saveyourassetsfirst3 |

- Signals Still Bullish for Silver

- Silver Backwardation – What To Make Of It

- Hi, Ho Silver!

- Asian Demand for Gold & Silver Will Cause Much Higher Prices – Here's Why

- Gold Will Outperform After Stocks Peak

- Silver to outperform gold in 2011 - Eric Sprott

- Gold Silver Ratio Near Lows, Timberline Drills Nevada Gold

- Gold Bullion Considered as Collateral by International Clearing House - LCH.Clearnet

- Are The Gold And Silver Prices Going To Turn Up?

- Finding 90% in circulation

- Failed Blythe Raid in the early AM on Silver

- Why it's time to invest in the "breadbasket" of Europe

- Resource guru Sprott: This "gold tsunami" GUARANTEES much higher prices

- China raised rates, but gold didn't tank this time

- A "Gold Tsunami" is Coming

- Einstein was right - honey bee collapse threatens global food security

- Meet the rational gold investor, a rare bird

- China's 2010 gold output at record 340.88 tonnes

- Investors Have $102 Billion Bet on Gold, Silver Gains

- Gold in the House of Morgan

- Gold: the protector and creator of jobs

- Bullion Banks Get Smaller in COMEX Silver Futures

- Buying Silver While It’s Still Relatively Cheap

- Opening the Mint to Gold and Silver

- Gold "Goes Quiet" as US Futures Position Hits 18-Month Low…

- 59.9 Percent? Americans Are Racking Up Huge Credit Card Balances Once Again And Some Of The Interest Rates Are Absolutely Outrageous!

- When The Lights Go Out In The Lucky Country

- FW: Silver in backwardation/JPMorgan now accepts gold as collateral but not ETF's

- Growth or Hot Money: What’s Really Affecting Food Prices

- Greasing the Wheels of Oil Production

- Do any of you guys cast your own loaf bars?

- Egyptians Line Up for Cash as Banks Open, Currency Plummets to 2005 Low

- Gold Bullion Eyed as Collateral by LCH.Clearnet

- Gold Stocks May Revisit Hedging

- Collateral Consequences

- Silver in backwardation/JPMorgan now accepts gold as collateral but not ETF's

- Got Silver?

- Talison Lithium (TSX – TLH) – the world’s only pure lithium producer

- Gold Seeker Closing Report: Gold Ends Near Unchanged While Silver Gains Almost 1%

- An Open Letter to the E.P.A., Region 10

- Extorre Extends High Grade Gold-Silver Zones at Cerro Moro

- Silver to Soar in 2011, says Investment Guru

- Summer Break

- ‘Suicide Bombers’ in the Gold Market?

| Signals Still Bullish for Silver Posted: 08 Feb 2011 06:40 AM PST As a follow-up to an article published two weeks ago, this is an update to data that leads me to believe that silver is gearing up for its next breakout due to bullish structural changes in the weekly COT reports, Bank Participation Reports, supply and demand dynamics, backwardation and the corresponding convenience yield. I covered the most recent COT report in another article but I will post the fully adjusted data for the sake of simplicity.

As I have said numerous times in various articles, Silver boasts one of (if not the best) supply-demand dynamics in the commodity world. It is a double edged sword as it possess a very unique blend of I Complete Story » | ||

| Silver Backwardation – What To Make Of It Posted: 08 Feb 2011 06:36 AM PST | ||

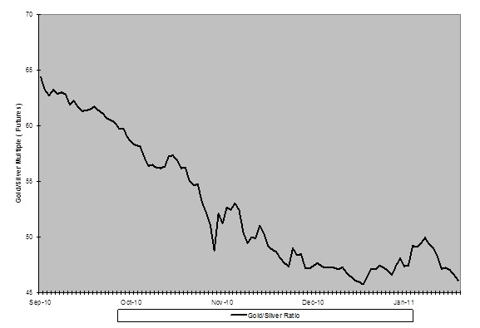

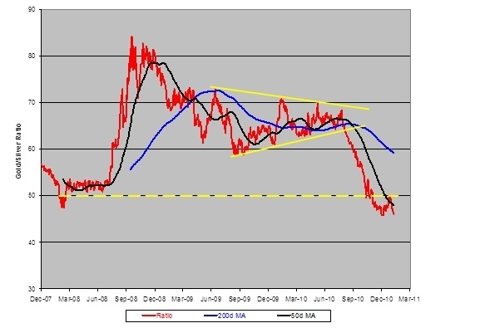

| Posted: 08 Feb 2011 05:36 AM PST Hard Assets Investor submits: By Brad Zigler My kids have no clue about the Lone Ranger. They have no memory, as I do, of the masked man putting spurs to his steed with a hearty "Hi, Ho Silver!" to gallop down a dusty trail in pursuit of bad guys in black hats. No matter. They have, bless their hearts, noticed another silver on the move. No doubt you have as well: Silver's run ahead of gold in the recent precious metals rally. With that, the gold/silver ratio's resumed the downward trajectory begun last September. [Click all to enlarge] Gold/Silver Multiple (Futures) You might say silver's jumped over a little bump in the trail on the way to ... to ... well, some lower proportion of gold's price. Actually, we've got a better idea of where the ratio's not going. In late September, we puzzled on the ratio's direction and projected an interim target around 50-to-1. That target was hit by November and, after dawdling some, was finally penetrated with a dip down to the 45-to-1 level at year's end. The bump in the trail you see above was a test of the 50x multiple. You get a better sense of this if you look at a continuation chart from the September article. The old support at 50x has now become overhead resistance. Gold/Silver Ratio (London Cash) Low multiples are typically thought of as markers of Complete Story » | ||

| Asian Demand for Gold & Silver Will Cause Much Higher Prices – Here's Why Posted: 08 Feb 2011 05:09 AM PST Ignoring real estate, most people invest their hard earned money in paper things - stocks, bonds, annuities, insurance - [except] in China and India... [where] they are converting their hard earned paper money into gold and silver bullion. [While] that is nothing new the scale and speed with which they are accumulating precious metals IS new, and it's driving the fundamentals that will lead to higher prices in 2011. Words: 1421 | ||

| Gold Will Outperform After Stocks Peak Posted: 08 Feb 2011 04:42 AM PST | ||

| Silver to outperform gold in 2011 - Eric Sprott Posted: 08 Feb 2011 04:04 AM PST | ||

| Gold Silver Ratio Near Lows, Timberline Drills Nevada Gold Posted: 08 Feb 2011 03:03 AM PST HOUSTON – As we write this Tuesday morning the gold/silver ratio (GSR) has moved lower to a 45-handle, meaning that it now takes about 45 ounces of silver to "buy" an ounce of gold metal. One quick glance at the chart just below will confirm that is close to a 20-year low for the ratio. | ||

| Gold Bullion Considered as Collateral by International Clearing House - LCH.Clearnet Posted: 08 Feb 2011 03:03 AM PST | ||

| Are The Gold And Silver Prices Going To Turn Up? Posted: 08 Feb 2011 02:59 AM PST | ||

| Posted: 08 Feb 2011 01:04 AM PST I haven't found any 90% in the wild in years but my wife's luck is spooky, 2 quarters and 3 dimes in the past 4-5 months. She works at a VA health facility and says that all of the 90% seems to come from the gift/snack shop there. Just why there would seem to be an unusual concentration of 90% at a VA clinic is open to conjecture but I notice one strange thing about all of the coinage that she has found: it is all dated the year 1964. Maybe somewhere along the line, there is someone (or a group of people) confused about silver coinage dates. They think that it is pre-1964 and so the 1963 and earlier stuff gets trapped. If it were senile Vets mistakenly spending their collections, the dates would be random. I posted this before but here is a quarter that she found a few month back. This sucker hadn't been in circulation long.  | ||

| Failed Blythe Raid in the early AM on Silver Posted: 08 Feb 2011 12:27 AM PST Well she tried on the China rate raise news, but got SMOKED. Expect some volatility today as the powers to be scratch their heads and try and figure out a way to quell this buying frenzy. On a different note, Gold Bullion considered as collateral by international clearing house – LCH.Clearnet-how bout them apples? | ||

| Why it's time to invest in the "breadbasket" of Europe Posted: 07 Feb 2011 11:42 PM PST From Frank Holmes of U.S. Global Investors: Tim Steinle, co-manager of the Eastern European Fund (EUROX), was in Kiev, Ukraine this week doing some field research on growing investment opportunities in the former breadbasket of the Soviet Union. With a territory larger than France and a population more than half of Germany's, Ukraine has the potential for becoming a major European economy. Ukraine was one of the worst-hit economies in Europe during the economic downturn, as the country's GDP fell 15 percent in 2009 on a year-over-year basis. However, the economy has rebounded and VTB Capital is estimating 4.2 percent year-over-year GDP growth for 2010, and another 4.4 percent in 2011. While certain sectors of the country's economy, such as industrials, have shrunk since Ukraine's liberation from communism, its agribusiness is booming. Roughly 16 million Ukrainians (one in three people) subsist on working the land. And this is special land... Read full article... More on agriculture: This is the fuse that could set off a global food crisis AGFLATION: World food prices surge to an all-time high Forget gold... One of America's favorite commodities is headed to all-time highs | ||

| Resource guru Sprott: This "gold tsunami" GUARANTEES much higher prices Posted: 07 Feb 2011 11:40 PM PST From Zero Hedge: Ignoring real estate, most people invest their hard earned money in paper things. Stocks, bonds, annuities, insurance – it's all paper, and it sits nicely in our bank accounts and shows up on our computer screens. Halfway across the world, investors in China and India have never trusted paper investments as a store of value – and they're converting their hard-earned paper money into gold and silver bullion. Not that this is anything new. It isn't. But the scale and speed with which they are accumulating precious metals IS new, and it's driving the fundamentals that we believe will lead to higher prices in 2011. Demand for the metals is literally exploding in Asia, and it's creating shortages of physical bullion around the world. The statistics are extraordinary. China, the world's largest gold producer, now requires so much of the precious metal (in addition to what it already mines), it imported over 209 metric tons (6.7 million oz) of gold during the first 10 months of 2010. This represents a fivefold increase from the estimated 45 metric tons it imported in all of 2009. According to the World Gold Council, Chinese retail demand for gold increased by 70% from October 2009 to September 2010, representing a total of 153.2 tonnes of gold imports. Yet over the same period, the demand for gold jewelry rose by only 8%. There is a clear trend developing for Chinese investment in gold as a monetary asset, and China is buying so much gold for investment purposes that it now threatens to supercede India as the world's largest gold consumer. Chinese demand in 2010 is expected to reach approximately 600 tonnes, just behind India's 800 tonnes. To put that in perspective, 2010 world mine production is forecast to be 2,652 tonnes, which means China and India could collectively lock-up over half of global annual production. Even more surprising is the increase in... Read full article... More from Eric Sprott: Resource guru Sprott: Silver will be this decade's gold Hedge fund guru Sprott: "The U.S. government is broke" Hedge fund guru Sprott: Gold looks better than ever before | ||

| China raised rates, but gold didn't tank this time Posted: 07 Feb 2011 09:25 PM PST | ||

| A "Gold Tsunami" is Coming Posted: 07 Feb 2011 08:26 PM PST U.S. Mint sells another 711,500 silver eagles. China's 2010 gold output at record 340.88 tonnes. China Silver imports hit record 3,500 tons in 2010. Sprott Warns of Physical Gold Shortage...and much, much more. ¤ Yesterday in Gold and SilverThere wasn't much action in the gold price yesterday and, considering the volume [which was unbelievably light], I'm not entirely surprised. I wouldn't read a thing into this price action...except that the New York low spot price was at the London p.m. gold fix at 10:00 a.m. Eastern...3:00 p.m. GMT in London. But what really stands out, now that the scale on the graph has changed, is the big smack-down in gold on Friday. It didn't look too big on Friday, but looms mightily on the chart now.

Silver is only slightly more interesting in the fact that there was a bit of a price spike between 10:45 and 11:00 a.m. in New York...which got sold back down. The New York low was at the London p.m. gold fix as well. Note Friday's similar spike in price, which got dealt with in the usual manner.

The world's reserve currency spent most of Monday within 25 basis points of its opening price in the Far East. The one rally of consequence began shortly before 9:00 a.m. in London...and hit its zenith precisely at the London p.m. gold fix...which was a few minutes before 10:00 a.m. in New York...3:00 p.m. in London...gold and silver's exact low ticks in New York. Coincidence? Not bloody likely.

Of course, it nearly goes without saying that the gold stocks bottomed at the London p.m. gold fix...which were the lows for gold and silver...and the high for the U.S. dollar. The subsequent smallish rally in the gold price took the HUI up a bit over one percent...but those gains disappeared by the end of the New York trading day...and the HUI finished basically unchanged.

As I mentioned in my Saturday column, the CME did not update their Daily Delivery Report on Friday...and didn't get around to it until Monday. That delivery report showed that 70 gold and 12 silver contracts were posted for delivery today. Monday's Daily delivery report from the CME showed that 448 gold and 1 [one] silver contract were posted for delivery tomorrow. Month-to-date there have been 10,097 gold contracts posted for delivery...and only 204 silver contracts. Yesterday's report is linked here. Neither GLD nor SLV had a report yesterday. But over at Switzerland's Zürcher Kantonalbank [for the week that was] they reported that their gold ETF declined a rather large 46,410 troy ounces. Their silver ETF rose a smallish 121,498 troy ounces. As always, I thank Carl Loeb for those numbers. The U.S. Mint had some silver eagle sales on Monday. They reported selling another 711,500 of them...bringing the month-to-date total up to 838,000. They reported no gold eagles sales...and for February the total figure stands at 13,500 ounces sold. For a change, the Comex-approved depositories showed an increase. On Friday they received 1,164,723 troy ounces of silver...and shipped out 212,981...for a net increase of 1,007,369 ounces of the stuff. The link to the action is here. Before I post the stories I have for you today, here's a graph that was sent to me by reader Peter Corlis. In his covering e-mail, Pete had this to say..."Here's an interesting chart of the Commodities Price Index (CRB) vs. Baltic Dry index (BDI) to knock some sense into anyone who still thinks that rising commodity prices are demand related. Note the clear disconnect around the middle of 2010 just before the start of QE2."

One has to wonder what this Baltic Dry Index would look like plotted against the old CRB...the Continuous Commodity Index, or CCI...as it is at new record highs...whereas the old CRB is nowhere near new highs. While on the subject of commodity graphs...here's one that reader U.D. sent around last night. This is the chart of Commodity price increases over the last 12 months...as of Feb. 1, 2011. Just remember that the government says that there is no price inflation. There is no food stuff that is not up double digits on this entire chart. It's worth of a moment of your time.

¤ Critical ReadsSubscribeBank of England Attempting Inflation 'Confidence Trick,' Says Former MPC Member Kate BarkerMy first offering for you today is this inflation-related piece from the Saturday edition of The Telegraph that I found posted as a GATA release. The headline pretty much says it all..."Bank of England Attempting Inflation 'Confidence Trick,' Says Former MPC Member Kate Barker". Keeping inflation under control is a "confidence trick" that the Bank of England may fail to pull off, Kate Barker, one of its former rate-setters, has warned. This is exactly the same parlor trick that Bernanke and Co. are trying to pull off as well. It's the 21st century version of selling snake oil out of the back of a covered wagon. It's worth the read...and the link is here.  Einstein was right - honey bee collapse threatens global food securityThe next item is one of many stories provided by reader Roy Stephens today. This piece is also from The Telegraph...this one from the Sunday edition. This is an unusual subject for Ambrose Evans-Pritchard to write about...but its importance is critical for just about all life on earth...and I've posted several stories about this issue over the years. Being a farm boy from way back...I can say that this is 100% food/commodity related...and the headline reads "Einstein was right - honey bee collapse threatens global food security". The bee crisis has been treated as a niche concern until now, but as the UN's index of food prices hits an all time-high, it is becoming urgent to know whether the plight of the honey bee risks further exhausting our food security. This is a must read from one end to the other...and the link is here.  Walker's World: Europe Fails AgainRoy's next reading material is a UPI posting from London that's headlined "Walker's World: Europe Fails Again". France and Germany sought to give some much-needed and sensible leadership to their European partners at Friday's summit but found themselves short of followers. This is a rather short piece for UPI Editor Emeritus Martin Walker...and if you have the time, it's worth the read...and the link is here.  Protesters flood the streets of Belgrade calling for early electionsFirst it was Algeria, then Tunisia, Egypt, Yemen...and now Serbia. Here's a story posted over at the france24.com website that Roy sent me on Sunday. The headline reads "Protesters flood the streets of Belgrade calling for early elections". Tens of thousands of protesters hit the streets of Belgrade Saturday calling for political reform and threatening further demonstrations if early elections are not held ahead of a scheduled May 2012 parliamentary vote. The link to the story is here.  As Mubarak Digs In, U.S. Policy in Egypt Is ComplicatedMy last three stories before I get into the precious metal offerings, are all about Egypt...and all from Roy Stephens. The first one is from the Sunday edition of The New York Times. The headline reads "As Mubarak Digs In, U.S. Policy in Egypt Is Complicated". Like most Arab countries, Egypt is totally under the thumb of the American Empire...and I'm sure that the U.S. is making every attempt to have this revolution turn out for their benefit. It's a longish read...but I found it to be worthwhile. The link is here.  Egypt's opposition wary after historic talks to solve crisisThe next story about Egypt was this Reuters piece posted over at the france24.com website. This one is headlined "Egypt's opposition wary after historic talks to solve crisis". The United States, which had bankrolled Mubarak and the army to the tune of $1.3 billion a year, has backed the talks, but said dialogue must be given time. Washington and its allies were caught by surprise by the uprising against Mubarak's government, whom they saw as a bastion against Islamic militancy and a friend, albeit a reluctant one, of Israel. In my opinion, this is also worth your time...and the link is here.  The Fragile Dream: Egypt's Fight for FreedomThe last Egypt-related story is from the German website spiegel.de. The headline reads "The Fragile Dream: Egypt's Fight for Freedom". The Egyptian revolution is fragile, and it isn't yet clear where it will lead. Still, it does provide reason for hope: Those reaching for power are not bearded old men, but young people who yearn for democracy. They have impressed the world, inspired their neighbors and forced the West to allow an old ally to fall. This is a very long read...but all in-depth articles are that way...and the link is here.  Meet the rational gold investor, a rare birdThe first gold-related story I have for you today is one that I dug out of a GATA release yesterday.& | ||

| Einstein was right - honey bee collapse threatens global food security Posted: 07 Feb 2011 08:26 PM PST Image:  The next item is one of many stories provided by reader Roy Stephens today. This piece is also from The Telegraph...this one from the Sunday edition. This is an unusual subject for Ambrose Evans-Pritchard to write about...but its importance is critical for just about all life on earth...and I've posted several stories about this issue over the years. Being a farm boy from way back...I can say that this is 100% food/commodity related...and the headline reads "Einstein was right - honey bee collapse threatens global food security". The be | ||

| Meet the rational gold investor, a rare bird Posted: 07 Feb 2011 08:26 PM PST Image:  The first gold-related story I have for you today is one that I dug out of a GATA release yesterday. It's from the Saturday edition of the Austin American-Statesman...and is headlined "Meet the rational gold investor, a rare bird". This one is named Shayne McGuire. He manages gold investments for the Texas Teacher Retirement Fund. Although the amount of money is large, he is quick to put it in perspective: It is less than 0.5 percent of the roughly $100 billion fund. | ||

| China's 2010 gold output at record 340.88 tonnes Posted: 07 Feb 2011 08:26 PM PST Image:  Next is a story that is a Reuters piece from Saturday that was posted over at the Indian website economictimes.com. The headline reads "China's 2010 gold output at record 340.88 tonnes". The figure confirmed an earlier forecast by the Ministry of Industry and Information Technology that China was on course to produce more than 340 tonnes of gold in 2010. It's a short story that's courtesy of reader Bob Fitzwilson...and the link is read more | ||

| Investors Have $102 Billion Bet on Gold, Silver Gains Posted: 07 Feb 2011 08:26 PM PST Image:  Reader 'Jeff in Switzerland' was kind enough to forward the following Bloomberg story from yesterday that's headlined "Investors Have $102 Billion Bet on Gold, Silver Gains". After the worst January for precious metals in two decades, investors still have a $102 billion bet on higher prices, hoarding more gold than all but four central banks and more silver than the U.S. can mine in almost 12 years. The link is here. | ||

| Posted: 07 Feb 2011 07:34 PM PST

Mercenary Links Roundup for Monday, Feb 7th (below the jump). 02-07 Monday

| ||

| Gold: the protector and creator of jobs Posted: 07 Feb 2011 06:15 PM PST | ||

| Bullion Banks Get Smaller in COMEX Silver Futures Posted: 07 Feb 2011 05:30 PM PST | ||

| Buying Silver While It’s Still Relatively Cheap Posted: 07 Feb 2011 05:00 PM PST James Cook of InvestmentRarities.com reminds us, in his "Market Update" newsletter, that the silver inventory held above ground totals 1.4 billion ounces, and that annual industrial use of silver is 900 million ounces, so that a year and half's worth of silver exists, "although a third of it is destined for industrial consumption," which has been increasing its use of silver by 18% in 2010. | ||

| Opening the Mint to Gold and Silver Posted: 07 Feb 2011 04:00 PM PST | ||

| Gold "Goes Quiet" as US Futures Position Hits 18-Month Low… Posted: 07 Feb 2011 03:37 PM PST | ||

| Posted: 07 Feb 2011 01:55 PM PST

59.9%? You mean there are people that are stupid enough to actually sign up for a credit card that will charge them 59.9% interest? Unfortunately the answer is yes. In fact, the top rate was 79.9% before First Premier Bank lowered it. These cards are targeted at Americans that have a poor credit history, and these days there are a whole lot of those. A recent story on the website of CNN described how large numbers of U.S. consumers with poor credit are gobbling up credit cards like these. Unfortunately, many of these consumers are also not smart enough to realize what they are getting into. The CNN story contained a quote from a woman who was in complete shock when she discovered that her interest rate was going to go up by 50 percentage points....

First Premier Bank has since lowered the top rate on those cards to 59.9%, but that it still completely outrageous. Not only are the interest rates on those cards super high, but they also charge a whole bunch of fees on those cards as well. The following are some of the fees that First Premier Bank charges.... *$45 processing fee to open the account *Annual fee of $30 for the first year *$45 fee for every subsequent year *A monthly servicing fee of $6.25 So you would think that nobody in their right mind would ever sign up for such a card, right? Wrong. CNN is reporting that almost 700,000 Americans have signed up for the card. Ouch. In fact, CNN says that First Premier Bank gets between 200,000 to 300,000 new applications a month for the card, but that they only open about 50,000 new accounts each month. Are there really this many Americans that are this gullible? If Americans would just remember the "DBS" rule they would be so much better off. DBS = Don't Be Stupid Do you know how long it would take to pay off a credit card with a 59.9 percent interest rate? Just a 20 percent interest rate is bad enough. According to the credit card repayment calculator, if you owe $6000 on a credit card with a 20 percent interest rate and only pay the minimum payment each time, it will take you 54 years to pay off that credit card. During that time you will pay $26,168 in interest rate charges in addition to the $6000 in principal that you are required to pay back. Ouch! The number one piece of financial advice that most of the "financial gurus" give is that you should get out of credit card debt - particularly credit card debt that has a high interest rate. Unfortunately, 46% of all Americans carry a credit card balance from month to month today. According to the United States Census Bureau, there are approximately 1.5 billion credit cards in use in the United States. Of U.S. households that have credit card debt, the average amount owed on credit cards is $15,788. This is how the bankers enslave us. We end up paying them 3, 4 or even 5 times as much as we originally borrowed. Month after month after month we slave away to make them wealthy. So how do you stop this vicious cycle? You quit buying stuff that you can't afford! Unfortunately, the vast majority of Americans have never received any formal training on how to manage finances. Most of us were never taught any of this stuff in school. Most of us were totally unprepared when the financial predators started preying on us in college. Most of us got sucked in and spent years and years trapped in credit card debt. When you carry a balance from month to month you are willingly signing up to become a debt servant to the big banks. They get rich while you suffer. The sad thing is that the mainstream media is pointing to increased credit card spending as a sign that the U.S. economy is getting back to normal. But gigantic mountains of debt is what got us into all of this trouble in the first place. Average household debt in the United States has now reached a level of 136% of average household income. In China that figure is only 17%. Obviously, we have a massive, massive problem with debt in this country. Cranking the debt spiral back up is not going to cause the economy to recover. Well, the profits of the big banks might recover, but the rest of us will suffer. If you want to be financially free, then it is time to pay off your credit card debt and get off the debt payment treadmill for good. The entire global economy is on the verge of collapse, so now is a great time to renounce consumerism. Instead, we need to be preparing ourselves and our families for the hard times that are coming. So what do you all think about the outrageous interest rates that the credit card companies are charging these days? Feel free to post your thoughts in the comments section below.... | ||

| When The Lights Go Out In The Lucky Country Posted: 07 Feb 2011 12:32 PM PST --Last Friday's storm of biblical proportions briefly knocked the power out at your editor's St Kilda compound. Like an idiot, we went to each room in the compound and flipped on the light switches, just to make the power was really out. It was. We lit a few candles and read our Kindle with a hand-held LED torch. --Earlier that day we'd published Greg Canavan's latest report, "Three Little Charts and the Coming End of Australia's Economic Miracle." The report shows how the decline in Australian manufacturing has left the economy incredibly vulnerable. We just had no idea the decline would come so quickly and knock out the power! --But one of the consequences of a banking sector that over-invests in mortgage lending (because it's safe) is an industrial and manufacturing sector that has trouble attracting capital for long-lived capital assets. You know...things like power plants...and power transmission lines...the assets that make your lights go on when you flick a switch. --Greg revealed the Achilles heel of the Aussie economy. And today's Australian Financial Review rubbed salt in the heel. "Australia will need to build at least two power stations a year to cope with surging demand over the next twenty years, as state governments and the private sector struggle to invest in new generation." --In the real world, building things costs money. And according to a report from the Australian Energy Market Operator, it's going to cost Australia's power industry $120 billion to build the energy infrastructure the country needs for the next twenty years. The report also said it could take as much as $9 billion in investment in the transmission network to keep the lights on continuously at the Crown Casino. --The fact that Australia has seemingly under-invested in domestic power plants and fuel for those power plants may surprise you. After all, Australia is the sixth-largest exporter of liquid natural gas (LNG) in the world, according to the latest Australian Energy Resource Assessment from ABARE. The country is rich in energy commodities like coal and uranium and gas. --But there are two problems (which may actually lead to an investment opportunity). The first problem is that Australia doesn't have any plans to invest in nuclear power. This is a result of a childish and unserious attitude in public policy circles about nuclear power. It's kind of embarrassing. --By the way, you can still make money investing in Australian-listed uranium producers. The spot uranium price is over $70 now, making a nice recovery from the GFC lows. Australia may not be building any nuclear power stations. But China and India are. And the supply of nuclear fuel coming from old Soviet nuclear warheads is running out. --But back to Australia and its own power reserves and requirements. According to ABARE, 92% of Australia's conventional gas resources are located in the Carnarvon, Browse, and Bonaparte basins. Those are all off-shore in the North West Shelf. And most of that gas is exported to Asia and points north and west, as you can see on the chart below.

--So who is going to supply Australia's East Coast with the gas it needs to fire power plants? It won't be the producers in the North West Shelf. What isn't exported from those fields is used to power the mining and power industries in Western Australia. It's not coming back east, at least not in sufficient quantity to keep the Opera House lit up at night. --And don't forget Professor Ross Garnaut. He's not a climate scientist. But he's sure acting like one. And he's haranguing Australia to introduce a carbon price while connecting the recent wild weather with global warming/climate change. If he gets his way, the price of power is going to go up at the wholesale and retail level. You wonder what business would be willing to invest in long-term, high-capital-cost assets in this kind of political environment. --Kris Sayce correctly spotted coal-seam-gas from Queensland as the first major effort to produce more gas domestically. Yet most of this gas, if and when it is ever produced, will also be exported. Long-term off-take agreements with mostly Asian utilities have provided the certainty that there will be customers, which has allowed the projects to go ahead. --Kris was also right in going after the small-fry developers and explorers to capture the big share gains. The big share price gains are to be had at the margins with new sectors and technologies. Maybe the operating profits will go to bluer chips like Santos. But the major producers and operators are not as leveraged to structural shifts in Australia's energy mix. --Our take is to bypass the unconventional gas sector in Queensland altogether. Instead, we just wrapped up a report on the unconventional shale gas sector in the Cooper Basin. That's Australia's most promising geologic basin for the kind of unconventional gas production that has turned the United States back into the world's largest natural gas producer and an exporter. --This shale gas is usually found at much lower levels that coal seam methane. Thus, the controversial process of horizontal hydraulic fracturing, or "fracking". If you haven't already heard of it, get used to it. A documentary about the process called "Gasland" is up for an Oscar. It could be the next big thing in energy documentaries since Al Gore's elaborate Power Point presentation. --Our take in the latest issue of the Australian Wealth Gameplan is that unconventional gas in the Cooper Basin can supply gas-fired power plants on the East Coast for years to come—if politics doesn't quash the industry. As an early stage investor in companies that don't even have proven reserves (or a defined resource) and may never produce anything, you can add a little political risk. --That makes any energy investments in Aussie exploration stocks speculative in nature. But hey, in Ben Bernanke's big global casino where everyone on Wall Street plays with house money, everything is speculative. As the dollar goes down, energy assets are going to go up, and take some shares with them. Similar Posts: | ||

| FW: Silver in backwardation/JPMorgan now accepts gold as collateral but not ETF's Posted: 07 Feb 2011 12:32 PM PST | ||

| Growth or Hot Money: What’s Really Affecting Food Prices Posted: 07 Feb 2011 11:22 AM PST We came down to Nicaragua for a business meeting. We invested down here more than 10 years ago. We were supposed to be businessmen. But how could businessmen be so unbusinesslike? More on that discussion tomorrow... The Dow rose another 29 points on Friday. Gold lost $4. Which is to say, nothing much happened one way or the other. Unemployment data came out, moving the unemployment rate down to 9%. But there were suspicious adjustments in the numbers. From the reports we read, nobody really knew if the numbers were good or bad. The more interesting news continues to come from America's central planners. At least, they are entertaining...in roughly the same way that TV shows such as 1000 Ways to Die or Jackass are entertaining. Maybe it's just human nature. But it's fun to watch people do stupid things - sometimes, even when they're fatal. And now comes Ben Bernanke, chairman of the US Federal Reserve, former chairman of the Princeton Economics Department, with a claim so dumb that we don't what to think. What's the matter with Princeton? What's the matter with economics? What's the matter with the Fed? What's the matter with Ben Bernanke? The Telegraph has the report:

Now, let's see. The Fed adds $2 trillion to the world's supply of "hot money." Maybe that has no effect? What do you think? The Telegraph continues:

Well, how do you like that? It's growth that it driving food prices to records. Not money printing. But wait...hold on...is the emerging world growing faster now than it was two or three years ago? Nope. Hmmm... Is the growth a big surprise? Did something happen to make investors and traders suddenly realize that...well...hey...the world is growing! Nope. Then, how come prices are shooting up now? Why didn't they shoot up 4 years ago? Or 2 years ago? Or last year? What has changed? Well... How about the $1.5 trillion of brand spanking new money that the Fed put into the world's money supply in 2009-2010? And how about the $600 billion more it's pumping in now? That's new, isn't it? So, here's a wild and crazy idea. Maybe...just maybe...the fundamentals of supply and demand really do work. Maybe...just maybe...if you increase the world's hot money supply (hot money does not come from an increase in real wealth or consumer demand...but from central banks' low interest rates and money printing)...well, maybe prices on global, auction-priced goods - such as food - go up. Just look at what is happening to other global, auction-priced goods. Oil, for example, soared above $100 over the weekend. And look at gold. Put oil and food in terms of gold and what do you find? That they haven't gone up at all! What does that tell you? That the "growth" hypothesis is nonsense. In other words, yes...the developing world is growing. It has been growing at a high rate for the last 20 years. Nothing new there. What's new is that central banks are printing money at a record pace. They are creating more bubbles. And more thoughts... Isn't this going to end badly? Why would governments play such a dangerous game? Aren't they putting their own credibility, currencies and solvency in jeopardy? Yes, of course they are... But there is something you have to understand. Governments always look out for the elite groups that control them. They're not necessarily concerned with the betterment of humankind...or even the best interests of their own people. Here's an example, from The New York Times:

Meanwhile, Barry Ritholtz says the feds are using Fannie and Freddie as another way to shovel taxpayer money to Wall Street. As you know, the Fed already plays Sugar Daddy to the bankers. If the bankers have some trash mortgage-backed security that they lost money on, the Fed buys it from them at an inflated price. Of course, just having the Fed in the market buying MBSs inflates the markets. But it turns out, the Fed isn't the only one. The US Treasury also gave Fannie and Freddie a blank check to save the housing industry. But they let the housing industry go bust. Instead, they took the money and saved the housing industry's creditors. The big banks, in other words. Wall Street. The richest of the rich. Why should taxpayer money be used to bail out the rich? Well, they're not just rich. They're powerful. They're the people the government was set up to protect. Give the feds a break; they're just doing their jobs. The private sector innovates. Government procrastinates...hesitates...and vegetates. That's just the way it works. That's what government has always been for. The government of ancient Egypt protected the pharaohs. The government of the Ottoman Empire protected the Ottomans. The government of Genghis Khan looked out for Genghis. And who does the US government look out for? Naturally, it looks out for the elite groups that control it. Who's that? The big banks, of course. More on that tomorrow, too. Regards, Bill Bonner | ||

| Greasing the Wheels of Oil Production Posted: 07 Feb 2011 11:08 AM PST There's a common theme to my efforts on behalf of my Outstanding Investments subscribers. Yes, I like companies that control real resources like oil, natural gas, copper, gold, silver, etc. I look for the basic resource value. But beyond these basics, I look for companies that control resources and have the technology to extract them and add value. A company like Venoco (NYSE:VQ) is just one intriguing example. Venoco is applying rock-fracturing technology to California's Monterey Shale. If the company accomplishes what it aims to do - increase oil recovery from shale - there's the strong potential for Venoco to transform its shale acreage into a recoverable billion-barrel oil resource. Or look at Talisman (NYSE:TLM). Here's a company that's not just leading the charge to fracture shale formations for the shale gas, but also working with South African refiner Sasol to turn "stranded," low- value natural gas into high-value liquid fuel. In other words, Talisman is working to add value at the upstream stage and capture that value for its bottom line - and, of course, for the shareholders. Over and over in Outstanding Investments, I have highlighted resource technology companies like Schlumberger (NYSE:SLB), Halliburton (NYSE:HAL) and Baker Hughes (NYSE:BHI). These global oil field service giants provide the essential technological foundations of modern-day energy extraction. If any of these three companies simply vanished overnight, the world energy system would start to break down by the following morning. Without their technology - and their corporate ability to integrate systems of systems - the world would quickly revert to an energy state of the 1850s or so. I should add that you can't just pigeonhole these guys. It's way too glib to say that Schlumberger is a great wireline company, Halliburton is a great well cementing company and Baker Hughes is a great drill bit company. Yes, each statement is true, as far as it goes. But each company also offers a full line of energy-development technology, with the process thinking and systems management to make it happen. Beyond just the extraction phase, you need to think in terms of upgrading the products into something else - product transformation. For example, I've held Weyerhaeuser (NYSE:WY) in the Outstanding Investments portfolio for a couple of years. No, it's NOT that I'm playing on the possibility of a housing recovery, although that would doubtless be good for a "tree growing company" like Weyerhaeuser. It's more that I like Weyerhaeuser because it controls large swaths of biomass - that is, "trees" and all the other stuff that comes from growing and harvesting trees. I mean lumber, of course, plus bark, chips, sawdust and everything else that comes out of those vast swaths of forestland up in Washington, Oregon, etc. So Weyerhaeuser controls biomass - but now what? Weyerhaeuser is partnered with no less than oil giant Chevron to develop - "leapfrog" is more like it - new technology to turn this biomass into something that a refinery can process. This is far beyond the primitive idea of using corn for ethanol. Really, burn your food and deplete the agricultural soil just for motor fuel? (That's why I call it "deathanol"). So Weyerhaeuser has the biomass - the fundamental raw material. Chevron has the refining and marketing power. Now all they need is the correct technology to turn wood chips, etc., into a feedstock for refining fuel. It's going to happen in a big way, and likely within five years or so. So when you're looking around for hi-tech investments, don't forget to look around for the world's cutting-edge energy service companies. Regards, Byron King Editor's Notes: Byron received his Juris Doctor from the University of Pittsburgh School of Law, was a cum laude graduate of Harvard University, served on the staff of the Chief of Naval Operations and as a field historian with the Navy. Our resident energy and oil expert, Byron is the editor of Outstanding Investments and Energy and Scarcity Investor. Similar Posts: | ||

| Do any of you guys cast your own loaf bars? Posted: 07 Feb 2011 10:54 AM PST | ||

| Egyptians Line Up for Cash as Banks Open, Currency Plummets to 2005 Low Posted: 07 Feb 2011 10:25 AM PST Egyptians Line Up for Cash as Banks Open, Currency Plummets to 2005 Low http://www.bloomberg.com/news/2011-0...-protests.html >> Hundreds of Egyptians queued outside banks to withdraw funds as lenders opened for the first time in more than a week. . . . The pound dropped to the lowest level since 2005. >> The central bank moved 5 billion pounds ($854 million) of cash into the financial system. . . . used military cargo planes to bring in the funds. Their "Fed" claims to have $36B in reserve. . | ||

| Gold Bullion Eyed as Collateral by LCH.Clearnet Posted: 07 Feb 2011 10:00 AM PST LCH.Clearnet have been considering allowing gold as collateral since October 2009 and a move by the CME and JP Morgan to allow physical gold as collateral may have made their plans in this regard more concrete. | ||

| Gold Stocks May Revisit Hedging Posted: 07 Feb 2011 10:00 AM PST Investors attending Mining Indaba heard two opinions on miners hedging their bullion output. One view was scathing in criticism of mining company hedging incompetence. The other suggests that the time may be ripe for limited hedging. | ||

| Posted: 07 Feb 2011 10:00 AM PST The snapshot price check indicated gold ahead by $10.00 an ounce, at $1,362.1o on the bid-side. CFTC data continued to reveal that speculative interest in gold bullion is still waning – to the benefit of other, apparently more 'attractive' metals. | ||

| Silver in backwardation/JPMorgan now accepts gold as collateral but not ETF's Posted: 07 Feb 2011 09:47 AM PST This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 07 Feb 2011 09:04 AM PST COMEX NEWS: Gold: -ZERO deposit into the dealer inventory (Rare in delivery month) -1,080,000 standing for delivery this month Silver: -Circus show continues, cant find the physical -massive 1.43 million oz standing (OMFG) -no outflows in SLV inventories (Monday is off day for Blythe) I would like to dive straight into my commentary. I had an exceptional conversation with one of Canada's | ||

| Talison Lithium (TSX – TLH) – the world’s only pure lithium producer Posted: 07 Feb 2011 08:02 AM PST TLH on AOTH By Richard (Rick) Mills Ahead of the herd As a general rule, the most successful man in life is the man who has the best information

Talison does not produce lithium chemical products, instead the company sells lithium concentrate directly to customers for processing into lithium chemicals. Presently Talison is expanding its lithium production to supply the growing need in the battery market. Talison designed its initial Stage 1 expansion to increase total production capacity to approximately 62,000 tonnes of lithium carbonate equivalent.

Talison is the only primary pure lithium producer in the group and is the only one of the four not producing from brine operations in South America. Ahead of the Herd Special Report The synergies of the two production methods, together in one company, means guaranteed delivery of lithium supplies to Talison's customer base with potentially lower overall production costs. Talison's "Salares 7″ project is siutated in the Atacama Desert, Chile. Drilling is expected to start in early February 2011. The potential for potash credits may very well come along with this drill program. The "Salares 7" lithium project consists of 117,904 hectares with over 39,400 hectares of exploration potential solely within actual salares/brine lakes. Historic sampling (non NI43-101 compliant) has returned lithium and potassium in all seven salares with grades up to 1,080 ppm lithium and 10,800 ppm potassium. Talison controls 100% of five of the salares. Cash: $38,000,000 (As of December 31st.) Pre-Financing

Talison has been included in the Solactive Global Lithium Index. Global X Lithium is the world's first lithium based Exchange Traded Fund (ETF) and uses the Solactive Global Lithium Index to track the performance of lithium mining, refining and battery producing companies. Talison increased sales in the three months ended December – the company's second quarter – to 97,559 tonnes of lithium concentrate, 54% higher year over year (yoy). Both production and sales rose to company records in the December quarter. Richard is host of aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell.com, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense. Talison Lithium TSX – TLH is an advertiser on his website aheadoftheherd.com. | ||

| Gold Seeker Closing Report: Gold Ends Near Unchanged While Silver Gains Almost 1% Posted: 07 Feb 2011 07:13 AM PST Gold climbed $5.30 to $1352.90 by about 9AM EST before it fell back to $1344.95 at 10AM and then rebounded back to $1352.25 just after 11AM, but it then fell back off a bit in the last couple of hours of trade and ended with a loss of 0.015%. Silver climbed to $29.34 and fell to $29.073 in early New York trade before it rose to a new session high $29.465 by late morning and then also fell back off a bit, but it still ended with a gain of 0.9%. | ||

| An Open Letter to the E.P.A., Region 10 Posted: 07 Feb 2011 05:47 AM PST What part of NO! do you not understand? When all seven villages and cities of the Coeur d'Alene Mining District say NO! to your 50- to 90-year, billion-dollar-plus Superfund juggernaut, please consider the significance of this historical unanimity. | ||

| Extorre Extends High Grade Gold-Silver Zones at Cerro Moro Posted: 07 Feb 2011 05:37 AM PST Extorre Gold Mines Limited (TSX:XG, Frankfurt: E1R, OTC: EXGMF – "Extorre" or the "Company") is pleased to report that discovery drilling continues to extend gold-silver mineralization at its 100% owned Cerro Moro Project, in Santa Cruz Province, Argentina. The latest drilling has returned high grade to "bonanza" grade intersections from the Esperanza, Gabriela and Martina veins. | ||

| Silver to Soar in 2011, says Investment Guru Posted: 07 Feb 2011 05:07 AM PST Silver promises to become the next big buzzword among investors in 2011 and beyond, according to one of the investment industry's most prescient and successful experts on precious metals. Eric Sprott is the founder of the Toronto-based investment firm, Sprott Asset Management LP. His renowned hedge fund, Sprott Hedge Fund LP, is heavily weighted in precious metals and has generated an estimated 23% annualized return over the past decade. Other similarly oriented funds under his stewardship have also been stellar performers in recent years. | ||

| Posted: 07 Feb 2011 04:29 AM PST

It has been my contention all along that the Fed would print until something breaks. Once that break occurs we will enter the next leg down in the secular bear market. This time I don't expect it to be the credit markets, although we will almost certainly have trouble in the municipal and state bond markets. Some may even default. I actually think the greater risk is from massive layoffs by state and local governments in an effort to cut expenses and avoid default. When that begins we will see unemployment levels start to spike again. The real danger is going to come from inflationary pressures unleashed by the Fed's QE programs. We are already starting to see severe inflationary pressures in food and energy and it's already causing social unrest in many third world countries. Expect this to continue and intensify as we move into the summer months. Besides starting an inflationary spiral QE is also stretching the stock market cycles. To explain; the`09 yearly cycle low occurred in March. The 2010 yearly cycle low should have arrived in the early spring roughly 12 months after the March `09 bottom. We did have a decent correction in early February. That should have marked the yearly cycle low. However, because of QE1 that cycle stretched into July, and was more severe that it should have been absent Fed meddling. We even witnessed another mini-crash – a direct result of the extreme complacency generated by the QE driven rally in March and April. Under normal conditions the cycles would adjust and we would get a shortened cycle this year that should have bottomed right about now. Obviously that isn't going to happen since we don't even have a top yet. It's now clear that QE2 is going to stretch this cycle also. I now look for the next intermediate bottom to arrive this summer sometime around July (roughly 12 months after the 2010 bottom). This should correspond with a violent dollar rally as it blasts out of the three year cycle low. This should mark the beginning of the next leg down in the secular bear market. Confirmation will come if the correction is severe enough to test the July 2010 lows. In a healthy bull market each intermediate correction should bottom well above the prior low (higher highs and higher lows). A move down to the 1050-1000 level will be a clear sign the bull is in trouble. We should also see the dollar rally out of the three year cycle low force the CRB down into its 3 year cycle low (actually the cycle runs about 2 1/2 years on average). And, gold will go down into a severe D-wave correction. (We still have one more parabolic leg up before this D-wave starts.) Even though I have been expecting the market to correct (into the normal yearly cycle timing band) I've been warning subscribers not to short the market because the dollar is dropping down into a major cycle low. I suspected there was the possibility the dollar collapse would stretch the cycles and make selling short very risky. The time to short will come once the dollar puts in the three year cycle low and all markets begin the move down into the timing band for the next yearly cycle low this summer. I will be watching for a sign the dollar cycle has bottomed sometime in April or even as late as early May. At that point one might consider looking for a sector, or sectors, that are extremely stretched above the mean to sell short. (Not precious metals though. I never short a bull market.) Until that time it's still too early to play the short side. The odds are better positioning for the final leg up in gold's massive C-wave advance. | ||

| ‘Suicide Bombers’ in the Gold Market? Posted: 07 Feb 2011 04:22 AM PST I was listening to another fine interview on the King World News site, this one with Ben Davies of Hinde Capital, when I was immediately intrigued by some of Davies' remarks. He stated that he considered the entire, recent trading-episode in the gold market "suspicious", for two reasons. First of all, he was susprised that any (competent) trader would have leveraged himself into such a dangerous position in the first place. Secondly, and connected with his first observation, he expressed equal surprise that the so-called "regulator" (i.e. the CME Group) would have allowed such a flawed and vulnerable trading position to have been created, in the first place. What Davies (and others) have apparently not considered is that this "leveraged", "dangerous" trade was created to fail – in spectacular fashion. Essentially it appears that the Wall Street banksters (and the corrupt institutions who serve them) have imported the terrorist concept of "the suicide bomber" to precious metals markets. For those not familiar with the episode Davies refers to, a previously unknown "metals trader" named Daniel Shak used $10 million to leverage his way into an $850 million "spread trade" (i.e. 85:1 leverage) in the U.S. gold futures market - equal in size to more than 10% of this entire market. With the banksters printing-up "money" by the trillions, $10 million is nothing more than "pocket change", and even eating the entire $850 million loss represents just slightly more than 0.1% of Bernanke's most recent money-printing. Does anyone here think that Wall Street would be happy to throw away a mere $850 million – when default in the precious metals market threatens JP Morgan (and others) with out-and-out bankruptcy? The logic here is elementary. When you have a committed hyperinflationist like Ben Bernanke ready to create another $600 billion (out of thin air) with merely a mouse-click – any and every time Wall Street requests a new shipment of Bernanke-bills – then throwing away (deliberately) a few billion dollars on a "bad trade" is (literally) no different than losing a game of "Monopoly". The "game" ends, another batch of Bernanke-bills is printed up – and another "suicide bomber" enters the precious metals market. While readers may be horrified at yet another example of Wall Street's incessant "economic terrorism", precious metals investors need have no fear of yet another desperation tactic by this crime syndicate. As I regularly remind readers, none of the games the bankers play in markets (and "terrorism" is currently their favorite game) can do anything more than briefly stall the rise in precious metals. The bottom-line will always remain that once the last of the banksters' (real) bullion has been given away…by themselves…at rock-bottom prices, then their manipulation games are finally over. Yes, the banksters have leveraged their actual bullion by (at least) 100:1. Yes, these reckless criminals will continue to increase that insane leverage – to 1000:1, or even 1,000,000:1. The only important number in this ratio is the "1" on the right. It is totally irrelevant (on a long-term basis) how far the banksters are able to ratchet-up their leverage – on their road to self-destruction. Once the "1" on the right becomes a "0", the game is over. A "hundred times" zero is still zero. A "billion times" zero is still zero. When their "physical" bullion is gone, their entire empire of manipulated bullion markets, and bogus "bullion products" will simply evaporate into thin air – just like the rest of the banksters' fiat-paper empire. |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment