saveyourassetsfirst3 |

- More MSM coverage:The price of gold has been manipulated. This is more scandalous tha

- Leyland -- Gold May Have Been Manipulated Like Libor

- Robust Asset Allocation with Gold

- Gold Subject to “High Emotions in Quiet Market”, Retail Investors Could Lose Out in Spanish Banks Bailout

- Here's a good read on the future of gold prices

- Why The Gold Rally Depends On U.S Money Base?

- ECB: gold and gold receivables remain unchanged

- Brazilian Oil Dreams Get Sobering Reality Check

- Erste Bank - Sixth Annual ‘In Gold We Trust’

- Gold to Outshine Dollar?

- Libor Manipulation Raises Questions about Gold

- More Long Term Bearish News for the US Dollar

- Snapshot: Growing Piles Of Stuff, Few Takers

- Gold purchases made easy

- Does Central-Bank Buying Signal the Top for Gold?

- Bullion Subject to 'High Emotions in Quiet Market'

- Robert Shiller talks with Greg Hunter

- Silver Update: Dollar Daze – 7.10.12

- Measure Electricity Consumption And You Have A Good Idea On GDP

- China Imports More Gold From Hong Kong in Five Months Than all of UK's Combined Gold Holdings

- Links 7/11/12

- Gold & Silver Market Morning, July 11 2012

- Gold Still Portfolio Diversifier, Hedge & Wealth Preserver

- The Mortgage Condemnation Plan: Fleecing Municipalities as Well as Investors

- Links for 2012-07-10 [del.icio.us]

- Browns Bottom: Why Gordon Brown Sold Englands Gold On the Cheap To Bail Out the Banks

| More MSM coverage:The price of gold has been manipulated. This is more scandalous tha Posted: 11 Jul 2012 12:16 PM PDT The Telegraph of London no less. The price of gold has been manipulated. This is more scandalous than Libor By Thomas Pascoe Economics Last updated: July 11th, 2012  Governments can't will gold into existence The new media and the 24-hour news cycle have a great deal to answer for, not least encouraging a political class which would otherwise be happily engaged expensing duck houses into the belief that it should demonstrate perpetual action on our behalf – hence the endless stream of badly drafted legislation from the corridors of Whitehall. It does, however, reveal things that would otherwise be ignored. The issue of manipulation in the gold market which I wrote about last week is a case in point. The ball of half-truths and downright lies which have surrounded the issue for a long time is beginning to unspool in an issue internet activists kept alive long before it was acknowledged by the mainstream media. People ask why the issue is important at a time of naked market manipulation of the Libor rate. The answer is simple: the Libor manipulation scandal can be seen as the thin end of the wedge in terms of government market manipulation. Although Libor manipulation affects the interest rates we pay on all number of credit products, gold market manipulation is more serious still. The price of gold is traditionally a proxy for the value of money. A soaring bullion price is indicative of a lack of faith in fiat currency. Our financial system is predicated on the notion that money stands as a proxy for the factors of production – capital, labour, land and enterprise. In short, the abundance of money in the economy should be related to the abundance of those factors. The harder we work, for instance, the more we create. There is more labour in the economy, therefore a rise in the money supply is legitimate in order to mirror this. There is nothing wrong with printing money per se so long as the printing reflects an expansion in the real economy. Twentieth and Twenty-First century economics appears to have done away with this. Money is now created ex nihilo to feed both the top and bottom ends of society. Money printing or Quantitative Easing is mainly of benefit to two parties. Firstly, the Government, which is able to borrow more and borrow cheaper than it otherwise would have done. This is because QE money is used to buy bonds, forcing down yields. The Government uses this money to finance both existing debt and an expansive welfare state which bribes large portions of the population to accept a life of hellish boredom and dribbling docility in exchange for £70 a week in dole money. Such payments are not a genuine transfer of the fruits of existing production within an economy; they are borrowed. They help governments electorally at the cost of the vigour of society. At the top end, Quantitative Easing money goes directly to banks, who are able to sell their government bonds at a profit. In theory they may use this to even up their balance sheet. In reality they frequently use it as stake money at riskier tables. In both cases, paper money has been stripped of meaning. It is no longer a reflection of production nor any of its components. It now simply exists of its own right – but it can survive as a measure only for so long as the government keeps such printing in small enough doses that the de-leveraging does not become apparent to workers. As with everything in economics, there is a correctional market mechanism for this scenario – the flight to commodities, particularly precious metals like gold. Gold holds its value when paper money loses value, because it is beyond the gift of the government to simply will gold into being and give it to friends in high places or voters in low ones. If gold has been manipulated downwards and if that process continues, then all recourse to a store of value (other than land and property) has been taken from the individual. The value of our money is falling thanks to Quantitative Easing. Fixing in the gold market takes away one of the key hedges for those with cash assets but no property. The true fall in the value of money is probably better seen through the rise in house prices since the 1980s – a much better reflection of the market mechanism thanks to the suppliers being so large and because of the lack of a two-way interplay between house prices on the street and derivative products for traders. In any case, it would appear that the Libor scandal at Barclays has acted to draw out more market figures willing to claim openly that organised price fixing has occurred in gold. Ned Naylor-Leyland, investment director at Cheviot, a British investment firm, had the following to say on CNBC the other day (H/Tt Chris Powell): In the aftermath of the Libor scandal, the Bank of England complained that it had received no forewarning from the marketplace. Gold price manipulation may well be the next big scandal to break – if it does, this time nobody can say that they were not warned. Finally, a mea culpa – the tonnage figure quoted in the original article certainly undershot the true extent of the short position held by the US bank in question. It was very difficult to get accurate tonnage figures from anyone I spoke to for the article, and I took a pithy aside relating to a "couple of tonnes" rather too literally in a desire to include some. The true extent would have been far greater as many of you pointed out in the discussion board below the article. http://blogs.telegraph.co.uk/finance...us-than-libor/ | |

| Leyland -- Gold May Have Been Manipulated Like Libor Posted: 11 Jul 2012 11:59 AM PDT Gold may have been manipulated like the London interbank rate or Libor over a long time frame, Ned Naylor-Leyland, investment director at Cheviot, told CNBC. The scandal surrounding the fixing of the Libor has opened markets up to "more scrutiny and more investigation," Naylor-Leyland said.

| |

| Robust Asset Allocation with Gold Posted: 11 Jul 2012 11:49 AM PDT Forget wipe-out inflation and mass credit default. There are plenty of unscary reasons for Gold Investing too... | |

| Posted: 11 Jul 2012 10:33 AM PDT Gold Subject to "High Emotions in Quiet Market", Retail Investors Could Lose Out in Spanish Banks Bailout HAVING seen sharp falls during Tuesday's US trading, gold prices regained some lost ground Wednesday morning, climbing as high as $1583 per ounce, while stocks and commodities were broadly flat and US Treasuries dipped. The Euro also rose after hitting a new two-year low on Tuesday, while by Wednesday lunchtime Spain's Ibex stock index was up nearly 1% on the day despite news that ordinary Spanish investors may have losses imposed on them as part of Spain's banking sector restructuring. A day earlier, gold fell by more than 2% on Tuesday after briefly touching $1600. "The market looked non directional with low volumes," says a note from Swiss refiner MKS. "Profit taking kicked in around $1600." Silver prices also saw a slight bounce this morning, hitting a high of $27.24 per ounce falling a 3% fall on Tuesday. "The silver market saw a rather wide trade range [on Tuesday]," says a note from commodities exchange operator CME Group, "which in turn probably emboldened the bear camp from a technical perspective." Tuesday brought news of the collapse of Iowa futures brokerage PFGBest amid allegations that client funds have gone missing. "The whereabouts of the funds is currently unknown," said a complaint from the Commodity Futures Trading Commission, which says the brokerage's owner, who is reported to have attempted suicide, lied to regulators to cover a shortfall of more than $200 million. An estimated $1.6 billion of client money went missing last year when brokerage MF Global went bankrupt. Investment bank Jefferies confirmed yesterday it had begun liquidating PFGBest positions. "If Jefferies is doing an orderly liquidation, you have to believe that there have to be some concerns about 'Do I let [my] positions go?'" says George Nickas, commodities broker at INTL FCStone "You've got a higher degree of emotions now in a quiet market…with the €100 billion being made available to Spanish banks, gold should not be lower," he added. European leaders agreed last month that Spain could borrow up €100 billion for rescue funds to recapitalize its banking sector, while this week Eurozone finance ministers agreed €30 billion will be made available by the end of this month. Banks that receive official aid however will be required to write off their subordinated bonds and preferred shares, according to a draft Memorandum of Understanding obtained by Spanish newspaper El Pais. "The difference between Spain and other European countries is that these instruments are held mainly by retail investors," says Nomura banking analyst Daragh Quinn. "People who bought them might not have known exactly what they were investing in." Spain's prime minister Mariano Rajoy meantime unveiled his fourth austerity package in seven months Wednesday, announcing €65 billion of spending cuts and tax increases. Elsewhere in Europe, German consumer price inflation fell to 1.7% last month – down from 1.9% in May – official data published Wednesday show. Holdings of gold bullion to back shares in the SPDR Gold Trust (GLD), the world's largest gold ETF, fell by 4.2 tonnes Tuesday to 1271 tonnes. The volume of GLD gold holdings has fallen by 10 tonnes over the last two weeks – though it remains higher than it was at the start of 2012. Over in India, where the weak Rupee has contributed to record local gold prices in recent weeks, gold ETFs saw their biggest monthly outflow on record by value in June – Rs 2.3 billion – India's Money Control reports. "If you look at the total amount which has gone out…I would think it is marginal, not even marginal for that matter," says Sanjiv Shah, managing director at Goldman Sachs Asset management in Mumbai. "Some people [have] book[ed] profits. But I won't even call it anywhere close to huge amount of redemptions." Analysts at Credit Suisse meantime have cut their 2012 average gold price forecast to $1680 per ounce – down from $1765. Credit Suisse's Silver price forecast has also been cut by three Dollars to $30.50 per ounce. Based on afternoon London Fix prices, gold has averaged $1648 per ounce so far this year, while the average silver price has been $30.88 per ounce. Ben Traynor Gold value calculator | Buy gold online at live prices Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK's longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. (c) BullionVault 2011 Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. | |

| Here's a good read on the future of gold prices Posted: 11 Jul 2012 09:38 AM PDT | |

| Why The Gold Rally Depends On U.S Money Base? Posted: 11 Jul 2012 09:13 AM PDT By Lior Cohen: The U.S. Monetary base declined again during June by 0.91%. This news might imply that gold will continue to dwindle during July (assuming the Fed won't introduce another quantitative easing plan). I have already examined in the past the relation between U.S. Monetary base and gold: As the U.S. Monetary base shrinks, the price of gold tends to decline. By extension this could also mean that if the U.S. Monetary base will continue to shrink the price of SPDR Gold Shares (GLD) may also fall. The minutes of the recent FOMC meeting might reveal something that could suggest the Fed is considering introducing another QE anytime soon. Further, if the upcoming FOMC meeting at the end of July will put the QE program on the table again, this may pull up not only the U.S. money base, but also gold prices. I still speculate the Complete Story » | |

| ECB: gold and gold receivables remain unchanged Posted: 11 Jul 2012 08:55 AM PDT | |

| Brazilian Oil Dreams Get Sobering Reality Check Posted: 11 Jul 2012 07:44 AM PDT

from caseyresearch.com: By Marin Katusa, Chief Energy Investment Strategist Stories of doubles, five-baggers, or even tenfold returns abound in the resource sector. These successes are exactly why we play the game: The discovery and development of a new oilfield or gas basin can create immense value, and being part of a story like that is extremely satisfying, not to mention financially rewarding. However, the potential for big resource returns can all too easily make investors forget just how risky the sector really is. Investors are not the only ones who get caught up in the hype – an exciting discovery can turn normally conservative CEOs and geologists into starry-eyed daydreamers waxing poetic about grand possibilities and great riches. As a story out of Brazil recently reminded us, even the world's most successful investors can get carried away by dreams of resource riches. That is precisely what happened to the richest man in Brazil. Eike Batista earned his formidable wealth in the resource sector, starting with a gold-trading firm and moving into precious-metals mining before branching out into oil and gas. His empire is now contained within the EBX Group, a conglomerate of five public companies with the same majority owner: OGX is an oil and gas explorer and producer; MPX is an energy entity that generates power, mines coal, and produces natural gas; MMX is a mining company with operations in Brazil and Chile; LLX is a logistics company focused on resource-sector needs; and OSX is an offshore oil and gas service provider that also builds ships and constructs ports. Keep on reading @ caseyresearch.com | |

| Erste Bank - Sixth Annual ‘In Gold We Trust’ Posted: 11 Jul 2012 07:35 AM PDT Our good freind Ronald-Peter Stöferle, CMT, CFTe, of Erste Group Bank AG in Vienna has released Erste Bank's sixth annual very comprehensive research report on gold entitled "In Gold We Trust." The entire 120-page report is available in PDF format via a link at the end of this notice. Ronni writes in an email introduction to the report: "The foundation for new all-time-highs is in place. As far as sentiment is concerned, we definitely see no euphoria with respect to gold. Skepticism, fear, and panic are never the final stop of a bull market. In the short run, seasonality seems to argue in favor of a continued sideways movement, but from August onwards gold should enter its seasonally best phase. USD 2,000 is our next 12M price target. We believe that the parabolic trend phase is still ahead of us, and that our long-term price target of USD 2,300/ounce could be on the conservative side.The study is covering the following topics: · Central bank's monetary inflation supports progressive remonetisation of gold · Inflation ≠ rising prices: confusing terminology with grave consequences · The chronology of a hyperinflation – Explanation based on Peter Bernholz' "Monetary Regimes and Inflation" · Gold in an environment of a deflationary loss of confidence · The biggest misconception with regard to gold · High stock-to-flow ratio is the most important characteristic of gold · The advantages of a gold standard · Financial repression: the alleged magic formula · Why gold remains (dirt) cheap in India and China · Excursus on Interventionism - It is a fine line between manipulation and intervention · On the search for a "fair value" for Gold · Possible price targets for gold · Why gold is (still) no bubble · Gold improves portfolio characteristics The renaissance of gold in traditional finance · Why is gold such a highly emotional topic? Cognitive dissonance and normalcy bias as possible explanation · Challenges for the gold miners: Peak Gold and increasing resource nationalism · Gold shares (still) with historically low valuations" Our thanks to Ronni Stöferle and Erste Bank for sharing this important, very timely research. The full report is at the link below. | |

| Posted: 11 Jul 2012 07:35 AM PDT Merk Fund | |

| Libor Manipulation Raises Questions about Gold Posted: 11 Jul 2012 07:23 AM PDT The "Liebor" scandal is the latest scandal to befall Wall Street and City of London banks and official regulators and central banks. It is creating further mistrust of our already wounded financial and monetary system. | |

| More Long Term Bearish News for the US Dollar Posted: 11 Jul 2012 07:17 AM PDT

from traderdannorcini.blogspot.ca: While the near term chart picture for the US Dollar is decidedly friendly, more and more frequently we are reading reports such as the following out of Dow Jones. It is not difficult to see where all of this is heading. The US is declining and going the way of all empires and kingdoms throughout history who spent themselves into oblivion and refused to consider the long term implications of their policies. Esau squandered his birthright for a bowl of stew. The US monetary authorities and inept political leaders have squandered the Dollar's reserve currency status for what??? A pox on the whole pathetic batch of them all. Keep on reading @ traderdannorcini.blogspot.ca | |

| Snapshot: Growing Piles Of Stuff, Few Takers Posted: 11 Jul 2012 05:51 AM PDT The midweek precious metals trading session started with a bit of a recovery effort following Tuesday's price rout. Market participants pushed the US dollar a tad lower on the index and lifted gold prices by about half a percent. | |

| Posted: 11 Jul 2012 05:15 AM PDT When buying gold, you need to make sure that you're getting a good deal. Are you paying a fair premium, based on gold's market price - or are you at risk of getting ripped off by unscrupulous ... | |

| Does Central-Bank Buying Signal the Top for Gold? Posted: 11 Jul 2012 05:12 AM PDT From our friends at Casey Research, Jeff Clark writes: Doug Casey told me in January, "The only thing that scares me is that central banks are buying a lot of gold; they're historically contrary indicators." When it comes to buying gold, central banks have such a poor timing record that they're frequently joked about as a contrary indicator. We dislike referring to tonnes of gold instead of ounces. Gold is priced by the ounce. But certain market players, especially central banks, report gold transactions in tonnes. One metric ton (tonne) equals 32,150.7 troy ounces.Recently, they have been buying, quite literally, tonnes of it. Consider the following:

Here's the picture of what has transpired since the financial crisis hit in late 2008. (Click on image to enlarge) Central banks have added a net of 1,290 tonnes since the fourth quarter of 2008. This total excludes China and other nations that don't regularly report their activity, as well as countries that have been surreptitiously buying their own production. That's a lot of gold buying. One has to wonder whether so much buying may in fact signal a top for gold. After all, a number of prominent analysts have claimed for some time that gold is in a bubble and that it's all downhill from here. Not so fast. Like many mainstream reports, looking at the short-term picture usually leads to erroneous conclusions. Let's put central-bank purchases into historical perspective. (Click on image to enlarge) In spite of the recent activity, world central-bank holdings are far below what they were in 1980. Clearly, a few years of net buying does not a bubble make. The difference is greater than you might realize. Consider that since 1980…

It seems rather obvious that a lot more "catch-up" buying is needed before we start talking about a top for gold on this basis. Meanwhile, we think the trend of central-bank gold buying will continue. It's not hard to see why: central bankers around the world know what it must ultimately mean to run the printing presses the way the US has since 2008, even if price inflation is not immediately obvious. It's no surprise that they want to hedge their bets, moving more reserves into something with actual value... something that can't be debased with a few keystrokes. The US dollar has been the world's reserve currency since WWII, and that's beginning to change – the movement into gold is just one facet of that change. The entire world may indeed be beginning to understand that it's operating on a fiat currency system backed by nothing. At the same time, the sovereign debt crisis in the Eurozone is intensifying, and some countries have succeeded in inflating their currencies faster than the Fed has inflated the USD. It doesn't take Nostradamus to read this writing on the wall… and while the world's central bankers can lie to the public, they themselves know how bad things are. In fact, the WGC is so confident that central banks will continue to buy gold that it's changed its reporting structure: it's added "official sector purchases" as a new element of gold demand, while eliminating "official sector sales" as a negative supply factor. Of course, gold will someday top, and Doug Casey believes a bubble in gold and related equities is highly likely at some point, courtesy of the trillions more currency units governments will create in a desperate (and ultimately unsuccessful) attempt to stave off the Greater Depression. But we're nowhere near that point. There's a long way to go before we start legitimately using the "B word" (bubble) or "S word" (sell). In the meantime, I suggest using the "B word" (buy) or "A word" (accumulate) to make your decisions about gold. While we're convinced that buying gold and silver right now will provide handsome rewards, much more money will be made by investing in companies that mine these precious metals. For investors with an appetite for risk, the really big paydays will come from speculating in the best of the best junior miners. You can get the latest scoop on the most promising juniors at the upcoming Casey Research/Sprott, Inc. Navigating the Politicized Economy Summit in Carlsbad, California. Our own Louis James will be on hand to update attendees on his latest fact-finding mission, which includes upcoming visits to under-the-radar mining operations in China that he believes could yield life-changing gains. Joining him will be a host of financial luminaries and former government officials who will highlight the risks and opportunities that today's troubled economy presents. Reserve your seat before July 31 to receive $300 off of Summit registration. July 9, 2012 (Casey Research) http://www.caseyresearch.com/cdd/does-central-bank-buying-signal-top-gold | |

| Bullion Subject to 'High Emotions in Quiet Market' Posted: 11 Jul 2012 05:10 AM PDT Having seen sharp falls during Tuesday's US trading, gold prices regained some lost ground Wednesday morning, climbing as high as $1,583 per ounce, while stocks and commodities were broadly flat and US Treasuries dipped. | |

| Robert Shiller talks with Greg Hunter Posted: 11 Jul 2012 04:51 AM PDT Yale Professor Robert Shiller predicted the current housing meltdown in the late 1990′s. Even though the crisis is now five years old, don't think we are at the bottom. from usawatchdog: When asked, "If the current housing crisis was a baseball game, what inning would it be?" Shiller replied, "Maybe we're in the fourth." Shiller recently said that home prices may not recover "in our lifetime." He cited the Florida land boom in the 1920′s, where prices did not rebound for a "half century." Shiller adds, "There are a lot of long term doubts about home prices right now." If real estate does not recover "in our lifetime," what about the banks still holding it? Shiller called that a "dark scenario." Shiller says, "A lot of people have the mistaken impression that we must be at a bottom." He goes on to say real estate could go up in price but "There is also the risk of further substantial drops in home prices." Please join Greg Hunter of USAWatchdog.com as he goes One-on-One with Robert Shiller. ~TVR | |

| Silver Update: Dollar Daze – 7.10.12 Posted: 11 Jul 2012 04:36 AM PDT | |

| Measure Electricity Consumption And You Have A Good Idea On GDP Posted: 11 Jul 2012 03:25 AM PDT Here we see falling demand for electric power in China. No Surprise to us as China's customers are fleeing on, no products demand. Greater Depression II is beginning to bite hard. "In what may come as a shocking surprise to exactly nobody, the next great discovery as more and more layers of the global Ponzi onion are exposed, is that China was, in fact, lying about everything…" "From the NYT: As the Chinese economy continues to sputter, prominent corporate executives in China and Western economists say there is evidence that local and provincial officials are falsifying economic statistics to disguise the true depth of the troubles. Record-setting mountains of excess coal have accumulated at the country's biggest storage areas because power plants are burning less coal in the face of tumbling electricity demand. But local and provincial government officials have forced plant managers not to report to Beijing the full extent of the slowdown, power sector executives said. Even that lonely indicator that some, even us, had considered somewhat realistic: electric output, is a mirage." "Electricity production and consumption have been considered a telltale sign of a wide variety of economic activity. They are widely viewed by foreign investors and even some Chinese officials as the gold standard for measuring what is really happening in the country's economy, because the gathering and reporting of data in China is not considered as reliable as it is in many countries." "But, an economist with ties to the agency said that officials had begun making inquiries after detecting signs that electricity numbers may have been overstated." "Another top corporate executive in China with access to electricity grid data from two provinces in east-central China that are centers of heavy industry, Shandong and Jiangsu, said that electricity consumption in both provinces had dropped more than 10 percent in May from a year earlier. Electricity consumption has also fallen in parts of western China. Yet, the economist with ties to the statistical agency said that cities and provinces across the country had reported flat or only slightly rising electricity consumption." "In other words, the chart we showed a month ago showing already collapsing Chinese power production is far, far worse in reality." -zerohedge.com / By Tyler Durden / June 23, 2012 This posting includes an audio/video/photo media file: Download Now | |

| China Imports More Gold From Hong Kong in Five Months Than all of UK's Combined Gold Holdings Posted: 11 Jul 2012 03:17 AM PDT ¤ Yesterday in Gold and SilverThe gold price traded flat on very light volume through the entire Far East trading day on Tuesday, but as I mentioned in 'The Wrap' yesterday, that all ended shortly after 9:00 a.m. in London. The rally that began at that point ended just minutes after 9:00 a.m. in New York when it broke through the $1,600 spot price. Gold's high price tick...$1,603.00 spot...occurred at that point. Then 'da boyz' let loose their high-frequency traders...and by the time that the low price tick for gold occurred, gold was down to $1,563.70 spot...and intra-day move of almost forty bucks. The low came at 2:45 p.m. in electronic trading...and then traded sideways into the 5:15 p.m. New York close. Gold closed the Tuesday trading session at $1,566.50 spot...down $20.80 from Monday's close. For such a price move, net volume wasn't overly heavy...125,000 contracts, give or take. Hopefully all of the volume associated with the price decline up until the 1:30 p.m. Eastern time Comex close, will be in Friday's Commitment of Traders Report. It was pretty much the same price action in silver, although the high tick of the day, somewhere north of $27.60 spot, occurred within a one hour time period around the London silver fix at noon local time. Silver's secondary high occurred just minutes after the 9:00 a.m. Eastern time mark in New York...and then silver [along with platinum and palladium] suffered the same fate as gold, with the low tick [$26.66 spot] coming around the 2:35 price mark in electronic trading. From that point, silver also trade flat into the close. Silver closed at $26.81 spot...down 53 cents on the day...but had an intraday price move of just over a dollar. Considering the hit that silver took, the net volume was a rather subdued 30,000 contracts. The dollar index rallied about 15 basis points from its Tuesday open...with the Far East high coming around 2:00 p.m. Hong Kong time. From that point, it rolled over pretty hard, hitting its low of the day [82.98] about 8:30 a.m. local time in London. But from there, the dollar index rallied strongly, hitting its high tick [83.47] about 11:15 a.m. in New York. From its zenith, the dollar index slipped back about 10 basis points or so...and then traded flat into the close...finishing the Tuesday trading session around 83.40. It should have been obvious to any impartial observer of the dollar index, that it played no meaningful roll either before nor during the engineered price decline in all the precious metals yesterday. The gold stocks gapped down a bit at the open of the equity markets...and then followed the gold price lower all day long...with the low tick coming in the last half-hour of the New York trading day. The HUI finished down 2.89%. I thank reader Scott Pluschau for providing today's chart once again, as the good folks over at yahoo.com still haven't done a thing with their HUI chart problem. (Click on image to enlarge) All the silver stocks got it in the neck again yesterday...and Nick Laird's Silver Sentiment Index closed down a whopping 4.41%. (Click on image to enlarge) Well, the CME's Daily Delivery Report was another yawner...as only 3 gold and 7 silver contracts were posted for delivery on Thursday. But there are still 1,791 silver contracts open in July...and one has to wonder how many of these long/stoppers will stand for delivery, and who the big short/issuers will be that will be forced to deliver the physical metal itself. The friendly bet I have with myself is Jefferies, but it isn't big money. The GLD ETF reported that an authorized participant[s] withdrew 135,830 troy ounces of gold yesterday...and there were no changes in SLV. There was no sales report from the U.S. Mint. The Comex-approved depositories did not receive any silver on Monday...but Scotia Mocatta shipped 996,615 troy ounces of the stuff out the door...and the link to that action is here. The July Bank Participation Report didn't show much change from the June report. The data for this report was taken from last Friday's Commitment of Traders Report. In gold, it showed that 4 U.S. banks are net short 75,895 Comex Futures contracts...and the 19 non-U.S. that hold Comex futures contracts are net short another 49,949 contracts. Both the U.S and non-U.S. bank categories increased their net short position by about 5,000 Comex contracts from the June report...10,000 contracts in total. The four 4 U.S. banks are net short 7.59 million ounces of gold...and the 19 non-U.S. banks are net short an additional 4.99 million ounces. From last Friday's COT report, the Commercial net short position was reported as 16.66 million ounces...so these 23 banks hold 75.5% of the entire Commercial net short position in gold. In silver, it's an entirely different story, as it has been since JPMorgan took over Bear Stearns short position in silver back in the spring of 2008. Four [4] U.S. Banks are net short 18,272 Comex silver contracts...an insignificant decline of 600 contracts from their June position. I'd bet serious coin that about 80% of this amount is held by JPMorgan...and 19.99% is held by HSBC USA. The other 0.01 percent is held by Citigroup and one other bank...but are immaterial, regardless. The 11 non-U.S. banks that hold Comex silver contracts are net long 904 contracts...a minor drop of about 300 contracts from the June BPR. The net Commercial short position in silver in last Friday's COT report was 17,354 Comex contracts. JPMorgan and HSBC hold over 100% of that amount in silver all by themselves. And as I pointed out in the previous paragraph, the 11 non-U.S. banks are actually net long the silver market. This is not rocket science, dear reader, as the silver price management scheme is obviously 100% 'Made in America'. And with 4 U.S. banks holding just about 50% of the Commercial net short position in gold, they are a powerful force to be reckoned with in gold as well...especially since they collude in this price fixing scheme. When I say "JPMorgan et al"...or 'da boyz'...that's who I'm referring to. Most of the 'et al's are not U.S. banks...but other Commercial traders that work together with JPMorgan. This is precisely the same way that the LIBOR scandal works/worked. I would guess that a lot of other markets work that was as well...and the dollar index and the New York equity markets would be two others that fall into that category. As GATA's Chris Powell said..."The are no markets anymore...only interventions." Of course, since the cut-off for both the BPR and COT reports from last Tuesday's 1:30 p.m. Eastern time Comex close, the engineered price decline in all precious metals has changed both reports dramatically...and as Ted Butler so quaintly pointed out...both reports are now very much "yesterday's news". Here are two charts courtesy of Washington state reader S.A. that he borrowed from Monday's edition of Casey's Daily Dispatch...which is linked here. Both are self-explanatory...and neither of them require any further embellishment from me. Reader Scott Pluschau has another blog posted on his website. This one is entitled "Gold is Coming to a Fork in the Road"...and the link is here. I have the usual number of stories for a mid-week column, so I hope you have the chance to read the ones that interest you. It's absolutely amazing how blatant the price management scheme in the precious metals is becoming. Mike Kosares: Gold's secular bull market -- past, present, and future. Propping Up The Gold Price? - Zero Hedge Guest Post. Gold vs. paper money: Which should we trust more? ¤ Critical ReadsSubscribeFitch Affirms Its 'AAA' Rating On the US, Keeps Outlook NegativeFitch Ratings on Tuesday affirmed its AAA credit rating on the United States and maintained a negative outlook, citing a diversified and wealthy economy that is undermined by the government's inability to agree on deficit reduction measures. "The uncertainty over tax and spending policies associated with the so-called 'fiscal cliff' weighs on the near-term economic outlook," Fitch said in a statement. A negative outlook gives Fitch 12 to 18 months by which it is expected to make a decision on the U.S. sovereign credit, pushing a decision well beyond the next presidential and congressional election cycle. You can't make this stuff up. Like most of the PIIGS...all U.S. debt paper should be downgraded to junk. This CNBS story was posted on their website late yesterday afternoon...and I thank West Virginia reader Elliot Simon for sending it along. The link is here if you're seriously thinking about reading it.  PFG's Chairman Was Forging Bank Documents For Years Even As The CFTC Gave An "All Clear"If there is an event that should cost Gary Gensler his job as head regulator at the CFTC, it is this. According to a just released Reuters report, the head of MFG(lobal) part 2, PFG, whose story we broke yesterday, Russell Wasendorf Sr. "intercepted and forged bank documents for more than two years to cover up hundreds of millions of dollars in missing money, a person close to the situation." Once Wasendorf realized he was caught, and knew the implications of his actions would be exposed for the whole world to see, he tried to commit suicide, and failed. "Wasendorf, 64, is reported to be in a coma after a suicide attempt Monday morning, according to a complaint filed by the Commodity Futures Trading Commission on Tuesday that accuses Wasendorf and Peregrine of fraud." And while crime happens all the time, what is truly stunning is that as we reported previously, the CFTC gave the firm a clean bill of health in its January inspection of Peregrine Financial Group. That's 6 months ago. This Zero Hedge story from yesterday is worth skimming...and I thank reader Phil Barlett for sending it along. The link is here.  Bank Scandal Turns Spotlight to RegulatorsAs big banks face the fallout from a global investigation into interest rate manipulation, American and British lawmakers are scrutinizing regulators who failed to take action that might have prevented years of illegal activity. Politicians in both London and Washington are questioning whether regulators allowed banks to report false rates in the run-up to the 2008 financial crisis and afterward. On Monday, Congress stepped into the fray, requesting information about the role of the Federal Reserve Bank of New York, according to people close to the matter. The Senate Banking Committee on Tuesday also announced it was looking into the issue. The focus on regulators and other financial institutions has intensified in the last two weeks after the British bank Barclays agreed to pay $450 million to resolve an enforcement case. British and American authorities accused the bank of improperly influencing key interest rates to deflect concerns about its health and bolster profits. This story was posted in The New York Times late on Monday evening...and I thank Phil Barlett for sending it. The link is here.  Fed knew of Libor issue in 2007- 08, proposed reformsThe Federal Reserve Bank of New York may have known as early as August 2007 that the setting of global benchmark interest rates was flawed. Following an inquiry with British banking group Barclays Plc in the spring of 2008, it shared proposals for reform of the system with British authorities. The role of the Fed is likely to raise questions about whether it and other authorities took enough action to address concerns they had about the way Libor rates were set, or whether their struggle to keep the banking system afloat through the financial crisis meant the issue took a backseat. A New York Fed spokesperson said in a statement that "in the context of our market monitoring following the onset of the financial crisis in late 2007, involving thousands of calls and emails with market participants over a period of many months, we received occasional anecdotal reports from Barclays of problems with Libor. I found this Reuters story posted in a GATA release early yesterday morning...and the link is here.  New York Sun: What's so magical about interest-rate rigging?Reflecting on the LIBOR interest-rate report rigging scandal, the New York Sun wonders why interest rate setting is considered so magical, particularly in the hands of the Federal Reserve. The Fedsters, the Sun writes, are "supposed to set their rates with an eye to maintaining full employment. But they've been lathering trillions of dollars over to the federal government and to banks, yet it seems the more they do it, the more contented the unemployment rate seems to be resting above 8 percent. That doesn't even count hidden unemployment and underemployment and persons dropping out of the look for work. It's gotten so bad that members of Congress are starting to think about whether they want to end the employment mandate. A key committee unanimously called for a tough, unprecedented audit of the Fed, and the chairman of the Fed, Ben Bernanke, is so concerned that he's broken precedent and started holding quarterly press conferences. ... "Our own prediction is that out of this debacle will come greater impetus to monetary reform and the introduction into the conduct of monetary policy a reference to gold." The Sun's editorial is headlined "Jawbone of an Ass"...and I thank Chris Powell for providing the headline...and the introduction. It's posted on the nysun.com website...and the link is here.  Viewpoint: Eliot Spitzer and Matt Taibbi Discuss LIBORThis 9:04 minute wimp.com video was sent to me by Vancouver Island reader John Ditomasso. I haven't had the time to watch all of it, but from what I've seen, I would suggest that it's an absolute must view...and the link is here. Also on the panel is Dennis Kelleher, President and CEO of Better Markets, Inc.  Many Wall Street executives says wrongdoing is necessary: SurveyIf the ancient Greek phil | |

| Posted: 11 Jul 2012 03:12 AM PDT Records Show Triple Crown Contender Had History of Ailments New York Times Hidden Government Scanners Will Instantly Know Everything About You From 164 Feet Away Gizmodo (Dr. Kevin) Freak weather linked to global warming Financial Times Google would pay record FTC fine under tentative Apple Safari settlement Washington Post Economically Healthy 'Daily Planet' Now Most Unrealistic Part Of Superman Universe Onion David Brooks Blames Women for Income Inequality Helaine Olen, Forbes The mysterious tools of Chinese monetary policy MacroBusiness U.S. and Russia Send Numerous Warships to Middle East George Washington Norway intervenes to avert oil industry closure CNBC (bob) Spain reveals further austerity measures Financial Times Desperate Europeans Are Entering Sham Marriages To Get Brazilian Visas Clusterstock Revealed: The £93m City lobby machine The Bureau of Investigative Journalism (Richard Smith) Liborfest!

How They Do Drought in Texas The Daily Impact (martha r) San Bernardino, California, Weighs Chapter 9 Bankruptcy Bloomberg Weimar America: Four Major Ways We're Following In Germany's Fascist Footsteps Alternet Jeff Daniels Rants About Why America Isn't The Greatest Country In The World On 'The Newsroom' Manolith. This has been making the rounds, but in case you haven't seen it yet… Oligarchy in the USSA Edwin Tucker (furzy mouse) The Spreading Scourge of Corporate Corruption New York Times. So it's finally OK to talk about the obvious? The Vanishing Entrepreneur Washington Monthly. You have to be nuts to start a business. 90% fail. Being on the corporate meal ticket, if you have the personality and survival skills, is vastly easier. Scandal Shakes Trading Firm Wall Street Journal Ain't No Criminals on Wall Street masaccio, Firedoglake (Carol B) Living Cells Show How to Fix the Financial System Bloomberg Claw Is Out for 'Whale' Officials Wall Street Journal The Politics of Getting a Life Jacobin (martha r) D – 59 and counting* "After all, the chief business of the American people is business. We make no concealment of the fact that we want wealth, but there are many other things we want very much more. We want peace and honor and that charity which is so strong an element of all civilization." – Calvin Coolidge Occupy. #NatGat retrospective: "I left on a quest to the Society of Friends parking lot, a few blocks away, made available to Occupy National Gathering organizers by the Society's consent as refuge. The lot would shortly become a very real sanctuary." The National Park Service is what we thought it was, but Quakers are awesome. Montreal. Scaling: "The co-spokesperson for CLASSE, Gabriel Nadeau-Dubois, will be at the University of Ottawa Thursday to talk about the success of the Quebec student movement. '[GND:] The key principle of success in Quebec is exportable. Because it's our mode of organization.'" …. Symbol production: "Thus was born the École de la montagne rouge: a meeting place, an office, a workshop, but also a small-scale silkscreening factory." AK. Extractive economy, local businessman called "Mayor": "Initially, I was very supportive of [The Pebble Project]. I am now avowed neutral, awaiting a site specific detailed plan, so I can make an intelligent response to a concrete proposal." … Extractive economy: "What is happening [at Pebble Mine] is so extreme and contentious that it is setting the pinnacle (and possible the standard) for debate about opening new mines in sensitive places." …. Pebble Mine, Walker's iron mine, mountain-top removal, uranium mining, landfills, fracking: One story. Not six. AZ. "I was hoping to see evidence of an Obama For America Voter Registration Drive surge by now." CO. Romney: "Mitt Romney rolled up his sleeves and used his teeth to rip open plastic food packaging during a stop at a food bank." … Obama: "President Barack Obama has directed federal officials to offer seasonal firefighters the option of purchasing federal health insurance coverage." It's great that swing state firefighters are recipients of the imperial largesse. But we are all seasonal firefighters! FL. Epidemic planning: "Last year, Duval County sent 11 patients to [TB hospital] A.G. Holley under court order. With A.G. Holley now closed [by the State], one was sent to Jackson Memorial Hospital in Miami instead of the nearby Shands hospital. [Other TB patients] remaining in Jacksonville are being placed in motels to make it easier for public health nurses to keep tabs on them, Duval County officials said. "It's scary," [State Sen D Maria] Sachs said. "All they have to do is go on a city bus." Yes, you read that right. TB is an airborne illness. And the state of FL is warehousing TB patients in motels. … Mice roar: "My name is Lisa Epstein. I am running for Clerk of Circuit Court in Palm Beach County's August 14, 2012 election. Our county's voters have spoken loud and clear; expose and rid our county of fraud." … Voting: Media misreporting skews Federal court ruling on FL's deceptive purge of 'non-citizen' voters. Defeat for Scott reported as victory. GA. Mass incarceration: "About 40 demonstrators gathered outside the state Capitol in Atlanta on Monday to express support for Georgia prison inmates who have reportedly been on a hunger strike for nearly a month. The protesters, including members of the Occupy Atlanta movement, also demanded that the state enact prison reform. " … Food: "A food-safety law enacted in the wake of nine deaths from tainted peanut butter at a Georgia plant isn't being strictly enforced." … Corporate GOTV: Sam Williams, president and CEO of the Metro Atlanta Chamber, is leading the charge in this effort to squeeze employees into voting themselves a 10-year tax increase for a transportation plan. IA. Kleptocracy, Cedar Falls Council member: "Shock. That was the principal reaction [to Peregrine CEO's Russell Wasendorf's suicide attempt] and then a feeling of sadness really. Mr. Wasendorf was quite an influential figure in town." What's shocking isn't that another FIRE firm looted customer accounts, but that the CEO attempted suicide. … Civics 201, Area Man: "It's neat to see what the President is all about. I mean there had to be 25-to-30 vehicles." … Tax cuts: "I continue to believe that no matter what he promises today, Obama will sign another bill extending the Bush tax cuts at all income levels (either for a year or two, or perhaps permanently). As he did in late 2010, the president endorses the Republican message that we can't afford to let taxes go up in a weak economy." Staunch D, BTW. LA. Corruption: "District Judge Tim Kelley, of the 19th Judicial District, ruled that he did not have jurisdiction to provide an injunction sought by opponents of the [charter schools] program, saying his hands were tied by a state law that prohibits him from blocking the policy if that would create a deficit. Because affidavits from state school Superintendent John White and Commissioner of Administration Paul Rainwater said that would be the effect of an injunction, there was nothing the court could do, Kelley said." Totally not gameable! ME. Privatization: "[Eastern Maine Medical Center] wants to outsource its dialysis services to DaVita Inc. The Denver company is the nation's largest for profit provider of dialysis services." What could go wrong? NV. Voting: "The plaintiffs argue that the voters who choose NOTA [None Of The Above, which is on NV ballots] are not being treated equally, because a vote for NOTA is a vote but the state isn't giving that vote any legal effect." NY. Fracking: "[Cuomo] says his administrations' hydro-fracking policy will be released later this summer. Cuomo says if communities want fracking, or are against fracking, then home rule should be taken into 'consideration', if fracking is in the end allowed." OH. Kleptocracy: "An AEP Ohio spokeswoman said that the company planned to ask the Ohio Public Utilities Commission to pass [millions to restore power to hundreds of thousands of Ohioans after the derecho on] to customers. Last year, AEP Ohio earned $1.9 billion in profits, $700 million more than the previous year." See, making the system work reliably comes extra. ONT, Canada. Extractive economy: "In just the first leg of [Enbridge's] Line 9 pipeline, 357 'crack-like features' were detected during the last inspection, which led to the rupture in Michigan.' PA. Razor thin margin: "A poll released on June 27 by Quinnipiac suggests that both [candidates] face similar rates of defection by their party bases: Obama carries Democrats by a margin of 82 percent to 7; Romney wins Republicans 76 to 10." … Extractive economy: "D candidate Linda Small has called on Harrisburg to end $3 billion in taxpayer subsidies to oil, gas and coal corporations, saying it would help people not only in York County, but across the state." TN. Tinpot tyrants: "While invitees [to Gov Bill Haslam's conference on the future of higher education] include politicians and even representatives of the Tennessee Chamber of Commerce, the Governor's office left out invitations to faculty, staff, and students." TX. Water: "Last summer, during the height of the drought, West TX farmers kept watering their cotton crops despite knowing they wouldn't grow. They needed to do so to qualify for federal crop insurance." …. Neanderthals: "Harris County even went so far as to ban piñatas at nearly 3 dozen of its parks." VA. Uranium mining: "At a rough count, based on the number of people applauding different speakers, about two-thirds of the attendees were anti-mining and a third supported lifting the [uranium mining] moratorium" (Pittsylvania County). VT. Privatization? "Low levels of two herbicides, clopyralid and picloram, have been detected in some samples of compost made at Chittenden Solid Waste District facilities. … Many gardeners have reported that some plants grown in some of the compost products have damage characteristic of these herbicides: cupped leaves, twisted stems, distorted growing points and reduced fruit set." (Can't figure out the trash flows from CSWD's site, but I'm guessing that Casella, the Materials Recovery Facility contractor, also single-streams UVM's food scraps into the Compost operation. And who knows what else.) WI. Civics 201: "Wisconsin Power & Light is warning customers about a scam that claims President Barack Obama is providing credits or applying payments to utility bills." Works for banksters! Media critique. "Americans' confidence in television news is at a new low by one percentage point, with 21% of adults expressing a great deal or quite a lot of confidence in it. This marks a decline from 27% last year." … How top election journalists are framing their campaign coverage. Handy chart! HCR. The narrative: [ObamaCare requires that] every state must have an exchange where consumers can go online and compare insurers' offerings. This means not only that the market for health insurance is going to expand but also that much of it is likely to be sold directly to individual consumers rather than through an employer. …. That there is already a robust community of [health care specialists in] public relations, marketing, advertising, and market research professionals … is itself an interesting story. But getting inside the dynamics of how that business is now going to explode – and which big players, such as the largest ad agencies, are likely to start buying up the specialists – is a much bigger deal." Direct marketing of health insurance to consumers by public relations professionals. What could go wrong? The trail. Katie, bar the door! Dinesh D'Souza interviews Obama's brother, George, in Kenya, for "documentary" film. … Stasis: "About two-thirds of Americans consider the country seriously off course, a majority have not approved of Obama's overall job performance in more than a year, and the president remains in negative territory on dealing with the economy, health care and immigration. Also unmoved since fall are Americans' attitudes toward spending, with as many saying they would prefer an increase in federal spending to try to spur economic growth as wanting to prioritize deficit reduction." You'd never know the last point from our famously free press. …. Charlie Cook: "If President Obama's campaign machine can define Mitt Romney before his own campaign even tries, my bet is Obama wins reelection. … A willingness to fire the president is only one step. Voters also have to be willing to hire Romney. [A] potentially decisive slice of the electorate could reluctantly return to the incumbent. Voters' willingness to hire Romney is being severely damaged, at least in swing states, by the advertising efforts of the Obama campaign and Priorities USA, a pro-Obama super PAC. The ads are devastatingly tough." Maybe. Priorities USA certainly commissioned a poll to show it. …. Independents: "The collective total of independents grew by about 443,000 in CO, FL, IA, NV, NH and NC since 2008 [via Bloomberg]. During the same time, Democrats saw a net decline of about 480,000 in those six states, while Republicans — boosted in part by a competitive primary earlier this year — added roughly 38,000 voters in them." … Legacy party: "[The Rs are] a bunch of old, white guys, and unfortunately, a lot of them are fat like me." Greens. Ballot access: "This year, it's actually easier being Green. … While candidates seeking the R or D lines in most areas must file 500 signatures for an Assembly seat and 1,000 for the state Senate, people looking for third party nominations need 5 percent of its enrollees in a district. The Greens are fielding two candidates in Bronx districts where, because they are so outnumbered, the threshold was just one nomination signature." Elizabeth Warren. Money: "Warren is already the nation's leading congressional fundraiser and the latest figures are likely to widen her lead." 2016! Robama vs. Obomney watch. Meme watch, "extreme": "[ROMNEY:] It's the sort of thing only an extreme liberal could come up with." "…[Obama IA spokeshole:] Mitt Romney and his extreme conservative allies…." "A majority of American voters said the political views of [Obama and Romney] are extreme." [Noises off: Head pounding on desk. Screams. Breaking glass] … Money, Lynn Sweet: "What Romney and Obama have in common: the campaigns will offer up fund-raising statistics about low-dollar donors–and ignore data to show the importance of high-dollar donations." Obama. Oh ha ha ha: "[MICHELLE OBAMA:] That fundamental promise of no matter who you are, if you work hard, you can build a decent life for yourself and an even better life for your kids. That is the American dream." … Meme watch: "[OBAMA:] Let's stand up for families like yours that are working hard every day, give you some certainty so you can start planning, so you have an idea of what's coming next year." I like this vile "uncertainty" meme as much today as I did yesterday. … Razor thin margin: "Axelrod briefed House and Senate lawmakers about the president's nine-state campaign strategy…" Why not just airdrop palettes of cash in the swing counties of those nine states? That would create "certainty"…. * 59 days 'til the Democratic National Convention ends with Chinese take-out on the floor of the Bank of America Stadium, Charlotte, NC. Satchel Paige became the oldest major league baseball player at age 59. Antidote du jour (martha r): | |

| Gold & Silver Market Morning, July 11 2012 Posted: 11 Jul 2012 03:00 AM PDT | |

| Gold Still Portfolio Diversifier, Hedge & Wealth Preserver Posted: 11 Jul 2012 02:22 AM PDT On Tuesday the World Gold Council pared down its earlier estimate of 2012 Chinese gold demand from 1,000 tons to 870 tons, saying a firmer dollar and the stall in gold price rally have lowered consumers' desires to buy gold. | |

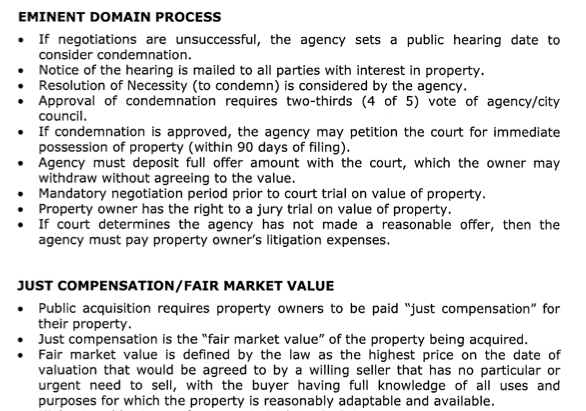

| The Mortgage Condemnation Plan: Fleecing Municipalities as Well as Investors Posted: 11 Jul 2012 02:14 AM PDT Beware of financiers bearing gifts. A scheme proposed by a group called Mortgage Resolution Partners, which is being considered by San Bernardino, CA, to use the traditional power of eminent domain to condemn mortgages, was pretty certain to be a non-starter, so I've ignored it. But it's gotten enough attention to have roused the ire of a whole host of financial services industry lobbying groups, as well as endorsements from Bob Shiller and Joe Nocera, and a thumb's down from Felix Salmon, so it looked to be in need of serious analysis. One of the big problems with this plan, which seems to have been overlooked so far, is that any municipality who goes down this path is likely to be the designated bagholder. Mind you, that isn't based just on the general tendency of municipalities to be easy prey for clever bankers, but also based on the few, but nevertheless troubling, operational details that have been made public. This is the theory of how the plan would work, from one of its prime promoters, law professor Robert Hockett:

If you believe that, I have a bridge I'd like to sell you. No, this plan isn't a "partnership". There has been troubling little detail about what Mortgage Resolution Partners will do or how it will be paid. This whole process has been hidden from public view. Why wasn't the original request for proposal made public? Why haven't the operational arrangements, as in what the roles and obligations of the parties are, and most important, what the fees are, been reported anywhere? The way this plan works is that MRP and its allies plan to steal. And no, I'm not exaggerating. But the odds are high that if this program were to go anywhere, it would be a costly and embarrassing disaster for its municipal backers. MRP's Fees Are Obscene Individuals who've met with people involved in the MRP scheme have said, consistent with the very sketchy presentation on the MRP website, that it is acting only in an advisory capacity. Translation: it is not a partner, it's a hired gun. And for that, it is to get a fee on every mortgage condemned, reportedly 5.5% (I assume of the value paid by the authority to the investors, but this is the sort of detail that needs to be made public). 5.5% is an egregious fee, particularly for a large scale, largely repetitive process where key tasks like servicing will be contracted out. My sources say MRP has a $6 million budget for PR (and that number suggests PR is defined rather liberally, and probably includes inducements like sports tickets). That give you an idea of how rich they expect the pickings to be. And it's even more unreasonable when you look at the risks that will be borne by local governments detailed below (I'd be stunned if the authorities were shrewd enough to have MRP indemnify them against any of these hazards). Municipality Bears Valuation Risk The proposal has the municipal authority (the idea is that various localities will join one umbrella authority, presumably per state) borrowing funds from "investors" (key terms not specified) to condemn mortgages. MRP's own website makes clear that they intend to target only performing mortgages. Yet various accounts also say consistently that MRP thinks it can condemn the mortgages at a discount to face value, and refi them at a profit. This premise is fundamental to the entire scheme working; it's how the municipalities can afford to pay the considerable operational costs as well as MRP's fees. And it amounts to theft. One of the requirements of eminent domain is that the property owner be paid fair market value. For a performing mortgage, it's awfully hard to argue that that is less than 100 cents on the dollar (in fact, as Felix Salmon points out, it's actually more these days since interest rates have fallen). MRP argues that they ought to be less since 18% of homes that were performing but underwater in 2010 became delinquent in 2011 (aside, I wonder how many of these were people who defaulted because servicers told them they needed to be delinquent to qualify for HAMP). First, that figure should be lower for the remaining mortgages (presumably, the weakest borrowers default, so the ones who are left are presumably sounder). Second, that logic cannot extend to specific mortgages, since it is specific mortgages that are being condemned. Would you accept an offer less than the blue book value of your car simply because someone said you had a 5% odds of being in a car wreck in the next year? No, but this is the argument that is being made. And the examples all presume large discounts. From Nick Timiraos of the Wall Street Journal:

Now remember how this works: the municipality condemns the mortgages, then supposedly takes over the mortgage (more on that assumption soon). The loan would still have to be serviced but then would be refinanced, with FHA loans as the targeted takeout (properties would be pre-screened to fit FHA parameters) Institutional investors or banks would then loan the municipality the money to pay the prior owners of the mortgages the supposed fair market value for their condemned mortgages. So if things work out, the investors are providing a fairly short term bridge financing facility. If not, they'd presumably be repaid from ongoing cash flows from the mortgages. But how does that work? The last thing investors want is to be at risk of having a short term loan become a long term loan. Presumably, there are penalties of some sort if that happens. And what happens if borrowers who can't refi default (if nothing else, shit does happen, a homeowner could die or suffer a job loss after the condemnation but before the takeout was in place). Given that the whole premise was to refinance the mortgages, would the municipalities be prepared to make new loans to replace the existing ones? I sincerely doubt the investors intend to provide longer-term financing. You'd need to see how various scenarios are dealt with and how risks and fees are shared to assess this plan. Yet these crucial details remain under wraps. What happens if this all proves to be more costly than MPR promised? It's certain that the municipality is on the hook, and it's not hard to see how expenses could spiral out of control. Consider this layperson-friendly overview of the eminent domain process in California: Second, the very act of condemning with an intended takeout at a higher price via a Federal government program smells an awful lot like a scheme to defraud. Clearly the ability to refi ad a much higher price than the condemnation price is proof in and of itself that the condemnation price was too low. And the best part? The party whose property is condemned can take the money offered and go fight in court for more. And if he wins, the other side, the municipality, pays his legal fees. The examples contemplate only $25,000 or say $50,000 of "spread" between the condemnation price and the refi amount. $25,000 doesn't even get you started in litigation. Any level of lawsuits (particularly if the municipalities also have to repay the costs of big ticket lawyers on the other side) will run into the hundreds of thousands of dollars per borrower, pronto. Municipalities/Special Authorities Would Be Targets of Suits on Constitutionality This use of eminent domain is a huge stretch from its intended aims. It's meant for public purposes, such as roads, new amenities, removal of blighted property, or redevelopment. You can see how disingenuous this approach is from the Robert Hockett paper attempting to justify its use. His evocation of the "public purpose" is to prevent foreclosures and neighborhood decay. But the program has nothing to do with that. It targets an only somewhat at risk population, and that capriciously. Fannie and Freddie borrowers (contra Felix) will not be eligible. Borrowers are also to be chosen to minimize the risk of litigation as well as on FHA eligibility, rather than based on some notion of need. For instance, my moles said that MRP was making sure no more than four loans would be condemned out of any one trust. Given the unified outrage from the banking industry lobbyists (SIFMA, the ABA, the Financial Services Roundtable, the American Securitization Forum, the Mortgage Bankers Association, and the only bona fide investor, as opposed to sell side group, the American Mortgage Association), I'd expect a broad-based challenge on constitutionality, possibly in addition to a loan by loan war of attrition on pricing. Now at first, you'd think that the big boys wouldn't care. Aside from a few peeps by AMI, there were pretty much no complaints of the transfer from investors to banks embodied in the mortgage settlement. And no wonder. The banks are vastly more powerful than disenfranchised investors (who are in for the most part in the hands of institutional investors who don't want to ruffle the banksters). I had initially thought that the reason for the unified uproar was the ongoing top priority of not exposing the insolvency/impairment of the four biggest banks by making them write down their second liens to realistic levels. After all, one would think that condemning a first lien would force the wipeout of the second, right? It turns out that may not be the case. Despite Hockett's and others efforts to treat mortgages the same as real estate, they aren't. Specifically, the reason the MRP scheme isn't touching Fannie and Freddie mortgages apparently is that they are subject by Federal pre-emption from action by state authorities. Arguably, the same logic would apply to any second liens made by an OCC chartered bank. If the OCC said they were off limits, they'd be off limits (and notice, in keeping, the silence in all the public discussions about what would happen to the second liens). In addition, remember that FHA is the planned takeout, and FHA refis allow the seconds to stay in place as long as the lender agrees to resubordination. What lender wouldn't be delighted to agree if the principal balance of the first lien gets reduced a ton? It makes his second a much better asset. So if this program might help alleviate the second lien problem, why are the staunch defenders of Big Finance up in arms? Despite the huffing and puffing, it certainly doesn't have anything to do with "no one will ever lend to you guys again." The residential mortgage market is on government life support, and the incumbents have been completely unwilling to back reforms that might bring investors back into the pool. The reason may be that if any mortgages that were condemned got a court ruling supporting a well below par value price, the ramifications would be considerable. Remember, these would be jury trials, and litigation is a crapshoot, even with the facts stacked in favor of investors, a few condemnations could still get a clean bill of health). A price that low is justified only if the court bought the idea that the mortgage was at imminent risk of default. The fact that these mortgages could be refied (and the investors were at risk of a takeout below that amount) would mean the servicers would be exposed to large scale litigation for their failure to do mods for similarly situated borrowers. The PSAs that limit mods either contain percentage restrictions, like 5% of the pool, or require that the borrower be in default or at imminent risk of default. Classifying a large new group of borrowers as being at imminent risk of default, and putting a discount on their mortgages would make it easy to arrive at pretty large damages. What Happens If/When Servicers Can't Produce Properly Endorsed Notes? The promoters are blithely assuming servicers can produce properly endorsed notes and assign liens. Has anyone done an analysis of the issues here? Recall, as a particularly prominent example that in Ibanez, two different servicers had two years to produce evidence of ownership. As noted in the concurring opinion:

Lack of Transparency Many elements of how this scheme came about are troubling. While the interested municipalities have released the agreement that creates the joint authority, that tells us pretty much nada about the money and risk issues. This program looks to have been awarded to MRP with insufficient competition. Was there a request for proposal? If so, why has no one seen it? This process smacks of special dealing (for instance, designing a process to favor MRP, say by drafting the RFP to assure they'd be selected, or having too narrow a window for proposals to allow other firms to come forward). The RFP, the proposed agreement, any correspondence, and a record of meeting between public officials and MRP should be made public. Par for the course, San Bernardino announced only today that a public meeting on this issue will be held Friday. And this also comes as the If you are in the San Bernardino area, the meeting notice claims "all writings received by the Board of Directors related to these items are public records" and will be available for review. I hope an NC reader can go and see if the RFP and contract are indeed being made public. If so, it would be very helpful to provide a summary of them for the benefit of the public; we'd be delighted to publish it. And if they aren't, it would be hard not to surmise that the officials are pulling a fast one. | |

| Links for 2012-07-10 [del.icio.us] Posted: 11 Jul 2012 12:00 AM PDT

| |

| Browns Bottom: Why Gordon Brown Sold Englands Gold On the Cheap To Bail Out the Banks Posted: 10 Jul 2012 11:00 PM PDT |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment