Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek

- Crude Remains Supported by Growth Optimism, Gold Unfazed by Bernanke Testimony

- Ira Epstein's Weekly Metal Report

- The Perfect Storm for Gold

- Pricing the World in Gold: 4 Charts

- Municipal Bond Shock Could Ignite Silver Charts

- Perth Mint Out of 100 Ounce Silver Bars for at least 6 Weeks

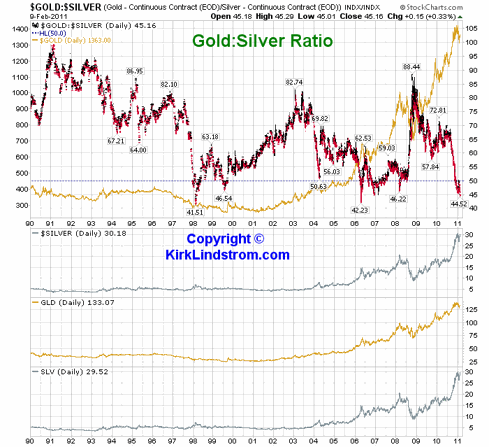

- Gold Silver Price Ratio Near Multi Decade Lows

- Gold Seeker Closing Report: Gold and Silver Close Slightly Higher

- China, Inflation & Gold

- States in Peril Must Cut to the Bone?

- Guest Post: China, Inflation & Gold: China Created Paper Money And Paper Money Then Created Inflation

- Insider Traders Investigated For ETF Stripping, Or How The SEC Is Now Only 10 Years Behind The Curve

- In The News Today

- Alan Grayson On Mortgage Fraud (Lack Of) Accountability: "President Obama... Let These Crooks Off The Hook"

- Under the Big Stock Market Top

- “Without persistent (and rising) food imports, Egypt cannot feed itself. It has managed to cover up the shortfall by having enough oil to export, but, like every country, their oil reserves are finite and eventually they'll face a day of reckoning.&

- Silver and Gold Price Both Remain in an Uptrend With All Indicators On Go, or Are They?

- Gold Markets At A Crossroad – What Now?

- How Much More Demand Can Silver Handle? - February 9, 2011

- WikiLeaks’ Old News

- Showdown in the Metals Markets: Let's Get Ready to Rumble

- Gold at Unchanged

- The World Priced in Gold

- Taylor MacDonald: The Perfect Storm for Gold

- WEDNESDAY Market Excerpts

- The Violent Declines the Follow Overbought Rallies

- Costs and exploration the big issues for gold miners

- Guest Post: Fifty Ways To Leave Your Lender

- The Truth Behind Saudi Arabia’s Oil Supply

- WikiLeaks’ Old News

- Cisco Afterhours Carnage

- Grandich Client Crocodile Gold

- Hourly Action In Gold From Trader Dan

- Market Commentary From Guild Investment

- Blowing Bubbles

- Gold Daily and Silver Weekly Charts

- Gold May Outshine Silver in the Medium Term

- Gold: A Bad Investment and Getting Worse, Part II

- Why Contrary To The Chairman's Lies, A Record Steep Yield Curve May Be The Most Bearish Indicator Available

- ‘Welfare Bum' JP Morgan: We Need Gold!

- G7 Banana Republics ON the Road to ZIMBABWE!

- What to Deduce from Rising Bond Yields

- Mythology & Official Nonsense

- Technical Analysis DOES Work For Gold

- Silver to outperform gold in 2011 - Eric Sprott

- Gold Discovery Contenders: ICN Resources Gearing Up to Drill Bonanza

- Brussels think tank maps exit from euro debt crisis

- Warren Bevan: Technical analysis does work for gold

- LGMR: Gold/Silver Ratio Falls Through "Major Support" as Both Metals Rise

| GoldSeek.com Radio Gold Nugget: Peter Schiff & Chris Waltzek Posted: 09 Feb 2011 07:02 PM PST | ||

| Crude Remains Supported by Growth Optimism, Gold Unfazed by Bernanke Testimony Posted: 09 Feb 2011 06:30 PM PST courtesy of DailyFX.com February 09, 2011 07:51 PM Crude oil was once again supported by improving economic fundamentals. Meanwhile, gold held onto gains from earlier this week as Fed Chairman Bernanke delivered his testimony to Congress. Commodities – Energy Crude Remains Supported by Growth Optimism Crude Oil (WTI) - $86.83 // $0.12 // 0.14% Commentary: Most benchmark crudes rose on Wednesday, with Brent adding $1.90, or 1.9%, to settle at $101.82, just shy of last week’s 27-month high closing level of $102.34. WTI continues to be an outlier given pipeline and storage issues in the Midwest; it fell $0.23, or 0.26%, to settle at $86.71. Wednesday’s move higher was merely a continuation of the upward momentum we have seen in crude since November. Excluding the very sharp and temporary correction in November, this uptrend has been in place since August. That means that oil has been advancing rather steadily for six months in a row- a remarkable rally by an... | ||

| Ira Epstein's Weekly Metal Report Posted: 09 Feb 2011 06:09 PM PST China surprised the financial markets by raising interest rates on Tuesday. They raised the exchange rate for the Yuan by a fraction today. The rate hike had long been anticipated, but having it occur on the Lunar Holiday seemed to have surprised the market. The net result was that the Dollar broke off this news while the Eurocurrency rallied. | ||

| Posted: 09 Feb 2011 06:05 PM PST A lot of short-term peaks and troughs can make things messy in the resource space, and the associated volatility can whipsaw people out of investments. "Still," says Pathfinder Asset Management Limited's Associate Portfolio Manager Taylor MacDonald, "the long-term picture itself is very much intact." | ||

| Pricing the World in Gold: 4 Charts Posted: 09 Feb 2011 06:03 PM PST | ||

| Municipal Bond Shock Could Ignite Silver Charts Posted: 09 Feb 2011 05:25 PM PST Less than 45 days into 2011, it appears that this just may be the year of the paper recovery, but that doesn’t mean that lingering problems have been wiped away. At center stage now is the municipal bond market, which having grown tremendously as investors fled to safe havens in 2009, may soon find itself in a perilous situation. The problem now is that the markets are struggling to find enough capital. Throughout the financial crisis, municipal bonds perceived to be less risky than other investments accepted cash in droves. This new investment was buoyed mostly by a large, Federal stimulus package that stood as an underwriter for new debt issuance. That is, states could issue more debt to take advantage of ultra-low financing costs before passing on the one-year expenditures to the Federal government. Thus, first-year borrowing costs were nil, and so too were the long-term borrowing costs expected to be. However, as the markets recover with tons of paper ... | ||

| Perth Mint Out of 100 Ounce Silver Bars for at least 6 Weeks Posted: 09 Feb 2011 04:49 PM PST  King World News has verified with the Perth Mint that they have run out of 100 ounce silver bars and they are not slated to be available again until the end of March. As of the close Thursday, 100 ounce silver bars were still unavailable at ScotiaMocatta as well. King World News has verified with the Perth Mint that they have run out of 100 ounce silver bars and they are not slated to be available again until the end of March. As of the close Thursday, 100 ounce silver bars were still unavailable at ScotiaMocatta as well. This posting includes an audio/video/photo media file: Download Now | ||

| Gold Silver Price Ratio Near Multi Decade Lows Posted: 09 Feb 2011 04:01 PM PST Kirk Lindstrom submits: The gold-to-silver price ratio, defined as the price of an ounce of gold divided by the price of an ounce of silver, closed Wednesday at 45.16 This means an ounce of gold is just over forty five times more expensive than an ounce of silver. As my chart below shows, twenty years ago in 1991, gold was over 100 times more expensive than silver. Since then, the gold-to-silver price ratio never went below 41.51. The chart also shows that it is very rare for gold to be less than 50 times more expensive than silver, as indicated by the small percentage of time the ratio is below the dashed black line. click to enlarge One of the safest and easiest ways to trade gold and silver is through an exchange traded fund. The fund managers buy and store the metal for you so you don't have to worry about storage costs or security. The major disadvantage is if the whole financial system melts down, you may lose access to your investment. For that reason, many that want to hedge for an "Armageddon type" event buy gold and silver bars and coins. Comparison of SLV to GLD GLD: SLV: Complete Story » | ||

| Gold Seeker Closing Report: Gold and Silver Close Slightly Higher Posted: 09 Feb 2011 04:00 PM PST Gold fell $1.70 to $1361.40 in Asia before it chopped its way up to $1366.90 in midmorning New York Trade and then fell all the way to $1357.80 by about 11:30AM EST, but it then rallied back higher in the last couple of hours of trade and ended near its earlier high with a gain of 0.1%. Silver rallied to as high as $30.51 by about 8AM EST before it fell back to $30.06 by late morning in New York, but it also rallied back higher in late trade and ended with a gain of 0.23%. | ||

| Posted: 09 Feb 2011 03:09 PM PST China created paper money and paper money then created inflation..Asian nations,China and India in particular, have a long history with gold. Precious metals as a hedge against chaos is deeply embedded in Asian cultures and when chaos takes the form of inflation, gold is the default hedge; and, today, inflation is on the rise.China raised interest rates for the third time since mid-October ahead of a report forecast to show inflation accelerated to the fastest pace in 30 months. - February 8, 2011, Bloomberg News This has profound implications for the price of gold. As inflation continues to increase, the buying of physical gold by the Chinese will send the price of gold skyrocketing. In fact, it has already begun. On February 2nd, the Financial Times reported: Fears of inflation have also driven demand for gold as a retail investment… Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. "The demand is unbelievable. The size of the orders is enormous," said one senior banker, who estimated that China had imported about 200 tonnes in three months. More Here.. This posting includes an audio/video/photo media file: Download Now | ||

| States in Peril Must Cut to the Bone? Posted: 09 Feb 2011 02:04 PM PST The WSJ reports that U.S. House Republicans said Wednesday they are concerned about a "looming fiscal crisis" in state and local finances but ruled out any federal bailouts for states. This is placing pressure on states to introduce tough budget measures, pitting states against public unions:

There is no question that state pensions need to be reformed. The question is what type of reforms and how will they benefit all stakeholders? I think there needs to be some give and take from all sides. The fact remains that state pension funds used rosy investment projections and have been neglected for far too long. Nobody bothered putting money in them, and their governance model left them vulnerable to fraud and mismanagement.

I have no problem with Governor Christie's recommendations but they're missing something important. Reforms are also needed in the governance of the state pension plan. Get rid of rosy investment projections, appoint an independent board, hire seasoned money managers and compensate them properly, aligning their interests with stakeholders' interests. And for Pete's sake, stop skimping on funding your pension!

| ||

| Posted: 09 Feb 2011 02:02 PM PST From Darryl Robert Schoon of 321 Gold China, Inflation & Gold: China Created Paper Money And Paper Money Then Created Inflation Ralph T. Foster in his invaluable book, Fiat Paper Money, The History and Evolution of Our Currency, writes that paper money made its first appearance in Szechwan, a remote province of China early in the 11th century. Because of a shortage of copper coins, provincial officials had begun circulating iron coins; but the difference in value and weight between the two metals caused unexpected problems. As Foster writes: [housewives needed] one and one-half pounds of iron [coins] to buy one pound of salt…Paper was the answer. People began to deposit their iron money in money shops and exchanged deposit receipts to transact business. The money shops’ deposit receipts then began circulating as money. But the money shops soon issued more deposit receipts than their supply of coins and by 1022, confidence had eroded in both the notes and the supporting iron money [and] government authorities closed the private note shops. When the Chinese government intervened, the government quickly discovered the advantages paper money - at least to the issuers. The Sung dynasty immediately banned the issuance of paper notes by private money shops and on January 12, 1024, the Sung court directed the imperial treasury to issue national paper money for general use. In the beginning, the imperial treasury backed its paper notes with cash coins equal to 29% of the paper money issued. Eventually, however, the Sung, like each succeeding dynasty, would print far more money than it actually possessed in backing. The consequent loss of confidence in paper money caused Chinese scholars to question the nature of money...Ye Shi (1150-1223) spoke out against excessive amounts of what he called “empty money” when he observed how paper inflation hurt the economy; and scholar Hu Zhiyu (1127-1295) concluded that only backing gave paper value and blamed the retreat from convertibility for the loss of public confidence.. paper money, the child, is dependent on precious metals, the mother. Inconvertible notes are therefore “orphans who lost their mother in childbirth”. (page 19) For the next 600 years, succeeding dynasties would each attempt to utilize the advantages of paper money and avoid its disadvantages. Not one dynasty was able to do so. All attempts to use paper money ended in runaway inflation and dynastic collapse. By 1661, China finally learned its lesson and the new Qing dynasty officially outlawed paper money. Regarding China’s 600 year experiment, Foster writes: Over the course of 600 years, five dynasties had implemented paper money and all five made frequent use of the printing press to solve problems. Economic catastrophe and political chaos inevitably followed. Time and again, officials looked to paper money for instant liquidity and the immediate transfer of wealth. But its ostensible virtues could not withstand its tragic legacy: those who held it as a store of value found that in time all they held were worthless pieces of paper. (page 29) Today, almost 1,000 years after paper money first appeared and 350 years after China banned its use, China’s is again issuing excessive amounts of paper money; and, once again, paper money’s initial prosperity is about to give way to inflation and economic chaos in the celestial kingdom. Southern Weekly, a Chinese language publication, recently noted: China has not only been the country that prints money at the fastest rate but also been the country with the largest money supply in the world in the past decade. China’s M2, a broad measure of money supply, was up 19.46% at the end of November from a year earlier...This compares with 3.3% and 2.5% of annual M2 growth in the US and Japan respectively over the same period…

China's money supply, M2-to-GDP ratio over the past decade is the highest in the world. The nation with the longest history of excessive money printing and consequent inflation has clearly forgotten its past. The past, however, has not forgotten China. 2011: CHINA, INFLATION & THE PRICE OF GOLD Asian nations, China and India in particular, have a long history with gold. Precious metals as a hedge against chaos is deeply embedded in Asian cultures and when chaos takes the form of inflation, gold is the default hedge; and, today, inflation is on the rise. China raised interest rates for the third time since mid-October ahead of a report forecast to show inflation accelerated to the fastest pace in 30 months. - February 8, 2011, Bloomberg News This has profound implications for the price of gold. As inflation continues to increase, the buying of physical gold by the Chinese will send the price of gold skyrocketing. In fact, it has already begun. On February 2nd, the Financial Times reported: Fears of inflation have also driven demand for gold as a retail investment… Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. “The demand is unbelievable. The size of the orders is enormous,” said one senior banker, who estimated that China had imported about 200 tonnes in three months. On February 8th, Karen Maley in Australia’s Business Spectator discussed this growing phenomenon in her article, China’s gold tsunami: It’s not hard to understand the growing Chinese enthusiasm for gold. Officially, China’s inflation rate was 4.6 per cent in December, but many believe the actual inflation rate is considerably higher. But Chinese savers earn a paltry interest rate of 2.75 per cent on one-year deposits, which means that they face negative real interest rates. Faced with these dismal returns, Chinese households and businesses have been pouring money into physical assets, such as food, real estate, and commodities as a hedge against inflation. Chinese authorities are now trying to quell property market speculation by making it more difficult for buyers to get bank finance for their second and third investment properties, and have begun experimenting with property taxes in some cities. This has caused Chinese investors to turn to gold. According to the Sprott newsletter, China, which is already the world’s largest gold producer, imported more than 209 metric tons of gold in the first ten months of 2010 alone. This compares with the estimated 45 metric tons it imported in all of 2009. DON’T WORRY ABOUT 2012 The response to the 2008 global collapse set in motion an even greater danger - runaway inflation. In 2009 world governments attempted to offset the global collapse in demand with historic levels of liquidity. The excessive printing of money has now led to higher prices. Prices, especially food prices are rapidly rising. Tyler Durden, www.zerohedge.com, makes this point with stunning clarity: One of the benefits of America finally seeing what Zimbabwe went through as it entered hyperinflation, ignoring for a second that the Zimbabwe stock market was the best performing market, putting Bernanke's liquidity pump to shame, is that very soon everyone will be naked, once companies finally realize they have no choice but to pass through surging input costs. And while some may be ecstatic by the S&P's modest rise YTD, it is nothing compared to what virtually every single agricultural product has done in the first month of 2011. To wit: Corn spot up 7.76%, wheat up 5.63%, Rice up 10.08%, Hogs up 10.16%, Sugar up 5.64%, Orange Juice up 3.33%, and cotton.... up 17.08%. That's in one month!

Rapidly rising food prices have already contributed to governments falling in Tunisia and Egypt. Other governments, well aware of the risk that inflationary food prices pose to their continued rule, are now stockpiling food to prevent further protests. This buying will only drive the cost of food even higher: Jim Gerlach, of commodity brokerage A/C Trading, said: "Sovereign nations are beginning to stockpile food to prevent unrest." "You artificially stimulate much higher demand when nations start to increase stockpiles." "This is only the start of the panic buying," said Ker Chung Yang, commodities analyst at Singapore-based Phillip Futures. "I expect we'll have more countries coming in and buying grain.- Read here INFLATION & THE FUTURE PRICE OF GOLD Even the hardened paper boys on Wall Street are aware of inflation’s impact on the price of gold. The meteoric rise of gold in the late 1970s was caused by rapidly rising prices. In the last decade, however, gold began moving steadily higher as did all commodities in a disinflationary atmosphere. That, however, is about to change. With gold already moving higher, the increasing inflationary impetus will send the price of gold far beyond its present price. Gold’s spectacular ascent in the 1970s is now about to be dwarfed. Last night, I, Ralph T. Foster, our wives and another couple had dinner together and the topic turned to the future price of gold. There was agreement that while its ascent was certain, gold’s ultimate price was a matter of pure conjecture since the reference points used to value that price would be virtually worthless pieces of paper money. History is the context within which our present circumstances present themselves. Of late, change has been so rapid that many believe the past is merely that which preceded the present. They are wrong. History is about to repeat itself, albeit in a new iteration. Paper money’s journey to the west and back again is about to reach its fatal climax. Paper money’s ten-century drama is almost over; and while a new and better era will replace it, the collapse of the present era will be unprecedented in magnitude. h/t John | ||

| Insider Traders Investigated For ETF Stripping, Or How The SEC Is Now Only 10 Years Behind The Curve Posted: 09 Feb 2011 01:49 PM PST The brilliant minds as the SEC have finally realized that when it comes to insider trading, they are and will forever continue to be, about 10 years behind the curve. To wit: today, for the first time we learn that the transvestite midget porn fanatics have realized that one can use ETFs, and, gasp, swaps to mask insider trades. So while the SEC brainiacs diligently scour for those who buy massive blocks of stock (or calls) 2 minutes ahead of an acquisition announcement, virtually everyone else has been sneaking by unscathed simply because they have, rightfully, assumed that the SEC are a bunch of retards. Such investigative brilliance deserves to be rewarded with at least one taxpayer funded screening of Long Dong Silver (oh wait, they may realize there could be manipulation in the silver market, and by none other than JP Morgan, if they were to watch that.) More on this moment of unparalleled SEC serendipity:

And the money shot, er, line:

They are concerned about this now, when this has been used by pretty much everyone in the hedge fund community for the past decade? How the hell stupid were all the analysts and traders in the Galleon-SAC insider trading circle to have been caught if the SEC has only figured out about this now??? And it gets funnier:

The punchline:

Actually no, traders have always used these tactics. It is just the SEC that has forever been a bunch of beyond incompetent, porn-addicted rejects from any private jobs that actually pay anything. But wait: there's more. Hedge funders, even those caught with their pants down, have a prearranged excuse:

In other words, pretty soon the entire "get-Stevie" affair will fall appart at the seams after it becomes clear that not only is the SEC's enforcement division an evolutionary bottleneck in orangutan to simian evolution, but their lawyers are pretty much pro rata vertically in the whole Darwinian survivial of the dumbest game. | ||

| Posted: 09 Feb 2011 01:26 PM PST

Jim Sinclair's Commentary The OTC derivative gang did a lot better with no risk. Tanker with $200 million in oil hijacked off Oman LONDON/ATHENS — Suspected Somali pirates captured a U.S.-bound tanker carrying around $200 million worth of crude oil in the Indian Ocean on Wednesday in one of the biggest hijackings in the area so far. The hijacking marks a significant shift in piracy and the crisis could "strangle" vital shipping lanes, the association of supertanker owners warned. The Irene SL, the length of three soccer pitches and with 25 crew members on board, was carrying about 2 million barrels of oil, or nearly one fifth of daily U.S. crude imports. The hijacking came a day after an Italian tanker carrying oil worth more than $60 million was snatched by Somali pirates, reinforcing industry fears that the piracy scourge is "spinning out of control". "This morning the vessel was attacked by armed men," the Irene SL's Greece-based manager Enesel said. "For the moment there is no communication with the vessel."

Jim Sinclair's Commentary The states of the US as it pertains to the country's credit rating are the same as the states of the EU as it pertains to the credit rating of the EU. Here comes the landslide. New Jersey rating cut while Arizona outlook negative SAN FRANCISCO (Reuters) – Standard & Poor's on Wednesday cut New Jersey's bond rating a notch due to an unfunded pension shortfall and high debt, while Moody's Investors Service warned Arizona of a possible downgrade by revising its outlook on the state to negative from stable. Concerns are mounting about the finances of state governments. Some in Congress have even suggested legislation to allow states to declare bankruptcy to help them put their finances in order. State governments continue to struggle with the effects of the 2007-2009 recession. Their revenue remains weak and altogether they face budget deficits of at least $100 billion for the next fiscal year, beginning for most in summer. S&P's action turns up the heat on New Jersey Governor Chris Christie. S&P downgraded New Jersey to AA-minus from AA two weeks before the Republican governor proposes his own fix for the state's shaky finances. President Barack Obama is expected to propose some financial relief for states in his budget plan but Republican lawmakers say there is no support for the kind of rescue mounted for states in the $814 billion economic stimulus approved by the Democrat-run Congress in 2009.

Jim Sinclair's Commentary Have you noticed the group with the most volume in Egypt is the Brotherhood? The media is dead wrong that the developments in Egypt are the birth of a durable Democracy. Democracy is not the answer in certain cultures. Protesters return after Egypt's VP slams call for president's exit Cairo, Egypt (CNN) — A mass of protesters maintained their ground at the epicenter of demonstrations Wednesday after Egypt's vice president said the call for President Hosni Mubarak's immediate departure is disrespectful to the people of the country. Protesters united in Cairo's Tahrir Square Wednesday for a 16th day of demonstrations. A massive Egyptian flag was sprawled across part of Tahrir, and by 1 p.m. (6 a.m. ET) a large section of the square was packed. Meanwhile, another group of protesters tried to block the country's army from breaking up demonstrations near Egypt's parliament. The army tried to talk protesters into leaving, but demonstrators blocked off two ends of the street in front of the parliament. "The word 'departure,' which is repeated by some of the protesters, is against the ethics of the Egyptians because Egyptians respect their elders and their president," Suleiman told a group of newspaper editors, according to a state-run news agency. "It is also an insulting word not only to the president but for the people of Egypt as a whole." State-run Nile TV showed footage of Mubarak meeting Wednesday with the country's foreign minister and Alexander Sultanov, Russian deputy foreign minister and Mideast envoy. It was not immediately clear what the officials were discussing.

Jim Sinclair's Commentary What I find baffling is why a person who understands this problem accepts the derivative level at $600 trillion dollars just because the Bank for International Settlements changed the means of measure to Value to Maturity. Value to Maturity assumes the vast majority of OTC derivatives have value or will function, making it a sick cartoon. The real number is over one quadrillion one thousand forty-four trillion dollars. Derivatives: The Real Reason Bernanke Funnels Trillions Into Wall Street Banks We've been over the numerous BS excuses that US Dollar destroyer extraordinaire Ben Bernanke has made for QE enough times that today I'd rather simply focus on the REAL reason he continues to funnel TRILLIONS of Dollars into the Wall Street Banks. I've written this analysis before. But given the enormity of what it entails, it's worth repeating. The following paragraphs are the REAL reason Bernanke does what he does no matter what any other media outlet, book, investment expert, or guru tell you. Bernanke is printing money and funneling it into the Wall Street banks for one reason and one reason only. That reason is: DERIVATIVES. According to the Office of the Comptroller of the Currency's Quarterly Report on Bank Trading and Derivatives Activities for the Second Quarter 2010 (most recent), the notional value of derivatives held by U.S. commercial banks is around $223.4 TRILLION. Five banks account for 95% of this. Can you guess which five? click to enlarge Looks a lot like a list of the banks that Ben Bernanke has focused on bailing out/ backstopping/ funneling cash since the Financial Crisis began, doesn't it? When you consider the insane level of risk exposure here, you can see why the TRILLIONS he's funneled into these institutions has failed to bring them even to pre-Lehman bankruptcy levels. | ||

| Posted: 09 Feb 2011 01:17 PM PST Now that Alan Grayson is no longer in Congress, Fed hearings have certainly lost that certain dose of panache which only a man, wearing a dollar sign tie, and cross examining the Fed's General Counsel which grinning like a diabolical Tasmanian Devil, would bring to the table. We managed to catch up with Grayson during today's session of Radio Free Dylan, in which the traditionally opinionated Fed critic had some very choice words about the President. In essence, the former Florida Democrat said that it is none other than the President, who is the reason there have been no prosecutions on banks: " I am not only blaming the Obama administration, if the Bush administration had its head on straight they would have prevented a lot of these things from happening to start with. But the President Obama administration said at the beginning, we are going to look forward and not back and therefore in the process of making that decision basically let these crooks off the hook." But that's ok - see the SEC, which incidentally has to give a person by person org chart and job description of its 3,500 porn addicts before it receive one additional penny of funding, is about to catch one or two criminal masterminds who bought some NYX calls after the information of today's merger, which was so badly leaked that virtually everyone knew about the deal ahead of the announcement, are about to spend some time in prison. In the meantime, all those who knowingly and willfully committed crimes in the great housing pump and dump (up to and including misrepresenting underwriting documents), are about to get away scott-free. Thank you Mr. President. That's some might fine change you got there. More choice selections from the Ratigan-Taz interview. On the complete lack of prosecutions and Obama's responsibility:

On the auditing the Fed process, for which Grayson, alongside Paul, had a major contribution in getting at least some partial disclosure from Bernanke:

And on Grayson's next steps:

Full interview can be heard here. | ||

| Under the Big Stock Market Top Posted: 09 Feb 2011 12:05 PM PST 1,332. That is a 100% in the S&P since it's March 2009 low of 666 (see David Fry's chart). Does it matter? Can we expect even a LITTLE pullback after a 100% run or is it "to the moon Alice" and maybe Mars and Jupiter while we're at it as the Federal Reserve's multi-Trillion Dollar thrusters send us to the stars, breaking the bonds of gravity (and logic) as they send stocks every higher in an expanding universe of freshly supplied money. As fellow stock market physicist, Art Cashin said yesterday: | ||

| Posted: 09 Feb 2011 11:12 AM PST | ||

| Silver and Gold Price Both Remain in an Uptrend With All Indicators On Go, or Are They? Posted: 09 Feb 2011 11:09 AM PST Gold Price Close Today : 1364.80 Change : 1.40 or 0.1% Silver Price Close Today : 30.273 Change : 0.002 cents or 0.0% Gold Silver Ratio Today : 45.08 Change : 0.043 or 0.1% Silver Gold Ratio Today : 0.02218 Change : -0.000021 or -0.1% Platinum Price Close Today : 1854.10 Change : -3.80 or -0.2% Palladium Price Close Today : 830.25 Change : -7.15 or -0.9% S&P 500 : 1,320.88 Change : -3.69 or -0.3% Dow In GOLD$ : $185.39 Change : $ (0.07) or 0.0% Dow in GOLD oz : 8.968 Change : -0.003 or 0.0% Dow in SILVER oz : 404.32 Change : 0.22 or 0.1% Dow Industrial : 12,239.89 Change : 6.74 or 0.1% US Dollar Index : 77.59 Change : -0.406 or -0.5% Y'all might expect me to be a drooling cheerleader for SILVER PRICE and GOLD PRICE, but I'll tell you, today inspireth not. Gold rose $1.40 to $1,364.80; silver rose 2/10 (two-tenths) of a cent to 3027.3c. GOLD/SILVER RATIO climbed a bit to 45.08. I've pored over charts till my eyelids have bled, but I still have no certainty what's happening. There is precedent for this indecision at gold/silver ratio reaction highs (made after a long fall and low) but not at the lows. Usually the ratio drops straight down, then springs straight up, no indecision, no hesitation. There's always a first time, I suppose, but it seemeth more logical that it foretells another silver and gold price rise, but today's closes are tired, tired, and plumb out of breath. Yet silver and gold both remain in an uptrend with all indicators on go. Well, that's not QUITE accurate. RSI and MACD point up, but silver bumped today against its top Bollinger Band and gold isn't far from the same barrier. Bollinger Bands delimit two standard deviations from the 20 day moving average, and only rarely does a move pierce that boundary, up or down. That argues for a slight rebound down off the Bollinger Bands at least. For the nonce, watch GOLD downside at $1,355, because it shouldn't violate that support, and must not violate $1,345. Up above it must challenge and conquer $1,380. Watch SILVER to see how it acts at 2970c, and at 3000c. Above silver must breach 3050c. I'm not a traffic cop, but I know where the curbs are. Forgot to mention that premium (actually a discount, or, as a creative government bureaucrat might say it, a "negative premium") on US 90% silver coin fell today. That's a little hint silver is getting heavy. I was surprised to hear from a reader today that he didn't know that we sell silver and gold. In case some of the rest of y'all don't know either, yes, we do -- or at least, we try to. Y'all will find ordering instructions at the bottom of this email every day. It's hard, hard, hard to befriend the US dollar, like trying to befriend a meth-head. About the time you think it's going straight, it falls again. Today the US dollar index fell 40.6 basis points (0.52%) to 77.593. Just getting CLOSE to the 20 day moving average (78.17) slapped the dollar silly. Best the dollar might hope for is that the chart is building an upside down head and shoulders (see stockcharts.com, "$usd", 6 month chart, OHLC bars). If that's true, the dollar index will not dip below 77.50. Otherwise, it is merely meandering its way to perdition. The Dollar Index's MACD, by the way, has turned up. In my short life I've seen some big whoppers, but I have hardly ever seen a lie as shameless as today's Dow close. Every other stock index was down, and the Dow itself spent a tortured day trying to stand up and getting kicked in the teeth. Every other index closed down, S&P500 down 3.69 at 1,320.88, but not the Dow. Look there on the far right side of the chart, that little booger there. Right, that's the uptick at day's end that raised the Dow 6.74 to 12,239.89. See, that's the thing about the Nice Government Men: they ain't subtle. Stocks remain the nasty used sneakers in the Great Investment Shoe Store. Leave 'em alone or you might catch something fungal. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | ||

| Gold Markets At A Crossroad – What Now? Posted: 09 Feb 2011 11:08 AM PST We are very bullish for the long-term for the resource sector, i.e., gold, silver and the resource shares. However, we need to live life and the markets in real time and the question is where are we now and what should investors do, if anything? The big question mark is for the short-term (several weeks) and the immediate term (1 – 3 months). | ||

| How Much More Demand Can Silver Handle? - February 9, 2011 Posted: 09 Feb 2011 11:00 AM PST How Much More Demand Can Silver Handle? - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] February 9, 2011 | [url]www.CaseyResearch.com[/url] Dear Reader, Everyone is familiar with the myth that booms can last forever. But another, less noticeable myth takes hold right when the boom begins to weaken. It's the idea that the central bank can slowly unwind apparent problems on the horizon. The U.S. experienced this during... | ||

| Posted: 09 Feb 2011 11:00 AM PST The 5 min. Forecast February 09, 2011 02:01 PM by Addison Wiggin - February 9, 2011 [LIST] [*]Breaking news: WikiLeaks exposes the sham of Saudi Arabia's oil reserves [*]Somali pirates make one of their biggest strikes yet: Byron King on why it's even more alarming than the industry is letting on [*]Silver holds firm above $30… How China could drive it to $100 [*]Newest indignity for Romania's witches: Fines and prison terms if their predictions don't pan out [/LIST] We've suspected for some time Saudi Arabia has less oil in the ground than they claim. Apparently so do diplomats in the U.S. State Department... at least, according to even more scintillating cables released from Julian Assange's WikiLeaks website. The cables come from inside the Saudi Arabia's state-owned oil company, Saudi Aramco. In 2007, Aramco's former head of exploration Sadad al-Husseini told the U.S. consul general in Riyadh that the firm had purposely overstated its reserves by 40% to spu... | ||

| Showdown in the Metals Markets: Let's Get Ready to Rumble Posted: 09 Feb 2011 10:55 AM PST | ||

| Posted: 09 Feb 2011 10:22 AM PST courtesy of DailyFX.com February 09, 2011 07:48 AM 240 Minute Bars Prepared by Jamie Saettele Gold has held a multiyear support line. However, the decline from 1425.40 is in 5 waves, indicating that the larger trend is most likely down. Price has reached the 50% retracement of the impulsive decline, with the 61.8% at 1380.82 serving as additional resistance if needed. Expectations are for the corrective advance to terminate.... | ||

| Posted: 09 Feb 2011 10:18 AM PST If gold really was money today, what would equities, housing, commodities and bonds look like...? | ||

| Taylor MacDonald: The Perfect Storm for Gold Posted: 09 Feb 2011 10:18 AM PST Source: Sally Lowder of The Gold Report 02/09/2011 A lot of short-term peaks and troughs can make things messy in the resource space, and the associated volatility can whipsaw people out of investments. "Still," says Pathfinder Asset Management Limited's Associate Portfolio Manager Taylor MacDonald, "the long-term picture itself is very much intact." The U.S. dollar is in the process of breaking down, and that will ultimately be supportive of gold. "And when you sidecar the dollar breakdown with quantitative easing, he says, "you essentially have a perfect storm forming for gold." Find out why Taylor expects the junior mining space to shine even brighter in 2011 in this exclusive interview with The Gold Report. The Gold Report: There was certainly a buzz surrounding junior mining at the recent Cambridge House Conference, but first please tell us a little bit about your mandate at Pathfinder Asset Management in terms of companies you invest in and clients you serve. T... | ||

| Posted: 09 Feb 2011 10:16 AM PST Gold futures steady in quiet trading The COMEX April gold futures contract closed up $1.40 Wednesday at $1365.50, trading between $1358.30 and $1367.70 February 9, p.m. excerpts: | ||

| The Violent Declines the Follow Overbought Rallies Posted: 09 Feb 2011 10:00 AM PST I am as skeptical as the next guy about technical analysis, maybe more so, so I was kind of intrigued when Robert McHugh of Main Line Investors wrote an essay titled "Time Analysis of the Coming Market Top." He writes, "We have identified when an extended overbought rally has likely reached its expiration date." And what is this time frame? "Two and a half months," he says. This "two and half months" time frame is particularly intriguing to me, as this is the approximate time it took for my wife to realize that marrying me was the worst mistake of her Whole Freaking Life (WFL). Without showing the usual sympathy that my wife gets from her friends and family, the parallels are eerily obvious when he goes on that "once this condition reaches the 2.5 month age, the rally not only ends, but a sharp, sometimes violent decline begins." Violent declines! That's it! Of course, there are those who say that since she did not actually hit me with anything that she threw at me, it cannot be termed "violent," although nobody is contending that it wasn't a "decline" in our relationship. But this has taught me two valuable lessons. One is that I should never pick her to be on my softball team because she obviously can't throw worth a crap. The other one is that there is perhaps something profound about this "two and half months" thing. And apparently there is, because he goes on, "Guess what? We are inside one of these overbought extended rally periods, which will reach the 2.5 month age over the next week. So, based upon this time analysis, we could be about to see markets drop sharply, perhaps violently." And this "violent drop" in the stock market is when, I assume, people will slap themselves on the forehead and exclaim, "What in the hell am I doing to be risking my entire net worth in the corrupt stock market, when even an idiot can see that, even in a completely honest market, it is impossible for all the people to take more money out of the stock market than they put into it, a dismal mathematical fact that is borne out by the entire last century of seeing the vast majority of people losing money by investing in stocks!" And it is worse than that, as the few who do "make money" actually broke even since the money they took out in "gains" had less buying power than the money they put in! Hahaha! April fools, chumps! If you want to know how accumulating a retirement nest egg really works, it is when people save a fraction of their weekly income by putting it in the bank, whereupon the bank would pay them enough interest on the deposited funds to stay even with inflation. For the more adventurous, investing maybe 10% of their savings in the stock market was considered a "bold move," especially seeing that most people lost most of that money, although there are always enough successes to keep people doing it. Gathering enough successes is the trick! Of course, nowadays, with the despicable Federal Reserve forcing interest rates to zero in a pathetic, desperate, frantic attempt to reverse the calamity caused by its previous incompetence and Keynesian stupidities, saving money in the bank is foolish since they pay the depositors about 0.1%, if that. Certificates of Deposit are now paying an average of 0.41%, which means, with inflation running at more than 6%, that the stupid owner of a Certificate of Deposit is losing 5.59% and ordinary depositors are losing the whole 6%! Hahaha! Suckers! I know what you are thinking. You are thinking, "What in the hell is the point of all this? Do you have a point, or is this just more of you running your Stupid Mogambo Mouth (SMM) until we are sick of listening to you and that is why nobody likes you?" Well, it's a "bad news/good news" thing. The bad news is that I don't know why I run my mouth so much or why people don't like me, which I figure only shows how hateful and stupid they all are, and how those treacherous bastards are always "out to get me," as I always suspected. The good news, on the other hand, is that I do have a point. The point is, to what I assume is your obvious delight, twofold. Firstly, for those of you who are optimistic enough to invest your money in the hopes of a big score, Mr. McHugh seems pretty confident of shorting the indexes. Secondly, buying gold and silver is a guaran-freaking-teed winner of an investment by virtue of 4,500 years of history, massive undervaluation due to decades of governments and markets manipulating their prices to be low, incipient hyperinflation due to the odious Federal Reserve creating So Freaking Much Money (SFMM) and the foul Obama administration deficit-spending almost $2 trillion a year ($6,536 dollars for every man, woman and child in America), and (most importantly) exploding demand for the metals but falling supply. And you can keep gold and silver with you at home, warm and snuggly, and not have to deal with banksters or custodians of any kind, who I assume are, even as we speak, thinking of new ways to screw you Good And Hard (GAH). And since buying gold and silver is so easy ("Here is my money. Give me my metal!"), what can you do except say, "Whee! This investing stuff is easy!" The Mogambo Guru The Violent Declines the Follow Overbought Rallies originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | ||

| Costs and exploration the big issues for gold miners Posted: 09 Feb 2011 09:50 AM PST by Geoff Candy Speaking to Mineweb at the Mining Indaba in Cape Town, AngloGold Ashanti CEO, Mark Cutifani, said it costs more than $1,000/oz to produce an ounce of gold when you take project development, exploration and all the other costs – cash operating costs and sustaining capital – into account. Asked whether this means that gold is unlikely to go much below $1,000 an ounce, Cutifani said: "I believe the likelihood is that we're in the right territory and it's unlikely that we'll see a trade much below $1,000 for any length of time… anything under – in my view – $1,000/oz would see a fairly quick shakedown in terms of production capacity and that would be the thing that would drive the price back up again." Randgold Resources CEO, Mark Bristow agrees adding … that costs are an interesting dilemma for the industry, "the real driver of costs at this time is always grade and so the pressures that you're seeing in the costs – and it's easy to blame fuel which is a real cost for some – but what you're seeing is an ever decreasing pay limit as the gold price goes up, and the industry tries to keep producing more and keeping their reserves intact." [source] RS View: Increased costs and lower rates of production both arise from the natural business inclination toward "low-grading" into higher prices. This proclivity to extend mine life through low-grading is one of the primary reasons that investments in mining shares often fail to measure up consistently to the the sort of leverage that their promoters always claim they will offer atop movements in the gold price. AND ALSO . . . Miners, and government – partnership or nationalism? In Australia, the furore over a proposed mining tax led to a new prime minister and a sudden uncertainty on the part of the mining industry about whether or not to invest heavily in the country. In South Africa, continued calls for the nationalization of mines by various corners of the political scene were met with forceful resistance both by companies and, indeed by Minister of Mines Susan Shabangu. And, in a number of other mining jurisdictions, the royalties imposed on miners were raised. … Speaking on Mineweb.com's Metals Weekly podcast, Ernst & Young's global leader for Metals, Mike Elliot expects that governments are likely to look increasingly toward equity participation as way of getting their own, bigger slice of the resources pie. "What we've seen in the first round [of the reemergence of resource nationalism] was things which are directly related to fiscal outcome, so the two most common manifestations we saw in 2010 was the change in the royalty or tax regimes and its one of those things that once you've had a first and second mover, then it provided essentially global coverage for others to do something similar. "The second part we saw was that there were a lot of nations which were impacted by the global financial crisis where the slowdown in capital projects meant that they were deferring the government revenue stream to sometime much more distant in the future, and that really wasn't seen as satisfactory by a lot of these nations' states. So we saw them invoking the use it orlose it clauses in order to try and accelerate some of that activity. "Going forward, we probably see there being a greater interest in government participation in the financial wealth – not just through taxation, but maybe through greater equity interests or direct participation in new mining projects". Giles Taylor, Head of EMEA Mining and Metals at Barclays Capital agrees that we are likely to see a greater degree of partnership between miners and governments but says it is more a renewed awareness of the commodity sphere, rather than pure nationalism. "Resources are quite a political play now, all around the world, countries want to work with partners to develop their assets; there is more focus on resources now by governments than there was maybe 2 or 3 years ago." see more… | ||

| Guest Post: Fifty Ways To Leave Your Lender Posted: 09 Feb 2011 09:40 AM PST Submitted byTerry Coxon of Casey Research Fifty Ways to Leave Your Lender It was Otto von Bismarck who explained that “politics is the art of the possible.” We can thank him for that much, but he didn’t tell the whole story. I’ll give you the rest of it. Politics is the art of the possible fictions you can get away with. | ||

| The Truth Behind Saudi Arabia’s Oil Supply Posted: 09 Feb 2011 09:15 AM PST We've suspected for some time Saudi Arabia has less oil in the ground than they claim. Apparently so do diplomats in the US State Department…at least, according to even more scintillating cables released from Julian Assange's WikiLeaks website. The cables come from inside Saudi Arabia's state-owned oil company, Saudi Aramco. In 2007, Aramco's former head of exploration Sadad al-Husseini told the US consul general in Riyadh that the firm had purposely overstated its reserves by 40% to spur foreign investment. "Our mission now questions how much the Saudis can now substantively influence the crude markets over the long term," reads one of the cables. "Clearly, they can drive prices up, but we question whether they any longer have the power to drive prices down for a prolonged period." None of this will be news to longtime readers, but it might register a minor blip on the EKG of the couch-surfing nightly news set. It could even make an impression on readers of the Drudge Report, where the headline is prominently displayed this morning. Ultimately, however, the revelation that the Saudis are 40% less impressive than they were yesterday will have little impact. "The bottom line is that in the short term," says our oil analyst, the vastly popular Byron King, "Saudi's problem doesn't really matter. They'll export as much oil as they need to cover their bills and shape the price environment. The tankers will sail. "Medium term, Saudi will have trouble meeting its goals. But characteristically, the Saudis will cover up the problem. "Long term, every day that we don't plan for new ways of running the energy-consuming part of the world is another day closer to disaster." Addison Wiggin The Truth Behind Saudi Arabia's Oil Supply originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | ||

| Posted: 09 Feb 2011 09:01 AM PST by Addison Wiggin - February 9, 2011

The cables come from inside the Saudi Arabia's state-owned oil company, Saudi Aramco. In 2007, Aramco's former head of exploration Sadad al-Husseini told the U.S. consul general in Riyadh that the firm had purposely overstated its reserves by 40% to spur foreign investment. "Our mission now questions how much the Saudis can now substantively influence the crude markets over the long term," reads one of the cables. "Clearly, they can drive prices up, but we question whether they any longer have the power to drive prices down for a prolonged period." None of this will be news to longtime readers of The 5, but it might register a minor blip on the EKG of the couch-surfing nightly news set. It could even make an impression on readers of the Drudge Report, where the headline is prominently displayed this morning.

"The bottom line is that in the short term," says our oil analyst, the vastly popular Byron King, "Saudi's problem doesn't really matter. They'll export as much oil as they need to cover their bills and shape the price environment. The tankers will sail.

Our New Oil War scenario just got another shot of adrenaline care of Mr. Assange. [Ed note. For a sneaky way to legally "steal" oil from Iran's largest known field, we recommend you follow this presentation, right here. Provided, of course, Somali pirates don't beat you to the punch.]

The attack marks "a significant shift in the impact of the piracy crisis," according to Joe Angelo, managing director of INTERTANKO, the association whose members own the majority of the world's tanker fleet. "If piracy in the Indian Ocean is left unabated, it will strangle these crucial shipping lanes with the potential to severely disrupt oil flows to the U.S. and to the rest of the world." "Do you know how hard it is to find a target," asks Byron King, "even a large one, 100 miles out to sea, in deep, blue water? Then intercept a moving ship, close to range, board and take it over? "There must be some truth to the stories about how the pirates have moles within the world shipping and insurance community," Byron goes on, saying what the industry guys won't: "identifying potential targets, cargo load, time of passage, course, speed, etc." More on this story is sure to come.

"There is a seasonality to gold, and very often it doesn't start running until the end of February," Robin Griffiths, private wealth strategist at Cazenove Capital in London told blogger Eric King this morning. "Once we get into March, I think we can expect it to start motoring higher again." Longer term, the sky's the limit. "I think gold's secular trend will go a long way higher," says Griffiths. "So far, it's been a linear trend from $250 to $1,400, and technicians always know these things end up going exponential... If we haven't gone exponential by $1,400, the final high is going to be way higher than current levels." A trend we'll gladly observe right here in The 5.

"On top of that, particularly China already has more than enough dollars and they're finding that a problem. [China doesn't] want to crack the dollar, but it doesn't want to go long of any more because of their trading activities." Ordinary Chinese are taking their cue from their monetary mandarins. As we mentioned last week, Chinese gold imports in the run-up to Chinese New Year were double last year's pace. "The growth in demand is being attributed, in part, to Chinese families giving each other gifts of gold, instead of traditional red envelopes filled with cash," says U.S. Global Investors chief and Vancouver favorite Frank Holmes.

Sprott says investment demand is starting to overwhelm existing silver supplies. As with gold, China is a huge factor: "China's net imports of silver were 112 million ounces last year. In 2005, they were net exporters of 100 million ounces," he says. "That's a 200 million ounce shift in an 800 million ounce annual market that seldom ever grows because production hardly ever goes up. So where's it all going to come from? We don't know."

We'll be receiving Mr. Sprott as a speaker in Vancouver this year following the announcement that he and our friend Rick Rule have merged their respective businesses. These two resource powerhouses alone make attending the Agora Financial Investment Symposium worth the journey. Vancouver in July is just icing on the delicious cake. Make your plans to join us today. Early, early bird discounts still apply. Contact Barb Perriello at (800) 926-6575 and reserve your seat. (Last year, we sold out in record time!) Meanwhile, we'll stick to our own silver forecast: We expect to see silver outperform gold 3-to-1 over the next 24 months. For ideas on how to play it, look here. [Ed. Note: Our friends at First Federal have seen an overwhelming response to their offer of the U.S. Mint's newest issue -- a massive 5-ounce silver coin. As an Agora Financial reader, you get dibs on these coins before anyone else -- but only for three more days. As always, we have an advertising relationship with First Federal and we may be compensated if you buy. Please be sure you examine these 5-ounce coins thoroughly before you buy.]

Under the deal, LSE shareholders would own 55% of the combined company, TSX shareholders 45%. The deal may run into trouble with Canadian regulators, though. They're still edgy after blocking the Australian mining giant BHP's bid for Canada's PotashCorp.

In fact, the index is now barely above the low it set in March 2009 -- down 31% from the peak.

Under a bill that's already passed one of the two houses of parliament, witches whose predictions fail to come true will be subject to fines or even prison terms. "I will fight until my last breath for this not to be passed," says Queen Witch Bratara Buzea. When we last checked in with Buzea a month ago, she had cast a spell of cat excrement and a dead dog to curse the politicians who subjected the occupation of witchcraft to the country's income tax. Didn't seem to work.

Romania's GDP has contracted for the past two years. Hmnn, wonder why?

"Many of the corporations that left the U.S. for countries like Mexico or China, due to our 'restrictive' regulatory environment, became polluters in their new homes. We know this just from reading the news about the pollution problems these nations have that accompany their economic development. Royalist brats just won't be bothered with the costs or philosophy of social responsibility until people as represented by government hold their feet to the fire, and in that sense, this shows us how capitalism doesn't work. The 5: Yeah, because the people who would run a system of "collectively owned resources" would never, ever try to enrich themselves and act like "'more equal' piggies." And they would never, ever favor their friends and punish their enemies when leasing or licensing those resources, would they?

"But the brand-new regulators could not be fired once initial regulations were written. What could be done with these government workers? They immediately looked for other aspects of water quality to regulate and added more and more regulation, and have done so for over 50 years. Regulations take on a life of their own and never seem to be too much. Plus, there are special interest groups that always want more regulation for more and more reasons.

"The biggest problem in public sector is how these organizations have turned into large-scale workfare programs that reward large percentages of people who underwork yet insist on 'industry' wages. Wages are all adjusted up to the high end of 'industry standard' wages in the name of fairness while the quality of employees we hire is considerably less than standard. "There are departments within my organization in which half the employees who earn an average of $60,000 per year are not worth minimum wage. That is no exaggeration. This puts undue pressure on the minority of employees who are competent and often very overworked. They eventually leave and their departure is used as an excuse to raise the wages of all the remaining parasites. "It's a terrible cycle and it has to end." The 5: Following the president's now infamous address to the Chamber of Commerce on Monday -- in which he beseeched business leaders to "get in the game" while sidestepping the giant elephant of government "reform" and regulation in the room -- our friend and CEO of Odyssey Marine responded in kind. Unfortunately, we've used all of our 5 Min. today... so keep an eye out for Mr. Stemm's entire response tomorrow. Regards, Addison Wiggin P.S. The Zagros oil basin of southwestern Turkey has a distinct advantage in the world market today: Much of its product would be shipped out via the Mediterranean Sea, far from Somali pirates. It's one more argument in favor of Chris Mayer's newest "special situation." One of this company's major owners turned $500 into $1 billion (that's not a typo) with his last oil venture. To learn how promising this one is, please review Chris' latest presentation. | ||

| Posted: 09 Feb 2011 08:51 AM PST Update: $19.90 now One of these years Cisco will actually trade up after earnings. We promise. Just not yet... not yet. In the meantime, enjoy the latest carnage. But never forget: the gross margin collapse, the plunge in the consumer business, and that whole "transition" language - that's all very much company-specific. There is no way, repeat no way, that Cisco weakness can ever be systemic. And forget that Cisco was the first company to go pop during most previous bubbles. That also does not fit the script. | ||

| Grandich Client Crocodile Gold Posted: 09 Feb 2011 08:51 AM PST | ||

| Hourly Action In Gold From Trader Dan Posted: 09 Feb 2011 08:31 AM PST | ||

| Market Commentary From Guild Investment Posted: 09 Feb 2011 08:31 AM PST View the original post at jsmineset.com... February 09, 2011 12:38 PM Inflation is taxation without legislation -Milton Friedman Inflation: Say Goodbye to Buying Power Economy watchers see its growing presence in official government statistics. Yet you won't hear government officials admitting it. It's too politically unpleasant — and threatening — to do so. Official spin and fantasy aside, the reality is that inflation is here and here to stay for quite a while. That means the buying power of the dollar is declining and being experienced on a daily basis. We have noticed for decades the decline in the purchasing power of the U.S. dollar, perhaps as a byproduct of spending significant time travelling outside the U.S. We've seen the dollar buying less and less and less. Looking ahead, we unfortunately see the rate of decline gathering steam, and that's not just our opinion. It's shared by many sharp economic minds, among them, Jim Sinclair who has been discussi... | ||

| Posted: 09 Feb 2011 08:30 AM PST For now, the earnings narrative dominates the market. All the big-picture items seem not to matter. Unemployment? Who cares? Debt and deficits at every level of government? Whatever. Companies are turning in good profits and the market is uncorking the champagne. There are reasons to be careful, which I'll get to. First, on the face of it, we've had a great run. The S&P 500's fourth-quarter earnings, at the halfway mark, were 17% ahead of last year's. Importantly, sales were up 9%. So this is no longer a story of cost cutting. Most everyone is doing well, save utilities and health care companies, which have reported declines in profits as a group. Mining and energy companies are doing especially well, with profit growth north of 40%. The media don't get how this earnings picture squares with stubbornly high unemployment. I talked to one reporter recently about this very thing. One simple reason for this disconnect is that some of the best sources of profits for many of these firms has been from overseas operations. Many US firms are still cutting jobs, like Boeing and Lowe's. Profits from emerging markets, meanwhile, grow apace. There are bright spots in the US, too, of course. US manufacturing is getting a boost. Caterpillar will spend $3 billion this year in capital expenditures to add capacity, more than half in the US. And Emerson said it expects US nonresidential investment to grow 8-9%. Eaton, another US manufacturer, actually said it expects its US sales to grow faster than its overseas operations. US new vehicle sales were up 17% in January. We're at a run rate of 12.6 million vehicles, much better than the 10.8 million run rate of a year ago, but well off the 16 million automakers enjoyed pre-crisis. So it's a bit of a muddled cherry. As always, you have to pick your spots, which is what we're all about. A fly in this whole whiskey sour is inflation. It's definitely here and it's having an impact. Rising costs are squeezing some manufacturers. Whirlpool, for example, said it would boost prices 8-10% to cover rising raw material costs. This sort of thing is rippling across all sectors. Prices are going up everywhere. Nalco Holding (NYSE:NLC), a world leader in water purification, recently reported disappointing earnings, largely due to rising raw material costs. The stock sold off on the news. But looking out longer term, the world's need for clean water only grows more acute. Despite the short-term effects of rising raw material costs, Nalco ought to be able to grow core profits at double-digit percentages for years to come. It is a very strong company that generates a tremendous amount of free cash flow – $185 million last year, to be exact. So if companies as robust as Nalco are feeling the effects of rising prices, run-of-the-mill companies across the country must also be feeling the effects. In fact, I was fascinated recently by a story in The Wall Street Journal titled, "Fearing Inflation, Firms Stocking Up." The story talks about how companies are stockpiling rubber tires, cotton clothing and other goods to insulate themselves from inflation. Anecdotally, McCormick stockpiled some ingredients for its spices, Anton Sport bought more fabric than it needed, and Monro Muffler bought extra tires and oil. These purchases are still a small part of overall purchases, but it's a new trend and something we haven't seen in years. For most of the last handful of years, companies tried to shed inventory, not carry it. But what these actions essentially say is that these firms would rather hold real things than cash. I think we'll see more of the same. While inflation is here and everyone seems to see it, the central bankers of the US and Europe seem unconcerned. Of course, they have every incentive to continue to let the money presses run. According to economists Joshua Aizenman and Nancy Marion, inflation did half the work of cutting US government debt from 122% of the economy to 25% from 1945-1973. So with the US government saddled with debts it can never repay, the way out is to debase the currency. Let those printing presses hum and keep interest rates low. Of course, such money printing also puts in motion great monetary accidents. As the old Austrian economists warned, the new money stimulates investing, but it creates an illusion. It's like giving off signals that there is plenty of gas in the tank when, in fact, it's nearly empty. These easy-money policies helped create the great housing bubble. And the easy-money policies today will create a big bubble somewhere else, which will turn into tomorrow's bust. Regards, Chris Mayer Blowing Bubbles originally appeared in the Daily Reckoning. The Daily Reckoning has published articles on the impact of quantitative easing, bakken oil, and hyperinflation. | ||

| Gold Daily and Silver Weekly Charts Posted: 09 Feb 2011 08:22 AM PST | ||

| Gold May Outshine Silver in the Medium Term Posted: 09 Feb 2011 08:19 AM PST Przemyslaw Radomski submits: Political as well as economical developments around the globe, especially in the Middle East, have affected the commodity markets during the previous week. Notwithstanding the uncertainty associated with the social illness, a strong demand has supported the precious metals. In talking about the reasons, the Chinese New Year celebrations top the discussions. The growth in demand is being attributed in part to Chinese families giving each other gifts of gold instead of traditional red envelopes filled with cash. Fears of inflation have also driven demand for gold. China’s gold imports are estimated to have more than doubled from a year ago in the run-up to Chinese New Year. This means that China is on track to overtake India as the world’s largest consumer of the yellow metal. China consumes about 527 tons of gold a year, according to the World Gold Council, an industry body representing gold miners. Traders say China will overtake India as the largest consumer of gold this year. The Indian festival of Diwali was once the key driver of seasonal demand patterns because of the large number of weddings taking place during the holidays. But Now the Chinese New Year is starting to have a bigger impact. Ongoing demand surge from China could support the precious metals market significantly in the short-term. Precious metals traders in London and Hong Kong said this week in a Financial Times article that they were stunned by the strength of Chinese buying in the past month. “The demand is unbelievable. Complete Story » | ||

| Gold: A Bad Investment and Getting Worse, Part II Posted: 09 Feb 2011 08:01 AM PST Charles Lewis Sizemore submits:

I couldn’t help but remember Mr. Soros’s words when I read Thomas Kaplan’s recent opinion piece in the Financial Times. Kaplan, Chairman of Tigris Financial Group, writes that gold, even after its 10-year bull market, still only represents 0.6% of total global financial assets. This is double the all-time low of 0.3% hit in 2001 — when gold was just beginning its ascent — but far below the 3% it was in 1980 or the 4.8% that it was in 1968. Kaplan notes that if gold rose to just 1.2% of global investments — less than half the 1980 level — this would equate to 26,000 tons, or ten years worth of current production. The implication, of course, was that the gold bull is only getting started. As more investors diversify parts of their portfolios into the yellow metal, the increase in demand will cause the price to soar ever higher. There are so many flaws in this thinking it’s hard to know where to start, but let’s give it a shot. We could start by noting that the global economy has grown by leaps and bounds since 1980 and that assets that reflect this surge of wealth creation — such as the stocks and bonds of the companies that have benefitted from the growth — should be a larger piece of the global asset pie relative to gold. Complete Story » | ||

| Posted: 09 Feb 2011 07:38 AM PST The most important characteristic of current capital markets, aside of course from now completely irrelevant stocks, which there is no point in even discussing any more as the Russell 2000 has become nothing more than a policy tool for Bernanke in pitching idiot Congressmen how "successful" his failed monetary policy has been when all it indicates is how good he is at manipulating stock prices, is the record steepness of the yield curve, as we have been pointing out month after month (oddly the topic never gets boring as it hits a new record wide with each passing month). And while to Ben the steepness is simply more good news to regale his questioners, who have no idea what the difference between a bond price and yield is, with, it is just as easily the most bearish indicator available. Nick Colas explains why "the bears also have more fodder from the steep yield curve than an Alaskan salmon run: the long end of the curve could be blowing out over inflation fears, persistent government debt issuance, or even a future downgrade of U.S. sovereign debt." But don't worry- the Chaircreature will never acknowledge that there is a yang to every ying. Especially not when the ying has to be so well priced, that Bernanke's midichlorian count has to be off the charts to get his liquidity extraction timing perfectly and avoid either a hyperdeflationary or hyperinflationary collapse. From BNY Convergex: Smoke from a Distant Fire, or what the 2s10s really indicates Summary: The U.S. Treasury yield curve is setting records for its “steepness” – the difference between short duration yields and those that stretch out for 10 to 30 years. The current yield spread between 2-year and 10-year notes is now 290 basis points. We’re clearly in record-setting territory, but this is one of those data points that seems to fully support both full-on bullish and bearish viewpoints. History is on the side of optimism: the two previous periods of Matterhorn-like yield curves were in the early 1990s and 2000s and served as precursors to an improving U.S. economy and large gains for stocks. Yet the bears also have more fodder from the steep yield curve than an Alaskan salmon run: the long end of the curve could be blowing out over inflation fears, persistent government debt issuance, or even a future downgrade of U.S. sovereign debt. This argument will be settled by how much loan growth we see in the banking system, for that is the way steep yield curves traditionally catalyze economic growth. “People only see what they are prepared to see.” That quote comes from Ralph Waldo Emerson, the American 19th century writer and philosopher. While he meant it largely in a spiritual sense – his first vocation was in ministry – there is much truth to it when it comes to the world of investing. You only have to look as far as the tech and housing bubbles or the Financial Crisis to see that human judgment is strongly colored by what we want to see. What we are “Prepared to see.”

The steepness of the Treasury curve, defined here as the difference between 2 year and 10 year Treasury yields, is therefore an ongoing tug of war. On one side you have 11 people – the current size of the Federal Open Market Committee. On the other side is the open and highly liquid marketplace for government bonds. This struggle between closed-door policy and marketplace pricing is now at an important juncture. Consider the following (a 35 year chart of the 2-10 year spread follows immediately after the text):

The current spread, at 290 basis points, is extremely unusual and demands separate analysis. Three points on the state of play today:

First is the possibility that long-dated Treasuries are discounting inflation more than economic recovery. The Federal Reserve won a battle with inflation in the early 1980s, causing a long-term bull market in 10-30 year bonds. Now the Fed is actually trying to spark inflation - a very different dynamic. A strong dose of inflation, beyond the Fed’s ability to control it, would damage economic growth and give banks very little incentive to lend more, or produce little demand for capital from business managers. This would, of course, also drag down stock prices. If a steep yield curve is meant to spark loan growth, it has yet to create this outcome. According to the Fed’s own data (see here: http://www.federalreserve.gov/releases/h8/current/) growth in loans and leases on bank balance sheets are still stuck in neutral. Bank credit of all types was down 5.6% in December 2010 from the prior year. For the month of January 2011 bank credit is essentially unchanged to December. Some loans considered to be leading indicators are up, however. Commercial and industrial loans, for example, were up 7.6% in December although January has not seen any further advance.

| ||

| ‘Welfare Bum' JP Morgan: We Need Gold! Posted: 09 Feb 2011 07:26 AM PST | ||

| G7 Banana Republics ON the Road to ZIMBABWE! Posted: 09 Feb 2011 07:23 AM PST Tedbits: The Economic and Financial NO SPIN Zone By Theodore (Ty) Andros The global financial cataclysm is mushrooming with every stroke of the keyboard at a central bank, with the issuance of new debt to cover old debt, and with the illusion of creating money out of thin air. It is all debt, nothing else, with no final settlement…. EVER. You exchange the money you work for and save and buy a government bond; they print the money to pay you back and PRETEND you have been paid. The situation is just as Von Mises outlined: "There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved" -Ludwig Von Mises The LEADERS of the developed world have chosen the latter route. This is a currency and financial-system extinction event, make no mi... | ||