Gold World News Flash |

- Janet Tavakoki: “JPMorgan Chase and a couple of financial market exchanges have effectively declared that gold is an alternative currency. In other words, gold is money.”

- Crude Profit Taking Picks up Pace, Gold Struggles Near $1350

- Gold Seeker Closing Report: Gold Ends Near Unchanged While Silver Gains Almost 1%

- Global Pension Assets Hit Record High in 2010

- I WONDER WHY CHINA HAS BOUGHT 200 TONNES OF GOLD IN LAST THREE MONTHS

- The Gold Price Must Clear $1,353, Then Move Above $1,362, Longer it Lingers Here the Weaker it Becomes

- Is Deflation Really a Risk Today?

- Buying Silver While It’s Still Relatively Cheap

- China's gold tsunami

- Trading the Gold to Silver Ratio

- MONDAY Market Excerpts

- Silver Shorts On the Run

- Buying Silver While It’s Still Relatively Cheap

- Three Critical Drivers for the “Rational Gold Investor”

- Ratigan And Fleckenstein Explain The Fed's Role In Recent Food Price Ignited Revolutions

- Randgold Resources Ltd. CEO Discusses Q4 2010 Results - Earnings Call Transcript

- Should You Still Ask TED About Gold?

- Real-Time Gold Bubble Data

- Time Lapse Interactive Video Of Global Debt: 1870 - 2010

- Silver to Soar in 2011, says Investment Guru

- Doug Groh: What's Old Is New Again in Gold

- Gold Reverses Ahead of Measured Level

- Copper’s Warning Signal

- Gold Daily and Silver Weekly Charts

- It's Time to Buy

- Hourly Action In Gold From Trader Dan

- Copper, Food Prices and Strength of the Global Economy

- Why it is still important to have gold in your portfolio

- Gold Tsunami

- For week ending 04 February 2011

- Monday Market Movement - Where Else?

- LGMR: Silver-Price Backwardation Points to "Heavy Physical Buying"

- Greasing the Wheels of Oil Production

- Eric Sprott On A "Gold Tsunami"

- Silver Backwardation – What To Make Of It

- Einstein Was Right - Honey Bee Collapse Threatens Global Food Security

- Jim's Mailbox

- China says 2010 gold production hit record high

- Commodities Update: Copper Above $10,000 a Ton as Supply Concerns Continue

- ‘Suicide Bombers’ in the Gold Market?

- J.P. Morgan to accept gold as repo collateral

- Morgan will take gold pledged against any crappy paper

- As regions around globe ignite, good time to get as much Silver as you can. The GIABO is on!

- Newmont Buys Fronteer Gold, Miners In Nevada Gaining Investment Interest

- Growth or Hot Money: What’s Really Affecting Food Prices

- Near Term Market Outlook

- Bearish on Gold, For the Wrong Reasons

- Gold bars run short in Emirates as price retreats

- The REAL Reason Ben Bernanke Leaves a Paperweight on the “Print” Button When His Finger Gets Tired

- China in the Year of the Rabbit

| Posted: 07 Feb 2011 07:13 PM PST | |

| Crude Profit Taking Picks up Pace, Gold Struggles Near $1350 Posted: 07 Feb 2011 05:00 PM PST courtesy of DailyFX.com February 07, 2011 08:51 PM Crude oil traders finally began locking in profits, as a light economic calendar saps recent momentum. Meanwhile, gold is at a critical technical level. Commodities – Energy Crude Profit Taking Picks up Pace Crude Oil (WTI) - $89.12 // $0.09 // 0.10% Commentary: Crude oil sold off on Monday as traders gained confidence that the unrest in Egypt would not have a major impact on crude oil production or transportation. WTI lost $1.55, or 1.74%, to settle at $87.48, while Brent shed $0.58, or 0.58%, to settle at $99.25. Brent is now down about $4 since last week’s peak over $103. As we wrote yesterday, crude oil looks ripe for profit taking given the enormous gains we have seen recently and the lack of economic data this week. But even so, fundamentals remain supportive given the robust global economic outlook and supply-side risks that seem to pop up intermittently. Thus, we would be looking at corrections as buyi... | |

| Gold Seeker Closing Report: Gold Ends Near Unchanged While Silver Gains Almost 1% Posted: 07 Feb 2011 04:00 PM PST Gold climbed $5.30 to $1352.90 by about 9AM EST before it fell back to $1344.95 at 10AM and then rebounded back to $1352.25 just after 11AM, but it then fell back off a bit in the last couple of hours of trade and ended with a loss of 0.015%. Silver climbed to $29.34 and fell to $29.073 in early New York trade before it rose to a new session high $29.465 by late morning and then also fell back off a bit, but it still ended with a gain of 0.9%. | |

| Global Pension Assets Hit Record High in 2010 Posted: 07 Feb 2011 02:55 PM PST Julia Kollewe and Philip Inman of the Guardian report,Value of global pension funds hits record high at &ound;16tn, study shows:

Towers Watson provided more information on their website, Global pension fund assets hit record high in 2010:

This study is very interesting because it clearly demonstrates that global pensions are a force to be reckoned with. Trillions of dollars are being invested in global equities, bonds, real estate, infrastructure, commodities, hedge funds and other assets. Those who scoff at pensions just show how ignorant they truly are. But the study also shows how vulnerable global pensions remain. As Roger Urwin stated: "By and large pension funds still have a long way to go to make sure assets match their liabilities". pensions aren't just about assets; they're about matching assets to liabilities. To look at one side of the equation without looking at the other is to distort the underlying state of global pensions. Finally, I noted that Australia, Canada and the US have increased their proportion of alternative assets the most from nearly 8% in 2000 to more than 20% in 2010. The cynic in me tells me it's all about beating benchmarks, compensation and chasing after hot alternatives. It remains to be seen if countries allocating a greater proportion of their pension assets to alternatives will outperform on a risk-adjusted basis over the next ten years. This afternoon a colleague of mine reminded me that "JGBs outperformed the S&P 500 since 1998". I told him: "Wouldn't it be something if US Treasuries outperform all other asset classes in the next ten years?". You just never know. | |

| I WONDER WHY CHINA HAS BOUGHT 200 TONNES OF GOLD IN LAST THREE MONTHS Posted: 07 Feb 2011 01:25 PM PST The Chinese seem to be buying into the inflationary scenario. Good video from NIA. http://dailypaul.com/156131/friday-video-day-5000-gold-500-silver-just-released-nia // if (flashTarget) { pe.stop(); // This embed code expects swfobject.js to have already been included. A copy of the version we currently use (not the most up-to-date) is // available here: http://casttv.com/javascripts/swfobject.js var so = new SWFObject("http://www.youtube.com/v/Qi8fV8n_UBM&autoplay=0&hl=en&fs=1&rel=0&ap=%2526fmt%3D18", "foo", 620, [...] | |

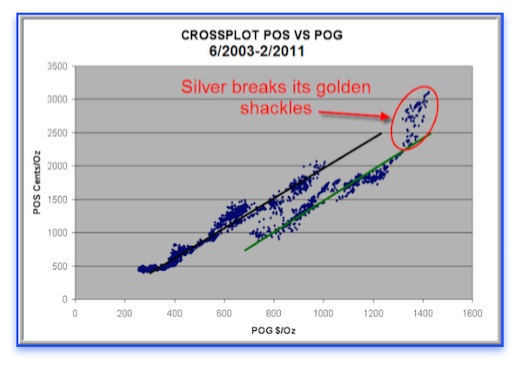

| Posted: 07 Feb 2011 11:43 AM PST Gold Price Close Today : 1,347.60 Gold Price Close 28-Jan : 1,340.70 Change : 6.90 or 0.5% Silver Price Close Today : 2934.8 Silver Price Close 28-Jan : 2793.4 Change : 141.40 or 5.1% Gold Silver Ratio Today : 45.92 Gold Silver Ratio 28-Jan : 48.00 Change : -2.08 or -4.3% Silver Gold Ratio : 0.02178 Silver Gold Ratio 28-Jan : 0.02084 Change : 0.00094 or 4.5% Dow in Gold Dollars : $ 186.56 Dow in Gold Dollars 28-Jan : $ 182.31 Change : $ 4.25 or 2.3% Dow in Gold Ounces : 9.025 Dow in Gold Ounces 28-Jan : 8.819 Change : 0.21 or 2.3% Dow in Silver Ounces : 414.39 Dow in Silver Ounces 28-Jan : 423.27 Change : -8.88 or -2.1% Dow Industrial : 12,161.55 Dow Industrial 28-Jan : 11,823.70 Change : 337.85 or 2.9% S&P 500 : 1,319.04 S&P 500 28-Jan : 1,276.34 Change : 42.70 or 3.3% US Dollar Index : 78.034 US Dollar Index 28-Jan : 78.135 Change : -0.10 or -0.1% Platinum Price Close Today : 1,839.80 Platinum Price Close 28-Jan : 1,792.40 Change : 47.40 or 2.6% Palladium Price Close Today : 817.65 Palladium Price Close 28-Jan : 812.50 Change : 5.15 or 0.6% The GOLD PRICE and the SILVER PRICE, I mind not confessing, have me baffled. What keeps me from throwing in my bearish towel is gold's toe-kicking and heel scuffing refusal to climb above that last $1,353 intraday low. This smells all the more suspicious when silver has climbed 5.1% while gold has climbed only 1/2%. Why am I fighting this rise when gold's MACD and RSI have turned up? More, gold has broken through the downtrend line from the 3 January high. Last two days gold has sparred with the 20 day moving average ($1,352.15), but not penetrated it. Mayhap gold's fecklessness in crossing that line has merely been wrestling to get through the 20 DMA. Thursday, Friday, and today gold traded range-bound by 1355 and 1345. Ranges are zones where opposing selling and buying pressure match evenly. When one side or the other flinches, the breakout comes. Gold weekly chart still points down, but that moves slower than daily. What can I say? Gold must clear $1,353, must close above that and more, must clear $1,355, then move smartly above $1,362. Longer it lingers here, weaker it becomes. Downside gold must not pierce $1,343. Contradictions bother me. What's behind them? Friday gold fell $4.00 while silver rose 33.1c. Hmmm. Today silver added another 28.4c while gold lost 70c. Why are they gainsaying each other? The GOLD/SILVER RATIO has fallen quickly nearly to its 3 January low. Comex today closed 45.92, just above 3 January's 45.75. If the ratio breaks 45.75, it implies BUT DOES NOT NECESSARILY GUARANTEE that silver and gold will reach new highs. If a new ratio low appears, then it throws my expectations for reaction price lows out another month, or, I might have to scrub that and think it all through again. Historical data says that it is not unknown for the ratio to trifle along as much as a month, making two lows near each other, before turning and shooting up. Platinum and Palladium are knocking at their last highs, which as yet tells us nothing. The SILVER PRICE jumped up on Thursday from a 2790-ish low to 2900c in a single bound. Friday it tested that 2900c support, then bolted fro 2925c. Since then it has gently risen to a ceiling at 2940. Comex today gained 28.4c to close at 2934.8c. The silver/gold contradiction is not yet, as some allege, rooted in a silver backwardation. "Backwardation" occurs when any futures market shows higher prices for the spot or closest month than the normal contango. Normal contango reflects the carrying cost of interest, insurance, and storage, so the months further out in time cost more. From February, you ought to have to pay more for silver if you want to buy it for September delivery, because of that carrying cost. So whenever a market backwardates it shows a shortage of deliverable metal, perhaps a short squeeze where those who have shorted silver can't find the metal to deliver against their obligations, and so pay more and more to get their hands on it. Only problem with the backwardation/shortage of silver theory is that today the market was not backwardated. Rather, it showed normal positive contango. One ought also recall that interest is the largest component of contango, and right now interest rates, thanks to Big-Hearted Ben Bernanke, are unnaturally low, which keeps contango low. On Friday something appeared more like a zero-contango, with the March 2011 contract at 2905.9. and the Cash market at 2907.5c Might be a harbinger, but it's a tee-tiny one. If I am wrong, gold will break through $1,362 in the next day or two and silver will keep on rising while the ratio sinks below or matches 45.75. I can only watch. My trip to Maryland was very restful, and I enjoyed meeting some of you subscribers. Thanks for your encouragement and courtesy. I don't know which is more bewildered, the markets or me. One of two things is happening with SILVER and GOLD. Either they are about to break out for another big rally, or they are about to fail and complete their correction of the 3 January 2011 high. Stocks? Well, you tell me. Nobody every went broke overestimating the gullibility of American Investors. Dollar hangs on, but barely. What hints and clues do the markets give? US DOLLAR INDEX bottomed (intraday) last Wednesday at 76.88, and has clumb ever since. Today it stands above 78 at 78.034. It fell only 2.3 basis points today, 0.03%. What signs point up for the dollar? MACD has turned up, and RSI is rising. 76.71 was the next to the last low, so there's lateral support for a bottom here. Over last 4 days dollar has painted a muscular upmove but slowed down today. High nearly touched the 20 day moving average (78.44 vs. 78.35). If the dollar crosses that line, it would flash the first warning confirmation of an uptrend. I expect the dollar to rise again tomorrow, but watch that 77.85 low from today. Dollar must not dip down there and surely must not close below 78. Euro also appears to have topped and today touched its 20 DMA from above, first warning of a downmove. STOCKS don't move me with greed, fear, desire, or joy. I know I am watching a sucker trap, and want nothing to do with it. They can go higher, although they are already heavily overbought. Do yourself a kindness and stay away from stocks. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | |

| Is Deflation Really a Risk Today? Posted: 07 Feb 2011 11:28 AM PST

Due to the overwhelming number of emails I received in response to my earlier article detailing the behemoth that is the derivative market.

The primary question I’m receiving is: does deflation pose a REAL risk today?

My response is absolutely. Remember, the entire financial system is broken in the US. Until we take our medicine and deal with the hundreds of trillions of bad debts sitting on the banks’ balance sheets, there is ALWAYS the risk of another 2008-type event.

The Federal Reserve has attempted to paper over these issues by offering Wall Street an endless stream of Dollars. But this hasn’t addressed the underlying issues in any way. The banks are still insolvent and the derivatives market is still the primary concern for anyone who works in finance whether they know it or not.

So yes, deflation is and always will be a potential threat that can erupt at any time. However, should deflation even take hold of the markets again, the Fed and other central banks’ responses will GUARANTEE that it is short-lived and that inflation, then hyper-inflation takes over in a short period of time.

Remember, Bernanke has NEVER admitted that he was wrong about anything. The guy literally believes he’s an economic genius who can save the world (thanks Time magazine for buffering his ego). He is 100% positive that his policies are the right policies. So if deflation reared its head again, he would do the same things he’s already done (print money, engage in more QE, etc) only on an even larger, more aggressive scale.

This will destroy the US Dollar and insure that we experienced either severe inflation similar to that of the ‘70s or hyper-inflation similar to Weimar. Bernanke’s nearly pushed into the former already and deflation hasn’t been seen in the financial markets in over two years.

So you better believe he’d go all out if deflation poked its head up again. Imagine if a grizzly bear got up and tried to attack you after you already brought it down with repeated gunfire. What would you do? You’d blow its head off and then walk up to the body and shoot it until you ran out of bullets to make sure the thing didn’t get up again.

Bernanke would do the same thing to deflation. He’d throw so much money at it that he’d not only kill it dead, but he’d also kill the US Dollar and send us straight into Zimbabwe-land without even a moment’s pause.

So yes, deflation is a threat. And it will always be. But we might very well not see it again thanks to Bernanke’s actions. And if it does show up again, its presence would be very short-lived.

Prepare accordingly,

Graham Summers

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

PPS. We ALSO publish a FREE Special Report on Inflation detailing three investments that have all already SOARED as a result of the Fed’s monetary policy.

You can access this Report at the link above.

| |

| Buying Silver While It’s Still Relatively Cheap Posted: 07 Feb 2011 11:11 AM PST James Cook of InvestmentRarities.com reminds us, in his "Market Update" newsletter, that the silver inventory held above ground totals 1.4 billion ounces, and that annual industrial use of silver is 900 million ounces, so that a year and half's worth of silver exists, "although a third of it is destined for industrial consumption," which has been increasing its use of silver by 18% in 2010. And it surely will be used in industrial consumption, because as Mr. Cook says, "it's hard to fathom all the bullish aspects credited to silver. You have a rare metal used in so many important industrial applications as to be termed miraculous," so much so that "the billions of ounces mined over 2,000 years are gone forever." In fact, I am considering raising money to launch a Discovery Channel special, which will be a revealing new documentary that blows the lid off the explosive situation in silver, beginning with how things would have been worse a long time ago if the Neanderthals had invented ... | |

| Posted: 07 Feb 2011 10:58 AM PST by Karen Maley At the same time, there are signs that gold is expanding its role as an alternative currency. Overnight, the US investment bank, JP Morgan Chase & Co said it would accept physical gold as collateral against securities lending and repurchase obligations. … The latest newsletter from Sprott Asset Management, entitled 'Gold Tsunami', focuses on gold's attractiveness as an inflation hedge for Chinese and Indian investors. It argues that while western investors are content to hold paper assets, such as stocks, bonds, annuities and insurance, along with their real estate investments, the attitude of Chinese and Indian investors is very different. "Halfway across the world, investors in China and India have never trusted paper investments as a store of value – and they're converting their hard earned paper money into gold and silver bullion. Not that this is anything new. It isn't. But the scale and speed with which they are accumulating precious metals IS new, and it's driving the fundamentals that we believe will lead to higher prices in 2011." … According to the Sprott letter, "There is a clear trend developing for Chinese investment in gold as a monetary asset"… At the same time, it's also becoming easier for the Chinese to invest in gold. The Sprott newsletter points out that Chinese citizens have only been able to purchase gold freely since the early 2000s, when the long-term monopoly of the Chinese central bank was abolished. … While precious metals prices have corrected on the paper exchanges, the inflation resurgence in Asia is quietly driving new, unforeseen levels of physical demand for the metals. "While the world continues to float on a sea of paper, this massive wave of physical demand silently threatens to crash into the physical gold and silver market, potentially wiping out tangible supply." [source] | |

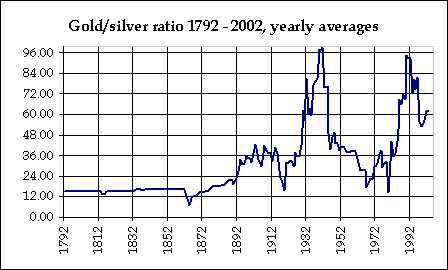

| Trading the Gold to Silver Ratio Posted: 07 Feb 2011 10:50 AM PST Kurtis Hemmerling submits: Silver bulls will often point to the gold to silver ratio as a potential upside for Ag. Here are two arguments made:

With gold prices hovering around $1,350 – does this imply an upside silver price of $52 - $90 per ounce? Silver Prices Become Law If the abolishment of bi-metalism continues, it would be difficult for me to justify and immediate return to the 15:1 ratio. However, it seems that some House bills are being submitted that call for a return to the ‘gold standard’ in response to recent quantitative easing inflation and perceived mismanagement of the dollar by the Federal Reserve. There are many variations of this game, but if it became necessary for banks and the government to at least increase the proportion of gold in their vaults to back to the currency, this would create demand.

Complete Story » | |

| Posted: 07 Feb 2011 10:02 AM PST Gold chops sideways in narrow range-bound trading The COMEX April gold futures contract closed down $0.80 Monday at $1348.20, trading between $1344.10 and $1354.50 February 7, p.m. excerpts: | |

| Posted: 07 Feb 2011 09:38 AM PST | |

| Buying Silver While It’s Still Relatively Cheap Posted: 07 Feb 2011 09:28 AM PST James Cook of InvestmentRarities.com reminds us, in his "Market Update" newsletter, that the silver inventory held above ground totals 1.4 billion ounces, and that annual industrial use of silver is 900 million ounces, so that a year and half's worth of silver exists, "although a third of it is destined for industrial consumption," which has been increasing its use of silver by 18% in 2010. And it surely will be used in industrial consumption, because as Mr. Cook says, "it's hard to fathom all the bullish aspects credited to silver. You have a rare metal used in so many important industrial applications as to be termed miraculous," so much so that "the billions of ounces mined over 2,000 years are gone forever." In fact, I am considering raising money to launch a Discovery Channel special, which will be a revealing new documentary that blows the lid off the explosive situation in silver, beginning with how things would have been worse a long time ago if the Neanderthals had invented electrical generation and a distribution network, both silver-consuming, 100,000 years ago. And ditto those Renaissance hotshots who everybody thinks are so hot, but couldn't even come up with a good cell-phone, or how Thomas Edison can invent a light bulb and the phonograph, but not take the logical next step of inventing the CD and CD player, which would have produced much better sound quality than those stupid, scratchy, tinny wax cylinders of his. Now, as interesting as all this is, it is not enough to enthrall us because we have such short attention spans, but as soon as we say, "Bah! Show me how to make money on it!" and reach for the remote control with which to change channels, our ears prick up in sudden rapt attention when he says, "The disappearance of this hoard should have sent the price to much higher levels. It didn't." This seemed so odd that Theodore Butler went to "track down the reason" and, as I understand it, discovered the gigantic short futures position in silver, and all of that slimy, illegal rigging of the silver futures markets, and by extension, all the rigged markets, and all of it made possible only because the foul Federal Reserve created the excess money to finance it all! Hahahaha! Of course, rigged markets are nothing new, and again our interest wanes, and soon we are beginning to think of pizza, and our stomachs gurgle, "BurrRRRrrRRrrRRp!" This was unfortunate, because while we were distracted, we almost missed the whole point, which is making a lot of money without working. And on that subject, the aforementioned Theodore Butler writes that JP Morgan, apparently the biggest naked short-seller of silver futures and thus the biggest price suppressor, looks like it has decided to get out of the business of depressing the price of silver by creating and selling so much "paper silver" futures out of thin air, and has unexpectedly "covered roughly 4,000 contracts in the past month and 8,000 contracts in the last two months, the equivalent of 40 million ounces" of silver. Familiar with the explosive results of suppressed prices that stop being suppressed, I am beside myself in Greedy Mogambo Glee (GMG) in anticipation of silver shooting to the moon, and I am humming the tune "We're in the money! We're in the money! We got a lot of what it takes to get along!" Mr. Butler, who is much more professional than I, calmly and cautiously opines that "This holds profoundly bullish implications for the future of silver prices," which may have something to do with the fact that covering a naked short position when the price of silver is rising means taking a loss, and, "In the history of the silver manipulation going back to 1983, never has the big concentrated silver short ever covered shorts on rising silver prices." I am always impressed with the use of the word "never," probably because of that time when I was young and full of hormones, when I asked Debra Sue, the hottest girl in the tenth grade and who knew it, too, to go out with me, but she pretended not to hear me, but who told her friend Jessica, who told her friend Mary, who told her boyfriend Bob, who was my friend, who told me that Debra Sue said she would never – never! – go out with me because she thinks I am "icky." Sure enough, she never did go out with me! Or even acknowledge my existence, for that matter, except to once say to me, in the hallway outside of the chemistry lab, "Get out of my way, creep!" That girls think I was creepy is not interesting, not surprising to anybody, but probably the most interesting fact about silver is that it is "used in tiny amounts in its multitude of applications. This makes much of its usage insensitive to price." If you are not sure what being "insensitive to price" means, imagine that you are the CEO of a company manufacturing Mogambo Hair-Growing Machines (MHGM) under license from Mogambo Interstellar Enterprises (MIE). In the course of production, you use one ten-thousandth of a cent of silver per unit, meaning that you use 10 cents worth of silver a day to make a full day's run of 100,000 units, most of which are defective because my design is bad and I insist that you use the cheapest and shoddiest of materials and labor so as to keep profit margins high enough to make the most money on the front-end before people find out what a worthless rip-off my stupid hair-growing machine really is, and people stop buying the damned things because word gets around that they don't work. In my defense, the business plan looked good on paper, but my lack of ethics as the price of greed is neither here nor there, and the point is that you are "insensitive to price" if the price of silver doubles to 20 cents a day. "Ho-hum," you would say, unconcerned about such a trifle. And you don't care if the price triples to 30 cents a day, either, as would be evidenced by another bored "ho-hum" were you even told of this trifling news. Ditto if the price quadruples to 40 cents a day, or quintuples to 50 cents a day. And you don't even care if the price of silver goes up by a thousand-fold to cost you $100 per day, even though there will plenty of people who will care if the price of silver is $29,000 an ounce! And now with China, a third of the world's population is going to want electrical and electronic things that all must have silver in them, insensitive to price as those things are, the upper end on the price of silver is so hard to imagine that I don't even try, and I just buy it now while the price is still ludicrously low. Whee! This investing stuff is easy! The Mogambo Guru Buying Silver While It's Still Relatively Cheap originally appeared in the Daily Reckoning. The Daily Reckoning recently published an article looking at the impact of quantitative easing. | |

| Three Critical Drivers for the “Rational Gold Investor” Posted: 07 Feb 2011 09:20 AM PST If you may recall, we've written about this "rational gold investor" before… Shayne McGuire manages roughly $330 million in a gold portfolio for the $100 billion Teacher Retirement System of Texas fund. In addition to having a gold-dedicated portfolio larger than most exclusive to the yellow metal, he's written the book on making gold a "serious" investment. It's titled, Hard Money: Taking Gold to a Higher Investment Level, and in it he highlights three critical reasons for why everyone should own gold. Here are the three essential drivers, as described by Scott Burns in The Statesman:

Back in November, the Wall Street Journal pointed to McGuire's eye-popping predictions of gold heading to about $10,000 an ounce. Burns, on the other hand, says the McGuire vision of gold's future probably looks more like $6,240 an ounce. Either value is a fair bit loftier than where gold stands now, which means, at least by his math, that it remains in a rise to be a part of. You can read much more detail in Scott Burns' commentary for The Statesman on meeting the "rare bird" that is the rational gold investor. Best, Rocky Vega, Three Critical Drivers for the "Rational Gold Investor" originally appeared in the Daily Reckoning. The Daily Reckoning recently published an article looking at the impact of quantitative easing. | |

| Ratigan And Fleckenstein Explain The Fed's Role In Recent Food Price Ignited Revolutions Posted: 07 Feb 2011 09:19 AM PST For over a year now, Zero Hedge has been predicting that in its foolhardy attempt of "inflation or bust", the Fed's actions would sooner or later lead to mass rioting and possible revolutions as a result of surging and out of control food prices (which are just the peak of the alternative investment pyramid - yes, stunningly free money can go into other things besides stocks). There have been those who have claimed that deflation is still a far greater force, despite that the all important shadow banking system made a positive inflection point in ending deleveraging in Q3 (and on March 10 we will know whether the Q3 strength persisted into Q4) as was discussed previously, and today's first time in over two years increase in revolving credit merely confirms this view. Alas, to all who believe that deflation or deleveraging is a greater threat: you have our sympathies, as fundamentally your are correct, and were the business cycle have the benefit of playing out in normal course, all the world's banks would become insolvent and yes, deflation would be rampaging. The problem is that these same people do not realize that to Bernanke (whom we have referred Genocide Ben for precisely this reason) there is no other alternative, and inflation must be achieved no matter how terrible the social cost, or the damage to the monetary system. Regardless, the actions in North Africa are just the start. Commodities will run up far higher, and discontent will sooner or later reach to Asia, and possibly to countries which have nuclear arsenals at their disposal. What happens then is anyone guess. Yet for anyone who is still confused about the ultimate Fed agenda, Dylan Ratigan and Bill Fleckenstein sat down late last week to make it so clear that virtually anyone and everyone can understand what the Bernanke endgame is.

Visit msnbc.com for breaking news, world news, and news about the economy | |

| Randgold Resources Ltd. CEO Discusses Q4 2010 Results - Earnings Call Transcript Posted: 07 Feb 2011 09:17 AM PST Randgold Resources Ltd. (GOLD) Q4 2010 Earnings Call February 7, 2011 11:00 a.m. ET Executives Philippe Lietard – Chairman Mark Bristow – Chief Executive Officer Graham Shuttleworth – Chief Financial Officer Analysts Grant Sporre - Deutsche Bank Charles Kernot - Evolution David Robinson - DSP Cailey Barker - Numis Securities Donaco Cain - Lehman Capital Presentation Mark Bristow A very good afternoon to everyone in London as well. Graham Shuttleworth, our CFO is hosting the London party. I've got a large audience here in Cape Town. Everyone has migrated almost from London to Cape Town in the last couple of days. So again a warm welcome. Also a very special welcome to some of our colleagues from the governments of our host countries. Again, welcome to South Africa and Cape Town and most importantly, our 2010 results. To kick off the proceedings we have also got our Chairman of the Board here today. He is going to be at the conference through the next three days. It's part of his responsibilities to make himself available to shareholders and the like from time to time. And so should anyone want to engage with him or bring to his attention anything in particular, he's available and you can make arrangements through our both at the conference. And without further ado I'll ask Philippe to introduce the proceedings. Philippe Lietard Thank you Mark and welcome again to all of you. (Et bienvenue tout particulier a vous ministres admins). At the Complete Story » | |

| Should You Still Ask TED About Gold? Posted: 07 Feb 2011 09:13 AM PST Hard Assets Investor submits: By Brad Zigler Used to be that whenever you wanted to know what the market really thought about gold, all you had to do was consult TED. TED is an archaic acronym for the "Treasury bill-eurodollar" spread—the price/yield differential between then-extant Treasury bill and eurodollar futures. (Eurodollars are greenbacks on deposit in foreign—mostly London—banks; futures on bills and eurodollars used to trade on the Chicago Mercantile Exchange, but have been long-delisted). Though bill and eurodollar futures are gone, the TED spread is still followed. It's now commonly tracked as the yield differential between cash market bills/notes and Libor—the London interbank offered rate—for dollar deposits. There's a strong relationship between TED spread and gold lease rates and, consequently, the shape of the gold futures curve. Lease rates reflect the interest paid to borrow ("lease") physical gold for a specific period of time. Put another way, it's the opportunity cost for holding gold and not lending it out. Typically, gold lease rates move inversely with the level of COMEX gold inventories—specifically, registered stocks. Registered inventories are those that are immediately deliverable against COMEX contracts. Presently, registered inventories comprise 24 percent of total warehouse stocks. Generally speaking, an increase in COMEX registered inventories decreases the lease rate, while a spike in the TED spread sparks a hike in gold borrowing costs. Think of it this way: The lease rate represents the price investors pay to hold physical gold as opposed to owning gold futures. Since investors can gain exposure to gold price movements Complete Story » | |

| Posted: 07 Feb 2011 09:08 AM PST | |

| Time Lapse Interactive Video Of Global Debt: 1870 - 2010 Posted: 07 Feb 2011 08:57 AM PST Ever wanted to run a Sid Meyer Civilization end of game recap scenario on the world and see which country, region or continent had built up the most debt the fastest? Or, far simpler, just to watch a time lapse video of total debt/GDP by country or by region? The IMF now allows you to do both. The international monetary organization has released a Data Mapper tool which not only shows a snapshot map chart of instantaneous sovereign leverage at any given moment, but also shows just how global debt levels have changed through the ages. Of particular note is total debt/GDP at advanced countries in the post-WW1, Great Depression and WW2 period. And while back then the result was either hyperinflation (Weimar) or various stages of removal of the gold standard (until all currencies became freely floating under Nixon), we now no longer have the option of a relative devaluation, and the only chance left for a world levered to its gills is either absolute revaluation of a brick of gold, accelerating, rampant inflation or outright default. Have fun playing with the drilldown function. | |

| Silver to Soar in 2011, says Investment Guru Posted: 07 Feb 2011 08:57 AM PST By Marc Davis, BNW News Silver promises to become the next big buzzword among investors in 2011 and beyond, according to one of the investment industry's most prescient and successful experts on precious metals. Eric Sprott is the founder of the Toronto-based investment firm, Sprott Asset Management LP. His renowned hedge fund, Sprott Hedge Fund LP, is heavily weighted in precious metals and has generated an estimated 23% annualized return over the past decade. Other similarly oriented funds under his stewardship have also been stellar performers in recent years. He's now so bullish on silver that he launched the $575 million Sprott Physical Silver Trust in November of last year as he believes that: "Silver will be the investment of the decade." "I think that silver could easily get to $50 this year," he tells BNWnews.ca. This all bodes especially well for publicly traded companies that are already mining silver, he says. Likewise for ones that are developing p... | |

| Doug Groh: What's Old Is New Again in Gold Posted: 07 Feb 2011 08:55 AM PST Source: Brian Sylvester of The Gold Report 02/07/2011 Do old investment strategies apply to the new gold market? Doug Groh, a fund manager and senior research analyst with Tocqueville Asset Management in New York City, has been analyzing basic materials and gold equities for more than 25 years. In this exclusive interview with The Gold Report, Dough explains how to view gold's history when making investments in its future. The Gold Report: Gold dipped from about $140 per ounce in the bull market of January 1976 to below $105/oz. in September of that year. Ultimately, it proved only a pullback on the way to gold's peak of $850/oz. in 1980. Are we seeing a similar pattern now, or is this correction simply much ado about nothing? Doug Groh: It's hard to say if this is a similar pattern. The market conditions are different than they were 35 years ago. However, cycles can be somewhat repetitive. I think the more important questions are: What does this correction mean and ... | |

| Gold Reverses Ahead of Measured Level Posted: 07 Feb 2011 08:51 AM PST courtesy of DailyFX.com February 07, 2011 07:45 AM 240 Minute Bars Prepared by Jamie Saettele Gold has held a multiyear support line. However, the decline from 1425.40 is in 5 waves, indicating that the larger trend is most likely down. Price reversed just ahead of the 100% extension of the initial rally off of 1308.70. Equality among waves a and c in corrections are common. Expectations are for a resumption of weakness (silver has also nearly reached its 61.8% retracement).... | |

| Posted: 07 Feb 2011 08:49 AM PST by Addison Wiggin - February 7, 2011

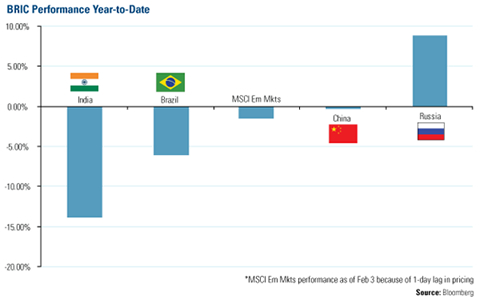

The week begins with another record high for copper and the suggestion, from an unlikely source, that the Federal Reserve may be sowing the seeds of its own demise. The week begins with another record high for copper and the suggestion, from an unlikely source, that the Federal Reserve may be sowing the seeds of its own demise. First, our friend “Dr. Copper,” as it’s sometimes known. The red metal is used in so many things -- electrical wiring, plumbing, computers, air conditioning, refrigeration, defibrillation, horseless carriages, etc. -- traders use its demand, and consequently its price, to “diagnose” the global economy. First, our friend “Dr. Copper,” as it’s sometimes known. The red metal is used in so many things -- electrical wiring, plumbing, computers, air conditioning, refrigeration, defibrillation, horseless carriages, etc. -- traders use its demand, and consequently its price, to “diagnose” the global economy.At $4.59 a pound, the good doctor would seem to be saying the global economy is fit as a fiddle. Or… indicating the onset of fever. From its panic low around $1.25, the copper price has nearly quadrupled in just two years.  “Emerging market demand has been the big driver behind industrial metals,” our managing editor Chris Mayer discusses the more likely scenario in a recent MarketWatch article. Hence, “these metals would also seem the most susceptible to any slowdown.” “Emerging market demand has been the big driver behind industrial metals,” our managing editor Chris Mayer discusses the more likely scenario in a recent MarketWatch article. Hence, “these metals would also seem the most susceptible to any slowdown.”And what are the chances of that? Pretty significant. “The industrial metals as a group are unattractive simply because I believe that emerging market demand will slow,” Chris says. “There is too much hitting these countries too fast.” Like oil. It’s back to $100 a barrel, using the yardstick of Brent Crude that’s becoming the new world standard. And food. “All around the world, emerging markets have a big problem with rising food prices,” Chris wrote his Capital & Crisis readers last month. And that problem’s set to get worse, judging by this development.  The U.S. Grains Council forecasts China’s imports of corn are set to explode sevenfold in just a year -- from 1.3 million metric tons in 2010-11 to 9 million in 2011-12. The U.S. Grains Council forecasts China’s imports of corn are set to explode sevenfold in just a year -- from 1.3 million metric tons in 2010-11 to 9 million in 2011-12.Nine million tons would double the previous record of 4.3 million tons set 15 years ago after a disastrous crop. If true, the high numbers will be driven by three factors:

“In China, people spend 50% of every incremental dollar on food,” Chris continues. “In India, it’s more like 70%. So the rising price of food is felt more keenly in these markets” than we feel it in the West. “In China, people spend 50% of every incremental dollar on food,” Chris continues. “In India, it’s more like 70%. So the rising price of food is felt more keenly in these markets” than we feel it in the West.Prices are rising faster in both of those markets. “In India, food prices are up 18% and at their highest level in a year. China has the same problem. Prices rose 5% in November alone. “All around the world, emerging markets have a big problem with rising food prices. Indonesia’s president is trying to get people to grow their own chili peppers. And the South Korean government recently released emergency stores of cabbage, pork, mackerel, radish and other staples. “The emerging markets boom is not going to go far when it faces a food crisis. And if China and India and the rest slow down, it’s going to have a huge impact on all those stocks and commodities most sensitive to emerging market growth.” We’ll be watching both food prices and copper to see if and when this fever turns to chill.  Stocks are starting the week solidly in the green, the Dow breaking through 12,100. The S&P sits at 1,316 and is “on its way to 1,400,” according to Jonas Elmerraji, a leading researcher with our small-cap team. Stocks are starting the week solidly in the green, the Dow breaking through 12,100. The S&P sits at 1,316 and is “on its way to 1,400,” according to Jonas Elmerraji, a leading researcher with our small-cap team.“If stocks sustain a break above 1,300,” Jonas suggested in this space last week, “expect rally mode; if the S&P falls below 1,275, brace for selling.” Here’s his update: “Despite some flirtations around support at 1,275 on Friday, the S&P 500 pushed definitively above 1,300 on Wednesday, clearing the last overhead barrier between the major index and its next important resistance level at 1,400.” There are reasons to be skeptical; insider selling still overwhelms insider buying, and money is still fleeing domestic stock mutual funds. But “don’t fight the trend,” says Jonas. The philosophy has worked out nicely for readers of our newest premium service. So far in 2011, the average play is up 9.5%… with a holding time of just 31 days. If you’d like to gain nearly 10% in a month as a matter of routine (and break all of Wall Street’s “rules” in the process)… give this presentation a look.  Just as AOL’s acquisition of Time Warner signaled the top of the Internet bubble, AOL’s newest deal may signal the top of the social media boomlet. In its biggest acquisition since Time Warner spun it off in 2009, AOL is buying Huffington Post for $315 million. Just as AOL’s acquisition of Time Warner signaled the top of the Internet bubble, AOL’s newest deal may signal the top of the social media boomlet. In its biggest acquisition since Time Warner spun it off in 2009, AOL is buying Huffington Post for $315 million.Arianna Huffington gets a new sandbox to play in, since she’ll now oversee AOL sites like Engadget and TechCruch, in addition to HuffPo. Other AOL sites like Politics Daily and DailyFinance will probably get folded into HuffPo. We wonder -- and we realize this is something of an apples-and-oranges question, but we still can’t help it: If HuffPo currently has 270 million users, and it’s valued at $315 million… how does Facebook, with roughly double the number of users, get valued at $50 billion?  For U.S. Treasuries, the new week begins with the same trend we saw all last week -- rising yields. The 10-year note is up to 3.66% -- levels last seen in early May of last year. For U.S. Treasuries, the new week begins with the same trend we saw all last week -- rising yields. The 10-year note is up to 3.66% -- levels last seen in early May of last year.“Technically, a 4.5% yield is now in sight,” Steve Sarnoff wrote his Options Hotline readers over the weekend. “In a speech on economic outlook and macroeconomic policy, Fed Chairman Bernanke made it clear that he and his crew will keep sailing their QE2. The rest of the world should be happy to sell Ben all the bonds he wants to buy. “Money moving out of bonds may find a home in stocks, but there is likely to come a point where rising rates attract funds back. “It was my opinion, back in the fall of 2010, and it remains my opinion, that we have likely seen the end of the decades-long bull market in bonds and this market is likely to make a big move in its new direction (prices falling and interest rates rising).” Already since October, the rate on the 10-year has jumped from 2.4% to 3.6% -- a 50% increase.  The trend has delivered substantial gains for Options Hotline readers. One Treasury play is up 133% after five months… and another is up 56% in just two months. Steve has new recommendations most every Sunday. If you’d like to be on board for the next one, look here.  It is one thing for the International Monetary Fund (IMF) to discuss plans for an alternative to the U.S. dollar. But the Old Dominion? It is one thing for the International Monetary Fund (IMF) to discuss plans for an alternative to the U.S. dollar. But the Old Dominion?Virginia can adopt an “alternative sound currency that the commonwealth’s government and citizens may employ without delay in the event of the destruction of the Federal Reserve System’s currency,” according to a bill in the Virginia legislature that would order up a study of the issue. “The fact that the Federal Reserve has resorted to the printing presses,” says Delegate Robert Marshall, “these are the ingredients, the precursors to hyperinflation. We can’t predict when it will happen, but we should be prepared for it if we’re serious about being in public office.” For the moment, the idea languishes in subcommittee.  Other than copper, there’s not much else going on with metals today. They’re starting the week more or less where they ended last week -- gold at $1,349 and silver at $29.23. Other than copper, there’s not much else going on with metals today. They’re starting the week more or less where they ended last week -- gold at $1,349 and silver at $29.23. High copper prices have indeed made copper thieves bolder; that much we know. But those thieves have nothing on this… High copper prices have indeed made copper thieves bolder; that much we know. But those thieves have nothing on this…

Thieves are poaching lead from the roofs of old buildings in England… especially churches, where lead roofing is commonplace among Church of England parishes. About 8,000 churches have filed insurance claims over the last three years. It appears the thieves are using Google Earth to spot their targets from the sky. “This is a crime that has to be taken seriously, says Tony Baldry, the Church of England’s estate commissioner. “Night after night, lead is being stolen from church roofs.” One church has had its roof ripped off 14 times. Um, you think they might want to try to replace the stolen portions with a different material?  “Kindly get your ‘minimalist government’ head out of your ass,” a friendly reader opens up today’s mailbag. ”OSHA saves lives, rather than allow industry to add a few pennies to their bottom line through the collateral damage of the death or disability of workers. “Kindly get your ‘minimalist government’ head out of your ass,” a friendly reader opens up today’s mailbag. ”OSHA saves lives, rather than allow industry to add a few pennies to their bottom line through the collateral damage of the death or disability of workers.“Sometimes it is off-track, so this needs to be fixed. Sometimes Congress -- which gives us the best government money can buy -- eviscerates the fines through industry lobbyists. So this needs to be remedied if at all possible. But once your own children work in a Massey coal mine or on the next BP drilling station, perhaps we may suddenly hear another tune. “Surely, you people are smarter than your glib comments suggest.” The 5: We wouldn’t be so sure.  “Regarding your disdain for EPA trying to force corrective behavior by business entities,” another agrees, ”you’d be chirping a different tune if you were getting your drinking water from a well where some industry was pissing in your groundwater. “Regarding your disdain for EPA trying to force corrective behavior by business entities,” another agrees, ”you’d be chirping a different tune if you were getting your drinking water from a well where some industry was pissing in your groundwater.“I’m all for business being able to do what they want as long as they don’t shovel their cost of production on those who aren’t buying their product. If you can’t make stuff without being able to incorporate the total cost of the item to the end consumer, go find something else to make, or better yet, innovate.” The 5: For the record, while we may share it, it wasn’t originally our disdain.  “We depend on regulatory agencies in the U.S. to keep industries from polluting air, water and ground and OSHA to enforce workplace safety. Industry will not do it themselves.” “We depend on regulatory agencies in the U.S. to keep industries from polluting air, water and ground and OSHA to enforce workplace safety. Industry will not do it themselves.”The 5: This debate calls to mind the archeologists in the Black Swan case. Background: Our friends at Odyssey Marine have been trying to introduce a commercial model into the shipwreck salvage business. Among other roadblocks they face is the belief among entrenched and vested interests within the academic archeology community -- and in government in the U.S., Great Britain and Spain -- that a private “for profit” company can’t possibly practice good archeology. What, we want to ask, makes removing the profit motive and handing over the responsibility of preservation of artifacts or the maintenance of clean water and air to bureaucratic institutions a good idea? Are people who work for nonprofits and governments somehow more pure and honest than business and industry leaders?  “If you can stand one more note on the EPA/regulation/who’s going to protect us from big bad BP debate, how about an observation for the reader who’s having problems fathoming stupidity. “If you can stand one more note on the EPA/regulation/who’s going to protect us from big bad BP debate, how about an observation for the reader who’s having problems fathoming stupidity.“The BP disaster, on which Byron King kept us up-to-date with preternatural accuracy, was arguably the worst man-made environmental disaster ever. It was also probably one of the most amazing engineering feats ever. “The entire alphabet soup of federal meddlers did nothing to prevent the disaster, and once it occurred, they did nothing to fix it, except to helpfully promise to keep their boots on the necks of the only people with the capacity to solve it. They were forced by the extreme urgency of the situation to do the only thing they could possibly do to help -- stay out of the smart people’s way. “Credible reports say the problem of plugging a pipe spewing millions of gallons of unwanted goo was evidently solved by… a plumber! He knew one of the academic eggheads involved, who sneaked the plumber’s proposal up through the chain of command. With the government no longer ‘protecting’ us, idea to engineering to fabrication to completion took about a month. “Hold that thought. “Almost simultaneously, my local paper (The State Journal-Register, Springfield, Ill., July 24, 2010) ran an article called ‘Flush With Resources.’ In Lake County, one of the Chicago collar counties, a forest preserve had just received permission to use rainwater collected in a cistern to flush some toilets. After four years. It took that long to work through all of the various bureaucracies. The actual work took a couple of weeks. Oh, and they’re required to treat the rainwater and dye it. So people can flush it down a urinal. “Recap: With government standing down, it took a plumber one month to solve the greatest man-made environmental screw-up of all time. With government at full capacity, it takes four years for a plumber to hook up a few toilets with technology that was ancient when Jesus was born. “Fathom that.”  “I really love reading the Forecast, but please don’t use “Christ” in a commentary as you did in replying to that incoherent correspondent -- I know, I know, there are some whack jobs out there, and it is hard NOT to swear, but c’mon, guys, you are much better writers than that.” “I really love reading the Forecast, but please don’t use “Christ” in a commentary as you did in replying to that incoherent correspondent -- I know, I know, there are some whack jobs out there, and it is hard NOT to swear, but c’mon, guys, you are much better writers than that.” “Mr. Wiggin, I didn’t know that you were so religious! To emphasize your point in yesterday’s last comments, you called upon Christ and then the Almighty to help make your secular point. “Mr. Wiggin, I didn’t know that you were so religious! To emphasize your point in yesterday’s last comments, you called upon Christ and then the Almighty to help make your secular point.“I would be surprised if Christ or the Almighty lent any weight to your point. I just hope that he will help you use other words to make your points and treat those names with respect. Both those holy names are sacred for some of us.” The 5: You’re probably right. But I will point out only the first use of His name in vain was our own. We’ll do our best to be more respectful. Cheers, Addison Wiggin The 5 Min. Forecast P.S.: Ensco Intl., a respected builder and operator of offshore oil rigs, reported today they’ll buy out a competitor, Pride Intl., in a cash-and-stock deal valued at $7 billion. “I’m biased against such big acquisitions in general,” says Chris Mayer. “They rarely ever work out well for the acquirer’s shareholders who, most of the time, would’ve been better off without the deal. “Ensco is not the same company we bought,” Chris concluded. And, as such, told readers of Capital & Crisis to sell this morning… for 130% gains in two years. We bring this up for another reason. This is Chris’ third sell of 2011. The other two were for gains of 42% and 55%. And that’s added on to his 2010 track record -- nine new recommendations that gained an average 39%. Gains like that will offer ample protection against what Chris calls “the biggest scam in American history.” Details on how the scam works… and how you can protect yourself… in this presentation. | |

| Gold Daily and Silver Weekly Charts Posted: 07 Feb 2011 08:32 AM PST | |

| Posted: 07 Feb 2011 08:19 AM PST The value of gold may be plummeting but many gold stocks are clocking double-digit gains, according to Lawrence Roulston, the editor of the Resource Opportunities newsletter and an expert on mining investments. "It's definitely a buying opportunity. The fundamentals are strong, and we're seeing weaknesses in the prices on a short-term basis here," he says. In this exclusive interview with The Gold Report, Roulston explains why he loves the prospect generator model and why now is the perfect time to snub bullion and cozy up to mining equities. | |

| Hourly Action In Gold From Trader Dan Posted: 07 Feb 2011 08:10 AM PST | |

| Copper, Food Prices and Strength of the Global Economy Posted: 07 Feb 2011 07:51 AM PST The week begins with another record high for copper and the suggestion, from an unlikely source, that the Federal Reserve may be sowing the seeds of its own demise. First, our friend "Dr. Copper," as it's sometimes known. The red metal is used in so many things – electrical wiring, plumbing, computers, air conditioning, refrigeration, defibrillation, horseless carriages, etc. – traders use its demand, and consequently its price, to "diagnose" the global economy. At $4.59 a pound, the good doctor would seem to be saying the global economy is fit as a fiddle. Or…indicating the onset of fever. From its panic low around $1.25, the copper price has nearly quadrupled in just two years. "Emerging market demand has been the big driver behind industrial metals," Chris Mayer, editor of Capital & Crisis, discusses the more likely scenario in a recent MarketWatch article. Hence, "these metals would also seem the most susceptible to any slowdown." And what are the chances of that? Pretty significant. "The industrial metals as a group are unattractive simply because I believe that emerging market demand will slow," Chris says. "There is too much hitting these countries too fast." Like oil. It's back to $100 a barrel, using the yardstick of Brent Crude that's becoming the new world standard. And food. "All around the world, emerging markets have a big problem with rising food prices," Chris wrote his Capital & Crisis readers last month. And that problem's set to get worse, judging by this development. The US Grains Council forecasts China's imports of corn are set to explode sevenfold in just a year – from 1.3 million metric tons in 2010-11 to 9 million in 2011-12. Nine million tons would double the previous record of 4.3 million tons set 15 years ago after a disastrous crop. If true, the high numbers will be driven by three factors:

"In China, people spend 50% of every incremental dollar on food," Chris continues. "In India, it's more like 70%. So the rising price of food is felt more keenly in these markets" than we feel it in the West. Prices are rising faster in both of those markets. "In India, food prices are up 18% and at their highest level in a year. China has the same problem. Prices rose 5% in November alone. "All around the world, emerging markets have a big problem with rising food prices. Indonesia's president is trying to get people to grow their own chili peppers. And the South Korean government recently released emergency stores of cabbage, pork, mackerel, radish and other staples. "The emerging markets boom is not going to go far when it faces a food crisis. And if China and India and the rest slow down, it's going to have a huge impact on all those stocks and commodities most sensitive to emerging market growth." We'll be watching both food prices and copper to see if and when this fever turns to chill. Addison Wiggin Copper, Food Prices and Strength of the Global Economy originally appeared in the Daily Reckoning. The Daily Reckoning recently published an article looking at the impact of quantitative easing. | |

| Why it is still important to have gold in your portfolio Posted: 07 Feb 2011 07:36 AM PST by David Levenstein … But, no matter your personal investment choice and no matter what your stock broker tells you, every single investment portfolio should hold a percent of gold and silver. And, when it comes to gold, it is important to understand the dynamics of this precious metal. … It has everything to do with evaluating current economic and geopolitical trends as these are two main issues that will likely impact on the gold price in the next few years.

… When we look deeper and see that governments, especially the USA, have been debasing their currencies by their expansionary monetary policies we should understand the ramifications of this. What this has done and will continue to do is to make the US dollar weak. In the last ten years the US dollar has already lost more than 30% of its value when compared with other currencies. But, ultimately, since the US dollar is the reserve currency of the world this devaluation will drive the prices of commodities higher. Now, not only do governments have to find a way to stimulate their economies, they also have to find a way to deal with the burgeoning debt as well as high unemployment. But, in addition, as commodities become more expensive, the rate of inflation is going to increase. And, when these higher prices affect the price of staple foods of many poorer nations, we can expect to see unrest amongst the population. So, now in addition, to huge national debt, currency wars, slow GDP growth, high levels of unemployment, increasing inflation we are also going to see more geopolitical turmoil. … Peter Munk, chairman of the world's largest gold producer Barrick Gold, couldn't have said any better when he spoke in an interview at Davos recently. He said, "If you are a utopian, if you believe the problems of currency, the problems of terrorism, the problems of unrest around the world will all be resolved by the end of the year, then gold would have a difficult path. If you believe like I do that we bought ourselves a temporary peace from the panic of last year and the year before, [and] that the fundamentality of the problems are long term still issues, then your attitude will be a bit more positive toward gold." [source] | |

| Posted: 07 Feb 2011 07:08 AM PST Ignoring real estate, most people invest their hard earned money in paper things. Stocks, bonds, annuities, insurance - it’s all paper, and it sits nicely in our bank accounts and shows up on our computer screens. Halfway across the world, investors in China and India have never trusted paper investments as a store of value - and they’re converting their hard earned paper money into gold and silver bullion. Not that this is anything new. It isn’t. But the scale and speed with which they are accumulating precious metals IS new, and it’s driving the fundamentals that we believe will lead to higher prices in 2011. Demand for the metals is literally exploding in Asia, and it’s creating shortages of physical bullion around the world. The statistics are extraordinary. China, the world’... | |

| For week ending 04 February 2011 Posted: 07 Feb 2011 06:44 AM PST Technically Precious with Merv Gold bottomed and looks to be moving higher BUT the volume is just not there to be encouraging. The next week or so will tell us if it is going towards higher levels or if the downside will continue. Time constraints and no chit chat this week, just the facts. GOLD LONG TERM Well, the P&F advice to wait for the $1320 support to be broken, with a move to $1305, before going P&F bearish is working, so far. The final support is still holding so we'll keep our fingers crossed hoping that now we can go into higher ground. With the turmoil in the Middle East I would have expected a more exuberant gold move but it does what it has to do to confuse most traders. My normal indicators are still giving us a positive reading. Gold bounced off its long term moving average line and remains above the line. The moving average line itself is still in a positive trend. The long term momentum remains in its positive zone although it has... | |

| Monday Market Movement - Where Else? Posted: 07 Feb 2011 06:36 AM PST Monday Market Movement - Where Else?Courtesy of Phil of Phil's Stock World

I read the news today, oh boy... I need to remember not to do that when I'm trying to get bullish. Fortunately, we already grabbed a new set of "5 Trades that Make 500% in a Rising Market" to follow up on our original set, now just about 2 months old, that have already hit their cumulative 5,000% target gains in this totally ridiculous, always rising market. We may complain about HOW the game is rigged but if practically every single roll of the dice comes up seven or eleven - you can't blame us for betting on the trend. As the United States of Zimbabwe barrels forward on Ben Bernanke's hyper-inflationary crazy train - we will go along for the ride - just don't be surprised if we jump out before the rest of the riders hit the final terminal, with terminal being the operative word. Take silver (please) as an example. There are now $102 Billion tied up in metals ETFs and the silver ones now hold 4 full years of US production. This is not including stockpiles that have been added to Central Banks and private investors (JPM is rumored to be one) and it makes us wonder - what is the exit strategy. How do you sell 4 years worth of production in a single year, or in two years? Do you try to undersell the miner's production costs (for silver, that would be about $5) to get them to shut down production while you unload or do you form some kind of cartel that controls the flow of silver for the next 20 years? Gold is just as bad with speculators now holding more gold than all but 4 of the World's Central Banks. 2,028 metric tons of gold, worth $88Bn are now held by ETFs. They accounted for 21% of all global demand last year and, despite hedge funds (the "smart money"?) cutting their positions by 42% since October, the net long float of futures contracts is STILL 151,000, almost 3 times the 18-year average. That, my friends, is a lot of bull! Investing into commodities, like high-flying stocks, is easy. The trick is getting out. That's why we've been using short-term bearish bets to cover long-term bullish positions - you never know when this ride will come to and end and there's no guarantee that we'll be able to get out with our bullish trades intact. Still, the bullish trades we continue to take in our aggressive portfolios are still inflation-based as that does seem to be the story that is not going away... We were into gold since March of 2009, when we set a $875 entry target in our public article - "Spinning Straw Trades Into Gold." Gold hit our $875 entry point ($859.90 was the low) and we rode that baby to the moon - or at least to $1,200 in October, when we decided we were on the boarder of greed and led the charge of the hedge funds out of the metal. I have since been looking for a pullback to $1,150 for a re-entry but, at this point, I'll settle for $1,200 - but we might not even get that the way our Central Bankers have been talking ("Mo Free Money!"). That's why you've gotta love those "Secret Santa's Inflation Hedges" which, as noted in the weekend post, is also way outperforming our expectations although, of course, not on the level of our more-leveraged "Breakout Defense" plays. The unusual "up every day" aspect of this market is KILLING our short-term bearish plays. We like to see SOME corrections - just to let us know how firm the bottoms are but no such luck in SUPER Market, which is up, up and away almost every day - but especially on Mondays. Does that mean it's time to give up and go 100% bullish? No, that would be dumb. As I said over the weekend, this is the same pattern we went through last December - first leading off with some aggressive bullish plays, like our Breakout Defense Trades and then layering in more upside, inflationary trades like the Secret Santa set - in addition, of course to our usual, sensibly-hedged, long-term positions we like to base on the actual fundamentals of the companies we invest in (I know - what is that?). So if we are out of gold along with 42% of our hedge fund buddies then who is buying? If we are (and I hope we are!) the "smart money," who is the "dumb money" that has taken gold 10% higher than our exit? One candidate I see is Hosni Mubarak and other nervous World "leaders" who are shifting their assets to something more "transportable" while the peasants mass outside their gates, holding signs like "bread or heads."

If we are going to try to get more bullish - we need to know who our co-investors are so we can contemplate where they are likely to begin stampede for the exits but, as I noted last week - the dumbest money on the planet has the deepest pockets of them all - our beloved Uncle Ben and his multi-trillion dollar printing machine. That machine can keep spitting out bills forever as it has a hose on the back end that sucks the money right back out of our bank accounts through currency devaluation and inflation. As Bloomberg states: "The Federal Reserve’s Treasury purchases already have succeeded in driving investors to junk bonds and stocks. Now, policy makers are focusing on benchmark government securities, helping contain rising yields that set rates on everything from corporate debt to mortgages. More than 40 percent of the government bonds the Fed bought in January for its so-called quantitative easing were auctioned in the previous 90 days, up from 20 percent in December and 15 percent in November, according to Bank of America Merrill Lynch. " Oops, sorry - trying to stay bullish! - Phil Top chart by Gordon T. Long Try out Phil's Stock World with a 20% discount here. | |

| LGMR: Silver-Price Backwardation Points to "Heavy Physical Buying" Posted: 07 Feb 2011 06:05 AM PST London Gold Market Report from Adrian Ash BullionVault Mon 7 Feb., 08:20 EST Gold "Goes Quiet" as US Futures' Position Hits 18-Month Low; Silver-Price Backwardation Points to "Heavy Physical Buying" WHOLESALE PRICES to buy gold and physical silver bullion were unchanged on Monday morning in London, holding steady with commodity prices as global stock markets rose. With the US Treasury slated to sell $72 billion in new debt this week, major-economy government bond prices slipped, pushing 10-year UK gilt yields up to a 9-month high ahead of Thursday's Bank of England decision on interest rates. The Bank of England last changed its key "Bank Rate" in March 2009, cutting the cost of loans to commercial banks to a record low of 0.5%. Since then, prices to buy gold have risen by more than one-quarter against the Pound Sterling, rising 17% in real, inflation-adjusted terms. Cash held in UK bank-deposit accounts has meantime lost 6.5% of its real purchasing power. "Gold is go... | |

| Greasing the Wheels of Oil Production Posted: 07 Feb 2011 06:00 AM PST There's a common theme to my efforts on behalf of my Outstanding Investments subscribers. Yes, I like companies that control real resources like oil, natural gas, copper, gold, silver, etc. I look for the basic resource value. But beyond these basics, I look for companies that control resources and have the technology to extract them and add value. A company like Venoco (NYSE:VQ) is just one intriguing example. Venoco is applying rock-fracturing technology to California's Monterey Shale. If the company accomplishes what it aims to do – increase oil recovery from shale – there's the strong potential for Venoco to transform its shale acreage into a recoverable billion-barrel oil resource. Or look at Talisman (NYSE:TLM). Here's a company that's not just leading the charge to fracture shale formations for the shale gas, but also working with South African refiner Sasol to turn "stranded," low-value natural gas into high-value liquid fuel. In other words, Talisman is working to add value at the upstream stage and capture that value for its bottom line – and, of course, for the shareholders. Over and over in Outstanding Investments, I have highlighted resource technology companies like Schlumberger (NYSE:SLB), Halliburton (NYSE:HAL) and Baker Hughes (NYSE:BHI). These global oil field service giants provide the essential technological foundations of modern-day energy extraction. If any of these three companies simply vanished overnight, the world energy system would start to break down by the following morning. Without their technology – and their corporate ability to integrate systems of systems – the world would quickly revert to an energy state of the 1850s or so. I should add that you can't just pigeonhole these guys. It's way too glib to say that Schlumberger is a great wireline company, Halliburton is a great well cementing company and Baker Hughes is a great drill bit company. Yes, each statement is true, as far as it goes. But each company also offers a full line of energy-development technology, with the process thinking and systems management to make it happen. Beyond just the extraction phase, you need to think in terms of upgrading the products into something else – product transformation. For example, I've held Weyerhaeuser (NYSE:WY) in the Outstanding Investments portfolio for a couple of years. No, it's NOT that I'm playing on the possibility of a housing recovery, although that would doubtless be good for a "tree growing company" like Weyerhaeuser. It's more that I like Weyerhaeuser because it controls large swaths of biomass – that is, "trees" and all the other stuff that comes from growing and harvesting trees. I mean lumber, of course, plus bark, chips, sawdust and everything else that comes out of those vast swaths of forestland up in Washington, Oregon, etc. So Weyerhaeuser controls biomass – but now what? Weyerhaeuser is partnered with no less than oil giant Chevron to develop – "leapfrog" is more like it – new technology to turn this biomass into something that a refinery can process. This is far beyond the primitive idea of using corn for ethanol. Really, burn your food and deplete the agricultural soil just for motor fuel? (That's why I call it "deathanol"). So Weyerhaeuser has the biomass – the fundamental raw material. Chevron has the refining and marketing power. Now all they need is the correct technology to turn wood chips, etc., into a feedstock for refining fuel. It's going to happen in a big way, and likely within five years or so. So when you're looking around for hi-tech investments, don't forget to look around for the world's cutting-edge energy service companies. Regards, Byron King Greasing the Wheels of Oil Production originally appeared in the Daily Reckoning. The Daily Reckoning recently published an article looking at the impact of quantitative easing. | |