saveyourassetsfirst3 |

- Seeds of Their Own Destruction

- More Metal for the Silver ETF

- Unstoppable Silver ?

- Is a New Reserve Currency Really Necessary?

- Cracks in Oil's Bullish Facade? How to Profit From Dropping Crude Prices

- Weekly Commodity ETF Flows: Investors Pile Into Gold; XOP Assets Plunge

- Do You Need a 'Pure' Gold Miners ETF?

- India Markets Monday Wrap-Up

- Silver Investors "Still Not Stretched" as Golds Fresh Dollar Record Leaves Euro-Price Unchanged

- Bill Gross Is Now Short US Debt, Hikes Cash To $73 Billion, An All Time Record

- Silver New Record Near $42/oz…

- When the long-awaited gold mania could begin

- Ben Bernanke should wake up and listen to gold

- Endeavour Silver Reports Record Production in First Quarter, 2011; Produces 900,133 oz Silver (Up 17%) and 5,008 oz Gold (Up 33%)

- More Can-Kicking

- Investing In Gold And Silver

- classic commemoratives website

- The Nightmare German Inflation

- How Venice Rigged The First, and Worst, Global Financial Collapse

- Money Problems That Never Seem To End: 25 Reasons To Be Absolutely Disgusted With The U.S. Economy

- The Hexagonal Model of Capital Markets

- The Anti-Gold Gospel According to Smith

- BHP Pursues New Profits

- Record Profits

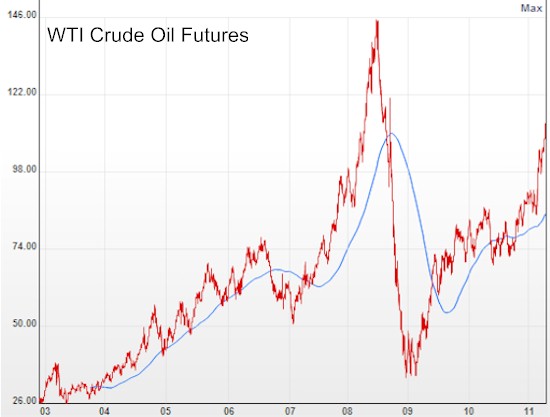

| Seeds of Their Own Destruction Posted: 11 Apr 2011 05:58 AM PDT All those new dollars being created by an apparently-still-panicked Fed are pushing up asset prices across the board (with housing the only exception) and pushing the dollar down to near-record lows versus other currencies. The charts look eerily like a replay of 2007, which, of course, is exactly what policymakers want. Rising asset prices, according to the prevailing logic, will get us spending and borrowing again and return the economy to self-sustaining expansion. 2006 and 2007, for the people running this show, were the good old days. What they seem to be missing is that these trends contain the seeds of their own destruction, just as they did four years ago. Oil, for instance, is back above $100 a barrel, which translates into $4 a gallon gas, which amounts to a sizable tax increase on the consumers who are supposed to start spending again. CNBC just reported that gas sales have fallen for five straight weeks.

Same thing for food. Ag commodity prices are through the roof, which is gradually translating into higher prices at grocery stores and restaurants. Consumers, as a result, will be eating out a lot less in the year ahead — and will still have fewer dollars to spend on other things.

For policymakers, gold and silver occupy a kind of shadow world. They're not "real" money like dollars and euros, but for some inexplicable reason people still respect them. Central bankers worry that they're being unreasonably blamed for their inability to keep their currencies stable versus these atavistic lumps of metal. As masters of their universe, they don't like being contradicted by the rabble in the marketplace. And as managers of fictitious currencies they're terrified of an "emperor's new clothes" scenario in which everyone suddenly sees the con they're running. So they're watching gold in particular with rising anxiety. …and the dollar is approaching the low it hit just before the world fell apart in 2008. This too is a desired goal of US policy, because it makes US exports more attractive for the rest of the world. But of course it also makes imports more expensive, which raises the question of how much lower the dollar can go before headline writers put currency depreciation and rising food/energy prices together. A series of New York Times articles speculating about the end of dollar hegemony (and explaining the nature of money) is the Fed's nightmare because it will get people to thinking about what exactly a paper currency is. Once that train leaves the station its inevitable destination is the conclusion that a fiat currency isn't really anything. It's just a consensual hallucination founded on our trust for the people managing it. Which in turn leads newly-awakened citizens to check out those YouTube videos of Bernanke and Greenspan getting pretty much everything wrong, documentaries like Inside Job, and the ongoing hearings of Ron Paul's subcommittee, in which Fed and Treasury officials are revealed to be mumbling incompetents and frauds. As an understanding of the scam spreads, consumers and investors start converting their dollars into other currencies and hard assets and the game is over. A crisis of confidence sends the dollar into free-fall. This of course is to be avoided at all costs, which makes the dollar's recent decline versus food, energy, and other currencies such a dilemma. It can't keep falling indefinitely, so if it doesn't stabilize on its own — i.e., if gold, oil and food don't stop going up — action will have to be taken to stop it. With Europe and China now raising interest rates, how long will it be before the Fed is forced to follow suit and start sucking liquidity out of the system? And how long after that before everything that's been going up in concert starts to fall together? | ||

| Posted: 11 Apr 2011 05:57 AM PDT | ||

| Posted: 11 Apr 2011 05:42 AM PDT Iacono Research | ||

| Is a New Reserve Currency Really Necessary? Posted: 11 Apr 2011 05:21 AM PDT Eddy Elfenbein submits: Over the weekend, Nobel laureate Joseph Stiglitz called for a new global reserve currency.

Complete Story » | ||

| Cracks in Oil's Bullish Facade? How to Profit From Dropping Crude Prices Posted: 11 Apr 2011 05:15 AM PDT Brian L. Wilson submits: I've been surprised how far crude oil has come up since the Egyptian crisis. Mubarak's resignation initially seemed to quell the surge in oil prices, but the current prices are simply not justified on an intrinsic supply and demand equilibrium. Demand is not going to justify $112/bbl crude for very long. Without Middle East headlines hyped by CNN, oil was sub $90/bbl in February, and has appreciated around 30% since. The U.S. dollar index shows that the greenback has become weaker since oil started its run, but those numbers point to an approximate 3.5% decline. The crisis in Libya has run on for quite a while, with oil continuously breaking resistance levels. Clearly being a supply side issue, the removal of Libya from the list of oil supplies during its revolution has a minor effect on the actual supply demand equilibrium due to the increase in production from Saudi Arabia. Complete Story » | ||

| Weekly Commodity ETF Flows: Investors Pile Into Gold; XOP Assets Plunge Posted: 11 Apr 2011 04:55 AM PDT Hard Assets Investor submits: By Sumit Roy This week's 32-month highs in commodities were reflected in fresh inflows into commodity-related exchange-traded products. Assets in the space reached $172 billion thanks to a combination of $1.8 billion in inflows and $2.3 billion in capital appreciation. All five sectors saw net inflows in the period. Precious metals — last week's laggard — rose to first place this week on the back of inflows totaling a whopping $679 million. But inflows into broad market ETPs, agriculture funds and energy products were not too shabby either, at $332 million, $322 million and $314 million, respectively. Rounding out the list were the industrial metals ETFs, which received $175 million in investor capital. In recent weeks, gold has rallied, but we hadn't seen a similar move in ETF inflows; all that changed this week, as investors plowed $397 million into the iShares Gold Trust (IAU Complete Story » | ||

| Do You Need a 'Pure' Gold Miners ETF? Posted: 11 Apr 2011 04:49 AM PDT Michael Johnston submits: As interest in achieving exposure to commodities has increased in recent years, various issuers have introduced exchange-traded products designed to access this potentially attractive asset class. While assets have flowed into exchange-traded products that offer exposure to natural resources prices through futures contracts and physical commodities, ETFs that invest in stocks of the companies engaged in the extraction and production of commodities have also become popular tools. Commodity-intensive equities often exhibit a positive correlation to the spot price of the underlying resource or resources, since the profitability of these firms depends on the prevailing market price for their goods. Because the underlying assets are stocks, this strategy may diminish some of the diversification benefits found when investing directly in commodities or futures contracts. But there are some potential advantages as well. Investing in commodity-related equities avoids the thorny issue of contango, and results in the underlying assets having an identifiable Complete Story » | ||

| Posted: 11 Apr 2011 04:27 AM PDT Equitymaster submits:

Complete Story » | ||

| Silver Investors "Still Not Stretched" as Golds Fresh Dollar Record Leaves Euro-Price Unchanged Posted: 11 Apr 2011 04:17 AM PDT Bullion Vault | ||

| Bill Gross Is Now Short US Debt, Hikes Cash To $73 Billion, An All Time Record Posted: 11 Apr 2011 03:26 AM PDT

A month ago, Zero Hedge first reported that Bill Gross had taken the stunning decision to bring his Treasury exposure from 12% to 0%: a move which many interpreted as just business, and not personal: after all Pimco had previously telegraphed its disgust with US paper, and was merely mitigating its exposure. This time, in another Zero Hedge first, we discover that it is no longer business for Bill – it has now become personal (and with an attendant cost of carry). In March, Pimco's flagship Total Return Fund (TRF) has now taken an active short position in US government debt: -3% on a Market Value basis (or $7.1 billion), and a whopping -18% on a Duration Weighted Exposure basis. And confirming just what PIMCO thinks of US-related paper is the fact that the world's largest "bond" fund now has cash, at a stunning $73 billion, or 31% of all assets, as its largest asset class on both a relative and absolute basis. We repeat: cash is more than PIMCO's holdings of Treasurys and Mortgage securities ($66 billion) combined. To paraphrase: in March PIMCO was dumping everything related to US rates (see chart below). This is the first net short position that PIMCO has had in Government-related debt since the Great Financial Crisis of 2008, and going positive in February of 2009 only after it became clear that the Fed would commence monetizing US debt one month later. This is the closest that Gross has come to making a political statement and is now without doubt putting his money where his mouth is. The only event that could possibly derail Gross' thinking is a huge market crash forcing a rush to Treasury safety. Alas, as has been made all too clear recently, US debt is no longer the safe haven it once was. Which begs the question: when will the TRF break out a "gold" asset holdings line item. And another side effect of the firm's scramble away from debt and into cash is that the effective duration of TRF is now down to 3.6: only the second lowest since the 3.38 posted in December of 2008… when the world was on the verge of ending. That Bill Gross is willing to risk a surge in redemptions (after all who would be wiling to pay PIMCO to manage a third of their assets in the form of supposedly devaluating cash) in order to make a statement about the credibility of the US government, and specifically the viability of its IOUs, is easily the only thing that the US government has to consider when evaluating the prospects for funding trillions and trillions of US deficits at "acceptable" rates in the absence of further quantitative easing by the Chairman. If Gross is indeed right, something very wicked this way comes. | ||

| Silver New Record Near $42/oz… Posted: 11 Apr 2011 01:43 AM PDT gold.ie | ||

| When the long-awaited gold mania could begin Posted: 11 Apr 2011 01:05 AM PDT From Louis James, editor of Casey's International Speculator: It's understandable that people want to know where the precious metals market is headed next. And not just because big fluctuations can be nerve-wracking, but because it makes a big difference how you'd invest today if, for instance, you think there's a big correction ahead (save cash to buy cheaper) or not (load up and ride the wave). But the reality is that I don't know. Nobody knows what will happen next. That's why it's called speculation. Further, you can be right about the trend and still get wiped out if your timing is wrong. That's why it's easier to say what is likely to happen than what is likely to happen next. And that, in turn, is why we at Casey Research still have quite a bit of concern and uncertainty about... Read full article... More on gold: What the world's best gold experts are saying now Porter Stansberry: What every American needs to know about gold WARNING: Traveling with gold just became much more dangerous | ||

| Ben Bernanke should wake up and listen to gold Posted: 11 Apr 2011 12:51 AM PDT From Pragmatic Capitalism: Ben Bernanke needs to wake up and listen to gold's message. Late in 2010, Fed Chairman Ben Bernanke was confident that inflation would remain low, and that the Fed could "remove policy accommodation" at the appropriate time. But rising food and gasoline prices are forcing him to start changing his tune. Here is a sampling: "Overall, inflation remains quite low." – February 3, 2011 "The most likely outcome is that the recent rise in commodity prices will lead to, at most, a temporary and relatively modest increase in U.S. consumer price inflation." – March 1, 2011 "I think the increase in inflation will be transitory." – April 5, 2011 Bernanke's complacency seems to be weakening, and it may have come from... Read full article... More on gold: What all gold investors should know about the crisis in Japan Porter Stansberry: What every American needs to know about gold Gold is breaking out to new highs... This is where the rally could end | ||

| Posted: 11 Apr 2011 12:47 AM PDT Endeavour Silver Corp. (TSX:EDR)(AMEX:EXK)(DBFrankfurt: EJD) announced today that the Company set new records for silver and gold production in the First Quarter, 2011 from the Company's two operating silver mines in Mexico, the Guanacevi Mine in Durango State and the Guanajuato Mine in Guanajuato State. | ||

| Posted: 10 Apr 2011 09:30 PM PDT We Continue To Forecast More Can-Kicking, Market Fixing, And Price Manipulation, Which Can Last Lots Longer Than Major Shorting Of Trades. Consider the banker-corporation cabal and their respective positions. They must sell gazillions in new IPOS, let the markets digest them over time and, then race to the exits dumping losses on the Sheeple. We think it takes through next fall to finish the game. However, we are expecting haircuts of magnitude this year on the order of 2-3 events with the fall cycle being the more dire. Our best chart source, DecisionPoint, usually agrees with our Trader Tracks viewpoint. "My observation of how markets normally move leads me to believe that the next bear market will begin with a gradual deterioration of prices, sufficient to give us the technical warning to exit before a crash. A crash-type event will probably follow to let one and all know that the bear is back in town. This is my best case scenario, because the debt problem is too big to solve easily. Worst-case, the potential for a sudden collapse without warning is greater than I can remember, but I am not predicting a crash." -Carl Swenlin DecisionPoint Note how traders got the price above the moving averages and channel line for a buy signal. Volume is near normal on thin trading. The PMO momentum has based to stop selling and move into a rally. Major support was not violated (red dotted line) near 1225. And, the media Pollyanna's, bought and paid for, continue to chortle all is well. It's great fun watching the hedge fund managers and top analysts try to make hay out of dirt when pumping their favorite positions. Buffet said this morning he does not like gold. Ooh, Pleeeze! This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 10 Apr 2011 08:50 PM PDT | ||

| classic commemoratives website Posted: 10 Apr 2011 05:42 PM PDT neat website with background info on the classsic commems interesting stories behind the designs http://www.usrarecoininvestments.com...tive_coins.htm | ||

| The Nightmare German Inflation Posted: 10 Apr 2011 04:45 PM PDT USA Gold | ||

| How Venice Rigged The First, and Worst, Global Financial Collapse Posted: 10 Apr 2011 04:30 PM PDT Schiller Inst | ||

| Money Problems That Never Seem To End: 25 Reasons To Be Absolutely Disgusted With The U.S. Economy Posted: 10 Apr 2011 04:10 PM PDT

A lot of Americans do not like to read about economics, but what has been going on over the last few years has been nothing short of extraordinary. The Federal Reserve has basically tripled the adjusted monetary base. We have now been conditioned to accept that trillion dollar deficits are "normal". The U.S. dollar is being systematically destroyed right in front of our eyes and most Americans don't even seem alarmed about it. Our entire financial system is coming apart. The signs are everywhere. The following are 25 reasons to be absolutely disgusted with the U.S. economy.... #1 There are now 6.4 million fewer jobs in America than there were when the recession began. #2 In Southern California, the average price of a gallon of gasoline is $1.00 higher than it was at this time last year. #3 The average price of gasoline in the United States has jumped about 20 cents in just the last two weeks. #4 Over the past 12 months the average price of gasoline in the United States has gone up by about 30%. #5 In the 8 days leading up to the "historic" $38.5 billion budget deal, the U.S. national debt increased by $54.1 billion dollars. #6 The $38.5 billion in budget cuts that the Republicans and the Democrats have agreed to represent approximately one percent of the federal budget. #7 During the 2010 campaign, the Republicans promised voters they would cut $100 billion from the budget for 2011. Instead, they gave in when the Democrats offered just $38.5 billion. #8 The Obama administration had been estimating that the federal budget deficit for fiscal 2011 would be approximately 1.6 trillion dollars. Now it will likely be somewhere around 1.55 trillion dollars which will still be an all-time record. #9 According to numbers released by Deloitte Consulting, a whopping 875,000 Americans were "medical tourists" in 2010. #10 The median pay for CEOs increased by 27 percent during 2010. #11 Thanks to globalism, U.S. workers now must directly compete for jobs with workers in places such as Indonesia. In Indonesia, full-time workers make as little as two dollars a day. So how are Americans supposed to compete with that? #12 Last week, the price of gold set a new all-time record on Tuesday, on Wednesday, on Thursday and on Friday. #13 The price of silver rose almost 7 percent last week alone. #14 Total home mortgage debt in the United States is now about 5 times larger than it was just 20 years ago. #15 According to the Economic Policy Institute, almost 25 percent of U.S. households now have zero net worth or negative net worth. Back in 2007, that number was just 18.6 percent. #16 Americans now owe more than $903 billion on student loans. #17 According to the New York Times, as of 2009 the wealthiest 5 percent of all Americans had 63.5 percent of all the wealth in America. Meanwhile, the bottom 80 percent had just 12.8 percent of all the wealth. #18 According to a recent report from the National Employment Law Project, higher wage industries accounted for 40 percent of the job losses over the past 12 months but only 14 percent of the job growth. Lower wage industries accounted for just 23 percent of the job losses over the past 12 months and a whopping 49 percent of the job growth. #19 The first week of air strikes in Libya cost the U.S. government about 600 million dollars. #20 The price of corn has more than doubled over the past year. #21 According to the U.S. Bureau of Labor Statistics, the average length of unemployment in the U.S. is now an all-time record 39 weeks. #22 Back in the 1950s, corporate taxes accounted for about 30 percent of all federal revenue. Today they account for less than 7 percent of all federal revenue. #23 If the U.S. government eliminated all discretionary spending and all defense spending it would still not balance the budget. #24 It is being projected that U.S. government debt will rise to about 400 percent of GDP by the year 2050. #25 Americans spend approximately 27.7 billion dollars a year preparing their tax returns. That last statistic really gets me. During the month of April the American people are going to be spending massive amounts of time and money to prepare their taxes. But what do Americans get in return for their taxes? What they get is a government that is completely and totally incompetent. Our "leaders" are running the greatest economy in the history of the world into the ground, but unfortunately most Americans have no idea what is happening. Why are Americans so clueless? Well, the truth is that over time we have been turned into a nation of idiots and morons. To get an idea of just how "dumbed down" we have become as a nation, just check out this Harvard entrance exam from 1869. I wouldn't have a prayer of passing that exam. What about you? Thanks to the slothfulness of society, the deficiencies in our education system and the toxins in our food, air and water it has become hard for most of us to think clearly. Most of us are fat, dumb and totally clueless. The entire economic system is being shredded and most of us just drool and turn up the television a little louder. If we have money problems, most of us just run out and apply for another credit card. If our state and local governments run into financial problems they just borrow even more money. Of course the biggest offender of all is the federal government. What our politicians are doing to future generations is not just criminal. It is beyond criminal. It is absolutely unconscionable. So please excuse me if I am absolutely disgusted with the U.S. economy. We took the greatest economy in the history of the world and we wrecked it. How in the world are we going to explain this to our children and our grandchildren? | ||

| The Hexagonal Model of Capital Markets Posted: 10 Apr 2011 04:00 PM PDT Gold University | ||

| The Anti-Gold Gospel According to Smith Posted: 10 Apr 2011 04:00 PM PDT Gold University | ||

| Posted: 10 Apr 2011 01:28 PM PDT --Giant mergers among resource companies...record-setting initial public offerings for commodity traders...these are usually the events that signal the top of the commodity cycle, aren't they? Well...yes...but not automatically. --For example, how are you to evaluate whether BHP Billiton's possible $46 billion bid for Woodside Petroleum is a good deal? It's certainly an exciting deal. Riding a pony is exciting too, when you're five years old. And everyone loves a parade. But is it a good deal? --This would be an important question not just for existing shareholders of BHP and Woodside, but anyone who was thinking about buying BHP in the future. BHP has $16 billion in cash, thanks to surging iron ore and coal prices. Buying Woodside's energy assets would add to BHP's energy portfolio. But would it add to BHP's profitability? --"What determines a company's value is in any industry," wrote Greg Canavan in the February 23rd issue of Sound Money. Sound Investments, "is the rate of profitability it can generate on newly invested funds." -- He pointed out that new investments (or acquisitions) can actually have the effect of lowering a company's intrinsic value if the rate of profitability on the new assets is lower than what the company is already getting. --In BHP's case, it reported a 41% return on capital in its last half-year profit statement. The big driver behind that incredible return (for a company its size) was the surge in iron ore and coal prices. BHP's bid for Woodside now—to match or equal that return on capital—depends massively on rising oil and gas prices. --Of course, oil and gas prices ARE rising now. And they could go a lot higher. But if BHP pays too large a premium for Woodside now—the $46 billion is a 26% premium on Woodside's Friday closing market cap of $37 billion—it will looks foolish if oil prices fall. In his February report, Greg reckoned that at around $42, Woodside's share price was already pricing in growth for all of 2012. --We shot him a note this morning asking about the deal and he wrote back:

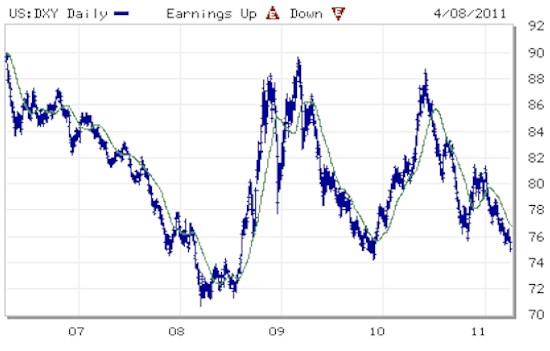

--Greg will no doubt be following up in his mid-week alert. And by the way, the February report included valuations of BHP, Santos, and Oil Search as well. If you're interested in reading the report, you can sign up for a trial subscription to Sound Money. Sound Investments with a new quarterly billing offer. Go here to learn more. --We wouldn't be having this conversation if Brent Crude wasn't at a 30-month high of US$126.12. And THAT wouldn't be happening if the Middle East andU.S. dollar weren't slowly disintegrating. --The first story here is on oil's supply side. Blackouts in Venezuela affected refineries there. And Nigeria—one of Africa's largest oil exporters—has elections this weekend with interruptions in oil production possible. But by far the biggest worry on the supply side continues to be the Middle East. --In the most recent issue the Australian Wealth Gameplan, published Friday, we wrote that investors are underestimating the threat to global oil supplies from Middle East uncertainty. That's because it's not just uncertainty. It's a geopolitical revolution. It will last years and put in doubt the security of energy supplies coming from the world's most oil-rich region. --The change in the political landscape of the Middle East puts a premium on proven non-Middle Eastern oil reserves (the subject of the investment recommendation in the AWG report). It also makes conventional and unconventional natural gas a lot more appealing, which partly explains BHP's Woodside interest. --The other factor behind the rising oil price is the state of the U.S. dollar. And what a sorry state it is. The dollar index chart below shows that the greenback is getting ready to break below support at 74 on its way to new lows. It's also important to note the dollar has failed to rally on the "flight to safety" trade as it did in 2008 and early 2010. Not even an historic earthquake/tsunami/nuclear crisis has moved investors back into the dollar. Dollar Index threatens to make new low

--And why WOULD anyone buy the dollar or loan the U.S. government money for any length of time? The weekend shenanigans between the President of the United States and the so-called leaders of the U.S. Congress were farcical bordering on the surreal and rage-inducing. Someone should send a memo to the ass-clowns in Washington that the United States of America is broke. Get it! Broke! -- If cutting $33 billion in non-defence discretionary spending is the best these guys can do, they have shown how profoundly unfit they are as guardians of the nation's purse strings. What a bunch of entitled, elitist morons. They should all be fired and then deported, although we wouldn't wish that kind of export on our worst enemy. --The image below from the Congressional Budget Office tells you part of the U.S. budget story. In simple terms, 61 cents out of every tax dollar is mandatory spending, under the current budget rules. The "Mandatory" chunk includes Social Security, Medicare, Medicaid, unemployment, Veteran's benefits, and public pensions. By statute, it's money the government can't "unspend".

--That is why last week's negotiations were supposedly so dramatic. The cuts had to be made from non-defence discretionary spending, even though that makes up just 19% of the total Federal budget. The lawmakers were arguing over a variety of smaller, boutique Federal programs that are near and dear to the corrupt hearts of various legislators. --By the way, we're counting the 6% interest payments on the $14.3 trillion national debt as mandatory, too. It is possible, of course, that the U.S. could, at some point, stiff its bondholders. When you can simply print them the money you owe, defaulting seems overly dramatic. But you can see why Bill Gross has exited his Treasury position and compiled a $54 billion cash war chest. --It gets worse for America. Federal receipts in 2010 totalled $2.16 trillion. That was just enough to cover the "mandatory spending" part of the Federal budget, which amount to about $2 trillion. The other $1.3 trillion in spending—defence and discretionary spending—was all financed by Federal borrowing. And the morons were arguing over $33 billion. Unbelievable. Laughable. Pathetic. --Think about that scenario for a second. The United States is barely garnering enough in tax revenues to pay for mandatory spending. And the best its political leaders can do is agree, at the 11th hour, to cut $33 billion in spending. It shows you just how completely removed from reality America's political class is. --No wonder gold and silver are spiking. Now that is a reality we can get behind. --It's pretty obvious what the U.S. ought to do. First, it ought to end its long wars in the Middle East and Afghanistan, bring home troops from the 135+ nations in which they are currently deployed, including Japan and Germany more than 50 years after the end of World War Two. That would be a start. The U.S. has more than enough submarines and nuclear weapons to defend itself. --Then the U.S. would have to begin rewriting the "social contract" that has made entitlement spending mandatory. People won't like that. No one likes a lower standard of living. Look at the arguments raging in Europe. --But the debate is not about what kind of country you want to live in. The debate is about what the country can afford. And when the country is broke, you either face reality and make some very hard decisions...or you kick the can down the road like a coward. --Trouble is, there's not much of the road left. America's statutory debt limit of $14.3 trillion will be reached sometime in early May. Of course the Congress can raise that ceiling by law. But it can't make people buy the dollar or U.S. debt if they don't want to own them. And fewer and fewer investors (that aren't the Fed) want to own U.S. debt. --The global attitude toward the dollar is fast reaching a tipping point. This is one reason the Aussie dollar continues to break record after record. U.S. leaders will either make a serious and believable effort at real spending cuts. Or the next move down in the dollar crisis will be even more disruptive for financial markets, and even more bullish for precious metals. Dan Denning | ||

| Posted: 10 Apr 2011 12:47 PM PDT

Mercenary Links Roundup for Sunday, April 10th (below the jump).

04-10 Sunday

| ||

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment