saveyourassetsfirst3 |

- Bill Still: The Gold Standard, End of Freedom

- Will Central Banks Unload Gold?

- Sinclair sees U.S., gold banks battling central banks that need more gold and less paper

- Tom Ferguson: How Wall Street Hustles America’s Cities and States Out of Billions

- VB Update Notes for June - July 2012 – Help is on the Way

- Why Warren Buffett is Loading Up on Tungsten

- Corvus Gold Announces Latest Drill Results From Bulk Tonnage Oxide Deposit, North Bullfrog Project, Nevada

- So Far, Facebook IPO Has Had No Significant Impact On Housing Market Near HQ

- Has gold gone as low as it will this year?

- Gold Deposits Of USD 1 Billion To Be Collected By Turkish Bank

- Gold Back Above $1600 as Italy 'May Also Need Rescuing'

- Sit tight and be right

- Turkish Bank to Collect $1B of Gold Deposits

- T&S: Desperate World, Silver Analysis, & More

- Silver Update: Cry Argentina – 6.11.12

- The End of Cheap Everything: Ron Hera

- Platinum industry investigation already underway – Shabangu

- Not the end of gold and silver bull markets; bargains abound – Berry

- Gold coin collecting a deadly business as metals prices rise

- Buy A House and Put Nickels In It

- Spain/Spain and Spain

- World Chaos Erupting as Governments & Institutions Collapse

- Turk – Capital Controls, Bank Bailouts & Escalating Fear

- Max Keiser: Cuckoo Trading

- Momentum Turned Higher

- Gold & Silver Market Morning, June 12 2012

| Bill Still: The Gold Standard, End of Freedom Posted: 12 Jun 2012 06:10 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Will Central Banks Unload Gold? Posted: 12 Jun 2012 05:57 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sinclair sees U.S., gold banks battling central banks that need more gold and less paper Posted: 12 Jun 2012 05:51 AM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tom Ferguson: How Wall Street Hustles America’s Cities and States Out of Billions Posted: 12 Jun 2012 05:46 AM PDT Yves here. While the municipal swaps fiasco may seem like old news, this piece discusses a post-crisis type of swap which is even more appalling. The old scam was to talk local and state authorities who would have been far better served with old-fashioned fixed rate financing into doing floating rate financing and entering into a series of swaps to get a fixed rate deal, with a supposed improvement in funding costs. The problem is that many of those floating rate deals were auction rate securities, and when that market failed in early 2008, the borrowers were doubly hosed. The ARS went to penalty rates. In addition, payments on the swaps often kicked up shortly thereafter (due to the slow-motion failure of monoline guarantors, which was the hidden trigger behind both events. The downgrade of the monolines de facto downgraded the municipality, which led to increased payments on the swaps). The latest scam is more appalling. Municipal authorities would borrow fixed rate, then enter into a variable rate swap on the side. Earth to base, no responsible manager wants uncertain funding costs on a long-term capital investment. This is tantamount to the owner of a candy store borrowing money at a fixed rate from his bank to finance an expansion of his business, then betting at the racetrack to try to lower his costs. Not surprisingly, many of these swaps have proven to be costly time bombs. By Tom Ferguson, Professor of Political Science at the University of Massachusetts, Boston. Cross posted from Alternet Many powerful interests have jumped at the opportunity to use the crisis to eviscerate what's left of the welfare state. We all know that America's cities and towns are in the throes of a deep financial crisis. And are told, over and over, what's supposedly behind it: unreasonable demands by grasping state and municipal workers for pay and pensions. The diagnosis is a grotesque cartoon. Many of the biggest budget busters are on Wall Street, not Main Street. In a country as big and locally diverse as the U.S., any number of wacky pay and pension schemes are likely to flourish, though some of the most outrageous turn out to cover not workers, but legislators. But overall state and local pay has not been growing faster than in the private sector for equivalent work for many years now. What has driven cities and towns to the brink is not demands from their workforce but the collapse of national income and the ensuing fall in tax collections. Or, in other words, the Great Recession itself, for which Wall Street and the financial sector are principally to blame. But many powerful interests have jumped at the opportunity to use the crisis to eviscerate what's left of the welfare state, roll back unionization to pre-New Deal levels, and keep cutting taxes on the wealthy. The litany of horror stories that now fills the media is ideal for their purposes. The selective character of this press campaign became obvious last week. As the latest wave of stories started rolling in the wake of elections in California and Wisconsin, a striking piece of evidence surfaced that flies in the face of the conventional narrative. The Refund Transit Coalition, a coalition of unions and public interest groups, put out a study that documented in stunning detail how Wall Street banks have for years been hustling American cities, states, and regional authorities out of billions of dollars. But save for Gretchen Morgenson's "Fair Game" column for the New York Times, the study drew almost no attention. At a time when cities and states are taking hatchets to services and manically raising fees and fares, the group's analysis merits a closer look and a much, much wider audience. Its starting point will be familiar to anyone who recalls the debate over financial "reform" of the last few years. In the bad old days of pre-2008 deregulated finance, bankers started pedaling hot new "structured finance" products that they claimed were perfect for the needs of clients who had thrived for decades using cheaper, plain vanilla bonds and loans. The new marvels – swaps and other forms of so-called "derivatives" whose values changed as other securities they referenced fluctuated in value – were often complex and frequently not priced in any actual market. Their buyers thus had difficulty understanding how they really worked or how they might be hurt by purchasing them. In many documented cases, buyers also had only faint ideas about how profitable these products were to the houses selling them. One befuddled Pennsylvania school board, for example, diffidently quizzed J.P. Morgan Chase: "The school-board official knew they were getting $750,000 for entering into a 'swaption' with J.P. Morgan Chase & Co. They wanted to know what was in it for the bank. They wanted to know the price. They seem like reasonable requests. 'I can't quantify that to you,' the banker told them. 'It is not a typical underwriting and I can't quantify that for you and there's no way that I can be specific on that.'" One popular product involved an "interest rate" swap built into a bond deal. In these, as the Transit study explains, some hapless municipal authority brings out a bond and commits to making fixed payments to buyers. That sounds like any other old fashioned bond offer. But here's the twist. In the swap version, the bank offers, for a handsome charge, to pay a variable fee to the issuer of the bonds. The idea was that the money could be used to make payments owed to the bond buyers. Payments were supposed to vary with the course of interest rates. The contrivances were heralded as protecting issuers against a rise in rates and saving them money on their payments. But there was a catch: If rates fell, then banks could make out big, while issuers faced disaster, because the latter still had to make the fixed payments on their bonds, while the banks' payments would shrink as rates fell. In effect, issuers were gambling on interest rates and betting they somehow knew better than the banks what was going to happen. And, ah, yes, the final touch: With old style bonds, you could refinance if rates fell; with the new fangled derivatives, the banks made sure to impose huge termination fees. The result, for years now, has been literally billions of dollars of losses for cities, states, and other local authorities, including school boards and state college loan agencies. Locked in by the termination fees, they can stay in the swaps and pay and pay as the banks' payments to them dwindle. Or they can buy their way out of the swaps at preposterous prices – Morgenson indicated that New York State recently paid $243 million dollars to get out of some swaps, of which $191 million had to be borrowed. The Refund Transit study concentrated on local transit systems. Some of its numbers are stunning. The study pegged annual swap losses at the Massachusetts Bay Transportation Authority (Boston area) at $25.8 million and suggested that the MBTA will "lose another $254 million on these swaps" before they lapse. The study added that the MBTA was losing money on swaps even before the crisis, with total losses running in the "hundreds of millions" of dollars. In Charlotte, site of the Democratic Convention, the study suggests that swaps with Bank of America and Wells Fargo cost the area transit system almost $20 million a year – something to think about as the President gives his scheduled acceptance speech at Bank of America Stadium. Other localities that the study suggests are wracking up big annual losses include Chicago ($88 million), Detroit ($54 million), frugal Chris Christie's State of New Jersey ($83 million), New York City ($113.9 million), Philadelphia ($39 million), and San Francisco ($48 million). The study includes a useful table of the main banks benefiting from these arrangements. They include all the usual suspects: Besides Bank of America and Wells Fargo: Citigroup, Morgan Stanley, Goldman Sachs, J. P. Morgan Chase, UBS, and AIG, among others. Most were recipients of TARP funds, while all have profited from super cheap Federal Reserve financing, Fed, Freddie, and Fannie purchases of mortgage backed securities, and extended deposit guarantees as well as tax concessions granted by the Treasury in the wake of the 2008 disaster. Given all the other advantages conferred on our Too Big To Fail Banks by the government and both major political parties, it would be a stretch to argue that the toleration of these swaps by federal, state, and local authorities – and the press, which in virtually all areas has defaulted on reporting the basic facts – constitutes the greatest outrage of all. But it is high time that they came in for full public scrutiny. These products were obviously very risky; few agencies that bought them appear to have understood this. Despite some reforms aimed at eliminating crude "pay for play" deals, state and local finance remains a area rife with conflicts of interest. The whole series of deals needs to be investigated, the advisers who recommended them to the authorities need to be identified, the full losses added up, and responsibility fixed for the continuing series of bad decisions. Many State Attorneys General and general counsels also need to explain why they have not more aggressively publicized these arrangements and challenged them in court. (A New York court ruled that such deals were private contracts, not securities; that should have brought forth howls of protests and immediate legal fixes.) It is high time citizens, instead of banks, start occupying the transit authorities, school boards, and other state and local entities that are so vital to communities and real people. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| VB Update Notes for June - July 2012 – Help is on the Way Posted: 12 Jun 2012 05:24 AM PDT HOUSTON – We begin this VB Roundup update with the notion that bear markets do not last forever. They just seem like they do in real time. The worst bear markets can last far longer and do more damage than all but the most grizzled veteran Vulture traders are mentally prepared for. That applies to even the Big Miners as we have all seen, but smaller, less liquid and more speculative issue bears can take that same idea to wild extremes. (We are all witness to that too, are we not?) Our best case in point today is the Canadian Venture Exchange Index or CDNX which is still grinding out either a bear consolidation or a sure-enough bottom formation as shown in the simple chart below. The figurative jury is still out deliberating the bottom verdict evidence, but all of the evidence is no longer all one way (no longer all bearish). Consider for example the "V" shaped, bottom looking formation evident in the much larger, Big Cap Miners that populate the AMEX Gold Bugs Index or HUI. (By the way Grant Williams reminds us that the "Bugs" part stands for "Basket of Un-hedged Gold Stocks"). The "jurors" have a possible capitulation to deliberate for the 'Bigs' after a stunning, confidence destroying nine-month plunge from the HUI of as much as 41.6% (a HUGE plunge for such a large index). And not one of the jurors likely appreciates that the HUI has already recovered as much as 24% since the April near-panic nadir of 372.74, but the HUI has bounced that much, believe it or don't. Or the jurors can consider the further 'evidence' of the CDNX's arguably larger cousin, the Market Vectors Junior Gold Miners Index ETF or GDXJ now showing a promising "V Bottom" looking formation following a blood curdling cascade sell down which loped off as much as a nasty 43% just since February; part of an overall 56.9%, 14-month whipping for the small and mid-tier miner ETF. (GDXJ chart next page.) Did we say "whipping?" That's more than a whipping – it's a crash. All of us involved for the past 14 months have been involved in a slow-motion, teeth-grinding crash of historic proportions. We are part of history. (Small consolation to many, we know.) It was not very long ago that neither of those two "relatives" of the CDNX showed any "help" or evidence to support the case before the "CDNX bottom jury." Now both do. So the jury has more evidence to consider than just the 14-month wicked price drubbing for The Little Guys. We haven't overlooked the fact that this is June which is typically a month of poor price action and even poorer liquidity for The Little Guys and likely neither will our figurative jury. We haven't overlooked the fact that volume for the CDNX remains abysmal, more in keeping with a buyer's strike than a more friendly volume reversal. But we do try to keep in mind that buyer's strikes and extended periods of very low volume are when some of the best buying ops arrive. We do try to keep in mind at all times that The Little Guys are some of the most volatile, most dangerous stocks to trade there are. But, having done this Vulture Bargain Hunting gig for longer than we care to admit, we can hunker down and weather protracted, brutal, wicked, seemingly insane bear market Negative Liquidity Events (NLE's) with the best of them. Second Coming of the Market From Hell Not incidentally, the current bear for the CDNX is officially the second longest period of consistent weakness since 2001 – the bottom of the 20-year gold bear market. If we mark the beginning of this (CDNX) NLE as March, 2011, it has begun its 15th month (unless the bottom proves to have been in May, in which case it was 14 months). By comparison, the all time worst value and confidence destruction for the CDNX began in March, 2007 and didn't end until it "V Bottomed" in December, 2008 – a 21-month, nearly 80% bone crushing market from hell. Versus the 2007-08 debacle, the current NLE example is a close second any way one wants to measure it. Value destruction: 79.9% versus today's 50.7%. Time: 21 months versus today's 15 months. Fear: Armageddon versus Europe-ageddon. Sentiment: Rotten on both score cards... We'll stop there because the point is made. Gigantic, value destroying, confidence crushing cascade style full-blown bears are, as one might expect, pretty rare, but we Vultures have been given two of them in a very short time frame (just four years apart). People have spent entire careers on Wall Street without ever getting the kind of value devastating events we have been given to work with. (Although they do seem to occur with the Little Guys more frequently than with the Big Markets to be fair.) From a Vulture point of view, it doesn't get very much better than this, though, in terms of volatile opportunity. The Little Guys have so far not convincingly broken the uber low volume bear yet. That's the bad news. But the news is no longer 'all bad.' The signs and signals we (and our fantasy bottom jury) review are no longer all terrible, as they were a month or two months ago. ... We sure would hate to put a hex or jinx on a potential burgeoning bottom-looking rally for the CDNX ... so we'll just say, as we did on May 18 that it looks like to us that 'Help is on the Way' and leave it at that. Oh, the good news? This super buying op has been so "good" that we find ourselves running low on the ammunition we devote to this sub-sector for (at least) the second time. In December of 2011 we increased our Little Guy ammunition by 50% to take advantage of deals we never thought we would see with gold above $1,500 the ounce. Then, the deals got even better in April, prompting us to sell some of our gold in the $1,640s to put some firepower back into our Little Guy magazine, which we've whittled down to not all that much left as of the beginning of June. Why is that good news? Well, we are unlikely to increase our firepower again for this space, unless the buying gets so incredibly cheap that we just cannot resist it and then we'll think long and hard before we sell any more metal or sell something else to add more of the miners or explorers. So the "good news" is that for all intents and purposes and subject to extreme, insanely cheap opportunities that even we cannot imagine, we are as close to "all-in" as we are going to get with The Little Guys. Let's pause here and move directly into the Vulture Bargain (VB) Roundup update for June- July, 2012. *** As always, the first place to look for new commentary is directly in the charts themselves (available to Subscribers). As we have been saying frequently in these reports, moving forward the charts will become more and more the focus and these formerly too-long written reports less and less the focus. This current issue is the first in a new, less wordy, and shorter format in direct response to our consistent member feedback. This is the first iteration of the new format, so bear with us – it is likely not the final form. To continue reading, please log in or click here to subscribe to a Got Gold Report Membership | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Why Warren Buffett is Loading Up on Tungsten Posted: 12 Jun 2012 04:14 AM PDT Although he says he doesn't want to own gold, the world's most famous investor has taken a shine to what may be the most precious metal of the 21st century – tungsten. The world is running out of it and that spells opportunity for savvy investors. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Jun 2012 04:03 AM PDT

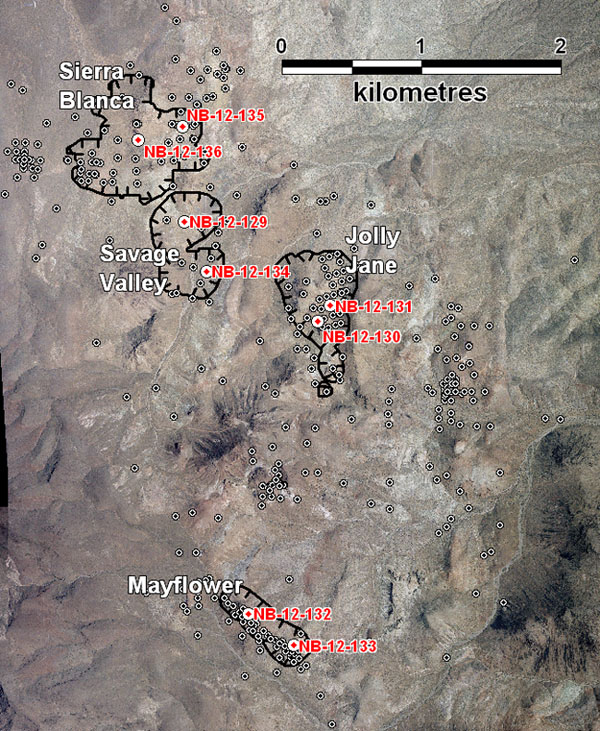

Vancouver, B.C…. Corvus Gold Inc. ("Corvus" or the "Company") – (TSX: KOR, OTCQX: CORVF) is pleased to announce results from a series of large diameter diamond drill holes within the current resource designed to provide materials for advanced metallurgical testing for its North Bullfrog Project in Nevada (Figure 1). The initial Preliminary Economic Assessment (NR 12-07, Feb 28, 2012) outlined indicated resources of 19.5M tonnes at 0.32 g/t gold and inferred resources of 123.3M tonnes of 0.23 g/t gold. Materials from these metallurgical holes will be used for a program of column testing to model the heap leach performance and gold recovery at the project. Large diameter column tests reported earlier this year showed an average gold recovery of 70% at the Sierra Blanca area and 64% at the Jolly Jane area (NR 12-02, Jan 17, 2012). Results are pending from additional holes on the Yellow Jacket high-grade gold and silver zone and a series of large diameter core holes at the Mayflower deposit. Jeff Pontius, Corvus Gold CEO states: "The core drilling displays the quality of the resource at North Bullfrog and the column testing will allow us to develop a more precise processing flow sheet to optimize this large oxide heap leach resource as we move this project toward mine development". Table 1

*Intercepts calculated with 0.1 g/t cutoff and up to 3.7 m of internal waste.

Figure 1: North Bullfrog Project area showing the location of metallurgical holes reported in this release. For reference, the locations of the current resource as outlined in the Preliminary Economic Assessment (NR 12-07, Feb. 28, 2012) are shown. The current North Bullfrog program drilling is focussing on infill and step out drilling, advanced metallurgical work and environmental baseline characterization studies in conjunction with a completion of a feasibility study by early 2013 on the Mayflower deposit. The recently completed financing has now provided the Company with the financial resources needed to rapidly advance the mine development assessment of the North Bullfrog area as well as continued exploration of this major new high-grade Nevada gold discovery. About the North Bullfrog Project, Nevada Corvus controls 100% of its North Bullfrog Project, which covers approximately 43 km² in southern Nevada just north of the historic Bullfrog gold mine formerly operated by Barrick Gold. The property package is made up of a number of leased patented federal mining claims and 461 federal unpatented mining claims. The project has excellent infrastructure, being adjacent to a major highway and power corridor. The Company and its independent consultants completed a robust positive Preliminary Economic Assessment on the existing resource in February 2012. The project currently includes numerous prospective gold targets with four (Mayflower, Sierra Blanca, Jolly Jane and Connection) containing an NI 43-101 compliant estimated Indicated Resource of 15 Mt at an average grade of 0.37 g/t gold for 182,577 ounces of gold and an Inferred Resource of 156 Mt at 0.28 g/t gold for 1,410,096 ounces of gold (both at a 0.2 g/t cutoff), with appreciable silver credits. Mineralization occurs in two primary forms: (1) broad stratabound bulk-tonnage gold zones such as the Sierra Blanca and Jolly Jane systems; and (2) moderately thick zones of high-grade gold and silver mineralization hosted in structural feeder zones with breccias and quartz-sulphide vein stockworks such as the Mayflower and Yellowjacket targets. The Company is actively pursuing both types of mineralization. A video of the North Bullfrog project showing location, infrastructure access and 2010 winter drilling is available on the Company's website at http://www.corvusgold.com/investors/video/. Qualified Person and Quality Control/Quality Assurance Jeffrey A. Pontius (CPG 11044), a qualified person as defined by National Instrument 43-101, has supervised the preparation of the scientific and technical information (other than the resource estimate) that form the basis for this news release and has approved the disclosure herein. Mr. Pontius is not independent of Corvus, as he is the CEO and holds common shares and incentive stock options. Mr. Gary Giroux, M.Sc., P. Eng (B.C.), a consulting geological engineer employed by Giroux Consultants Ltd., has acted as the Qualified Person, as defined in NI 43-101, for the Giroux Consultants Ltd. mineral resource estimate. He has over 30 years of experience in all stages of mineral exploration, development and production. Mr. Giroux specializes in computer applications in ore reserve estimation, and has consulted both nationally and internationally in this field. He has authored many papers on geostatistics and ore reserve estimation and has practiced as a Geological Engineer since 1970 and provided geostatistical services to the industry since 1976. Both Mr. Giroux and Giroux Consultants Ltd. are independent of the Company under NI 43-101. The work program at North Bullfrog was designed and supervised by Russell Myers (CPG 11433), President of Corvus, and Mark Reischman, Corvus Nevada Exploration Manager, who are responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project log and track all samples prior to sealing and shipping. Quality control is monitored by the insertion of blind certified standard reference materials and blanks into each sample shipment. All resource sample shipments are sealed and shipped to ALS Chemex in Reno, Nevada, for preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for assaying. ALS Chemex's quality system complies with the requirements for the International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and precision are monitored by the analysis of reagent blanks, reference material and replicate samples. Finally, representative blind duplicate samples are forwarded to ALS Chemex and an ISO compliant third party laboratory for additional quality control. McClelland Laboratories Inc. prepared composites from duplicated RC sample splits collected during drilling. Bulk samples were sealed on site and delivered to McClelland Laboratories Inc. by ALS Chemex or Corvus personnel. All metallurgical testing reported here was conducted or managed by McClelland Laboratories Inc. Corvus Gold Inc. is a resource exploration company, focused in Nevada, Alaska and Quebec, which controls a number of exploration projects representing a spectrum of early-stage to advanced gold projects. Corvus is focused on advancing its 100% owned Nevada, North Bullfrog project towards a potential development decision and continuing to explore for new major gold discoveries. Corvus is committed to building shareholder value through new discoveries and leveraging noncore assets via partner funded exploration work into carried and or royalty interests that provide shareholders with exposure to gold production.

On behalf of (signed) Jeffrey A. Pontius Contact Information: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| So Far, Facebook IPO Has Had No Significant Impact On Housing Market Near HQ Posted: 12 Jun 2012 04:01 AM PDT By Dr. Duru: Last week, Zillow (Z) published an infographic on its blog site purportedly describing the impact of the Facebook (FB) IPO on home listings in the local neighborhood of its Menlo Park headquarters (see Millionaire's Row: How Did Facebook's IPO Affect Silicon Valley Real Estate?). The summary caught my attention:

However, even a casual glance at the infographic makes one doubt there was any impact at all. Facebook filed its IPO in Complete Story » | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Has gold gone as low as it will this year? Posted: 12 Jun 2012 03:43 AM PDT I was hoping it would get down below $1500/oz. and thought with the Eurozone in crisis, it probably would. But now I just don't know. The guy at CNI said they "expect price to move up" and ONLY up from here on out. Does that sound right to you? I'm confused... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Deposits Of USD 1 Billion To Be Collected By Turkish Bank Posted: 12 Jun 2012 03:43 AM PDT gold.ie | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold Back Above $1600 as Italy 'May Also Need Rescuing' Posted: 12 Jun 2012 01:12 AM PDT Bullion prices on the wholesale gold market rose back above $1,600 an ounce shortly before Tuesday's US trading, after failing to breach that level in the earlier Asian session, while European stock markets also ticked higher after a quiet morning's trading. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 12 Jun 2012 01:05 AM PDT

from goldmoney.com: The "EUphoria" from the weekend's Spanish bailout died out quickly yesterday, following news that Italy's GDP fell 0.8% during Q1. Concerns that Italy is heading for the same rocks that the stricken ships SS Hellas and Iberia struck sent stocks lower, with the Dow closing down 1.1%. Ten-year Italian government bond yields crept into the dangerzone above 6% this morning, but have retreated back below this level since (perhaps as a result of the European Central Bank massaging the bond market). Platinum and palladium prices continue to drift lower with weakening industrial sentiment, but gold and silver are holding firmer, though for the moment gold remains capped at "round-number" resistance at $1,600. Italy is in some respects in a stronger economic position than Greece or Spain. Though its government debt is around 123% of GDP (second only to Japan among major economies) its deficit is only around 2.4% of GDP – much lower than in Greece, Spain, Portugal, Ireland or France. In the UK and US this figure is closer to 10%. Italian private debt as a percentage of GDP is also much lower than in Spain, the UK or US. Keep on reading @ goldmoney.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkish Bank to Collect $1B of Gold Deposits Posted: 11 Jun 2012 11:25 PM PDT Gold fell initially in Asia before trading sideways and this range trading has continued in European trading. Gold edged higher Tuesday after hopes were dashed that Spain's bank bailout would be the panacea that would lead to alleviating the euro-zone debt crisis. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| T&S: Desperate World, Silver Analysis, & More Posted: 11 Jun 2012 11:22 PM PDT The Spanish bailout isn't what it is made out to be – what a surpruse huh? The level of desperation must be getting rather high because it is now starting to blatently not maske sense what we are reading in the media. I also cover long term silver analysis and one financial investment I plan to make soon. from mrthriveandsurvive: ~TVR | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Update: Cry Argentina – 6.11.12 Posted: 11 Jun 2012 11:19 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The End of Cheap Everything: Ron Hera Posted: 11 Jun 2012 10:27 PM PDT For his money – and the portfolio he offers investors is also his own – the founder of Hera Research, wants uniquely good companies. Hera shares why he is bullish on gold, finds silver volatile but worth investment and encourages new investors to dig a little. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Platinum industry investigation already underway – Shabangu Posted: 11 Jun 2012 10:21 PM PDT

from mineweb.com: Resources minister, Susan Shabangu, has tasked a team at the resources ministry to look into the barrage of problems currently facing the South African platinum sector. Shabangu said that she had commissioned a report on the challenges currently facing the sector and potential solutions to address the situation and that the completed report is waiting for her on her desk at the ministry. Shabangu is mindful and concerned with regards the prevailing conditions and said that the next step after considering the report would be to engage stakeholders in the industry. The minister made particular reference to road shows held when the South Africa gold sector encountered its own difficulties. Keep on reading @ mineweb.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not the end of gold and silver bull markets; bargains abound – Berry Posted: 11 Jun 2012 10:18 PM PDT

from mineweb.com: The Gold Report: The Gold/Philadelphia Gold and Silver Index (XAU) ratio recently surpassed its high in 2008, slightly crossing 11 and peaked in the high 10s at the bottom in 2008. Do you think we have put in a bottom? Michael Berry: If I were 100% sure, I would be a very wealthy person. I think we're close to a bottom here. Gold is too important. The long-term secular bull markets, such as we've seen in gold and silver and in fact in many of the metals, do not end this way. They end with a parabolic move upward. That is why I don't think this is the end of the gold bull market at all. I think it's probably a welcome reprieve. But ultimately, if we are not at the bottom, we're fairly close to it. TGR: You testify to the Federal Reserve Board twice a year. In the last meeting, was there any indication of more easing on the way? Keep on reading @ mineweb.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold coin collecting a deadly business as metals prices rise Posted: 11 Jun 2012 10:14 PM PDT

from mineweb.com: As gold and silver prices have soared, thieves are now targeting rare coins, coin collections and rare coin dealers. The Washington Post noted in a recent article, "Coin thieves are often part of organized rings, some from Colombia and others with ties to the Russian mafia, that orchestrate sophisticated, lightning-quick and sometimes ruthlessly violent heists, according to the Numismatic Crime Information Center." Steve Ellsworth, a coin security expert, told the Post, "Why rob a bank with cameras, witnesses and a good chance your picture will end on up the evening news? Coin thefts often don't have witnesses, and criminals can make off with far more money." The FBI estimates only about 4% of stolen precious metals and jewelry is recovered annually. Keep on reading @ mineweb.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buy A House and Put Nickels In It Posted: 11 Jun 2012 10:02 PM PDT

from whiskeyandgunpowder.com: "Why are you throwing away your money on rent?" we were often asked between 2004 and 2006. "You could be making a killing right now if you were buy a house." Long-suffering readers know that their Whiskey editor opted to stock up on silver instead of real estate in those critical years. It was clear to us that silver was ridiculously undervalued. We greedily bought up the shiny metal at bargain single-digit prices. Meanwhile the whole housing thing seemed awfully frothy. Manic even. And we understood that some very non-free market forces were driving real estate higher and higher. We opted to sit it out. Especially when we realized that it was cheaper to rent a place than buy a comparable property. Combine that with the near-inevitability of a painful bust and we were only too happy to look like fools for sitting out and just renting our living space. Keep on reading @ whiskeyandgunpowder.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Jun 2012 09:57 PM PDT

from harveyorgan.blogspot.ca: Good evening Ladies and Gentlemen: Gold closed up today by $5.40 to $1595.50. Silver added 14 cents to $28.60. Before heading into those stories and others, let's travel to the comex and see how trading fared on this first day of the week: Keep on reading @ harveyorgan.blogspot.ca | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| World Chaos Erupting as Governments & Institutions Collapse Posted: 11 Jun 2012 09:42 PM PDT

from kingworldnews.com: With mounting worries about the financial systems of Europe and the US, 40 year veteran, Robert Fitzwilson wrote the following piece exclusively for King World News. Fitzwilson is founder of The Portola Group, one of the premier boutique firms in the United States. Here are Fitzwilson's observations: "The financial markets continue to show extreme volatility as the various institutions and governments deal with the end of their respective roads. The announcement regarding the bailout of the Spanish banks created euphoria as markets opened around the world, but the euphoria quickly dissipated. Governments, economies and societies are converging on a common dead end, and it is a dead end of historic proportions." Robert Fitzwilson continues: "In the U.S. markets, the Dow Jones Industrial Average saw a high of 12,650, but finished near the low at 12,398, a swing of about 250 points. The bailout, as presented, was to provide a sum that does not exist based upon a document that has not been created and has yet to be agreed upon, finalized and signed. On top of that, other countries, such as Ireland, are now wanting to renegotiate their prior bailout to make the terms comparable to those Spain received. Keep on reading @ kingworldnews.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turk – Capital Controls, Bank Bailouts & Escalating Fear Posted: 11 Jun 2012 09:40 PM PDT

from kingworldnews.com: With continued volatility in major markets, as well as gold and silver, today King World News interviewed James Turk out of Europe. Turk discussed the capital controls being proposed in Europe, bank bailouts and escalating fear, but first, here is what Turk had to say about the recent action: "It has now been 16 trading days since the May low, Eric, which means that the base being formed in the precious metals is getting stronger with each passing day. Importantly, prices have been moving away from the May low, with both gold and silver up more than 4% since then." James Turk continues: "These are exceptional gains for such a short period of time, but sentiment remains at rock bottom. One reason for the miserable sentiment is that the gold price has fallen half of the trading days since the May low. The same for silver, and some of the daily price declines have been huge, which really affects sentiment negatively. Keep on reading @ kingworldnews.com | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Jun 2012 09:33 PM PDT ¤ Yesterday in Gold and SilverThe dollar index did about a 70 basis point face plant at the open of trading on Monday morning in the Far East...Sunday night in New York. The gold price blasted higher, but ran into a not-for-profit seller within twenty minutes...and it took them about four hours to beat the price back to below the $1,600 spot price mark. Volume in the first four hours of trading was three or four times normal for that time of day...and week, so it was obvious that JPMorgan et al had their hands full getting the price back under control. The gold price managed to sneak back above that price by shortly after 3:00 p.m. Hong Kong time...but then got sold down during early trading in London. Gold rallied a bit starting about 11:30 a.m. BST...and then got sold off again at the open of the equity market in New York at 9:30 a.m. Eastern...a pattern we've seen lots of times before over the years. I'll have more to say about that in 'The Wrap'. The New York low...$1,581.00 spot...came at the London p.m. gold fix. Gold made it back above $1,600 for a very few minutes around 3:40 p.m. Eastern time in the thinly-traded electronic market, but then got sold off below that by the 5:15 p.m. Eastern close. Gold closed at $1,596.10 spot...up a whole $1.40 on the day. One can only imagine what price it might have closed at if it wasn't for the obvious interventions. Net volume was decent at around 114,000 contracts...and would have been much, much lower if you were to subtract the volume in the first couple of hours trading in the Far East. Silver blasted through the $29 spot price mark like a hot knife through butter...but it didn't take long for the 'day boyz' to get silver back below that number...and it barely got a sniff of it again for the rest of trading day on Monday. Also note the obligatory sell-off at the 9:30 a.m. Eastern open as well. Silver rallied into the end of Comex trading...and then mostly traded sideways into the close of electronic trading. Silver's New York low was also at the London p.m. gold fix...and that price was $28.23 spot. From its Far East high to its New York low, silver intraday move was over a dollar. Silver finished the Monday trading session up a whole nickel from Friday. It would have obviously done much better if it had been left to its own devices. Net volume was around 28,000 contracts. Platinum and palladium also moved very sharply higher on Sunday night as well, but neither metal got sold off much at the open of New York trading. Gold closed up 0.09%...silver closed up 0.18%...platinum closed up 0.91%...and palladium finished up 0.82%. At one point, platinum was up over 2%...and palladium up over 3.0%...before getting sold off. As I stated in the opening sentence of this column..."The dollar index did about a 70 basis point face plant at the open of trading on Monday morning in the Far East...Sunday night in New York." The dollar index stayed down until its low of about 81.79 which came about 2:50 p.m. Hong Kong time. From there, the index went into rally mode...and by the close of trading in New York was up a bit over 20 basis points from Friday's close. The dollar index low corresponded almost exactly with gold's second breakthrough of the $1,600 spot price mark. But that doesn't alter the fact that if JPMorgan et al hadn't bombed gold and silver prices at the open on Sunday night...and killed them again at the open of the New York equity markets, both [along with platinum and palladium] would have finished materially higher, regardless of what the dollar index was doing. It's that simple...and that obvious. Despite the fact that gold got sold off hard at the 9:30 a.m. open of the N.Y. equity markets, the gold stocks opened in positive territory, with a low coming at the 10:00 a.m. Eastern time London p.m. gold fix. The absolute low for the stocks came around 11:15 a.m. Eastern time, even when the low for gold was at the gold fix...something you don't see too often. Despite the fact that gold worked its way back into positive territory, the stocks didn't follow...and rolled over about 1:40 p.m. Eastern time...and came close to finishing on their lows of the day. The HUI finished down 1.46%. The Dow also began rolling over at the same time, so it's entirely possible that the gold stocks got sold off along with everything else. The silver stocks didn't do particularly well, either...and Nick Laird's Silver Sentiment Index closed down 2.32%. (Click on image to enlarge) The CME's Daily Delivery Report showed that 26 gold and zero silver contracts were posted for delivery tomorrow. There were no reported changes in either GLD or SLV on Monday. The U.S. Mint had a sales report. They sold another 3,500 ounces of gold eagles...500 one-ounce 24K gold buffaloes...and 158,500 silver eagles. It was a quiet day over at the Comex-approved depositories on Friday. They only reported receiving 82,335 troy ounces of silver...and shipped 30,696 ounce of the stuff out the door. Well, I knew it was going to happen sooner or later...and it finally did over the weekend. Enough of Ted Butler's paying subscribers have now complained about all the 'free stuff' that I was giving away on Tuesday and Thursday in this space that I am no longer allowed to post any information from Ted's bi-weekly column. That's too bad, as consider Ted to be THE best silver analyst on Planet Earth by a country mile...and I've thought so from the time I read his first essay when it was posted over at the gold-eagle.com Internet site over twelve years ago. To be able to share some of his insights into the inner workings of the silver market was always a bonus in this column...but sadly, no longer. Now you have to pay for it...and if you're interested, the link to his website is here. Here are a couple of charts for you. The first is from newsletter writer, Grant Williams, whose commentary is always entitled "Things That Make You Go Hmmm...". Australian reader Wesley Legrand stole it from his latest column...and here it is. The chart is self-explanatory. The second is from Washington state reader S.A...and it doesn't need any embellishment from me, either. I have the usual number of stories for a Tuesday...a lot...and the final edit is up to you. The 9:30 a.m. smack-down for both gold and silver was no surprise, as that is one of their favourite times to do the dirty. Sinclair sees U.S., gold banks battling central banks that need more gold and less paper. Reserves in ground make gold stocks incredibly cheap - Don Coxe. Brave Enough to Buy Low: Louis James. ¤ Critical ReadsSubscribeFamily Net Worth Drops to Level of Early '90s, Fed SaysThe recent economic crisis left the median American family in 2010 with no more wealth than in the early 1990s, erasing almost two decades of accumulated prosperity, the Federal Reserve said Monday. A hypothetical family richer than half the nation's families and poorer than the other half had a net worth of $77,300 in 2010, compared with $126,400 in 2007, the Fed said. The crash of housing prices directly accounted for three-quarters of the loss. Families' income also continued to decline, a trend that predated the crisis but accelerated over the same period. Median family income fell to $45,800 in 2010 from $49,600 in 2007. All figures were adjusted for inflation. The new data comes from the Fed's much-anticipated release on Monday of its Survey of Consumer Finances, a report issued every three years that is one of the broadest and deepest sources of information about the financial health of American families. No surprises here. This story was posted in The New York Times yesterday...and I thank reader Phil Barlett for sending it along. The link is here.  North Dakota voters to decide on abolishing property taxNorth Dakota voters will decide Tuesday on the ultimate tax revolt: abolishing the property tax altogether. A citizen-led petition drive has put the daring, all-or-nothing proposal before the voters in a state flush with tax revenue, jobs and prosperity generated by an oil boom. If the property tax is eliminated, it would be the first time since 1980 — when oil-rich Alaska got rid of its income tax — that a state has discontinued a major tax, reports the Tax Foundation, a non-partisan research group. North Dakota would become the only state not to have a property tax, a levy the state has had since before it joined the union in 1889. "The oil boom makes it easier to get rid of the tax, but we started this before the oil boom took off," said Charlene Nelson, chairman of Empower The Taxpayer, which is leading the tax repeal effort. "Any state would benefit from this same thing." This story was posted on the usatoday.com Internet site late yesterday evening...and I thank Washington state reader S.A. for bringing it to my attention. The link is here.  Debt crisis: Spain requests bailout to save banksSpain is asking for an international bailout to rescue its debt-laden banking sector, its finance minister announced tonight, as sources suggested the package could total £81 billion. "Since the funds will be asked for to attend to the financial sector's needs, it has been agreed with the eurogroup that it will be specifically for the financial system only." No economic or fiscal reforms are attached. He did not give a figure but said the results of independent valuations of the Spanish banking sector's needs will be made public later this month. The eurozone's bailout fund will be used to receive and disburse the money, he added. This story was posted on the telegraph.co.uk website early Saturday evening...and it's worth skimming. It's no surprise that it's a Roy Stephens offering...and the link is here.  Spanish debt crisis: 'fear of a bank freeze is palpable'Savers in Spain can find their banks refusing to hand over their money, even if it is held in an instant-access account, thanks to changes to terms and conditions introduced by the government. Should you want to see the real effects of the Spanish debt crisis, the Pluton Bar in Sant Pol de Mar, Catalonia, is a good place to start. Over morning coffees, customers discuss sovereign defaults, credit spreads and a possible euro exit. There is certainly plenty to talk about – and complain about too. Local property taxes are set to rise by 15pc, on top of recent state income and capital gains tax increases. The national tax increase is supposed to be temporary, but no one believes rates will come down any time soon. Banks also come in for a lot of stick. A local restaurant owner complained that her savings bank manager refused to let her take €30,000 out of her account. The money was needed to get the restaurant ready for the summer rush. New small print lets the bank block withdrawals, even on instant-access accounts. It took two weeks for the bank to relent. Apparently, it could block savings for two years if it wanted. This is another Roy Stephens offering from The Telegraph, this one from early yesterday morning. The link is here.  Debt crisis: EU contradicts Rajoy and says Spain will be supervisedSpain faces supervision by international lenders after a bailout for its banks agreed at the weekend, EU and German officials said, contradicting Prime Minister Mariano Rajoy who had insisted the cash came without such strings. Mr Rajoy said on Sunday that Madrid had scored a victory by securing aid from eurozone partners without having to submit to a full state rescue programme, saying Spain's rescue had "nothing to do" with the procedures imposed on Greece, Ireland and Portugal. But EU Competition Commissioner Joaquin Almunia and German Finance Minister Wolfgang Schaeuble said that as in those other bailouts, a "troika" of the International Monetary Fund, the European Commission and the European Central Bank would oversee the financial assistance. "Of course there will be conditions," Mr Almunia told Spain's Cadena Ser radio. "Whoever gives money never gives it away for free." This story was posted on The Telegraph website at 2:45 p.m. BST...and I thank Roy Stephens for sending it along. The link is here.  Ireland wants rescue deal negotiated to match Spain'sIreland wants to renegotiate its rescue plan to benefit from the same treatment as Spain, which looks set to win a bailout for its banks without any broader economic reforms in return, European sources said on Saturday. "Ireland raised two issues: one is the need to ensure parity of the deal with Spain retroactively on its bailout from EFSF," one European government source told AFP, referring to the temporary rescue fund, the European Financial Stability Facility. Another European government source confirmed the information. This AFP story was picked up by the france24.com website on Saturday...and it's a piece I borrowed from yesterday's edition of the King Report. The link is here.  The World from Berlin: Spain Bailout 'Won't Buoy Sentiment for Long'The hastily arranged bailout of Spain's banks on the weekend won't calm financial markets for long, write German commentators on Monday. The move exposed shortcomings in Europe's crisis-management system and is already being overshadowed by the make-or-break election in Greece next week, they say. After Greece, Ireland and Portugal, Spain became the latest -- and largest -- euro zone member to seek aid in the debt crisis at the weekend, the only difference being that the money will be confined to recapitalizing its ailing banks, and will not involve the humiliation of European Union or International Monetary Fund controllers being dispatched to Madrid to make sure the government is doing its homework. After month of refusing assistance, the Spanish government swallowed its pride following massive pressure from its partners, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 11 Jun 2012 09:21 PM PDT Below I give my forecast as I see it from the charts at the end of the day June 7. Dow Jones Industrial Average: Closed at 12460.96 +46.17 as markets started to have a good day, but then were hit with non-advice from Ben Bernanke, who was busy testifying before a committee. The shares were doing better, but since they got no hint of QE-3, but instead were told things are just being watched, investors decided to sell-off and sit back and wait some more. However, this week, we have posted two solid days of recovery gains on higher than normal volumes at about +112% for Wednesday and Thursday. New support is the important 200-day average at 12,464.06 with close resistance at 12,500. These markets need two things: (1) Some kind of a satisfaction Spain is being helped and won't crash, at least for now and, (2) The idea Mr. Bernanke is going to get busy with QE-3 to liquefy these shutting down credit markets. Momentum has based and has turned higher. For Friday, we forecast a mild upside in trading to 12,500 resistance with potential for more buying pressure on Monday. This market has been oversold from a recent high above 13,250 down to 12,000 lower support. Expect new trading toward 12,750 resistance next week. S&P 500 Index: Closed at 1314.99 -0.14 on 110% of normal volume and based momentum preparing to rise. The close was two points above the 200-day moving average providing solid support. Trading closed where it opened offering a negative trading pattern. However, despite this, we see new buying on Friday adding maybe ten points for the day. Trading came up and out of the technical bear flag pattern. Next week, buying pressures could take price to the 50-day moving average at 1341.35 with interim resistance on the 20-day average at 1319.17. S&P 100 Index: Closed at 600.60 +0.47 on 105% of normal volume and based and rising momentum. The price is doubly supported by the 200-day moving average at 595.19 and today's closing price of 600.00 plus. Further, this week, the price moved-up and out of a bear flag pattern and has now gained new higher support on the top channel line of that bear flag. This means the big stocks have strong support and should now trade up to the 50% retracement near 615 resistance, next. We might not get there yet on Friday, but I would think the Monday close would be on 615 new support, or higher. Nasdaq 100 Index: Closed at 2535.41 -10.91 on based and rising momentum, normal volume and a close far above the 200-day moving average at 2488.92. Further, we had two price gaps higher this week and a close above the bear flag and previously falling prices. The recent problems at Facebook have been a negative along with other litigation among tech companies but overall, the tone is one saying buy most of these stocks. Next higher resistance is the 20-day average at 2547.56, which is our next objective. After that price is broken, we should see a bull move toward 2650 on a bull retracement. The 50-day moving average at 2593.44 is resistance, but our price should go there and resist followed by higher trading action to 2650 over a few days. 30-Year Bonds: Closed at 148.47 -0.76 on peaked and turning down momentum. The price is above all moving averages, which is bullish. However, the top has been touched and we are now selling with the latest expectations Europe's credit problems are temporarily repaired; especially in Spain. We agree with this and forecast more bonds selling. However, understand that this market is massively manipulated on all continents throughout the world, particularly in Europe, the United States and throughout the ECB hemisphere. Bonds have new support on the 20-day moving average at 148.03. They also have support near that price above an up-trending channel line. Bloomberg reported today that Spain's banks could report losses of up to US$112 billion. As we reported in our newsletter this week, statements were made that the credit machinery in Europe is not able to contend with this huge problem, nor do they have the resources to do so. Expect the bonds to sell mildly toward 145.50-146.50 support as stocks begin to rise on Friday and during next week. XAU: Closed at 161.14 -4.55 on rising momentum and a recently rising, very accurate metal to shares ratio. That ratio went up with gold, but has now gone sideways flat, but remains supported for now. The close was above the 20-day average at 158.35. The 50-day average at 162.56 is nearby resistance. The 200-day average, the most important of all, is way higher at 181.87. We expect price congestion in this market until the middle of June to be followed by another rally in the precious metals and the XAU. That rally could last until the end of July on the cycles and calendar. The following subsequent low should than occur in early August followed by another higher rally leading gold and silver higher. We probably won't get much more upside in the XAU until the end of June, but July could take us up to the 200-day moving average resistance at 181.87-185.00-190.00. For now we are stuck sideways in chop until gold gets moving higher. Gold: Closed at 1590.50 -29.40 on rising but smothered momentum. This month of June should be flat to down for gold all the way to nearly July 1st. The new buying could begin earlier but we doubt it. The fumbling and stalling around in Europe with the ECB and Spain plus those non-decisions from the Federal Reserve creates non-directional, choppy markets. Mr. Bernanke is going to have to do something, but the pressures are manageable for now. He would prefer to get closer to the election before having to announce QE-3 to make the administration look good. Gold is supported at 1575 with a trading top in the new lower range of 1608. Traders and investors are going to have to continue to be patient and wait for some better moves in July and August. Silver: Closed at 28.63 -0.78 on mildly rising momentum with resistance on the 20-day moving average at 28.70. The 50-day at 29.80 and the 200-day at 31.96 are higher and more formidable resistance. Silver has already produced a bull double bottom in December, 2011 and in May, 2012. With this month being weaker, we could see another bull double bottom with silver support as low as $26.48. Do not despair as the price should be negative in chop until the end of June followed by a new rally taking our price to at least $38.18 by mid-August or early September. Our forecasts for the 4th quarter of 2012 and the first quarter of 2013 are pure mayhem for all the reasons we have reported in our alerts, newsletter, conference speeches, and on the radio. The recent rising silver prices have peaked and should be selling in chop through the end of June, 2012. US Dollar: Closed at 82.23 +0.04 on rising but peaked and turning down momentum. The dollar got above 83.00 plus briefly, but has now fallen below the rising trend line, which is bearish. However, the currencies should now move slow in chop for most of this summer. Normal calendar trading action taking the price out of the doldrums usually happens at the end of August. On the intermediate view, the dollar should sell back mildly toward 80.00 major support and resistance. Any perceived out of control credit messes in European nations, or with the ECB will spike the dollar higher and the Euro currency much lower. For now, we think they mush along in chop through June, July, and August. Look for US Dollar support at 81.50-82.50 for an extended number of trading days. Crude Oil: Closed at 84.82 -0.63 on falling momentum, high reserves and spreading deflation with slowing commerce throughout the world including Asia. Asian stocks are falling on this Thursday evening of 6-7-12 following the performance of the United States today. Along with that, despite the bold needs for energy in Asian nations, they have enough to keep going for now with the exception of new and higher LNG demand in Japan. Japan is re-starting two nuclear power plants on an emergency basis for this summer's air conditioning demands. They have over 30 nuclear power facilities and all of them were shut-down after the tidal wave tragedy of last year. Crude oil is hovering weakly near 82.50-86.50 in a trading range. We are expecting further summer selling in crude oil with natural gas prices firming and rising mildly toward a summer trading range of 2.50-2.75. The solar and windmill greenie commercial failures and disasters have provided manufacturer GE a chance to pick the bones of these wrecks and buy the supposed good ones on the cheap. We predicted they would fail and this has happened with vigor. Expect an oil low of $80 this month with potential lower lows in August depending upon whether, or not QE-3 becomes an announced reality. QE-3 has been actively in play in a stealth fashion since QE-2 ended May, 2011. CRB: Closed at 274.01 +0.24 with a price under all moving averages on falling energy and metals prices. Grains have been lower too, but we expect them to rise on weather and inflation later this year. With crude oil selling and other commodities flat to down, we could see selling taking the CRB price to lows near 250, or even lower. Resistance is 280 but we forecast we'll not see that number again for months. However, with hard inflation coming in the intermediate future, the market should turn around and base nicely for new rallies this fall. The lower support price of 270 is next followed by more selling in steps and stairs lower, all the way to this fall. -Traderrog This posting includes an audio/video/photo media file: Download Now | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gold & Silver Market Morning, June 12 2012 Posted: 11 Jun 2012 09:00 PM PDT | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment