Gold World News Flash |

- GoldSeek.com Radio Gold Nugget: Dr. Stephen Leeb & Chris Waltzek

- Asian Metals Market Update

- Market's First Law of Bernankity: What Goes Up, Must Go Up

- Peak Oil and Wikileaks: Serious Concerns About Saudi Arabia's Reserves

- Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3%

- China to Add Staggering 5,042 Tons of Gold for 10% Reserves

- Presenting Obama's Plan To Bail Out The (Otherwise Perfectly Solvent) States

- Technical & Fundamental Analysis Fall Woefully Short in Assessing Manipulated Markets

- Failed Danish Bank Makes History With First Senior Bondholder/Depositor Impairments To The Tune Of 41% Of Total

- CalPERS Accuses Lehman of Fraud

- Are the Gold and Silver Prices going to turn up?

- J.S. Kim: Technical, fundamental analysis no good in gold and silver

- Is Deflation Really a Risk Today?

- MARC FABER – THERE WILL BE WAR

- Robin Griffiths - China’s Gold Reserves to Rise From 2% to 10%

- Silver class-action suits against Morgan, HSBC consolidated in New York

- Jim's Mailbox

- Why Another Financial Crash is Certain

- Marc Faber And Nassim Taleb On Risk, And The One Asset To Own Whether One Is Bearish Or Bullish

- Critical Times for Critical Metals

- Derivatives: The Real Reason Bernanke Funnels Trillions Into Wall Street Banks

- Gold Price is Without Question Rallying and Will Go Higher, Watch Closely How it Behaves at $1,380

- TUESDAY Market Excerpts

- Silver Liberation Army (SLA) is on the march!

- Gold Tests 50% Retraement

- Gold: End of a Trend or a Buying Opportunity?

- No More 40-Cent Gasoline

- Hourly Action In Gold From Trader Dan

- In The News Today

- Kevin Bambrough: Fiat Currencies Are Worthless

- China, Inflation and Gold

- Gold Daily and Silver Weekly Charts

- “It looks like the much maligned correction in silver is over”

- Cramer: Go Long Gold

- Gold May Outshine Silver in the Medium Term

- Why The Fed's Policies Are Actually Hurting The Unemployment Rate

- The Most Watched VIDEO in 2011: Will It Be Cash or Gold Bullion?

- Signals Still Bullish for Silver

- Silver Backwardation – What To Make Of It

- Tell Me, Which Asset Class Would YOU Rather Own?

- How Food Inflation Translates Into Social Unrest

- The 'Gold Covered Call Writing' Managed Futures Program

- Americans Will Flock Into $5,000 Gold and $500 Silver

- Gold & Energy: 70/30 Long Short Tactics

- A "Gold Tsunami" is Coming

- Hi, Ho Silver!

- Gold Will Outperform After Stocks Peak

- Silver Closes Well Above $30 As The Dip Is Now Fully Bought

- LGMR: Silver "Outperforms" as Food-Price Inflation Gets "Serious"

- Global Credit Contagion On the Verge Again

| GoldSeek.com Radio Gold Nugget: Dr. Stephen Leeb & Chris Waltzek Posted: 08 Feb 2011 07:02 PM PST |

| Posted: 08 Feb 2011 06:00 PM PST I have been reading the net and a lot of analysts have written off gold and silver. I have received calls from traders on gold and silver's crash. I have been a silver bull all my life and will remain a silver bull for the next five years. Corrections are a part and parcel of a long term bull rally. In the last decade gold prices have risen from $300 to $1434 while silver prices have risen from $7.0 to over $31.0 an ounce. Corrections of twenty percent are a part of a long term bull rally and should be used as an investment opportunity. |

| Market's First Law of Bernankity: What Goes Up, Must Go Up Posted: 08 Feb 2011 05:53 PM PST The market rose for the 7th straight day (and the day was so straight that it wouldn't even look at other days of the same gender, and yeah, that means you Thursday) as earnings continue to be relatively decent (until the speedboat effect of rising input prices catches up with them next Q, which is nowhere near as fun as the motorboat effect catching up with Katie Price, but it is what it is), the Fed both hinted that QE2 was a success (because the paper portfolios of rich people are now higher giving them more fake money they eventually won't spend, so good on QE2) and that there may be no QE3 (because they'll call it QE2 Lite, the alliterative QE Cubed, or simply "Suckers"), and Ben Roethlisberger didn't rape anyone.

With the market now passing levels it hasn't seen since unemployment was half of what it is today, home prices were worth 20% more, and Jenna Jameson still had a career (and her original facial structure, because really Jenna, how the fuck did you turn this, into this? It's more bizarre than getting killed by a knife wielding bird at a cockfight since the only thing one usually needs to be worried about in a cockfight is getting poked in the eye), one has to wonder at what point having people with income and real wealth will matter or if the economy can leap ahead of where it was despite more than 8MM fewer people contributing. Of course, all of that is irrelevant because as long as you buy the rip, all should be good (as long as you sell before you get ripped).

As for macro news, the only sort of real data out today was a survey from the National Federation for Independent Businesses that showed small business confidence picked up marginally in December rising 1.5 points to 94.1. Of course since Money McBags has no idea what the 94.1 is out of (perhaps a billionity?), what the fuck the magnitude of a 1.5 move means, and why he had never heard of the lovely Anja Rubik until today (and he would solve any of her cubes, and yes, that pun had to be made), all he knows it that it is likely irrelevant. That said, the report highlighted that "Owners are not optimistic enough about the future to commit to some serious spending and hiring," so um, Money McBags guesses the 94.1 really is out of a billionty.

In other news, the Fed continued their Winter of Discontent 2011 speaking tour as today Federal Reserve Bank of Richmond President Jeffrey Lacker (lack her? Money McBags doesn't even know her) addressed all three students who attend the University of Delaware while Federal Reserve Bank of Atlanta President Dennis Lockhart addressed the Calhoun County Chamber of Commerce in between their Business 'N Biscuits lunch and their History of French Wine seminar (and really?). Of course as both are non-voting members of the FOMC (the fluff girls of the Fed meetings if you will), Money McBags cares what they say about as much as he cares about who the next guest star on Glee will be (unless it's the AIDS virus), but news is news.

In his speech, Lacker said that we can almost halt QE2 right now as the "distinct improvement we’ve seen in the economic outlook since the program was initiated suggests taking that re- evaluation quite seriously," When asked to quantify this "distinct improvement" he has seen, Lacker simply stated: "The market is up, dickbag." And in Money McBags' favorite example of either positive thinking, complete lunacy, or a credibility gap bigger than Anthony Garcia serving as a yogurt spokesperson (and the thing Money McBags loves most about that story is that the woman immediately knew what the yogurt tasted like, proving practice does make perfect), Lacker said the decline in the savings rate suggests that many households have made substantial progress toward repairing their balance sheets following the financial crisis. Yeah, and it also (and more likely) suggests that people aren't making enough money to be able afford food and gas with rising prices and thus can't fucking save anything in this ponzeconomy™. But hey, if economists want to take a decline in savings as a positive sign for an economy still reeling from an over-extended credit bubble, then, well, buy the rip.

As for Dennis Lockhart, he shared that he thinks inflation is below the Central Bank's comfort level because apparently the Central Bank's comfort level is somewhere around stagflation. Lockart went on to say "For the moment, inflation, properly defined, is tame, in my view. And the rise of individual prices does not signal incipient inflation'' and there is so much wrong with that statement that it makes Money McBags balls hurt. First of all, "inflation, properly defined" should include the shit that people need to buy like food, gas and copies of Italy's February GQ magazine featuring the lovely Diora Baird, so the Fed's insistence on using "core inflation" to gauge prices is like using a rectal thermometer as a pregnancy test. Secondly, "The rise of individual prices does not signal incipient inflation?" Really? Hmm let's see, per the definition, inflation is a "rise in the general level of prices" and incipient means "to become apparent." So just for shits and giggles, Lockhart said "the rise of individual prices does not signal an apparent rise in the general level of prices." So um if prices rising doesn't signal an apparent rise in prices, what the fuck does?

Elsewhere, President Obama will ask congress for $53B for a high speed rail which would be awesome if A. We didn't have something called airplanes and B. We had $53B to fucking waste on a piece of shit train that no one is going to use anyway. For fucksake, take that $53B and pay some fucking teachers, get sick people some fucking health care, have one hell of a night out at RICKs, or just don't fucking spend it. Just because you can print money, doesn't mean you have to, shit, just because Money McBags can go to spankwire, doesn't mean he has to, well, actually bad example. But Money McBags knows why the White House wants this as GE is the leading manufacturer of diesel-electric locomotives, and who is the new Chairman of Obama's outside economic advisers? The guy who runs GE, Jeffrey Immelt. Does anyone know if conflict of interest spelled with one "fuck you" or two?

Internationally, China raised interest rates for the third time since October as the government tries to put a lid on the rapid inflationary growth which has been driven by a fuckton of lending, massive state investment projects, and the introduction of and now rampant demand for new technologies such as the fork. A slow down in China would be worse for the ponzeconomy's™ recovery than having to live in Stockton, CA as the US needs the growth of developing countries to make up for the lost consumption due to the 17% U6 unemployment.

In the market, commodities continued to rally with gold trading up again and copper reaching all-time highs but as commodities don't go into making all of the shit we use and thus won't increase final prices, there is no reason to worry about inflation (and yes that was sarcasm). In earnings news, Toyota raised their profit forecast even as profit slumped 39% in Q3 due to slow sales in Japan, the lingering effect of recalls, and cars being really fucking expensive. Also, MCD announced same store sales were up 5.3% even with US sales being hurt by the fucking weather and that sent the company up ~3%. MCD had strong growth internationally (7% up in Europe, 5.2% in Asia), in their nascent breakfast segment (McCafe and oatmeal), and finally caught the Hamburglar. Money McBags is a shareholder of MCD because as always, cheap shit with a ton of brand equity should outperform in developing markets as poor foreign people want to emulate the poor people in the US. Finally, AIG delayed their re-IPO as apparently they can't find enough investors who have never heard of AIG.

As always, Money McBags has more at the award winning When Genius Prevailed. And if you missed his analysis of the B(L)S jobs report over the weekend, which will surely win him whatever has bigger tits than a Pulitzer (perhaps a Hendrickszer), you should definitely check it out as all the cool kids are talking about it. |

| Peak Oil and Wikileaks: Serious Concerns About Saudi Arabia's Reserves Posted: 08 Feb 2011 04:17 PM PST I want to begin this post with a repost of an article I wrote last September, 2010, The Inextricable Relationship Between Energy and Money: Modern civilization is based on the continued growth of what I call the "Trinity" of money, credit, and energy. Credit, of course is what drives money. Money is lent into existence, that is, one man's loan is another man's savings. The two can not be separated. Savings cannot be created without someone, somewhere in the system, taking on debt. This applies to individuals, corporations, and governments. So what of energy? Energy is the real world, tangible engine of growth. Energy feeds us, it transports us, it builds things, in essence, it IS the economy. Money is what we use to measure our progress, to allocate resources, to "keep score" so to speak. Without a constant, affordable supply of energy, balance sheets, budgets, asset valuations - all get affected. If you think of an economy as a system of inputs and outputs, energy is the greatest input that creates wealth. But energy is not free. It takes energy to extract energy - i.e. coal, oil, gas, etc... And just as a monetary system needs to grow to survive, so too does the supply of energy need to grow to allow the monetary system to grow. And that supply of energy doesn't just have to grow, but it has to grow at best, at a constant cost. That is, if the cost of extracting energy rises, then that impacts the ability of the money supply to grow. Think of it this way. I have an investment. At first, for every dollar I sink in to that investment it yields me $1.50 - I'm doing pretty well. But what if, over time, there is a diminishing rate of return? What if I only receive $1.25 for each dollar of input? Or less? That is what is happening to industrial civilization today. It is taking more energy to produce energy. The easily accessible oil and natural gas is diminishing, and we are now extracting more difficult sources of energy. And on top of that, there are billions of more people in the world today that want that industrial lifestyle, and hence, need the same energy usage. So what does that do to a monetary system based on irredeemable currency, born of credit? How does that impact future growth? The US Department of Energy commissioned Scientist Robert Hirsch to produce a report that was published in 2005 titled "Peaking of World Oil Production: Impacts, Mitigation, and Risk Management." Here is the REPORT. Robert Hirsch was recently interviewed by Matthieu Auzanneau, Oil Man (blog), Le Monde, to discuss his upcoming book, and how his 2005 report and conclusions have been handled by various US government officials. Here's an excerpt: oil man: What should we expect, before the world is able to catch up with the 'peak oil' issue ? Hirsch: From a world standpoint, Growth Domestic Product will decline every year for over a decade, and could easily be down 20 or 30 % over this period of time. That's what I mean when I say « catastrophic ». Wherever you live, somebody has to get food to you. And modern farming is run by oil, because the tractors that plow the ground and plant the seeds, and do the harvesting, run on oil. And then you have to transport the food to some kind of processor, and from there to the consumer.From Part II of the interview: oil man: - What happened after you published your 2005 report on 'peak oil' for the US Department of Energy (DoE) ? Hirsch: The people that I was dealing with said : « No more work on peak oil, no more talk about it ». oil man: People that were high in the administration hierarchy? Hirsch: The people that I was dealing with were high in the laboratory level. They were getting their instructions from people on the political side of the DoE, at high levels. After the work we did on the 2005 study and the follow-up of 2006, the Department of Energy headquarters completely cut off all support for oil peaking and decline analysis. The people that I was working with at the National Energy Technology Laboratory were good people, they saw the problem, they saw how difficult the consequences would be – you know, the potential for huge damage – yet they were told : « No more work, no more discussion. » Yesterday, the Guardian reported: WikiLeaks cables: Saudi Arabia cannot pump enough oil to keep a lid on prices From the article: The US fears that Saudi Arabia, the world's largest crude oil exporter, may not have enough reserves to prevent oil prices escalating, confidential cables from its embassy in Riyadh show. The cables, released by WikiLeaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels – nearly 40%. The revelation comes as the oil price has soared in recent weeks to more than $100 a barrel on global demand and tensions in the Middle East. Many analysts expect that the Saudis and their Opec cartel partners would pump more oil if rising prices threatened to choke off demand. However, Sadad al-Husseini, a geologist and former head of exploration at the Saudi oil monopoly Aramco, met the US consul general in Riyadh in November 2007 and told the US diplomat that Aramco's 12.5m barrel-a-day capacity needed to keep a lid on prices could not be reached. According to the cables, which date between 2007-09, Husseini said Saudi Arabia might reach an output of 12m barrels a day in 10 years but before then – possibly as early as 2012 – global oil production would have hit its highest point. This crunch point is known as "peak oil". The article continues: One cable said: "According to al-Husseini, the crux of the issue is twofold. First, it is possible that Saudi reserves are not as bountiful as sometimes described, and the timeline for their production not as unrestrained as Aramco and energy optimists would like to portray." It went on: "In a presentation, Abdallah al-Saif, current Aramco senior vice-president for exploration, reported that Aramco has 716bn barrels of total reserves, of which 51% are recoverable, and that in 20 years Aramco will have 900bn barrels of reserves. "Al-Husseini disagrees with this analysis, believing Aramco's reserves are overstated by as much as 300bn barrels. In his view once 50% of original proven reserves has been reached … a steady output in decline will ensue and no amount of effort will be able to stop it. He believes that what will result is a plateau in total output that will last approximately 15 years followed by decreasing output." The US consul then told Washington: "While al-Husseini fundamentally contradicts the Aramco company line, he is no doomsday theorist. His pedigree, experience and outlook demand that his predictions be thoughtfully considered." SOURCE So what to say of this? Much of the Western world is bogged down in a debt or currency crisis, and only strong economic growth can avert such crises. If Peak Oil is indeed happening, it will become much more costly for economies to grow. As I have said before, cheap energy is needed to sustain a certain level of economic growth. After all, energy is a cost that affects everything, and as this cost rises, so too does the price of everything else. If your state, or city, or country, or even business or household has a certain level of debt that needs to be serviced, any energy cost increases affect the ability to manage that debt. It's as if the interest rate on all your loans suddenly rises. And if you really think about it, all the balance sheets in the world, all the loans made out to all types of entities - government, corporate, individual, function under an implied assumption: that energy costs will remain stable. A sudden rise in energy costs would have catastrophic effects on governments and economies worldwide - and ultimately, the debt based currency system we use today. |

| Gold Seeker Closing Report: Gold and Silver Gain Over 1% and 3% Posted: 08 Feb 2011 04:00 PM PST Gold rose about $10 in Asia before it fell back to almost unchanged at $1348.30 by a little before 8AM EST, but it then popped to $1365.09 in the first 15 minutes of trade in New York and continued to as high as $1368.05 before it closed with a gain of 1.17%. Silver rose over 1% in Asia before it fell to see a $0.033 loss at $29.267 in London, but it also soared back higher in New York and ended near its last minute high of $30.283 with a gain of 3.1%. |

| China to Add Staggering 5,042 Tons of Gold for 10% Reserves Posted: 08 Feb 2011 03:20 PM PST Dear CIGAs, On the heels of the Robin Griffiths interview where Griffiths is looking for the Chinese to increase their gold reserves five-fold from 2% to 10%, King World News interviewed Dan Norcini to get his thoughts. "Eric, if you base Chinese reserves on $2.5 trillion, for China to move from 2% to 10% they will have to increase their gold holdings a staggering 5,042 tons at current prices." Norcini continues: "I've been seeing reports and I don't think that it is any secret that the Chinese officials have been telegraphing their intention to dramatically increase their gold reserves. The reason behind this is that China wants to ultimately position the Yuan for the longer-term as being part of a basket of currencies that would comprise a new official global reserve currency. A dramatic increase in gold holdings is necessary for China to achieve this goal. By way of comparison, right now both the US and Germany have roughly 70% of their reserves in gold, while China is at a paltry 2%. We don't want to leave out China's neighbor Japan which also only holds 2.5% of their total reserves in gold. |

| Presenting Obama's Plan To Bail Out The (Otherwise Perfectly Solvent) States Posted: 08 Feb 2011 02:57 PM PST We all know by now that Meredith is a witch: an unpatriotic, racist bitch, who eats kittens for breakfast, who deserves to be grilled by Joe McCarthy's exhumated corpse for telling communist truths, pardon, lies (just a Freudian slip dear Department of Central Planning and Internet supervision), and who will soon be accused of having unprotected (yet arguably consensual) sex with a Swedish man. But just in case she is on to something, here comes the president's plan to bail out the (otherwise perfectly solvent and all, we promise) states. The NYT reports that "President Obama is proposing to ride to the rescue of states that have borrowed billions of dollars from the federal government to continue paying unemployment benefits during the economic downturn. His plan would give the states a two-year breather before automatic tax increases would hit employers, and before states would have to start paying interest on the loans." But where are the details you may ask? Patience grasshopper: they will be included in the latest budget proposal which has been delayed for nearly half a year now as the printer ran out of zeroes. "The proposal, which administration officials said would be included in the 2012 budget that the president is scheduled to unveil next week, was greeted coolly by Republicans on Capitol Hill, who warned that the plan would ultimately force many states to raise their unemployment taxes in the years to come." Ah yes, the Republicans - those paragons of sound financial judgment and sounder virtue. After all who can forget whole "Tea Party thing" which did so much to prevent the incurrence of a few hundred billion in additional debt over the next decade to pay for the latest Russell 2000 at 36,000 hairbrained ponzi scheme concocted by Rudolph von Bernankestein. More from the NYT on why QE3.1 - the Muni Edition (not to be confused with QE3.7 the MBS edition, or the QE3.495 the ICE gold margin requirement edition, and most certainly not with QE3.495,440,559 the "Kill the David Einhorn shorts" edition) is just around the corner:

So, uh, can we all drop the pretense and agree that while certainly scaring the children (who will all need PhDs in number theory in a few years just to count to the debt target, pardon, limit) and the idiots, Meredith has been pretty much spot on? In fact, we can even forgive her for telling Congress to fuck off with their witch hunts:

And some more details on how Obama will arrive in one of Blackhawk Ben's stealth Commanche gunships:

Don't worry children. It is for your own good. Plus if this plan falls through, the world will end. And yes, Meredith is certainly a witch and should be burned at the stake. Surely she will be able to fly away to safety due to the null hypothesis of her witchiness, and if she actually does burn: well, mistakes were made...

|

| Technical & Fundamental Analysis Fall Woefully Short in Assessing Manipulated Markets Posted: 08 Feb 2011 02:40 PM PST I have stated this for many years now and I'll continue to stand by this statement: Technical and fundamental analysis are of limited utility in predicting short-term trends in manipulated markets when analyzed in a vacuum absent of the context of government and bank manipulation. This not only applies to US stock markets but also to two of the most manipulated markets of all, the gold and silver futures markets. Often, with technical analysis, two analysts with multi-years of experience may offer widely diverging analyses when interpreting the exact same chart. However, if an analyst refuses or fails to take into account the massive amount of fraud and manipulation when interpreting charts of the S&P 500 or the Gold & Silver Continuous Contracts, then I would fathom that analyst would be off the mark at a much higher clip than he or she would be on the mark. For the past decade, it has been foolish to deny that massive fraud and manipulation existed in these aforementioned markets. Re... |

| Posted: 08 Feb 2011 02:28 PM PST Danish bank Amagerbanken A/S has just made history. The bank (which together with all other Danish, and not to mention Irish banks passed last year's European stress farce test) failed yesterday, this time for good, after its previous near death experience in the summer of 2010, when it only continued to exist in a zombi state courtesy of $2 billion in financial guarantees by the government. That guarantee, which was subject to "Amagerbanken strengthening its capital base and solvency by 750 million crowns in the form of equity or subordinated loan capital by Sept. 15" has ultimately been wiped out and on Monday, the Danish equivalent of the FDIC, the Finansiel Stabilitet A/S, announced that administrators would close the bank. And while the failure itself is not surprising (it was roughly the same size as the mid-2008 collapse of Roskilde Bank, previously the biggest Danish bank failure), nor is the reason for the failure, the bank said fourth-quarter writedowns wiped out its equity, attributing a large part to failed property investors (but we thought European real estate was doing so much better?), what is unique about this failure is that it is the first one to proceed according to new new regulations designed to ensure senior bondholders suffer losses in a bailout. And suffer they will. According to Bloomberg, bondholders of senior debt, including bonds formerly guaranteed by the government, will face write-offs of about 41%. "The bank estimates its assets amount to about 59 percent of liabilities." Another loser: depositors, who just happen to be pari passu with senior bondholders. To put this failure in context, recall that every Failure Friday the FDIC bail outs numerous banks, with the tab in most cases running up into the hundreds of millions if not billions. What Europe has done, is instead of getting a deposit insurer to guarantee the loses (at the expense of more taxpayer capital), is it has allowed bond bondholders and depositors to be impaired to the point where pro forma assets equal liabilities. Something, which in bankruptcy is known as Fresh Start, and is the most apt way to make sure that in addition to unlimited upside, bank bondholders actually also incur risk. Which is why this brilliant approach to zombi bank resurrection with NEVER materialize in the US. After all, how can we possibly ask the banksters to dare accept the possibility of loss on even one penny of their investments... More from Bloomberg on what is truly a beacon of logic in a world that puts bizarro to shame:

Only when the FDIC, and the corrupt oligarchs, not to mention bankers who literally rule the US, acquiesce to a comparable form of loss-sharing arrangement (in which the taxpayer does not end up footing the bill in perpetuity for banks' desire to load up their balance sheets with worthless paper, which once upon a time produced yield and now just produces negative cash flow), can we say that America is truly on the way to some form of (fair and equitable) recovery. Everything else is just smoke, mirrors, corruption and lies. h/t Scrataliano |

| CalPERS Accuses Lehman of Fraud Posted: 08 Feb 2011 01:12 PM PST Marc Lifsher of the Los Angeles Times reports, CalPERS suit accuses Lehman Bros. of fraud:

In a separate article, Liz Moyer reports in the WSJ, Calpers Alleges Top Lehman Execs Misled On Exposures, Financial:

I'm not sure where CalPERS is going with this lawsuit but if they're able to find out exactly what Dick Fuld and Chris O'Meara knew prior to the storm, then it's worth the cost. I also think CalPERS is sending a clear message to bankers: if you screw around again, we will come after you with everything we got. There are other developments that I find interesting. Reuters reports that tips from whistleblowers to the Securities and Exchange Commission have increased significantly since the Wall Street reform law was enacted last year:

More importantly, Bloomberg reports that the FDIC proposes bonus delay for bankers:

Of course this proposal is already being questioned:

I wonder if Ms. Allen has factored in the "societal costs" of millions of unemployed workers who lost their job following the financial crisis. For me, it's all about having skin in the game and aligning interests with shareholders. Warren Buffett was right when he said you got to punish failed bankers:

Alignment of interests is why I endorse CalPERS' latest lawsuit. And it's not just CalPERS. Increasingly, pension funds are suing banks and companies over a host of issues ranging from investment losses to overcharging pension plans on currency trades. In all likelihood, nothing will come out of these lawsuits, but the message to the financial and corporate elite is clear: if you defraud investors or cause serious losses through negligence and malfeasance, then pensions will come after you.

|

| Are the Gold and Silver Prices going to turn up? Posted: 08 Feb 2011 01:00 PM PST As we write, the gold price is at $1,364 having bounced off support at $1,324. It is now consolidating, so we have to ask is it about to return to an upward movement longer-term? If it is just consolidating before another strong drop we need to know because it could mean that the long-term upward trend will be broken. For sure the gold market has moved into one of those high risk areas where one expects a sudden and a strong mover, either way. But if it is going to rise, then we are at the point where we should be entering or re-entering the market. |

| J.S. Kim: Technical, fundamental analysis no good in gold and silver Posted: 08 Feb 2011 12:57 PM PST 8:57p ET Tuesday, February 8, 2011 Dear Friend of GATA and Gold (and Silver): J.S. Kim, founder of the SmartKnowledgeU investment research firm, joins Alasdair Macleod in questioning the use of technical and fundamental analysis in manipulated markets, particularly the gold and silver markets. Kim's commentary is headlined "Technical and Fundamental Analysis Fall Woefully Short in Assessing Manipulated Markets" and you can find it at ZeroHedge here: http://www.zerohedge.com/article/technical-fundamental-analysis-falls-wo... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php |

| Is Deflation Really a Risk Today? Posted: 08 Feb 2011 12:54 PM PST Is Deflation Really a Risk Today? Due to the overwhelming number of emails I received in response to yesterday's article detailing the derivatives market, I've decided to write a follow up article focusing on the implications of this $200+ trillion behemoth on the rest of the financial markets The primary question I'm receiving is from readers is: does deflation pose a REAL risk today? My response is absolutely. Remember, the entire financial system is broken in the US. Until we take our medicine and deal with the hundreds of trillions of bad debts sitting on the banks' balance sheets, there is ALWAYS the risk of another 2008-type event. The Federal Reserve has attempted to paper over these issues by offering Wall Street an endless stream of Dollars at nearly 0% interest. But this hasn't addressed the underlying issues in any way. The banks are still insolvent and the derivatives market is still the primary concern for anyone who works in finance whether they know it or not. So yes, deflation is and always will be a potential threat that can erupt at any time. However, should deflation ever take hold of the markets again, the Fed and other central banks' responses will GUARANTEE that it is short-lived and that inflation, then hyper-inflation take over in a very short period of time. Remember, Bernanke has NEVER admitted that he was wrong about anything. The guy literally believes he's an economic genius who can save the world (thanks Time magazine for buffering his ego). He is 100% positive that his policies are the right policies. So if deflation reared its head again, he would do the exact same things he's already done (print money, engage in more QE, etc) only on an even larger, more aggressive scale (we're talking a $5 trillion QE or something of that nature). This in turn would destroy the US Dollar and insure that we experienced either severe inflation similar to that of the '70s or hyperinflation similar to that of Weimar, Germany. Bernanke's nearly pushed us into the former already and we haven't see deflation in the financial markets in over two years. Bernanke literally hates the US Dollar. He opened currency swaps during the Euro Crisis back in April to bring its rally to a halt. He then kicked it in the teeth with QE lite in August. And he smashed its latest rally attempt in November with QE 2.

Literally, EVERY time the US Dollar starts a sustainable rally Bernanke launches a new anti-Dollar policy to push it down again. So you better believe he'd go all out if deflation poked its head up again. Imagine if a grizzly bear got up and tried to attack you after you already brought it down with repeated gunfire. What would you do? You'd blow its head off and then walk up to the body and shoot it until you ran out of bullets to make sure the thing didn't get up again. Bernanke would do the same thing to deflation. He'd throw so much money at it that he'd not only kill it dead, but he'd also kill the US Dollar and send us straight into Zimbabwe-land without even a moment's pause. So yes, deflation is a threat. And it will always be. But we might very well not see it again thanks to Bernanke's actions. And if it does show up again, its presence would be very short-lived. This is why I'm already preparing subscribers for inflation NOW rather than waiting to see if deflation grabs the markets first. And we're preparing ourselves with three inflation hedges that will outperform even Gold and Silver during the coming. Don't believe me? Have a look at how one of them has performed vs. Gold since we recommended it on December 15, 2010. Now imagine what this inflation hedges would do when the US Dollar COLLAPSES. I will be blunt, these are the three BEST inflation hedges on the planet. They not only rally even when Gold and Silver correct… but they're completely off the radar for the investment community. I'm not exaggerating. Out of 700,000+ financial companies in the US, only 17 even cover these investments.

That's right, 17… out of over 700,000. To say that these investments are relatively unknown would be the understatement of the year. However, even more importantly, they're all trading at such ridiculously low valuations that they're prime buyout targets for larger firms in their fields. In fact, I full expect all three of these investments to be bought out within the next six months. Their valuations today are absolutely ABSURD. And when this happens their share prices will absolutely EXPLODE. To get in on these incredible inflation hedges BEFORE this happens… all you need to do is sign up for a "trial" subscription to my paid newsletter Private Wealth Advisory, and I'll send you a copy of my Inflationary Storm Special Report detailing all three of them (their names, symbols and how to buy them). To do so… I want to be clear here, I in no way am slighting Gold and Silver as inflation hedges. I own both (bullion) personally and will be adding to my positions in the future. However, both Gold and Silver are extremely popular inflation hedges. And in investing, if you want to make a KILLING you have to buy the investments BEFORE the rest of the investment world catches on to them. Investments like the three detailed in my Inflationary Storm Special Report.

As I stated before, only 17 financial firms in the US even COVER these investments. Now consider that 864 institutional owners. And those 864 alone control over $27 BILLION in value. In contrast, only 17 firms even COVER the three investments from my Inflationary Storm Special Report. This number literally has nowhere to go but up. And what do you think will happen to their share prices when this occurs? Don't delay another minute. If you want to get in on these incredible inflation hedges before the rest of the investment world catches on… Good Investing! Graham Summers PS. An annual subscription to Private Wealth Advisory costs just $199. However, I realize my analysis and investment style are not for everyone. That's why I offer "trial" subscription periods. You see, when you sign up for Private Wealth Advisory, your purchase isn't a "done deal." Instead, I give you a full month (30 days) to explore my insights and investment strategies. If, at any point during those 30 days, you decide Private Wealth Advisory is not for you, all you have to do is shoot me an email and I'll give you every single cent of your subscription cost back, NO QUESTIONS ASKED. Everything you've learned from me, including my trading ideas, market analysis, and my Inflationary Storm Report are yours to keep, EVEN IF YOU CHOOSE TO CANCEL. Why do I offer this trial period? Because I am so confident in my ability to make money in the market... that once you start reading my reports and following my trading ideas... you'll never want to leave. To get started with your trial subscription today…

|

| MARC FABER – THERE WILL BE WAR Posted: 08 Feb 2011 12:54 PM PST Bernanke has already caused violent food riots and is surely starving people to death across the globe. Marc Faber believes Bernanke will eventually cause war. "We have a big debate in the world whether we will have a deflationary collapse or an inflationary boom…usually after a period of very heavy money printing war follows." "When [...] |

| Robin Griffiths - China’s Gold Reserves to Rise From 2% to 10% Posted: 08 Feb 2011 12:45 PM PST  With gold and silver on the move today, King World News interviewed one of the top strategists in the world, Robin Griffiths of Cazenove Capital. Griffiths had this to say about clueless western journalist commentary on gold, "The kind of western journalists that continually write down gold, two things, they almost certainly don't understand the Asian culture, and they were educated as strict Keynesians and he (Keynes) made the remark it was a barbarous relic. With gold and silver on the move today, King World News interviewed one of the top strategists in the world, Robin Griffiths of Cazenove Capital. Griffiths had this to say about clueless western journalist commentary on gold, "The kind of western journalists that continually write down gold, two things, they almost certainly don't understand the Asian culture, and they were educated as strict Keynesians and he (Keynes) made the remark it was a barbarous relic. And when they are really desperate they say well, Mr. Buffett said you have to store it and of course you don't get a dividend out of it. The thing they are choosing to forget is you're only going to buy it with a piece of paper, and the piece of paper is being printed and thrown from a helicopter window, and they just choose to ignore that fact." This posting includes an audio/video/photo media file: Download Now |

| Silver class-action suits against Morgan, HSBC consolidated in New York Posted: 08 Feb 2011 12:22 PM PST By Evan Weinberger http://www.law360.com/securities/articles/224556 A judicial panel on Tuesday consolidated class-action litigation alleging that JPMorgan Chase & Co. and HSBC Holdings PLC violated antitrust laws by manipulating the silver market and potentially reaped billions of dollars while keeping the price of silver artificially low. The U.S. Judicial Panel on Multidistrict Litigation on Tuesday consolidated the seven class-action lawsuits pending against the two banks in the U.S. District Court for the Southern District of New York. "A majority of the domestic defendants are located in that district, and thus many witnesses and discoverable documents are likely to be found there," the panel ruled. "In addition, a substantial majority of the constituent and potential tag-along actions are pending in that district (including the first-filed action)." The MDL has been assigned to Judge Robert P. Patterson Jr. ... Dispatch continues below ... ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php According to the order, six of the seven cases pending against JPMorgan and HSBC were filed in the Southern District of New York, while the seventh is pending in the U.S. District Court for the Eastern District of New York. The panel found that consolidating the litigation would "eliminate duplicative discovery; prevent inconsistent pretrial rulings on class certification, discovery, and other pretrial issues; and conserve the resources of the parties, their counsel and the judiciary." The suits were spurred in part by a statement in October by Commissioner Bart Chilton of the U.S. Commodities Futures Trading Commission saying there had been "repeated attempts to influence prices in the silver markets." The CFTC has been investigating the silver market for two years, and Chilton said the "fraudulent efforts to persuade and deviously control" silver prices should be prosecuted. The suits, which specifically allege violations of the Commodity Exchange Act and the Sherman Act, claim that the banks collaborated to suppress the price of silver futures and options contracts by amassing "enormous" short positions in Commodity Exchange Inc., or Comex, beginning June 1, 2008. Many of the allegations in the suits come from information provided by a whistleblower who used to work in the London office of Goldman Sachs Group Inc., the suits say. The whistleblower is not named in the complaints, but in testimony before the CFTC in March, Bill Murphy, chairman of the advocacy group the Gold Anti-trust Action Committee, said it was a metals trader in London named Andrew Maguire. After Maguire went public in March, the defendants began to unwind their positions in Comex, the suits claim. Since then, the net short position of silver futures that are held by commercial banks -- the vast majority of which are made up of JPMorgan and HSBC -- has dwindled by more than 30 percent, the suits say. As that happened, the price of silver skyrocketed, reaching $24.95 an ounce in October, its highest level in 30 years, the suits contend. JPMorgan and HSBC declined to comment on the suits. Cleary Gottlieb Steen & Hamilton LLP is representing HSBC. Counsel for JPMorgan was not immediately available. The MDL is In re: Commodity Exchange Inc., Silver Futures and Options Trading Litigation, MDL number 2213, in the U.S. District Court for the Southern District of New York. Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf |

| Posted: 08 Feb 2011 12:12 PM PST Greetings Jim, Gold closed moderately higher today, moving up to a new short-term high for the developing reaction from late January. Technical indicators are now moderately bullish overall on the daily chart, supporting a continuation of the advance. Technical indicators are strengthening on the Gold Currency Index (GCI) daily chart as well, indicating that the short-term uptrend will likely continue. From a temporal perspective, today's strong move higher has confirmed that the current short-term cycle from January 27 is right translated, forecasting additional gains and a likely return to previous all-time highs. The current short-term cycle has developed almost exactly as anticipated since the initial cycle low signal setup was generated in late January. Now that we have a confirmed Short-Term Cycle Low (STCL) followed by a right translated cycle, the Intermediate-Term Cycle Low (ITCL) that we have been expecting is one strong weekly close away from forming. Both price oscillators have experienced bullish crossovers and a bullish engulf pattern has formed on the weekly chart. Therefore, if gold closes on Friday at current levels or higher, a confirmed intermediate-term cycle low signal will be generated, forecasting 2 to 3 months of gains and a likely breakout to new all-time highs. Best, CIGA Erik McCurdy

'Toxic' Assets Still Lurking at Banks Accounting tricks may hidden the problem from plain view, but out of sight, out of mind approach hides the problem behind layers of complexity. Trillions of dollars of toxic assets still exist and have no market. This largely explains why the Fed refuses to throttled back on it's liquidity programs despite the illusion of an economic recovery. During the financial crisis, investors fretted over "toxic," hard-to-value assets that banks were carrying. Those fears have faded as bank profits have rebounded, loan delinquencies have declined, and bank stocks have soared 25% in the past five months. But banks still hold plenty of the bad assets that once spooked investors: mortgage-backed securities, collateralized debt obligations and other risky instruments. Their potential impact concerns some accounting and banking observers. Source: online.wsj.com

Dear Jim, Note the mention of the Chinese bank offering a gold buying plan that has 1 million investors signed up to purchase $42 dollars of gold per day! CIGA Marc in the Trenches |

| Why Another Financial Crash is Certain Posted: 08 Feb 2011 12:11 PM PST Why Another Financial Crash is CertainCourtesy of MIKE WHITNEY, originally published at CounterPunch

BNP had been involved in credit intermediation, that is, it was exchanging bonds made up of mortgage-backed securities (MBS) for short-term loans in the repo market. It all sounds very complex, but it's no different than what banks do when they take deposits from customers and then invest the money in long-term assets. (aka--"maturity transformation") The only difference here was that these activities were not regulated, so no government agency was involved in determining the quality of the loans or making sure that the various financial institutions were sufficiently capitalized to cover potential losses. This lack of regulation turned out to have dire consequences for the global economy. It took nearly a year from the time that subprime mortgages began to default en masse, until the secondary market (where these "toxic" bonds were traded) went into a nosedive. The problem was simple: No one knew whether the underlying mortgages were any good or not, so it became impossible to price the assets (MBS). This created, what Yale Professor Gary Gorton calls, the e coli problem. In other words, if even a small amount of meat is contaminated, millions of pounds of hamburger has to be recalled. That same rule applies to mortgage-backed securities. No one knew which MBS contained the bad loans, so the entire market froze and trillions of dollars in collateral began to fall in value. Subprime was the spark that lit the fuse, but subprime wasn't big enough to bring down the whole financial system. That would take bigger ructions in the shadow banking system. Here's an excerpt from an article by Nomi Prins which explains how much money was involved:

Shadow banking emerged so that large cash-heavy financial institutions would have a place to park their money short-term and get the best possible return. For example, let's say Intel is sitting on $25 billion in cash. It can deposit the money with a financial intermediary, such as Morgan Stanley, in exchange for collateral (aka MBS or ABS), and earn a decent return on its money. But if a problem arises and the quality of the collateral is called into question, then the banks (Morgan Stanley, in this case) are forced to take bigger and bigger haircuts which can send the system into a nosedive. That's what happened in the summer of 2007. Investors discovered that many of the subprimes were based on fraud, so billions of dollars were quickly withdrawn from money markets and commercial paper, and the Fed had to step in to keep the system from collapsing. Regulations are put in place to see that the system runs smoothly and to protect the public from fraud. But banking without rules is more profitable, so industry leaders and lobbyists have tried to block the efforts at reform. And, they have largely succeeded. Dodd-Frank – the financial reform act -- is riddled with loopholes and doesn't really resolve the central issues of loan quality, additional capital, or risk retention. Banks are still free to issue bogus mortgages to unemployed applicants with bad credit, just as they were before the meltdown. And, they can still produce securitized debt instruments without retaining even a meager 5 per cent of the loan's value. (This issue is still being contested) Also, government agencies cannot force financial institutions to increase their capital even though a slight downturn in the market could wipe them out and cause severe damage to the rest of the system. Wall Street has prevailed on all counts and now the window for re-regulating the system has passed. President Barack Obama understands the basic problem, but he also knows that he won't be reelected without Wall Street's help. That's why he promised to further reduce "burdensome" regulations in the Wall Street Journal just two weeks ago. His op-ed was intended to preempt the release of the Financial Crisis Inquiry Commission's (FCIC) report, which was expected to make recommendations for strengthening existing regulations. Obama torpedoed that effort by coming down on the side of big finance. Now, it's only a matter of time before another crash. Here's an excerpt from a special report on shadow banking by the Federal Reserve Bank of New York:

So, between $4 to $7 trillion vanished in a flash after Lehman Brothers blew up. How many millions of jobs were lost because of inadequate regulation? How much was trimmed from output, productivity, and GDP? How many people are now on food stamps or living in homeless shelters or struggling through foreclosure because unregulated financial institutions were allowed to carry out credit intermediation without government supervision or oversight? Ironically, the New York Fed doesn't even try to deny the source of the problem; deregulation. Here's what they say in the report: "Regulatory arbitrage was the root motivation for many shadow banks to exist." What does that mean? It means that Wall Street knows that it's easier to make money by eliminating the rules....the very rules that protect the public from the predation of avaricious speculators. The only way to fix the system is to regulate all financial institutions that act like banks. No exceptions. Pic credit: Evgeni Dinev at freedigitalphotos.net. |

| Marc Faber And Nassim Taleb On Risk, And The One Asset To Own Whether One Is Bearish Or Bullish Posted: 08 Feb 2011 12:09 PM PST Last year's Russia Forum was one of the must see events of the year, pitting such high powered independent thinkers as Marc Faber, Hugh Hendry, Nassim Taleb in a free for all. While the cliffhanger back then was the suggestion by Hendry that he had recreated the Paulson ABX trade with "1.5% downside and 75% upside" (which has since not been fully revealed aside from some occasional snippets in the periodic letters that it is a synthetic China short trade), the true brilliance was in the debate between the Treasury skeptics and the fan (Hendry). That said, with the entire curve surging wider, we hope Hendry took profits on his short as we are now virtually exactly where we were a year ago. This year's forum was just as entertaining, and while it didn't have quite a distinguished audience, it did feather Marc Faber and Nassim Taleb in a discussion of whether Russia is the best or worst BRIC. That said, trust both Faber and Taleb not to stick to the script and go off on wild tangents. Sure enough, the line of the night as usual belonged to Faber: "We have a big debate in the world whether we will have a deflationary collapse or an inflationary boom...usually after a period of very heavy money printing war follows." That is the philosophical gist of it. As for Faber's recommendation, it is precisely the asset which has become a short-seller's nightmare in the current geopolitically fragile environment: oil. "Whether you are very bullish or very bearish you should invest in oil." Some other key quotes from Faber:

As for Taleb, the NYU philosopher once again looks at the world in terms of his favorite risk parameters: fragility vs robustness. Nassim compares the US and Russia on the fragility vs robustness scale. Try to guess which one according to the polymath is the fragile and the robust one. Faber starts at 25 minutes into the clip, while Taleb is 40 minutes in. Is Russia the Best or Worst in BRIC? from Troika Dialog on Vimeo. And as a reminder, here is what Hendry said of Treasury's almost exactly one year ago to the day:

Link to the 2010 Russia Forum. |

| Critical Times for Critical Metals Posted: 08 Feb 2011 11:37 AM PST Access to sources of real-world critical metals is in serious jeopardy. A variety of experts gathered recently in Vancouver to learn more about the reasons we're at risk and what we can do about it. Join The Gold Report as we venture into the complex, complicated, cloudy, uncertain, conflicted world they explored. The same issues that have jolted U.S. officials awake to awareness about the nation's vulnerabilities in the supercharged atmosphere of the critical metals space drew an eager, attentive audience to the world's first-ever Critical Metals Investment Symposium, sponsored by Cambridge House, a Vancouver-based producer of resource investment conferences. Morning Notes publisher Mike Berry, who co-chaired the two-day gathering, credits Cambridge House with taking an innovative approach by catering to the needs and interests of a wider-than-usual audience, including end-users and government authorities and financiers as well as junior explorers and institutional in... |

| Derivatives: The Real Reason Bernanke Funnels Trillions Into Wall Street Banks Posted: 08 Feb 2011 11:36 AM PST We've been over the numerous BS excuses that US Dollar destroyer extraordinaire Ben Bernanke has made for QE enough times that today I'd rather simply focus on the REAL reason he continues to funnel TRILLIONS of Dollars into the Wall Street Banks. I've written this analysis before. But given the enormity of what it entails, it's worth repeating. The following paragraphs are the REAL reason Bernanke does what he does no matter what any other media outlet, book, investment expert, or guru tell you. Bernanke is printing money and funneling it into the Wall Street banks for one reason and one reason only. That reason is: DERIVATIVES. According to the Office of the Comptroller of the Currency's Quarterly Report on Bank Trading and Derivatives Activities for the Second Quarter 2010 (most recent), the notional value of derivatives held by U.S. commercial banks is around $223.4 TRILLION. Five banks account for 95% of this. Can you guess which five? More Here.. This posting includes an audio/video/photo media file: Download Now |

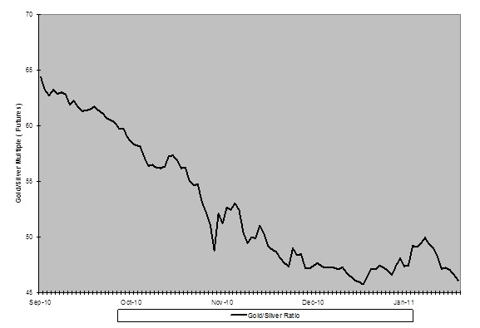

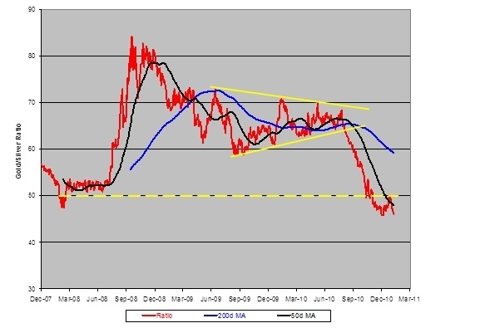

| Gold Price is Without Question Rallying and Will Go Higher, Watch Closely How it Behaves at $1,380 Posted: 08 Feb 2011 11:13 AM PST Gold Price Close Today : 1363.40 Change : 15.80 or 1.2% Silver Price Close Today : 30.271 Change : 0.923 cents or 3.1% Gold Silver Ratio Today : 45.04 Change : -0.878 or -1.9% Silver Gold Ratio Today : 0.02220 Change : 0.000425 or 1.9% Platinum Price Close Today : 1857.90 Change : 18.10 or 1.0% Palladium Price Close Today : 837.40 Change : 19.75 or 2.4% S&P 500 : 1,324.46 Change : 5.41 or 0.4% Dow In GOLD$ : $185.48 Change : $ (1.05) or -0.6% Dow in GOLD oz : 8.973 Change : -0.051 or -0.6% Dow in SILVER oz : 404.13 Change : 2.25 or 0.6% Dow Industrial : 12,233.53 Change : 71.90 or 0.6% US Dollar Index : 77.95 Change : -0.081 or -0.1% Today's GOLD PRICE crashed through that $1,353 barrier and thru next resistance at $1,362. It rose $15.80 to close on Comex at $1,363.40. Silver rose faster, by 92.3c, to close Comex at 3027.1c. Stabbed by my own words, I cast down the sweaty, bearish towel and pick up the bullish banner. Yesterday I said that gold needed to rise above 1,355 then $1,362. With gold above that level and silver over 3000c, and the ratio making a new low today, my mouth is shut. The SILVER PRICE gained a whopping 92.3c today to close Comex at 3027.1c. Remember that the 3 January high was 3109c. By the way, silver today is strongly UN-backwardated or, in easier English, in normal contango: Feb 11 3009.5c, Mar 11 3029.5c; April 11 3030.5c; July 11 3034.5c; Dec 11 3032.5c. However, the 2012 contracts are all over the place, as are the 2013d, 2014s, and 2015s. May be those just didn't see any trading today. More importantly, the GOLD/SILVER RATIO made a new low today at 45.04 oz. of silver per ounce of gold. If you meant to swap silver for gold earlier, then the market has given you another chance. SWAP NOW, SILVER FOR GOLD! I remain curious why silver and gold are so reluctantly confirming each other. That ratio low might stop here, or might continue to 43.6, or even 41. Odd is that gold is 4.1% below its high, while silver is only 2.7% below its high. That begs a question: Does this constitute only a lower low (a kind of double bottom) in the ratio that will not reach the previous highs and thus end in lower silver and gold prices? Or will silver and gold proceed to make new highs? We just have to wait for that answer. For now, SILVER and GOLD are without question rallying and will go higher. Watch closely how they behave at $1,380 and 3100c. It is an anomaly for me to recommend buying more gold than silver, but because of the low ratio, that's what I would do right now. I am often, yes, often, baffled by the media's interpretation of markets. Today (taking advantage of a holiday as government's usually do making such announcements) China announced it would raise interest rates to cool inflation. MarketWatch interpreted that as the event raising gold's price. Hmmmm. China cooling inflation means MORE demand for gold? How's that, since inflation is the primary driver for monetary demand? How's that, since rising interest rates make it more costly to hold gold? Well, supposedly that Chinese government move "validated" a Chinese inflation problem. Wow. Deep, very deep, but who, down to the lowest goat in the herd, didn't already know China has an inflation problem? DOW IN GOLD DOLLARS is faltering, whispering that stocks are about to turn down against gold. STOCKS rose again today in nominal terms. Dow added 71.9 to 12,233.53 and S&P500 rose 5.41 to 1,324.46. The Dow in Gold Dollars points to a drop in stocks coming soon, but let us take the longer view. First, stocks are in a Primary Down Trend (Bear Market). A primary trend lasts 15 to 20 years once it begins, and stocks began this bear market in January 2000 (in August 1999 against gold). That means that stocks will be trending downward, never mind the zigs and zags inbetween, until 2015 or so. Down, not up. Second, an answer for those who argue that stocks will benefit from inflation as a hard asset refuge (they represent bricks and mortar). Constantino Bresciani-Turroni conducted the classic study of the German hyperinflation 1920 - 1923. He reports that although stocks showed HUGE nominal gains, in real terms they in fact lost value. Third, stocks are in a Primary Down Trend (Bear Market) against both silver and gold. Stocks have already lost 80% of peak value, and will lose another 80% before this bear market ends. Knowing that, why would I own stocks rather than silver or gold? Questions, anyone? Trapped in a hotel room last weekend, I was forced to turn the TV to Fox news and CNN. Noticed the long, expensive, celebrity-endorsed articles for four big gold sellers. Because this advertising costs so much, it ought to tell you something about the advertisers. Now I sell silver and gold, so anything I say sounds like invidious comparison, but LO! I will say it anyway. These folks BURY customers, charging 40 to 50% more than most dealers. How do I know? Because I have dealt with so many of their corpses when the customers come asking us to dig them out of their rotten investment. Folks, celebrities do NOT endorse gold dealers because they believe in them, but because they get paid large money to pander for them. Bear that in mind, and buy carefully. This plethora of advertising also tells us that huge demand is flowing into silver and gold. Sometimes that's good news, sometimes bad. Generally the public is most excited, the advertising most intense, the headlines loudest, at tops, not bottoms. Will the gentleman who wrote me about selling the Chilean gold doubloons please write again? I have a quotation but erred by deleting your email. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Posted: 08 Feb 2011 10:00 AM PST Gold price climbs on softening dollar and inflation concerns; China raises rates The COMEX April gold futures contract closed up $15.90 Tuesday at $1364.10, trading between $1348.90 and $1368.70 February 8, p.m. excerpts: |

| Silver Liberation Army (SLA) is on the march! Posted: 08 Feb 2011 09:47 AM PST |

| Posted: 08 Feb 2011 09:41 AM PST courtesy of DailyFX.com February 08, 2011 07:37 AM 240 Minute Bars Prepared by Jamie Saettele Gold has held a multiyear support line. However, the decline from 1425.40 is in 5 waves, indicating that the larger trend is most likely down. Price has reached the 50% retracement of the impulsive decline, with the 61.8% at 1380.82 serving as additional resistance if needed. Expectations are for the corrective advance to terminate.... |

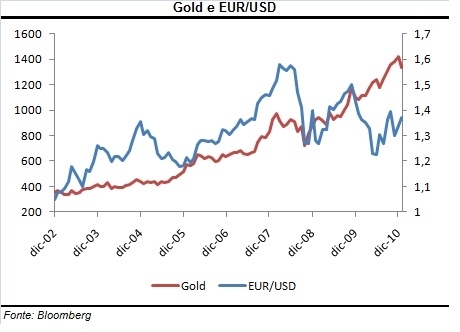

| Gold: End of a Trend or a Buying Opportunity? Posted: 08 Feb 2011 09:28 AM PST Matteo Radaelli submits: Even with the rally of the last few days, gold prices still have had a negative performance year-to-date despite two elements that should give sustained prices:

For these reasons many investors and analysts indicated that Gold’s upward trend that began in 2001 may have ended. The Wall Street Journal’ article “Is gold’s golden era over” was the pillar of the negative views on the precious metal. Indeed, the article said,

Also major investment banks' recommendations on Gold became less positive in the last few weeks: i.e. UBS economist Larry Hatheway reduced on January 31 the rating on gold from BUY to NEUTRAL. However, other economist are less sceptical on Gold's prospects. As an example, in a recent article published on Seekingalpha, Frank Holmes indicated two reasons for remaining bullish on gold:

Complete Story » |

| Posted: 08 Feb 2011 08:51 AM PST The 5 min. Forecast February 08, 2011 12:07 PM by Addison Wiggin - February 8, 2011 [LIST] [*] Improbable: Nation that just banned foreign cooking on TV achieves fuel independence [*] Unusual opportunity emerges for Western investors to “steal” oil from Iran [*] Revealing chart correlates rising stocks with Fed’s easy money [*] Goldman sees nothing worthwhile to buy, JP Morgan looks to scarf up clients’ gold [*] Poster grandpa for meaningless government regulation... as the reader debate rages on [/LIST] Over the weekend, the government in Iran ordered the nation’s TV cooking shows to cease showing foreign cuisine. Seriously. The word came down Saturday from the chief of the state broadcasting company. God forbid Iranians be exposed to pommes frites or spaghetti alla vodka… or, worse, hamburgers and hot dogs. Gasp. Egypt may be grabbing headlines from the Middle East, but they’ve go... |

| Hourly Action In Gold From Trader Dan Posted: 08 Feb 2011 08:21 AM PST View the original post at jsmineset.com... February 08, 2011 11:11 AM Dear CIGAs, Today's big news once again came out of China, which announced yet another rate increase in what has now been a series of hikes over the last several months. In what has to be a significant development, gold, which initially dipped lower upon the news, ricocheted higher, surging through overhead resistance just above the $1350 level. It appeared that a series of buy stops were set off which then allowed price to run into the next resistance zone centered around the $1365 level. What I find so noteworthy about today's performance in gold is that it also mirrored what was taking place to a greater extent across the entire commodity complex. If anything, gold took on a leadership role along with silver. You might recall that in the past, these rate hikes by China have brought in extremely heavy selling in commodities as the prevailing sentiment at those times has been that any attempt by China to rein in ... |

| Posted: 08 Feb 2011 08:19 AM PST Dear CIGAs, There is a reasonable argument that North America should stay out of the political affairs of other cultures. There are examples today of beneficent dictatorships that have delivered good and plenty to their nation. The view of the Egyptian situation varies from the US to Asia and the Middle East. Democracy was not contained in the 10 Commandments Moses carried down the holy mountain. The Democratic process has the potential of a major backfire inherent in it. I suggest that rose colored glasses might not be the best tool to determine what the change in Egypt will mean. Think back to the 2006 Democratic process surprise. People with others opinions will seek protection against violent currency price changes like Egypt has just experienced. There are 10 situations internationally that have the same profile as Egypt from which Saudi Arabia is not exempt.

Jim Sinclair's Commentary An interesting comment was made by a Bloomberg interviewer today at 2.24pm. That comment was that if the USA measured their food inflation using the same measures as China does, the food inflation here would be exactly the same as in China.

Jim Sinclair's Commentary Is the media not quite complimentary of Omar? Mubarak's New Deputy Under Fire for Assisting CIA Egyptian President Hosni Mubarak recently appointed his first-ever deputy, Intelligence chief Omar Suleiman, and Suleiman is now coming under fire for cooperating the American Central Intelligence Agency (CIA) . According to AFP, Suleiman has been linked to a program thought up by the CIA that saw terror suspects questioned using torture. Under the CIA's "extraordinary rendition" program, suspects were taken to countries other than the United States, where they could be interrogated without adherence to U.S. laws on torture. Suleiman has allegedly allowed the U.S. to send terror suspects to Egypt since 1995. He has also targeted Egypt's domestic terrorists. "Human rights" groups have criticized both the U.S. and Egypt for the "extraordinary rendition" agreement. They argue that suspects are tortured in Egypt, using methods that would violate U.S. law. According to one allegation, detainee Ibn Sheikh al-Libi was locked in a cage and beaten, and pressured into confirming a suspected connection between international terrorist group Al-Qaeda and then-Iraqi President Saddam Hussein. Al-Libi later said he gave false testimony due to the pressure.

Jim Sinclair's Commentary No bees and no bats lead to hyperinflation in food. Einstein was right – honey bee collapse threatens global food security The bee crisis has been treated as a niche concern until now, but as the UN's index of food prices hits an all time-high, it is becoming urgent to know whether the plight of the honey bee risks further exhausting our food security. Almost a third of global farm output depends on animal pollination, largely by honey bees. These foods provide 35pc of our calories, most of our minerals, vitamins, and anti-oxidants, and the foundations of gastronomy. Yet the bees are dying – or being killed – at a disturbing pace. The story of "colony collapse disorder" (CCD) is already well-known to readers of The Daily Telegraph. Some keep hives at home and have experienced this mystery plague, and doubtless have strong views on whether it is caused by parasites, or a virus, or use of pesticides that play havoc with the nervous system of young bees, or a synergy of destructive forces coming together. |

| Kevin Bambrough: Fiat Currencies Are Worthless Posted: 08 Feb 2011 08:12 AM PST Source: George Mack of The Energy Report 02/08/2011 Kevin Bambrough founded Sprott Resource Corp. in 2007 to take advantage of a future in which he believes trust in paper currencies will diminish. The idea is to invest in natural resources, including precious metals, energy and agriculture, which represent tangible value from which investors will benefit as necessities become more precious. Unlike closed- or open-end mutual funds, the business is a corporation that can buy private equity to ultimately sell, spin out or even take an active investor approach through majority ownership in publicly traded companies. The company also looks for distressed deals. In this exclusive interview with The Energy Report, Kevin and Sprott COO Paul Dimitriadis share their investment philosophy and ideas on how to protect wealth. The Energy Report: Kevin or Paul, Sprott Resource Corp. (TSX:SCP) bought $74 million of physical gold in 2008 and 2009, which is held in vaults at Scotiabank... |

| Posted: 08 Feb 2011 08:05 AM PST |

| Gold Daily and Silver Weekly Charts Posted: 08 Feb 2011 08:05 AM PST |

| “It looks like the much maligned correction in silver is over” Posted: 08 Feb 2011 08:04 AM PST |

| Posted: 08 Feb 2011 08:01 AM PST by Constance Parten "People keep confusing gold as a commodity," he said. "I regard it as a currency and Jamie Dimon now regards it as a currency. People who are trying to trade gold, forget about it. It's an investment." Right now less than 1 percent of investment funds are in gold, Cramer noted. Historically it's been between 3 and 5 percent. "Until we get back to the 3 or 5 percent, stay long gold," Cramer said. [source] |

| Gold May Outshine Silver in the Medium Term Posted: 08 Feb 2011 08:00 AM PST Summing up, the outlook is bullish short-term for the white metal as is the case for gold. Higher prices in the short-term appear quite probable, however if a lot of your long-term capital is currently invested in silver, we suggest paying close attention to what happens in the main stock indices in the following days. |

| Why The Fed's Policies Are Actually Hurting The Unemployment Rate Posted: 08 Feb 2011 07:53 AM PST We received an interesting letter from a reader today: