Gold World News Flash |

- In The News Today

- Forget Gold Bullion! Those in the Know Own Silver and Gold Miner Warrants

- Crash JP Morgan Buy Silver campaign has forced backwardation in Silver – and for Silver to break free of Gold!!!!

- Gold lenders of last resort

- In the traditional Muslim understanding money is gold and silver

- Crude Consolidates Recent Gains, Gold Tries to Keep Rebound Alive

- GoldSeek.com Radio Gold Nuggets: Robert Kiyosaki, Dr. Stephen Leeb, James Turk, Peter Schiff, Dr. Roger C. Tutterow, & Chris Waltzek

- Paper Money is Heavier than Gold!

- Day Of De-Bottom

- How to Buy a Vacation Home

- It’s Super Gold Sunday!

- Silver Can Swing Your Wealth Between Rich and Poor

- Graham Summers Free Weekly Market Forecast (Euro Reversal Edition)

- It's Super Gold Sunday!

- Sparrow's Belch in a Typhoon

- Weekk 173: Baseline Shifts in Basic Commodities

- Silver Breaks its Golden Shackles

- Full-blown backwardation in silver

- Guest Post: Silver Breaks Its Golden Shackles

- So What's Up With Gold?

- Einstein was right - honey bee collapse threatens global food security

- Why Dylan Grice's Commodities "Pair Trade" Is Irrelevant During Times Of Central Planning And Failed Market Efficiency

- Activists and Local Communities Gaining Ground on Exposing Wal-Mart For Deceptive Practices

- Lies, Damn Lies, and The B(L)S Jobs Report

- Richard Maybury on the Collapse of the Anglo-American Empire

- SUMMER BREAK

- Citi's Steven Englander On The USD Impact Of A Second Homeland Investment Act

- Einstein was right - honey bee collapse threatens global food security

- Countries To War And Collapse: Magnetic Polar Shifts Causing Massive Global Superstorms

- Adrian Douglas: Silver breaks its golden shackles

- Egyptian Pound Plummets As Egyptians Get Their First Taste Of A Bank Run

- Turk, Davies interview audios posted at King World News

- Bank of England playing 'confidence trick' on inflation, MPC veteran says

- International Forecaster February 2011 (#2) - Gold, Silver, Economy + More

- Money & Markets - Week of 2.6.11

- Haynes impressed by silver's strength, Norcini by long bond's weakness

- Why holding on to a core position in gold and silver makes sense, buy on the dips

- The Government-Gold Screw Job of 1933

- Meet the rational gold investor, a rare bird

- Is Silver Gaining Momentum?

- How to Profit From the New Oil Boom in Texas

- Value of Gold? (vs. currency, oil and stocks)

- Debt-Financed Trade Caused the New Depression

- U.S. Mortgage Crisis: Where Does The Homeowner Stand?

- The Inflation of Gold: Is a Price Collapse Inevitable?

| Posted: 06 Feb 2011 08:00 PM PST View the original post at jsmineset.com... February 06, 2011 08:20 PM Jim Sinclair's Commentary The following chart is of the USA's economic recovery. The only thing recovering is economist bliss due to the Dow 1200 happy pills. The fact that equities are being pushed by the same mechanism, QE, that pushes gold is lost on them. Jim Sinclair's Commentary Here we go again. We have been in Yemen for quite awhile. All this costs lives and money. Senior US Marine Says "Multiple Platoons" Are Headed To Egypt Nicholas Carlson | Feb. 5, 2011, 11:42 PM A senior member of the US Marine corps is telling people "multiple platoons" are deploying to Egypt, a source tells us. There is a system within the US Marines that alerts the immediate families of high-ranking marines when their marine will soon be deployed to an emergency situation where they will not be able to talk to their spouses or families. That alert just went out, s... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Forget Gold Bullion! Those in the Know Own Silver and Gold Miner Warrants Posted: 06 Feb 2011 06:46 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 06:38 PM PST Silver Breaks its Golden Shackles MK: The Gold/Silver ratio – hovering around 50, to 60 to 1 looks set to contract to 20:1. This implies a current Silver price of $65. Gold at $5,000 implies a Silver price of $250. My target for Gold is $10,000 which translates into $500 for Silver. The revolutions in [...] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 06:30 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| In the traditional Muslim understanding money is gold and silver Posted: 06 Feb 2011 06:18 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Crude Consolidates Recent Gains, Gold Tries to Keep Rebound Alive Posted: 06 Feb 2011 04:02 PM PST courtesy of DailyFX.com February 06, 2011 08:51 PM A light economic calendar means that commodity markets may take their cues from other considerations. Oil looks ripe for profit taking, while gold struggles to maintain its recent rebound. Commodities – Energy Crude Consolidates Recent Gains Crude Oil (WTI) - $89.12 // $0.09 // 0.10% Commentary: Crude oil is kicking off the week slightly to the upside, after falling toward the end of last week. The fact that the U.S. unemployment rate hit the lowest level since April, 2009 was encouraging, but given that oil prices are near $100, a lot has already been priced in. A sell-off toward the mid-$90’s in Brent wouldn’t be surprising, but expect prices to be well-supported as long as the economic outlook remains this bullish. The economic data for the coming week is rather uneventful, thus trading action will be dictated by the push and pull of upside momentum and profit taking considerations. Tech... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 04:00 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Paper Money is Heavier than Gold! Posted: 06 Feb 2011 02:55 PM PST (Gold is Lighter than same value in $20 bills!) Silver Stock Report by Jason Hommel, Feb 5th, 2011 Click the youtube link to watch the video, "Paper Money is Heavier than Gold!" [ame=http://www.youtube.com/watch?v=PIbxbTq_ihg]YouTube - Paper Money is Heavier than Gold![/ame] In case you can't see the video, let me sum up in just a few words. I weighed a 1 oz. gold eagle. It weighs 1.09 troy oz., because it's a 22k coin, with added copper, for hardness. Equivalent value in paper money is $1446, which is 72 $20 bills. And what does the stack of $20 bills weigh? 2.25 troy oz.! And even silver weighs less than paper money. Silver is now $32.78, and 33 $1 bills weigh 1.05 troy oz., so paper money now weighs heavier than silver! ===== I strongly advise you to take possession of real gold and silver, at anywhere near today's prices, while you still can. The funda... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 02:49 PM PST [U]www.preciousmetalstockreview.com February 5, 2011[/U] Friday was to be a day of departure for Egypt's Mubarak, but it wasn’t yet to be. It won’t be long now imagine though as many countries are joining together and are ever closer to asking and even forcing him to leave now. While de-parture didn’t occur, de-bottom seems to have for Silver and Gold. Even US indices are shedding off all the calls for a correction in what is an unprecedented run higher. Markets don’t work like this unless they are being propped up. It looks like our move to a bearish posture was incorrect and we are now slightly offsides. It’s never fun, but it will be made back quickly and with Gold and Silver breaking out trading profits are never far away. Metals review Gold rose 1.02% this past week and more importantly moved above the uptrend line on a closing basis. Gold also closed the week above the 21 day moving average,... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 02:46 PM PST By Jeff Clark, BIG GOLD For most people, there are some surefire luxuries that signify wealth, a few pearls of conspicuous consumption that say you've made it. For me, it's always been a second home. My grandparents owned a vacation home in Arizona and then Florida when I was a kid, and it was an annual highlight to travel there every year. But something happened on the way to my generation’s version of the American dream. Of all the people I knew that had second homes, only one acquired it through their own hard work and success. The rest inherited them. With high unemployment, shaky business conditions, desperate governments, weak real estate demand, and a suspect stock market, owning a vacation home is not even on the radar these days for most Americans. Paying their existing mortgage is the primary concern, something millions of homeowners still aren’t able to do. So, how is it that I can suggest a way to buy a vacation home in thes... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 02:43 PM PST While Ben Bernanke says we are not seeing any inflation, I think most of us know that is a load of BS as other countries like Egypt see food prices surging. Over the past couple years everyone has been talking about how inflation will soon start and that has been one of the main driving forces for higher precious metals prices. As we all know the market does the opposite as to what the majority of investors are doing. And while everyone has been buying metals in anticipation of inflation, I find it amusing how inflation for the first time is clearly presented on TV (Egypt issues) and we see gold and silver trading lower than they were a month ago. Seems like the buy the rumor sell the news lives is playing out. But the question everyone is starting to ask is how far will the metals correct? Personally, I do not think they will drop much further but I do think it’s going to take 6-8 months before we see new highs in both gold and silver. They have had a nice run bu... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Silver Can Swing Your Wealth Between Rich and Poor Posted: 06 Feb 2011 02:41 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Graham Summers Free Weekly Market Forecast (Euro Reversal Edition) Posted: 06 Feb 2011 02:39 PM PST Graham Summers Free Weekly Market Forecast (Euro Reversal Edition) Well, the Euro hit my target to a "T" at 137.5 last week. Indeed, the European currency just poked its head above this line before falling back below it again. Having gone nowhere but up since early January, this move represents not only the Euro's first correction of any real size, but ALSO a reversal week: a week in which a security hits a new high before falling.

This reversal is even more noticeable on the weekly chart, though the correction is not a sharp one… yet. Indeed, if this correction picks up speed, it will trigger the developing Head and Shoulders pattern I've been noting for several weeks. As readers well know, I believe the Euro will no longer exist in its current form within a year. On that note it's worth considering that should this H&S pattern be confirmed, the downside target is 118: the exact low from the June '10 collapse. However, I think we'll be breaking even this line and seeing the Euro at new lows below 118 before we get through the first half of 2011.

This would result in the US Dollar staging a sizable rally, not because the US's financial position somehow improved, but simply because the Euro accounts for over 50% of the US Dollar index. So any collapse in the European currency will push the US Dollar higher. This in turn would hurt the commodities space, which continues to move as anti-inflation hedges. However, I want to be clear here. I would not view a rally in the US Dollar as negating my forecast for massive inflation, if not hyperinflation within the next two years. Indeed, we've already seen asset prices explode higher WITHOUT the Dollar falling.

These gains occurred at a time when the US Dollar didn't fall a CENT. So the idea that you need the US Dollar to collapse in order for inflation to hit is a lie. However, at some point, the Euro collapse will end. I cannot say when, but at some point the political pressure on politicians (nearly 60% of Germans want out of the Euro), combined with a currency collapse will result in the European union changing, possibly splitting into two regions or even being done away with entirely. When this happens, the attention will shift to the US Dollar. Consider the US's financial position. Our entire financial system is held up by blatant fraud. The banks don't have anything even resembling accurate accounting. Our former Treasury Secretary and Chairman of the Federal Reserve BROKE THE LAW multiple times and have yet to face any consequences. Corruption, fraud, and even front running are the NORM in the US markets. On top of this, the US $14+ trillion. And if you include unfunded liabilities like social security and medicare, you're talking about $70+ TRILLION in total debt on the US's balance sheet. After all, Gold and Silver are the most obvious inflation hedges out there. And to be blunt, anyone who invests in these two assets will likely do very well in the coming months as inflation erupts in the US (see their 2010 performance). However, to make truly ENORMOUS gains from inflation you need to find the investments that are off the radar... investments that the rest of the investment world hasn't discovered yet. I'm talking about investments that own assets of TREMENDOUS value that are currently priced at absurdly low valuations: the sorts of assets that larger companies will pay obscene premiums to acquire. Investments like three inflation hedges detailed in my Inflationary Storm special report. Case in point, since recommending them on December 15, they've OUTPERFORMED Gold and Silver by 7%, 10%, and 27%, respectively. And they're just getting started. You see, because these three investments are currently unknown to 99.9% of the investment world. It is literally impossible for them to become less popular. Which means that they have only one direction to go and that's to become more and more known to the investment world. After all, how many inflation hedges can you name that CRUSH Gold and Silver, rallying even when those precious metals FALL (yes, my three investments have done this). If you haven't already taken steps to prepare your portfolio for the inflationary storm that is coming, don't wait another day. You can reserve a copy of my Inflationary Storm Special Report today, receive the names, symbols, and how to buy the three investments it details... and get in on these investments before the rest of the investment world does, simply by taking out a "trial" subscription to my paid newsletter Private Wealth Advisory. In fact, you can keep my Inflationary Storm Special Report even if you choose to cancel your trial subscription and receive a full refund during the first 30 days of your subscription. How's that for a low risk offer? To take out a trial subscription to Private Wealth Advisory and receive a copy of my Inflationary Storm Special Report today….

An annual subscription to Private Wealth Advisory costs just $199. However, I realize my analysis and investment style are not for everyone.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 02:39 PM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 01:57 PM PST Who knows where the headline risk will come from this week. It could be a surprise number from one of the many releases. I'm looking for hot inflation numbers from all around the globe. We might have a riot someplace new that gets people’s attention. There has been a lot of that lately. Hard to believe it is just going to fade. One area that might get some press (and move prices around) is the President’s budget. This budget covers the period 10/1/2011 through 9/30/2012. That makes this all about elections. That being the case don’t expect to see any evidence of that “fiscal responsibility” we keep hearing about. That’s not to say that the Administration won’t make a big deal of some big cutbacks they will propose. We got a whiff of that from the Presidents budget director Jacob Lew. He listed $750mm of savings that will be proposed in a NYT OpEd piece. The billion or so of savings will not make a dent in the growing expenditure line. Depending on where the revenue estimates are made the deficit will come in around $1.2 T (1.5T in 2011). Depending on how honest the numbers are, the media is going to have a field day, and so will the Republicans. While the notion of another mega deficit in 2012 is not a surprise on Wall Street it is not going to over so well on Main street. But what can the President do? Answer: Nothing. One character in this drama is Alan Simpson. The former Co-head of the Deficit Commission is 80 years old and has a very bad habit of saying things that color the debate. He did it again recently. But as whacky as this guy is, he is right. There is no way the US is going to make any dent in the deficit unless Social Security, Medicare, Medicaid and the Military (“the Big Four or BF”) are put on the table and sliced up. The discretionary budget comes to only 10% of outlays. There is no room to make big changes. Simpson had this to say about cuts outside of the BF: (Bloomberg link) Promises to cut earmarks, waste, fraud and abuse and foreign aid are a “sparrow belch in the midst of the typhoon”. Simpson put it on the line with this comment about the need to make cuts outside of discretionary spending: Anybody giving you anything different than that, “you want to walk out the door, stick your finger down your throat, and give them the green weenie.” Just a question, What is a green weenie? Keep in mind that this guy is serious player in the outcome of this. It’s too bad he is such a nut. A saner elder statesman might have made a difference. It’s possible that the US budget will be a ho-hummer for the markets. It’s hard to expect this to be one of those ‘confidence boosters’. Depending on how the foreign press handles the story it could be a source of some dollar weakness. I think the long end of the bond market might not like to be reminded how bad the supply problems really are. The question is, do we see any leakage in the short end. If two’s and fives react, the broader market will take note. The equity market is oblivious to any bad news of late. That said, You can’t ignore this elephant forever. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weekk 173: Baseline Shifts in Basic Commodities Posted: 06 Feb 2011 01:55 PM PST Market Update for 04 February 2011 & Baseline Shifts in Basic Commodity Prices Mark J. Lundeen [EMAIL="Mlundeen2@Comcast.net"]Mlundeen2@Comcast.net[/EMAIL] 04 February 2011 The Dow Jones has had a good run since November. Nothing spectacular here, just consistent upward progress. The DJIA's BEV chart below shows every new all-time high, each bull market correction, and two major bear market bottoms since 1996. Currently, the Dow is within striking range of taking out the highs of October 2007, at a nice leisurely pace. Don't get me wrong, that's better than a poke in the eye with a sharp stick. But if you want to see how a * REAL * bull market deals with a sharp correction take a look at silver's BEV chart! Silver's credit crisis decline was a few percentage points deeper than the Dow's, as my BEV charts clearly show. But unlike the Dow, silver reached new post 1981 highs again last September, while six months later the Dow is still 15% below its O... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

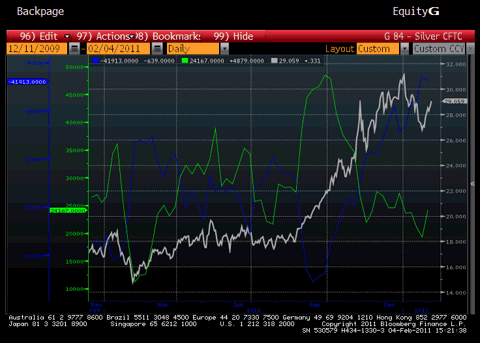

| Silver Breaks its Golden Shackles Posted: 06 Feb 2011 01:50 PM PST By Adrian Douglas On September 21, 2010 I published an article entitled "More Forensic Evidence of Gold & Silver Price Manipulation". In that article I showed how silver from 2003 to 2010 had never traded freely at all; I showed that silver was algorithmically traded with gold and there was a very clear relationship between the price of gold and the price of silver. For those who haven't read the previous article the following figure 1 (figure 4 in the previous article) demonstrates the inter-relationship. Figure 1 Cross-plot of Silver versus Gold 2003-2010 Figure 1 is a cross-plot of the price of gold against the price of silver for every trading day from June 2003 to September 2010. There are two linear relationships, one is pre-2008 (black line) and the second is post 2008 (green line). The best fit equations for the two data sets are also given on the chart. The stunning revelation from the data analysis was that if on any day I knew what the price of gold was ... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-blown backwardation in silver Posted: 06 Feb 2011 01:44 PM PST Got Gold Report Near Zero Contango in COMEX Silver Futures HOUSTON -- We are in the process of poring over the data from this week, and just below is something we are going to be hearing a lot more about in the coming days and weeks. As of Friday, February 4, 2011, there was near zero contango in the COMEX silver futures market. More in a moment, but first, here is this week’s closing table. Note the very strong outperformance of silver to gold this week. There is likely a very good reason for it. No Contango in Silver Contango, where the spot price of a commodity is lower than the following futures contracts, is the normal condition in the precious metals futures markets. Contango is a sign that a commodity is in ample or adequate supply. Backwardation means that the cash or spot price is higher than the futures price for the same commodity. Backwardation occurs when demand for immediate delivery outstrips the market’s ability to deliver the... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Guest Post: Silver Breaks Its Golden Shackles Posted: 06 Feb 2011 01:16 PM PST From Adrian Douglas Of Market Force Oracle Silver Breaks its Golden Shackles On September 21, 2010 I published an article entitled “More Forensic Evidence of Gold & Silver Price Manipulation”. In that article I showed how silver from 2003 to 2010 had never traded freely at all; I showed that silver was algorithmically traded with gold and there was a very clear relationship between the price of gold and the price of silver. For those who haven’t read the previous article the following figure 1 (figure 4 in the previous article) demonstrates the inter-relationship. Figure 1 Cross-plot of Silver versus Gold 2003-2010 Figure 2 Cross-plot of Silver versus Gold 2003-2011 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 09:25 AM PST It looks like the price of gold has settled in a range where it is trading sideways. To me, it reflects a market suffering from some sort of bi-polar disorder. Add some Middle East instability, QE2 helping to push up the stock market, a simmering EU crisis that lately hasn't made many headlines, and dubious unemployment figures coming out of the US Bureau of Labor Statistics, and what do you get? Sideways movement. But the overall trend, if one looks back ten years, is definitely to the upside. And unless you think the global pension crisis, EU debt crisis, massive trade imbalances, massive Central Bank interventions, etc... are ending anytime soon, it's not looking to me that gold has peaked. Far from it. I don't believe in short term forecasts on price movements - most people get those wrong. I choose to look at overall macro trends, and to me, there is definitely an endgame that is unavoidable. But I also believe that we are heading towards massive volatility. Gold could even severely drop for awhile. I still believe that gold will re-enter the global monetary system, in some form. And that ultimately, the price will not plummet when this occurs. I have covered my reasoning for this in my post back in September 2010: Gold Will Be A Bubble Until It Isn't. I still stand by that. I recently read an article that reminded me of that post I wrote in September last year written by Robert Lenzner for Forbes: Gold Is Not The Ultimate Bubble Yet In the article, Lenzner concludes with: The ULTIMATE GOLD BUBBLE will occur when and if confidence in the dollar plummets due to an inability of dealing with the nation's debt load or there is a sudden horrific spike in inflation, ie oil prices double to $200 a barrel– or some insane terrorist act frightens the holders of paper money into hoarding gold. A more reasonable ultimate bubble would be the decision to create a new global currency, which would have a serious weighting in gold. Think gold as a monetary reserve. It's happening but gradually, not as a sudden panic. I agree with Lenzner "more reasonable ultimate bubble" and that it is indeed happening, and gradually so. Central Banks are becoming net buyers of gold for a reason. To them, it represents a debt free, counter-party free (pure) asset that relies on no other government's credit rating or currency (mis)management. To the Central Banks and Treasuries of the world, gold is insurance. It has only been forty years since gold has completely left the international monetary system. For the thousands of years prior to that, there was never a period in history when the entire world traded with pure fiat. And so, privately, countries fear that this recent, fledgling global fiat experiment may end badly. So when economists and governments make light of "gold bugs" as irrational worriers, you have to look at what they do, not what the say. Governments, especially those in most developing nations, are buying the stuff. They're worried. But they can't tell you why they're worried, for such a statement could create a self fulfilling panic. And so gold muddles along, exasperating those that trade it short term, or those that believe the "end is nigh" and they want that gold coin to turn into a jackpot tomorrow. I am genuinely worried about how these global debt and trade imbalances play out. History tells me that such imbalances are like negative stored energy. That stored energy, created by a massive global credit bubble and massive trade imbalances - the largest in history - will not simply fizz out. Bubbles don't deflate. They pop. And there are societal and political repercussions to that. I hold gold as insurance. And like any type of insurance, I worry about having to rely on it. Gold is not the bubble that will pop. The current fiat paper debt based monetary system is the bubble that will pop. That's what most neo-Keynesians and Monetarists are getting backwards - they see gold as the bubble, not credit. But can you blame them? It's not like they "saw this (crisis) coming." And so how can anyone really believe them on how this monetary/debt crisis ends when they never saw it begin in the first place? | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Einstein was right - honey bee collapse threatens global food security Posted: 06 Feb 2011 08:00 AM PST February 06, 2011 09:08 AM - The bee crisis has been treated as a niche concern until now, but as the UN's index of food prices hits an all time-high, it is becoming urgent to know whether the plight of the honey bee risks further exhausting our food security. Read the full article at the Telegraph...... | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Posted: 06 Feb 2011 06:25 AM PST Some time ago, SocGen's Dylan Grice wrote an extended essay which could be synthesized in the following line: "to be 'long commodities is to be short human ingenuity'." Many took this statement as a sign of capitulation from the otherwise highly skeptical Grice, who not once has criticized the current financial and economic status quo. Last week, as Zero Hedge pointed out, Grice made the effort to clear up any confusion about why gold is not and was never meant to be included under this broad umbrella defintion: "although I've said I'm not a fan of plain commodities as investment vehicles because buying commodities was equivalent to selling human ingenuity, I exclude gold from that logic. I prefer to see buying gold as buying into the stupidity of governments, policy-makers and economists, and I'm comfortable doing that." Then over the last few days, Diapason Securities' Sean Corrigan, took a turn at also deconstruction the corollary to the Grice "pair trade" adding the key qualifier: "while Mr. Grice is right in so far as he goes, he has only stated half the case. The true dictum is that 'to be long commodities is to be short human ingenuity but also to be long political stupidity and avarice.'" What has gotten Corrigan so riled up? Why the same underlying premise that makes all those who once had a fascination with the stock market, deride and ridicule it: namely the fact that in doing all he can to flip reality by 180 degrees, Ben Bernanke has completely destroyed the core principle of capital markets: price formation by way of proper information content, i.e. "the free market [must] be allowed to work its magic and that price formation not be deprived of much of its crucial informational content by our dysfunctional monetary and, hence, corrupted financial systems." Sadly, free markets are now only a topic best left to the history books, and as such any idealistic perspective on commodities and the like must take this key persistent variation from the mean into account. An extract from Sean Corrigan's latest "Material Evidence": Recently, the always-interesting Dylan Grice at SocGen received some well deserved blog virality for his aphorism that to be 'long commodities is to be short human ingenuity' — a sentiment with which the current author is fully in accord. This is therefore not so much an outright as a paired trade (or perhaps a call option where Grice's view constitutes the time decay element): one firmly based on Franz Oppenheimer's observation that the only two ways to acquire wealth are to make it through honest work, or, once someone else has made it, to take it thence by dishonesty and force, i.e., via the terrifying apparatus of the state.

No longer the first duty to arrest, but rather the first duty to ensure, alas! With the rights to so much of the resource base of the world claimed as its fiefdom by the dead hand of the state and so subject not just to a lamentably inefficient and ill-directed exploitation, but to a heavy and harmfully inconsistent burden of taxation and regulation, is it any wonder that the scope for the exercise of 'human ingenuity' can sometimes seem so cramped?

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Activists and Local Communities Gaining Ground on Exposing Wal-Mart For Deceptive Practices Posted: 06 Feb 2011 06:02 AM PST | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lies, Damn Lies, and The B(L)S Jobs Report Posted: 06 Feb 2011 05:48 AM PST Wow. Just fucking wow. Even with stability in the Middle East more fragile than an osteoporosis sufferer’s boney coccyx as Egyptian government officials join in the protests against their own government (which is a bit like Alan Greenspan protesting against fiat currency or Camille Crimson protesting against hummers) and Jordan contemplates reforms to lessen the monarchy’s power (and newsflash King Abdullah, you might want to do some reading on Czar Alexander II because once you let Pandora out of the box, she’s not going back in, it’s called entropy (though if it were Brooklyn Decker‘s box that she were let out of, perhaps she would go back in)), with the jobs report not just relatively awful by missing guesses by a fuckton, but absolutely awful by showing fewer jobs are being created than in Whoopi Goldberg‘s pants (and Money McBags is not entirely sure what that means), and with propoganda being spread to impressionable of age females that a rise in cancers are linked to oral sex, the market still went up. Unfuckingbelievable. As the market seems to care about geopolitical unrest, a national depression, and anything tangible about as much as Mark Sanford cares about family values, all we can do is buy the fucking rip.

The big news was obviously the B(L)S jobs report which headlines lauded as a fantastic report as the unemployment rate dropped to 9.0% in a mathematical sleight of hand that would make Fibbonaci proud and Bernie Madoff’s dick hard, the private sector added 50k jobs which would have been more if not for that frisky weather (and um, the fucking depression), and the last two months of data were revised upwards by 20k each month (apparently the checks got lost in the mail).

So while analysts try to spin this number as positive (even though it was more disappointing than the book Cooking with Pooh is for coprophiliacs who order it sight unseen) as it was way below their guesses of 145k and way fucking below the whisper number of 180k (and as always, Money McBags only cares about whisper numbers if Kelly Brook is doing the whispering and the number is 69), Money McBags will break it down for you and show why it was so ugly that not even Bill Clinton would sleep with it. So below are Money McBags’ thoughts on the B(L)S employment situation report and the Street’s reaction to it:

1. Using the weather as an excuse for the ginormous miss is just fucking absurd. Honestly, the weather has now been blamed for everything from lower retail sales (except retail sales were actually decent), to the Protests in Egypt, to the Fat Boys breaking up. Analysts point out that a big reason for the miss was that construction jobs were down 38k and transportation jobs were down 32k and those two sectors are most levered to bad weather (construction is also most levered to the glut of foreclosed homes available and the crash of home prices, but that’s not important). That said even if we add back the 70k jobs that were “weather related,” the jobs report number would still be 25k below guesses. But that is not the most important point here.

The most important point is that these numbers are SEASONALLY FUCKING ADJUSTED (bolding intentional, because, yes Money McBags is yelling) which means that they should TAKE IN TO ACCOUNT THE WEATHER because, you know, THAT IS THE WHOLE FUCKING POINT OF SEASONALLY ADJUSTING SOMETHING. Now look, Money McBags is no Willard Scott (and not just because he doesn’t have a GMILF fetish), but as far as he can tell, the weather this past January wasn’t any kind of anomaly (like Carrot Top’s career), it was just kind of an average January, or at least within one standard deviation of a normal January. So given that, the seasonal adjustment should have seasonally adjusted for the fucking weather and thus this huge miss shouldn’t have been caused by a little snow.

2. The economy didn’t really add 50k jobs, it only added 36k because the government cut 14k jobs which is a trend that promises to get worse than Rick Rolling or promise rings. That said, there were 11k fewer temporary jobs which took away from the numbers, so one could say 47k permanent net jobs were added to the ponzeconomy™. Either way, you need to keep your eye on these government numbers because they are only going to get worse (more importantly though, you need to keep your eye on these numbers).

3. The 9% unemployment rate is more misleading than Citigroup’s corporate derivatives team and it only takes third grad math to figure it out. Just think about it. All else being equal, if only 36k jobs were added and ~150k people enter the workforce every month, right off the fucking bat we have ~100k more unemployed people going in to the population, and using the theory of something called Mathematics, that should cause the unemployment rate to increase, not decrease. Of course the actual calculation has more moving parts than a Rube Goldberg machine or the Octomom’s vagina, so it’s not quite that clear cut (though it should be), but the point is that just using the headline numbers and saying unemployment dropped by .4% is intellectually bankrupt.

Here is a simpler, logical way to think about it. The unemployment rate went from 9.4% to 9.0% with the addition of 36k jobs, so that would imply that for every 9k jobs added, the rate goes down by .1%, holding everything else equal (and Money McBags would like to hold these equal). So, using basic math, for a 1% drop in the unemployment rate, the ponzeconomy™ just needs to add 90k jobs and thus to get the rate down from 9%, to a cockposterous 0% full employment, never been reached before level, the ponzeconomy™ just needs to add 810k jobs. Ok, sounds simple enough, but here is the part where our minds get blown (and please let it be Alice Eve doing the blowing, and it not be our minds), according to B(L)S’ report, there are 13.9MM unemployed people, so if 810k jobs get added (and thus take unemployment to absolute zero, according to our calculations above), we’ll still have 13.1MM people unemployed. That’s right, using the B(L)S’ math, 13.1MM unemployed people equals a 0% unemployment rate which only makes sense in the land of Make Believe or Art Laffer’s head. Perhaps it’s a derivative of the Heisenberg uncertainty principle, we’ll call it the Hildasolis uncertainty principle where the more you know the unemployment rate the less you know the number of unemployed. So just step back from the numbers and think about this for a second (and then step back from that and think about this for a few hours).

Anyway, the real reason unemployment dropped by .4% was that more people simply dropped the fuck out of the workforce and thus the labor force participation fell from 64.3% to a record low 64.2%. If the labor force participation rate had stayed at 64.3%, an extra ~300k people would have been added back to the unemployed bucket and back in to the labor force, boosting the 13.9k unemployed to ~14.2k and yielding an unemployment rate ~9.3%, which is pretty much flat with last month’s number (though there is still some fudging in there that would bring the rate higher, but whatever).

In all honesty, this remains the most brilliant government strategy since giving Marilyn Monroe a key to the back door. Last month Money McBags called it the “Fuck off” strategy because simply telling the unemployed to fuck off, and thus kicking them out of the labor force, is the quickest and easiest way to get the unemployment rate down. Sure it doesn’t make the economy better, and sure it is a bit heartless, but remember, the important thing isn’t the numbers, but it is the perception of the numbers, and a 0% unemployment rate would be perceived as something as awesome as Tolstoy’s War and Peace or Malene Espensen’s tits. So if you all elect Money McBags to office in the next round of elections when he heads up the BOGUS party, he promises you in his his first afternoon of work he will cut unemployment to 0% with just the stroke of a few keys. Now that is some fucking change we can believe in (and apparently another change we can believe in is ending sentences with prepositions, as somewhere the great William Safire rolls over in his grave).

4. Just some quick stats: 6.2MM of the 13.9MM unemployed (which is 42%) are long-term unemployed, with the other 7.7MM being pre-long-term unemployed. 2.8MM were considered marginally attached to the workforce (up from 2.5MM) and they are as marginally attached to the work force as Egyptians are marginaly attached to Mubarak or Taco Bell is marginally attached to beef. Of those not counted in the labor force, 1MM of them are “discouraged”, which means the other 1.8MM are “fucking discouraged.”

5. The U6 unemployment rate was 16.1%, unless you want it seasonally adjusted (and the seasons Money McBags likes in his adjustment are cayenne pepper and stripper juice), then it was 17.3%. And since the U6 rate is a better measure of all employment because it includes the discouraged, the perplexed, and Mickey Rourke, and since it also negates the effect of the “fuck off strategy,” it is more bizarre that we don’t refer to this when talking about unemployment than it is that trying to grow meat in a lab is so fucking hard (because really, if you want to grow meat, just look at a picture of Sofia Vergara).

6. Whatever this meinmyplace thing is, it is deliciously awesome (though unclear why it takes so long to load). And yes, this has nothing to do with the jobs report, but one can only look at made up numbers for so long without a break.

7. The last 2 months were revised up by 40k lifting job creation in November to 93k from 71k and in December to 121k from 103k, while dropping the B(L)S’ credibility from none to Lindsay Lohan. And this brings us to our most important point:

8. ALL OF THESE NUMBERS ARE FULL OF SHIT ANYWAY (even moreso than Manuel Uribe‘s colonoscopy bag): The B(L)S manipulates the numbers more by using seasonal adjustments, the fictitious Birth/Death goal seek model, benchmark revisions, and telling numbers it won’t love them anymore if they don’t do what it says. It is these benchmark revisions which shoot down any credibility the No Labor Department might have had. For instance, the 2.3MM job losses from April 2009 to March 2010 were just revised up to 2.6MM. Come again? And if you are Jennifer Metcalfe, then by all means, please come again. But seriously, how the fuck can they change numbers from over a year ago? Shit, if tomorrow the NFL awarded the Arizona Cardinals the 2009 Super Bowl or the AVN awarded Kelly Madison 2010 MILF of the Year, don’t you think those fine organizations would lose credibility (even if the lovely Ms. Madison deserved it)? So why did Money McBags just waste all of his time analyzing this shit if it will just be a different number next month, next year, shit even next fucking decade?

Here is an example of how ridiculous these numbers are: The Birth/death model black box model (and as always, the only model with a bigger black box is Nyomi Banxxx) had all of its numbers from the past year changed in the benchmark revisions. No really, the numbers which were completely made up anyway, are now a different set of completely made up numbers so any analysis done with them (and Money McBags always shows the preposterousness of them) was all for fucking naught. Money McBags was so perplexed by these numbers having changed and by the birth/death model number for January coming in at an unheard of -339k (which is so far out of the norm that not it is not even within a Kim Kardashian fat tail of the mean), that he emailed some guy named Mish to see if he had any fucking clue (and Mish got all down and dirty with it so Money McBags wouldn’t have to, so enjoy, and if you need something to wake up after reading that, enjoy this). So the 36k jobs added include a non-seasonally adjusted 339k somehow mashed in there. Sounds credible to Money McBags.

9. Ok, Money Mcbags has harped on the math plenty so far, but there is one more thing he is having trouble understanding (other than people who watch American Idol and how Minnie Driver has a career), so bear with him. Last month, there were 14.485MM people unemployed, this month there were 13.9MM, for a difference of 585k. So if 36k got new jobs, and the labor force was reduced by 504k (though the people not in the labor force only went up by 319k, so um, explain that, oh right, the total population fell by 185k somehow, must have been a breakout of that terrible “rounding error” disease), where did the other 45k to 230k people go?

Or

Perhaps the unaccounted for are the new “Lost Generation.”

As usual, if you care about the made up numbers that are going to change anyway, here are the details from Table B:

Subscribe to:

Post Comments (Atom)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No comments:

Post a Comment