Gold World News Flash |

- Don Coxe – Get Ready, Gold To Re-Enter The Financial System

- Silver Update 8/05/12 Unregulated Regulators

- *BREAKING* Bart Chilton Says FT Report Claiming CFTC to Drop Silver Investigation is ‘Inaccurate & Premature’, ‘There Have Been Devious Efforts to Move Price of Silver’

- Guest Post: It's A Matter Of Trust - Part 1

- RON PAUL vs BEN BERNANKE: SILVER is MONEY! – Megan Duffield

- Libor May Be Manipulated, But Silver Is Not, CFTC To Conclude

- Got Gold Report – August 5, 2012

- CFTC Said to “Drop” 4-Year Investigation Into Silver Just Before Promised Release – CFTC To Investing Public: ‘Drop Dead.'

- Escalation of the Extortion Racket: Now It’s ‘The Dissolution Of Europe’ Not Just The Eurozone

- Jay Taylor: Canada's BNN doesn't want GATA mentioned on the air

- Precious Metals Short-Term Outlook is Bullish

- GoldSeek.com Radio: Nick Barisheff, Harry S. Dent Jr., and your host Chris Waltzek

- Jay Taylor: Canada's BNN doesn't want GATA mentioned on the air

- Credibility Trap: CFTC Said to "Drop" Four Year Investigation Into Silver Just Before Promised Release

- Weekend Precious Metals Update

- The Incomparable Faith of Keynesian Investors

- Sunny Spain Turns Frigid on Economic Freedom

- Rest Times

- What a surprise: FT says CFTC to drop silver investigation

- Don Coxe - Get Ready, Gold To Re-Enter The Financial System

- FT: US drops probe into silver price manipulation

- Subjective value and currencies

- Margin Call Levity

- Precious Metals Market Report – 8.9.12

- Alf Field: Gold STILL Targeted to Reach $4,500 ? Preceded By Violent Upside Action

- Precious Metals – Week of 8.5.12

- Ronald Reagan – Nomination Acceptance Speech of 1984

- Cash-for-gold shops boom as Italians sell off their bling

- Silver Price Forecast: Big Breakout Just Around the Corner?

- Silver Prices Soar When the Metal Gets This Hated

| Don Coxe – Get Ready, Gold To Re-Enter The Financial System Posted: 06 Aug 2012 12:00 AM PDT from KingWorldNews:

Today King World News is pleased to share with its global readers the investment recommendations of 40 year veteran Don Coxe. Coxe believes, "This schizophrenic period of gold and gold stock valuation is unsustainable." He feels very strongly that "Investors need to invest where the demand is—and will be for coming decades." Coxe, who is Global Strategy Advisor to BMO ($538 billion in assets), also warned, "We remain of the view that what might be the only way for the eurozone to assemble enough firepower to give credibility to the markets is for governments which have gold to use it to back very long-term convertible bonds." He also issued this critical warning: "The euro's death throes could take a long time. The elites may try to drag down as many innocent victims as possible to deflect attention from themselves." |

| Silver Update 8/05/12 Unregulated Regulators Posted: 05 Aug 2012 11:32 PM PDT |

| Posted: 05 Aug 2012 11:13 PM PDT from Silver Doctors:

Just like Usain Bolt at the 2011 World Championships, it appears that the FT has jumped the gun. Commissioner Chilton has informed us that 'The Financial Times report related to silver is not only premature, but inaccurate in several respects'. As to whether Chilton believes the silver market has been manipulated the Commissioner informed us: 'I continue to believe, consistent with my previous statements to which you referred, and based upon information from the public, that there have been devious efforts related to moving the price of silver. Incidentally, I also believe there have been silver and gold market anomalies outside of the silver investigate window that have raised, and continue to raise, market concerns.' The Doc's full correspondence with Commissioner Chilton is included below: |

| Guest Post: It's A Matter Of Trust - Part 1 Posted: 05 Aug 2012 11:12 PM PDT Submitted by Jim Quinn of The Burning Platform, "All the world is made of faith, and trust, and pixie dust." ? J.M. Barrie – Peter Pan

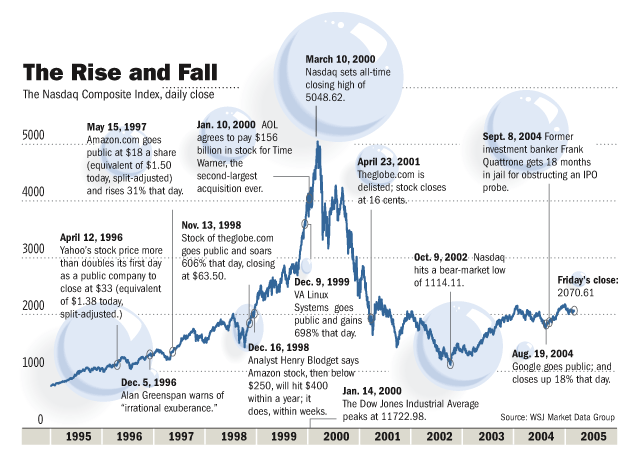

"The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks." – Lord Acton Who do you trust? Do you trust the President? Do you trust Congress? Do you trust the Treasury Secretary? Do you trust the Federal Reserve? Do you trust the Supreme Court? Do you trust the Military Industrial Complex? Do you trust Wall Street bankers? Do you trust the SEC? Do you trust any government agency or regulator? Do you trust the corporate mainstream media? Do you trust Washington think tanks? Do you trust Madison Avenue PR maggots? Do you trust PACs? Do you trust lobbyists? Do you trust government unions? Do you trust the National Association of Realtors? Do you trust mega-corporation CEOs? Do you trust economists? Do you trust billionaires? Do you trust some anonymous blogger? You can't even trust your parish priest or college football coach anymore. A civilized society cannot function without trust. The downward spiral of trust enveloping the world is destroying our global economy and will lead to collapse, chaos and bloodshed. The major blame for this crisis sits squarely on the shoulders of crony capitalists that rule our country, but the willful ignorance and lack of civic accountability from the general population has contributed to this impending calamity. Those in control won't reveal the truth and the populace don't want to know the truth – a match made in heaven – or hell. "Most ignorance is vincible ignorance. We don't know because we don't want to know." – Aldous Huxley The fact that 86% of American adults have never heard of Jamie Dimon should suffice as proof regarding the all-encompassing level of ignorance in this country. As the world staggers under the unbearable weight of debt built up over decades, to fund a fantasyland dream of McMansions, luxury automobiles, iGadgets, 3D HDTVs, exotic vacations, bling, government provided pensions, free healthcare that makes us sicker, welfare for the needy and the greedy, free education that makes us dumber, and endless wars of choice, the realization that this debt financed Ponzi scheme was nothing but a handful of pixie dust sprinkled by corrupt politicians and criminal bankers across the globe is beginning to set in. A law abiding society that is supposed to be based on principles of free market capitalism must function in a lawful manner, with the participants being able to trust the parties they do business with. When trust in politicians, regulators, corporate leaders and bankers dissipates, anarchy, lawlessness, unscrupulous greed, looting, pillaging and eventually crisis and panic engulf the system. Our myopic egocentric view of the world keeps most from seeing the truth. Our entire financial system has been corrupted and captured by a small cabal of rich, powerful, and prominent men. It is as it always has been. History is filled with previous episodes of debt fueled manias, initiated by bankers and politicians that led to booms, fraud, panic, and ultimately crashes. The vast swath of Americans has no interest in history, financial matters or anything that requires critical thinking skills. They are focused on the latest tweet from Kim Kardashian about her impending nuptials to Kanye West, the latest rumors about the next American Idol judge or the Twilight cheating scandal. Bubble, Bubble, Toil & TroubleEconomist and historian Charles P. Kindleberger in his brilliant treatise Manias, Panics, and Crashes details the sordid history of unwitting delusional peasants being swindled by bankers and politicians throughout the ages. Human beings have proven time after time they do not act rationally, obliterating the economic teachings of our most prestigious business schools about rational expectations theory and efficient markets. The only thing efficient about our markets is the speed at which the sheep are butchered by the Wall Street slaughterhouse. If humanity was rational there would be no booms, no busts and no opportunity for the Corzines, Madoffs, and Dimons of the world to swindle the trusting multitudes. The collapse of a boom always reveals the frauds and swindlers. As the tide subsides, you find out who was swimming naked. "The propensity to swindle grows parallel with the propensity to speculate during a boom… the implosion of an asset price bubble always leads to the discovery of frauds and swindles"– Charles P. Kindleberger, economic historian The historically challenged hubristic people of America always think their present-day circumstances are novel and unique to their realm, when history is wrought with similar manias, panics, crashes and criminality. Kindleberger details 38 previous financial crises since 1618 in his book, including:

Kindleberger wrote his book in 1978 and had to update it three more times to capture the latest and greatest booms and busts. His last edition was published in 2000. He died in 2003. Sadly, he missed being able to document two of the biggest manias in history – the Internet bubble that burst in 2001 and the housing/debt bubble that continues to plague the world today. Every generation egotistically considered their crisis to be the worst of all-time as seen from quotes at the time:

Human beings have not changed over the centuries. We are a flawed species, prone to emotional outbursts, irrational behavior, alternately driven by greed and fear, with a dose of delusional thinking and always hoping for the best. These flaws will always reveal themselves because even though times change, human nature doesn't. The cyclical nature of history is a reflection of our human foibles and flaws. The love of money, power, and status has been the driving force behind every boom and bust in history, as noted by historian Niall Ferguson. "If the financial system has a defect, it is that it reflects and magnifies what we human beings are like. Money amplifies our tendency to overreact, to swing from exuberance when things are going well to deep depression when they go wrong. Booms and busts are products, at root, of our emotional volatility." – Niall Ferguson Not only are our recent booms and busts not unique, but they have a common theme with all previous busts – greedy bankers, excessive debt, non-enforcement of regulations, corrupt public officials, rampant fraud, and unwitting dupes seeking easy riches. Those in the know use their connections and influence to capture the early profits during a boom, while working the masses into frenzy and providing the excessive leverage that ultimately leads to the inevitable collapse. As the bubble grows, rationality is thrown out the window and all manner of excuses and storylines are peddled to the gullible suckers to keep them buying. Nothing so emasculates your financial acumen as the sight of your next door neighbor or moronic brother-in-law getting rich. As long as all the participants believe the big lie, the bubble can inflate. As soon as doubt and mistrust enter the picture, someone calls a loan or refuses to be the greater fool, and panic ensues. This is when the curtain is pulled back on the malfeasance, frauds, deceptions and scams committed by those who engineered the boom to their advantage. As Kindleberger notes, every boom ends in the same way. "What matters to us is the revelation of the swindle, fraud, or defalcation. This makes known to the world that things have not been as they should have been, that it is time to stop and see how they truly are. The making known of malfeasance, whether by the arrest or surrender of the miscreant, or by one of those other forms of confession, flight or suicide, is important as a signal that the euphoria has been overdone. The stage of overtrading may well come to an end. The curtain rises on revulsion, and perhaps discredit." – Charles P. Kindleberger – Manias, Panics, and Crashes When mainstream economists examine bubbles, manias and crashes they generally concentrate on short-term bubbles that last a few years. But some bubbles go on for decades and some busts have lasted for a century. The largest bubble in world history continues to inflate at a rate of $3.8 billion per day and has now expanded to epic bubble proportions of $15.92 trillion, up from $9.65 trillion in September 2008 when this current Wall Street manufactured crisis struck. A 65% increase in the National Debt in less than four years can certainly be classified as a bubble. We are currently in the mania blow off phase of this bubble, but it began to inflate forty years ago when Nixon closed the gold window. This unleashed the two headed monster of politicians buying votes with promises of unlimited entitlements for the many, tax breaks for the connected few and pork projects funneled to cronies, all funded through the issuance of an unlimited supply of fiat currency by a secretive cabal of central bankers running a private bank for the benefit of other bankers and their politician puppets. Crony capitalism began to hit its stride after 1971.

The apologists for the status quo, which include the corporate mainstream media, intellectually dishonest economist clowns like Krugman, Kudlow, Leisman, and Yun, ideologically dishonest think tanks funded by billionaires, and corrupt politicians of both stripes, peddle the storyline that a national debt of 102% of GDP, up from 57% in 2000, is not a threat to our future prosperity, unborn generations or the very continuance of our economic system. They use the current historically low interest rates as proof this Himalayan Mountain of debt is not a problem. Of course it is a matter of trust and faith in the ability of a few ultra-wealthy, sociopathic, Ivy League educated egomaniacs that their brilliance and deep understanding of economics that will see us through this little rough patch. The wisdom and brilliance of Ben Bernanke is unquestioned. Just because he missed a three standard deviation bubble in housing and didn't even foresee a recession during 2008, doesn't mean his zero interest rate/screw grandma policy won't work this time. It's done wonders for Wall Street bonus payouts. The growth of this debt bubble is unsustainable, as it is on track to breach $20 trillion in 2015. The only thing keeping interest rates low is coordinated manipulation by Ben and his fellow sociopathic central bankers, the insolvent too big to fail banks using derivative weapons of mass destruction, and politicians desperately attempting to keep the worldwide debt Ponzi scheme from imploding on their watch. Their "solution" is to kick the can down the road. But there is a slight problem. The road eventually ends.

At some point a grain of sand will descend upon a finger of instability in the sand pile and cause a collapse. No one knows which grain of sand will trigger the crisis of confidence and loss of trust. But with a system run by thieves, miscreants, and scoundrels, one of these villains will do something dastardly and the collapse will ensue. Ponzi schemes can only be sustained as long as there are enough new victims to keep it going. As soon as uncertainty, suspicion, fear and rational thinking enter the equation, the gig is up. Kindleberger lays out the standard scenario, as it has happened numerous times throughout history. "Causa remota of the crisis is speculation and extended credit; causa proxima is some incident that snaps the confidence of the system, makes people think of the dangers of failure, and leads them to move from commodities, stocks, real estate, bills of exchange, promissory notes, foreign exchange – whatever it may be – back into cash. In itself, causa proxima may be trivial: a bankruptcy, suicide, a flight, a revelation, a refusal of credit to some borrower, some change of view that leads a significant actor to unload. Prices fall. Expectations are reversed. The movement picks up speed. To the extent that speculators are leveraged with borrowed money, the decline in prices leads to further calls on them for margin or cash and to further liquidation. As prices fall further, bank loans turn sour, and one or more mercantile houses, banks, discount houses, or brokerages fail. The credit system itself appears shaky, and the race for liquidity is on." – Charles P. Kindleberger – Manias, Panics, and Crashes Despite centuries of proof that human nature will never change, there are always people (usually highly educated) who think they are smart enough to fix the markets when they breakdown and create institutions, regulations and mechanisms that will prevent manias, panics and crashes. These people inevitably end up in government, central banks and regulatory agencies. Their huge egos and desire to be seen as saviors lead to ideas that exacerbate the booms, create the panic and prolong the crashes. They refuse to believe the world is too complex, interconnected and unpredictable for their imagined ideas of controlling the levers of economic markets to have a chance of success. The reality is that an accident may precipitate a crisis, but so may action designed to prevent a crisis or action by these masters of the universe taken in pursuit of other objectives. Examining the historical record of booms and busts yields some basic truths. The boom and bust business cycle is the inevitable consequence of excessive growth in bank credit, exacerbated by inherently damaging and ineffective central bank policies, which cause interest rates to remain too low for too long, resulting in excessive credit creation, speculative economic bubbles and lowered savings. Low interest rates tend to stimulate borrowing from the banking system. This expansion of credit causes an expansion of the supply of money through the money creation process in our fractional reserve banking system. This leads to an unsustainable credit-sourced boom during which the artificially stimulated borrowing seeks out diminishing investment opportunities. The easy credit issued to non-credit worthy borrowers results in widespread mal-investments and fraud. A credit crunch leading to a bust occurs when exponential credit creation cannot be sustained. Then the money supply suddenly and sharply contracts as fear and loathing of debt replace greed and worship of debt. In theory, markets should clear through liquidation of bad debts, bankruptcy of over-indebted companies and the failure of banks that made bad loans. Sanity is restored to the marketplace through failure, allowing resources to be reallocated back towards more efficient uses. The housing boom and bust from 2000 through today perfectly illustrates this process. Of course, Bernanke declared housing to be on solid footing in 2007.

The housing market has not been allowed to clear, as Bernanke has artificially kept interest rates low, government programs have created false demand, and bankers have shifted their bad loans onto the backs of the American taxpayer while using fraudulent accounting to pretend they are solvent. Our owners are frantically attempting to re-inflate the bubble, just as they did in 2003. Our deepest thinkers, like Greenspan, Krugman, Bush, Dodd, and Frank knew we needed a new bubble after the Internet bubble blew up in their faces and did everything in their considerable power to create the first housing bubble. If at first you don't succeed, try, try again.

Human nature hasn't changed in centuries. We have faith that humanity has progressed, but the facts prove otherwise. We are a species susceptible to the passions of power, greed, delusion, and an inflated sense of our own intellectual superiority. And we still like to kill each other in the name of country and honor. There is nothing progressive about crashing the worldwide economic system and invading countries for "our" oil. History has taught that there will forever be manias, bubbles and the subsequent busts, but how those in power deal with these episodes has been and will be the determining factor in the future of our economic system and country. Humanity is deeply flawed; the average human life is around 80 years; men of stature, wealth, over-confidence in their superior intellect, and egotistical desire to leave their mark on history, always rise to power in government and the business world; this is why history follows a cyclical path and the myth of human progress is just a fallacy. "That men do not learn very much from the lessons of history is the most important of all the lessons that History has to teach" – Aldous Huxley In Part 2 of this three part series I will examine the one hundred year experiment of trusting a small cabal of non-elected bankers to manage and guide our economic system for the benefit of the American people. |

| RON PAUL vs BEN BERNANKE: SILVER is MONEY! – Megan Duffield Posted: 05 Aug 2012 10:30 PM PDT |

| Libor May Be Manipulated, But Silver Is Not, CFTC To Conclude Posted: 05 Aug 2012 09:05 PM PDT from Zero Hedge:

|

| Got Gold Report – August 5, 2012 Posted: 05 Aug 2012 08:48 PM PDT Vultures (Got Gold Report Subscribers) please log in to the Subscriber pages and navigate to the Got Gold Report Video Section to view a new video offering released late Sunday, August 5. To continue reading, please log in or click here to subscribe to a Got Gold Report Membership |

| Posted: 05 Aug 2012 08:07 PM PDT from Jesse's Café Américain:

This could be one of the best examples of the credibility trap in action. The government regulators can say nothing because of their government's long complicity. If the CFTC in fact does 'drop' the investigation without presenting findings, one could consider that a slap in the face of the American public which on the whole asked for the investigation to be done in the first place, by the regulators who purportedly are hired and paid to serve their interests. Given the recent admissions about widespread manipulation in LIBOR, the timing of this outcome to the CFTC invesigation could hardly be more arrogant and high-handed, and designed to put the investing public in their places. It will certainly not inspire any confidence in the integrity of the markets and their regulation. It would probably be unwise for the investing public to accept this outcome without presenting some consequences. |

| Escalation of the Extortion Racket: Now It’s ‘The Dissolution Of Europe’ Not Just The Eurozone Posted: 05 Aug 2012 07:15 PM PDT Wolf Richter www.testosteronepit.com It has been an onslaught. Eurozone heads of state, top politicians, unelected kingpins, and bureaucratic honchos threatened everyone in sight with the demise of the euro, or promised to do “everything” or “whatever it takes” to save it even if it violated treaties or the very foundation of European democracy. In between the lines, bit by bit, the mammoth costs of continuing the endless bailouts or of breaking everything to pieces finally oozed to the surface. Sunday it was Italian Prime Minister Mario Monti, whose country, after years of living beyond its means, is suffocating under a mountain of debt. He needs the European Central Bank to print a trainload of euros and massively buy up Italian sovereign bonds to force their yields down and keep Italy financially viable—which is precisely what the treaties that govern the ECB don’t allow it to do, though the ECB had done it before, despite all-out opposition from Germany, including the resignation of ECB Council Member and Bundesbank President Axel Weber and ECB Chief Economist Jürgen Stark. After buying €211 billion in sovereign bonds, the ECB stopped in March. And since then, all heck has re-broken loose. So Monti went on attack. The Eurozone bailout chaos and Germany’s resistance to ECB printing operations have created tensions that show “the traits of a psychological dissolution of Europe,” he told the Spiegel, a threat designed for German consumption—the latest in a series of escalating threats issued by politicians of debt sinner countries. And like his predecessors, he took it a step further than anyone before him. Further even than Alexis Tsipras, the firebrand leader of Greece’s left-wing SYRIZA party, who’d threatened during the chaotic election, “If Greece doesn’t get its next loan installment, the Eurozone will collapse the following day.” But now comes Monti—and it’s no longer just the demise of the 17-member Eurozone but the dissolution of Europe. Europe as a whole. If the ECB doesn’t print whatever it takes to bail out Italy, “the foundations of the project Europe are destroyed,” he said. Then, indefatigable, the unelected technocrat went after democracy itself: “If governments let themselves be tied down completely by the decisions of their parliaments,” he said, and he was directly addressing Germany, “then the breakup of the Eurozone is more likely than a tighter integration”—the latter being Chancellor Angela Merkel’s brainchild and the focus of much of her efforts. Thus he’d lashed out at Germany’s democratic processes, including parliament’s involvement in some of the bailout decisions, limited as it is. Instead of allowing elected representatives of the people who will pay for the bailouts to have a say in the bailouts, Monti wants Merkel and her government to go around parliament and impose their decision on the citizenry. “Attack on democracy,” is what Alexander Dobrindt, Secretary General of Merkel’s coalition partner CSU, called Monti’s words on Sunday. He lamented that “greed for German tax money is sprouting undemocratic flowers.” He didn’t mince words. “Mr. Monti apparently needs to be told that we Germans will not be ready to abolish our democracy just so that Italy’s debt can be financed.” On Saturday already, Dobrindt had taken on ECB President Mario Draghi by accusing him of abusing the ECB for the benefit of his native Italy. “It’s striking that Draghi always becomes active and wants to buy sovereign bonds when Italy is once again in a tight spot,” he said. Even Draghi would have to adhere to the treaties governing the ECB. “He must decide where he stands: on the side of the stability union or on the side of the crisis countries that try to sneak their way to German money.” Higher yields were a sign countries needed to reform, he said, and forcing yields down through bond purchases would only treat the symptoms, not the causes. Draghi’s plans, he said, reveal the life-long lie of European “centralists” in Brussels who want to guarantee “the same standard of living from Athens to Munich.” But this cannot be done, least of all through printing money for debt sinner countries. “That’s euro socialism,” he said. Six of the 17 Eurozone countries are on life support, including Spain, whose banks got €100 billion, and whose central government will need much more. A bailout far larger than any prior bailout. And then there’s Italy. Leaves one question..... But Who The Heck Is Going To Do All The Bailing Out? And some food for thought: “Like Europe,” writes David Galland, “the economy of the US has been increasingly under the control of central planners at the expense of the free market.” With devastating consequences. Read.... Have You Overlooked Comprehending This Piece of the US Economic Puzzle? |

| Jay Taylor: Canada's BNN doesn't want GATA mentioned on the air Posted: 05 Aug 2012 07:11 PM PDT 9:12p ET Sunday, August 5, 2012 Dear Friend of GATA and Gold: Few financial newsletter writers work harder than Jay Taylor, editor of J. Taylor's Gold, Energy, and Tech Stocks newsletter (http://www.miningstocks.com/). Taylor not only provides weekly analysis from a hard-money point of view but also produces an Internet radio interview program on which GATA Chairman Bill Murphy and your secretary/treasurer have appeared and speaks on financial television and raido programs and at financial conferences around the world. Last week Taylor was appearing on Business News Network in Canada and his latest letter describes how he was urged not to mention GATA on the air. This is a change of attitude for BNN, as for years, under the editorship of Jim O'Connell, the network was glad to inquire into gold market manipulation and let GATA be part of the discussion. But O'Connell died five years ago, perhaps taking BNN's courage with him. Taylor's letter about BNN and GATA is excerpted below. CHRIS POWELL, Secretary/Treasurer * * * By Jay Taylor For some reason -- I'll let you imagine why -- the news media treats the name "GATA" with the same contempt and unfairness with which it treated Ron Paul. How do I know free speech and fairness are denied GATA, a civil rights organization? While I have suspected for quite some time that "GATA" was a dirty word in the minds of the establishment, I received first-hand evidence of it last week when I was interviewed by a producer for Business News Network in Canada before appearing on BNN's "Top Picks" show yesterday. (You can watch my comments on Dynacor, Sandstorm, and Timmins Gold here: http://watch.bnn.ca/#clip733129.) Here is what happened. The producer wanted to know why I thought the gold price had fallen on Thursday, as he thought it should have risen because of the decline in stock prices and a downturn in confidence in the European Union's resolve to "fix" Europe's economic problems. I suggested to him that I thought the work of GATA helped explain one possible answer to that question. I told him I thought GATA provided some pretty strong evidence that the gold price is from time to time rigged by the same folks responsible for the LIBOR fraud. ... Dispatch continues below ... ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf The producer responded by asking me to please avoid talking about GATA. It was OK for me to say what I believed, he said, but not to say the name "GATA," because, in his words, "That causes a lot of trouble around here." I can see this only as a form of media control by the establishment. Just as the media was fearful that Ron Paul would catch on en masse, so all manner of unfairness was used against him so he couldn't get traction among masses of Americans, and so it is that someone high up in the media world does not want the public to get the idea that the gold price is rigged and thus headed to much, much higher levels -- because that concept, if it were to become popular with people other than a few of us "libertarian nut cases," could lead to a panic out of the dollar. I have believed for some time, based at first on my own intuition and then in recent years increasingly on the work of an army of GATA writers and researchers, that this was the motive for the establishment's "managing" the gold price. Most of you are no doubt very much aware of GATA, but if you aren't, I urge you to go to www.GATA.org and begin digging into the evidence that gold and silver prices have been at least "played with" and that because the paper markets have been used to suppress metals prices, when and if the masses decide they want to take delivery of the metals, the price of gold could indeed rise to untold thousands of dollars per ounce. Despite all the anti-gold propaganda, there is no reason to doubt that we are in the bull market of a lifetime for both gold and mining shares. Very soon we are going to see a dramatic increase in both the real and nominal price of gold, and the gold shares are going to break out as well. Hence my unflinching support of the yellow metal and gold mining shares as well as silver and silver mining shares. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| Precious Metals Short-Term Outlook is Bullish Posted: 05 Aug 2012 07:07 PM PDT |

| GoldSeek.com Radio: Nick Barisheff, Harry S. Dent Jr., and your host Chris Waltzek Posted: 05 Aug 2012 05:08 PM PDT |

| Jay Taylor: Canada's BNN doesn't want GATA mentioned on the air Posted: 05 Aug 2012 05:05 PM PDT Few financial newsletter writers work harder than Jay Taylor, editor of J. Taylor's Gold, Energy, and Tech Stocks newsletter (http://www.miningstocks.com/). Taylor not only provides weekly analysis from a hard-money point of view but also produces an Internet radio interview program on which GATA Chairman Bill Murphy and your secretary/treasurer have appeared and speaks on financial television and raido programs and at financial conferences around the world. Last week Taylor was appearing on Business News Network in Canada and his latest letter describes how he was urged not to mention GATA on the air. |

| Posted: 05 Aug 2012 04:51 PM PDT |

| Weekend Precious Metals Update Posted: 05 Aug 2012 04:48 PM PDT I'm not ashamed to admit it; I took a net loss "day-trading" gold since the breakout of the triangle pattern on the daily chart. My trade setups were right, and there is ZERO regret. Looking back I did nothing wrong. While there is no way to control how much we make on a trade, we certainly can control our losses. Any trader who thinks they can be right all the time is going to have a tough time with the ego, which leads to a host of psychological issues and down a path toward ruin. |

| The Incomparable Faith of Keynesian Investors Posted: 05 Aug 2012 04:40 PM PDT The ECB is an extension of his power, a generation after his death. So is the European Union. So is the eurozone. Will they collapse? No. Will they slowly disintegrate? Yes. Why? Because the dream of political centralization in our day is the dream of central planning in every area of economic life. Central economic planning always produces disintegration. |

| Sunny Spain Turns Frigid on Economic Freedom Posted: 05 Aug 2012 04:37 PM PDT From sun-drenched Spain, here's a dispatch from 'Buster,' an occasional contributor to the Rick's Picks forum. Much as Buster loves the warm climate of Spain, the economic and political climate have grown so frigid that he's thinking about moving to…Iceland. The country is becoming a very appealing place to live, says Buster, because it has taken to heart lessons learned from the banking collapse of 2008. |

| Posted: 05 Aug 2012 04:34 PM PDT Gold fell 0.85% this past week after hitting a resistance level just under the $1,640 level. We took a trade in GLD on the breakout above $1,600 and sold around the top. Now we are looking to enter another GLD trading position for a few months as the seasonal time for gold to move up begins now and the stars seem to be aligned for gold. |

| What a surprise: FT says CFTC to drop silver investigation Posted: 05 Aug 2012 04:23 PM PDT But such an outcome would be completely consistent with a finding that the really big player in the silver market is not JPMorgan at all but the U.S. government acting through intermediary brokerage houses. After all, as he signed the legislation demonetizing silver in 1965, President Lyndon B. Johnson pledged that the U.S. government would rig the silver market if necessary to prevent the price from rising: http://www.gata.org/node/11601 And the Gold Reserve Act of 1934, which created the U.S. Exchange Stabilization Fund, explicitly authorizes the U.S. treasury secretary to trade secretly in all markets on behalf of the U.S. government: http://www.treasury.gov/resource-center/international/ESF/Pages/esf-inde... Four-Year Silver Probe Set to Be Dropped By Jack Farchy and Gregory Meyer http://www.ft.com/intl/cms/s/0/45329d42-dd97-11e1-8be2-00144feab49a.html A four-year investigation into the possible manipulation of the the silver market looks increasingly likely to be dropped after US regulators failed to find enough evidence to support a legal case, according to three people familiar with the situation. The Commodity Futures Trading Commission announced that it was investigating "complaints of misconduct in the silver market" in September 2008, following a barrage of allegations of manipulation from a group of precious metals investors. In 2010, Bart Chilton, a CFTC commissioner, said that he believed there had been "fraudulent efforts" to "deviously control" the silver price. ... Dispatch continues below ... ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... But after taking advice from two external consultancies, the first of which found irregularities on certain trading dates that it believed deserved more analysis, CFTC staff do not have sufficient evidence to bring a case, according to the people familiar with the situation. The agency's five commissioners have not yet formally determined the outcome of the investigation, leaving the possibility that staff could be instructed to dig deeper. A CFTC spokesman said: "The investigation has not reached its conclusion." He declined further comment. Ending the probe would infuriate some US silver investors, who claim that a group of large investment banks -- in particular, JPMorgan -- has conspired to drive the price of silver lower. "I'm sure it will be met with some concern from a certain group of aggressive silver speculators," said one person familiar with the investigation. In a recent blog post, Ted Butler, a newsletter publisher and unofficial champion for the silver investors, accused the CFTC of being "negligent in failing to terminate the obvious manipulation ongoing in silver." The CFTC has analysed over 100,000 documents and interviewed dozens of witnesses since it began investigating the market in 2008, it said last year. The people familiar with the situation said the evidence included records from JPMorgan. The conclusion of the investigation will come as a relief to JPMorgan. Although no company or individual was named in the CFTC investigation, the Wall Street bank has suffered a torrent of allegations from silver investors on the blogosphere. One campaign exhorted sympathetic readers to "crash JPMorgan" by buying silver -- based on the assumption, which JPMorgan has repeatedly denied, that the US bank has a large bet on lower silver prices. In addition, a class-action lawsuit has been filed against JPMorgan. Lawyers for the bank have asked a judge to dismiss it, arguing that plaintiffs "fail to identify a single trade" showing manipulation. Blythe Masters, head of commodities at JPMorgan, in an April interview with CNBC conceded that there had been "a tremendous amount of speculation, particularly in the blogosphere, about this topic," but maintained that the bank had no large bets on silver prices. "We have no stake in whether prices rise or decline," she said. JPMorgan declined to comment on the CFTC investigation. Previous CFTC silver inquiries in 2004 and 2008 found no evidence of wrongdoing. Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf |

| Don Coxe - Get Ready, Gold To Re-Enter The Financial System Posted: 05 Aug 2012 03:51 PM PDT  Today King World News is pleased to share with its global readers the investment recommendations of 40 year veteran Don Coxe. Coxe believes, "This schizophrenic period of gold and gold stock valuation is unsustainable." He feels very strongly that "Investors need to invest where the demand is—and will be for coming decades." Today King World News is pleased to share with its global readers the investment recommendations of 40 year veteran Don Coxe. Coxe believes, "This schizophrenic period of gold and gold stock valuation is unsustainable." He feels very strongly that "Investors need to invest where the demand is—and will be for coming decades." Coxe, who is Global Strategy Advisor to BMO ($538 billion in assets), also warned, "We remain of the view that what might be the only way for the eurozone to assemble enough firepower to give credibility to the markets is for governments which have gold to use it to back very long-term convertible bonds." He also issued this critical warning: "The euro's death throes could take a long time. The elites may try to drag down as many innocent victims as possible to deflect attention from themselves." This posting includes an audio/video/photo media file: Download Now |

| FT: US drops probe into silver price manipulation Posted: 05 Aug 2012 03:29 PM PDT Stacy Summary: via @Peterhuwfarmer – the front page of the Financial Times tomorrow, Four Year Silver Probe Set to be Dropped: You can only count on the Silver Liberation Army now! UPDATE FROM SILVER VIGILANTE: The Silver Vigilante: JP Morgan silver … Continue reading |

| Subjective value and currencies Posted: 05 Aug 2012 02:47 PM PDT The following article has been posted at GoldMoney, here. Subjective value and currencies2012-AUG-05“The issuer’s promise” is a phrase I have used recently to describe the backing for fiat currencies. The purpose of this article is to define it further, given that it is increasingly likely to be challenged in the foreign exchange markets with respect to the euro. To begin we need to define the principal difference between gold and a fiat currency. Gold has no price when it is used as money, other than what it is exchanged for in goods. Uniquely as money, it was in demand everywhere by all societies to settle their own domestic and foreign trade. Fiat money is only used to settle transactions in the jurisdiction to which it relates, and foreigners who end up with it exchange it for their own fiat money, because out of jurisdiction it is not money. There are three basic exceptions to this rule. The dollar, through its original gold convertibility became a substitute for gold, and still enjoys an international role as a result of that legacy. A second exception is when governments intervene and build up holdings of foreign fiat money. And the third is when ownership of foreign currencies accumulates for speculative purposes. Otherwise, outside its jurisdiction a fiat currency has no useful value. Its validity is based on a promise by the issuing central bank and the relevant government that it actually has value. The value of that promise is subjectively assessed in foreign exchange markets, where dealers compare fiat currencies. The result is that the purchasing power of a fiat currency can diminish substantially in foreign exchanges before disrupting its domestic monetary role. The dollar, for example, has lost most of its purchasing power since it became completely disconnected from gold in 1971, but Americans still think automatically “I have 10 bucks to spend: what shall I buy?” rather than “I must get rid of these 10 bucks before they lose yet more value”. We all think like that with our respective fiat currencies, and the moment we don’t marks the start of a collapse in confidence in the issuer’s promise. This could be the euro’s Achilles Heel, because there is no identifiable government actually prepared to stand behind the European Central Bank, and as the crisis intensifies, there is a growing risk the promise will be found wanting by the eurozone’s own citizens. Fiat money is managed by neoclassical economists at central banks who think they understand price theory. The euro is in danger of a sudden collapse, and it is not clear that the powers-that-be in the ECB understand this. It is not even clear if they understand that hyperinflation is not, as the term in modern usage suggests, an accelerating rise in the price of goods. Instead it is a collapse in the value of fiat money that arises from a reassessment of the issuer’s promise by domestic users. The euro’s future is essentially tied to a collection of disparate governments. If any of them leaves, it risks bringing on a collapse in its value that is completely beyond the control of the ECB. Tags: euro crisis, fiat currency, inflation Alasdair Macleod Twitter @MacleodFinance |

| Posted: 05 Aug 2012 01:18 PM PDT And now for something completely different...

For a taste of what the full scene looked like, here is a small part of it.

Finally, here's the movie trailer for those who have access to On Demand.

The movie is worth the time to view. Okay, back to the, uh, "vacation." |

| Precious Metals Market Report – 8.9.12 Posted: 05 Aug 2012 11:49 AM PDT By Catherine Austin Fitts It's time for the Precious Metals Market Report. I'm will be speaking to you from the Michael Fields Agricultural Institute in Wisconsin and Franklin will be "on the farm" in Tennessee. We will review recent developments in the gold and silver markets, including the FDIC and Federal Reserve issuance [...] |

| Alf Field: Gold STILL Targeted to Reach $4,500 ? Preceded By Violent Upside Action Posted: 05 Aug 2012 10:50 AM PDT We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085 So says Alf Field in edited excerpts from*an article entitled “What Happened to Gold?”*posted on Egon von Greyerz’ site [url]www.goldswitzerland.com[/url]*which is a further follow-up (initial follow-up is #3 below) to*a speech he gave to the Sydney Gold Symposium last November which was edited and*presented*in*two articles, as follows: [*]Alf Field is Back! The "Moses" Generation and the Future of Gold [*]Alf Field: Gold Going to $4,500/ozt. in Next Wave Towards Parabolic Peak [*]Alf ... |

| Precious Metals – Week of 8.5.12 Posted: 05 Aug 2012 09:45 AM PDT Ted Butler: U.S. government is part of the war on silver What Happened to Gold? |

| Ronald Reagan – Nomination Acceptance Speech of 1984 Posted: 05 Aug 2012 05:15 AM PDT Sixth in a series. President Ronald W. Reagan accepts the nomination at the Republican National Convention in Dallas on August 23, 1984. From a time when the occupant of the White House was presidential. It has been a while since that was true. A few notable quotes: "Will Rogers once said he never met a man he didn't like. Well, I could paraphrase Will. Our friends in the other party have never met a tax they didn't like. – They didn't like or hike."

"In 1981 we (republicans) gained control of the senate and the executive branch. With the help of some concerned democrats in the House, we started a policy of tightening the federal budget instead of the family budget." "Those who government intended to help discovered a cycle of dependency that could not be broken. Government became a drug providing temporary relief, but addiction as well." "Pouring hundreds of billions of dollars into programs in order to make people worse off was irrational and unfair. It was time we ended this reliance on the government process and renewed our faith in the human process. In 1980 the people decided with us that the economic crisis was not that they lived too well, government lived too well." "In the Middle East it remains difficult to bring an end to historic conflicts, but we're not discouraged. And we shall always maintain our pledge never to sell out one of our closest friends the State of Israel." "None of the four wars in my lifetime came about because we were too strong. It is weakness that invites adventurous adversaries to make mistaken judgments." "Yes, government should do that which is necessary, but only that which is necessary." "We don't celebrate 'dependence' on the Fourth of July, we celebrate independence." "We cheered in Los Angeles as the (Olympic torch) flame was carried in and the giant Olympic torch burst into a billowing fire in front of the teams. The youth of 140 nations assembled on the floor of the coliseum. And in that moment, maybe you were struck as I was, with the uniqueness of what was taking place before a hundred thousand people in the stadium – most of them citizens of our country – and over a billion worldwide watching on television. There were athletes representing 140 countries here to compete in the one country in all the world whose people carry the bloodlines of all those 140 countries and more. Only in the United States is there such a rich mixture of races, creeds and nationalities. Only in our melting pot." Source: Reagan Foundation via YouTube Comment: The election in 1984 was an overwhelming electoral landslide for Ronald W. Reagan and VP George H.W. Bush. The tally was 525 to 13, carrying 49 states - a feat done only once before. The popular vote was 54.5 million to 37.6 million. Walter Mondale (with Geraldine Ferraro as the VP hopeful) carried only his home state and the District of Columbia.

|

| Cash-for-gold shops boom as Italians sell off their bling Posted: 05 Aug 2012 05:09 AM PDT Italy's traditional goldsmiths are up in arms over a boom in the poorly regulated cash-for-gold sector that is making billions for the mafia as hard-up Italians rush to sell off their bling. This posting includes an audio/video/photo media file: Download Now |

| Silver Price Forecast: Big Breakout Just Around the Corner? Posted: 05 Aug 2012 03:55 AM PDT |

| Silver Prices Soar When the Metal Gets This Hated Posted: 05 Aug 2012 03:48 AM PDT Brett Eversole writes: You're not going to want to hear this. No one wants to hear it right now... But we have an incredible opportunity to buy silver. It doesn't feel good to trade precious metals here. Gold is down more than 10% from its highs this year. Platinum is down 20%. Silver is down about 27%. |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

When we first learned Sunday night that the

When we first learned Sunday night that the

In what may be the most amusing news of the day, according to the FT the CFTC will shortly drop its 4 year old investigation into silver manipulation, "after US regulators failed to find enough evidence to support a legal case, according to three people familiar with the situation." How about evidence to support an "illegal" case? Of course, that this is happening after the recent discovery that the world's most pervasive fixed income benchmark was manipulated for years, if not decades, can only be reason for laughter and wonder if the CFTC used the same assiduous diligence methods in pursuing the alleged perpetrators of precious metal manipulation as it did in letting the fraud at PFG slip through its fingers for two decades. We will probably never know, or at least not until an email mentioning bottles of Bollinger and silver price "fixing", (or "

In what may be the most amusing news of the day, according to the FT the CFTC will shortly drop its 4 year old investigation into silver manipulation, "after US regulators failed to find enough evidence to support a legal case, according to three people familiar with the situation." How about evidence to support an "illegal" case? Of course, that this is happening after the recent discovery that the world's most pervasive fixed income benchmark was manipulated for years, if not decades, can only be reason for laughter and wonder if the CFTC used the same assiduous diligence methods in pursuing the alleged perpetrators of precious metal manipulation as it did in letting the fraud at PFG slip through its fingers for two decades. We will probably never know, or at least not until an email mentioning bottles of Bollinger and silver price "fixing", (or " This leak to the FT *could* just be a 'trial balloon' by Mr. Gensler and his crew to see if they can get away with it. But that seems unlikely.

This leak to the FT *could* just be a 'trial balloon' by Mr. Gensler and his crew to see if they can get away with it. But that seems unlikely.

No comments:

Post a Comment