saveyourassetsfirst3 |

- What Is the Euro's Relative Value?

- Federal Reserve Continues to Underwrite 'Big'

- Hugo Salinas Price: Monetizing silver in British pounds

- Mainstream Media Misses the Boat (Again) on Manufacturing Report

- Beat the BRICs With Three South American Profit Plays

- The Coming Flight to Gold

- Geopolitical Instability in Middle East - Gold Today Like Gold in the 1970s?

- Further discussions with FOFOA on GLD

- Fifteen "superfoods" everyone can afford

- Pimco: These bonds could offer the highest returns in 2011

- Must-see: Senator Rand Paul delivers his own "State of the Union" address

- Donald Trump: China is "looking to strip us of everything"

- SUNDAY NIGHT WEBINAR

- GOLD-The real reason for the drop-Commercial Liquidation!

- Gold and Silver Price Decline is Over: James Turk

- Another Jim Rickards Interview

- Trading Comments, 1 February 2011 (posted 10h30 CET):

- When and How Gold Will Begin its Bubble

- Germany promised U.S. in 1967 not to convert dollars to gold

- Will Gold, Silver and Oil Prices Soar on Social Unrest In The Middle East?

- Gold Cuts Friday Surge as Dollar Falls…

- Gold Standard University Live

- Housing Armageddon: 12 Facts Which Show That We Are In The Midst Of The Worst Housing Collapse In U.S. History

- Monday January 31st, Updated 10:00 pm EST

- Huge gold standing for delivery; problems in Egypt intensifies

- U.S. Dollar and Gold: We Saw Their Future on TV Tuesday Night

- When All Roads Lead to Default

- My Largest Personal Investment

- Precious Metals & the Dollar’s Next Big Move II

- Bring Back, Bring Back, Oh Bring Back My Gold Bond To Me

- O’Sullivan: Blue Ocean Thinking for Copper & Gold

- Middle East Instability – Today and the 1970s

- Gold Slips as Correction Resumes, Oil Rises

- The Continuing Argument Over Fiscal Policy

- Is Silver A Good Investment Idea ?

- United Mining Group is Set for Silver Production in Idaho Next Year

- Gold Seeker Closing Report: Gold and Silver End Mixed

- Merkels caution in euro crisis born of experience

- Gold Bar Premiums at 17-Year High in Hong Kong…

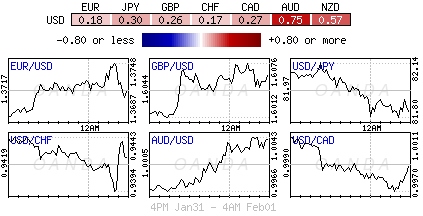

| What Is the Euro's Relative Value? Posted: 01 Feb 2011 04:39 AM PST MarketPulse FX submits: By Dean Popplewell Global PMI surveys remain firmly in expansionary territory, with evidence of out performance. The market all week had been looking for an excuse to own Cable, and finally this morning we get it. U.K.’s manufacturing PMI aggressively jumped four ticks to 62. The EUR bears have been given the run around over the last 24 hours with month-end requirements, fixes, geopolitical risk premium been priced out and a market record short. Eurozone inflation data has heightened speculation that ECB rates would soon be increased, all this is counterbalancing Egypt’s political instability. Forget the noise and keep your eye on "relative value." At 1.3800 the EUR looks toppy, at 1.3500 it has value. In between the market is second guessing themselves. The USD$ is mixed on the O/N trading session. Currently, it is higher against 8 of the 16 most actively traded currencies in a "whippy" O/N session.

Stronger U.S. data surprisingly has added to the dollar's woes. December consumer spending was double that of the previous month (+0.7%) and aggressively trumped all forecasts (+0.4%). Digging deeper, most of the spending gains were focused on goods, led by nondurables (+1.5%) and the discretionary spending category, durables (+0.7%) reversing the previous months decline (+0.4%). Even the service spending happened to advance (+0.4%) for a second consecutive month. Most of the rise in spending was due to higher volumes and analysts note that "a little more than half of the headline rise will flow through to GDP growth." It’s worth Complete Story » | ||

| Federal Reserve Continues to Underwrite 'Big' Posted: 01 Feb 2011 04:24 AM PST John M. Mason submits: The economic spokesperson for the Obama administration, Ben Bernanke, and the Federal Reserve System continue to underwrite “big”…Big Companies and Big Banks. The Federal Reserve has just released its survey of senior credit officers. The headlines, “Large United States Banks are Starting to Ease Credit Terms.” Terrific! “Large companies may also be finding an appetite to borrow, especially for mergers and acquisitions…The start of January was marked by a record level of M&A and 77 per cent of banks that reported an increase in loan demand said deal financing was a somewhat to very important reason for it.” But wait…”A flood of cash by investors seeking to profit from rising interest rates is having an unintended effect in the deal world, where this money is being recycled into corporate buyouts. Investors have been selling bonds, which typically lose money when interest rates rise, and putting their cash in funds that invest in bank loans that finance corporate buyouts. The loans have floating rates, so the interest they pay investors rises as rates go up.” Wow! Have I got a deal here! And, what about big banks? Well, Bloomberg News has an answer for that: “Fed’s Easy Money Helps European Banks Refinance.” Seems as if European banks are selling record amounts of dollar-denominated bonds Complete Story » | ||

| Hugo Salinas Price: Monetizing silver in British pounds Posted: 01 Feb 2011 03:20 AM PST Long, 40-page read, but Hugo proves once again that he is the Mexican Master of Money. Includes his "Bill to monetize the silver ounce in Mexico" Hugo Salinas Price: Monetizing silver in British pounds | ||

| Mainstream Media Misses the Boat (Again) on Manufacturing Report Posted: 01 Feb 2011 02:29 AM PST Karl Denninger submits: From the January 2011 Manufacturing ISM Report On Business:

Uh huh. Global demand, eh? What about profits? Input prices recorded at 81.5%, up nine full points since last month. Growth? Okay. But growth in what? Input prices can only go two places: Final prices go to consumers or they get eaten by the manufacturer. Unless you can show me actual private wage growth (not government teat spending) then you're headed for either a demand collapse, profit collapse or both. This is mathematics. I know everyone wants to "make hay while the sun shines," but the fact remains that what's happening here is not sustainable and the media is still cranking out noise about "small business borrowing surges" and similar lines of balderdash. With what will they collateralize their borrowing when the asset base for that borrowing -- their homes -- contracted by $7 trillion, Complete Story » | ||

| Beat the BRICs With Three South American Profit Plays Posted: 01 Feb 2011 02:04 AM PST Martin Hutchinson submits: The stock exchanges of Colombia, Peru and Chile agreed last November to merge their trading, giving international investors access to roughly 600 stocks - more than any single country in Latin America. As readers well know, I have recommended Chile a number of times. And with good reason: In this period of high commodities prices, I continue to believe that this is the most attractive of all emerging markets. Complete Story » | ||

| Posted: 01 Feb 2011 01:24 AM PST | ||

| Geopolitical Instability in Middle East - Gold Today Like Gold in the 1970s? Posted: 01 Feb 2011 01:18 AM PST | ||

| Further discussions with FOFOA on GLD Posted: 01 Feb 2011 12:54 AM PST FOFOA, Firstly, I'll have to be more careful in how I write. My post was really mixing up responding to specific quotes of yours but then veering off on to related concepts/positions that are not yours. My exploration of the idea that APs would fraudulently take GLD gold or "GLD is bad because bullion banks involved" was directed at the simplistic anti-GLD ranters not looking to the subtleties and not at yourself. One of the problems with writing rather than speaking face to face I think. Anyway, on to the discussion. "Market-price reversible swap" makes more sense, I read "essentially lent" as implying some obligation to return the physical. With regards to the "naked short" I was talking from a financial point of view, whereas you are using the term in the sense of physical. To clarify the distinction for our readers, let us consider a bullion bank with a physical ounce asset backing an unallocated ounce liability to its clients. If that bullion bank then lends that physical to a jewellery company who use it in their operations, then the bullion bank now has an ounce claim asset backing it unallocated ounce liability. From your point they are short "physical" but I would also note that the bullion bank is not short "financially", that is they are not exposed to any movement in the price of gold. Yes they are exposed to the risk the jeweller does not return the physical at the end of the lease. Probably more importantly, they are exposed to liquidity risk. I think this is the sense that you use "short" and is reflecting the issue of "maturity transformation" (see Unqualified Reservations blog for an excellent explanation of why this is a big problem). My use of the word "short" is for situations where the bullion bank exchanges (or sells) the physical backing its unallocated ounce liabilities for cash. This creates a financial risk as there is a mismatch between the denominations of the liability (ounces) and the asset (dollars). When you used the phrase "sell them for dollars that can then chase an ROI" this implied to me a financial short and that was what I was addressing. I now understand what you meant by "special right" when you say "once the price of physical gold starts running away from the paper price". I will have to disagree with you on this to some extent. Now by that I'm not saying GLD does not have its risks or that any not-in-your-hands gold is better than in-your-hands gold, but I have, maybe naively, a stronger belief in arbitrage and greed. Let us consider your scenario where the markets have been closed for a week, during which no doubt the price for physical gold has risen. On market opening I agree we are likely to see much selling by retail investors who no longer have any trust in the markets. They are wanting cash so they can buy physical gold. Their selling pushes the price of GLD down. Now you state that "the APs can just scoop up those shares at a panic discount". This I'm not so sure about. The prospectus lists 16 APs, only some of which are actually bullion banks (with their angry) unallocated creditors): BMO Capital Markets, CIBC World Markets, Citigroup Global Markets, Credit Suisse Securities, Deutsche Bank Securities, EWT, Goldman, Sachs, Goldman Sachs Execution & Clearing, HSBC Securities, J.P. Morgan Securities, Merrill Lynch Professional Clearing, Morgan Stanley, Newedge, RBC Capital Markets, Scotia Capital and UBS Securities. I find it hard to believe that all of these will conspire to agree to hold off on buying GLD until a significant discount appears. Arbitrage traders in each firm will be watching GLD drop relative to the physical price of gold. As it goes to $1 to $2 discount per ounce etc, the traders will be thinking "if I don't take that discount and lock in easy profit now then one of the other APs will and I'll lose the profit". With 16 traders I find it hard to believe that one will not jump first, providing offers to buy and thus arresting the decline in GLD's price. What does Newedge care about JP Morgan's angry unallocated customers and why let them get GLD gold at a big discount to save them and deny yourself a profit? Now I will concede that for my scenario to work all of the 16 APs have to have access to physical in the OTC market, which may not be the case for the smaller players. But then when you say the physical price is diverging from GLD's price, this implies that there is market for physical at a price and thus would it not be more easier for the 16 APs to acquire physical compared to retail investors, given their connections in the OTC market? As you say we are talking about systemic failure. I suppose I'm nit picking, but is not systemic failure a situation where gold goes into Feketian "hiding" in which case there ceases to be a gold price? What I'm saying is that up until that parabolic breaking point, while gold is still being sold for cash, the backstabbing greedy profit motive of the 16 APs will ensure GLD's price stays in touch with the physical gold price. That is my answer to your question "Will anything other than physical gold itself track the price of physical gold in a physical-only market?" For readers who don't find this particularly helpful or are not comfortable assessing these risks, I would suggest taking FOFOA's advice:"I don't know the answers but I do know one way to avoid the risks." - that is, buy physical! The ability of non-APs to borrow GLD shares and then sell them short I think we are in agreement on and is another problem with GLD, or to be fair with stock exchanges in general it seems. Finally, I take some issue with your statement that "or some other coin the ETF shareholders would have bought had there not been an ETF. The ETF diverted demand in many ways".I partly disagree with this, but I also partly disagree with those who think GLD's tonnage is "additional" demand. The truth is in between both in my opinion. There is no doubt that a fair portion of investment in GLD would have occurred anyway, either into other funds (eg Central Trust), Allocated account or cash and carry coins and bars. In this sense all GLD does is make this investment more visible than it would have been. Unfortunately commentators obsess about GLD simply because it is visible and ignore the other 28,000t or so of privately held gold (not to mention Asian demand in "jewellery", which is really investment in nature). However, I do believe that the creation of stock exchange listed gold products has increased demand for gold by making it easier to get exposure to gold. Buying it through a stock broker eliminated the perceived inconvenience to some investors of having to go down to a coin shop and then worry about where to store gold. As to the WGC, in my dealings with them I don't agree with your view that "they are focused on all aspects of the gold market, including the structural integrity of the Bullion Banks' fractional reserves given that the CBs have removed their physical backstop." They are a miner trade group. Their focus was on physical offtake and thus obsessed about the metal behind GLD being Allocated gold. Funny when you consider that the legal structure introduced, in my opinion, some holes that negated the "security" of the Allocated gold backing. I can't say anymore except that I'd guess I'm one step closer to them than yourself (note: the first exchange traded gold product in the world was the Australian Gold Bullion Securities, the second was the Perth Mint's ASX code:PMGOLD, the WGC naturally took some interest in these Aussie upstarts). Unless of course you are close to the WGC, but then that would be revealing a bit too much? :) | ||

| Fifteen "superfoods" everyone can afford Posted: 31 Jan 2011 11:46 PM PST From Mercola.com: Are you afraid that trying to eat healthy will drain your wallet? Not to worry – some of the healthiest foods in the world are actually very, very cheap. Planet Green lists a number of foods that are great for your body but won't break the budget: Kale – It's loaded with vitamin C, vitamin B, and calcium, and costs just over a dollar a bunch. Broccoli and Cabbage – These low-cost cruciferous vegetables neutralize toxins in your liver. Winter Squash – It's just a few dollars a pound, it's a good source of vitamin B6 and folate. Sweet... Read full article... More health tips: This common habit could cause you to gain 15 pounds this year... Physicians are speaking out on the dangers of the new airport scanners This "environmentally friendly" product could pose a serious risk to your health | ||

| Pimco: These bonds could offer the highest returns in 2011 Posted: 31 Jan 2011 11:40 PM PST From Bloomberg: Higher-rated junk bonds in Asian countries where infrastructure spending is fueling growth, such as Indonesia, should offer the best returns in 2011, according to Pacific Investment Management Co. With Asia's emerging economies forecast to grow quicker than its developed nations, "while you may be constructive on a region or country, individual credit assessment is crucial," Lian Chia-Liang, head of emerging Asia portfolio management for Pimco, manager of the world's biggest bond fund, said in an interview in Singapore. "Ideally we like to invest in markets which reside in a neighborhood of growth." Indonesia, Southeast Asia's biggest economy, will expand 6.28 percent this year, outpacing the 5.35 percent growth in Singapore and 4.3 percent in South Korea, according to economists' estimates compiled by Bloomberg. President Susilo Bambang Yudhoyono, who targets 6.6 percent average annual growth through the remainder of his term ending in 2014, has pledged to double infrastructure spending to $140 billion. The nation, with a foreign and local-currency bond rating of Ba1, the highest speculative-grade by Moody's Investors Service, signed an infrastructure agreement worth as much as $24 billion with Japan last month to build projects including a mass rapid transit system for Jakarta and a water plant. "If Indonesia gets it right I don't see why they can't move back to the investment-grade rating they had in the mid 1990s," Lian said. "A country's rating upgrade tends to have a salutary effect on its quasi-sovereign and corporate bonds. We view Indonesia as an improving credit story." Adaro Energy The extra yield investors demand to own Indonesian coal miner PT Adaro Energy's $800 million of 7.625 percent 2019 bonds instead of similar maturity government debt has fallen 32 basis points in the past month to 292 basis points, according to Royal Bank of Scotland Group Plc prices on Bloomberg. Pimco Advisors LP is the eighth-largest holder of Adaro Energy's debt among companies required to make regulatory filings, Bloomberg data show. Junk debt is rated below Baa3 at Moody's or lower than BBB-at Standard & Poor's and Fitch Ratings. The spread on Indonesian state utility company PT Perusahaan Listrik Negara's $500 million of 7.875 percent notes maturing 2037 has widened 1 basis point in the same period, RBS prices show. Relative yields have increased 19 basis points to 277 basis points, or 2.77 percentage points, in the past month across 18 securities, including Listrik Negara's, tracked by HSBC Holdings Plc's Indonesian Dollar Bond Index. That's after the inflation rate rose to a 20-month high in December. 'Differentiation is Key' "If you have a cautious view on the sovereign, you would be mindful of the potential negative effect on corporate debt issued in the country," said Lian. "We think credit differentiation is key to outperformance this year." Pimco, a unit of Munich-based insurer Allianz SE, also favors debt of companies with government backing, Lian said. The Newport Beach, California-based fund manager is the largest holder among those required to make regulatory filings of $650 million of 7.375 percent bonds due July 2020 issued by PT Indosat, Bloomberg data show. Indonesia's second-largest phone operator is a unit of Qatar Telecom QSC, or Qtel, which is controlled by Qatari government entities. The spread on the notes, rated Ba1, has narrowed 27 basis points in the past month to 250 basis points, RBS prices show. "The sovereign back-stop provides an extra comfort level," Lian said. "You have to look at the consistency in performance through economic cycles, corporate governance, and the track record of the management team. These are factors that are important to consider when assessing corporate credits in emerging Asia." Fitch Projection Fitch, which upgraded Indonesia's debt to BB+, the highest junk grade, in January 2010, says the country may achieve an investment-grade rating and see its outlook boosted to positive from stable if it improves infrastructure and sustains growth. "Indonesia has large infrastructure needs and it's been relatively slow putting in place the legal measures needed," Andrew Colquhoun, head of Asia Pacific sovereigns for Fitch, said in Singapore on Jan. 26. "If we see some progress there, that would be constructive for the sovereign credit." Pimco's Emerging Asia Bond Fund returned 2.8 percent in the past month, outperforming 98 percent of its peers, according to data compiled by Bloomberg. The $240 billion Total Return Fund, managed by Bill Gross and the world's biggest bond fund, gained 0.9 percent, the data show. To contact the reporter on this story: Katrina Nicholas in Singapore at knicholas2@bloomberg.net. To contact the editor responsible for this story: Will McSheehy at wmcsheehy@bloomberg.net. More on bonds: Top analyst Rosenberg: Buy muni bonds! Marc Faber: Owning these bonds is "suicidal" Pimco CEO: These investors should prepare for major losses | ||

| Must-see: Senator Rand Paul delivers his own "State of the Union" address Posted: 31 Jan 2011 11:37 PM PST From RandPaul.com: In one week, Senator Rand Paul has taken several bold and proactive steps in getting our nation’s fiscal house in order. Sen. Paul followed through on his campaign pledge when he introduced $500 billion in spending cuts to be enacted in one year. He also introduced legislation allowing for a full audit of the Federal Reserve, which would deliver answers to the American people about how their money is being spent in Washington. On Thursday, Sen. Paul was joined by Sens. Jim DeMint (S.C.), Mike Lee (Utah), Pat Toomey (Pa.), and Jerry Moran (Kan.) during the first ever meeting of the Senate Tea Party Caucus. While in response to President Obama's State of the Union Address, Sen. Paul broadcast his own message... Click here to watch the video... More Cruxallaneous: The three best ways to hide valuables in your home... One of the most important things Ron Paul has ever written The unbelievable new way Americans can escape the dollar | ||

| Donald Trump: China is "looking to strip us of everything" Posted: 31 Jan 2011 11:35 PM PST From Newsmax: Billionaire real estate mogul and reality TV star Donald Trump tells Newsmax he is considering a run for president in 2012 because he "hates what is happening to this country." In the first part of his wide-ranging interview, Trump ripped China, OPEC, President Obama's Middle East policies, and more. Now he takes aim at the banks, oil prices, Obamacare, the weak dollar, and American diplomats, asserts it is "insane" to spend fortunes in other countries when the United States is in dire need of rebuilding, and says if someone is going to take over the oil in Iraq, "maybe it should be us." ... Trump reveals what he would say to Obama if he were to meet the president: "You can do better." Trump would also tell him he should not hire "diplomats to negotiate with the Red Chinese, because we're dealing with people who truly are not only smart, they're great natural negotiators. They're not our friends. They're looking to strip us of everything they can strip us of... Read full article... More Cruxallaneous: Porter Stansberry: Our government is in imminent danger David Rosenberg: A startling fact about Obama's State of the Union address This "environmentally friendly" product could pose a serious risk to your health | ||

| Posted: 31 Jan 2011 10:48 PM PST If you'd like to learn more about trading, gold and the secular bull market… here's an invitation to a private event. A long time SMT subscriber has convinced me to go on a live call and answer your questions about gold, cycles, the stock market and the economy… Here's what you need to do.. Go here: http://www.AskAboutGold.info Enter your name, email address and whatever question you have for me. There are less than 150 seats left so register now to get all the details. We will be looking at massive gains from the gold bull in the next few months so don't miss out: http://www.AskAboutGold.info | ||

| GOLD-The real reason for the drop-Commercial Liquidation! Posted: 31 Jan 2011 10:21 PM PST GOLD-The real reason for the drop-Commercial Liquidation! Monday, January 31, 2011 by Gary Kamen of TrendsinFutures.com We noted several weeks ago that gold may be setting up for a medium-term top. Since that time, gold has fallen by about $55 and has posted a new 4-month low. As the chart below shows, gold has been falling even though the dollar has been weakening, which is an unusual situation that suggests underlying weakness in gold. In addition, physical gold assets are declining in gold ETF funds, which means some investors are cashing in their chips . (See chart below) The current gold sell-off is being caused mainly by reduced financial crisis fears, as evidenced by the twin sell-off in the dollar and gold on reduced safe-haven demand. The U.S. economy has picked up significantly in the past several months and is slowly growing its way out of the 2008-09 financial crisis. China's economy has been slowing, but not by nearly enough to cause a serious risk of a hard landing. Germany is growing strongly, giving a lift to Europe as a whole. Eurozone officials are finally drawing up more serious plans to address the European debt crisis. Adding to the negative mix for gold, ECB President Trichet has started talking tough about inflation, which increases the chances that Mr. Trichet will start to drain reserves later this year. The Fed will likely start draining reserves by early 2012 at the latest. Gold has an ephemeral value. Gold's perceived value is driven more by technicals and market psychology than by the true supply and demand factors seen in normal commodity markets. Analysts and traders like to talk about "fiat currencies," but the reality is that gold is a "fiat metal"-it only has value because human beings decided it does. In any case, with the current easing of crisis pressures, gold's value is downshifting and we see that process continuing over the near-term as the stock market rallies and the European crisis ebbs. If we were given a choice of which metal to be long on say a 5-year trade, we would rather be long copper than gold since copper's strong demand picture is much more identifiable than for gold with copper's benefit from the long-term global development theme. Gold's demand, on the other hand, is driven by the dollar and by crisis levels, which are much shakier demand variables. Also producers and swap dealers have been liquidating their shorts as you can see from the weekly chart below. In the old legacy COT report you can see that Commercials are at a 52-week net high with -197,483 contracts. Back on Oct 1,2010 Commercials were at a 52- week net low at -302,740 contracts. Remember this is "big money" moving around, much like an elephant in a room. When the elephant moves you best move with it or you can picture what will happen. Have a prosperous trading week.  Fundamentals Gold prices corrected down to a 3-1/2 month low from last month's record high of $1431.10 (nearest-futures Dec contract). Bearish factors include (1) hedge-fund liquidation after assets in gold-backed ETPs fell to a 5-1/2 month low as of Jan 26, (2) slack inflation pressures with the Q3 core PCE deflator falling to +0.5% q/q, the lowest figure since data began in 1959, and (2) speculation that an economic recovery will curb safe-haven demand for gold. Bullish factors include (1) continued strong demand for gold as a currency substitute and as an inflation hedge with quantitative easing programs in the US, UK and Japan, and (2) underlying safe-haven demand due to the European sovereign-debt crisis. Fundamental Outlook - Bull market correction - Gold prices are correcting lower as hedge-funds liquidate record long positions and safe-haven demand for gold is reduced with the stronger US economy. However, the long-term picture remains bullish for gold with market uncertainty about whether the Fed and the ECB will start withdrawing liquidity before there is an inflation outbreak.  http://insidefutures.com/article/213...uidation!.html | ||

| Gold and Silver Price Decline is Over: James Turk Posted: 31 Jan 2011 08:20 PM PST China Central Bank Advisor Urges Increase In Official Gold And Silver Reserves. Egypt and Tunisia usher in the new era of global food revolutions. Jim Rickards speaks twice...and much more. ¤ Yesterday in Gold and SilverGold jumped over five bucks right at the open, but there was a not-for-profit seller waiting in the wings...and gold was soon down below its Friday closing price...and never made it back above it for the rest of the trading day on Monday, as every rally attempt ran into selling. Volume was very heavy in the first couple of hours trading in the Far East yesterday morning...so it took a fair amount of firepower to keep the gold price down during that time period. Early Far East trading volume is normally extremely light in both metals. That wasn't the case yesterday.

It was the same story in silver...with silver up 30+ cents at the Far East open. Every silver rally attempt ran into selling as well...especially the two that occurred at 9:30 a.m. and noon in the New York trading session. By the time the smoke cleared, silver had finished basically unchanged on the day.

The world's reserve currency spiked up about 15 basis points right at the Far East open in New York on Sunday night. But that proved to be the high of the day...and by the time the low was around 10:20 a.m. Eastern...the dollar had shed about 65 basis points, although it recovered some of its loses going into the New York close. As you can tell by looking at the gold chart, there was no sign of this rather significant slide in the U.S. dollar anywhere to be found.

Here's the 6-month dollar chart. As you can see, it's really oversold at the moment...and it will be interesting to see if it continues lower, or whether we'll get a bounce at this point. If the bullion banks want to continue downward pressure on gold or silver, a rally in the dollar would give them a perfect opportunity. We'll see.

The gold stocks were under pressure for most of the day...and the New York high in the gold price did not correspond to the highs in the stocks. The HUI, which was down almost 2% by 2:30 p.m. Eastern time yesterday afternoon, rallied into the close...and finished down only 0.69% on the day.

The CME's Daily Delivery report showed that another 1,699 gold contracts were posted for delivery...these ones for delivery on Wednesday. There were numerous issuers and stoppers...and the stand-out was the 989 contracts stopped/received by HSBC USA in their house/proprietary trading account. In the first two days of the February delivery month...8,594 gold contracts have already been posted for delivery. That's a fair chunk. In silver, there were only 10 contracts posted for delivery on Wednesday. Only 121 silver contracts have been posted so far this month...and the link to the action in both metals [which is well worth checking out] is here. The GLD ETF reported receiving 97,576 ounces of gold yesterday...and there were no reported changes in the SLV ETF. Over at Switzerland's Zürcher Kantonalbank for the week that was...they reported adding 10,033 ounces to their gold ETF...and their silver ETF reported no change. As always, I thank Carol Loeb for those numbers. For the seventh business day in a row...and the last day of January...the U.S. Mint reported no sales in either gold or silver eagles. Very strange. For the month of January, the mint reported selling 83,000 ounces of gold eagles, along with 4,724,000 silver eagles. Over at the Comex-approved depositories, they reported a decline of 104,706 ounces of silver on Friday...and the link to that action is here. Here's a neat graph that Nick Laird over at sharelynx.com in Australia sent me on the weekend. It's the Baltic Dry Index updated as of last Friday...and it ain't a pretty sight. Nick mentioned to me that Tropical Cyclone Yasi was bearing down on Cairns [where he lives]...and it's a category IV...with winds in the 125-150 knot range. He figures he might be offline for a week, as Cairns is expected to take a direct hit, so no more charts for the moment. The link to the cyclone track map from the Australian Bureau of Meteorology is here.

¤ Critical ReadsSubscribeInterview With Jim RickardsSince it's Tuesday, I have lots of stories. I've narrowed it down as tight as I could...and it's up to you to do the final edit. The first is an "Interview With Jim Rickards" on Fox Business News on January 28th that was sent to me by reader Randall Reinwasser. Jim talks about the impact that inflation is having on emerging markets. The video runs 4:20...and is definitely a must listen...as both he and the interviewer head off on several very noteworthy tangents. The link is here.  European Inflation Quickens to Two-Year High of 2.4%While on the subject of inflation...here's a Bloomberg piece from yesterday that's courtesy of reader Scott Pluschau. The headline reads "European Inflation Quickens to Two-Year High of 2.4%". If the EU lies as much as the BLS in the U.S.A. does...then the real inflation rate is, without doubt, much higher than that." The link to the story is here.  Egypt and Tunisia usher in the new era of global food revolutionsReader Richard Di Nucci has our next item of interest. This is an Ambrose Evans-Pritchard offering from The Sunday Telegraph that's headlined "Egypt and Tunisia usher in the new era of global food revolutions". Political risk has returned with a vengeance. The first food revolutions of our Malthusian era have exposed the weak grip of authoritarian regimes in poor countries that import grain, whether in North Africa today or parts of Asia tomorrow. It's a longish piece for Ambrose, but worth skimming...and the link is here.  Egyptians defend their homes from looters after another day of violent demonstrationsThe next article is from the france24.com website on Sunday. It's courtesy of reader Roy Stephens...and the headline states..."Egyptians defend their homes from looters after another day of violent demonstrations". Armed with sticks and guns, residents in Cairo set up overnight neighbourhood watches to prevent looting following another day of demonstrations in which protesters pressed for Egyptian President Hosni Mubarak's ouster. This story is also worth running through...and the link is here.  Egypt in crisis: vigilantes and prisoners on the streetsMy last story on the big uprising in Egypt is also from Roy Stephens...and this one is from The Sunday Telegraph...and is headlined "Egypt in crisis: vigilantes and prisoners on the streets". Egypt's anti government uprising showed signs of fraying into lawlessness on Sunday as a series of mass jail breaks saw thousands of prisoners released on to the streets. The link to that story is here.  Fed Hoards a Trillion in TreasuriesWashington state reader S.A. sent along this story from The Wall Street Journal that's very much worth your time. The headline reads "Fed Hoards a Trillion in Treasuries". This story is subscriber protected...so you only get to read the first couple of short paragraphs, but that's enough...and the link is here.  "Monetary Disorder and Global FragilitiesI haven't run a Doug Noland commentary for a while. Here's his Credit Bubble Bulletin from last Friday that's posted over at prudentbear.com...which was sent to me by reader U.D. You won't want to read the whole thing, or you'll be there all day, so just scroll down to the best part...which is near the bottom. It's headlined "Monetary Disorder and Global Fragilities". It will take you about five minutes to run through it...and it's definitely worth it. The link is here.  Loneliest Man in Davos Foresees 2015 Bank Crisis While Global Elites PartyAlso singing that tune in Davos was Barrie Wilkinson, a partner at London-based consulting firm Oliver Wyman. Barrie says that..."The things that caused the previous crisis -- loose monetary policy and trade imbalances -- they're actually bigger now than they were then." Here's the Bloomberg story [courtesy of Roy Stephens] that contains this. It's current headline reads "Analyst Warns of 2015 Bank Crisis Amid 'Upbeat' Davos"...but prior to that, it bore the headlined "Loneliest Man in Davos Foresees 2015 Bank Crisis While Global Elites Party". I prefer the latter...and the link is here. | ||

| Another Jim Rickards Interview Posted: 31 Jan 2011 08:20 PM PST Image:  I have another big bunch of precious metals-related stories on top of what you've just waded through. I'll start it off with "Another Jim Rickards Interview"...with a preamble I stole from Chris Powell...Interviewed by Eric King of King World News, market analyst Jim Rickards speculates on a new world financial system that uses several reserve currencies. Rickards also discusses China's need for more gold to become an economic superpower. | ||

| Trading Comments, 1 February 2011 (posted 10h30 CET): Posted: 31 Jan 2011 07:30 PM PST Rising commodity prices across the board are a clear indication of how badly national currencies are being managed. It is only a matter of time therefore before gold starts climbing | ||

| When and How Gold Will Begin its Bubble Posted: 31 Jan 2011 06:22 PM PST The bull market in Gold is in its 12th year (globally it began in 1999) but has yet to exhibit any "bubble-like" conditions. In fact, we still see many people referring to this bull market as "the Gold trade," as if its an aberration that needs to be reversed or corrected. That aside, we know that Gold is under-owned as an asset class. The very well respected BCA Research estimates that globally only 1% is allocated to Gold and that fits with some of the charts that I've shown in the past. Institutional accumulation began in 2009 (e.g. Paulson, Einhorn) and we know that phase lasts at least a few years before a bull market gives birth to a bubble. Part of the problem for Gold has been the solid performance of other asset classes through most of the Gold bull market. Stocks performed very well from 2003 to 2007 and from 2009-2010. Commodities performed well from 2001-2002 and in the first half of 2008. If stocks are doing well or if commodities such as oil and agriculture are performing well, it detracts from Gold. Gold performs its absolute best when the other asset classes underperform or don't perform too well. Let me explain the conditions and setup that will facilitate the birth of a bubble and Gold going mainstream. First, stocks are going to peak in Q2 of this year and enter a mild cyclical bear market. The chart below details the previous three secular bear markets and the template that each follows. After the mid-point crash (i.e 1907, 1938, 1974 and 2008) the market rallied significantly over the next one to two years. After that rally stocks went into a mild cyclical bear market for several years. Those periods were associated with rising commodity prices, rising interest rates and rising inflation. Sounds like history could repeat again. In the next year there is a good chance that we'll see stocks and bonds in a bear market, simultaneously for the first time since the late 1970s. It is at that point that hard assets will emerge and mainstream managers will no longer be able to ignore that barbarous relic. This could begin as early as Q2 of this year or as late as 2012. It is hard to say but we think it begins somewhere in the middle. Here is why the backdrop will ultimately support Gold and not stocks or bonds. Economic growth is simply too low and too meager to put any dent into debt to GDP ratios. The economy is recovering but the debt load is growing larger. Two trillion dollars was added to the national debt in FY 2010. The CBO just came out and projected a deficit of $1.5 Trillion in FY 2011. This is why monetization will not only continue but it will be more frequent and in larger amounts. We already see the effects. Inflation is rising and interest rates may be in a new cyclical uptrend. These are the factors and not deflationary conditions, which will cause the next mild bear market and mild recession. We say mild because the private sector was in recession for three years of the last decade. The survivors are better able to handle any current difficulties. In fact, the credit markets and the global economy have improved. After a recession like 2007-2009, there tends to be a slow but arduous period of recovery for the private sector. Slowing economic growth and a mild recession can give bonds a boost to some degree but it won't reduce the need for monetization. Remember, from 2004-2007 we had a housing boom, strong global growth and the budget deficit declined. With no housing recovery in sight, the likelihood of higher interest rates and more of the budget devoted to interest expense, the reality is continued monetization. This doesn't include the potential for bailouts to states and municipalities, which also comprise a part of GDP. No bailouts there and the economy will be affected. In the early 1980s, we had the ability to raise interest rates and defeat inflation. This time around, there is no realistic and hope and no legitimate solution other than a new monetary regime. We all know the economy cannot grow out of this mess. Furthermore, we know that higher rates will only lead to eventual bankruptcy. Debt levels in the US, Japan and Europe are already too large. Higher interest rates will raise debt service costs and this will eventually lead to default or hyperinflation. Huge government debt wasn't a problem 30 years ago. We've discussed some macroeconomic factors but now let's look at the charts so you can visualize the precious metals complex, where it is and where it is going in the next few years. Technicals Below we show the Nasdaq from 1982-1996. Note that the market essentially consolidated from year five to year eight of the bull market. It was from 1991-1993 that the market began its acceleration and then it became obvious in 1995. We show the Canadian Gold Stocks ETF as it smooths out the currency volatility. The market made a key breakout in 2010, is now retesting that breakout and by the end of the year will be in accelerating mode. The consolidation took place in year six to year ten of the bull market. Our Junior Gold Index has been stronger as the 2006, 2008 and 2010 peaks are slightly higher than each other. However, the look is very similar. The current correction is serving as a retest to the 2010 breakout to new all time highs. Our Junior Silver Index shows the breakout quite clearly. This correction is simply a retest of what was a multi-year breakout in a major bull market. This consolidation occurred in year six to year ten of the bull market. Of course, the Godfather of all "breakouts" is the DJIA in 1983. While this was a breakout from a 16-year base (and not four or five year base), the process was similar. Breakout, retest then acceleration for several years. Gold itself looks different as it has been leading the rest of the complex the same way it did in 1929-1930 and the 1970s. Note how its acceleration began in late 2005 and then again at the 2008 low. A move beyond channel 4, which halted the recent advance could engender a stronger acceleration than the one we've seen in the last 24 months. Conclusion Precious metals have been in a steady bull market for almost 11 years. During most of that time, stocks and bonds have performed reasonably well. Thus, mainstream advisers and managers could avoid precious metals and still generate reasonable returns. An example is 2009-2010. We expect this to change within the next 12 months. Stocks are very likely to enter a mild cyclical bear market while bonds are at risk of a new bear market. Certainly, without the massive monetization by the Federal Reserve, bonds would be in a bear market and rates would be higher. If and when stocks and bonds enter a bear market it will be the first time they are in a bear market simultaneously since the 1970s. As the entire precious metals complex continues its upward climb, mainstream pundits and fund managers will be forced to buy in due to the other asset classes (stocks, bonds, real estate) being in bear markets. With a global allocation to Gold of only 1%, one can see clearly where things are headed. We are years away from a true bubble, but 2011-2012 could serve as the beginnings of a precious metals bubble as 1994 was for the technology sector. Our charts show that this present correction is very likely a retest of multi-year breakouts. As we showed with the Nasdaq in the 1990s and the DJIA in the 1980s, markets tend to follow a retest with at least several years of acceleration to the upside. Whether this retest lasts weeks or months isn't the point. The point is to be ready for the period that follows. For our subscribers we are working on a top 10 juniors report for 2011-2012. Now is the time to find growth and high potential at a discount. Consider a free 14-day trial to our service as we seek to prosper from the bull market and bubble that lies ahead! Good Luck! Jordan Roy-Byrne, CMT | ||

| Germany promised U.S. in 1967 not to convert dollars to gold Posted: 31 Jan 2011 05:30 PM PST | ||

| Will Gold, Silver and Oil Prices Soar on Social Unrest In The Middle East? Posted: 31 Jan 2011 05:07 PM PST | ||

| Gold Cuts Friday Surge as Dollar Falls… Posted: 31 Jan 2011 04:56 PM PST | ||

| Posted: 31 Jan 2011 04:00 PM PST | ||

| Posted: 31 Jan 2011 02:21 PM PST

Right now there is a gigantic mountain of unsold homes in the United States. It is estimated that banks and financial institutions will repossess at least a million more homes this year and this will make the supply of unsold properties even worse. At the same time, millions of American families have been scared out of the market by this recent crisis and millions of others cannot qualify for a home loan any longer. That means that the demand for unsold homes is at extremely low levels. So what happens when supply is really high and demand is really low? That's right - prices go down. Hopefully housing prices don't have too much farther to go down. Ben Bernanke and the boys over at the Federal Reserve are doing their best to flood the system with new dollars in order to prop up asset values, but you just can't create qualified home buyers out of thin air. Many analysts are projecting that U.S. housing prices will decline another ten or twenty percent before they hit bottom. In fact, quite a few economists believe that the total price decline from the peak of the market in 2006 will end up being somewhere in the neighborhood of 40 percent. But whether prices go down any further or not, the truth is that the housing crash that we have already witnessed is absolutely unprecedented. The following are 12 facts which show that we are in the midst of the worst housing collapse in U.S. history.... #1 Approximately 11 percent of all homes in the United States are currently standing empty. #2 The rate of home ownership in the United States has dropped like a rock. At this point it has fallen all the way back to 1998 levels. #3 According to the S&P/Case-Shiller index, U.S. home prices fell 1.3 percent in October and another 1 percent in November. In fact, November represented the fourth monthly decline in a row for U.S. housing prices. Many economists are now openly using the term "double-dip" to describe what is happening to the housing market. #4 The number of homes that were actually repossessed reached the 1 million mark for the first time ever during 2010. #5 According to RealtyTrac, a total of 3 million homes were repossessed by mortgage lenders between January 2007 and August 2010. This represents a huge amount of additional inventory that somehow must be sold. #6 72 percent of the major metropolitan areas in the United States had more foreclosures in 2010 than they did in 2009. #7 According to the Mortgage Bankers Association, at least 8 million Americans are at least one month behind on their mortgage payments. #8 It is estimated that there are about 5 million homeowners in the United States that are at least two months behind on their mortgages, and it is being projected that over a million American families will be booted out of their homes this year alone. #9 Deutsche Bank is projecting that 48 percent of all U.S. mortgages could have negative equity by the end of 2011. #10 Some formerly great industrial cities are rapidly turning into ghost towns. For example, in Dayton, Ohio today 18.9 percent of all houses are now standing empty. 21.5 percent of all houses in New Orleans, Louisiana are standing vacant. #11 According to Zillow, U.S. home prices have already fallen further during this economic downturn (26 percent) than they did during the Great Depression (25.9 percent). #12 There are very few signs that the employment situation in the United States is going to improve any time soon. 4.2 million Americans have been unemployed for one year or longer at this point. While there has been some nominal improvement in the government unemployment numbers recently, other organizations are reporting that things are getting even worse. According to Gallup, the unemployment rate actually rose to 9.6% at the end of December. This was a significant increase from 9.3% in mid-December and 8.8% at the end of November. But even many Americans that do have jobs are finding out that it has become very, very hard to qualify for a home loan. In an attempt to avoid the mistakes of the past, banks and financial institutions have become very stingy with home loans. While it was certainly wise for them to make some changes, the truth is that perhaps the pendulum has swung too far at this point. The U.S. housing industry will never fully recover if they can't get their customers approved for mortgages. Congress is talking about passing even more laws that will make it even more difficult to get home loans. Even though they give speeches about how they want to help the U.S. housing industry, the truth is that Republicans and Democrats are both backing proposals that would make home mortgages much more expensive and much more difficult to obtain as a Bloomberg article recently explained....

While all that may sound reasonable, the truth is that the U.S. middle class has become so cash poor that the vast majority of them cannot afford homes without the kind of mortgages that were available in the past. Not that we should go back and repeat the mistakes of the past 20 years. It is just that nobody should expect the U.S. housing market to "bounce back" in an environment that has fundamentally changed. The housing market is not like other financial markets. It is difficult to artificially pump it up with funny money. If the U.S. housing market is going to rebound, it is going to take lots of average American families getting qualified for loans and going out and buying houses. But they can't do this if they do not have good jobs. Today, only 47 percent of working-age Americans have a full-time job at this point. Without a jobs recovery there never will be a housing recovery. In fact, there are all kinds of warning signs that seem to indicate that the U.S. economy could get even worse in 2011. Many economists are now openly using the word "stagflation" for the first time since the 1970s. Back in the 70s we had both high unemployment and high inflation at the same time. Well, we have already had very high unemployment, and thanks to the relentless money printing of the Federal Reserve, it looks like we are going to have high inflation as well. Middle class American families are going to be spending even more of their resources just trying to survive, and this is going to make it more difficult for them to purchase homes. In fact, in recent years average Americans have been getting significantly poorer. Over the past two years, U.S. consumers have withdrawn $311 billion more from savings and investment accounts than they have put into them. That is very troubling news. Now the price of food is soaring and the price of oil is about to cross $100 a barrel again. So what is going to happen if we have another major financial crisis and we witness another huge spike in the unemployment rate? The Federal Reserve is trying to smooth all of our problems over with a flood of paper money, but it isn't going to work. Yes, increasing the money supply will produce some false highs on the stock market and some false economic growth statistics for a while, but the tremendous damage that will be done to the economy is just not worth it. In any event, let us all hope that we see some really great real estate deals over the next couple of years, because in the times ahead land will be something very good to own. In fact, down the road it will be much better to own land than to have your money sitting in the bank where it will continuously decline in value. Use your paper money wisely. It will never have more value than it does today. So what do all of you think? Is the "housing Armageddon" almost over, or do housing prices still need to decline a bit more? Feel free to leave a comment with your opinion below.... | ||

| Monday January 31st, Updated 10:00 pm EST Posted: 31 Jan 2011 01:27 PM PST Okay so lets dive into it. The Silver front month delivery saw its OI (open Interest) today, and it came in at 152. 152! February is NOT a delivery month! I will have more on this tomorrow as the options data comes in and I can patch things a little more clearer. This means we are somewhere around 1.3 million ounces to deliver for February and should continue to rise! I need to point out | ||

| Huge gold standing for delivery; problems in Egypt intensifies Posted: 31 Jan 2011 12:14 PM PST | ||

| U.S. Dollar and Gold: We Saw Their Future on TV Tuesday Night Posted: 31 Jan 2011 11:15 AM PST

The other night, watching the State of the Union address, I couldn't help but be confounded by what I saw on the TV—a bunch of men and women, dressed like they are going to a wedding, hugging each other, smiling, laughing—and then it hits me. What are these people celebrating? We have a Congress that each year increases the amount of debt the United States can legally borrow to new record levels. The government needs to borrow $0.40 out of every dollar it spends (The Globe and Mail, 1/26/11) and the U.S. Congressional Budget Office estimates that the U.S. government deficit will reach a record $1.5 trillion this year. What's there to celebrate about this? I couldn't take out my wife and celebrate if this were happening in my household. If we take the $400 billion that President Obama says he wants cut from the budget, this will bring the annual deficit to $1.1 trillion. Let's be generous and say we can get that deficit number down to $1.0 trillion a year. If we add a conservative average of trillion-dollar yearly deficits to the $14.0-trillion current national debt, we will be sitting on a national debt of $23.0 trillion by the end of this decade (not far off a White House report from 2010 that said our national debt will hit $20.0 trillion by 2020.) In my calculations, I've left out any surprises that would increase our annual deficits. For the remainder of this decade, we will not be immune to new economic plunges, new wars or terrorist events, new natural disasters—all of which would spike the deficit should they occur. More importantly, I've left out increases in interest rates, which will all know will happen, pushing our deficit even higher. Ben Bernanke et al. did the impossible: They fended off the Great Depression II. We'll just call 2008 and 2009 the worst recession since the Great Depression. But the Federal Reserve itself has said on multiple occasions that we need to get government spending under control. If we are optimistic and assume that U.S. Gross Domestic Product (GDP), the value of all the goods and services produced by the U.S., will rise 2.5% each year until 2020, our GDP will be $18.5 trillion in 2020—well below our national debt at that time. My biggest question for my investor readers this morning: Under the scenario I just painted above, how can the value of the U.S. dollar not deteriorate significantly between now and the end of this decade? How can the price of gold not rise? How are you positioning yourself and how will you benefit from the possible demise of our currency? Michael's Personal Notes: GDP unexpectedly fell in the United Kingdom in the quarter ended December 31, 2010—the first time in a year that the U.K. has seen a contraction in its quarterly GDP. Will it happen here in America? Of course it will. In its effort to keep the bond vigilantes away, the U.K. (a sovereign state made up of four countries: England; Northern Ireland; Scotland; and Wales) cut spending in 2010, while it raised taxes. We would do the same here in America if foreigners stopped buying our bonds. But, surprise; while fiscal tightening was the taste du jour in the U.K. in mid- to late-2010, inflation spiked. The official U.K. inflation rate is now 3.7%—more than double the inflation rate in America. I don't believe it is the U.K. inflation rate that will come down; I believe it is the inflation rate in the U.S. that will spike, closing the gap between the two. If businesspeople in America believe we are economically "out of the woods" and that we will not have a negative GDP quarterly report in 2011 or 2012, they are the ones who will be in for a surprise. See my opinion on the stock market below as it relates directly to the economy. Where the Market Stands; Where it's Headed: The Dow Jones Industrial Average opens this morning up 3.5% for the year. Yesterday, the Dow Jones Industrials moved slightly above the 12,000 level and there was "Dancing in the Streets." Financial web sites were quick to show pictures of traders celebrating as the market crossed the 12,000 level for the first time since June 2008. CNN Breaking News was even kind enough to send me an e-mail alert when the Dow Jones Industrials crossed the 12,000 mark. Well, as we all know, the market closed below 12,000 yesterday, but I do expect the market to eventually close on the positive side of 12,000. After all, isn't that what bear markets are all about? Take stocks down sharply in phase one of a bear market (to the lows we saw in March 2009); in phase two, bring the market back up sharply so investors believe all is well again (the period of March 2009 to now); and, in phase three, bring the market back down again (sometimes to a point lower than the original pullback). Everywhere we that read the economy is getting better. Investors and analysts are turning bullish en masse. We even have the President telling America that the stock market is back up (State of the Union Address, January 25, 2011). But, before you run off and sell your stocks because you, too, believe that we have reached a market top, remember the two cardinal rules of investing: 1) The "trend is your friend;" and 2) "Don't fight the Fed." The trend has been very strong on the upside. We don't bet against it. The Federal Reserve is pulling all the stops out to ensure great liquidity in the financial system. Don't bet against the Fed's efforts. In the immediate term, enjoy the market's rise. In the short term, be prepared for a sharp reversal of the market's fortunes. What He Said: "As investors, we need to take a serious look at our investment portfolios and ask, 'How will my investments be affected by an American-grown recession?' You should take what precautionary steps you can right now to protect yourself from a recession in 2007. Maybe you need to cut your own spending or maybe you need to sell some stocks that will take a beating during a recession. You know what tidying up you need to do. Don't procrastinate…get to it now. And please remember: Recessions can happen quickly, stock markets don't go up during recessions, and the longer the boom before the recession, the longer the recession. Just based on my last point, we have plenty to worry about in 2007." Michael Lombardi inPROFIT CONFIDENTIAL, November 13, 2006. Michael was one of the first to predict a U.S. recession, long before Wall Street analysts and economists even thought it a possibility. Sign Up for PROFIT CONFIDENTIAL and | ||

| When All Roads Lead to Default Posted: 31 Jan 2011 10:57 AM PST Friday may have been a key turnaround day. Stocks fell 166 points on the Dow. Gold leaped $22. What's up? Hard to say... We'll have to see what happens this week. A falling gold price means people think things are under control...that they believe the present system works...and that it will deliver growth without excessive inflation. When people lose confidence in the system, on the other hand, the gold price goes up. By the end of last week, people must have been losing confidence. Egypt seemed on the brink of a major blow-up, possibly destabilizing the entire mid-east. And from Japan came more disturbing news: "S&P Downgrades Japanese Debt," said the headline. Standard and Poor's said Japan had no plausible plan for keeping itself from bankruptcy. The country has the highest debt to GDP ratio in the world. And it just keeps adding debt. Is that a problem? Lenders – mostly the Japanese themselves – don't seem to think so. They lend money to the Japanese for 10 years and ask only 1.24% interest. Can you imagine? If the yen lost only 2% per year – which is the TARGET in most advanced economies – the real interest rate would be negative. Meaning, the lender would lose money every year. And how will the Japanese repay the money? Lenders are putting up money to a borrower who, as the S&P puts it, has 'no plausible plan' for paying it back. And asking only 1.24% interest. What are they thinking? Are they thinking at all? Saving rates in Japan are falling. People are getting older. More people are retiring than entering the workforce. How can this movie possibly have a happy ending? Meanwhile, here's another headline. This one probably didn't rattle investors. But it should have shown them where we're headed:

What is this? It's a default. Spain is defaulting on promises made to its working classes. We'll see a similar default in all the advanced, social welfare economies. America included. They all made promises they can't keep. Now, they have to default...in many different ways. Some will cut back fast on promises in order to protect their credit. Others will let themselves be pushed to the wall – like Argentina in '01. They will not willingly cut back...they will be forced to do so. Then, when they run out of money, they will be unable to keep their promises. In desperation, they will seize assets and cause all sorts of mischief – just like the Argentines did. Still others...like a ruined man reaching for a loaded pistol...will turn to the printing press. It doesn't matter how many bailouts you give them. It doesn't matter how far down the road you "kick the can." All will default. The only questions are how and when... And more thoughts... Now here's something interesting. Every year, Foreign Policy magazine produces a list of the Top 100 Global Thinkers in the World. We picked up the list...looking for our own name. But wait... The key is that these are "global" thinkers. They're not just thinkers, in other words, they are people who are thinking about how people on the other side of the planet should conduct their business. We were suspicious even before we looked at the list. "Foreign Policy"? We're against it. Why should we worry about things that don't concern us? "Well... You can't put your head in the sand," you might reply. "You have to be concerned, because things that happen overseas do affect you." Yes, that is true. They affect us. But so does the price of whiskey, the traffic on the Beltway, and the weather. None of them is worth thinking about. We can do nothing about them. And it would be indecent for us to try. Imagine if we took an interest in the whiskey distiller's business. What could we do? Try to force him to lower his prices? Try to show him how to operate more efficiently – as if we could know? Set up a buyers' cartel to negotiate for lower prices? At best, we'd be wasting our time. At worse, we might succeed! Then, whiskey producers would be responding not to market forces...but to meddlers' forces. What a mess that would be! Meddling with things close at hand is bad enough. Meddling with things far away is worse. Remember our Daily Reckoning dictum: ignorance increases by the square of the distance. The farther you get away the harder it is to tell what is going on. The details disappear. All you can make out are the rough outlines. Shadows...reflections...silhouettes... In the darkness, you step on every rake and fall into every hole. The next thing you know, you are calling for "reforms" in countries you've never even visited...setting the price of China's money...and invading Iraq. But let's look at who Foreign Policy magazine thinks are the 100 Top Global Thinkers. Uh oh. In the first and second place are Warren Buffett and Bill Gates. Hmmm... They're smart guys. But what makes them "thinkers"? What have they been thinking about? And what are their thoughts on the subject? FP says they are there, not for their contributions to the wealth of mankind, but for their philanthropic activities. Wait a minute. What's philanthropy got to do with thinking? Okay... We're stumped on that one... So, who's the number 3 thinker? Barack Obama! Hold on... This is getting silly. Have you ever heard Barack Obama come up with an original thought? Or any kind of thought worthy of the word? No. That's not his thing. He's a politician. Politicians are not thinkers. They may be doers...but they're not thinkers. Obama gives us plenty of empty expressions and hollow words – "change you can believe in"..."hope"... "winning the future" – but real thoughts? Original ideas? Nope. Generally, politicians are not thinkers. Occasionally, you get a politician who pretends to be a thinker – such as Princeton University chief Woodrow Wilson. But he almost invariably turns out to be a jackass and a fool. There must be exceptions – Marcus Aurelius and Thomas Jefferson come to mind. But they seem ill-suited to the political profession and probably should have eschewed public office in the first place. So let's keep moving. There must be someone on this list who is a real thinker. Let's look back at last year...let's see...who was FP's top thinker? Ben Bernanke! Well, that does it for us. What's the matter with these people? Can't they tell the different between tired hacks with worn-out, crackpot ideas...and real thinkers? The Foreign Policy editors should do some real thinking of their own. Then, maybe they'd mind their own business. Regards, Bill Bonner. | ||

| My Largest Personal Investment Posted: 31 Jan 2011 10:57 AM PST I'm going to share with you something that I have put a good deal of my own money into. In fact, I have more money invested here than in anything else – about 40% of my personal investment account at the moment. Last year, I made 38.2% in these low-risk special situations – easily whipping the market's 13% return. It was some of the easiest money I've made in my investing career. I'll tell you how you can do the same thing. I'd like to call these special situations one of the market's best-kept secrets. Though many people still don't understand the basic mechanics, or even know these opportunities exist at all, the truth is that these aren't really secrets. Investing great Peter Lynch wrote two chapters about them in his bestselling book Beating the Street. (This is one of the best books about investing out there, by the way, along with One Up on Wall Street. My well-thumbed hardcovers have made me a lot of money over the years.) Lynch called the idea a "can't-miss proposition (almost)." And Seth Klarman, another famous and skilled investor, has a chapter about them in his book Margin of Safety. Even the measured Klarman, a master of understatement, calls this special situation "a compelling investment opportunity." Heck, even Barron's recently called these a "once-in-a-lifetime investment opportunity." And that may be literally true, as the biggest opportunity in these ideas may disappear forever by the summer of this year. (More on why below...) I've been an enthusiast of these things for years. I first wrote about them in 2005 in my Capital & Crisis newsletter. You would think such opportunities would close with all this coverage. Yet nearly every year, new deals crop up and the opportunities persist. I have a few hunches why more people still don't buy these. Part of it is that they seem boring. Part of it is the payoff doesn't often come right away. I earned 38% over the course of a full year. Sometimes it might take a little longer. Ideally, you should look at these as three-year holds. And part of it is simply that people have prejudices that prevent them from buying. So what am I talking about? I'm going to tell you, but I want you to keep reading even if, initially, the idea has no appeal to you. It's important you understand the full story before you pass judgment. I'm talking about thrift conversions. A thrift, or a savings and loan, is a bank. But it is a special kind of bank. It is a bank owned by its depositors. When a thrift goes public, it's called a thrift conversion because the thrift is converting from a company owned by depositors to one owned by public shareholders. This process is what creates the investment opportunity. Let me give you a simplified example. Say we have a thrift worth $100. For simplicity's sake, let's just say that all of its assets are in cash and it has no liabilities. The thrift decides to convert to a public thrift. So it sells 10 shares at $10 each. Now it has $200 in cash and there are 10 shares outstanding. But look at it from the investor's point of view. He put $10 in, but he owns a stock backed by $20 of cash – $200 divided by 10 shares outstanding. Put another way, he owns a bank at 50% of book value, or net worth, per share. In the real world, the values are not usually as extreme, but the idea is very much reality. As Klarman writes: "The preexisting net worth of the institution joins the investors' own funds, resulting immediately in a net worth per share greater than the investor's own contribution... In a very real sense, investors in a thrift conversion are buying their own money and getting the preexisting capital in the thrift for free." Peter Lynch called it the "hidden-cash-in-the-drawer rebate." Imagine buying a house and then discovering that the former owners have cashed your check for the down payment and left the money in an envelope in a kitchen drawer, along with a note that reads: "Keep this, it belonged to you in the first place." You've got the house and it hasn't cost you a thing... This is the sort of pleasant surprise that awaits investors who buy shares in any S&L that goes public for the first time. It's pretty simple. You get a bank at a big discount to book value – a book value that includes a whole bunch of fresh cash. Most bank stocks over time gravitate toward book value, at least. What often happens to these thrifts is that they get bought out at premiums to book value. According to SNL, a research organization, about 59% of the 488 thrifts that have converted since 1982 have been bought out at a premium to book value. In recent years, the pattern is even stronger. Since 1995, 64% have been acquired. The multiples paid are pretty good right now. In the last quarter of 2010, there were four pending acquisitions. The average multiple was 111% of book value. There was an additional transaction that closed in that quarter at a value of 148% of book value. So now you can see the opportunity. If you pay even 80% of book value for a cash-rich thrift and it trades to just book value, you've got a 25% gain and you've taken very little risk. Of course, you can do much better. But there are a few points you need to understand... First, new thrifts have to follow some rules. One is that they can't sell for three years. This is why I said you should look at these investments as three-year holds. Ideally, you want to give the thrift time to ripen and give yourself a shot at maximum gains. (Lynch tells the story of Morris County Savings Bank. It went public at $10.75 per share and sold three years later for $65.) Of course, you don't have to wait three years. I made my 38% in one year and I could sell if I wanted, but I'm content to let the investment story play out. My thrift still trades for less than book value. And more good things can happen after that first year – and this gets us to our second point. New thrifts can't buy back stock for at least one year. This is another important date in the life of a thrift – its one-year anniversary. After that, the thrift could use its ample cash to buy back stock at a discount to book value, thereby enriching the remaining shareholders even further. So after one year, if the thrift trades for less than book value, a stock buyback is likely the best use of cash. And many thrifts do implement buybacks. In the last quarter of 2010 alone, five different thrifts announced buybacks of 5-10% of their shares. The third point is why buy these now. The reason is there are many new deals to choose from. After only a handful of conversions in 2009, things started to pick up in 2010. Last year, there were 23 deals completed and they raised $2.2 billion in capital. This year looks like another rich one for thrifts. There are 17 deals in the pipeline already. The flurry of activity is due to uncertainty over the new financial overhaul bill, which would take effect this summer. It could mean the end of this long-running investment gold mine: the thrift conversion process. So many thrifts will try to convert before the summer. Finally, one last point before we look at specific opportunities: There are no free lunches. Even here. That is to say you have to be careful which thrifts you buy. Some thrifts come with problems and risks you probably don't want to take. Remember the 1980s? Charles Keating in handcuffs? The S&L crisis? Lots of thrifts got in trouble doing all kinds of stupid things. Greedy guys always manage to ruin a good thing. You can easily avoid the problems with a little attention upfront to some key details. Peter Lynch goes through some of his favorites in his book, and I've relied on his guidance when investing in these things over the years. There is a certain kind of thrift we want to own to increase our odds of success. Lynch calls them the "Jimmy Stewarts." Surely, you've seen the classic It's a Wonderful Life, in which Jimmy Stewart plays the part of a humble banker at an old savings and loan. Lynch wants to find the Jimmy Stewarts. The no-frills, low-cost neighborhood thrifts that make old-fashioned mortgage loans. They don't have splashy advertising. They don't pay to have their names on stadiums. Their branches don't look like Greek temples. So the first thing we want to pay attention to is the loan portfolio. We want low-risk loans, like simple old-fashioned mortgages. We don't want a lot of construction loans or anything that smacks of high finance. We also want to look at nonperforming loans (stuff that's gone bad) as a percent of assets. Ideally, we want low numbers, like 2%. Second, we want to look at financial strength. We want lots of equity. This is usually not hard to find with recently converted thrifts because they just went public and have lots of cash. It's pretty common to find ones with equity to assets of 13% or 17%, or even 20%. For perspective, the nation's biggest banks – the JP Morgans and Citis – have ratios of 5% or 6%. (And that's surely overstated, given all the off-balance sheet stuff. More likely, they have ratios of 1% or 2%.) This is why they are always getting in trouble. They operate with huge leverage. Thrifts are financially strong. We also want to look at book value. Ideally, we want to buy for less than book value for all the reasons I went through above. As Lynch advises, "Pick five S&Ls that fit the Jimmy Stewart profile, invest an equal amount in each of them and await the favorable returns. One S&L would do better than expected, three OK and one worse and the overall result would be superior to having invested in an overpriced Coca-Cola or a Merck." This is the plan I am implementing for the subscribers of Mayer's Special Situations. I don't expect this opportunity to be around forever, but it is around for the moment. Regards, Chris Mayer | ||

| Precious Metals & the Dollar’s Next Big Move II Posted: 31 Jan 2011 10:00 AM PST Market sentiment is so bullish it should make for a sharp selloff in the coming weeks. Everyone is overly bullish and owns a lot of stocks and commodities; therefore the market should top and leave them holding the bag. | ||

| Bring Back, Bring Back, Oh Bring Back My Gold Bond To Me Posted: 31 Jan 2011 10:00 AM PST "The mountains went into labor and gave birth - to a mouse! This ancient quotation could be cited to characterize the publication of the long-awaited Financial Crisis Inquiry Report on Thursday, January 27, commissioned by an earlier Congress. Another characterization is the title of an article in The New York Times from Frank Partnoy, professor of law, San Diego University: "Washington's financial disaster"on Jan. 29. The trouble with the Report is that it misdiagnoses the problem and comes | ||

| O’Sullivan: Blue Ocean Thinking for Copper & Gold Posted: 31 Jan 2011 10:00 AM PST The chief operations officer of Nautilus Minerals is modest about the huge obstacles the company has overcome in proving that deep water mining is viable. In base metals exploration, the results could be significant. | ||

| Middle East Instability – Today and the 1970s Posted: 31 Jan 2011 10:00 AM PST The two oil shocks of the 1970s saw gold prices rise by more than 24 fold (2,300%) in nine years – from $35/oz to $850/oz. To put that in perspective, today gold's rise has been far more gradual and it has risen some fivefold (430%) in 11 years. | ||

| Gold Slips as Correction Resumes, Oil Rises Posted: 31 Jan 2011 10:00 AM PST Gold shed $3.95, or 0.3%, to settle at $1,332.80 as some of the geopolitical risk premium came out of prices. In the bigger picture, gold remains in correction mode thus traders are likely looking at rallies as selling opportunities. | ||