saveyourassetsfirst3 |

- China in the Year of the Rabbit: A Change in Government Policy Can Power Markets Higher

- Junior Resource Market Will Soon Begin Heating Up

- What the Action in 10-Year Treasuries Is Telling Us

- Bullion Banks Get Smaller in COMEX Silver Futures

- Forget Gold Bullion! Those in the Know Own Silver & Gold Miner Warrants

- NIA VIDEO Explains Why Economic Conditions in U.S. Will Result in $5,000 Gold and $500 Silver by 2015

- JP Morgan Accepts Gold Bullion as Collateral - Silver Backwardation to Lead to Short Squeeze?

- Silver Breaks its Golden Shackles

- Investors are making a huge bet on higher gold and silver prices

- How hyperinflation could come to America

- Bearish on Gold, For the Wrong Reasons

- Gold

- View From the Turret: The Beat Goes On

- The New $100 Bill Will Usher In A NEW Gold Standard

- Explosive Youth

- Forget Gold Bullion! Those in the Know Own Silver and Gold Miner Warrants

- Gold Price Recovers as Safe Haven Demand returns

- Gold lenders of last resort

- Its Super Gold Sunday!

- It’s Super Gold Sunday!

- South Australian Gold mining

- Silver At Near Zero Contango- "A cada chancho le llega su Sabado"

- The Past Week In Gold

- Forget Gold Bullion! Those in the Know Own Silver $ Gold Miner Warrants

- Inflation or Deflation? That is the Question

- Governments Struggle to Stand Still

- Newmont Buys Out Fronteer, What’s Next

- RCM- $20 fiat for $ 20 silver coin .999

- Ashley's Tragic Story: A Heartbreaking Example Of How The Economic Collapse Of America Is Destroying Lives

- Gene Arensberg : Full blown backwardation in Silver

| China in the Year of the Rabbit: A Change in Government Policy Can Power Markets Higher Posted: 07 Feb 2011 02:42 AM PST Frank Holmes submits: Happy New Year 4708!

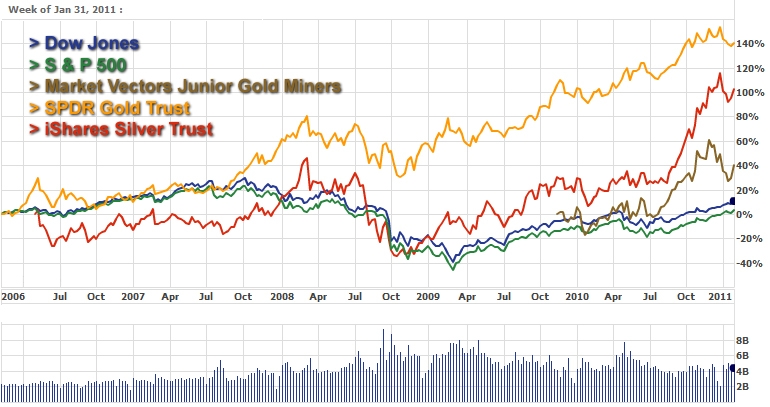

According to the Chinese calendar, it’s the Year of the Rabbit. The leading Asian brokerage firm CLSA reports the Rabbit will “wrest the reins from the decidedly unpleasant and erratic Tiger that’s been tossing and turning the markets over the past 12 months.” We all could appreciate a respite from extreme volatility. Chinese New Year is the longest and most important of the traditional Chinese holidays. It is celebrated around the world wherever there are significant Chinese populations. Customs vary widely but traditionally include an outpouring of gift giving, decorating, feasting, forgiveness and wishing for peace and happiness for everyone. This is the fourth stage in the seasonally strong period for gold, which began back in August with Ramadan. Junior Resource Market Will Soon Begin Heating Up Posted: 07 Feb 2011 02:02 AM PST It's hard to believe we have come so far. Since the crash of 2008, the markets have raged on, taking everything along to the upside. If you look at prices over the past years since the crash, everything has climbed dramatically - especially the precious metals sector which we have been extremely bullish on (see Playing Ball With Resources, April 2009). While there have been pull-backs, those who have been bearish about this climb have lost an amazing opportunity to profit. Just take a look at the following price chart comparison [click to enlarge]: Since 2008, we have been placing big bets on gold, silver, and the junior miners. One look at their performance relative to the Dow Jones and S&P 500 and you can see why it has been an extremely successful year for our readers who made bets on the Big Three. But can this last? Despite the slight pullback, especially in the junior commodities market, I think it will. While I am an investor by nature, I can't help but see the price patterns that urge me to trade and buy on every possible dip and rebound. These trading patterns remind me of the lessons taught by one of the greatest traders of all time, Jesse Livermore. The shocking similarities presented will shock you, so read on. Legendary trader Jesse Livermore once said that we should trade with the trend - buy in a bull market and short in a bear market. It was during the panic | ||

| What the Action in 10-Year Treasuries Is Telling Us Posted: 07 Feb 2011 01:48 AM PST ETF Prophet submits: By Skill Analytics I’ve been a big fan of watching the 10-year yield for some time – and I think what is happening right now is very interesting. If you think that stocks are overbought and due for a pullback (something that I also believe), it is hard to square that with what is happening in the 10-year treasury yield right now. So let’s take a look: (Click to enlarge) In the top pane we have the 10-year treasury yield. As you can see, we’ve had a breakout above a forming base which would seem to indicate that yields may be heading higher this year. The bottom panes show the relative strength of different markets such as SPY/IEF, EEM/EFA, SPY/DIA, SPY/IWM, SPY/QQQQ and SPY/GLD. What’s apparent here is that large cap strength continues to grow across the board, perhaps indicating a large shift in assets into large caps stocks and into developed markets vs. emerging markets. We can also see that while SPY is outperforming DIA, that outperformance is in decline. Overall, I think what we’re seeing here is a shift in moving away from risky assets to less risky assets. GLD continues to underperform although I am watching it closely right here as it is still, technically, in a bull market. Commodities – particularly copper (JJC) and sugar (SGG) (not shown here) continue to do well. (Click to enlarge) Now let’s take a look at $TNX on a longer time frame – above, monthly back to 1990. The downward Complete Story » | ||

| Bullion Banks Get Smaller in COMEX Silver Futures Posted: 07 Feb 2011 01:43 AM PST HOUSTON – Keeping tabs on what the largest, best funded and presumably the best informed commercial futures traders are doing opens a window into their expectations for the price of gold and silver ahead – we think. But what happens when these long-time veteran traders do the unexpected? | ||

| Forget Gold Bullion! Those in the Know Own Silver & Gold Miner Warrants Posted: 07 Feb 2011 01:42 AM PST The world of warrants is the undiscovered constellation in the universe of securities. Long term (LT) warrants shone brightly in 2009 - up 242% in U. S. dollar terms - and were up a further 91% in U.S. dollar terms in 2010. The warrants world consists of only 135 stars (i.e. constituents) of which only 32 are associated with 29 commodity-related stocks that have sufficient brightness (i.e. 24+ months duration) to warrant (the pun is intended!) the attention of earthly investors. Words: 1581 | ||

| Posted: 07 Feb 2011 01:42 AM PST By 2015 people will be lining up to buy gold at $5,000 per ounce and silver at $500 per ounce as hyperinflation takes hold. Middle-class Americans will be spending at least 30% to 40% of their income on food. As such, if you don't have enough money to accumulate physical gold and silver at today's [...] | ||

| JP Morgan Accepts Gold Bullion as Collateral - Silver Backwardation to Lead to Short Squeeze? Posted: 07 Feb 2011 01:31 AM PST | ||

| Silver Breaks its Golden Shackles Posted: 07 Feb 2011 12:40 AM PST Since September 2010 silver has broken its golden shackles. The algorithmic trading that kept the price of silver subdued for seven years has been completely annihilated. On Friday silver closed in complete backwardation on the Comex. Spot silver closed at $29.075/oz while FEB 2011 closed at $29.064/oz and DEC 2015 closed at $29.026/oz. I believe this is the first time in history that this has happened. Silver traded in backwardation between the spot price and futures contract up to one year out during the blatantly manipulative precious metals bashing of January, but now the entire futures structure is in backwardation. This is a sure sign there are shortages of silver because it means that buyers will pay a premium for silver delivered sooner rather than later. | ||

| Investors are making a huge bet on higher gold and silver prices Posted: 07 Feb 2011 12:10 AM PST From Bloomberg: After the worst January for precious metals in two decades, investors still have a $102 billion bet on higher prices, hoarding more gold than all but four central banks, and more silver than the U.S. can mine in almost 12 years. The five analysts ranked by Bloomberg as the most accurate over two years expect silver to rise as much as 23 percent before the end of 2011 and gold 20 percent, the median of their estimates show. UBS AG predicts the strongest industrial demand for silver since at least 1990 and the second-highest sales of exchange-traded gold products on record. The decade-long surge in gold attracted fund managers from John Paulson to George Soros and is now spurring central banks to add to their reserves for the first time in a generation. Once written off as demand for photographic film waned, silver found new uses in everything from solar panels to plasma screens, making it the precious metal most used in industry. As stocks rose 9 percent and Treasurys returned 67 percent since the end of 2000, gold surged fivefold and silver sixfold. "I had to chuckle when I saw reports that it was over for gold," said Michael Cuggino, who helps manage $10 billion at Permanent Portfolio Funds in San Francisco, and has about 20 percent of his assets in gold. "Some investors have taken money off the table after a significant run-up in 2010. If you look at the macro environment, the instability around the world, the worldwide currency devaluation, these factors all bode well." The Standard & Poor's GSCI Precious Metals Index dropped 6.5 percent in January, the most for the month since 1991. Gold traded in London retreated 6.2 percent and silver 9.3 percent. Monthly Slumps Gold has had bigger monthly slumps four times in the last decade and plunged 34 percent from March to October 2008, before jumping 47 percent in the following four months. Silver posted larger monthly declines nine times over the same period and plummeted 57 percent over three months in 2008. It rallied 73 percent in the next four months. Silver will climb as high as $36 an ounce this year, from $29.2025 now, and gold will reach $1,620 an ounce, from $1,347.40, according to the Bloomberg survey of analysts. Investors in exchange-traded products backed by gold own 2,028 metric tons, worth $88 billion, even after cutting their holdings by 4.1 percent since December, data compiled by Bloomberg show. ETPs trade on exchanges, with each share representing metal held in a vault. They accounted for 21 percent of investment demand last year, according to GFMS Ltd., a London-based research firm. Silver-backed ETPs fell 4.4 percent to 14,511 tons worth about $14 billion since December. CFTC Data While hedge funds cut their bets on higher gold prices by 42 percent since October, they still hold a so-called net-long, or bullish, position of more than 151,000 futures contracts, almost three times the average over the last 18 years, according to data from the Commodity Futures Trading Commission. Central banks, the biggest owners, will add to reserves for a third consecutive year in 2011, the first time that's happened since the 1970s, Deutsche Bank AG predicts. The risk now is that an improving economic outlook will cut the allure of precious metals as a wealth protector. The MSCI World Index of equities has risen 4.2 percent since the start of January, the best start to a year since 1998. The International Monetary Fund on Jan. 25 increased its forecast for 2011 global economic growth to 4.4 percent, from 4.2 percent. "Gold is going quiet," said Pete Sorrentino, who helps manage $13.8 billion at Huntington Asset Advisors in Cincinnati, Ohio. "It's good and healthy and characteristic of gold's stair-step rally. We'll see a little more downward pressure and then begin to trade sideways for an indeterminate time." SEC Reports Gold accounts for 5 percent of the company's $98 million commodity fund, compared with 15 percent in mid-December. Another risk is the biggest investors, whose holdings are scheduled to be reported by the U.S. Securities and Exchange Commission on Feb. 14, according to Credit Suisse Group AG. Prices will likely drop and volatility increase should quarterly data show any of them cut their position, the bank said in a report Jan. 28. Investors last disclosed their stakes as of Sept. 30 in filings in November. Paulson & Co. is the largest investor in the SPDR Gold Trust, the biggest ETP backed by gold, according to data compiled by Bloomberg. The 7.8 percent stake was worth $4.03 billion on Sept. 30 and would be valued at $4.15 billion now. Armel Leslie, a spokesman for Paulson, 55, declined to comment. Soros Fund Soros Fund Management LLC, which manages about $27 billion, also listed the SPDR Gold Trust as its biggest holding in a Nov. 15 filing. Soros described gold at the World Economic Forum's January meeting in Davos, Switzerland, last year as "the ultimate asset bubble." In a Nov. 15 speech in Toronto the 80-year-old said conditions for the metal to keep rising were "pretty ideal" and at this year's Davos forum said the boom in commodities may last "a couple of years" longer. Michael Vachon, a spokesman for Soros, declined to comment. The precious metals most used in industry outpaced gold since the U.S. economy returned to growth in the third quarter of 2009. Palladium rose threefold, silver more than doubled and platinum jumped 57 percent, compared with gold's 46 percent gain. Platinum and palladium are used in catalytic converters for cars and trucks. The London Metal Exchange index of industrial metals from aluminum to zinc jumped 86 percent. Industrial demand for silver, excluding photography, will rise 18 percent to 478 million ounces this year, according to UBS, Switzerland's biggest bank. Investors will buy 450 tons of gold through ETPs this year, the Zurich-based bank forecasts. Mining Index The 16-member Philadelphia Stock Exchange Gold and Silver Index, led by Freeport-McMoRan Copper & Gold Inc. and Barrick Gold Corp., fell 8.5 percent this year as metal prices dropped. All but one firm in the mining index is forecast to report an increase in annual earnings, according to the median of analyst estimates compiled by Bloomberg. Higher silver prices hurt the profit of Rochester, New York-based Eastman Kodak Co. last year and are a "significant headwind" in 2011, Chairman Antonio M. Perez said on a conference call Jan. 26. Agfa-Gevaert NV, Europe's biggest maker of healthcare imaging systems, said in a statement Nov. 15 that its Agfa HealthCare division was increasing prices for all imaging film products because of higher raw-material costs. Bullion's slide from a record is attracting buyers. "We struggle to recall a month when our total physical sales have been stronger," led by Chinese gold demand, and turnover on the Shanghai Gold Exchange in January was a record, Edel Tully, an analyst at UBS, said in a report last week. "Elevated physical demand usually signals an impending bottom," she said. Silver Coins Silver buying is also accelerating. One-ounce silver coin sales from the U.S. Mint jumped to a record last month. Ex Oriente Lux AG, based in Reutlingen, Germany, will start adding the metal to its U.S. ATMs that sell gold in banks, shopping centers, and jewelry stores this month. Investor demand for precious metals accelerated after the collapse of Lehman Brothers Holdings Inc. in September 2008 and as governments and central banks led by the Federal Reserve pumped more than $2 trillion into the world financial system. That stoked concern that inflation will accelerate. The Fed cut interest rates to near zero in December 2008 and have kept them there since and Greece and Ireland got bailouts. "At the moment, people still have fear about inflation, about the debt crisis, and I don't see any resolution to the debt crisis when the Fed is buying debt again and again," said Thorsten Proettel, an analyst at Landesbank Baden-Wurttemberg in Stuttgart. "Most people will be loyal to their investment because the fear doesn't evaporate." To contact the reporters on this story: Nicholas Larkin in London at nlarkin1@bloomberg.net; Pham-Duy Nguyen in Seattle at pnguyen@bloomberg.net. To contact the editors responsible for this story: Claudia Carpenter at ccarpenter2@bloomberg.net; Steve Stroth at sstroth@bloomberg.net. More on gold and silver: This is fantastic news for gold and silver investors The No. 1 reason you must own gold and silver now Why every hard-working American should be loading up on silver | ||

| How hyperinflation could come to America Posted: 07 Feb 2011 12:08 AM PST From Gonzalo Lira: For better or worse, in the financial blogosphere, I'm "Hyperinflation Boy." ... To begin: Last August 23, I posted an article called How Hyperinflation Will Happen. I guess the piece must've struck a nerve, because between my site and a couple of other places where it was reprinted, it got over half a million page views. My basic thesis was simple: If there is another financial crisis, I argued that capital would not flee to Treasury bonds. Instead, it would flow to commodities. And this spike in commodity prices would lead to dollar hyperinflation. ... Then a couple months later, on October 28, I wrote a follow-up piece, called Signs Hyperinflation Is Arriving. In this follow-up post, there were two noteworthy points: One, I backtracked a bit on the issue of a Treasury bond panic. And two, I made some hard-and-fast predictions as to the timing of hyperinflation of the dollar... Read full article... More on hyperinflation: Buy gold, silver, and tiny bottles of scotch Williams: Hyperinflation could happen sooner than anyone expects Market legend Vic Sperandeo: U.S. is nearing the hyperinflation "breaking point" | ||

| Bearish on Gold, For the Wrong Reasons Posted: 06 Feb 2011 11:32 PM PST | ||

| Posted: 06 Feb 2011 11:14 PM PST | ||

| View From the Turret: The Beat Goes On Posted: 06 Feb 2011 10:42 PM PST

Like it or not, today's investors are perfectly willing to shrug off macro risks like rising food costs, EM inflation, European debt and high unemployment. And so as traders, we tread that fine line between understanding the danger signals, while still capturing profits in the now. The Mercenary Trader book is now net long. We continue to ride selective bullish trends for as long as they remain intact and allow our profits to compound. Our exposure isn't focused on the crazy, speculative junk that has become frothy and unpredictable. But there are a number of bullish areas that such as precious metals, traditional and alternative energy, and infrastructure, which offer attractive setups. These are areas where fundamental, technical and sentiment metrics align – giving us the best shot at success while keeping our risk firmly in check. This doesn't mean we're avoiding the bearish side all together. An important part of the Mercenary Model is to counterbalance positions – especially during times of relative uncertainty. While each trade should stand on its own in terms of expected profit, we look for opportunities to balance existing net exposure – and reduce the overall risk of a broad market shift having a negative effect on our overall returns. Heading into this week, we have a few key pending short positions along with a roster of bearish possibilities. These pending shorts will only be entered as price action confirms. But setting up these trades ahead of time ensures that we are ready to respond immediately if the overall shift happens quickly. So let's look at some of our key trades heading into this first full week in February… Natural Gas Producers Soldier On Natural gas producers have been trending higher for a number of months now – thanks to strong production, robust demand, and stable natural gas prices. In the US, an expanding pipeline grid creates a more efficient market, and a more predictable business environment. At the same time, rising oil prices leaves natural gas as a more economically attractive opportunity. Investors are once again embracing the long-term concept of more gas fired electricity plants, and widespread adoption of gas-powered vehicles. We have a number of individual natural gas opportunities we are tracking along with a broad ETF that covers the group. On December 1, 2010 we took a position in the ISE Revere Natural Gas ETF (FCG) as it broke out of a three-week bullish consolidation. Within four trading days, the ETF hit our Half Profit Target (HPT) and we booked gains on the first half of our position. Since that time, we have periodically tightened the risk point on the second half, while the group continues to push methodically higher. Today, FCG represents our most profitable position with plenty of room left to run, and a risk point that ensures an attractive profit whenever the trend is complete. All of our trades reflect actual capital in play and are presented real-time in the Mercenary Live Feed. Precious Metals Once Again Provide Safety Last week we noted a renewed interest in precious metals after the group spent roughly 2 months retracing previous gains. The expectation was that a higher fear premium with the Egyptian unrest would cause long-only managers to seek areas of safety. This week, the underlying drivers have shifted a bit, but the trend remains intact. Precious metals are still attracting institutional capital, but it appears that speculation rather than defensive posturing is driving the renewed interest. The Market Vectors Junior Gold Miners (GDXJ) rebounded sharply last week and is now above all key moving averages. Junior miners are more leveraged to the price of gold, and typically hold more risk due to production uncertainty and significant debt loads. If investors are favoring the junior miners over more established players, it indicates more willingness to take on risk – which has significant implications for other sectors as well. We will be keeping a close eye on the dynamics here this week with the possibility of adding more speculative exposure to our current exposure. By the same token, silver prices have experienced less of a drawdown than their gold counterparts. Now that precious metals are back in play, the iShares Silver Trust (SLV) may be actionable this week. The ETF held firmly above the 200 EMA last month, and has been more quick to rebound. One of the major fundamental arguments for silver centers around the fact that silver is actually consumed in various industrial processes, while gold serves less of a functional purpose. A few months ago we profiled three attractive silver miners. These individual names could set up promising trades once again, but this week the opportunity looks better for SLV.  Hotels / Casinos On Tilt? It's a fairly bearish sign when a high-multiple growth stock reports strong earnings – and then promptly trades lower. Thursday, after the close, Las Vegas Sands (LVS) reported what was lauded as a "strong" earnings report, thanks to healthy growth in its emerging market operations. From the Wall Street Journal:

Despite the breathless reporting, investors sold the news, sending LVS down a "robust" 8% on the day. To justify the current PE of $46, the company is going to have to keep putting up impressive numbers for quarters to come. Friday's action indicated that risks may finally matter – and further weakness could set up an attractive short opportunity. MGM Resorts International (MGM) is another casino recovery story that appears to be topping out. The company is still posting quarterly losses as emerging market strength fails to offset weakness in its core Las Vegas operations. With a debt to equity ratio listed at 335%, there is a significant amount of embedded risk here. If the company is unable to grow out of this financial hole, investors could face nasty issues like debt restructuring and ownership dilution. These issues are not pressing today, but traders could certainly accelerate the selling well in advance. A break of recent lows would also take out the key 50 EMA. With negative earnings, excessive debt, and difficult industry trends, any further weakness would likely trigger a mass exodus. Shipping Struggles As oil prices continue to find support, the effects are beginning to hit the broad economy. Last week's Chart Focus pointed out the failure of the transports to confirm strength in the Dow and S&P. This week we've got our eye on Fedex Corp. (FDX) which has already broken a key support area near $92. The next leg lower would take the stock below the 200 EMA and also reverse a significant breakout from late November. Considering the challenging environment, and a recent slowdown in earnings growth, Traders could quickly bail on this vulnerable name, sending the stock into the mid 80′s or eventually much lower. A couple hours before the open, the futures are modestly higher. Traders appear encouraged by relative calm in Egypt and the economic calendar for the week doesn't present any major risks to the bull camp. We're locked and loaded with our net-long exposure in play and a number of attractive short candidates in our back pocket. The beat goes on and we're positioned accordingly. Trade 'em well this week! | ||

| The New $100 Bill Will Usher In A NEW Gold Standard Posted: 06 Feb 2011 10:00 PM PST | ||

| Posted: 06 Feb 2011 06:00 PM PST

Mercenary Links Roundup for Sunday, Feb 6th (below the jump).

02-06 Sunday

| ||

| Forget Gold Bullion! Those in the Know Own Silver and Gold Miner Warrants Posted: 06 Feb 2011 05:46 PM PST | ||

| Gold Price Recovers as Safe Haven Demand returns Posted: 06 Feb 2011 05:37 PM PST | ||

| Posted: 06 Feb 2011 05:30 PM PST | ||

| Posted: 06 Feb 2011 05:20 PM PST | ||

| Posted: 06 Feb 2011 04:31 PM PST While Ben Bernanke says we are not seeing any inflation, I think most of us know that is a load of BS as other countries like Egypt see food prices surging. Over the past couple years everyone has been talking about how inflation will soon start and that has been one of the main driving forces for higher precious metals prices. As we all know the market does the opposite as to what the majority of investors are doing. And while everyone has been buying metals in anticipation of inflation, I find it amusing how inflation for the first time is clearly presented on TV (Egypt issues) and we see gold and silver trading lower than they were a month ago. Seems like the buy the rumor sell the news lives is playing out. But the question everyone is starting to ask is how far will the metals correct? Personally, I do not think they will drop much further but I do think it's going to take 6-8 months before we see new highs in both gold and silver. They have had a nice run but now it looks as though they may cool off for a while. We could see some strength in the dollar for a little while and that should keep some pressure on metals even though inflation is clearly starting to show up around the world. Then the metals should start to climb the wall or worry again. Below I are my updated charts on gold, silver and the gold miners index. Not much has really changed from last week analysis other than both gold and gold miners are getting deeper into a resistance level forming a bear flag pattern. Gold Daily Chart Gold is working its way up into a key resistance level and forming a possible bear flag. Silver Daily Chart Gold Miners Daily Chart Index | ||

| Posted: 06 Feb 2011 04:00 PM PST | ||

| Silver At Near Zero Contango- "A cada chancho le llega su Sabado" Posted: 06 Feb 2011 02:11 PM PST "for every pig his Saturday arrives... the day he is slaughtered" Well, it wasn't very long before this was going to happen. Near Zero contango, its seems everyday more and more 'rare' and unexplainable events are happening in the physical markets. Zero Contango means that there is not ONE futures contract higher than the current spot price. Add the fact we are in backwardation is incredible. This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 06 Feb 2011 01:38 PM PST 2/05/2011 GLD – new buy signal this week. SLV – new buy signal this week. GDX – new buy signal this week. XGD.TO – new buy signal this week. Summary Disclosure | ||

| Forget Gold Bullion! Those in the Know Own Silver $ Gold Miner Warrants Posted: 06 Feb 2011 01:24 PM PST

The world of warrants is the undiscovered constellation in the universe of securities. Long term (LT) warrants shone brightly in 2009 – up 242% in U. S. dollar terms - and were up a further 91% in U.S. dollar terms in 2010. That's correct: 242% in 2009 followed up with a further 91% in 2010! The warrant world consists of only 135 stars (i.e. constituents) of which only 32 are associated with 29 commodity-related stocks that have sufficient brightness (i.e. 24+ months duration) to warrant (the pun is intended!) the attention of earthly investors. - 55% increase in a basket of mid- and small-cap miners as represented by the GDXJ; - 18 (81%) are miners The breakdown of the months until expiry for each of the 25 warrants is as follows: - 2 (8%) 60+ months Index Constituent Companies | ||

| Inflation or Deflation? That is the Question Posted: 06 Feb 2011 10:04 AM PST No time for much reckoning today. Dow up 20. Gold up $20. Associated Press reports:

Meanwhile, inflation in primary, international auction priced goods is beginning to work its way into consumer prices everywhere. Bloomberg has that story:

Ben Bernanke is talking nonsense. Well...nonsense of a particular sort. He wants to inflate the economy. His line of talk explains why... Bloomberg:

Bernanke still regards the threat of deflation as greater than the threat of inflation. Or, he says he does. We judge them about equal and figure they'll both hit us. Hard. And more thoughts... Did we say we had more thoughts? We don't have time for more thoughts. Not today. The thoughts will have to wait until next week. Regards, Bill Bonner. | ||

| Governments Struggle to Stand Still Posted: 06 Feb 2011 10:04 AM PST Facebook didn't even exist until 2004. Maybe it's just a fad. But it is a fad that the financial markets value at $50 billion. Mark Zuckerberg is now one of the richest men in the world. If he stole the idea, he is one of the most successful thieves in history. Google is another parvenu. It was created in 1998. Now it is worth $197 billion. Yahoo!, founded in the middle of the Clinton years, is worth $20 billion. eBay, which set up shop about the same time, has a market value of $40 billion. Capitalism is a process of "creative destruction," said Joseph Schumpeter. New wealth is created. Old wealth is destroyed. Unless the feds can make time stop, these great successes of today will be the great failures of tomorrow. The "crisis in capitalism" is now in its 5th year. But where's the crisis? Capitalism responds to demands that haven't even been invented yet. We didn't know we needed a Facebook, for example, and there it is. Whole new industries are growing up, worth trillions of dollars, with hundreds of thousands of well-paid employees, high margins and rapid growth rates. Capitalists are taking trillions of dollars from old businesses and re-allocating it to new ones. Emerging markets have grown 85% in the last 5 years, while mature markets have been flat. According to a McKinsey study, global investment is expected to jump from $11 trillion this year to $24 trillion in 2030 - with most of the money going to market economies that didn't even exist 30 years ago. Capitalism is destroying fortunes too. In the US household sector alone, some $7 trillion has been taken off housing values since 2006. And in the corporate sector, in terms of gold, US stocks have lost 80% of their worth over the last 10 years. The world's erstwhile biggest automaker, GM, would have gone broke if it had been allowed to do so. Many of the planet's biggest and most prestigious financial institutions would have been demolished too. We will never know for sure. Because just as capitalism was getting out its wrecking bars and sledgehammers, it was called off the job. The financial crisis that began in 2007 was widely, and intentionally, misunderstood. People who were paid not to see it coming earned even more pretending to see it go away. Bankers, for example, made billions in fees for promiscuously mongering debt during the bubble years. Then, when the itching and soreness began, they profited from the quack cures. It was a "liquidity" problem, they said; "give us more money and the economy will recover!" Politicians were happily bamboozled. They mislabeled the problem a "failure of capitalism." Very convenient for the leveraged speculators capitalism was about to destroy. And very convenient too for the central planners who wanted to bring it under control. In 2009, Foreign Policy magazine, for example, named Ben Bernanke its #1 Top Global Thinker, for his role in staving off another Great Depression. Without Bernanke's decisive rescue, bankers who lent imprudently would have lost their jobs, failed economists would be parking cars, reckless investors and fund managers would have gone broke. Trillions in unpayable debt would have been written off. But thanks to Bernanke it's still there! Thanks a lot. First, the US Fed bought the banks' bad mortgaged-backed securities - about $1.5 trillion of them from all over the world. Fiscal policies worldwide contributed $2.3 trillion more to the bailout. Altogether, the bill came to more than $7 trillion - not including the trillions in free money that came from central banks' lending below the inflation rates - only to the big banks, of course. The fix is in. And who knows how long it might go on? The Irish bail out their banks. The Europeans bail out the Irish. The Chinese bail out the Europeans. The Chinese bail out the Americans too, who also bail out the European banks. It doesn't matter how broke you are. You can still be bailee or bailor. There seems to be no end to it. Why else would investors lend to the US government for 10 years at only 3.41%? Or to the Japanese government - with debt to GDP of 200% - at just 1.23%? As long as the money keeps flowing, insolvency has no meaning. Government hates change. When a stranger comes to town, it calls the cops. That is its role, to protect the elites who control it. But adjustments need to be made. The US government alone faces a financing gap of more than $200 trillion. Every day the sun still rises. By the time it sets, another $4 billion has been added to America's debt. But only phony "reforms" are put forward; Barack Obama's proposed budget cuts would only reduce the US deficit by 3%. The feds resist change. But change happens anyway. Were it not so, the Hohenzollerns would still be in power in Prussia, the Ottomans in Istanbul, Pharaohs would still rule the Nile and the Moguls would still sit on the peacock throne in India. And what happened to the Romanoffs, the Habsburgs, the Bourbons, the First Republic, the Second Republic, the Third Republic, the Forth Republic...the First Reich, the Second Reich, the Third Reich? Like dodos and dinosaurs, they did not adapt. They went extinct. Regards, Bill Bonner | ||

| Newmont Buys Out Fronteer, What’s Next Posted: 06 Feb 2011 10:00 AM PST Newmont believes that the gold prices is moving much higher and they are using their large cash position to find growth. It is much cheaper to buy a quality asset rather than go out and find it yourself. | ||

| RCM- $20 fiat for $ 20 silver coin .999 Posted: 06 Feb 2011 09:05 AM PST Works out to about $72 per oz. Maybe they think ag will be $72 soon. http://www.mint.ca/store/product/pro...D=EMSx310x3391 | ||

| Posted: 06 Feb 2011 09:02 AM PST

Sometimes it can be really easy to get lost in the economic numbers and to forget that this economy is really and truly destroying lives. The truth is that there are millions of Americans out there today that are hurting just like Ashley is. Her story is more dramatic than most, but that doesn't mean that we all don't know someone that could use our help. We have lost our sense of community in America, and thousands upon thousands of people like Ashley are falling through the cracks. I cannot even imagine going through the things that Ashley has had to go through over the past year. If you think about it, please say a prayer for her. Also, let this story be an inspiration to all of us to stop being so cold-hearted and to help out those in need that are all around us. The following is Ashley's story as told in her own words.... ***** Dear Michael, My name is Ashley. I live in Upstate New York I have been reading your Economic Collapse blog for the past year. Everything that you have said is true. Our economy is dying, and the economic collapse has destroyed the lives of many, many people. I should know. I am one of them. I lost my house, my car, my feet and my father, all in just seven months. My father and I had a great life together. He raised me as a single parent. My mother died while giving birth to me. So it was just him and me as I was growing up, and things were wonderful for us, but then everything changed. In September of 2009, my father was laid off from his job after 26 years. He tried so hard to find another job, but he just couldn't get one. The economy was too horrible. As a result of the loss of income, he was unable to continue making the mortgage and car payments. Our car was repossessed, and not long after that, the bank foreclosed on us and we lost our house. We moved into a low rent, hole in the wall apartment and lived off of his savings and his unemployment benefits for the next few months. Finally, in December of 2009, I was lucky enough to get a part time job at a pizza place. It was a really long walk from our apartment, but we needed the money badly. So I took the job. By mid winter, my old snow boots, which had successfully lasted me through several terrible winters, were beginning to rapidly deteriorate. They had holes all over them and they were splitting at the seams. My feet were soaked and freezing all day long. At that point, we were lucky to have food on the table. We had to watch every penny. We couldn't afford to get me new boots. So I had to make do with the ones I had. My father worked feverishly to try and repair them. He spent hours supergluing them duct taping them. In addition to that, I doubled up on socks and wore plastic bags inside my boots, but nothing did any good. My feet still got drenched. One morning, in mid February of 2010, I took the last walk I would ever take on my own two feet. There was a huge blizzard raging outside, but we couldn't afford to lose a day's worth of pay. So I ventured out into the blizzard and made the long trudge to work anyway. As usual, my feet were drenched and freezing within minutes of leaving my apartment, but there was no choice but to just stick it out. So I kept going. I finally arrived at work to find the place closed. Nobody had called to tell me. There was nothing to do but turn around and make the long trudge back home. By the time I got home, I knew that something was seriously wrong with my feet. They felt horrible. My father helped me out of my drenched boots and socks and we discovered that my feet were all purple and swollen. They were severely frostbitten. My father was terrified to take me to the emergency room because that would have bankrupted us. So he did everything he could to try and rewarm my feet at home. He spent the next several days giving me hot chocolate, bundling my feet up in blankets, putting my feet on his stomach, etc. But nothing did any good. My feet didn't get any better. They just kept getting worse. They eventually turned black and began to ooze. At that point, my father broke down and called a car service to take us to the hospital. The doctors told us that, given the extent of the damage, they would not able to save my feet. The frostbite had progressed too far. I ended up having both of my feet amputated. For the next whole month, my father didn't do anything but sob. He sobbed himself to sleep every night. He blamed himself for me losing my feet. I rolled myself into his room on my wheelchair every night and wrapped my arms around him as tight as I could. I told him that it wasn't his fault and that I didn't blame him for anything. I told him he was the best father any girl could ever have and that I wouldn't trade him for anything. I think it helped a little in the moment, but as time went on, he just fell further and further into depression. On the morning of March 15th, 2010, I was awakened by a knock on the door from a police officer. He told me that my father was dead. I told the officer that was ridiculous and that there had been a mistake, but he insisted that my father was dead and that I should come with him. I went racing into my father's room as fast as my wheelchair could carry me, but he was gone. There was a note on his bed that he had left for me. In the note, he told me that he loved me dearly. He loved me more than anything, but that he had failed me. He told me that I would be better off without him. At that moment, my heart stopped as I began to realize what must have happened. Horrified, I made my way back to the police officer, and he told me that my father had jumped out the window of our apartment in the middle of the night. I went into shock and begged the police officer to let me see him, but he insisted that I wouldn't want to see him that way. I started sobbing so hard that the police ended up having to take me to the hospital. I've cried myself to sleep every night since. I'll never understand how my father could have thought that I'd be better off without him. If only he had known how much I needed him. If it wasn't for my extremely kind hearted and caring neighbor, I don't know where I would be right now. She's such a sweet lady. After I lost my father, she took me in and took care of me as though I were her own family. She has gradually helped nurse me back to health, both physically and mentally. This is probably going to sound really crazy, but throughout this past year, you have been one of my heroes, Michael. As devastating as the truth of your words may be, it is refreshing that somebody has the good sense and the good judgement to come forward and say them. All the government and the media do is lie to us, every single day. I only wish more people would listen to you and heed your warnings. Feel free to post my story on your blog if you would like. You have my permission to do so. I just ask that you not reveal my full name and my email address. Just use my first name. Perhaps my story will serve some purpose in the way of helping to wake some of these idiots up and getting them to realize that this nightmare is real. Best Regards, Ashley | ||

| Gene Arensberg : Full blown backwardation in Silver Posted: 05 Feb 2011 03:59 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Not even an Egyptian uprising could derail the stubbornly bullish market. After an initial spike in oil prices, and a one day retracement for broad equity indices, last week was "back to normal" for the buy and hold crowd.

Not even an Egyptian uprising could derail the stubbornly bullish market. After an initial spike in oil prices, and a one day retracement for broad equity indices, last week was "back to normal" for the buy and hold crowd.

No comments:

Post a Comment