Gold World News Flash |

- COMEX Daily Report

- The Outlook for 2011

- Just Another Panic Monday for Shorts, Will Tomorrow be Their Funday?

- COT Update to Graphs

- Gold Seeker Closing Report: Gold and Silver Close At New Highs

- Crude Oil Rises but Underperforms Equities, Gold Carves out an Ascending Triangle

- Social Network: Tech Bubble 2.0?

- This Is Bad News For Dollar Bulls: India To Stop Using The Dollar In Oil Trading With Iran

- Sovereign Man's 2010 Look Back And 2011 Predictions

- The Housing Market Could Get Annihilated In 2011...

- The Reweighting of Commodity Indices

- Is The World's Richest Man, Carlos Slim, Entering The Silver Fray?

- Likely new White House chief of staff has bided time at Morgan Chase

- Competitive devaluations continue as Chile weakens peso against dollar

- James Turk: Gold rises in 2010 to end a stellar decade

- Gold Price Gained Only $1.50, Was it a Good Idea to Prefer Silver to Gold Over the Last Year?

- MONDAY Market Excerpts

- The Nomadic Nature of Money

- While the entire world looks on at the despair being seen in places such as Greece and Ireland, many are failing to see what is fast becoming the worst economy in the developed world, America.

- Crash JP Morgan Buy Silver – Stop the Ebola Virus of Wall St. from spreading any further

- Our 2011 Forecasts

- Graham Summers’ Free Weekly Market Forecast (Hold the Line Edition)

- How Much is Facebook Really Worth?

- Byron Wien's Prediction Track Record: Zero Out Of Ten

- Dollar Index: One Way Or Another, It's Going To Hurt

- Ian Gordon: Bundle Up for Bitter Kondratieff Winter

- In The News Today

- Gold Price Rising Faster in Euros Than in Dollars

- Gold Daily and Silver Weekly Charts

- COT Gold, Silver and US Dollar Index Report - January 3, 2011

- Manipulated Monday – New Year Starts with a Bang

- Blackstone sees gold at US$1,600, Treasury yields to rise 5%

- Correlation Desks Gone Apeshit: Announcement Gov't To Allow 13 Oil Firms To Restart GOM Drilling Whacks... Silver??!!

- Gold Ending Diagonal?

- Gold buying in India continues unabated

- Video: Why Gold Should Surpass $1650 This Year

- Guest Post: “I argue that North has set the stage for a face-saving retreat of support for the gold standard that has gained so much support and sway among many alternative economics circles and individuals in the past few years.”

- Is zillionaire Slim taking a position in silver?

- update 03/01/2011

- George Soros: The United States Must Stop Resisting The Orderly Decline Of The Dollar, The Coming Global Currency And The New World Order

- The Plight of the Baby Boomers

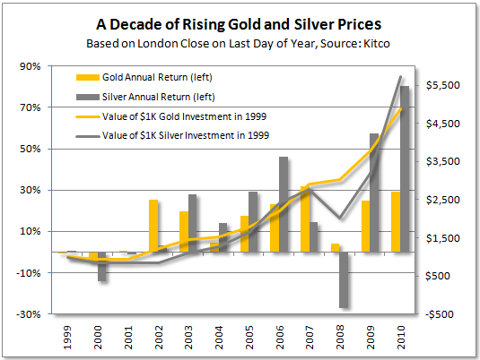

- A Decade of Gains for Gold and Silver

- How You Trade the Big Trends in 2011

- Gold climbs above $1,420 as 2011 gets underway

- 2-Year High for Oil Pushes the Loonie Higher

- Question of the Month Winners

- Predictions for 2011

- Inflation & Hyperinflation: One...or Both?

- US Mint Sales: 2010 Proof Silver Eagles Sell Out

- Silver Leads the Way

| Posted: 03 Jan 2011 06:00 PM PST Economic numbers from the US are very positive which suggests more gains in store for commodities. If the global economy continues to grow at a sustained pace then (A) Expectations of higher interest rates will rise (B) Treasury yields will all also rise. This combination will reduce the pace of the rise of gold and other commodities. Higher interest rates will imply lower speculative flows into commodities which has been the key driver in 2010. |

| Posted: 03 Jan 2011 05:22 PM PST FGMR - Free Gold Money Report January 3, 2011 – It is that time of the year again to record my expectations and outlook for the year ahead. But before looking at 2011, as always I first re-visit what I was expecting for this past year in order to evaluate whether my forecasts were close to the mark. My forecasts for 2010 were driven by my expectation that paper assets would continue the well-established trend that began with the outbreak of financial trouble in 2007. It has been my ongoing expectation that paper assets in general and currencies in particular will become increasingly suspect, and therefore decline in value. We remain in a financial and monetary bust, and I had already noted in my forecast for the year before that “the bust will not end in 2009”. My point was that financial assets would continue to fall out of favor. So I recommended to “avoid the dollar and other national currencies as well as the paper issued by governmen... |

| Just Another Panic Monday for Shorts, Will Tomorrow be Their Funday? Posted: 03 Jan 2011 04:58 PM PST The market ran today like Ben Bernanke was giving out free money (which um, he kind of is, as long as you have already proven that you are untrustworthy and have bad judgment), or giving out free shares of Facebook (which at this rate will be valued higher than an original copy of Birds of America, a dozen Faberge eggs, or Jessica Hall's vulva, when they go public) as investors rejoice in the new year as if the new year were 1997. So we've now gone from "rally" to "FUCKING RALLY" because what goes up, doesn't come down (except for some birds in Arkansas, an erection after seeing Kathy Griffin in a bikini, and well, everything fucking else in the world).

But who cares because with a spree of relatively positive macro data, investors are willing to ignore that the unemployment rate is 10% (~18% including the discouraged, the beaten down, and the people who green lighted the Tron sequel), that the average stock ownership lasts just 22 seconds (or twice the time Money McBags would last with Kelly Brook), and that the dollar doesn't buy what it used to anymore (except for dong, because one can currently buy a fuckload of dong for a dollar, which explains why Tom Cruise doesn't work as much). Investors are willing to throw money in to the market because their memories are shorter than the line for handshakes will be at Thomas Hoenig's upcoming retirement party. But great, really, with common sense now about as useful as Zsa Zsa Gabor's leg (or her uterus), let the capitulation begin, just remember that capitulation isn't just an anagram for "Anal pic I tout." If the market can get back to 1500 with 10% unemployment, then Money McBags says we need to lay a fuckload more people off because clearly there is some strange inverse correlation here.

In macro news today, the ISM's manufacturing index for December rose to 57, which was slightly better than the 56.9 guessed by witch doctors and was the 17th consecutive month the index rose. Wow. Money McBags hasn't seen something rise that consistently since the market for MBS CDOs right before the meltdown or Jessica Alba's popularity before she got married. Leading the way were faster rates of new orders, though unfortunately those new orders weren't for jobs as factory sector employment dropped to a nine month low.

In other US macro news, construction spending rose .4%, up from a .7% gain in October, and better than the .2% gain guessed at by analysts, as stimulus spending seeks to make sure every state has at least one bridge to nowhere. Federal spending rose 8.2% with the government investing in such things as schools, office buildings, and even water supply plants (and with $35B to spend, the government no doubt went all out and installed gold-plated pipes in to these facilities to make sure all showers will be golden). Absent government spend, which is a bit like reading Dickens (or Money McBags) absent run-on sentences, judging Alan Greenspan absent his interest rate policy, or giving a critical assessment of the work of Janine Lindemulder absent Where the Boys Aren't 10, private construction was up only .3% and local government spend was down .1%. So as long as Uncle Barack and Aunt Timmy keep getting their spending on, everything should be ok (except for the dollar and the long-term economy, but those are just minor fucking details).

Internationally, China's manufacturing slipped a bit as the country has already produced an oversupply of pee-pee flavored Coke (and yes Money McBags is aware that he goes to that line way to often, but if you got anything better, let him know). The index fell from 55.2 to 53.9 as Premier Wen Jiabao seeks to tighten monetary policy to curb inflation and to not be such a dick.

The big news of the day was the market though as stocks shot the fuck up like they were Heath Ledger on a bender. If you owned anything, you made money today so congratulations for playing, but unfortunately with success like that, none of you win the booby prize. Financials led the way today as all of a sudden investors believe whatever banks say they put on their balance sheet (and Money McBags trusts bank balance sheets about as much as Maria Menounos trusts bikinis). Bank of America pushed financials higher after they agreed to pay a $3B settlement to FNM and FRE for selling them some bad mortgages (or what is known at Goldman Sachs as "Tuesday"). That said, there are still likely to be $8B to $35B of claims against BAC from insurers and private investors who bought tainted loans from the bank after being misled by BAC's shitacular credit approvals on mortgages, so buyer beware.

The other big news was that Goldman invested ~$500MM in the Facebook, giving the Facebook a ~$50B valuation which is roughly equivalent to the GDP of Belarus, the personal fortune of Warren Buffett, or a week of trades by Brian Sack. The Facebook now promises to be the most overvalued thing on the internet since AOL or that fucking dancing baby shit. More importantly, with the Facebook's cockposterous valuation, Money McBags is once again bringing to your attention that he has put the award winning When Genius Prevailed up for sale with a starting price of only $10MM. While a $10MM valuation may seem high, Money McBags can assure you it is actually quite low as it is only .02% of the value of the Facebook and if you all don't get .02% of the enjoyment from the award winning When Genius Prevailed that you get out of the Facebook, then Money McBags is not this author's real name. The point is, for $10MM you can have one of the hottest internet properties (though not as hot as this very very NSFW property) and not only that, but Money McBags will promise to keep running the place for the next 5ish years and will devote 100% of his time to it (and right now, Money McBags does this with only 50% of his time, so imagine how titriffic it would be with 2x the McBags). If you want to talk turkey, Money McBags is reachable at moneymcbags@gmail.com, serious offers only.

Elsewhere in the market, ODP and SPLS rose strongly on upgrades from Janney which shows the preposterousness of the market since it marks the first time any stock has moved because of a Janney analyst's recommendation. Also, BKS jumped 10% after reporting same store sales were up ~10% in the holiday season thanks to their e-reader (the awfully named Nook) and strong sales of Economics for Dummies in their South Side of Chicago book store.

As always, Money McBags has plenty more material on the award winning When Genius Prevailed. So if you're bored (and certainly you must be if you made it this far), feel free to check it out. |

| Posted: 03 Jan 2011 04:41 PM PST HOUSTON – The first thing we need to remember when looking at the COT data which was just released by the Commodities Futures Trading Commission Monday, January 3, is that it is the last report for 2010, not the first report for 2011. This COT data is for the second trading day after Christmas, and it includes the three trading days prior to Christmas, a lighter than normal liquidity period when some large fraction of the "normal" traders were taking a holiday. ... |

| Gold Seeker Closing Report: Gold and Silver Close At New Highs Posted: 03 Jan 2011 04:00 PM PST Gold rose to see a $3.34 gain at $1423.94 at the open of trade in New York before it chopped its way back lower to see a $4.80 loss at $1415.80 by a little before 11AM EST, but it then rallied back higher in the last few hours of trade and ended with a gain of 0.1% at a new all-time closing high. Silver climbed over 1% to $31.228 before it fell to see a slight loss at $30.824, but it also rallied back higher in late trade and ended with a gain of 0.68% at a new 30-year closing high. |

| Crude Oil Rises but Underperforms Equities, Gold Carves out an Ascending Triangle Posted: 03 Jan 2011 03:53 PM PST courtesy of DailyFX.com January 03, 2011 07:51 PM Most crude oil benchmarks are now approaching the psychologically-significant $100 level, but fundamentals suggest that a sustainable break is not yet in the cards. Commodities – Energy Crude Oil Rises but Underperforms Equities Crude Oil (WTI) - $91.71 // $0.33 // 0.36% Commentary: Crude oil hit a fresh 26-month high on Monday before falling back to settle up only $0.17, or 0.19%, to $91.55. Oil’s price action is best characterized as a grind higher, though we did see a noticeable underperformance relative to equities in the latest session. The S&P 500 rose by 1.1% to reach a 27-month high of its own. With sentiment so bullish, risk assets have a tendency to gravitate to the upside with little resistance. That will change, of course. Once news flow turns negative, risk aversion will sweep the financial markets and that will be the time to initiate long positions. With regard to crude specifically, we believe t... |

| Social Network: Tech Bubble 2.0? Posted: 03 Jan 2011 02:54 PM PST By Dian L. Chu, EconForecast |

| This Is Bad News For Dollar Bulls: India To Stop Using The Dollar In Oil Trading With Iran Posted: 03 Jan 2011 02:26 PM PST |

| Sovereign Man's 2010 Look Back And 2011 Predictions Posted: 03 Jan 2011 01:59 PM PST Simon Black currently in Santiago, Chile, presents a quick introspective on the key events of 2010, before moving on to a few broad forecasts for 2011. We hope his predictive ability is better than that of one Byron Wien. The key among Simon's predictions is that very soon we may see the same kind of power vacuum that brought about the Thermidorian Reaction in that last major systemic overhaul. Of course, the fact that we still have to experience a an actual storming of the Bastille is a little perturbing. But everything in due course... From Sovereign Man Simon Black A look back, and some 2011 predictions After a wonderful, relaxing weekend here in beautiful Santiago that involved meeting up with a couple of subscribers, I'm buckling down to the business at hand that will include finalizing preparations for our upcoming workshop, as well as exploring initial plans for the community.

|

| The Housing Market Could Get Annihilated In 2011... Posted: 03 Jan 2011 01:43 PM PST Happy New Year everyone! Back in 2002 I made the prediction that housing values would eventually drop 70-80% from peak bubble valuations. Of course, back then I would have been horrified to know just how high prices were to get by 2007. At this point, in a lot of markets prices have dropped 10-20% on average so far, with 40-50% declines (or more at the high end) in the worst bubble States (Cali, FLA, Nevada, Arizona). The late and great Sir John Templeton, who was one of the pioneers of the modern mutual fund industry and a highly regarded investor, said in an interview sometime in 2002 that he would not touch U.S. real estate until it had fallen by 90% in value. I'm sticking with my call. As to be expected, the mass financial media and most real estate market professionals (and of course a lot folks who have been well-trained by the Fed to "buy the dip" over the last 30 years) expect that the worst is over for the sector. Au contraire, mon frére (I guess I should say "al contrario, il mio amico - lol), there are several key forces at play, most of which go underreported, not reported, or are based on industry/Govt data which is highly manipulated. Inventory - The biggest problem facing the housing market is the massive inventory sitting out there. Of course, the Nat'l Assoc. of Realtors reports the inventory of homes for sale to be around 3.7 million, or 9.5 month supply based on the existing rate of sales. Remember that rate of homes sales is still declining - existing home sales were down 28% for Nov '10 vs. '09 and new home sales were down 21% - so as we go forward, unless this rate picks up, the number of months it would take to clear the existing "for sale" inventory increases. But there is a "shadow" inventory out there defined as pending REO (bank owned), pending foreclosed inventory and homes with mortgages in serious delinquency. Corelogic has defined this number to be around 2 million homes. Here's a great chart I borrowed from calculatedriskblog.com: (click on chart to enlarge) As you can see, if you include the homes that are likely to be foreclosed and assumed by the banks, a more realistic estimate of the housing inventor is close to 6 million. And there are also a lot of people who are not in danger of defaulting on their mortgage, but who would sell if the market "bounces." If you are skeptical of the forces of foreclosure, here's a news report from Reuters that came out last week describing the big jump in foreclosures during Q3: LINK So just based on the pure, good old fashioned law of supply/demand, there is going to have to be a major downward adjustment in the price of housing in order to clear this massive inventory overhanging the market. Credit Markets - The biggest factor here is interest rates. For several reasons, not the least of which is the rapidly expanding Government spending deficit and Treasury bond supply, interest rates will continue moving higher during 2011. This factor alone, unless you have cash to buy a house, will make the current price level of housing unsustainable as the higher cost of a mortgage will reduce the overall amount someone can pay for a home by reducing the size of an affordable mortgage. This is going to hammer the mid-priced housing segment. The other obvious factor here is the much tighter standards being enforced on mortgage lenders. No more "liar" loans, pay-option ARMS and "sub-primers" qualifying for conventional GSE mortgages. This factor not only eliminates a chunk of the population that had been buying homes during the bubble, but it too reduces that size of mortgage most people can assume. And finally, there is another tsunami of adjustable rate mortgage resets and refi's coming in 2011. Here's a chart to illustrate that is from Credit Suisse (edit in red is mine): (click on chart to enlarge) As you can see, the housing market price collapse that started in 2007 is highly correlated with the first wave of resets. It took a few trillion of printed dollars from the Fed and the Treasury in order to stabilize the banking system and slow down the collapse in housing from this first wave. Take a look at the size and composition of the second wave. The beige bars are the nefarious pay-option ARMS, which were designed to let people opt not to pay most of their mortgage, with the unpaid portion added to outstanding mortgage balance. It was this garbage that took down Countrywide, Washington Mutual and Wachovia. The credit obligation from that abortion was largely transferred to the Treasury (i.e. the taxpayer). Rest assured, the pay-option reset factor alone will make this next default wave even more nuclear than the last one. (Also, I am skipping over all of the related collateral destruction the first time around, which includes the implosion of the big mortgage reinsurance companies, including AIG - who's garbage found a home with the U.S. Treasury). This will devastate housing/real estate values. There are several other factors which will further influence the declining value of housing and real estate. The most prevalent being the general weak condition of the economy in the U.S. And I am of the view that the economy will double dip this year (although massive QE/money printing may prevent this). The reality is that the two major factors discussed above will be sufficient to cause what I believe will be a much larger than expected (by the media/Wall Street in general) decline in housing values during 2011. I would not be surprised to see at least 10% in most markets. While I have stopped putting a definitive timeframe on my economic/market predictions, I still believe that average prices in the housing market will get cut in half from here before this over. This posting includes an audio/video/photo media file: Download Now |

| The Reweighting of Commodity Indices Posted: 03 Jan 2011 01:27 PM PST Dear Friends, Every year around this time some of the big commodity indices that are used as benchmarks by various fund managers are reweighted with the percentage of the commodities making up the basket tracked by each particular index varying depending on the methodology employed by the owners of the index. Two of the larger commodity indexes are the Goldman Sachs Commodity Index (now called the S&P GSCI) and the Dow Jones – AIG Commodity Index). My preliminary read of the GSCI index shows a heavier weighting in both silver and copper over the weighting given to each last year (2010) and a bit of a lighter weighting given to gold than last year. Copper and silver are both being increased 2.7% over last year while gold is being reduced 2.5% compared to last year. Disclaimer – I hate reading through these reports issued about the various indices as my head goes numb from looking at the all the calculations so these numbers should not be taken as gospel until I can confirm the exact change. For now – this is my preliminary read. Generally what this translates to in terms of the average market watcher is that the commodity style funds that commit investment funds into the commodity complex, must match the percentage of their holdings to these various indices. Depending on which index they choose to benchmark against and what changes may or may not be made for the new calendar year, such changes may result in an increase in buying for some commodities and an increase in selling for others. The reason is that the fund managers must rebalance their holdings to bring them into line with the new weightings in the index. Since the largest portion of the money driving our commodity markets these days is the result of these commodity funds, the changes can sometimes explain some of the price action that the various commodity markets will experience during the rebalancing phase. This phase tends to last a few weeks as the index re-weightings become published and disseminated through the investment community and are then implemented by fund managers. Keep this in mind as we watch the price action over this month. Also keep in mind that any fresh money coming into the markets for investment for the new year is going to find itself being spread across all of the various commodities making up each commodity index. Sometimes that new money is more than enough to offset the selling of the older positions from the previous year as the fund managers rebalance. For those markets where the percentage weighting has been increased from the previous year, the combination of fresh, new investment money for the new year in combination with the increased need by the funds to buy extra positions in those commodities, can be quite a powerful combination for any market already in a bullish uptrend. I have yet to examine the DOW JONES AIG index. When I do, I will report back to our readers. |

| Is The World's Richest Man, Carlos Slim, Entering The Silver Fray? Posted: 03 Jan 2011 01:12 PM PST From King World News Continue reading at King World News |

| Likely new White House chief of staff has bided time at Morgan Chase Posted: 03 Jan 2011 12:08 PM PST It's like he never left the government. ... * * * Obama Said to Consider William Daley for Top White House Post By Julianna Goldman and John McCormick http://www.bloomberg.com/news/2011-01-03/obama-said-to-consider-william-... President Barack Obama is considering naming William Daley, a JPMorgan Chase & Co. executive and former U.S. commerce secretary, to a high-level White House post, possibly as his chief of staff, people familiar with the matter said. Such a move, which is still under discussion and which White House officials wouldn't confirm, would bring a Washington veteran -- and someone with strong business ties -- into the administration as Obama enters the second half of his term. The president is faced with a Republican majority in the House of Representatives and is trying to accelerate the U.S. economic recovery while addressing the budget deficit. Daley, 62, who typically responds to questions, didn't return two messages seeking comment left on his cell phone yesterday or a phone call to his office and an e-mail sent to him today. White House officials declined to discuss the matter. "I'm not going to comment on personnel speculation," White House spokesman Robert Gibbs said in an e-mail. ... Dispatch continues below ... ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf As he remakes his staff at the midway point of his presidency, Obama also is seeking to address complaints from some executives that the Democratic administration is anti- business. Daley is JPMorgan's Midwest chairman and the bank's head of corporate responsibility. Among the pressing personnel decisions Obama must make is naming a successor to Lawrence Summers as head of the National Economic Council, which could come as early as this week. Gene Sperling, a counselor to Treasury Secretary Timothy Geithner, has emerged as the leading candidate for the post. If selected, Sperling would be returning to the position he held for four years under President Bill Clinton, making him the longest-serving NEC director. While he doesn't have strong ties to the business community or Summers' standing as an economist, Sperling has played key roles crafting the administration's economic policies, most recently in forging Obama's compromise with Republican leaders to extend Bush-era income tax cuts. Yale University President Richard Levin and Roger Altman, the founder of Evercore Partners Inc., are under consideration for the NEC post as well. If named as chief of staff, Daley would replace Pete Rouse, whom Obama selected to fill the role on an interim basis after Rahm Emanuel resigned Oct. 1 to pursue a bid for mayor of Chicago. Rouse has indicated to administration officials that he is reluctant to serve in that job for the remainder of Obama's presidency, according to a person familiar with the matter. Rouse also has signaled that he would stay as chief of staff if asked by the president, the person said, speaking on condition of anonymity because the discussions are private. Rouse, who has worked for Obama since his days in the Senate, is conducting an internal review that covers personnel, policy and political strategy as the president contends with a new political landscape and gears up for his re-election bid less than two years from now. Obama is considering a number of staff changes. Senior adviser David Axelrod has said that he plans to leave in the coming months, and former campaign manager David Plouffe will join the administration. During the 2008 presidential campaign, Daley served as an Obama economic adviser. After the election, he was a co-chairman of Obama's transition team. Daley, the younger brother of Chicago Mayor Richard M. Daley, was commerce secretary during the second term of the Clinton administration, serving from January 1997 to June 2000. He was chairman of Vice President Al Gore's unsuccessful presidential campaign in 2000. After serving as president of SBC Communications for more than two years, he joined JPMorgan Chase in 2004. While there, Daley has worked on some of the Midwest's biggest takeovers. He advised Chicago's Exelon Corp. on its unsuccessful 2004 proposal to buy Public Service Enterprise Group Inc. for $17.8 billion, and CBOT Holdings Inc., also based in Chicago, on its 2007 sale to CME Group Inc. for $11 billion, according to Corporate Control Alert, an industry newsletter. Daley was a political mentor to Emanuel. The two worked together to get the union-opposed North American Free Trade Agreement passed in 1993. Emanuel was then a senior aide to Clinton and Daley was a special counsel to the president. The youngest of seven children born to longtime Chicago Mayor Richard J. Daley and Eleanor "Sis" Daley, William Daley is a member of Illinois' most powerful political dynasty. Besides his work as a banker, he serves on several corporate boards, including Boeing Co. and Abbott Laboratories. The administration has come under fire from the business community, including the U.S. Chamber of Commerce. The nation's biggest business lobbying group opposed Obama's health-care and financial-regulatory overhauls and committed $75 million to political ads in the midterm congressional elections, mainly directed against Democrats. Still, Obama is generating more optimism among corporate executives after a series of actions and overtures, including a deal to extend tax cuts enacted in 2001 and 2003, efforts to boost exports such as a U.S.-South Korea free-trade agreement, and a loosening of controls on some technology sales. Obama met with 20 company executives on Dec. 15 in Washington and said afterward that he made "good progress" toward establishing closer cooperation between government and business to accelerate the economic recovery. The president has said private companies are crucial to the U.S. climbing out of the worst recession since the Great Depression. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Competitive devaluations continue as Chile weakens peso against dollar Posted: 03 Jan 2011 11:59 AM PST Chile Central Bank to Buy $12 Billion to Stem Peso's Region-Beating Rally By Sebastian Boyd http://www.bloomberg.com/news/2011-01-03/chile-central-bank-to-buy-12-bi... SANTIAGO, Chile -- Chile's central bank plans to buy $12 billion of U.S. dollars to help exporters by weakening the peso, Latin America's best-performing currency last year. The bank will buy $50 million a day from Jan. 5 to Feb. 9 and will announce further plans later. The move will boost international reserves to the equivalent of 17 percent of gross domestic product, the bank said today in a statement. The bank will sell bonds to drain the equivalent amount of cash from the economy. Policy makers are intervening to weaken the peso after the currency gained 8.4 percent last year and climbed 0.5 percent today to 465.75 per U.S. dollar, the highest since May 2008. The bank warned last month that the country's real exchange rate had gained to the strongest level coherent with fundamentals. ... Dispatch continues below ... ADVERTISEMENT Prophecy Receives Permit To Mine at Ulaan Ovoo in Mongolia VANCOUVER, British Columbia -- Prophecy Resource Corp. (TSX-V:PCY, OTCQX: PRPCF, Frankfurt: 1P2) announces that on November 9, 2010, it received the final permit to commence mining operations at its Ulaan Ovoo coal project in Mongolia. Prophecy is one of few international mining companies to achieve such a milestone. The mine is production-ready, with a mine opening ceremony scheduled for November 20. Prophecy CEO John Lee said: "I thank the government of Mongolia for the expeditious way this permit was issued. The opening of Ulaan Ovoo is a testament to the industrious and skilled workforce in Mongolia. Prophecy directly and indirectly (through Leighton Asia) employs more than 65 competent Mongolian nationals and four expatriots. The company also reaffirms its commitment to deliver coal to the local Edernet and Darkhan power plants in Mongolia." The Ulaan Ovoo open pit mine is 10 kilometers from the Russian border and within 120km of the Nauski TransSiberian railway station, enabling transportation of coal to Russia and its eastern seaports. Thermal coal prices are trading at two-year highs at Russian seaports due to strong demand from Asian economies. For the complete press release, please visit: http://prophecyresource.com/news_2010_nov11.php "This intervention should smooth the effects of the exchange-rate adjustment to which our economy has been subjected," the bank said in the statement. Policy makers will publish their 2011 bond-sale calendar tomorrow. The bank last intervened in the currency in April 2008, when it announced a $8 billion program of buying dollars, also in $50 million-a-day clips. It abandoned the program after Lehman Brothers Holdings Inc. collapsed, having bought $5.75 billion. The currency may weaken by 48 pesos per dollar because of the intervention, according to Jorge Selaive, chief economist at Banco de Credito e Inversiones in Santiago, "the greater part of that tomorrow." Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going: GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: |

| James Turk: Gold rises in 2010 to end a stellar decade Posted: 03 Jan 2011 11:52 AM PST 7:50p ET Monday, January 3, 2010 Dear Friend of GATA and Gold (and Silver): GoldMoney founder, Free Gold Money Report editor, and GATA consultant James Turk tonight summarizes the performance of gold and silver in 2010, reporting that gold did spectacularly, rising substantially in all currencies except the Australian dollar, and silver did even better. As he expects monetary debasement to remain central bank policy around the world, Turk expects 2011 to be another great year for the metals. His commentary is headlined "Gold Rises in 2010 to End a Stellar Decade" and you can find it at GoldMoney's Internet site here: http://goldmoney.com/gold-research/gold-rises-in-2010-to-end-a-stellar-d... CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Opportunity in the gold coin market Swiss America Trading Corp. alerts GATA supporters to an opportunistic area of the gold coin market. While the gold bullion market has been quite volatile lately and as of November 29 gold has risen only $7 per ounce over the last month, the MS64 $20 gold St. Gaudens coin has risen about 10 percent in the same time. The ratio between the price of these coins and the price of gold is rising. If you'd like to learn more about the ratio and $20 gold coins, Swiss America can e-mail you a three-year study of it as well as other information. Swiss America also can provide a limited number of free copies of "Crashing the Dollar," a book written by Swiss America's president, Craig Smith. For information about the ratio between the $20 gold pieces and the gold price and for a free copy of "Crashing The Dollar," please call Swiss America's Tim Murphy at 1-800-289-2646 X1041 or Fred Goldstein at X1033. Or e-mail them at trmurphy@swissamerica.com and figoldstein@swissamerica.com. Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52 percent NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Gold Price Gained Only $1.50, Was it a Good Idea to Prefer Silver to Gold Over the Last Year? Posted: 03 Jan 2011 11:10 AM PST Gold Price Close Today : 1422.60 Change : 1.50 or 0.1% Silver Price Close Today : 31.096 Change : 0.186 cents or 0.6% Gold Silver Ratio Today : 45.75 Change : -0.227 or -0.5% Silver Gold Ratio Today : 0.02186 Change : 0.000108 or 0.5% Platinum Price Close Today : 1767.10 Change : -1.50 or -0.1% Palladium Price Close Today : 795.00 Change : -7.00 or -0.9% S&P 500 : 1,271.87 Change : 14.23 or 1.1% Dow In GOLD$ : $169.59 Change : $ 1.19 or 0.7% Dow in GOLD oz : 8.204 Change : 0.058 or 0.7% Dow in SILVER oz : 375.31 Change : 2.98 or 0.8% Dow Industrial : 11,670.75 Change : 93.24 or 0.8% US Dollar Index : 79.19 Change : 0.008 or 0.0% I consider it very bad manners and even worse taste ever to say "I told you so." Therefore I will offer y'all the following statistics without comment, as res ipsa loquitur. These are the percentage changes from 31 December 2009 to 31 December 2010. Dow in gold Dollars, -14.5% Dow in silver Ounces, -45.9% Gold, + 29.8% Silver, +83.7% Gold/Silver Ratio, -29.4% Dow Jones Industrial Avg., +11.0% S&P500, +12.8% Nasdaq Comp, +12.8% Platinum, +20.5% Palladium, +95.6%. But one leetle question does pop up! Was it a good idea to prefer silver to gold over the last year? The SILVER PRICE managed to close above 3100c for the first time in this bull market. Added 18.6c to close 3109.6c on Comex. The GOLD PRICE stalled at Friday's ending prices, gaining only $1.50 to $1,422.60. I liken this to wading through the deep mud in the lake as you walk up the shore out of the water. Once gold breaches $1425 'twill pick up speed. Silver's meeting resistance at 3100c, but hasn't given up yet. The five day chart shows a clear 5-wave up move from last Thursday and a three wave correction from today's high in the forenoon. Ditto Gold, but not as clear. I expect tomorrow to see higher prices, maybe even JUMPING higher. The GOLD/SILVER RATIO today hit 45.6. We are still swapping silver for gold, and now the ratio has dropped a bit more and we've found someone to buy large amounts of US 90% silver coin so that we can do the swaps a little closer to the spot ratio than the earlier ones. I have been pouring over past price action on earlier swaps, and that leads me to believe all the more strongly that a price peak, which coincides with a ratio low, does not lie far in the future. Remember one of the characteristics of the ratio is that once it hits its low, it VERY rapidly rises. That reflects silver's volatility and the speed of its collapse after a peak. That collapse occurs over a fairly uniform time, then hits a low, which coincides with the ratio high. That's when we swap gold back into silver. From here the ratio might hit -- possibly -- 43.3. Might go lower. But 45.5 really was my lowest target, and I am happy as a mouse in a pie factory to get these trades off where we have, and thankful for whatever other ones we might do. Remember the market proverb when you are tempted to wait for "just a little more movement in your favour." "Bears get rich, and bulls get rich, but pigs get slaughtered." The US DOLLAR INDEX today lost 8/10 of a basis point to close at 79.193. This no more than confirms the dollar intends to move lower, at least to 78.50. At 78.50 it will have to decide whether it will bounce and rally, or fade away. STOCKS today benefitted from something. Dow rose 93.24 to close at a scandalous 11,670.75. Here's an assignment for you number-crunchers. The 2000 Dow high was 11,722.45. Find yourself an inflation calculator on the Internet and throw in that 11,722.45 number to see where the Dow would have to be today just to equal January 2000. S&P 500 rose 14.23 points to 1,271.87. Y'all buy stocks with your money, and let me know next year how that works out for you. My guess is that the economy will hit a brick wall again this year -- banks forced to do something about all those rotten mortgages on their balance sheets, municipal bond defaults, or, if not that, then stray dogs -- and that will trim stocks' sails considerably. But what do I know? I'm just a natural born fool from Tennessee, not one of them Wall Street smart boys that's been to Haahvaahd. During the Twelve Days of Christmas (Christmas thru Epiphany, 6 Jan) our office will be working only four hours a day. Please be patient, leave a voice mail or send us an email at helpdesk@the-moneychanger.com. Thanks for your understanding. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Posted: 03 Jan 2011 10:13 AM PST Gold chops sideways, ends at fresh closing high The COMEX February gold futures contract closed up $1.50 Monday at $1422.90, trading between $1414.50 and $1424.40 January 3, p.m. excerpts: |

| Posted: 03 Jan 2011 10:00 AM PST I was intrigued that a guy named David Thurtell, of Citigroup, surprisingly said, "The liquidity pumped out by central banks means that there is a lot of money sloshing around that needs to find a home." I was so intrigued that I was tempted to use it as the basis for my first report to the new supervisor for this quadrant of the galaxy, Karpus Klegg the Implacable, at his new office at Intergalactic Headquarters after the "palace coup" and interstellar personnel shake-up that I just found out about. However, I did not want to start off a relationship with some guy I never met named Karpus Klegg the Implacable by saying that people on this planet believe that money can find a home, as it sounds so stupid. After a little checking, I learned that I just needed to say that the people on this planet had evolved to the point where they seek pleasure all the time, and just send him some porno films of earthlings, which he will like better than anything else I could send him. So, with that feather in my cap, I turn my attention to denizens of this planet, singling out for Mr. Thurtell of Citigroup to receive the Hot Mogambo News (HMN) that money never finds a home! Never! Money never "finds a home" because money, once created, is always being exchanged for an asset, and then the asset seller has to exchange the newly-acquired money for another asset, and then that asset seller has to exchange the newly-acquired money for another asset, and then that asset seller, and then another, and another, around and around, up and down, back and forth, with all the new money constantly being used to add to the money already bidding on goods and services, causing higher prices, higher and higher prices, even as the money is being nibbled away, bit by bit and piece by piece, by relentless and total government taxation at each exchange. And yet, even then, as soon as any of the money is taxed away out of the private economy, it immediately reappears! It is reborn as higher government spending, and becoming "new money" that needs to "find a home," too! So the idea of money ever "finding a home" makes me laugh the cruel Mogambo Laugh Of Scorn (MLOS) at such a benign-sounding phrase, as all this new money does is to increase prices! And, if you want to know my opinion, deliberately increasing prices is a cruel, mean-spirited, despotic and despicable thing to do to people. However, cruelty of an elitist government towards the population is nothing new, and it is a little known fact that the Elvis Presley hit, "Don't Be Cruel", originally had the lyrics: "Don't be cruel, "To the currency of a guy who trusted you Fed bastards to maintain the purchasing power of the dollar. "Don't be cruel, "To the currency of a guy who trusted you Fed bastards to maintain the purchasing power of the dollar. "I don't want no other cash! "But the dollar's turned to trash! "Don't be cruel!" Firstly, thank you, thank you, thank you for your kind applause of appreciation for my fabulous impersonation of Elvis Presley! Thank you! Thank you! Secondly, there is a moral about the purchasing power of money in there, probably in the second verse where he had a leash around his neck and being led around, which is now unfortunately lost, so you have to take my word for it, where Elvis himself – The King! – was advising you to buy gold and silver when the Federal Reserve was creating so much money, which it was doing at the time of his death in 1977, all because Nixon severed the dollar's convertibility to gold in 1971. If you don't believe that Elvis was a gold-bug and Austrian-school of economics kind of "cool guy," and/or that these are the original lyrics, then perhaps you will start to believe me when I say that the Federal Reserve creating trillions of dollars per year is going to make Elvis look more visionary than ever when gold soars to the moon in the terrifying inflation in consumer prices and the destruction of the economy! And to think you can prevent all that by just buying, as suggested by Elvis Presley himself, gold and silver! Don't be cruel, indeed! Whee! This investing stuff is easy! The Mogambo Guru The Nomadic Nature of Money originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 03 Jan 2011 09:57 AM PST |

| Crash JP Morgan Buy Silver – Stop the Ebola Virus of Wall St. from spreading any further Posted: 03 Jan 2011 09:44 AM PST |

| Posted: 03 Jan 2011 09:22 AM PST The 5 min. Forecast January 03, 2011 01:20 PM by Addison Wiggin - January 3, 2011 [LIST] [*] The 5’s 2011 forecast issue... Facebook at $50 billion? Ha! [*] Why Chris Mayer sees gold stocks as the top-performing sector [*] Alan Knuckman’s audacious silver outlook... After $30, where next? [*] Amoss on “margin squeeze,” Cofnas on the return of dollar bulls and more [*] Devil in the details... The 5 dives inside upbeat manufacturing numbers [*] If consumers are roaring back, why are fewer buying movie and concert tickets? [/LIST] Welcome to 2011... early this morning, we learned Goldman Sachs and a Russian firm called Digital Sky Technologies have pumped $500 million into Facebook. The deal values the “popular social networking site” at $50 billion... more than eBay, Yahoo! or Time Warner. Ha. Ha. Ha! This first nugget of fresh news makes our first official forecast of 2011 a slam-dunk: Facebook and Goldman will fleece million... |

| Graham Summers’ Free Weekly Market Forecast (Hold the Line Edition) Posted: 03 Jan 2011 09:11 AM PST

The first item to note is that the Euro bounced off of support to end 2010. It’s difficult to tell if this was a REAL development or just a kind of end of the year “window dressing.” I say this because the blizzard in New York made holiday trading even lower than usual, allowing for even more gaming.

This week will determine the deal. As the below chart shows, the Euro is now coming up against resistance at 134.2. If we break above here, then the Euro is starting another leg up which could take it to 136. This move would be accompanied by additional gains in stocks and Gold and Silver.

The US Dollar is giving us a hint that this may in fact prove to be the case. Indeed, while the Euro has yet to break out above resistance, the US Dollar has taken out support establishing a series of lower lows as it builds a clear downward trading channel.

Of course, we could see a bounce here which would correlate with the Euro dropping. However, if this is going to happen it needs to start in the next few days.

Elsewhere in the financial markets, Treasuries have staged a bounce. It’s truly staggering to think that Bernanke and pals can claim with a straight face that Quantitative Easing will lower interest rates when long-term Treasuries have dropped 10% in just four months since the Fed’s QE lite and QE 2 programs were announced.

Indeed, the technical picture for Treasuries going forward is decidedly ugly as we’re getting darn close to breaking the 28-year old bull market in bonds.

The above chart is a MAJOR warning of what’s to come to the US when this latest bounce in Treasuries ends. Once we take out this trendline we’re going to see interest rates spike in a BIG way. This in turn will push the US economy into an even deeper Depression and renew the debt deleveraging the financial system began in 2008 (which the Fed has done everything in its power to try and stop).

In plain terms, the markets are officially on “borrowed time.” The three key charts for determining when things get ugly again are the Euro, US Dollar, and long-term US Treasuries. At some point one of these is going to breakdown in MAJOR way. When it does, it’s going to drag us back into Crisis mode.

Thus, the question is, what Crisis will it be?

1) A Euro banking system Crisis? 2) A US Dollar collapse Crisis? 3) A US debt collapse Crisis? 4) Some combination of the above?

Personally, I believe we’ll be entering an inflationary death spiral for the US Dollar at some point in the next year or so. When this happens inflation hedges across the board will explode higher.

Some, like the most popular picks (Gold an Silver bullion) will records strong gains. Good Investing!

Graham Summers

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

PPS. We ALSO publish a FREE Special Report on Inflation detailing three investments that have all already SOARED as a result of the Fed’s monetary policy. You can access this Report at the link above.

|

| How Much is Facebook Really Worth? Posted: 03 Jan 2011 09:09 AM PST Welcome to 2011… Early this morning, we learned Goldman Sachs and a Russian firm called Digital Sky Technologies have pumped $500 million into Facebook. The deal values the "popular social networking site" at $50 billion… more than eBay, Yahoo! or Time Warner. Ha. Ha. Ha! This first nugget of fresh news makes our first official forecast of 2011 a slam-dunk: Facebook and Goldman will fleece millions of Americans of their retirement funds… maybe not this year, maybe not next, but before they are done with the whole charade. Sure, we know the story. Social media exploded in 2010. Facebook passed Google as the most visited site on the planet, with one out of every four webpages viewed in the U.S. belonging to Facebook. Yeah, yeah, it's a good story. But we've also seen this movie before. You have 500 million people playing Farmville and Mafia Wars and telling the world how wasted they got last night… but what makes them worth an average $100 in market value? Our own social media maven suggests "the real value" of the company is in "leveraging all the user data they've collected on their members. The ability to develop tools, apps and targeted advertising will allow you to monetize. As they open up their API, it will allow developers to access this info and use this community to create more and more interaction." That's possible. But we think the real value is in the story itself, reflected in the company's shares… which you can't buy right now. Barely a month ago, TechCrunch.com reported Accel Partners, an early-round investor in Facebook, sold off a big portion of their stock in the company at a $35 billion valuation — a return of "something like 247 times" on that sale. Now Goldman intends to set up a special purpose vehicle (SPV) so its high-net-worth clients can skirt IPO laws and get their money in before Facebook goes public. "While the SEC requires companies with more than 499 investors to disclose their financial results to the public," says Andrew Ross Sorkin on his site DealB%k, "Goldman's proposed special purpose vehicle may be able get around such a rule because it would be managed by Goldman and considered just one investor, even though it could conceivably be pooling investments from thousands of clients." Whether Facebook is profitable now – we don't know because the books are still private – or whether they can figure out how to be profitable in the future is largely irrelevant. The big money is going to be made early in the "secondary market" for private shares. If and when the IPO happens – like any good Ponzi scheme – retail investors, those last in the door, will get stuck holding very expensive paper. Our advice: Steer clear. Addison Wiggin How Much is Facebook Really Worth? originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Byron Wien's Prediction Track Record: Zero Out Of Ten Posted: 03 Jan 2011 09:06 AM PST Instead of wasting time with Byron Wien's Top 10 "predictions for 2011" we have decided to skip this latest and greatest worthless charade in prognostication, and instead we believe that presenting the list of what the man whose retirement age has come and gone, thought would happen in the past year, is a great example of why all these so called institutional Wall Street experts are nothing but two bit hacks. As may be expected, somehow Wien got exactly zero out of ten correct! The man is the contrarian indicator on Wall Street. Also keep in mind: it takes a lot of skill to be this bad. Byron Wien Announces Top Ten Surprises for 2010New York, January 4, 2010 – Byron R. Wien, Vice Chairman, Blackstone Advisory Services, today issued his list of the Ten Surprises for 2010. This is the 25th year Byron has given his predictions of a number of economic, financial market and political surprises for the coming year. He started the tradition in 1986 when he was the Chief U.S Investment Strategist at Morgan Stanley. Byron joined The Blackstone Group in September 2009 as a senior advisor to both the Firm and its clients in analyzing economic, political, market and social trends. The Surprises of 2010

h/t Atierny1 and nolsgrad |

| Dollar Index: One Way Or Another, It's Going To Hurt Posted: 03 Jan 2011 08:53 AM PST From Nic Lenoir of ICAP I have been constructive on the dollar index for a little while. I had drawn attention a few weeks back when we broke the 60-dma as it has been an excellent envelope since 2008 for the price action bullish or bearish. My thinking was that one should try buying on a retest. Sure enough we almost saw tick-for-tick the moving average on Friday (at a time when most certainly very few bought). |

| Ian Gordon: Bundle Up for Bitter Kondratieff Winter Posted: 03 Jan 2011 08:46 AM PST Source: Source: Karen Roche of The Gold Report 01/03/2011 Bundle up. The bitter Kondratieff Winter looks as though it will worsen in 2011. Longwave Group Founder Ian Gordon sees strong signs that point to impending catastrophe, citing historic precedents in this exclusive interview with The Gold Report. But despite his chilling forecast, which includes the Dow dropping to about 1,000, Ian expects investments in high-quality junior gold miners to pay off royally. . .because the capital that flees the markets will flow in their direction. The Gold Report: In the 11 years that you've been investing in gold juniors, you've recorded an annual rate of return of approximately 70%. Going back to 2000, most brokers and money managers likely would've categorized your investment strategy as very risky. However, you've stated that you always felt it's been very safe because you understand the Kondratieff Cycle. What about the Cycle gave you the confidence to go long on gold and go... |

| Posted: 03 Jan 2011 08:41 AM PST View the original post at jsmineset.com... January 03, 2011 09:25 AM Dear CIGAs, The Penguin represents earnings. The Bear is of course the Bear of Junior Gold shares that have production now, or in the very near future. Gold likely to surpass $1,650 this year Posted: 03 Jan 2011 01:13 AM PST Jim Sinclair's Commentary And how much did the US goodwill trip to India cost per day? India to drop US buck in Iran oil dealing India may drop the US dollar as payment for oil from Iran. The replacement would be the Japanese yen and the Emirates dirham. According to London's Asharq Al-Awsat, the switch could help India avoid American retaliation for dealing with the Iranians. Iran is under international sanctions for refusing to come clean on the nature of its nuclear energy programme. The United States has unilaterally imposed some extra sanctions. More…... |

| Gold Price Rising Faster in Euros Than in Dollars Posted: 03 Jan 2011 08:38 AM PST Zecco submits: By Richard Bloch Over the past few months I’ve seen a variety of interviews where investor and commentator Dennis Gartman mentions his preference for being long gold “in euro terms.” Complete Story » |

| Gold Daily and Silver Weekly Charts Posted: 03 Jan 2011 08:17 AM PST |

| COT Gold, Silver and US Dollar Index Report - January 3, 2011 Posted: 03 Jan 2011 07:56 AM PST |

| Manipulated Monday – New Year Starts with a Bang Posted: 03 Jan 2011 07:36 AM PST Manipulated Monday – New Year Starts with a BangThe futures are so bright, we have to wear shades this morning. Those shades would be blinders, like we put on horses to keep them from being distracted by reality while they race forward as we left 3 of our jockeys - Japan, China and the UK back at the paddock as they are all closed today, making this a very thinly traded open to 2011 and causing us to take all the early-morning exuberance with a Lot's wife-sized grain of salt. Oh we're ready to get bullish! Ready in much the same way a fraternity pledge is ready to eat the worm at the bottom of the tequila bottle - it's disgusting and we'll probably be sick tomorrow but, for tonight - we get to hang out with the party boys and, if nothing else - we'll always have our memories to look back on. The Republicans have already put Obama on Double Secret Probation, threatening to "go nuclear" and shut down government by refusing to raise the debt ceiling unless Obama agrees to "a range of painful cuts." According to White House Economic Adviser, Austan Goolsbee, the Republicans are "playing chicken with the Nation's financial credibility."

"To not raise the debt ceiling could be a default of the United States on bond and Treasury obligations," said Republican Senator Lindsey Graham of South Carolina. "That would be very bad for the position of the United States in the world at large," Graham said. "But this is an opportunity to make sure the government is changing its spending ways." Graham, speaking on NBC's "Meet the Press," said he would not vote to raise the debt ceiling unless spending is cut back to 2008 levels. So happy 2011 to you, we're really starting the year off with a bang! Investors should, of course, thank the Republicans for their convoluted stance as this latest round of idiocy is already undermining faith in the dollar and that has already sent oil prices up $3.20 off Friday's close - all the way to $92.20 in pre-market trading and that's worth an extra $300M a day for the various oil cartels that will be removed from consumers pockets (and put into the pockets of friendly politicians, of course). The good news is though, that that will also make Billions of more dollars available to terrorist and that will give us a great justifications to keep spending $1,000,000,000,000 per year on the military without any cutbacks at all while we strip-mine all those horrible social safety-net programs that dare to give downtrodden Americans hope. Of course the stock market futures are loving this and the Dow, at 7:45, looks like it will open up 100 points as the combination of a weak dollar and a weak President is the investing class's fondest wish for the New Year. It's not entirely too late to go back and read Christmas Weekend's "Secret Santa Inflation Hedges for 2011" or even some of our Breakout Defense plays from earlier in the month. As I pointed out in this weekend's "Reviewing the Reviews" article, our GE play from the Dec 11th breakout set is "only" up .35 out of $2.65 of potential gains so far as these hedges are designed to return that steady 10-20% per month while we're on target. My review of the 2010 reviews is mainly backwards looking as I have little different to add to my "2010 Outlook - A Tale of Two Economies," which is an ongoing story and was very nicely updated by our friend Robert Reich just last week, which Washington's Blog did a nice job of coloring in as well.

Although he was talking about slavery, Lincoln could just as well have been talking about the gap between the rich and the poor which is now wider than the records set in the roaring 20's, the year before the great collapse of 1929. Even a 1920's sharecropper was closer economically to his plantation owner than a secretary at Goldman Sachs is to Lloyd Blankfein today. How long will modern Americans keep accepting the premise that the rich are just better and more deserving than they are - even as the standard of living for that other 99% sinks lower and lower with each celebratory tick of the indexes for the investing class? As I pointed out to Members in this morning's Alert, we had a very nice up day last Jan 4th - the first day of the new year, when the Dow popped 200 points early on and settled in for the day up 155 points at 10,583. We topped out on Jan19th (options expiration day) at 10,725 before beginning a pretty relentless pullback that took us back to 9,900 (down 7.5%).

7.5% would bring us back to S&P 1,165 and Dow 10,700 but let's assume we get that extra 2.5% between Friday's close and expiration day - that's going to take us to Dow 11,850 and S&P 1,285 and then pullbacks to 10,900 and 1,188 both of which should be rising 200-day moving averages by the time we pull back to them so I guess that means we'll be looking for failed tests of the Dow's 50 dma at 11,350 and the S&Ps 1,225 line this week. To round our the rest of our index family - it's Nasdaq 2,600, NYSE 7,750 and Russell 750 that will need to hold between now and the month's end to crush our crash premise. As long as those levels hold - we can ride our bull plays along and even pick up a few new ones along the way. I like JWT Intelligene's "100 Things to Watch in 2011," it's good to exercise your brain by thinking of things you don't normally look at: Presentations like this do remind me why its OK to be optimistic about our future. We still live in a World that is filled with millions of bright, innovative people and you can't stop them all from innovating and creating. Real solutions to our problems may never come from Corporate America but, clearly from the above presentation, they haven't quite strangled the life out of small business innovators, despite the 2-year cut-off of funding as Big Business and Banksters alike hoard their cash and send more and more jobs overseas in the hopes of eliminating all possible competition on their home turf.

Also boosting the Dow this morning is JPM's timely upgrade of BA with a $83 target. Fellow Gang of 12 Member DB upgraded fellow Dow component AA with a $22 target (maybe they read my picks this weekend!) while Bloomberg helps out by citing INTC, HPQ, IBM and CSCO's huge piles of cash as very bullish signs for 2011. So we will join the market for today and accentuate the positive as we try to eliminate the negatives like the Euro bond nightmare, Howard Davidowitz's take on the retail sector, worrying about our CINNs catching up to us (California, Illinois, New York and New Jersey) or Steve Harney's Doomsday prediction for housing. If we ignore all that, everything will be fine because the best thing to do about a problem is to ignore it until the next Administration takes over - who says politicians have nothing to teach us? 2011 is off to an amazing market start, at this pace we'll be at Dow 30,000 by the end of the year so let's sit back and enjoy the ride while it lasts! - Phil |

| Blackstone sees gold at US$1,600, Treasury yields to rise 5% Posted: 03 Jan 2011 06:41 AM PST by Nikolaj Gammeltoft

The price of corn will surpass US$8 a bushel, wheat will top US$10 and soybeans will exceed US$16, while housing starts climb past 600,000, said Wien, chairman of Blackstone's advisory services unit, in his annual "Ten Surprises" list published since 1986. … Commodity prices beat stocks, bonds and the dollar last year as China, the biggest user of everything from cotton to copper to soybeans, led the recovery from the first global recession since World War II. At the same time, crops were ruined by Russia's worst drought in at least a half century, flooding in Canada and parched fields in Kazakhstan, Europe and South America. The Thomson Reuters/Jefferies CRB index of 19 raw materials gained 17% in 2010. Global bonds returned 4.88%, based on Bank of America Merrill Lynch's Global Broad Market Index. The U.S. Dollar Index, a gauge against six counterparts, added 1.5%. The CRB outpaced the other measures for the first time since 2007. In 2009, Wien, who was chief investment strategist for the Pequot Capital Management Inc. hedge fund, correctly predicted rallies in equities, gold and oil. [source] |

| Posted: 03 Jan 2011 06:27 AM PST And then there was one... correlation desk. Following Reuters news that the US government would allow 13 oil firms to restart deep-water Gulf of Mexico drilling without the new environmental review (under certain conditions), oil drops, drillers spike... and precious metals plunge. Obviously, this is just because silver extraction is so very closely tied to how deep underwater a given jack up can reach. Record correlations may have declined, but only to be replaced with correlations that no longer make absolutely any sense. This is just how ridiculous the power of Wall Street's correlation desks is now that almost nobody is trading. Crude and... Silver...?

|

| Posted: 03 Jan 2011 06:21 AM PST |

| Gold buying in India continues unabated Posted: 03 Jan 2011 06:19 AM PST by Shivom Seth Gold continues to be one of the regulated sectors in India. The Indian government allows only state-run and private banks to trade in bullion at the wholesale and the retail level. Though jewellers are also permitted to sell coins and bars through retail outlets, consumers throng to banks to get a purer variety of the precious metal. … "The total number of banks that can ship precious metals in the country has risen to 30. This will now induce more customers to buy directly from banks. The year 2010 also provided the perfect setting for gold, especially in India, where the metal has given a return of over 19%, while the stock market (and Nifty Index in particular) gave only 15% return for the similar period," said Nagesh Zaveri, a bullion dealer with a nationalised bank in Mumbai. [source] ALSO… RBI allows 7 [more] banks to import gold… The bullion industry is gung ho over RBI's latest move, which would help the network of gold supply to widen and thereby add to some fair competition. Jewellers also sell both gold and silver coins and bars through retail outlets. The mandate for additional banks to import precious metals are likely to increase purchases and also help banks in boosting their gold lease facility for manufacturers. … Observers in the bullion market maintain that demand for gold investment may have risen in the second half of 2010 as a result of perceptible shift in preferences from jewellery to exchange-traded funds (ETF), bars and coins gathers pace. At the same time, traditional jewellery buyers in India are shifting their preferences to coins as they see great potential for a huge growth this calendar and a bullish price outlook. Experts view that sales of investment products could outpace jewellery demand in the next one to two years. [source] |

| Video: Why Gold Should Surpass $1650 This Year Posted: 03 Jan 2011 06:11 AM PST  Prieur du Plessis submits: Prieur du Plessis submits: Spot gold prices will rise to at least $1,650 in 2011, believes Juerg Kiener, CEO at Swiss Asia Capital. He explains his bullish outlook to guest host Tai Hui of Standard Chartered Bank and CNBC’s Martin Soong and Sri Jegarajah. Complete Story » |

| Posted: 03 Jan 2011 06:08 AM PST |

| Is zillionaire Slim taking a position in silver? Posted: 03 Jan 2011 05:47 AM PST 1:45p ET Monday, January 3, 2011 Dear Friend of GATA and Gold (and Silver): Eric King of King World News and GoldMoney's James Turk today discuss speculation that Mexican zillionaire Carlos Slim is considering getting into the precious metals market by purchasing a large position in silver miner Fresnillo. Excerpts from their discussion have been posted at the King World News blog under the headline "Is the World's Richest Man Getting into Silver?" and you can find them here: http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/1/3_Is_... Or try this abbreviated link: CHRIS POWELL, Secretary/Treasurer ADVERTISEMENT Sona Drills 85.4g Gold/Ton Over 4 Metres at Elizabeth Gold Deposit, Extending the Mineralization of the Southwest Vein on the Property Company Press Release, October 27, 2010 VANCOUVER, British Columbia -- Sona Resources Corp. reports on five drillling holes in the third round of assay results from the recently completed drill program at its 100 percent-owned Elizabeth Gold Deposit Property in the Lillooet Mining District of southern British Columbia. Highlights from the diamond drilling include: -- Hole E10-66 intersected 17.4g gold/ton over 1.54 metres. -- Hole E10-67 intersected 96.4g gold/ton over 2.5 metres, including one assay interval of 383g of gold/ton over 0.5 metres. -- Hole E10-69 intersected 85.4g gold/ton over 4.03 metres, including one assay interval of 230g gold/ton over 1 metre. Four drill holes, E10-66 to E10-69, targeted the southwestern end of the Southwest Vein, and three of the holes have expanded the mineralized zone in that direction. The Southwest Vein gold mineralization has now been intersected over a strike length of 325 metres, with the deepest hole drilled less than 200 metres from surface. "The assay results from the Southwest Zone quartz vein continue to be extremely positive," says John P. Thompson, Sona's president and CEO. "We are expanding the Southwest Vein, and this high-grade gold mineralization remains wide open down dip and along strike to the southwest." For the company's full press release, please visit: http://sonaresources.com/_resources/news/SONA_NR19_2010.pdf Join GATA here: Yukon Mining Investment e-Conference http://theyukonroom.com/yukon-eblast-static.html Vancouver Resource Investment Conference http://cambridgehouse3.com/conference-details/vancouver-resource-investment-conference-2011/15 Cheviot Asset Management Sound Money Conference Phoenix Investment Conference and Silver Summit Or a colorful poster of GATA's full-page ad in The Wall Street Journal on January 31, 2009: http://gata.org/node/wallstreetjournal Or a video disc of GATA's 2005 Gold Rush 21 conference in the Yukon: Help keep GATA going GATA is a civil rights and educational organization based in the United States and tax-exempt under the U.S. Internal Revenue Code. Its e-mail dispatches are free, and you can subscribe at: To contribute to GATA, please visit: http://www.gata.org/node/16 ADVERTISEMENT Prophecy Drills 71.17 Metres of 0.52% NiEq Prophecy Resource Corp. (TSX-V: PCY) reports that it has received additional assays results from its 100-percent-owned Wellgreen PGM Ni-Cu property in the Yukon, Canada. Diamond drill holes WS10-179 to WS10-182 were drilled during the summer of 2010 by Northern Platinum (which merged with Prophecy on September 23, 2010). WS10-183 was drilled by Prophecy in October 2010. Highlights from the newly received assays include 71.17 metres from surface of 0.52 percent NiEq (0.310 percent nickel, 0.466 g/t PGMs + Au, and 0.233 percent copper) and ended in mineralization. For more drill highlights, please visit: http://prophecyresource.com/news_2010_nov29.php |

| Posted: 03 Jan 2011 05:42 AM PST |