saveyourassetsfirst3 |

- ETF Correlation Among Asset Classes Is Dropping

- Silver Breaks its Golden Shackles

- Friday Bond Market Recap

- SUMMER BREAK

- The List of Three (Silver, Agriculture, Rare Earth)

- silver in complete backwardation.

- The Penny breaks the 3 cent mark.

- Fed Holdings of U.S. Treasuries Surpass China's

- Is Silver Gaining Momentum?

- TiVo, Shire, E*Trade, GE Appliances Among Possible Deal Plays in 2011

- Finding the Next Google / Apple: The Predictability of Growth Rates

- Gold lenders of last resort

- More Reports of Silver Supply Shortage

- Richard Maybury on the Collapse of the Anglo-American Empire and What It Means for You

- Chart Shows Dramatic Plunge of Silver Contango

- Newmont Buys Out Fronteer; Whats Next in Gold Mining Sector?

- Fed can keep most gold secrets but must yield one, judge rules

| ETF Correlation Among Asset Classes Is Dropping Posted: 06 Feb 2011 05:13 AM PST Tom Lydon submits:  The markets and exchange traded funds (ETFs) moved in unison during the financial crash and when the markets began to recover, but if you’re looking to diversify, you may be relieved to know that asset correlations are – at last – beginning to drop. ConvergEx Group’s Chief Market Strategist Nicholas Colas points out that the correlation between ETFs in the various financial market asset classes has diminished, which could indicate a positive sign that the financial markets are recovering, writes Olivier Ludwig for IndexUniverse. In a sampling of 19 market-, sector- and asset-type ETFs, ConvergEx concluded that the correlation of returns for industry sectors, precious metals, fixed-income and currencies are all hitting a 12-month low. That’s great news for investors; the lower the correlations, the less sectors are moving in tandem, giving you more opportunities to play trends. The data shows that we are returning to a healthier market environment where investors may use different assets to diversify and reduce overall risk as correlations diminish. “This move lower for correlations is a long-awaited piece of good news for fundamentally-oriented, bottom-up money managers,” remarks Colas. Additional findings include:

Complete Story » |

| Silver Breaks its Golden Shackles Posted: 06 Feb 2011 04:40 AM PST |

| Posted: 06 Feb 2011 04:24 AM PST Bondsquawk submits: By Maulik Mody Stocks gained slightly while Treasuries fell across the curve after the Labor Department reported lower unemployment in January, despite a fall in payroll. The dollar gained against most currencies, while commodity prices were mostly lower. This week saw a gain in sto Complete Story » |

| Posted: 06 Feb 2011 04:21 AM PST It has been my contention all along that the Fed would print until something breaks. Once that break occurs we will enter the next leg down in the secular bear market. This time I don't expect it to be the credit markets, although we will almost certainly have trouble in the municipal and state bond markets. Some may even default. I actually think the greater risk is from massive layoffs by state and local governments in an effort to cut expenses and avoid default. When that begins we will see unemployment levels start to spike again. The real danger is going to come from inflationary pressures unleashed by the Fed's QE programs. We are already starting to see severe inflationary pressures in food and energy and it's already causing social unrest in many third world countries. Expect this to continue and intensify as we move into the summer months. Besides starting an inflationary spiral QE is also stretching the stock market cycles. To explain; The `09 yearly cycle low occurred in March. The 2010 yearly cycle low should have arrived in the early spring roughly 12 months after the March `09 bottom. We did have a decent correction in early February. That should have marked the yearly cycle low. However, because of QE1 that cycle stretched into July, and was more severe that it should have been absent Fed meddling. We even witnessed another mini-crash. A direct result of the extreme complacency generated by the QE driven rally in March and April. Under normal conditions the cycles would adjust and we would get a shortened cycle this year that should have bottomed right about now. Obviously that isn't going to happen since we don't even have a top yet. It's now clear that QE2 is going to stretch this cycle also. I now look for the next intermediate bottom to arrive this summer sometime around July (roughly 12 months after the 2010 bottom). This should correspond with the violent rally as the dollar blasts out of the three year cycle low. This should mark the beginning of the next leg down in the secular bear market. Confirmation will come if the correction is severe enough to test the July 2010 lows. In a healthy bull market each intermediate correction should bottom well above the prior low (higher highs and higher lows). A move down to the 1050-1000 level will be a clear sign the bull is in trouble. We should also see the dollar rally out of the three year cycle low force the CRB down into it's 3 year cycle low (actually the cycle runs about 2 1/2 years on average). And gold down into a severe D-wave correction. (We still have one more parabolic leg up before the D-wave starts.) Even though I have been expecting the market to correct (into the normal yearly cycle timing band) I've been warning subscribers not to short the market because the dollar is dropping down into a major cycle low. I suspected there was the possibility the dollar collapse would stretch the cycles and make selling short very risky. The time to short will come once the dollar puts in the three year cycle low and all markets begin the move down into the next timing band for a yearly cycle low this summer. I will be watching for signs the dollar cycle has bottomed sometime in April or even as late as early May. At that point one might consider looking for a sector, or sectors, that are extremely stretched above the mean to sell short. (Not precious metals though. I never short a bull market.) Until that time its still too early to play the short side. The odds are better positioning for the final leg up in gold's massive C-wave advance. This posting includes an audio/video/photo media file: Download Now |

| The List of Three (Silver, Agriculture, Rare Earth) Posted: 06 Feb 2011 04:17 AM PST As you all know you need to read my disclaimer at the bottom of the page please. Juniors are not for the weak as they could go to ZERO tomorrow so don't invest if you don't plan on losing everything. Okay now that I got that out of the way, lets get to the goodies. In one of my videos I make a comment that if you are investing to make fiat, then its better to trade juniors as they are heavily |

| silver in complete backwardation. Posted: 06 Feb 2011 04:15 AM PST |

| The Penny breaks the 3 cent mark. Posted: 06 Feb 2011 01:23 AM PST 0.0301079 is the melt value for the 1909-1982 copper cent on February 04, 2011 http://www.coinflation.com/coins/190...nny-Value.html |

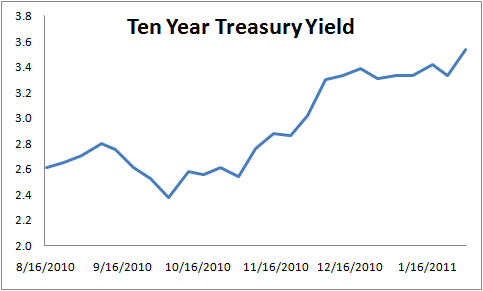

| Fed Holdings of U.S. Treasuries Surpass China's Posted: 06 Feb 2011 12:46 AM PST Doug Carey submits: A bit of recent news that hasn't gotten enough press is the fact that the Federal Reserve has surpassed China in total U.S. Treasury holdings and is now the largest holder of Treasuries in the world. As of last week, China held $896 billion of Treasuries while Japan held $877 billion. The Fed now holds $1.108 trillion and it has not even passed the halfway mark of its second round of money printing, which they call Quantitative Easing. By June the Fed could own $1.6 trillion of Treasury bonds. The experiment that the Fed has embarked upon is simply unprecedented in this country. So far it has been an abysmal failure. Ten year treasury yields are nearly 120 basis points higher since the Fed announced their second round of Quantitative Easing just three months ago. Food inflation is raging throughout the world, even though Ben Bernanke denies any responsibility for it. Speculation is running rampant as to how much inflation the U.S. will export.  This is what fiat currencies and the printing of money bring: Rampant speculation and volatile prices. It is incredibly difficult to predict how the Fed’s printing will impact prices, so speculators are doing what they do: They’re jumping ahead of the curve and buying commodities before they all shoot through the roof. Sugar is now at a 30 year high and cotton is at a 28 year high. Cotton has risen 100% in the past six months alone. All of this is happening while we’re supposed Complete Story » |

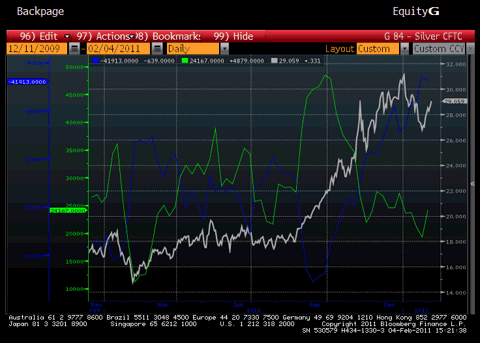

| Posted: 06 Feb 2011 12:19 AM PST Ananthan Thangavel submits: Silver has regained quite a bit of luster since January 28th, rallying more than 8% from 26.80 to 29.12 at the close Friday. We believe the month-long correction in precious metals is ending, and gold and silver should trade to new highs in the coming weeks. While we endured a 1.5% loss in January due to the pullback, our accounts are already back to positive for the year, showing a 3.4% gain for 2011. Since we added to silver and gold positions on the way down, we were able to build on our 67% return in 2010. As we stated in the past, Managed Money long participation was necessary for silver to start rallying again, and Managed Money returned to the silver market with force this week. This week's CFTC report shows that in the week between January 25 and February 1, Managed Money increased their net long exposure by 4,879 contracts. This marks a 25% increase in Managed Money long participation in the market. When viewing silver from this light, the large rally is no surprise. click to enlarge The chart above shows silver price in gray, Managed Money net longs in green and Producer net shorts in blue. As can be seen, we are still more than 24,000 contracts away from the high in Managed Money net Complete Story » |

| TiVo, Shire, E*Trade, GE Appliances Among Possible Deal Plays in 2011 Posted: 06 Feb 2011 12:03 AM PST Alacra Pulse Check Blog submits: By Sheena Lee Deal Idea: The Dow Jones Investment Banker put out its deal predictions for 2011 and said that companies in technology, pharma and industrials sectors will see particularly intense activity

A deal between E*Trade Financial (ETFC) and Ameritrade (AMTD) would create efficiencies and beef up the bottom line, and China’s Haier Electronics Group (1169) could buy GE Appliances. Deal Idea: 3M (MMM) should put some of its efforts into the renewable energy sector by purchasing solar efficiency leader SunPower (SPWRA), said Travis Holum of the Motley Fool. Dolby Laboratories (DLB) should also buy IMAX, and Apple (AAPL) should buy TiVo, said Holum. Rumor: There is market talk that Hewlett-Packard (HPQ) could be interested in Teradata (TDC). (RANsquawk) Other Deal Activity: Beckman Coulter (BEC), a maker of diagnostic research equipment for biomedical companies, has received second-round takeover offers from a number of suitors, including names like the Blackstone Group (BX), TPG Capital, Apollo Global Management (AGMTZ) and the Carlyle Group. (DealBook) Newmont Mining (NEM), the biggest gold producer in the United States, said that it had agreed to acquire Fronteer Gold of Vancouver (FRG), Complete Story » |

| Finding the Next Google / Apple: The Predictability of Growth Rates Posted: 05 Feb 2011 11:43 PM PST YCHARTS.com submits: Imagine if you could have gotten in on Google’s (GOOG) IPO, or if you had recognized the brilliant future that Apple’s (AAPL) iMac and iPod signified. These are the types of investment calls that make investors salivate. But were people who got in early making well-reasoned decisions, or were they just lucky? YCharts is constantly seeking to outperform the market. We would love to claim that we have a reliable way to locate the future Apples and Googles of the world before they grow, but the successful strategies that we uncovered do not frequently suggest purchasing high-growth companies. We wanted to know why finding future growth was so difficult, so we read the research and extended it with our own analysis. The results were both were surprising and invaluable. So we decided to share them with you. From August of 2004 to December of 2010, Google’s price increased from $100 to $600 per share. And Apple, from the end of 2000 to the end of 2010, returned 43.35X. Those are returns that put dollar signs in any investors’ eyes. Some still kick themselves for not investing in these companies before they grew. Now what happened looks obvious: Google was the search engine that the tech guys were using. Steve Jobs had returned to Apple and was sowin Complete Story » |

| Posted: 05 Feb 2011 11:26 PM PST Another post by FOFOA that will get you thinking. My response below. FOFOA, There would be many within the Mint who would be amused at you categorising me as a "mainstream" view. I understand you are using my explanations as representative of the mainstream view but I would like readers to be clear that my personal view is different. To clarify this, some comments on your piece. While I have no direct evidence of the bullion bank's (BB) activities, I am not as sure as others that the BBs are massively financially short gold (this is not to say they don't run short term speculative positions). My reasoning for this is that gains and losses on such positions impact their reported profit and loss. If they were as massive short for as long as some claim, their losses would have been visible. I would also suggest readers ask why a BB would take on hundreds and hundreds of tonnes of short gold positions over time in some attempt to suppress the gold price. You only do this if you have a philosophical hatred of gold. I understand that gold ownership is a political action, a rejection of fiat currency and banking, but would (at this time) a bank with a BB division really be threatened by the pathetic fraction of a percent of those investors who hold gold? Threatened to the extent that they would of their own accord take on a massive short position? Now the above does not mean I think everything is OK. On my fractional fubar post you mentioned, I commented " It troubles me as well. The Mint has been under no illusions about London unallocated as the legals say we are an unsecured creditor and the bullion banks would never make any statement one way or another about what they did with it. We have operated accordingly." Bankers make money by intermediating – buying from one, selling to another, borrowing from one, lending to another – and taking their cut along the way. I would suggest readers consider the theory that BBs would be willing to intermediate for someone else with that philosophical hatred of gold and take their riskless cut along the way. Why risk your own money when someone else is willing to do so, with the bonus that their activity protects your banking "franchise"? This then leads on to your statement that "there is no clearly defined lender of last resort to cover the risks". Is this really the case? You mention two risks the BBs have. 1. Default – Borrowing gold doesn't solve this problem, as the act of borrowing gives you an gold asset but also a gold liability. The only way to solve this problem is to buy the gold, which results in a loss because you have to give up dollars to acquire the gold asset. 2. Liquidity – Buying gold doesn't solve this problem as while it gives you gold to give to your creditor but also gives you price exposure as you have technically bought your gold asset which is due in the future. The solution is to borrow gold directly, repaying it when your gold asset comes due. Alternative, you can borrow synthetically by buy spot gold and then selling forward (using the gold from your gold asset to deliver into this forward sale). I would therefore agree that BBs have "exchange rate risk" for the default situation but not for the liquidity situation. This assumes that holders of gold (which in cases of large volume really just means central banks) are willing to sell (in case of default) or lend ( in case of liquidity) to BBs. I therefore suggest the question is not whether central banks are lenders of last resort, but whether they have the capacity, or willingness, to fulfil that role now or in the future. In my previous post I stated that central bankers are the gold market's lenders of last resort. The fact that central banks hold gold as a physical asset (and only gold) in addition to fiat currencies is clear indication to me that gold is not just another commodity. However, the other side of this is that central banks can be lenders of last resort of this "money", just as they are of dollars. Central banks have been more than willing to lend dollars to banks to help them out with their liquidity problems, eg taking on their crappy mortgages etc, rather then have them fail and to avoid a systematic collapse of the banking system. Consider the situation where a bank comes to its central bank and say "Hey, I've got all these pesky unallocated gold holders wanting physical but all I have is these long term loans. Can you lend me some of your physical gold and I'll replace it later when those borrowers repay their leases? If you don't I'll have to declare bankruptcy, the gold price will rocket up, this will cascade through the gold market and we will have a systematic collapse of the banking system." Why would a central bank not be willing to support a bank's BB division in such a situation, especially when they would do the same for dollars? For me this is not the issue, I think they will do (are doing?) it. You mention the CBGA as proof that (some) central banks are "are no longer going to be the lender of last resort to this system". I think it is therefore very interesting that the 2009 statement makes no reference to leasing as the previous two statements did. Why the change? To me then the key issue is whether the central banks have the capacity".The interesting thing about capacity in respect of gold of course is that you can't print it! Easy to do if your bank has a dollars problem, not so if they have a gold problem. Questions to consider: a. How much gold would central banks be willing to lend to prop up banks? All of it? Or would they balk in the case of gold? Who cares about dollars, just print more – but risk the country's only real asset? b. Out of the total they are willing to lend, how much has already been lent? A speculation: maybe the reference to no more leasing in the 1999 and 2004 CBGA statements was a message to the BB to clean up their books. However, around 2008-09 the banks said they will fail without the backstop, need more time to unwind, have increasing physical redemptions, so CBGA drops the leasing reference to enable them to continue the "extend and pretend that there is not a run on the bullion bank reserves." In conclusion, I would like to suggest the following in respect of the two risks 1. Default – This is most likely to happen if the BB lend to a short seller who is now bust. In this case we should see buying and thus an increase in the gold price. 2. Liquidity – As agreed, this will happen if unallocated holders are calling for physical. In this case we should see an increase in the lease rate. Note that in the past the lease rate was around 1% to 2% with low gold prices, during gold's bear market. This was because of the large amount of miner forward selling that was going on. What we have seen in recent times with miners closing down their hedging is low lease rates and high gold prices (see this post for a chart). So there is a very general relationship between short selling and lease rates over the long term. What would be interesting would be sustained increasing gold prices AND higher lease rates, as it may indicate buying to cover defaults and borrowing to cover liquidity. |

| More Reports of Silver Supply Shortage Posted: 05 Feb 2011 10:59 AM PST Silver Shortages Continue According to Pan American CEO With silver closing over $29 today, King World News interviewed the head of one of the largest silver producers in the world, Pan American Silver CEO Geoff Burns. When asked if he was hearing anything regarding continued reports of shortages in the silver market Burns stated, "Really only anecdotally. I have heard that the end users on the commodity side are having trouble locating silver. I have heard that through a couple of traders who have proven to be reliable sources." "What it means in my world is that from the end users there is going to be price support. If we can see an escalation in price, you'll likely see profit taking which in turn could create flows coming out of the ETF's and into the market. We will probably need to see higher prices to free up more silver for the end users. The end users are being forced to come back into the market and that could be the torque to move the price of silver higher. For example, Deutsche Bank has forecast $50 silver in 2012. Investors are going to stay with silver because the value of their dollar is going down each day they wake up. We may have significant volatility in silver, but I believe it is headed higher over time. For Pan American shareholders we put out a forecast that said we were going to produce 23.5 million ounces for the full year and I am comfortable that we are going to beat that number. We are also going to be able to beat the forecast of $5.90 per ounce of production. The bottom line is that our byproduct credits from lead, zinc and copper are more than offsetting increases that we are seeing in crude and in overall absolute dollars spent to mine. This phenomena is something that we have been expecting to see and it's why we have been focused on silver and why we have been expanding our business over time." Geoff Burns is running one of the top silver producers in the world, so his comments carry a lot of weight with me. I think the bottom line here is that Geoff is right, we need higher prices to bring the silver market to an equilibrium. Eric King KingWorldNews.com |

| Richard Maybury on the Collapse of the Anglo-American Empire and What It Means for You Posted: 05 Feb 2011 10:00 AM PST The Daily Bell is pleased to present another exclusive interview with Richard Maybury. The former Global Affairs editor of MONEYWORLD, Richard Maybury is one of the most respected business and economics analysts in America. His articles have appeared in major publications. Books include "Whatever Happened to Penny Candy?" "Whatever Happened to Justice?" and "Evaluating Books: What Would Thomas Jefferson Think of This?" His current interest is "The Fall of the U.S. Empire". |

| Chart Shows Dramatic Plunge of Silver Contango Posted: 05 Feb 2011 08:40 AM PST Following up on this morning's offering which noted the absence of contango in the COMEX silver futures market, please see the graph just below which reflects the dramatic plunge in contango in the COMEX silver futures "strip." ... |

| Newmont Buys Out Fronteer; Whats Next in Gold Mining Sector? Posted: 04 Feb 2011 08:12 AM PST |

| Fed can keep most gold secrets but must yield one, judge rules Posted: 04 Feb 2011 03:14 AM PST |

| You are subscribed to email updates from Gold World News Flash 2 To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment