation that even they have to come up with an excuse. Richard is right. That is what is called "an operation." Those watching the precious metals markets (this excludes the CFTC) are well aware of yesterday's options expiry for Gold and Silver on the COMEX, and the Friday "first day notice" just ahead…and some violent 'games' by the Cartel in the paper markets were duly expected. This morning Blythe apparently unleashed her heavily-caffeinated flying monkeys to 'game' the markets. Completely incredible paper volume in view of existing physical supply. In seconds. Good morning! Oh, did I say 'physical?' – Yesterday's Manfra 'force majeure' excuse (one of COMEX's five bullion stores) for non-delivery of physical bullion should (in a regulated, unmanipulated market) have sent the spot price of Gold several hundred dollars higher, but it looks like the Banksters have discovered Bennie's secret CTRL+P trick of creating binary electronic digits out of thin air…beats mining with a pick and shovel, eh? These are no longer markets as price-discovery vehicles, but more resemble playing naked-twister with sociopaths and crooks. – The MF Global and LIeBOR frauds were just a small 'taste' of what's coming when it is discovered that the paper masters of the universe have hypothecated and rehypothecated physical bullion (both private and sovereign) many times over. [For CFTC regulators read: it's long gone and many are not going to get it back, ever.]    ___________________________________ By Debarati Roy & Joe Richter - Nov 28, 2012 2:42 PM ET Bloomberg Gold futures fell the most in three weeks as pessimism on a U.S. budget resolution eroded demand for commodities. On the Comex in New York, gold futures for February delivery tumbled 1.5 percent to settle at $1,718.80 an ounce at 1:38 p.m., the biggest drop for a most-active contract since Nov. 2. In the first 30 seconds of floor trading, 7,700 contracts traded, according to PVM Futures Inc. __________________________________ In the FIRST 30 SECONDS of floor trading, 7,700 contracts traded!!! That equates to a 770,000 ounce dump of Gold onto the market. But was it real Gold, or merely "paper Gold"? 770,000 ounces represents 1% of global annual Gold production. Gold was trading at $1735.59 an ounce prior to the NY Open of the COMEX. 770,000 ounces x $1735.59 = $1,351,034,300 !!!!!!! What moron would SELL $1.3 BILLION of Gold in 30 SECONDS, let alone sell it in the face of "Fiscal-Cliff Concerns"? Selling Gold in this environment seems hugely counter-intuitive, does it not? Dealer inventory [the MTBs of the COMEX world] is 2.528 million ounces. 770,000 equals 30% of ALL the Gold available to meet delivery demand held by the COMEX depositories. How can 30% of all the available COMEX Gold be sold in 30 SECONDS not raise a single red flag at the CFTC? The question that begs to be asked is...who bought 770,000 ounces of Gold in 30 SECONDS. There is a buyer for every seller don'tcha know? And what if the person[s] that bought that Gold decides to demand delivery of it next month? Mere speculation... If I had to guess, JP Morgan's left had bought the 770,000 ounces of Gold it's right hand sold...all in the name of 1. bailing out the bullion banks that were underwater at the end of a bullish month for the price of Gold, and 2. Suppressing the price of Gold when it should obviously be rising as the USA heads for financial doomsday. 28 November 2012Comex Open Saw 24 Tonnes of Paper Gold Dumped at Market - Sharks, with Laser BeamsI am open to more data and other possibilities, but it certainly looks like the infamous Dr. Evil strategy being employed for the Comex post-option expiration in which a large number of call options are turned into active December futures contracts, and then hit hard with a manipulative price effort the next day. I suggested that this might happen given the way in which the option market closed on Tuesday. Such phenomena are like old friends now in these markets. Funny too how roughly the same thing happened in the Silver futures about the same time. Silver is also post option expiration today. As you know I used to track the big price drops around key option expiration dates on the precious metal charts. That is not the only possibility. It could also be some 'tape painting' as the big shorts knock the price down before they close the books on their losing positions for the month. But I am inclined to think it was a special post-expiration event. And it *could have been* just an unfortunate accident that happened in two different and important global markets simultaneously. Maybe it just 'vaporized.' Not to worry, I am sure Bart Chilton and the stalwarts at the CFTC, who are closely watching the gold and silver markets, have already identified the seller(s), and examined their selling motivations, and the size and placement of their 'fat finger.' I am sure they will let us know about it, four or five years from now. "Gold saw a massive 24 tonne sell order (7,800 contracts) at 08:20 a.m. New York time - bang on the opening of the world's largest gold exchange - which [saw] a fall of 2.25% in the market price. ___________________________________ If the bullion bank cartel was covering their grossly underwater shorts today, it would be a MAJOR signal that prices are going higher very soon! Only time will tell, but a clear signal that prices may be back on the rise as early as tonight's Asian market open is the simple fact that the HUI Gold Bugs Index closed up almost 1% today in spite of the beat down of the Precious Metals bullion prices over at the notoriously nefarious NY COMEX this morning. A move and close back above $1723.25 in Gold should put this contrived sell off in the rear view mirror. That Gold's price closed above $1713.77, the 50% Fib retracement of the November rally, today should be considered a "buy the dip" opportunity. Take advantage of it, and reconsider ONLY if price closes below $1713.77 in New York. The fact that Silver BOUNCED HARD at $32.90, the 38% Fib retracement of the November rally, should be considered HUGELY BULLISH. In fact I would not question the bullishness of Silver at this time unless price closes below $32.46 in New York. Congratulations if you bought today's dip. Reconsider ONLY if price should fall below $32.90. Only a fool would believe that the US Government is going to fix, resolve, improve the nation's and/or the World's burgeoning economic morass. And only a bigger fool would unload his Precious Metals on the cusp of Global Financial Armageddon. THERE IS STILL TIME TO ACCUMULATE PHYSICAL GOLD AND SILVER...BUT ONLY WHILE SUPPLIES LAST. | ||

| Sharp Gold Decline Blamed On Large Sell Order, Technicals, Softer Euro Posted: 28 Nov 2012 05:46 PM PST (Kitco News) - Technical-chart oriented selling, weakness in outside markets and an apparent unusually large sell order are all being blamed for the tumble in gold futures Wednesday. Some look for bargain hunting to emerge at support near the session lows to maybe $20 to $30 below. As of 11:18 EST, December gold was $28.60, or 1.7%, lower to $1,713.70 an ounce on the Comex division of the New York Mercantile Exchange. The contract slipped as far as $1,705.50, its lowest level since Nov. 15. A couple of traders said the move did not appear to be tied to any fresh news. "At this point, we're viewing the move lower as technical," said Dave Meger, director of metals trading with Vision Financial Markets. The declines accelerated as prices broke down below the $1,730 area, he said. This was around the top of an old price-consolidation range. The move also occurred as the euro broke down below the $1.30 area, he continued. Gold and other metals often move inversely to the U.S. dollar. "Everybody expected some kind of risk-on trade or bounce in the euro on the back of the Greek deal yesterday," he said. "When that did not materialize and the euro was not able to sustain above $1.30, it slowly faded and took the metals with it yesterday and it culminated in significant weakness today." Several traders cited market chatter that a large seller apparently came into the market early in the morning. "It was down $25 in a minute," said one New York desk trader. "Somebody came in and whacked it. Nobody knows (who) except the people who did it…It was some hedge-fund type that just hit it. They probably set off stops. I'm sure they weren't the entire volume." Silver and copper tumbled around the same time, he added. A sell order of around 7,800 contracts came into the market around the New York open, said Sharps Pixley CEO Ross Norman. He said the most likely explanation is "this could be a short play, with the seller looking to trigger stops below the market at $1,730 and thus extend the move significantly lower and thus increase his profits." The activity appears related to options activity on Tuesday, when there was a large amount of buying of January puts from around $1,700 to $1,690, said Kevin Grady, president of Phoenix Futures and Options. "There is definitely a correlation there," he said. (Image - Ross Norman, Sharps-Pixley) Tim Gardiner, managing director of global precious metals with TD Securities, concurred with Grady. The 2 million troy ounce "sell order in gold that went through the Comex was perhaps something to do with the 1.1(million troy ounce) of $1,700 January Comex gold puts that were purchased yesterday. Regardless, the day was always shaping up to be a 'risk off' event as commodities are all down … the stock markets lower, and the U.S. (dollar) stronger. There is some look of a recovery now, but the longs that piled into gold last Friday are bruised and battered," Gardiner said. Grady also said some "weaker longs" may be exiting the futures market. This is recent buyers who cannot afford to have the price drop much or else their profit is wiped out or they end up with a loss. Sean Lusk, precious-metals analyst with Ironbeam, also said there are rumors of a large order that may have been liquidation, with the decline triggering sell stops. He pointed out that the move occurred a day after options expiration and ahead of first-notice day for gold and silver on Friday, which could mean some unraveling of positions. "There was no economic data at that time to precipitate the move," he said. He later added: "Outside markets are weak, so it's going to add to the pressure," citing softer equities and crude oil. "A lot of this is off of worries about the fiscal cliff." Lusk put his nearby support for December gold around $1,700 to $1,698, then the October low, which was $1,672.50. Lusk said he remains upbeat about gold for the longer term. "Let's see if these (support) levels hold," he said. "Long term, I don't think anything has changed….I think they are going to get a (fiscal cliff) deal done. It's going to be a partial deal where they kick the can down the road. Central banks are still easing and providing more liquidity. The Fed is going to provide more liquidity. If they take it down to $1,700 or $1,698, I think it will represent a buying opportunity." Grady put nearby support around $1,705. If that fails, there could be further long liquidation that means a slide to around $1,685, he added. From there, however, he suggested the pullback could be used as a buying opportunity. "There is definitely some buying underneath the market," he said. "Right now, there is no panic with people saying 'I need to buy the highs.' Gold keeps coming (back) to them…Around those levels, I think you're going to find buyers. "The action I've seen over the last month or so is on these dips, there is strong buying. When the market looks worst is when people are buying. I don't see any major change yet." Follow me on Twitter! If you want to keep up with metals news and features, then follow me on Twitter @allensykora . By Allen Sykora of Kitco News; asykora@kitco.com (Emphasis added.) | ||

| Guest Post: BRICS: The World's New Bankers? Posted: 28 Nov 2012 05:45 PM PST Authored by Rajeev Sharma via The Diplomat, The BRICS (Brazil, Russia, India, China and South Africa) bloc has begun planning its own development bank and a new bailout fund which would be created by pooling together an estimated $240 billion in foreign exchange reserves, according to diplomatic sources. To get a sense of how significant the proposed fund would be, the fund would be larger than the combined Gross Domestic Product (GDP) of about 150 countries, according to Russia and India Report. Many believe the BRICS countries are interested in creating these institutions because they are increasingly dissatisfied by Western dominated institutions like the World Bank and the International Monetary Fund (IMF). For example, although the European debt crisis has allowed BRICS countries to push for more influence at the IMF, they currently only hold about a combined 11% of the Fund's voting shares. By way of comparison, the U.S. holds a 16.75% voting share, allowing it to veto any major decision, which require an 85% supermajority, while the United Kingdom and France both have larger voting shares than any of the BRIC countries singularly. The new institutions were first discussed in March during the 4th BRICS summit in New Delhi. A subsequent special working group was set up by the BRICS in June to hash out the details. If all goes to plan, the proposed development bank and bailout mechanism will be formally established at the 5th BRICS summit in Durban, South Africa in March 2013. In setting up the development bank, the BRICS would be mounting a challenge to global institutions like the World Bank and the European Bank for Reconstruction and Development, which attach political conditions to the low-interest loans they disburse to developing countries. In contrast, the BRICS development bank is expected to offer non-conditional loans at a higher interest rate. At the same time, it has been suggested that the BRICS bank could augment the World Bank by funding projects in industries that the World Bank does not, such as biofuels, large dams and nuclear power plants, which don't meet the World Bank's environmental standards. The proposed bailout mechanism, on the other hand, could act as an alternative to global financial institutions like the International Monetary Fund. If so, the bailout fund could also significantly enhance the BRICS countries international stature and influence. At the same time, this bloc is reportedly considering linking the bailout fund partially or in whole to the IMF or another Bretton Woods institution, much as ASEAN+3 decided to do in establishing the Chiang Mai Initiative, a similar pooled fund designed to inject liquidity into markets and minimize the impact of external shocks. Earlier this year the Chiang Mai Initiative boosted the size of its fund to $240 billion, the same amount as the BRICS are said to be considering. One potential stumbling block the BRICS face is deciding what currency(s) to use for the mutual fund and development bank. For a while now, China has been pushing for its currency, the yuan, to be added to the Special Drawing Rights (SDR), which is the IMF's international reserve asset based on a basket of currencies. China is likely to view the BRICS institutions as an avenue in which to boost the international statue of its currency. Accordingly, it is likely to advocate including the yuan as one of the currencies the proposed institutions will use. The other member states, however, are similarly likely to resist Chinese pressure in this area, and instead push for using the U.S. dollar or the IMF's SDR, which includes the euro, Japanese yen, British pound sterling, and the U.S. dollar. | ||

| The Gold Price May Close Lower Tomorrow but Huge Buying Interest Lurks Around $1,705 Posted: 28 Nov 2012 05:33 PM PST Gold Price Close Today : 1716.50 Change : -25.80 or -1.48% Silver Price Close Today : 33.684 Change : -0.297 or -0.87% Gold Silver Ratio Today : 50.959 Change : -0.314 or -0.61% Silver Gold Ratio Today : 0.01962 Change : 0.000120 or 0.62% Platinum Price Close Today : 1610.10 Change : -7.90 or -0.49% Palladium Price Close Today : 673.15 Change : -4.95 or -0.73% S&P 500 : 1,409.93 Change : 10.99 or 0.79% Dow In GOLD$ : $156.38 Change : $ 3.60 or 2.36% Dow in GOLD oz : 7.565 Change : 0.174 or 2.36% Dow in SILVER oz : 385.50 Change : 6.52 or 1.72% Dow Industrial : 12,985.11 Change : 106.98 or 0.83% US Dollar Index : 80.26 Change : -0.093 or -0.12% The GOLD PRICE got hit over the head with a baseball bat just about exactly when the New York market opened this morning, plunging in seconds from $1,735 to $1,705.88 by 9:30. Then it began to climb, reached as high as $1,722, and traded the rest of the day above $1,715. Closed down $25.80 at $1,716.50. Filter out the noise. On the 4 month chart the GOLD PRICE merely fell back to the neckline of that upside-down head and shoulders. Yep, it fell through its 50 DMA (1,740.90) and the 20 DMA ($1,722.51). Two outcomes are possible: lower or higher. If lower, gold will breach $1,705 tomorrow and trade toward $1,670. If this marks gold finishing the correction begun in October, it could fall all the way to $1,640, where the rising uptrend line from the June low awaits. If higher, then gold may piddle tomorrow, perhaps climb above $1,720, licking today's wounds. Any close above $1,726 points it upward, but this shame will only be fully removed by a close above that $1,740.90 fifty-day moving average. The market will tell you which route it prefers tomorrow. Same forces that attacked gold today as the market opened assaulted the SILVER PRICE as well, driving it from 3380c to 3291 by 9:30 a.m. Yet silver came back sharply and reached 3365 by 12:45, then traded sideways above 3360c the rest of the day. Silver lost 29.7 cents to close Comex at 3368.4c, down only 0.87% to gold's 1.48% loss. Ratio showed silver's relative strength by closing at 50.959, down from yesterday by 0.61%. The SILVER PRICE four month chart looks right different to gold's, mostly because it stands so far above the neckline of that upside-down head and shoulders. Silver did prick its 50 DMA (3319c) but closed way above that. Once again, two outcomes are possible. If lower, silver will trade through the neckline (now about 3200c) and trade to the uptrend line from the June l02, now about 3025c. Before that comes the 300 DMA (3128c) and the 200 DMA (3098c) either of which might prove to be silver's safety net. If higher, silver ought to turn tomorrow and not trade below 3290 and closing at least above the 50 DMA (3319c). Best of all would be a close -- soon, if not tomorrow --above the last intraday high at 3428c. Market is going to tell you tomorrow, and that right early, I suspect. Maybe silver and gold can move lower, but a huge buying interest lurks around $1,705 and 3300c. Right about the time you think you are pretty smart had have this market thing pert nigh figured out, markets slap you winded to remind you how priceless humility is. US dollar index lost 9.7 basis points today to 80.252, so that did not occasion the drop in silver and gold. It's flat today, but headed to the bowels of the earth. Euro rose 0.11% to $1.2958, but merely continues to dance over and around its 50 DMA ($1.2913) and 62 DMA ($1.2879). News out of Europe reported today that EU regulators approved E37 bn (US$47.9bn) for Spanish banks. Top 4 have a credit portfolio equal to 40% of Spain's GDP. EU approved E100 bn last June, but this is the first dose they've released. Spit in the wind, but the markets suck it up as if it were angels riding to the rescue on chariots of fire. Yen today rose 0.08% to 121.85c/Y100. Has risen enough to close the gap left behind on its plunge. Can it continue to advance? Like betting on a one-legged rooster at a cockfight. Believe it or not, stocks rose 106.98 (0.83%) to Dow 12,985.11 and 10.99 (0.79% to S&P500 1,409.93, and they STILL couldn't break through the downtrend line from October. I expect they will, though, and rally further between now and year end, but it's a doomed rally. As always, the media, seeking some cause, offered the meretricious US budget talks and a rise in housing prices. In fact, stocks plunged until 10:00 a.m., and only then began to rise. Do yourself a favor and stay away from stocks. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | ||

| Posted: 28 Nov 2012 05:30 PM PST by Axel G. Merk, Gold Seek:

So many foreign exchange ("FX") speculators have lost money shorting the yen that the currency earned the nickname the widow maker. Indeed, as the yen has had a weak patch as of late, some are already cautioning the trade might be crowded. But we don't talk about a trade; we talk about a fundamental shift in the dynamics that might finally be unfolding. | ||

| Posted: 28 Nov 2012 05:17 PM PST Professor Jim: Perhaps the best Orwellian headline I have seen to date. Metals and Mining Gold Prices Sink on Global Economic Concerns (Update 1) NEW YORK (TheStreet) — Gold prices tumbled Wednesday as uncertainties in the United States and Europe were stoking the biggest selloff since early November. Gold for December delivery dropped $25.80 Continue reading Jim's Mail Box | ||

| Will We Hold It Wednesday – Fiscal Cliff Fever Edition Posted: 28 Nov 2012 05:13 PM PST

Will We Hold It Wednesday – Fiscal Cliff Fever Edition

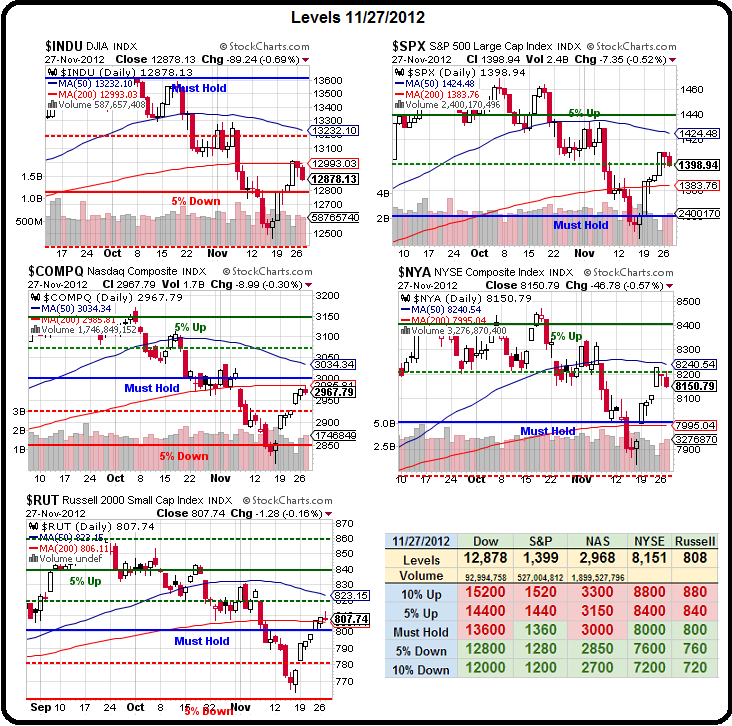

Time to worry about the cliff again! We took a few days off from worrying but comments from Senators Harry Reid and Mitch McConnell yesterday both indicated that little progress was being made on the ongoing negotiations and that was all it took to panic people out of positions yesterday afternoon, as we gave back most of Friday's ill-gotten (low volume) gains. In context, we're still making good, bullish progress but yesterday's action pretty much takes a "V"-shaped recovery off the table and now we'll have to fight and claw tooth and nail just to get back to our strong bounce lines by the week's end. Anything less than that will not be a bullish signal into the weekend. Our levels remain:

No serious damage yet but those paying attention to what's going on in China are becoming very concerned about the Shanghai Composite, which just spent it's 2nd day below the the very-critical 2,000 line – and that's down 16.66% since June. So far, the Hang Seng has avoided the same fate – trading at 22,000 and that's up from 18,500 in January (18,9%) but it's going to matter a lot which one of these indexes breaks first to follow the other. So far, the drag is down, with the Shanghai finishing today down 0.9% at 1,973 and the Hang Seng dropping 0.62% to finish at 21,708. It's been a while since China has been a big concern but, if we finish out the month this way – expect it to be a big topic of conversation in December.

Chinese economic growth relies on excessively high and potentially destabilizing levels of investment, according to an IMF paper – catching up to news from 2 years ago. The investment is mostly funded by domestic savings – good news, say the authors, but likely only meaning the coming adjustment will look different than if the country relied on foreign capital. As you can see from the chart above, we still rely on those emerging markets for the majority of Global growth in GDP. With Europe in Recession, we can ill-afford to lose China in 2013 and, of course, that's assuming our own Fiscal Cliff nonsense doesn't throw the US into Recession as well. This morning, in Member chat, I predicted $85 or less for oil on any kind of build in supply on today's inventory report. We didn't have to wait as it turns out, as oil has already hit $85.50 in pre-market trading – down $2 already from yesterday's $87.50. The problem facing oil is the same one facing copper ($3.50), silver ($33.16), gold ($1,712) and gasoline ($2.66) at the moment – people are losing faith in demand growth – especially in Asia. We'll watch this story unfold very closely and we'll keep an eye on our levels.

| ||

| Profit taking, fat finger or take-down? – gold crashes again Posted: 28 Nov 2012 05:00 PM PST Big 24 tonne gold futures sales designed to put the frighteners on gold investment but may just be providing opportunities for those with a more long term outlook. by Lawrence Williams, MineWeb.com

| ||

| Goldman's Stolper Sets 'New' Four-Year FX Plan Posted: 28 Nov 2012 04:56 PM PST This morning, Goldman announced their 10 Themes for the year. The succinct summation of them (which we will discuss later in more depth) is that: there'll be some volatility on the way but in the end it will all be unicorns and faeries (our translation). In line with these global forecasts, everyone's favorite contrarian FX strategist updated his short- and long-term FX projections. So presented with little comment are Tom Stolper's guide to stop-hunting and fading the crowd. High conviction ideas such as AUD weakness, JPY stability, and a 1.40 EURUSD stood out to us.

Via Goldman Sachs:

| ||

| Posted: 28 Nov 2012 04:54 PM PST by Andy Hoffman, MilesFranklin.com:

…which is probably why he deems it the "investment of the decade"… Eric Sprott – explains why silver is an investment of this decade – June 2011 Like myself, Sprott focuses heavily on the gold/silver ratio; currently at 51, roughly in line with its average since the gold standard was abandoned in 1971… | ||

| Flash Crash in GOLD A Real Whodunit Posted: 28 Nov 2012 04:46 PM PST Gold saw a massive 24 tonne sell order (7,800 contracts) at 08:20 a.m. New York time – bang on the opening of the world's largest gold exchange – which produced a fall of 2.25% in the market price. If the selling was year-end profit-taking then it was inept. Dealers try and finesse big sell Continue reading Flash Crash in GOLD A Real Whodunit | ||

| Posted: 28 Nov 2012 04:26 PM PST by Harvey Organ, HarveyOrgan.Blogspot.ca:

Gold closed down $25.70 to finish the comex session at $1716.50. Silver finished down 30 cents to $33.68 Today, the bankers through 7800 contracts at the opening of the comex for a sale of 780,000 oz of gold. This represents 1.00% of global annual production. What doorknob would want to sell that quantity in such a very tiny time constraint. I just shake my head at the vicious collusion as our regulators are bought and paid for. Tomorrow I would expect gold/silver to rise due to the fact that the gold/silver equities rose today. Please remember that Friday is first day notice and we usually see gold and silver rise on the first day of deliveries. The silver open interest for December remains elevated. The next couple of days will be critical to see how many paper longs roll or stand for delivery. We have many stories for you tonight but first… | ||

| Thursday gold tour of the NY Fed Posted: 28 Nov 2012 04:15 PM PST from SilverFuturist: 11:30am 44 Maiden Lane NYC meeting for the Fed tour, which is filled up. | ||

| "Whack-A-Mole" Job on Gold takes it Down Posted: 28 Nov 2012 04:05 PM PST [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Reading the wire feed commentary from early in today's session was another exercise in the cluelessness and lemming-like parroting that proceeds forth from the US financial media these days. It was that nasty, infamous "FAT FINGER" once again that was initially blamed for the smashing avalanche of sell orders that crushed the gold price lower early in today's session. Never mind the fact that the market did not immediately pop right back, which would have indeed been the case were there an actual trading error involved. The other annoying fact is that "fingers", fat or skinny or otherwise, have very little if anything to do with today's trading volume. We are talking about gigantic hedge funds and other large commercial interests, most of whom use some sort of automated computer trading platform which places orders for them. The only thing a "finger" is needed for is to beckon the servant to b... | ||

| Posted: 28 Nov 2012 03:40 PM PST from Gold Money:

Silver has spent an impressive amount of time hanging above the $34.00 mark since the start of the week, in the face of "risk off" headwinds that have hurt the CRB Commodity Index as a whole. But silver succumbed to the bearish pressure this morning – falling below $34, on negative sentiment about the latest Greek deal and the fiscal cliff talks in Washington. Gold has also fallen further back from the highs it reached at the end of last week. The euro rose yesterday to $1.30 following confirmation that Athens would be receiving a $44.6bn loan instalment, but traders are now concerning themselves with whether or not later this week the Bundestag will ratify a deal that may mean German losses on bailout loans. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

This story has been making the rounds since Monday. One of the "5 depositories licensed to deliver" for CME (subsidiary of COMEX) has issued "force majeure" because of hurricane Sandy. They say that their vault is flooded (an act of nature) and cannot make any deliveries of their gold or palladium holdings.

This story has been making the rounds since Monday. One of the "5 depositories licensed to deliver" for CME (subsidiary of COMEX) has issued "force majeure" because of hurricane Sandy. They say that their vault is flooded (an act of nature) and cannot make any deliveries of their gold or palladium holdings. Reading the wire feed commentary from early in today's session was another exercise in the cluelessness and lemming-like parroting that proceeds forth from the US financial media these days.

Reading the wire feed commentary from early in today's session was another exercise in the cluelessness and lemming-like parroting that proceeds forth from the US financial media these days. The International Monetary Fund is "reviewing" its position on capital controls and will come out with a new policy soon, one which addresses the "significant consequences" of currency appreciation in emerging markets such as the Philippines. The IMF has historically been officially opposed to capital controls, although it has instituted them in hundreds of countries since its inception after World War II, employing what it itself has termed "shock therapy" and "economic medicine" so as to "readjust" the economic superstructure of a nation.

The International Monetary Fund is "reviewing" its position on capital controls and will come out with a new policy soon, one which addresses the "significant consequences" of currency appreciation in emerging markets such as the Philippines. The IMF has historically been officially opposed to capital controls, although it has instituted them in hundreds of countries since its inception after World War II, employing what it itself has termed "shock therapy" and "economic medicine" so as to "readjust" the economic superstructure of a nation. Back in 2009, the Royal Canadian Mint [RCM] claimed that it had lost $15 million worth of gold bullion. What ensued from the time the loss was made "public" can best be described as a 'fumbling exercise' where – initially – different accounts were put forward as to the reason for the loss. Finally, public catcalls regarding this loss at one of the world's most renowned Mints led to an official investigation by the Royal Canadian Mounted Police [RCMP].

Back in 2009, the Royal Canadian Mint [RCM] claimed that it had lost $15 million worth of gold bullion. What ensued from the time the loss was made "public" can best be described as a 'fumbling exercise' where – initially – different accounts were put forward as to the reason for the loss. Finally, public catcalls regarding this loss at one of the world's most renowned Mints led to an official investigation by the Royal Canadian Mounted Police [RCMP].  Below are charts and comments from 54-year market veteran and analyst Ron Rosen:

Below are charts and comments from 54-year market veteran and analyst Ron Rosen:

Because of Japan's massive public debt burden, pundits have called for the demise of the Japanese yen for years. Are the yen's fortunes finally changing? Our analysis shows that the days of the yen being perceived as a safe haven may soon be over. Let us elaborate.

Because of Japan's massive public debt burden, pundits have called for the demise of the Japanese yen for years. Are the yen's fortunes finally changing? Our analysis shows that the days of the yen being perceived as a safe haven may soon be over. Let us elaborate.

Reports of a massive 24 tonne sale of gold futures at precisely 8.20 am New York Time this morning just ahead of market opening there, saw a drifting gold price fall off a cliff with a $26 drop in a couple of minutes and a further downwards slip thereafter. If profit taking, offloading that kind of quantity of gold at one shot seems a strange way of doing so – or inept as Ross Norman of Sharps Pixley puts it. The fat finger possibility (keyboard error), which has been used to explain similar falls in the past when gold looks to be beginning to regain its lustre, seems, as ever, unlikely and we are left with the intentional take-down of the gold price by persons or institutions unknown as seemingly the most likely answer to what has happened.

Reports of a massive 24 tonne sale of gold futures at precisely 8.20 am New York Time this morning just ahead of market opening there, saw a drifting gold price fall off a cliff with a $26 drop in a couple of minutes and a further downwards slip thereafter. If profit taking, offloading that kind of quantity of gold at one shot seems a strange way of doing so – or inept as Ross Norman of Sharps Pixley puts it. The fat finger possibility (keyboard error), which has been used to explain similar falls in the past when gold looks to be beginning to regain its lustre, seems, as ever, unlikely and we are left with the intentional take-down of the gold price by persons or institutions unknown as seemingly the most likely answer to what has happened.

In February of this year – just before the "

In February of this year – just before the " Good evening Ladies and Gentlemen:

Good evening Ladies and Gentlemen:

No comments:

Post a Comment