Gold World News Flash |

- Chinese Gold Demand Stuns London & Hong Kong Traders

- Gold Seeker Closing Report: Gold and Silver Fall Slightly

- Crude Rises as Geopolitical Concerns Linger, Gold Inches Lower after Channel Test

- Forget Gold: I-Phones as Money

- China on Track to Become Top Gold Buyer

- Cash is trash in China as rabbit-themed gold fills 'unbelievable' demand

- The Simple Truth About Gold Leverage Programs

- Hourly Action In Gold From Trader Dan

- ENERGY? NO THANKS

- Anticipating a Budget Deficit

- Gold Price Has Work To Do Down Below, Stocks Setting Up For Painful Break

- WEDNESDAY Market Excerpts

- Ireland to S&P: Oh Downgrade, Where is Thy Sting

- Big Gains Are to be Made in Platinum and Palladium

- Buyer Of December $1,800 Gold Calls Back For Second Day In A Row, Gold Options Market Approaching Talebian "Fat-Tails" Proportions

- They Missed the Money

- Forum 201

- In The News Today

- Silver’s Record Month

- Gold Daily and Silver Weekly Charts - Hyperinflation vs. Deflation Debate

- Silver’s Record Month

- Gold: The King of Currencies

- David Goguen: Finding Real Value in the Ground

- Finding Real Value in the Ground

- Gold Just Below Resistance

- Silver Circle HOTTIES raise $5,000 in one day

- Demand juggernaut keeps commodities supercycle going strong

- Outperforming even Silver . . . Artisanal Glass

- Capital Leaving Middle East Looking For Safe Havens In Hard Assets and Oil

- Gold and Silver to Rise Slowly, Buoyed by Emerging Market Growth in Near Term

- Tracing the Fed’s Vital Role in the Decline of the US Dollar

- Grandich interviewed in MarketWatch

- Indications of the Broadest Measure of Money Supply

- Silver Eagle Sales Hit Their Second-Highest Ever

- 'Question of the Month' Winners

- The Dollar Index: How Low Can You Go?

- Gold and Precious Metals - It's Time for a Breather

- Relative Wealth and the Struggle for Economic Dominance

- U.S. Mint Sells 6,442,000 Silver Eagles in January

- LGMR: Gold Holds Flat, Shows "No Direct Link" to Mid-East Unrest

- When and How Gold Will Begin its Bubble

- Risk Assets Get Pumped Up Next to Profit Taking

- What Is the Gold Miners / Gold Ratio Telling Us?

- Are Gold Spreaders the Bad Guys?

- Gold Is Not a One-Way Street

- The Morning Gold Report

- Paper Tiger, Golden Rabbit

- Gold Seeker Closing Report: Gold and Silver Gain With Stocks

- Gold prices fall on jobs report

- When is it Time to Buy Gold?

| Chinese Gold Demand Stuns London & Hong Kong Traders Posted: 02 Feb 2011 04:14 PM PST Dear CIGAs, When asked about Chinese demand Norcini stated, "Your sources have been reporting for months that demand from Asia, particularly China has been staggering, especially as the market has moved lower. This FT story has simply confirmed what King World News has been reporting for months, and that your sources have been accurate. It's apparent to me that there has been a very large buyer in the gold market, particularly on moves down towards the low $1,300's on gold. It is obvious now that China has in fact had an insatiable appetite for gold. This explains why we have had such a huge drop in open interest in the gold market, while gold has only fallen a mere 6%. Open interest has fallen almost 30%, but as I said gold has only dropped 6%. Normally if you are a short in a market and you start to have an asset correct because of significant liquidation, you will see a precipitous drop in price. Given the sheer volume of contracts that has been liquidated, we should have seen a massive correction in gold. Instead it has stayed incredibly strong. You can see the footprints of the Chinese buyers, it is becoming very obvious to all of the players in the gold market, and this is causing the shorts to have to cover prematurely. I think the key here Eric is that inflation is roaring out of control in Asia, particularly in China. While the western monetary authorities are doing their best to convince their citizens that inflation is not a serious problem, the reality is quite different. To quote Bernanke, 'Fear of inflation is overstated.' The citizens of Asia and other regions are not impressed with such statements. Those people have been buying gold and they will continue buying gold as long as inflation is alive and well and I see no end to that in the foreseeable future." | |

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Posted: 02 Feb 2011 04:00 PM PST Gold fell $7.45 to $1332.05 by a little before 8AM EST before it bounced back near unchanged in early New York trade and then fell to a new session low of $1326.54 by early afternoon ahead of a decent rally back higher in the last hour of trade, but it still ended with a loss of 0.63%. Silver fell to $28.21 in London before it rose to see a 12 cent gain at $28.61 in midmorning New York trade, but it then fell to a new session low of $28.107 by early afternoon and ended with a loss of 0.77%. | |

| Crude Rises as Geopolitical Concerns Linger, Gold Inches Lower after Channel Test Posted: 02 Feb 2011 03:41 PM PST courtesy of DailyFX.com February 02, 2011 07:51 PM Crude oil managed to hit fresh multi-year highs on Wednesday, but prices are beginning to look overbought. Meanwhile, gold continues to digest recent losses. Commodities – Energy Crude Rises as Geopolitical Concerns Linger Crude Oil (WTI) - $90.89 // $0.12 // 0.13% Commentary: Crude oil was higher on Wednesday, with WTI inching higher by $0.09, or 0.1%, to settle at $90.86, while Brent rose by $0.22, or 0.21%, to settle at $102.56. The protests in Egypt turned violent according to news headlines throughout the day, thus the geopolitical premium in crude oil prices was maintained. If and when the situation settles down, prices are likely due for a bit of a pullback, but the trend clearly remains higher until OPEC- Saudi Arabia in particular- draws a line in the sand and opens the spigots. Technical Outlook: Prices have put in a bearish Dark Cloud Cover candlestick formation below resistance at $92.58, December’... | |

| Forget Gold: I-Phones as Money Posted: 02 Feb 2011 02:56 PM PST Ready to give your bank account info to Apple and Google? Ready for Sergei to issue our money? Here ya go: RE Jan. 29, 2011 Credit Cards to Become Obsolete? Upcoming Smart Phone and Other Technology Could Render Plastic Passe – or Perhaps Make It a Mere Fallback Payment Method Font size Print E-mail Share [...] | |

| China on Track to Become Top Gold Buyer Posted: 02 Feb 2011 02:52 PM PST By Leslie Hook and Jack Farchy Financial Times, London Wednesday, February 2, 2011 http://www.ft.com/cms/s/0/f79b1824-2eed-11e0-88ec-00144feabdc0.html China's gold imports are estimated to have more than doubled from a year ago in the run-up to Chinese new year, putting the country on track to overtake India as the world's largest consumer of the precious metal. The growth in demand is being attributed in part to Chinese families giving each other gifts of gold instead of traditional red envelopes filled with cash. The growth in demand is being attributed in part to Chinese families giving each other gifts of gold instead of traditional red envelopes filled with cash. Fears of inflation have also driven demand for gold as a retail investment. Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. "The demand is unbelievable. The size of the orders is enormous," said one senior banker, ... | |

| Cash is trash in China as rabbit-themed gold fills 'unbelievable' demand Posted: 02 Feb 2011 02:03 PM PST Bugs to Bernanke: That's all, folks! * * * China on Track to Become Top Gold Buyer By Leslie Hook and Jack Farchy http://www.ft.com/cms/s/0/f79b1824-2eed-11e0-88ec-00144feabdc0.html China's gold imports are estimated to have more than doubled from a year ago in the run-up to Chinese new year, putting the country on track to overtake India as the world's largest consumer of the precious metal. The growth in demand is being attributed in part to Chinese families giving each other gifts of gold instead of traditional red envelopes filled with cash. The growth in demand is being attributed in part to Chinese families giving each other gifts of gold instead of traditional red envelopes filled with cash. Fears of inflation have also driven demand for gold as a retail investment. Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. "The demand is unbelievable. The size of the orders is enormous," said one senior banker, who estimated that China had imported about 200 tonnes in three months. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Gold prices softened in January on the back of positive economic data in the US, but prices for physical gold in Shanghai have been at a premium of about $20 per troy ounce over those in London, underscoring the tightness in Asian markets. That spread fell to $4 on Wednesday because of slow trading during the new year. Official data show China importing 209 tonnes of gold the first 10 months of last year, versus 333 tonnes for India for the whole year. The Indian festival of Diwali was once the key driver of seasonal demand patterns because of the large number of weddings taking place during the holidays. But now, as India's gold demand has started to smooth out because of changing wedding habits, Chinese new year is starting to have a bigger impact. Last year about a third of Chinese gold consumption was linked to the holidays, according to a precious metals trader, but this year the spike is more pronounced. Gold gifts are more popular in China this year than ever, particularly rabbit-themed gold pieces to mark the year of the rabbit. Small bars of 100 ounces or less are elaborated engraved with auspicious rabbit idioms or scenes of rabbits at play. A gold store in Tangshan, a mid-tier steel town near Beijing, was all but sold out of rabbit-themed products on a recent visit. With about a five days to go before the start of the holidays, the store clerk said all that was left in stock was a 20-oz carved rabbit bar and a few leftover Bugs Bunny-style statuettes. Edel Tully, precious metals strategist at UBS, said: "China is on the fast track to replace India as the largest physical consumer. And the Chinese new year is now significantly more important than Diwali in volume terms." China consumes about 527 tonnes of gold a year, according to the World Gold Council, an industry body representing gold miners. Traders say China will overtake India as the largest consumer of gold this year. "The seasonality around Chinese new year is something that we've seen in the last two to three years," said a senior trader in Asia. "This year the demand may actually also carry on after Chinese new year." This week China's exchanges are closed for the holidays and traders are debating how much of the growth in imports has been seasonal and how much is a result of underlying demand. Gold has become popular with retail investors as a hedge against inflation because of curbs on the property market and negative real interest rates for Chinese bank deposits. Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | |

| The Simple Truth About Gold Leverage Programs Posted: 02 Feb 2011 01:03 PM PST Below please find the latest commentary from Peter Schiff, CEO of Euro Pacific Precious Metals and author of the hit economic parable How an Economy Grows and Why it Crashes. [COLOR=blue][/COLOR] www.europacmetals.com PLEASE NOTE: This commentary is from Peter Schiff in his role as CEO of Euro Pacific Precious Metals. Per financial industry regulations, this article CANNOT be attributed to or link back to Euro Pacific Capital. by Peter Schiff A lot of people ride motorcycles, but there's a reason most don't try to be Evel Knievel. Sure, there's a big reward if you can land a jump over 14 school buses - but what if you don't? A new craze among our competitors is to push gold buyers into "leveraged accounts." In one of these accounts, the dealer lends you money to buy gold, on the assumption that gold will go up faster than the rate of interest on the loan. In other words, if you call with $5K, they'll give you another $20K in credit to make a $25K total purc... | |

| Hourly Action In Gold From Trader Dan Posted: 02 Feb 2011 12:33 PM PST Dear Friends, Another day, another all time record high in commodity prices as the CCI (Continuous Commodity Index) did it yet again. Corn, wheat and soybeans all put in 30 month highs with wheat now having effectively doubled in price since June of last year. Brent crude is now trading above $102/barrel and is now back to levels last seen in September 2008. Ditto for Unleaded gasoline. Coffee is at another 13 year high, sugar hit an astonishing $0.36/pound while copper added on more to its record high from yesterday. Cotton is near 140 year highs, last seen during the era following the War between the States. What makes this feat of the CCI even all the more remarkable is that the meats were down sharply today with the precious metals lower. In other words, the index made a lifetime high with no help from these two sectors which were actually a drag on it. Based on what I can project from the price charts, the CCI is on a trajectory to hit the 750 level within a matter of 4 months unless something arises to stem the rise. It is now currently trading at 659. We are seeing what amounts to a near perfect storm in the grain markets with a confluence of speculative money chasing after tangibles coupled with difficult growing conditions which is limiting supply. That is occurring against a backdrop of what might best be described as "panic buying" by nations caught up in the social unrest erupting across North Africa and the middle East who are fearful of being caught short handed on grain supplies at a time in which prices are already on the rise. This is creating a type of feedback loop in which demand for the physical product keeps prices strong which then feeds into the momentum brought about by hedge fund money chasing commodities which then feeds back into nations becoming more fearful of not having enough food on hand which then exacerbates the already volcanic tensions that have been simmering beneath the surface of the social fabric of many of those nations and has now erupted into the open. I repeat – this is the handiwork of the Federal Reserve which is determined to keep pushing money into the US economy no matter how much chaos across the globe they create. Yesterday Rice finally broke out of its long sideways pattern and saw further strength today as now it is making up for lost time. It is now at a 27 month high in price. Rice is a key food in the diet of many of the nations in the far East so there is potential for the same sort of social unrest in some of those nations should this market suddenly catch on fire. Thus far it has not really garnered the attention of many of the hedge funds as it is a relatively thin and illiquid market, but that in itself is no guarantee that it will not become thus. This is part of the reason that gold has thus far not broken down. Speculative money continues to bleed out of this market for the time being but one wonders how much longer that can continue with the rampant inflation now firmly entrenched in the food sector and beginning to push with more intensity in the energy sector. Asia in particular is getting hit very hard with serious inflation issues and that is the reason gold demand from that quarter of the globe is so intense right now. They are not as easily duped into believing the stupid assertions coming from the monetary leaders in the West that "inflation fears are overstated". Along those lines here are some excerpts from a story in today's Financial Times out of London (thanks John!): China on track to become top gold buyer February 2 2011 (Financial Times) — China's gold imports are estimated to have more than doubled from a year ago in the run-up to Chinese new year, putting the country on track to overtake India as the world's largest consumer of the precious metal. … Precious metals traders in London and Hong Kong said on Wednesday they were stunned by the strength of Chinese buying in the past month. "The demand is unbelievable. The size of the orders is enormous," said one senior banker, who estimated that China had imported about 200 tonnes in three months. Gold prices softened in January on the back of positive economic data in the US, but prices for physical gold in Shanghai have been at a premium of about $20 per troy ounce over those in London, underscoring the tightness in Asian markets. … This week China's exchanges are closed for the holidays… Bonds were lower today and are perched quite precariously just above the lower level of the range that has held them in check to the downside for nearly 6 weeks now. Will the Fed's buyers come in and rescue them again? They had better or they risk a downside technical breakout which would portend higher long term interest rates. Expect them to immediately pop higher on the reopening of trade this evening. Click either chart to enlarge in PDF format with commentary from Trader Dan Norcini | |

| Posted: 02 Feb 2011 12:31 PM PST Seems like everyone has now jumped back on the energy band wagon.To be precise energy, solar's, uranium and rare earths. I hear it constantly in the media. However if something has gone up long enough and far enough to garner the attention of the media it's usually closer to a top than a bottom. For instance, the oil service ETF is now stretched 33% above the 200 day moving average. One has to wonder how much upside potential is left after a 5 month rally. What I don't hear anyone talking about anymore is gold or mining stocks (unless it's to tell us that the bubble has popped). While virtually every other sector has gotten extremely stretched above the mean the precious metal sector, the only sector in the world that is still in a secular bull market, has quietly moved down into an intermediate degree correction. So when you hear the countless analysts spouting nonsense about the gold bubble bursting, or the fear trade coming off, or any number of ridiculous reasons they dream up for why gold has moved down, you will know the real reason for golds pullback is nothing more complicated than the average run of the mill profit taking event. An event that happens like clockwork about every 20-25 weeks on average. These intermediate degree corrections are the single best buying opportunity one ever gets during a C-wave advance. Also in the bullish column, sentiment in the sector has now reached bearish extremes. Evan better is the fact that most of the sector has pulled back to long term support, and or tested a major breakout level. The upside potential in many of the mining sector ETF's and bell weather stocks is now huge, even if they were just to get back to the recent highs. One has to ask themselves whether they think the profit potential is biggest in a sector where everyone is falling over themselves to buy. A sector that has already had a huge move and is incredibly stretched above the mean. Or if the odds might be better buying a secular bull market that has experienced a nice pullback. A sector where a return just to the old highs would already constitute a huge gain, not to mention gold should still have one more parabolic move higher this spring as the final leg of this two year C-wave finally tops out. My money is on the area where no one is looking. Buffett said it best. "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." Be sure to sign up for the free webinar this weekend. This posting includes an audio/video/photo media file: Download Now | |

| Posted: 02 Feb 2011 12:22 PM PST I am constantly amazed at the number of people who think that a budget deficit is the same thing as the total federal deficit, which it ain't. Actually, I remember one time early in my career where I was so desperate to cover up the results of my own incompetence that I tried to exploit this confusion with a "budget deficit" scam of my own, and it seemed to work for almost a month! I called it "unanticipated deficit", which was not exactly a lie like the other lies I'd told my bosses over the years. Running though my Personnel File, we can see a long list of lies that have made their way into my file, like the ones I told about how, yes, I knew what I was doing, and yes, I am trained and educated to do what I am hired to do. There's another one where I am lying and saying no, I am not goofing off all the time or sneaking off to play golf, and then there's this other one where I lied and said no, I do not think I am smarter than everyone else just because I am buying gold, silver an... | |

| Gold Price Has Work To Do Down Below, Stocks Setting Up For Painful Break Posted: 02 Feb 2011 10:51 AM PST Gold Price Close Today : 1331.50 Change : (8.10) or -0.6% Silver Price Close Today : 28.299 Change : (0.225) cents or -0.8% Gold Silver Ratio Today : 47.05 Change : 0.087 or 0.2% Silver Gold Ratio Today : 0.02125 Change : -0.000039 or -0.2% Platinum Price Close Today : 1833.00 Change : 6.90 or 0.4% Palladium Price Close Today : 815.05 Change : -7.15 or -0.9% S&P 500 : 1,304.03 Change : -3.56 or -0.3% Dow In GOLD$ : $186.95 Change : $ 1.18 or 0.6% Dow in GOLD oz : 9.044 Change : 0.057 or 0.6% Dow in SILVER oz : 425.53 Change : 0.10 or 0.0% Dow Industrial : 12,041.97 Change : 1.81 or 0.0% US Dollar Index : 77.09 Change : 0.026 or 0.0% The GOLD PRICE did nothing today to inspire a raft of optimism. Low came at $1,326.40, which over the past three days gold has thrice struck. That raises the expectation that gold will break DOWN through that mark. However, it could clear $1,345 that would erase that expectation. Arguing against lower prices are the MACD and RSI turning up or trying to turn up. The SILVER PRICE met its 50 day moving average today (2872c) but liked it not. Fell 22.5c to 2829.9c on Comex, and closed slap on its 20 DMA. Now that might be nothing more than the jiggling that a market does trying to break through resistance, or it might be the jiggling a market does just before it gives up and falls. Daily chart looks like -- believe it or not -- a rounding TOP. Silver must clear resistance at 2860c. Downside it must hold 2790c. Below that awaits a waterfall. Be patient, the market will tell us. Platinum rose to $1,833 today, not quite touching its last high at $1,843. Palladium fell from yesterday's high. Everywhere I turn, things are talking out of both sides of their mouths at once. Bottom line is that I believe the SILVER PRICE and GOLD PRICE have a little more work to do down below, and stocks are setting up for a painful break. I am not, however dogmatic about anything but my anti-dogmaticism, and can tolerate anything but intolerance. The re-printing of Edwin Vieira's classic legal-monetary history has revived, 2 vols., 1700 pp. GoldMoney Foundation is republishing it. I am late notifying y'all, but to order send a check for $159.95 to Edwin Vieira, 52 Stonegate Ct., Front Royal, VA 22630. Add $7.50 tax for orders shipped to Virginia. I cannot recommend this work highly enough. Nothing else comes close to it. Tomorrow I am travelling to Maryland where I will be speaking on Friday evening for the Institute on the Constitution. See www.iotconline.com for details. That means today's commentary will be my last this week. God willing I will return on Monday, probably as confused as ever. Turns out my suspicions yesterday might have been justified. Might, I say, might. Those stocks that yesterday were jubilant at a new high for the move looked a mite hungover today, like they'd gotten deep into some really bad 'shine. The Dow's chart today looked like a clothesline full of rags on a bad windy day, blowing up and down and every which way. Of all the stock indices the Dow alone rose today, and that by a mighty 1.81 points (yep, you read that aright) to 12,041.97. S&P fell 3.56 to to 1,304.03. Folks, the truth is that if you lie down with dogs you're gonna wake up with fleas. Just hang in there with stocks and watch what happens. Be sure to buy yourself a couple of shakers of flea powder, though. And before it's over, you may need some of that really bad moonshine. At 77.093 the dollar index rose a miniscule 2.6 basis points, but it looks better than that on the chart. There it looks like a rounding bottom about 76.85. Today MIGHT have marked the end of the dollar's fall, but stay flinched, because nothing's sure yet. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | |

| Posted: 02 Feb 2011 10:07 AM PST Dollar rally, risk appetite weigh on gold price The COMEX April gold futures contract closed down $8.20 Wednesday at $1332.10, trading between $1327.30 and $1345.60 February 2, p.m. excerpts: | |

| Ireland to S&P: Oh Downgrade, Where is Thy Sting Posted: 02 Feb 2011 10:06 AM PST What if a rating agency downgraded a country and no one listened? With all of the news outlets focused on tensions in the Middle East, have we forgotten about the elephant(s) in the room? Ireland’s credit rating was downgraded one level to A- today by Standard & Poor’s - leaving it four levels above “junk” status. To add insult to injury, S&P said that the country remains on “credit watch with negative implications.” Nonetheless, the market barely shrugged. In fact, we remain within points of the post meltdown highs. The real kicker was the fact that Ireland’s 5-yr Credit Default Swaps FELL 4.6% today in the face of the downgrade. Perhaps the market has become numb to the rating agencies. Or maybe it is because S&P is late to the party. Fitch downgraded Ireland to BBB+ in December and Moody’s quickly followed suit lowering it to Baa1 (with a negative outlook). At that time the Euro slid against the Dollar. In fact the headlines suggested that the market still cared. Reuters, for its part, noted “Europe shares fall after Moody’s Ireland downgrade” as the FTSE slipped 0.4% on the news. Looking back, when Ireland was downgraded by Standard & Poor’s back in August, there was still concern about the cost of bailing out the country’s banks. At that time, Fox Business proclaimed “Europe stocks fall after Ireland’s downgrade.” Even the S&P 500, trading at 1066 the day before the downgrade, fell to 1055. Today, we are over 20% higher in the US. In fact, there are few headlines tying the downgrade to the market’s lackluster performance. Reuters could only muster “S&P, Dow dip on Ireland downgrade” as a response. Oh downgrade, where is thy sting? Are we too complacent, have rating agencies lost their relevance, or were investors too busy watching scenes from Cairo’s Tahrir Square? With the action in the CDS market, one could say that the downgrade was already priced in, S&P was just catching up. Will the market refocus on the PIIGS once the dust settles or have we really moved on? Time will tell. Follow me on Twitter @GTWNJACK | |

| Big Gains Are to be Made in Platinum and Palladium Posted: 02 Feb 2011 09:42 AM PST | |

| Posted: 02 Feb 2011 09:36 AM PST Courtesy of FMX Connect, which has shared this premium subscriber update with Zero Hedge readers. A

Analysis: The day started with December volatility being offered in risk reversal form. Volatility continued to soften through the front months until late morning when the December 1800 C buyer resurfaced (ZH: And if the rumor of who the buyer is ends up being true, this will be a doozy...). Iron butterflies are synthetically offered as dealers offer straddles and funds buy wings. Active Options

ATM Volatility Curve:

Volatility Smile:

| |

| Posted: 02 Feb 2011 09:30 AM PST The Federal Crisis Inquiry Commission (FCIC) had as much chance of satisfying the public as the Warren Commission did of closing the debate on the Kennedy assassination. The FCIC published its report on January 27, 2011. This was the "Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States." The FCIC itself could not come to a conclusion. The Democrats wrote for the majority, the Republicans for the minority, and a think-tank fellow motored off on a tangent of his own. By the way, these conclusions, cleaved by the politics of the season, demonstrate the immaturity of Washington. The members could not forsake their hobbyhorses to address the time bomb that, unaddressed, will explode. A half-century's accumulation of bad debt tumbled over in 2008 and a much larger mountain of waste and ruin lies ahead. My gripe: the FCIC found the greatest fault with the effects rather than the cause. This is true of all three conclusions. The cause of the crisis was too much money and credit. An economy needs enough credit to operate, but not so much that speculation runs the country. (This, of course, is so obvious that it might seem a waste to write, but the so-called policymakers revved the cyclotron faster and faster.) Among the "Conclusions" of the Financial Crisis Inquiry Commission Report, the majority averred: "[I]t is the Commission's conclusion that excess liquidity did not need to cause the crisis. It was the failures outlined above – including the failures to rein in the excesses in the mortgage and financial markets – that were the principal cause of the crisis." Our dear readers may remember Advice to the Financial Crisis Inquiry Commission: How to Question Alan Greenspan. This was a letter I wrote before the FCIC's hearing on subprime lending, addressed to FCIC Chairman Phil Angelides, in anticipation of former Federal Reserve Chairman Alan Greenspan's testimony. Paragraph number three follows: The Federal Reserve is Cause, Not Effect, for Abuses in Subprime Lending There would have been no lending of any sort without the Federal Reserve. The Fed prints the money that enters the economy. It has a monopoly. Counterfeiters know that. Credit springs from money. The commercial banking system produces credit, by and large. The Federal Reserve sets reserve requirements on commercial bank credit growth. If the Fed sets the bank reserve ratio at 10:1, a bank cannot lend more than $10 for every $1 on deposit. That effectively limits the growth of credit. The Federal Reserve has the authority to increase or decrease bank reserve requirements at any time. During Alan Greenspan's chairmanship, the Fed reduced bank reserve requirements several ways; it never increased them. The result of the Greenspan Fed's money and credit expansion: commercial banks, having run out of proper projects to fund, lent to investment banks, hedge funds, private-equity funds, subprime mortgage lenders, and commercial property speculators. (An investment bank may have lent to a non-bank mortgage company, but it first had to borrow from the commercial banking system.) The Federal Reserve, under Alan Greenspan, both printed every dollar that entered the economy and had sole authority to set bank reserve requirements. If the Fed had reduced reserve requirements, this would have restricted the lending that proved so destructive. There is, of course, much more than I have written above for a full understanding of money and credit, but Alan Greenspan will not attempt to enlighten the commission… Greenspan's testimony was indeed reprehensible, but let him rust. In 2011, Federal Reserve Chairman Ben S. Bernanke is the cause of various asset-price inflations. He is increasing money at a rate far beyond Alan Greenspan's worst excesses. The resulting overinvestment (also called "liquidity" or "speculation") has nourished widespread speculation in the financial markets, while still failing to nourish long-term capitalistic enterprises out in the real world. As a result, in the current investment environment, investors have a better chance of a triple buying Chinese dot.coms than they do investing in a profitable solution to world hunger. The Fed has rigged the markets, so make money fast before everyone realizes Vegas is a squarer deal. Regards, Frederick J. Sheehan They Missed the Money originally appeared in the Daily Reckoning. Recent articles featured in The Daily Reckoning include the impact of quantitative easing and US debt. | |

| Posted: 02 Feb 2011 09:05 AM PST This is a new kind of comment forum, similar to an Open Forum, in honor of Wendy and others who suffer in silence, unable to access comments in excess of 200. And just for the record, do not buy this coin! Believe it or not, it is priced at a post-Freegold price. Your break-even point on this coin is gold at $33,102.47 per ounce (after shipping and handling)! Funny that it says the price can | |

| Posted: 02 Feb 2011 08:47 AM PST The Good & Lucky Indicator Dear CIGAs, My Mother was Abbey's Irish Rose. I grew up hearing all things relevant about signs. It is an Irish thing. One of the most interesting signs is that if you put on your pajamas backwards it was a sign of luck coming. The longer the sleeping hours they remained backwards the greater the good luck. Well, a winning Power Ball must be coming my way because today, late afternoon, I discovered I had my Carhartts on backwards. Carhartts are a type of insulated bib overalls. Yes, the bib was in the back. I could not understand why this thing had to be taken totally off for a minor call of nature. There was no fly. Great luck has to be on the doorstep or maybe it is here already.

Jim Sinclair's Commentary It grows and grows but nobody knows where or if it will stop. U.S. Treasury Will Sell $72 Billion in Long-Term Securities This Quarter The U.S. Treasury Department today said it would keep its long-term borrowing at steady levels and warned that the federal debt limit could be reached as soon as April 5. Mary Miller, the Treasury's assistant secretary for financial markets, said the department so far is borrowing as usual while Congress debates when and how to raise the $14.29 trillion debt limit. Secretary Timothy F. Geithner has warned that the U.S. faces "catastrophic damage" if lawmakers do not act in time. "We expect that Congress will do the right thing and raise the debt ceiling in a timely manner," Miller said at a press conference. The Treasury today said it plans to sell $72 billion in long-term debt next week, in line with the median forecast in a Bloomberg News survey of bond dealers. The department's quarterly auctions will consist of $32 billion in three-year notes on Feb. 8, $24 billion in 10-year notes Feb. 9 and $16 billion in 30-year bonds Feb. 10. The Treasury now expects the debt ceiling to be reached between April 5 and May 31, compared to the range of March 31 to May 16 it predicted early last month. The department will update its forecast again in the first week of March.

Jim Sinclair's Commentary Ok, I could not help it. My tracked vehicle is unstoppable in the snow. I just got in from a ride through the woods cutting tracks in snow I couldn't tell you how deep it was. The undercarriage plows snow and will not let the vehicle get hung up. Six gigantic lights look forward and backwards making this thing look like a snow vehicle from outer space. First gear rumbles a bit – it is required to make it uphill. Uphill in this thing is like no uphill ever. It climbs in deep snow up to a 70% slope. The vehicle undulates as the snow does giving you the feel of a boat going through swells. Work hard and occasional play with sattvic toys is required to keep things in perspective. What we are doing in gold is 100% right regardless of significant reactions common to a higher price. Now back to business. Later tonight we will be back to the blizzard. Living on a farm is the only way to go for a lot of reasons.

Jim Sinclair's Commentary What does the Fed know that financial TV does not? The entire Western world financial community is broke. The fragile recovery is Happy Juice from the Dow. Fed passes China in Treasury holdings The Federal Reserve has surpassed China as the leading holder of US Treasury securities even though it has yet to reach the halfway mark in its latest round of quantitative easing, according to official figures. Based on weekly data released on Thursday, the New York Fed's holdings of Treasuries in its System Open Market Account, known as Soma, total $1,108bn, made up of bills, notes, bonds and Treasury Inflation Protected Securities, or Tips. According to the most recent US Treasury data on foreign holders of US government paper, China holds $896bn and Japan owns $877bn. "By June [the Fed] will have accumulated some $1,600bn of Treasury securities, likely to be in the vicinity of China and Japan's combined holdings," said Richard Gilhooly, a strategist at TD Securities. "The New York Fed surpassed China in the past month as the largest holder of US Treasury securities," he noted. The Fed is buying Treasury debt under two programmes. The largest is QE2, which began in November and is scheduled to involve $600bn of purchases by June. It is also buying $30bn of Treasuries a month as it reinvests principal payments from its large holdings of mortgage debt and debt issued by government housing agencies – a programme dubbed QE lite. | |

| Posted: 02 Feb 2011 08:22 AM PST The 5 min. Forecast February 02, 2011 01:17 PM by Addison Wiggin - February 2, 2011 [LIST] [*] Totaling up silver’s record month... and a chart that means good things for gold [*] Zombie alert: Wall Street pay and benefits reach a record high... as does the number of Americans on food stamps [*] Why Egypt is a mess... and why it’s a “canary in the coal mine” for other emerging markets [*] Conflicting indicators: In an era of $3 gas, people shun carpooling and seek out the bus [*] Reader points out a crucial connection between rare earths and Obama’s State of the Union [/LIST] We knew it would be a record… but the question remained: by how much? The U.S. Mint sold 6,422,000 Silver Eagles in January 2011 -- half again as many as were sold in the previous record-setting month of November 2010. There are a few nattering nabobs who say the figures are skewed because the Mint credited some December sales to January. So what? If you ad... | |

| Gold Daily and Silver Weekly Charts - Hyperinflation vs. Deflation Debate Posted: 02 Feb 2011 08:19 AM PST | |

| Posted: 02 Feb 2011 08:17 AM PST by Addison Wiggin - February 2, 2011

We knew it would be a record… but the question remained: by how much? We knew it would be a record… but the question remained: by how much?The U.S. Mint sold 6,422,000 Silver Eagles in January 2011 -- half again as many as were sold in the previous record-setting month of November 2010. There are a few nattering nabobs who say the figures are skewed because the Mint credited some December sales to January. So what? If you add up December and January sales and average them, you still get second-highest monthly total ever… right behind November 2010. Fact is demand is intense.  After just one week, Canada’s biggest bullion bank sold out its limited stock of 100-ounce silver bars. Now ScotiaMocatta has no silver bars to sell in any size. One ounce, 5 ounces, 100 ounces and the kilobars -- all gone. After just one week, Canada’s biggest bullion bank sold out its limited stock of 100-ounce silver bars. Now ScotiaMocatta has no silver bars to sell in any size. One ounce, 5 ounces, 100 ounces and the kilobars -- all gone. For its part, the spot price of silver remains in “consolidation mode” -- down this morning to $28.35. Still, in many ways, silver is better to own in times of uncertainty than its dearer cousin gold. For seven reasons why, check here. For its part, the spot price of silver remains in “consolidation mode” -- down this morning to $28.35. Still, in many ways, silver is better to own in times of uncertainty than its dearer cousin gold. For seven reasons why, check here. Gold is fetching $1,337 this morning. Gold is fetching $1,337 this morning. For the second time this year, we’re hearing reports of high premiums for gold bars in Hong Kong -- the highest since 1994, by one account. For the second time this year, we’re hearing reports of high premiums for gold bars in Hong Kong -- the highest since 1994, by one account.Dealers attribute it to the advent of Lunar New Year in China and wedding season in India. “There’s a lot of interest from India,” a Singapore-based dealer tells Reuters, “but it’s just that we can’t meet their demand. Everybody is snatching the available stocks.” That’s what Vancouver favorite Frank Holmes calls “the love trade” in gold -- the traditional affinity for gold in emerging-market cultures. Then there’s the “fear trade.”  “The fear trade drivers,” says Frank, “are negative real interest rates and deficit spending to support social welfare programs. The Federal Reserve reaffirmed last week that real interest rates will remain negative for the long haul.” “The fear trade drivers,” says Frank, “are negative real interest rates and deficit spending to support social welfare programs. The Federal Reserve reaffirmed last week that real interest rates will remain negative for the long haul.”Meanwhile, Frank reminds us that at $14.13 trillion dollars, we’re getting perilously close to the congressionally mandated national debt ceiling of $14.29 trillion. “Since the mid-1980s, the U.S. has raised its debt ceiling hand in hand with the country’s economic growth, even faster, in some cases.”  Bottom line: “The only thing keeping gold prices from skyrocketing has been money supply, which has been slow to rise. The correction in gold appears to be over for the reasons cited above. We’re near the 200-day moving average, which is a key psychological support level.”  The Federal Reserve just surpassed China as the largest holder of U.S. Treasury debt. According to weekly data from the New York Fed, Treasury holdings now total $1.108 trillion. The Federal Reserve just surpassed China as the largest holder of U.S. Treasury debt. According to weekly data from the New York Fed, Treasury holdings now total $1.108 trillion.That compares with China’s $896 billion and Japan’s $877 billion. Heh... and QE2 is barely a third of the way done. By the time that winds down in June, the Fed could hold as much Treasury paper as China and Japan combined.  Or more. Kansas City Fed chief Thomas Hoenig -- a monetary hawk who dissented from nearly every Fed statement last year during a stint on the Federal Open Market Committee -- says QE3 could be on the way. Or more. Kansas City Fed chief Thomas Hoenig -- a monetary hawk who dissented from nearly every Fed statement last year during a stint on the Federal Open Market Committee -- says QE3 could be on the way.If data on jobs and housing turns out to be “disappointing,” then another round of Treasury buying “may get discussed,” Hoenig tells Market News International. Oy. If you want to know what happens to a central bank hellbent on monetizing the nation’s debt... well, we recommend you read the chapter on John Law and the Mississippi scheme in our book Financial Reckoning Day again.  Stocks are flat, traders catching their breath after yesterday’s run-up to Dow 12,000. Stocks are flat, traders catching their breath after yesterday’s run-up to Dow 12,000.Traders appear unimpressed with ADP’s estimate of 187,000 new private-sector jobs in January. Perhaps, that’s because the December figure was revised downward a round sum of 50,000, to 247,000.  This next bit ought to fan the flames of populist rancor some more: Pay and benefits on Wall Street reached a record last year. A Wall Street Journal analysis calculates total compensation during 2010 was $135 billion -- up 5.7% from 2009. This next bit ought to fan the flames of populist rancor some more: Pay and benefits on Wall Street reached a record last year. A Wall Street Journal analysis calculates total compensation during 2010 was $135 billion -- up 5.7% from 2009.Meanwhile, another 394,957 Americans went on food stamps during November, according to the new figures from the U.S. Department of Agriculture. 43.6 million people are now on the program -- a record. For the record, that’s 14% of the population. So we ask (as flippantly as possible)... the Feds bail out the banks; their employees take home the taxpayer money. The Feds bail out the un- and underemployed and go back to the trough for more. Who’s actually making stuff?  Pro- and anti-Mubarak protesters are now fighting each other in the streets of Cairo. As we began to do yesterday, we step back a little further today and ask why the place is such a mess. Pro- and anti-Mubarak protesters are now fighting each other in the streets of Cairo. As we began to do yesterday, we step back a little further today and ask why the place is such a mess.How about this…

End result -- $240 billion in “dead capital” -- an amount equal to “30 times the value of all shares on the Cairo Stock Exchange and… 55 times all foreign direct investment.” The irony is that for much of the past decade, de Soto has consulted personally with Gamal Mubarak, the son and -- until recently -- presumed successor of President Hosni Mubarak. We’re not privy to what sort of reforms they discussed… but whatever they were, they haven’t been enough to satisfy the masses. [Ed. Note: De Soto, also discusses the way in which clear property title was developed in the U.S. as settlers moved west and recommends to this day the model as a way to bring emerging markets out of abject poverty. For understanding how capital is built, unlocked and deployed in an economy, The Mystery of Capital is a must-read. It’s a good read, to boot. We checked this morning. There are a few copies on the shelves at Laissez Faire Books. Click here and enter coupon code E401M203 at checkout to claim your discount.]  “Egypt could be something of a canary in the coal mine for many emerging markets,” says Chris Mayer. “Egypt’s economy grew 5-7% in recent years, even through the global financial crisis. Foreign investors put a lot of money to work in Egypt as many state-owned companies made the transition to privately owned ones. “Egypt could be something of a canary in the coal mine for many emerging markets,” says Chris Mayer. “Egypt’s economy grew 5-7% in recent years, even through the global financial crisis. Foreign investors put a lot of money to work in Egypt as many state-owned companies made the transition to privately owned ones.“If high food prices and social unrest dent that progress, we could see similar disruptions in many emerging markets. The big ones, such as China and India, also have problems with rising food prices. Something to keep an eye on.”  “Then there is oil,” Chris adds, pivoting to another angle. “Egypt is not a big oil producer, ranking 21st in the world. But it is home to two of the world’s major oil trade routes. “Then there is oil,” Chris adds, pivoting to another angle. “Egypt is not a big oil producer, ranking 21st in the world. But it is home to two of the world’s major oil trade routes.“The Suez Canal carries 1.8 million barrels of crude oil a day. It is the key way in which Persian Gulf oil finds its way to Western markets. Apart from oil, nearly 8% of all seaborne trade passes through the Suez Canal. Since Egypt nationalized it in 1956, the Suez Canal provides a steady stream of cash at little cost. Last year, it brought in $5 billion. “The other is the 200-mile Sumed pipeline. It carries 1.1 million barrels of oil a day. The pipeline allows tankers from the Persian Gulf to offload oil in the Red Sea, where others pick it up on Egypt’s Mediterranean coast.” Tanker stocks rallied last Friday as the broad market cratered. “If the Suez Canal closes or has problems, tankers will have to take much longer routes,” says Chris. “Like taxicabs, the meters will be running. It could take 10 days more for oil to reach the U.S. and 18 more for it to reach Northern Europe. “So far, there have been no problems. And I suspect that the oil tanker rally will be fleeting. More worrisome, though, is unrest spreading to oil exporters such as Libya and Algeria, or even Saudi Arabia. “Troubles there could easily send oil over $100 a barrel.”  On the market today, crude oil has rebounded from yesterday’s losses to $91.46 a barrel. On the market today, crude oil has rebounded from yesterday’s losses to $91.46 a barrel. Retail gasoline prices have registered their first weekly drop since November, according to the Energy Information Administration. The national average of $3.10 a gallon is 44 cents higher than it was a year ago. Retail gasoline prices have registered their first weekly drop since November, according to the Energy Information Administration. The national average of $3.10 a gallon is 44 cents higher than it was a year ago.We’re not sure how current gas prices figure into the next two stories, but we pass them along anyway…  The popularity of carpooling nowadays is about half of what it was in 1980, according to new data from the Census Bureau. The popularity of carpooling nowadays is about half of what it was in 1980, according to new data from the Census Bureau.Back during the days of the Iran hostage crisis and the Carter-Reagan campaign, one out of four Americans who drove to work shared a ride with others. Now it’s one in eight. Experts interviewed by The New York Times are all over the map about the possible reasons -- more people living in far-flung suburbs, higher rates of car ownership. But the answer may well lie in the average fuel cost of a 30-mile round-trip commute. In inflation-adjusted 2010 dollars, it works out like this…

In other words, people just got used to cheap gas over the last 30 years. But if their commuting habits aren’t changing, their other travel habits are.  For the third year in a row, bus travel is the fastest-growing way of getting from one city to another, outpacing rail and air. For the third year in a row, bus travel is the fastest-growing way of getting from one city to another, outpacing rail and air.Research from DePaul University shows intercity bus operations grew 6% last year, led by 24% growth among “curbside” operators. Those are the newer outfits like BoltBus and Megabus, which don’t operate through traditional Greyhound-like terminals. Megabus chief Dale Moser figures 65% of his riders would drive if his service weren’t available. “There’s, obviously, a pent-up demand and need for intercity bus travel,” he says.  “In Obama’s State of the Union address,” a reader writes, “he said he wanted to invest in green energy and communications. They both use rare earths, right?” “In Obama’s State of the Union address,” a reader writes, “he said he wanted to invest in green energy and communications. They both use rare earths, right?”The 5: Good point. Byron King made the same point recently: Without rare earths, “many modern technologies would cease to exist -- including millions of...

This is why China’s control over 97% of current world production is such a big deal. And it’s why the race to get the first non-Chinese mine up and running is so crucial. The winner of that race will have an unbeatable advantage. Most of the “usual suspects” in that race have had huge ramp-ups in their share prices… only to see them crash. (Byron recommended readers get out of Molycorp near the top, for a 178% gain.) But one key player -- a dark horse in the race -- could beat every one of them. “In my 30-year career as a geologist and researcher,” Byron says, “I’ve never been more excited than I am about this little-known mining company’s bonanza in a place you’ve most likely never heard of before.” He reveals all in a special research report… and we’re offering access only through tomorrow at midnight. To learn how to get your own copy, please review Byron’s most recent presentation.  “It’s hard to fathom the stupidity of the reader who bewails the cost of environmental and safety rules,” another writes. “It’s hard to fathom the stupidity of the reader who bewails the cost of environmental and safety rules,” another writes.“When these protections are removed, the resulting costs such as associated deaths, disabilities and destruction of other businesses through collateral damage such as seen with the BP disaster are simply shifted off the offending industries and onto the backs of the states” tax roles, or the impacted communities or the individual workers themselves. “The question is not whether we can find a way or no way to pay -- the question is simply who pays?”  “My first home, in 1960, cost $11,000 at 3%, and my next house cost $19,000 in 1962 in a much-better neighborhood,” writes another, who’s using a roundabout example to disagree. “My first home, in 1960, cost $11,000 at 3%, and my next house cost $19,000 in 1962 in a much-better neighborhood,” writes another, who’s using a roundabout example to disagree.“Many years later, I asked a contractor (in Southern California) why housing had become so expensive. His comment was rules; the EPA; regulations that cost him in licenses, permits, etc., $26,000 before he started building!” Regards, Addison Wiggin The 5 Min. Forecast P.S.: The gyrations in the price of oil yesterday handed a one-day gain of 38% to readers of Strategic Currency Trader. Today Abe’s laying on another play that could be worth up to 300% by tomorrow. We’ll have to see... Access to these recommendations, until now, has been limited to Agora Financial Reserve members. Let us know how you’ve been doing with them. If you’re not in the Reserve and would like to participate, please be patient. And... watch this space for updates. Cheers. | |

| Posted: 02 Feb 2011 07:57 AM PST

The following is an excerpt from our FREE Special Report on the current bull market in Gold titled, How to Buy Gold for $350 Per Ounce. Enjoy!

Do you own gold yet?

As I’m sure you’re aware, starting in July 2007, the financial markets entered one of the most severe crises in history. In response to this, the Feds (Federal Reserve, Treasury Department, etc.) have tried to prop up the financial system with endless money printing and stealth bailouts.

And that’s a BRIEF recap (I’m sure I left something out).

At some point (and I cannot tell you when), the money printing and bailouts will result in a horrific wave of inflation similar to the one this country saw in the early ‘70s. No central bank in the history of mankind has ever been able to print money ad nauseum without devaluing its currency. And the US central bank is currently producing TRILLIONS of dollars to aid their friends on Wall Street.

Indeed, inflation is actually already here as the headlines attest:

Global Food-Price Index Hits Record

China has raised interest rates twice in recent months to combat inflation. Euro-zone inflation jumped past the bloc's target rate for the first time in more than two years, data released this week showed, and economists said the rise was likely due to higher food and energy prices.

UN body warns of ‘food price shock’

The world faces a “food price shock”, the Food and Agricultural Organisation has warned after its benchmark index of agricultural commodities prices shot up to a nominal record last month, surpassing the levels of the 2007-08 food crisis.

The warning from the UN body comes as inflation is becoming an increasing economic and political challenge in developing countries, including China and India, and is starting to emerge as a potential problem even in developed countries, including the UK and the eurozone.

China Acts To Prevent Collusion On Prices

China's economic planning agency unveiled regulations to prevent price collusion and monopolistic pricing practices, giving the government more tools to rein in inflation pressures… Under the new rules, competitors will be banned from reaching agreements to fix prices, while business partners will be barred from agreeing to minimum resale prices, the NDRC said.

China PBOC: To Give Higher Priority To Curbing Inflation

China's central bank will give a higher priority to curbing inflation in 2011, the People's Bank of China said Thursday, boosting expectations that it will adopt more tightening measures, such as raising interest rates.

China has adopted various measures in the past few months in a bid to rein in inflation. The PBOC hiked benchmark interest rates on Dec. 25, the second time since Oct. 19, which was the first rate hike in nearly three years.

Brazil pledges to stop US 'melting the dollar'

Brazil has sounded a new note of warning in the international "currency war" by pledging not to allow the United States to "melt the dollar". Guido Mantega, the Brazilian finance minister, raised the prospect of introducing greater controls on short-term flows of speculative capital into his country.

All of these come from major media outlets (not exactly at the forefront of investigative journalism). At this point I actually wonder if Ben Bernanke can even read. I realize that sounds harsh, but how on earth can he claim inflation is under control? I mean, does this guy even bother reading anymore? He’s an academic right? Isn’t his entire job supposed to consist of reading and thinking?

Let’s be clear here, inflation has already begun to rear its head around the world, especially in food prices. This is a MAJOR problem for emerging market economies where food comprises a higher percentage of consumer spending than in the US. So expect to see food riots and greater civil unrest in many emerging markets.

And you BETTER prepare for inflation in the US.

Indeed, We’ve already seen commodity prices spike across the board in the US in the last year:

The next stage is the paper currency collapse: the stage at which inflation accelerates as the US Dollar collapses, destroying purchasing power while inflation hedges EXPLODE higher.

So it’s no surprise that the smart money (investing legends like Jim Rogers, David Winters, and the like) have been preparing in advance buying inflation hedges and companies that profit during periods of high inflation.

And nothing protects against inflation like GOLD.

Gold was, is, and always will be THE ultimate storehouse of value. Mankind was prizing this stuff during the prehistoric period, long before the concept of stocks, mutual funds, or paper money even existed.

Today, with world central bank’s printing paper money day and night it is no surprise that Gold is now emerging as the ultimate currency: one that cannot be printed. Small wonder then that it has recently hit new all-time highs against ALL major world currencies.

And despite its historic rally Gold is still cheap on historic standards.

Indeed, while a lot of commentators have noted that gold is already trading above its 1980 high ($850 an ounce) they failed to note is that thanks to inflation, $1 in the ‘70s has a heck of a LOT MORE purchasing power than $1 today.

For gold to hit a new all time high adjusted for inflation, it would have to clear at least $2,193 per ounce. If you go by 1970 dollars (when gold started its last bull market) it’d have to hit $4,666 per ounce.

Now the question is, should you buy physical Gold or invest in one of the paper-based Gold ETFs (GLD and the like)?

Two Golds: One Paper & One REAL

Gold is somewhat unique amongst investments in that it trades both in physical form (bullion, or the actual metal) and a “paper” form (the Gold ETF (GLD) and COMEX). The differences between the two are striking:

To my way of thinking, you only own Gold if you OWN Gold. By this I mean you have REAL ACTUAL GOLD in your hands, NOT a claim on Gold that someone else CLAIMS is exists. After all, the paper-based Gold ETFs are all run by large banks that claim to have enormous warehouses of Gold. Seeing as these institutions are all lying about the toxic debts, off-balance sheet assets, and more… what’s to stop them from lying about their bullion reserves?

So when it comes to buying Gold, you HAVE to own some actual physical Gold. And regardless or whether you’re investing in gold as an inflationary hedge, a backup source of wealth should the world’s financial markets collapse, or because gold remains one of the few means of hiding one’s wealth from unwanted attention, there are several key rules you should always follow:

Only buy from a dealer you know and trust. And buy bullion that is liquid enough that you can buy or sell it quickly.

How much you purchase is up to you. But you should have several months’ worth of expenses in gold and silver bullion. Why Gold AND Silver? Because if the banks are closed or if paper money is worthless, you don’t want to be walking around with an ounce of gold (worth $1k+) to buy groceries. No, you will want some precious metals of smaller denomination to purchase/ barter with, hence the need for some silver.

In terms of actual gold coins, there are three coins that comprise the bulk of the bullion market. They are Kruggerands, Canadian Maple Leafs, and American Gold Eagles. I’ve been told to avoid Maple Leafs by both a trader and a bullion dealer as they can easily be scratched which damages the gold and reduces the coin’s value.

In terms of silver, the easiest way to get it is in pre-1965 coins (often termed “junk” silver). The bullion dealer I spoke to prices them at 50 cents over spot. However, you can also get silver one-ounce rounds (coin-like medallions) and 10 ounce bars both of which can be bought at 95 cents over spot. Finally, you can buy Silver Eagles at $2.50 over spot.

Again, I cannot tell you which dealer to go with, but look for someone who’s been dealing for years (not a newbie). You should also ALWAYS ask for references from the dealer (former clients you can talk to about their purchases/ experiences).

Some warning signs to avoid are dealers who try to store your bullion. NEVER, I repeat, NEVER store your bullion with someone else. ALWAYS store it yourself. Also, be sure to talk to the dealer for some time and ask him or her numerous questions about the industry, the coins, etc. If they can answer everything you ask in a knowledgeable fashion, their references check out, and you verify everything they say with a 3rd party, you should be OK.

In terms of storing your bullion, you can store it in a safe deposit box or buy a decent home safe from Target or Wal-Mart (or a specific safe store). If you go the safe deposit box route, make sure it’s with a bank that has as little exposure to derivatives as possible.

To continue with the rest of our FREE report on Gold swing by http://www.gainspainscapital.com and click on FREE REPORTS. This 17-page report details not only what’s likely to come, but how to prepare for it. And it’s all 100% FREE.

Good Investing!

Graham Summers

| |

| David Goguen: Finding Real Value in the Ground Posted: 02 Feb 2011 07:42 AM PST Source: George Mack of The Gold Report 02/02/2011 PI Financial Institutional Sales VP David Goguen sees real potential for share price appreciation in select mining companies with expandable resources. Through their quantitative research report Select Golds, Dave's team, including Associate Brodie Dunlop, are focused on Latin American explorers and producers. But they don't stop there; they continue to search the globe for companies moving through the industry lifecycle of advanced explorers and emerging producers all the way up to junior producers. In this Gold Report exclusive, Dave and Brodie share a few mining plays that range in size from micro cap to liquid small cap that offer real opportunity to leverage the power of value. The Gold Report: When you spoke with The Gold Report last November, you said you were looking for undervalued plays. Valued by what measure? The value unrecognized by the Street, or value that has yet to be developed and driven out of the ... | |

| Finding Real Value in the Ground Posted: 02 Feb 2011 07:35 AM PST PI Financial Institutional Sales VP David Goguen, in this Gold Report exclusive, sees real potential for share price appreciation in select mining companies with expandable resources. Through their quantitative research report Select Golds, Dave's team, including Associate Brodie Dunlop, are focused on Latin American explorers and producers. | |

| Posted: 02 Feb 2011 07:30 AM PST courtesy of DailyFX.com February 02, 2011 07:41 AM 240 Minute Bars Prepared by Jamie Saettele Gold has held a multiyear support line. However, the decline from 1425.40 is in 5 waves, indicating that the larger trend is most likely down. Price has nearly reached initial resistance from the former 4th wave at 1348.50. Just above there is the 38.2% retracement at 1353.28. This area is reinforced by former support.... | |

| Silver Circle HOTTIES raise $5,000 in one day Posted: 02 Feb 2011 07:23 AM PST Silver Circle Fiat Money Bomb – Press Release For Immediate Release: 2/2/11 contact: Megan Duffield | megan@silvercirclemovie.com Silver Circle is proud to announce $5,000 was raised in one day for the film's production budget in the successful "Fiat Money Bomb". Although a small portion of the overall production budget, this money will off-set production costs [...] | |

| Demand juggernaut keeps commodities supercycle going strong Posted: 02 Feb 2011 07:13 AM PST by Lawrence Williams … The current supercycle Watling sees as driven by the momentum of emerging market industrialisation and economic growth – particularly in the mega-economies of Asia, of which India and China are the most prominent. He points to the rise of the middle class in this area. In 1990 it was estimated that there were 565 million people in the middle class (obviously though still at a much lower income level than the West might consider middle class). This was estimated to have risen to 1.9 billion people by 2008 and growth is still probably accelerating creating tremendous purchasing momentum, which in turn has been having a huge impact on commodities – including both industrial and precious metals. While he remains a little cautious on price growth near term, he is confident on continuing substantial growth longer term as the cycle moves towards its peak which may still be 10 years hence. … He sees the dollar as being in a 10 year downgrade – a process which will continue as the U.S. will be forced to maintain its Quantitative Easing programmes to ward off recession. Although there are signs of recovery it is not strong enough and unemployment there remains well above what is politically acceptable. Gold too is an integral part of the cycle and there has been a massive gold surge as real interest rates remain low or even negative – and again the pattern is likely to continue unless and until real interest rates move sharply upwards. [source] | |

| Outperforming even Silver . . . Artisanal Glass Posted: 02 Feb 2011 07:08 AM PST I told you six months ago that artisanal glass was about to explode on the art scene; escape the decorative ghetto and start to take its place alongside sculpture in the collections of galleries and individuals. Led by young rebels like Jeremy Maxwell Wintrebert the scene and prices are now exploding as covered in this [...] | |

| Capital Leaving Middle East Looking For Safe Havens In Hard Assets and Oil Posted: 02 Feb 2011 07:01 AM PST | |

| Gold and Silver to Rise Slowly, Buoyed by Emerging Market Growth in Near Term Posted: 02 Feb 2011 06:41 AM PST Marco G. submits: The author thought to put some words down on paper as this usually serves to clarify my own thinking and perceptions. The main question on my mind is, "What is going to happen to gold and silver in the near term?" Overall, the precious metals have enjoyed a 10 year bull market with gold at about $250 USD and silver at about $4 USD a decade ago. Presently, gold is at $1300+ or up five times and silver is at $28+ or up seven times. Does this mean that gold has peaked and finished its run or does this mean this particular cycle is over? Having perused the idea for the last while, it became clear to me that this is what rational financial people think, that the prices are too high, but I am not a traditional rational financier. Logical and steadfast people depend upon previous history and talk about cycles and try to rationalize trends with numbers and charts and indicators and try to talk about the precious metals unemotionally. My opinion is that gold is irrational, and does not perform according to cycles and or indicators. Let me clarify this, when people talk about gold, there are a small number of gold bugs, a quantity of rational financial people and then there is the rest of the world, which is in the majority. With gold, there are a small number of people with emotional ties, who are either for or against. The majority of the world's people Complete Story » | |

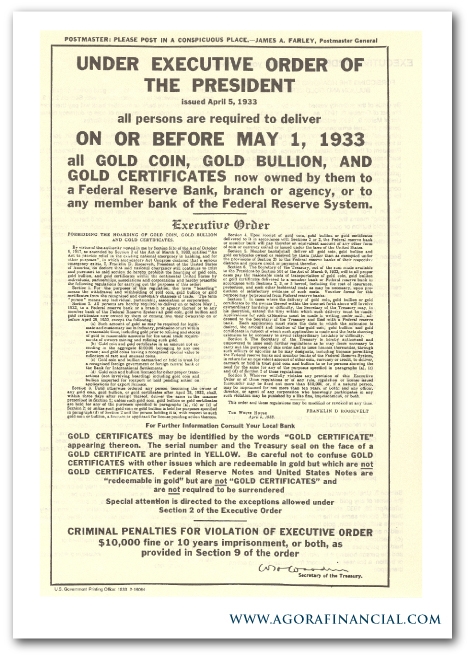

| Tracing the Fed’s Vital Role in the Decline of the US Dollar Posted: 02 Feb 2011 06:19 AM PST In 2013, we Americans will commemorate a century of wealth destruction in the United States – the Federal Reserve will be 100 years old. In 1913, the Federal Reserve Act became law – granting sole authority to the Federal Reserve to "issue legal tender." Armed with its new power and its good intentions, the Fed embarked on a 98-year process of currency debasement. That's not what the Fed set out to do; it's just what it did do. In the early days of the Federal Reserve, this monetary authority enjoyed the support of a gold standard. Few Americans doubted that the Fed's new greenbacks would be as good as gold. As such, gold coinage and paper dollars intermingled effortlessly in the US economy for most of the Fed's first two decades. But as the wheels of progress roared ahead, America's "hard money" coinage disappeared and soft promises took its place – soft promises and lots of chatter about hard money. As it turns out, chattering about hard money does not preserve wealth as well as hard money itself. The purchasing power of a one dollar bill has plummeted more than 95% since the Federal Reserve first began printing its legal tender in 1914. Although the dollar's epic decline began glacially, it has gathered luge-like momentum. The greenback's value dropped only 50% during the first 33 years of the Fed's stewardship – i.e. between 1913 and 1946. But the 1946 dollar would lose half its value in just 24 years, while the 1970 dollar would lose half its value in just nine years. The rate of decay slowed somewhat during the Volcker years, as the 1979 dollar did not lose half its value until 14 years later. Nevertheless, the dollar's progression toward zero since 1913 feels more geometric than arithmetic. In 1914, the year the Federal Reserve began conjuring dollar bills into existence, 700,000 shimmering new $10 Indian Head Gold Eagles rolled out of the Philadelphia, San Francisco and Denver Mints. Once in the hands of a working stiff, each $10 coin would buy $10 worth of goods and services. Likewise, the Fed's crisp, new McKinley $10 bill would also buy $10 worth of goods and services. Over the ensuing 98 years, a succession of Federal Reserve Chairmen labored to "preserve" the purchasing power of their McKinleys, Washingtons and Lincolns. The Gold Eagles had to take care of themselves. The results are in; the unprotected Gold Eagles flourished, while the "protected" Mckinleys withered. Based on its metal content, a 1914 $10 Indian Head Gold Eagle is worth $643.45. A 1914 $10 bill is still worth ten dollars. To examine this contrast from a slightly different perspective, consider the divergent paths of the two $50 bills pictured below.

The first $50 bill is a 1913 "Gold Certificate," issued directly by the US Treasury and fully convertible into gold. The second $50 bill was issued by the Federal Reserve in 1914 and was convertible into nothing. Both versions of this $50 bill circulated freely in American commerce. Any holder of the $50 Gold Certificate held title to 2.41896 troy oz. of Gold – at the fixed rate of $US20.67 per troy oz. These certificates could be redeemed at any bank or from the US Treasury itself at any time…until 1933, when FDR outlawed gold ownership.

Notwithstanding this little nuance, let's consider the plight of two hypothetical buddies from 1914. The first buddy, Caleb, stashes a $500 "rainy day" fund under the floorboards of his house – a roll of ten $50 Ulysses S. Grant dollar bills. The second buddy, Josiah, also stashes $500 under the floorboards – he walks into the neighborhood bank with ten $50 Ulysses S. Grant Gold Certificates and exchanges them for gold. Josiah then takes his gold and hides it under his floorboards. Both buddies forget about their hidden stashes. Eventually, let's say 2010, the respective heirs of these two long-deceased buddies happen to conduct simultaneous renovations of their respective residences. Caleb's heirs find the ten ancient $50 bills. "How quaint," they think to themselves. Josiah's heirs find $32,172 worth of gold! Thus, 98 years of history demonstrates conclusively that a blind monkey could have preserved the dollar's purchasing power better than a Federal Reserve Chairman. Unfortunately, it's tough to find a blind monkey who will take the job. Eric Fry Tracing the Fed's Vital Role in the Decline of the US Dollar originally appeared in the Daily Reckoning. Recent articles featured in The Daily Reckoning include the impact of quantitative easing and US debt. | |

| Grandich interviewed in MarketWatch Posted: 02 Feb 2011 06:15 AM PST The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! February 02, 2011 09:41 AM Feb. 2, 2011, 12:00 p.m. EST Gold futures fall as investors eye riskier assets Analysts expect further weakness, but decline may be 'healthy' By Myra P. Saefong and Deborah Levine, MarketWatch SAN FRANCISCO (MarketWatch) — Gold futures fell Wednesday morning, pressured as investors favored riskier assets following gains in Asia and recent strength in the U.S. stock market. Click here to read more [url]http://www.grandich.com/[/url] grandich.com... | |

| Indications of the Broadest Measure of Money Supply Posted: 02 Feb 2011 06:12 AM PST | |