saveyourassetsfirst3 |

- Donner Metals, Xstrata Zinc and the Bracemac-McLeod Mine

- The Gold Roller Coaster

- Gold & Silver Daily Brief 1/31

- Monday Janurary 31st. - Problems with GOLD surfacing

- Precious Metals Bull-Riding

- UBS Cuts Its Gold Recommendation

- Paramount Gold and Silver Ideal for Owning Gold and Silver

- Gold Bar Premiums at 17-Year High in Hong Kong…

- Real-Time Gold Bubble Data

- Numbers lie

- FOFOA: Who Is Draining GLD?

- This is how the next crisis could start

- Food Prices Show Inflation

- View From the Turret: Trade Like an Egyptian

- GEAB schrieb es im Juni 2008: "Arabische Staaten: Die pro-westlichen Regierungen am Rande des Abgrunds / Risiko für eine politische und soziale Explosion von Ägypten bis Marokko bei 60%"

- GEAB l'a écrit en juin 2008 - "Monde arabe : Les régimes pro-occidentaux à la dérive / 60% de risques d'explosion politico-sociale sur l'axe Egypte-Maroc"

- Fraud on GLD holders

- Kitco News reports on GATAs lawsuit seeking Feds gold records

- Who is Draining GLD ?

- Gold price in Arab States

- Precious Metals and the Dollar’s Next Big Move Part II

- Scored some silver

- Crash / Buying Opportunity Alert for THIS WEEK - (Jan 31 onwards)

- The Petro-Dollar Standard In Crisis

- Don’t Trust the Numbers

- ‘Fear and Love Make Gold Strong’

- Flight Club

- Metals Rebound on Safe Haven Demand

- So Close, Yet So Far on Gold

- Friday’s Panic in the S&P 500 & Gold Futures

- Another View of Silver Futures COT

- The big question

- Sunday January 30th, 630 pm est

- A Conservative Silver Forecast

- Got Gold Report – Spread Traders Exit Silver Too

- account of 9/11 gold and silver recovery operation

| Donner Metals, Xstrata Zinc and the Bracemac-McLeod Mine Posted: 31 Jan 2011 05:22 AM PST As a general rule, the most successful man in life is the man who has the best information I recently talked with David Patterson, David is the CEO of Donner Metals TSX.V – DON. Donner Metals is a Canadian based junior resource company currently building a zinc, copper, silver and gold mine with Xstrata Zinc (LSE – XTA) in Québec, Canada. In this discussion with aheadoftheherd.com David talks about working with Xstrata and Donner Metals plans for the future. A presentation on Xstrata's website from the London Metal's Week shows their outlook for zinc demand and plans for the new mine in Québec. At full production beginning in Q1 2013, the Bracemac-McLeod mine will produce 80,000 tonnes of zinc and 10,000 tonnes of copper annually. One page, shown below, of Xstrata's presentation highlights Bracemac-McLeod's mine plan.

DP: We've been partners with Xstrata on six different joint ventures in Newfoundland, Quebec, Manitoba, and the Arctic. So we have a long history with Xstrata. That speaks to an excellent working relationship and there are three reasons we work well together. One – synergy between our technical teams; two – we understand Senior companies; three – financially, we have always kept our end of the arrangement. AOTH: Meaning you succeed in raising money. DP: Yes, but most importantly we've proven that we can do it in all market conditions. In 2006, when zinc was on its way up, everyone was able to raise money for zinc projects. Then the market tanked in 2008 and 2009, we were able to keep up with our funding commitments. AOTH: Where do those commitments stand now? DP: We're six months away from earning our interest, we have less than $1 million worth of expenditures and $3 million in the treasury. AOTH: In the last six months zinc prices have risen 25% – and yet zinc mines are closing, can you explain this? DP: There's been a lack of capital put into developing new mines and a lack of economic discoveries. Many existing mines were discovered 50-60 years ago. They've been in constant production. The deeper you go, the more it costs. Eventually, it becomes uneconomic. In 2006, Xstrata was the number eight zinc producer in the world. Now they are number one. AOTH: As a required ingredient in galvanized steel, zinc is tied to the construction industry which is growing at an annualized rate of 11% in China and India. How important are these markets to Donner? DP: Very important. China accounts for about 30% of the global demand for zinc. Zinc is also used in the production of cars. And last year China built more cars than the USA. So China is just getting started. AOTH: What about India? DP: Even bigger. India has a market economy whereas China has a controlled economy. But when that tiger gets going, it will outpace China. You have 1.3 billion people in India and another 1.3 billion people in China. You throw in Brazil, Indonesia, that's close to 3 billion people. AOTH: So zinc is riding a big wave. DP: Absolutely – you've got half the population of the world moving from an agrarian to an urban existence? That puts enormous upward pressure on metal prices – particularly those linked to infrastructure. AOTH: The Fraser Institute has declared Quebec to be the most attractive mining jurisdiction in the world. You've developed assets internationally. What are the advantages in operating in Quebec? DP: First of all, you have a mining work force that is highly experienced and motivated. They are sought after around the world. I've run into Québec drillers in the Andes. When you have a project in Quebec, you are able to get the best people in the world. AOTH: Explain the role of the Quebec government? DP: The Province will support responsible mining. Permitting moves quickly through an established system of approvals when a Company can demonstrate responsible practice. AOTH: How quickly? DP: In the case of Bracemac-McLeod, 12 weeks, compared to a recent case in British Columbia where permitting is measured in years. AOTH: That is a big difference. DP: It's huge – but let me be clear: an exploration company is not going to be doing anything foolish in Quebec. You will live by the law of the land. But it's a positive business culture. The government is not there to stop you from working. They are there to ensure that you are working correctly. AOTH: Can you describe the Quebec tax landscape? DP: The tax laws are competitive and designed to draw investors to the Province and incentives are in place to support exploration. AOTH: How much of Donner is owned by retail investors? DP: The original $12 million funding was 90% institutional investors. It's now somewhere close to 50%. I can make a dozen phone calls and talk to 40-50% of our shareholders. AOTH: What is the ideal ratio of retail to institutional investors? DP: There isn't one. Exploration is retail and development is institutional. Companies in transition from exploration to production change from having majority retail holders to majority institutional holders. Always remember; liquid markets are good for both institutional and retail shareholders. AOTH: How much of your $25 million commitment to Xstrata have you spent? DP: $24.1 million as of our last quarterly statement. AOTH: Bracemac-McLeod is a Volcanogenic Massive Sulphide deposit. DP: Correct. AOTH: Can you explain the geology of these deposits? DP: Essentially, a VMS deposit occurs when a volcanic hot spring develops on the ocean floor. At Matagami, this happened a couple of billion years ago. Under enormous heat and pressure, hot fluids come piling out from deep underground carrying valuable metals like zinc, copper, silver, and gold. The metals come out of solution as massive sulphides and condense at or near the paleo sea floor. And then over millions of years other volcanic rocks are laid down on top of the mineral deposits and the whole sequence starts again. AOTH: And this is how you get multiple deposits stacked on top of each other. DP: That's right. The upper Bracemac is virtually at surface, and beneath it we have the Bracemac Tuffite zone and then the Key Tuffite zone, and we think this multiple formation may be duplicated elsewhere on the property. AOTH: As well as the zinc, you have a significant amount of copper, silver, and gold. Your base cost was done at $0.80 zinc and $2.50 copper. Economic modeling suggests that a 10% rise in metal prices would create a 1200% rise in the NPV of this mine. DP: Yes, at today's spot prices, we are already looking at a project value in excess of $200 million. AOTH: What is the next challenge for Donner? DP: We need to raise $40 million for Donner's share of the mine. AOTH: How difficult is that in the current financial climate? DP: Well, it's harder than going out to your local bank and borrowing money to buy a house. The fact is, major Canadian banks love to finance billion dollar mining projects. Smaller operations like ours are AOTH: So where are the potential lenders? DP: In Europe. AOTH: How do you pitch them? DP: It's very simple: we invite them to Matagami. They meet the engineers and the geologists. We show them, "This is the mill. This is the Perseverance mine which will be depleted in 2012. This new portal to the ramp is going to be our mine. How do I know this? Because Xstrata says it's going to be a mine. Xstrata will not build 65% of the mine. They will build 100% of the mine." AOTH: What is your deadline for raising the $40 million? DP: Our first contribution to the capital requirements will be May 31, 2011, then monthly cash calls of approximately $1.5 million. AOTH: How would you rate your level of confidence? DP: High. And I'll explain why: Donner has until May 31 to earn its interest, but Xstrata started construction a year earlier. So, from the bank's point of view, you've taken a year out of the process, which means you've reduced a lot of risk by shrinking the time to the first loan repayment. We're asking the banks for $40 million in debt financing. We are advancing our agenda with a number of different lenders and we think we'll be able to reach an agreement that's advantageous to Donner. In fact, I expect to have competing bids. AOTH: Assuming no further increase in the price of zinc or copper, what would be the annual earnings? DP: About $40 million. AOTH: For a company with a $30 million market cap, that's considerable cash flow. DP: Yes. AOTH: And at $5 copper and $2 zinc – which many are predicting. DP: The numbers get crazy. AOTH: What does the market not understand about Donner? DP: People see what's right in front of them. That we've made a discovery. That we're constructing a mine. That production will start within 26 months. That PD-1 is supplemental feed. But they haven't grasped the wider vision. This company is built by explorers. Harvey Keats, 25 years with Falconbridge; Robin Adair, 25 years with Falconbridge; Ken Thorsen, 35 years with Teck. Look at our rate of discovery: about one a year. These men have built careers on exploration. It is in our DNA. And we're going to continue to make discoveries for another generation in this huge project area that exceeds 4,700 square kilometers over one of the most productive regions in Canada. AOTH: Thank you for your time. DP: You're welcome. David Patterson has been involved with exploration companies for over two decades. He has an MBA from Vancouver's Simon Fraser University. Mr. Patterson has an extensive European and North American network which has enabled him to raise in excess of CDN$100 million for mineral exploration companies, including Donner Metals Ltd. Conclusion Donner has the option to earn a 50 percent participating joint venture interest in the Matagami project by incurring a total of $25 million of expenditures on exploration and related work on or before May 31, 2011. To date, Donner has provided $24.9 million towards exploration and has the balance of the funds at hand required to exercise the option. Following earn-in, five separate joint venture (JV) areas will be formed with initial interests of 50 per cent Xstrata Zinc and 50 per cent Donner. The JV areas are:

Following earn-in, Xstrata Zinc has a right in each of the five JV areas to earn back a 15-per-cent interest by completing a bankable feasibility study or incurring a maximum of $20-million toward a bankable feasibility study. The area of mutual interest remains in effect for two years following earn-in. In between this discussion being conducted and its publication Donner Metals Ltd. Has received a National Instrument 43-101 compliant resource calculation for the PD1 deposit from partner Xstrata Canada Corp. The combined mineral resource (measured and indicated) is 1.74 million tonnes grading 4.55 per cent zinc, 1.16 per cent copper and 19.88 grams per tonne (g/t) silver. Is Donner Metals and its Matagami joint venture with Xstrata on your radar screen? If not, maybe it should be. Richard (Rick) Mills rick@aheadoftheherd.com If you're interested in learning more about the junior resource market please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for. *** Richard is host of www.aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell.com, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense. *** Legal Notice / Disclaimer This document is not and should not be construed as an offer to sell or the solicitation of an offer to obtain or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no representation or warranty and accepts no legal responsibility as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty or legal responsibilty for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, will assume no legal consequences for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a consequence of the use and existence of the information provided within this Report. Richard Mills does not own shares of any company mentioned in this report. Donner Metals TSX.V – DON is an advertiser on his website aheadoftheherd.com. |

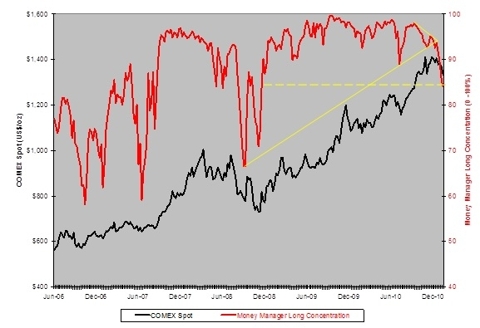

| Posted: 31 Jan 2011 05:01 AM PST Hard Assets Investor submits: By Brad Zigler The crisis in Egypt really stirred up the gold market Friday. And why shouldn't it? After all, there was a weekend — and a likelihood of increasing violence — ahead. On Monday morning, though, with the world markets open, the fear seemed to dissipate. There's a lot of fear premium embedded in gold's price. Over the past three months, we've come to see the degree of volatility in that component. Now, there's opinion aplenty explaining the weakness leading into Friday's price spike. The truth is laid out in the numbers. The weekly Commitment of Traders reports have been signaling a downtrend in speculative interest in gold for months. There's a lot of talk about the power of commercial traders — banks in particular — in the gold market, but for the past three years, there's been a back-and-forth struggle between commercials and money managers for market dominance. It's been fairly common, in fact, for the net long position of these funds to outsize commercials' net short stake. The degree of the funds' commitment to the long side, though, has been waning since the run-up to last fall's election. The ratio of long-to-total positions held by fund managers, once as high as 99.6 percent, fell to 84.0 percent last week. Money Managers' Net Long Gold Concentration To put this number in perspective, consider this: The funds' five-year average long concentration has been 88.6 percent. Last week's number were subpar. Of course, money managers aren't the only traders who Complete Story » |

| Gold & Silver Daily Brief 1/31 Posted: 31 Jan 2011 04:36 AM PST Gold is stuck between a bottom of $1310 and resistance at $1350. It has tested $1350 six of the past seven trading days. Should it breakthrough then we'd turn our focus to $1380 as the next key resistance. Silver is performing better. It held $26.50 last week (clear support dating back to November) and has already reached resistance at $28.50. Silver could climb as high as $29.50 (next resistance). The COTs look pretty favorable, but we need to see the public less bullish. Last week 2/3 of the public remained Silver bulls. We need to see that decline. Jordan Roy-Byrne, CMT Jordan@TheDailyGold.com |

| Monday Janurary 31st. - Problems with GOLD surfacing Posted: 31 Jan 2011 04:32 AM PST Well, Houston, it looks like we have a problem. All the fraudulent actions within the CRIMEX are starting to come full circle in the gold arena now. Within the next 48 hours I will be received information about the gold insiders, and how the options played out, and who is standing for delivery. It is a rarity to see all metals up but gold. Silver is having a great day, I am awaiting Blythe to |

| Posted: 31 Jan 2011 04:16 AM PST For obvious reasons, there is no metaphor more applicable to investing in the precious metals sector than riding a bull. With gold and silver prices having risen relentlessly for a decade, the stature and stamina of this "bull" are beyond question. Equally, remaining atop this "bull" has been an activity to challenge the perseverance and staying-power of the most dedicated rider. Helping us to improve our prowess as bull-riders have been two groups of "trainers". However to state that these two groups have opposite intentions is clearly an understatement. On the one side are long-established websites like Jim Sinclair's site, GATA, and LeMetropole Café. These fine sites have performed several valuable functions. They provided novice bull-riders with guidance on the precious metals sector. Of equal importance, they have continuously shone a spotlight on the manipulative activities of the bullion-banks. In other words, they have taught us about the tactics and motives of the "bull" we have sought to ride. Lastly, they have supported those whose "grip" was weakening to help them stay atop the bull, while encouraging those who have been "thrown" to get back on the beast. The value of this last service cannot be overstated. My own "moment of weakness" occurred in the summer of 2007, after a very long stretch of sideways trading in the sector. From an intellectual standpoint, I never lost my conviction about where gold and silver must be headed over the longer-term. The "arithmetic" of the fiat money-printing of the bankers leads to only one possible outcome. However, emotionally I had begun to question whether the bankers could still exert such control over this market that the "long term" would be a test of endurance which would exhaust the patience of most investors. It was the unwavering conviction of the principals of these sites who helped me conquer those doubts. A major "break-out" took place in the fall of 2007, and my own doubts have never returned. In subsequently founding Bullion Bulls Canada, we have endeavoured to follow in the fine tradition established by these sites: keeping those already in the sector well-informed, educating those new to the sector, and reassuring both "veteran" and "novice" alike – when the inevitable banker-generated "volatility" tests their faith. Our site (and others) swell the ranks of the "old guard" who came before us, just in time to meet the rising tide of precious metals investors flowing into the sector. At the same time, we cannot overlook the contribution of the other group of "trainers", without whom we could have never become the fearless, veteran "bull riders" that we are today: the bullion bankers. As with learning any other skill, there is only so much expertise we can acquire through being "taught" and "told" what to do. At some early point in skill-development we need to be able to put into practice what we have learned, as part of the trial-and-error method of learning which epitomizes our species. In this respect the bullion-bankers have been invaluable: they have supplied the "training bull" which all novices to this sector have been forced to ride, in order to earn their own status as bull-riders. |

| UBS Cuts Its Gold Recommendation Posted: 31 Jan 2011 03:58 AM PST Market Blog submits: By David Berman UBS economist Larry Hatheway is cutting his recommendation on precious metals from “overweight” to “neutral,” thanks to receding economic risks and a recovering global economy. “The recovery in the advanced economies is showing more signs of strength and sustainability,” he said in a note. “Inflation fears are overdone, in our view, in emerging and developed economies alike. And worries that Fed easing (‘QE2’) would lead to a dollar collapse and ‘currency wars’ have proven unfounded (as we always thought they would be).” In other words, he’s not overly keen on gold right now because the financial demand for precious metals is declining. At the same time, bond yields and stock prices are climbing higher with an improving economic backdrop, which raises the opportunity cost of holding gold. “Gold is unlikely to out-perform if cyclical risk premiums fall,” Mr. Hatheway said. “As a result, we believe it is correct to pare back overweight positions to neutral.” As for a hedge against the U.S. dollar, he noted that its negative relationship to the dollar (rising when the dollar falls) hasn’t actually been playing out since 2009. While the trade-weighted dollar index has been mostly flat since 2009, gold prices have risen, most likely because of sovereign risk emanating from the euro zone. “To be sure, we’re not yet ready to consign European sovereign risk to the history books,” he said. “But other ‘fear factors’ hitherto supporting gold prices are receding. Expectations regarding the durability of the US economic recovery Complete Story » |

| Paramount Gold and Silver Ideal for Owning Gold and Silver Posted: 31 Jan 2011 03:03 AM PST Michael Bryant submits: Some people say silver will outperform gold. Some people say they are both bound for a pullback. I say geopolitical tensions such as the Egyptian crisis, looming debt crisis in Europe, and buying of precious metals by both the central banks and investors will keep gold and silver from falling. But as far as the question, “will silver outperform gold?” I ask, “can’t you own them both?” And Paramount Gold and Silver (PZG) appears to be ideal for this. click to enlarge Source: Yahoo Finance The top black line in each graph is overbought territory and the bottom black line is oversold territory. As one can see, the graph of the stock price and its technicals show an ideal buying point. The price is hitting a bottom resistance line, which could make the stock verse higher. The %K and %R shows a bullish cross, as depicted by a red circle. The W%R just crossed back above oversold territory. RSI is in oversold territory. And the MFI is approaching oversold territory. Thus, the graphs look very bullish. Analysts on Yahoo Finance give a 12-month price target of $12.11, a whopping 357% gain over Friday’s closing price of $3.39. Is this too high of a target? Though the company currently has a negative earnings and a price/book ratio of 6.38, they have $18.78 million in cash and zero debt. Institutional ownership is a low 4.10%, meaning there is plenty of room for buying for institutions, which is a major force in driving Complete Story » |

| Gold Bar Premiums at 17-Year High in Hong Kong… Posted: 31 Jan 2011 01:52 AM PST |

| Posted: 31 Jan 2011 01:37 AM PST |

| Posted: 31 Jan 2011 01:31 AM PST Why is gold going down? As expected, the Great Correction continues. Domestic consumer price inflation is still subdued. Speculators are getting worried. They bought gold at high prices. What if there really is a recovery; who will need gold? Now prices threaten to go down. |

| Posted: 31 Jan 2011 01:17 AM PST Heads up and a big FYI - a must read imho: http://fofoa.blogspot.com/2011/01/wh...ining-gld.html Okay, which one of you is it backing up the truck and redeeming baskets of GLD shares for physical? :biggrin: I would imagine much the same could also be said of SLV. R. |

| This is how the next crisis could start Posted: 30 Jan 2011 11:42 PM PST From Gold Scents: All markets are subject to the forces of regression... Newton's basic laws of motion: Action and reaction. At current levels, both the S&P and Nasdaq 100 are stretched further above the 200-day moving average than virtually any other time in the last 10 years. Not surprisingly, the further a market stretches in one direction, the harder it snaps back in the other once the forces of regression gets its hooks into the market. The Fed is exacerbating this process with its constant meddling in the markets. The flood of liquidity unleashed by Greenspan and Bernanke from 2002 to 2007 in the vain attempt to abort the bear market was directly responsible for creating the conditions that led to the market crash of '08/'09. The rally last April was pushed much higher than it would normally have risen by the forces unleashed during QE1. The end result... the correction when it finally came was much more severe than it would have been normally, even including a mini-crash in May. QE2 has now driven the market even further above the mean than in April. Unless the... Read full article (with charts)... More on stocks: Stocks are tracing out a frightening pattern Six big signs the market could plunge soon A group of stocks you should sell immediately |

| Posted: 30 Jan 2011 10:32 PM PST Food Prices Primarily Driven By Grain And Meats Are Skyrocketing. I was food shopping this weekend and am always watching prices for our reports on inflation. While I was not buying meat on this trip I happened to notice a package of rib eye steaks (4 in one package) that was normally $33.00, priced Saturday at $58.00!! This price jump happened in one month or less. This store is a Big Box Retailer known for quality and very competitive prices. I switched my milk buying to this store and they offer a current bargain with two one gallon containers for $4.00. My local market is about $3.49 for one gallon. Milk remains under-priced and over-supplied but this could change, too.

Normally corn futures in the past few years have been trading in the $3.75-$5.00 per bushel range. This is for a 5,000 bushel contract on the Chicago Board of Trade. The corn contract is usually the largest commodity contract by volume. This Tuesday morning before the open we see $6.68/bu and expect prices to touch $8.00 per bushel before a yearly high is achieved. The highs come in July and/or December based upon reserves, counted plants-acres and projected weather. "Like many environmentalists, Lester Brown is worried. In his new book "World on the Edge," released this week, Brown says mankind has pushed civilization to the brink of collapse by bleeding aquifers dry and over-plowing land to feed an ever-growing population, while overloading the atmosphere with carbon dioxide. If we continue to sap Earth's natural resources, "civilizational collapse is no longer a matter of whether but when," Brown, the founder of Worldwatch and the Earth Policy Institute, which both seek to create a sustainable society, told AFP. What distinguishes "World on the Edge" from his dozens of other books is "the sense of urgency," Brown told AFP. "Things could start unraveling at any time now and it's likely to start on the food front. We've got to get our act together quickly. We don't have generations or even decades — we're one poor harvest away from chaos," he said. "We have been talking for decades about saving the planet, but the question now is, can we save civilization?" -AFP & Breitbart.com This posting includes an audio/video/photo media file: Download Now |

| View From the Turret: Trade Like an Egyptian Posted: 30 Jan 2011 09:41 PM PST

LOLO investors (Long Only, Leveraged Outright) are suddenly confronted with the reality of a two-way market, and the concept of "risk" once again matters when it comes to allocating capital. On Friday, the Dow dropped 166 points – good for a 1.4% drop, and more volatile indices like the Russell 2000 dropped as much as 2.5%. Of course, the iShares Emerging Market Index (EEM) lost more than 3.1% as skittish traders quickly reversed their sentiments on international growth opportunities. Barron's had an unintentionally tongue-in-cheek statement regarding the resurgence of volatility:

to which I might add: "or maybe those assumptions shouldn't have been made in the first place…" At the beginning of the year, Jack commented on Niels Jensen's twelve major risks for 2011. The point was not to speculate which one(s) of these risks will actually come to fruition, but rather to point out that even with low probabilities for any ONE particular event occurring, the cumulative effect of a number of low probability events can actually lead to a much greater chance that something will happen to disrupt the low-volatility bullish chug higher. When traders turn a deaf ear to these risks, the situation becomes all the more dangerous. The long side becomes more crowded, trends become extended, and valuations become excessive. In such an optimistic environment, it doesn't take much to spook the herd – and send everyone running for the exits. At that point, it's just a matter of how much chaos is necessary to flush out the system. The Mercenary Portfolios handled the Egyptian disruption in stride, with our relatively bearish positioning sparking profits – and our watch list flush with new breakdown opportunities. Of course there are also a few niche bullish ideas that could flourish in the newfound uncertainty. So let's dive into the setups for this dynamic upcoming week.

~~~~~~~~~~~~~~~~~~ Emerging Markets Feel the Sting There's nothing like an international crisis to make investors think twice about allocating capital to emerging markets. But the emerging market dominoes were actually already lined up and vulnerable before the Egyptian crisis began. Rising food costs and currency manipulation had already created a tinderbox that was beginning to smolder. The quote below is from the Mercenary Live Feed archives before the market opened Thursday:

Before the close on Thursday, EWZ triggered our stop/limit order and we shorted the ETF at $74.46 (all trades time stamped and archived in the Mercenary Live Feed. The action on Friday simply added fuel to the fire, and sent EWZ plummeting. At this point, we have moved our risk point to breakeven and with any continuation, we expect to take half profits on this trade. Fear Premium For Energy Of course, while the unrest in Egypt is a major risk for domestic and even global economic expansion, the actions are very bullish for oil prices which surged on Friday. The potential for much more widespread turbulence could disrupt energy supplies and serve as a further catalyst for what was already a bull market for oil prices. A push back above $92.50 for crude would create yet another set of higher lows and higher highs – confirming the positive trend. And with currency debasement already acting as a tailwind behind a broad assortment of commodities, it's easy to see how the bullish trend in oil could accelerate. There are a number of ways to trade this trend including crude futures, the iPath S&P Oil Total Return Index (OIL), the United States Oil Fund (USO) as well as traditional E&P (exploration and production) equities and a number of alternative energy opportunities. Hess Corp (HES) is a global driller whose reserves could quickly add value for shareholders as prices rise. The stock is reasonably priced based on earnings trends, and the company has a very manageable debt load. Investors have already begun building positions in the stock, driving the price from a short-term low near $50 in mid 2010 to its current level above $80. A recent consolidation gives traders a chance to buy on a clear break higher, while creating a risk point near the low of the recent pullback. If HES has stable supply lines from production locations outside the Middle East, it could recognize a premium price and traders are already placing their bets on stronger profits. If Middle Eastern oil supplies are cut off, companies with non-traditional oil production will likely catch traders' attention. Canadian Natural Resources (CNQ) has developed expertise in oil sands production and the stock is rallying with bullish energy prices. With significant production in areas outside the Middle East, and a technology edge above its peers, CNQ makes a compelling long-term investment case. Of course as swing traders we are looking for a catalyst and clear chart validation for entering a long position. The stock recently pulled back to test its bullish trendline, and Friday's action once again confirms that the bulls have control. With a solid fundamental base, and Egypt acting as the catalyst, a bullish trade with tight risk point should give us a good shot at large trading profits with our risk carefully managed. Denison Mines Corp. (DNN) is one of very few opportunities to participate in the uranium market. With emerging markets as well as the developed world increasingly turning to nuclear energy, uranium stockpiles will quickly be used up. Spot prices for the nuclear fuel have been ramping, and the Middle East fear premium only adds to this trend. Denison is growing revenue at an impressive rate and is expected to post its first profitable year since 2003. More importantly, the value of its underground reserves continues to increase with the depletion of global uranium stockpiles and the prospect of more reactors coming online. The stock has been consolidating below $3.60 for several weeks now and a breakout would present an attractive buying opportunity.  Precious Metals Once More Attractive The hallmark of a good trader is the ability to be nimble and flexible as market forces shift. Midway through January, we noted a reversal of fortune for precious metal stocks, and placed our bearish bets on a sharp pullback. The trade ran counter to the broad sentiment, as traders had recently increased their commitment to the PM area – and the environment was looking quite frothy. After taking half profits on the majority of our bearish PM positions, we tightened our risk points to lock in profits on the remaining shares. Friday's action indicated that this pullback was likely complete and we called an audible, closing our remaining bearish positions. At this point, gold and silver miners could represent a flight to safety – and a place for institutional managers to park capital. Many fund managers are required to hold long exposure, but want to protect their capital from risk in traditional industrial or economically sensitive holdings. Gold and energy positions represent a great alternative and could once again attract a significant amount of capital flows. This week we like the Market Vector Gold Miners (GDX) because the large-cap index will be viewed as more safe and stable – as opposed the the speculative junior gold miners. In months past, speculation on gold prices was the major driver behind the precious metal boom. But today, buyers are looking for stability and preservation of the real value of their capital. This argues for a stronger surge in the blue-chip miners, and we're watching GDX closely for an opportunity to step in. Base Metals and Australia Base metal producers have been running into resistance for several weeks now as commodity bulls take a break, and the rate of global consumption is called into question. If emerging markets take a break or simply slow the rate of infrastructure projects, spot prices for copper and iron ore could take a hit. Last week we took a position in BHP Billiton Ltd. (BHP) as the stock broke the 50 EMA and traded through the low of its recent consolidation. In addition to growth fears in China, the new Middle East tension makes for an even more uncertain environment. Considering the run that stocks like BHP as well as Rio Tinto (RIO), VALE SA. (VALE) and others have experienced, a significant pullback could be in the cards. If base metals weaken, that's bad news for Australia – a major producer of natural resources. Already reeling from recent floods, a drop in base metal pricing could be a huge challenge. The Australian dollar index has been consolidating just below $100 for several weeks now and if it turns lower, it could pick up momentum quickly. There are a number of ways to trade this trend reversal including the forex markets, currency futures, the Currency Shares Australian Dollar Trust (FXA) as well as option contracts. With international uncertainty as well as a number of key earnings reports, this week is sure to be full of twists and turns. Flexibility is key as we react to the shifting dynamics. Stay nimble and fluid! |

| Posted: 30 Jan 2011 09:38 PM PST - Auszug GEAB N°26 (17. Juni 2008) -  Nach unserer Auffassung trägt die umfassende weltweite Krise bereits im jetztigen Stadium dazu bei, die pro-westlichen Regierungen in den arabischen Staaten zu schwächen : Hungeraufstände, religiöser Fanatismus (der von dem erstarkenden Iran, Syrien, der Hisbollah und Hamas geschürt wird), westliche Verbündete (Washington und die europäischen Staaten), die sich auf eine Politik beschränken, die sich ausschließlich an ihren Sicherheitsinteressen ausrichtet... (1) In Ägypten geht die Herrschaft Mubaraks allmählich zu Ende, das Land befindet sich innenpolitisch in einer Sackgasse, und die Unfähigkeit der Regierung, den Menschen bessere soziale und wirtschaftliche Bedingungen zu schaffen, radikalisiert immer größere Teile der Bevölkerung (2). Nach unserer Auffassung wird das pro-westliche Regime Ägyptens unter den Schockwellen der Aufprallphase der umfassenden weltweiten Krise politisch zusammen brechen (3). Dessen Repressionsapparat wird es nicht vermögen, die sozialen Spannungen unter Kontrolle zu halten. Dabei ist dieses Land die letzte Verteidigungslinie des Westens vor einem Maghreb, der ansonsten ungeschützt der Einflussnahme anti-amerikanischer Kräfte ausgesetzt ist, die im Mittleren Osten inzwischen dominieren. Wenn in Ägypten, wovon wir überzeugt sind, bis Anfang 2009 die politischen Verhältnisse instabil werden, werden auch sehr schnell Tunesien, Algerien und Marokko in den Strudel gerissen werden. Auf jeden Fall werden auch in diesen Staaten die sozialen Unruhen zunehmen, und zwar gerade zu einem Zeitpunkt, in dem ihr großer europäischer Partner selbst mit einer Wirtschaftsabschwächung zu kämpfen haben wird. ----------- Noten: (1) Und das wolkige Projekt einer Mittelmeer-Union des französischen Präsidenten wird daran auch nicht das Geringste ändern. (2) Die Hungeraufstände werden noch lange die Region in Atem halten, denn die globale Ernährungsituation verschlechtert sich weiter. Zum Beispiel rechnet der amerikanische Landwirtschaftsminister in diesem Jahr mit einer um zehn Prozent reduzierten Maisernte. Quelle: Bloomberg, 10.06.2008 (3) Selbst die US-Entwicklungshilfe, von der das Land einer der Hauptnutznießer ist, wird angesichts des Dollar-Kursverlusts immer weniger wert. |

| Posted: 30 Jan 2011 09:33 PM PST - Extrait GEAB N°26 (15 juin 2008) -  Pour LEAP/E2020, la crise systémique globale contribue déjà à fragiliser fortement les états arabes pro-occidentaux face à un mélange d'émeutes de la faim, de montée de l'intégrisme, alimenté par la montée en puissance de l'Iran, de la Syrie, du Hezbollah et du Hamas, et d'incapacité de Washington et de ses alliés européens à tenir un discours autre que sécuritaire (1). L'Egypte est chaque jour plus déstabilisé à cause de l'impasse politique dans laquelle la place la fin de règne de Moubarak, tandis que l'incapacité du régime à répondre aux attentes économiques et sociales radicalise une part croissante de la population (2). Pour nos chercheurs, l'Egypte va être politiquement emportée par les conséquences du plongeon au coeur de la crise systémique globale (3). L'instabilité sociale va primer sur la nature sécuritaire du régime. Selon notre équipe, ce pays est le dernier rempart empêchant l'implosion du Maghreb sous la pression des forces anti-américaines qui dominent désormais le Moyen-Orient. Si, comme nous le pensons, l'Egypte entre en situation de grande instabilité d'ici le début 2009, alors la Tunisie, l'Algérie et le Maroc seront emportés dans la tourmente très rapidement. Ils vont de toute façon devoir eux aussi faire face à une contestation interne croissante pour des motifs socio-économiques, au moment même où leur grand partenaire européen va voir son économie ralentir. -------- Notes: (1) Et ce n'est pas le virtualisme de l'Union pour la Méditerranée du président français qui va changer quoi que ce soit à la donne. (2) Les émeutes de la faim n'ont pas fini d'agiter la région puisque, sur le front alimentaire mondial, la situation continue à se dégrader. Ainsi, par exemple, le ministère américain de l'Agriculture s'attend à une baisse de 10% de la production américaine de maïs cette année. Source : Bloomberg, 10/06/2008 (3) Même l'aide américaine, dont elle est l'un des principaux bénéficiaires, se réduit comme peau de chagrin du fait de la baisse continue du Dollar. |

| Posted: 30 Jan 2011 08:07 PM PST Further to my post yesterday, FOFOA left this comment on his blog discussing two risks he sees with GLD: 1. That the gold in GLD has multiple claims on it. Quote: "GLD's gold bars originated as reserves in the mainstream bullion banking system. That is, they are essentially reserves on loan to the ETF from the bullion bank's fractional reserves. And the lending of anything always creates a synthetic supply" and "that lent its reserves to paper GLD investors in the first place" 2. That shorting of GLD results in multiple claims on the gold: Quote: "The other side is the lending of this "synthetic gold supply" that creates an additional synthetic supply of synthetic gold. When someone shorts GLD they borrow the shares from someone else. And that same share can potentially be borrowed again and again." My short response is I disagree with 1 in respect of "lending" but agree with 2. Now for the long response. The idea in point 1 that GLD has encumbered gold in it was raised in Catherine Fitts' "Precious Metals Puzzle Palace" and also Hinde Capital's "Precious Metals ETF Alchemy GLD – the new CDO in disguise?" I discussed this issue in this post. If Authorised Participants borrowed physical (or used physical backing their unallocated liabilities to their clients, which is the same thing) and delivered that to GLD, there is no claim or encumbrance by the original lender to the Authorised Participant on those bars held by GLD. To claim otherwise is to question the entire basis of Allocated gold that the market (and "giants") operate and rely on, as no giant with a couple of tons of gold can just bury it in their backyard. It would also question the integrity of GATA consultant James Turk's GoldMoney as well. The second part of FOFOA's comment is that any delivery to GLD by a bullion bank of physical gold that was supporting/backing the bullion bank's fractional unallocated liabilities is a "synthetic supply" that effectively suppresses price by "divert[ing] growing investment demand away from the tightening physical market." I would note that for this statement to be true the bullion bank(s) in question must be naked short. Not all Authorised Participants for GLD would have access to the physical to do this, nor would they all be willing to take on such a financial exposure. Question to FOFOA: how many tonnes of GLD do you think are short? A final point (and FOFOA probably won't like this conclusion). I would claim that those at risk from this activity are not holders of GLD, but bullion bank unallocated clients because the legal title to the metal in GLD is held by the Trust, not the Authorised Participants or bullion bank unallocated clients. Now this is a simple legal fact. It does not mean that in any meltdown when fractional claims come home to roost, holders of GLD will survive while bullion bank clients will not. It may happen that the custodians do "take" the gold behind GLD and give it to their unallocated clients first and use the get out clauses in GLD to say they "lost it" or some such other fraud if they are unable to subsequently replace it. Some believe that this is likely behaviour, others that no matter how ruthless bullion banks may be, that they would not engage in such outright fraud. I'll leave that to you to have an opinion on. FOFOA seems to be sure of this because he thinks that the bullion banks somehow have a special right to the gold in GLD, see this comment: A place to park your unallocated deposits and sell them for dollars that can then chase an ROI, knowing that the gold will still be there for you to buy back any time it is needed, because you are an Authorized Participant with special rights to the gold. I do not see how Authorized Participants have any special rights. Once they deliver gold and get GLD shares and then sell them for cash which they then "chase an ROI", they give up an rights to the GLD share or gold. Yes an Authorized Participant has special ability to redeem GLD shares for gold, but they have to tender the GLD share first, which in the situation above, they can only obtain by buying GLD shares off investors, thus pushing the price up. If you think that it is likely that bullion banks would steal Allocated gold, I would then argue that if a bullion bank was to consider engaging in such fraud, it would not do so with GLD's Allocated metal because that is an exchange listed product with regulatory, audit and client visibility (through the bar list). Using Allocated metal held by other clients with the bullion bank would be a far lower risk as that is an over-the-counter market arrangement, subject to far less oversight as it is in the "dark". Again, GLD represents the least risky paper gold – the last to fall, so to speak. Remember that gold ETFs are only 2,000t out of 30,000t of privately held gold, a fair bit of which is Allocated with bullion banks and other custodians. I think it is a more believable thesis that any short covering, fraud etc is more likely to occur in the over-the-counter "dark" market first, leaving the visible ETFs to maintain the façade that everything is OK. The point of my discussion above is not to suggest GLD is a safe investment. It is just to introduce a little more nuance beyond a simplistic "GLD is bad because bullion banks involved." In respect of point 2 about the shorting of GLD, I would like to see some numbers on that. I am not sure it is as pervasive as implied. This article on ETF shorting in general and ETF settlement fails give a sense of the extent of the issue, but unfortunately GLD is not mentioned. One final comment by FOFOA: From my perspective, GLD had the opposite effect on the price of gold (and may have been intended for just that purpose) as it diverted growing investment demand away from the tightening physical market. All I will say to this is that is was not intended by the WGC for that purpose and there was obsession about creating a product that resulted in "physical offtake". Whether the vehicle that resulted was the best design is another matter. There seems to be this view that the WGC is part of the "bullion bank conspiracy". I suggest you look at the membership of the WGC and some of the companies and their involvement in other activities supportive of gold. WGC wanting the gold price to drop doesn't stack up in my view. |

| Kitco News reports on GATAs lawsuit seeking Feds gold records Posted: 30 Jan 2011 05:00 PM PST |

| Posted: 30 Jan 2011 05:00 PM PST |

| Posted: 30 Jan 2011 04:30 PM PST |

| Precious Metals and the Dollar’s Next Big Move Part II Posted: 30 Jan 2011 02:43 PM PST We have seen some exciting moves in the market and with the market sentiment so bullish it should make for a sharp selloff in the coming weeks. Meaning everyone is overly bullish and owns a lot of stocks and commodities; therefore the market should top and leave them holding the bag while the smart money runs for the door. The market will not bottom until all of these individuals holding the bag finally cannot take the pain of losing any more money and once we see them panic and sell them all at once only then will we be looking to go long again. The past couple weeks I have been bombarded with emails asking if gold and silver have bottomed and if they should be buying more on these pullbacks. Those of you reading my work for the past few months know that my analysis clearly has shown how both gold and silver have been topping out. There have been strong distribution selling and price patterns on the charts are also clearly signaling a top was near. A couple weeks ago I posted an important report covering gold, silver and the US Dollar and where the next big moves will be. Well it's time for another update on Gold, Silver and the Dollar as they have come a long way from my last report. Take a quick look at my previous charts here for 15 second recap from where we were and are now: http://www.thegoldandoilguy.com/articles/precious-metals-and-the-dollar%E2%80%99s-next-big-move/ Ok let's move on to today's charts…. Silver Daily Chart Silver has formed a very nice looking top and it is now trading under its key moving averages. It is also currently testing a key resistance level after Friday's bounce on the back of fears in Egypt. Unless something happens internationally I figure silver sill continue its trend down. Gold Daily Chart US Dollar 2 Hour Chart Pre-Week Metals and Dollar Trend Analysis: |

| Posted: 30 Jan 2011 01:57 PM PST I was replacing my mother-in-laws bathroom sinks and when I finished I found her and my wife going through some silver of hers. She said I could have it for fixing the sinks. I told her to keep it but she insisted so I took it. After getting home I was going through it and turns out to be about $50 bucks worth. Not a whole lot but I wasn't planning on charging her anything to begin with. In the lot was a 1890 Morgan. Too bad she didn't have a bunch of those. Oh well, silver is silver. |

| Crash / Buying Opportunity Alert for THIS WEEK - (Jan 31 onwards) Posted: 30 Jan 2011 12:29 PM PST Picked this link up from www.maxkeiser.com: Gold and Silver alert: traders at JPM and other Wall St. firms instructed by Fed/Treasury to attack PM's – HARD ON MONDAY – to try and boost dollar and reduce food/energy prices – as inflation fueled revolts go global – and regimes in US and UK are now looking vulnerable Linking to ZeroHedge Article: Citigroup - The Last Recourse Against Runaway Inflation? A Commensurately Greater Jump In The Dollar Citi's head of FX, Steven Englander, has some contrarian observations on the fate of the US dollar, which a more nuanced read may even indicate a slightly conspiratorial bent, namely that in order to cut the surging global inflation dead in its tracks (alas, too late for the regimes of Tunisia and Egypt), the dollar will have to surge even more. To wit: "If the world's inflation problem is primarily derived from rising commodity and food prices, it is very likely that a stronger USD will help mitigate this inflation quickly and efficiently. There is a well established relationship between USD strength and weaker commodity prices." Of course, with the Printing Dutchman at the helm, what hope is there for a sustainable strong USD thesis: "The problem is that there does not appear to be a market driver for USD strength." Yet this could very well be the contrarian trade going forward as the G-20 looks aghast at events in Africa and realizes that the "last case" scenario just seems that much more credible. If this happens and there a concerted effort to reincarnate the dollar, look for the EURUSD to plunge, and all USDXXX pairs to surge in the following days, especially as the carry funding shorts realize that they will once again, just like in late 2008, be the sacrificial lambs at the altar of "Kicking the can down the road one last time"-dom. Quote Englander: "During a similar high commodity price episode in mid-2008, we saw some evidence of high reserves growth, which is unusual when the private sector is buying dollars. Moreover, then as now, market macro investor positions appeared to be long commodities. While it would be unusual for reserve managers to buy USD for inflation stabilization reasons, as a quick solution to a major problem it may be more effective than most." Full must read note from Citi, which may explain why Goldman suddenly high tailed it out of its 1.40 tactical EURUSD target without hitting it and just two days after the revision. Global Focus - A Strong Dollar is in the world's interest |

| The Petro-Dollar Standard In Crisis Posted: 30 Jan 2011 12:00 PM PST --Boy, it sure isn't a good look for the land of the free and the home of the brave that American-made F-16s and M1 Abrams battle tanks are out in force across Egypt now. But cosmetics and theatrics aside, there's a bigger story here: the entire geopolitical arrangement that has grown up around the U.S. dollar standard is unravelling. The modest task of today's Daily Reckoning is to figure out what that means for your investments. --First we should probably back-pedal on our statement above about Middle East tyrannies being supported by American policy and American weapons. Or wait, should we? Hmm. The fact the Egyptian Army is now in the streets of Cairo and NOT firing on people is an argument that the Army itself may force out Egyptian President Hosni Mubarak and end his 30-year U.S.-backed rule. --Whatever happens in the next few days, it's getting clearer by the day that as global food and fuel prices rise (Bernanke exports), so does political instability. Of course if you're in Egypt and have been living under the heel of the State for 30 years, a little instability might be welcome. In fact, the desire for stability—to freeze things as they are so we can control them and manage them just the way we like—is often the motivator for more State control in private and public life. --Viva instability! --Financial markets continue to operate when geopolitical tensions rise. But they shift to risk aversion. For example, spot gold was up $23.50 in Friday trading. Short-sellers must have taken one look at the pictures coming from Cairo and decided to cover their bet on falling gold prices. Over in America the Dow fell 1.39%. --It's obvious that in the short-term, a crisis in Egypt is bearish for stocks and bullish for oil and precious metals. But you are not paying for the Daily Reckoning to read what is obvious to everyone. So what is the un-obvious point to take away from the last few days? Well we actually count four separate points. --Watch out Europe. Energy is capital. A U.S. dollar rally cannot be ruled out. Seek out public companies with many years of energy reserves. --Why should Europe watch out? Popular protests can spread like a bad cold. Egypt may not be experiencing a revolution so much as a changing of the institutional guard. And it's unlikely, in our view, that the wave of anger/resentment/optimism spreading through North Africa will reach, say, Saudi Arabia and its 263 billion barrels of light sweet crude oil. But like a psychic tsunami, that wave could travel across the Mediterranean and into Europe. --There are large populations of North African immigrants in Europe's major cities. Many of them arrived at the end of World War Two. They provided cheap labour for Europe's rebuilding economies. Are those large immigrant populations now a potential source of even more unrest in Europe? --Well, the art of organising protests to take down the authorities is refined each time one of these "revolutions" takes place. Facebook, Twitter, YouTube, flash mobs, it's all getting pretty sophisticated...and very difficult to shut down (even when the State does the ham-fisted thing and turns out the lights on the Internet.) -- Popular uprisings happen at the margin. A small, well-organised cadre of individuals can set a whole process in motion that reaches a tipping point. And after that, all bets are off. You never quite know where your revolution/uprising will take you. --What's happening in Egypt is not just something to watch on Sky News over dinner. It's a preview of what may happen in the developed world too in coming years. The reasons will be different. In the developed world it will happen because of the corrupt and debt-laden financial system continues to reward the elites at the top at the expense of the Middle Class. But the results (a deposed or decapitated leadership) may be the same. --So good luck Europe and good luck the Euro! --The second point is energy itself (especially crude oil) is a kind of capital in a world where there's a bear market in paper money. Energy is normally just a commodity. It's an economic input that, along with labour, land, and capital combines to bring you goods and services. -- But the urbanisation and population of the modern world would not be possible without cheap energy. These days, access to cheap and abundant energy is as important as anything else if you want to ensure your economic competitiveness. If you don't have energy, or at least a boatload of money to bid for it, you have nothing. --You could further argue that the U.S. dollar is the world's reserve currency because of its relationship with energy. The Saudis agreed to price oil in U.S. dollars in exchange for a U.S. security umbrella. But as the dollar is sabotaged from within by Ben Bernanke and Tim Geithner, all the geopolitical arrangements that evolved around the dollar standard—including the pricing of oil in dollars and the security of oil producing regimes—is slowly crumbling like the crust of a three-day old homemade apple pie. --The unravelling of this strategic arrangement for energy puts a geopolitical premium on the actual ownership of oil, gas, coal, and uranium. Australia scores pretty well in three out of those four categories. But you still have to be careful. If you own a company that has large energy reserves, are those reserves located in politically risky areas? --Point three: watch out for a U.S. dollar rally. You may disagree with your editor that the Euro could be a surprising next victim of the events in North Africa. But when S&P downgraded Japan last week, it was definitely dollar bullish. Betting on a dollar rally to contain inflation while U.S. deficits show no sign of getting smaller is admittedly pretty contrarian. But you shouldn't rule it out. --And keep in mind that dollar strength against the Yen and the Euro is only relative. You don't have to be a dollar bull to see that it could go up against other paper currencies in the next few weeks. The important price to watch is gold. If gold goes up against all paper currencies even as the dollar clobbers the Euro and the Yen, you'll know the primary trend of the last ten years is still firmly in place. --Finally, alluding to the point we made above, the big takeaway for investors is to look at your portfolio and find out if you have enough exposure to energy stocks. The oil price climbed over the weekend. It wasn't because Egypt is a major exporter of oil (it's not) or that the Suez Canal is critical to the flow of oil to Europe (it's not, the canal was built in the 19th century and is not big enough to handle modern super tankers). --But it's the speculation that U.S.-backed authoritarian regimes in the Middle East may now be living on borrowed time...THAT's what has oil speculators worried. As well they should be. Regards, Dan Denning |

| Posted: 30 Jan 2011 11:24 AM PST Let's throw out a few numbers. Numbers lie. The 5 is crooked. The 8 goes nowhere. The 0 is nothing, whatever that is. So, let's throw them out. 15, 34, 92, 98888, 21... Throw them all out. Or, how about this...? $14. That's how much gold fell yesterday. Why is gold going down? As expected, the Great Correction continues. Domestic consumer price inflation is still subdued. Speculators are getting worried. They bought gold at high prices. What if there really is a recovery; who will need gold? Now prices threaten to go down. It wouldn't surprise us to see gold under $1,300. Or under $1,200. Or even under $1,000. But don't mistake a dip for a change of direction. The bull market in gold won't end until the financial crisis is over. And that's not going to happen soon. Here's another number we can throw out to prove our point: 1,500,000,000,000 What the heck is that? That's the number of dollars that the US government is supposed to need this year to fill the gap between what it collects in taxes and what it spends. It's the deficit, in other words. And it's a lot of money. But remember, it's just a number. And you can't trust numbers. Because it was just a few months ago that we were told the budget deficit would be much, much lower. Remember those numbers? Less than $1 trillion? Then, $1.2 trillion. Numbers, numbers...1,2,3,4,5,6,7,8,9 - we've seen them all! But the important thing is not the number itself... It's like a Christmas present; it's the spirit behind it that counts. And behind every number in the federal budget is the Spirit of Christmas...well, it would be the Spirit of Christmas if Santa was a kleptomaniac and he gave all the loot to himself and his friends. We're not complaining about it. It's just what happens in an advanced, degenerate economy. More people spend their time trying to figure out how to redistribute wealth than trying to create it. In the event, the Obama team is going to redistribute $1.5 trillion more than it can collect in taxes. Let's throw out some more numbers. That's $5,000 per person...$20,000 for a family of four. And we're talking spending IN EXCESS of tax receipts. This is just the deficit. That's in addition to the $8,000 or so per person that is taken from one taxpayer and given to others. Okay... So the feds spend $1.5 trillion more than they take in. Or $4 dollars in spending for every $2.50 they get in taxes. Big deal? Yes... You can imagine how long you could do that. It's like earning $100,000 and spending $160,000. Do that once...maybe you could get away with it. Do that every year...? And the feds are doing this when the economy is supposed to be growing at 3% to 4%. If it grows more slowly, or not at all, the deficit gets worse. You'll notice also that $1.5 trillion is about 10% of GDP. You'll notice also - since we're having such a good time with numbers - that if you keep adding 10% of GDP to the debt that pretty soon you have a lot more of it than you want. That's why we were so disappointed with Mr. Obama's State of the Union address. He gave a false impression. He talked about "winning the future" and made it sound like it was just a matter of doing things better. Not so. Americans have to do things differently. They'll never win the future this way. They have to change the numbers. You can't borrow 10% of GDP, year after year, with no end in sight, and still hope to have a healthy economy. You can't expect to win the future that way. Let's face it, that's the way to be a big loser... The East Coast is getting hammered by snow. That's what the news reports tell us. Here in Washington it seems like a normal winter. But the drive last night was unusually difficult. We waited until 7 PM to leave the office. Most people were off the roads. It was snowing hard. The streetlights and the remaining Christmas decorations made Baltimore more beautiful than we'd ever seen it. A few people walked around. There were almost no cars moving. We figured we'd be able to take our F-150 and just cruise down I95 without any trouble. Not that we have good traction. Without weight in the back, a pick-up truck is not particularly roadworthy in the snow. But you don't need much traction on a flat road. The trouble was that the snow had so slowed traffic that there were still drivers on the road who should have gotten home hours ago. They slipped. They slid. They wandered all over the road, trying to follow the tracks of the driver in front of them. There were too many of them. We tried to stay away from other cars, but it was impossible. Soon, we were in the middle of them. And then, on Washington's beltway, the traffic stopped all together. Drivers turned off their motors. Cleaned their windshields. Talked to their snow-locked neighbors. The atmosphere was almost gay and insouciant. We turned off the highway and snaked our way through the back streets. The snow was higher. Power lines and trees were down. But we kept moving in the right direction. It was hard driving. But it was remarkably pretty. Finally, we got home. Regards, Bill Bonner. |

| ‘Fear and Love Make Gold Strong’ Posted: 30 Jan 2011 11:24 AM PST An interview with Frank Holmes For the BIG GOLD annual gold forecast survey published in January, Jeff Clark surveyed seven gold experts and nine top economists and fund managers, along with Doug Casey himself, to provide their best insight on what to expect in 2011 and how to invest. One expert he interviewed was Frank Holmes, head of US Global Investors, which manages 13 no-load mutual funds, many of them recognized for consistently high performance by Lipper Fund Awards. Last year, Frank's Gold & Precious Metals fund returned 36.8% - more than triple the Dow - and the World Precious Minerals fund gained 45.4%, outgunning the S&P almost four-fold. Read on for Frank's thoughts on gold and precious metals stocks... BIG GOLD: Gold was up 30% in 2010; to what do you attribute its rise? Frank Holmes: Investors have to look at gold demand as both the fear trade and the love trade. What most media focus on is the negativity of government policies to drive gold prices. I characterize this as the fear trade - deficit spending and negative real interest rates for the G7 countries. More significant is the love trade - where more than 60% of the world's population is in emerging countries averaging over 6% GPD growth and 8% rising personal income, and they believe in giving gold as a gift for birthdays, weddings, religious holidays, etc. This love trade is entrenched, and it is not going away. Fears over the European debt crises were a big driver of gold in the first half of the year, as investors bought both gold and the dollar for safety. However, by mid-year, the dollar started to break down as smoldering budget woes in the US began to reignite concerns over the fiscal situation here. Gold got a second lift by October as both the fear and love trade showed up together. We had the season of Diwali lights in India and we had QEII, so gold went to new highs. By year end almost all the gains made by the dollar were eroded away, while gold finished the year with a respectable rise of 29.5%. BG: What forces will move gold this year? And what's your price projection for 2011? FH: US equity strategists are way too complacent and so are risk measures such as the VIX, which is back to pre-Lehman lows despite government debt levels at even higher levels. The broad view is that there will be no inflation in the US, as labor markets are slack, with 10% unemployment; however, rising commodity prices, which are controlled by international demand, will remain strong. A second wild card will be whether the German public will go along with the "transfer society" concept. European woes are not over. Third, US lawmakers will have a bitter potion to swallow, as the vote on raising the US debt ceiling will be a rallying point for the Tea Party this year. And if inflation, such as rising oil prices, starts to sap spending, wages in the US may have to rise, and then the cat would be out of the bag. It's been a great ten years for gold, which was fully justified due to the explosion in consumer credit and debt, but gold may still have a very important role to play going forward. I believe in the next five years the price of gold will double from current levels, and that means it has the potential to have a 15% annual compounded rate of return. BG: How volatile do you expect gold to be? FH: What is really key in understanding and managing expectations in the capital markets is that over any 12-month period, it is a non-event for gold to go plus or minus 15% in a year. This happens 68% of the time. The stocks of gold producers can go plus or minus 40% over any 12-month period, so they have greater risk but can also provide substantial returns. It is thus important to respect and look at volatility as an opportunity. BG: Gold stocks as a group did not outperform gold in 2010 - does that change in 2011? And if the broader markets sell off, do gold stocks fall along with them or trade on their own? FH: Actually, 2010 may have been a turning point, as major gold- producing companies, measured by the Gold Bugs Index (HUI), gained 34.1%. This hopefully has reversed the trend of the last couple years where bullion outperformed the stock. Junior gold mining companies, on average, returned roughly twice the gain of gold bullion, but some of those names were fairly silver rich, and we know how well silver did last year. In the scenario of a market sell-off, gold stocks are still equities and can get pulled down with any surge towards liquidity. However, the price action since the 2008 credit crises showed us that gold stocks did very well for investors relative to the broader markets. In addition, while those of us in the gold business are very close to the story, there are a lot of people that are still coming around to investments in the precious metals sector. When one looks at what has been some of the best-performing stocks over the last 10 years, gold and gold stocks may very well trade on their own as a preferred asset class. BG: Silver was up 81.9% in 2010, but is still below its 1980 nominal high. What's your outlook for silver in 2011? FH: Silver may have gotten ahead of itself a bit. In the coin market, for instance, it is not uncommon to see certain gold coins sell for a 30% premium to the spot price, but in the last quarter we saw some collectable silver coins with asking prices as much as a 300% premium. Silver does offer exceptional leverage to gold, almost 2 to 1. Right now, while it looks like the economy is getting stronger, silver could continue to benefit from a pick-up in industrial uses. BG: What's your best advice for precious metal investors in 2011? FH: Investors should consider buying gold as insurance. We recommend having about 10% of their portfolio in gold and gold stocks, and rebalancing every year. Two stocks that we like at current prices are Randgold (GOLD) and Silvercorp (SVM). Both companies focus on high-quality ore deposits that will be economic at prices substantially below current spot prices. In Randgold's case, their share price has fallen about 20% since the presidential elections in the Ivory Coast became locked in a stalemate. The company's Tongon mine is their newest project and is currently being commissioned, but news flow has been slow and hasn't drawn much attention. Look to see this issue resolved over the next couple of months. Silvercorp is one of the few companies that has successfully navigated in China, and our models indicate there is much more upside available from these assets than where the stock is currently priced. SVM also has a very attractive relative valuation to its North American peers, where in some cases we have seen 5% of their market capitalization turn over fairly consistently everyday over the last month - those shareholders are obviously not around for the long term. Regards, Jeff Clark |

| Posted: 30 Jan 2011 10:00 AM PST The Friday rebound in gold, largely induced by the escalating turmoil in Egypt, came to an abrupt halt this morning, despite declarations that 'capitulation' was over and despite a renewed salvo of assurances that gold does not find itself in a bubble. |

| Metals Rebound on Safe Haven Demand Posted: 30 Jan 2011 10:00 AM PST Gold and silver are inching higher after a volatile last week. Recall that the metal sold off aggressively before rebounding on Friday on the back of the Egypt turmoil. Gold–currency correlations faded as gold marched to the beat of its own drum. |

| Posted: 30 Jan 2011 10:00 AM PST Close, but no cigar on getting out of my gold puts on Friday. We opened low enough on Friday morning to get within striking distance of my downside target at $1,280. But once the rout in equities started in earnest, it was off to the races. |

| Friday’s Panic in the S&P 500 & Gold Futures Posted: 30 Jan 2011 10:00 AM PST There have been times when both gold and the dollar have rallied together in the past, however at this point it is too early to determine what the market is trying to tell us. It is obvious that gold needed to bounce to work off oversold conditions. |

| Another View of Silver Futures COT Posted: 30 Jan 2011 10:00 AM PST Traders have to remember they are a zero-sum game. Every short has an offsetting long, and vice versa. It's easy to get bogged down and derailed in the COT, giving this report more credit than it deserves. |

| Posted: 30 Jan 2011 09:47 AM PST Will we lose Asia's gains once again, or was Friday the start of a new upward movement? |

| Sunday January 30th, 630 pm est Posted: 30 Jan 2011 09:39 AM PST Well, it looks as though Blythe has not made it into work yet, and the situation in the middle east is getting worse not better. Libya is now getting ready for what looks like an imminent revolution like its neighbors. Silver is being squeezed to $28.30 as I write this. I also want to point out the spread between Brent Crude and WTI is, quite blunt, now retarded at $10. I am still hungover from my best man's wedding last night, so those of you whose penis' shriveled up and did not buy some silver at $26.50 thursday night in fear it would go to ZERO, like I said to pick up a little, are now probably pounding your keybords. I would have liked to come into the $25.49's, but 1 million protesters kinda derailed that. Dont worry about it. I am here for you. Many, many more opportunities here to buy at what you perceive is a 'lower' price relative to fiat. Tomorrow morning Blythe should show up at 7 am, and realize the horror, if her asshole has not yet pukered with tonights action already. I expect the panic to begin...but I also suspect a some dollar strength...more to come. |