saveyourassetsfirst3 |

- Gold Seeker Closing Report: Gold and Silver Gain Almost 2%

- Today in Commodities: The Dollar and Lack of Correlations

- John Paulson: Restructured Equities Will Drive Future Returns

- Options Offer Clues to Gold's Direction

- Chart Focus: Tranny Trouble

- Silver and Gold go Parabolic after Blythe hammers it

- Who lit the rocket?

- Chinese Gold Demand Enormous and Unbelievable - Stuns Analysts and Dealers

- Silver at Rally Midpoint?

- Copper SOARING: Just hit $10,000 for the first time in history

- China on Track to Become Top Gold Buyer

- Trader Rog’s Market Update

- The Simple Truth About Gold Leverage Programs

- Further discussions with FOFOA on GLD

- Italy With the Gold Standard 1861-1914

- Lost Dutchman’s Gold Mine

- Even Donald Trump Is Warning That An Economic Collapse Is Coming

- Ships Passing in the Geopolitical Night

- Senate Votes to Repeal 1099 Reporting

- Silver Vaults=DISASTER

- Relative Wealth and the Struggle for Economic Dominance

- They Missed the Money

- ENERGY? NO THANKS

- Coin bezel pendants

- David Patterson: Donner, Xstrata Zinc and Bracemac-McLeod

- Chinese Gold Demand Surprises Market Watchers

- Silver Butterfly: An Option Trading Lesson

- When Gold Bullion Fails

- Anticipating a Budget Deficit

- Big Gains Are to be Made in Platinum and Palladium

- Gold Seeker Closing Report: Gold and Silver Fall Slightly

- Paolo Lostritto: Dont Retreat, Reload Your Gold

- The Dollar Index: How Low Can You Go?

| Gold Seeker Closing Report: Gold and Silver Gain Almost 2% Posted: 03 Feb 2011 07:11 AM PST Gold fell $3.80 to $1327.20 in Asia before it rose to see a $6.55 gain at $1337.55 in early New York trade and then fell off rather markedly in midmorning trade to as low as $1325.10 by a little after 10AM EST, but it then spiked back higher midday and ended near its early afternoon high of $1355.64 with a gain of 1.58%. Silver fell to $28.175 at the open of trade in New York before it rose to see an almost 1% gain at $28.487 by about 9AM EST and then dropped to as low as $27.965, but it also surged back higher midday and ended near its early afternoon high of $28.852 with a gain of 1.73%. Both metals have continued even higher in after hours access trade at the time of writing. | ||

| Today in Commodities: The Dollar and Lack of Correlations Posted: 03 Feb 2011 06:15 AM PST Matthew Bradbard submits: The dollar will likely bounce from here but that does not mean commodities priced in dollars will all lose their value…case in point today’s action. Very indecisive action in Crude and the distillates today. We favor bullish exposure but a breach of the 50 and 100 day MA likely brings prices back near the trend line at $86.50 in March. We are cautiously long willing to cut and run with clients on a trade lower and add length on a new high…trade accordingly. In March natural gas a trade closer to $4 and we would start exploring longs again for clients until then stand aside. As we alluded to yesterday all eyes will be focused on the jobs number for the next leg in securities albeit higher or lower…we have no feel clearly thinking a correction is long overdue. A dead cat bounce in the greenback…yes a near 1% appreciation today. Continue to fade rallies in the Pound and Euro; lower by 1.3% and 0.25% as of this post. Live cattle traded down today but were able to maintain the 20 day MA once again. We like scaling into longs in April expecting fresh contract highs. Both gold and silver were higher by nearly the same amount on a percentage basis picking up 1.4%. Longs may have dodge a bullet as we should be back near the highs in coming weeks. For confirmation it would take settlements over the 50 day MA in silver at $28.80 and above the 100 Complete Story » | ||

| John Paulson: Restructured Equities Will Drive Future Returns Posted: 03 Feb 2011 06:12 AM PST Market Folly submits: John Paulson is out with his hedge fund firm's year-end letter, and in it we learn that his funds have seen impressive compound annual growth rates ranging from 13.81% to 84.85% over their lifespan. Paulson & Co. now has $35.9 billion in assets under management (AUM). The bulk of Paulson's AUM can be found in his event funds (Paulson Advantage, Advantage Plus), as they collectively manage $18.6 billion. His original merger arbitrage funds garner just over $5 billion, his Credit Fund manages $8.6 billion, and his Recovery Fund manages $2.6 billion. Also, Paulson's gold fund (which we've covered in-depth) now manages just under $1 billion. Focus on Restructuring Equities Paulson's Recovery Fund, which is obviously betting on an economic recovery, primarily focuses on the financial sector but also takes stakes in industrials, hotels, and real estate. Interestingly enough, Paulson & Co.'s investment roadmap lays out the case for a focus on restructuring equities. We've detailed before how Dan Loeb's Third Point likes post-reorg equities as well. Paulson writes:

Complete Story » | ||

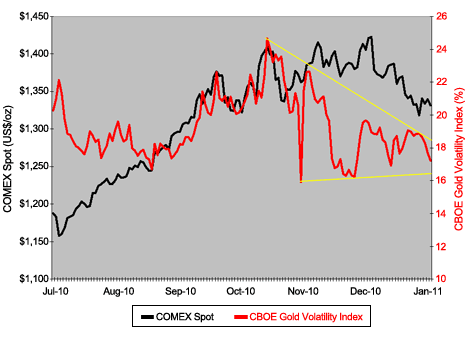

| Options Offer Clues to Gold's Direction Posted: 03 Feb 2011 05:59 AM PST Hard Assets Investor submits: Gold's weak response to the Egyptian crisis has puzzled many investors. You'd think the market would reflect growing fear, sending gold prices higher. But despite Wednesday's escalation in violence, bullion prices slumped $8 an ounce. The price decline bespeaks an overreaction on Friday, when gold jumped $14/oz. Such is volatility. But gold market volatility has actually diminished recently. Or, rather, expected volatility - as measured by the options market - has shrunk. The CBOE Gold Volatility Index is derived from the implied volatility in SPDR Gold Shares Trust (GLD) option premiums. And if you've tracked it over the past couple of months, you probably have noticed that readings have moved into an ever-tightening range: CBOE Gold Volatility Index Vs. London A.M. Fix

Investors with experience in chart reading may recognize the pattern that's developed - the "wedge" is predictive of a breakout move. But the question now is whether that breakout will occur against a background of higher or lower gold prices. Gold's recent track record and a little probability the Complete Story » | ||

| Posted: 03 Feb 2011 04:32 AM PST | ||

| Silver and Gold go Parabolic after Blythe hammers it Posted: 03 Feb 2011 03:25 AM PST Only have a few minutes here, but POS and POG just said "fuck you Blythe" The Ben Bernank just said, "US economy appeared to have recovered, long term fiscal challenges are daunting, optimism in employment, and its...ready... A SELF SUSTAINING ECONOMY" I guess printing 5 trillion is self sustaining you monkey. Note: Silver over $29 and held for 24 hrs is extremely bullish. Lets see if we can | ||

| Posted: 03 Feb 2011 03:10 AM PST | ||

| Chinese Gold Demand Enormous and Unbelievable - Stuns Analysts and Dealers Posted: 03 Feb 2011 01:26 AM PST | ||

| Posted: 03 Feb 2011 12:46 AM PST One possible scenario we are considering in the Got Gold Report is that silver is in the midst of a mid-point consolidation. Consider the chart just below for an illustration: The three previous major tops all share some common traits. One of them being that they sold off hard once the up-move was expended. | ||

| Copper SOARING: Just hit $10,000 for the first time in history Posted: 03 Feb 2011 12:00 AM PST From Bloomberg: Copper rose to records in London and New York, reaching $10,000 a metric ton for the first time on speculation recovering economies will spur demand. Prices also gained today as Xstrata Plc closed copper operations at Mount Isa in Australia because of a storm. Orders to draw copper from inventories tracked by the London Metal Exchange jumped the most in more than three weeks. Figures due tomorrow will show stronger hiring in the U.S., according to economists surveyed by Bloomberg. "The market remains buoyed by strong economic data and the prospect of decent U.S. payrolls tomorrow," said David Thurtell, an analyst at Citigroup Inc. in London. Copper for three-month delivery on the LME climbed as high as $10,000 a ton and was up $2 at $9,947 at 11:51 a.m. local time. Copper for March delivery slipped 0.15 cent to $4.5425 a pound on the Comex in New York after touching $4.58. Tin gained to an all-time high for a 10th day in a row. Copper has tripled since 2008, when the U.S. was stuck in the worst recession since the Great Depression. Prices surged 30 percent in 2010 as LME inventories shrank 25 percent, the first annual decline since 2004. Industrial-metals demand has been gaining since 2009's second half, according to Credit Agricole SA. Mining companies have failed to keep pace with demand because new reserves are harder to find and metal from ore is declining. Copper supplies may lag behind demand by 822,000 tons this year, more than double last year's deficit, according to Barclays Capital. Supply Concern Copper may advance in the "near term" because of concern about supply, Xstrata Mount Isa Mines Chief Operating Officer Steve de Kruijff said in an interview on Bloomberg Television. "It's just another threat to supply, and all the little problems seem to add up," Citigroup's Thurtell said. "In a tight market, shorts get nervous about even the most minor disruptions," he said, referring to bets on lower prices. Markets in China, the world's biggest consumer, are closed for the weeklong Lunar New Year holiday. "There isn't a lot of commitment to a sharp move in prices either up or down" with China shut, and copper may encounter resistance above $10,000, Thurtell said. Copper prices may consolidate this year in a range from $9,500 to $10,500 a ton, said Daniel Major, an analyst at RBS Global Banking & Markets in London. "Supportive underlying fundamentals will likely provide strong price support during periods of investor risk aversion" compared with other commodities, he said. Canceled Warrants "We expect physical tightness and critical inventories to drive prices well above $10,000 a ton 2012-14," Major said. Canceled warrants, as the inventory orders are called, jumped 15 percent to 15,925 tons today, daily exchange figures showed. The gain was the biggest since Jan. 10. LME copper stockpiles, up 4.5 percent this year, rose 700 tons to 394,475 tons. Prices gained this week as figures showed stronger manufacturing in the U.S., Europe, the U.K., China, and India. A report due at 1:30 p.m. London time tomorrow may show employers in the U.S. raised payrolls by 140,000 last month, more than December's increase of 103,000, economists said. Tin for three-month delivery on the LME was unchanged at $30,650 a ton after reaching a record $30,920. Prices are up 14 percent this year. PT Timah, the Indonesian company that's the biggest supplier of tin worldwide, said on Jan. 14 its production may drop for a fourth straight year in 2011. "Like copper, bottlenecks on the supply side are supporting prices," Commerzbank AG said in a report today. "The Peruvian mining ministry has reported lately that mining output fell last year by almost 10 percent to nearly 33,848 tons." Aluminum for three-month delivery added 0.6 percent to $2,539 a ton and lead gained 0.3 percent to $2,573.25 a ton. Zinc rose 0.6 percent to $2,491 a ton and nickel fell 0.4 percent to $27,899 a ton. – With assistance from Rebecca Keenan in Melbourne. Editors: Dan Weeks, John Deane. To contact the reporters on this story: Maria Kolesnikova in Moscow at mkolesnikova@bloomberg.net; Glenys Sim in Singapore at gsim4@bloomberg.net. To contact the editor responsible for this story: Claudia Carpenter at ccarpenter@bloomberg.net. More on copper: Dr. Copper says the coast is clear Credit Suisse: $10,000 copper is coming JPMorgan: This industrial metal is beginning to trade like gold and silver | ||

| China on Track to Become Top Gold Buyer Posted: 02 Feb 2011 08:52 PM PST Scotia Mocatta Sells Out Of All Silver Bars. Commodity prices explode in January. Record copper price tests $10,000. Authoritarian governments start stockpiling food to fight public anger...and much more. ¤ Yesterday in Gold and SilverThe gold price sold off a bit over one percent from the beginning of Far East trading on Wednesday morning, to the New York low of $1,325.90 spot...which occurred at precisely 12:30 p.m. Eastern time. From that low, the gold price recovered a bit, but still closed the day down about seven bucks from Tuesday's closing price.

The silver price peaked around $28.75 spot at lunchtime in Hong Kong yesterday...and hit its low of the day at the same precise 12:30 p.m. New York time that gold did. That low checked in at $28.12 spot. Then, like gold, the price recovered somewhat into the New York close...but was still down about two bits from Tuesday's close.

For the first time this week, the dollar actually posted a small gain on the day. It opened flat in Far East trading yesterday...and remained that way until about 11:00 a.m. in London. From that point, a smallish rally developed...with the high of the day [such as it was] coming around 2:00 p.m. Eastern time. It also could have been at 12:30 p.m...which was the precise low for the precious metals.

The gold stocks pretty much followed the gold price to the tick...with the HUI hitting its low at precisely 12:30 p.m. along with the shares. The HUI struggled back to finished down 0.84% on the day.

The CME's Daily Delivery report showed that 312 gold and zero silver contracts were posted for delivery on Friday. The big issuer in gold was the Bank of Nova Scotia...and the big stopper was HSBC USA. The link to the action is here. There were no reported changes in GLD yesterday...and a smallish 146,847 ounces of silver was withdrawn from SLV. The U.S. Mint had no sales report yesterday...but over at the Comex-approved depositories on Tuesday, there was a lot of frantic activity both in and out. By the time they parked the fork lifts, they had received 1,072,722 ounces of silver...and shipped out 895,088 ounces...for a net gain of 177,634 troy ounces. It must have been a busy day. The action is worth looking over...and the link is here. My coin guy here in Edmonton sold several thousand ounces of silver yesterday...and not one ounce of gold. He guesses that his silver/gold sales ratio is about 500 to 1.

¤ Critical ReadsSubscribeBuilders began work on fewer projects in 2010I have a lot of stories today and, once again, the final edit is in your hands. The first item is a finance.yahoo.com story that was sent to me by reader Scott Pluschau. The headline reads "Builders began work on fewer projects in 2010". Construction spending dropped 10.3 percent last year, marking the fourth annual decline...and pushing total building activity down to the lowest point in a decade. The link is here.  As World Becomes Zimbabwefied, Cotton Futures Surge 17% In One MonthHere's a must read zerohedge.com piece that several readers sent me yesterday...but the first one through the door was Bill King over at the King Report. The headline reads "As World Becomes Zimbabwefied, Cotton Futures Surge 17% In One Month". That's just cotton. How about corn spot up 7.76%, wheat up 5.63%, rice up 10.08%, hogs up 10.16%, sugar up 5.64%, and orange juice up 3.33%. That's in one month! Like I said, it's a must read...and the link is here.  US cotton rises for third day as mills rush to buyWashington state reader S.A. has a Reuters piece about "How high's the cotton, mama"...and this one is headlined "US cotton rises for third day as mills rush to buy". The link is here.  Authoritarian governments start stockpiling food to fight public angerThis next story comes from reader U.D...and is contained in the January 28th edition of The Telegraph. "Authoritarian governments start stockpiling food to fight public anger". Commodities traders have warned they are seeing the first signs of panic buying from states concerned about the political implications of rising prices for staple crops. This story is worth you time...and the link is here.  Record copper price tests $10,000Reader Roy Stephens has another rising prices story for us today. This is from yesterday's edition of The Telegraph...and the headline reads "Record copper price tests $10,000". Copper has hit a fresh record high just below $10,000 a tonne on hopes of increased demand amid supply shortages, which could be made worse by giant Cyclone Yasi in Australia. The link is here.  Cyclone YasiSince the previous story mentioned Cyclone Yasi...here's a satellite photo that shows this Category 5 monster just before it made landfall in north Queensland yesterday morning.

Wall Street Pay Broke Record Last YearThis next story is also courtesy of Roy Stephens...and it's a little something from The Huffington Post. The headline should be no surprise. It reads "Wall Street Pay Broke Record Last Year". Wall Street pay is rising, while income for normal Americans has stagnated. Even as the real economy limped, financial firms paid employees a record sum last year. The link is here.  Marc Faber Calls Bernanke A Liar, Thinks US Inflation Is Running Up To 8%, Believes Pakistan Will Fall NextA Marc Faber interview comes next...and it was first sent to me by reader Randall Reinwasser. However, I'm going to use the zerohedge.com write-up on it that Australian reader Wesley Legrand sent me, as Tyler Durden has a few pointed things to say in his preamble. The longish headline reads "Marc Faber Calls Bernanke A Liar, Thinks US Inflation Is Running Up To 8%, Believes Pakistan Will Fall Next". The interview runs 5:37...and is well worth your time...and the link is here. Marc really calls it like it is.  Moody's downgrades 5 Egyptian banksNext is an AP story posted over at news.yahoo.com...and it's another offering from reader Scott Pluschau. The headline states "Moody's downgrades 5 Egyptian banks". Moody's cuts come just two days after it lowered Egypt's sovereign rating, citing the unrest that has gripped the Arab world's most populous nation for more than a week. It warned that the five banks' ratings remain on review for possible additional downgrades. The link to the story is here.  | ||

| Posted: 02 Feb 2011 08:27 PM PST Market closing numbers from latest week ended. Dow Jones Industrial Average: Closed at 11823.70 -166.13 after bumping 12,000 and then falling on Middle Eastern violence and riots. Volume was normal and the price is above all moving averages, which is bullish. The action today, despite being induced by a Black Swan event, was not abnormal in the amount of selling. The close was 30 points higher than the 20 day average and trading remains in the rising bull channel. New support is 11,800-11,750 and resistance is 11,900. However, if the Middle Eastern mess does not calm down over the weekend, we could see more powerful selling as markets react to this disturbance next week. One major effect was a corresponding pop in crude oil prices up over +4.5%. Share traders do not like this kind of trading news particularly in the midst of new inflation. Crude oil is big deal. S&P 100 Index: Closed at 575.64 -10.08 with price almost on top of the 20-day moving average at 576.59. The close is above the 50 and 200 day averages. I would call this one still safely within the bull trading range but threatening to drop under it next week. Volume was higher than normal at 116% of trend. Traders were selling some and rebalancing with others. Momentum was flat to down but we expect mild selling on Monday barring any more negative surprises over this weekend. The broader stock market could yet recover after a mild 3-7% selling event. However, if the Egypt mess continues and spreads, oil will rocket and stocks will sell. Gold and silver and related stocks will rally further with commodity currencies. S&P 500 Index: Closed at 1276.34 -23.20 on higher than normal volume and flattening momentum. While the close was three points under the 20-day average at 1279.27, we think this could just be a mild overshoot near the close. For all intents and purposes, the 500 can bull quickly again if and when politics calms down. Resistance and support are the 20-day average. Volume was 120% of normal and we would not be at surprised to see the PPT jump in on Sunday evening or early Monday morning buying thousands of S&P futures to prop this market and stocks in general. Never ever discount their manipulative ability to save New York traders and banks. Nasdaq 100 Index: Closed at 2270.51 -59.56 on higher volume and flattening momentum. Unlike the other charts, this one has a perfect bear double top. Since this is the leading indicator of the index markets, it is signaling that more selling is coming despite some of the other positive fundamentals propping-up stocks. The Wilshire Index 5000 is producing a massive, wide bear head and shoulders but in estimating the right shoulder position, the truly big selling could be this fall or even further out into next year. Next week on Monday, we will watch to see if this index sells more to 2043.22, the 200-day average and holds. If it goes there and drops under 2040, we think the over all selling of these markets will continue and become stronger to the down side; even sooner than we had expected. 30-Year Treasury Bonds: Closed at 121.44 +0.72 on perceived security and safety after overseas social problems in Egypt. Bonds have been bottoming out as stocks were topping but today an inverted head and shoulders (bullish) has formed giving bonds some buying power. Momentum is up and 120.00 (major) is new firm support. Resistance is 121.50 and we expect price to close above that if not on Monday then Tuesday for sure. While we think all bond markets are a disaster, most continue to see them as a haven of security. Gold: Closed at 1335.90 +24.40 on falling momentum and price spiked today on fear and safety. Gold's bearish parabolic top may have finally ended and based. If so, we can expect a new mild rally with silver earlier next week sometime after Tuesday. Monday is January 31 and when the calendar falls this way ending a month on a Monday, we usually get chop, flat or down. Cycles tell us its time to rally. Silver on this Friday was up +3.5% to touch $28.00. New support is 1,332.50 and resistance is 1,338.50-1,342.50. We think a new gold rally is imminent and could take price to 1,365.50 before another mild correction. Silver: Closed at 27.99 +1.10 with a nice recovery after selling hard earlier this week. The close is six cents above the 50-day average which provides good strong support at 27.93. The close is right up against important resistance and it held; telling me more buying is coming with price returning to at least 29.48 and possibly higher in the next mini-rally. Silver has been stronger than gold lately and we continue to see similar trading action. The mini-chart next to the daily on Decisionpoint signals a nice near-term double bull bottom. More buying ahead for next week. Electronic after hours trading this weekend should be volatile and bullish. Gold & Silver Index XAU: Closed at 199.71 as the very important metal to shares ratio is basing. Momentum went to the bottom and has little room to fall any more. A full five wave correction is now complete with waves one and two in the next rally set nearly completed. We could see new rallies in shares next week as the metals begin to rise. Support is the 200-day average at 195.47 and resistance is the 20-day average at 207.17 and also major resistance on the close at 200.00. Watch for a new rally to 215 above the 50-day average. U.S. Dollar Index: Closed at 78.15 finding support at 77.50-78.00. The 20-day average is 78.90 providing new resistance. Momentum is still sinking and the recent top is a wide-spread bearish pattern. Last November we touched a new low at 76.00 and we could continue in that direction again over the next few weeks. The inverse Euro currency trade peaked and sold today as the dollar found support. Next week this should continue for at least one full dollar point higher. This is consistent with a rising Swiss Franc. The 200-day moving average remains at 80.00; the main support and resistance for the dollar. This new rally should take us toward 80.00 but stop short at 79.00. Crude Oil: Closed at 89.46 after rising +4.5% today in reaction to Egypt troubles. When the Middle East goes hay-wire; oil rallies immediately. Momentum was falling but is now basing. Price hit a low near $85 and is now touching $90. Since this riot stuff usually lasts a few days we think oil rallies to recent resistance at 92.50. New support is 88.50 and this will increase gasoline prices at the pump for the next few days. Normally, a geopolitical event negative to crude oil can raise the oil price $5 to $10. Today, we already got the $5 so next week we should see at least another 2.50 to 92.50 as a minimum. We got a broker report today the Suez Canal operations are moving smoothing and a previously scheduled pass through of war ships is scheduled for next week. This had nothing to do with the rioting but it might prove useful. CRB Index: Closed at 335.44 +4.05 primarily on the oil rally. Gold and silver helped too, along with some other smalerl CRB markets. Momentum has based with the faster moving average component moving up. The pattern completed a five wave sell-off and the new wave one is up larger than normal. Usually that means the next rally could have more power than normal, which is consistent with our other market forecasts. New support is 330 and resistance is 340. February is the peak in heating oil prices and with colder winter and snow, especially in New England, the whole sector including natural gas is biased upwards. Everyone should be loading pantries and freezers with food. We see some shocking food prices ahead for most of this year on new inflation and growing reserve shortages. -Traderrog This posting includes an audio/video/photo media file: Download Now | ||

| The Simple Truth About Gold Leverage Programs Posted: 02 Feb 2011 05:35 PM PST | ||

| Further discussions with FOFOA on GLD Posted: 02 Feb 2011 05:30 PM PST | ||

| Italy With the Gold Standard 1861-1914 Posted: 02 Feb 2011 05:28 PM PST | ||

| Posted: 02 Feb 2011 04:30 PM PST | ||

| Even Donald Trump Is Warning That An Economic Collapse Is Coming Posted: 02 Feb 2011 02:02 PM PST

Trump says that the U.S. government is broke, that all of our jobs are being shipped overseas, that other nations are heavily taking advantage of us and that the value of the U.S. dollar is being destroyed. The following interview with Trump was originally posted on Newsmax and it is really worth watching.... Now, you may or may not think much of Donald Trump as a politician, but when a businessman of his caliber starts using apocalyptic language to describe where the U.S. economy is headed perhaps we should all pay attention. The following are 12 key quotes that were pulled out of Trump's new interview along with some facts and statistics that show that what Trump is saying is really happening. #1 "If oil prices are allowed to inflate and keep inflating, if the dollar keeps going down in value, I think there's a very distinct possibility that things could get worse." Donald Trump is exactly right - we are headed for big trouble if we continue to allow the Federal Reserve to pump hundreds of billions of new dollars into the system. As I have written about previously, all of this new money will give us the illusion of short-term economic growth and it will pump up the stock market, but in the end all of the inflation the new money is gong to cause is going to be very painful. Just look at how rapidly M1 has been skyrocketing over the last couple of years. Is there any way that we are going to be able to avoid paying a very serious price for all of this reckless money printing?.... Already all of this money printing has had a very serious affect on world financial markets. The price of agricultural commodities is skyrocketing and the price of oil has almost reached $100 a barrel once again. The last time that the price of oil soared above $100 a barrel was in the early part of 2008, and we all remember the horrific financial collapse that followed in the fall of 2008. #2 "....you're going to pay $25 for a loaf of bread pretty soon. Look at what's happening with our food prices. They're going through the roof. We could end up being another Egypt. You could have riots in our streets also." The price of corn has risen 88 percent over the past year and the price of wheat has soared a whopping 114 percent over the past year. Let's hope that we don't have to pay $25 for a loaf of bread in the United States any time soon, but in some areas of the world that is what it now feels like. Approximately 3 billion people in the world today live on the equivalent of $2 a day or less, and most of that money ends up getting spent on food. When food prices go up 10 or 20 percent in deeply impoverished areas of the globe, suddenly the lives of millions are threatened. The riots that we have seen in Egypt, Algeria, Tunisia and other nations recently were not entirely caused by rising food prices, but they were certainly a big factor. #3 "I think gold will go up as long as people don't have confidence in our president and our country. And they don't have confidence in our president." Investors run to gold and other precious metals when they don't feel secure. We saw that happen a lot in 2010. As confidence in the paper currencies and the financial systems of the world has rapidly diminished, precious metals have become increasingly attractive. In fact, the price of gold has doubled since the beginning of the economic downturn in 2007. As the global financial situation continues to become more unstable, the demand for precious metals is likely only going to become more intense. #4 "The banks have really let us down. Number one, they did some bad things and caused some bad problems. Number two, if you have something that you want to buy, like a house, they're generally not there for you." Banks were given massive bailouts with the understanding that they would open up the vaults and start lending money to average Americans again. Well, that has not happened. In particular, it has become much, much harder to get a mortgage in the United States today. Not that the big banks didn't need to make changes to their lending practices, but things have gotten so tight now that it is choking the real estate market to death. #5 "I see $3.50 for a gallon of gas for cars, and cars are lined up trying to get it and it's $3.50. It's a shame, a ridiculous shame." Our lack of a cohesive energy policy is a national disgrace. There is no way in the world that a gallon of gas should be $3.50 a gallon. The U.S. has massive reserves of oil and natural gas that it should be using. In addition, the lack of progress on developing alternative energy sources in light of our sickening dependence on foreign oil is very puzzling. We should be very far along towards solving our energy problems by this point. Meanwhile, we keep pouring billions into the pockets of foreign oil barons every single month. Unfortunately, Trump was exactly correct in the interview - if something is not done the price of gas is going to keep going higher.

#6 "I think the biggest threat is that our jobs are being stolen by other countries. We're not going to have any jobs here pretty soon." Donal Trump is one of the few prominent leaders that is openly speaking the truth about the predatory economic practices of some of our "trading partners". Most of our politicians have just kept endlessly promising us that free trade is "good for us" even as tens of thousands of factories and millions upon millions of jobs have been shipped overseas. Back in 1970, 25 percent of all jobs in the United States were manufacturing jobs. Today, only 9 percent of the jobs in the United States are manufacturing jobs. Yes, computers and robots have replaced a lot of manual labor today, but technology does not account for most of the decline we have seen in manufacturing. n 1959, manufacturing represented 28 percent of all U.S. economic output. In 2008, it represented only 11.5 percent. Meanwhile, manufacturing in the "developing world" has absolutely exploded. #7 "We're like a whipping post for other countries. We are standing there and just being beaten by South Korea, by Mexico, by China, by India." Most Americans have absolutely no idea how lopsided many of our "trade agreements" actually are. Other nations openly manipulate their currencies in order to keep their exports dirt cheap and we allow it. Other nations openly subsidize their domestic industries that are directly competing with businesses in the United States and we don't complain. Other nations make it incredibly difficult for American companies to do business in their countries while we allow foreign corporations to come on in and do pretty much whatever they want here. Then there are certain nations (such as China) that brazenly rip off trade secrets from foreign corporations time after time after time and never get penalized for it. Meanwhile, our economy continues to bleed jobs at a staggering pace. The number of net jobs gained by the U.S. economy during this past decade was smaller than during any other decade since World War 2. Fortunately, more Americans than ever seem to be waking up and are realizing that globalism is causing many of these problems. A NBC News/Wall Street Journal poll conducted last year discovered that 69 percent of Americans now believe that free trade agreements have cost America jobs. #8 "All of our jobs are going to China. We're rebuilding China and other places." China is doing great. China is now the number one producer in the world of wind and solar power. They now possess the fastest supercomputer on the entire globe. China also now has the world's fastest train and the world's biggest high-speed rail network. Most Americans don't realize that China is literally kicking the crap out of us. Back in 1998, the United States had 25 percent of the world's high-tech export market and China had just 10 percent. Ten years later, the United States had less than 15 percent and China's share had soared to 20 percent. Every single month we buy about 4 times as much stuff from them as they buy from us. Our trade deficit with China has ballooned to enormous proportions. In fact, the U.S. trade deficit with China during this past August was more than 4,600 times larger than the U.S. trade deficit with China was for the entire year of 1985. So when Donald Trump says that we are rebuilding China he is not joking around. Nobel economist Robert W. Fogel of the University of Chicago is projecting that the Chinese economy will be three times larger than the U.S. economy by the year 2040 if current trends continue. Yes, that is how serious things have become. #9 "We are a laughingstock throughout the world." Donald Trump has said on several occasions that his friends and business partners in China just laugh and laugh at us. They can't even believe what they are getting away with. We have become an incompetent giant that is the butt of all the jokes. According to Stanford University economics professor Ed Lazear, if the U.S. economy and the Chinese economy continue to grow at current rates, the average Chinese citizen will be wealthier than the average American citizen in just 30 years. Our formerly great industrial cities are slowly becoming ghost towns. The number of long-term unemployed Americans is at an all-time high. Tens of millions of Americans can't even survive without government assistance anymore. The number of Americans on food stamps set a new all-time record every single month during 2010, and now well over 43 million Americans are enrolled in the program. We really have become a joke. #10 "The federal government has no money." Unfortunately, our federal government has continued to borrow and spend like there is no tomorrow. According to the Congressional Budget Office, the U.S. government will have the biggest budget deficit ever recorded (approximately 1.5 trillion dollars) this year. So much for fiscal discipline, eh? It is being projected that the U.S. national debt will increase by $150,000 per U.S. household between 2009 and 2021. Do you have an extra $150,000 to contribute for your share? By 2015 our national debt will be somewhere in the neighborhood of 20 trillion dollars. It is the biggest mountain of debt in the history of the world by far, and it is the gift that we are going to pass down to future generations of Americans. If there are any future generations of Americans. #11 "I hate what is happening to this country." We should all hate what is happening to this country. Our economic guts are being ripped out, we are being abused by the rest of the world, America's infrastructure is being sold off piece by piece, our federal government is drowning in debt, our state governments are drowning in debt and our local governments are drowning in debt. The only way we can even keep going is to run around to the rest of the world and beg them to keep lending us more money. The mainstream media keeps proclaiming that we are the greatest economy on earth, but the truth is that we are being transformed into a pathetic loser and our politicians are just standing there with their hands in their pockets letting it happen. All red-blooded Americans should be horrified by what is happening to this nation. We have been betrayed by corrupt and incompetent leaders. As a nation, we have become fat, lazy and stupid. Hopefully what Donald Trump and others are saying about a coming economic collapse will serve as a huge wake up call and the sleeping giant will arise once again. If the sleeping giant does not arise, we are in a massive amount of trouble, because right now the road we are on is leading to the biggest economic collapse the world has ever seen. | ||

| Ships Passing in the Geopolitical Night Posted: 02 Feb 2011 11:55 AM PST --On behalf of everyone at DR headquarters in Melbourne, we want to let everyone in Northern Queensland know you're in our thoughts and prayers. It seems like we've had to write that a few times this summer. Here's hoping you're safe and well. --While other Australians have more urgent personal matters to attend to, financial markets trundle on. In fact, there's already been a direct response in commodities markets to Cyclone Yasi before the wind has even died down. --Sugar futures have hit a new 30-year high, according to Bloomberg. Crop damage in Australia and India is crimping supply. Raw sugar for March delivery was up 4% to about 35 cents per pound in New York Futures trading. Wheat was up again and according to the Chicago Board of Trade is up 77% in the last year. --How much of soaring agriculture prices can you attribute to supply-side issues and how much to the weak U.S. dollar? We ask the question to raise the possibility that maybe we're over-reacting to these prices. Maybe they're just normal in the cyclical life of commodities. Maybe they aren't telling us what we think they are telling us. --Or maybe they are! --The biggest supply-side factor in commodity prices is the supply of cheap U.S. dollars and cheap credit to speculators on Wall Street. Dollar weakness translates directly into rising prices for real "stuff". The trouble now is that dollar weakness is causing other things (like Egypt's political arrangement) to break. --This is problematic because it makes bets on higher commodity prices: bets! The best bet now, according to the research we're set to publish later today in Australian Wealth Gameplan, is that oil will get a bid as the most strategically valuable commodity in the world. Not only does oil react to the weakness in the dollar, but it also becomes more attractive/valuable as the geopolitical scene becomes less stable. --Expect more instability as the global dollar standard unravels and leads to higher inflation. Egypt is a case in point. It looked like the army had played its role perfectly in keeping law and order while arranging for Hosni Mubarak to save face and, more importantly, arrange for an orderly transition of political power. --But overnight that arrangement seems to have unravelled too. People don't always do what they're told. And one thing we're finding out from Egypt is that political legitimacy can vanish more quickly than the elites in power think possible from their entrenched view points. That's worth keeping in mind when looking at Europe in America. --Speaking of America, it's becoming clearer by the day that America has a date with debt default and/or hyperinflation. With trillion-dollar annual budget deficits as far as the eye can see, the bankers who run America's borrowing program are getting desperate. They are even floating the idea of 100-year 'ultra-long' bonds. --What kind of jack ass would ever loan the American government money for 100 years? Only a brain dead jack ass, of course. Or, if not brain dead, perhaps a company with long-lived, long-term liabilities might try and match those liabilities with long-term Treasuries. But frankly, the whole exercise seems like the sign of an establishment that's running out of ways to make its debt attractive to investors. --People notice. "China's gold imports are estimated to have more than doubled from a year ago in the run-up to Chinese new year, putting the country on track to overtake India as the world's largest consumer of the precious metal," reports the FT. The FT also reports the Federal Reserve has surpassed China as the leading holder of U.S. Treasury Securities. --Let's see. The Fed is set to replace China as the top buyer of U.S. bonds. China is set to become the top buyer of gold. Ships passing in the geopolitical night? --The big danger for Aussie investors right now is that this is the beginning of another massive speculative bubble in commodity prices. The race out of the dollar has driven up precious metals, base metals, grains, and most of the commodity complex. Oil could be next. --But how does it all end? In massive hyperinflation? Or massive deflation? Stay tuned... Similar Posts: | ||

| Senate Votes to Repeal 1099 Reporting Posted: 02 Feb 2011 11:46 AM PST "The Senate approved an amendment Wednesday to repeal the expanded 1099 information reporting requirements in the health care reform law." [These include the gold/silver sales over $600] http://www.accountingtoday.com/news/...t-57177-1.html | ||

| Posted: 02 Feb 2011 11:46 AM PST First off in the Gold vaults we are witnessing a sure fraud. A delivery month with 3 days with no delivery into the dealer vaults is rare-we are wondering how they are settling, if settling at all. As for silver: Zilch into the dealer vaults. Nada. Zero hero. The customer deposits 1 million oz (today! think about what 1 million oz looks like) and then its ALL massively withdrawn. Epic. | ||

| Relative Wealth and the Struggle for Economic Dominance Posted: 02 Feb 2011 11:41 AM PST It's still the same old story - "As time goes by", By Herman Hupfeld Dow up 148 points yesterday. Gold rose $5. And look at the euro. It's back up to $1.38. Or, looked at from the other direction...the dollar is headed down again. All that new money is having the effect Ben Bernanke wanted - sort of. It's boosting asset prices. People feel richer. So, they spend more money. Trouble is, they're not really richer. And after they spend more...they have less. Here's a subject you're going to hear more about: wealth inequality. The rich have gotten richer. The poor have gotten poorer. People don't know why. But they don't like it. And they figure it has something to do with the rich rigging the system. They're right...but not in the way they think. But who cares if some people are richer than other people? People obviously have a need for wealth. That is, they must eat. They need shelter, clothing... They don't really need much more than that. But there's more to it, isn't there? People have a desire for wealth. For status. For power. These things are more important than wealth itself. Why? After a bare minimum, wealth doesn't really affect a person's survival. You don't need more than the basics for that. Arguably, anything you eat more than what you actually need has a negative effect on your life. And clothes? You can go to Wal-Mart and get all the clothes you need for $100. Maybe less. Shelter? Well, that's a bit more expensive. But there's a guy we see everyday who lives out on the street. He stands in the entrance to the abandoned Greyhound bus station in Baltimore, next to a mattress and a sleeping bag. He is always standing when we come by. And he is always facing south. He never turns his head, neither right nor left, neither up nor down...but he just looks straight ahead to the south. Arguably, you don't need more shelter than that. He seems to stay there...at no cost whatsoever. Not that we'd recommend it. But you could get a perfectly comfortable trailer for practically nothing. What's our point? That you don't really NEED much money. So why bother with it? And why do people care if you have a lot more than they do? Humans seem driven to fight for wealth, power and status. Partly, you can explain it as a survival mechanism. No, you don't need much money to survive. But for thousands of years, the person who was able to store up a little extra grain...or hunt a little extra meat...was the one who, in time of famine, might survive. Of course, this is just theory...but you can imagine too that women would want to be close to the fellow who could get food when no one else could. She would want to have his children - fit and able - rather than the children of say, a tax collector or TSA inspector. First, because she might have a better chance of survival. And second, because her children might have a better chance of survival. He might keep them fed - after all, they're his children! Not only that, they might be genetically well suited for survival anyway. So, the kids that survive are likely to have the same survival instincts as the parents...which is to say, they're likely to be good hunters/providers...or want to hook up with one. There, anything else you want to know about socio-biology? No? We didn't think so. So, let's keep moving. Why did we bring this up? Just to show that the relative wealth or status of people is very important - even though it is not directly related to their own survivability. Everyone wants to be rich, famous, and an Olympic rower - like the Winklevoss twins! Naturally, they've got their eyes open all the time - sizing up the competition. They want to know where they stand. So, they spend a lot of time and effort not only trying to get ahead - trying to become rich, famous, and an Olympic rower - but also trying to bring the other fellow down! Yes, dear reader, we're sorry to have to tell you this. But jealousy, envy, resentment, backbiting, backstabbing, and income redistribution are just natural human instincts too. And here's another important point. Since more wealth is only interesting from a RELATIVE point of view...that is, it is only useful when it gives you higher status...a normal, healthy human being cares more about "fairness" than he does about absolute wealth. Of course, fairness can mean practically anything you want it to mean. It can mean fairness of opportunity - as in, we all play by the same rules. Or it can mean fairness of outcome - as in, we all end up in the same place. In an up and coming economy, with limited government and low taxes - like the US in the early part of the last century - people care more about fairness of opportunity. People are making money. They're creating status for themselves. Things change fast. You are responsible for creating your own wealth, power and status. Later, as the economy matures, fairness of outcome becomes more important. New wealth is harder to get. It's harder to move "up" in society. People get a hold of the government and turn it into a zombie- protector. They use it to make sure the rich get richer and the poor stay poor. That is when people become very interested in "equality of income." They think it is not fair. And, they're often right. Because, by that time, the elites, the privileged, and the zombies have usually been able to rig the system for their own benefit. As we put it in this space a week ago, when government meddling plays a bigger role in an economy, having access to the meddlers becomes more important. The fight for love and glory continues...but the battlefield moves to the government. And more thoughts... "You know, I always try to figure out what license plates are telling me." The person speaking was probably insane. But you come across a lot of insane people. He was an electrician we call from time to time. "Sparky," we call him. Maybe he had been shocked too often. "Well, the numbers mean something. You just have to figure them out. Last night, for example, I saw a license tag with 8 7 59 on it. Well, I knew it was talking to me. Because that was the day I was born. The 7th of August, 1959. "But why was it speaking to me? Well, I had to read the other license plates and try to decipher it. It's not easy. And it's not always clear. I mean sometime they give you lottery numbers to play. Sometimes they tell you who you should be talking to. "After I saw my birth date, for example, I saw 301. Well, I knew what that meant. I had to call my mother. That's her area code. "But I was looking at the auto tags so much, I almost ran into a cement truck. His license tag was a warning. It was 666, you know, the mark of the beast. It was telling me to stay away...watch out for the devil and all his works." *** What's the matter with apples? Half of them are inedible. We had a beautiful Delicious apple yesterday. Looked great. But the skin was tough. And the fruit was mealy. That's the trouble. They're meant to look good. Hotels put them in baskets. Businesses display them. They're everywhere. More than half are probably thrown away. They're decorative items. Not foodstuffs. Some people are like that too. Regards, Bill Bonner. | ||

| Posted: 02 Feb 2011 11:40 AM PST The Federal Crisis Inquiry Commission (FCIC) had as much chance of satisfying the public as the Warren Commission did of closing the debate on the Kennedy assassination. The FCIC published its report on January 27, 2011. This was the "Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States." The FCIC itself could not come to a conclusion. The Democrats wrote for the majority, the Republicans for the minority, and a think- tank fellow motored off on a tangent of his own. By the way, these conclusions, cleaved by the politics of the season, demonstrate the immaturity of Washington. The members could not forsake their hobbyhorses to address the time bomb that, unaddressed, will explode. A half-century's accumulation of bad debt tumbled over in 2008 and a much larger mountain of waste and ruin lies ahead. My gripe: the FCIC found the greatest fault with the effects rather than the cause. This is true of all three conclusions. The cause of the crisis was too much money and credit. An economy needs enough credit to operate, but not so much that speculation runs the country. (This, of course, is so obvious that it might seem a waste to write, but the so- called policymakers revved the cyclotron faster and faster.) Among the "Conclusions" of the Financial Crisis Inquiry Commission Report, the majority averred: "[I]t is the Commission's conclusion that excess liquidity did not need to cause the crisis. It was the failures outlined above - including the failures to rein in the excesses in the mortgage and financial markets - that were the principal cause of the crisis." Our dear readers may remember Advice to the Financial Crisis Inquiry Commission: How to Question Alan Greenspan. This was a letter I wrote before the FCIC's hearing on subprime lending, addressed to FCIC Chairman Phil Angelides, in anticipation of former Federal Reserve Chairman Alan Greenspan's testimony. Paragraph number three follows: The Federal Reserve is Cause, Not Effect, for Abuses in Subprime Lending There would have been no lending of any sort without the Federal Reserve. The Fed prints the money that enters the economy. It has a monopoly. Counterfeiters know that. Credit springs from money. The commercial banking system produces credit, by and large. The Federal Reserve sets reserve requirements on commercial bank credit growth. If the Fed sets the bank reserve ratio at 10:1, a bank cannot lend more than $10 for every $1 on deposit. That effectively limits the growth of credit. The Federal Reserve has the authority to increase or decrease bank reserve requirements at any time. During Alan Greenspan's chairmanship, the Fed reduced bank reserve requirements several ways; it never increased them. The result of the Greenspan Fed's money and credit expansion: commercial banks, having run out of proper projects to fund, lent to investment banks, hedge funds, private-equity funds, subprime mortgage lenders, and commercial property speculators. (An investment bank may have lent to a non-bank mortgage company, but it first had to borrow from the commercial banking system.) The Federal Reserve, under Alan Greenspan, both printed every dollar that entered the economy and had sole authority to set bank reserve requirements. If the Fed had reduced reserve requirements, this would have restricted the lending that proved so destructive. There is, of course, much more than I have written above for a full understanding of money and credit, but Alan Greenspan will not attempt to enlighten the commission... Greenspan's testimony was indeed reprehensible, but let him rust. In 2011, Federal Reserve Chairman Ben S. Bernanke is the cause of various asset-price inflations. He is increasing money at a rate far beyond Alan Greenspan's worst excesses. The resulting overinvestment (also called "liquidity" or "speculation") has nourished widespread speculation in the financial markets, while still failing to nourish long-term capitalistic enterprises out in the real world. As a result, in the current investment environment, investors have a better chance of a triple buying Chinese dot.coms than they do investing in a profitable solution to world hunger. The Fed has rigged the markets, so make money fast before everyone realizes Vegas is a squarer deal. Regards, Frederick J. Sheehan

| ||

| Posted: 02 Feb 2011 11:31 AM PST Seems like everyone has now jumped back on the energy band wagon.To be precise energy, solar's, uranium and rare earths. I hear it constantly in the media. However if something has gone up long enough and far enough to garner the attention of the media it's usually closer to a top than a bottom. For instance, the oil service ETF is now stretched 33% above the 200 day moving average. One has to wonder how much upside potential is left after a 5 month rally. What I don't hear anyone talking about anymore is gold or mining stocks (unless it's to tell us that the bubble has popped). While virtually every other sector has gotten extremely stretched above the mean the precious metal sector, the only sector in the world that is still in a secular bull market, has quietly moved down into an intermediate degree correction. So when you hear the countless analysts spouting nonsense about the gold bubble bursting, or the fear trade coming off, or any number of ridiculous reasons they dream up for why gold has moved down, you will know the real reason for golds pullback is nothing more complicated than the average run of the mill profit taking event. An event that happens like clockwork about every 20-25 weeks on average. These intermediate degree corrections are the single best buying opportunity one ever gets during a C-wave advance. Also in the bullish column, sentiment in the sector has now reached bearish extremes. Evan better is the fact that most of the sector has pulled back to long term support, and or tested a major breakout level. The upside potential in many of the mining sector ETF's and bell weather stocks is now huge, even if they were just to get back to the recent highs. One has to ask themselves whether they think the profit potential is biggest in a sector where everyone is falling over themselves to buy. A sector that has already had a huge move and is incredibly stretched above the mean. Or if the odds might be better buying a secular bull market that has experienced a nice pullback. A sector where a return just to the old highs would already constitute a huge gain, not to mention gold should still have one more parabolic move higher this spring as the final leg of this two year C-wave finally tops out. My money is on the area where no one is looking. Buffett said it best. "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." Be sure to sign up for the free webinar this weekend. This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 02 Feb 2011 11:27 AM PST Is anybody else into wearing a bit of thier stash? My wife has 2 of the 2.5 gram Suisse pendants and a 1/10 GAE in a bezel she wears. I have a 1/10 Krugerrand I wear at times. Im thinking of putting a proof sovereign in a bezel too. I think they look great!:bowdown: Attachment 6400 | ||

| David Patterson: Donner, Xstrata Zinc and Bracemac-McLeod Posted: 02 Feb 2011 10:00 AM PST The CEO of Donner Metals talks about working with Xstrata building a zinc, copper, silver and gold mine and plans for the future. | ||

| Chinese Gold Demand Surprises Market Watchers Posted: 02 Feb 2011 10:00 AM PST Many participants tend to focus on daily fluctuations and 'noise' of the market and not see the 'big picture' major change in the fundamental supply and demand situation – particularly due to investment and central bank demand from China and Asia. | ||

| Silver Butterfly: An Option Trading Lesson Posted: 02 Feb 2011 10:00 AM PST Successful option traders understand the limitations and advantages of the vehicles available to them. The butterfly can deliver outstanding risk/reward scenarios, and the probability of its success is enhanced by understanding the nuances of its use. | ||

| Posted: 02 Feb 2011 10:00 AM PST Call it "diversification" if you must, but gold bullion tends to do badly when other assets go up. | ||

| Posted: 02 Feb 2011 09:00 AM PST I am constantly amazed at the number of people who think that a budget deficit is the same thing as the total federal deficit, which it ain't. Actually, I remember one time early in my career where I was so desperate to cover up the results of my own incompetence that I tried to exploit this confusion with a "budget deficit" scam of my own, and it seemed to work for almost a month! I called it "unanticipated deficit", which was not exactly a lie like the other lies I'd told my bosses over the years. Running though my Personnel File, we can see a long list of lies that have made their way into my file, like the ones I told about how, yes, I knew what I was doing, and yes, I am trained and educated to do what I am hired to do. There's another one where I am lying and saying no, I am not goofing off all the time or sneaking off to play golf, and then there's this other one where I lied and said no, I do not think I am smarter than everyone else just because I am buying gold, silver and oil and they aren't, even though I kept telling them to buy them because the evil Federal Reserve is creating So Freaking Much Money (SFMM) that inflation in prices is guaranteed, and how I think that their attitude constitutes stupidity, and that they ought to be fired before they cause any more damage. The most embarrassing lie in my Personnel File is when I said no, I did not leer lasciviously at Miss Lundell's long, luscious legs with my tongue hanging out, nor did I offer her fifty bucks to let me lick her ankles, no matter WHAT dozens of lying eyewitnesses say they saw, and/or heard, nor what the lying security cameras caught on tape, either. My argument was, "Is the inadequacy of your new-hire screening process my fault?" I mean, if they had asked me, "Are you some kind of weirdo, emotionally-stunted, deviant creep who is going to spend an inordinate amount of company time harassing the other employees to buy gold, silver and oil as some panicky defense against the inflation and ruination caused by the Federal Reserve creating so much excess money and/or flirting with the female employees?" I would have admitted "Well, sure, kind of." But they didn't ask! And apparently, it is important to know this stuff beforehand! My wife is, too, upset at this same error, and is constantly complaining, "If only I had known before I married you!" that I was, in summary, the very antithesis of everything she wanted, or could even tolerate except for short periods of time, in a husband. So my almost-lie of an "unanticipated deficit" was derived from taking my department's actual loss, and subtracting from it the projected loss that was shown in my initial budget, which would result in a lower number that I could use as my "deficit." Thus, my Fabulous Mogambo Plan (FMP) was to use this "unanticipated deficit" statistic until I could figure out something to, hopefully, salvage my career, which was in flames, and what was not in flames, was in tatters, and probably going to burst into flames soon. And if my boss stuck those Quarterly Reports under my nose, I would say, "Whoa! Hold on! My figures show that my unanticipated deficit is less than the loss already in the budget, so something must be wrong in the accounting department! You need, if you want my opinion, to fire all those liars and morons and then start over, fresh, not even looking at any of today's tainted documents, blighted reports, corrupted files, printouts, spreadsheets, interoffice memos or that stupid Qualified Opinion of some stupid auditors that I never even met, so how could I have been 'uncooperative' and 'evasive'?" Well, like I said, the scam didn't last that long, but did cause a lot of confusion and name-calling before the whole thing fell apart on me. But the government gets away with this kind of lying all the time! For instance, as recently as October 15, 2010, the government was still insisting that the "deficit" for fiscal year 2010 was only $1.3 trillion, which is such a horrifically large number that it has momentarily made me forget what I was going to say, but at the last second I remembered that I was going to make the point that the national debt, measured between October 1, 2009 and October 1, 2010 to coincide with the federal budget year, increased by more than $1.7 trillion! A $400 billion difference that somehow gets "lost" when people talk about "the deficit"! Wow! We're Freaking Doomed (WFD)! Doomed, that is, unless, of course, we (meaning you and me) buy gold, silver and oil stocks as protection against the raging inflation that will result from the Federal Reserve creating enough money to buy all of this humongous, staggering, suffocating load of new debt, and then it becomes, "Whee! This investing stuff is easy!" The Mogambo Guru Anticipating a Budget Deficit originally appeared in the Daily Reckoning. Recent articles featured in The Daily Reckoning include the impact of quantitative easing and US debt. | ||

| Big Gains Are to be Made in Platinum and Palladium Posted: 02 Feb 2011 07:27 AM PST

The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. While a majority of investors, analysts and experts dwelt on gold and (to a lesser extent silver) in 2010, sister precious metals platinum and palladium notched up significant gains matching gains in the investment safe havens. While gold and silver gained close to 30% and 80% respectively, platinum and palladium were nowhere lagging – gaining in the region of 20% and 100% in that order. We inspect long-term prospects of these lesser invested metals in this essay. A strong case for platinum and palladium makes for diversification of precious metals funds into these metals. This diversification of funds is of particular importance when Investors are being suggested to wait for medium-term corrections before stocks become 'investable' again. Automobile Demand – Key Support for Platinum, Palladium One of the key developments for the platinum group metals over the past few years has been China's rise to dominance as the largest auto market. China, along with India and the other BRIC nations (Brazil and Russia) has witnessed robust auto sales despite a drop in the US and Europe during the recession. Turnaround in auto sales in the West has also been swift, thanks to government initiatives such as the cash-for- clunkers programs. The overall sales figures in 2010 have been encouraging and it can be safely concluded that the worst is behind us. The upcoming years will yet witness growth in auto sales, particularly in the developing world, which in turn renders prospects for the platinum group bullish. Although, the removal of subsidy, rising fuel prices and stricter new registration laws are likely to hit the Chinese auto markets in 2011, China will remain a primary support for automobile manufacturing for the next few years. Another oriental economy touted to have the potential to replicate China's growth story in the auto market is India. Both India and China have registered robust sales numbers while the auto market remained damped elsewhere in 2009 and progressed by leaps and bounds in 2010. India is home to well over 40 million passenger vehicles – a healthy 26% sales growth was registered in 2009 while the rest of the bigger auto markets were reeling, making India the second fastest growing automobile market globally. Long-term auto sales data shows that the saturation in the auto sector in the US and Europe is more than compensated by a growing market in China and India. Additionally, unlike what looked apparent during the recession, sales in the developed markets will not plunge as sharply as expected. The health of the auto sector augurs well for platinum and palladium – we do not foresee any perceptible change in the dynamics of the auto sector at least for the next 2-3 years, which is as far as suggested long positions will aim. Emission Norms to Boost Platinum Group Metals in US and Europe The U.S. administration has revised the target of achieving a 35.5 mpg (miles per gallon) or 6.7 liters/100 km fuel economy to 2016, four years earlier than the initial target of 2020. The ambitious 40% rise in fuel economy, from the present standards, implies that even if fuel efficiency improves by half of the target, it would exert a positive influence on the demand for PGM. The calculations numbers are only for the U.S., while standards that are even more stringent are intended for Europe, Australia and Japan. While Europe has targeted a fuel economy of 42 mpg by 2016, Australia is aggressively pursuing the 34 mpg target by 2010. These fuel economy standards are expected to impact industrial metals demand over the next five years. It is estimated that, approximately 15% of the automobiles will comply with the standards by 2012. Is the Threat from Hybrid Vehicles Real? However, the good news (for platinum and palladium Investors) is that currently, HEVs constitute only a small proportion (less than a 3% market share) of the auto market – approximately 1.5 million units per year. The U.S. Department of Transportation's expectations that, by 2012, the market penetration of HEVs will be approximately 30% of the total production, is surely not on track. Given the current demand trends for hybrid vehicles, a slow to medium penetration will be the probable scenario in the next few years. Currently, HEVs do not present any price advantage over the non-hybrid cars implying that the market penetration will depend on the technological advancements, which could improve the financial viability of these vehicles for both manufacturers and consumers. Therefore, the penetration of HEVs is expected to be a slow process, which may take four to five years to take off in a big way. Interestingly, despite claims of a dampening of PGM demand from the invasion of hybrid vehicles, some car makers are of the opposite view. Hybrid vehicles use a combination of a battery and a standard internal combustion engine. The use of a combustion engine requires the use of a catalytic converter. In fact, in many cases the catalysts used in hybrid electric battery/internal combustion engine vehicles use more PGMs than regular vehicles. Clearly, the threat is not due to hybrid vehicles but fully electric vehicles which have an even lower penetration level. Overall, the threat from hybrid vehicles (if any) is compensated by a growth in demand for platinum and palladium due to stricter emission norms. And to think, the developing regions are yet to enforce strict emission norms as in the US and Europe. Once the developing regions also jump into the emission norm bandwagon, the threat from a not so fast expanding hybrid vehicles market will likely be well overcome. Add to that an expanding car market and a shrinking supply side and the outlook at least for the next few years is bullish. Fundamentally, prospects for the PGM group are positive for the long-term. Investors may time their entry after minor corrections in the short-term due to a run-off from sister precious metals and a pause in the current rally. To keep yourself up-to-date with movements in the precious metals markets, we encourage you to subscribe to our Premium Updates, providing in-depth analysis and cutting edge observations. We also have a free mailing list (sign up today) that provides free 7 day access to our website, and you can unsubscribe at any time. Remember, as the gold rally enters this critical phase, investors will be well armed if well informed. Thank you for reading. Mike Stall Sunshine Profits provides professional support for Precious Metals Investors and Traders. All essays, research and information found above represent analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mr. Radomski and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above belong to Mr. Radomski or respective associates and are neither an offer nor a recommendation to purchase or sell securities. Mr. Radomski is not a Registered Securities Advisor. Mr. Radomski does not recommend services, products, business or investment in any company mentioned in any of his essays or reports. Materials published above have been prepared for your private use and their sole purpose is to educate readers about various investments. By reading Mr. Radomski's or his associates' essays or reports you fully agree that they will not be held responsible or liable for any decisions you may make regarding any information provided in these essays or reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise that you consult a certified investment advisor and we encourage you to do your own research before making any investment decision. Mr. Radomski, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. | ||

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Posted: 02 Feb 2011 07:18 AM PST Gold fell $7.45 to $1332.05 by a little before 8AM EST before it bounced back near unchanged in early New York trade and then fell to a new session low of $1326.54 by early afternoon ahead of a decent rally back higher in the last hour of trade, but it still ended with a loss of 0.63%. Silver fell to $28.21 in London before it rose to see a 12 cent gain at $28.61 in midmorning New York trade, but it then fell to a new session low of $28.107 by early afternoon and ended with a loss of 0.77%. | ||

| Paolo Lostritto: Dont Retreat, Reload Your Gold Posted: 02 Feb 2011 07:18 AM PST | ||

| The Dollar Index: How Low Can You Go? Posted: 02 Feb 2011 05:11 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

An assortment of briefly annotated charts (below the jump).

An assortment of briefly annotated charts (below the jump).

No comments:

Post a Comment