Gold World News Flash |

- Gold Stocks Breakout Inches Closer

- More Long Term Bearish News for the US Dollar

- Silver Update 7/10/12 Dollar Daze

- Gold to Kiss 1600 Goodbye?

- Mike Kosares: Gold's secular bull market -- past, present, and future

- What's Iran doing with Turkish gold? Accepting payment for oil

- 'Everything in these markets is fake,' Embry tells King World News

- Propping Up The Gold Price?

- The Gold Price Closed $1,579.30 Teetering on the Edge but Bull Markets Usually Resolve Upside

- Guest Post: Propping Up The Gold Price?

- The Dark (Pool) Truth About What Really Goes On In The Stock Market: Part 4

- Oil, Gold, Asia and the Best Investment in the World Right Now - An Interview with Jim Rogers

- Oil, Gold, Asia & the Best Investment in the World Right Now - An Interview with Jim Rogers

- Silver Chart - by Request

- With Regards To "Fed Hopes" Bernanke Says "F.U."

- The Race for Energy Resources Just Got Hotter

- The Age of Envy, Updated

- Gold Miners are Cheap, Cheap, Cheap!

- Loose Monetary Policy "Will Mean Strong Demand" for Gold

- Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil

- Gold Daily and Silver Weekly Charts

- The War Between Manipulation and Buying

- The Gold Stocks Compared to Past Bull Markets

- Gold May Have Been Manipulated Like Libor: Expert

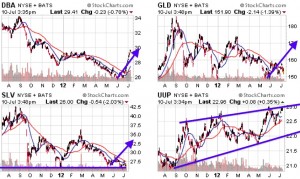

- Inflation Reemerging: Food Prices Gapping Higher, Precious Metals May Follow

- Gold Falls to Settle at $1,579 on Market Jitters

- Brazilian Oil Dreams Get Sobering Reality Check

- So Freaking Obvious (SFO)

- In The News Today

- REE Stocks Are Down but Not Out: Siddharth Rajeev

| Gold Stocks Breakout Inches Closer Posted: 10 Jul 2012 11:49 PM PDT | |

| More Long Term Bearish News for the US Dollar Posted: 10 Jul 2012 11:37 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] While the near term chart picture for the US Dollar is decidedly friendly, more and more frequently we are reading reports such as the following out of Dow Jones. It is not difficult to see where all of this is heading. The US is declining and going the way of all empires and kingdoms throughout history who spent themselves into oblivion and refused to consider the long term implications of their policies. Esau squandered his birthright for a bowl of stew. The US monetary authorities and inept political leaders have squandered the Dollar's reserve currency status for what??? A pox on the whole pathetic batch of them all. DJ Australia's Swan: To Discuss With China Possible Direct Conversion of Australian Dollar, Yuan HONG KONG--Australia will discuss with China officials the potential for direct conversion of the Australian dollar and the Chinese yuan for transactions completed in mainla... | |

| Silver Update 7/10/12 Dollar Daze Posted: 10 Jul 2012 11:29 PM PDT | |

| Posted: 10 Jul 2012 10:26 PM PDT courtesy of DailyFX.com July 10, 2012 02:24 PM Weekly Bars Prepared by Jamie Saettele, CMT No change other than to note that gold may have tagged 1600 for the last time in a long time today…I’m still looking lower against 1641. “Gold has oscillated on both sides on 1600 since May 2011. This length of consolidation will probably fuel an impressive break…eventually. The sideways trading from the May 2012 low is taking on the form of a head and shoulders continuation pattern (bearish) but a break below 1548 is needed to confirm. Exceeding 1641 would shift focus to 1671 (May high).” LEVELS: 1527 1548 1576 1597 1625 1641... | |

| Mike Kosares: Gold's secular bull market -- past, present, and future Posted: 10 Jul 2012 09:46 PM PDT 11:45p ET Tuesday, July 10, 2012 Dear Friend of GATA and Gold: Mike Kosares, proprietor of Centennial Precious Metals in Denver, writes this week that while gold has entered the "public participation" phase of its bull market, the monetary metal likely has far more to run because the participation is only a fraction of what it has been in previous bull markets. Kosares' commentary is headlined "Gold's Secular Bull Market: Past, Present, and Future," and it's posted at Centennial's Internet site, USAGold.com, here: http://www.usagold.com/publications/sr07092012.html CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... | |

| What's Iran doing with Turkish gold? Accepting payment for oil Posted: 10 Jul 2012 08:45 PM PDT By Humay Guliyeva and Pan Kwan Yuk Financial Times, via GATA:

That is the question [the] Beyondbrics [column] found itself asking after it had a look at Turkey's latest trade figures. According to data released by the Turkish Statistical Institute (TurkStat), Turkey's trade with Iran in May rose a whopping 513.2 per cent to hit $1.7 billion. Of this, gold exports to its eastern neighbour accounted for the bulk of the increase. Nearly $1.4 billion worth of gold was exported to Iran, accounting for 84 per cent of Turkey's trade with the country. So what's going on? In a nutshell — sanctions and oil. In recent months, Western powers, notably the US and the European Union, have tightened financial sanctions on the Islamic regime in an attempt to force Iran to scale back or halt its efforts to enrich uranium. | |

| 'Everything in these markets is fake,' Embry tells King World News Posted: 10 Jul 2012 08:24 PM PDT 10:20p ET Tuesday, July 10, 2012 Dear Friend of GATA and Gold: Sprott Asset Management's John Embry tells King World News that the LIBOR scandal will awaken people to other market manipulations, including the long-running manipulation of the gold and silver markets. Embry adds, "Virtually everything in these markets is fake." And when everything else is fake, the only reality left for investors may be the monetary metals in their hands. An excerpt from the interview with Embry is posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/7/9_Emb... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... | |

| Posted: 10 Jul 2012 08:12 PM PDT from Azizonomics:

Kaminska seems to believe that gold's price is not just central-bank supported, but its trajectory is downward: If not for the gold bar/coin frenzy and ETF demand (now substituted by official buying), one might speculate that the collapse in conventional demand (i.e. for industrial and jewelery purposes) may have led to a very different price path for gold post 2008. Now that ETF demand is waning, however, marginal support for the gold price is actually being provided by the official sector more than ever. Though, given the gold price reaction of late, clearly even this is not so effective so, either gold and coin buying has started to wane as well – and there is evidencethat this is the case – or it's taking ever more buying (by official sources) to keep prices supported at the current level. | |

| The Gold Price Closed $1,579.30 Teetering on the Edge but Bull Markets Usually Resolve Upside Posted: 10 Jul 2012 07:16 PM PDT Gold Price Close Today : 1579.30 Change : -9.30 or -0.59% Silver Price Close Today : 2685.10 Change : -56.0 or -2.04% Gold Silver Ratio Today : 58.817 Change : 0.862 or 1.49% Silver Gold Ratio Today : 0.01700 Change : -0.000253 or -1.47% Platinum Price Close Today : 1427.00 Change : -23.40 or -1.61% Palladium Price Close Today : 575.30 Change : -15.35 or -2.60% S&P 500 : 1,341.47 Change : -10.99 or -0.81% Dow In GOLD$ : $165.62 Change : $ (0.10) or -0.06% Dow in GOLD oz : 8.012 Change : -0.005 or -0.06% Dow in SILVER oz : 471.23 Change : 6.59 or 1.42% Dow Industrial : 12,653.12 Change : -83.17 or -0.65% US Dollar Index : 83.40 Change : 0.282 or 0.34% Mercy! The GOLD PRICE made it one day, and lost it the next. Worse than tourists at Las Vegas. GOLD today lost $9.30 to close Comex at $1,579.30. Silver lagged not far behind, dropping 56 cents to 2685.1c. Recall what I wrote yesterday about the even-sided triangle gold has scratched out. Today the bottom triangle boundary stands about $1,550; gold's low touched $1,564.57. 'Tis the triangle's nature to ping-pong back and forth betwixt top and bottom limits. Gold just better not break that lower frontier. So strong was my curiosity about that lower boundary wax that I went back to the two year chart, and LO! What found I there? That a line drawn from the November 2010 high at $1,424.30 through the December 2011 low at $1,523.90 supports the declines of mid-2011 and most of the lows since August 2011. Plainly, that's very strong support, which favours the GOLD PRICE. However, gold has fallen below its 50 day moving average ($1,595.90) and 20 DMA ($1,595.92). That leaves things teetering on the edge, but remember: "It's a bull market, and bull markets usually resolve to the upside." On our side also is this correction's age, arguing that the bottom is behind us. The SILVER PRICE chart offers no such comfort. That is, you can draw a line from the January 2011 bottom at 2630c to the September 2011 low at 2615c to the December 2011 trough at 2615c and the June low at 2610c. This line is the last ditch. But silver specializes in last ditches, and in scaring the life out of you. Remember November 2008 when the SILVER PRICE hit 880c, losing 105% of the foregoing gain? Wasn't enough aspirin in Tennessee to ease my pain, but I hung with it and silver came back. I hung with it not because I was too stupid to change my mind, but because I knew that the small silver market is way, way more volatile than gold, AND that silver was only in the early stages of a primary up trend (bull market). That bull market ain't over yet. Few days ago I was reading something by Jim Willie of the Golden Jackass that really hit home. He implied -- with facts to back him up -- that the "flight to safety" explanation trotted out by the media every time the dollar rises is so much hogwash. It's not a flight to safety, but Nice Government Men fighting to keep the dollar from sinking out of sight. Regardless, as the economy and financial world continue relentlessly to deteriorate, the "flight to safety" folks will surely begin to prefer an airline that doesn't crash every other flight and has better planes than a Sopwith Camel with a canvas skin, namely, gold and silver. That said, note that the Dollar index today for the third day knocked against the 83.50 ceiling, only to fall back down the ladder. More times it knocks, of course, more likely it is to break thru next time, but it seems odd the dollar's hung up there. Upside it needs to break 83.50 to continue rallying (the most likely outcome), downside it must close below 81.52 to turn down. Jury's still out. Yen is poking it's head through the downtrend line, but since the trend is firmly down, that probably won't hatch anything but another fall. Closed today 125.92c/Y100 (Y79.41/US$), up 0.19%. Your job may be bad, but you can thank heaven you don't have the job of nurse-maiding the euro. It dropped to a new low today, $1.2235, down 0.54% on its way to the earth's core. No reason now to expect it to stop before it reaches $1.2000, maybe even $1.1800 Stocks tried to rally today early but spent the rest of the day puking back those gains. Dow ended down 83.17 (0.65%) while the S&P500 joined the song, down 10.99 or 0.81% to 1,341.47. A reader wrote today and asked me how so-and-so the famous radio personality and financial guru could write a book advising people to invest in mutual funds. My only answer is, either the jails or the loony bins are all full, so he's still running loose. Listen, if you never hear anything this natural born fool says, hear, mark, learn, and inwardly digest this First Principle of All Investing: ALWAYS align your investments with the primary trend. The trend is your friend. NEVER buck the trend. The primary trend is the tide that carries an investment up (bull market) or down (bear market) for 15 or 20 years. Stocks entered a primary down trend in spring 2000, and that will last 15 or 20 years. Will every stock drop? No, of course not, but the majority will, the indices will, and almost every mutual fund. The guru's advice to buy mutual funds is comes with a guarantee: He WILL lose your money. On 10 July 1040 Lady Godiva rode naked on horseback to force her husband, the Earl of Mercia, to lower taxes. Can y'all imagine what might have happened if Hillary Clinton had done that to get Bill to lower taxes? One thing for sure, nobody would have looked. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com 1-888-218-9226 10:00am-5:00pm CST, Monday-Friday © 2012, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate bubble has burst, primary trend down. WARNING AND DISCLAIMER. Be advised and warned: Do NOT use these commentaries to trade futures contracts. I don't intend them for that or write them with that short term trading outlook. I write them for long-term investors in physical metals. Take them as entertainment, but not as a timing service for futures. NOR do I recommend investing in gold or silver Exchange Trade Funds (ETFs). Those are NOT physical metal and I fear one day one or another may go up in smoke. Unless you can breathe smoke, stay away. Call me paranoid, but the surviving rabbit is wary of traps. NOR do I recommend trading futures options or other leveraged paper gold and silver products. These are not for the inexperienced. NOR do I recommend buying gold and silver on margin or with debt. What DO I recommend? Physical gold and silver coins and bars in your own hands. One final warning: NEVER insert a 747 Jumbo Jet up your nose. No, I don't. | |

| Guest Post: Propping Up The Gold Price? Posted: 10 Jul 2012 07:11 PM PDT Submitted by John Aziz of Azizonomics Propping Up The Gold Price? Izabella Kaminska makes the point that central banks have turned net gold buyers: Kaminska seems to believe that gold's price is not just central-bank supported, but its trajectory is downward:

The obvious thing, though — even if we take central bank buying out of the equation altogether — is that total demand for gold is still increasing. And the price of gold has increased faster than sales, illustrating that the market has struggled and continues to struggle to keep pace with underlying demand. And it's not just demand for gold-denominated paper (i.e. ETFs or other such as-risky-as-anything-you'll-get-from-MF Global assets) — it's recently manifested as demand for hard physical gold: It's true that central banks are presently supporting the gold price — after years of selling off national wealth at pennies-on-the-dollar into a bear market and thus suppressing prices. Yet it's not the Western central banks that are pushing demand for gold. It's the BRICs. As PBOC official Zhang Jianhua noted:

And as I noted yesterday, BRICs have founded and legitimate fears of buying even deeper into an increasingly ponzified, over-leveraged, rehypothecated and interconnective paper financial system. The PBOC (and other American creditors) already faces the risk of the US Treasury inflating much of their holdings away; the entire point is to get out of such assets into something much harder to duplicate, and impossible to inflate away. According to China's State Council's Xia Bing:

No; I don't think it's particularly wise to announce to the world that you're going to get elbow-deep into gold bullion either, but this isn't just a bluff. China is importing hard-to-fathom quantities of gold: Ultimately, the surge in demand for gold reflects one thing alone: distrust of the increasingly messy, interconnected, over-leveraged and fraudulent financial system. Whether it is China — fearful of dollar debasement — loading up on bullion, or retail investors in the United States or Europe — fearful of another MF Global (or PFG, or Lehman Brothers) — stacking Krugerrands in their basement, demand for gold reflects distrust in finance, distrust in the financial establishment, distrust in banks, distrust in regulators, distrust in government and distrust in the financial media. And it is that distrust — not (by any stretch of the imagination) central bank interventionism — that is the force moving demand for gold. The distrust is not going anywhere because the system is still rotten. We all know — even Business Insider readers know deep down, I think — that there is something exceedingly rotten at the heart of the global financial system. We don't know quite how rotten, how deep the rabbit hole goes, who will be implicated, or how fast. But with every LIBOR-rigging scandal (which the Fed, of course, was aware of), every raided segregated account, every devalued pension fund, every failed speculative "hedge", every Facebook or Zynga pump-and-dump, we get closer to the truth. There will be no bear market for physical gold until trust in the financial system and regulators is fixed, until markets trade fundamentals instead of the possibility of the NEW QE, until governments represent the interests of their people instead of the interests of tiny financial elites. | |

| The Dark (Pool) Truth About What Really Goes On In The Stock Market: Part 4 Posted: 10 Jul 2012 06:55 PM PDT Courtesy of the author, we present to our readers the following excerpt from Dark Pools: High-Speed Traders, AI Bandits, and the Threat to the Global Financial System, by Scott Patterson, author of The Quants. In the dark dawn hours of yet another frigid New York morning, Josh Levine dressed quickly and left his apartment in the shadow of the Twin Towers at Battery Park. He trudged through city blocks clogged with treacherous mounds of packed dirt-pocked snow and ice from the year's record-breaking string of storms. It was February 16, 1996. A Friday. Earlier that week, IBM's AI supercomputer Deep Blue defeated world chess champion Garry Kasparov for the first time. Bill Clinton was entering his second term in office. The country was in the midst of a powerful economic boom that would culminate in a massive tech-stock bubble, and Levine and Datek's army of traders would be at the center of it. The programmer walked east on Wall Street, then turned south on Broad, passing by the marble façade of the NYSE. At 50 Broad, he took the elevator to the sixth floor and walked past a few early risers, the wired, sunken-eyed day traders for Datek. Staring at their computer terminals, hugging their steaming coffees, waiting impatiently for the action to start at the opening bell, they nodded to Levine quietly as he passed. Months earlier, Levine had decamped from the tiny cluttered room on the tenth floor of 50 Broad to a larger room on the sixth. The room quickly slouched toward the en- tropic chaos Levine seemed to thrive in. He brought in an inflatable kiddie pool and populated it with turtles. He grew sea monkeys in a glass jar. An Israeli army bazooka leaned in a corner. The ubiquitous garbage piles, the tech 'zines such as PC World, stacks of computer books, pizza boxes, magazines, crunched Coke cans, crumpled computer printout paper, and candy wrappers rose to the ceiling like tropical plants, competing for space with the baker's racks of computers, rows of computer terminals lined up on card tables, electric cords and creeping cables shooting out of the floor and through holes in the ceiling. Levine shed his jacket, sat down before his monitor, and hit a but- ton. His computer hummed awake. It was time. The pieces were in place. Now he was about to bring to life the heretical idea that he'd been nurturing ever since he was a teenage runner in the 1980s. "Island is here!" Levine wrote on Watcher News. "You now have the ability to execute Island orders from the safety and comfort of your own Watcher." Wall Street would never be the same. But Island proved too big to ignore. One day in the late 1990s, several of Renaissance's top executives, including a pair of AI experts who'd formerly worked at IBM, Peter Brown and Bob Mercer, paid a visit to 50 Broad. They were bemused by the giant lizard, the pool full of turtles, the trash. Renaissance's headquarters in East Setauket, Long Island, were as pristine as an Ivy League campus. More than anything, Brown and Mercer were deeply impressed by Levine, whom they instantly realized was a programming genius with a profound understanding of the market's plumbing. Renaissance deployed cutting-edge AI programs to build its models and guide its trading. But Renaissance's AI was an evolutionary leap beyond what any other firm had ever attempted, creating a strategy that would turn Renaissance into the most profitable trading machine in the world, with annual returns averaging north of 40 percent a year. Island's high-speed platform was an ideal match for its strategies. The Island-Renaissance fusion was a vision of the future in which high-speed AI-guided robots would operate on lightning-fast electronic pools, controlling the daily ebb and flow of the market. The AI Bots poured their valuable liquidity into Island, which, in turn, made it possible for the Bots to operate at high frequencies. They fed off one another, creating a virtuous cycle that would become un- stoppable. Little-known outfits such as Timber Hill, Tradebot, RGM, and Getco would soon start trading on Island, forming the emergent ganglia of a new space-age trading organism driven by machines. Tricked-out artificial intelligence systems designed to scope out hid- den pockets in the market where they could ply their trades powered many of these systems. In the process, the very structure of how the U.S. stock market worked would shift to meet the endless needs of the Bots. The human middlemen, though they didn't know it, were being phased out, doomed as dinosaurs. And the machines were breeding more machines in an endless cycle of innovation, as programmers pushed the boundaries of speed more ruthlessly than Olympic sprinters. Trading algorithms would mutate, grow, and evolve, feeding off one another like evolving species in a vast and growing digital pool. In the 1990s, that future had been inconceivable to all but a few visionaries—such as Levine, who had a bird's-eye view of the market as it evolved. But in an ironic twist, what the market would evolve into would be a market far darker than anything Levine could ever have imagined—a market dominated by secret trading algos, vast data centers, and dozens upon dozens of dark pools. Neil Johnson, a University of Miami physicist who studies complex market patterns, warned in a February 2012 interview of a "global war between competing computer algorithms" that could cause a "big system wide collapse" in which the stock market shatters like broken glass. The market, he said, had evolved into a "lake full of different types of piranhas" devouring one another in a high-speed frenzy. In a working paper he co-authored—"Financial black swans driven by ultrafast machine ecology"—Johnson showed that the market in the past few years had undergone "an abrupt systemwide transition from a mixed human-machine phase to a new all-machine phase characterized by frequent black swan events with ultrafast durations." It was a brave new world that few people outside Wall Street knew existed. The Algo Wars were leaving a path of destruction in their wake. And what about the Securities and Exchange Commission? The nation's top stock-market cops were clearly outgunned. In May 2011, SEC Chairman Mary Schapiro told Congress that "the Commission's tools for collecting data and surveilling our markets are wholly inadequate to the task of overseeing the largest equity markets in the world." It was as if the FBI were admitting that it couldn't track organized crime. Everyone, it seemed, was in the dark. | |

| Oil, Gold, Asia and the Best Investment in the World Right Now - An Interview with Jim Rogers Posted: 10 Jul 2012 04:32 PM PDT | |

| Oil, Gold, Asia & the Best Investment in the World Right Now - An Interview with Jim Rogers Posted: 10 Jul 2012 04:01 PM PDT [LIST] [*]Why recent oil price falls are a good buying opportunity [*]Why oil prices could fall to $40 a barrel [*]Investment opportunities with the renewable energy sector [*]Why he is optimistic about Nuclear energy [*]Why agriculture offers good opportunities to investors [*]Why Myanmar is the best investment opportunity in the world right now [*]Why there could be further unrest in the Middle East [*]Why we should let Greece fail [/LIST] ... | |

| Posted: 10 Jul 2012 03:53 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Taking a look at silver on the weekly chart it is not too difficult to see that it has been in a well-defined downtrend since peaking in the spring of last year. Rallies are being sold but dips into the region near $27.00 - $26.00 have been bought. The result has been to form a perfect triangle pattern on the chart. This latter or bottom level of support has thus become CRITICAL to the future prospects of the metal. It is getting very close to this downside line again this week. Bears are going to continue to try to press it to see if they can push enough longs out of the market to break it lower. If the bulls falter or waver in the least, the metal will buckle and then drop very quickly to the 75% Fibonacci Retracement level near $25.47 with the $25 level also within range. To get anything going to the upside in this market is going to require a push through the $30 level that can maintain a... | |

| With Regards To "Fed Hopes" Bernanke Says "F.U." Posted: 10 Jul 2012 03:48 PM PDT So... Friday July 6 saw yet ANOTHER dismal Non-Farm Payrolls report by the US Government. After initially rising on the report, Gold was swiftly beaten down by our ever vigilant Gold Cartel Bankers. Nothing new there, as our criminal bankers were pounding Gold ahead of the report all day Thursday from the NY open. Silence the Golden Truth-sayer. But was Gold really beaten down by the criminal bankers, or simply reacting to the rising Dollar as the US equity markets tanked on the news? I would have thought the markets would have raced higher on the "Fed Hopes" this dismal NFP number should have elicited...alas, all Fed Hopes were tossed to the wind on Friday. But the Fed Heads would have none of that, and they lined up on Monday to resurrect Fed Hopes yet again: DJ Fed's Rosengren: Latest U.S. Jobs Data Indicate U.S. Needs Much More Growth Mon Jul 09 00:00:17 2012 EDT BANGKOK--The latest U.S. jobs data released on Friday were disappointing and indicated that the U.S. economy needs much more growth, a top Federal Reserve official said Monday. It is possible that the U.S. authorities will come up with a fresh round of quantitative easing measures, Federal Reserve Bank of Boston President Eric Rosengren said at an economic forum in Bangkok. When asked when a third round of quantitative easing should be implemented, he said it was data-dependent. On the ongoing crisis in Europe, he said the European Union has the capacity to deal with its economic problems, but the road ahead remains bumpy and the bloc has a long way to go. Mr. Rosengren isn't a voting member of the Fed's policy-setting committee this year. ============= Mon Jul 09 03:45:18 2012 EDT BANGKOK--More accommodative policy is needed to improve the U.S. labor market after the latest "discouraging" non-farm payrolls data released Friday, which suggested a "horrific downturn" in the U.S. economy, a top Federal Reserve official said Monday. "We need more stimulus one way or another," Federal Reserve Bank of Chicago President Charles Evans told reporters at an economic forum in Bangkok. Mr. Evans is a non-voting member of the monetary-policy-setting Federal Open Market Committee. ============== Mon Jul 09 11:53:37 2012 EDT NEW YORK--While he stopped short of calling for additional action, a key Federal Reserve official on Monday said the central bank should stand ready to provide new stimulus to the economy if conditions warrant it. Calling for "extraordinary vigilance," Federal Reserve Bank of San Francisco President John Williams said "we stand ready to do what is necessary to attain our goals of maximum employment and price stability." Noting that the Fed is "falling short" on both its inflation and employment mandates, Williams said the central bank is likely to make "only very limited progress toward these goals over the next year." Because of that, "it is essential that we provide sufficient monetary accommodation to keep our economy moving towards our employment and price stability mandates," the official said. If the Fed does need to ramp up its stimulus activities, "the most effective tool would be additional purchases of longer-maturity securities, including agency mortgage-backed securities."… =============== The Fed has been trying to talk the market higher for months now because as W.C. Fields once said: "If you can't dazzle them with your brilliance, baffle them with your bullshit!" Fed Hopes is all the equity markets cling to now, but perhaps the equity markets have finally seen Bernanke's hidden agenda:  Is Bernanke giving us the finger? Two can play at that game Ben, you Bubble Headed Booby. Buy Gold and Buy Silver. Pinning your hopes on some sugar from Papa Ben is a fools game. It's not how much you paid for either precious metal you hold in your possession, but how many ounces of either that you actually possess. Because when the entire financial system inevitably collapses, you won't be able to buy much of anything with little pieces of paper with dead presidents on them. Central banks: Running out of ideas, road By Detlev Schlichter On July 9, 2012 · On page two of today's Wall Street Journal Europe you will find the result of a readers' poll from last Friday: Question: Will the ECB's rate cut help restore confidence in the bloc's economy? Answer: 81 percent of readers say no, 19 percent yes. Last week's round of global monetary easing – another ECB rate cut, another round of debt monetization from the BoE, another rate cut from the People's Printing Press of China – is, of course, more of the same old same old. It has a discernible touch of desperation about it and this is not lost on the public. Monetary policy is ineffective. Or, to be precise, it is only effective in delaying a bit further the much-needed liquidation of the massive imbalances that previous monetary policy helped create, and thereby is contributing, on the margin, towards making the inevitable endgame even more painful. It is counterproductive and destructive. It is certainly not restoring confidence….. …We will see more rounds of QE, more rate cuts where this is still possible, and further expansions of central bank balance sheets. Pension funds and insurance companies will be forced by regulators to hold assets that the state wants them to hold (government bonds anyone?), and the reintroduction of capital controls appears a near certainty at this stage. Remember, a toxic mix of stubbornness and desperation rules policy making at present. It is best to be prepared for everything but the sensible solution. Come to think of it, the title of this essay may be misleading. The central banks have reached the end of the conventional road but they will push their policies further. This will end badly. http://papermoneycollapse.com/2012/07/central-banks-running-out-of-ideas-road/ =============== Biderman Blasts The Bernanke Put And Questions QE-Hopers Submitted by Tyler Durden on 07/10/2012 11:54 -0400 Scoffing at the smugness of a CNBC talking head suggesting he is long-term bullish because of the Bernanke Put, TrimTabs' CEO Charles Biderman empirically analyses the effects of QEs-past and just as we have noted again and again - highlights the fact that without at least a 15% drop in stocks, Bernanke will not ride to the rescue. Based on his analysis of wage and salary growth, he believes the US economy is now starting to contract in line with what is going on in Europe and the rest of the emerging world. Earlier this year in the US, portfolio managers hoped and prayed that what looked like rapid growth was real, "It Wasnt!" and, as we have noted, Charles adds that with earnings season starting we will see future guidance cut and this will kick the leg out from the bullish stool - leaving only the hope for another QE flush to save us. However, with the effects of Bernanke's beneficence diminishing with each round, he suspects that we will be lucky to see a 10% rally on NEW QE. =============== Until all Fed Hopes are dashed there is no way forward. Has the Fed solved or fixed a damn thing over the past four years? Why then the belief that more Fed "interference" will be the solution to that which has no solution? The 10-year US Treasury is at 1.49% today...is the economy growing? The President of the United States wants you to "believe" it is...but then this man currently occupying the White House doesn't know his ass from a hole in the ground, and quite frankly couldn't lead a horse to water...let alone engineer a "real" economic recovery. The Global Economy: It's All About Increasing Leverage (July 10, 2012) by Charles Hugh Smith from Of Two Minds If the global State/finance Empire can't increase systemic leverage, it will implode. If we look at the global economy with unclouded eyes, we reach this conclusion: "This whole thing is about leverage." If leverage doesn't increase, the system implodes. But since collateral is disappearing from the global economy like sand castles in a rising tide, and disposable income has stagnated, there is no foundation for more leverage. As a result, the State/finance cartel has only one choice: increase leverage by whatever means are left. There are only two: 1. Allow banks to claim phantom assets as capital/reserves 2. Lower interest rates so stagnant income can leverage ever greater quantities of debt The State/finance Empire and its army of academic toadies (economists) must cloak this reliance on leverage from the citizenry, lest they grasp the precariousness of the entire financial system. As the economic Establishment is discredited by reality (that their sputtering reflation policies have come at an unbearable cost is now undeniable), their attempts to discredit their critics become increasingly comic: only PhD economists in the employ of the Empire are qualified to comment on the Empire's policies, etc. Most discussions of leverage focus on the role of capital or reserves as the basis for leverage. This is the basis of the fractional reserve banking system: $1 in capital (cash, reserves) can be leveraged into $15 of debt. The easiest way to "grow" is to increase leverage so more money/debt can be created.If a bank was constrained to only loaning the cash it held in deposits, that would severely limit the amount of money available in the system for purchasing villas in Spain, BMW autos manufactured in Germany, etc. If we magically enable 25-to-1 leverage, then every euro supports 25 euros in debt (mortgages, auto loans, etc.) The danger is obvious: if 1 of the 25 euros of debt goes bad, the lender has zero reserve. If 2 euros of debt go bad, the lender is insolvent. The only way to "save" an over-leveraged system is to increase leverage and lower interest rates. If we claim phantom assets as real and increase leverage from 25-to-1 to 50-to-1, we have enabled a doubling of loans. All that wonderful new money will flow into the economy as spending, fueling "growth." This explains why the State/finance Empire in Europe keeps lowering reserve requirements for its insolvent banks. If the reserve requirement is 10%, then you need 100 million euros on deposit in cash to support 1 billion euros in loans. If you lower the reserve requirement to 1 euro, then the contents of a child's piggy bank supports 1 billion euros in debt. The other game is to claim phantom assets have market values that justify their substitution of cash. Let's say a bank owns a villa in Spain since the mortgage went bust. The market value of the villa is 100,000 euros and the bank's mortgage was 300,000 euros. If the bank sold the villa, it would have to absorb a 200,000 euro loss. Yikes. Absorbing losses that exceed the net increase in reserves from profits would lead to the lender's insolvency being recognized. The "work-around" is to keep the villa on the books at 500,000 euros. Not only does the 200,000 euro loss go away, the bank now has 200,000 in capital to leverage into more debt. (500,000 in assets minus 300,000 in mortgage leaves 200,000 in phantom assets/capital.) Any loan is fundamentally a claim on future income. Interest and principal will be paid out of future income. The key to keeping the leverage-based system afloat is to lower interest rates.Let's say a household has $10,000 in disposable income to spend on housing. If mortgage interest rates are 15% (as they were in 1981), the household can only leverage that income into a $50,000 mortgage. That's all the debt that can be prudently leveraged from the $10,000 in income. That inhibits "growth," so let's drop the rate to 1%. Presto-magico, the household now "qualifies" for a $500,000 mortgage. Wasn't that easy? You see the problem here: once rates fall to near-zero, the leverage-income-into-more-debt machine runs off the cliff. Just in case you missed this chart from yesterday's entryElection Year 2012: two Landslides in the Making?, notice that the incomes of 90% of American households has gone nowhere for the past 40 years.  Unsurprisingly, the bottom 90% leveraged their stagnant incomes into mountains of debt to compensate for their declining purchasing power. The Federal Reserve (a key player in the global State/finance Empire) has been publicly fretting over the dreaded "debt divide," which is Orwellian econo-speak for the bottom 90% running out of leverage. Like Wiley E. Coyote, the bottom 90% has run off the cliff and is now in looking down at the air beneath them. (This chart shows the bottom 95% is in trouble.)  The same reliance on leverage has occurred in China, Japan, Europe and the U.S.The entire global economy's "growth" was based on increasing leverage. That machine has soared off the cliff, and now the Empire's global army of toadies is desperately attempting to mask this reality by substituting phantom assets for actual capital. They can't do anything about lowering interest rates, though; that mechanism has already been maxed out as rates approach zero. Longtime correspondent Harun I. recently described the leverage endgame in this deeply insightful commentary: Much has been made over the Fed's efforts to "stimulate", however, IMHO the Fed's efforts are more concerned with preventing the sudden death of the monetary and banking systems. With private sector balance sheets hobbled, some entity must step in and create enough debt so that debts can be paid and, therefore, maintain the illusion that there is money (debt) in the system. At first this must seem contradictory. Remember there is no collateral, there is no asset. Therefore, the debt, which people will claim as an asset (at par (to what?)), is in reality an illusion. It must be understood that leverage is such that even if there were no defaults, just normal everyday retirement of debt occurring at a rate faster than debt creation would cause the complete monetary base to disappear in short order. With $600 trillion or more in derivatives alone, that must be settled in the reserve currency with a monetary base of $2 trillion, there is 300,000 to 1 leverage. The fact is, leverage must continue to increase exponentially to avoid sudden death. Phase and jitter cannot be tolerated. The idea of stimulating the economy at this point poses certain problems. One of my neighbors, a family of six, noted that their food bill had increased 50%. This presents the choices of consume less or save less. Cutting back on food is usually not the first thing people will resort to. So, as costs rise, they are consuming less, which is the opposite of stimulative. Further, this creates trends that will likely be insurmountable in the future. The amount saved by this generation and the returns they must achieve to reach the goal of an independent retirement become more negatively skewed with each passing month of currency/labor debasement (notice I did not use the term "stagflation"). If there was no price inflation there would be no problem but prices are rising relative to wages, meaning dollars/labor is losing value, which, regardless of definitions, has the same effect as inflation. Since time can not be manipulated, people must save more (which the Fed is fighting) or they must receive higher returns, which usually means assuming greater risk. Frankly, the situation works out that this generation would need the performance of the top money managers today to achieve a non-subsidized retirement. Having allowed themselves to be misled about the true nature of housing as an investment, and with most throwing their money in some vehicle resembling a 401K while hoping for something good to happen, Boomers will have their challenges but the next generation, saddled with significant student loan debt and the debts of the previous generation, also facing, "The End of Work" will be even more challenged to retire with any semblance of simple dignity. Of course, I don't think it gets this far. As I have stated, the system is now terminal. It is only a matter of time before, even without any defaults, the two factors of amplitude and frequency overwhelm system capacity in terms of money printing. I differentiate because productive capacity, which is the only reason for an exchange medium (the existence of money), has already been overwhelmed by the exponential phenomenon. Money now exists for the sake of itself, which is to say that it is worthless. As Einstein pointed out, "reality is merely an illusion, albeit a very persistent one." Thank you, Harun. After four long years of protecting vested interests at the expense of everyone else and playing "stimulus and backstop" games, the State/finance Empire's Wily E. Coyote moment is finally approaching. Maybe they manage a few more extend-and-pretend mind-tricks (because we all want to believe the magic trick is real) and push the reckoning into 2013; we'll just have to see how long Wiley E. Coyote can run in mid-air. =============== Big Banks Are Rotten to the Core It also shows that the big banks are literally rotten to the core. And see this. UC Berkeley economics professor and former Secretary of Labor – Robert Reich – explains today: What's the most basic service banks provide? Borrow money and lend it out. You put your savings in a bank to hold in trust, and the bank agrees to pay you interest on it. Or you borrow money from the bank and you agree to pay the bank interest. How is this interest rate determined? We trust that the banking system is setting today's rate based on its best guess about the future worth of the money. And we assume that guess is based, in turn, on the cumulative market predictions of countless lenders and borrowers all over the world about the future supply and demand for the dough. But suppose our assumption is wrong. Suppose the bankers are manipulating the interest rate so they can place bets with the money you lend or repay them – bets that will pay off big for them because they have inside information on what the market is really predicting, which they're not sharing with you. That would be a mammoth violation of public trust. And it would amount to a rip-off of almost cosmic proportion – trillions of dollars that you and I and other average people would otherwise have received or saved on our lending and borrowing that have been going instead to the bankers. It would make the other abuses of trust we've witnessed look like child's play by comparison. Sad to say, there's reason to believe this has been going on, or something very much like it. This is what the emerging scandal over "Libor" (short for "London interbank offered rate") is all about. *** This is insider trading on a gigantic scale. It makes the bankers winners and the rest of us – whose money they've used for to make their bets – losers and chumps.The fact that the big banks have committed insider trading on their core function – setting rates based upon market demand for loans – is particularly damning given that traditional deposits and loans have become such a small part of their business. As we noted last week:

Billions of dollars can be made from inside information leaks from the Fed's monetary policy operations. One necessary step to stop leaks is to severely limit inside information on future Fed policy to a few Fed employees. This has not happened. Congress received information in 1997 that non-Federal Reserve employees attended Federal Reserve meetings where inside information was discussed. Banking Committee Chairman/Ranking Member Henry B. Gonzalez (D, Texas) and Congressmen Maurice Hinchey (D, New York) asked Fed Chairman Alan Greenspan about the apparent leak of discount rate information. Greenspan admitted that non-Fed people including "central bankers from Bulgaria, China, the Czech Republic, Hungary, Poland, Romania and Russia" had attended Federal Reserve meetings where the Fed's future interest rate policy was discussed. Greenspan's letter (4/25/1997) contained a 23-page enclosure listing hundreds of employees at the Board of Governors in Washington, D.C. and in the Federal Reserve Banks around the country who have access to at least some inside Fed policy information.Senator Sanders also noted last October: A new audit of the Federal Reserve released today detailed widespread conflicts of interest involving directors of its regional banks. "The most powerful entity in the United States is riddled with conflicts of interest," Sen. Bernie Sanders (I-Vt.) said after reviewing the Government Accountability Office report. The study required by a Sanders Amendment to last year's Wall Street reform law examined Fed practices never before subjected to such independent, expert scrutiny. The GAO detailed instance after instance of top executives of corporations and financial institutions using their influence as Federal Reserve directors to financially benefit their | |

| The Race for Energy Resources Just Got Hotter Posted: 10 Jul 2012 03:19 PM PDT | |

| Posted: 10 Jul 2012 02:30 PM PDT The 5 min. Forecast July 10, 2012 11:53 AM Dave Gonigam – July 10, 2012 [LIST] [*]Envy, 2012 style: When the media hate on a wealthy person few people ever heard of or remember… [*]The “biggest fire sale in history” gets a truckload of new inventory: In a world of worry, Chris Mayer finds four pockets of opportunity [*]Byron King with some shocking facts about the electrical grid… and a sector you shouldn’t overlook [*]A forecast for $1,800 gold… Readers recall sweet childhood memories soured by the dollar’s decline… $250k becomes the new $100k… and more! [/LIST] Is it the summertime heat? What in the world would drive Matt Lauer — a guy who pulls down $25-30 million a year — to wax indignant this morning about Denise Rich giving up her U.S. citizenship? We don’t actually know the income or net worth of Ms. Rich — shoe heiress, socialite, songwriter — but “she is a frequent habitue of ... | |

| Gold Miners are Cheap, Cheap, Cheap! Posted: 10 Jul 2012 02:22 PM PDT Gold mining shares deserve their own discussion. I am bullish on gold without qualification. I am also bullish on gold miners…but with one very large qualification: they must produce positive cash flow. I think the bull market in gold is intact. And I think gold prices will make highs within a year. However, gold stocks have done poorly. Few have been spared. Like the other mining companies, they suffer from the same affliction: an eager willingness to take whatever cash they generate and dump it right back into the ground. So even though the four largest listed gold miners — Goldcorp, Barrick, Newmont and Newcrest — generated $47.5 billion in operating cash flows in the last decade, they spent $62.5 billion in new mines, acquisitions and other capital expenditures. The big four have made no money in one of the greatest gold bull markets on record. In fact, they've lost money. How did they make up this deficit? They sold more shares to the ever-gullible public — always a suck... | |

| Loose Monetary Policy "Will Mean Strong Demand" for Gold Posted: 10 Jul 2012 02:20 PM PDT WHOLESALE prices for gold bullion climbed to $1597 an ounce during Tuesday morning's trading in London – their highest level so far this week – while stock markets also ticked higher following news that Spain should receive some financial assistance for its banks later this month. Silver bullion also gained, climbing as high as $27.61 per ounce, while other commodities were broadly flat. | |

| Gold Seeker Closing Report: Gold and Silver Fall With Stocks and Oil Posted: 10 Jul 2012 02:17 PM PDT Gold fell $5.32 to $1582.48 in Asia before it climbed to as high as $1601.00 at about 9AM EST, but it then fell back off for most of the rest of trade and ended with a loss of 1.22%. Silver dropped to $27.137 in Asia before it rebounded to $27.57 in London, but it then also fell back off in New York and ended with a loss of 1.83%. | |

| Gold Daily and Silver Weekly Charts Posted: 10 Jul 2012 02:12 PM PDT | |

| The War Between Manipulation and Buying Posted: 10 Jul 2012 02:09 PM PDT **Originally posted July 6, 2012** My Dear Extended Family, Next week is the war between manipulation of gold by the West, and appetite for buying gold in the East, both from friendlies and enemies. Anyone that does not see today's gold market as a rig is blind or brain dead. There is a Continue reading The War Between Manipulation and Buying | |

| The Gold Stocks Compared to Past Bull Markets Posted: 10 Jul 2012 02:09 PM PDT In researching past equity bull markets, we've found numerous similarities between all. Each bull market has three clearly defined phases. The last phase of each bull market is driven by valuation expansion which is made possible through the wall of worry phase in which valuations contract and the weak hands give way to the strong hands. Though the gold stocks may have already bottomed, plenty of fear and despondency persists. However, when one compares the present bull market in the gold stocks to five previous equity bull markets, they should realize that things are on par with the past and the gold stocks are right on track. | |

| Gold May Have Been Manipulated Like Libor: Expert Posted: 10 Jul 2012 02:05 PM PDT | |

| Inflation Reemerging: Food Prices Gapping Higher, Precious Metals May Follow Posted: 10 Jul 2012 02:00 PM PDT An old melody advises us to look for the silver lining whenever dark clouds appear in the blue. There is economic and political upheaval all over the world. So we direct our attention to an area where silver is shining. Poor man's gold may come into prominence shortly and provide our subscribers with possible profits. See the video below why supply may be disrupted over the next several years and why we may be facing hyper inflation. The price of food is beginning to soar and this may be showing early signs of a global inflation. Could silver and gold follow food prices higher an as Central Banks worldwide fight the global economic slowdown?

| |

| Gold Falls to Settle at $1,579 on Market Jitters Posted: 10 Jul 2012 01:59 PM PDT July 10 (CNBC) — Gold futures fell to settle at $1,579 an ounce after news of missing client funds from another U.S. futures brokerage prompted commodity investors to lessen positions. The selling erased early gains that occurred amid optimism for a European Union aid package for Spain. Bullion weakened after PFGBest late on Monday told customers their accounts had been frozen. A U.S. industry body said about $220 million in customer funds were not in the brokerage's bank accounts. "With the 100 billion euro being made available to Spanish banks, gold should not be lower," said George Nickas, commodities broker at INTL FCStone. "If Jefferies is doing an orderly liquidation, you have to believe that there have to be some concerns about 'Do I let the positions go? You've got a higher degree of emotions now in a quiet market," Nickas said. | |

| Brazilian Oil Dreams Get Sobering Reality Check Posted: 10 Jul 2012 01:58 PM PDT Synopsis: A billionaire precious-metals investor finds oil a much tougher game. By Marin Katusa, Chief Energy Investment Strategist Stories of doubles, five-baggers, or even tenfold returns abound in the resource sector. These successes are exactly why we play the game: The discovery and development of a new oilfield or gas basin can create immense value, and being part of a story like that is extremely satisfying, not to mention financially rewarding. However, the potential for big resource returns can all too easily make investors forget just how risky the sector really is. Investors are not the only ones who get caught up in the hype – an exciting discovery can turn normally conservative CEOs and geologists into starry-eyed daydreamers waxing poetic about grand possibilities and great riches. As a story out of Brazil recently reminded us, even the world's most successful investors can get carried away by dreams of resource riches. That is precisely what happened to the richest man in Brazil. Eike Batista earned his formidable wealth in the resource sector, starting with a gold-trading firm and moving into precious-metals mining before branching out into oil and gas. His empire is now contained within the EBX Group, a conglomerate of five public companies with the same majority owner: OGX is an oil and gas explorer and producer; MPX is an energy entity that generates power, mines coal, and produces natural gas; MMX is a mining company with operations in Brazil and Chile; LLX is a logistics company focused on resource-sector needs; and OSX is an offshore oil and gas service provider that also builds ships and constructs ports. OGX is the firm that propelled Batista into the headlines in late June. Just months after CEO Paula Mendonca reassured investors that the company was on track to meet its targeted production volumes at its nascent Tubarao Azul field, OGX admitted that the first two wells at Tubarao are only pumping out half of their expected production. Since Tubarao is the company's first producing operation, the downgrade forced OGX to slash its 2016 production guidance in half. The market responded in kind, cutting OGX's value in half. The fall was the biggest anyone at the Sao Paulo stock exchange can remember, erasing R$16 billion – US$7.9 billion – of value in just two days. There are many lessons to draw from such an investment calamity, but all of them harken back to one primary fault: OGX overpromised and underdelivered. Blame undoubtedly goes to OGX's management team, but questions remain. Why didn't an incredibly successful and experienced chairman like Eike Batista provide better counsel? Why did the company set itself up for failure by promising the moon? The answer to both questions is the same: they thought they could do it. OGX's concessions in Brazil and Colombia contain resources totaling a whopping 10.8 billion barrels of oil equivalent (boe); and everyone at the company, including Batista, let themselves believe they could develop those reservoirs with nary a stumble and would soon be pumping out barrels and barrels of oil. If it had worked out as planned, OGX might still be worth R$50 billion (US$25 billion). But it is never easy to develop any kind of natural resource, and even though the Campos Basin – where OGX kick-started its development efforts – is in relatively shallow waters and does not present any specific technical challenges (it is not a sub-salt deposit, like so many of Brazil's offshore barrels are), it proved more difficult to tap than the company expected. A management team with more temperance would have incorporated the potential for setbacks in its outlook, which would have meant more modest production targets. Had that been the case, the company's share price wouldn't have rocketed skyward the way it did, but perhaps OGX would have met – or even bettered – its oil guidance. Instead, what we got was a dramatic reminder that even highly experienced resource investors can all too easily forget the litany of risks inherent in moving a resource project from potential to reality. Developing resource deposits is very difficult. Just about the only guarantee is that something will go wrong. Eike's Oil Endeavor Batista had already created $20 billion in shareholder value in the mining arena before he set foot in the energy sector. He took that step in 2005, creating OGX as his vehicle to participate in Brazil's burgeoning offshore oil industry. OGX snapped up a raft of offshore concessions, gaining ownership of almost five billion barrels of oil. Based on that resource, the company managed to raise US$3.3 billion in its IPO in 2008, a record in Brazil at the time. That Eike was able to raise so much in OGX's public debut even though the company had not yet produced a drop of oil speaks to the excitement Batista and his team stirred up around the company. They spoke glowingly of OGX's future as Brazil's largest oil producer and emphasized that OGX's offshore concessions were not overlaid by a layer of salt, which was supposed to mean that the oil would be easy to access. Batista and his management team at OGX took turns telling the markets just how much oil OGX would churn out. CEO Mendonca predicted repeatedly that the Tubarao field in the Campos Basin alone could produce as much as 80,000 barrels per day (bpd). Batista loved to tell whoever would listen that OGX would be pumping 730,000 bpd by late 2015. By 2019 the company was aiming for 1.4 million bpd. It all sounded fantastic, but when it comes to output forecasts, the proof is in the pudding: Geologists and CEOs can talk about potential production rates until their throats are dry, but the only way to know what a field will really produce is to drill some production wells, open the taps, and see how quickly the black gold comes out. And since OGX did not produce a drop of oil until January of this year, investors had no way of knowing whether OGX's forecasts were realistic. They just had to wait for production data. In January OGX produced its first oil, pumping from its initial Tubarao production well. Excitement over the long-awaited moment lifted the company's share price above R$18. Just six weeks ago, after several months of production but before the company released any real data about Tubarao, Mendonca publicly reaffirmed that OGX would be producing 40,000 to 50,000 bpd from four Tubarao wells by 2013. His confidence suggested that things were going well, but investors must have sensed trouble: OGX's share price slid to R$10 by mid-June. Those investors who fled the stock were right to follow their gut instincts – things were not going well. On June 26 OGX revealed that its first two Tubarao wells are currently producing just 10,000 barrels of oil equivalent per day (boepd), half of what Mendonca said they would pump in their early days. Since wells decline with time, OGX has now projected these wells will produce just 5,000 boepd over their producing lifespans, far below the 10,000 -13,000 boepd originally forecast. By the end of 2013 Tubarao will now be producing just 20,000-25,000 boepd, not the 40,000-50,000 bpd Mendonca estimated just weeks ago. By the end of 2015 Tubarao was supposed to be spitting out 730,000 boepd; now OGX expects less than half that volume. The news had two instant ramifications. First, OGX's future cash flows were slashed. Fitch now projects OGX will book earnings before interest, tax, depreciation, and amortization (EBITDA) of $2 billion in 2015, down from a forecast of $6 billion before the Tubarao production revision. Second, the company lost all credibility with investors. Analysts with Bank of America Merrill Lynch put it well when they wrote that the production downgrade "puts into question all the assumptions behind the company's growth program." In short: No one has any reason to believe any of OGX's production predictions… and since OGX grew into a R$58-billion company based completely on its future production potential, much of the company's value evaporated alongside its credibility. OGX is now down 62% since the beginning of the year. Its market capitalization stands at R$20 billion. The company has deep pockets – its bank account is well stocked and Batista's remains very healthy despite losing $11 billion on paper in recent weeks – and so it will likely survive. But it will never forget the lesson it learned in 2012: never underestimate the challenges of resource development. And OGX investors will never forget the sting of a resource investment gone terribly wrong. For Batista, who lost more than every other OGX investor combined, the lesson is that pumping hydrocarbons is not the same as mining metals. Mining has its many challenges, but exploration drilling and metallurgical testing can determine with reasonable certainty where a gold deposit lies, how much gold it contains, how difficult it will be to blast apart the rocks and collect the ore, and whether the gold can be separated from the other minerals to produce an economic product. Obstacles to mine development and operation are still aplenty, ranging from water in the rock formation that causes wall collapse to politicians in the country who want more money, but defining an orebody is easier than outlining an oil reservoir.

As one infamous quote put it, a geologist looking for an oil reserve is akin to a blind man in a dark room looking for a black cat that may or may not be there. If you manage to find the cat, you still have to figure out how it behaves… but you're still completely blind. With oil reserves, the resource is a liquid under immense pressure from a mixture of gases, and the reservoir holding this liquid-gas balancing act has to remain under high pressure or wells will run dry. Maintaining pressure requires a sealed unit; while exploration drilling and geophysical surveys provide some information about reservoir size and pressure, there is no way to be sure the reservoir does not connect to an adjacent reservoir or some other kind of geologic formation that will impact production. That is precisely what happened at Tubarao. When flow rates declined much more rapidly than anticipated, OGX geologists reassessed their data and concluded that natural fractures connect the reservoirs feeding the first two wells. With two wells pumping from a joint system, pressures in the reservoirs decreased double-time. Whether this will happen to every Tubarao well is yet to be seen, but it is certainly possible. And Tubarao is just one of the fields OGX is developing – if OGX has been equally optimistic in projecting production flows from its other oil and gas fields, the company and its remaining investors could be in for many more unpleasant surprises. And this from a reservoir that was not even supposed to be that hard to develop! Most of Brazil's vast hydrocarbon wealth is contained in reservoirs that lie underneath deep waters and shifting salt formations; by contrast Tubarao is in shallow waters and outside of the salt zone. In addition, OGX operates in a country with fairly good oil infrastructure and reasonable, well-defined levels of government take. Just imagine how much harder it can be when the geology gets complex, the environment is harsh, and the fiscal rules of the game change under your feet. Such is the nature of the oil and gas game. The days when one could drill a simple, shallow well into the Texan soil or Saudi Arabian sand and be rewarded with gushing flows of black crude oil are over. Today's oil discoveries are in increasingly challenging reservoirs that demand evermore sophisticated technologies to unlock. The inescapable truth is that developing a successful new oil project becomes more difficult with every passing day. The result is that every investor who fails to appreciate this new reality will see an investment sideswiped by an unexpected geologic complexity, or a greedy government that takes a bigger piece of the pie, or a lengthy but ultimately fruitless battle for permits that relegates a promising project to the history books, or some similar obstacle that stops a project in its tracks. This does not mean that oil and gas is a hopeless investment landscape! It means that every energy-investment decision requires careful due diligence and that investors have to take every company promise with a grain of salt. The rising risk barometer also makes it even more important for investors to temper their greed – it is better to sell too early, locking in a small or mid-sized gain, than to wait too long and lose it all. The energy exploration and production landscape is becoming more difficult to navigate every day. Without a guide you could easily get lost, regardless of how many gains you've booked already – for proof of that, look no further than Eike Batista.

| |