saveyourassetsfirst3 |

- Silver Is About As Close As You Can Get To A Sure Bet! Here's Why

- Declines of 10%-20% Expected Soon in Gold and Silver! Here's Why

- The U.S. Dollar Will Collapse Within 24 Months! Got Gold (or Silver)?

- Don't Delay: Get Your Fair Share of Silver Today! Here's Why

- The Dollar Bear Is Returning In 2011! Got Gold?

- The U.S. Dollar: Too Big to Fail?

- Free Shares on Constantine Metal Resources

- Rate Our Reckoning in 2010

- Year-End Review of Dollar: Very Weak

- That’s a Wrap

- The Australian Dollar Ends Year With a Flourish

- Commodities, Gold Are 'The New Reserve Currency': Kevin Kerr

- Themes for 2011: Housing, Jobs, Stocks, Commodities and Dollar

- Review of 2010 and Outlook for 2011

- Predictions for 2011

- New Lows for Gold Silver Ratio

- Bankclosure: What goes around…

- SIR #12: Quick Service Restaurants Poised for Even Quicker Decline

- Bull Breakout Can Carry Silver to 37.50 With a Spike to 40

- The Collapse of Price Fixing Will Keep Silver Prices Rising

- Wall Street Journal Aids Silver Price Suppression

- John Swifts lost Silver Mine

- Silver and Gold Raid/both metals hold up well

- Video: Silver Shortage This Decade, Silver Will Be Worth More Than Gold

- Silver/Rhodium to replace Palladium?

- Nifty: Silver Will Be at $50

- Markets Update

- Scrap Gold Value Calculator

- Chicago Blowout

- Gold Seeker Closing Report: Gold and Silver Fall Slightly

- The Last Angry Man’s Problem With IMF Gold Sales

- Global Macro Notes: Twelve Major Risks for 2011

- ChinaÂ’s Gold Rush

- Some thoughts about the manipulation of gold and silver prices.

- Gold and silver shorts losing control, Turk tells King World News

- Gold / Silver ratio reconsidered

- Forget gold, how about playing the spike in the silver price?

- Putting preps before PM's ???

- Gold Consolidates Over $1400/oz - CFTC Data Bullish - Silver Nominal 30 Year High

- Gold 2011: "Old Normal" Returns

- Gold coins in India are sold like hot cakes

- Interview with Jim Rickards

- Ted Butler on Silver Manipulation Problem

- Everything Gold Is New Again

- Silver Closes At Another 30-Year High

- Gold and Silver Shorts Are Losing Control

- Gold Mania. And Then What?

- Gold/Silver Ratio Reconsidered

- Gold Bears Predicting The Price of Gold

- Gold Breaks $1400, Hits New Euro & GBP Records as Silver Gains 6% in Thin Holiday Trade

| Silver Is About As Close As You Can Get To A Sure Bet! Here's Why Posted: 31 Dec 2010 05:49 PM PST I am very, very bullish on silver; the metal which is overlooked by most but will make the few who own it extremely rich. While gold will have a spectacular performance over the course of this bull market, it is silver that will be the MVP. Silver is about as close as you can get to a sure bet. Here are 7 reasons why silver will make you rich. Words: 2074 | ||

| Declines of 10%-20% Expected Soon in Gold and Silver! Here's Why Posted: 31 Dec 2010 05:49 PM PST While most investors and traders are super bullish right now on precious metals (and I can hardly blame them, as I am very bullish long term on the metals sector as well) the fact of the matter is that the recent leg up in gold and silver is not sustainable. A pullback is way overdue. Despite all the reasons to be bullish even short term all of my indicators tell me this is NOT the time to be buying gold and silver. Words: 915 | ||

| The U.S. Dollar Will Collapse Within 24 Months! Got Gold (or Silver)? Posted: 31 Dec 2010 05:49 PM PST The consequences of decades of abuse to the system of credit in the United States are coming to a head and the gray clouds that loom over the skies of the dollar are growing bolder by the day and darker by the minute. The cold hard fact is I expect the U.S. dollar to ultimately collapse within 24 short months. Words: 682 | ||

| Don't Delay: Get Your Fair Share of Silver Today! Here's Why Posted: 31 Dec 2010 05:49 PM PST Silver's dramatic rise over the last two months is no fluke - it's the result of a compelling supply/demand dynamic within a unique market structure. We hope the following comments convey our enthusiasm for "the other shiny metal" as an exceptional investment opportunity. Words: 2226 | ||

| The Dollar Bear Is Returning In 2011! Got Gold? Posted: 31 Dec 2010 05:49 PM PST These days it is almost impossible to find anyone who is long-term bearish on [the U.S. dollar], the stock market or the economy but I think they are all going to be wrong - horribly wrong. I believe that in 2011 inflation will spike horribly, the dollar will collapse, the stock market will begin its third leg down in the secular bear market and the global economy will tip over into the next recession that will be much worse than the last one. Words: 555 | ||

| The U.S. Dollar: Too Big to Fail? Posted: 31 Dec 2010 05:49 PM PST Those in the U.S. power structure know what the plan is if the U.S. dollar should fail. They are not admitting publically that there is even the remotest chance that it could happen but, rest assured, there is a plan. There is always a plan. To paraphrase Franklin Roosevelt, nothing happens by chance in government, so don't be caught up in such a 'surprise' event - whatever it may be and whenever it occurs. Words: 1345 | ||

| Free Shares on Constantine Metal Resources Posted: 31 Dec 2010 11:55 AM PST As we close out the year, our Vulture Bargain #6, Constantine Metal Resources (TSX:CEM.V or CNSNF) has traded to and through our stated target to go "Free Shares" or FS.... | ||

| Posted: 31 Dec 2010 09:40 AM PST Dear Reader, Happy New Year! Our first and most important resolution for 2011 is a simple one: to keep Reckoning. Normal services will resume on Wednesday, January 5th. In the meantime, we thought we'd do something a little different. The beginning of a New Year is a good time to reflect on the months that just passed us by...and wonder how they will affect the months ahead. The following selection of musings from Dan Denning and Bill Bonner highlight a year of lies and larceny, ludicrous tax proposals and loan debacles... and leaks (of both oil and diplomatic intelligence)... Enjoy and see you in 2011! Dan's Forecasts and Strategies for 2010 "Stocks up and then down?" CHECK. "US Dollar down against the Aussie?" CHECK. "A slow but steady slide toward an existential crisis for the Nation State as a competent, solvent institution for the 21st century?" We'll say CHECK to that one too. But what did Dan get wrong? Bill's Trade of the Decade Last decade it was sell stocks, buy gold. It's still early days... there are nine years to go... but how did Bill Bonners new Trade of the Decade fare in 2010? The Day the Oil Stopped Flowing And on the 85th day, after vomiting 184 million gallons of oil into the Gulf of Mexico, British Petroleum finally capped the oil well drilled by the Deepwater Horizon drilling rig under one mile of water. Should you have joined the contrarians and bought BP shares? "Complete, full-bore China collapse" in 2011? Dan Skypes with Capital and Crisis' Chris Mayer - at the Grand Hyatt in Beijing at the time - and gets his worst case scenario for China. It has grave implications for Australian investors. You find part one here and part two here. Foreclosuregate - Get Ready for the Coming Total Destruction of the U.S. Mortgage Market What happens when borrowers lie on their loan applications...the mortgage originators makes loans without any documentation of work or income...the securitiser packages these faulty loans and sells them to investors...the ratings agency says these bad debt investments are just fine to buy...the insurance companies sell default insurance by the bucket-load... and the government happily presides over the whole debacle? We didn't find out in 2010. Chances are we will in 2011... A Rally in a Bull Costume "This rally has gone on for so long most people think it is not a rally at all, but a new bull market. Worldwide, it has taken equities up some 73%... making it one of the greatest rallies ever. What are we to think? Are we alone in thinking it's still a trap? What happened to the problems that led to the crisis of '07-'09?" Both Bill and Admiral Akbar were right. It WAS a trap. Nasty Dan Makes Reader Sad "He's a geopolitical Shinboner with a modem and he's not afraid to use it." Forget the diplomatic cables. Boring. Dan uncovers a much more astounding revelation surrounding Wikileaks founder Julian Assange here. "It's time to save every possible penny. 2011 is going to be worse than 2008 - a lot worse." A colleague of Bill warns: "The problems of 2008 haven't gone away. We've just borrowed a lot more money to make people think everything would be okay. As the veneer wears off, there's going to be a real panic; and this time it will be worse, because there's zero trust and confidence left in the government or the bankers. Here's what I'd do if I were in your shoes..." Night of the Living Zombie Bureaucratic Socialists An army of wealth-stealing Zombies from the government are now on the march. They walk amongst us in broad daylight. And their ludicrous proposals to impose super taxes on every industry and to bludgeon free people into unthinking submission are starting to become a real threat to personal freedom and your ability to achieve financial independence. Dan tries to come up with some rules for defeating these zombies here. It's a Parity Party. And Everyone's Invited. First the Aussie dollar reached parity with the U.S. dollar. Then it reached a new high against the Euro? Is double parity possible in 2011? Come to think of it, is there a currency that isn't invited to this Aussie parity party? Find out here. Gold is Not a Perfect Way of Measuring Wealth, Just the Best Way Gold is inert. Lifeless. Incorruptible. But inherently shiftless. It never gets out of bed in the morning. It has never earned a penny in its entire life. Gold won't make you rich. But it could very well stop you going poor in 2011. Regards, Dan Denning | ||

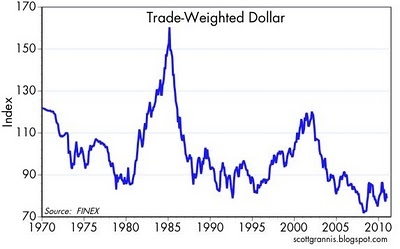

| Year-End Review of Dollar: Very Weak Posted: 31 Dec 2010 07:36 AM PST Calafia Beach Pundit submits: As the year winds down and we survey what's done well and what hasn't, the dollar stands out as not having done much on balance. It's down against the yen, up against the euro, down against the loonie, down against the aussie, and up against the pound. It's about unchanged against a basket of major currencies, weaker against a large basket of currencies, and weaker against the Indian and Chinese currencies. On an inflation-adjusted basis, against a very large basket of trade-weighted currencies, the dollar is weaker on the year. From a long-term perspective, the dollar stands out as very weak, and by one measure (arguably the best) it is now as weak as it's ever been. Complete Story » | ||

| Posted: 31 Dec 2010 05:35 AM PST

Mercenary Links Roundup for Friday, Dec 31st (below the jump).

12-31 Friday

| ||

| The Australian Dollar Ends Year With a Flourish Posted: 31 Dec 2010 04:50 AM PST Dr. Duru submits: I thought it would be fitting to close out another year of blog posts to celebrate the performance of one of my favorite investments: the Australian dollar. Despite beginning the week with another round of tightening by Chinese monetary authorities, the Australian dollar put on another stellar show. The “Aussie” closed the week up over 2% against the U.S. dollar. The currency made fresh all-time highs since it was freely floated against the dollar in 1983. The monthly view shows that the ride has been a wild one to get to this point (data available only to 1990). Complete Story » | ||

| Commodities, Gold Are 'The New Reserve Currency': Kevin Kerr Posted: 31 Dec 2010 04:42 AM PST Hard Assets Investor submits: With over 20 years' experience in natural resources, Kevin Kerr (the "Maniac Trader") is one of the most recognizable analysts in the commodities biz today. Kerr is the president and CEO of Kerr Trading International, editor of the "Global Commodities Alert" and a frequent voice at Hard Assets Investor. Editor Dave Nadig recently sat down with Kevin to talk about how the markets have changed over the past year and where he sees the markets going, including how ETFs and position limits could affect the markets, why investors think of gold as a new reserve currency, and why high commodity prices might just end up being the cure for high prices. Complete Story » | ||

| Themes for 2011: Housing, Jobs, Stocks, Commodities and Dollar Posted: 31 Dec 2010 04:37 AM PST Chris Ciovacco submits: As the global economy shows continued signs of a sustainable economic recovery, there are two notable areas lagging behind: Employment and housing in the United States. Continued trends in these areas could lead to renewed weakness in the U.S. dollar (UUP), which in turn could help boost stock (SPY) and commodity prices (DBC). From a December 26th Bloomberg article:

Complete Story » | ||

| Review of 2010 and Outlook for 2011 Posted: 31 Dec 2010 04:28 AM PST Mark O'Byrne submits: Review of 2010 Summary 2010 was a year that many will be glad to see the back of, due to the deepening of the global economic crisis and the ensuing financial and economic hardship visited upon many. Worst hit were the unfortunately named PIGS with Portugal, Spain, and particularly Greece and Ireland suffering the wrath of the bond vigilantes, austerity measures and deepening economic crises. Complete Story » | ||

| Posted: 31 Dec 2010 03:41 AM PST It's once again time for the obligatory "predictions" for the upcoming year. With the world being a crazier and more chaotic place than ever, such an exercise is inherently masochistic. However, being a good sport, I'll peek into my own crystal ball and attempt to decipher my vision for the future. In keeping with tradition, I must first review my predictions for 2010 (here's where the masochism comes into play). As I attempt to "explain" how and why the world did not unfold as I predicted one year ago, two themes come into play: in one respect, I simply overestimated the speed at which events would progress in 2010; while in the other, I grossly underestimated the human capacity for stupidity. I expected civil unrest in the U.S. in 2010 (as did the U.S. government when it illegally deployed a unit of the U.S. Army on American soil) due to the widespread recognition that the "U.S. economic recovery" was nothing but a propaganda hoax. Instead, placid American sheep went through all of this year still acquiescing to the delusion that the U.S. economy is "growing". Part of the reason I expected the non-existent U.S. "recovery" to be acknowledged is that I considered this the only way that the U.S. government would be able to justify throwing "more than $1 trillion" at the U.S. economy, in attempting to reanimate this corpse. I was wrong here. While the Obama regime threw $800 billion at the U.S. economy (in extending tax-cuts for fat cats), and Bernanke threw another $600 billion at the economy (via more "QE"), these two colossal frauds did so while managing to avoid admitting that all of their rhetoric about a "U.S. economic recovery" was nothing but shameless lies. I also expected clear acknowledgment of a "decoupling" between the U.S. economy (and a few other, weak Western economies) and the rest of the world. Here I was wrong as well. With the American people not even willing to acknowledge their economic fantasy, it was obviously less likely that people across an ocean would see through the façade. I was correct that Western governments would have to make their "choice" between the expediency of more debt and money-printing or attempting to restore fiscal and monetary sanity to their economies. And I was correct that most would choose "expediency" (and future bankruptcy) ahead of attempted restraint. Indeed, the only Western economies which made any attempts at "austerity" were those who had it forced on them through the artificial Euro "debt crisis". Turning to the precious metals market, I was ahead of myself in predicting gold prices: looking for $1500/oz by the spring of this year, and somewhere around $1800 by year end. With respect to silver however, my crystal ball was functioning much more effectively – where I stated that I "would not be surprised to see silver break $30/oz next year – if only briefly". On that high note, let me turn now to 2011. I'll begin with a vow that is sure to disappoint many precious metals enthusiasts who read my work: I will not engage in any general predictions for gold and silver prices going forward – and likely never again. The reason? As is obvious, these markets are now so close to imploding/exploding that any attempt at "predicting" prices in the future is nothing more than facile guess-work. Before disgruntled readers brand me a "cop out", let me attempt to justify that stand. I see a minimum of three dynamics, each of which is highly probable to occur next year, and each of which would cause an eruption in precious metals markets on a scale where "predictions" are impossible and/or useless. | ||

| New Lows for Gold Silver Ratio Posted: 30 Dec 2010 11:51 PM PST Important index challenging key former "support." Breakout (breakdown of the ratio) possible if GSR trades below 44. Gold/Silver Ratio Breakdown Watch to begin 2011. HOUSTON -- The gold/silver ratio (GSR) tickled a 45 handle on Wednesday, at one point trading down to 45.69. The GSR closed Wednesday and Thursday at 46.18, the lowest daily close since December 11, 2006 when this important ratio closed at 45.26 after an intra-day dip to 44.73. The 20-year chart just below is in weekly terms so the intra-day lows do not show, but it does highlight that the GSR is flirting with historic, two-decade lows. Indeed we have reached the point in the 20-year charts that has proven to be overwhelming "support" since 1998. | ||

| Bankclosure: What goes around… Posted: 30 Dec 2010 11:00 PM PST USA Gold | ||

| SIR #12: Quick Service Restaurants Poised for Even Quicker Decline Posted: 30 Dec 2010 10:17 PM PST This report was sent to subscribers on December 29, 2010. Join our free mailing list to receive actionable SIR information 48 hours before it is posted for the public… EXECUTIVE SUMMARY:

• Modest sales growth in 2010 raises concerns about the sustainability of a consumer recovery. • Investor sentiment is largely bullish. Optimistic assumptions, and high stock multiples are pricing in the best-case-scenario. • Three quick service restaurants are particularly vulnerable, and offer exceptional short opportunities:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ The past six months have featured an astonishing run for agriculture (or soft) commodities. Emerging market demand for food products, coupled with currency concerns have charged prices for ALL commodities – with grain, beef, poultry and other "soft" commodity experiencing particularly strong demand.

A global population with a higher standard of living has triggered sharp increases in demand for resource-rich food supplies. From an investment standpoint, this has created an environment for both winners and losers in the agflation environment. At this point, a number of well-known quick service restaurants (QSRs) face a much more difficult business environment, and should wind up on the losing side of the agflation ledger in 2011. Margin Contraction Even in the best of times, operating a nationwide restaurant chain can be a challenging business. Companies in this industry must decide whether they want to compete based on quality of the menu, or based on price. As any Business 101 student understands, the low-price approach must lean heavily on volume – as each individual unit sold accounts for a minuscule profit margin. When competing on quality, the business isn't necessarily any easier. Restaurants must adapt to fickle changes in customer taste, and in challenging economic periods they must still offer value to customers. Diners may be willing to pay more for a healthier or tasty meal, but premium prices can discourage a large portion of potential customers. Many QSRs attempt to offer something to premium customers as well as to the price-conscious diner – with premium sandwiches alongside "value menu" items. But regardless of what approach each QSR chain takes to attract customers, each company is facing the threat of margin contraction in the coming year. The sharp increase in soft commodity prices directly affects food costs. A few well-managed companies have long-term supply contracts in place, or have hedged their exposure using commodity futures. But as these hedges expire and contracts are re-negotiated, food costs will rise, and it will be difficult to pass the higher costs on to consumers. If restaurants have little to no pricing power, and still must accept higher costs, the natural result will be tighter profit margins. As restaurant companies begin to report Q4 earnings, and issue guidance for the coming year, investors should brace for less-than-optimistic news and sharply lower stock prices. Sales Growth (or Lack Thereof) In 2010, US consumers increased their frequency of dining out. Many QSRs saw positive traffic patterns as a result of offering value menu items. Even though profit margins were more constrained, the increase in revenue was a good trade. Earnings began to recover from crisis levels and investors embraced the recovery story. But 2011 could very well be a different story. Consumer confidence has been improving over the past few months, but may be reaching a peak inflection point. Unemployment remains high and several business surveys point to flat year end bonuses (despite improving corporate profitability). To a large degree, the improvement in QSR sales has been driven by lower price points and better perceived value. But with food costs picking up, restaurants may not be able to continue to offer these value items at current prices – and any price increase would invite customers to think twice before hitting the drive-through or walking through the burrito line. It's difficult to come up with a scenario that would allow restaurant companies to significantly increase revenue guidance. A full-fledged economic recovery could provide some support… but even then we would likely face destabilizing inflation trends that would affect profitability. We are much more likely to see revenue growth continue at modest levels if the economy continues a slow rebound – and the potential for a contraction in year-over-year revenue is not out of the question for mature chains who already have a large geographic footprint. The Potential for Disappointment Despite the potential challenges, restaurant investors have been extremely optimistic. Prices for QSR companies have been climbing as companies increase the number of domestic storefronts – and some have been expanding aggressively into emerging market venues. Profit margins have held up relatively well as companies have cut the fat (pardon the pun) out of operations, and in some cases delayed cap-ex investments to keep stores remodeled and in top shape. Barron's recently noted investors are paying premium prices, expecting strong earnings growth to continue. But with macro challenges still casting a shadow on the industry, the danger of disappointment is significant. Premium multiples for growth stocks certainly have their place. When a company is young and growing rapidly – and the economic environment supports this growth – it makes sense to pay up for the opportunity to participate in the growth. But when the majority of traders and investors are caught leaning on the bullish side, with significant challenges mounting, stock prices become vulnerable and nimble traders become profitable. Heading into the New Year, three QSR chains with premium prices look vulnerable. All three have chart patterns that are beginning to break down. And all three could fall a significant distance before value investors decide to step in and risk their capital. So let's take a look at these short opportunities… Chipotle Mexican Grill (CMG)

• Quality ingredients particularly vulnerable to commodity price increase. • Higher priced menu could be a liability if consumer confidence peaks. • EPS growth can't keep up with previous rapid expansion period. • Premium stock multiple leaves plenty of room for disappointment. In July we mentioned Chipotle as a vulnerable restaurant stock with a potential drop ahead… While optimistic investors continued to push the stock higher, the fundamental concerns are still in play. At this point, the only major change is the fact that CMG's price is roughly 70% higher and investors are once again exiting positions, with the chart is looking "toppy." Chipotle has carefully managed their corporate image by focusing on "food with integrity." This means the company seeks to purchase commodities from ethical farming organizations, and is attempting to use organic beef, poultry and pork whenever possible. Considering the rapid growth of the organization, purchasing foods that meet these high standards has become a significant challenge. More importantly, as emerging economies compete for access to agricultural commodities, premium organic foods are going to command an even wider price differential. Also because of the relatively tight supply of premium organic food, CMG could face a number of unexpected supply shocks in the coming months. When a resource is in heavy demand, a small imbalance or unexpected event can have an exaggerated effect on near-term price points. Speaking of prices, Chipotle's menu is relatively simple, and at the high end of the price range for most QSR companies. The management team wants to distance itself from the general QSR category, putting themselves closer to a "casual dining" operation. Logistically, CMG offers a QSR layout and since prices reflect the premium ingredients – the company is vulnerable to any increase in consumer price sensitivity. Up to this point, CMG has generated most of its growth from geographic expansion. Same-store-sales growth have been attractive, but the real benefit is in opening new locations. The company has plenty of cash to burn when it comes to paying for new store openings, but Chipotle is unlikely to get the same impact from new stores that they have experienced in the past. Chipotle has already expanded into the majority of very attractive US cities and now faces challenges when determining where to invest its growth capital. Of course there are plenty of additional locations available – and management is committed to continued geographic expansion. But each new store should see weaker sales levels and tighter margins than store openings over the past three years. Despite these challenges, the stock price still reflects significant investor optimism. Analysts are calling for 21% EPS growth next year, with earnings coming in at $6.57. With the stock priced near $220, investors are paying 33 times forward earnings – a premium growth value that more accurately reflects the company's history than its future growth expectations. If CMG simply meets analyst expectations with earnings growing in the low 20% bracket, I would expect the stock to eventually trade with a multiple in the low 20′s. This would represent a stock price near $145 – or a 34% decline from the current price. However, if CMG stumbles and fails to meet those expectations, all bets are off! Growth investors would likely flee the scene and momentum traders could pile on short exposure. Suggesting the stock could break $100 may sound outrageous today, but if earnings are below $5.00 per share, and investors refuse to give the company a growth multiple, the level could easily be breached. CMG is well off its high, printed in late November. The stock is beginning to roll over and recently broke below the 50 EMA. Momentum traders are likely questioning the wisdom in continuing to play this scenario, and of course value investors will view this stock as too expensive. If CMG doesn't find support soon, it could become one of the first casualties in what could be a dismal year for restaurant stocks. Panera Bread (PNRA)

• Investors are paying a premium growth multiple, and could be blindsided by any flaws in the company's execution. • Stock momentum has slowed with key trendlines in jeopardy. Broken technical support could ignite short interest. Panera Bread has been a strong success story, posting robust earnings growth over the last decade, and maintaining strong performance even during the 2008/09 financial crisis. The company has received accolades from mainstream media outlets including recent favorable press from Businessweek, Forbes, and the Economist. Once again, store expansion has been a significant part of the company's growth – with nearly 1,400 locations operational today. Management will continue to aggressively expand its footprint with roughly 100 new locations expected to open in 2011. But similar to Chipotle, aggressive expansion in the past means that the most attractive store locations are now in place, and it is becoming more challenging to find new opportunities with the same demographics that existing locations enjoy. The Panera Bread management team is working to determine the best strategy for this new period in the company's life-cycle… A period in which cash flow is abundant, and growth opportunities are more difficult to find. With this in mind, management is aggressively repurchasing shares – spending roughly $80 million in the third quarter alone. While there's nothing particularly wrong with this approach, it DOES signal a lack of opportunity as management sees more value in buying shares, instead of more aggressive expansion. Sales growth for PNRA has been surprisingly light – well below the 20% target growth rate for earnings. In 2011, the company expects same-store-sales growth of 7% to 8% for stores open a year and a two year target of 11.5% to 13.5%. This implies that management is counting on slightly increasing margins along with new store openings to supply a significant portion of expected earnings growth. Management expects to be able to increase menu prices by about 1.5% during the coming year – a hike that will not likely cover increases in food costs. So the expectations for 22% earnings growth in the coming year appear to be very optimistic and once again investors will be vulnerable to disappointment. The stock is currently trading at about 23 times expected earnings for next year, which might appear to be reasonable at first blush. But when you consider the risk to earnings growth, the light revenue increases over past quarters, and the potential for margin compression next year, the danger quickly becomes apparent. If PNRA still continues to grow next year, but only increases earnings by 10%, EPS would likely fall below $4.00. If this were to happen, the failure to meet expectations would be a wake up call to investors and traders, and the stock's growth multiple would quickly contract. Using a PE ratio of 15, and EPS of $4.00, PNRA could reasonably trade near $60 sometime in the next year. This would represent a decline of 40% and still assumes growth for the company. Of course, if PNRA sees earnings actually decline during 2011, the stock could be hit much harder. At this point, the stock is only a few percentage points off its high logged in December. But Tuesday's action has pushed the stock below the 20 EMA, which has proven to be support for the stock since the August 1 breakout. If traders cannot recover this line quickly, it could be a psychological defeat that would encourage momentum traders to exit their positions. Keep a close eye on this growth darling as a true breakdown and a failure to hold $100 could set up a very attractive short trade.  Yum! Brands Inc. (YUM)

• Exposure to emerging markets may turn out to be more of a liability than a growth opportunity. • Significant debt raises risk profile for the entire company. If you look at the YUM stock pattern for the majority of 2010, you might confuse Yum! Brands with a small-cap growth stock. After hitting a low of $32.49 in February, the stock tacked on 61%, topping out at $52.47 in early November. However, despite the strong stock performance, YUM as a company has little fundamental strength. The past four quarters feature sales "growth" of (negative 1%), 6%, 4%, and finally 3%. The earnings figures are a bit better with growth of 9%, 23%, 16% and 4% respectively. So despite flat sales increases, YUM has been able to cut costs and keep earnings moving modestly higher. The environment in 2011 should make this feat a little more difficult. Analysts are expecting earnings growth of 13% in 2011, but as food prices continue to march higher, YUM investors are beginning to hit the exits. In order to keep earnings growing at this level, YUM will almost certainly need to increase prices by a significant amount. This could be a difficult feat for franchises such as Taco Bell which cater to low-budget fast service diners. Even higher priced KFC and Pizza Hut will likely face resistance from customers if menu prices are increased by any material amount. When it comes to growth, YUM has significant exposure to emerging markets. For the majority of 2010, the investment community saw this as an asset with China representing the primary growth engine for the global economy. But as the PBOC begins to increase rates and policy makers attack inflation, YUM could see this strategy backfire. Emerging markets may have provided the world with growth over the last several years, but deflationary effects on developed nations, coupled with rampant inflation across the BRIC investment block are causing investors to question long-term growth assumptions. If YUM sees less growth from emerging markets, more competition in the US, and a weak consumer in Europe, then the stock could quickly give back the gains posted in 2010. In fact, a stock multiple of 12 (reasonable for a mature enterprise like YUM) and no change to analyst estimates would still put the stock below $34. At this point, investors seem unconcerned with YUM's 300% debt to equity ratio. As with most major risks, the liability simply doesn't matter… until it DOES matter. Today, YUM has plenty of cash flow to service the debt, and management is willing to carry the leverage to accentuate returns and reinvest in EM expansion. But this level of debt can quickly become a problem if margins are constrained by higher food costs, or revenues are hit by weak emerging markets. The company doesn't have to actually default on any of its debt for the stock to take a significant hit. Just the threat of a liquidity crisis could set off alarm bells and in today's environment investors are more likely to sell first and ask questions later. Over the past several weeks, YUM has been trading in a very tight range. Bullish investors are pretty much done accumulating shares, and are now waiting to see whether the emerging market storm will pass over or become a bigger problem. A break lower would set off technical alarms and attract bearish traders. At the same time, resistance is building between $50 and $52 – a level that will be difficult to breach without significantly positive news out of the company. Higher commodity prices lead to tighter profit margins. Emerging market weakness leads to modest growth or possibly a contraction in earnings. And of course both of these major factors create an attractive environment to capture short profits. Bull Breakout Can Carry Silver to 37.50 With a Spike to 40 Posted: 30 Dec 2010 05:50 PM PST Jesse's cafe | ||

| The Collapse of Price Fixing Will Keep Silver Prices Rising Posted: 30 Dec 2010 05:02 PM PST Reliable market estimates suggest that there around two billion ounces of gold held above ground in bullion, and only one billion ounces of silver. Over time there has been far more silver mined than gold, say around 45 billion ounces, but it has almost all been consumed by industry. Much more of the five million ounces of gold mined by mankind remains. | ||

| Wall Street Journal Aids Silver Price Suppression Posted: 30 Dec 2010 04:33 PM PST | ||

| Posted: 30 Dec 2010 04:00 PM PST Rootsweb | ||

| Silver and Gold Raid/both metals hold up well Posted: 30 Dec 2010 03:55 PM PST | ||

| Video: Silver Shortage This Decade, Silver Will Be Worth More Than Gold Posted: 30 Dec 2010 03:45 PM PST | ||

| Silver/Rhodium to replace Palladium? Posted: 30 Dec 2010 01:54 PM PST Silver/Rhodium to replace Palladium? Japan nano-tech team creates palladium-like alloy: report (AFP) – 21 hours ago TOKYO — Japanese researchers have created an alloy with properties similar to palladium, a precious metal used in many high-tech goods, a news report said Thursday, dubbing the breakthrough "present-day alchemy". Kyoto University professor Hiroshi Kitagawa and his team said they used nano-technology to combine rhodium and silver, elements which do not usually mix, to produce the new composite, the Yomiuri daily said. continued- see http://www.google.com/hostednews/afp...de88768880.4e1 | ||

| Posted: 30 Dec 2010 01:48 PM PST Nifty: Silver Will Be at $50 By Patrick A. Heller December 28, 2010 The Dec. 27 issue of The Wall Street Journal features a front page article titled "Price of Silver Soaring." It is written by Carolyn Cui, who quoted me in another front page article on gold back in September, and Robert Guy Matthews. I could say that The Wall Street Journal is starting to catch up to me as most of the details in the article have already appeared in my previous writings. While the article is largely accurate as far as it goes, it omits so much significant news about what is really going on in the silver market that it is obvious that the Journal still doesn't "get it." The sixth paragraph quotes Stephen Briggs, who is the senior metals strategist at the major French bank BNP Paribus, as saying, "This is a story almost entirely about investment." Well, yes, the silver market has jumped dramatically in 2010 because of soaring investment demand. The article goes on to cite other examples to confirm the increase in demand this year. But nowhere does the article examine why investment demand is soaring. 2009 20 Euro Silver Peace Coin 2009 20 Euro Silver Peace Coin The first silver collector coin to be issued by the Mint of Finland with a face value of 20 Euros. Get your coin today! The real reasons why investment demand for silver has soared are also the reasons why I believe that silver prices will jump by an even higher percentage in 2011 than they have for 2010. That will push it beyond $50. A recently released video featuring two talking bears can be viewed at http://www.zerohedge.com/article/jp-...pulation-story. [Note: I was unable to bring up this article by clicking on this essay, but it worked if I entered it directly (and, yes, whistleblower is misspelled in the accurate Web address). If this does not work for you might want to direct people to www.zerohedge.com, have them click on "News" and search for "JP Morgue Whistleblowers Are Back."] Several points in this video are supposedly derived from a JPMorgan Chase insider who has confirmed several suspicions of mine. I cannot vouch for the accuracy of the assertion that this is really from a JPMorgan Chase insider or that the alleged insider made the allegations stated in the video. However, the information in the video which I could crosscheck matches what is available from multiple sources, so it is plausible that most or all of the information could be accurate. Among the reasons that I anticipate an even greater percentage increase in 2011 silver prices compared to the strong 2010 results are: 1. The London Bullion Market Association (LBMA) has virtually no silver available to fulfill contract obligations. At the March 25, 2010, Commodity Futures Trading Commission (CFTC) hearings, both Jeffrey Christian and Adrian Douglas testified that gold and silver markets in London, which are theoretically 100 percent backed by metal, only had enough gold and silver in the vaults to cover 1-3 percent of the contracts. 2. The London gold and silver markets are both in backwardation. In normal commodity markets, futures prices are higher than the current month, or "spot," price. The higher future prices normally reflect the prevailing interest rate less a small amount for storage costs. This normal condition is called contango. When a market is in backwardation, this is an indication of a severe supply squeeze. In other words, that means that there is insufficient physical commodity to fulfill maturing contracts (let alone future contracts). For more than a year, the London gold market one and three months contracts have been in backwardation - meaning that the spot month price was higher than the prices of these future contracts. Since Nov. 5, the six-month contract has also been in backwardation, which has never occurred in the London market during the available database that goes back to 1989. In silver, the supply shortage is more extreme, where the six-month contract has been in backwardation for much of the past year, and continuously since June 2. The only way to cure a market in backwardation is for prices to rise high enough to reduce demand and to encourage greater supply. 3. Testimony at the CFTC hearing in March pointed a direct finger at JPMorgan Chase's London office for suppressing prices in the silver market. The whistleblower, Andrew Maguire, also released copies of his e-mails with CFTC enforcement personnel to show how he tried to provide this information to the CFTC in the months before this hearing, but had not received a satisfactory response. 4. On Oct. 26, CFTC Commissioner Bart Chilton issued a statement saying he is convinced there have been violations of the Commodity Exchange Act with respect to the silver market that resulted in the suppression and manipulation of prices. He urged prosecution of the guilty parties. 5. Starting on Oct. 27, a series of lawsuits (now about 25 or so) were filed against JPMorgan Chase and HSBC, the two banks suspected of having the largest silver short positions on the New York COMEX. Two of the suits were filed by law firms who hold the records for collecting the largest settlements under the Sherman Anti-Trust Act, Commodity Exchange Act, and Investment Company Act. These are firms who are able to cherry-pick the cases they expect to win easily, so they need to be taken seriously. 6. After failing to report - and even denying - that big banks such as JPMorgan Chase had been holding a large short position in the COMEX silver market, the mainstream financial media started reporting a few weeks ago that JPMorgan Chase had reduced its short position since the beginning of 2010. In a Dec. 13 letter to CFTC Commissioner Chilton, analyst Adrian Douglas drew attention to the fact that U.S. banks have been reducing their COMEX gold and silver market short positions over the course of 2010. However, foreign banks that are exempt from CFTC regulations have been increasing their short sales. In the silver market, the new short positions from foreign banks over the past five months have more than offset the decline in U.S. bank short positions. As a result, total short positions continue to rise. You can review a copy of Douglas's letter to Chilton at https://marketforceanalysis.com/arti...le_112010.html. At the Dec. 16 CFTC hearings, Chilton shared much of the information from Douglas's letter, implying that U.S. banks may be trying to hide their short positions by moving them behind foreign fronts. 7. There are a growing number of reports that owners of COMEX gold and silver contracts, who elect to take delivery upon contract maturity, are being settled for cash instead of with physical metal. In examining the daily movements of silver in and out of COMEX warehouses, the total inventories have declined more than 10 percent since midJune. The analysis also shows that when a large deposit of physical silver comes into the COMEX, it is invariably withdrawn within two trading days. To me that is a sign that there is more demand for metal than the COMEX can supply. 8. Since early October, the 10-year US Treasury debt interest rate has jumped 35 percent. This is a significant sign that the value of the U.S. dollar will fall in the next few months. 9. One of my most accurate sources of inside information, a London metals trader, stated in a recent interview that gold and silver buyers in the Far East were having such great difficulty locating physical metal to purchase that they were now buying paper contracts in order to dump billions of U.S. dollars. It is the purported plan of these buyers to later purchase physical metals as they are able to locate any quantities, with little regard to how much above the spot price they may have to pay, and close out the corresponding amount of paper contracts as they do. In the video posted at zerohedge.com, the last tidbit of information is that JPMorgan Chase may be shorting silver to the Chinese government as part of this activity. 10. Much of the gold sold by the International Monetary Fund was channeled through the Bank for International Settlements. The largest chunk of this gold was purchased by India's central bank. India's purchases have supposedly been deposited into unallocated storage - where they may be subject to multiple ownership claims. Because of the risk of losing ownership of gold placed in unallocated storage, a growing number of Far East and Middle East buyers of gold and silver are removing their purchases from London vaults to other locations where this risk is absent. If the London contracts really were backed 100 percent by the underlying metal, this would not matter. But, as you can see from the foregoing information, the decline of physical gold and silver stored in London's vaults is starting to matter very much. The above list is not exhaustive of all the reasons why I expect silver prices to soar in 2011, possibly within the next two months. However, I think you better understand that the reason for the strong investment demand for silver (and also gold). It stems from an expectation of a huge drop in the value of the U.S. dollar and an almost total collapse in the trading of "paper" silver (and gold). While the Journal article mentions a projected 2010 surplus of more than 64 million ounces of silver, this figure does not account for the huge silver short contracts that, literally every day, are coming closer to imploding and inflicting huge losses on those who do not have physical silver in their direct custody or stored in segregated storage under their personal name. For The Wall Street Journal to even give front page coverage to the silver market is an encouraging sign that the general public is starting to realize what is happening. I hope that the Journal's reporters can pursue this story even further. I am confident that this would result in an even more eye-opening story for the newspaper's readership. http://www.numismaster.com/ta/numis/...rticleId=16521 | ||

| Posted: 30 Dec 2010 01:04 PM PST Market data as of Dec 23. Dow Jones Industrial Average: Closed at 11559.49 +26.33, climbing a wall of worry filled with peaking signals and patterns. Yet, we think some positive news in our capitol on tax legislation has helped traders continue to hold and not enter a larger selling event. Price is now solidly above 11500 support and is showing signs of providing another trend similar to last year. During that event, we had a pre-Christmas rally that peaked in the middle of January. Volume today was typical pre-holiday lower on rising momentum as price remained above all moving averages, which is bullish. The first ten days of January normally sets the tone for trading for the entire year. This year, however, we expect a two week rally peaking about January 15th and then selling-off on profit-taking. This then is followed by a new inflation driven rally with a forecast of stronger selling in May-June. The credit markets, we think will provide major selling pressures in the last half of 2011. Traders and investors should think about this and plan accordingly. S&P 500 Index: Closed at 1258.84 +4.24 on 80% of normal volume and mildly rising momentum. Price is above all moving averages, which is bullish. Support is solid at 1250. We had expected something more than a very mild correction this fall but there is so much hot money for trading sloshing around, the selling was hardly noticeable. On the daily chart the S&P has completed a five wave rally up and should be next followed by the standard ABC correction. Since the move is super-imposed over the holiday, we suggest it's a yawner and that normal bullish trading resumes when traders return on the 27th for the last week of the year. S&P 100 Index: Closed at 565.96 +2.27 on lower volume and gently rising momentum. Price has completed the five wave rally and now enters the ABC correction (mild) just like the S&P 500 chart. The price of 560 is new major support and 570 is new resistance. Normally the movements and patterns on this index mirror the the S&P 500 but do it with more modesty and less extremes. Since today's chart is more aggressively, identical, we suggest the new buying after Christmas could potentially be more aggressive and faster until January 15th. Nasdaq 100 Index: Closed at 2235.91 +1.34 on lower volume and flat momentum for the holiday. Price is bullish over all moving averages. The price of 2250 is new resistance with 2200 on support. The five wave rally is complete and the ABC correction (mild) transpires over the holiday weekend. Our forecast for this index is 2250 by Friday, December 21 with resumption of buying on the 27th next week. 30-Year Treasury Bonds: Closed at 120.78 -0.41 after momentum hit the basement and price finally supported at the critical level of 118.50 last Friday. Bonds are on stronger support at that lower number from one year ago. There was also similar support last May. As stocks rise until January 15th, bonds will continue to be under pressure and we forecast the price to once again move back to 118.50 before any recovery. That recovery will be tepid to poor remaining weak for the first quarter of 2011. The primary danger to all markets would be the problems from Europe that continue to escalate. In our view, sometime in 2011, something busts the credit markets with very serious consequences. For now, we think we are safe for the first half of 2011. However, that may be stretching it and being too hopeful. Today, Bloomberg reported Spain would be in dumps for the next five years. These are not good signals for the longer view. Gold: Closed at 1385.30 +0.60 after completion of an ABC mild correction and the start of the next rally. Price is above all moving averages with the 20-day offering support at 1382.50 going into the holiday. Momentum peaked in mid-October and has been steadily declining since that time. However, we see it as a rest on flat trading and topping action after a longer rally. Look for gold to trade sideways in chop with a down bias until the 27th when trader's return to buy more and drive the prices higher. The price of 1407 is new resistance for gold futures. Silver: Closed at 29.25 -0.05 with peaking and mildly selling momentum and showing a very aggressive up-biased ABC correction. In that correction we saw a stronger bear A wave going lower but price immediately jumped up in higher than normal B wave. The C wave down to finish had a higher than normal bottom (bullish) followed by a new one wave of five up to begin the new rally. In summary, the buy side has demonstrated abnormal power and the pattern tells us on the next break out, we might expect something dramatic with a very hard rally through $30 to about $32.48 on a peak near the first of February, 2011. Gold & Silver Index XAU: Closed at 219.16 -1.65 on flattening momentum and the flatter to selling metal to shares ratio. These signals to say to me that this is pre-holiday resting not so much a selling signal. Further, the more important weekly chart has more positive momentum, metal-shares-ratio signals and a definitive up trend for price. These things summarize as a bull market for the shares after Christmas lasting at least until mid-January. Expect a rally taking price back to the recent high near 230 to form a bear double top to sell in about three weeks. U.S. Dollar Index: Closed at 80.66 -0.06 firmly sitting on 80.00 as a major number support and resistance. Momentum is flat and price is channeled and choppy for a few days. The weaker Euro is supporting the dollar. The bullish Swiss has broken out as Eurolanders dump Euros for Swiss Francs. These are bullish moves for the dollar. We forecast that the dollar after touching nearly 80.75 this week will go back there and try to break out and through 80.50-81.50, which is very difficult and hard resistance. If the Euro falls under 118.50 and its only two points away right now, the dollar will break out and sell commodities somewhat. On the other hand there are so many credit problems, gold and silver will ignore a rising dollar and keep right on buying. Crude Oil: Closed at 90.63 +0.87 on flat to rising momentum and riding on a new breakout on fundamental shortage news. The trading range for oil is 88.50 to 92.50. After 92.50 we see 96.50 resistance on a longer range up-channel line. Oil is going over $100 in 2011 and we think inflation might even create $5.00 gasoline. The USA embargo on gasoline into Iran has tripled gas prices on the street for them from a subsidized $.38 per gallon to $1.52 US. Iran has little or no refining capacity and must import refined unleaded. Inflation is now on the table across the board in most all commodities with copper hitting $4.20 today. Traders and investors should consider some long positions in the energy sector with an eye for risk on a credit accident. CRB: Closed at 328.11 +1.31 on rising oil and other commodities. Cotton trading twice hit the daily limit up in the past few trading days. This temporarily stopped traders on circuit breakers. With oil in a larger bull market, watch for the precious metals to follow with this entire market sector moving-up smartly. Support is the 20-day average at 316.65 and the five day moving average sitting at 324.47 for nearby support. The price of 340 is new resistance and that is where we are going next. Please ignore the greenie type trading and shares. Stick with crude oil, natural gas, coal and the standard components of energy. This is where the power comes from and where you can make some good trades and investments. -Traderrog This posting includes an audio/video/photo media file: Download Now | ||

| Posted: 30 Dec 2010 09:18 AM PST http://goldcalc.com/ Kinda interesting but I think it's unrealistic to expect to get spot for gold that has to be melted/refined.... :s9: | ||

| Posted: 30 Dec 2010 07:55 AM PST

Mercenary Links Roundup for Thursday, Dec 30th (below the jump).

12-30 Thursday

| ||

| Gold Seeker Closing Report: Gold and Silver Fall Slightly Posted: 30 Dec 2010 07:13 AM PST Gold saw a $2 gain at $1415 in Asia before it fell back off in London and morning New York trade to as low as $1402.15 by about noon EST, but it then rallied back higher in afternoon trade and ended with a loss of just 0.55%. Silver climbed over 1% to as high as $30.90 in Asia before it fell to as low as $30.295 by midday in New York, but it then rallied back higher into the close and ended with a loss of just 0.39%. | ||

| The Last Angry Man’s Problem With IMF Gold Sales Posted: 30 Dec 2010 05:00 AM PST Adrian Ash of BullionVault.com writes that "the International Monetary Fund said it has completed the gold bullion sales program begun in October 2009," and now 403 tonnes of gold have been sold. I bring this up all the time because the whole thing pisses me off because we gave those IMF bastards the gold to provide gold-standard legitimacy for their stupid fiat currency, the Special Drawing Right (SDR). And yet here they are selling the gold we loaned them! Gaaahhh! Mr. Ash is apparently not particularly interested in how I have such a low opinion of the IMF and its little empires of crooks and liars, probably because, at the root, they are just more corrupt bankers, and it is always bankers who are the source of all economic problems, as they are the ones who can create money out of thin air just by making an accounting notation. Oddly enough, early in my career, I tried this "accounting notation" approach with my boss as a way to "fix" the problem of my poor work performance and dismal results, instead of firing me on the spot, which was her original plan. The way I explained it was that my Brilliant Mogambo Plan (BMP) was inspired by the fact that We're Freaking Doomed (WFD) because the foul Federal Reserve is creating so much money. Thus inspired, I suggested that we likewise bring sales forward by creating them out of that selfsame thin air, we book the sales as a profit, thus showing that I am highly profitable, and not incompetent as implied in those lying Quarterly Employee Performance Evaluations. When she asked, with this stupid look of confusion on her face, "Huh? What? How did you get into my office?" I allayed her natural suspicions by telling her that I figured that this would be offset by subsequent cancellations of those sales, along with our "paying" penalties for breaking the contracts, meaning that, in effect, we would deduct these additional phantom expenses from income to shelter real income from taxation, turning a loss into a profit, everybody's happy, and we would both get all kinds of terrific bonuses and awards and promotions, and make a lot more money, too! I remember leaning in towards her and whispering, "All it would take is for the accounting department to 'play ball' with us to somehow create money out of thin air, and it is your job to get their compliance and complicity, like Wall Street lobbyists extort compliance from Congress!" The rest of the story is too ugly to talk about, and suffice it to say that it did not turn out well for me, the moral of which seems to be that creating things out of thin air, like money or sales, is a Very Bad Idea (VBI). I could tell by the look of puzzlement on Mr. Ash's face that he probably wonders what in the hell some stupid story, by some stupid guy, about some stupid tax fraud proposed a long time ago, and that probably never happened at all, has to do with gold, or the IMF, or anything that anyone cares about. Suddenly, I realized he was right! So I sat down and shut up, and was pretty embarrassed until he said, "Some 57% of the 403-tonne total was bought directly by central banks, led by India." Inquisitive and suspicious, I wondered, "How much gold is that in terms of ounces?" Quickly, my Agile Mogambo Mind (AMM) set to the task of multiplying 32,150 ounces per tonne times 403 tonnes, only to realize I have no idea what I am doing, and sure to be wrong, as I have been so, so wrong so, so many times about so, so many things, including, and especially, math, ranking, as it does, second on the list of Things That Confuse The Mogambo (TTCTM), losing the top spot to, "What women want and why they just don't shut up when I tell them to shut up about my not knowing what they want like I am some kind of stupid mind-reader or something." That is why I am happy to report that, thanks to some help, we know that 32,150 ounces times 403 tonnes is just under 13 million ounces, which actually ain't much at $1,400 an ounce, amounting to a lousy $18 billion, which is so little money in an age when the word "trillion" and "trillions" appears so many times in the literature, including that magazine reader who wrote in to say that he liked the beautiful Miss February so much that he could stare at her for a trillion years and never get tired of it. The point is not that I am rambling and apparently have forgotten to take my pills this morning, but that central banks, Junior Mogambo Rangers (JMRs) and everybody else is buying gold, gold, gold, which should indicate to you that you should, too. And if you don't, you will learn that life can be hard, instead of easy, and which is so easy to achieve because merely buying gold and silver is enough, making it so, so easy that you giggle as you say, "Whee! This investing stuff is easy!" The Mogambo Guru The Last Angry Man's Problem With IMF Gold Sales originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." | ||

| Global Macro Notes: Twelve Major Risks for 2011 Posted: 30 Dec 2010 04:54 AM PST

With more explanation to follow, here are Jensen's 12 risks in brief:

Against a backdrop of extreme bullish complacency, with many professional prognosticators seeing little to no risk at all through their rose-colored glasses, a discussion of "gray swans" — not so hidden risks of low probability but potential high impact — feels appropriate here. As traders we have very little respect for overly precise market forecasts, especially smug ones. We're more inclined to agree with Howard Marks (see box). No one can have absolute certainty as to what the future holds, which makes single-track forecasts ("the S&P will do this" etc.) an exercise in folly. And such unshakeable faith is not required anyway, because markets are an odds game. Regardless of conviction, the most clear and compelling scenario can be utterly upended by a single variable that no one expected (or did not weight heavily enough). So why isn't probabilistic thinking more popular? Probably because it is alien to conventional thought patterns (and often hostile to the ego). Say, for example, there is a dominant "goldilocks" scenario in which everything goes right. This in fact seems the horse many are betting on. In the absence of any wild cards, 2011 could be a smooth year, propelled by the ongoing stimulative policies of Western governments, robust emerging market growth, and a slowly recovering U.S. economy. But now further say there are a dozen top down shocks (i.e. "goldilocks derailment scenarios") that could disrupt the market if any single one occurred. If each of these dozen shocks has a mere 6% chance of derailing the markets, what are the odds of goldilocks sailing through the year unscathed (avoiding all twelve)? A mere 47.6%, or worse than coin flip… even though each "shock" had only a 6% chance of occurring. As low probability risks add up, the realistic chance of avoiding them all goes down. The confident predictors are thus the ones with egg on their faces. You can't really point to a gray swan scenario with only single-digit percentage odds and say "THIS, for certain, will destroy the bull case." But nor can one confidently embrace the goldilocks case, given so many landmines that the odds of dodging them all are slim. The year could go either way, and that's just the way it is. The answer to this "forecaster's dilemma"? Give up the childish need for certainty, or rather:

Another reason to think probabilistically is the utility of reward to risk profiles — and the tendency of large payoffs to be associated with lower probability outcomes. For instance, which of these trades sounds more attractive:

Trade "A" will come up a winner less than 1 time out of 3, but returns $5 for every $1 risked, thus creating a nicely positive expectation. (If you could do this trade 1,000 times, you would make a lot of money). The second trade wins almost every time (9 out of 10), but pays only 20 cents for every $1 risked, with the occasional disaster in which $10 or more is lost. Do this trade enough times and you will look smart and sophisticated — right up until the day your account blows up. Amusingly, trade "B" is the rough equivalent of what many investors do in their quixotic quest for certainty. They mistake a high degree of certainty as the sole criteria for a good bet… or worse still, convince themselves they "know" and pretend as if they aren't wagering at all.  Now let's take a closer look at Jensen's "Dirty Dozen" — not all twelve, but the handful that stand out in light of our own scenario building:

Lest it be said we are die-hard bears, it remains possible that all these serious risks are avoided (or otherwise "contained" for another few quarters). That is why there are a number of attractive long positions — not just shorts — in the Mercenary portfolios. At the end of the day we are neither bulls nor bears, but traders — ready to maximize opportunity come what may. | ||

| Posted: 30 Dec 2010 04:52 AM PST China's Gold Rush By Tony D'Altorio The United States has become an exporting nation once again. But this time, it's exporting inflation thanks to Ben Bernanke and his QE1 and QE2. The countries affected the most, naturally, are those pegged to the U.S. dollar. Like China. A weakened dollar means pricier commodities across the board. And that inevitably means food and fuel prices going up as well. Chinese government authorities have tackled rising inflation by raising interest rates twice already in the past few months. And they'll likely have to hike them again in the new year. If not, their other choice is elevating their currency value, something the U.S. government has wanted for a while. Funny how it works out that way… Yet also ironic is how the Federal Reserve's actions have unleashed other forces. China's Inflation With inflation on the rise in China, the Chinese have developed into huge gold bugs. Sure, they always have enjoyed the shiny commodity. But China's love affair with gold ended when the Communists took over in 1949. The new rulers declared the metal bourgeois and assumed control of all gold mines. But now it has reemerged as a popular hedge against inflation and currency appreciation. More than likely, the Fed didn't intend for that to happen as it plotted and schemed. Chinese inflation data for November showed prices up 5.1% from the previous year, the sharpest increase since July 2008. Much of that happened in the food sector, like the 60% hike in vegetable prices year-on-year. Combined, rising inflation and low Chinese interest rates often turn bank deposit returns into the red in real terms. Chinese households keep about $2 trillion in such accounts, with few other options to store their cash. Add to that falling real estate investments and a slump in the stock market – both due to government intervention – and mainstream China has few other options. So gold products simply work best for them in the end. Chinese Gold Imports The U.S. government wants China to become a bigger importer. And it looks like they got their wish as Chinese gold imports soared in 2010. Already the world's biggest gold mining country, China has now turned into a major buyer. It imported over 209 metric tons of gold during the first ten months of the year… a fivefold increase from the estimated 45 metric tons in 2009. And according to the World Gold Council, Chinese retail demand for the metal jumped 70% to 153.2 tons October 09' – September '10 compared with the previous 12 months. Yet demand for gold jewelry rose just 8% during the same period to 373.6 tons. This highlights gold's increasing popularity as a hedge against inflation and economic uncertainties. China's bullion bullishness is clearly having a big effect on global markets. Its buying surge even threatens to upset India as the world's largest gold consumer. Chinese demand in 2010 is expected at around 600 tons, just behind India's 610. Gold-linked investment products, or paper gold, are also multiplying in China. The government recently approved its first overseas, gold-backed ETFs. Similarly, Hong Kong's bullion exchange announced a gold contract denominated in renminbi, expected to launch in early 2011. Gold Investments China's gold rush has to be making gold investors smile at this point. Private Chinese gold demand has risen 26% annually by volume in the last decade. And between the Chinese government opening its gold market and the Fed's inflation quest, this trend looks set to continue. As Walter de Wet of Standard Bank in London said, "The trend is undeniable – gold demand in China is rising rapidly." U.S. investors don't have to worry about missing out either. They can purchase gold coins, bullion or individual stocks such as Randgold Resources ADR (Nasdaq: GOLD). Or there are always ETFs such as two from Van Eck: Market Vectors Gold Miners (NYSE: GDX) and Market Vectors Junior Gold Miners (NYSE: GDXJ). If those don't look good enough, some ETFs claim to be backed by gold bullion. That includes SPDR Gold Trust (NYSE: GLD) and ETFS Gold Trust (NYSE: SGOL). With China renewing its centuries-old love affair with gold, these investments will put a shine on investors' portfolios for some time to come. Disclosure: Investment U expressly forbids its writers from having a financial interest in any security they recommend to our subscribers. All employees and agents of Investment U (and affiliated companies) must wait 24 hours after an initial trade recommendation is published on online - or 72 hours after a direct mail publication is sent - before acting on that recommendation. http://seekingalpha.com/article/2441...h?source=yahoo | ||

| Some thoughts about the manipulation of gold and silver prices. Posted: 30 Dec 2010 04:04 AM PST | ||

| Gold and silver shorts losing control, Turk tells King World News Posted: 30 Dec 2010 03:54 AM PST | ||

| Gold / Silver ratio reconsidered Posted: 30 Dec 2010 03:33 AM PST | ||

| Forget gold, how about playing the spike in the silver price? Posted: 30 Dec 2010 03:18 AM PST Citywire | ||

| Posted: 30 Dec 2010 03:03 AM PST After seeing yet another newbie thread asking for advice on investing in PM's semi-breakdown into yet another semi-argument over prep'ing and the collapse of civilization, I thought it best to start a new thread rather than address this on that particular discussion. Personally, I think it's doing a disservice to newbies, and to GIM2, to jump in and scare the fool out of every newbie that comes along. I'm talking about folks who discover this site through researching a move into Gold and Silver. If they enter the site asking about preps it's quite another story. I am not against prep'ing or the hard core prep'ers. However, I do think it needs to be considered that not everyone shares the expectation of a Mad Max world, even if an economic collapse comes to be. While I do think preps are a good thing, I do not think that people on a limited budget should necessarily put them ahead of protecting financial savings. It seems to me that PM's serve all situations... after all, that's a big part of why GIM2 attracts prep'ers in the first place. Therefore newbies interested in metals should be left to explore and learn about them without having to bring in the whole TEOTWAWKI discussion every time one joins GIM2 looking for PM info. I'm all for prep'ing, but frankly I can't see it coming before PM's. PM's are probably good in most any scenario. Food is good in some. Guns and ammo only in the most extreme... and, BTW, Hollywood has the whole Mad Max, The Road, A Boy and His Dog, post apocalyptic thing wrong... if there are few people left then there will be plenty of resources... if there are limited resources it will be because there are millions of people competing for them (more than you can ward off with a shotgun or a semi-auto plinker). 1) If our current economic woes do manage to be resolved, PM's are still a good thing to have. Let's face it, fiat money is here to stay unless there is a total sea-change. PM's will hold value regardless. 2) If we go through an extended economic depression, PM's will be great to have. With a pocket full of Gold you are mobile. You can move where the best opportunities exist. Not so much with a bunker full of canned goods and ammo. 3) If the US and/or world goes into total economic collapse, PM's will be an essential thing to have. Gold is money, and having money when others have none is a key survival tool. 4) If society disintegrates into total lawlessness, PM's will be a fantastic thing to have. They'll buy your way into a group for protection. They'll buy you food and shelter. And, they'll buy you better weapons than you can legally own now in most civilized countries. I'm going to leave it at that for the moment. My point being, advising newbies interested in investing in PM's to instead go spend their money on food and ammo is doing them a disservice in all but the most extreme of possible futures... and even in those extremes PM's may well be just as good or better than preps. As Sgt-Maj Plumley said in We Were Soldiers when the Col suggested he arm himself with an M-16, "Sir, if the time comes I need one, there'll be plenty lying on the ground." Extrapolate. | ||

| Gold Consolidates Over $1400/oz - CFTC Data Bullish - Silver Nominal 30 Year High Posted: 30 Dec 2010 01:24 AM PST gold.ie | ||

| Gold 2011: "Old Normal" Returns Posted: 29 Dec 2010 10:59 PM PST | ||

| Gold coins in India are sold like hot cakes Posted: 29 Dec 2010 08:34 PM PST Image:  Here's a gold-related story that reader 'David in California' admitted he stole from Kitco. It's filed from Mumbai... posted at the commodityonline.com website... and is headlined "Gold coins in India are sold like hot cakes". It's a handful of short paragraphs... and the link is here. | ||

| Posted: 29 Dec 2010 08:34 PM PST Image:  The next item for you today is a 7 minute 11 second interview with Jim Rickards over at cnbc.com's 'Squawk Box'. This interview is about the yuan, the dollar... and the bail out of Europe. As you are already aware, I have all the time in the world for whatever Jim has to say on any subject... and this interview is no exception. I thank Casey Research's own Bud Conrad for bringing this story to my attention. The link is here. | ||

| Ted Butler on Silver Manipulation Problem Posted: 29 Dec 2010 08:34 PM PST Image:  I mentioned this last story to Ted Butler yesterday afternoon... and he pointed out his attempt of 21 years ago to involve then-Attorney General Thornburgh in the silver manipulation problem... with no results. Ted points out in the first paragraph of this letter than he had already spent three years trying "to expose and eliminate, through the proper channels, a massive fraud and manipulation in one of our leading commodity markets." The letter is dated April 25, 1989... long before the Internet was in common use. | ||

| Posted: 29 Dec 2010 08:34 PM PST Image:  The next story is a rather longish read that was posted in the December 29th edition of Newsweek of all places. It showed up in a GATA release yesterday... and is headlined "Everything Gold Is New Again". The author, Shayne Mcguire, has been featured in this column several times over the last year or so... and his was one of the first U.S. | ||

| Silver Closes At Another 30-Year High Posted: 29 Dec 2010 08:34 PM PST Gold and Silver Shorts Are Losing Control: James Turk. Everything Gold Is New Again. Gold coins in India are sold like hot cakes. I'm still 'all in'. ¤ Yesterday in Gold and SilverWednesday's price action wasn't particularly exciting... with the gold price hovering around unchanged by the time that Far East... and most of London trading... was done... and the New York open came around. Once the London p.m. gold fix was in at 10:00 a.m. in New York, the gold price ran up a quick five bucks or so... and then did next to nothing for the rest of the day.

Silver was up about 15 cents by the time New York trading began yesterday morning... and then added about a dime after 10:00 a.m. Eastern before trading sideways into the close.

The world's reserve currency gave back almost all of its Tuesday's gains during Wednesday's trading day. Between the open in the Far East... and 11:00 a.m. in New York, the dollar slide a bit over 20 basis points. Then, at 11:00 a.m. sharp, the dollar sell-off became somewhat more serious... and by 1:15 p.m. Eastern was down another 50 basis points before recovering a hair into the New York close. And, like Tuesday, the dramatic dollar action had no effect whatsoever on gold or silver prices.

The gold shares pretty much followed the gold price 'action'... such as it was... and the HUI closed up 0.45% on the day. As I mentioned yesterday, once the Toronto stock market opened yesterday for the first time since December 24th, the junior silver and gold companies went on a tear... especially the smaller silver companies... with gains in the 6-12% range a common sight.

The CME Delivery Report wasn't overly exciting either... as only 43 gold and 22 silver contracts were posted for delivery on Friday. JPMorgan, Bank of Nova Scotia and Deutsche Bank were front and centre as per usual. The link is here. There were no reported changes in either GLD or SLV yesterday... and no sales report from the U.S. Mint, either. However, over at the Comex-approved depositories, another big chunk of silver was withdrawn from their collective inventories on Tuesday. This time it was 614,039 troy ounces... and the link to that action is here.