Gold World News Flash |

- Silver, the Canary in the Gold Mine

- When Will The Gold Bull Market End?

- Gold - 8 Hour chart update 11:45 PM CDT

- Gold Seeker Closing Report: Gold and Silver End Mixed

- Food Fights

- Gold's Slow Rise To The Top

- In The News Today

- Jim Sinclair:Stay Focused

- French Nuclear Group Warns that Children and Pregnant Mothers Should Protect Themselves from Radiation

- Are ETFs Really Safe? An Interview With Andrew Bogan

- Why High Oil Prices Are Likely Here to Stay

- Nuclear Whistleblower: “Spent Fuel Pools In US Are A Potential Timebomb, Situation Can Get Worse Than Chernobyl”

- 12 Stunning Silver Stocks

- Leonard Melman: On Freedom and Gold's Future

- Gold Daily and Silver Weekly Charts - Correction Underway, How Low Will They Go?

- Five Dollar Gasoline in California

- Government Spending Screws the Little Guy

- Gold Objective at 1520

- Silver - 8 hour chart update

- Oil, Gold, and Silver Prices Reflect International Coalition Shortcomings in MENA

- Gold falls on stronger dollar; silver gains

- The Sell-Off in Paper Gold

- A Better Bargain at $1470

- On Freedom and Gold's Future

- Why Silver Is Likely to Correct at 20%

- Seeds of Their Own Destruction

- No Inflation in Sight

- Gold and Silver Breaks Out: Technical Targets Being Monitored

- Stiglitz calls for new global reserve currency to prevent trade imbalances

- Magnitude 7.1 Monday – Yet Another Quake Shakes Japan

| Silver, the Canary in the Gold Mine Posted: 11 Apr 2011 06:09 PM PDT Silver, the Canary in the Gold Mine was my talk at a Gold Standard Institute symposium in Canberra, Australia in November 2008. The topic could well describe today's gold and silver markets. Today, both silver and gold are achieving record highs but silver's accelerating price indicates silver may indeed be the canary in the gold mine, the leading indicator for gold's long-awaited explosive move upwards, a move the Fed and major bullion banks have colluded since the 1980s to prevent. |

| When Will The Gold Bull Market End? Posted: 11 Apr 2011 06:07 PM PDT The main reason that we expect the gold bull market to run for at least a few more years relates to the theories that dominate thinking within the halls of policy-making -- chiefly the theory that the economy can be made stronger via more monetary inflation, more credit expansion and more government spending. In effect, policy-makers have been trying to fight cancer by feeding the cancer, and there is every indication that they will continue to do so. |

| Gold - 8 Hour chart update 11:45 PM CDT Posted: 11 Apr 2011 05:31 PM PDT |

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 11 Apr 2011 04:00 PM PDT Gold climbed to a new all-time high of $1475.60 in Asia before it fell back to $1463.70 in London and then bounced back higher in New York, but it still ended with a loss of 0.41%. Silver surged to a new 31-year high of $41.94 in Asia before it fell back to as low as $40.555 in early afternoon New York trade, but it still ended with a gain of 0.1%. Both metals are, however, falling in after hours access trade. |

| Posted: 11 Apr 2011 03:27 PM PDT |

| Posted: 11 Apr 2011 02:32 PM PDT My Dear Friends, Today was full of business meetings in New York. Having spent 27 years on Wall Street, getting me into that city is not easy. When duty calls however, who am I to argue. I watched the gold market today somewhat displaced from the action. In fact it is via a CME app on an iPhone. A few times I was asked a question, but my mind was on gold. I had to on more than one occasion ask for the question to be repeated. What I saw impressed me. All during the USA night gold held its highs nicely. The trend certainly confirmed that the drama of closing down the US government shined the light of day on the over the top US debt position. Today was an operation in the gold market because it was scary for it to have held its high. Just as the Exchange Stabilization Fund thinks a strong dollar policy is that it dies in front of our eyes slowly, control of the gold market is only that it does not go straight up to $3000 – $5000. Gold is heading to $1500 plus, will get blasted back to these levels and then on to $1521, $1600 and $1650. There is no desire to stop it but only to make the climb challenging. Stay focused on debt. Do not accept any of the hawkish central bank governor's MOPE. They simply like to hear their own voices and to see their sketches in the Journal. There is no practical way to drain the liquidity put in by QE everywhere in Western World finance. The operative word is PRACTICAL. Academically there are many ways with the risk inherent of bombing the weak recovery and running the Western World into a depression of all time. Alf and Martin may well be right with their predictions of gold going to $3000 to $5000 and maybe beyond. Regards, |

| Posted: 11 Apr 2011 02:03 PM PDT Jim Sinclair's Commentary The madness cannot be stopped. Watch the following video. Know that the price of gold is super glued to debt. Debt is totally out of control, and gold is going to flash past $1650 as if it did not exist.

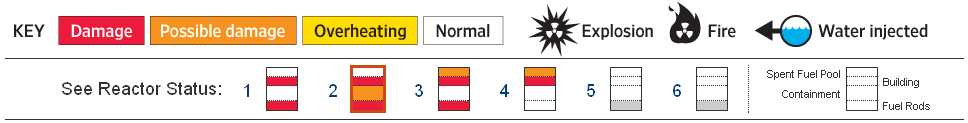

Jim Sinclair's Commentary Reports are coming in that Nuclear Plant #4 in Japan is burning, and the threat of a Nuclear meltdown is imminent. Magnitude-6.4 quake hits Japan hours after 6.6 temblor A magnitude-6.4 earthquake struck Japan Tuesday morning, after a similar quake rattled the northeastern part of the country Monday evening. The latest quake struck at about 8:08 a.m. Tuesday (7:08 p.m. Monday ET), according to the U.S. Geological Survey. It had a depth of about 13 kilometers (8 miles) and was centered about 77 kilometers (47 miles) east-southeast of Tokyo. Earlier, a 6.6-magnitude earthquake struck Monday night, on the one-month anniversary of the country's devastating 9.0-magnitude quake and tsunami.

Fire at Japan's crippled nuclear plant, more aftershocks TOKYO (Reuters) – Engineers were fighting a fire at Japan's crippled nuclear plant on Tuesday as another major aftershock rocked eastern Japan, swaying buildings in central Tokyo and closing Narita airport runways. Japan is considering raising the severity level of its nuclear crisis to put it on a par with the Chernobyl accident 25 years ago, the worst atomic power disaster in history, Kyodo news agency reported on Tuesday. Operator of the crippled Fukushima Daiichi nuclear plant, 240 km (150 miles) north of Tokyo, said on Tuesday that its workers were fighting a fire near damaged reactor No. 4. It was unclear how serious the fire was. "Flames and smoke are no longer visible but we are awaiting further details regarding whether the fire has been extinguished completely," said a spokesman for Tokyo Electric Power Co (TEPCO). News of the fire came only minutes after a 6.3 aftershock struck off the coast of Chiba, 77 km (48 miles) northwest of Tokyo. Kyodo said Japan's main international airport Narita closed runways for checks but later resumed flights. |

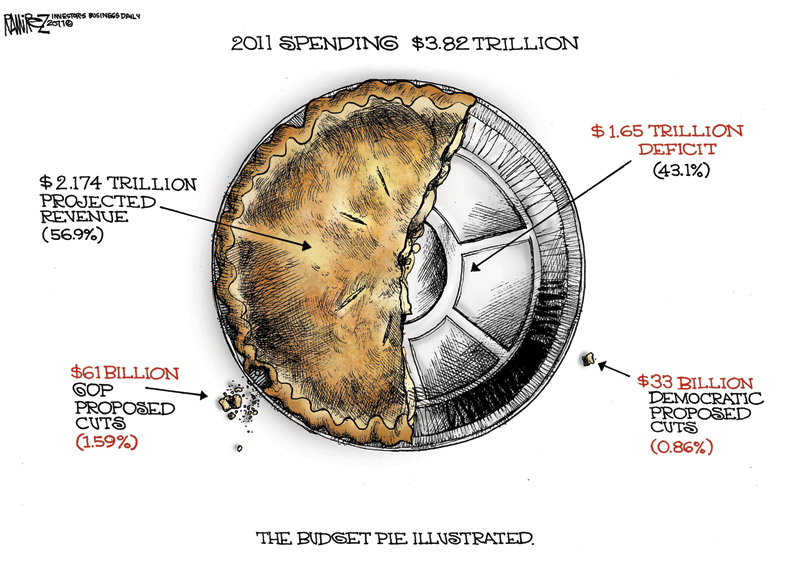

| Posted: 11 Apr 2011 01:44 PM PDT Dear CIGAs, Thinking back to the following post from April 5th: Expect the Round Number Effect at $1500 for gold, but less severe than the battle at $1400. Angel $1650 is quickly coming into focus. If we have learned one thing, it is not to get short term focused on this market. Stay focused on what is important and not the noise. Think for a moment if Armstrong and Alf are right on gold. That would mean the following prices are coming: $1650 $3000 $5000 $12,500 Jim Sinclair's Commentary See things in perspective. The close/open government game was a political show. Look at what it all really means in the big picture. 33 billion is nothing more than crumbs.  More Here.. |

| Posted: 11 Apr 2011 01:00 PM PDT As Euractiv notes:

CRIIRAD appears to count credible scientists among its ranks, including director Bruno Chareyron - who holds an engineering degree in Energy and Nuclear Technology and postgraduate degrees in Nuclear Engineering and Particle Physics. The Euractiv article notes that radiation levels are much higher in the U.S. than in France:

(The French use a comma instead of a period as a decimal point). 0.17 becquerels per liter equals 4.59 picocuries per liter. But cesium levels of 19 picocuries per liter of radioactive cesium plus 18 picocuries per liter of radioactive iodine have been found in milk from Hilo, Hawaii (this is the official EPA data): It is not surprising that radiation levels are higher in the U.S. than in Europe. As Canada's Simon Fraser University notes:

As I noted on March 12th:

So should American children and pregnant mothers also protect themselves from exposure to radiation by avoiding drinking rainwater and eating certain foods? |

| Are ETFs Really Safe? An Interview With Andrew Bogan Posted: 11 Apr 2011 12:53 PM PDT Submitted by Andrew Bogan of Casey Research Are ETFs Really Safe? Dr.Andrew Bogan is a managing member of Bogan Associates, LLC in Boston, Massachusetts. He has spoken at many international investor conferences – his specialty being global equity investing – and has been interviewed on live television for CNBC's Strategy Session. In an attempt to understand the relatively new but wildly popular Exchange Traded Funds (ETFs), Dr. Bogan did extensive research into the structures used by ETF operators, with a special focus on the potential risks that might arise should they be faced with large and sudden liquidations. Given that there are about 2,000 ETFs in existence, with assets totaling over $1 trillion, we thought it appropriate to find out what Dr. Bogan has learned in his research. David Galland: Our primary goal today is to give readers a better understanding of exchange-traded funds (ETFs) and the risks that come with them. Speaking personally, I've been in this business for a long time, and I find anything that grows as quickly as ETFs have a bit worrisome. To begin, maybe you could just talk a little about the difference between an ETF and a traditional stock or bond mutual fund. Andrew Bogan: Yes. Shares in a traditional mutual fund, whether it's an index fund or has a managed portfolio, don't trade in the open market. If you want to own shares, you buy them from the fund. If you want to get rid of your shares, you sell them to the fund. A traditional mutual fund takes its shareholders' capital and invests it directly on a one-to-one basis in stocks or bonds and holds those securities in custody. Thus it's always 100% reserved, meaning that the securities it owns correspond exactly to the shares its investors own. If you want your capital back, the fund can deliver it to you either in kind or in cash, depending on market conditions. That's not the case with an ETF. Shares in an ETF trade in the open market, which is where retail investors buy and sell them. An ETF also issues and redeems shares every day, like a mutual fund. But, unlike a mutual fund, it does so only through "authorized participants," which are brokers, market-makers and other institutions. DG: Jumping right to the point, has there ever been a problem with an ETF? AB: ETFs have operated pretty well historically, but the mechanics of share issuance and redemption also creates some unique differences that we believe may lead to unintended consequences. There already have been a few problems with ETFs, some more significant than others. The Flash Crash on May 6 of last year showed some structural issues with ETFs and perhaps with our whole market system for equities as well. It's hard to decide where to draw the line, but a lot of securities departed from their perceived value during the Flash Crash by very large amounts. The reasons are still not completely understood, although the SEC has made a reasonable effort to understand what happened. Another incident occurred in September 2008, when the Lehman and AIG mess was upon us. The commodity ETFs run by ETF Securities, Ltd., in London halted trading when AIG's solvency came into question. The funds were investing in derivative contracts, including swap agreements, some of which were with AIG. It was only the Federal Reserve pumping in tens of billions of dollars that prevented those products from going. Bailing out AIG averted a disaster for the funds, and they continued to trade the next day. DG: So, the issue with the ETF securities fund was more around the derivatives the fund held, not the structure of the fund itself? AB: In that particular case, it was around the derivative contracts that underlay the fund, although that kind of arrangement is very common with European ETFs. Even equity index ETFs in Europe tend to be structured that way, and that's also not uncommon with a lot of the foreign stock ETFs as well – including some of those traded here in the United States. I think it's a clear example where you have a counterparty risk wrapped inside the fund that could be very significant in bad circumstances. DG: In the case of the Flash Crash, your research paper pointed out that even though ETFs represent only 11% of the listedsecurities in the U.S., 70% of the canceled trades during the Flash Crash involved ETFs. Is there an explanation for that? AB: Some clarity is starting to emerge from work done by the SEC and others. But from our perspective, those statistics are quite alarming. There's no good reason 70% of canceled trades would be in ETFs while only 11% of listed securities are ETFs. And even though ETFs trade more actively, they don't represent 70% of all trading volume. So any way you look at it, they were badly overrepresented among the canceled trades, i.e., overrepresented among the most extremely off-priced trades. From the perspective of financial theory, that makes absolutely no sense. ETFs are meant to be index-fund trackers. They’re meant to represent a whole basket of shares, and yet these very securities that are meant to be diversified actually fell more than their underlying stocks during the Flash Crash, more often and more deeply. That's quite worrisome; it tells you that in a crisis environment ETFs don't behave the way financial logic suggests they ought to, which suggests to me that the theory is incomplete. People haven’t really looked closely enough at what the unintended consequences of ETF issuance and redemption mechanics are, and what the realities are in stressful market conditions. DG: At this point, more than half the American Stock Exchange's daily volume is ETFs, which is quite a number. These things have only been around for, what, less than 20 years. Yet from everything I've read, it seems they’re not very well understood, even by you guys. Which is saying something because you’ve spent a lot of time looking at them, and there are still blank spots in your knowledge about how they actually operate. AB: Absolutely, and I think that's an important point. We understand the mechanics of how an equity trades and from where it derives its value and how it's priced in the market. The mechanics for mutual funds are well understood also. The challenge with ETFs is that the process of issuing and redeeming shares that also are trading is much more complicated than a lot of people want to talk about. It allows for some unintended consequences, particularly in connection with short-selling, which became an important factor only in the last decade. DG: Let’s talk about the process of creating new shares. If I'm running an ETF that is designed to mimic the S&P 500 index and I have a lot of people who want to own my fund, I can simply issue new shares based upon the flow of stocks into my fund, right? AB: Shares can be created at the end of any day if someone delivers a basket of underlying stocks to the ETF through an authorized participant. And shares that are not wanted in the marketplace can be redeemed in kind for the underlying stocks – or in some cases cash. That's all been carefully structured and works smoothly. The issue is what happens when short-selling dominates the trading. People have been short-selling ETFs up to shocking levels, like 100% short, 500% short, sometimes over 1,000% short. That's in a world where stocks like Apple are 1% short, or IBM is 1.4% short, or General Electric is 0.5% short. You really don’t see traditional stocks with short positions anything like this, so clearly something is fundamentally different. The difference is that ETF short-sellers – including hedge funds, dealers and arbitragers – are confident they can always create the shares needed to cover, so they see less risk of being squeezed. DG: But in a traditional short-selling situation, you typically have to borrow the shares before you can short them. AB: Yes, and that's true here too. But if you look at the Securities Settlement Failure data, ETFs are very oddly overrepresented, so it does look like there is some short-selling that happens before the shares are borrowed. But that's a small matter. The problem is that there is no limit to the amount of short-selling you can theoretically do while still having borrowed the shares. It simply requires the same share to have been borrowed, short-sold, borrowed from the new owner and short-sold again down a daisy chain. That's how you get these arbitrarily large short interest figures. The short-selling involves new buyers coming in without the shares being created at all, and that's the fundamental asymmetry in the short-selling that we're most concerned about. DG: Let's get to that, because you have retail investors, for lack of a better word, and you’ve got the hedge funds. I suppose they could both own the same fund, but for completely different reasons; a hedger to hedge another bet, and a retail investor to pursue a certain goal, but the net result is that the short interest is still way out of whack from what you'd expect to see in a traditional stock. I suspect this is something that most of the retail investors are unaware of. So, where is the potential for the ETFs to get into trouble? AB: The trouble could come from a number of different angles. One concern is that the huge short interest building up essentially leaves the ETF as a fractionally reserved stock ownership system. If you have a fund, for example, that is 500% net short, then for every one holder of an actual share there are five other investors who own IOUs for the shares. Their real shares have been lent out and short-sold to someone else – usually without the original owner's knowledge, unless they read and still remember the margin agreement they signed when they opened the account 10 years ago. For the ETF itself, it means that the fund holds only 15% of the underlying securities implied by the gross number of fund shares that investors think they own. The other 85% isn't totally missing, it just isn't held by the fund. Morningstar commented that the money is all there, it's just in hidden plumbing in the financial system, and we agree with that exactly. The question is, how many investors understood they were storing their money in the hidden plumbing? DG: So walk us through what might happen if there were large-scale redemptions. Let's just say that for whatever reason, people decided this was the time to get out of a particular fund. How do things get unwound? AB: Redemptions have to flow through an authorized participant, which is usually a broker or market-maker, and it's only that institutional layer that can actually redeem. If for some reason a significant portion, say, half or 80% or so, of the total fund ownership wanted to redeem and get the underlying stocks from the ETF through the authorized participant layer, you would fundamentally have a crisis in a fractional-reserve system. The ETF could not deliver the underlying stocks to all the would-be redeemers. The investors who really owned just an IOU on shares that had been lent to short-sellers wouldn't have a direct claim on the fund, so their demand to redeem would force an unwinding of the short-sales. DG: So it seems that it's not so much the fund that might have a problem. The fund is only liable for the shares it has issued. The risk seems to lie in the counterparties – the brokers or the investors that brokers lent shares to. AB: Right. Essentially you have just that. You have quite a bit of counterparty risk here, because if you think your shares can be redeemed and then the fund halts redemptions because they’re running out of the underlying stocks, you're stuck. Normally ETF shares are redeemable through the authorized-participant channel, but an ETF or any other institution that issues something that is redeemable but fractionally reserved could be hit with a run, like a bank run. Now the big question is, in practice, would this happen? It's up to everyone to form their own conclusion, but interestingly the first argument we heard when we began looking into ETFs was that this was just a theoretical topic and that there would never be a really big redemption in a large ETF. But we have since learned that's actually not the case, because a giant redemption in IWM, one of the largest ETFs, occurred in 2007. Now we think that 2007, being one of the best markets for equities since maybe the late ‘90s, was a pretty forgiving time to test the crashworthiness of an ETF that runs into a massive, unexpected redemption. But IWM was redeemed from millions of shares outstanding down to something on the order of 150,000 shares, and in one day, and that's because somebody tried to crash the fund. DG: Was that a really lousy fund, and somebody just said, "Enough, I'm going to punish you guys and get out of it,” or – AB: Oh, no, no, IWM is one of the largest and most liquid ETFs in the entire market. It's the Russell 2000 iShares ETF. It is the poster child of why ETFs are great. But even so, what's interesting is that the first argument we got from industry insiders was that our misgivings are nonsense, growing out of some theoretical conversation about what might happen but is never going to happen, and now we're being told it already has happened and nothing broke too badly, so what are we worried about. DG: Let’s stick with this potential problem of a huge bunch of redemptions. People say, "Oh my god, I've got to get out of my ETFs," and there is a wholesale run on the funds. Because of the way ETFs are structured, it would seem that if they post net redemptions for a day, that the broker that had lent fund shares to short-sellers would just force the borrowers to buy back and cover their obligations. AB: That's exactly right, but remember, for an ETF to create units requires someone to deliver the underlying stocks, so there's somebody who's on the hook to buy those stocks en masse all at the same time. DG: No matter what has happened to the price in the interim. AB: Yes, which gives rise to the question of who's on the hook and what's their creditworthiness when they get put on the hook. Have their prime brokers really been keeping appropriate track, as they’re required to do and on most days have done, of the creditworthiness of those, say, hedge funds or other kinds of short-sellers? DG: Because you're not talking about small amounts of money. AB: No. In fact, in one ETF, IWM again, short positions recently amounted to 14 billion dollars. That's not an enormous amount for the capital markets, but it's a pretty significant amount with respect to 2,000 small stocks. If there were a run, actually doing that unwind and getting those 14 billion dollars' worth of extra ETF shares would require buying 14 billion dollars’ worth of Russell 2000 stocks. If you didn’t want to be more than, say, 10% of volume, it would take 40 trading days to buy all you needed. So we think that if you actually had a very sudden redemption run on IWM, there is a real likelihood of a short squeeze occurring in the Russell 2000. We don’t expect that at any particular time, it's just something that could happen if enough things went wrong. The short position in an ETF like IWM being over 100% means that a large amount of the money investors think they have placed in Russell 2000 stocks has in fact been lent to hedge funds and other short-sellers. You take that across the entire ETF industry and you're looking at about 100 billion dollars in short interest – money that did not go into the underlying shares or gold or whatever the ETF represents. It was instead lent to hedge funds. It has been deposited in a shadow banking system where ETFs allow short-sellers to borrow money from institutional and retail investors. DG: And what are they doing with that money? AB: Well, no one knows. Presumably they invest it in what they think is going to make a better return than what they shorted, because you can't score the 10% or 20% those guys are all trying to make every year by buying the index. So it's anybody's guess. DG: One question that Terry Coxon asked as I prepared for this interview was whether there is any way for the marketplace to let the fund's share price deviate for long from NAV? AB: The tracking of an ETF's price with the fund's NAV, which historically has been extremely close, is totally dependent on an arbitrage mechanism. The arbitrager can make money by continuously pushing the price of the ETF toward its NAV. The question is... what NAV? What they mean by NAV is a value per share outstanding of the fund's underlying stocks. But of course you have this huge implied ownership through short-selling, and the short-sellers' shares are not being counted in the shares outstanding number. DG: A lot of our readers have money in GLD, which is the ETF that invests in physical gold. You've looked at GLD, and it's based upon the premise that as investors pour money in, the operators of GLD turn around and buy physical gold and store it. And likewise with redemptions, they just sell the gold. My understanding is that there isn't anywhere near the same level of short interest on GLD. AB: The short position in GLD isn't nearly as large as it is for some equity funds – but we have looked at GLD, and it has the same structural issues, just to a lesser extent, at least for now. The short interest in GLD has fluctuated around 20 million shares. Now, GLD is a pretty big fund. With 20 million shares short, it is roughly 95% fractionally reserved. So for all the investors who think they own the underlying physical gold, the fund actually has 95% of it in the vaults. But GLD does not have to stay at 95% fractionally reserved. If there were a massive wave of short-selling in GLD, you could end up with a very significant fractional-reserve situation. If that were followed by heavy redemptions, you'd have the same kind of problem I described earlier – not enough gold to redeem all the shares. DG: Could they just say, "From here on, we're not issuing any more shares"? Would that stop the short-selling? AB: Not necessarily, because, you know, the short-sellers are selling – in fact, it would probably exacerbate the short-selling. So as long as a fund is issuing shares, aggregate buying demand can be satisfied by expanding the fund. If they stop issuing shares, aggregate demand would get satisfied by short-sales of existing shares. So, if anything, closing the issue window should make the problem worse, not better. DG: Working through the mechanics of this, let's say gold drops by a few hundred bucks. Say, for instance, that there is some major change in the market along the lines of when Volcker raised interest rates back in '79-'80. And at that point a lot of short-sellers say, "Okay, this is it for gold," they pile on, they start shorting the hell out of GLD, and now all of a sudden you’ve got a real problem because the fractional aspect of it balloons, if you will. AB: Well, you don’t necessarily have an immediate problem. It depends on the market conditions and the level of panic. You certainly would have a ballooning fractional-reserve situation, meaning that the reserves held in actual gold versus the implied ownership by people who think they own GLD (even though the shares have been hypothecated by the broker) will shrink. Those investors may believe they are still entitled to the metal, but the reserve of gold held on their behalf starts to shrink very quickly under those conditions. The bigger challenge might be if there were an actual redemption wave. If that happened when GLD was already substantially fractionally reserved, then you're back to an 1800s gold bank problem. Fractionally reserved banks can be hit with a run. DG: Right. Is there anything else that would make this whole "house of cards" collapse? Suppose a highly visible ETF stumbles and is unable to meet redemptions, or they just have to postpone redemptions. That might be the sort of trigger that could really send people off. AB: You know, one of the big risks, by the way, that no one has really discussed much, is if an ETF were to have a big redemption run in panicky market conditions and halted redemptions. Halting redemptions is a complicated decision, because it breaks the symmetry that allows the arbitragers to go long or short both the basket of stocks and the ETF shares to move price toward NAV. So it's quite possible that if redemptions were halted for any length of time, the arbitragers wouldn't be keeping the share price in line with NAV. We already know from the Flash Crash that significant price departures from NAV are quite possible for ETFs. DG: Knowing what you do, I mean, obviously you deal on an institutional level with your money-management firm, do you own ETFs personally? AB: We do not. We do not own any ETFs either personally or on behalf of the funds we manage. DG: Is it because of the research you’ve done or just because it's not what you guys do? AB: I would say it's primarily because it's not part of our strategy, but obviously we did the research because we were interested in understanding the product better. DG: So, any advice for readers? Is there a short interest over which a person should be concerned about his holdings? AB: Well, I don’t know if I could set a threshold, but I would certainly encourage people to make sure they know what the short interest is in any fund they are considering. That's a metric that is starting to become more accessible. Since |

| Why High Oil Prices Are Likely Here to Stay Posted: 11 Apr 2011 12:20 PM PDT |

| Posted: 11 Apr 2011 11:53 AM PDT Nuclear Whistleblower: “Spent Fuel Pools in US are a potential timebomb, situation can get worse than Chernobyl” Interview by Tuur Demeester George Galatis became world famous in 1996, when Time Magazine featured him in its cover article “Nuclear Warriors”. Today, he warns that that the situation in the USA may soon become much graver than that in Japan. Working as a Senior Engineer at Northeast Utilities company (NU) in Connecticut, Galatis noticed that across the country, After a lengthy legal battle, and dealing with an uncooperative Nuclear Regulatory Commission (NRC), the Northeast Utilities Company was eventually convicted of 25 federal felonies, was forced to sell all of its nuclear plants, and lost over $3 billion in what company CEO Bruce Kenyon called “the largest management turnaround in the history of the nuclear industry”. Eventually, NU grudgingly made the fuel pool cooling system changes that Galatis had suggested. Though treated as a hero by the public, collegues continued intimidation and threats, according to Galatis, which eventually killed his career in the nuclear industry. In light of the Fukushima nuclear disaster, where spent fuel rods are in effect melting down in the aftermath of an earth quake and subsequent tsunami, these sentences of the 1996 Time article have a prophetic ring to them:

So what does whistleblower George Galatis make of the global nuclear crisis that developed since the earthquake and tsunami of March 11? George Galatis: “Since the start of the Japanese nuclear crisis, I have been very concerned about its consequences to the Japanese people, to the general public, and about the lack of attention to what I perceive as being the real issue.” Tuur Demeester: What is the real issue at stake, in your opinion? GG: “The real issue is that of nuclear safety. Right now the true risk to public health and safety associated with the generation of nuclear power is intentionally kept from the public. Because of misplaced trust, these enormous risks are in effect being enforced on the public without their knowledge or consent. People need to know about and agree to accept the real risks involved so that when a scenario like Fukushima—or worse—arises here, there is already a degree of acceptance. Without this formal public acceptance, nuclear power will never be cost effective nor will it survive.” “And despite many years of hard work of the Union of Concerned Scientists (UCS) and others such as Robert Alvarez of the Institute for Policy Studies, the risks associated with nuclear power and in particular, the storage of spent fuel in the spent fuel pools, have not been properly addressed by the nuclear industry and its Federal regulator. Without appropriate action, the nuclear tragedy in Japan may very well be reproduced on American soil at some point in the near future.” TD: Why were these risks kept hidden from the public? GG: “The reason for this, in my opinion, is that the radiation dose limits of a spent fuel pool accident would now exceed the limits set by Congress and originally agreed to by the public when the license to operate or build a nuclear plant was approved. Had the radiological consequences or risks associated with a spent fuel pool accident been communicated to the public prior to the NRC and the nuclear industry opting to perform full core off loads and store vast amounts of spent fuel in the pool, the public would not have accepted them. So, the NRC opted instead to ignore this change “from original operation” and its radiological impact by offering this as their official position: “the agency [NRC] analyzes dose rates at the time a plant opens—when its pool is empty. The law does not contain a provision for rereview.” Unfortunately, the industry also went along with this line of reasoning, even though it blatently contradicts reality.” TD: Could you name some specific risks the public is facing today? GG: “For example, one of the big surprises the public has become aware of is that the spent fuel pools in the Japanese nuclear power plants do not have a containment structure over them to prevent the escape of radioactive contaminants. People today can not believe how the design of a plant could so grossly compromise the health and safety of the general public. Yet this is one of the key safety issues we have right here in the USA as well: 23 American reactors are based on the same ‘Mark I’ blueprint as the Fukushima plant, and all 33 US Boiling Water Reactors share the same spent fuel pool design.” TD: What are the safety issues with the spent fuel pools? GG: “These pools were originally designed to hold less than half of a reactor’s core of fuel as a normal mode of operation, and that on a temporary basis. They were never intended to serve as a long-term nuclear fuel storage facility. However, today most nuclear plants in the USA contain more than five cores, which is at least ten times their original design for normal operation, and at least 2-3 times more than the amount held at the Fukushima unit 4 spent fuel pool. This means the US power plants, especially those with elevated spent fuel pools, are potential ticking timebombs, waiting for earth quakes, human error, acts of malice, or terrorism to cause a radiological crisis.” TD: Your success as a nuclear whistleblower did not turn the tide? GG: “Only temporarily, but I knew that beforehand. Many warnings to the industry, the nuclear industry regulators, and Congress, have not been heeded at all. For example, after the 9/11 attacks here in the USA, a Congressional Commission was formed and one of the issues was how vulnerable the nuclear plants were to terrorist attacks, especially airplane attacks. In response, the Nuclear Regulatory Commission issued a public proclamation that the plants are safe because of the concrete dome protecting the ‘reactor’. Their initial answer was entirely beside the question, and the issue of the spent-fuel pools remained unanswered, in my opinion intentionally.” TD: Worldwide, there are sixty reactors under construction in 15 countries, with most in Asia, the USA, and eastern Europe. According to the Council of Foreign Relations, the USA currently has 25 reactors in the planning stages, with $8.33 billion in loan guarantees for the construction of two nuclear reactors in Georgia. What are your thoughts about this expansion of nuclear power production? GG: “In the USA, I would not consider any future expansion until the current nuclear safety, national security, and long-term storage issues have been addressed, approved by all stakeholders (public, industry, regulators, legislators), implemented fully, and are fully functional. It would be premature and unwise to start building new plants when the issues of the present plants haven’t been addressed yet, especially the spent fuel and national security issues. In addition, much can be learned from from the current Japanese crisis which may need to be incorporated into the new designs once that evaluation and analysis is completed. “ TD: Do you have any final words of advice to share? GG: “In my experience, official sources of information are often confusing and of little transparency. Given the enormous risks involved, it is vitally important for everyone to do their own research and become more informed. Fortunately today, thanks to the Internet, there are sufficient resources available. As I mentioned before, I think the Union of Concerned Scientists is doing an excellent job in addressing the pressing issues at hand and educating the public. Hopefully, the industry, the NRC, and Congress will heed their advice and remember whose interests it is they are supposed to serve: those of the general public.”

Recommended background articles: Time Magazine 03/17/1997: “Nuclear Safety Fallout” New York Times: “Experts Had Long Criticized Potential Weakness in Design of Stricken Reactor” The Boston Channel tv: Plants stockpiling nuclear waste? All Things Nuclear: Internal NRC Document Reveals Doubts about Safety Measures Union of Concerned Scientists: Nuclear Power Safety Union of Concerned Scientists: Sabotage and Attacks on Reactors CNN: “Nuclear Whistleblower Explains Design Flaws of Fukushima Nuclear Power Plant in Japan” Wikipedia: List of Boiling Water Reactors |

| Posted: 11 Apr 2011 11:08 AM PDT Marco G. submits: With the fast-rising prices for silver and gold that have set new all-time highs this past week of April 2011, many investors must be wondering, what does one do to take advantage of this situation? It does seem to the author that there is a distinct lack of media attention covering the precious metal rise. As always, there seems to be an equal number of bears calling the rise in prices a bubble and signalling danger versus an equal number of bulls calling for a further rise to $50 USD and beyond, based upon currency debasement. For myself, I see further gains based upon supply and demand factors of the emerging markets growth, and I will watch with interest. As for a prediction for the silver price, based upon a quick look at the charts and the application of some Elliott Wave's principles, I call for silver to rise to Complete Story » |

| Leonard Melman: On Freedom and Gold's Future Posted: 11 Apr 2011 11:07 AM PDT Source: Brian Sylvester of The Gold Report 04/11/2011 How has the increase in government in the last 150 years driven precious metal prices? In this exclusive interview with The Gold Report, Leonard Melman, editor of The Melman Report newsletter and the author of Reverse the Way In, discusses why he recommends precious metal stocks, but advocates changes in monetary policy that could diminish the price of gold. The Gold Report: Your report is a hot commodity in the mining space. You also recently published a book, Reversing the Way In. Can you tell me about it? Leonard Melman: It amounts to this: I believe the world has too much government. I don't think too many people would argue about that, except the dedicated leftists. Two phases have occurred in the last 300 years to create our present situation. The first, from 1700 to 1850, was immensely positive because the principles of real liberty became established. Authors like John Stuart Mill wrote about the tremendous benefits o... |

| Gold Daily and Silver Weekly Charts - Correction Underway, How Low Will They Go? Posted: 11 Apr 2011 10:05 AM PDT |

| Five Dollar Gasoline in California Posted: 11 Apr 2011 10:01 AM PDT Geez, it's only mid-April and they're already paying $5 a gallon for premium in parts of California. While CNBC correspondent Jane Wells appears almost giddy when pointing out these high prices, host Maria Bartiromo emotes real anguish, a combination that, unfortunately, we could see again and again in the months ahead. The national map at Gasbuddy shows that the average price for regular unleaded in the Golden State is now over $4.10 a gallon – visitors are advised to fill up that rental car before getting within a mile of the airport in order to five or ten dollars. |

| Government Spending Screws the Little Guy Posted: 11 Apr 2011 10:00 AM PDT Joel Bowman, managing editor of The Daily Reckoning, is in Argentina, and it looks like he is discovering that the corruption that comes with creating more money, so that the government can stupidly spend it, is now everywhere, and, indeed, the ugly end result is everywhere, too. In his essay "The Unfortunate Sate of the Argentine Beef Industry" an Argentine friend of Mr. Bowman's explains, "as usual, the little guy, the one who the government supposedly set out to help, ends up paying more." Ain't that the truth! Hahaha! I laughed, as I cleverly noted by appending, "Hahaha!" to the end of the sentence, because inflation in prices is the Same Damned Thing (SDT) that always, always, always happens when the government tries to, in one way or another, "help the little guy." And yet everybody has a government that just keeps on screwing "the little guy," by creating more and more inflation in the money supply, that creates inflation in prices, that screws "the little guy" during the process of "helping the little guy." Luckily, I can ascertain how much "the little guy" is getting screwed because The Economist magazine is within easy reach, and by deftly going to the back page, I scan down the table to see that Argentina has a monstrous 10% inflation in consumer prices, but with three mysterious little asterisks. "Asterisks? What's with the asterisks?" I wonder. When I go to the bottom of the page to hopefully find out what these asterisks mean, I find that they mean, "unofficial estimates are higher." Whoa! Does this mean that Argentina's government is a corrupt, lying piece of worthless trash like all the other countries in the world, only more so than any other? Hmmm! Then, curious, I scan up and down the table, and note that none of the other countries in the Whole Freaking World (WFW) have their inflation figures marked with asterisks, even though I am sure they are shot through with lying corrupt crap. So "Hmmm!" again! In fact, the only other country in that selfsame Whole Freaking World (WFW) that has any symbol attached to their inflation figures, at all, is Britain, so as to note that their 4.0% inflation is the "Centred 3-month average," which is, I cynically note since I don't know what it means nor do I care, probably just another kind of corrupt, lying fraud where a lot of people should wind up in prison, too. So, with that kind of exhaustive, unbiased research on my part, I guess the three asterisks denotes Argentina as being this week's winner of the Mogambo Biggest Liar Award (MBLA) about inflation. Congratulations! And my pity to the "little guys" of Argentina who must pay these higher and higher prices, reminding me about the song title, "Don't cry for me, Argentina," although I don't know what that's about, either. Then, to expand my fabulous foray into real research, I cast my eye up the page to the United States, and read across to note that inflation in consumer prices is a laughable 2.1%! Hahaha! Hell, The Economist magazine shows that the dollar index of "all items" is up 42.4%, and the latest government report shows that inflation in food and energy is at double-digit rates, for crying out loud! And, I am loathe to report, it's going to get worse because the Federal Reserve is still creating money out the ying-yang, which has increased the monetary base by $73 billion in the last week, which is a rise of 3.1% in One Freaking Week (OFW), and the monetary base is up $160 billion in the last three weeks, which is an expansion of the money supply of over 7% in Three Freaking Weeks (TFW)! We're Freaking Doomed (WFD)! That is why I laugh when Spencer Jakab, writing in The Financial Times, writes that, despite acknowledging Milton Friedman's famous aphorism that "inflation is always and everywhere a monetary phenomenon," and even after stipulating that "the monetary base has indeed mushroomed," he nonetheless qualifies it with "in the quantity theory of money, it is not a simple increase in the base that causes inflation. It is an excess supply of money, which is the not the case – not yet anyway." I screech, "What? No, it doesn't! The money goes into government deficit spending! That's how the government gets money into the damned economy! And I further argue that 'a simple increase in the monetary base' is not significantly different from 'an excess supply of money,' too, even though you say one will cause inflation and one will not, even though the prices of food and energy are up by double-digits everywhere!" "So where does the money go?" you ask with that cute little look on your face that melts my heart. He says, "At the moment, the money shows up as excess reserves on bank balance sheets, for which they receive interest." I say, "The money goes into higher prices." He does not say to buy gold and silver to protect yourself against the gigantic inflation in prices that is guaranteed by the Federal Reserve creating So Freaking Much Money (SFFM). I say to buy gold and silver to protect yourself against the gigantic inflation in prices that is guaranteed by the Federal Reserve creating So Freaking Much Money (SFFM). And while, by his photo, I cannot imagine him saying, "Whee! This investing stuff is easy!" that is exactly what I am saying. In fact, I'll say it now! "Whee! This investing stuff is easy!" The Mogambo Guru Government Spending Screws the Little Guy originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Posted: 11 Apr 2011 10:00 AM PDT courtesy of DailyFX.com April 11, 2011 06:46 AM 240 Minute Bars Prepared by Jamie Saettele A break of long term trendline support in gold is needed in order to suggest that an important top has formed. The trendline is at 1371 this week. Continue to favor the upside towards long term channel resistance, which intersects with 1600 in the next several months. The 161.8% extension of the 1381.80-1449.70 rally is an objective at 1521.... |

| Posted: 11 Apr 2011 09:40 AM PDT |

| Oil, Gold, and Silver Prices Reflect International Coalition Shortcomings in MENA Posted: 11 Apr 2011 09:38 AM PDT Carlos X. Alexandre submits:c First and foremost, and as reported by Reuters last night, "Gaddafi 'accepts peace roadmap': South Africa's Zuma," and I hope this is the real deal. But the writing has been plastered on the wall. Instability has a way to propel oil and precious metals higher, and the current geopolitical landscape is fertile ground for conspiracy theories, apocalyptic dreams, and allodoxaphobia when views are a bit off the beaten track. As a side note, the various spellings of the name Gaddafi is due to a lack of a "universally accepted authority for transliterating Arabic names," according to the The Christian Science Monitor. We find ourselves in the midst of uncommon times, and currency games keep most of us off balance, with the European Central Bank and Federal Reserve playing ping-pong with each other, while the rest of the World simply observes and acquires uncomfortable neck pain. Portugal's expected bailout didn't affect Complete Story » |

| Gold falls on stronger dollar; silver gains Posted: 11 Apr 2011 09:04 AM PDT By Claudia Assis Gold for June delivery declined $6, or 0.4%, to settle at $1,468.10 an ounce on the Comex division of the New York Mercantile Exchange. Silver ended a smidge higher, keeping above $40 an ounce. Gold ended at a record high of $1,474.10 an ounce Friday, the latest in a series of such milestones for the metal on the past week. Investors took profits following the record, and some discussion in Washington about curbing the U.S. debt also took a toll on gold, said James Cordier, a portfolio manager at OptionSellers.com in Florida. The debate made investors feel "that maybe there's an end to the dollar printing and the increase in debt," he said. Friday's record was partly achieved on fears of a government shutdown, averted with a last-minute deal, that knocked the dollar. This week, President Barack Obama is expected to unveil a plan to reduce the U.S.'s debt. The metal notched a 3.2% weekly gain, its highest five-day gain since early December and its third weekly gain in a row. [source] |

| Posted: 11 Apr 2011 09:00 AM PDT syndicate: 0 Author: Vedran Vuk Synopsis: The number of gold ounces held in trust at ETF giant GLD peaked in July 2010 and has been in decline since, as the number of shares redeemed has exceeded those created. Kevin Brekke tells us more. Also in this edition: Some recommended readings for investors; and forex trading websites – only for the initiated. Dear Reader, This weekend, I was perusing through the business and economics section of a large chain book store. With my graduate degree almost complete, I'll soon have too much excess time on my hands, and a few books might be the perfect way to fill it. However, rather than discovering something interesting in the section, I was highly disturbed by the selection. The shelves were filled with book after book of dumb, irrational and borderlin... |

| Posted: 11 Apr 2011 09:00 AM PDT The 5 min. Forecast April 11, 2011 12:31 PM by Addison Wiggin [LIST] [*] World calms down, silver shoots up… Why Marc Faber sees gold cheaper today than in 1999 [*] Bond King puts even more conviction behind our New Trade of the Decade [*] Do bull markets in commodities spell bear markets for stocks? Surprising evidence against an old saw [*] Icelandic taxpayers say no (again)… we prepare to bear witness to an exploding snowman… irritated reader asks, “Where’s the humility?” [*] And a farewell tribute to one of the giants of our trade… [/LIST] As we might have forecast, the government didn’t shut down. Gaddafi in Libya wants a cease-fire. And while another earthquake has hit northeast Japan, it doesn’t appear to have wrecked anything that wasn’t already destroyed. Yet silver has pushed to another post-1980 high. At last check, it’s $41.27. Spot gold hit an intraday r... |

| Posted: 11 Apr 2011 08:55 AM PDT How has the increase in government in the last 150 years driven precious metal prices? In this exclusive interview with The Gold Report, Leonard Melman, editor of The Melman Report newsletter and the author of Reverse the Way In, discusses why he recommends precious metal stocks, but advocates changes in monetary policy that could diminish the price of gold. |

| Why Silver Is Likely to Correct at 20% Posted: 11 Apr 2011 08:46 AM PDT Geoffrey Ching submits: Silver has had a phenomenal run over the last year more than doubling in price. However, I think that it is overextended and is likely to suffer a correction of at around 20% Complete Story » |

| Seeds of Their Own Destruction Posted: 11 Apr 2011 08:39 AM PDT |

| Posted: 11 Apr 2011 08:30 AM PDT In response to the recent multi-month, multi-year and all-time highs posted by the Dow, oil and gold respectively, your suitably-entertained editor last week remarked, "Good Golly…what isn't going up?!" Indeed, commodities across the board are on the march and prices from the grocery store to the gas pump are beginning to reflect that reality. One headline we saw this morning called for "$5 gas by Memorial Day." According to the Lundberg Survey, the national average for a gallon of regular unleaded as of Monday was $3.76…and rising. Up, up and away! Meanwhile, gold was off to the races last week, at one point inching north of $1,475 per ounce. Silver, too, tickled $42 an ounce. Let's say that again. Silver. $42. Per ounce. That's ONE ounce. At the turn of the millennium, you could have bought EIGHT ounces for that price…and had enough change for a couple of dollar meals at McDonalds or a pint at the pub. You see what's going on here, don't you Fellow Reckoner? You're paying attention? Right. Of course you are. You've been reading all about Bernanke's crackpot monetary elixirs and conjuring tricks in these pages for long enough. You can probably recite the whole sordid tale in your sleep. It's a tale that involves debasing the dollar…and debauching our good language to boot! It turns "money printing" into "quantitative easing," "too-stupid-to-succeed" into "too-big-to-fail," and "change" into more of exactly the same expansionist, statist policy that free men and women are eternally called to rage against. And, when the rhetoric has subsided, when the dust has settled and the phony-baloney prestidigitation is exposed for what it really is, you get what you always get when a central bank muscles in and carves out for itself a coercive monopoly in the counterfeiting business. You get – eventually, inevitably – inflation, that most creeping, insidious of taxes. But wait! The International Monetary Fund says not to worry, that, "in advanced countries, we do not see much pass-though to core inflation." So reads their latest, as reported by the papers this very morning. Did you read that, truck driver in Chicago (where gas is now over $4.35 per gallon)? Did you see that, grocery-shopping mom in Middle America, (where retail meat prices have risen more than 7% in the last year)? You read that, right, person who eats cheese and/or drinks milk and who has seen dairy prices climb by 15% during last month alone, and milk futures, as traded on the Chicago Mercantile Exchange, rise more than 50% in the past year? Cheese, in case you're wondering, is currently trading at prices not seen since 1984. That's right, cheese-eating, milk-drinking, burger-chomping, car-driving people of America. There's nothing to see here. Move it right along. Kindly return to your sofa for the latest episode of American Idol. Your government has everything under control. Joel Bowman No Inflation in Sight originally appeared in the Daily Reckoning. The Daily Reckoning recently featured articles on stagflation, best libertarian books, and QE2 . |

| Gold and Silver Breaks Out: Technical Targets Being Monitored Posted: 11 Apr 2011 08:11 AM PDT |

| Stiglitz calls for new global reserve currency to prevent trade imbalances Posted: 11 Apr 2011 08:05 AM PDT By John Detrixhe and Sara Eisen A "global system" is needed to replace the dollar as a reserve currency and help avoid a weakening of U.S. credit quality, said Stiglitz, a professor at Columbia University in New York. The dollar fell to an almost 15-month low against the euro last week, and the U.S. trade deficit widened more than forecast in January to the highest level in seven months. "By taking off the burden of any single country, we don't have to have trade deficits," Stiglitz said in an interview in Bretton Woods, New Hampshire. "Things would be much worse if it were not the case that Europe was having even more of a problem, but winning a negative beauty pageant is not the way to create a strong economy." … "Reserves are IOU's," Stiglitz said. "When IOU's get big enough, people start saying maybe you're not a good credit risk. Or at least, they would change in their sentiment about credit risk." Stiglitz, who won the 2001 Nobel Prize for economics, was attending the Institute for New Economic Thinking's conference in Bretton Woods at the hotel where U.S. and European officials met in 1944 to remake the global monetary system. … The existing monetary system means "there's a very good risk of an extended period of low growth, inflationary bias, instability," Stiglitz said. It's "a system that's fundamentally unfair because it means that poor countries are lending to the U.S. at close to zero interest rates." [source] RS View: Forgive my old friend Joe for not speaking more clearly on this matter. He said, "Reserves are IOU's," which could inadvertently lead a dim listener to draw the erroneous conclusion that reserves must be IOU's. He should have said, "As presently practiced, reserves today are largely IOU's". Expressed in this latter form, it clears the stage of clutter so that any reasonable thinker can more easily see that the practice of reserve management/accumulation has a natural course of evolution ahead, which will shift away from holding IOU's and move more predominately toward holding that one reserve asset in the present assortment which is NOT an IOU. Gold. Physical gold. |

| Magnitude 7.1 Monday – Yet Another Quake Shakes Japan Posted: 11 Apr 2011 08:01 AM PDT Magnitude 7.1 Monday – Yet Another Quake Shakes JapanCourtesy of Phil of Phil's Stock World

This is getting to be a daily event! Just last Friday Japan had a quake early in our morning of about a 7 and today, at about 4:50 am EST, they had a 7.1. This one didn’t even bother our futures traders and it came after the Nikkei was closed and just after the Japanese Government announced a 50% increase in the size of the evacuation zone, from 20Km to 30Km, but still well short of the US’s warning of 50Km and even shorter of other nations who have expanded their evacuation zone to – JAPAN.

Now that we have a budget deal (such as it is) – with Europe still in turmoil and Japan’s currency going into melt-down – what is going to keep the Buck down? U.S. Retail sales for March were strong – doesn’t that mean there’s a demand for the Dollar? Oil prices are at record highs – oil trades in Dollars – doesn’t that mean there is demand for Dollars? The US stock market is enjoying the fastest rise in its history – US stocks are traded in Dollars – where is the demand?

It’s yet another way that the market feels like it’s in the low-volume, Fed-medicated, range-trading, easy-corporate-credit, buyout-happy days of the middle part of the last decade or, as I often say – we are partying like it’s 1999. But, is it early 1999, when the Nasdaq opened the year at 2,300 and topped out over 5,000 in March of 2000 or are we at that top now (with our current Nasdaq at 2,800)? The Nasdaq peaked out at 5,050 on March 10 of 2000 on relief that Y2K worries never happened but by April 15 we had fallen back to 3,250 – down 35% in 35 days. That’s why I get so worried when I think things are "toppy" – like they are now… That time was not "different" – we had a bubble in stocks based on unlimited future growth potential that have been proven to be utter BS in the subsequent decade. Now we have a commodity bubble based on the same assumption that will burst the same way as demand fails to prove out AND we have a new dot com bubble for stocks like PCLN, NFLX, OPEN, Groupon, Facebook etc who have the common thread of not actually producing anything of their own but acting as middle-men in various transactions as if the ancient and inevitable phrase "cutting out the middle man" no longer is understood by US investors.

“The fall in imports from a year ago reflects the negative arbitrage we’ve seen in the past few months,” Peng Bo, an analyst at Guosen Securities Co., said from Shenzhen. “While we think it’s still too early to say demand from China has dropped, it’s something to watch out for in the coming months.” Negative arbitrage for a few months? That’s not what CNBC told us, is it? Gosh, I can’t imagine how there could have been negative arbs on copper at the same time that retail investors were being told to buy it – I wonder how that could have happened? [end sarcasm font] Copper stockpiles monitored by the Shanghai Futures Exchange climbed to a 10-month high of 177,365 tons in the week ending March 18.

Official commodity inventories aren’t readily released by China’s government, forcing industry watchers to resort to other means—either physically scouting warehouses themselves or finding government sources—to try to determine just how much copper has actually been used. "The risks now appear, for the first time in quite a while, to be skewed to the downside," said Stephen Briggs, senior metals strategist of BNP Paribas. In my note to Members last night we shorted silver futures off the $42 line and yes, we have been wrong on silver a lot but one day we won’t be (and this morning we already got $41) and it will make a very nice correction. So will copper, gold and oil – it’s just a question of keeping yourself in the right place (short on the commodity) and waiting PATIENTLY for the right time. With our option plays we accomplish this by rolling our short positions, just like the NYMEX traders roll their long positions out in time until they finally find a buyer for their jacked-up commodity. NYMEX futures expire on April 19 and delivery must be accepted at Cushing, OK, in May for any May contracts still open on the 20 of April. There is nothing that the conga-line of tankers between here and OPEC would like to do more than unload an extra 277 Million barrels of crude at $112.79 per barrel (Friday’s close on open contracts and price) but, unfortunately, as I mentioned last week, Cushing, OK is already packed to the gills with oil and can only handle 45M barrels if it started out empty so it is, very simply, physically impossible for those barrels to be delivered. This did not, however, stop 287M barrels worth of May contracts from trading on Friday and GAINING $2.49 on the day.

Who is buying 287,494 contracts (1,000 barrels per contract) for May delivery that can’t possibly be delivered for $2.49 more than they were priced the day before? These are the kind of questions that you would think regulators would be asking – if we had any. In fact, the last contract actually purchased in June was at $104.03 and the last contract purchased in July was at $91 and the last contract purchased in August was $95.70. Why? Because the price you pay at the pump is set by the FRONT-month contract only and it’s not worth manipulating the forward contracts until they become the front month. Again – if only there were regulators to look into these things…

Keep in mind that the entire United States uses "just" 18M barrels of oil a day so 677M barrels is a 37-day supply of oil but we also make 9M barrels of our own oil and import "just" 9Mbd, and 5M barrels of that is from Canada and Mexico who, last I heard, aren’t even having revolutions. So, ignoring North Sea oil Brazil and Venezuela and lumping Africa in with OPEC, we are importing 3Mbd from unreliable sources and there is a 225-day supply under contract for delivery at the current price or cheaper plus we have a Strategic Petroleum Reserve that holds another 727 Million barrels (full) plus 370M barrels of commercial storage in the US (also full) which is another 365.6 days of marginal oil already here in storage in addition to the 225 days under contract for delivery. Wow, that is some long-term supply disruption that they are pricing in, isn’t it? It’s a scam folks, it’s nothing but a huge scam and it’s destroying the US economy as well as the entire global economy but no one complains because they are "only" stealing about $1.50 per gallon from each individual person in the industrialized world. It’s the top 0.01% robbing the next 39.99% – the bottom 60% can’t afford cars anyway (they just starve quietly to death as food prices climb on fuel costs). If someone breaks into your car and steals a $500 stereo, you go to the police but if someone charges you an extra $30 every time you fill up your tank 50 times a year ($1,500) you shut up and pay your bill. Great system, right? Despite the fact that we put up a new virtual portfolio this weekend aimed at producing a steady investment income – I am less than enthusiastic about jumping in and buying anything right now. Perhaps because of that, my first post of options expiration week (plus tax day on Friday!) is a cautionary one and I haven’t even gotten around to the mess that is Europe or Japan’s smacked down economy or anticipated Q1 margin pressures yet. Needless to say – PLEASE – be careful out there!

Try out Phil's Stock World here > |

| You are subscribed to email updates from Save Your ASSets First To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Apr 10, 2011 (Bloomberg) — The world economy needs a new global reserve currency to help prevent trade imbalances that are reflected in the national debt of the U.S., said Nobel-prize winning economist Joseph Stiglitz.

Apr 10, 2011 (Bloomberg) — The world economy needs a new global reserve currency to help prevent trade imbalances that are reflected in the national debt of the U.S., said Nobel-prize winning economist Joseph Stiglitz.

The

The  Clearly something is wrong somewhere in this chain. Perhaps,

Clearly something is wrong somewhere in this chain. Perhaps,  As Barron's notes, black-box, arbitrage-oriented "high frequency traders" are the marginal providers of volume on a daily basis. Without the machines – would there be any volume at all? Many of our own Members trade in quantities large enough to "move the markets" – or at least individual securities and often enough it does feel like the only counter-party to our trades is a robot trying to pick off our orders.

As Barron's notes, black-box, arbitrage-oriented "high frequency traders" are the marginal providers of volume on a daily basis. Without the machines – would there be any volume at all? Many of our own Members trade in quantities large enough to "move the markets" – or at least individual securities and often enough it does feel like the only counter-party to our trades is a robot trying to pick off our orders. ![[ABREAST]](http://si.wsj.net/public/resources/images/MI-BJ059_ABREAS_NS_20110410202404.jpg) Speaking of demand that fails to prove out. Once again copper is rejected at the top of our range at $4.50 as

Speaking of demand that fails to prove out. Once again copper is rejected at the top of our range at $4.50 as .jpg)

The great thing about the NYMEX is that the traders don’t have to take delivery on their contracts, they can simply pay to roll them over to the next settlement price, even if no one is actually buying the barrels. That’s how we have developed a massive glut of 677 Million barrels worth of contracts in the front four months on the NYMEX and, come rollover day – that will be the amount of barrels "on order" for the front 3 months unless a lot barrels get dumped at market prices fast.

The great thing about the NYMEX is that the traders don’t have to take delivery on their contracts, they can simply pay to roll them over to the next settlement price, even if no one is actually buying the barrels. That’s how we have developed a massive glut of 677 Million barrels worth of contracts in the front four months on the NYMEX and, come rollover day – that will be the amount of barrels "on order" for the front 3 months unless a lot barrels get dumped at market prices fast.

No comments:

Post a Comment