Gold World News Flash |

- “GATA considers its lawsuit a success for having established in open court that the Fed has many secrets about gold.”

- Gold Mining Acquisitions to Continue in 2011 & 2012

- Jim?s Mailbox

- Fed can keep most gold secrets but must yield one, judge rules

- The Goldsmiths, Part CLXXIX

- Two Huge No-No’s for Gold Investors

- It's All Good for Gold

- Better than Gold? … Jim Rogers Thinks So.

- Crude Falls on Profit Taking, Gold Rebounds on Bargain Buying

- The US Dollar: Dead On Its Feet, Dead Cat Bounce, or Dying to Rally?

- Grandich Interviewed in Market Oracle

- Gold Seeker Closing Report: Gold and Silver Gain Almost 2%

- Ben Davies: Pensions need gold, the currency of hard assets

- Senate votes to repeal 1099 provision

- Banks Overcharging Pension Plans?

- Jim's Mailbox

- AXA Rosenberg's Attempt To Conceal Its Quant Glitch Costs $242 Million

- Why Food Prices Must Go Up

- Bernanke Either Is Smoking Some Strong Weed Or Is A Malicious Liar

- Chinese Silver Buying Just Beginning

- The Truth About Gold

- Should Investors Continue to Buy Gold?

- Guest Post: Can’t See the Forest For The Trees

- Don't get mugged. Buy Silver.

- Fed Excess Reserve Cumulative Deficiency Hits Record

- The Real Reason for Rising Commodity Pricesw

- Ben Bangs Bonds Out of Range

- Guest Post: Smoot Hawley Redux

- Egypt And The Muslim Brotherhood: A Stratfor Special Report

- Keiser Report: Silver Stick for JP Vampire (E118)

- Ben Davies: “Pensions are an accident waiting to happen.”

- THURSDAY Market Excerpts

- On the African gold trail with GoldStone Resources

- Is Egypt A Preview of 2015 America?

- In The News Today

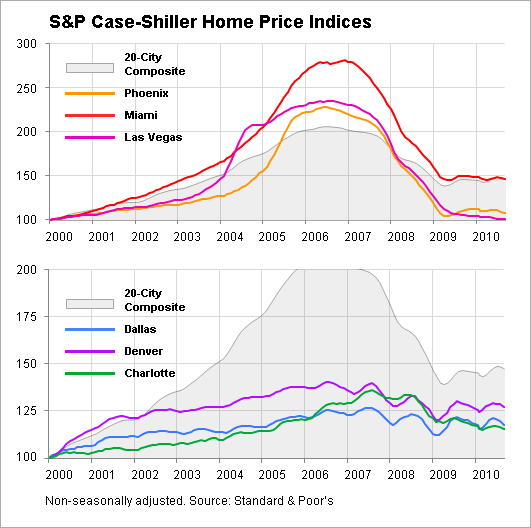

- Housing Armageddon: 12 Facts Which Show That We Are In The Midst Of The Worst Housing Collapse In U.S. History

- Fronteer Bought Out By Newmont, Readers Up Over 120%

- Fuzzy Logic: Those Who Fail to Learn From History...

- Gold Unchanged

- Modern Monetary Theory and Why We Have a Debt Based System

- Gold Thoughts

- It's Official: ICE Sets Cotton Position Limit

- Gold Daily Silver Weekly Charts - Panic Hits the Money Printers As Benny Signals QE -> infinitum

- “At Great Risk”

- “At Great Risk”

- No Sale Thursday - Will the Dollar Save Retail or Doom Us All?

- Gold: Quickly climbing the wall of worry

- Inflation’s First Phase

- Hourly Action In Gold From Trader Dan

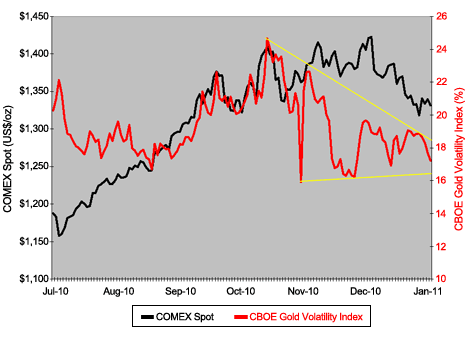

- Options Offer Clues to Gold's Direction

| Posted: 03 Feb 2011 08:03 PM PST | |||||||||||

| Gold Mining Acquisitions to Continue in 2011 & 2012 Posted: 03 Feb 2011 08:00 PM PST  King World News is taking a look at gold mining takeovers after Newmont announced its $2.3 billion takeover of Fronteer Gold. Legendary trader Jim Sinclair commented today, "The majors must buy qualified juniors. They have never been successful explorers. Reserves of the majors hold have hit a plateau or are on the decline." King World News is taking a look at gold mining takeovers after Newmont announced its $2.3 billion takeover of Fronteer Gold. Legendary trader Jim Sinclair commented today, "The majors must buy qualified juniors. They have never been successful explorers. Reserves of the majors hold have hit a plateau or are on the decline." This posting includes an audio/video/photo media file: Download Now | |||||||||||

| Posted: 03 Feb 2011 07:00 PM PST View the original post at jsmineset.com... February 03, 2011 07:24 PM Greetings Jim, We have been monitoring the gold market closely for the past several weeks in anticipation of the development of a meaningful low, and today’s sharp move higher was a bullish signal that suggests the anticipated low may be in the process of forming right now. Gold closed well above resistance at the upper boundary of the downtrend from early January on the daily chart, confirming the start of a new reaction. From a temporal perspective, we are 5 trading days into the cycle following the Short-Term Cycle Low (STCL) on January 27, and today’s move up to a new short-term high is a bullish sign that indicates the current cycle may be right translated. If the developing reaction continues to strengthen and consolidates the gains of the past 5 sessions at current levels or higher, the bullish translation will be confirmed. However, the most important potential development relates to ... | |||||||||||

| Fed can keep most gold secrets but must yield one, judge rules Posted: 03 Feb 2011 06:08 PM PST The Federal Reserve can keep secret most of the gold documents at issue in GATA's freedom-of-information lawsuit against it, a federal judge ruled today. But the judge, Ellen Segal Huvelle of U.S. District Court for the District of Columbia, ordered the Fed to disclose to GATA a potentially crucial document by February 18. | |||||||||||

| Posted: 03 Feb 2011 06:03 PM PST As discussed in prior Goldsmiths, the Rothschild Cabal money changers are the very people who have created oscillating, up and down, financial markets. While this can be argued as plausible in stocks, because of the great diversity in businesses and the periodic changing circumstances, it makes no sense to me at all for items that should have some stability based on fundamentals—like with currencies and most commodities (to certainly include gold and silver). | |||||||||||

| Two Huge No-No’s for Gold Investors Posted: 03 Feb 2011 06:01 PM PST The recent Resource Investment Conference in Vancouver may well have set a new attendance record for that venue. So many company booths filled the display area that they overflowed onto the confines of the massive Vancouver Convention Centre West. I was asked to speak in place of Kitco's Jon Nadler, who was unavoidably absent from the conference. My topic was entitled The Precious Metal's BIG Money Train is Leaving the Station…Are You Ready? | |||||||||||

| Posted: 03 Feb 2011 05:03 PM PST Robert Kientz submits: Gold began the New Year tumble and the bears came out in force to discuss the end of the gold rush. Gold was back up again Thursday, offering us the perfect chance to discuss why fundamentals are still strong. Gold's Pullback Quite a few reasons have been cited for Gold's recent pullback. The first was a change in COMEX margin requirements that showered cold water on traders opening new long positions due to higher cash requirements. Secondly, the Federal Reserve announced an accounting change, saving it from potential bankruptcy. If the Federal Reserve cannot technically go bankrupt, then a major reason for holding gold and silver, the currency crisis, loses some steam in the eyes of some investors. I don't think the accounting gimmick will ultimately eliminate the currency crisis trade, but it buys the Fed some time with the public before they lose confidence in the central bank. A quote from Reuters:

And, Complete Story » | |||||||||||

| Better than Gold? … Jim Rogers Thinks So. Posted: 03 Feb 2011 04:46 PM PST

The following is an excerpt from our FREE Inflationary Holocaust Survival Guide.

Do you know Jim Rogers?

The legendary investor first went to work on Wall Street with $600 in his pocket in the late ‘60s. In 1970, he and George Soros founded the Quantum fund: one of the greatest investment funds in history.

Between 1970 and 1980, the Quantum fund returned 3,365%, outperforming the S&P 500’s performance of 47% by an enormous margin. On an annual basis, Rogers and Soros produced average returns of 38%. Rogers then “retired” with millions in his bank account at the ripe age of 37.

Since then, he’s taken two trips around the world, the first on a motorcycle, the second in a custom-made Mercedes. Still managing his own money, Rogers has used his “on the ground” knowledge of foreign markets to make numerous major calls. He went long stocks in 1982 when everyone was still bearish. Stocks more than tripled in the five years following this. He also went short before the market crash in 1987.

However, his most famous call was the commodities bull market that began in 1999. At that time, everyone thought he’d lost his mind. Commodities had done nothing in 15 years. The Dow Jones Commodities Index hadn’t been revised since the 1960s. and Reuters’ hadn’t revised its commodity index since the 1930s.

With no decent options available, Rogers decided to launch his own commodities index. He did so August 1, 1998. He then took off on his second world trip as chronicled in Adventure Capitalist. Since that time, the Rogers International Commodities Index has more than doubled. In contrast, the S&P 500 has fallen.

And Jim believes we’re just getting started.

Historically commodities have always done well during periods of high inflation. And Jim, like myself, believes the Feds’ moves are highly inflationary. In fact, I borrowed the term “Inflationary Holocaust” from one of Jim’s interviews with CNBC. Jim said, "We're setting the stage for when we come out of this of a massive inflation holocaust,"

Jim has publicly stated that he is looking to get all of his money out of the dollar in the coming months. He’s also continually buying more commodities. And one segment in particular interests him.

Agricultural commodities.

It’s not difficult to see why. You only make big money by buying investments that have been ignored for years. And few investment classes are as unpopular as agricultural commodities (when was the last time someone you knew opened a sugar plantation or soy bean farm?)

It’s not mere anecdotal evidence either. Inventories for corn, wheat, and soybean are all near 40-year lows. Other soft commodities like cotton, sugar and coffee are at historically low inventories too. So there’s very limited supply.

And it’s only going to go lower.

The credit crisis has made it a lot more difficult for farmers to get access to credit for fertilizer. And low commodity prices have made it no longer economical to grow certain crops (I personally know of a large farm that will not be planting any corn this year for the first time in 60 years).

Yet, while supplies are dwindling, demand is growing rapidly. From 1974-2005, the world’s population grew by more than 1.1 billion people. Initially, most of them¾ and the rest of the world for that matter¾ weren’t eating anything resembling a western diet. For example, in 1980 the average Chinese consumer lived off $1 a day.

However, as emerging markets’ economies began to expand, so did the diets of their citizens. In 1985 the average Chinese consumer ate 44 pounds of meat per year. Today, it’s more than doubled to 110 pounds.

Now, it takes 17 pounds of grain to generate one pound of beef. So grains demand is soaring... But land is limited. In 1989,worldwide arable land was 1.6 billion acres. It’s 1.6 billion acres today.

It’s the perfect set up for any investment: dwindling supplies and growing demand. The inflationary holocaust will only be adding gasoline to the fire, pushing agricultural commodities to record highs. As Jim Rogers puts it, “God knows how high the price of agriculture is going to go, so that's where I'm putting more of my money now than in other things… I think I'm going to make more money in agriculture than I make in precious metals.''

To continue with the rest of our Inflationary Holocaust Survival Guide, go to http://www.gainspainscapital.com and click on FREE REPORTS. All in all its 14 pages explain not only why inflation is here now, why the Fed is powerless to stop it, and three investments that absolutely EXPLODE as a result of this (including Jim Rogers personal favorite on playing agricultural commodities).

Good Investing!

Graham Summers

| |||||||||||

| Crude Falls on Profit Taking, Gold Rebounds on Bargain Buying Posted: 03 Feb 2011 04:40 PM PST courtesy of DailyFX.com February 03, 2011 07:51 PM It was a quiet day for crude oil, but gold managed to rise as bargain hunters entered the fray. Commodities – Energy Crude Falls on Profit Taking Crude Oil (WTI) - $91.05 // $0.51 // 0.56% Commentary: Crude oil was fell on Thursday, with WTI shedding $0.32, or 0.35%, to settle at $90.54, while Brent fell $0.58, or 0.57%, to settle at $101.76. It was a day of profit taking as some traders lock in the gains from this week. Recall that Brent surpassed $100 for the first time in 27-months this week. In fact, prices have been above $100 every day this week. As we’ve been writing, the trend remains decisively higher, but a correction is overdue. Tomorrow’s U.S. nonfarm payrolls report provides a bit of event risk, but forecasts aren’t calling for any fireworks, with a 146K increase expected. Technical Outlook: Prices have put in a bearish Dark Cloud Cover candlestick formation below resistance at $92.58,... | |||||||||||

| The US Dollar: Dead On Its Feet, Dead Cat Bounce, or Dying to Rally? Posted: 03 Feb 2011 04:36 PM PST

Well, the US Dollar has staged a small bounce at $77 or so. The question now is whether this becomes anything substantial, or is merely a result of the Euro/USD pair becoming so stretched that a brief pullback had to happen.

We should know the deal within a few days. However, the greenback is now only 2% away from breaking its multi-year support line. If the Dollar turns down again now then the inflationary collapse will intensify rapidly.

I’m inclined to say that we may get a decent bounce here, possibly to 79 or so. The reason I say this is that while the US Dollar is so close to breaking CRITICAL support, the Euro (which comprises over 50% of the US Dollar index) remains well below its multi-year downward trendline:

Ultimately all of this is just question of which paper currency will collapse first. From a fundamental standpoint the Dollar is more sound than the Euro (the Dollar is backed by the US Government while the Euro is backed by… ???). However, the US Dollar also happens to be under the watch of a man who thinks nothing of killing a currency (and indirectly people via soaring food prices).

Indeed, only one currency continues to soar to new highs and is actually increasing purchasing power and that’s Gold. So if you own Dollars OR Euros, I strongly urge you to consider moving some of that paper into the Ultimate Currency.

After all, wouldn’t you like to own something that Ben Bernanke and Jean Claude Trichet didn’t control?

Good Investing!

Graham Summers

PS. If you’ve yet to take steps to prepare your portfolio for the coming inflationary disaster, our FREE Special Report, The Inflationary Holocaust explains not only why inflation is here now, why the Fed is powerless to stop it, and three investments that absolutely EXPLODE as a result of this.

All in all its 14 pages contain a literal treasure trove of information on how to take steps to prepare AND profit from what’s to come. And it’s all 100% FREE.

To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

| |||||||||||

| Grandich Interviewed in Market Oracle Posted: 03 Feb 2011 04:02 PM PST The following is automatically syndicated from Grandich's blog. You can view the original post here. Stay up to date on his model portfolio! February 03, 2011 07:56 PM Major Pools of Capital and The Mother of All Gold Bull Markets Commodities / Gold and Silver 2011 Feb 03, 2011 – 04:00 AM [url]http://www.grandich.com/[/url] grandich.com... | |||||||||||

| Gold Seeker Closing Report: Gold and Silver Gain Almost 2% Posted: 03 Feb 2011 04:00 PM PST Gold fell $3.80 to $1327.20 in Asia before it rose to see a $6.55 gain at $1337.55 in early New York trade and then fell off rather markedly in midmorning trade to as low as $1325.10 by a little after 10AM EST, but it then spiked back higher midday and ended near its early afternoon high of $1355.64 with a gain of 1.58%. Silver fell to $28.175 at the open of trade in New York before it rose to see an almost 1% gain at $28.487 by about 9AM EST and then dropped to as low as $27.965, but it also surged back higher midday and ended near its early afternoon high of $28.852 with a gain of 1.73%. Both metals have continued even higher in after hours access trade at the time of writing. | |||||||||||

| Ben Davies: Pensions need gold, the currency of hard assets Posted: 03 Feb 2011 03:32 PM PST 11:08p ET Thursday, February 3, 2011 Dear Friend of GATA and Gold: Writing exclusively for King World News, Hinde Capital CEO and gold advocate Ben Davies details why gold has become indispensable to pension funds as government pension schemes collapse into insolvency. Davies' essay is headlined "Pensions Need Gold, the Currency of Hard Assets" and you can find it at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/2/3_Ben... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | |||||||||||

| Senate votes to repeal 1099 provision Posted: 03 Feb 2011 02:59 PM PST By Laurie Kulikowski http://www.thestreet.com/story/10995960/1/senate-votes-to-repeal-1099-pr... Congress is one step closer to repealing the IRS 1099 reporting requirement that small-business owners were finding such a burdensome part of health care reform. The Senate voted 81-17 late Wednesday to pass an amendment to the FAA Air Transportation Modernization and Safety Improvement Act (S. 223) that would do away with the provision. The quick turnaround in the Senate comes on the heels of President Barack Obama's call for repeal during his State of the Union Address last week. As part of the health care reform act passed a year ago, beginning in 2012 business owners would have to use 1099 IRS tax forms for all transactions greater than $600 each year. Business owners and trade organizations claimed the rule would create too much red tape for a small firm. The House has yet to pass a version of the repeal. At least four proposals are working their way through the House of Representatives, two of which originally came from the Senate. ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | |||||||||||

| Banks Overcharging Pension Plans? Posted: 03 Feb 2011 02:28 PM PST Carrick Mollenkamp, Lingling Wei and Gregory Zuckerman of the WSJ report, Suit Alleges Mellon Created Fake Trades, Overcharged: Bank of New York Mellon Corp. currency traders used a foreign-exchange system called "Charlie" to create fake trades and overcharge Virginia pension funds by at least $20 million, according to allegations in recently unsealed documents in a Virginia court. In a separate Reuters article, Martha Graybow and Tom Hals report, U.S. states ramp up foreign currency trade probes:

Finally, this little tidbit from Advisor One:

Currency trading is huge business for banks. HUGE! The amount of money they make trading currencies on behalf of clients is incredible. And it's a market that's not regulated so a lot of dubious things can take place, especially with unsuspecting clients who can be easily duped. I'm not going to comment on the allegations in these articles but if State Street or Bank of New York Mellon lose these cases, their reputation will take a hit. It's going to cost them a lot more than damages. You may be shocked to know that many pension funds do not pay attention to currencies. And yet on any given year, large currency swings can have a material impact on performance. Here is where I'm going to plug my former boss from PSP Investments, Pierre Malo. Before joining PSP, Pierre was head of currencies at the Caisse de dépôt et placement du Québec. He retired from PSP and is now consulting. You can visit his site, Pierre Malo Consulting Inc., and feel free to contact him with any questions you have on F/X matters and pension funds. He is one of the nicest people I ever met in finance and he knows currencies and how to deal with banks to make sure they're not screwing you (he is also an expert on governance). I have nothing against banks making money in F/X markets trading fairly, but if they're screwing customers to juice their profits, then they should be prosecuted. Period. The same goes for other activities in bond, equity and derivatives markets (banks are making a killing in CDS market). Pensions have a fiduciary duty to safeguard pension assets and make sure that banks are not shortchanging them in any way. | |||||||||||

| Posted: 03 Feb 2011 02:24 PM PST Greetings Jim, We have been monitoring the gold market closely for the past several weeks in anticipation of the development of a meaningful low, and today's sharp move higher was a bullish signal that suggests the anticipated low may be in the process of forming right now. Gold closed well above resistance at the upper boundary of the downtrend from early January on the daily chart, confirming the start of a new reaction. From a temporal perspective, we are 5 trading days into the cycle following the Short-Term Cycle Low (STCL) on January 27, and today's move up to a new short-term high is a bullish sign that indicates the current cycle may be right translated. If the developing reaction continues to strengthen and consolidates the gains of the past 5 sessions at current levels or higher, the bullish translation will be confirmed. However, the most important potential development relates to the intermediate-term cycle. We are now 27 weeks into the cycle following the Intermediate-Term Cycle Low (ITCL) on July 30, and 90% of all intermediate-term cycles are less than 23 weeks in duration, so the next low is well overdue. A strong close tomorrow would create a bullish engulf pattern on the weekly chart, signaling that the latest ITCL very likely occurred last week and forecasting additional gains during the next 2 to 3 months. Best, CIGA Erik McCurdy

How Much is a Nickel Worth? More than Five Cents, Says Michael Lewis What's commonly known as Gresham's law, the debasement of currency causes the hoarding of good (old) relative to bad (new) money, is not a new human behavior. This tendency had been observed as far back as the 5th century BC. It's becoming clear that the public is beginning to relearn a very old monetary lesson. Source: tvsquad.com | |||||||||||

| AXA Rosenberg's Attempt To Conceal Its Quant Glitch Costs $242 Million Posted: 03 Feb 2011 01:54 PM PST So much for quant trading being an innocent program that can never do any harm. After a year ago AXA Rosenberg disclosed that it had kept its clients in the dark about a massive error in the computer code of its "quantitative investment model", today the SEC fined the one time asset manager of over $70 billion with a record for its kind fine of $242 million. As a reminder the immediate effect of the error when first reported was the major underperformance of the fund compared to its peers: "A number of the funds managed wholly or partly by AXA Rosenberg performed poorly last year." Yet what supposedly did not alert the firm that anything was wrong was that the system was performing in line with other comparable models: ""It wasn't obvious if there were any problems or any impact from this error on our fund because it followed a similar trend to other quant managers," Vanguard spokeswoman Rebecca Katz told Reuters on Saturday." In other words, it is safe to assume that other AXA peers have or had been operating with comparable system flaws, yet due to the SEC's preoccupation with porn, had never been caught, and as a result investors in such funds may have well been fleeced of millions due to comparable uncaught computer glitches. So much for robotic efficiency, especially when coupled with a human's eagerness to engage in willful securities fraud... From today's SEC announcement charging AXA Rosenberg with Securities Fraud, and imposing a $242 million fine:

What happened with AXA will soon enough happen with all other HFT firms, that today are still all the rage, but following the next major market meltdown that not even all the talent of Sack Frost will be able to recover from, the ensuing scapegoating will immediately focus on blaming those most defenseless and most silicon endowed: the various collocation boxes that do nothing but "provide liquidity." And as a reminder, scalping and frontrunning HFT algos collect rebates in up markets... as well as down. | |||||||||||

| Posted: 03 Feb 2011 01:54 PM PST Since, being as melodramatic as I can be, all is lost, there is nothing that can be done, except for the government(s) to come up with plans for some new Big Screw Jobs (BSJs) with which to forestall the Big Ugly Inevitable (BUI). This is the take I get on a Bloomberg article that starts off with, "Speculation and price swings in agricultural markets may threaten food security, 48 farm ministers meeting in Berlin said a month after a United Nations gauge of global costs reached a record." There was, alas, nothing in the report about how The Courageous Mogambo (TCM) was there, and who cried out, in his outrage and his grief, "That's because you morons are all printing money and deficit-spending like it is some kind of freaking virtue or something! Milton Friedman said, and history has proved, that inflation is always and everywhere a monetary phenomenon, which, if you don't understand English, means you must have somebody who does savvy the lingo translate it into whatever indeciphera... | |||||||||||

| Bernanke Either Is Smoking Some Strong Weed Or Is A Malicious Liar Posted: 03 Feb 2011 01:13 PM PST "History repeats itself, first as tragedy, second as farce" - Karl Marx I don't think it's any coincidence that today's spike in gold coincided with Bernanke's smoke-blowing session in front of the National Press Club. What is really sad and pathetic is that most of the country that bothers to read/follow the news will wake up tomorrow morning to headlines which proclaim that Bernanke said the economy is improving. BUT, if you look at the real TRUTH behind the economic numbers released lately, you will see that the indices used to measure economic activity have been skewed to the upside primarily by price inflation at the "non-core" level, where "non-core" as defined by the Fed/Govt is "the cost of food and energy." Yes, 'tis indeed a massive farce. Let's use today's factory orders report as an example, which posted a .2% gain vs. an expected .4% decline. If you read thru the details of the report, which you can do HERE, you will find that the index gains were driven primarily by an increase in the output of non-durable goods and inventory build-up. If you read thru the data table, you'll find that "petroleum and coal products" were nearly 15% of the total value of the index and represented one of the largest % increase in value from Nov to Dec. Given that we know that the price of oil increased during November by almost 13%, it stands to reason that a large percentage of the gain in the factor order index was the price of oil (and coal). Furthermore, the price of steel has been climbing sharply, ergo the increase in the value of the durable goods component of the index. More here.. | |||||||||||

| Chinese Silver Buying Just Beginning Posted: 03 Feb 2011 01:02 PM PST Just a few decades ago, China the Giant was barely a mortal. It produced most of what it consumed, and the corporate mega-producers installed during the darkest days of Asian freedom and democracy produced all the commodities the country might need within its own borders. One such commodity was the one we all love: silver. In fact, China produced so much that it couldn't use all of it, nor was it interested in holding onto the metal. The country was a net exporter until four years ago, when at the height of the most recent credit bubble, net imports materialized. Today, China consumes more silver than it ever has in history. It's not that China isn't still producing silver—it is, but it's consuming and hoarding more of it. Through 2010, net imports increased some 15%, while exports fell by nearly 60%. Such a fast swap from exporter to importer means additional strain on the silver markets. From 2009 to 2010, total net imports surged three hundred percent in ju... | |||||||||||

| Posted: 03 Feb 2011 12:49 PM PST www.theablespeculator.com [EMAIL="analyst@theablespeculator.com"]analyst@theablespeculator.com[/EMAIL] DAILY REPORT February 04, 2011 "The guiding principle (for American government) is that as long as the public is under control, everything is fine" --- Noam Chomsky Egypt seems to be coming apart at the seams and the unrest may be spreading to Jordan as the King fired members of his cabinet in order to stave off potential problems. Then comes Saudi Arabia and pent up resentment against that royal family. We already know that Tunisia and Syria are experiencing difficulties and it’s not far from where we are today to a Middle East engulfed in an uprising. Bin Laden and the Taliban have been planting seeds for ten years and thanks to a very short sighted American foreign policy, it looks like they’ll bare fruit sooner rather than later. Now the US is doing what it always does, calling for the removal of a man they supported for twenty years. J... | |||||||||||

| Should Investors Continue to Buy Gold? Posted: 03 Feb 2011 12:28 PM PST Avery Goodman submits: Recently, UBS analyst, Larry Hatheway, issued a bearish forecast for the price of gold. He thinks that continuing economic recovery will cause lower demand, and that this will cause the price to drop. He is naive. Economic recovery, in the United States and the rest of the world, is being driven by the printing of money and the monetization of government debt. Complete Story » | |||||||||||

| Guest Post: Can’t See the Forest For The Trees Posted: 03 Feb 2011 12:17 PM PST Submitted by Miss America Can’t See the Forest for the Trees Five years ago, when I showed up on the doorstep of Nouriel Roubini’s RGE Monitor, I was in the minority of macro economists who saw a financial tidal wave coming. For the rest of the world, including Wall Street’s financial analysts, Fed bankers, Politicians, or even Moses himself, none of them could see how the contagion from subprime loans could cascade into a systemic crisis. A crisis that would then expose larger problems that would eventually lead to a complete financial meltdown. Similar to the subprime loans and the subsequent credit crisis, we face a new tsunami of what on the surface appears to be of minor financial relevance, but what will be the final straw that breaks the camel’s back if not politically achieved. What it is is ownership and accountability, from a political standpoint, for ALL of the politically fueled economic decisions being made as well as their side effects. For investors, it would be a catastrophic misjudgment to not escalate these macro political views into the analysis of economic work. (This is starkly different then a political debate, but rather a true non-partisan skyview of policies and rhetoric and their overall effects on the psyche of the economy.) For a financial system that is running on the fumes of confidence, we need to properly analyze this new dynamic. Quite simply put… The cross pollination of politics and economics is not only the #1 factor in investing right now… IT’S THE ONLY FACTOR!!! We are not facing a credit crisis. (The printers solved that.) We are facing a confidence crisis. Papering over financial voids, changing accounting rules, socializing loses, removing moral hazards… these are the death throws of ponzi scheme that is allowed to continue through the TBTF virus of our worldwide interrelated financial systems. The current green shoots are nothing but weeds of: “well if we’re all screwed, then none of us are screwed.” When that’s the good news… what’s the bad? It doesn’t take a rocket scientist (or a high frequency trade algorithm) to see that stocks are now all trading within a standard correlation with one another. From an analytical standpoint… Fundamentals are dead. (yes, there can be momentary exceptions, which is what keeps the addicted gamblers coming back… but from a macro standpoint, nothing withstands the tsunami.) In Egypt right now, no one is looking at the P/E ratio of the Egyptian Company for Mobile Services S.A.E.! No one is looking at what the likelihood of the National Bank of Egypt paying a dividend! No. Instead what is driving that market is civil unrest. The results of events like these can be easy to see in hindsight. We can accurately dissect them afterwards… but the warnings are almost always unseen in forethought. I Guarantee you that no current investment models place the proper risk management weighting on this tsunami. What starts as a cultural awareness, eventually grows to an upheaval of entitlement and elitists. This is the ebb and flow as the meek try to once again inherit the earth. (or at least 50% of it from the top 1%) An Egyptian setting himself on fire was the spark that set Egypt on fire. To try and time our markets is the financial equivalent to dousing yourself with gasoline and hoping things turn out all right. Five years ago, I watched people’s eyes glaze over as I explained the financial Armageddon we faced. It was a fictional story that could never actually happen. Now, 2 years after the collapse, understated unemployment still grows, growth is muted or faked, …but most of all, faith is swaying. The next dominoes to fall. In Europe, Eastern European countries (EECs) that grew, and enabled EU nations to leverage their own growth through funding these EEC’s, will now see the rugs pulled out from under them. As the EU has to ring fence their selves to bail one another out, there is no longer spare change to debt finance these EEC countries. These same counties who are not part of the EURO then are forced into the reality of inflation as they have to print their unwanted currencies to pay off their EURO denominate debt. …and this speaks nothing of the actual size of the obligation due for the EURO zone countries that have no cross border contractual obligations to one another other then fear of contagion. Similar to the problems of Europe, the US at the muni level will see the states run similarly dry. As this trickles to local governments who largely depend on the trickle down, we see a cascading affect on the negative outlook for economic recovery. As these funds fizzle, they cause more cutbacks, more layoffs, more mortgage defaults, less tax revenues from houses and unemployed, and a greater dependence on federal aid, which once again circle back to the taxpayers and our future generations. For those EEC countries, they know violence. Their existence is born from revolution. Not much differentiates a social regime from a debt slave regime! For Americans, the fantasy of the past 99 weeks of paid unemployment, comes to a reality end. Those barely treading water, no longer receiving aid, and having less decent prospects for work will have to find a means to survive. While at the same time, cutbacks in police forces, education, and various other evolutionary services will be the enablers for those who have no other choice to find their means. A future without civil unrest seems a bit unrealistic. Mark my words, in the coming 2 years… not a single word a CEO says, nor a single dividend a company announces will have nearly the financial importance of what society grades the current politicians who are now in control of our economy. This new social science of pricing in the psychological effects of things like truth and accountability will paramount. And being pioneers in understanding the political effects of the market are what will keep you ahead of the game. In the meantime, if you feel you have to invest… Well then invest in real productive (not servicing) things that will affect the society you are part of. Invest in your health. Invest in your relationships, and invest in the future of our kids. Avoid the servicing sectors of the world. For example, Facebook, which was born in 2003/4 has no historically comparable measure. (forget the fact that it is born from stolen ideas, affiliated with napster/music theft… and we are just handing them all of our personal information?!?!?!) This king of information in the information age, whom collects advertising revenue, is service, servicing a service. The “pro’s” over at Goldman Sachs try buying a 1% share, thus valuing the company at $50,000,000,000.00… …Well of that $50billion, what portion of Facebook would an Egyptian want to own right now??? …especially when the internet is shut down? In god we trust? In the politicians we trust? (Who speak for our currencies, our countries and our economies?) Well, this new level of “faith economics” will have to stand up to scrutiny that leaves us potentially valuing a service somewhere in-between $0-$50billion. That’s a wide range of trust. That’s a wide range of faith! Now do you get the underestimated risk assessments associated with civil unrest and political economics??? Do you see the Tsunami of accountability? All the best, Miss America – Rich Hartmann | |||||||||||

| Posted: 03 Feb 2011 12:00 PM PST | |||||||||||

| Fed Excess Reserve Cumulative Deficiency Hits Record Posted: 03 Feb 2011 11:51 AM PST Today, instead of the traditional, and sometimes boring, weekly balance sheet format (no surprises: another week, another record) we want to focus on one particular aspect of the Fed's balance sheet: namely the unprecedented differential between bank excess reserves and Fed asset purchases since the start of the latest round of quantitative easing (since the launch of QE Lite in August 2010). Since this cumulative number has now hit $170 billion, it can no longer be qualified as pocket change, even by the Chairman's standards. First, below is a weekly presentation of the change in the key merkatble assets since QE Lite. To the negative we have the paydown in MBS and Agencies, offset by Treasury purchases on the positive side. As the black line demonstrates, marketable Fed assets have increased by just under $200 billion, with the $361 billion in Treasury purchases being offset by $168 billion in mortgage related paydowns. Yet while in theory the increase in assets should match the change in bank excess reserves, this is surprisingly not the case, not by a lonch shot. The next chart show the huge differential between the two: The highlighted bar demonstrates just how large the different has become (as a reference, the Fed's most recent excess reserves were $1.08 trillion). On the other hand, with the SFP unwind, the offset should be a dollar for dollar increase in excess reserves. So if in the coming weeks if we do not see a surge in excess reserves that means that banks are actively using capital not to lend (see G.19) but to speculate in stocks, and as Zero Hedge predicted the money from the SFP program, all $195 may end up being used to purchase GM and other worthless stock. Also for purists, here is the most recent complete Fed balance sheet... And also the relative holdings of the Fed compared to those of the other five biggest institutional holders. China is becoming an increasingly irrelevant player in the global game theory of international leverage. | |||||||||||

| The Real Reason for Rising Commodity Pricesw Posted: 03 Feb 2011 11:40 AM PST FGMR - Free Gold Money Report February 3, 2011 – An article today in The Wall Street Journal highlights the latest rise in the price of wheat. Blaming bad weather, it notes that the “global wheat market is caught between freezing winds and a sirocco.” The WSJ therefore warns that “investors should beware of whiplash as weather normalizes.” Given that wheat is “up 13% since the start of December”, it is good advice – if weather were to blame. The reality is that wheat is being driven higher by more than bad weather. The price of wheat has been climbing since June, a fact conveniently ignored in the WSJ article, perhaps because it doesn’t square with its premise that bad weather is causing higher wheat prices. Are we to believe that the market knew seven months ago that weather around the world today would be so bad that it would impact global wheat output? Or has wheat – which has risen $3.50 per bushel, ... | |||||||||||

| Posted: 03 Feb 2011 11:18 AM PST The long end of the bond market has been stuck in a range for almost two months. I think it may have broken out of the range today. The closing price on the bond contract today was 118.99. The low set back on 12/14 was 119.05. It didn’t take much for the contract to stumble to this foul smelling level. The last 50bp came thanks to Bernanke. At one PM the minutes of his speech came out. Essentially Ben commits himself to continuing QE. We take another step down in bond land. Maybe an important one. The day chart: Knee jerk reactions and hourly market trends don’t mean much in the scheme of things. What consequence Ben had today will be lost in the noise a few days from now. That said, it's interesting to watch the market’s reaction. When Ben said, “We’re going to continue with the QE” bonds traded cheaper. Ben’s not going to quit. QE2 will run its full course. Long bond yields are going up as a result. It must kill Ben to see how the market now trades him and his policies. Ben is an academic, no market experience to speak of. Maybe he his clueless how the boys in the futures pits are pricing him these days. If so, he should ask his partner in QE crime, Brian Sack. He runs the NY Fed desk and does understand market sentiment. Brian would tell Ben the markets are fading him. And making money in the process. I lived through this once before when William Miller was running the Fed. The markets beat this poor guy to death. He couldn’t say a word with out stocks, bonds or the dollar falling out of bed. I was one of many who would just short things ahead of any of his scheduled comments. Ducks in a barrel. Miller came in March of 1978. He was out by August the following year. The markets crushed him. They did him in.

| |||||||||||

| Guest Post: Smoot Hawley Redux Posted: 03 Feb 2011 10:33 AM PST Submitted by Jim Quinn Smoot Hawley Redux As the Greater Depression continues along a parallel pathway with the Great Depression of the 1930s, Congress is about to commit the same blunder it made in 1930. The rocket scientists in the House of Representatives in September passed the Currency Reform for Fair Trade Act, which aims to crack down on Chinese currency manipulation by targeting imports from China and other countries with currencies that are perceived to be undervalued. The vote was 348 to 79, with more than 100 Republicans voting in favor of the bill. It died in the Senate before the mid-term elections, but Representative Sander Levin, Representative Tim Ryan and Representative Tim Murphy are expected to reintroduce the bill when the House returns in February from a congressional district work break. Senators Shumer and Casey are also planning legislation to punish the Chinese for unfair trade practices. The head rocket scientist, Nancy Pelosi, declared: “For so many years, we have watched the China-U.S. trade deficit grow and grow and grow. Today, we are finally doing something about it by recognizing that China’s manipulation of the currency represents a subsidy for Chinese exports coming to the United States and elsewhere. We owe that to American workers.” This legislation is part of the Democrats’ “Make It in America” initiative that endeavors to increase domestic manufacturing and creating new American jobs. In classic congressional fashion, they are attempting to pass a bill that will make them look good in the eyes of their constituents, but will exacerbate already dangerous world trade imbalances. You can count on Congress to pander to unions, protectionists, and America Firsters with hollow legislation, when 40 years of bad decisions, bad policies, and bad choices placed us in this situation. When you have made legislative choices that will require the U.S. government to borrow another $6 trillion in the next four years and you already owe someone $868 billion, it is not a good idea to punch them in the nose. The U.S. is running an annual trade deficit exceeding $500 billion per year. It has not run an annual trade surplus since 1975. The trade deficit peaked at $769 billion in 2006, subtracting 5.7% from GDP. The enormous trade deficits are a result of government spending policies, Federal Reserve monetary policies, and corporate outsourcing that have gutted the industrial base of the U.S. These policies resulted in personal consumption expenditures surging from 62% of GDP in 1970, to 71% of GDP in 2009. The trade deficits are not the fault of the countries selling goods to American consumers. Trade subtracted 3.5% from growth in April through June, the most since 1947, as imports surged at the fastest pace since 1984.

The trade deficit with China reached a record level in August of $28 billion, as imports skyrocketed. The U.S. is on track to exceed the 2008 record trade deficit with China of $268 billion. The facts that you don’t hear from the protectionist crowd is that exports to China are on track to reach $84 billion in 2010, 20% higher than the previous peak in 2008. Exports to China have increased by 525% since 2000, while imports from China have increased by 340%. The storyline about China not allowing U.S. imports into their country is false. Putting tariffs or quotas on goods coming from China will not create jobs in America and will only deepen and lengthen the current depression, just as it did in the 1930s. Protectionism During the Great DepressionThe complete collapse of worldwide trade during the 1930s, with its root in trade protectionism, did not cause the Great Depression, but it certainly didn’t help. In 1929, exports totaled $5.9 billion and accounted for 5.7% of GDP. By 1933, exports had plunged to $2.0 billion and accounted for only 3.5% of GDP. Imports plummeted by an equal amount. Global trade declined by 60% as tariffs were imposed and retaliation created a downward spiral. The U.S. provoked the trade war with the passage of the Smoot-Hawley Tariff Act.

Senators Reed Smoot and Willis C. Hawley sponsored the bill, and it was signed into law on June 17, 1930, by Herbert Hoover. It raised U.S. tariffs on over 20,000 imported goods to the highest levels since 1828. The new tariff imposed an effective tax rate of 60% on more than 3,200 products and materials imported into the United States, quadrupling previous tariff rates. According to the U.S. Statistical Abstract, the overall effective tariff rate was 13.5% in 1929 and 19.8% by 1933. It seems politicians never change. During the 1928 presidential campaign, Herbert Hoover promised to help beleaguered farmers by increasing tariffs on agricultural products. After getting elected, Hoover asked Congress for an increase of tariff rates for agricultural goods and a decrease of rates for industrial goods. The Republican-dominated House and Senate did him one better and increased tariffs across the board. In May 1930, a petition was signed by 1,028 economists asking President Hoover to veto the legislation. Henry Ford begged him to veto the legislation. Hoover opposed the bill and called it “vicious, extortionate, and obnoxious” because he felt it would undercut his pledge to international cooperation. Then he proved that he was a standard-issue weak-kneed politician by signing the bill. Hoover’s initial instinct proved correct. The international community levied their own tariffs in retaliation after the bill became law. Canada, Britain, and other European countries immediately imposed their own tariffs. World trade came to a grinding halt. Germany, with its war reparations, was particularly vulnerable to this contraction. Ironically, the U.S. was the lender to the world during the 1920s. American lending propped up the entire world economy. Former allies paid war-debt installments to the U.S. chiefly with funds obtained from German reparations payments, and Germany was able to make those payments only because of large private loans from the U.S. and Britain. Similarly, U.S. investments abroad provided the dollars, which alone made it possible for foreign nations to buy U.S. exports. By killing world trade with the Smoot-Hawley tariffs, the U.S. shot itself in the foot and contributed to worsening the Depression in Germany. This inadvertently led to the rise of Hitler. Talk about unintended consequences. Decades of Bad ChoicesBlustering politicians like Nancy Pelosi and Chuck Schumer are attempting to ram through populist legislation in order to appear to be on the side of the American people. The Treasury secretary of the United States has declared China a currency manipulator. Chinese Premier Wen Jiabao responded in kind: “If we increase the Yuan by 20% to 40%, as some people are calling for, many of our factories will shut down and society will be in turmoil. If China saw social and economic turbulence, then it would be a disaster for the world.” They are playing a high-stakes game of chicken, and the ante is much higher than it was in 1930. Exports account for 12.5% of our GDP today, versus 5.7% prior to the Great Depression. The United States was a net exporter when the 1970s started. Our enormous trade deficits, which subtract from GDP, were not imposed on us by foreign countries. We are in this predicament because we made appalling choices.

We chose to allow the Federal Reserve to inflate away 95% of the purchasing power of the USD since 1971. We chose to elect politicians that have driven the national debt from $371 billion in 1970 to $13.6 trillion today. We chose to support “free trade” legislation that allowed corporate CEOs to gut our industrial base and ship good-paying jobs to China, while filling the pockets of these executives with millions. We chose to spend rather than save and invest in our country. We chose to become a consumer debt-centered society, relishing in the cheap goods we could buy from China on credit. We chose low prices at Walmart over small-business owners and sustainable domestic production of goods. Decades of bad choices cannot be reversed through taxation, tariffs, and quotas.

The Chinese have pegged their currency to the USD since 1995. For a decade, the U.S. was just fine with the peg, as American consumers got cheap goods, American corporations reaped huge profits from outsourcing, and banks raked in billions by lending money to everyone. Now that we have entered the Greater Depression, the finger pointing and accusations have begun. Politicians and the people who elected them want someone to blame for their bad choices. The Chinese are the bogeyman that forced Americans to buy on credit. They forced American corporations to offshore millions of U.S. jobs. If the U.S. had a strong dollar policy, ran surpluses, and lived within its means, the Chinese peg would be meaningless. U.S. GDP has grown by 335% since 1985. Over this same time frame, exports to China have grown by 1,800%, and imports from China have grown by 7,700%. Do politicians actually believe that imposing 30% tariffs on all Chinese products will magically create new manufacturing jobs in America? The 42,400 factories that have closed since 2001 and the 5.4 million manufacturing jobs lost are not coming back. A 30% upward revaluation of the yuan or 30% tariffs on Chinese products would devastate an economy that is still 70% dependent upon consumer spending. Just as in 1930, protectionist measures would boomerang and smack America in the back of the head.

If the pandering politicians in Washington D.C. are myopic enough to ignore the lessons of the past and start a trade war with China and/or the rest of the world, the possible implications would be:

| |||||||||||

| Egypt And The Muslim Brotherhood: A Stratfor Special Report Posted: 03 Feb 2011 10:12 AM PST If indeed as Credit Suisse speculated gold's move was predicated by concerns that the Muslim Brotherhood may end the peace treaty with Israel, then the relationship between Egypt and the country's largest Islamist movement, the Muslim Brotherhood, deserves a special focus. Below we publish a special report by Stratfor focusing precisely on this relationship, and what the future may hold for either. Egypt and the Muslim Brotherhood: A Special Report With Egypt’s nearly 60-year-old order seemingly collapsing, many are asking whether the world’s single-largest Islamist movement, the Muslim Brotherhood (MB), is on the verge of benefiting from demands for democracy in Egypt, the most pivotal Arab state. Western fears to the contrary, the MB is probably incapable of dominating Egypt. At best, it can realistically hope to be the largest political force in a future government, one in which the military would have a huge say. The MB and the Egyptian StateThe fear of Islamism for years allowed the single-party state to prevent the emergence of a secular opposition. Many secular forces were aligned with the state to prevent an Islamist takeover. Those that did not remained marginalized by the authoritarian system. As a result, the MB over the years has evolved into the country’s single-largest organized socio-political opposition force. Even though there is no coherent secular group that can rival the MB’s organizational prowess, Egypt’s main Islamist movement hardly has a monopoly over public support. A great many Egyptians are either secular liberals or religious conservatives who do not subscribe to Islamist tenets. Certainly, the bulk of the people out on the streets in the recent unrest are not demanding that the secular autocracy be replaced with an Islamist democracy. Still, as Egypt’s biggest political movement, the MB has raised Western and Israeli fears of an Egypt going the way of Islamism, particularly if the military is not able to manage the transition. To understand the MB today — and thus to evaluate these international fears — we must first consider the group’s origins and evolution. Origins and Evolution of the MBFounded in the town of Ismailia in 1928 by a schoolteacher named Hassan al-Banna, the MB was the world’s first organized Islamist movement (though Islamism as an ideology had been in the making since the late 19th century). It was formed as a social movement to pursue the revival of Islam in the country and beyond at a time when secular left-leaning nationalism was rising in the Arab and Muslim world. It quickly moved beyond just charitable and educational activities to emerge as a political movement, however. Al-Banna’s views formed the core of the group’s ideology, which are an amalgamation of Islamic values and Western political thought, which rejected both traditional religious ideas as well as wholesale Westernization. The MB was the first organizational manifestation of the modernist trend within Muslim religio-political thought that embraced nationalism and moved beyond the idea of a caliphate. That said, the movement was also the first organized Islamic response to Western-led secular modernity. Its view of jihad in the sense of armed struggle was limited to freedom from foreign occupation (British occupation in the case of Egypt and the Israeli occupation of Palestinian land). But it had a more comprehensive understanding of jihad pertaining to intellectual awakening of the masses and political mobilization. It was also very ecumenical in terms of intra-Muslim issues. Each of these aspects allowed the movement to quickly gain strength; by the late 1940s, it reportedly had more than a million members. By the late 1930s, there was great internal pressure on the MB leadership to form a military wing to pursue an armed struggle against the British occupation. The leadership was fearful that such a move would damage the movement, which was pursuing a gradual approach to socio-political change by providing social services and the creation of professional syndicates among lawyers, doctors, engineers, academics, etc. The MB, however, reluctantly did allow for the formation of a covert militant entity, which soon began conducting militant attacks not authorized by al-Banna and the leadership. Until the late 1940s, the MB was a legal entity in the country, but the monarchy began to view it as a major threat to its power — especially given its emphasis on freedom from the British and opposition to all those allied with the occupation forces. The MB was at the forefront of organizing strikes and nationalist rallies. It also participated, though unsuccessfully, in the 1945 elections. While officially steering clear of any participation in World War II, the MB did align with Nazi Germany against the United Kingdom, which saw the movement become involved in militancy against the British. MB participation in the 1948 Arab-Israeli war further energized the militants. That same year, the covert militant entity within the movement assassinated a judge who had handed prison sentences to a MB member for attacking British troops. It was at this point that the monarchy moved to disband the movement and the first large-scale arrests of its leadership took place. The crackdown on the MB allowed the militant elements the freedom to pursue their agenda unencumbered by the movement’s hierarchy. The assassination of then-Prime Minister Nokrashy Pasha at the hands of an MB militant proved to be a turning point in the movement’s history. Al-Banna condemned the assassination and distanced the movement from the militants but he, too, was assassinated in 1949, allegedly by government agents. Al-Banna was replaced as general guide of the movement by a prominent judge, Hassan al-Hudaybi, who was not a member of the movement but held al-Banna in high regard. The appointment, which conflicted with the MB charter, created numerous internal problems and exacerbated the rift between the core movement and the militant faction. Meanwhile, the Egyptian government’s October 1951 decision to abrogate the 1936 Anglo-Egyptian treaty set off nationwide agitation against British rule. Armed clashes between British forces and Egyptians broke out. The MB’s militant faction took part while the core movement steered clear of the unrest. It was in the midst of this unrest that the 1952 coup led by Gamal Abdel Nasser against the monarchy took place. The MB supported the coup, thinking they would be rewarded with a political share of the government. The cordial relationship between the new Free Officers regime and the MB did not last long, however, largely because the military regime did not want to share power with the MB and, like the monarchy, saw the MB as a threat to its nascent state. Initially, the new regime abolished all political groups except the MB. The Nasser regime, in an attempt to manage the power of the MB, asked it to join the Liberation Rally — the first political vehicle created by the new state. Unsuccessful in its attempts to co-opt the MB, the Nasser regime began to exploit the internal differences within the movement, especially over the leadership of al-Hudaybi. The MB leader faced mounting criticism that he had converted the movement into an elite group that had reduced the movement to issuing statements and had taken advantage of the notion of obedience and loyalty to the leader to perpetuate his authoritarian hold. Al-Hudaybi, however, prevailed and the MB disbanded the covert militant entity and expelled its members from the movement. In 1954, the regime finally decided to outlaw the MB, accusing it of conspiring to topple the government and arresting many members and leaders, including al-Hudaybi. Meanwhile, the military regime ran into internal problems with Nasser locked in a power struggle with Gen. Muhammad Naguib, who was made the first president of the modern republic (1953-54). Nasser succeeded in getting the support of al-Hudaybi and the MB to deal with the internal rift in exchange for allowing the MB to operate legally and releasing its members. The government reneged on its promises to release prisoners and the complex relationship between Nasser and al-Hudaybi further destabilized the MB from within, allowing for the militant faction to regain influence. The MB demanded the end of martial law and a restoration of parliamentary democracy. Cairo in the meantime announced a new treaty with London over the Suez Canal, which was criticized by the al-Hudaybi-led leadership as tantamount to making Egypt subservient to the United Kingdom. This led to further police action against the movement and a campaign against its leadership in the official press. The Nasser government also tried to have al-Hudaybi removed as leader of the MB. Between the internal pressures and those from the regime, the movement had moved into a period of internal disarray. The covert militant faction that was no longer under the control of the leadership because of the earlier expulsions saw the treaty as treasonous and the MB as unable to confront the regime, so it sought to escalate matters. Some members allegedly were involved in the assassination attempt on Nasser in October 1954, which allowed the regime to engage in the biggest crackdown on the MB in its history. Thousands of members including al-Hudaybi were sentenced to harsh prison terms and tortured. It was during this period that another relative outsider in the movement, Sayyid Qutb, a literary figure and a civil servant, emerged as an influential ideologue of the group shortly after joining up. Qutb also experienced long periods of imprisonment and torture, which radicalized his views. He eventually called for the complete overthrow of the system. He wrote many treatises, but one in particular, Milestones, was extremely influential — not so much within the movement, as among a new generation of more radical Islamists. Qutb was executed in 1966 on charges of trying to topple the government, but his ideas inspired the founding of jihadism. Disenchanted with the MB ideology and its approach, a younger generation of extremely militant Islamists emerged. These elements, who would found the world’s first jihadist groups, saw the MB as having compromised on Islamic principles and accepted Western ideas. Further galvanizing this new breed of militant Islamists was the Arab defeat in the 1967 war with Israel and the MB’s formal renunciation of violence in 1970. Anwar Sadat’s rise to power after Nasser’s death in 1970 helped the MB gain some reprieve in that Sadat gradually eased the restrictions on the movement (but retained the ban on it) and tried to use it to contain left-wing forces. After almost two decades of dealing with state repression, the MB had been overshadowed by more militant groups such as Tandheem al-Jihad and Gamaa al-Islamiyah, which had risen to prominence in the 1980s and 1990s. Close ties with Saudi Arabia, which sought to contain Nasserism, also helped the organization maintain itself. While never legalized, the MB spent the years after Sadat’s rise trying to make use of the fact that the regime tolerated the movement to rebuild itself. Its historical legacy helped the MB maintain its status as the main Islamist movement, as well as its organizational structure and civil society presence. Furthermore, the regime of Sadat’s successor, Hosni Mubarak, was able to crush the jihadist groups by the late 1990s, and this also helped the MB regain its stature. The MB thus went through different phases during the monarchy and the modern republic when it tried to balance its largely political activities with limited experiments with militancy, and there were several periods during which the state tried to suppress the MB. (The first such period was in the late 1940s, the second phase in the mid-1950s when the Nasser regime began to dismantle the MB and the third took place in the mid-1960s during the Qutbist years.) MB beyond EgyptShortly after its rise in Egypt, the MB spread to other parts of the Arab world. The Syrian branch founded in the late 1930s to early 1940s grew much more radical than its parent, wholeheartedly adopting armed struggle — which sparked a major crackdown in 1982 by Syrian President Hafez al Assad’s regime that killed tens of thousands. In sharp contrast, the Muslim Brotherhood in Jordan in the early 1940s very early on established an accommodationist attitude with the Hashemite monarchy and became a legal entity and founded a political party. Until the Israeli capture of the West Bank and Gaza Strip in the 1967 war, the Palestinian and Jordanian branches constituted more or less a singular entity. The Gaza-based branch was affiliated with the Egyptian Muslim Brotherhood, which Israel used to weaken the Palestine Liberation Organization (PLO). Those elements went on to form Hamas in 1987, which has pursued its activities on a dual track — political pragmatism in intra-Palestinian affairs and armed struggle against Israel. Hamas also emerged in the West Bank though not on the same scale as in Gaza. Similarly, in the Arabian Peninsula states, Iraq and North Africa, there are legal opposition parties that do not call themselves MB but are ideological descendants of the MB. The parent MB, by contrast, was never legalized and has never formed a political party per se. While the Muslim Brotherhood in Egypt is the parent body and there is a lot of coordination among the various chapters in different countries, each branch is an independent entity, which has also allowed for a variety of groups to evolve differently in keeping with the circumstances in the various countries. Despite dabbling in militancy, Egypt’s MB always remained a pragmatic organization. Egypt’s true militant Islamists in fact represent a rejection of the MB’s pragmatism. Decades before al Qaeda came on the scene with its transnational jihadism, Egypt was struggling with as many as five different jihadist groups (born out of a rejection of the MB approach) fighting Cairo. Two of them became very prominent: Tandheem al-Jihad, which was behind Sadat’s assassination, and Gamaa al-Islamiyah, which led a violent insurgency in the 1990s responsible for the killings of foreign tourists. The jihadist movement within the country ultimately was contained, with both Tandheem al-Jihad and Gamaa al-Islamiyah renouncing violence though smaller elements from both groups joined up with al Qaeda-led transnational jihadist movement. Global perceptions of the MB and of political Islamists have not distinguished between pragmatist and militant Islamists, especially after the 9/11 attack and rising fears over Hamas and Hezbollah’s successes. Instead, the MB often has been lumped in with the most radical of the radicals in Western eyes. Very little attention has been paid to the majority of Islamists who are not jihadists and instead are political forces. In fact, even Hamas and Hezbollah are more political groups than simply militants. There is a growing lobby within the United States and Europe, among academics and members of think tanks, that has sought to draw the distinction between pragmatists and radicals. For more than a decade, this lobby has pushed for seeking out moderates in the MB and other Islamist forces in the Arab and Muslim world to better manage radicalism and the changes that will come from aging regimes crumbling. AssessmentBecause Egypt has never had free and fair elections, the MB’s popularity and its commitment to democracy both remain untested. In Egypt’s 2005 election, which was less rigged than any previous Egyptian vote, given the Bush administration’s push for greater democratization in the Middle East, MB members running as independents managed to increase their share of the legislature fivefold. It won 88 seats, making it the biggest opposition bloc in parliament. But the MB is internally divided. It faces a generational struggle, with an old guard trying to prevent its ideals from being diluted while a younger generation (the 35-55 age bracket) looks to Turkey’s Justice and Development Party (AKP) as a role model. The MB also lacks a monopoly over religious discourse in Egypt. A great many religious conservatives do not support the MB. Egypt also has a significant apolitical Salafist trend. Most of the very large class of theologians centered around Al-Azhar University has not come out in support of the MB or any other Islamist group. There are also Islamist forces both more pragmatic and more militant than the MB. For example, Hizb al-Wasat, which has not gotten a license to operate as an official opposition party, is a small offshoot of the MB that is much more pragmatic than the parent entity. What remains of Tandheem al-Jihad and Gamaa al-Islamiyah, which renounced violence and condemned al Qaeda, are examples of radical Islamist groups. And small jihadist cells inspired by or linked to al Qaeda also complicate this picture. Taken together, the MB remains an untested political force that faces infighting and competitors for the Islamist mantel and a large secular population. Given these challenges to the MB, confrontation with the West is by no means a given even if the MB emerged as a major force in a post-Mubarak order. The MB is also well aware of the opposition it faces within Egypt, the region and the West. The crumbling of the Mubarak regime and perhaps the order that damaged the MB for decades is a historic opportunity for the movement, which it does not wish to squander. Therefore it is going to handle this opportunity very carefully and avoid radical moves. The MB is also not designed to lead a revolution; rather, its internal setup is such that it will gradually seek a democratic order. The United States in recent years has had considerable experience in dealing with Islamist forces with Turkey, under the AKP, being the most prominent example. Likewise in Iraq, Washington has dealt with Islamists both Sunni (Iraqi Vice President Tariq al-Hashmi for many years was a prominent figure in the Iraqi chapter of the MB called the Iraqi Islamic Party) and Shiite (Prime Minister Nouri al-Maliki, Islamic Supreme Council of Iraq leader Abdel Aziz al-Hakim, Muqtada al-Sadr, etc.) as part of the effort to forge the post-Baathist republic. That said, the Muslim Brotherhood of Egypt is viewed as a very opaque organization, which increases U.S. and Israeli trepidations. Neither of these powers are willing to place their national security interests on the assumption that the Muslim Brotherhood would remain a benign force (as it appears to be) in the event that it came into power. Concerns also exist about potential fissures within the organization that may steer the movement into a radical direction, especially when it comes to foreign policy issues such as the alliance with the United States and the peace treaty with Israel. The possible looming collapse of the 60-year Egyptian order presents a historic opportunity for the MB to position itself. Even though the movement has remained pragmatic for much of its history and seeks to achieve its goals via constitutional and electoral means and has opted for peaceful civil obedience and working with the military as a way out of the current impasse, its commitment to democratic politics is something that remains to be seen. More important, it is expected to push for a foreign policy more independent from Washington and a tougher attitude toward Israel. At this stage, however, it is not clear if the MB will necessarily come to power. If it does, then it will likely be circumscribed by other political forces and the military. There are also structural hurdles in the path of the MB taking power. First, the ban on the movement would have to be lifted. Second, the Constitution would have to be amended to allow for religious parties to exist for the MB to participate as a movement. Alternatively, it could form a political party along the lines of its Jordanian counterpart. Being part of a future coalition government could allow the United States to manage its rise. Either way, the MB — an enormously patient organization — senses its time finally may have come. | |||||||||||

| Keiser Report: Silver Stick for JP Vampire (E118) Posted: 03 Feb 2011 09:58 AM PST | |||||||||||

| Ben Davies: “Pensions are an accident waiting to happen.” Posted: 03 Feb 2011 09:56 AM PST | |||||||||||

| Posted: 03 Feb 2011 09:51 AM PST Gold pops back above $1350 after Bernanke comments The COMEX April gold futures contract closed up $20.90 Thursday at $1353.00, trading between $1325.30 and $1356.60 February 3, p.m. excerpts: | |||||||||||