Gold World News Flash |

- 25 Signs The Collapse Of America Is Speeding Up As Society Rots From The Inside Out

- When will the Currency Crisis happen? When will Silver hit $400/oz?

- CFR to US: International Regulatory Standardization Begins Regionally in North America

- How Indias government might adapt to its peoples trust in gold

- 10 things the recent D.C. power outage taught us about a real, large-scale collapse

- Got Gold Report: July 8, 2012 [Physical Silver Supplies Appear to be Tight - Silver in Backwardation, Again]

- BIGGEST STORY of the 21st CENTURY, GOLD & MORE – Gerald Celente:

- The Real Testosterone Junkies

- Economic Report Card - Fail

- China's staggering gold potential – and parallels in South America

- Cliffhangers, Collisions and Confirmations

- Things That Make You Go Hmmm - Such As The Transition From Conspiracy Theory To Conspiracy Fact

- Key Events In The Coming Week

- WARNING: The World's Financial Market is Undergoing Total Collapse

- Japan Machinery Orders Implode As Global Economy Grinds To A Halt

- Got Gold Report for July 8 2012

- Roubini On 2013's "Global Perfect Storm" And Greedy Bankers "Hanging In The Streets"

- Adrian Douglas: Deflation -- nowhere to be seen

- Ouch! The Wine Bubble Blows Up

- Signs of Gold Bulls Cracking, A Glimpse of Gold Capitulation?

- Most Accurate Stock Market Predictions Using the Dollar Index

- This Major Fed Move Is About To Cause Gold To Skyrocket

- von Greyerz: Put More Than 50% of Your Liquid Assets in Physical Gold! Here?s Why

- Hathaway: A Gold Price of $2,000/ozt Could See Gold Mining Stocks Double! Here?s Why

- Market Report: A Glimpse of Gold Capitulation?

- Job Insecurity: It's the Disease of the 21st Century -- And It's Killing Us

- Thanks and reflections upon leaving Asia

| 25 Signs The Collapse Of America Is Speeding Up As Society Rots From The Inside Out Posted: 09 Jul 2012 02:30 AM PDT from The Economic Collapse Blog:

| ||||

| When will the Currency Crisis happen? When will Silver hit $400/oz? Posted: 09 Jul 2012 01:30 AM PDT [Ed. Note: Here's a You Tube precious metals commentator that's new to us, please leave us your feedback below if you'd like to see more of this commentary.] from bullorbearreport: | ||||

| CFR to US: International Regulatory Standardization Begins Regionally in North America Posted: 09 Jul 2012 12:30 AM PDT from Silver Vigilante:

As is well-known in geopolitical circles, this trend is well under way in North America. Along an aging pattern for increasing North America (and beyond) integration, in May 2012 Barack issued an executive order establishing an interagency working group, fronted by the White house's office of information and regulatory affairs, to promote international regulatory cooperation in order to reduce unnecessary cross-border differences. Participating US agencies are charged with implementing its recommendations. According to Bollyky, the agencies should adopt the following strategies: - Focus first focus first on international standards and regulatory burden sharing in the food, drug and biotechnology sectors. Trade talks should be used to drive adoption of international standards. - Increase the ability of US regulators to police internationally - Focus on the regional level. | ||||

| How Indias government might adapt to its peoples trust in gold Posted: 09 Jul 2012 12:00 AM PDT | ||||

| 10 things the recent D.C. power outage taught us about a real, large-scale collapse Posted: 08 Jul 2012 10:45 PM PDT by Mike Adams, Natural News:

Here are 10 hard lessons we're all learning (or re-learning, as the case may be) from this situation: #1) The power grid is ridiculously vulnerable to disruptions and failure | ||||

| Posted: 08 Jul 2012 10:30 PM PDT [Ed. Note: We will not be posting every issue of the 'Got Gold Report' because we are not traders. We are dollar cost averaging stackers. But here's a taste of Gene Arensberg's technical analysis of silver in case you want to sub the You Tube channel.] from GGRPrivate: | ||||

| BIGGEST STORY of the 21st CENTURY, GOLD & MORE – Gerald Celente: Posted: 08 Jul 2012 10:00 PM PDT from KingWorldNews:

Actually (these are) the words of Rothschild, which he wrote some 200 years ago: "The few who understand the system, will either be so interested in its profits, or so dependent on its favors that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantages…will bear its burden without complaint, and perhaps without suspecting that the system is inimical (harmful) to their best interests." He hit it right on the head. He knew it. The people have become vassals to the bankers, but they still like to call it freedom and democracy. It's a takeover. | ||||

| Posted: 08 Jul 2012 09:30 PM PDT from Azizonomics:

Zero Hedge is a financial news website. The writers all write under the pseudonym of "Tyler Durden", Brad Pitt's character from Fight Club. Each post comes with a little black and white icon of Brad Pitt's head. On Zero Hedge you can read news, rumors, facts, figures, off-the-cuff analysis, and political screeds (usually anti-Obama, anti-government, and pro-hard money). On the sidebars, you can click on ads for online brokerages, gold collectibles, and The Economist. The site is a big fat hoax. And if you read it for anything other than amusement, you're almost certainly a big fat sucker. | ||||

| Posted: 08 Jul 2012 09:10 PM PDT From Jim Quinn of The Burning Platform Economic Report Card - Fail We are now three and one half years into Barack Obama's presidency. I thought a few pertinent charts would help us assess the success of his economic policies. Upon his election he demanded an $800 billion stimulus package in order to keep the unemployment rate from surpassing 8%. The $800 billion was to be spent over two years we were told and then government spending would be scaled back to pre-stimulus levels. There were 145 million Americans employed when Obama was elected. There are 9 million more working age Americans today than there were in 2008. There are now 142.4 million employed Americans. So, we've added 9 million potential workers and still have 2.6 less Americans employed. We have the same number of Americans employed as we did in early 2006, when there were 17 million less working age Americans. The Obama stimulus plan was passed with everything he wanted. Democrats controlled the House and Senate and gave him exactly what he proposed. By October 2009, the unemployment rate was 10%. Obama's stimulus package and economic policies have been so successful that he has been able to get the unemployment rate all the way down to 8.2% after three and one half years, even though he said his stimulus package would keep the unemployment rate under 8%. And all it took to get the unemployment rate down to 8.2% was for 8 MILLION Americans to leave the labor force. A critical thinking person who doesn't swallow the crap peddled by the BLS and the rest of the government propaganda machine might question WHY 8 million Americans would leave the workforce when people desperately need income. If the labor participation rate had stayed constant, the current unemployment rate is 10.9%.

The long-term chart below tells the true story. The BLS classifying millions as not in the labor force is a crock. The Obama apologists and sycophants peddle a false storyline about Baby Boomers retiring as the cause for this labor force decline. The fact is people over the age of 55 have the highest participation rate in history and it continues to rise. Of the 142.4 million employed Americans, only 114 million works more than 35 hours per week, with 28.4 million working part-time. That means that 20% of those employed are part time workers with no benefits. In 2008, prior to the ascendency of Obama, there were 125 million full-time workers and 20 million part-time workers. Obama has been able to increase the percentage of part-time workers from 14% to 20% in just over 3 years. Remember this fact when Obama touts the 3 million new jobs he's created since 2010.

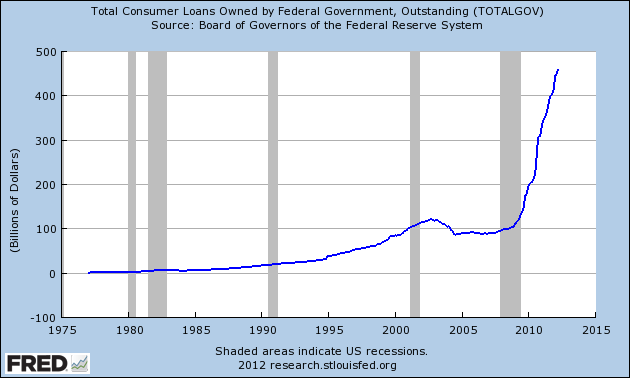

If you were wondering what the 8.5 million Americans who have left the labor force since 2008 were doing, look no further than the millions of bedrooms now functioning as classrooms for the University of Phoenix and the other on-line, for profit diploma mills that have proliferated with the doling out of hundreds of billions in cheap government student loans. These for profit diploma mills know how to game the system and get their money even if the students drop out after a few months. They educate 12% of students, receive 25% of federal student aid and account for nearly 50% of loan defaults. Sounds like a great business model. Low interest Federal government loans have skyrocketed from $100 billion when Obama took office to $450 billion today. Total student loan debt has surpassed $1 trillion, with the average student graduating with $25,000 of debt and many more burdened with $100,000 or more of debt. Those part-time jobs making lattes at Starbucks aren't cutting it. Default rates are already at a ten year high and are poised to skyrocket as more people graduate into a jobless job market. Not only is the American taxpayer on the hook for the $450 billion of direct Federal student loans, but the Federal government is guaranteeing another $450 billion. When the student loan bubble pops, the taxpayer financed bailout will be epic. And this is all being engineered by the Obama administration in order to artificially reduce the unemployment rate. Does this graph remind you of another bubble that resulted in a few problems for the American taxpayer?

After three and a half years, Obama's policies have led to 11 million less full-time workers and 8 million more part-time workers – just like he drew it up on the board when he committed $800 billion of your tax dollars to saving our economy through classic Keynesianism. Obama declared the stimulus would be a two year jolt to get our economy back on track. Federal government spending was $2.7 trillion in 2006, $2.7 trillion in 2007 and $3.0 trillion in 2008, the last three years of Bush's administration. If spending stayed on a standard trajectory, it would have been $3.1 trillion in 2009, $3.2 trillion in 2010, $3.3 trillion in 2011 and $3.4 trillion in 2012. With the end of the Iraq occupation in 2010, it should have dropped by $200 billion, resulting in total spending of $3.1 trillion in 2011 and $3.2 trillion in 2012. Obama declared the stimulus would be short-term. Federal government spending should have risen to $3.5 trillion in 2009, $3.6 trillion in 2010 ($300 billion stimulus – $200 billion Iraq withdrawal), and then revert back to $3.3 trillion in 2011 and $3.4 trillion in 2012. Let's see whether Obama was honest in his promises: Federal Government Spending 2009 – $3.5 trillion 2010 – $3.5 trillion 2011 – $3.6 trillion 2012 – $3.8 trillion After three and one half years of stimulus spending, Cash for Clunkers, Home Buyer Tax Credits, mortgage modification programs, Fannie, Freddie & FHA accumulating billions in bank losses, zero interest rates, QE1, QE2, Operation Twist, unlimited student loans, wars of choice in the Middle East, mark to fantasy accounting standards for Wall Street, and hundreds of billions in bonuses for criminal bankers, we are left with a $5.3 trillion (50% increase) higher national debt and a $300 billion (2.3% increase) higher real GDP. That's not exactly a big bang for your Keynesian buck. The response you will get from the Obama apologists is, "Imagine how bad it would have been if we didn't spend the money". This is a classic liberal response when their solutions are a total failure. Krugman will declare that if we had only spent another $2 trillion all would be well.

As you can see, Obama and all the politicians in Washington DC are really good at spending your money on pork projects, paying off campaign contributors and compensating their corporate cronies. Do you see any reversion back to normalized spending? How can current spending be $300 billion higher than the two stimulus years if Obama was telling the truth in 2009? The Obamanistas declare we are still in an emergency and must borrow and spend to save the economy. The emergency never ends for politicians of both parties. This is how they have bastardized John Maynard Keynes' theory. They love to implement spending when the economy is in the dumper, but they forget his admonition to pay down debt during the good times. It never happens. There will always be another emergency. Even 2nd grade level Sesame Street fans can see the Federal government spending and debt accumulation never reverses. It couldn't be any more obvious, unless you are an intellectually dishonest Keynesian ideologue hack (aka Krugman).

This brings us to the crowning economic achievement of the Obama administration. His most successful program is unequivocally the SNAP food stamp program. When Obama assumed power in January 2009 there were 32 million Americans on food stamps and the annual cost of the program was $44 billion. Today there are 46 million Americans on food stamps and the annual cost is pacing at $75 billion. He has been able to get fully 15% of the U.S. population enrolled in this fantastic program and the Department of Agriculture is even running advertisements to convince more people to join.

And don't worry about any restrictions. You can buy as much soda, ice cream, cheetos, and fudge brownies with your SNAP card as you choose. Of course, you are still free to purchase higher end fare.

A cynical less trusting soul than me might even conclude that Obama's goal is to provide government entitlements to as many people as possible in order to win votes in the upcoming election. One might ask how he can tout an economic recovery and the millions of "new" jobs he has created since 2010, when 6 million people have been added to the food stamp rolls since his economic recovery officially began in 2010. I'm confused by the Obama distinction between success and utter failure. Not far behind the food stamp program, the SSDI program has been another resounding Obama success. He has been able to enroll twice as many participants in this program as jobs created since the end of the recession. There are already 10 million people on SSDI costing the American taxpayer in excess of $150 billion per year. There are 250,000 people per month applying for benefits and the program will be broke by 2015. In a shocking development, when people began to roll off the 99 week unemployment gravy train, the number of new SSDI applications soared. I guess they were depressed at not being able to collect unemployment for two more years. Bob Adelman recently summed up the SSDI scam: "The program, funded federally but administered by the states, is being milked by many who have run out of unemployment benefits and other resources and haven't been able to find work. At present one out of every eight working-age, non-retired individuals receive disability payments, some for "mental disorders" and "back pain." Claims for mental disorders, for instance, have more than tripled from 10 percent of cases in 1982 to 32.8 percent in 2012, with half of those based on "mood disorders" such as depression or anxiety. Back or neck "problems" have increased by 31 percent and were the top cause of disability for 50- to 64-year olds. Depression and anxiety and other emotional problems increased by 20 percent, and now constitute one-third of all disability claims. Once on the rolls, beneficiaries have little incentive to return to work because their disability entitles them to additional benefits such as food stamps, Medicaid, Section 8 housing, and student-loan forgiveness. As a result less than one half of one percent of those on disability ever go back to work." I'm depressed by the results of Obama's economic policies. Maybe I should apply for SSDI.

It appears that former college professor Obama never paid attention in his macroeconomics undergraduate course. The "guns versus butter model" doesn't enter the equation for a profound thinker like Barack. Why do hard choices need to be made when Ben Bernanke is manning the printing press? In the real world, a nation has to choose between two options when spending its finite resources. It can buy either guns (invest in defense/military) or butter (invest in production of goods), or a combination of both. This can be seen as an analogy for choices between defense and civilian spending in more complex economies. Politicians and bankers have been ignoring this rational model since 1971 when Nixon closed the gold window. Why make difficult choices when you can borrow and print your way to prosperity? As a country we've chosen guns, butter, BMWs, McMansions, free unfunded healthcare, unfunded pensions, unfunded sickcare, and DHS implemented security for all. In order to prove himself tougher than George W., Obama, the socialist, has actually increased war spending by 23% to an all-time high. Fiat currency is an amazing invention. Guns, butter and healthcare for all. Mainstream media liberals like Ezra Klein dutifully trot out charts and storylines trying to convince the ignorant masses that Obama is not to blame for the soaring national debt. They declare it was the Bush tax cuts and his wars. This blame Bush storyline is growing old as Obama has already extended the Bush tax cuts once, ramped up wars in the Middle East and cut payroll taxes for the last two years. The Office of Management and Budget has calculated the total increase in the national debt will be $7.8 trillion after eight years of Obama, 269% more than was accumulated during the Bush reign of error. I believe the $7.8 trillion is ridiculously optimistic. The national debt has increased by $5.3 trillion since Obama took office. It will go up another $200 billion by the end of this fiscal year. It will surely exceed $1 trillion per year during a 2nd Obama term as he would extend most of the Bush tax cuts, extend the payroll tax cuts, continue to increase war spending, and the hidden delayed Obamacare costs would arrive. His eight year report card will show a $9.5 trillion increase in the national debt, reaching the magic grand total of $20 trillion. The national debt to GDP ratio will be close to 120%.

This scathing assessment of Obama's economic policies is by no means an endorsement of Mitt Romney or his economic plan, since he has never provided a detailed economic plan. After four years of a Romney presidency, the national debt will also be $20 trillion as his war with Iran and handouts to his Wall Street brethren replace Obama's food stamps and entitlement pork. There was only one presidential candidate whose proposals would have placed this country back on a sustainable path. The plutocracy controlled corporate mainstream media did their part in ignoring and then scorning Ron Paul during his truth telling campaign. The plutocracy wants to retain their wealth and power, while the willfully ignorant masses don't want to think. The words of Ron Paul sum up what will occur over the coming years as the interchangeable pieces of this corporate fascist farce drive the country to ruin: "Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers." "A system of capitalism presumes sound money, not fiat money manipulated by a central bank. Capitalism cherishes voluntary contracts and interest rates that are determined by savings, not credit creation by a central bank." "Believe me, the next step is a currency crisis because there will be a rejection of the dollar, the rejection of the dollar is a big, big event, and then your personal liberties are going to be severely threatened."

The politicians, bankers and corporate titans running this country are too corrupt and cowardly to reverse the course on our path to destruction. The debt will continue to accumulate until our Minsky Moment. At that point the U.S. dollar will be rejected and chaos will reign. The Great American Empire will be no more. At that time sides will need to be chosen and blood will begin to spill. Decades of bad decisions, corruption, cowardice, ignorance, greed and sloth will come to a head. The verdict of history will not be kind to the once great American Empire. | ||||

| China's staggering gold potential – and parallels in South America Posted: 08 Jul 2012 09:00 PM PDT by Brian Sylvester, MineWeb.com

The Gold Report: Noel, you're a geologist with about a 40 year history in mineral exploration. These days, public companies pay you for advice on how to run their exploration programs. What are some common mistakes junior mining companies make when it comes to exploration? Noel White: Junior companies have difficulty developing a clear and realistic strategy. TGR: You try to temper their enthusiasm? NW: Not at all. In fact, I try to encourage their enthusiasm. But I try to get what they do aligned with what their objectives are in a realistic way. | ||||

| Cliffhangers, Collisions and Confirmations Posted: 08 Jul 2012 08:27 PM PDT [COLOR=#e06666]Editor's note: The following commentary is updated and summarized from "Trends in Transition", "This is Not Rocket Science" and "Trend Forces in Collision". It also applies to Gold, Silver and the XAU since their structure, trends and cycles are quite similar. [/COLOR] The TDI down trends continue in gold, silver and XAU. These trends may override all widely recognized support areas or result in cliffhangers. However, there are elements suggesting a significant bottom may occur later this month. [CENTER]TDI Trends in Collision[/CENTER] The following metaphorical example is useful to illustrate the negative and powerful effects of TDI trend forces in down trends. Two cement trucks (weekly and monthly TDI trends) in a fog are coming down a hill and collide with a small sedan (daily TDI trend) traveling up the same hill. Clearly, the sedan is demolished and begins to slide back down the hill. This illustration precisely describes the current technical conditions for... | ||||

| Things That Make You Go Hmmm - Such As The Transition From Conspiracy Theory To Conspiracy Fact Posted: 08 Jul 2012 07:57 PM PDT From Grant Williams, author of Things That Make You Go Hmmm, Attempts to manipulate free markets invariably end badly - after all, they are, supposedly, by their very nature, free. ... Over the past few weeks, the exposure of the Libor-rigging scandal has monopolized the headlines of the financial press and inveigled its way onto the front pages of every major news publication in the world through the sheer size and scale of the story. Something as big as this just CAN'T be hidden from the public. Only... it can. It has been. It no doubt still is to a certain extent. I'm not going to go through all of the events of the past few weeks as you are no doubt familiar with them, but [simply understanding how LIBOR works makes for a simple conclusion]. I'm afraid it's rather obvious. Given that almost half the reported inputs that help establish the Libor rate are discarded immediately, Barclays simply CANNOT have manipulated the Libor rate alone. Period. What's more, to effectively ensure the rate is set at the price required, you'd need to not only establish the highest and lowest 25% of prices, but then ensure the remaining 50% average out to the required rate and, based on the fact that there are 16 banks that submit rates, that would mean about 13 of the 16 involved would need to be complicit. As a very good friend of mine put it earlier this week; at best this is a cartel, at worst it's outright fraud on a scale that is completely unprecedented. So for five years there have been attempts to fix the Libor rate and, take it from me, during that time, many inside the financial industry were familiar with the rumors of such manipulation but it was another huge scandal with such highpowered connected interests that it would no doubt be brushed squarely under the carpet. Forget 'too big to fail'. This was 'too deep to prove'. Libor is so important to so many people in the financial industry that the question of why it was manipulated really ought to be framed differently:

The answer to this question would ordinarily be:

... So, working from the ground up; we have a set of traders looking to produce the best profits they can for personal gain, the major bank they work for and who should be supervising them with a need to disguise the level of its own funding costs and above them all, a government seeking to keep borrowing costs down in the middle of a gigantic financial storm. From such alignments of interest are the greatest of conspiracies born. In my humble opinion, the Libor scandal (which has a LONG way to go before it has played out and which will claim a LOT more scalps) will mark a fundamental change in the treatment of financial conspiracy theories in the media. The sheer amount of coverage it will undoubtedly receive will signal a shift in attitude towards the exposing of such scandals rather than the blind-eyes that have been regularly turned in recent years. ... But perhaps, most-of-all, watching how quickly those in high places begin to throw each other under the bus, it will hasten the end of many other possible government conspiracies as exposing such events becomes an exercise in self-preservation. Prime amongst conspiracy theories that may soon be finally proven to be either valid or the figments of overactive imaginations, are those alleged in the gold and silver markets. The allegations concerning precious metal price manipulation predate those surrounding Libor by decades but until now day they have remained similarly acknowledged within financial circles and ignored without. That may well be about to change.

If the long-stated claims about government-sanctioned, bank-led manipulation of precious metals markets put forward so eloquently by the likes of Ted Butler, Bill Murphy & Chris Powell at GATA as well as Messrs. Sprott, Sinclair, Davies et al are eventually proven to have any validity whatsoever, the fallout from the Libor scandal will prove to be (to use the words of Jamie Dimon) just another "tempest in a tea pot" as the precious metals are the very underpinnings of the entire global financial system. Conspiracy or no, it would be a blessed relief to get closure no matter what the truth turns out to be.

As for the full note by Grant Williams, which has much more in it, it can be found below (pdf): | ||||

| Posted: 08 Jul 2012 07:35 PM PDT A preview of the key events in the coming week (which will see more Central Banks jumping on the loose bandwagon and ease, because well, that is the only ammo the academic econ Ph.D's who run the world have left) courtesy of Goldman Sachs whose Jan Hatzius is once again calling for GDP targetting, as he did back in 2011, just so Bill Dudley can at least let him have his $750 million MBS LSAP. But more on that tomorrow. What Matters in FX This Week : China Growth and Inflation Data, Ecofin Meeting, FOMC The past week undid a large part of the constructive price action posted the week before and a significant part of the progress made following the Euro-area summit. First off, it was a data heavy week, during which, key releases such as the ISM and Payrolls disappointed, but not to an extent that would justify further and imminent easing of monetary policy by the Fed. Overall, the deterioration in activity and the higher threshold for Fed easing continue to push the dollar higher and continue to challenge our FX views, which are predicated on dollar weakness. On the European front, the ECB cut both the refi and the deposit rate by 25bps, pushing the EUR lower against most trading partners. Despite broader risk-off sentiment, EUR under-performed even currencies highly sensitive to global growth like NJA FX and AUD. The latter were broadly supported by the announcement that China eased policy rates following softer growth and inflation prints. The recovery in metals and oil prices backed the market view that policy driven demand strength in Asia may prove to be a bright spot amid this generalized deceleration in DM growth. More broadly, although our GLI indicator has shown signs of deeply negative momentum in global industrial output, it is also true that PMI data hints at underperformance of DM growth vs EM. Net-net, this has resulted in further demand for "short DM vs long EM" trades but in a risk-neutral way. The most obvious candidate over the last few weeks has been the EUR; short EUR vs long commodity or EM FX positions have attracted considerable market interest. However, the key question remains how resilient will EMs prove to be should DM growth continue to deteriorate and risk aversion continues to pick up. Back to Euro-area issues, following the summit results, markets likely expected to hear – either from the ECB or from governments – some provisions to protect against high and rising funding costs for Spain and Italy, even if that was a short term assurance until longer term policy goals are specified more clearly. However, the lack of clarity weighed heavily on peripheral bonds pushing Italian and Spanish yields to erase more than 2/3rds of the post summit gains. The net result was obviously also negative for risky assets more broadly. Looking ahead, China data will be closely watched. The CPI is expected to dip significantly – to 2.1% in our forecasts vs expectations of 2.3%. A lower CPI print would leave further room for easing by local authorities, particularly if growth data justified it. In that sense, 2Q GDP will be followed by markets – we expect growth to have decelerated by 0.2% from 8.1% yoy in Q1 to 7.9%. IP probably stayed flat relative to last month. In addition to China, a large number of countries are scheduled to release IP numbers in this coming week. The Eurogroup/Ecofin meeting will discuss some of the details missing from the latest summit results and will also discuss developments in the Greek adjustment program. FOMC minutes will provide further insight into the Fed's assessment of slowing economic conditions in the US and the probability for balance sheet expansion ahead. Monday July 9

Tuesday July 10

Wednesday July 11

Thursday July 12

Friday July 13

| ||||

| WARNING: The World's Financial Market is Undergoing Total Collapse Posted: 08 Jul 2012 07:13 PM PDT [Ed. Note: This red alert warning comes from Steve Quayle's international banking contact, V.] from Steve Quayle:

The Unofficial Euro collapse has hastened the hemorrahging of various sectors around the financial world. Lets start with a few shall we. Derivatives: I have documented that the real loss of JPM's previous London trade debacle is not the purported intial $2billion or the now admitted $9 billion but $150 billion total loss. This coming from a Zombie Bank that recieves 77% of its profits from the government trough. The IR Swaps that are played in this field is astronomical and is accounting for more than 85% of all derivative trades. So what does this mean? I stated many times, when people have asked me, "what is THE SIGN of a financial collapse?" I have always said that it will begin in the derivative market first. After all we have an unsustainable world wide derivative debt that is in the Quadrillions. $1.4 Quadrillion by most estimates. What does this mean and how will it play out? Hacking: The supposed "hacking" that is occurring in over 60 banks at the same time is nothing more than those with the funds moving their assets out. It is a smoke screen, a diversion, a silent stealth bank run by the elites. Why all of a sudden there is total media black out? The funds that have been taken have crossed in to the billions of dollars. The total stealth bank runs are closer to 200 banks. LIBOR: All over the news you hear the mother of all scandals, the fact that all the major multinational banks have been rigging the interest rate system and keeping it artificially low. Which robs you of your dividends and annihilates your savings but profiteers the banksters in their risky gamble with your money. They profit and you are left holding the bag. The banks involved in this LIBOR mess total 200 about the same that just so happen to be the same banks that are all of a sudden being "hacked" and are having "glitches". This LIBOR scandal puts into risk an $800 trillion market made up of savings, investments, mortgages, loans and retirement accounts. Taking a sledgehammer to the confidence of the whole entire global market and western backed banking system. I laugh at these pundits who talk about the LIBOR. You see my friends there is no oversight over LIBOR,it's just a bunch of crooks deciding what they will charge for lending amongst themselves and how they can profit off of you. LIBOR was invented to be MANIPULATED the very design of this screams so. You have to wonder why now all of a sudden LIBOR is an issue? Read on. So what does it all mean? Simple really my friends. The whole entire western banking system is being flushed out, the whole house is being purposely burned to the ground in order to make way for the new. If you are still in paper you are a madman or woman. Pull your money out now while you still have time. I will make it as clear for you as possible, your wealth, your way of life and your posterity's future is being PURGED, FLUSHED, BURNED OUT. The order of things are about to change officially. Watch the dollar, get out of paper, get into metals. You have been warned….Again. | ||||

| Japan Machinery Orders Implode As Global Economy Grinds To A Halt Posted: 08 Jul 2012 06:46 PM PDT Japan's core machinery orders were expected to post a modest -2.6% drop. Instead they had a worse collapse than anything seen in the aftermath of the Fukushima disaster, plunging by a stunning 14.8% . And the kick in the groin cherry on top was the current account surplus plunged by 62.6%: consensus forecast: -14.5%. The Japanese economy has once again ground to a halt, only this time it has no earthquake or nuclear explosion to blame. This time it is the entire world's fault, where demand has collapsed proportionately. As a reminder the BOJ expanded its QE yet again on April 27. Must be time for another QE because this time will certainly be different after more than 30 years of failures. It is time for those brilliant central planners Ph.D's to do engage in more of the same insanity that Einstein warned about decades ago. And incidentally this is not a joke: on Thursday the BOJ is expected to ease yet again. As a reminder, the BOJ already buys ETFs, Corporate Bonds, and REITs. What's left: gold? Instant View via Reuters: HIROSHI SHIRAISHI, ECONOMIST, BNP PARIBAS "The numbers are weak. Although the BOJ tankan indicated stronger (capital spending), uncertainty about the outlook for the overseas economy is making Japanese companies cautious. "Things won't be as strong as the tankan suggested. We didn't think capital spending would be that strong, because we can't expect much growth in overseas economies. "The pace of capital spending is gradually becoming weaker. "We believe that BOJ will loosen monetary policy (at Thursday's meeting)." YASUO YAMAMOTO, SENIOR ECONOMIST, MIZUHO RESEARCH INSTITUTE IN TOKYO "Looking at the May figure alone you may say that machinery orders were weak, but given that the data is volatile you cannot say capital spending is losing momentum. "Corporate capital spending remains in a moderate uptrend as the Bank of Japan's June tankan confirmed, although the pace is tepid and levels are below those seen before the Lehman crisis. "Public spending and personal consumption are driving the Japanese economy but economic growth is likely to slow after the summer partly as government subsidies for low-emission cars run out of money. You cannot expect much from exports given uncertainty over Europe and the global economy. "The BOJ is likely to sit tight this week given the current yen movements, but it could ease policy further as early as September if it becomes clearer that the economy is slowing down." HIROAKI MUTO, SENIOR ECONOMIST, SUMITOMO MITSUI ASSET MANAGEMENT CO, TOKYO "Machinery orders from both manufacturers and non-manufacturers fell a lot. External demand looks weak. A lot of companies have turned cautious about overseas economies. The global economy is weaker than we thought. "Machinery orders suggest capital expenditure is weaker than what companies indicated in the most recent Bank of Japan tankan survey. This suggests that capital expenditure plans in the tankan are likely to be downgraded. "The current account surplus took a hit from imports of liquefied natural gas. Prices for these imports should start to follow oil prices lower. "There are increasing worries for the Japanese economy. The BOJ looked like it would be on hold this week, but given weak U.S. economic data and monetary easing by central banks in China and Europe, there is now a 50 percent chance that the BOJ could ease this week." | ||||

| Got Gold Report for July 8 2012 Posted: 08 Jul 2012 05:07 PM PDT

To continue reading, please log in or click here to subscribe to a Got Gold Report Membership | ||||

| Posted: 08 Jul 2012 04:35 PM PDT In an extended interview with Bloomberg TV, Nouriel Roubini lives up to his doom-saying reputation and goes where few have as he opines on Lieborgate that: "bankers are greedy and have been for 1000 years" and "nothing is going to change" unless there are criminal sanctions; to which he follows up - briefly silencing the interviewer, "If some people end up in jail, maybe that will teach a lesson to somebody - or somebody will hang in the streets". The professor goes on to note that the EU "summit was a failure" since markets were expecting much more and warns that without full debt mutualization, debt monetization by the ECB, or a quadrupling of the EFSF/ESM 'bazooka'; Italian and Spanish spreads will continue to blow out day after day - leading to a crisis "not in six months but in two weeks". The only entity capable of stopping this is the ECB which needs to do outright unsterilized monetization in unlimited amounts which is 'politically incorrect' to talk about and claimed to be constitutionally illegal. 2013 will be a very difficult year to find shelter as policy-makers ability to kick-the-can runs out of steam as he sees the possibility of a 'Global Perfect Storm' of a euro-zone collapse, a US double-dip, a China & EM hard-landing, and a war in the Middle East. Dr. Doom is back. Must watch 9 minutes of reality: On Lieborgate:

On Greed:

On Sanctions:

On TBTF banks:

On The EU Summit:

On The ECB saving the world:

On Debt mutualization:

On kicking the can:

On 2013 being worse than 2008:

| ||||

| Adrian Douglas: Deflation -- nowhere to be seen Posted: 08 Jul 2012 04:30 PM PDT 6:25a HKT Monday, July 9, 2012 Dear Friend of GATA and Gold: Commodity price data contradicts complaints of deflation, GATA board member and Market Force Analysis letter editor Adrian Douglas argues today. Douglas writes that there hasn't been deflation in the United States in almost 80 years and that some prices are showing increases of as much as 15 percent annually. Douglas' commentary is headlined "Deflation: Nowhere to Be Seen" and it's posted as part of his Market Force Analysis letter at GATA's Internet site here: http://www.gata.org/files/AdrianDouglasDeflationNowhere.doc CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res...

This posting includes an audio/video/photo media file: Download Now | ||||

| Ouch! The Wine Bubble Blows Up Posted: 08 Jul 2012 04:17 PM PDT Wolf Richter www.testosteronepit.com Disclosure: I’m biased. I love wine—almost as much as I love craft brews—but I’m leaning towards Californian wines; they’re awesome and grow in my extended neighborhood. More precisely, I love drinking wine, not keeping it locked up in a refrigerated vault, and certainly not investing in it. Hence, I have little sympathy for those who got the timing wrong when they bought high-dollar French wines for the sole purpose of investing in them, instead of drinking them, and I certainly don’t feel sorry for them in their plight. But a plight it is. It all has to do, like so many things, with the China bubble, and central banks. Wine as an asset class, if you will, didn’t do much until the China bubble got going seriously and rich Chinese began piling into the market: from the summer of 2005 through the Beijing Olympics in 2008, the asset class skyrocketed 152%. But then the world experienced the Lehman Moment, and from September to December that year, the asset class plunged 22.3%. The fact that wine could fall off a cliff like this scared central bankers around the world, and they dusted off their printers, plugged them into their 440-volt outlets—these are big industrial machines, not desktop devices (see video link at the bottom)—and they started printing money to buy up assets of whatever kind, possibly even wines, which would explain their drunken stupor at the time. As all this freshly printed money out there was searching for a place to go, it created numerous bubbles, and revived others that had been gasping for air. Including the wine bubble. And so, from December 2008 through June 2011, the wines rallied another 76%. What a ride! That June, as we can see from the graph of the Liv-ex Fine Wine 100 index, was the peak of the wine bubble.

The Liv-ex Fine Wine 100, calculated monthly, is the “fine wine industry’s leading benchmark” and represents the price movement of 100 of the most sought-after wines, largely Bordeaux, “a reflection of the overall market,” but it also includes wines from Burgundy, the Rhone, Champagne, and Italy (but not from California). Now the index is back where it was just before the Lehman Moment, a 27.3% plunge. Thin mountain air appears to be all that’s underneath it. The Liv-ex Fine Wines 50 tracks the daily price movement of the most heavily traded commodities in the fine wine market—the last ten vintages of the five Bordeaux First Growths, namely Haut Brion, Lafite, Latour, Margaux and Mouton. And it delineates the dynamics of the wine bubble in even more gruesome terms.

It powered up 63% from February 2010 (limit of data) to June 28, 2011, the peak of the bubble. By September it had dipped 8% - 10%, when Chinese bottom fishers jumped back in, smelling with their legendary accuracy a huge opportunity—and in such a manner that the LA Times reported:

Alas, he ended up grabbing a falling knife and getting his fingers sliced off. Based on the Liv-ex Fine Wine 50, he lost 27% so far. From its peak through Friday, the index plunged 33.1%; on Friday alone, our hapless Chinese investor lost 1.6%. But unlike stocks, you can always drink your asset and drown your sorrows. And yet, drinking it is precisely what these investors fear the most because their investment might be ... counterfeit. A “large industry issue,” particularly in China. Making money on fake fine wines is lucrative, and common. Methods range from refilling empty bottles of famous Bordeaux to sticking fake labels on cheap bottles. Less sophisticated Chinese consumers might not be able to tell the difference. And investors who keep their wines locked up rather than drink them? A devastating thought—and investors have lost confidence. The industry is trying to combat this. Some wine makers implant NFC chips into their labels. When scanned with a smart phone, a website shows information about the wine and confirms its authenticity. Auction house Christie’s breaks its empty bottles with a hammer after wine tastings in Hong Kong and China so that they can’t be sold on the black market and refilled. But these measures might not be able to offset the double whammy of a pricked bubble and of counterfeit assets that are wreaking havoc on investor confidence—and on the value of their assets, fake or not. Also read.... Fishy Economic Data and the China Crash. Wine production in China has been on a stellar trajectory. While much of it might not meet our preferences, or safety standards, some of it made it to a stunning wine competition. Read.... Merde! Chinese Wines Did What to French Wines? And to round off the weekend with humor, here is a hilarious video from down-under comedians Clarke & Dawe that sums up in 2½ minutes the true nature of Quantitative Easing. | ||||

| Signs of Gold Bulls Cracking, A Glimpse of Gold Capitulation? Posted: 08 Jul 2012 04:02 PM PDT Looking around it seems we finally have some clues to the bulls cracking and throwing in the towel, yet I have been telling members that Gold or Silver is not a buy as the trend has been down since the Feb 2012 highs. Staying under $1641 on Gold has been key for us and try as they like the Gold bulls have failed at every attempt, although the usual crackpot excuses are coming out, like JPM made the markets lower and the markets are rigged etc. | ||||

| Most Accurate Stock Market Predictions Using the Dollar Index Posted: 08 Jul 2012 01:52 PM PDT | ||||

| This Major Fed Move Is About To Cause Gold To Skyrocket Posted: 08 Jul 2012 12:15 PM PDT  With remarkable precision, Michael Pento correctly predicted that there would be central bank fireworks in his KWN July 4 piece. The world immediately witnessed a series of major moves by central banks around the world. Today Michael Pento, of Pento Portfolio Strategies, writes exclusively for King World News to put global readers ahead of the curve, once again, on the next major move by central planners. With remarkable precision, Michael Pento correctly predicted that there would be central bank fireworks in his KWN July 4 piece. The world immediately witnessed a series of major moves by central banks around the world. Today Michael Pento, of Pento Portfolio Strategies, writes exclusively for King World News to put global readers ahead of the curve, once again, on the next major move by central planners. Pento is now calling for another significant move, and he noted that when this unfolds, "...watch for the gold market to explode higher in price." Here is Pento's piece: "Spanish and Italian bond yields have now risen back up to the level they were before last week's EU Summit. We also learned last Friday that U.S. job growth remains anemic, producing just 80k net new jobs in June. The global manufacturing index dropped to 48.9, for the first time since 2009. And emerging market economies have seen their growth rates tumble, as the European economy sinks further into recession." This posting includes an audio/video/photo media file: Download Now | ||||

| von Greyerz: Put More Than 50% of Your Liquid Assets in Physical Gold! Here?s Why Posted: 08 Jul 2012 08:40 AM PDT I have consistently told people for over a decade to put up to 50% of their money into physical gold stored outside of the banking system. I now believe investors should consider putting even more of their liquid assets into physical gold. In my view this is the best way to protect against the risks the financial system faces today, and the chaos that is still in front of us. The above were the concluding remarks of Egon von Greyerz, founder and managing partner at Matterhorn Asset Management,*in his latest interview with Eric King of King World News which can be read in its entirety here. Take Note: Go [COLOR=#ff0000]here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com. It’s FREE![/COLOR] An easy "unsubscribe" feature is provided should you decide to cancel at any time. There is such a "fear of gold" amongst most people that it must be due to statist indoctrination and propaganda because it makes no rational sense to h... | ||||

| Hathaway: A Gold Price of $2,000/ozt Could See Gold Mining Stocks Double! Here?s Why Posted: 08 Jul 2012 08:40 AM PDT We will not be surprised if gold revisits the high of last year ($1,900) or pushes through to new all- time highs by year end….and gold stocks should respond very favorably to the perception of a directional change in bullion. We believe that the ten month decline in the gold price has been the major headwind for gold mining stocks….but if gold were to trade at $2000/oz. later this year, and should the ratio of gold mining shares (XAU basis) return to the mid -point of its range since the launch of GLD in 2004, or roughly 15% versus the current level roughly 10%, mining stocks could double on a 25% increase in the gold price. So says John Hathaway in edited excerpts from his most recent interview with Eric King of King World News brought to you by Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!). Hathaway concludes his*interview by saying, “We believe that gold remains under owned and misunderstood notwithstanding a thirteen year bull market. ... | ||||

| Market Report: A Glimpse of Gold Capitulation? Posted: 08 Jul 2012 08:08 AM PDT | ||||

| Job Insecurity: It's the Disease of the 21st Century -- And It's Killing Us Posted: 08 Jul 2012 05:28 AM PDT  A massive, Xanax-fueled public health crisis driven by chronic employment worry is headed our way. A massive, Xanax-fueled public health crisis driven by chronic employment worry is headed our way.Remember Dilbert, the mid-level, white-collar Cubicle Guy of the '90s who could never seem to get ahead? In the 21st century, his position looks almost enviable. He has been replaced by Waiting-For-the-Other-Shoe-to-Drop Man. Across America, freaked-out employees are coping with sweat-drenched nights and heart-pounding days. They're reaching for the Xanax and piling on the work of two or three people. They're running the risk of short-term collapse and long-term disease. The hell created by three grinding years of 8 percent-plus unemployment brings us plenty of stories of what people suffer when they lose their jobs. But what about the untold millions who live in chronic fear that tomorrow's paycheck will be their last? Research shows that the purgatory of job insecurity may be even worse for you than unemployment. And it's turning the American Dream into a sleepwalking nightmare. From young temporary workers to middle-aged career veterans, Americans are being pushed to their physical and psychological limits in what has the makings of a major national public health crisis. Read more...... This posting includes an audio/video/photo media file: Download Now | ||||

| Thanks and reflections upon leaving Asia Posted: 08 Jul 2012 12:49 AM PDT 2:45p HKT Sunday, July 8, 2012 Dear Friend of GATA and Gold: As he prepares to return home after a few weeks of proselytizing in Asia, your secretary/treasurer is overwhelmingly obliged to longtime GATA supporter and dear friend Peter Wynn Williams, investment director of The Henley Group in Hong Kong (http://www.thehenleygroup.com.hk/hong-kong.aspx), whose constant yet modest assistance and guidance there and in Singapore are largely responsible for whatever success has been or still may be achieved. Some of your secretary/treasurer's observations arising from a little personal time spent elsewhere in Asia have been turned into newspaper commentary here: http://www.journalinquirer.com/articles/2012/07/08/chris_powell/doc4ff5c... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Discovers Potential High-Grade Gold Mineralization From a Company Press Release VANCOUVER, British Columbia -- With its latest surface diamond drilling program at its 100-percent-owned, formerly producing Blackdome gold mine in southern British Columbia, Sona Resources Corp. has discovered a potentially high-grade gold-mineralized area, with one hole intersecting 13.6 grams of gold in 1.5 meters of core drilling. "We intersected a promising new mineralized zone, and we feel optimistic about the assay results," says Sona's president and CEO, John P. Thompson. "We have undertaken an aggressive exploration program that has tested a number of target zones. Our discovery of this new gold-bearing structure is significant, and it represents a positive development for the company." Sona aims to bring its permitted Blackdome mill back into production over the next year and a half, at a rate of 200 tonnes per day, with feed from the formerly producing Blackdome mine and the nearby Elizabeth gold deposit property. A positive preliminary economic assessment by Micon International Ltd., based on a gold price of $950 per ounce over eight years, has estimated a cash cost of $208 per tonne milled, or $686 per gold ounce recovered. For the company's complete press release, please visit: http://www.sonaresources.com/_resources/news/SONA_NR18_2011-opt.pdf Join GATA here: Toronto Resource Investment Conference New Orleans Investment Conference * * * Support GATA by purchasing DVDs of our London conference in August 2011 or our Dawson City conference in August 2006: http://www.goldrush21.com/order.html Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Platinum Announces Wellgreen Preliminary Economic Assessment: Company Press Release VANCOUVER, British Columbia, Canada -- Prophecy Platinum Corp. (TSX-V: NKL, OTC-QX: PNIKF, Frankfurt: P94P) reports the results of an independent NI 43-101-compliant preliminary economic assessment for its fully owned Wellgreen nickel-copper-platinum group metals project in the Yukon Territory. The independent assessment, prepared by Tetra Tech, evaluated a base case of an open-pit mine (with a mining rate of 111,500 tonnes per day), an on-site concentrator (with a milling rate of 32,000 tonnes per day), and an initial capital cost of $863 million. The project is expected to produce (in concentrate) 1.959 billion pounds of nickel, 2.058 billion pounds of copper, and 7.119 million ounces of platinum, palladium, and gold during a mine life of 37 years with an average strip ratio of 2.57. The financial highlights of the preliminary economic assessment, shown in U.S. dollars, are as follows: Payback period: 3.55 years Prophecy Chairman John Lee says: "We are pleased with the preliminary economic assessment results. The numbers indicate that Wellgreen is one of most exciting mineral projects in the Yukon. The company is drilling to upgrade and expand the resource base. The infrastructure is excellent as the project is only 1,400 meters in altitude and 14 kilometers from the paved Alaska Highway, which leads to the Haines deep seaport. Discussions are under way with support from local stakeholders regarding permitting and logistics." For the complete press release, please visit: http://prophecyplat.com/news_2012_june18_prophecy_platinum_announces_res... |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

The problems that America is experiencing right now are not just confined to the field of economics. The truth is that there are signs of deep decay wherever we look, and without question the United States is rotting from the inside out in thousands of different ways. For a long time our debt-fueled prosperity has masked much of the social decay that has been festering underneath the surface, but now it is becoming increasingly apparent that the thin veneer of civilization that we all take for granted is beginning to disappear. For many Americans, it is easy to point a finger at a particular group or political party and blame them for all of our problems, but the reality of the matter is that our societal decay cuts across all income levels, all political affiliations and all regions of the country. We are being destroyed from within, and this decay can be seen on the streets of the most dilapidated sections of major U.S. cities and it can also be seen in the halls of power in Washington D.C. and on Wall Street. It is undeniable that something has fundamentally changed. The American people do not seem to possess the same level of character that they once had. So where do we go from here?

The problems that America is experiencing right now are not just confined to the field of economics. The truth is that there are signs of deep decay wherever we look, and without question the United States is rotting from the inside out in thousands of different ways. For a long time our debt-fueled prosperity has masked much of the social decay that has been festering underneath the surface, but now it is becoming increasingly apparent that the thin veneer of civilization that we all take for granted is beginning to disappear. For many Americans, it is easy to point a finger at a particular group or political party and blame them for all of our problems, but the reality of the matter is that our societal decay cuts across all income levels, all political affiliations and all regions of the country. We are being destroyed from within, and this decay can be seen on the streets of the most dilapidated sections of major U.S. cities and it can also be seen in the halls of power in Washington D.C. and on Wall Street. It is undeniable that something has fundamentally changed. The American people do not seem to possess the same level of character that they once had. So where do we go from here? Thomas Bollyky, senior fellow for global health, economics and development at the CFR has underlined the importance of international regulatory integration under the guise of fair work conditions, etc. According to Bollyky, this struggle begins at home: "The United States should pursue regulatory integration on a regional basis and in the areas where the interests of trade officials, national regulatory authorities, and exporting nations overlap."

Thomas Bollyky, senior fellow for global health, economics and development at the CFR has underlined the importance of international regulatory integration under the guise of fair work conditions, etc. According to Bollyky, this struggle begins at home: "The United States should pursue regulatory integration on a regional basis and in the areas where the interests of trade officials, national regulatory authorities, and exporting nations overlap." In the wake of violent storms, the power went out for millions of Americans across several U.S. states. Governors of Virginia, West Virginia and Ohio declared a state of emergency. Over twenty people were confirmed dead, and millions sweltered in blistering temperatures while having no air conditioning or refrigeration. As their frozen foods melted into processed goo, some were waking up to a few lessons that we would all be wise to remember.

In the wake of violent storms, the power went out for millions of Americans across several U.S. states. Governors of Virginia, West Virginia and Ohio declared a state of emergency. Over twenty people were confirmed dead, and millions sweltered in blistering temperatures while having no air conditioning or refrigeration. As their frozen foods melted into processed goo, some were waking up to a few lessons that we would all be wise to remember. "It's a rigged game. What people don't realize is the banks have taken over the world. It's as simple as that. The financial crime syndicate is in charge.

"It's a rigged game. What people don't realize is the banks have taken over the world. It's as simple as that. The financial crime syndicate is in charge. I especially enjoy reading things that I disagree with, and that challenge my own beliefs. Strong ideas are made stronger, and weak ideas dissolve in the spotlight of scrutiny. People who are unhappy to read criticisms of their own ideas are opening the floodgates to ignorance and dogmatism. Yet sometimes my own open-minded contrarianism leads me to something unbelievably shitty.

I especially enjoy reading things that I disagree with, and that challenge my own beliefs. Strong ideas are made stronger, and weak ideas dissolve in the spotlight of scrutiny. People who are unhappy to read criticisms of their own ideas are opening the floodgates to ignorance and dogmatism. Yet sometimes my own open-minded contrarianism leads me to something unbelievably shitty.

Geologist Dr. Noel White* believes there are huge gold discoveries yet to be found within China's borders and unearths parallels in Latin America – Gold Report interview.

Geologist Dr. Noel White* believes there are huge gold discoveries yet to be found within China's borders and unearths parallels in Latin America – Gold Report interview.

It has begun – the unofficial collapse of the Euro that I have announced back in late June has started to run into the massive canyon like fissures of the financial world. As web site after web site and expert after expert talk endlessly about the failing frame work of the whole western financial system; they over look one main point. That point is this; when a patient is brain dead, you may debate that there is still blood coursing through their veins, that their heart still beats, that there is still a modicum of respiration still occurring. The fact remains though the vestigial systems of the organism works, it's main source of control that dictates every one of its voluntary mechanical operation IS DEAD. So it is with Western Banking. There are still "signs" of life, the ATMs work (for most anyway) online transactions are for the most part operational (again for most) but the arguments of liquidity and solvency rage because of the simple lack of omission that the very needed rudiments of the financial system, it's modus operandi, it's organized brain of safeguards and cognition has ceased functioning.

It has begun – the unofficial collapse of the Euro that I have announced back in late June has started to run into the massive canyon like fissures of the financial world. As web site after web site and expert after expert talk endlessly about the failing frame work of the whole western financial system; they over look one main point. That point is this; when a patient is brain dead, you may debate that there is still blood coursing through their veins, that their heart still beats, that there is still a modicum of respiration still occurring. The fact remains though the vestigial systems of the organism works, it's main source of control that dictates every one of its voluntary mechanical operation IS DEAD. So it is with Western Banking. There are still "signs" of life, the ATMs work (for most anyway) online transactions are for the most part operational (again for most) but the arguments of liquidity and solvency rage because of the simple lack of omission that the very needed rudiments of the financial system, it's modus operandi, it's organized brain of safeguards and cognition has ceased functioning.

No comments:

Post a Comment