Gold World News Flash |

- Key FX Market Events In The Coming Week: Grand Plan In Europe, Asian Intervention And Broader USD Strength

- News That Matters

- Goldrunner: The Gold Tsunami Wave Cycle

- “I think physical buyers are going to respond to the drop in price by increasing their purchases. That’s how the market works, when prices are lower, you want to buy more….”

- Gold coming under selling pressure in very early European trading

- Market Snapshot: Gold & Silver Continue Slide As ES Drops 20pts From Highs

- Gold on Hold; The New Play May Be in Munis

- You Can't Buy Physical Silver or Gold at Gainsville Coins Tonight

- Gold Market Update - Sept 25, 2011

- Silver Market Update - Sept 25, 2011

- Bull & Bear Cases for Gold, Silver and Stocks

- Where is Mexico's gold, and is it really gold at all?

- International Forecaster September 2011 (#7) - Gold, Silver, Economy + More

- 2008 or 1979 All Over Again?

- Gold and Silver Pullback as Forecasted Now for the Big Opportunity - Part 2

- Michael Pento: What You Must Know About Gold & Silver Selloff

- What's Really Going On

- Ackerman Takes Fresh Look at Old Foe Lira’s Ideas

- KWN Special – James Turk: “We are Looking at Another Lehman”

- Precious Metals vs. U.S. Treasuries

- Where is Mexico's gold, and is it really gold at all?

- Is China Business News following the gold issue through GATA?

- The Federal Reserve Plans To Identify “Key Bloggers” And Monitor Billions Of Conversations About The Fed On Facebook, Twitter, Forums And Blogs

- Why Invest in Commodities?

- Central banks are intervening in currency markets all over the place

- On The Gold/Silver Crash: CME Rate Hikes, Banker & Market Manipulation & More…

- THE D-WAVE BEGINS

- Gold and Silver See Tons of Selling

- Avoid counterparty risk as financial system topples, Turk tells King World News

- Gold’s fall attributed to Fed’s unexpected restraint with bonds, and to intervention

| Posted: 25 Sep 2011 06:41 PM PDT Goldman summarizes the key events in the coming week: After many weeks of sluggish FX response to the risky asset weakness, last week finally marked a change. The trade weighted USD strengthened markedly, mainly on the back of a move relative to EM currencies. When looking in a more quantitative way at this development, we notice a rapidly rising beta when regressing changes in the trade weighted Dollar on changes in the SPX. For most of August and the first half of September, the beta was about 0.1, meaning a 10% decline in the SPX translated into a 1% rise in the trade weighted Dollar. This has now doubled where a 10% decline in stocks pushes the Dollar up by 2%. Not unexpectedly, therefore, we also got stopped out of our long-standing long EUR/$ recommendation. This increase in FX sensitivity occurred against the backdrop of ongoing uncertainty regarding the Greek and Eurozone sovereign situation. The preliminary Eurozone PMIs last week indicated that the financial market jitters in recent months continue to put downside pressure on business sentiment. Over the weekend, the G20/IMF/Worldbank meetings produced the expected stream of policymaker comments with most of the focus on the Eurozone. There is now considerable external pressure on Eurozone policymakers to finds ways to contain the crisis. As Huw Pill and Francesco Garzarelli have pointed out in two notes published on Sunday (September 25), despite much speculation, the likelihood for very fast action remains low. The ratification process of the July 21 summit agreement cannot be short-circuited. In the upcoming week, debate and speculation about any "grand" Eurozone plan will certainly dominate FX markets and risk sentiment. We are cautious. On one hand, we continue to believe that USD downside pressures remain the dominating medium trend in FX, and hence the current rise in risk premia creates attractive opportunities to position for renewed US weakness. On the other, we still see plenty of Eurozone headline risk. For example, the tug-of-war over the next Greek tranche will likely continue for at least another 10 days. And important parliamentary votes are still outstanding in a number of EMU nations, in particular those with unclear majorities to implement the enhanced EFSF. The second key development in FX markets will be the reaction of Asian central banks to the intense depreciation pressures. A number of EM central banks intervened in the second half of last week, and in the upcoming week markets will try to gauge the determination to intervene again to dampen or even block the sell off in many crosses, in particular in NJA. Key macro data this week are business surveys, specifically the Chicago PMI and the German ifo. US durable good data is a timely activity indicator as well. Finally, we would have a look at Germany CPI data, as inflation trends in the Eurozone core could add to the multiple challenges faced by the ECB. Key data points in the upcoming week: Monday, September 26th: German Ifo Tuesday 27th: US consumer sentiment, Richmond Fed index Wednesday 28th: German CPI, US durable goods Thursday 29th: US unemployment claims, UK consumer confidence Friday 30th: Japan IP, Chicago PMI |

| Posted: 25 Sep 2011 06:38 PM PDT

Ft.com

China's yuan may become a fully convertible currency in five years, Li Daokui, an adviser to the People's Bank of China, told a forum in Washington. Bloomberg reports Li said flexibility of the yuan will increase over coming years, http://ftalphaville.ft.com/thecut/2011/09/26/685036/yuan-convertible-in-... The government of Mongolia is seeking a bigger stake in Oyu Tolgoi, the biggest undeveloped copper mine in the world, the FT reports, in a surprise move that underlines the challenges ahead for Rio Tinto and Ivanhoe Mines as they develop the country's flagship mining project. The government of Mongolia has asked to reopen discussions over the 2009 investment agreement for Oyu Tolgoi, http://ftalphaville.ft.com/thecut/2011/09/26/685001/mongolia-presses-for... US investment banks are facing losses on financing commitments for buy-outs and other deals struck before the recent market turmoil, as they sell down about $25bn in loans and junk bonds, the FT reports. Banks have had to make concessions to entice a broader range of investors to buy loans linked to mergers and acquisitions, http://ftalphaville.ft.com/thecut/2011/09/26/684976/us-banks-face-losses... The IMF annual meetings wrapped up in Washington on Sunday with widespread concern over the eurozone sovereign debt crisis but no immediate consensus on the solution, the FT reports. Participants said they were waiting for the ratification of the action plan agreed on July 21 by the eurozone, http://ftalphaville.ft.com/thecut/2011/09/26/684936/imf-talks-fail-to-fi... US tax authorities are targeting cross-border finance deals worth billions of dollars between leading US and UK banks as they step up efforts to clamp down on abusive tax avoidance, a joint investigation by the FT and ProPublica has found. Four US banks – BB&T, Bank of New York Mellon, http://ftalphaville.ft.com/thecut/2011/09/26/684926/us-tax-authorities-t... Senior Russian government figures have rebelled against a deal between President Dmitry Medvedev and Vladimir Putin, the prime minister, to switch jobs next year. The rebellion indicates that the handover arrangement will not be as smooth as the two leaders had anticipated. After Saturday's announcement that Mr Medvedev would take over as prime minister, while backing Mr Putin to return to the presidency in March 2012 elections, Alexei Kudrin, finance minister, announced during a meeting in Washington that he would "definitely refuse" to work with Mr Medvedev in the cabinet. http://www.ft.com/intl/cms/s/0/594a509e-e78f-11e0-9da3-00144feab49a.html... The South Korean central bank surprised the markets on Friday with a $4bn lightning intervention in support of the won, carried out in the last two minutes of trading, The day before, Brazil spent $2.75bn selling dollars in the currency swaps market to stop the rapid decline of the real. Does this mean central banks in emerging markets are finally trying to reverse the sharp plunge in their currencies over the past month? Probably not, currency strategists believe. Officials are primarily aiming to curb what they see as excessively wild swings in their currencies. They want stability, not appreciation. http://www.ft.com/intl/cms/s/0/91057f04-e609-11e0-960c-00144feabdc0.html... Wsj.com For months it has been all about Europe and the U.S. Suddenly, investors have reasons to worry about the rest of the world. Last week, the Dow Jones Industrial Average tumbled 6.4%, its worst week since October 2008, leaving it down nearly 7% for the year. The Standard & Poor's 500-stock index did nearly as poorly last week and now is down 9.6% this year. But rather than focus solely on Greek debt, European banks and the U.S economy, many investors have begun to wring their hands about a new set of indicators they say portend a serious slowdown in http://online.wsj.com/article/SB1000142405297020401060457659279064942955... A coalition of conservative parties that support Nicolas Sarkozy appeared Sunday to have lost its majority in the upper house of France's parliament, a major political setback for the president eight months ahead of next year's presidential election. The opposition Socialist Party, together with other left-leaning movements, won a large chunk of the 170 seats in the Senate that were up for re-election, according to preliminary results. Although balloting was still under way Sunday evening in some of France's overseas territories, the left, which hasn't dominated the Senate in the past 50 years, claimed it would control at least 175 seats in the 348-seat chamber. http://online.wsj.com/article/SB1000142405297020401060457659310029476921... Greece's center-right opposition party further widened its lead over the ruling Socialists, two public-opinion polls showed, although both major parties continued to see historically low support from the public. According to a poll in the Sunday Proto Thema newspaper, the center-right New Democracy party holds a 5.8-percentage-point lead over the Socialists. A second poll in the Eleftheros Typos newspaper recorded a six-percentage-point lead for New Democracy. http://online.wsj.com/article/SB1000142405297020483130457659240283486742... The construction-financing and real-estate-loan troubles that brought down 16 savings banks this year aren't likely to harm the rest of South Korea's banking sector, the nation's top financial regulator said Sunday. With savings banks accounting for just 2.4% of South Korea's financial assets, said Kim Seok-dong, chairman of the Financial Services Commission, "It can't influence the whole financial sector of the country. So it's OK to relax." http://online.wsj.com/article/SB1000142405297020401060457659252410272932... Vietnam's consumer price index in September was up 0.82% from August, easing from its 0.93% rise in August from July, the government's General Statistics Office said Saturday. The rise mainly stemmed from higher prices for education services, food and foodstuff, the office said in a statement. The index for January through September was up 22.42% from a year earlier, compared with 23.02% rise for January-August. http://online.wsj.com/article/SB1000142405297020442240457659319214394293... Congress was scheduled to be off this week, but lawmakers must stay in Washington because they made no progress over the weekend in settling a dispute over spending that threatens a possible government shutdown. Despite promises to work together following a public backlash against the bickering that consumed much of the summer, Republicans and Democrats face the reality that disaster aid could run out Tuesday and the government could partially shut down beginning this weekend unless they strike a deal quickly. http://online.wsj.com/article/SB1000142405297020401060457659307249954811... Marketwatch.com Benchmark crude-oil futures recouped a small portion of its heavy losses last week, climbing 80 cents or about 1% to $80.65 a barrel in Nymex electronic trading Monday morning in Asia. Oil futures slumped last week along with other commodities, with crude oil for November delivery falling $5.41 Friday -- as escalating concerns about global growth trends prompted heavy selling in the sector http://www.marketwatch.com/story/oil-futures-pare-some-of-last-weeks-los... Reuters.com Iran's reformist opposition has watched with admiration as revolutions have toppled three Arab leaders, but despite divisions in the ruling elite it looks incapable for now of taking its protest movement back out onto the streets. Mass protests against the 2009 re-election of President Mahmoud Ahmadinejad marked the worst unrest since the Islamic Revolution three decades earlier, but were quelled with lethal force by the state's security apparatus, headed by the elite Revolutionary Guards. http://www.reuters.com/article/2011/09/25/us-iran-opposition-idUSTRE78O1... Unconventional monetary policy tools like large-scale bond purchases can effectively lower long-term borrowing costs, but the effect on the real economy is less clear, a top Federal Reserve official said on Friday. "Specifically, does lowering Treasury yields through large-scale asset purchases have the same effect on the economy as an equivalent movement in the federal funds rate?" said John William, president of the San Francisco Federal Reserve Bank, in remarks prepared for delivery to the Swiss National Bank Research Conference. "To what extent is it the size or the composition of the central bank's balance sheet that matters?" http://www.reuters.com/article/2011/09/23/us-usa-fed-williams-idUSTRE78M... The build-up of debt before the 2007-2009 financial crisis, and the crisis itself, created an 'unusually anemic recovery' that has overwhelmed policymaker efforts to stimulate demand with monetary and fiscal easing, a top Federal Reserve official said on Friday. Regulators have made a "good start" on boosting capital requirements and creating other rules to rein in the kind of risk-taking that fueled the recent boom and bust, New York Federal Reserve Bank President William Dudley said in the text of remarks prepared for delivery in Washington on Friday. http://www.reuters.com/article/2011/09/23/us-usa-fed-dudley-idUSTRE78M53... Bloomberg.com That will leave worldwide expansion at about 2.5 percent, less than the 4 percent forecast by the International Monetary Fund this year and next. http://www.bloomberg.com/news/2011-09-25/pimco-s-el-erian-sees-rich-econ... German Chancellor Angela Merkel said euro-region leaders must erect a firewall around Greece to avert a cascade of market attacks on other European states that would risk breaking up the currency area. Expanding the powers of the region's rescue fund, the European Financial Stability Facility, as agreed by European leaders in July is necessary to avoid Greece's problems from spilling over to other countries, Merkel said late yesterday on ARD television. The fund's permanent successor, due to take effect in mid-2013, is needed "so we can in fact let a state go insolvent" if it can't pay its bills. http://www.bloomberg.com/news/2011-09-25/merkel-can-t-rule-out-euro-area... Betting on Ben S. Bernanke has been the most profitable trade for government bond investors in 16 years, defying lawmakers in the U.S. and abroad who said the Federal Reserve chairman's policies would lead to runaway inflation and the dollar's debasement. Treasuries due in 10 or more years have returned 28 percent in 2011, exceeding the 24.4 percent gain in all of 2008 during worst financial crisis since the Great Depression, according to Bank of America Merrill Lynch indexes. Not since 1995, when the securities soared 30.7 percent, have investors done so well owning longer-dated U.S. government debt http://www.bloomberg.com/news/2011-09-25/betting-on-bernanke-returns-28-... Israeli Prime Minister Benjamin Netanyahu and Palestinian Authority President Mahmoud Abbas emerged from their showdown at the United Nations buttressed domestically though no closer to peace talks. "Abbas succeeded in strengthening his standing among Palestinians and of his ideology of achieving statehood diplomatically against the challenge from the Islamist Right represented by Hamas," said Hussein Ibish, senior research fellow with the American Task Force on Palestine, a nonpartisan Washington-based group that advocates a peaceful two-state solution. Netanyahu also "solidified his political position," Ibish said. http://www.bloomberg.com/news/2011-09-25/middle-east-peace-no-closer-as-... Malaysia's inflation has probably peaked and price pressures may ease as the global economy deteriorates, central bank Governor Zeti Akhtar Aziz said, joining neighbors in signaling less pressure to tighten policy. "Right now, we have to wait for greater clarity on the outlook for growth and inflation before taking any further adjustments" on interest rates, Zeti said in an interview in Washington late yesterday. "Given the more moderate global growth and in terms of the external environment and its implications on the domestic economy, we believe domestic sources of inflationary pressures will be less." http://www.bloomberg.com/news/2011-09-26/malaysia-inflation-may-have-pea... It's "too early" to determine how emerging economies can further help the euro area overcome its sovereign debt crisis because reforms are still under way, China's central bank Governor Zhou Xiaochuan said. "We need to first see if euro-zone countries can implement their July 21 decision," Zhou told reporters at the |

| Goldrunner: The Gold Tsunami Wave Cycle Posted: 25 Sep 2011 06:30 PM PDT [/CENTER] So says Goldrunner (www.GoldrunnerFractalAnalysis.com)**in an article which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), edited for the sake of clarity and brevity to ensure a fast and easy read. The author's views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.* Goldrunner*goes on*to say: As the "Gold" waters receded, the diehard deflationists have run out onto the bare sea bed to whoop and holler that the sea of Dollar Inflation is ending.* They currently hop about the nearby sea floor waving their arms in victory as they envision a catastrophic deflationary depression that will wreck the financial market back to the Stone Age, and the price of the Precious Metals along with it.* Unfortunately, they fail to understand the wave cycle at work as the waters are sucke... |

| Posted: 25 Sep 2011 06:23 PM PDT |

| Gold coming under selling pressure in very early European trading Posted: 25 Sep 2011 06:13 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] Gold opened in Asian trade on a relatively firm note as buyers came in to take advantage of the break in prices. That buying eventually gave way to sellers looking for a bounce to exit from longs. As price dropped down to Friday's closing level (commensurate with the 100 day moving average), longs who had been bottom picking stepped aside removing any support from the market. That allowed the shorts to press it into stops below Friday's low which dropped the metal rapidly into the band of chart support near the $1600 level. Upon its initial test of this level, it did bounce somewhat but renewed selling then took it back lower and violated this key psychological level. Should it fail to recapture $1600, the next stop is near the $1580 level. Should that give way, it looks most likely to drop back into the band of congestion on the charts that held the price from late April of this year thro... |

| Market Snapshot: Gold & Silver Continue Slide As ES Drops 20pts From Highs Posted: 25 Sep 2011 06:03 PM PDT While Friday's dramatic skid lower in the precious metals was later blamed somewhat on a leaked margin hike (as well as the simultaneous and anti-empirical sell-off in 30Y), it seems the liquidations that were rumored (whether hedgie or central banker) are in play once again as both gold and silver (the latter very significantly!) are finding little support. After some early weakness (EUR strength), the China news we noted earlier and general lack of any actionable rescue plan or large-scale money-printing has markets in a decidedly risk-off mode for the last few hours as ES shifts into the red and very early credit runs show 2-3bps widening in the front-end of the European indices.

Its not only the precious metals but copper and oil are also dropping and the latest headline from Bloomberg is not helping:

UPDATE: Silver is now -16%! Gold/Silver Ratio has smashed higher as Silver plummets (to Sep2010 highs) - is it too simple to see similar jarring patterns leading up to crises? As Gold drops below $1600 for the first time since July and Silver is down a further 12% from Friday's close, it seems the relative under-performance of Gold and Silver suggest this is still liquidation (and margin-exaggerated). The dollar dipped out of the gate but has recovered and is back at last week's highs now with the EUR testing 1.34. Notably, JPY is rallying once again and while GBP is unch from Friday, JPY is stronger (vs USD) by around 0.5% as JPY crosses (carry pairs) all send a very risk-off signal. TSYs are rallying modestly off the late Friday peaks in yields with 30Y -3bps as the whole curve flattens very slightly for now. Stocks are much more active than TSYs or FX for now having managed to get up to 1144.5 in early Sunday trading only to drop back into the red retracing 50% of the upswing from early Friday - hovering around Friday's closing VWAP level for now. Charts: Bloomberg Early credit index runs show modest 2-3bps decompression in CDS and in cash, we see flattening/inversion and higher yields across the board with IRE and ESP worst performers so far (though not all are open). PTE is 22bps wider vs Bunds in 2Y and 11bps wider in 10Y. UPDATE: XOver +16bps and Main +4bps - Senior FINLs +6bps And finally, for some perspective, now all risk drivers are open we see ES pulling down towards its CONTEXT expected value: Chart: Capital Context |

| Gold on Hold; The New Play May Be in Munis Posted: 25 Sep 2011 05:43 PM PDT This article originally appeared in the Daily Capitalist. It was written by DoctoRx who writes market commentary for us. On Monday, Sept. 19, I suggested that the price of gold was vulnerable, and also suggested that the stock prices of miners were a better intermediate-term bet. This was two days before the FOMC meeting, which much of the "smart money" expected would produce a Jobsian "one thing more" in addition to the expected Operation Twist. Mr. Market was expecting something more like Twist and Shout rather than simply Twist Again. After the Fed failed to meet expectations, and issued a downbeat assessment of economic prospects, however, it was risk off with a vengeance in the DoctoRx financial environs. The Fed has kicked the economic problem to the administration and Congress, and to the business community at large (where it belongs IMHO). This sudden outbreak of financial prudence strikes me as both a good thing. By selling short-dated maturities, it alleviates the (? temporary) shortage of short-dated Federal debt. And rather than shrinking the balance sheet or letting mortgage-backed securities run off their balance sheet to be replaced by yet more Treasurys, the status quo is maintained. The Fed will have the advantage of surprise if and when QE 3 leaves port. On a global basis, the Fed is probably also looking at the probability of money-printing out of Europe. It's their turn to inflate. We've done our part. The markets are signaling price declines all over the place. Platinum is trading about $40/ounce below gold. This is anomalous. MIT's Billion Prices Project reported price declines in the U. S. in August (see final chart). The Economic Cycle Research Institute on Friday took the rare step of commenting in print that the stock market is at a significant risk for a further decline. Dangerously, Markit's CMBX index (or, more precisely, some of their constituent indicies) that tracks mortage-backed securities broke Friday to yet another new multi-year low. Right now, the only investment opportunities I see that are both relatively attractive vis-a-vis the alternatives and offer a likelihood of growing nominal capital are investment grade municipal bonds. This could include some of the leveraged muni bond funds that yield over 6% tax-free as well as properly selected individual issues. The latter are generally buy and hold investments, though the larger muni issues have decent liquidity. The above comment is predicated on the growing sense I have that the U. S. continues to go Japanese financially. This is not a new idea for me. This is what I wrote on January 6, 2009 (in "Land of the Setting Sun"):

Of course, we all like to quote from our best thoughts, and if you say enough things, some of them will look good in retrospect. I hope readers note that in typical fashion, the quote from Mr. Obama, who was not yet even President, showed that his view was that the economic recovery would come from Washington. He did not say, "the economic recovery that the American people and their businesses are going to make happen". In any case, this spring I argued that biflationary price risks had tilted to the deflationary side in Goldman Wrong on Rates, Zero Hedge Wrong on Oil as Deflationary Side of Biflation Begins Its Ascendancy when both interest rates and oil prices were much higher than today. Bond rates have gone lower than I foresaw relative to oil prices, which look to have room to decline more (perhaps much more). I exempted gold prices from my "risk off" recommendations then but as documented last week, gold is now off my buy list. With ZIRP here indefinitely, my bond broker wonders if one way or another, savers are sooner rather than later going to actually pay a fee to park money in an FDIC-insured financial institution. After all, it costs the bank 0.15% (15 basis points) simply for the FDIC coverage, and then it has the costs of handling your account. At the same time, 6-month T-bill rates are negative by 1 basis point. Negative! The implications of this have, I would say with a high degree of confidence, not sunk in to the public's consciousness yet. Therein lies a modest investment opportunity, perhaps. To wit: Just as what seemed impossible in the 1960s, which is that the U. S. would be in a seemingly endless era of rising interest rates, actually came to pass, we may find a high-quality 4% muni bond of any duration impossible to find soon, as "sticker shock" wears off. Later, one could find 3.5% muni bonds hard to find. If the 30-year T-bond stays at or below 3%, watch for AA muni yields track down to 3% or lower even at the long end, depending on call features and quality of the bond. And it's not just U. S. buyers who may be interested in these securities. Foreigners looking to park money in the perceived safety of the (still) global near-hegemon may become muni bond buyers at these rates, not caring about the current tax-exempt status that Americans enjoy. (At a time of zero to negative 6-month T-bill rates, it's the financial equivalent of what I have learned has been going on in prime California farmland: foreigners have been buying working farms at breakeven prices based on current profits of the farm, simply to bring their money to a real asset in America.) I am out of almost all my Treasurys, and right after the Fed announcement Wednesday, I called up my bond broker and said that I thought that munis were the only undervalued asset left now. I said that we ought to see prices rise (rates fall). He called me back later that afternoon and said that, mirabile dictu, one of his firm's bond desks said that they were marking up their inventory the next day. With apologies to Irving Berlin: There's no hunger like yield hunger, like no hunger I know. Everything about it (i.e. yield) is appealing, everything the traffic will allow . . . Perma-gold bugs and Internet 2.0 stock fans alike might wish look around the US of A and note that for now, people are clinging to their unbacked dollars as if they had value. No matter what the endgame of paper currencies has been throughout history, history is a series of timeless moments, and right now, paper money made in the U. S. A. (or the electronic equivalent thereof) remains one of the shrinking list of American-manufactured products in global demand. We pay our bills and buy our food with that product, and in some fashion so does much of the world when trading internationally or via an internal currency peg to the dollar (due to the reserve currency status of the USD), and during difficult financial times, that fact outweighs the argument that only gold and silver are "real money". Right now, the Fed is not creating new money ex nihilo. I see that as a blow to the gold bugs. Financial go-go now a no-no, as Maureen Dowd might pen. I continue onward with what recently seemed to be a boringly cautious thought, which is a price target for gold of $2000 fiatscos by or before the end of 2012, but I wouldn't be surprised to see much lower prices at some point in the months ahead as a period of debt deflation moves along while the Fed's printing press stays largely on hold. How low is low for gold? Do I hear $1500? Do I even hear $1300? Rather than sit with cash yielding zero which might (can it really happen?) go negative, more and more American savers may wish to gather their basis points while they may. I think there's still time to jump to the head of the line in munis. Stay tuned. |

| You Can't Buy Physical Silver or Gold at Gainsville Coins Tonight Posted: 25 Sep 2011 05:38 PM PDT Perhaps they just don't want to be giving physical silver away tonight at these prices, or more likely, they are preparing for the onslaught of traffic surely coming their way over the next several days. Regardless, this is the message you get when you visit Gainsvillecoins.com on Sunday night, in an effort to buy physical silver and gold. ~ SGT

|

| Gold Market Update - Sept 25, 2011 Posted: 25 Sep 2011 05:01 PM PDT Clive Maund In what turned out to be a devastating week for commodities, gold broke down from its intermediate top area and is now in full retreat. Both developments were accurately forecast in last week's Gold Market update and in other updates. clivemaund.com subscribers were positioned to make a fortune out of all this, and many did. After Friday's $77 breakdown move that saw gold smash decisively through the support at the lower boundary of the top area, what can we now expect? You may recall that last week we pointed out that gold was looking considerably more resilient than silver, and that remains the case, especially as it is not so ardently pursued by "get rich quick" speculators as silver, who as we expected have been wiped out in just 2 days of trading. For this reason we had our eye on the 100-day moving average now at about $1634 as a provisional target area for the drop, but as we can see on gold's year-to-date chart below, it has already arrived at this do... |

| Silver Market Update - Sept 25, 2011 Posted: 25 Sep 2011 04:56 PM PDT Clive Maund Having finally got the time machine operational at last we zipped forward a week, saw what happened to silver last week and then zipped back to last weekend and wrote the last Silver Market update, as you will see when you compare the year-to-date charts for silver from last weekend's update with the latest chart showing what actually happened to silver as the week unfolded. Hearty thanks to [ame="http://en.wikipedia.org/wiki/Emmett_Brown"]Doc[/ame] and Marty for the inspiration for this machine - this is how it should be used! More seriously we now have to consider the implications of last week's plunge which was even more brutal than we had expected, and we were expecting it to be bad. On the year-to-date chart shown above we can see that the C-wave smash phase is now underway in earnest, and that it has already crashed key support at the lower boundary of the large top area shown on the 6-year chart below. With the MACD indicator not yet at the so... |

| Bull & Bear Cases for Gold, Silver and Stocks Posted: 25 Sep 2011 04:49 PM PDT After gold and silver got hit hard last week, some of you probably wonder if that was the end of the 10 year+ bull market for precious metals. In this article, we will describe both the Bull & Bear Cases for Gold, Silver and Stocks and we will also make some interesting comparisons. Let’s start off with the Bull case for gold. Gold hit the red resistance line, which also halted gold’s rise in 2006 and 2008. I drew Fibonacci Retracement levels from the Bottom in 2001 to the “Inflation Adjusted Alltime High” around $2,300. We can see that the Fibonacci Levels have done their job in the past. Will we hit the 61.80% level again (and this hit the orange line, which is right between the red resistance line and the green support line)? That level comes in at $1,516 and is the July 2011 breakout level. Chart courtesy stockcharts.com Notice that the comparison with 1979 also gives us support at or near the low $1,500′s. When we reached overso... |

| Where is Mexico's gold, and is it really gold at all? Posted: 25 Sep 2011 04:25 PM PDT In the essay appended here, the Mexican journalist Guillermo Barba reports that the Bank of Mexico refuses to disclose where it is keeping the 93 tonnes of gold it claimed to have purchased this year, apparently doesn't even know the form of the gold it claims to have purchased, and thus for its new gold reserves may be only an unsecured creditor of banks that are members of the London Bullion Market Association, home of fractional-reserve gold banking and primary mechanism of the gold price suppression scheme. |

| International Forecaster September 2011 (#7) - Gold, Silver, Economy + More Posted: 25 Sep 2011 04:24 PM PDT The spot gold price fell $101.70 to $1,637.50, as December fell $80.70 to $1,661.00. The spot silver price fell $6.49 to $30.05, as December fell $5.37 to $31.20. That is what the CME and COMEX call an orderly market. This is simply unbelievable. After 53 years, as one of the experts in this field, we cannot believe they have done such a dastardly thing. Contact every Senator and representative and tell them what you think. At 1:00 a.m. EDT the attack had begun just as we finished the George Noory program on Coast-to-Coast AM. It continued all day because all the inside players knew ahead of the public that margin requirements would be raised. Gold and silver were deliberately forced down outrageously, as it becomes clearer that they were very serious problems ahead and that Europe and the US would have to print trillions of dollars to stabilize deteriorating markets, banks and sovereign countries. The destruction of gold and silver on the 3rd try was mandatory as a cover operation. Financially Europe is in a state of collapse. |

| Posted: 25 Sep 2011 04:23 PM PDT Let’s start with an update of an article I wrote on July 20th 2011. If the pattern isn’t broken soon, this could mean we are about to see 2008 all over again, and silver could drop another 50% from here: Chart courtesy Prorealtime.com The following chart is an updated version of one I also posted a while ago. It shows that when the dollar drops, commodities rally (green zones), and that when the dollar rallies, commodities drop (red zones). Currently we are in a red zone. Chart courtesy Stockcharts.com The following chart shows us the Gold Miners Bullish Percentage Index. As we can see, when the BPGDM Index fell below 50 and the RSI reached oversold levels, Gold was usually at or very close to a bottom (see green Diamonds on the chart). When the BPGDM index was above 70, gold often topped (see red Diamonds). Right now, the RSI is getting into oversold territory and the BPGDM index is at 30, meaning we might be at or very close to a bottom. Chart c... |

| Gold and Silver Pullback as Forecasted Now for the Big Opportunity - Part 2 Posted: 25 Sep 2011 03:32 PM PDT |

| Michael Pento: What You Must Know About Gold & Silver Selloff Posted: 25 Sep 2011 03:06 PM PDT from King World News:

Michael Pento continues: Read More @ KingWorldNews.com |

| Posted: 25 Sep 2011 02:46 PM PDT by Turd Ferguson, TFMetalsReport.com:

After a wild and crazy Globex opening, the metals have rebounded. Is the massacre over? Maybe. As you can see on the charts below, the PMs are going to try to form bottoms tonight and Monday. Whether they will is another question, altogether. With the margin hikes that go into effect tomorrow evening, you should still expect a lot of volatility overnight in London and on the Comex tomorrow. However, it is likely that we are fast approaching the point where everyone who is going to sell has sold. When that happens, you are left, of course, with nothing but buyers and UP goes price. Of the two, gold looks to be the closest to the bottom and safest to buy. It has stopped twice now almost exactly at its 100-day moving average (around $1633) which tells me that there are bargain buyers willing to step in here and halt the slide. |

| Ackerman Takes Fresh Look at Old Foe Lira’s Ideas Posted: 25 Sep 2011 02:44 PM PDT

With deflation tightening its choke-hold on the global economy, we thought we'd drop in on our supposed nemesis, Gonzalo Lira, to see how he was coping in these very un-hyperinflationary times. To his credit, the erstwhile arch-inflationist, bending to reality, has acknowledged forthrightly that deflation rules the economic and financial worlds right now. "Yields are low, unemployment up, CPI numbers are down (and under some metrics, negative) – in short, everything screams 'deflation.' " He wrote those words a month ago in an essay entitled How Hyperinflation Will Happen, and although we are obliged to point out below certain dangers in relying too heavily on the scenario he describes, readers should trust, as we do, that he has gotten the big picture right. For, as he asserts, economic recovery is no longer remotely possible for the U.S. Nor is it a case of double-dipping into recession, as most economists and the mainstream media would have it. In fact, as Lira flatly declares, we never emerged from the first recession. The inevitable result, he says – and we must unfortunately concur — is that an epic financial panic centered on the dollar's collapse is coming, and it will push the U.S. from intractable recession into full-blown Depression.

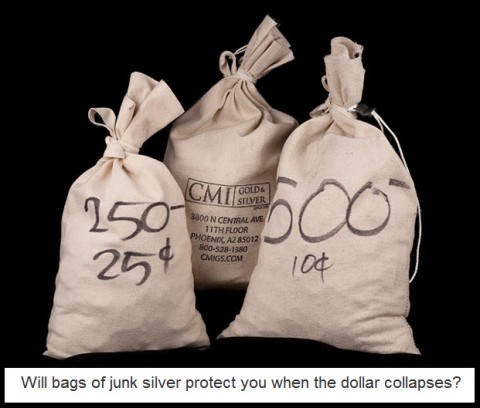

As to how we might prepare for this, Lira has his ideas and we have ours. Possessing physical bullion in any form, as he would doubtless agree, will be a part of the solution no matter what. Where we part company, however, is on the crucial question of whether any of us will be able to respond defensively, let alone advantageously, once the avalanche has begun. While Lira talks about shifting assets from paper to real goods as hyperinflation plays out, our fear is that the dollar's complete destruction will occur so swiftly – think May 2010's flash crash, but on a global scale – that there will be no chance for anyone to liquidate intangibles (to whom?) in order to replace them with real goods. For all we know, the world's bourses will be shuttered for a week or longer, diverting angry mobs to branch banks that, as the mobs will discover, hold precious little cash in their vaults. Under the circumstances, it's possible investors will have no opportunity to get money out of banks, or cash out of stocks, much less catalyze a hyperinflation by re-investing the proceeds in Lira's short list of defensive assets: "residential property, as well as equities in long-lasting industries; mining, pharma and chemicals especially, but no value-added companies, like tech, aerospace or industrials."

'Burp' Starts a Panic

Despite our concerns about the speed of the collapse, we think Lira's description of how it is likely to trigger is not merely plausible, but riveting. Since a summary would not do it justice, we've supplied the link above In brief, however, he believes that a panic out of dollars will begin with a price "burp" in some essential commodity such as oil. A nervous market will seize on the idea as never before, turning it into a flight from U.S. paper and currency. Lira has imagined the entire collapse in such vivid detail that we expect most readers will find his scenario as compelling as it is plausible. And although we would not attempt to argue that what he describes is impossible or even unlikely, there will remain the question, for one, of how securities regulators will react. Will they quell the panic too quickly for events to play out as Lira has described? What if the commodity exchanges raise margin requirements to 100 percent as soon as panic hits? That would shut out nearly all players save those with cash. Where would that cash come from – and what would even constitute "cash" in our all-too-digital financial system? And if The Players can get their hands on piles of cash, miraculously liquidating stocks into a collapsing market and having their trades settle instantly, how much of that cash could they deploy, given that lock-limit rules would effectively bar all but a lucky handful of commodity bidders from getting aboard?

These are not niggling questions, but rather the reflections of someone who has spent quite a few years on the trading floor. Now that I have raised these issues, many more such questions should occur to you when you read Lira's essay. The point is not to cut him down, but to help readers understand that it is impossible to predict with confidence how a hyperinflationary panic will play out. Because of this, even diligent hoarders of physical gold and silver should not be comforted by the notion that they possess the "ultimate hedge." While ingots, Maple Leafs, junk silver and such may prove to have been the best possible defense against financial Armageddon, there's no guarantee that these tried-and-true investables will not be decimated in the interim, as powerful deflationary forces currently in motion run their course. And if gold should reverse course with a vengeance thereafter, there's no reason to think it will be easy to convert it, even priced astromomically in dollars, into farmland or other assets high on the pyramid of essentials.

We're All 'Ruinists'

We want readers to understand that, despite any public disagreements we've had with inflationists in the past, we view the theoretical distance between us as slight. We are all of us Ruinists at heart, after all, and it is not the imminent, smoldering, wreck-of-an-economy that we see differently, only the path that takes us there. If we have come to "see the light" of the hyperinflationists' logic, it is via the realization that hyperinflation doesn't need a push from rising wages or prices to occur, only the epiphany that looms of the dollar's fundamental worthlessness. At that level, and even though we still believe a hyperinflationary spike will only very briefly punctuate an otherwise ruinously deflationary decade, we have no bones to pick with Lira or Gary North – nor, even with the volatile Jim Willie, whose work we have always enjoyed. Although they reacted with glee – or in one case, sadistic pleasure – when we wavered briefly in our steadfast commitment to deflationist arguments, we must concede that Lira had good reason to pounce. (Our wife, with a Masters Degree in Speech and Rhetoric, told us the day after that our essay had more argumentative holes than a wheel of Swiss cheese.) But if Lira and other hyperinflationists are honest, they will need to acknowledge that there is no predicting the course of the coming crash, let alone the very crucial matter of whether the dollar's plunge into de facto worthlessness is likely to take an hour, a day, a week, a month or longer. Such details will matter greatly, but we should have no illusions about handling them advantageously when the Day of Reckoning arrives. Since the collapse could begin as soon as…TODAY??, now is the time to prepare. On that note, I'll leave you with a link to the book that I consider the best work on the topic, Sean Brodrick's The Ultimate Suburban Survivalist Guide.

|

| KWN Special – James Turk: “We are Looking at Another Lehman” Posted: 25 Sep 2011 02:37 PM PDT from King World News:

With near panic recently in the gold, silver and global markets, today King World News interviewed James Turk out of London. When asked about the tremendous volatility and where we are headed from here, Turk stated, "Think about what's happening over here in Europe, Eric, you've got huge bank runs going on throughout the continent. There's a dollar shortage, the forward rates on the euro and the dollar are out of whack, the swap rates are way out of whack, the gold forward rates are way out of whack." James Turk continues: Read More @ KingWorldNews.com |

| Precious Metals vs. U.S. Treasuries Posted: 25 Sep 2011 02:26 PM PDT by Jeff Nielson, Bullion Bulls Canada:

Two weeks ago, I wrote that volatility was "the new bankster weapon" in the gold and silver markets. In writing that this marked a "new phase" for these markets, I admit to never imagining that we would immediately see the bankers display this new phase with such a vivid "exclamation mark". That said, it is now equally important to emphasize to investors that nothing at all has changed for gold and silver from a long term perspective. Indeed what makes this current episode of market manipulation all the more surprising is that there wasn't even any serious attempt by the mainstream media to manufacture a "reason" for the plunge in gold and silver – as "cover" for the banksters' actions. With "competitive devaluation" still the mantra for the economically/intellectually bankrupt governments of the West, and with most of the Rest of the World also being forced to play this game, we know that the banksters' fiat currencies will continue losing value at an increasing rate. Note the use of the word "competitive". It directly implies that these governments are driving down the value of their currencies as fast as they can. |

| Where is Mexico's gold, and is it really gold at all? Posted: 25 Sep 2011 01:27 PM PDT 1:03p ET Sunday, September 25, 2011 Dear Friend of GATA and Gold: In the essay appended here, the Mexican journalist Guillermo Barba reports that the Bank of Mexico refuses to disclose where it is keeping the 93 tonnes of gold it claimed to have purchased this year, apparently doesn't even know the form of the gold it claims to have purchased, and thus for its new gold reserves may be only an unsecured creditor of banks that are members of the London Bullion Market Association, home of fractional-reserve gold banking and primary mechanism of the gold price suppression scheme. Barba thus has demonstrated how easy it is for basic journalism to expose the gold price suppression scheme -- just by putting simple and obvious questions to central banks and publicizing their refusal or inability to answer. With his essay Barba has done more journalism on this issue than The New York Times, The Wall Street Journal, the Financial Times, and all the world's mainstream news agencies combined. If only one of those news organizations would emulate him. But perhaps at least some Mexican news organizations will pursue his work now. GATA's thanks go once again to the president of the Mexican Civic Association for Silver, Hugo Salinas Price, who spoke at GATA's Gold Rush 2011 conference in London this month and who translated Barba's essay into English. CHRIS POWELL, Secretary/Treasurer * * * And Where Is Banco de Mexico's Gold? By Guillermo Barba The title of this article should have an obvious reply, but that is not the case. Thanks to two requests for information made to the Banco de Mexico (Banxico), Mexico's central bank, based on the Federal Law for Transparency, we can say that it is probable that the gold in Mexico's international reserves is not in the country. The requests were made by someone who never imagined how complicated it would be to obtain an answer to the question: How many bars of gold make up the recent acquisition of 93 tonnes of gold made by Banxico in the first quarter of 2011? The bank's first denial of information was not long in coming: "We inform you that the information that you request is classified as reserved." ... Dispatch continues below ... ADVERTISEMENT Lewis E. Lehrman on How to Solve the U.S. Debt Problem Lewis E. Lehrman, chairman of the Lehrman Institute, sponsor of The Gold Standard Now project, advises that to reduce the $1 1/2 trillion U.S. deficit, the Republican Party must initiate an investment program. Working Americans are not saving, which enables the banks to lead the country into a cycle of debt, leverage, boom, panic, and bust. Lehrman says: Eliminating the budget deficit of a trillion and a half dollars cannot be done overnight. The proposal by U.S. Rep. Paul Ryan was very dramatic -- one Republican called it radical -- but it was not happily received. The solution, of course, is to design an American program for prosperity, because you can solve these entitlement problems with a growing economy. We need a tremendous program of investment, and investment comes from savings. When you pay savers, middle-income professionals, and working people 0 percent at the bank, you are not going to encourage them to save. Then we are left with a bank cycle of debt, leverage, boom, panic, and bust." To read more and to sign up for The Gold Standard Now's free, noncommercial, weekly report, "Prosperity through Gold," please visit: http://www.thegoldstandardnow.org/gata Two months later, after posing a request for revision, besides a procedure for remedying the non-compliance of a request for delivery of information, the Unit for Liaison of Banxico responded in August with written communication OFI007-4632, which increased doubts: "The gold that composes the reserve in question is made up of bars that may have a minimum and maximum of gold. The bars with minimum content weigh approximately 10.9 kilos, while those with maximum content have an approximate weight of 13.4 kilos. The information is published by the London Bullion Market Association. ... Due to the variability of the content of gold in the bars, it is not possible to specify with certainty the exact number of bars purchased." Having received this reply, we asked the central bank: In what country or countries is the gold that forms part of the international reserves of Mexico physically located? The answer, coded OFI007-4934 (documents of which this writer possesses copies), dated September 19, is extraordinary: "The Information Committee of Banco de Mexico ... confirms the classifications made by the Administrative Unit and, therefore, access to the requested information will not be granted, since it is classified as reserved." If Banxico doesn't even know how many bars it purchased, it is possible that it also does not have certain knowledge of where the gold is located. In the last communique we mention, Banxico sought shelter under Subsection III of Article 13 of the Law on Transparency, which states that information whose disclosure may "harm the financial, economic, or monetary stability of the country" may be classified as reserved. It is evident that information about physical gold, if maintained as an asset without counterparty risk and kept within Mexico itself, could not present any threat at all to the nation's financial stability. On the other hand, the reference made to the London Bullion Market Association (LBMA) is disquieting. The LBMA brings together the main companies specializing in the purchase and sale of precious metals -- bullion banks, producers, refiners, etc. -- and it is the center of the international market for gold and silver. Among its principal clients are most central banks with gold reserves, including Mexico's. For this reason Mexico's gold now might be located in the United Kingdom. The big problem is that the bullion banks operate under a system of fractional reserves, and thus may sell or lend with interest the same lot of gold several times over to maximize their profits at the cost of all their ingenuous clients who, thanks to a promise on paper, believe themselves to be the legitimate owners of their gold. For the fractional-reserve gold banking system to function, there is a serious condition: that the majority of those to whom gold has been sold shall never demand its delivery. For if delivery should be demanded, it would be impossible to satisfy all buyers. In other words, this system is a Ponzi scheme, a time bomb. Thanks to their fractional-reserve system, the bullion banks are gifted with a false power: that of creating gold out of nothing and selling it as real. Among the largest implications of this fraud is, naturally, of course, the suppression of the prices of gold and silver, for this fractional reserve operation generates a false sensation of greater supply. The Gold Anti-Trust Action Committee has studied and denounced this practice for years. As an indispensable reference we can cite an analysis carried out in 2010 by GATA Board of Directors member Adrian Douglas (http://www.gata.org/node/8627) of an essay published by the CPM Group (a company that specializes in commodities and is an apologist for the fractional reserve system of the bullion banks) in which it is explained how the bullion banks create so much fictitious gold. The author of the essay, CPM Group Managing Director Jeff Christian, last year testified to the U.S. Commodity Futures Trading Commission that "the precious metals are financial assets like currencies and Treasury bonds; they are interchanged at multiples of one hundred times their physical backing." This should invite the interest of the governor of the Mexican central bank, Agustin Carstens. Amid such evidence, it is obvious that it would be inconvenient to have Mexico's gold reserves located outside Mexico. Far from reducing our risk, this storage outside Mexico heightens our risk. Moreover, based on the replies of Banxico, we can infer that the bank has only an "unallocated" account for its gold -- an account in which, according to LBMA, there is no possession of specific bars of gold but only a simple "general right" to the metal, where the customer is an uninsured creditor. So how many other parties might claim the 3.4 million ounces of gold that belong to Mexico? For the moment this is impossible to know. What is certain is that in such a stormy financial sea as we have now, each day that passes without our having our gold here at home is a day when we are unnecessarily exposed to default. We draw attention to this because it is of the greatest importance for Mexicans. We hope there is prompt action. ----- Guillermo Barba is a journalist in Mexico. He can be e-mailed at memob@hotmail.com. This essay was translated from Spanish to English by Hugo Salinas Price, president of the Mexican Civic Association for Silver. Join GATA here: The Silver Summit http://cambridgehouse.com/conference-details/the-silver-summit-2011/48 New Orleans Investment Conference http://www.neworleansconference.com/ Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Be Part of a Chance to Discover Multi-Million-Ounce Gold and Silver Deposits in Canada Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. |

| Is China Business News following the gold issue through GATA? Posted: 25 Sep 2011 01:21 PM PDT 9:22p ET Sunday, September 25, 2011 Dear Friend of GATA and Gold: China Business News in Shanghai, whose February 8, 2010, commentary about Western central bank gold price suppression was quoted that day in a cable from the U.S. embassy in Beijing to the State Department in Washington, a cable published by the Wikileaks organization this month and discovered a few days later by GATA's friend R.M. in Ireland (http://www.gata.org/node/10416), seems to be following the issue even more closely now, and perhaps even following it through GATA. For today China Business News reprinted an obscure gold story from a week ago that appears to have been distributed only by GATA, Zero Hedge, and a couple other Internet sites. That story reports the questions put to the treasury secretary of the Netherlands by the Dutch Socialist Party about that country's gold reserves (http://www.gata.org/node/10454). China Business News headlines the story "Central Banks Getting Nervous about their Gold Reserves" and you can find it here: http://cnbusinessnews.com/central-banks-getting-nervous-about-their-gold... In case China Business News is following the gold issue in part through GATA, we send fraternal greetings to our journalistic comrades and wish them every success in their pursuit of the truth. CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Be Part of a Chance to Discover Multi-Million-Ounce Gold and Silver Deposits in Canada Northaven Resources Corp. (TSX-V:NTV) is advancing five gold and silver projects in highly prospective and politically stable British Columbia, Canada. Check out the exploration program on our Allco gold/silver project : -- A large (13,000 hectare) property, covering more than 15 square kilometers of a regional mineralized trend just 3km from a recently announced 1.2-million-ounce gold and 15-million-ounce silver deposit. -- The property hosts historic high-grade silver workings and many mineral -- A deep-penetrating airborne geophysics survey has just been completed on the entire property and neighboring deposits and its results are eagerly awaited. To learn more about the Allco property or Northaven's other gold and silver projects, please visit: http://www.northavenresources.com Or call Northaven CEO Allen Leschert at 604-696-3600. Join GATA here: The Silver Summit http://cambridgehouse.com/conference-details/the-silver-summit-2011/48 New Orleans Investment Conference http://www.neworleansconference.com/ Support GATA by purchasing gold and silver commemorative coins: https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Lewis E. Lehrman on How to Solve the U.S. Debt Problem Lewis E. Lehrman, chairman of the Lehrman Institute, sponsor of The Gold Standard Now project, advises that to reduce the $1 1/2 trillion U.S. deficit, the Republican Party must initiate an investment program. Working Americans are not saving, which enables the banks to lead the country into a cycle of debt, leverage, boom, panic, and bust. Lehrman says: Eliminating the budget deficit of a trillion and a half dollars cannot be done overnight. The proposal by U.S. Rep. Paul Ryan was very dramatic -- one Republican called it radical -- but it was not happily received. The solution, of course, is to design an American program for prosperity, because you can solve these entitlement problems with a growing economy. We need a tremendous program of investment, and investment comes from savings. When you pay savers, middle-income professionals, and working people 0 percent at the bank, you are not going to encourage them to save. Then we are left with a bank cycle of debt, leverage, boom, panic, and bust." To read more and to sign up for The Gold Standard Now's free, noncommercial, weekly report, "Prosperity through Gold," please visit: http://www.thegoldstandardnow.org/gata |

| Posted: 25 Sep 2011 01:02 PM PDT from The Economic Collapse Blog:

The Federal Reserve wants to know what you are saying about it. In fact, the Federal Reserve has announced plans to identify "key bloggers" and to monitor "billions of conversations" about the Fed on Facebook, Twitter, forums and blogs. This is yet another sign that the alternative media is having a dramatic impact. As first reported on Zero Hedge, the Federal Reserve Bank of New York has issued a "Request for Proposal" to suppliers who may be interested in participating in the development of a "Sentiment Analysis And Social Media Monitoring Solution". In other words, the Federal Reserve wants to develop a highly sophisticated system that will gather everything that you and I say about the Federal Reserve on the Internet and that will analyze what our feelings about the Fed are. Obviously, any "positive" feelings about the Fed would not be a problem. What they really want to do is to gather information on everyone that views the Federal Reserve negatively. It is unclear how they plan to use this information once they have it, but considering how many alternative media sources have been shut down lately, this is obviously a very troubling sign. You can read this "Request for Proposal" right here. Posted below are some of the key quotes from the document (in bold) with some of my own commentary in between the quotes…. |

| Posted: 25 Sep 2011 12:58 PM PDT By Richard (Rick) Mills, Ahead of the Herd As a general rule, the most successful man in life is the man who has the best information We have crossed a critical threshold. The demand we are now placing on our planets resources appears to have begun to outpace the rate at which they can be supplied. The gap between human demand on our planet's resources and the supply of those resources is known as ecological overshoot. To better understand the concept think of your bank account – in it you have $5000.00 paying monthly interest. Month after month you take the interest plus $100. That $100 is your financial, or for our purposes, your ecological overshoot and its withdrawal is obviously unsustainable. Access to raw materials at competitive prices has become essential to the functioning of all industrialized economies. As we move forward developing and developed countries will, with their:

Continue to place extraordinary demands on our ability to access and distribute the planets natural resources. Threats to access and distribution of these commodities could include:

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries. Numerous countries are taking steps to safeguard their own supply by:

There are several overriding themes effecting the demand for, and supply of, commodities. Country Risk Today many governments are looking at ways to get more money from miners as companies report record profits – the higher the returns and the higher the profits, the greedier governments become. As commodity prices rise governments try to boost their share of the proceeds from their countries energy and mining sectors. In 2011, Resource nationalism became the number one risk for mining companies. Miners are an easy target as mining is a long term investment and one that is especially capital intensive – mines are also immobile, so miners are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental/contractual misdeeds. There is no compensation offered and no recourse. All of this means increasingly scarce, and accessible resources, are going to become much harder to find and develop – meaning companies with projects in politically stable environments are that much more valuable. Urbanization Migration is defined as: the long-term relocation of an individual, household or group to a new location outside the community of origin. Today the movement of people from rural to urban areas is most significant. Migration cause can be explained two ways: Push factors – conditions in the place of origin which are perceived by migrants as detrimental to their well being or economic security. Pull factors – the circumstances in new places that attract individuals to move there. Unemployed, poor and hungry (push factor) people from rural areas are attracted to cities because cities are perceived to be places where they could make more money and have a better life (pull factor). Urbanization is a macro-trend, in 1800 two percent of the global population was urban, by 1950 it was 30%. Today half of all the people in the world live in cities. This is an economic migration – historically poverty rates are 4 times higher in rural than urban areas. The UN projects that by the year 2030 there will be 1.5 billion more people living in cities. Nowhere is this rural to urban migration – and a higher degree of industrialization – more evident today than in China and India. Out of Control Spending The US federal deficit in 2011 is a record $1.6 trillion — a number that requires the government to borrow 43 cents out of every dollar it spends. The US government's total debt will mushroom from $14.2 trillion now to almost $21 trillion by 2016. The 2012 budget projects that the deficits total $7.2 trillion over the next 10 years with the shortfalls never coming in below $607 billion. The US government cannot sell enough of its debt to its own citizens and foreigners to finance its deficit and pay the interest on its existing debt. "Yes, we are monetizing debt. You buy bonds and you monetize debt. Right now, a lot of that is going into excess reserves so it is not having an immediate effect on inflation. It will initiate inflationary impulses. It takes time." Thomas Hoenig, President, Federal Reserve Bank of Kansas City, early March 2011 The US government is already buying its own debt – this is the most inflationary thing a country can do - and it looks like we can expect this trend to continue and probably increase. Climate Change The Earth's climate has been continuously changing throughout its history. From ice covering large amounts of the globe to interglacial periods where there was ice only at the poles – our climate and biosphere has been in flux for millennia. This temporary reprieve from the ice we are now experiencing is called an interglacial period – the respite from the cold locker began 18,000 years ago as the earth started heating up and warming its way out of the Pleistocene Ice Age. These interglacial periods usually last somewhere between 15,000 to 20,000 years before another ice age starts. Presently we're at year 18,000 of the current warm spell. In the 1980s the consensus was that the Earth would experience a steady cooling over the next few thousand years. However as studies of past ice ages continued and climate models were improved worries about a near term re-entry into the cold locker died away – the models now said the next ice age would not come within the next ten thousand years. The earth will continue warming. Results from the study "Climate Trends and Global Crop Production Since 1980" indicated that from 1981 – 2002, warming reduced the combined production of wheat, corn, and barley – cereal grains that form the foundation of much of the world's diet – by 40 million metric tons per year. Climate change will impact sea levels and cause an increase in extreme weather events such as floods, droughts and wildfires. Disease such as malaria, carried by mosquitoes, will spread. Thanks to decades of warmer winter temperatures the Spruce Bark and Pine beetles have chewed their way through tens of millions of hectares of commercial forests. Oil While working for Shell Oil during the 1940′s Dr. M. King Hubbert noticed the production of crude oil from individual oil fields plotted a normal bell shaped curve. Roughly half of the oil from a field has been exhausted when the bell curve peaks. Carrying that insight further he surmised that oil production from a group of oil fields would follow a similar bell shaped pattern. In 1956 Dr. Hubbert predicted the cumulative group of oil fields within the US would reach peak production in the 1970′s, and thereafter decline – no matter how much money would be thrown at exploration and development of reserves US oil production would not rise higher after this date – his prediction was uncannily accurate. There are a few things we can learn from studying oil production on the upside slope of Hubbert's bell curve. As oil production nears its peak:

Mining Mine production of many different metals is showing a number of similarities:

There are a few differences between mining and oil:

Food The term Green Revolution refers to a series of research, development, and technology transfers that happened between the 1940s and the late 1970s. The initiatives involved:

Unfortunately the high yield growth from the Green Revolution is tapering off and in some cases declining. This is in large part because of an increase in the price of fertilizers, other chemicals and fossil fuels, but also because the overuse of chemicals has exhausted the soil and irrigation has depleted water aquifers. The United States Census Bureau estimates, as of July 1, 2011, the total number of living humans on the planet Earth to be 6.96 billion. By 2050, the world's population is expected to reach around nine billion – minimum and maximum projections range from 7.4 billion to 10.6 billion. Water Freshwater aquifers are one of the most important natural resources in the world today, but in recent decades the rate at which we're pumping them dry has more than doubled. The amount of water pumped has gone from 126 to 283 cubic kilometers per year – if water was pumped as rapidly from the Great Lakes they would be dry in roughly 80 years. These fast shrinking underground reservoirs are essential to life on this planet. They sustain streams, wetlands, and ecosystems and they resist land subsidence and salt water intrusion into our fresh water supplies. Almost all of the planet's liquid fresh water is stored in aquifers. Some of the largest cities in the developing world – Jakarta, Dhaka, Lima, and Mexico City – depend on aquifers for almost all their water. Water is a commodity whose scarcity will have a profound effect on the world within the next decade – the danger to us from the worsening ecological overshoot concerning the world's fresh water supply makes the reevaluation of our values mandatory. We will have to drastically change the way in which we view our freshwater as a resource. Ocean Fisheries World fisheries are in a state of collapse – caught between plagues of jellyfish, overfishing, nutrient pollution, bioaccumulation of toxics in marine mammals, carbon emissions turning our oceans acidic, the oceans phytoplankton declining by about 40 per cent over the past century, dead zones, garbage patch's, increasing ocean temperatures and changing currents – our entire marine food chain seems to be in peril. Populations of jellyfish are exploding around the globe. They feed on the same kinds of prey as fish so if fish numbers are depleted jellyfish fill the gap. The UN's Food and Agriculture Organization (FAO) says "The maximum wild capture fishery potential from the world's oceans has probably been reached." Industrial fishing has, over the past fifty years, depleted the topmost links in the marine food chain – worldwide about 90% of the stocks of large predatory fish stocks have disappeared. We've been "fishing down the food chain" – as the larger fish disappear we go after smaller and smaller fish. A United Nations Environment Program (UNEP) report "In Dead Water" published January 2008 said "as much as 80 percent of the world's main fish catch species have now been exploited beyond or close to their harvest capacity." SOFIA 2010 recorded a rise to 85% in the number of fisheries that are fully exploited or over exploited, depleted or recovering from depletion. Conclusion It's quite obvious urbanization is the driving force behind global commodities demand and inflationary pressures have moved from commodity inflation to core inflation. Both urbanization and inflation look set to continue for the foreseeable future. The world's oceans are already a mere shadow of what they once were and fish stocks are still dwindling. "Current estimates indicate that we will not have enough water to feed ourselves in 25 years time." International Water Management Institute (IWMI) Director General Colin Chartres The high yield growth in food production from the Green Revolution is tapering off and in some cases declining. Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political risk. Extraction of metals from the mined ore will become increasingly more complex and expensive. Every country needs to secure supplies of needed commodities at competitive prices yet supply is increasingly constrained and demand is growing. Barring a total global economic collapse or a dramatic reduction in the world's human population it doesn't seem to this author demand is going to collapse anytime soon. This is our reality – we're living on a relatively small planet with a finite amount of reserves and a growing human population. Broad spectrum peak commodities is a cause for concern over the longer term. Junior resource companies, the same ones who today are so oversold and undervalued, are the present owners of the world's future commodities supply and, most important for investors seeking outsized returns, they act like leveraged exposure (with price gains many times that of the underlying commodity) to the specific commodity(s) investors want exposure to. Are there a few junior resource companies, with exceptional management teams operating in politically safe jurisdictions, on your radar screen? If not maybe there should be. Richard (Rick) Mills If you're interested in learning more about the junior resource sector, bio-tech and technology sectors please come and visit us at www.aheadoftheherd.com Site membership and our AOTH newsletter are free. No credit card or personal information is asked for. *** Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 300 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Uranium Miner, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, and Financial Sense. |