saveyourassetsfirst3 |

- Marc Faber: This asset could soar no matter what happens next

- Corning: Best Bet on Tablet Revolution?

- Be Cautious About Shorting the Australian Dollar

- The Rarest Earth

- Portfolio Performance Update: January 2011

- update 09/02/2011

- The Nitty Gritty on Nickels

- Silver Under 'The J.P. Morgan Effect'

- The 5 Suppressors & Mr. Nash

- How to Profit From Earth's Most Precious Commodity: Water

- Mythology & Official Nonsense

- TSX Operator, London Exchange Plan Merge

- U.S. Housing ‘Vicious Circle’ Worsens

- Gold at EUR1,000/oz - Strong Physical Demand Leading to Illiquid Conditions

- Silver To Soar In 2011

- Gold May Outshine Silver in the Medium Term

- How to Unload Physical Silver?

- UAE sees dramatic rise in gold sales

- Alasdair Macleod: Why technical analysis fails with gold

- Murray Pollitt: World would benefit from a higher gold price

- Silver to outperform gold in 2011 - Eric Sprott

- The Gold Standard Before the Civil War

- Gold and Energy: 70/30 Long Short Tactics

- China, Inflation and Gold

- Gold Hits 3-Week High as China Raises Rates…

- Gold, the Golden Rule, and Government

- FYI China Gets New Papergold Vehicle

- Shocking Video Of Howard Dean Declaring That It Is The Job Of The Government To Redistribute Our Wealth

- “Gold & Energy: 70/30 Long Short Tactics.”

- War Footing

- The Inflation Hare

- JP Morgan Races to Construct Defenses Against the Dodd-Frank Law

- Silver Vaults Empty? End Game Nearing or Higher Prices?

- Ben Bernanke's Hot Money

- How to Profit From the Path of Progress

- Rising Gold Beaten by Silver Prices Again

- Metals Boosted by JP Morgan Collateral Move

- Help ID Engelhard Item

- Gold and silver skyrocket despsite rise in Chinese rates

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3%

- Who Has the Cheapest Bullion?

- Gold Will Outperform After Stocks Peak

| Marc Faber: This asset could soar no matter what happens next Posted: 09 Feb 2011 05:30 AM PST From Zero Hedge: Last year's Russia Forum was one of the must see events of the year, pitting such high powered independent thinkers as Marc Faber, Hugh Hendry, and Nassim Taleb in a free for all... This year's forum was just as entertaining, and while it didn't have quite a distinguished audience, it did feature Marc Faber and Nassim Taleb in a discussion of whether Russia is the best or worst BRIC. That said, trust both Faber and Taleb not to stick to the script and go off on wild tangents. Sure enough, the line of the night as usual belonged to Faber: "We have a big debate in the world whether we will have a deflationary collapse or an inflationary boom...usually after a period of very heavy money printing war follows." That is the philosophical gist of it. As for Faber's recommendation, it is precisely the asset which has become a short-seller's nightmare in the current geopolitically fragile environment... Read full article... More from Marc Faber: Must-see: The greatest Marc Faber interview EVER Marc Faber: The three commodity investments you must buy now Must-read market predictions from Marc Faber, Bill Gross, and more |

| Corning: Best Bet on Tablet Revolution? Posted: 09 Feb 2011 04:57 AM PST StreetAuthority submits: by Nathan Slaughter Last month, the world's top high-tech manufacturers gathered in Las Vegas for the annual Consumer Electronics Show. They hobnobbed. They exchanged business cards. But most important, they introduced their latest innovations to the world. Complete Story » |

| Be Cautious About Shorting the Australian Dollar Posted: 09 Feb 2011 04:45 AM PST Emerging Money submits: By Tim Seymour Yesterday we discussed going long the pound sterling and shorting the Australian dollar as a rate arbitrage play. There may be some a technical upside to gain in this trade, but not much. The theory goes that the Bank of England is going to need to raise interest rates aggressively — possibly as soon as its next monetary policy meeting on Thursday — in order to combat rising inflation in the United Kingdom. Meanwhile, the Australian central bank has elected to keep rates stable, at least in the short term. The B of E action might work to strengthen the British pound (GBP), while the Australian dollar (AUD) remains exposed to Australia’s 4% inflation. But potential for greater growth is in Australia, not the United Kingdom. And with the latest news that British GDP actually shrank last quarter, there is clearly a lot of work left to do on that front. In the meantime, the B of E will raise rates at its own peril — signaling a tough stance on inflation. The Australians defied the Fed and started tightening last year. They will do so again, just not while Queensland is cleaning up from massive flooding and local businesses are desperate to keep the lines of credit open. Ultimately, the Australian dollar is tied to rising commodities; GBP is tied to a service-driven economy that, while wealthy, is currently shrinking. Complete Story » |

| Posted: 09 Feb 2011 04:40 AM PST Since I'm not a REE expert why am I writing about them? The answer has to do with silver. Silver shares many characteristics with the rare earth elements and there is a lot to learn from them in our analysis of silver. In fact, the purpose of this article is to make the case that silver is the rarest of all the rare earth elements. |

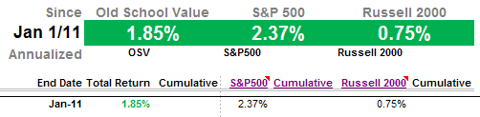

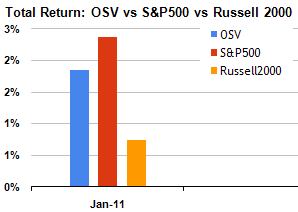

| Portfolio Performance Update: January 2011 Posted: 09 Feb 2011 04:40 AM PST Jae Jun submits: Old School Value Stock Portfolio Performance

Big events occurred in January which brought the final monthly performance down to 1.85%. Also, as you can see from the images above, I’m changing the way my performance will be presented. Portfolio Movers

January was good to many of my picks but the two big positions that make up my portfolio, YNGFF.PK and CCME, gave up a much of their December gains. New positions in TREVF.PK and ORVMF.PK are off to a good start. Transactions in JanuaryBought YUKON-NEVADA GOLD CP YNGFF has taken a tumble recently. As gold prices have gone down I took the opportunity to add a little more. With winter hitting the United States, especially in Jerritt Canyon, production has essentially stopped with machinery freezing up. Non working machinery = no new developments = no news = flat or decline in stock price. Just short term temporary stuff. The company has just offered warrant holders an 18% discount to the exercise price in order to raise funding for its 2011 capital budget. Here is what YNGFF proposes to do with the raised cash.

Complete Story » |

| Posted: 09 Feb 2011 04:26 AM PST I received another 5 USD from Alexander. Thank you Alexander! I believe in power to the people. Gold is about taking responsability. So is using this blog. It's up to the readers to decide what the Model is worth to them and if they want to participate or just want to benifit from the efforts of another. Daily I look at the blog's statistics and it is amazing to actually see who is visiting daily and from where. A small contribution from everyone would be a fortune... One contribution from a wealthy individual would be enough. The people will eventually decide the faith of the blog. Time will tell. This posting includes an audio/video/photo media file: Download Now |

| Posted: 09 Feb 2011 04:22 AM PST The Nitty Gritty on Nickels By James Wesley, Rawles on February 9, 2011 9:47 PM As I've mentioned before in SurvivalBlog, U.S. Five cent pieces ("Nickels") should be considered a long-term hedge on inflation. I recently had a gent e-mail me, asking how he could eventually "cash in" on his cache of Nickels. He asked: "Are we to melt them down, or sell them to a collector? How does one obtain their true 7.4 cents [base metal content] value?" My response: Don't expect to cash in for several years. I anticipate that there won't be a large scale speculative market in Nickels until their base metal value ("melt value") exceeds twice their face value ("2X Face"), or perhaps 3X face. Once the price of Nickels hits 4X face value, speculators will probably be willing to pay for shipping. By the way, I also predict that it will be then that the ubiquitous Priority Mail Flat Rate Box will come into play, with dealers mailing Nickels in $300 face value increments. The U.S. Postal Service may someday regret their decision to transition to "Flat Rate" boxes for Priority Mail with a 70 pound limit. Once the price of Nickels hits 5X face there will surely be published "bid/ask" quotations for $100, $300, and $500 face value quantities, just as has been the norm for pre-1965 U.S. 90% silver coinage since the early 1970s. (Those coins are typically sold in a $1,000 face value Bag (weighing about $55 pounds), or a "Half bag" (containing $500 face value.) Soon after the current Nickels are dropped from circulation, we will see $300 face value boxes of Nickels put up for competitive bidding, on eBay. An Aside: Nickel Logistics Nickels are heavy! Storing and transporting them can be a challenge. I've done some tests: $300 face value (150 rolls @$2 face value per roll) fit easily fit in a standard U.S. Postal Service Medium Flat Rate Box, and that weighs about 68 pounds.) They can be mailed from coast to coast for less than $25. Doing so will take a bit of reinforcement. Given enough wraps of strapping tape, a corrugated box will securely transport $300 worth of Nickels. The standard USGI .30 caliber ammo can works perfectly for storing rolls of Nickels at home. Each can will hold $180 face value (90 rolls of $2 each) of Nickels. The larger .50 caliber cans also work, but when full of coins they are too heavy to carry easily. Legalities Since late 2006 it has been illegal in the U.S. to melt or to export Pennies or Nickels. But it is reasonable to assume that this restriction will be dropped after these coins have been purged from circulation. They will soon be replaced with either silver-flashed zinc slugs, or tokens stamped out of stainless steel. (The planned composition has not yet been announced.) By 2015, when the new pseudo-Nickels are in full circulation, we will look back fondly on the days when we could walk up to our local bank teller and ask for "$20 in Nickels in Rolls", and have genuine Nickels cheerfully handed to us, at their face value. Death, Taxes, and Inflation It has been said that "the only two things that are certain in life are death and taxes." I'd like to nominate "inflation" as an addition to that phrase. For the past 100 years, we've been gradually robbed of our purchasing power through the hidden form of taxation called inflation. Currency inflation explains why gold coins and silver coins had to be dropped by the U.S. Mint in the 1930s and 1960s, respectively. Ditto for 100% copper Pennies, back in 1981. (The ones that have been produced since then are copper-flashed zinc slugs, but even the base metal value of those is now slightly greater than their face value.) Inflation marches on and on. Inflation will inevitably be the impetus for a change in the composition of the lowly Nickel. Each Nickel presently has about 7.3 cents in base metal ("melt") value, and they cost the Mint more than 9 cents each to make. You don't need a doctorate in Economics to conclude that the U.S. Mint cannot continue minting Nickels that are 75% copper and 25% nickel--at least not much longer. Without Later Regrets Don't miss out on the opportunity to hedge on inflation with Nickels. Just like the folks who failed to acquire silver dimes and quarters in the early 1960s, you will kick yourself if you fail to stock up on Nickels. Do so before they are debased and the older issue is quickly snatched out of circulation. The handwriting is on the wall, folks. Stop dawdling, and go to the bank and trade some of your paper FRNs for something tangible. |

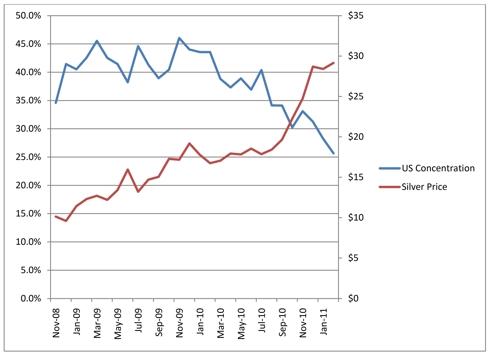

| Silver Under 'The J.P. Morgan Effect' Posted: 09 Feb 2011 04:22 AM PST Friday’s Bank Participation report showed a large reduction in the U.S. silver short position. The net short position changed from 22,340 contracts in January to 18,935 in February. The U.S. banks reduced their net short position by 9.2%. U.S. bank short covering has been the trend in silver since November 2009. As I've mentioned numerous times in recent months, the short covering can be attributable to several factors, all of which are important and will send silver higher over the next months, quarters and years. I really began pounding the table a few weeks ago, when silver was hovering around $27/oz (at least for the next leg-up, as I have been writing article upon article for Seeking Alpha and other sites since silver was in the low-mid teens and gold was under $900/oz). For those pressed for time, these factors include encouraging supply-demand dynamics, inflation, short covering by the commercial banks (see any of my numerous COT analyses for a more in-depth explanation) and most recently backwardation (which is telling the market there is a physical constraint as the futures curve is downward sloping). U.S. bank short covering has been accompanied by rising silver prices. Silver prices have risen 70% since U.S. bank concentration last reached 40% in July 2010. In fact, there has been a statistically significant negative relationship between bank concentration and silver prices (96.4%). Every one percent decrease in concentration has resulted in a 40 cent increase in silver prices. The above graph Complete Story » |

| Posted: 09 Feb 2011 04:16 AM PST The Grand Strategy of the manipulation is as follows. First the manipulators suppress Gold & Silver prices by creating false supply and diverting true demand. 1. Central Bank Metal Leasing: creates a false supply of Silver & Gold which cannot be returned and is essentially counted twice. 2. Silver and Gold Certificates: diverts demand into a false paper I.O.U. that is "more convenient" but which is unbacked by actual Silver & Gold and can be defaulted upon by forcing redemption in fiat currency at the false suppressed price set in the futures market. 3. GLD, SLV and other ETF's: diverts demand into a "large, convenient and easily tradable" electronic certificate program (which may be unbacked by actual Silver & Gold or seized by Government and Manipulator decree) and follows the manipulated price set in the futures market. 4. Silver and Gold Mining Stocks: diverts demand into company mining stock which promise higher returns than actual Silver and Gold but can be (and have been) nakedly sold short in unlimited quantities by the manipulators. Furthermore, the more Gold & Silver that enter the market from mining, the longer the price suppression scheme can run. Investing in Gold and Silver mining helps the manipulators to depress the price by increasing supply. 5. Futures & Options Contracts: diverts demand into derivatives contracts which promise far greater profits but can be sold short by the manipulators in unlimited quantities. Currently 2 Banks hold most of the commercial net short positions in Gold and over 90% of all commercial net short positions in Silver. As long as the Central Banks have Gold or Silver in their vaults or warehouses with which to dump on the market they are in control. We can not know for certain when they will run out or become unwilling to continue. Certificates, ETF's, Stocks, and Derivatives are all part of a mugs game that investors cannot win. They all promise greater profit & convenience but as the price of Silver and Gold increase investors are lured into these paper side bets which are used to suppress the price. Most precious metals investors are simply ignorant of the massive fraud directed against them. However, let us assume for the moment that all PM investors knew the truth thanks to the Internet and whistleblowers like Ted Butler & GATA, what then? This takes us to the second half of the Grand Strategy used by the manipulators. According to Game Theory the Nash Equilibrium for a Cooperative game in which any player can improve his outcome by betraying other players is a collective outcome which is not in any of the players best interests. Attachment 6477 As you can see in the above table, if all investors knew the truth and invested only in Physical, the fraud would end, the price would go up, and everyone would profit $10,000 each. However, as the price goes up, new investors arrive who do not know the truth. They invest in Paper rather than Physical because the profit potential is obviously much greater. They look down on Physical investors as stupid and "unsophisticated". They end up making far greater profit of $100,000 (at least on paper) than the well informed and virtuous Physical investors. The Physical investors look at the profit the Paper Investors are making and eventually break ranks in order to obtain greater profits or because everyone else is breaking ranks. This extinguishes the price rise and plays right into the manipulators hands. The unfortunate conclusion must be made that PM investors cannot end the manipulation even if they all knew the truth and acted in the most virtuous manner possible. New Investors would arrive in large numbers and invest in Paper. The only possible exception to this Nash Equilibrium would be a loss of trust in fiat paper. This may in fact be happening as shown by Professor Antal E. Fekete in his excellent essays on Gold Backwardation. Ironically, I believe it is only the industrial consumers who are motivated to keep price down who will eventually end this manipulation. Gold is not consumed industrially except in very small quantities and usually in an economically recoverable way. Silver is entirely different. The industrial demand for Silver has risen slowly but relentlessly over the past century. It is now used mostly in applications in which it is unrecoverable at nearly any price. Existing above ground stockpiles have fallen nearly every year for the past 100 years. There are approximately 7 Billion ounces of Gold in above-ground inventories but only 500 to 700 Million ounces of Silver. Silver is now 10 to 12 times rarer than Gold in above ground stocks. It is Silver and Silver alone that can end the manipulation. It is Industrial demand and Industrial demand alone that can destroy the power of the manipulators. Silver was the first metal to be demonetized in America (1873). There is a reason for that, remember: Vampires are afraid of Silver, not Gold. Got Physical Silver? |

| How to Profit From Earth's Most Precious Commodity: Water Posted: 09 Feb 2011 04:00 AM PST Money Morning submits: By Larry D. Spears 2010 was the year of the commodity. Gold prices soared, copper hit record highs, oil again marched towards $100 a barrel, and many agricultural products doubled in value. Consider the following data, compiled by the World Water Council from a variety of sources, including the United Nations (U.N.), the World Health Organization, the Pacific Institute and others:

Complete Story » |

| Mythology & Official Nonsense Posted: 09 Feb 2011 03:33 AM PST With the advent, then the continuation of the Quantitative Easing exercise in hyper-inflation and capital destruction, the US Federal Reserve has perhaps taken its deeply damaged reputation as a central banker and decimated it into shreds. They have lost the respect of the world, more so outside the nation's borders than inside. The financial sector and politicians seem unable to stop showing deep reverence for the post, even licking the Chairman's boots whenever he appears before the USCongress. Recent hints of contempt in WashingtonDC are encouraging. He has not made a single correct forecast on major items. The USFed in short has lost control. See the rising bond yields, which torpedo the housing ship, badly listing as a derelict vessel. The USFed seems thoroughly content to rescue the big US banks, whose wretched condition cannot possibly be rectified, even if such a rescue results in global price inflation and revolts. The decision made after recognition that a recent QE chapter has failed is clearly to repeat it. When QE2 is exhausted or deemed a failure, expect QE3 at the doorstep. This behavior exhibits insanity. The February package of Hat Trick Letter reports includes a special report entitled "USFed as Agent of Destruction" that elaborates on the deep damage. The USFed balance sheet reads like a Fannie Mae lookalike, with perhaps $1 trillion in negative value, if priced to market. No wonder they altered their rules for a major dump on the USDept Treasury. The next chapter should see a default in USGovt debt, as it spirals out of control, supported mainly by the monetization engines, the stuff of hyper-inflation. Meanwhile, back at the inflation farm, a widening array of economic mythology has sprung up, replete with nonsense and deep deceptions like shallow walls to defend the monetary press. The new myths extend from the standard Second Half Recovery dupe, the Jobless Recovery insult, the Green Shoots absurdity, and the Exit Strategy refrain that ushered in QE2. The inflation engineers must defend their craft, which has destroyed the USEconomy and rendered its banking system insolvent, as well as households. By the way, Ben aint no Atlas, holding up the world. He aint no Poseidon, controlling the oceans and all their liquidity. He sure aint pretty like Aprhodite neither, even though his bust might serve as a fine pin cushion. Hey! Don't mention pins when standing near the USTreasury Bond bubble!

The Hat Trick Letter has warned fully and repeatedly. The price inflation that has begun to show itself in clear terms will be passed off with pure economic deception, and extreme statistical fraud. The effect of higher prices will be called economic growth. The price inflation within the adjustment process with full motive will grossly under-estimate the actual rising price rate. Therefore, the adjustment off the nominal economic activity will be grossly inadequate. The 10% to 12% price inflation will be called 3% to 4%, and thus a 6% to 9% error in the Gross Domestic Product will be made. The consequence will be that a powerful recessionary surge downward will be called a positive 4% to 5% GDP growth. Credit goes to the stat rats who betray my field of expertise. The deception will calm public fears on the highly destructive effects of Quantitative Easing #2 and its price inflation side effects. Actually it is more like direct effects. No longer are the QE1 effects isolated to excess bank reserves held by the USFed. They were not excess anyway, since US banks simply held their loan loss reserves at the USFed. The main point is that price inflation will rise sharply, called economic growth, a process already begun. The USGovt and Wall Street handlers will ignore it, under-state it, and herald the return of growth as success of policy. The reality will be less growth, in a deeper decline into recession. It has been my contention for the entire seven years of the Hat Trick Letter that the topic of inflation has been the most egregiously misunderstood and most common used deception device used against the American people, as the USEconomy has deteriorated in grotesque fashion for 20 to 30 years. They have been told to hedge against that inflation by home ownership, which has backfired in a national catastrophe. The underlying cause of the deterioration is massive monetary inflation and price inflation, manifested structurally as an over-priced US labor market that has sent jobs to Asia since the first migration phase to the Pacific Rim in the 1980 decade. The semanal event was the Vietnam War, which urged the broken Bretton Woods accord. SCATTERED SUPPORTING DECEPTIONS The justifications, explanations, and clever deceptions have been and will continue to be widespread. They are many, like singers in a chorus, each with voices like Sirens leading men and their ships to the rocks and a watery grave. Destruction awaits those attracted by their serene tones. My ear is tuned to detect them and to record their many deceptions. Let's touch on the wrong messages made on the US Public Address systems one at a time and dismiss them. They are trumpeted by the USGovt, by the Wall Street bank staffers, by the USFed Chairman and most Board members, by the US Financial press, by the market mavens, and by numerous others, all of whom did not foresee the wreckage and charred ruins like the burning of Troy. To be sure, the principal player was Alan Greenspan, whose charisma and eloquence made him the Helen of Troy for our modern day. Both his visage and utterances more resembled Mr Magoo. A) Rising prices are proof that the USEconomy can handle the higher costs. Not true! They are an indirect effect of massive monetary inflation, as surplus loose money sloshes until it makes higher priced items. A direct effect comes from a falling USDollar in whose terms commodities are priced. B) Rising commodity and material costs mean more profits all around. Not true! The exact opposite is the case, since profit margins are being squeezed. Businesses are making this statement openly. C) Rising prices mean the USGovt and USFed stimulus applied is finally working, as the system is coming alive. Not true! It signals the arrival of the nightmare, in the form of price inflation that the banking leaders said would not arrive. They boasted a year ago that the monetary inflation would not have a spillover effect. That spillover effect is precisely broadly rising prices, most evident in food & energy. Witness the spillover. D) Rising prices mean final demand has arrived, which is pushing up the prices. Not true! Final demand remains weak. Businesses do not anticipate a big rush of new demand, as their business investment is modest to non-existent. Consumers are strapped with weak income and no more home equity to raid. E) The USEconomy is least vulnerable to price inflation effects, since strongest and most resilient. Not true! The chief export in recent years from the United States had been mortgage bond fraud, along with the usual fare of USTreasury Bond empty paper. The chief export in the current period is commodity price inflation. The USEconomy remains a major importer, and thus will import the price inflation, a process already begun with both commodities and finished products. The US is the originator of massive monetary inflation. Since its economy is deteriorating and stifled, the resilience is born of weakness. Its back door will usher in that price inflation. F) The housing decline has kept prices in check from powerful deflation effects. Not true! The housing decline has guaranteed that the rising cost structure cannot be handled by the entire system. With the resumption in housing price decline, the insolvent banks will grow deeper in insolvency, while the households will fall more broadly into insolvency. Demand will not meet the higher prices required by corporations to even remain in business. Watch more job cuts and business shutdowns, since they must but cannot pass along the higher costs to customers. G) Higher prices in the stock market is prologue and harbinger for the growth of the USEconomy and corporate profits. Not true! The massive monetary inflation has spewed new phony money into the system. It leaks through an array of sieves. It finds paths of least resistance. Almost no resistance exists toward the stock market, especially with the Working Group for Financial Markets openly pushing up stocks, no longer in hidden fashion. The USDept Treasury finally admitted as much. H) Being a food producer, the USEconomy does not see rising food prices. Not true! For five years, the USEconomy has turned into a net importer of food products, although only slightly. The farm sector has seen their costs from diesel and other energy sources rise uniformly. The farm end product prices (like corn, wheat, soybean, cotton) are controlled on the commodity exchanges, not by farmers. So higher product and costs mean much higher prices at the US dinner tables. I) Rising producer costs is obvious. The miracle of not ending up in final product prices results in success of the system. Not true! If final products cannot have higher costs passed on, that means the businesses suffer important profit margin squeeze. In parallel, the lack of job or income growth means that households suffer important squeeze also on discretionary spending. The squeeze is systemic, not a success, resulting in lower demand and business layout cutbacks. J) Jobs will come eventually. Not true! This propaganda mantra is losing its mojo totally. Be prepared for a brief rejoice followed by the horrors of recognition that the USEconomy is suffering from broadbased price inflation and continued powerful deterioration. Monetary inflation destroys capital, a concept our clueless cast of economists cannot seem to conceive. In response to failure from monetary inflation, they order more in higher volumes. Prepare for QE3. MORE SUBTLE CON GAMES Homes turned out to be leveraged financial assets after all. Notice that the housing sector is not rising in price, as almost every commodity in the universe is rising rapidly, from rice crude oil to gold to cotton. Actually gold is not a commodity, but rather MONEY, being pursued as the global monetary system fractures and crumbles. Some Jackass warnings went back to 2006, calling the home nothing but a leveraged futures contract that had no callable feature for banks, but offered renewable reloads known as refinances. Along with a drawdown in account balance (home equity) came a foreclosure notice to millions of unwary investors. So much for the American Ownership Society! It was more like a siren call to the marginal buyers and minorities to lose all their life savings. The great majority of victims never read the great warning by Thomas Jeffersona about banks. The clueless cast of US economists have lost their way so badly that they no longer comprehend legitimate income. They insist on USGovt programs to put more cash in people's hands, from tax credits, jobless benefit extensions, home equity loan interest deductions, anything to put green in grubby hands. Talk of helicopter cash drops never materialized. The economist and bank leaders never seem concerned about the origin of money put in hands. They seem ignorant that credit extension and monetary inflation are almost always the source. They US economists ARE totally ignorant of the founding principles of capitalism, led by a mindless stream of expectation indexes. They fund elite bankers, redeem fraud-ridden bonds, create liquidity facilities to grease the debt system, erect channels for corporate paper, bail out dead corporations, feed the Working Group for Financial Markets in their stock market support, reload JPMorgan after the Lehman killjob for more commodity market price suppression, and much more. All these devious endeavors are funded by funny money or tainted money. Nowhere is open debate about a grand revival of US industry, a return of factories to US shores, a reversal of the PacRim outsourcing that reached a climax with the Chinese low-cost solution, followed by the current national insolvency. The nation has lost its way on basic capitalism, whose mantle China has picked up from the ground. Their many factories produce not only shiny useful products, but legitimate income. The clueless cast of US economists would do well to read basic textbooks on capitalism, capital formation, and the other cycle. It starts with business investment, then hiring, then value added, then worker income, then consumer spending. The United States must shed its devotion to asset bubbles and the Virtuous Cycle espoused by the USFed, which ends in systemic ruin, a ruin they cannot even recognize. The recent history of enforcement against insider trading and excess speculation is criminal. Its pursuit of insider trading reads like a cheap spy novel. Right after the Lehman failure came attacks by Wall Street firms against their own hedge fund clients. Their trading investment positions were open to see. Wall Street banks cut the credit lines on hedge funds with prominent long positions in assorted commodities, including crude oil, gold, and silver. The attack was complete and vicious, leading to widespread liquidations. Many commodity prices fell hard. Obviously, Wall Street firms gobbled up the positions forced into liquidation on margin calls. The attack was followed by a ban on shorting the big US bank stocks. An exception was granted for Goldman Sachs, since they were busy doing God's work. My guess is their god is money, and their lord breathes fire not love. The last few months have seen a sequence of arrests and prosecutions against insider trading, except that no Wall Street firm is implicated. Those conducting the investigations are of Wall Street pedigree, to be sure. In my view, moves against insider trading are disguised attacks against Wall Street competitors and opponents to the heavy handed naked shorting of important commodities led by the titans in South Manhattan. Not a single effective prosecution took place after the May 2010 flash trading controversy, despite ample evidence that the malfeasance went far beyond insider trading. The illicit practice involved raids of the trading exchanges, deep looks at the order stacks, and front running of placed positions. The SEC and CFTC investigators should take a closer look at JPMorgan and Goldman Sachs orders placed in front of the actions taken by the Working Group for Financial Markets, aka the Plunge Protection Team. Furthermore, investigators should take a closer look at the common Wall Street practice of naked shorting of USTreasury Bonds. The evidence lies in the nearly $1 trillion in Failures to Deliver in the bonds. The inventive Wall Street firms found a way to produce instant liquidity from which they fund a large portion of their business operations, like meeting payroll and covering overhead costs. A high paradox is kept a dirty secret by the USGovt and USFed. Low interest rates hurt savers, to be sure. However, the low prevailing interest rates actually slow down the USEconomy, not stimulate it. The total typical income from savers through bank CDs and bond fund income is in the neighborhood of $850 billion annually, in usual times with normalized bond yields. Compare that figure to the estimated $620 billion paid in interest for consumer loans, student loans, and revolving credit also in usual times. Higher bond yields put more legitimate income in the hands of savers, which more than compensate for the higher interest payments made. This grand deception must be kept quiet. The Wall Street fraud kings want that 0% rate, since it fuels their USTreasury carry trade. Free money can redeem their disastrous errors that tarnish balance sheets. It produces income without work, the great advantage of the elite. SILVER BREAKS LOOSE OF GOLDEN LINK Numerous are the important events taking place behind the curtains, behind the closed doors, the stratospheric ploys, under the cover of intrigue. They are reviewed in the Hat Trick Letter issues with analysis. China is gobbling up COMEX gold & silver, draining the London supply chain. The widely done but hardly publicized practice of settling COMEX precious metals contracts in cash with a 20% bonus has caught the eye of many. So gold & silver contracts contain little metal anymore, mainly paper. The recent tactic of building Dollar Swap Windows to gobble up Southern Europe sovereign debt at discount by the Chinese was outlined in the last article. They will likely convert much of those ruined bonds to gold bullion, with the aid of the IMF harlot. A global shortage of silver has grown acute. Several nations have announced skyrocketing silver coin demand, and outright shortages at the official mints. The latest tactic reported by intrepid analysts is that China has been gobbling up SPDR shares from the GLD gold exchange traded fund. They intend to convert GLD shares directly to gold, according to the London Deep Throat broker. Massive deliveries of gold bullion from this SPDR, managed by HSBC, have been reported in recent weeks. Gold bullion is exiting the fund inventory vaults in high volume, an order of magnitude greater than only two to four months ago. Apparently, the Chinese have noticed a faster method to acquire vaulted gold than the COMEX. Central banks in the Eastern world are loading up with gold bullion, not reporting all their accumulation, as they prepare and executive the Paradigm Shift. Power will move eastward. An excellent source informs me that China is accumulating gold at least 5x faster than the official figures indicate, maybe up to 10x faster. Russia posts some official numbers, more as chicken bones tossed before the feet of conmen. These topics are analyzed in the private newsletter Hat Trick Letter reports. While the silver price leaps toward its high at $31/oz with reflex ease, the gold price struggles. My long held belief has been that on the Supply side argument, silver beats gold, and on the Demand side argument, silver beats gold. My forecast has been and will continue to be that the gains in Silver price will be around triple to the gains in the Gold price, due to tremendous shortages and colossal demand. So far, so good since last summer. It is my firm contention that China has been very busy buying silver. They probably are motivated by yet another USGovt betrayal. The Most Favored Nation status granted to China in 1999 apparently had at least two possible important components. In return for diverse industrial buildup, direct foreign investment, and shared technology, China appeared to have promised years of deep USTreasury Bond support. The side deal demanded by Wall Street appears to have been a large lease of Gold & Silver bullion left over from the Mso Tse Tung era. Recent demand for its return by the USGovt to China, as part of the lease contract, appears to contain a betrayal. Wall Street sold the leased hoard into the precious metal market, so it appears. To those who dispute the allegations, take note of the track record of profound fraud by the Wall Street banksters. Sale of the Chinese gold & silver came during and after sale of Fort Knox, and sale of the European swaps as well. The Silver price has advanced handsomely since July 2010. Its gains have outdistanced those fo Gold. In the last two weeks, the rebound for Silver has embarrassed that of Gold. Thanks to Adrian Douglas for the fine chart, not showing the dimension of time but instead the paired prices of Gold & Silver. The chart exhibits clearly the falling Gold/Silver ratio. He wrote, "This update of my previous work adds more fuel to the fire that the dynamics of the silver market have dramatically changed. Because silver has been suppressed for so long we do not know what its free market price should be, but we are going to find out soon. I strongly suspect it will be many multiples of the current price." Here, here!! Bring it on!! THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS. From subscribers and readers: At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue. "Days like these, I congratulate myself I had the good sense to follow your advice. I am much indebted to you!! For the last three years of my Hat Trick Letter membership, I have been able quickly to separate the grain from the chaff and save my assets from doom, having made sound investments in precious metals. Your thorough knowledge of macro-economics and financial cogwheels paired with your courageous visionary writing have been a much needed eye opening university." (PatrickB from France) "As for your financial and economic analysis, I appreciate your contemptuous style and how you bring facts and commentary to your readers before most of the alternative media and light years ahead of the mainstream press. You are a beacon in a dangerous storm." (DanC in Washington) "I think that your newsletter is brilliant. It will also be an excellent chronicle of these times for future researchers." (PeterC in England) Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com. For personal questions about subscriptions, contact him at JimWillieCB@aol.com |

| TSX Operator, London Exchange Plan Merge Posted: 09 Feb 2011 03:04 AM PST Looks like a 6billion + merger in the works http://news.aol.ca/2011/02/09/tsx-op..._lnk1%7C200244 Haven't seen this talked about here yet. The article makes mention that it may allow easier european/mideast investment into TSX traded companies. Anybody think this may help provide a boost to mining and energy stocks on the tsx? It also mentions that this merger will allow London to get into the derivative business. I am not learned enough in this context so can anybody explain what this derivative trading is acheiving in this setting? My cynical side comes out when i see merger news like this and i keep thinking to myself, "Whats in it for them, what aren't they telling us?" Other than the news they put out in the article i am looking reasons they didn't touch on. Any thoughts or insight? Sampson |

| U.S. Housing ‘Vicious Circle’ Worsens Posted: 09 Feb 2011 02:37 AM PST It wasn't supposed to be like this. For three years, two successive U.S. administrations have made "fixing the housing sector" explicitly a top priority. Since that time, we have been assured by a plethora of politicians, housing "experts", and media talking-heads that the U.S. housing sector had "bottomed", and (like the U.S. economy itself) had begun a "recovery". It was all fiction. New numbers show that roughly 27% of all U.S. mortgages are currently "underwater", worse than the (supposed) "bottom" of the original collapse, when that number soared to a previous record of 25%. This single number exposes a multitude of myths. For three years, Americans have been told by both politicians and bankers that they were "working hard" specifically to eliminate/alleviate the blight of underwater mortgages. In fact, what this number proves is that these charlatans were "hardly working". Their "progress" after three years is less-than-zero. For two years, Americans have been told by politicians and bankers that there is a "U.S. economic recovery" underway. Two years ago, the U.S. housing market was in the worst shape it had ever been in, after a collapse more severe than the worst years of the Great Depression. And now after two years of a "recovery", it's in even worse shape? Quite simply, one could spend their entire life scanning the annals of economic history, and would never find another example where a housing market which was already at a multi-decade bottom has deteriorated after two years of "an economic recovery". There is no "U.S. economic recovery". There never was a recovery. Rather than debate this obvious point, as the saying goes "a picture is worth a thousand words".

|

| Gold at EUR1,000/oz - Strong Physical Demand Leading to Illiquid Conditions Posted: 09 Feb 2011 01:23 AM PST |

| Posted: 09 Feb 2011 01:14 AM PST Silver To Soar In 2011 …Says Investment Guru Marc Davis 8 February 2011 Silver promises to become the next big buzzword among investors in 2011 and beyond, according to one of the investment industry's most prescient and successful experts on precious metals. Eric Sprott is the founder of the Toronto-based investment firm, Sprott Asset Management LP. His renowned hedge fund, Sprott Hedge Fund LP, is heavily weighted in precious metals and has generated an estimated 23% annualized return over the past decade. Other similarly oriented funds under his stewardship have also been stellar performers in recent years. He's now so bullish on silver that he launched the $575 million Sprott Physical Silver Trust in November of last year as he believes that: "Silver will be the investment of the decade." "I think that silver could easily get to $50 this year," he tells BNWnews.ca. This all bodes especially well for publicly traded companies that are already mining silver, he says. Likewise for ones that are developing primary silver deposits or gold deposits with plenty of silver as a byproduct. "If the price of silver continues to go up, silver stocks are going to perform even better," Sprott adds. Sprott says the big catalyst for surging silver prices in the coming years will be exponentially increasing investment demand, which is already beginning to overwhelm existing silver supplies. The mining industry only produces around 800 tonnes of silver per annum. This is a relatively inelastic supply, regardless of silver prices, he adds. As household investors are becoming increasingly jittery about the debasement of the U.S. dollar and other major currencies, they are loading up in record numbers on silver bars, coins and silver-denominated exchange traded funds, Sprott says. However, there's also a quantum shift in investment demand taking place among big players in the precious metals market, including India (which is aiming to increase its imports by about 77 million ounces per annum), and of course China. "China's net imports of silver were 112 million ounces last year. In 2005, they were net exporters of 100 million ounces," he says. "That's a 200 million ounce shift in an 800 million ounce annual market that seldom ever grows because production hardly ever goes up. So where's it all going to come from? We don't know." In fact, silver promises to outshine gold over the coming years, Sprott says. "Silver is the poor man's gold. Gold has had a great run for the past 11 years. But I absolutely believe that silver will outperform gold this year. Currently, there's more investment dollars going into silver than into gold." Such a game-changing scenario should recalibrate the gold to silver pricing ratio in silver's favor, thereby eventually restoring it to its traditional level of about 16 to 1, he says. "It's the easiest call of all time." "Silver as a currency always traded in a ratio of around 16 to 1 compared to gold, when it was a currency in the U.S. and the U.K. The current ratio is 48 to 1. If we go back to a 16 to 1 ratio, the implied price for silver would be $85.62 (per ounce)." he adds. "On that basis, if gold goes to $1,600, then that would value silver at $100. And we certainly think that gold is going to $1,600. In fact, I'm willing to bet that this ratio will overshoot on the downside. It might even get to 10 to one." The only reason why silver is still trading at a 48 to 1 ratio to bullion's spot price is that its price is being "manipulated" by big banks, Sprott says. That's because they don't want precious metals to become a popular alternative currency to Fiat money (currencies that are not backed by hard assets). "Then there's also a huge short position out there on silver," he adds. But time is on silver's side, he says, as the sovereignty debt crisis deepens in Europe and a continued policy of Quantitative Easing in the U.S. continues to undermine the value of the greenback. http://www.gold-eagle.com/editorials...vis020811.html |

| Gold May Outshine Silver in the Medium Term Posted: 09 Feb 2011 01:00 AM PST |

| How to Unload Physical Silver? Posted: 09 Feb 2011 12:31 AM PST While I sit here observing EE's attempt at financial destruction, I was perusing through my site stats and noticed one keyword entry..."How do I unload physical Silver?" As we move forward into new highs very soon, this new found fiat fortune will entice weak hands to give back their physical that the JP morgue desperately needs. As I said in my video's if you are buying physical to have a |

| UAE sees dramatic rise in gold sales Posted: 08 Feb 2011 08:31 PM PST Image:  I've got five precious metals-related stories...and the first one is courtesy of reader 'David in California'. It's a one-paragraph article about gold that's headlined "UAE sees dramatic rise in gold sales". The story is posted over at the Middle East website ameinfo.com...and the link is here. |

| Alasdair Macleod: Why technical analysis fails with gold Posted: 08 Feb 2011 08:31 PM PST Image:  The next two stories are both GATA releases...and, since Chris Powell has already wordsmithed the preambles, it saves me a bunch of typing. The first is headlined "Alasdair Macleod: Why technical analysis fails with gold". The reason it fails, Alasdair writes, is because analysts don't distinguish between investment in gold via paper markets and the hoarding of gold, the taking possession of the real stuff. The link to the entire GATA release is here. |

| Murray Pollitt: World would benefit from a higher gold price Posted: 08 Feb 2011 08:31 PM PST Image:  In his latest commentary, Murray Pollitt of Pollitt & Co. in Toronto, enumerates the many benefits to the world that would follow from a higher gold price. Pollitt headlines his commentary "Ramblings" and is contained in a GATA release linked here. |

| Silver to outperform gold in 2011 - Eric Sprott Posted: 08 Feb 2011 08:31 PM PST Image:  Reader Richard Di Nucci was kind enough to share this next item with us. It's a piece that was posted over at the mineweb.com yesterday...and the headline reads "Silver to outperform gold in 2011 - Eric Sprott". Not that we haven't heard this before elsewhere, but it's always worth a second visit...and the link is here. |

| The Gold Standard Before the Civil War Posted: 08 Feb 2011 05:30 PM PST |

| Gold and Energy: 70/30 Long Short Tactics Posted: 08 Feb 2011 05:01 PM PST |

| Posted: 08 Feb 2011 04:38 PM PST |

| Gold Hits 3-Week High as China Raises Rates… Posted: 08 Feb 2011 04:34 PM PST |

| Gold, the Golden Rule, and Government Posted: 08 Feb 2011 04:00 PM PST |

| FYI China Gets New Papergold Vehicle Posted: 08 Feb 2011 03:42 PM PST I wonder who's buying it (notice the start date :biggrin: - sorry if already posted). :eek_ma: Snip from: http://www.sprott.com/docs/Marketsat...nuary_2011.pdf "Precious metals ownership is arelatively new phenomenon in China, where Chinese citizens have only been able to purchase gold freely within the last ten years. Ownership restrictions were lifted in 2001 when the Chinese central bank abolished its long-term government monopoly over gold. The Shanghai Gold Exchange was then created in October 2002 to replace the People's Bank of China's gold purchase and allocation system, thus ushering in a new era of gold investment in China. Investor interest in precious metals has increased dramatically since then, and new investment products are making gold more convenient to purchase and easier to own. One such program recently caught our eye and speaks to the new era of gold investment within China. On April 1, 2010, the World Gold Council and Industrial and Commercial Bank of China (ICBC) issued a press release announcing a strategic partnership. Though seemingly innocuous, this press release introduced a completely new investment product for Chinese investors: The ICBC Gold Accumulation Plan ("ICBC GAP"). ICBC GAP allows investors in mainland China to accumulate gold through a daily dollar averaging program. The minimum investment required is either 200 RMB per month or 1 gram of gold per day (equivalent to approximately US$42). Customers may renew the contracts at maturity, convert them into cash or exchange them for physical gold. (Sound familiar? -R.)The accounts are perfect for investors who want to accumulate gold over the long-term. While gold accumulation plans exist in Japan, Switzerland and other countries, this is a first for mainland China. Kudos to the World Gold Council (Oh, really... -R.) for their efforts in setting up and promoting the program." fyi, R. |

| Posted: 08 Feb 2011 03:18 PM PST

If our founding fathers were alive today, they would be horrified by what we have turned into. In 1816, Thomas Jefferson wrote the following....

The sad truth is that democracy starts to break down once people start realizing that they can vote themselves money out of the national treasury. In fact, that is a very large part of what politics in America is all about today. Politicians are constantly promising what they are "going to do" for various groups of people. Benjamin Franklin once stated the following....

Not that our founding fathers were against charity. In fact, they believed in it very much. It is just that they did not believe in repressive taxation by a huge national government and they did not believe in large scale redistributions of wealth. With all of that in mind, watch this shocking video of Howard Dean declaring that it is the job of the government to redistribute our wealth.... Obviously Howard Dean envisions an "America" that is very different from the one that our founding fathers intended. But does that mean that all government welfare programs are bad? Of course not. In fact, if we were to cut them all off today we would have millions of people starving in the streets. A very large percentage of Americans today don't even know how to take care of themselves. If we pulled away all government support all of a sudden there would be chaos and anarchy in the streets. The sad reality is that we have tens of millions of Americans that are now deeply dependent on the socialist system that we have established. Unfortunately, this is what socialism does - it turns people into pets of the government. Our society should be teaching people to be self-sufficient, but instead we are teaching people to allow the government to take care of them from the cradle to the grave. So does that mean that our founding fathers would be in favor of the rampant corporate greed that we are witnessing today? Of course not. As I have written about previously, the founding fathers were against all large concentrations of power. During the Boston Tea Party, it was the tea of perhaps the most powerful corporation in the entire world at the time (the East India Trading Company) that our founders dumped into the harbor. If you study early American history, you soon come to realize that corporations were generally very limited in scope and size for many, many years. The era of the giant corporation is relatively new, and our founding fathers never intended for our society to be dominated by gigantic international corporations. So when the Democrats argue that we should give more power to the federal government and the Republicans argue that we should give more power to the big corporations they are both wrong. Our founding fathers did not intend for our federal government to have nearly so much power and they did not intend for big, wealthy corporations to have so much power either. Fortunately, many Americans today are getting back in touch with those principles. There is a growing dissatisfaction with the size of government, and according to Gallup two-thirds of Americans are now dissatisfied with the size and influence of major corporations in America today. However, it is one thing to discuss the finer points of political and economic philosophy, but it is another thing altogether to deal with the reality of tens of millions of people that cannot feed themselves. As I have mentioned many times before, there are over 43 million Americans on food stamps today. So what are we going to do with all of them? Allow them to starve? Almost 53 million Americans receive Social Security payments. What are we going to do - cut off Social Security and watch millions of elderly and disabled people freeze to death in their own homes? Of course not. But we have got to start swinging the pendulum back in the other direction. Right now one out of every six Americans is enrolled in some kind of anti-poverty program run by the federal government. How many Americans being taken care of by the federal government will be too much? One out of five? One out of four? One out of three? Eventually the entire system crumbles when there are too few people still willing to work hard. If you ever get the chance to visit a communist country you should. You will notice that nobody really works very hard. That is because there is no incentive to work hard. Very little real wealth gets produced and everyone suffers for it. So does that mean the U.S. system works? Of course not. What we have in the United States today is not real capitalism. It is more aptly called "corporatism". The big corporations and the big financial institutions have accumulated an absolutely stunning amount of economic power and over the decades they have gotten the government to tilt all of the rules of the game in their favor. In America today, it is really hard for the average person to start a successful business. The big, powerful international corporations that dominate our economy are everywhere. So most Americans today have to rely on working for an employer. Unfortunately, the big employers have started to realize that they can make much larger profits by shipping our jobs overseas. That is really bad news for the U.S. middle class. Well, can't we just tax all of these big corporations like crazy and even everything out? Unfortunately it just does not work that way in today's global society. As I have written about previously, the ultra-wealthy and many of the biggest corporations have figured out how to "minimize" their tax burdens. While you and I are being taxed into oblivion, the global elite have figured out how to move their money around to escape taxation as much as possible. In fact, it is estimated that today approximately a third of all the wealth in the world is held in "offshore" tax havens. Ultra-wealthy individuals and mega-powerful corporations can call just about anywhere "home" in today's global economy. That is just the way the world works now. In order to "tax the rich", you first must get legal jurisdiction over their money. Our tax system has become entirely unfair and it simply does not work. The whole thing needs to be scrapped. But as we discuss tax policy, there are tens of millions of Americans that are living in poverty. So what are we going to do about the growing number of Americans that cannot even feed themselves without government help? Well, the truth is that what they really need is not more handouts. If you give people handouts, they will just need more handouts tomorrow. No, what all of these Americans really need are good jobs. Unfortunately, there are a whole lot less good jobs in America today than there were ten years ago. Our politicians have stood by as the giant corporations have moved thousands of facilities over to places such as China and India where they can legally pay people slave labor wages. Since 2001, over 42,000 U.S. factories have closed down for good, and that number is going to continue to increase unless someone stops it. But nobody is. Virtually all of our politicians are just standing off to the side with their hands in their pockets. So now we have 19.3 percent of the workforce that is either unemployed or underemployed. Our entire economic system is breaking down. Millions of Americans families are scrambling to find some way to survive. Over the past two years, U.S. consumers have withdrawn $311 billion more from savings and investment accounts than they have put into them. Other Americans are going very deep into debt because they don't have any other options. When they finally can't keep up with all the debt, many of these families are losing their cars and their homes. We are in the middle of an economic nightmare that is absolutely unprecedented. "Redistributing the wealth" would just be like rearranging the deck chairs on the Titanic at this point. It would not fix a darn thing. When our politicians promise that a little "change" here or a little "tweak" there will get our economy back to normal they are lying to you and most of them know it. What we need is a comprehensive overhaul of our entire economy. Basically what we need to do is to go back to the blueprint (the U.S. Constitution) and essentially start over. But most Americans are not ready for that. Most Americans are still enjoying the tremendous prosperity that the biggest debt binge in the history of the world has purchased for us. Most Americans still do not believe that an economic collapse is really coming. But a massive economic collapse is coming. This whole thing is going to come crashing down and it is not going to be pretty. |

| “Gold & Energy: 70/30 Long Short Tactics.” Posted: 08 Feb 2011 01:34 PM PST

1. When you are involved in a roaring bull market, a great number of imaginary views come into existence around you. Great care must be taken so you don't become enveloped in these imaginary dreams, and then find yourself destroyed by nightmares of reality. 2. For example, Gold ground sideways from the early 1990s to the early 2000s in the $300-400 area generally. A long ten year basing period. It is also the period when the banksters accumulated (and traded) the great yellow metal. 3. Real and new wealth is built by the richest people, by accumulating during such periods of time and value pricing. When viewed from "outside the accumulation box", the reality of this discomfort and even pain is lost on smaller investors. 4. A imaginary view that "I can do it all, but do it differently!", begins to assert itself. Most gold bulls today are thinking, "Gold at $5000 with no starving Asians while I make free big money every day, sure we can do it, yes!". This thinking is childish imagination gone over the deep end. 5. Let's try some adult thinking: At Gold $400, if you were promised Gold $1100 the next day, and got it, you would beecstatic. In contrast, today, anyone who mentions master analyst Martin Armstrong's current phrase, "Gold $1100", is viewed as a Gold traitor. "Get him, he says paper money might have a rally. If there is one, don't book any profit on paper money. Instead, sell all your gold in a loss-booking panic while price-chasing paper money just in time for it to crash!" –hopefully not you, Feb 8, 2011. 6. Gold at $1100 was viewed an impossible pipedream in the late 1990s, by the same people who recently bought in the $1100-1400 area in a price chase that their cracker jack box prize told them was instead a "an asset here to stay" play. They created vast imaginary reasons to justify their price-chasing actions. The golf ball advisors and the investors each nodded their heads up and down in unison, getting into the price-chasing rhythm, and once all was in sync, the "buy Gold and book huge losses on dollars" button was pressed. I know many of them personally,and they will all be wiped out in this Gold bull market, long before it ends. 7. Stay real. As Gold goes higher, you will have to demand ever-larger price weakness to operate your buy programs, or you are setting yourself up to be destroyed by the banksters. 8. A real wealth-building program is an accumulation of wealth in the trenches program. Real wealth building feels like buying Gold did in the 1990s. 9. I'm doing it in natural gas and I'd like to remind you of Jim Sinclair's words back around Gold $330: "Rallies need to be sold". While building a major long position, most of you will need a tactical short position in the same asset, to survive. You need some sort of ongoing shorting program on natgas to survivethis accumulation program. This wealth-building program. 10. Will you make more money on a long only program? That's debateable. But what isn't debateable, regardless of how high it eventually goes against paper money, is that you need a shorting program to survive the here and now, both financially and emotionally. 11. Natural Gas is the world's most volatile commodity and the banksters will break you like a match stick, if you don't come prepared for a very long war. I covered natgas shorts yesterday, ringing the cash register, and added more longs, while most long-only players burned at the bankster stake, some mentally, some financially. Either way, it was a grand wieny roast. 12. Here's the NatGas Chart. The major markets are not an investment. They are a war. Fighting to the death means buying prepared to buy an asset that has a low chance of going off the board, all the way down, on sale, to the very lowest sale price, so you make the very largest amount of money on your core positions when the bear is finally gored to death by the bull. What time does it take for that action to occur? I have no idea what time the clock says when I get richer, and nor do those who pretend they know. 13. Think about wealth. Not time. I'm interested accumulating wealth and I just accumulated more wealth in natgas yesterday, while ringing my short side cash register. That sound, for those are wondering, is: "Kachingo!". Meantime, my competitors had a sprint race to price-chase paper money while booking ever-bigger losses in natgas. I enjoyed the show. All hail… Sir Orville Redenbacher? 14. If you have core positions that exceed $10,000 in natgas, you need to hold that in natgas mini futures with no leverage, not the trading ETFs that fail to track natgas properly. If your core positions exceed $40,000, you need to use the main natgas futures contract for your core. For natgas, I personally use both futures with no leverage and the ETFs, but I only am only long the futures. 15. Being naked short natgas at current prices for "a quick win" is not wealth building. It's a heroin addict working for minimum wage as a hamburger flipper. Sound good? That's because it isn't good. It is very simple to get fills on the short side on UNG-nyse, as it is so liquid. Use a 70% long, 30% short mantra in all major wealth building programs. To build wealth. To build sanity. Shoot me an Email if you understand natgas as a quality asset, have invested $10,000 or more in natgas core positions, and yet are still frustrated and want to start booking wins instead of wieners. I'll send you my natgas wealth-building video report, my gift to you. Cheers. 16. Gold! The ultimate asset has allowed paper money to stop losing value temporarily. A break in the lashing. Gold is fixed right in the middle of the $1310-$1430 range box. Here's an updated view of the Multiple H&S Pattern Chart. Failure of the $1344 and $1325 right shoulder lows opens the door to a test of the lows at $1310. The "$1225 Gold on sale for you" door is open if $1310 is taken out decisively. 17. Still, odds favour the upside, as they have since we went into this $1430-1310 box at $1387 back in October. I've drawn in a rough neckline (the black horizontal line around $1355) but that line could be drawn higher, up around $1460. Regardless, this h&s is a positive pattern, targeting $1400, and those of you who followed me into $1310 on the buy have already booked some profits on this $50 price to $1360. 18. My focus right now is GDX (gold stock). Gold $1100, if it happens, is seen as a disaster by most. If we go there, I can tell you right now that the amount of Gold-negative news you will be bombarded with will be endless. If you can somehow muster the stomach to face lower prices on the buy while understanding what Gold is, I think you all are going to blown away by what happens to gold stocks, in terms of reward, in the bullion $1400-1700 range. 19. You just can't join Elmer Fudd Public Investor on the Gold buy in the $1400-1700 range. That action is the horror of horrors. End the price-chasing and loss-booking madness, and focus on getting prepared to sell to Fudd in that area, at massive party pack profits for yourself! 20. Paper money is just one of the many assets that GDX seems to be setting up to maul. Whether you look at GDX against the dollar, agriculture, uranium, the Dow, bonds, or oil, all roads lead to GDX (gold stock), as the asset to put in play for the intermediate term. I have made a lot of money in wheat and corn with my 70% long and 30% short program, and I've shifting about 40% of that into GDX buy/sell programs. Here's why: I have one buy program buying every 50 cents down, and another buying every 5 cents down, so my paper widgets are being put where my mouth is. 21. GDXJ (gold juniors ETF or individually) is arguably even better. Here's the GDXJ against GDX Chart. While the short term Stochastics series has moved up, the overall picture for GDXJ is at minimum, very solid. 22. As you know, I am adamantly against just "gambling" or "betting" in the market, unless it is against an underlying core position with a smaller amount of money. Hedging totally produces no wealth, and in my view is an action based on fear, not logic. Don't short the Dow if you are not net long into Dow 6500. Buy gold stocks instead. In the case of the Dow, is it possible that the ultimate Gold Community dream is about to come true; a falling Dow and soaring gold stock, including Gold Juniors? 23. Here's a look GDX against the Dow. This is the weekly chart and it looks like that could really happen. Not all the oscillators are flashing buys, but some are. 24. Here's a shorter term look at the situation, via the daily. GDXJ Against Dow Chart. The power TRIX indicator is flashing a significant buy signal, and the longer term Stochastics is drastically oversold. Go Juniors!!! No promises on who wins, it's David and Goliath, but the fight is on!

Special Offer for Website Readers: Send me an Email tofreereports4@gracelandupdates.com and I'll rush you my free "Oil to Three!" report tomorrow morning. Learn why OIL is going not to $100, not to $200, but to three hundred dollars a barrel. Use the current sell off to position yourself in oil to reap those gains! I'll include analysis on what "oil to 3" could mean for mining companies that rely on oil for fuel. Hint. It's good news! Thanks! Cheers, st Email: stewart@gracelandupdates.com

|

| Posted: 08 Feb 2011 01:24 PM PST

Mercenary Links Roundup for Tuesday, Feb 8th (below the jump).

02-08 Tuesday

|

| Posted: 08 Feb 2011 12:50 PM PST --How do you know when inflation is hopping away like a rabbit? When the People's Bank of China (PBOC) raises one year lending rates by 25 basis points from 5.81% to 6.06%. For the third time since October. That's how! --The PBOC has repeatedly raised lending rates, deposit rates, and reserve requirements at banks. Sounds like an inflation problem, doesn't it? Sounds like a credit bubble, doesn't it? Sounds like excessive lending leading to a huge boom in fixed asset investment (real estate), doesn't it? Sounds like the sort of thing that might be bearish for Aussie resource producers, doesn't it? --Or not! --Rio Tinto is due to report its 2010 profit results tomorrow. Word on the street is that Rio's full year profit will come in around $14 billion, or more than double 2009's figure of $6.3 billion. That kind of profit makes the Commonwealth Bank's first-half profit of $3.34 billion look a little pedestrian. --It's definitely not 2009 anymore. Back then, the miners were licking their wounds from the GFC and dealing with lower commodity prices. But since then, commodity prices have rebounded. The combined stimulus efforts of China and America have unleashed much higher prices for tangible assets. Resource stocks loved it. --With Xstrata reporting a profit of $5.12 billion and Oz Minerals even posting nearly $600 million in profits, only BHP can spoil the party when it reports its results a week from today. But remember, these profit results are from last year. Even if the Efficient Market Theory is balderdash, these positive results aren't a surprise. They should already be priced into stocks. --What's not priced in is a China crash. Or at least much lower growth rates as the government in China tries to contain inflation. The repricing of resources and resource stocks on a China crash is the "other shoe" to drop on Australia. But it hasn't happened yet. --By the way, the "other, other shoe" to drop is a housing crash. That hasn't dropped either. That means Australia has both shoes in the air, ready to drop, like Wyle E. Coyote against a clear blue cartoon desert sky. --But maybe the resource boom will never really crash. At least not for another 15 years—according to David Gruen of the Australian Treasury. Gruen reckons, "The re-emergence of China and India into the global economy is the most important global economic development likely to have an impact on the industrial structure, and hence the demand for skills, in the Australian economy over the next 15 years." --If he's right, then this "one-off" event would sustain a continuous shift in the balance of power for resource pricing away from consumers and toward producers. All the capital spending and exploration in Australia for new projects would be justified. And profits to companies and shareholders would make everyone rich. --Thank you China! --But what if he's not exactly right? There are two ways of looking at the re-emergence of China and India. The first is that two 5,000-year-old civilisations are rapidly catching up with the industrialised West. For the world, this means flatter/falling wages (lower Western standards of living), lower prices for finished goods (more producers), but long-term support for real assets and presumably the companies that find, mine, or refine them. --If you're trying to reduce that to an investment strategy, it won't be easy. Where will the profits be? Two places, we reckon. --The consistent, plodding kind of profits will probably belong to entrenched incumbents. These should be safe but boring profits for long-term investors who have time on their side. Our colleague Greg Canavan keeps his eye out for the best time to buy the handful of Aussie companies that qualify as cash-generating blue chips that are very hard to compete with. --The bigger, riskier profits are obviously on offer for junior resource companies, especially the explorers. But finding which commodities have the most favourable dynamics and which companies can find and produce them the cheapest isn't easy. That's why we have several people who do nothing but look for those opportunities all day long. --Of course this whole first way of looking at the China story is exactly the way we were all looking at it in 2007. Before the GFC. But since then, we've learned that what's making these abnormal rates of Chinese GDP growth possible is an abnormal rate of fixed-asset investment. And what made THAT possible is an abnormal credit bubble. --Or, to follow the logic, China has condensed decades of economic development into a few years with the help of copious amounts of credit. This means China's story (like Egypt's) is, at heart, a currency story. But does that mean China's spectacular growth, like Mubarak's regime, will be a victim of the collapsing U.S.-dollar empire? Or will China surpass the dollar and keep on trucking? --If you read our "Exit the Dragon" report on this subject a year ago, you already know where we're going. But it's been a year and still no crashing Dragon. What gives? We're updating that report for the February issue of the Australian Wealth Gameplan. Stay tuned. --In the meantime, you'll note that Gruen's report showed the decline of Australian manufacturing, in terms of both employment and investment. This is what Greg recently called the hollowing out of Australia's economy. It's what happened to America over a 30-year period and what caused the country to become an inveterate borrower as it consumed more than it produced. --Is Australia different? Well, it's exporting raw materials in record volumes even as the labour market shifts to selling things (services) instead of making them. But whether this is a long-term wealth strategy....or just a way of becoming another Chinese province...is yet to be seen. --Your editor is an idiot! Doesn't he know that nuclear waste is a problem for which there is no solution and therefore nuclear power cannot be seriously contemplated by serious people who are serious? --That's the tone of quite a few notes that rolled in after yesterday's Daily Reckoning. Here's one:

--No deal. :-/ --There is no solution to the problem of nuclear waste, if by "solution" you mean a way of generating nuclear power that doesn't produce radiocative waste that has to be stored for tens of thousands of years. It is a serious problem. And for a serious movie about it, check out "Into Eternity", which is up for an Oscar this year. --The problem of how large urbanised societies and economies get their power without eroding their quality of life and degrading the environment is as serious as it gets. But the answer is not to simply give up and go back to subsistence farming. This viewpoint implies that it kind of sucks, but billions of people are just going to have to die for the Earth to be a bucolic, agrarian paradise. -- Or, a shorter version of this argument is that Malthus was right, he was just early. In the share market we call bad timing "being wrong". But we'll cut Malthus some slack since he's talking about the carrying capacity of the Earth as an eco-system. So how did he get it so wrong with his timing? --Malthus, like many of the Statist control freaks arguing for limits on population growth, badly underestimated human ingenuity. He saw people merely as mouths to feed, as variables in an equation that also happened to require calories, which had to come from somewhere. He did not see each new human brain as a creative resource unto itself, capable of solving problems in unexpected and unpredictable ways. --In point of fact, while human population continued to grow arithmetically in the last two hundred years, food production grew even faster. Cheap energy and better technology made this possible. The end of cheap energy will make it harder to sustain the big gains in food production in the last 100 years. But should we just give up now? Should we make like the dinosaurs and cede mastery of the earth to cockroaches and pigeons? --Nuclear energy may not be the ultimate solution to powering the planet. But it has real benefits. And given the time to develop, people will find ways to solve some of the associated problems. People adapt or they die. Technologies evolve too, given the chance. --What we find so strange about the opponents of nuclear energy is that at some deep philosophical/emotional/religious level, they are human defeatists. They seem to be ashamed of their species. They view human life as a parasite and think the planet would be better off without us. Of course we're generalising here, but you know the type. --People aren't problems. People as the economist Julian Simon wrote, are the "ultimate resource". He meant that having more people on the planet is not a problem. It's a benefit. It's more brains solving more problems and coming up with more ideas. He hasn't been wrong yet. Similar Posts: |