saveyourassetsfirst3 |

- Parabolic Silver: No Profit Taking Yet

- It's a Good Time to Consider Insuring Your Portfolio With the VIX

- Monday Options Recap

- The Silver Trade Is Taking Off

- Fed's Dual Mandate: Pump Up Stocks and Make the Dollar Worthless?

- Ways to Profit From the End of QE2

- Some dand people are just born to step in it.

- Dow Theorys Russell figures out that gold is manipulated

- Paging Blythe, SLV calls volume gone full retard, we have a problem, paging Blythe

- Goldrunner: “$52 to $56 Silver by Mid-year” Update

- Why Bank and Debt Crises are Helping the Gold and Silver Prices

- Hell has frozen over - Denninger changes his spots?

- Silver price reaches new all-time record high

- Vietnam to ban gold as legal tender

- Doug Casey – Debunking Anti Gold Propaganda

- China's shocking weekend announcement: Proposes to dump the majority of its dollar holdings

- Gold - What to Watch out for in Early May

- The "end of the dollar's reign" is no prediction... It's here right now

- Watch the dollar for signs the rally in precious metals is ending

- Shanghai gold exchange raises silver forward margins

- SO Silver is in a Bubble ...and

- Gold and Silver Set Record Highs on China Buying Bets, Oil Eyes April Top

- Commodity and Futures Prices in Perspective: Price Manipulation or a Confluence of Ev

- My blog, $50 silver, and the death of the $US dollar

| Parabolic Silver: No Profit Taking Yet Posted: 25 Apr 2011 06:58 AM PDT Amalgamator submits: It's the hot topic of the moment, and everyone is offering an opinion, so I'll be succinct. The question I am asking myself is, do I want to take partial profits on silver here? I don't want to take full profits and get out of the silver market, because, as per my previous analysis, I believe the secular commodities bull has 2 more years to run, silver will see $120 and gold at least $2000. The biggest gains for precious metals will be made in this secular finale. Furthermore, moving to cash is risky given that fiat money is losing value measured in 'real money'. So I want to maintain a long position until I see evidence building for a secular conclusion, but I have to expect that silver will see some jolts to the downside on its way to higher prices. So, is a correction imminent? The Daily Sentiment Complete Story » |

| It's a Good Time to Consider Insuring Your Portfolio With the VIX Posted: 25 Apr 2011 06:41 AM PDT James Duade submits: Talking about catastrophe is never fun, but avoiding the conversation can leave you unprepared and vulnerable. Worse it can lead to rash decision making if catastrophic events do occur. Preparing for a potential catastrophe is generally most successfully done when we are calm and clear headed. Furthermore, it is typically a good idea to purchase insurance during these placid periods in order to hedge ourselves against potential future storms. In this instance the future storms that loom over the US stock market and the US dollar--at least in the short term--are the end of QE2 this Summer, and the potential outcomes of the debt ceiling debate. The object of this article is not to discuss political ideology, but rather to discuss the potential negative outcomes from these two events, and a possible way to hedge a market collapse using VIX call options, or VIX ETNs like the iPath S&P 500 Complete Story » |

| Posted: 25 Apr 2011 06:41 AM PDT Frederic Ruffy submits: Sentiment

Stocks are trading mixed in slow trading Monday. The underlying tone seemed a bit cautious early ahead of a busy week of earnings reports. Kimberly Clark (KMB) and Johnson Controls (JCI) are among a handful of names that reported Monday morning. Both are trading lower on the results. The latest New Home Sales report failed to stir much excitement. It showed improvement to 300,000 in March, from 270,000 the month before. Economists were looking for 280,000. The data failed to stir the market. Record highs in gold and a 3 percent rally in silver is getting some attention. But overall, market action has been somewhat lackluster. The Dow Jones Industrial Average is down 25 points, but the tech-heavy NASDAQ gained 5. The CBOE Volatility Index (.VIX) added 1.04 to 15.73. Trading in the options market is light, with 6.1 million calls and 4.4 million puts traded so far. BullishComplete Story » |

| The Silver Trade Is Taking Off Posted: 25 Apr 2011 06:38 AM PDT Glen Bradford submits: There you have it folks: new all-time highs for Silver: Complete Story » |

| Fed's Dual Mandate: Pump Up Stocks and Make the Dollar Worthless? Posted: 25 Apr 2011 06:27 AM PDT Nicholas Southwick Levis submits: So, for the past six months the happily employed workers and Liberal voters have been reveling in the fact that their hero, President Barack Obama, has backed their "hipster" social issues, rendering free market capitalism as passe and in its place the era of the low brow working proletariat has taken its place as the hero of modern day Americana. Many argue that we now live in a Banana Republic because there is no middle class anymore. It's everyone against the upper crust of society these days, and public policy is certainly making this worse by the day. The poor don't understand currency trading or central bank debasement, so they just blame it all on the rich. Complete Story » |

| Ways to Profit From the End of QE2 Posted: 25 Apr 2011 06:12 AM PDT Glen Bradford submits: What happens when QE2 ends? Here are my thoughts. I think that if you look at the only commodity with a PhD in economics, Dr. Copper, you're looking at a commodity that has been telling you for months that commodity prices could be topping. In my opinion, when QE2 ends, the risk-off trade should start to become profitable and sustain its profitability through the summer. Although I am a believer in Peak Oil, I think Oil Prices are extended to the upside. That said, they likely will continue to go higher until they break consumers' backs like they did in 2008. Right now, I'm Surfing Silver and Gold for landslide profits. That said, I think that this is starting to get into bubble territory and I'm actively looking for any reason that I can find to take off the trade, at which point that I'll actively look for significant weakness Complete Story » |

| Some dand people are just born to step in it. Posted: 25 Apr 2011 04:53 AM PDT So the guy goes out on his little piece of property with just a fargin pick and a metal detector. So he finds a four ounce nugget. Hey, fun! Looks around, picks up a TEN ounce nugget. Gee, this is easy. Oh, lookit there where I dropped my pick:  Gee, gold mining ain't so hard -- that is an EIGHT POINT TWO POUND NUGGET :s9: |

| Dow Theorys Russell figures out that gold is manipulated Posted: 25 Apr 2011 04:18 AM PDT GATA |

| Paging Blythe, SLV calls volume gone full retard, we have a problem, paging Blythe Posted: 25 Apr 2011 04:10 AM PDT Smart money still piling into a higher price for May. I dont even see people hedging with puts now. |

| Goldrunner: “$52 to $56 Silver by Mid-year” Update Posted: 25 Apr 2011 04:01 AM PDT Back on February 18th I wrote an editorial showing that Silver could rocket up to $52 to $56 by mid-year. At the time of the writing Silver was sitting a little above $32 on the price chart. The original chart work was based off of the fractal chart work I do with Silver from previous fractal time periods. So far the rise in Silver appears to be right on track for our expected targets to be approached into mid-year. [Let me review the details with you.] Words: 1069 |

| Why Bank and Debt Crises are Helping the Gold and Silver Prices Posted: 25 Apr 2011 03:47 AM PDT |

| Hell has frozen over - Denninger changes his spots? Posted: 25 Apr 2011 03:45 AM PDT http://market-ticker.org/akcs-www?post=184915 Gold And Silver Are Money! Really! Yes, you'll have to listen to understand the argument, if you don't already. But that's what good radio is, right? 4:00 Central Today, 4/25, at http://blogtalkradio.com/marketticker _______________________________ This one I will have to listen to. |

| Silver price reaches new all-time record high Posted: 25 Apr 2011 03:40 AM PDT |

| Vietnam to ban gold as legal tender Posted: 25 Apr 2011 03:39 AM PDT |

| Doug Casey – Debunking Anti Gold Propaganda Posted: 25 Apr 2011 01:26 AM PDT Debunking Anti-Gold Propaganda

It pays to remain as objective as you can be when analyzing any investment. People have a tendency to fall in love with an asset class, usually because it's treated them so well. We saw that happen, most recently, with Internet stocks in the late '90s and houses up to 2007. Investment bubbles are driven primarily by emotion, although there's always some rationale for the emotion to latch on to. Perversely, when it comes to investing, reason is recruited mainly to provide cover for passion and preconception. In the same way, people tend to hate certain investments unreasonably, usually at the bottom of a bear market, after they've lost a lot of money and thinking about the asset means reliving the pain and loss. Love-and-hate cycles occur for all investment classes. But there's only one investment I can think of that many people either love or hate reflexively, almost without regard to market performance: gold. And, to a lesser degree, silver. It's strange that these two metals provoke such powerful psychological reactions – especially among people who dislike them. Nobody has an instinctive hatred of iron, copper, aluminum or cobalt. The reason, of course, is that the main use of gold has always been as money. And people have strong feelings about money. Let's spend a moment looking at how gold's fundamentals fit in with the psychology of the current market. What Gold Is – and Why It's Hated From an economic viewpoint, however, money is just a medium of exchange and a store of value. Efforts to turn it into a political football invariably are a sign of a hidden agenda or perhaps a psychological aberration. But, that said, money does have a moral as well as an economic significance. And it's important to get that out in the open and have it understood. My view is that money is a high moral good. It represents all the good things you hope to have, do and provide in the future. In a manner of speaking, it's distilled life. That's why it's important to have a sound money, one that isn't subject to political manipulation. Over the centuries many things have been used as money, prominently including cows, salt and seashells. Aristotle thought about this in the 4th century BCE and arrived at the five characteristics of a good money:

Of course we do use paper as money today, but only because it recently served as a receipt for actual money. Paper money (currency) historically has a half-life that depends on a number of factors. But it rarely lasts longer than the government that issues it. Gold is the best money because it doesn't need to be "faith-based" or rely on a government. There's much more that can be said on this topic, and it's important to grasp the essentials in order to understand the controversy about whether or not gold is in a bubble. But this isn't the place for an extended explanation. Keep these things in mind, though, as you listen to the current blather from talking heads about where gold is going. Most of them are just journalists, reporters that are parroting what they heard someone else say. And the "someone else" is usually a political apologist who works for a government. Or a hack economist who works for a bank, the IMF or a similar institution with an interest in the status quo of the last few generations. You should treat almost everything you hear about finance or economics in the popular media as no more than entertainment. So let's take some recent statements, assertions and opinions that have been promulgated in the media and analyze them. Many impress me as completely uninformed, even stupid. But since they're floating around in the infosphere, I suppose they need to be addressed. Misinformation and Disinformation Gold is expensive. Here's the crux of the argument. Before the creation of the Federal Reserve in 1913, a $20 bill was just a receipt for the deposit of one ounce of gold with the Treasury. The U.S. official money supply equated more or less with the amount of gold. Now, however, dollars are being created by the trillion, and nobody really knows how many more of them are going to be shazammed into existence. It is hard to determine the value of anything when the inch marks on your yardstick keep drifting closer and closer together. The smart money is long gone from gold. Gold is risky. In any event, risk is relative. Stocks are very risky today. Bonds are ultra risky. Real estate is in an ongoing bear market. And the dollar is on its way to reaching its intrinsic value. Yes, gold is risky at $1,400. But it is actually less risky than most alternatives. Gold pays no interest. Gold pays no dividends. Gold costs you insurance and storage. You can avoid the cost of insurance and storage by burying gold in a safe place – something that's not a practical option with most other valuable assets. But maybe you really don't want to store and insure your gold, because the government may prove a greater threat than any common thief. And if you pay storage and insurance, they'll definitely know how much you have and where it is. Gold has no real use. In point of fact, gold is useful because it is the most malleable, the most ductile and the most corrosion resistant of all metals. That means it's finding new uses literally every day. It's also the second most conductive of heat and electricity, and the second most reflective (after silver). Gold is a hi-tech metal for these reasons. It can do things no other substance can and is part of the reason your computer works so well. But all these reasons are strictly secondary, because gold's main use has always been (and I'll wager will be again) as money. Money is its highest and best use, and it's an extremely important one. The U.S. can, or will, sell its gold to pay its debt, depressing the market. From the '60s until about 2000, most Western governments were selling gold from their treasuries, working on the belief it was a "barbarous relic." Since then, governments in the advancing world – China, India, Russia and many other ex-socialist states – have been buying massive quantities. Why? Because their main monetary asset is U.S. dollars, and they have come to realize those dollars are the unbacked liability of a bankrupt government. They're becoming hot potatoes, Old Maid cards. But the dollars can be replaced with what? Sovereign wealth funds are using them to buy resources and industries, but those things aren't money. And in the hands of bureaucrats, they're guaranteed to be mismanaged. I expect a great deal of gold buying from governments around the world over the next few years. And it will be at much higher dollar prices. High gold prices will bring on huge new production, which will depress its price. But new production is trivial relative to the 6 billion ounces now above ground, which only increases by about 1.3% annually. Gold isn't consumed like wheat or even copper; its supply keeps slowly rising, like wealth in general. What really controls gold's price is the desire of people to hold it, or hold other things – new production is a trivial influence. That's not to say things can't change. The asteroids have lots of heavy metals, including gold; space exploration will make them available. Gigantic amounts of gold are dissolved in seawater and will perhaps someday be economically recoverable with biotech. It's now possible to transmute metals, fulfilling the alchemists dream; perhaps someday this will be economic for gold. And nanotech may soon allow ultra-low-grade deposits of gold (and every other element) to be recovered profitably. But these things need not concern us as practical matters in the course of this bull market. You should have only a small amount of gold, for insurance. This is poor speculative theory. The intelligent investor allocates his funds where it's likely they'll provide the best return, consistent with the risk, liquidity and volatility profile he wants to maintain. There are times when you should be greatly overweight in a single asset class – sometimes stocks, sometimes bonds, sometimes real estate, sometimes what-have-you. For the last 12 years, it's been wise to be overweight in gold. You always want some gold, simply because it's cash in the most basic form. But ten years from now, I suspect that will be a minimum. Right now it's a maximum. The idea of keeping a constant, but insignificant, percentage in gold impresses me as poorly thought out. Interest rates are at zero; gold will fall as they rise. Gold sentiment is at an all-time high. Some journalists like to point out that since there are a few (five, perhaps) gold dispensing machines in the world, including one in the U.S., that there's a gold mania afoot. That's ridiculous, although it shows a slowly awakening interest among people with assets. Journalists also point to the numerous ads on late-night TV offering to buy old gold jewelry (generally at around a 50% discount from its metal value) as a sign of a gold bubble. But this is even more ridiculous, since the ads are inducing the unsophisticated, cash-strapped booboisie to sell the metal, not buy it. You'll know sentiment is at a high when major brokerage firms are hyping newly minted gold products, and Slime Magazine (if it still exists) has a cover showing a golden bull tearing apart the New York Stock Exchange. We're a long way from that point. Mining stocks are risky. All these problems (and many more that aren't germane to this brief article), however, make them excellent speculative vehicles from time to time. Mineral exploration stocks are very, very risky. That's the bad news. The good news is that they are not only risky but extraordinarily volatile. The most you can lose is 100%, but the market cyclically goes up 10 to 1, with some stocks moving 1,000 to 1. That kind of volatility can be your best friend. Speculating in these issues, however, requires both expertise and a good sense of market timing. But they're likely to be at the epicenter of the gold bubble when it arrives – even though few actually have any gold, except in their names. Warren Buffett is a huge gold bear. I've long considered Buffett an idiot savant – a genius at buying stocks but at nothing else. His statement is quite accurate, but completely meaningless. The same could be said of the U.S. dollar money supply – or even of the world inventory of steel and copper. These things represent potential but are not businesses or productive assets in themselves. Buffett is certainly not stupid, but he's a shameless and intellectually dishonest sophist. And although a great investor, he's neither an economist or someone who believes in free markets. Gold is a religious statement. So Where Are We? My own view should be clear from the responses I've given above. But let me clarify it a bit further. Historically – actually just up until the decades after World War I, when world governments started issuing paper currency with no relation to gold – the metal was cash, and it was used as money everywhere, on a daily basis. I believe that will again be the case in the fairly near future. The question is: At what price will that occur, relative to other things? It's not just a question of picking a dollar price, because the relative value of many things – houses, food, commodities, labor – have been distorted by a very long period of currency inflation, increased taxation and very burdensome regulation that started at the beginning of the last depression. Especially with the fantastic leaps in technology now being made and breathtaking advances that will soon occur, it's hard to be sure exactly how values will realign after the Greater Depression ends. And we can't know the exact manner in which it will end. Especially when you factor in the rise of China and India. A guess? I'll say the equivalent of about $5,000 an ounce of today's dollars. And I feel pretty good about that number, considering where we are in the current gold bull market. Classic bull markets have three stages. We've long since left the "Stealth" stage – when few people even remembered gold existed, and those who did mocked the idea of owning it. We're about to leave the "Wall of Worry" stage, when people notice it and the bulls and bears battle back and forth. I'll conjecture that within the next year we'll enter the "Mania" stage – when everybody, including governments, is buying gold, out of greed and fear. But also out of prudence. The policies of Bernanke and Obama – but also of almost every other central bank and government in the world – are not just wrong. These people are, perversely, doing just the opposite of what should be done to cure the problems that have built up over decades. One consequence of their actions will be to ignite numerous other bubbles in various markets and countries. I expect the biggest bubble will be in gold, and the wildest one in mining and exploration stocks. When will I sell out of gold and gold stocks? Of course, they don't ring a bell at either the top or the bottom of the market. But I expect to be a seller when there really is a bubble, a mania, in all things gold-related. There's a good chance that will coincide to some degree with a real bottom in conventional stocks. I don't know what level that might be on the DJIA, but I'd think its average dividend yield might the |

| China's shocking weekend announcement: Proposes to dump the majority of its dollar holdings Posted: 25 Apr 2011 01:06 AM PDT From Zero Hedge: All those who were hoping global stock markets would surge based on a ridiculous rumor that China would revalue the CNY by 10% will have to wait. Instead, China has decided to serve the world another surprise. Following last week's announcement by PBoC Governor Xiaochuan that the country's excessive stockpile of U.S. dollar reserves has to be urgently diversified, today we get a sense of just how big the upcoming Chinese defection from the "buy U.S. debt" Nash equilibrium will be. Not surprisingly, China appears to be getting ready to cut its U.S. dollar reserves by roughly the amount of dollars recently printed by the Fed – $2 trillion or so. And to think, this comes just as news... Read full article... More Cruxallaneous: Doug Casey: What to do with your money now This weekend's gold news could change everything No way out: The Federal Reserve is in BIG trouble now |

| Gold - What to Watch out for in Early May Posted: 25 Apr 2011 01:00 AM PDT |

| The "end of the dollar's reign" is no prediction... It's here right now Posted: 25 Apr 2011 12:53 AM PDT From Bloomberg: |

| Watch the dollar for signs the rally in precious metals is ending Posted: 25 Apr 2011 12:48 AM PDT From The TSI Trader: From the inception of gold's secular bull market in 2001, gold has completed six ABCD wave patterns, which I have graphically detailed on my website. This precious metal is now in the final process of completing its seventh C-wave, which characteristically concludes with parabolic bravura. I thought it would be interesting to examine the concluding weeks of the preceding six C-waves for some insight into how our current situation might play out, and I decided to use the vehicle of the U.S. Dollar for this study. It turns out, each and every one of gold's previous C-waves concluded simultaneously with a precipitous drop in the U.S. Dollar index. And as the U.S. Dollar has recently taken out two key support levels and appears to have begun the swift crash process last week, it is not a likely coincidence that gold has moved decisively above $1,500, and appears headed for $1,600 in the month ahead... Read full article... More on the U.S. dollar: Marc Faber: The U.S. dollar is headed to "zero" A massive U.S. dollar selloff could be starting now This could be the most contrarian trade in the world today |

| Shanghai gold exchange raises silver forward margins Posted: 25 Apr 2011 12:21 AM PDT Shanghai gold exchange raises silver forward margins The Shanghai gold exchange said it has raised the level of deposit required for its silver forward contract by 3% to curb excessive speculation Posted: Monday , 25 Apr 2011 SHANGHAI (Reuters) - The Shanghai Gold Exchange (SGE) said it had raised the level of deposit required for its silver forward contract by 3 percent and may roll out further measures to curb excessive speculation and manage price volatility. The SGE said margins on its silver [Ag (T+D)] forward contract had been raised to 15 percent from April 25 compared with the previous 12 percent, according to a notice posted on its website (www.sge.sh). The SGE also it would raise from Tuesday the daily price limit for the contract, which has a lot size of one kilogram, to 8 percent over or under the previous session's settlement from the previous 7 percent. "Should the market continues to show signs of overheating, the exchange will implement other measures such as raising the deferred rates to improve risk controls," it said. The SGE's silver forward contract has soared in recent months in line with the meteoric rise in the U.S. silver futures contract. It was up 5.5 percent at 10,652 yuan ($1,637) a kilogram at 0624 GMT, bringing its gains so far this month to 33.6 percent. The most active U.S. silver futures contract SIcv1 surged by more than 5 percent to a 31-year high at $48.51 an ounce on Monday, in a broad rally in precious metals. There are 35.2 ounces in one kilogram. SGE also offers two spot contracts which trade silver of 99.90 percent and 99.9 percent purity. ($1 = 6.507 yuan) http://www.mineweb.com/mineweb/view/...ail&id=110649 |

| SO Silver is in a Bubble ...and Posted: 24 Apr 2011 11:50 PM PDT Apple computer @ $ 350.70 and Google @ $ 525.10 are both screaming buys according to the Wall St Guru's. Give me a break!! |

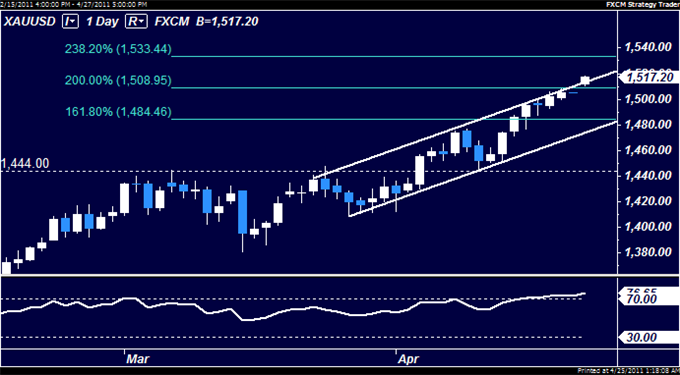

| Gold and Silver Set Record Highs on China Buying Bets, Oil Eyes April Top Posted: 24 Apr 2011 10:43 PM PDT Gold and Silver Set Record Highs on China Buying Bets, Oil Eyes April Top Monday, April 25, 2011 by Ilya Spivak of DailyFX Gold and silver prices shot to new record highs amid reports that China will invest some of its $3 trillion in foreign exchange reserves in assets including precious metals. Commodities – Energy Crude Oil Sets Sights on April High WTI Crude Oil (NY Close): $112.29 // +0.84 // +0.75% Prices are on pace to test the April 11 high at $113.44, a barrier reinforced by support-turned-resistance at a rising trend line set from the lows in mid-February, with a breakout to the upside exposing the $115.00 figure. Initial support lines up at $109.37, the 23.6% Fibonacci retracement of the 3/16-4/11 advance. Risk sentiment trends remain in focus, with short-term correlation studies pointing to the strongest link between the WTI contract and the MSCI World Stock Index in four months (0.71). With that in mind, S&P 500 stock index futures are pointing higher ahead of the opening bell on Wall Street, hinting the path of least resistance favors the upside over the near term. With that in mind, a sharp rise in Treasury yields ahead of this week's 2-, 5-, and 7-year bond sales amid fears that the recent S&P downgrade of the US' credit outlook will boost borrowing costs may prove to weigh on sentiment. Therefore, traders will keep an eye on Monday's sale of $56 billion in 3- and 6-month paper to set the tone for longer-term maturity auctions later in the week.  Gold, Silver Set Record High on China Buying Bets Spot Gold (NY Close): $1506.85 // +0.60 // +0.04% Prices gapped higher through resistance at $1508.95, the 200% Fibonacci extension of the 3/7-3/15 downswing, to challenge the top of a rising channel in place since mid-March. A break above this boundary exposes the 238.2% Fib at $1533.44. The 200% Fib level has been recast as near-term support. Precious metal prices soared in overnight trade following a report from Century Magazine that claimed China plans to invest some of its more than $3 trillion in FX reserves in various assets including energy and precious metals. PBOC chief ZhouXiaochuan has said the current build-up has exceeded "reasonable" levels, while independent reports have pegged the "right" amount of FX reserves for China at no more than $1.3 trillion. On balance, this hints a substantial amount of capital is due to enter commodity markets, suggesting prices will continue to press higher over the near term as traders returning from the long holiday weekend digest overnight news-flow.  Spot Silver (NY Close): $47.25 // +0.65 // +1.40% Prices gapped above resistance at the top of a rising channel in place since late January, setting a new record high at $49.78. The metal is now in uncharted territory, making forecasting decidedly difficult, but deeply overbought relative strength studies suggest the threat of reversal is increasingly high. The channel top, now at $46.91, stands as near-term support. The short-term directional correlation between gold and silver remains firm, suggesting the two metals will continue to move along the same trajectory. The gold/silver ratio has set a new record low however, meaning the cheaper metal is likely to continue outperforming its more expensive counterpart.  For real time news and analysis, please visit http://www.dailyfx.com/real_time_news To receive future articles by email, please contact Ilya at ispivak@dailyfx.com |

| Commodity and Futures Prices in Perspective: Price Manipulation or a Confluence of Ev Posted: 24 Apr 2011 10:39 PM PDT Commodity and Futures Prices in Perspective: Price Manipulation or a Confluence of Events Monday, April 25, 2011 by Fred Oltarsh of Libanman Futures The futures markets are roaring and a presidential investigation is making the news. Price Fixing seems pretty unlikely. I'd like to see an investigation which examines open interest and determines that a single company or group of companies manipulated the price of Crude Oil in the Futures Markets. More likely, the producers of oil have been able to manufacture and distribute a reasonable amount of Crude Oil and a confluence of world events has established prices at these levels. Crude Oil is not the only market where lofty prices exist. In fact, looking at Charts dating back 30 years, it appears that the following markets are trading at levels that, if nothing else, are not likely to be sustained for a considerable length of time. Coffee, Cotton, Corn, Gold and Silver all appear to have prices so significantly above their mean levels (mean as calculated by my own convoluted methodology) that trading at these levels for long periods of times seems unlikely. Each of these contracts has had significant run-ups in the past and the move has been followed by a significant correction. Thirty years of data and it's clear that markets trade around some type of longer-term level. While it is clear that these markets are experiencing enormous run-ups, it is unclear when they will revert to more appropriate levels for that commodity. Obviously picking the timing of market tops or bottoms is a very difficult thing to do. Looking at the Chart later and it appears obvious that the particular market could not maintain that price level. The Coffee market, for example, has traded near current levels about four times since the 1980s, each time, however, the rally was squashed and prices fell precipitously to around the $1.50 level. While Coffee, in all cases traded substantially below the $1.50 level, a look at a "reasonable level" of $1.50 provides a price point that might be considered fair. It is neither at the highs on the chart nor the lows but at a level where there is significant long-term congestion. The fact that Commodities are priced in U.S. Dollars and they all trade on the World Market entices one to believe that the Dollar Price of Commodities should be adjusted for the current value of the U.S. Dollar. It is on this basis that I compare Current Prices to a Congestion Mean Price and adjust the Price for the U.S. Dollar's weakness. The idea is that while prices trade at extreme levels, over time they revert to levels that are relatively consistent in the long-term. Commodities such as Silver, Gold and to a lesser extent Crude Oil, are currently trading at levels that are unlikely to be maintained over a long period of time. The Table below lists the Expected Level of Prices based on the hypothesis that by examining the Current Price and Establishing a Congestion Mean Price which dominates much of the commodities long-term trading action and adjusting that price by 12% based on the weakness of the Dollar, we create an Expected Value for the Commodity to trade at in the relatively near future. Current Congestion Expected Commodity Price Mean Level Coffee 2.9455 2.0000 2.2400 Corn 7.445 5.0000 5.600 Cotton 1.6751 1.0000 1.1200 Crude Oil 112.75 80.00 89.60 Gold 1503.80 800.00 896.00 Silver 46.077 20.00 22.40 $ Vs. Euro 1.4555 1.3000 NA go here for his table: http://insidefutures.com/article/261...%20Events.html |

| My blog, $50 silver, and the death of the $US dollar Posted: 24 Apr 2011 10:37 PM PDT Note: Weather Unit, News Unit, Silverbull-are are now down to 2 posts a DAY on all posts I make please, many requests for me to delete you since half the post are your posts with links to your blog. I will not warn again I will just delete. $50, big deal we are still $70 away from even being adjusted for inflation. Dollar tried to rally to 75 and failed miserably. You should see TINKA and |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment