Gold World News Flash |

- Wall Street Journal Editorial calls for a Return to a Gold Standard

- Data misses lead to small range in risk today, while silver looks toppish after almost hitting key $50 oz level

- James Turk - Silver Still in Backwardation, Headed Higher

- Don’t Fear a Pullback in Prices

- Crude Oil, Gold and Silver Set Sights on US Yields Ahead of 2-Year Bond Sale

- CME Group hikes margin requirements for Silver

- Physical Silver Investors Are Being Hoodwinked by the Futures Market

- The Federal Reserve Note is Dead, Long Live the Dollar

- Is 40 The New 20?

- Having risen from an average price of $5.00 to $46.05 an ounce, it is only reasonable that one question what may be occurring in the silver market

- GATA's Powell to be interviewed on Jay Taylor's Internet radio show

- Despite doubling in 3 months, silver still in backwardation, Turk says

- QE2 is Damaging the Economy and Reducing GDP Growth

- Don't Fear a Pullback in Prices

- Paul to announce exploratory committee for presidential campaign

- Ron Wortel: High Gold Prices Raise Old Mines

- Silver - 8 hour chart update

- Eric de Carbonnel: Acquiring AIG, U.S. govt. assumed huge commodity shorts

- APMEX offers big premiums to purchase gold and silver eagles

- Parabolic Silver

- The Dollar's Omnious New Record

- Sell Silver

- Apmex Starts Reverse Inquiry: Seeks To Buy "Any Quantity" Of Silver From Clients At $3 Over Spot

- Ron Paul Launches Presidential Campaign, Tells Truth To Whoopi's View

- Gold settles at record; also hits intraday record

- No Passport For You?

- In The News Today

- The Comfort of Low Interest Rates

- Capital Context Update: Debt Down on a Dull Day

- QE 3 is Coming… It’s Just a Matter of What Form It Will Take

| Wall Street Journal Editorial calls for a Return to a Gold Standard Posted: 25 Apr 2011 06:13 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] The headline from the commentary says it all: APRIL 26, 2011 Monetary Reform: The Key to Spending Restraint This is no small development. Although it does not reflect the view of the editors of the paper itself, since it is an editorial written by a Mr. Lehrman, of the Lehrman Institute, I find it extremely noteworthy that an article calling for a return to a gold standard would actually grace the pages of that prestigious leading financial newspaper. The WSJ is not a "Wild West" newspaper but is an establishment periodical, which is why I was quite surprised to see an article of this nature. Perhaps the paper will find room to allow for some other writer to make a case against a gold convertibility statute, but for now this just goes to show that the debt crisis that is engulfing our nation is resulting in serious discussion about the role of gold in any future monetary system or in the c... |

| Posted: 25 Apr 2011 05:21 PM PDT |

| James Turk - Silver Still in Backwardation, Headed Higher Posted: 25 Apr 2011 05:00 PM PDT  With gold and silver surfing the wave of volatility, today King World News interviewed James Turk out of Spain. When asked about the reason for the increased volatility Turk stated, "There are some earthshaking events coming, that's what the precious metals are telling us. That's what the dollar chart has also been telling us and that is why I am expecting a waterfall decline in the dollar index. The dollar has a unique position as the world's reserve currency and as people lose confidence in it they will go to other moneys they consider safer." With gold and silver surfing the wave of volatility, today King World News interviewed James Turk out of Spain. When asked about the reason for the increased volatility Turk stated, "There are some earthshaking events coming, that's what the precious metals are telling us. That's what the dollar chart has also been telling us and that is why I am expecting a waterfall decline in the dollar index. The dollar has a unique position as the world's reserve currency and as people lose confidence in it they will go to other moneys they consider safer." This posting includes an audio/video/photo media file: Download Now |

| Don’t Fear a Pullback in Prices Posted: 25 Apr 2011 04:40 PM PDT The S&P credit agency sent shockwaves through the global financial system on Monday when it issued a warning on U.S. debt and changed its outlook on the U.S. sovereign credit rating from "stable" to "negative." This sent markets lower and the prices of commodities such as oil rocketing back above $110 per barrel and both gold and silver to new highs. It should be clear the S&P announcement was just a warning, not a lowering of the U.S. debt rating, which was affirmed at AAA (the highest level possible). The fears quickly subsided and U.S. markets hit fresh three-year highs. Essentially there's only a one-third chance of a downgrade and anyone who's ever listened to the weather man knows that a 33 percent chance of rain means you probably don't need your umbrella.

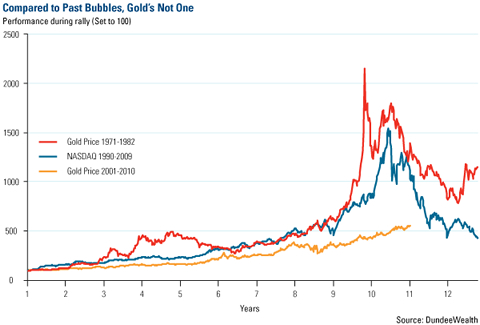

However, the warning validates what we already know: The U.S. needs a plan to address its debt and budget issues…and fast. Due to the fact that future fiscal austerity measures will likely act as a drag on the economy, we also think this opens the door for a third round of quantitative easing (QE3) heading into next year so we'll have to keep an eye on Bernanke and the Federal Reserve's next move. These factors will likely produce downward pressure on the U.S. dollar and upward pressure on commodity prices. This is why we emphatically believe the bull cycle for gold still has a long way to run. Last week, one of my fellow presenters at the Denver Gold Group's European Gold Forum was Dr. Martin Murenbeeld from Dundee Wealth who put the notion of a "gold bubble" in context with the following chart.

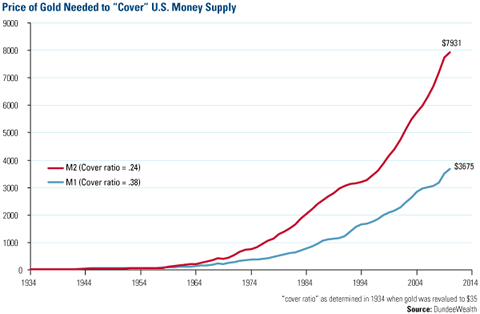

If you compare the current bull cycle for gold against gold's run from the 1970s and 1980s, you can see that today's run has been slow and steady. It's also missing the sharp spikes typical of a bubble. Also, a key difference in this gradual move higher is the growing affluence of the developing world. There people have traditionally turned to gold as a store of wealth and we are seeing that in unprecedented numbers in countries such as China and India. One of the things we recently pointed out was the effect money supply growth can have on gold. Dr. Murenbeeld also presented this fascinating chart showing how much gold would need to increase in order to cover the amount of money that has been printed since gold was revalued at $35 in 1934.

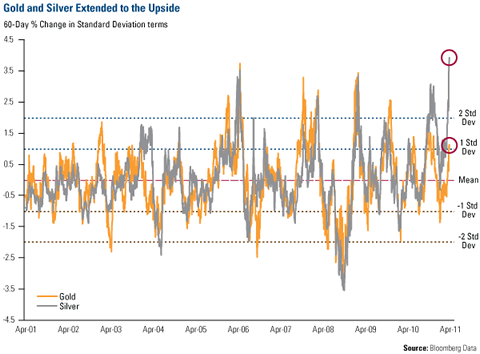

Using that as the cover ratio, gold would need to climb all the way to $3,675 an ounce to cover all paper currency and coins. If you use a broader—and more common—measure of money (M2), gold would need to rise all the way to $7,931 in order to cover the outstanding amount of U.S. money supply. With gold pushing through the $1,500 level and silver above $46, many investors are questioning whether we'll see a pullback. Going back over the past ten years of data, you can see that gold's current move over the past 60 trading days is within its normal band of volatility, up about 7 percent over that time period.

Silver, however, has traveled into extreme territory. Over the past 60 trading days, silver prices have jumped over 58 percent and now register nearly a 4 standard deviation move on our rolling oscillators (see chart). Based on mean reversion principles, odds favor a correction in silver prices over the next few months. We should be clear: If a correction occurs, this would not mean the rally is over. It would just be a healthy bull market correction and reflect the normal volatility inherent with these types of investments. Investors must anticipate this volatility before participating in these markets. This volatility also brings along opportunity. We believe we're only halfway through a 20-year bull cycle for commodities and investors can use these pullbacks as an opportunity to "back up the truck" and load up for the long-haul. Regards, Frank Holmes, P.S. Director of Research John Derrick contributed to this commentary. For more updates on global investing from me and the U.S. Global Investors team, visit my investment blog, Frank Talk. Don't Fear a Pullback in Prices originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Crude Oil, Gold and Silver Set Sights on US Yields Ahead of 2-Year Bond Sale Posted: 25 Apr 2011 04:33 PM PDT courtesy of DailyFX.com April 25, 2011 07:11 PM Crude oil, gold and silver have set their sights on the upcoming US 2-year bond sale, with traders keen to gauge the impact of rising yields on growth and inflation. Commodities – Energy Oil Focused on US Consumer Confidence, 2-Year Bond Sale WTI Crude Oil (NY Close): $112.28 // -0.01 // -0.01% Prices put in a bearish Spinning Top candlestick below resistance at $113.44, the April 11 high, a barrier reinforced by support-turned-resistance at a rising trend line set from the lows in mid-February. A pullback from here sees initial support at $109.37, the 23.6% Fibonacci retracement of the 3/16-4/11 advance. Risk sentiment trends remain in focus, with short-term correlation studies pointing to the strongest link between the WTI contract and the MSCI World Stock Index in four months (0.71). Over the next 24 hours, this puts the spotlight on US Consumer Confidence figures as traders size up the toll that recent... |

| CME Group hikes margin requirements for Silver Posted: 25 Apr 2011 04:33 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] After the extreme volatility in silver, it comes as no surprise to see the CMEGroup raise margin requirements for trading silver yet again. Speculators now need to pony up $12,825 to buy or sell a single full sized silver contract - that is up from $11,745. Maintenance margin now rises to $9,500 from $8,700. Some of what you are witnessing this evening in silver is due to this change being instituted as brokers are calling clients advising them of the coming change at the end of trading tomorrow (Tuesday). Emini silver and miny silver futures are also affected by this change. Hedgers' margin requirements are being increased to $9,500 from $8,700. Wouldn't it be nice to get hedger margins when the truth is that much of what occurs at the Comex is not hedging but is pure speculation on the part of the perma bear firms.... |

| Physical Silver Investors Are Being Hoodwinked by the Futures Market Posted: 25 Apr 2011 04:18 PM PDT By Dian L. Chu, EconMatters

There's Time To Buys |

| The Federal Reserve Note is Dead, Long Live the Dollar Posted: 25 Apr 2011 02:44 PM PDT |

| Posted: 25 Apr 2011 02:37 PM PDT On Tuesday, April 26th, I turn 40 years old. Every man I've talked to tells me "turning 40 is easy, wait till 50 hits you -- that's a tough one!". There are some excellent blog posts on turning 40, like this one, but I decided to write something different and hopefully this post will give young and old food for thought as I jot down my thoughts on life, health, relationships, work and investing.

Why do I admire guys like Andrew Lahde and Monroe Trout? Because you probably never heard of them and more importantly, they understand that there's a lot more to life than making a lot of money. They understand Pete Peterson's meaning of enough and how hopelessly meaningless it is to make the Forbe's list of ultra wealthy.

I've been giving a lot of thought on monetizing my blog. I put a lot of work in building this blog -- the links alone are worth keeping it on your bookmarks, especially if you work in asset management. I'm continuously adding to these links and updating them. I also try write insightful comments almost every night by analyzing articles and adding my thoughts.

|

| Posted: 25 Apr 2011 01:49 PM PDT |

| GATA's Powell to be interviewed on Jay Taylor's Internet radio show Posted: 25 Apr 2011 01:21 PM PDT Press Release from Thomson Reuters ONE / COMTEX News Network http://www.stockhouse.com/News/CanadianReleasesDetail.aspx?n=8140573 Jay Taylor, publisher of the J Taylor's Gold, Energy & Tech Stocks newsletter, will interview Chris Powell, co-founder of the Gold Anti-Trust Action Committee, on his weekly, three-hour VoiceAmerica Internet radio show, "Turning Hard Times into Good Times," which begins at 2 p.m. ET Tuesday. The Gold Anti-Trust Action Committee was organized in January 1999 to advocate and undertake litigation against illegal collusion to control the price and supply of gold and related financial securities. The committee arose from essays by Bill Murphy, a financial commentator, and Powell, a newspaper editor in Connecticut. Murphy's essays reported evidence of collusion among financial institutions to suppress the price of gold. Powell, whose newspaper had been involved in antitrust litigation, replied with an essay proposing that gold mining and investor interests should act on Murphy's essays by bringing suit against the financial institutions involved in the collusion against gold. The response to these essays was so favorable that the committee was formed and formally incorporated in Delaware. Murphy became chairman and Powell secretary/treasurer. Jay is hoping to have a surprise anti-GATA spokesperson on this week's show as well. Jay is scheduled to have several other guests, including Terry Coxon, an expert in legally investing money offshore; Dr. Mark Cruise, CEO of Trevali Resources (TSX:TV); and InvestmentPitch.com's Ted Ohashi, who will be discussing Colombia Crest Gold (TSXV:CLB) and Fischer-Watt Gold (OTCQB:FWGO), two companies that recently presented at the Chicago Resource Expo. "Turning Hard Times into Good Times" can be heard at: http://www.voiceamerica.com/show/1501/turning-hard-times-into-good-times ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Canuc Resources Pursues Ecuador and Nova Scotia Gold Projects Canuc Resources Corp. (TSX: CDA) has confirmed high-grade gold and the potential for large-tonnage, low-grade copper and gold mineralization at its primary asset, property in the historic Nambija gold mining district in southeastern Ecuador. Last November Canuc took an option on the Mill Village gold property in southwestern Nova Scotia, which includes two past-producing mines. Canuc plans to begin surface and underground exploration at Mill Village in the next several weeks, financed by $2 million recently raised through a private placement. To generate immediate income, Canuc is acquiring MidTex Oil and Gas Co., owner of a producing gas well and a lease on 320 acres in Stephens County, Texas. Canuc's CEO, Gary Lohman, has more than 30 years of experience in the mining industry, primarily as a geologist, and the company's officers include similarly experienced people. For more information about Canuc, please visit http://www.canucresources.ca/. |

| Despite doubling in 3 months, silver still in backwardation, Turk says Posted: 25 Apr 2011 01:06 PM PDT 9p ET Monday, April 25, 2011 Dear Friend of GATA and Gold (and Silver): Despite doubling in three months, silver remains in backwardation, GoldMoney founder James Turk told King World News in an interview today. As a result, Turk said, any declines in silver's price should be brief. Meanwhile, according to Turk, the gold chart looks ready for an explosion. An excerpt from the interview has been posted at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/4/26_Ja... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

| QE2 is Damaging the Economy and Reducing GDP Growth Posted: 25 Apr 2011 12:52 PM PDT By Dian L. Chu, EconMatters QE2 is going to go down as one of the worst monetary policy initiatives in the history of the modern Federal Reserve era. On almost any metric applied, QE2 ends up not only falling well short of its proposed goals, but actually turns certain metrics like GDP growth negative compared with the prior quarter, and heading in the wrong direction. Costs Eat into Corporate Profits = No Hiring Analysts all over Wall Street are starting to revise their 2nd quarter GDP forecasts down, and some like Goldman Sachs have made several downward revisions as higher input costs due to a weak dollar are creating an additional burden on businesses and consumers and thus slowing economic growth. A weak dollar (Fig. 1) to a point can help exports, but an extremely weak dollar which in combination with QE2 liquidity juicing up commodities even further, turns out to be a net negative on the economy, and risks sending the economy into another recession. The reason for this is if businesses are having to eat higher input costs, and start to have lower margins, guess what? They start cutting costs again, and that means either stagnant employment practices or workforce cuts in the future. This would start sending the employment figures in the opposite direction, and negate much of the recent progress made over the last year. Increase Cost of Living = Consumer Pullback These higher commodity prices negatively affect consumers as well because they have to apply more of their income to food and energy needs, which means they have less discretionary income to spend for entertainment, retail shopping, vacations, traveling, and discretionary consumption which infuses the economy and creates jobs in the overall economy. And since the US is largely a consuming nation, if the consumer pulls back, then businesses are going to pull back as well. This linkage of events does not bode well for employment growth, and this shows how rising input costs not only hurt one of the fed`s mandates for price stability, but can also have a negative impact on their other mandate which is to increase employment. Increase Consumer Debt…& Defaults There is another angle we saw back in2008 with these same level of gas prices. Namely, consumers were feeling pinched by the jump in costs for food and energy (see charts below), so they started filling out credit card applications, and charging up their credit cards in order to pay for the additional costs to their weekly and monthly budgets for food and energy. In short, the higher costs for these items resulted in more debt for consumers. This means that the recent gains of consumers paying off their debts, and having more money to spend at retailers over the past year will start to reverse as consumers pay a higher percentage of their monthly budget in finance costs. The real damage starts to add up as consumers start to default on their credit cards as the high food and energy costs continue to be financed on credit cards until the consumer hits the breaking point, and just defaults. We saw a lot of this in 2008, and this is where we are heading again unless commodity prices start to come down in a rapid fashion. There are a large group of consumers whose monthly budget doesn`t allow for a 30% increase in gasoline prices at the pump, or a 10% rise in food costs at the grocery store. So they just pile up debt until they max out their credit cards. Dominos to Credit Card Issuers These increases in credit card defaults hurt businesses like banks and credit card firms as they have to write off more accounts, and thus their margins start to get squeezed. This means additional contractionary effects as they respond by cutting costs, and you can readily see how this starts to become a vicious deflationary cycle. Deflation by High Commodity Prices This is why high commodity prices are actually deflationary in the long run. Something the fed should think about the next time they embark on a dollar weakening campaign, whether intended or not QE2 has been a dollar weakening campaign. And for those of you who still do not understand the chain of events, and how the Federal Reserve is responsible in large part for higher commodity prices here is the chain of events.

Currency Crisis Looming The momentum is the key; you either have an accelerating economy or a decelerating economy. And right now due to the effects of QE2 we are starting to decelerate, and another two months of deceleration makes it twice as hard to restart the acceleration process. So two months could make a huge difference in either creating or destroying momentum, and setting the growth rate pace for the remainder of 2011. |

| Don't Fear a Pullback in Prices Posted: 25 Apr 2011 12:50 PM PDT |

| Paul to announce exploratory committee for presidential campaign Posted: 25 Apr 2011 12:47 PM PDT By The Associated Press http://news.yahoo.com/s/ap/20110425/ap_on_el_ge/us_paul2012 DES MOINES, Iowa -- Texas U.S. Rep. Ron Paul plans to announce the formation of a 2012 presidential exploratory committee at an Iowa event. Drew Ivers, Paul's 2008 Iowa caucus campaign manager, says the Republican congressman will announce his plans Tuesday at a Des Moines hotel. An exploratory committee would allow Paul to raise and spend money toward a 2012 candidacy. Ivers says Paul also plans to name an Iowa campaign team. Paul finished fifth in the 2008 caucuses and has visited Iowa seven times since. He headlined an event in Sioux Center two weeks ago for a social conservative group, and he spoke at a rally for Christian home-school advocates at the Iowa Capitol in Des Moines last month. Paul is a favorite among libertarians and enjoys strong backing by many tea party supporters. ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php |

| Ron Wortel: High Gold Prices Raise Old Mines Posted: 25 Apr 2011 12:42 PM PDT Dramatic rises in metals prices over the past 2 years could bring 10 or more past-producing mining camps back to life. MineralFields Group's Engineer and Investment Analyst Ron Wortel shares how he finds promising gold juniors working these mines and structures tax-advantaged, flow-through investments to finance Canadian resource development. |

| Posted: 25 Apr 2011 12:42 PM PDT [url]http://www.traderdannorcini.blogspot.com/[/url] [url]http://www.fortwealth.com/[/url] The chart shows a very large volume spike on the big down candle suggesting the presence of long liquidation in a large way as many bulls rang the register once it appeared that the market was not going to take out $50. It is however a bit tricky reading this because we are also now into rollover activity where traders begin moving positions out of the May contract, which will soon be going into delivery, and into the July, which will then become the most active contract. Some of that activity tends to distort the overall volume readings. Nonetheless, the big volume down day is technically significant. Open interest in the July is now larger than the May by the way so I will soon be shifting my analysis to that contract once its volume exceeds that of the May. I should note two significant occurences here. First of all, there STILL IS NOT SHORT COVERING on a large scale occuring in silver base... |

| Eric de Carbonnel: Acquiring AIG, U.S. govt. assumed huge commodity shorts Posted: 25 Apr 2011 12:41 PM PDT 8:35p ET Monday, April 25, 2011 Dear Friend of GATA and Gold (and Silver): In commentary posted tonight at 24hGold, Eric de Carbonnel of Market Skeptics discloses that in taking over the bankrupt insurer and derivatives game player AIG the U.S. government apparently inherited a huge commodities short position -- which, of course, doesn't include the short positions in gold and silver nominally held by J.P. Morgan Chase and HSBC, which in all likelihood also are U.S. government market-manipulating positions. De Carbonnel's commentary is headlined "AIGFP's Massive Short Position In Commodities (Which Now Belongs to the Government)" and you can find it at 24hGold here: http://www.24hgold.com/english/news-gold-silver-aigfp-s-massive-short-po... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Canuc Resources Pursues Ecuador and Nova Scotia Gold Projects Canuc Resources Corp. (TSX: CDA) has confirmed high-grade gold and the potential for large-tonnage, low-grade copper and gold mineralization at its primary asset, property in the historic Nambija gold mining district in southeastern Ecuador. Last November Canuc took an option on the Mill Village gold property in southwestern Nova Scotia, which includes two past-producing mines. Canuc plans to begin surface and underground exploration at Mill Village in the next several weeks, financed by $2 million recently raised through a private placement. To generate immediate income, Canuc is acquiring MidTex Oil and Gas Co., owner of a producing gas well and a lease on 320 acres in Stephens County, Texas. Canuc's CEO, Gary Lohman, has more than 30 years of experience in the mining industry, primarily as a geologist, and the company's officers include similarly experienced people. For more information about Canuc, please visit http://www.canucresources.ca/. Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax |

| APMEX offers big premiums to purchase gold and silver eagles Posted: 25 Apr 2011 12:31 PM PDT 8:30p ET Monday, April 25, 2011 Dear Friend of GATA and Gold (and Silver): Zero Hedge reports tonight that a major precious metals dealer, American Precious Metals Exchange (APMEX) in Oklahoma City, today began offering a $38 premium over the spot gold price to purchase any amount of 1-ounce U.S. gold eagle coins and a $3 premium to purchase any amount of 1-ounce U.S. silver eagle coins. The APMEX flyer reproduced at Zero Hedge says the premiums are offered so the firm can meet "incredible" demand from buyers. After all, even imaginary Comex gold and silver are getting a bit pricey lately. The Zero Hedge report is headlined "APMEX Starts Reverse Inquiry: Seeks to Buy 'Any Quantity' Of Silver from Clients at $3 over Spot" and you can find it here: http://www.zerohedge.com/article/apmex-starts-reverse-inquiry-seeks-buy-... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT The Gold Standard Now: It Can Work Today a dollar is worth 80 percent less than it was 40 years ago, and less than 5 percent of its value a hundred years ago. We deserve a dollar that is as good as gold, a dollar that will hold its value from year to year so we can be financially secure and our economy can generate more and better jobs. For most of America's history, our dollar was literally as good as gold. But on August 15, 1971, our politicians destroyed the link between gold and the dollar. They destroyed the foundations of our economic system. A new Internet site, TheGoldStandardNow.org, provides news and cutting-edge analysis about this most important issue and explains how the gold standard worked in the past and how it can work in the future. Visit us today: http://www.thegoldstandardnow.org/about/137-welcome-newsmax Join GATA here: An Evening with Bill Murphy and James Turk World Resource Investment Conference Gold Rush 2011 https://www.amsterdamgold.eu/gata/index.asp?BiD=12 Or by purchasing a colorful GATA T-shirt: Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Canuc Resources Pursues Ecuador and Nova Scotia Gold Projects Canuc Resources Corp. (TSX: CDA) has confirmed high-grade gold and the potential for large-tonnage, low-grade copper and gold mineralization at its primary asset, property in the historic Nambija gold mining district in southeastern Ecuador. Last November Canuc took an option on the Mill Village gold property in southwestern Nova Scotia, which includes two past-producing mines. Canuc plans to begin surface and underground exploration at Mill Village in the next several weeks, financed by $2 million recently raised through a private placement. To generate immediate income, Canuc is acquiring MidTex Oil and Gas Co., owner of a producing gas well and a lease on 320 acres in Stephens County, Texas. Canuc's CEO, Gary Lohman, has more than 30 years of experience in the mining industry, primarily as a geologist, and the company's officers include similarly experienced people. For more information about Canuc, please visit http://www.canucresources.ca/. |

| Posted: 25 Apr 2011 12:06 PM PDT |

| The Dollar's Omnious New Record Posted: 25 Apr 2011 12:04 PM PDT |

| Posted: 25 Apr 2011 12:00 PM PDT Appears Scotty got it wrong again. We said to beam us up, and he beamed us back. All of a sudden we seem to have returned to 2008. Perhaps, though, we should not be so tough on Scotty. The Federal Reserve had a hand on the controls too, continuing the longest running stretch of asset price distortions in all of history. Think of 97-year-old sports team with one winning season, 1953. |

| Apmex Starts Reverse Inquiry: Seeks To Buy "Any Quantity" Of Silver From Clients At $3 Over Spot Posted: 25 Apr 2011 11:22 AM PDT Over the past hour Zero Hedge has been inundated with reader comments notifying us that Ampex has, validating the earlier post speculating about a possible silver shortage at the metals distributor, launched a "reverse ïnquiry" in which it will pay "you $3.00 over the current spot price of Silver for your Silver American Eagles. ANY year, ANY quantity!" and "We will pay you $38.00 over the current spot price of Gold for your Gold American Eagles. ANY year, ANY quantity!" So aside from this first public confirmation that one of the biggest wholesale retailers of precious metals is now inventoryless [sic], we can certainly see why Asia has decided to take silver down in the afterhours electronic session. |

| Ron Paul Launches Presidential Campaign, Tells Truth To Whoopi's View Posted: 25 Apr 2011 11:17 AM PDT Well, it's official: Ron Paul has launched his 2012 presidential campaign. Per the National Journal: "Rep. Ron Paul, R-Texas, whose outspoken libertarian views and folksy style made him a cult hero during two previous presidential campaigns, will announce on Tuesday that he's going to try a third time. Sources close to Paul, who is in his 12th term in the House, said he will unveil an exploratory presidential committee, a key step in gearing up for a White House race. He will also unveil the campaign’s leadership team in Iowa, where the first votes of the presidential election will be cast in caucuses next year." More:

Unfortunately, with the ridiculous publicity stunt that is the parallel campaign of Trump, whose only redeeming feature is that he knows more about bankruptcy and nuisance value than any other human being alive, a feature that will come in very handy to the US over the next 5 years, it would appear that Paul's campaign has the usual snowball's chance in a corrupt 7th circle of hell... Which is sad, because Paul, with all his faults, really continues to be the only sane alternative to completel meltdown of this once great country. That said, we hope Paul has more appearances such as this on The View, where he did not pander to his female hosts, and told the truth about many contentuous issues including the military industrial complex, planned parenthood, and the US outlook. One piece of advice for Ron: stay away from Bruno please. |

| Gold settles at record; also hits intraday record Posted: 25 Apr 2011 10:59 AM PDT By Claudia Assis and Chris Oliver, MarketWatch Gold for June delivery added $5.30, or 0.4%, to end at $1,509.10 an ounce on the Comex division of the New York Mercantile Exchange. Earlier, it hit an intraday record of $1,519.20 an ounce. That was gold's sixth consecutive high-water mark and its eighth straight day of gains. May silver rallied $1.09, or 2.4%, to $47.149 an ounce. It had traded as high as $49.82 an ounce. … Investors booked some profits in both metals Monday, said Bart Melek with TD Securities in Toronto. For silver, "the trajectory might be too steep," bringing to some investors' minds an asset bubble, Melek added. … Meanwhile, news reports in China said Beijing is considering the setup of an investment fund targeting sectors such as energy and precious metals, as well as a special fund geared toward foreign-exchange stabilization…. The fund would be structured to intervene in the foreign-exchange market and buy foreign-currency notes without the government having to print new yuan-denominated currency notes, the report said. The reports said the central bank's balance sheet would also be extended to support investment in precious metals and other commodities. [source] |

| Posted: 25 Apr 2011 10:20 AM PDT The 5 min. Forecast April 25, 2011 12:39 PM by Dave Gonigam – April 25, 2011 [LIST] [*]Busybody Alert: State Department wants to know all your former addresses and employers before handing out a passport [*]"A ridiculous notion"… It's Doug Casey's turn to take a whack at the "gold is a bubble" blather [*]Abe Cofnas on the currency market's "balancing act" going into Fed-Wednesday… and how to play it [*]Termites destroy $220,000 in paper currency, police looking at bank officials for "negligence" [*]Readers chime in on taxing and spending… plus a "pie" chart that really puts things in perspective [/LIST] We can't vouch for the verity of the following story, relayed to us by a reader. But in light of our item last week about Congress considering withholding passports from people who owe money to the IRS, it has the ring of truth: "Was on a flight from Costa Rica last week. The plane was delayed for 30 minutes or so on ta... |

| Posted: 25 Apr 2011 10:01 AM PDT View the original post at jsmineset.com... April 25, 2011 08:29 AM Afternoon Thought The risk of supporting the dollar at such an obvious point at USDX .7400 is to make that number more important than .7200 in market terms. Jim Sinclair’s Commentary The choice is simple: QE or default, because there is no solid balance sheet economic recovery in the Western world. The dollar will go down in flames before the US defaults on anything. US default could be disastrous choice for economy WASHINGTON (AP) — The United States has never defaulted on its debt and Democrats and Republicans say they don’t want it to happen now. But with partisan acrimony running at fever pitch, and Democrats and Republicans so far apart on how to tame the deficit, the unthinkable is suddenly being pondered. The government now borrows about 42 cents of every dollar it spends. Imagine that one day soon, the borrowing slams up against the current debt limit ceiling of $14.3 trillion... |

| The Comfort of Low Interest Rates Posted: 25 Apr 2011 10:00 AM PDT In this video that makes up in content for what it lacks in production quality, Bruce Krasting asks some of the same questions that others are asking about U.S. borrowing and the comfort – false or otherwise – currently provided by low long-term interest rates. Recall from this item last week that interest rates are surprisingly terrible at predicting debt crises in the near-term since, for a very long time, things seem to be going along smoothly until you wake up one day and borrowing costs are rising about as fast as the silver price. |

| Capital Context Update: Debt Down on a Dull Day Posted: 25 Apr 2011 09:48 AM PDT From Capital Context  Only Asian FX is weaker against the USD since Thursday's close but Silver was the clear star of the day with some serious swings Somewhat impressively, volumes managed to tail off even more incredibly on this RoW holiday as S&P futures traded 1mm contracts less than the recent average, and NYSE aggregate volume was around 75% of recent average levels. Stocks managed to hug the VWAP (and unch line) as we pointed out in the Midday Movers today was a huge possibility and credit markets stayed at their wides of the day all afternoon - just barely wider. Equities (unch) managed to algorithmically outperform credit (wider) and un-sync from correlation and vol on the day amid rather tepid conditions. Silver was the star of the day (until NFLX earnings after-hours generated some serious rebates) with an always predictable margin hike adding to the excitement into the close. The USD is still weaker vs all of our comparisons from Thursday's close (as seen in the upper chart) except for Asian FX which is very marginally weaker (ADXY in the chart). We discussed the relative selling pressure we were seeing in CDS and secondary bonds and the relative strength in Treasuries early on today and that theme remained all day though the afternoon saw some buyi8ng come back into financial bonds. Putting two and two together with modestly stronger FX and weaker Silver makes for an interesting derisking perspective but on such a low volume day, we are not easily convinced.

Macro prints were anything but supportive and while we did sell-off a little in stocks early on, the machines were in charge as we reached back up to VWAP and clung within 1-2pts of it for the afternoon. We have shown these charts many times (and discuss them with some of our clients) but it is fascinating just how many times the VWAP-reversion algos and standard-error bands (of VWAP) will contain price action on both quiet and active days.  S&P futures clung to VWAP and its standard error bands - in our view showing more algo-driven sensibilities than any marginal risk-taking human. The reason we highlight it is simple - all too often equity indices provide little real insight into the real action occurring under the covers in global risk allocations - or put more simply, following shifts in the capital structure context (debt, equity, and vol) from a bottom-up perspective intraday (and on broader time-frames) can often signal interesting shifts in regimes. This is why we spend so much time looking at intra and inter-asset relationships and furthermore enables us to scrape away some of the noise in search of signals. On a day such as this, we trust the credit markets more than the equity markets (with their lack of algo-driven reversion behavior and potentially larger more professional players involved). In credit we opened modestly tighter from Thursday's close and did nothing but widen all day long to end the day at the wides of the session and a tad wider close-to-close in IG for the widest close since last Tuesday. HY opened unch and slipped very minimally lower in price (wider in spread), also ending at its widest since last Tuesday. Perhaps most interesting was the flattening in 3s5s curves that was evident in both the indices as well as a majority of single-names today. HY saw 3Y 8.5bps wider vs 5Y 4bps wider (yes small moves but still). HY perhaps was driven by some index arbitrage at the 3Y level but the reflection in HY secondary bonds mirrored this with net selling in HY relative to net buying in IG (though we do note that much of the improvement from our Midday Movers comment in IG net flow was due to a reawakening of demand for financials debt. Morgan Stanley and Wells Fargo issues were the most bid with longer-dated issues dominating short-dated - 7-12Y most bid versus <3Y most offered. Somewhat cleaning up the picture we note that MS CDS underperformed today and this region of maturities looked a little rich earlier on today relative to CDS-implied valuations - i.e. someone liked the look of some longer-dated basis trades. For this reason, we would not read too much into the re-emergence of the bid for financials - especially since Treasuries continued to rally into the close - extending the rotation theme that we discussed this morning. Monolines, Builders, and broad finance names were weaker today in CDS land with insurers more mixed (looking like low beta preference) as breadth was quite negative in credit - around 3 wideners to each 2 tighteners and the same ratio in flatteners to steepeners in 3s5s - another concerned theme we have been highlighting recently. ABX tranche prices also dropped quite handily today making us wonder if that was maybe a little behind the moves in monolines/builders for hedgers. Our broad credit index is marginally wider overall and it was clear that higher beta names were underperforming today in credit land (examples include Sabre Holdings, Community Health, MBIA, Amkor Tech, and Eastman Kodak). Some consumer finance names seemed to outperform (SLM, SFI) but there was little thematic move to talk of aside from high spread underperformance and more up-in-quality rotation in single-name credit. Telecoms, Tech, and Media were the worst performing sectors in aggregate while Capital Goods, Energy and Utilities were the best performers - certainly not the most risk-on of days. In vol land, VIX was up on the day but it was all gap from the open and while implied correlation was up earlier, it drifted off as the day went on implying taht single-name vols were relatively bid as the day wore on. Interestingly this vol bid was most apparent in the lower beta names in our universe - suggesting some protection being bought on the 'safer' names while the riskier names (as we have already discussed) were being marginally unwound. SPY skews rose once again (OTM vols rose more than ATMs) and remain near record steeps in three-month (though less so in six-month) - QE2 end?

Contextually , 51% of CDS were wider in our capital structure universe while 60% of equities were down since Thursday's close. 92% of single-name vols rose though and that vol move was more evident in lower beta names (on average) than higher beta. We do point out that the largest rises in vol were in the crossover space (BBB to B rated names) with the better quality names seeing far less of a bid in vol - more rotation into quality. Equity was pretty mixed across qualities as was CDS with litle discernible credit quality theme bottom up. Based on our framework, Basic Materials and Consumer Non-Cyclicals saw the best relative performance of credit over equities today while Transports, Utilities, and Consumer Cyclicals saw the worst credit performance relative to equity performance. CSCO, YUM, HSP, PLD, and WEN were among the most divergent in terms of credit underperforming expectations based on equity and vol moves. AVT, ABX, HIG, KMB, and CLX were moang the most divergent in terms of credit outperforming expectations on the day relative to the rest of their capital structure. Bottom line for us today was such a low volume day leaves us a little non-plussed with anything in equity-land and the fact that credit underperformed equities at the same time as Treasuries outperformed equities (beta-adjusted) makes us wonder if some risk-off was on hand ahead of Wednesday's Bernank-a-palooza. Up-in-quality remains in cash and synthetic credit and protection in vol seems bid again (for now) and for those that prefer their wealth effect in real terms, we kindly remind you that the S&P is now -0.12% YTD (adjusted for DXY). No European or Asia coverage since markets were closed. Index/Intrinsics Changes CDX16 IG +0.4bps to 93.65 ($-0.01 to $100.24) (FV +0.08bps to 91.11) (58 wider - 52 tighter <> 53 steeper - 70 flatter) - No Trend. Spreads were mixed in the US with IG worse, HVOL improving, ExHVOL weaker, and HY selling off. IG trades 1.8bps wide (cheap) to its 50d moving average, which is a Z-Score of 0.6s.d.. At 93.65bps, IG has closed tighter on 122 days in the last 595 trading days (JAN09). The last five days have seen IG flat to its 50d moving average. HY trades 18.1bps wide (cheap) to its 50d moving average, which is a Z-Score of 0.8s.d. and at 440.45bps, HY has closed tighter on 60 days in the last 595 trading days (JAN09). Indices typically underperformed single-names with skews widening in general. Comparing the relative HY and IG moves to their 50-day rolling beta, we see that HY underperformed by around 1.1bps. Interestingly, based on short-run empirical betas between IG, HY, and the S&P, stocks outperformed HY by an equivalent 3.4bps, and stocks outperformed IG by an equivalent 0.4bps - (implying IG underperformed HY (on an equity-adjusted basis)). Among the IG16 names in the US, the worst performing names (on a DV01-adjusted basis) were Transocean Ltd. (+7.53bps) [+0.06bps], Barrick Gold Corp. (+5.25bps) [+0.04bps], and MDC Holdings Inc (+3.83bps) [+0.03bps], and the best performing names were SLM Corp (-8.94bps) [-0.07bps], RR Donnelley & Sons Company (-5bps) [-0.04bps], and Whirlpool Corp. (-3.53bps) [-0.03bps] // (absolute spread chg) [HY index impact]. Among the HY16 names in the US, the worst performing names (on a DV01-adjusted basis) were Sabre Holdings Corp (+40.42bps) [+0.39bps], Community Health Systems Inc (+27.56bps) [+0.26bps], and MBIA Insurance Corporation (+37.19bps) [+0.26bps], and the best performing names were Boyd Gaming Corporation (-15.83bps) [-0.15bps], Realogy Corporation (-15.93bps) [-0.14bps], and Goodyear Tire & Rubber Co. (-12.99bps) [-0.13bps] // (absolute spread chg) [HY index impact]. |

| QE 3 is Coming… It’s Just a Matter of What Form It Will Take Posted: 25 Apr 2011 09:40 AM PDT The Fed will absolutely have to engage in some kind of QE. It might be a toned down version like QE lite (which supposedly doesn’t involve additional money printing). Or the Fed might try to make it a QE that would be more palatable to homeowners (targeting mortgage rates or some such thing).

However, the fact remains that the Fed HAS to continue with QE of some kind. The reasons for this are:

1) The $180+ TRILLION interest rate based derivatives market (90+% all of which are owned by the TBTFs) 2) The debt implosion a spike in interest rates would have 3) Having become the primary buyer of US debt, the Fed must continue to buy or risk a debt collapse in the Treasury market

Whether or not you like QE (yes, there are some insane people who think it’s a good idea… unfortunately they work for the Fed), this is the reality our financial system faces.

Indeed, if the Fed were to quit QE for good the resulting crisis would make 2008 look like a picnic (the 2008 collapse was triggered by the CDS market which was only $50-60 trillion in size, les than one third of the interest rate based derivatives market).

So more QE is on the way. Which ultimately will result in the US Dollar collapsing. In fact, the only reason the Dollar hasn’t collapsed already is because it’s priced against a basket of similarly flawed currencies.

In other words, we’re pricing junk (the Dollar) with other junk.

The whole point of all of this is that inflation is coming in a BIG way. What we’ve seen so far is nothing compared to what’s going to hit once the US Dollar breaks to new all-time lows (at the pace we’re going this will hit within two months).

So if you’ve yet to take steps to prepare your portfolio for the coming inflationary disaster, our FREE Special Report, The Inflationary Disaster explains not only why inflation is here now, why the Fed is powerless to stop it, and three investments that absolutely EXPLODE as a result of this.

All in all its 14 pages contain a literal treasure trove of information on how to take steps to prepare AND profit from what’s to come. And it’s all 100% FREE.

To pick up your copy today, go to http://www.gainspainscapital.com and click on FREE REPORTS.

Good Investing!

Graham Summers

|

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

April 25, 2011 (MarketWatch) — Gold settled at a record and silver rallied 2.4% Monday as inflation fears kept investors attracted to precious metals, which were also helped by a weaker dollar.

April 25, 2011 (MarketWatch) — Gold settled at a record and silver rallied 2.4% Monday as inflation fears kept investors attracted to precious metals, which were also helped by a weaker dollar.

No comments:

Post a Comment