Gold World News Flash |

- Richard Russell - Gold is in the Process of Building a Bottom

- GoldSeek.com Radio Gold Nugget: Robert Kiyosaki & Chris Waltzek

- Germany promised U.S. in 1967 not to convert dollars to gold

- Will Gold, Silver and Oil Prices Soar on Social Unrest In The Middle East?

- Don't Retreat, Reload Your Gold

- Occam's Razor and the Gold Price

- Housing Armegeddon To Get Much Worse

- Gold Seeker Closing Report: Gold and Silver End Mixed

- Australian Dollar Holds Near Parity after RBA Rate Decision

- Canadian Pensions Surge Ahead

- Guest Post: The Road to Madness Is Paved With $100 Bills

- Gold Price Traded Down From Friday's High to Close at $1,333.80

- Spending Cuts - January 31, 2011

- Treasury Yields are Blinking Red

- Gold: Investment Demand In Flux

- MONDAY Market Excerpts

- The Continuing Argument Over Fiscal Policy

- The Meddling of Global “Thinkers”

- Monthly Gold Charts From Trader Dan

- Hourly Action In Gold From Trader Dan

- Gold and silver decline is over, Turk tells King World News

- Hugo Salinas Price: Monetizing silver in British pounds

- Policy makers at Davos see dollar losing reserve dominance

- Maybe there can be several reserve currencies, Rickards tells King World News

- Barrick CFO: Central Banks may shift more reserves into gold

- $2 Billion Up in Flames

- Social Unrest Rises With Food Prices

- Paolo Lostritto: Don't Retreat, Reload Your Gold

- Jim's Mailbox

- China’s Urban Underground Dwellers

- Stay Focused, Gold Investors

- Gold Daily and Silver Weekly Charts

- My Largest Personal Investment

- A Culture of Complacency

- Jump on the Gammon Wagon

- PopCon: The ‘Economic Recovery’ Lie

- Quest for the Best Gold Stock: Central GoldTrust

- More On Housing...

- James Turk - Gold & Silver Have Reached an Important Bottom

- Are Gold and Silver Still a Buy? Absolutely – & Here’s Why

- The Gold Roller Coaster

- The Economic Recovery Lie

- $50 Physical Silver by April 2011

- Crude Oil Spikes Like An Egyptian

- Gold investors should stay focused

- Donner Metals, Xstrata Zinc and the Bracemac-McLeod Mine

- Precious Metals Bull-Riding

- When All Roads Lead to Default

- UBS Cuts Its Gold Recommendation

- Precious Metals and the Dollar’s Next Big Move Part II

| Richard Russell - Gold is in the Process of Building a Bottom Posted: 31 Jan 2011 08:00 PM PST  With gold and silver off of the recent lows and the US Dollar staying below key support at 78.50, the Godfather of newsletter writers Richard Russell asked this important question, "Will the dollar continue its fall, and will the Dollar Index break below its March 2008 record low of 72.165?" With gold and silver off of the recent lows and the US Dollar staying below key support at 78.50, the Godfather of newsletter writers Richard Russell asked this important question, "Will the dollar continue its fall, and will the Dollar Index break below its March 2008 record low of 72.165?" This posting includes an audio/video/photo media file: Download Now | ||||||||||||||||||||||||

| GoldSeek.com Radio Gold Nugget: Robert Kiyosaki & Chris Waltzek Posted: 31 Jan 2011 07:02 PM PST | ||||||||||||||||||||||||

| Germany promised U.S. in 1967 not to convert dollars to gold Posted: 31 Jan 2011 06:30 PM PST | ||||||||||||||||||||||||

| Will Gold, Silver and Oil Prices Soar on Social Unrest In The Middle East? Posted: 31 Jan 2011 06:07 PM PST | ||||||||||||||||||||||||

| Don't Retreat, Reload Your Gold Posted: 31 Jan 2011 06:04 PM PST When it comes to the 2011 gold price correction, Wellington West Senior Analyst Paolo Lostritto says he's seen worse. He counsels investors to "use this opportunity," if they haven't already, to rebuild gold positions because he foresees upside by the second half of 2011. In this exclusive interview with The Gold Report, Paolo shares his insights. | ||||||||||||||||||||||||

| Occam's Razor and the Gold Price Posted: 31 Jan 2011 04:33 PM PST Dear CIGAs,

Using William of Ockham's method for analysis of the gold price reaction, the following has occurred. 1. $1400 was an embarrassment to the thesis of "Inflation under control." Occam's Razor applied to #1 through #7 summates that the entire gold situation can be addressed as "Technical Damage Requires Technical Repair" before it is off to the races again. | ||||||||||||||||||||||||

| Housing Armegeddon To Get Much Worse Posted: 31 Jan 2011 04:24 PM PST We are officially in the middle of the worst housing collapse in U.S. history - and unfortunately it is going to get even worse. Already, U.S. housing prices have fallen further during this economic downturn (26 percent), then they did during the Great Depression (25.9 percent). Approximately 11 percent of all homes in the United States are currently standing empty. In fact, there are many new housing developments across the U.S. that resemble little more than ghost towns because foreclosures have wiped them out. Mortgage delinquencies and foreclosures reached new highs in 2010, and it is being projected that banks and financial institutions will repossess at least a million more U.S. homes during 2011. Meanwhile, unemployment is absolutely rampant and wage levels are going down at a time when mortgage lending standards have been significantly tightened. That means that there are very few qualified buyers running around out there and that is going to continue to be the case for quite some time to come. When you add all of those factors up, it leads to one inescapable conclusion. The "housing Armageddon" that we have been experiencing since 2007 is going to get even worse in 2011. Right now there is a gigantic mountain of unsold homes in the United States. It is estimated that banks and financial institutions will repossess at least a million more homes this year and this will make the supply of unsold properties even worse. At the same time, millions of American families have been scared out of the market by this recent crisis and millions of others cannot qualify for a home loan any longer. That means that the demand for unsold homes is at extremely low levels. So what happens when supply is really high and demand is really low? That's right - prices go down. | ||||||||||||||||||||||||

| Gold Seeker Closing Report: Gold and Silver End Mixed Posted: 31 Jan 2011 04:00 PM PST Gold traded only slightly lower in Asia before it fell back off in London and saw a $17.80 loss at as low as $1323.00 by about 9:30AM EST, but it then rallied back higher for most of the rest of trade in New York and ended with a loss of just 0.52%. Silver fell $0.383 to as low as $27.517 at around 7AM EST before it also rallied back higher in New York and ended near its late session high of $28.425 with a gain of 0.93%. | ||||||||||||||||||||||||

| Australian Dollar Holds Near Parity after RBA Rate Decision Posted: 31 Jan 2011 03:00 PM PST courtesy of DailyFX.com January 31, 2011 07:51 PM The Reserve Bank of Australia maintained its cash rate target at 4.75% for a third month, matching expectations. The Australian Dollar- which was rallying prior to the monetary policy decision- continued higher, holding just below parity versus the U.S. Dollar. The Reserve Bank of Australia maintained its cash rate target at 4.75% for a third month, matching expectations. The Australian Dollar- which was rallying prior to the monetary policy decision- continued higher, holding just below parity versus the U.S. Dollar. In its accompanying statement, the RBA sounded a surprisingly optimistic tone. Referring to the impact from the flooding in Queensland as having a “temporary adverse effect on economic activity and prices,” the central bank went on to say that it will “look through the estimated effects of these short-term events on activity and prices.” Overall, the RBA continues to have a very favorable... | ||||||||||||||||||||||||

| Posted: 31 Jan 2011 01:17 PM PST Ten days ago, CNW reported, RBC Dexia survey: Canadian Pensions Surge Ahead of Pre-Crisis Levels (HT: Bruce):

The growing focus on asset-liability matching has increased pensions' demand for long bonds. Meanwhile, Canadian pensions enjoyed the benefits of a strong Canadian stock market. I was surprised to read nine out of ten TSX sectors experienced double digit annual gains in 2010. That "beta boost" helped Canadian pensions surge ahead from pre-crisis levels. And On Monday the S&P/TSX composite index jumped 114.41 points to 13,551.99 led by energy as political unrest in Egypt raised worries about a disruption in oil supplies and pushed crude prices higher:

There is increasing talk of Canada as a "safe haven". I'm not so convinced but global investors are buying up Canadian assets and the Canadian dollar. Just how much of this is speculative flow and how much of it based on fundamentals is very hard to ascertain, but there is no reason to believe the uptrend won't continue. In fact, I wouldn't be surprised to see the S&P/TSX make new highs in 2011. If it does, Canadian pensions will continue riding the beta wave higher. | ||||||||||||||||||||||||

| Guest Post: The Road to Madness Is Paved With $100 Bills Posted: 31 Jan 2011 12:57 PM PST Submitted by Graham Summers of Phoenix Capital Research The Road to Madness is Paved with $100 Bills

…just as I am affected by the maniac, so I am affected by most modern thinkers. That unmistakable mood or note that I hear from Hanwell [an insane asylum], I hear also from half the chairs of science and seats of learning to-day; and most of the mad doctors are mad doctors in more senses than one. They all have exactly that combination we have noted: the combination of an expansive and exhaustive reason with a contracted common sense. They are universal only in the sense that they take one thin explanation and carry it very far. But a pattern can stretch for ever and still be a small pattern. They see a chess-board white on black, and if the universe is paved with it, it is still white on black. Like the lunatic, they cannot alter their standpoint; they cannot make a mental effort and suddenly see it black on white.

| ||||||||||||||||||||||||

| Gold Price Traded Down From Friday's High to Close at $1,333.80 Posted: 31 Jan 2011 12:40 PM PST Gold Price Close Today : 1333.80 Change : (6.90) or -0.5% Silver Price Close Today : 28.174 Change : 0.240 cents or 0.9% Gold Silver Ratio Today : 47.34 Change : -0.654 or -1.4% Silver Gold Ratio Today : 0.02112 Change : 0.000288 or 1.4% Platinum Price Close Today : 1788.80 Change : -3.60 or -0.2% Palladium Price Close Today : 813.65 Change : 1.15 or 0.1% S&P 500 : 1,286.12 Change : 9.78 or 0.8% Dow In GOLD$ : $184.31 Change : $ 2.02 or 1.1% Dow in GOLD oz : 8.916 Change : 0.098 or 1.1% Dow in SILVER oz : 422.09 Change : 2.39 or 0.6% Dow Industrial : 11,891.93 Change : 68.23 or 0.6% US Dollar Index : 77.74 Change : -0.504 or -0.6% Over the weekend the GOLD PRICE traded down from Friday's $1,345+ high. While Europe had it, gold eroded from 1338 to $1,325. New York Open took it up over $1,330, but just as quickly it slammed back down to $1,323. A long rise followed from 9:30 to 1:00 p.m. EST to $1,337, but gold fell again to $1,333.80, down $6.90, when Comex closed at 1:30. Balance of the day was sideways. Bottom line here is that Gold reacted today against Friday's rise, no surprise, and has since Wednesday formed a clear upside-down head and shoulders, which usually leads to higher prices. Gold would smash the meaning out of that formation if it closes below $1,325, and signal lower prices to come. Let us watch, though, and see whether Gold can clear $1,360. The SILVER PRICE let go of nothing today and grabbed another 24c to close Comex at 2817.4c, clearly punching through 2800c resistance. Low today was 2752c, which was roughly the high on Wednesday and Thursday. Thus silver appears to have escaped gravity. Today's highs fell at 2844c. On a longer term chart silver touched its 20 day moving average today (2820c), but, but, but the 20 dma closed BENEATH the 50 DMA (2867) four days ago, and that is NOT a bullish sign. Just as SILVER and GOLD closed confused today, so am I. Over my shoulder I am looking for a surprise rally that might take metals up to new highs and the GOLD/SILVER RATIO to a new low. On the other hand, the charts before my eyes are mumbling and whispering about lower prices -- and the time elapsed since that 3 January high seems so short. Well, I reckon if it was easy politicians and bankers would be doing it. Markets never pass up a chance to humble and bewilder. Look at silver and gold today. Gold, which in the face of the Egyptian "crisis" should have risen, fell instead. Silver, which ought to have followed or been weaker than gold, rose. That famous safe-haven the US dollar fell, too -- hard. A reader wrote asking me why I didn't mention the upheaval in Egypt as a cause of gold's rise on Friday. Mainly because I don't put much stock in so-called "safe haven" moves. If they run counter to the prevailing trend, they have no lasting effect. If they run with the trend, they only drive it a bit further. Either way, as soon as the crisis passes, the effect passes. Usually it's just noise to filter out. Speaking of Egypt, do any of you mushrooms besides me entertain a tee-tiny doubt about the "spontaneity" of the uprising in Egypt? Does anybody with even a tenth of a brain left believe that a big, mean government that has held power 29 years by jailing and otherwise silencing its opponents can be overthrown by a bunch of hollering nerds on Twitter or Tweeter or Tweety-Bird or whatever it's called? Now think about that. Yes, yes, the Spirit Of Democracy rises up against the Tyrant, arm in arm in solidarity with the Easter Bunny and Tweety Bird. Hmmmm. Friends, I am just a natural born durn fool from Tennessee, but even I suspect a set-up, more so when Bernard O'Bama and Handsome Hillary mumble about democracy, which looks so much like throwing Mubarak out of the rowboat that I can't tell the difference. Just to show that even a blind hog finds an acorn now and then, the execrable Franklin Roosevelt said, "Nothing happens by accident in politics. If it happened, somebody made it happen." All that the US dollar index accomplished was to reach up and touch its 20 DMA at 78.22, then fall back. Today the dollar lost 50.4 basis points (0.65%) to end the day at 77.735, but during the day made a low at 77.55, slightly lower than Friday's 77.61. The dollar index has now carved out for itself a new shelf of support at 77.60. Fall off that, and it will revisit 76. My bias still hints that the dollar will turn and rise, but my chief grounds for that is the dollar's long fall accompanied by madly optimistic silver and gold markets. The pendulum swings, so count on it, be it sooner or later. On a five-day chart today's "advance" in the Dow, 68.23 points, looks like no advance at all. The gate looks firmly closed on the Dow at 11,900. Last two day's trading have dragged the Dow down to its 20 DMA (11,802.37) which might stop the fall, or might merely ring the first warning bell. I'll take that second. Dow closed at 11,891.93 and the S&P gained 9.78 to close at 1,286.12 I know the January rule for stocks, "As goes January so goes the year." If stocks gain from 31 December to 31 January, they supposedly will gain for the year. Well, ride that horse if you want 'til he falls dead beneath you, but I want no ride at all on stocks, thanks very much. Sorrow, woe, and grief lie that way. (Dec. 2010 Dow closed 11,573.42; today, 11,891.93.) On this day in 1609 the Amsterdam Exchange Bank was founded. It accepted deposits of foreign coin and silver and gold bullion, and issued the depositors credits. By generally sound management as and exchange and warehouse, it managed to stay in business until the city took it over in 1790. Sooner or later, I reckon, all banks go bad. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. | ||||||||||||||||||||||||

| Spending Cuts - January 31, 2011 Posted: 31 Jan 2011 11:11 AM PST Spending Cuts - Casey's Daily Dispatch [LIST] [*]Sign Up Now! [*]| [*]RSS Feed [*]| [*]Print this [*]| [*]Visit the Archives [*]| [*]Email to a Friend [*]| [*]Back to All Publications [/LIST] January 31, 2011 | [url]www.CaseyResearch.com[/url] Dear Reader, Most cautionary tales of gold hearken back to January 1980, its last major peak. Though there are important lessons to draw from this period, I don't think that's the best guidance in today's market. For one thing, the 1980 speculators were in some ways wrong. The same things that concerned investors then concern gold investors today: in... | ||||||||||||||||||||||||

| Treasury Yields are Blinking Red Posted: 31 Jan 2011 10:50 AM PST Here's an excellent article by Mike Whitney discussing what Treasury yields are telling us about Ben Bernanke's intentions. - Ilene Treasury Yields are Blinking RedCourtesy of MIKE WHITNEY, writing at CounterPunch Treasury yields are "blinking red", but the Fed keeps acting like nothing's wrong. What's the deal? Let's explain: Fed chairman Ben Bernanke's bond purchasing program (QE2) has sent the yield on the 30-year Treasury skyrocketing. At the same time, the the 2-year Treasury is stuck at a lowly 0.61. That means, the "yield curve" between the two bonds has grown steeper, which normally happens at the beginning of a recovery because investors are moving out of "risk free" bonds to riskier assets like stocks. Typically, the yield on the long-term bond will start to go down on its own because investors expect the Fed to raise short-term rates to curb potential inflation. But that's not happening this time. Why? And why should we care? The reason we should care is because the yield curve is signaling one of two things; inflation or default. What it is not signaling is a robust recovery. Remember, the Fed's main job is "price stability" which means keeping a lid on inflation. When the yield on long-term bonds spikes, then it's up to Bernanke to show the market he'll do what's necessary to fight inflation, that is, raise rates. It's a question of credibility. But Bernanke isn't interested in credibility. In fact, he's not only said that he will keep rates low for an "extended period of time" but also pledged to continue his $600 QE2 program until there's a "significant improvement in labor market." He was joined in his commitment by all of the active members of the FOMC. Now, granted, QE2 has boosted stock prices, but the extra liquidity has also inflated commodities prices (making it harder on consumers) and wreaked havoc in emerging markets forcing trading partners to control capital flows or raise rates to tamp down inflation. But QE2's greatest shortcoming is that is really doesn't create jobs as advertised. It's just more supply side, "trickle down" monetary theory designed to goose the market while workers languish in unemployment lines. Here's how the Wall Street journal's Kelly Evans summed it up:

In other words, the Fed is planning to give every working man and woman in the US a big pay-cut so they can go nose-to-nose with foreign labor. You can see how this blends seamlessly with Obama's State of the Union Speech where he focused on "competition" as his central theme. More importantly, Obama reiterated his pledge to double exports in the next 5 years. The only way that can be achieved is by destroying the dollar. Here's a clip from an op-ed by Judy Shelton that explains what's going on:

So, while working people and pensioners see their savings sliced in half to accommodate the globalist dream of an evenly-depressed world labor market; the investor class will get regular injections of Fed liquidity via QE2 to keep stocks "bubbly" and profits high. But large-scale monetary manipulation does involve some serious risks, as Deborah Blumberg points out in her WSJ article "Is Steep Yield Curve Signaling Pain to Come?". Here's an excerpt:

The United States will not default because it pays its debts in its own currency, (and the Treasury can always just print more money) but the prospect of a ratings downgrade is quite real. That means it would cost considerably more to finance the debt. Also, long-term interest rates will rise sharply. That will crimp consumer spending, slow economic activity, and deal a death blow to the struggling housing market. Bernanke's playing a dangerous game. If he's not careful, he could trigger a run on the dollar.

| ||||||||||||||||||||||||

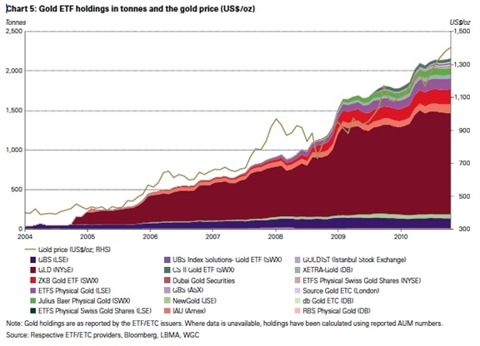

| Gold: Investment Demand In Flux Posted: 31 Jan 2011 10:32 AM PST Hard Assets Investor submits: By Julian Murdoch As gold prices skyrocketed last year, so too did investment demand, according to the World Gold Council's recent Gold Investment Digest. Although gold has since pulled back from its record $1,400/oz level, gold prices were still substantially higher in 2010 than the previous year. Last year, the average price of gold rose 25.9 percent year-over-year to $1,224.52, up from $972.35 in 2009. Much of that was driven by investment in ETFs and physical gold, as U.S. unemployment and lingering fears of further economic difficulties in Europe continued to support gold as a safe haven. ETFs: Surprises In GLD, India (Click to enlarge) ETF holdings monitored by the World Gold Council continued to grow in 2010, though not as quickly as we saw in 2009 — 361 tonnes vs. 617 tonnes. Still, by year-end, ETFs held a whopping 2,167.4 tonnes of metal. GLD saw the year's largest gains, with 147.1 tonnes added to the fund during 2010 to reach a total of 1,280.7 tonnes. But it's interesting to note that since the report's publication, GLD's holdings have dropped by more than 55 tonnes — its lowest levels since last May. This is a case where optimism can hurt. As Ong Yi Ling, investment analyst with Phillip Futures in Singapore, noted to TradeArabia, "The ETF is decreasing due to the optimism in the US economy. If we see concerns on unemployment coming back to haunt us, then perhaps we could see the ETF holding start to increase again." Another Complete Story » | ||||||||||||||||||||||||

| Posted: 31 Jan 2011 10:24 AM PST Gold futures end month down 6.1% The COMEX April gold futures contract closed down $7.20 Monday at $1334.50, trading between $1323.60 and $1347.20 January 31, p.m. excerpts: | ||||||||||||||||||||||||

| The Continuing Argument Over Fiscal Policy Posted: 31 Jan 2011 10:05 AM PST I note that a Bloomberg.com article reported that Jean-Claude Trichet – whom I refer to as "socialist moron Keynesian euro-trash halfwit," but which everyone else refers to as European Central Bank President – is said to have said, while "speaking on behalf of the world's central bankers," that "the global economy has recovered better than expected, boosting inflation pressures in emerging markets." Hahaha! What Mr. Trichet literally said is that, "It's clear that it is extremely important that we all keep control of inflation expectations, and that calls for appropriate decisions," which is actually a relief, because I hate it when something is extremely important, yet not in control, like when my wife is so mad at me about something that is, apparently, extremely important, yet her anger is so uncontrolled in that she is stammering in rage "You…you…you…!" And if I try to help her by asking, "What in the hell are you stammering about, now?" oddly enough, she gets worse! And her eyes kind of bug out, too! I mean, I can't win here! You can see the kind of crap that I have to put up with all the time! And it doesn't get any better with this Trichet character, either, as he says that it is clear, and that it is extremely important, to "keep control of inflation expectations" which, in this case, is apparently achieved by saying lying, stupid things like how the economy has recovered "better than expected," which is only true if you expected the world to erupt in anarchist flames where everything gets destroyed in a hyperinflationary catastrophic bankruptcy that sweeps around the world while flying saucers invade the Earth and enslave us all, or Democrats invade the Earth and enslave us all, one's as bad as the other, probably. And so, explains Mr. Trichet, the "recovery," which is better than expected, is why price inflation is up! Hahaha! And the lie of a recovering economy makes it suddenly OK that the poor, and everyone else, for that matter, slip a little closer to starvation because rising prices for food and energy consumes all their income? What kind of crazy, demonic government is that? The same kind as America has, that's what kind! Hahaha! And that – that! – is why I am a proud Tea Party member who wishes us the best, and who laments the fact that it is Far, Far Too Late (FFTL) to do anything, like a car going 90 miles an hour sailing off a cliff after careening crazily down a perilous and steep mountain road. As the car sails though the air, two guys inside are arguing, one saying, "More spending!" and the other saying, "Less taxes!" Now, there are those that do not understand that such examples of Real Mogambo Humor (RMH) are very, very subtle, and thus not suited to the masses, who do not see the glaring, obvious connection between comparative economic virtues of more spending or less taxes and the prospect of a speeding car going over a cliff and smashing onto the rocks below, everyone inside screaming in fear all the way down, until the sudden stop kills everyone in a horrible, gruesome death milliseconds before the car bursts into flames, destroying everything, including whatever the car landed upon, probably an endangered species of some kind, or somebody's mailbox, which aren't cheap. And when people gather around to see what happened, they will ask, "What happened?" If they did, then I would tell them that two guys in the car went over a cliff because they were arguing about fiscal policy when they should have been, instead, in total agreement to complain about the Federal Reserve creating so freakishly much money!" If I did, I am sure that they would look at me with those same blank looks of incomprehension and befuddled stupefaction that are on the faces of the people in the security video that shows I am peacefully standing in line, waiting for a cashier, and I am exercising my First Amendment rights by passing the time saying to the cashiers as I waited, "Take your time, morons! The longer you wait to ring up my sale, the utility of my purchase is still new and undiminished, even as my money becomes more worthless, losing purchasing value with every tick of the clock – tick tock, tick tock, tick tock! – because the foul Federal Reserve is creating $100 billion of new money Per Freaking Month (PFM)!" I expected, as I always expect, someone to say, "Well said! Well said, handsome, intelligent stranger to whom the bewildering world of economics seems but children's toys!" Well, they didn't. So you can see on the video where I tell them, "The Federal Reserve is creating money out of thin air so that the corrupt government can borrow the money and spend it, which increases the money supply, which distorts everything, leading to weird bubbles and busts, mostly busts, fads and flops, mostly flops, and inflation, inflation, inflation that is going to eat you alive!" This is when the security video shows the security guard coming over and asking me to leave, which I do, but not before saying, in my most melodramatic Mogambo eloquence and with a theatrical dismissive wave of my arm, "You have been warned, earthlings!" It's too bad that the video does not have a sound track, and thus there is no official record of my voice trailing off into the distance, saying, "So buy gold and silver, you morons! Gold and silver!" I hope I did some good! The Mogambo Guru The Continuing Argument Over Fiscal Policy originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||

| The Meddling of Global “Thinkers” Posted: 31 Jan 2011 10:00 AM PST Now here's something interesting. Every year, Foreign Policy magazine produces a list of the Top 100 Global Thinkers in the World. We picked up the list…looking for our own name. But wait… The key is that these are "global" thinkers. They're not just thinkers, in other words, they are people who are thinking about how people on the other side of the planet should conduct their business. We were suspicious even before we looked at the list. "Foreign Policy"? We're against it. Why should we worry about things that don't concern us? "Well… You can't put your head in the sand," you might reply. "You have to be concerned, because things that happen overseas do affect you." Yes, that is true. They affect us. But so does the price of whiskey, the traffic on the Beltway, and the weather. None of them is worth thinking about. We can do nothing about them. And it would be indecent for us to try. Imagine if we took an interest in the whiskey distiller's business. What could we do? Try to force him to lower his prices? Try to show him how to operate more efficiently – as if we could know? Set up a buyers' cartel to negotiate for lower prices? At best, we'd be wasting our time. At worse, we might succeed! Then, whiskey producers would be responding not to market forces…but to meddlers' forces. What a mess that would be! Meddling with things close at hand is bad enough. Meddling with things far away is worse. Remember our Daily Reckoning dictum: ignorance increases by the square of the distance. The farther you get away the harder it is to tell what is going on. The details disappear. All you can make out are the rough outlines. Shadows…reflections…silhouettes… In the darkness, you step on every rake and fall into every hole. The next thing you know, you are calling for "reforms" in countries you've never even visited…setting the price of China's money…and invading Iraq. But let's look at who Foreign Policy magazine thinks are the 100 Top Global Thinkers. Uh oh. In the first and second place are Warren Buffett and Bill Gates. Hmmm… They're smart guys. But what makes them "thinkers"? What have they been thinking about? And what are their thoughts on the subject? FP says they are there, not for their contributions to the wealth of mankind, but for their philanthropic activities. Wait a minute. What's philanthropy got to do with thinking? Okay… We're stumped on that one… So, who's the number 3 thinker? Barack Obama! Hold on… This is getting silly. Have you ever heard Barack Obama come up with an original thought? Or any kind of thought worthy of the word? No. That's not his thing. He's a politician. Politicians are not thinkers. They may be doers…but they're not thinkers. Obama gives us plenty of empty expressions and hollow words – "change you can believe in"…"hope"… "winning the future" – but real thoughts? Original ideas? Nope. Generally, politicians are not thinkers. Occasionally, you get a politician who pretends to be a thinker – such as Princeton University chief Woodrow Wilson. But he almost invariably turns out to be a jackass and a fool. There must be exceptions – Marcus Aurelius and Thomas Jefferson come to mind. But they seem ill-suited to the political profession and probably should have eschewed public office in the first place. So let's keep moving. There must be someone on this list who is a real thinker. Let's look back at last year…let's see…who was FP's top thinker? Ben Bernanke! Well, that does it for us. What's the matter with these people? Can't they tell the different between tired hacks with worn-out, crackpot ideas…and real thinkers? The Foreign Policy editors should do some real thinking of their own. Then, maybe they'd mind their own business. Regards, Bill Bonner The Meddling of Global "Thinkers" originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||

| Monthly Gold Charts From Trader Dan Posted: 31 Jan 2011 09:55 AM PST | ||||||||||||||||||||||||

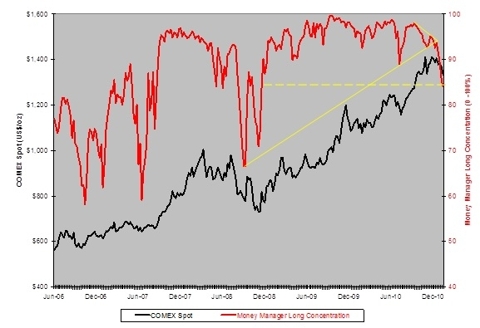

| Hourly Action In Gold From Trader Dan Posted: 31 Jan 2011 09:49 AM PST Dear CIGAs, Gold was strong upon its opening overnight in Asian trading but could not hold onto its gains as longs used the rally to lighten up further and reduce their exposure. While that is not unexpected considering the technical posture of the market, it is also disappointing that with the CCI index making yet another all time high today as commodities across the board were soaring, the yellow metal simply went nowhere. It appears that the "growth trades" are now the new norm for the time being with gold being jettisoned in favor of equities. You'll note that this is the reason that gold is down in unison with the Dollar as I explained in last week's comments. The "risk trades" were still being implemented but gold was not a part of them, at least for today. There was also the usual, "buy the rumor, sell the fact" trade associated with Egypt in the sense that it did not fall apart completely over the weekend, although that is a matter of perspective. Traders were fearing a region-wide proliferation of the unrest on Friday and by today they were practically bored by it all. We'll have to see how the metal handles any potential retest of last week's lows. I would actually prefer to see it move lower and then bounce away as that would more clearly denote those lows at the end of the recent price retracement but rest assured that the perma bears are attempting a push down through those levels. Whether or not it holds will depend on the willingness of longs to stop liquidating. As has been the case with this market since its decade long bull market began – the key to any upward progress is the willingness of managed money and other speculative interest to buy into it. If the specs continue dropping off of the long side, the market will move lower. Granted, they are selling into strong hands but that is little consolation for those who might be long the futures market or the ETF. When the exchange released the Open Interest figures from Friday's sharp price recovery and there was a sizeable reduction, I knew we were in trouble. Still, the metal has not given back all of its gains from Friday and that still gives the bulls the opportunity to hold it here if they will simply stop running. Demand for the metal is incredibly strong on the physical side of things and if the specs would stop disgorging their longs, the market could base here. We do know however that the bullion banks are buying like crazy as price descends. With the managed money side of things down to long side levels last seen when gold was trading at $920, there is not sufficient fresh selling to break the market down below $1300. That requires a spec rout and liquidation selling. We will have to see if those left in the market on the long side have the financial wherewithal to stand pat. The Dollar chart looks beyond awful right now with failure to hold today's low setting the market up for a move down towards 77.20. Dollar bulls need to at the very least take out today's high to stick a short term bottom in near 77.80. Bonds have broken back down once again (no surprise) giving up all of Friday's Egyptian turmoil-based gains plus some. They continue to tread water with Fed buying under the market preventing a deeper sell off. Watch for them to immediately pop higher on the reopen of electronic trade early this evening. As mentioned earlier, the CCI went on to set another all time record high in today's session as Bernanke's "the only thing we really need to fear about inflation is the unreasonable fear of inflation", took yet another round house kick upside the head. Crude oil shot up to a fresh yearly high just shy of $93 as that market is attempting to forge a solid close above $92 on the charts. If it does, it is going to move towards $95. Brent crude, which is arguably a better representative of crude prices globally shot up to $101.67 and as I write this is trading above the $100 bbl mark. But I am not the least bit concerned about these rising food and energy prices because Ben Kenobi has told me that the Force is strong with him and he can sweep it all away by merely waving his hand. Gold is probably the Darth Vader of the Federal Reserve universe so this time I am rooting for the dark side. A rising commodity index that is firing on all three cylinders, base metals, energy and food, is not conducive to continued selling pressure on the precious metals side of the sector. I suspect that the Jedi at the Federal Reserve are tremendously disconcerted over getting zapped by some lightning coming out of gold. The HUI was caught between a rising equities market and falling gold prices today but managed to hang in there fairly well. Obviously, it would have been beneficial to the cause of the precious metals for the thing to have gained on the day but it is still holding above 500 at this point. We need to see it get a close above 517 ( a strong close) to turn things solidly around. I should point out that its reluctance to stay below 500 is resulting in the 10 day moving average beginning to flatten out although it is still moving lower. We will be keeping close tabs on this index. Click charts to enlarge in PDF format with commentary from Trader Dan Norcini | ||||||||||||||||||||||||

| Gold and silver decline is over, Turk tells King World News Posted: 31 Jan 2011 09:44 AM PST 5:40p ET Monday, January 31, 2011 Dear Friend of GATA and Gold (and Silver): The recent decline in gold and silver prices is over as oil and other commodity prices continue to rise, GoldMoney founder and GATA consultant James Turk tells King World News. Excerpts from the interview can be found at the King World News blog here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/1/31_Ja... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||||||||||||||||||||||||

| Hugo Salinas Price: Monetizing silver in British pounds Posted: 31 Jan 2011 09:33 AM PST 5:30p Monday, January 31, 2011 Dear Friend of GATA and Gold (and Silver): The presentation of Hugo Salinas Price, president of the Mexican Civic Association for Silver, at last week's Cheviot Asset Management Sound Money Conference in London, described how silver might gradually be monetized in British pounds. You can find the presentation at the association's Internet site here: http://www.plata.com.mx/mplata/documentos/images/Hugo_Salinas_Price_Lond... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | ||||||||||||||||||||||||

| Policy makers at Davos see dollar losing reserve dominance Posted: 31 Jan 2011 09:25 AM PST By Paul Carrel http://www.reuters.com/article/2011/01/31/uk-davos-dollar-idUKTRE70U3X82... DAVOS, Switzerland -- The U.S. dollar's role as a reserve currency will diminish in the coming years as Asian economies like China grow and countries seek to diversify their monetary holdings, policymakers said on Friday. The U.S. Federal Reserve's policy of quantitative easing -- essentially printing money -- and a call by France to look at ways to wean the world off the dollar as the sole reserve money have put the U.S. currency in the spotlight. "I'm more optimistic about the euro gaining strength as a potential reserve currency," Bank of Israel Governor Stanley Fischer said during a panel discussion at the annual World Economic Forum here. ... Dispatch continues below ... ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php "We ourselves are diversifying into currencies which we would never have put in the reserves before, including the Australian dollar and so forth," he added. "I think people will diversify their reserves." French President Nicolas Sarkozy is trying to rally the Group of 20 powers to the idea of a more varied monetary system after decades of the dollar being the world's reserve currency and a major unit of international trade settlement. The dollar debate comes at a time when many countries are tempted to let their currency drop to promote exports and growth after the worst downturn since World War Two, even if that can be at each others' expense. Bank of Canada Governor Mark Carney and Fischer anticipated that, in the long run, Asian monies would have a greater role as reserve currencies. "I agree with Stan (Fischer) that over time there will be more of a multi-polar system. Other currencies will play a central role in reserves," he said. "The (Chinese) renminbi, over time, should have a role as a reserve currency." Turkish Finance Minister Mehmet Simsek saw the United States' quantitative easing policy leading to a diversification of reserve holdings. "If the U.S. continues the way it is ... certainly countries will look for alternatives because you can't print so much money and expect no consequences," he said. "Ultimately the centre of gravity is shifting toward the East," Simsek added. "Certainly 10 years from now there could be a very different landscape." Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf | ||||||||||||||||||||||||

| Maybe there can be several reserve currencies, Rickards tells King World News Posted: 31 Jan 2011 09:20 AM PST 5:17p ET Monday, January 31, 2011 Dear Friend of GATA and Gold: Interviewed by Eric King of King World News, market analyst Jim Rickards speculates on a new world financial system that uses several reserve currencies. Rickards also discusses China's need for more gold to become an economic superpower. The interview is 13 minutes long and you can listen to it at King World News here: http://kingworldnews.com/kingworldnews/Broadcast/Entries/2011/1/31_Jim_R... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Resource Spins Off Platinum/Palladium Venture: Company Press Release, January 18, 2011 VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY)and Pacific Coast Nickel Corp. announce that they have agreed that PCNC will acquire Prophecy's Nickel PGM projects by issuing common shares to Prophecy. PCNC will acquire the Wellgreen PGM Ni-Cu and Lynn Lake nickel projects in the Yukon Territory and Manitoba respectively by issuing up to 550 million common shares of PCNC to Prophecy. PCNC has 55.7 million shares outstanding. Following the transaction: -- Prophecy will own approximately 90 percent of PCNC. -- PCNC will consolidate its share capital on a 10 old for one new basis. -- Prophecy will change its name to Prophecy Coal Corp. and PCNC will be renamed Prophecy Platinum Corp. -- Prophecy intends to distribute half of its PCNC shares to shareholders pro-rata in accordance with their holdings. Based on the closing price of the common shares of PCNC on January 17, $0.195 per share, the gross value of the transaction is $107,250,000. For the complete announcement, please visit: http://prophecyresource.com/news_2011_jan18.php | ||||||||||||||||||||||||

| Barrick CFO: Central Banks may shift more reserves into gold Posted: 31 Jan 2011 09:12 AM PST by Phred Dvorak Jamie Sokalsky, chief financial officer of Canada's Barrick Gold Corp., said there has been a "sea change" in the past year, with central banks that had stocked up on U.S. dollars starting to buy more gold to diversify their holdings. Many forecasters say that trend will continue this year, since global currency reserves are approaching the $10 trillion mark — the bulk of it in U.S. dollars — even as a faltering economy and climbing debt load look set to depress the value of those dollars… Central banks are "concerned about how much they're holding in U.S. dollars," said Mr. Sokalsky. "There aren't that many alternatives." Barrick itself doesn't forecast how much gold central banks are likely to buy, he said. Barrick keeps close watch on currency values, particularly that of the U.S. dollar—because they affect both the price of the gold the company mines and the cost of digging the metal out of the ground. … a weakening greenback could [...] raise the cost of Barrick's operations in countries from Papua New Guinea to Argentina. Around a third of Barrick's costs are denominated in currencies other than the U.S. dollar. …… To fend off sudden increases in expense, Barrick watches movements in the Australian dollar closely and hedges aggressively. [source] RS View: Here's an encouraging thought for long-time conspiracists: you can't have it both ways. As the world's largest producer, either Barrick is in league with the central bankers of the world as a penultimate "insider", or else they are not. If they are not, then a lot of past rancor is merely so much noise on the wind, along with much that yet prevails. However, if they are, then here is yet another roadsign to count among the increasing number of official blessings being openly expressed upon the bright future of the gold market. [Regarding my own perspective on the matter, Barrick and her peers got themselves hip deep in the metal-hedging mire that pages upon pages have already detailed like so much water under the bridge. That ridiculous scene then had to run its sloppy collision course with permanent extinction, which it largely now already has, and now we all hear the same harpstrings as we float more or less together -- some pushing, some pulling, some shyly, some boldly -- into the future.] | ||||||||||||||||||||||||

| Posted: 31 Jan 2011 09:00 AM PST The 5 min. Forecast January 31, 2011 11:53 AM by Addison Wiggin - January 31, 2011 [LIST] [*] Poor return on investment: How $2 billion a year is literally going up in flames [*] Byron King with a chart that helps answer a burning question about Egypt: Why now? [*] China seeks more gold, cuts another U.S. energy deal [*] Rotten economy forces a merger of “till death do us part” with “rest in peace” [*] “Our very lifestyle makes us less competitive”… Readers sound off on U.S. labor costs [/LIST] Here’s a helpful reminder as we begin the week: Out of every $100 Uncle Sam spends, 52 cents buys this: Every year, Washington sends $2 billion in aid to the regime of Hosni Mubarak; $1.3 billion of that is for his military. Egypt is the No. 2 recipient of foreign aid, after Israel. Right now, the return on investment doesn’t look very good. Rising food prices were the cataly... | ||||||||||||||||||||||||

| Social Unrest Rises With Food Prices Posted: 31 Jan 2011 09:00 AM PST Here's a helpful reminder as we begin the week: Out of every $100 Uncle Sam spends, 52 cents buys this:

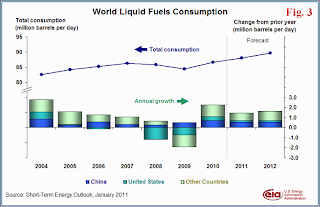

Every year, Washington sends $2 billion in aid to the regime of Hosni Mubarak; $1.3 billion of that is for his military. Egypt is the No. 2 recipient of foreign aid, after Israel. Right now, the return on investment doesn't look very good. Rising food prices were the catalyst that set off long-simmering anger over repression and corruption. But what exactly set off the food prices? "I believe this depicts a major aspect of Egypt's problem," says Outstanding Investments editor Byron King of the graph below:

"As of 2010, Egypt began consuming all the oil that it extracts. Egypt no longer exports oil. Interesting timing for social unrest, don't you think? "Here's what the numbers show. Egypt's net oil exports have been falling each year since the mid-1990s. So for the past 15 years or so, Egypt's government has been raising less and less income with which to offer food and fuel subsidies to the teeming masses in the country's expansive slums." Without those subsidies, huge numbers of people in Egypt – population 85 million – would not eat. As we mentioned last week, Egypt is the world's biggest wheat importer. "In the past few years," Byron continues, "Egypt has imported about 40% of its food overall and 60% of its wheat. Egypt buys the food on world markets, paying world prices. "In the past year or so, as net oil exports shifted down to zero, the food problem became even worse for Egypt. World wheat production is down, and global export markets are tightening." You know the story: drought in Russia, floods in Australia and so on. And at the very moment Egypt has less oil revenue, it's shelling out more for food. And the subsidies go only so far. "The bottom line is that energy is a problem for Egypt, compounded by revenue shortfalls, compounded by large and growing population, compounded by the need for food imports. "It's an explosive mix, and now the fuse has burnt down. I don't doubt that this all is why we're seeing riots in the streets." Addison Wiggin Social Unrest Rises With Food Prices originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||

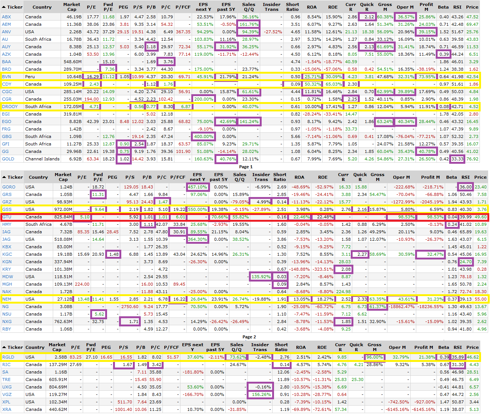

| Paolo Lostritto: Don't Retreat, Reload Your Gold Posted: 31 Jan 2011 08:45 AM PST Source: Brian Sylvester of The Gold Report 01/31/2011 When it comes to the 2011 gold price correction, Wellington West Senior Analyst Paolo Lostritto says he's seen worse. He counsels investors to "use this opportunity," if they haven't already, to rebuild gold positions because he foresees upside by the second half of 2011. Of the 19 companies he covers, only a handful will outperform the broader market in any given year. We know you want those names. And in this exclusive interview with The Gold Report, Paolo gives them to you. His colleague, Senior Research Analyst Steve Parsons, also shares his insights on a few of his favorites. The Gold Report: Reuters reported that for the fourth time in two months, China has boosted the reserve requirement ratio (RRR) for their largest banks in an effort to curb inflation. Thailand and South Korea have made similar moves in recent weeks, and the first RRR move in China was made after inflation reached above 5% in November. Do... | ||||||||||||||||||||||||

| Posted: 31 Jan 2011 08:41 AM PST Kick The Can Down The Economic Road Earning (sigh – as this heavily massaged and adjusted number is not what it seems) and spending more and save less philosophy has transitioned from economic choice to necessity for Americans. America's reliance on personal consumption, more commonly known as "spending", kicks the can down the road. The belief that economic problems are defined by weakness real estate is misguided. Real estate continues to be only a minor contributor to gross domestic product (GDP). It's contribution to GDP was only 6% at height of the real estate bubble. Residential Fixed Investment (RFI) As A %GDP and Residential Fixed Investment (RFI) As A %GDP Average from 1947: Real estate's importance since 2000, a point often missed by the headlines, resided in its ability to support and enhance leveraged consumption. Many Americans considered their homes as piggy banks for extra consumption prior to the collapse in 2006. The reliance on consumption to support GDP, however, did not fade with the decline of the real estate market. In fact, yesterday's personal consumption expenditures as a percentage of GDP nearly eclipsed the all-time highs achieved in 2009 (see chart below). In other words, spend more and save less, or the driving forced behind ongoing consumption bubble and economic imbalances within U.S., is live and well. Personal Consumption Expenditures (PCE) As A %GDP and Personal Consumption Expenditures As A %GDP Average from 1947 How's the consumption bubble maintained as real estate fades? The public sector through a combination of infinite quantitative easing (currency devaluation) and stimulus has replaced real estate as the boot that kicks the can down the economic road. The public sector spending which represented 17% of GDP in 2000 has surpassed 20% in 2010. Federal spending at 8.3% of GDP has jumped 43% during this period. Government Consumption Expenditures and Gross Investment (GCEI) As A %GDP Average from 1947: Federal Consumption Expenditures and Gross Investment (FED) As A %GDP Average from 1947: Investment and savings are the foundation of any sustainable economic recovery or economy. Investment in the US continues to flounder at levels not seen since the Great Depression. Unadjusted savings, heavily influenced by statistical assumptions and adjustments, thus, making historical comparisons meaningless, have turned but remain challenged despite the economic collapse. Gross Domestic Private Investment (GDPI) As A %GDP and Gross Domestic Private Investment (GDPI) As A %GDP Average from 1947 America is known for spending more and save less. The trends clearly reveal that is changed despite the rhetoric. Kick the can down the road until it's someone else's problem. Savings (SAV) As A %GDP Average from 1947: Headline: Americans earn and spend more, save less As incomes slowly creep back up, Americans are spending more freely and saving less. Personal income rose 0.4% in December, following a 0.4% increase in November, according to data released Monday by the Commerce Department. Spending by individuals ticked up 0.7%, compared to a revised 0.3% spike the prior month. Both measures beat expectations. Income was expected to increase by 0.5% in the month, according to a consensus estimate of economists from Briefing.com. The economists expected spending by individuals to rise 0.6% in December. Source: finance.yahoo.com | ||||||||||||||||||||||||

| China’s Urban Underground Dwellers Posted: 31 Jan 2011 08:40 AM PST In a city of about 20 million, it's no surprise Beijing has more than its fair share of housing challenges. However, a solution that's become common for many average wage earners is not one you would probably guess they'd consider first… living underground in a 30-square mile network of air defense basements. The bunkers were originally built as shelter to protect citizens in the event of foreign air raids, and the Telegraph estimates that "as many as a million people live in small, windowless rooms that rent for £30 to £50 a month." For the time being, despite China's rising wealth, the homes are some of the only affordable housing options available to Beijing's migrant laborers. According to the Telegraph: "In a Beijing suburb, beneath one of the thousands of faceless residential tower blocks that have carpeted the city's peripheries in a decade-long building frenzy, one of Beijing's 'bomb shelter hoteliers', as they are known, agrees to show us his wares. Passing under a green sign proclaiming 'Air Defence Basement', Mr Zhao leads us down two flights of stairs to the network of corridors and rooms that were designed to offer sanctuary in the event of war or disaster. "'We have two sizes of room,' he says, stepping past heaps of clutter belonging to residents, most of whom work in the nearby cloth wholesale market. 'The small ones [6ft by 9ft] are 300 yuan [£30] the big ones [15ft by 6ft] are 500 yuan.' "Beijing is estimated to have 30 square miles of tunnels and basements, some constructed after the Sino-Soviet split of 1969, when Mao's China feared a Soviet missile strike, and many more constructed since to act as more modern emergency refuges. [...] 'Some 80pc of our tenants are girls working in the wholesale market and the rest are peddlers selling vegetables or running sidewalk snack booths,' he adds. 'There are dozens of similar air defence basement projects in residential communities. In this area, they say 100,000 live underground.'" Time will tell whether or not there is a bubble in China real estate. On the one hand, there are fewer mortgages in China than in the US, and therefore less of that type of home ownership speculation. On the other hand, the article points out that a very basic small apartment, about 860 square feet, now costs over 2,000,000 yuan, while the typical monthly salary is about 4,000 yuan. This means, "the average person would take 50 years to buy such an apartment, assuming they saved every penny they earned." You can read more details, and arrive at your own conclusion, by visiting the Telegraph's coverage of the underground world that hints at China's coming crisis. Best, Rocky Vega, China's Urban Underground Dwellers originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||||||||||||||||||||||||

| Posted: 31 Jan 2011 08:08 AM PST Frank Holmes submits: Last week was an eventful week at home and abroad with several events directly showing up in the performance of global markets and the price of gold. On Friday, Egypt’s mayhem in the streets caused uncertainty in the markets, but sent gold shooting up over $21 to close at $1,336.75. On Wednesday, a continuation of the Federal Reserve’s easy monetary policy pushed gold up double-digits. Earlier in the week, a small hedge fund that had overleveraged itself to gold futures blew out its position, causing the biggest ever one-day reduction in futures contracts for the Comex. This small hedge fund trader fell victim to one of the oldest flaws in capital markets — arrogance with excessive leverage. This is the same infallible, overleveraged attitude that took down Fannie Mae (FNMA.OB), Lehman Brothers, Long-Term Capital Management, Enron and a number of Main Street American Home Buyers who leverage themselves 100-to-1. By overleveraging his small $10 million fund, he was able to control the equivalent of South Africa’s annual gold production, according to the Wall Street Journal. That’s one small fund controlling an amount of gold equal to the world’s third-largest producer? Leverage of this magnitude is impossible to manage, no matter how intelligent the investor. However, danger and crisis can equal opportunity for long-term investors. All these events have created a lot of short-term noise but not derailed the long-term story. Life is about managing expectations and that’s why we educate investors to anticipate before they participate (View our Anticipate Before Complete Story » | ||||||||||||||||||||||||

| Gold Daily and Silver Weekly Charts Posted: 31 Jan 2011 08:07 AM PST | ||||||||||||||||||||||||