Gold World News Flash |

- GoldSeek.com Radio Gold Nugget Interview - President and CEO of Caza Gold Corp. Dr. Greg Myers & Chris Waltzek

- GoldSeek.com Radio Gold Nugget: Michael Ruppert & Chris Waltzek

- Silver: From $30/oz to over $500 by 2020

- Will Growth Hamper Gold?

- Asian Metals Market Update

- Rising Consumer Inflation: The New World Order By Commodity

- Crude Oil Moves Closer to $100, Gold Rises as Fundamentals Remain Supportive

- Gold Seeker Closing Report: Gold and Silver Rise For Third Straight Day

- If The Gold Price Were to Break Through $1,390 or Even $1,400, it Would Jump Merely From Sending all Those Shorts Scurrying to Cover

- Precious Metals and the Dollar's Next Big Move

- Bailouts Postponed, But Can't Prevent the "Greatest Depression," Gerald Celente Says

- Food Price Shock Cometh

- JP Morgan Told Judge To Stop Paying Mortgage To Become Eligible For Loan Modification

- In The News Today

- Continuous Commodity Index Reaches Another All Time High

- Jim's Mailbox

- Guest Post: Gold A Bubble? Think Again!

- Market Recap: 1.12.2011

- Mark Lackey: Will Growth Hamper Gold?

- US National Debt: The Missing Years

- The “Risk On” Trade…Brazilian Style

- WEDNESDAY Market Excerpts

- Gold's stature and price to grow

- MISH: “I fully expect dollar bears and inflationists to be all over this story like sharks on raw meat.”

- Australia's Reserve Bank sold most of the nation's gold reserves more than a decade ago because the board believed its price would remain flat

- Silver manipulator and JPMorgan CEO said he expects to see more U.S. municipalities declare bankruptcy

- Societal Influences on the Creation of Wealth

- Guest Post: Ibanez – Denying The Antecedent, Suppressing The Evidence And One Big Fat Red Herring

- Gold and the “Love Trade”

- Gold and the “Love Trade”

- Where Gold, Bonds and Emerging Markets Converge

- Gold Daily and Silver Weekly Charts

- China wants “positive” statement from US on dollar assets

- Why Emerging Markets Love Gold

- Long Shadows Cast Over US Economy

- Virginia Considers Gold as Alternative Currency for When FED Breaks Down

- Silver's Tactical Performance

- Northern Tiger Attempts Gap Recovery - Hathor Drilling at Henday

- China Sets Stage for Vacuuming World's Silver

- Treasury's Geithner says China needs faster yuan rise

- Failing Elite Food Gambit?.. Gun Confiscation Frustration

- Paper Currencies = Derivatives

- Will Growth Hamper Gold? - Mark Lackey

- update 12/01/2011

- Global Wealth Shifts as Asians Stock Up On Bad Debt

- The Big China Takeover And The Dollar Collapse

- Gold's Correction Isn't Done

- Physical Gold Demand Exceeds Current Availability - Perth Mint

- LGMR: Shanghai Gold Premium Hits $23/Oz, China Opens 1 Million Gold-Savings Accounts

- Things

| Posted: 12 Jan 2011 07:05 PM PST |

| GoldSeek.com Radio Gold Nugget: Michael Ruppert & Chris Waltzek Posted: 12 Jan 2011 07:02 PM PST |

| Silver: From $30/oz to over $500 by 2020 Posted: 12 Jan 2011 06:05 PM PST Silver: From $30/oz. to over $500 by 2020. In under a minute, I can tell you why that price must happen, and likely when. It seems to me that the public will one day wake up and start buying silver to protect from inflation. Thus, long before, say 10-20% of people buy silver, at least 1% of the American public will buy silver. We can calculate what might happen to the silver price when that happens. |

| Posted: 12 Jan 2011 06:03 PM PST Has the U.S. economy turned the corner? Mark Lackey with Toronto-based financial services company Pope & Co. is forecasting modest growth and slight inflation. In this exclusive interview with The Gold Report, Mark explains why that shouldn't drive a continued correction in gold prices. He also shares some insights on what makes gold companies prosper—whether they've got an NI 43-101-compliant estimate or not. |

| Posted: 12 Jan 2011 06:00 PM PST Weakness in the US dollar along with lack of news for a sell off in commodities has resulted in all of them rising. There is scope for further gains as long as the US dollar trades with a softer bias. The European sovereign debt crisis in the headlines will result in continued demand of gold and other safe havens at lower prices. Technically all commodities are bullish and have room for further gains. |

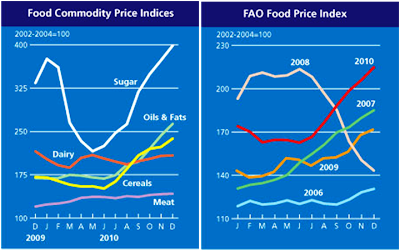

| Rising Consumer Inflation: The New World Order By Commodity Posted: 12 Jan 2011 05:19 PM PST By Dian L. Chu, EconForecast

|

| Crude Oil Moves Closer to $100, Gold Rises as Fundamentals Remain Supportive Posted: 12 Jan 2011 04:23 PM PST courtesy of DailyFX.com January 12, 2011 08:51 PM Crude oil rose to just shy of $100 after the U.S. petroleum surplus fell yet again. Meanwhile, gold continues to claw its way back after bouncing off technical support last week. Commodities – Energy Crude Oil Moves Closer to $100 Crude Oil (WTI) - $91.91 // $0.05 // 0.05% Commentary:Crude oil rose for a third day, with WTI putting in a $0.75, or 0.92%, gain to settle at $91.86, while Brent added $0.51, or 0.52%, to settle at $98.12. Bonny Light surpassed $100 briefly. The Trans-Alaska Pipeline that was shut down earlier this week was partially restarted to prevent crude oil inside from freezing. Crews are still performing repairs, thus the situation is not completely resolved yet. Today’s move higher seemed to be merely a continuation of the strong momentum from earlier this week on the back of the Alaska supply disruption. The fact that U.S. equity markets hit new 27-month highs also helped se... |

| Gold Seeker Closing Report: Gold and Silver Rise For Third Straight Day Posted: 12 Jan 2011 04:00 PM PST Gold saw a $2.45 gain at $1386.95 in Asia before it chopped its way back lower in London and early New York trade to as low as $1376.63 by a little after 10AM EST, but it then rallied back higher in the last few hours of trade and ended near its earlier high with a gain of 0.12%. Silver climbed $0.27 to $29.81 and fell to $29.372 before it also rallied back higher and ended with a gain of 0.03%. |

| Posted: 12 Jan 2011 03:34 PM PST Gold Price Close Today : 1385.70 Change : 1.70 or 0.1% Silver Price Close Today : 29.532 Change : 0.042 cents or 0.1% Gold Silver Ratio Today : 46.92 Change : -0.009 or 0.0% Silver Gold Ratio Today : 0.02131 Change : 0.000004 or 0.0% Platinum Price Close Today : 1800.60 Change : 32.90 or 1.9% Palladium Price Close Today : 810.00 Change : 22.30 or 2.8% S&P 500 : 1,285.96 Change : 11.48 or 0.9% Dow In GOLD$ : $175.37 Change : $ 1.05 or 0.6% Dow in GOLD oz : 8.483 Change : 0.051 or 0.6% Dow in SILVER oz : 398.06 Change : 2.82 or 0.7% Dow Industrial : 11,755.44 Change : 83.50 or 0.7% US Dollar Index : 80.03 Change : -0.820 or -1.0% The GOLD PRICE added another $1.70 on Comex today to close at $1,385.70, but that feels like a slowing, rounding trajectory. Also it merely brings gold back to $1,386 resistance. If gold were to break through $1,390 or even $1,400, it would jump merely from sending all those shorts scurrying to cover. My attention right now is focused more on the long term chart, and asking why since October Gold has been trapped between $1,315 and $1,430.60. (By the way, first of those peaks occurred at $1,387.10). Is this a top, where gold burns up buying power battering at $1,425 and fails? Or is it gold stretching and coiling for another spring upward? Today gold did manage to close above its 50 DMA ($1,383) but below its 20 DMA ($1,387.02). All this feels better than falling through a trap door, but doesn't tell us much yet. Tomorrow or Friday will come the crisis, where gold must either go forward or fall back. But here gold is merely marching back and forth over territory already traveled. The SILVER PRICE rose yesterday and today, but only by another 4.2c today to close Comex at 2953.2c. Again, this shows slowing momentum. In truth, silver merely traded sideways today, between 2970 and 2937c in US trading. Silver has crossed that first trip wire of a rally, the 20 day moving average (2936c) but done little else. Until silver climbs above 3121c, it is in a downtrend. DMA, 20 day moving average, 200 day moving average, what's all that about? A 200 day moving average takes prices of the last 200 days and averages them. Next day, it drops the oldest and adds the latest, hence it is a "moving" average. Same method but shorter periods work for 50 and 20 DMAs. Markets trending generally upwards will remain ABOVE their moving averages. When they dip below the first tripwire, the 20 DMA, they signal a possible trend change. At longish intervals upward trending markets correct and return to kiss off their 200 DMA, which marks the long term uptrend. All of this works upside down for markets in primary down trends, that is, they spend most of their time BELOW their moving averages. I went back and looked once more at that GOLD/SILVER RATIO data from the last 10 years. Occasionally the ratio will peek above its 20 dma and then resume its downward move, but only rarely. More, the number of days the ratio has spent below its 20 DMA this trip is nearing the maximum number of days for such moves. That argues that we probably won't see a lower ratio for this move. US DOLLAR INDEX took a whipping today, apparently because sufficient suckers -- Whoa! Scotch that! Make that "investors" -- were found to buy a $1.5 billion Portuguese bond offering. Since this -- for the nonce, at least -- means that Portugal won't default on its sovereign debt, that took pressure off the euro. Hence speculators sold the dollar and bought euros. Right, it IS a silly game of musical currencies. But the dollar broke important support at 80.40 and lost 82 basis points (1.05%) to end trading at 80.025, on the day's low. Shocking as it was, it's not the world's end yet for the dollar. Today's fall took the dollar only to its 20 day moving average (DMA, 80.09). More, the dollar index is still reacting downward to its touch of the 200 DMA. Then I look at the euro chart and wonder strenuously why anybody would want to own euros. Aren't dollars bad enough? Euros are clearly -- in spite of today's rise slightly above the 200 DMA and to the ten day moving average -- locked in a downtrend toward the centre of the earth. Dollar's slip today may have condemned it to a trip to 79, but maybe not. Dollar's most likely path remains upward. STOCKS did well today, passing that historic 11,722 year 2000 high and closing up 83.56 at 11,755.44. S&P rose 11.48 to 1,285.96. Dr. Robert McHugh at techincalindicatorindex.com last night noted that in the 11 years beginning in 2000 the Dow has topped and declined from 4.43% to 29.81% at the beginning of every single year for 11 years in a row. Oddly enough, a lot of technical evidence suggests that's about to happen again. Argentum et aurum comparenda sunt -- -- Gold and silver must be bought. - Franklin Sanders, The Moneychanger The-MoneyChanger.com Phone: (888) 218-9226 or (931) 766-6066 © 2010, The Moneychanger. May not be republished in any form, including electronically, without our express permission. To avoid confusion, please remember that the comments above have a very short time horizon. Always invest with the primary trend. Gold's primary trend is up, targeting at least $3,130.00; silver's primary is up targeting 16:1 gold/silver ratio or $195.66; stocks' primary trend is down, targeting Dow under 2,900 and worth only one ounce of gold; US$ or US$-denominated assets, primary trend down; real estate in a bubble, primary trend way down. Whenever I write "Stay out of stocks" readers inevitably ask, "Do you mean precious metals mining stocks, too?" No, I don't. |

| Precious Metals and the Dollar's Next Big Move Posted: 12 Jan 2011 03:17 PM PST |

| Bailouts Postponed, But Can't Prevent the "Greatest Depression," Gerald Celente Says Posted: 12 Jan 2011 01:42 PM PST For the last few years Gerald Celente, publisher of the Trends Journal has come on Tech Ticker and other media outlets talking of a further economic collapse, which he calls "the Greatest Depression." Yes, the economy is not robust, growth still hasn't returned to pre-crisis levels and unemployment remains above 9%. But by most metrics things are getting better, not worse. In the accompany clip, Aaron and Henry ask Celente how he accounts for this. Celente argues his dire predictions would have come to fruition if it had not been for an unprecedented set of bailouts that continue today. Most shocking to Celente was the disclosure, in late 2010, that the Federal Reserve lent hundreds of billions to foreign banks to bail them out during the height of the crisis in 2008 and 2009. "Absent those kind of schemes, if capitalism take it's course, at some remote level it used to be, we see the crash," he says. Here's how he puts it in his Top Trends of 2011 release: "In 2011, with the bailout funds and arsenal of other schemes to prop up the economy depleted, teetering economies will collapse, currency wars will ensue, trade barriers will be erected, economic unions will splinter, and the onset of the 'Greatest Depression' (a trend we forecasted before the massive bailouts existed) will be recognized by everyone…" The only way to avoid the coming disaster is do what we did coming out of the Great Depression - start manufacturing quality goods the world wants. "You can't print your way out of this," he argues. The only way to do that is to improve productive capacity through either manufacturing industrial goods or technological innovation. Otherwise, Celente says the "Greatest Depression" is inevitable. Financial Crisis Has 'Drained' the World: WEF Report |

| Posted: 12 Jan 2011 12:34 PM PST Today, some Fed member, arguably of a Dovish persuasion, made headlines by saying that inflation was tame in all but food and energy. We are confident he is right. So for all those readers who are lucky enough to not have to eat, fill up with gas, or heat their homes, the following video from the NIA on suddenly surging prices in virtually every vertical, is probably irrelevant. All others may be advised to watch it...

And just to make sure the point of the coming price crunch is not lost, the FT has just come out with an article titled, not too subtly, "World moves closer to food price shock"

And yes, as we have been predicting for months, kiss those record "earnings" goodbye:

Struggle yes, and eventually have no choice but to do so. In the meantime, readers better familiaries themselves with the definition of stagflation, also known as 10% unemployment (12% when factoring in the collapse in the labor force), and $4 gas. And while at it, they may also look up the term "rice bubble" - in 3-6 months it will be all the world will be talking about. |

| JP Morgan Told Judge To Stop Paying Mortgage To Become Eligible For Loan Modification Posted: 12 Jan 2011 12:17 PM PST In the latest stunner of disclosure in what goes on just below the murky surface of the biggest scam market in the world (that would be the multi-trillion residential debt market), we learn that a Cuyahoga County Juvenile Court judge, Peter Sikora, who is facing foreclosure on his million dollar (8 room) home. But that is not what makes him unique: after all the story of your average American who buys iPads and garter belts with money that should be going into mortgage payments is all too well known by now. What is amazing, however, is that the reason for his 12 month delinquency is that according to JP Morgan, who service the loan, the only way Sikora would be eligible for loan modification would be if he were in delinquency, which is what they advised him to do. That's right - a bank formally told a client to willfully default on a mortgage. Now obviously no institution in its right mind would ever tell a counterparty to stop paying it for a service it is providing. Which begs the question: how is it that there is an opportunity cost for JP Morgan that is lower than a person paying a set mortgage, which involves both the cessation of payments and the lowering of payment rates. If there is any smoking gun that JP Morgan makes up for mortgage delinquency shortfalls by dipping in the GSE piggy bank of infinite taxpayer capital, this is it. And since in the aftermath of Ibanez ever more mortgages are about to see a freeze on their payments, it begs the question: just how profound will the Fannie and Freddie rape this year be, if the GSEs end up having to fund hundreds of billions in capital shortfall for the Too Parasitic To Fail? We are certain that in any other banana republic, at least some answer to this rather important question would be sought. But not in this particular one... More from Cleveland.com on the curious case of Peter Sikora.

And the kicker: this judge, who voluntarily stopped making payments even though he knew full well this was against his contract, and knew he was in effect scamming the system, tried to be a Supreme Court judge on three seperate occasions! Is it any wonder then that the entire judicial system is paralyzed, and is corrupt beyond comparison? After all, it is full of thousands of Peter Sikoras who would do anything in their power, even break the law, just to get on the banks' good side.

What else is there to say? There are those who wish to fix the system out there, and god bless them. The problem is any attempt at fixing the system will inevitably end up in bringing the whole charade down. Which is why, as we have been claiming for just over two years now, the "scalpel" approach to cancer elimination is doomed. The cancer has metastasized long ago and the condition is terminal. |

| Posted: 12 Jan 2011 11:24 AM PST View the original post at jsmineset.com... January 12, 2011 04:12 PM "Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves." –Norm Franz, Money and Wealth in the New Millenium Jim Sinclair's Commentary Here is a short review on option trades. 1. If you believe it what you are doing, you should switch forward when 50% of the time left in the option has occurred. 2. Even if you are in the money on your option do not allow your position to remain open up to maturity unless your plan and finances allow you to take delivery. 3.If the underlying security or commodity is highly volatile, fade the market by legging the position. That means be wiling to sell your winner on the up and buy the next maturity option on the reactions. Do not do the opposite. 4. Always keep in mind that options are not investments, but speculations which require strategy. 5. Have a strategy. ... |

| Continuous Commodity Index Reaches Another All Time High Posted: 12 Jan 2011 11:24 AM PST View the original post at jsmineset.com... January 12, 2011 11:12 AM Dear Friends, The CCI, Continuous Commodity Index, which I use to track the commodity complex as a whole, today scored yet another all time record high. It should be noted that it moved to this new and higher level without any meaningful assistance from gold and silver which were fighting off selling for most of the session. The big movers were the grains on the heels of a bullish USDA report, crude oil as it pushed past $92 and the livestock sector, with cattle futures moving to yet another all time record high. With the commodity complex ratcheting upward, it is going to pose a real challenge for the perma bears at the Comex to keep the precious metals from moving higher. Selling pressure in gold was tied somewhat to relief over the Portuguese bond sale which was not a total fiasco. That led to bond selling as the need for "safe havens" was somewhat diminished for the time being and brought relief buying back ... |

| Posted: 12 Jan 2011 11:10 AM PST Dear Eric, All these auctions have QE 2 influence. The ECB and Fed buys Portuguese. The Fed buys US. In these cases are they good, great or bad? Regards, 10-Year Auction Results Good or bad, strength or weakness, are often defined by one's perspective. The 10-year bond auction, from the perspective of the bid to cover ratio, was viewed by many as strong (bond). A look under the hood shows that the participation rate trends remain in tact. That is, decreased participation from primary dealers and increased participation from indirect bidders. Primary dealers, once representing 70% to 80% of accepted bids, have fallen below 40% in late 2010 and 2011. You might be asking, who has filled the void left by the primary dealers? Indirect bidders, customers placing competitive bids through a direct submitter, including Foreign and International Monetary Authorities placing bids through the Federal Reserve Bank of New York, and direct bidders have filled it. In other words, the public sector is increasing becoming the buyer of last resort. Strong 10-year auction?, well, that's a matter of perspective. Headline: Treasurys Pare Losses On Strong 10-Year Note Auction A strong 10-year Treasury note auction on Wednesday helped the Treasurys market recoup some losses, but bond prices were weaker as U.S. stocks rallied. Treasurys fell earlier as worries over the euro-zone debt crisis eased. The bond market also is bracing for an auction Thursday of $13 billion in 30-year Treasury bonds, which will wrap up this week's $66 billion government note and bond supply. The amount of bids submitted for the sale was 3.3 times the amount on offer, compared to the average of 3.03 for the previous eight auctions. Source: online.wsj.com

Dear LT, How about this for a statement: "Soon to be "positively" worth-LESS vis a vis gold in the future!" CIGA BT China wants "positive" statement about dollar assets China would welcome a "positive" statement from the United States about the security of its dollar-denominated assets, a senior Chinese diplomat said on Wednesday, ahead of President Hu Jintao's visit to the United States. Chinese Vice Foreign Minister Cui Tiankai was speaking at a news conference in Beijing about Hu's state visit from Jan. 18 to 21, including a summit with President Barack Obama. Analysts estimate that about two-thirds of China's reserves, which hit a record $2.85 trillion at the end of 2010, are parked in dollar assets, though the currency composition is a state secret. |

| Guest Post: Gold A Bubble? Think Again! Posted: 12 Jan 2011 10:53 AM PST Submitted by Global Macro Monitor Gold a Bubble? Think Again! Think gold is a bubble driven only by animal spirits and speculation? We think not and have consistently maintained the fundamental driver of gold has been the massive accumulation of foreign reserves by global central banks and their need for diversification. Nothing illustrates this better than the chart below. We have included the table to illustrate how much gold China and Brazil would have to buy to get to the same proportional gold position as their fellow BRICs, India and Russia. We calculate the “global monetary base” as the sum of central bank reserves less gold and the U.S. monetary base. Notice, the gold price broke out in late 2003 along with every other commodity and asset, including housing prices. The Fed takes a lot of heat for its role in fueling the past bubble but foreign central banks played their part through depressing their currencies, accumulating reserves, and recycling the dollars back into U.S. markets. This created a very powerful positive feedback that drove every asset to the moon and pancaked market and implied volatility. Our view is that investing in gold is a journey and not a destination. There is no right target price for gold or a fair or fundamental value for the yellow metal. When the major central banks are maintaining a zero (or close to) interest rate monetary policies and foreign central banks are accumulating reserves at a rapid clip, the trend in gold prices is north. In a tightening mode or when foreign central banks stop accumulating reserves the trend will turn south. Until then, all else is noise and we will be buyers on the “french” dips as the bubbeistas provide the opportunity. We were hoping gold will move back to its 200-day moving average to provide us a nice reentry. We’re not so sure we’ll receive such a gift, however. One last point. Gold is a relatively benign “store of value” as opposed other commodities such as crude oil, copper, and foodstuffs, which have negative economic and societal consequences during price spikes. We believe we’re close to “tipping point” prices in some of these commodities. If central banks have been buying them, say, though their sovereign wealth funds, for example, we think they may pull back a bit. |

| Posted: 12 Jan 2011 10:44 AM PST From the always informative Henry Bowe at Goldman New day, new high in US equities. Financials leading again. GS Wavefronts group has initiated a long German equities trade, "We would emphasize that the fundamental rationale for this trade recommendation is that German equities are a key global cyclical asset that has lagged somewhat. We continue to have a decidedly pro-cyclical and pro-risk bias, looking for opportunities to express that view...Although this trade has started to move already, our constructive bias and robust forward views makes us comfortable that there is still room to run, as German equities catch up and as equity markets more broadly, continue to climb." SPX up 11 at 1286. The DOW up 84 at 11755. The NASDAQ up 21 at 2737. And an FX recap courtesy of www.talking-forex.com EUR/USD |

| Mark Lackey: Will Growth Hamper Gold? Posted: 12 Jan 2011 10:20 AM PST Source: Brian Sylvester of The Gold Report 01/12/2011 Has the U.S. economy turned the corner? Mark Lackey with Toronto-based financial services company Pope & Co. is forecasting modest growth and slight inflation. In this exclusive interview with The Gold Report, Mark explains why that shouldn't drive a continued correction in gold prices and shares some companies that are set to prosper—whether they've got an NI 43-101-compliant estimate or not. The Gold Report: Mark, when you worked for the Bank of Canada, you made regular forecasts on the U.S. economy. What is Pope & Co. expecting from the U.S. economy in 2011? Mark Lackey: We're expecting the gross domestic product in the second and third quarters to be in the 3% range with inflation around 1%. We're not looking for huge growth, but there could be some improvement in the labor market and in industrial production in a scenario with little inflation. Unlike some people who think deleveraging is going to co... |

| US National Debt: The Missing Years Posted: 12 Jan 2011 10:00 AM PST If you are one of those people whose eyes are bugging out in disbelief at the bullish action in the stock market and are wondering who in their right mind would be buying common equities at the same time as inflation is rising, bond yields are rising, food riots are breaking out, unemployment is rising to 22% (according to shadowstats.com), and 43 million people are on food stamps, I have the answer: The Federal Reserve, which created a huge $100 billion pile of new credit in December, and is promising another $100 billion per month for the next six months!! I will dispense with my usual loud and disrespectful denunciation of the Federal Reserve and all those half-witted "economists" who subscribe to their laughable neo-Keynesian econometric stupidity, which, as I recall, they refer to as Dynamic Stochastic General Equilibrium theory. Or maybe it's Stochastic Dynamic General Equilibrium theory. Or maybe it's General Dynamic Stochastic Equilibrium theory. Or maybe it's Dynamic Equilibrium General Stochastic theory, a confusion incandescently emblematic of its pure arrogance, its idiot-savant trappings and its complete, dismal failure, as you can witness first-hand by merely putting down that delicious bagful of cookies and looking around at the economy, or look at the first paragraph above, which will tell you the same thing. This rise in the stock market is, I figure, just the spillover from the federal government borrowing and immediately spending so much money (on track for $2 trillion this year), now that tax revenues are falling at the same time as the Social Security surplus has dried up, which is Especially Bad News (EBN) since the despicable Congresses have always treated Social Security payments as general revenue, mostly because the same despicable Congresses mandated that Social Security not be a "pay as you go" endeavor, but instead tax away much more money than was "needed" so that there money would "be there" in the future when the Baby Boomers started collecting Social Security! Hahaha! What a scam! So, Congress spent the excess SS money because there was nothing else they could do with the money. Nevertheless, ergo, now, general revenue is down! To be fair, the Social Security surplus has been declining for years as it approached this "zero point," which explains why the national debt has been rising so that the Congress can continually spend more and more money, despite declining Social Security money at hand, so that now, although not surprisingly (although alarmingly), the national debt is comfortably over a massive, titanic $14 trillion, and it has, since 2008, been increasing at the, again unsurprisingly, and again alarmingly, consistent rate of $1 trillion every 7 months! By contrast, from 2002 to 2008, it consistently took about 20 months to add a trillion dollars to the national debt. From 1995 to 2000, it took the entire 5 years to add another trillion dollars to the national debt. The more astute Junior Mogambo Ranger (JMR) has noticed that there is a 2-year period of time suspiciously missing, namely 2000 to 2002, sort of like that "missing time" last Wednesday night between when I "should" have been home versus when I actually "was" home, and about which my wife seems especially vexed and about which I don't remember a thing, which explains why I came home in a taxi and crawled unsteadily into the house, reeking of alcohol, cigarettes and, apparently, urine, and I have no idea where my freaking car is, either, so leave me alone already, for crying out loud! Well, this is where it gets interesting, because while we do not know what happened Wednesday, if anything, we know exactly what happened to the national debt. From 2000 until mid-2001, the national debt was actually in a go-nowhere, yet volatile, slight downtrend, which handily explains why the stock market collapsed in early 2000 and did not stop until 2003, after losing almost half its value. Of course, there are many other factors involved, and the strict relationship between national debt and the stock market seems a little stretched to those who are not firmly in the camp of the Suspicious And Cynical Mogambo (SACM), who sees this all as just a part of a vast Chaos Theory web of things and people interconnected to all things and people, with less than 6 Degrees of Separation, as indeed are all things connected to all other things, such as all this new money, which also explains why inflation over that time has been running at a terrifying rate of almost 7%!!! Yikes!!! The double set of triple exclamation points is Secret Mogambo Code (SMC) for "Buy gold, silver and armaments with ceaseless abandon, because otherwise We're Freaking Doomed (WFD)!" And with that kind of simplicity, what can you say but, "Whee! This investing stuff is easy!"? The Mogambo Guru US National Debt: The Missing Years originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| The “Risk On” Trade…Brazilian Style Posted: 12 Jan 2011 09:45 AM PST The new middle class in Brazil is growing…and spending their newfound wealth. Brazil is booming. And Brazil's northeast is growing at a faster rate than the rest of the country. The most exciting story to emerge from Brazil in recent years is the rise of the middle class. In the last eight years, Class C (Brazilians earning $650 to $2850 a month) grew quickly. Today, 94.5 million people fall into Class C. They are driving the Brazilian economy, buying cars, washing machines, vacations, and new homes. Investors in stocks and shares are riding the wave of this newfound wealth, betting on Brazilian companies that target domestic consumption. Drawn by hundreds of miles of beaches, it's to the northeast coast that Brazil's new, up-and-coming class comes to vacation and retire. This is good news for the rentals business here. Moreover, this is a great beach base for you if you're a globetrotter. Now, imagine your ideal retirement getaway. Maybe you see the surf of a turquoise sea gently lapping a beautiful sandy beach. You may simply want to escape the cold winters back home…or perhaps you're in the market for a new full-time home. Maybe you imagine a life where you travel for six months and spend the other six at your overseas retreat. Whatever you dream of, that life really can be yours – for much less than you'd imagine. In fact, your retirement escape could actually make you money. João Pessoa is a place where you can embrace this lifestyle without hurting your bank balance.

João Pessoa is the capital of the state of Paraíba. Surrounded by miles of beautiful beaches, this is where many Brazilians from southern cities come to retire, vacation and buy second homes. It's one of the safest capital cities in Brazil…with a healthy outdoors lifestyle, centered on the beach and boardwalk. The city is popular as a retirement destination for senior civil servants. The city has 1,730 acres of forest, providing a green backdrop to almost 25 miles of beach. João Pessoa has some of the nicest city beaches you'll find anywhere. Moreover, beachfront properties are still affordable…and there's a line forming of potential renters for your condo, when you're not there. While popular with tourists, João Pessoa doesn't offer much choice when it comes to hotels. The four-star Verde Green is the city's newest and nicest hotel. Not that it has a lot of competition…the other hotels are two- or three-star, and "tired." Yet according to my sources on the ground, estimated occupancy rates average 86% year-round. Rack rates in the Verde Green are in the range of $113 to $226 a night. Quality short-term rentals are difficult to find and command $468 per week for a small one- or two-bed unit. The best place to buy for rental is the prime residential area of Cabo Branco. Development is limited here by the city's 1,730 acres of protected forest to the back, and the boardwalk to the front. Cabo Branco sits between the ocean and the forest on a thin triangle of land. You'll find uncrowded stretches of beach, and the city's nicest restaurants and boardwalk kiosks here. It's a favorite with holidaymakers, younger retirees and second-home owners. Riacho Verde, for example, is a small project of 55 units located a block from the beach in Cabo Branco. Unit sizes here range from 592 square feet to 1,431 square feet. Prices start at $146,207. The rental demand for this type of condo is strong. The building will be constructed as a condo building but with hotel-type amenities. Projects like this sell fast. They are in hot demand. For short-term rentals, the average daily rate could be $73. Based on a 70% occupancy rate, that means $18,650 annually. Property management fees run around 25% – leaving almost $14,000. Enjoy a couple of months here yourself in the low season and you can still enjoy a healthy yield. "I cannot stress enough how strong the rental demand is for units like these," John Curtis, a real estate agent in João Pessoa, told me recently. "We have a waiting list of companies and individuals looking for accommodation…" About 700 kilometers up the coast from Joao Pessoa, the beachfront city of Fortaleza is also booming. Fortaleza is benefitting directly from the spending power of the new middle classes. It's the top tourism destination for Brazilians. Passenger traffic through Fortaleza airport in 2010 reached 4.16 million passengers by the end of October. That's an increase of 22.4% compared to the same period the previous year…and 2009 was a record year for passenger numbers. Brazilians come to Fortaleza for the vibrant nightlife, excellent restaurants, and beautiful beaches. East and west of the city, white-sand beaches run for miles. On the east side, Brazilians tourists head to a giant water park (South America's largest), a cluster of little beachside bars, cafes and clubs at Praia Futuro, and some amazing colored cliffs at Morro Branco. West of Fortaleza, the beaches roll to the horizon…silky, fringed with coconut palms, and luxuriously empty. Many foreign tourists come here to kite surf. Forbes reckons this sport is the new golf for Silicon Valley executives. The fresh ocean breezes west of Fortaleza provide the perfect environment for kite surfers. Little beach towns like Cumbuco offer chic lodgings, and kite surfing schools. For the rest of us, those ocean breezes keep us cool in our hammocks in the afternoons… You can profit from Fortaleza's strong economic and tourism base. Mid-level executives relocating to the city, and tourists alike, face a shortage of hotel rooms, and suitable rental condos. That makes finding decent long-term and short-term accommodation difficult. But it means rental opportunities for property buyers. So when you consider Emerging Market investments, don't forget to consider Emerging Market real estate. Regards, Ronan McMahon and Margaret Summerfield, The "Risk On" Trade…Brazilian Style originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Posted: 12 Jan 2011 09:27 AM PST Gold futures end higher on softening dollar The COMEX February gold futures contract closed up $1.50 Wednesday at $1385.80, trading between $1376.30 and $1387.00 January 12, p.m. excerpts: |

| Gold's stature and price to grow Posted: 12 Jan 2011 09:27 AM PST by Geoff Candy He adds, that while there has been a lot of talk about the possibility of the collapse of currencies like the dollar and the euro, such collapses will not happen as they are the world's means of exchange. "But," he said, "they will fail as an accurate measure of value and this is where gold will come in — it will grow in stature as a measure of value." "… to put it frankly, a growing world — East and West — would be too much for the resources of this world to cope with, therefore there will have to be volatility, spikes in various commodities and returning to something that can be trusted as a means of exchange globally, so I believe that gold's monetary role, even if it's off stage, will grow." For the same reasons, Phillips is of the opinion that it is physical gold buying that is likely to dominate in 2011, a theory supported by reports earlier this week that premiums on gold bars are currently at two-year highs… As he points out, gold's move from the $275 level in 2000 to around the $1,200 level in 2007, came in the face of a booming developed world set of economies and a slowly rising China. "If we were to see the same economic growth at this time in the developed world, and add to that Chinese development [...] and there is absolutely no reason, until there is a reformation of the monetary system, why gold and gold investments should diminish. In fact, if the developed world increased its investment capabilities through growth, I believe the demand for all such sound investment instruments will actually grow." [source] |

| Posted: 12 Jan 2011 09:21 AM PST |

| Posted: 12 Jan 2011 09:18 AM PST |

| Posted: 12 Jan 2011 09:14 AM PST |

| Societal Influences on the Creation of Wealth Posted: 12 Jan 2011 09:00 AM PST There are some activities that are positive sum activities. That is, they are productive. They increase the total of real wealth in a society. There are other activities that are zero sum activities…or even negative sum activities. War, for example. Excess legal wrangling. Paperwork. Too much time spent in schools. Too much support for the unemployed, the malingerers and the loafers. These things decrease the total of real wealth in a society. Sometimes people are bright, honest and hardworking. Sometimes they are lazy, shiftless and cunning. They always prefer to get wealth and status by the easiest means possible. In some societies, the best way is by working hard. In others, it is by being clever…becoming a lawyer…a banker…or a government hack. A new society…or a fresh economy (such as one that has just been flattened by war or hyperinflation)…or a new model for an economy…is generally a wealth-creating society. A free society is also generally a wealth creating society. People do what they want. If they want wealth, they are free to create it. But as societies (or economies) age, they become decadent, arthritic, and backward-looking. They shift from wealth creating to wealth shuffling…and then to wealth destroying. They evolve into societies that are more concerned with redistributing wealth than with creating it…more focused on the appearance of wealth creation than with the real thing. People shift with their societies. When hard work and creativity pays off…they become hardworking and creative. When connections and corruption pays, they are up to the job. That is true in almost all aspects of the society. Education, for example. In a new or free society people turn to education because they want to learn useful skills…or for the pure love of learning and contemplation. In decadent societies they covet degrees and diplomas – often in such drivel as "communications" and "political science," not to mention "gender studies" – and count on the paper to get them a cushy job where they don't really have to do anything. Since everyone believes "education" is such a good thing, there is little resistance to further spending by government and parents – even though the threshold of declining marginal utility for this type of education may have been passed long ago. This is also true of military spending. A little military spending may be a good thing – it protects the society from outside predators. But "defense" spending soon becomes totemic. Eventually, the decadent state is realizing a net negative return. The private entrepreneur switches from producing work boots at a 10% margin to furnishing the Pentagon with combat boots at a 20% margin. Not only is the productive economy squeezed to support the defense establishment, the over-financed military itself increases the odds of attack by foreign powers…and decreases the real defensive position of the society. Then, of course, there is the government itself. As Jefferson pointed out, a little of it may be a "necessary evil," but a lot of it is unnecessary, expensive, and a nuisance. Government does not create wealth. Governments shuffle wealth and stymie it. So, the more government you have, the less wealth-creation you have. Right now, America is beginning a transition. It is an old, decadent society…headed for bankruptcy…and trying to find a new model. One of the elements of that new model is lower wages. People who thought they should earn $100,000 a year because they have a masters degree are finding that their services are really only worth $9 an hour. More generally, people in the advanced, decadent societies – who are accustomed to earning 10 times as much as a person in China, India or Brazil – look over their shoulders and see the foreigners gaining on them. Americans' real wages, for example, are likely to be stagnant or falling for many years. Meanwhile wages in emerging markets are likely to double every 10 years or so. The latest figures from the US show national income still increasing at about 1.5% per year. Nominally. Before inflation. Adjust for the increased cost of energy and food (both of which are moving up fast…some setting new record highs) and the real income of the typical family in the US is actually falling. Tomorrow, we'll talk about the role of the Federal Reserve…the banks…and the financial industry… Stay tuned. Regards, Bill Bonner Societal Influences on the Creation of Wealth originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Guest Post: Ibanez – Denying The Antecedent, Suppressing The Evidence And One Big Fat Red Herring Posted: 12 Jan 2011 08:54 AM PST Submitted by Greg Lemelson of Amvona.com Ibanez – Denying the Antecedent, Suppressing the Evidence and one big fat Red Herring

The ruling, should not distract from the important underlying errors in the execution of securitized mortgages which appear to be all but universal. Thus the SJC ruling, is not an end in itself, but rather is part of a means to an end, which is discovering the realities of mortgage securitization in the US and what it may indicate regarding the banks motivations is expediting foreclosure actions in recent years.

1. By exercising the power of sale, although they were not holders of the underlying mortgage, and thus did not have proper standing to foreclose. The conventional industry practice, conveniently, is to assume that the mortgage follows the note; however in Massachusetts (a Title theory state), that is not the case. In Massachusetts, where a note has been assigned but there is no written assignment of the mortgage underlying the note, the assignment of the note does not carry with it the assignment of the mortgage: Barnes v. Boardman, 149 Mass. 106, 114 (1889). In other cases, the assignment of the mortgage may be held to be invalid, even if the note is properly conveyed, and thus renders the debt, nonetheless unsecured. It is possible that from the banks perspective an invalid assignment of the note is the more serious concern for the following reasons:

2. Notes (ownership of the debt asset), may be subject to further contention in bankruptcy proceedings where many creditors have a vested interst in the assets of a defunct mortgage lender, particuarly since these notes are often sold in bankruptcy for a fraction of their face value. 2. The trusts that are suppose to contain the validly conveyed notes will in fact, not actually contain them (because they are not bearer paper), thus violating the representations and warranties made to investors who purchase these securities. Therefore, it is unsecured debt, and potentially, no debt at all upon which to collect payments. 3. By way of exmaple, let's say there is an 11 billion dollar portfolio up for sale in bankruptcy, and strangely the successful bid is under 100 million. Now how do you think the other creditors of the original mortgage lender who went bankrupt are going to feel after taking a rather large "hair cut" when they find out that the bankruptcy trustee may not (according to the SJC), have had authority to actually sell the assets, because they were not properly owned by the bankrupt mortgage lender in the first place. Or how will the bidder feel when they find out they paid about 100 million for secured debt, that is not really secured at all? 4. What exactly is the relationship between US Bancorp, Wells Fargo and other large banks such as Credit Suisse? Probably will make for fun bedtime reading. Wells Fargo and US Bancorp sure do pop up on a lot of SEC filings for Mortgage Backed Securities - we'll learn further below from their press releases, they have "no role in it" 5. Even if the notes obtain a valid conveyance, or confirmation of conveyance at a later date, it is still may be impossible to place them into the MBS's: a. It will have been longer than 90 days (the typical expiry period to transfer assets into the trust) While there is no significant change in the law, other positives are likely to come from the ruling. For example, it may restore faith in the judiciary, or provide encouragement to foreclosure victims to seek proper remuneration for their trials and finally, it may provide a sound legal framework for homeowners to stop paying their mortgages (especially in Massachusetts), irrespective of their ability to pay, until their mortgage holder can guarantee clear, insurable title, we will discuss this prospect further below.

1. If there must be a perfected interest in the mortgage (according to MA law) at the time of foreclosure, then how many foreclosures have taken place in Massachusetts with the same profile as Ibanez, and are thus invalid? 2. Clear title is important - In the statement of the case, the banks actually brought the complaint before the land court as independent actions in order to “remove a cloud on the title” – thus the banks recognize that such defects are a problem for future conveyance. All MA homeowners should be worried about the same (discussed further below). 3. To foreclose on a mortgage securing property in the commonwealth, one must be the holder of the mortgage. To be the holder of the mortgage, the bank must: a. Be the original mortgagee 4. The notice requirements set forth in G.L.c. 244, ss 14 unequivocally requires that the foreclosure notice must identify the present holder of the mortgage. This likely was not the case in past foreclosures in MA. For future foreclosure actions the question is can the real mortgage holder be found and will they cooperate in assigning the security interest? 5. Assignees of a mortgage must hold a written statement conveying the mortgage that satisfied the statute of Frauds or even the most basic elements of contractual requirements. AG Coakley acknowledges that "the securitization regime was required to conform to state law prior to foreclosing, to ensure simply that legal ownership 'caught up' in order that the creditor foreclose legally in MA. The lenders, trustees and servicers could have done this, but apparently elected not to, perhaps on a 'Massive Scale' " Saying that they "could have done this" within the context of MA law is one thing, within the context of IRS tax code, or NY trust law, is another.

Critical points from the Massachusetts Supreme Court ruling 2. There must be proof that the assignment was made by a party that itself held the mortgage. 3. In MA, where a note has been assigned but there is no written assignment of the mortgage underlying the note, the assignment of the note does not carry with it the assignment of the mortgage. 4. The holder of the mortgage holds the mortgage in trust for the purchaser of the note, who has an equitable right to obtain an assignment of the mortgage, which may be accomplished by filing an action in court and obtaining an equitable order of assignment. If the average MBS has 5,000 notes for example, then we have to assume 5000 separate actions would have to be filed in court to ensure they are truly “Mortgage Backed Securities”, and that is only if the REMIC status isn’t jeopardized by such a revelation or action. 5. In absence of a valid written assignment of a mortgage or a court order of assignment, the mortgage holder remains unchanged. 6. A post foreclosure assignment cannot be treated as a pre-foreclosure assignment simply by declaring an “effective date” that precedes the notice of sale and foreclosure. 7. Title standard 58(3) should not be misinterpreted – the Court upheld that only where an assignment is “confirmatory” of an earlier, valid assignment, made prior to the publication of notice and execution of the sale, that confirmatory assignment may be executed and recorded after the foreclosure.

The AG suggested that the ruling not be merely prospective, but rather applicable to all previous foreclosure cases in the common wealth that would be aptly affected. SJC confirmed that foreclosures by note holders, who do not posses mortgages which have been validly conveyed, were improper foreclosures, and that no future proper conveyance of the mortgage can cure the fatal defects in foreclosure that have already taken place under similar circumstances – thus the SJC agreed with AG Coakley that the ruling not be only prospective. Given what has been revealed about the securitization industry, it is likely that most if not all foreclosures in the commonwealth of MA on securitized mortgages are invalid. The question going forward, is can Trusts which represent MBS investors, locate and properly convey the mortgages in order to proceed with future foreclosures? This course of action may present a further dilemma for the banks; either to loose REMIC status for these securities and incur tremendous back tax liabilities, and further harm investors interests (but possibly perfect the underlying securities), or accept the “unsecured” status of the debt and attempt to negotiate settlements with the debtors (formally considered mortgagees).

The American Securitization Forum – Suppressing evidence and a Red Herring to boot

Let’s explore this first statement further: 1. It is true that the SJC held “Where a pool of mortgage is assigned to a securitized trust, the executed agreement that assigns the pool of mortgages, with a schedule of the pooled mortgage loans that clearly and specifically identifies the mortgage at issue as among those assigned, may suffice to establish the trustee as the mortgage holder.” 2. For the SJC clearly and specifically means the written instrument “must contain the terms of the contract agreed upon – the parties, the locus…the price, and it must be signed by the party to be charged or by someone authorized to sign on his behalf.” Cousbelus v. Alexander, 315 Mass 729, 730 (1944). Mr. Deutsch claimed that because the deal documents with the loan schedules weren’t introduced as evidence in the Ibanez and LaRace cases, “the court ruled that an otherwise valid confirmatory assignment was not sufficient to prove right to foreclose.” That is not correct. The loan schedule was missing in one case, and insufficient in the other. As AG Coakley pointed out in her brief: “Neither US Bank or Wells Fargo… was an assignee under a valid assignment because, at the time of the foreclosure, neither US bank nor Wells Fargo held a written statement conveying the mortgage that satisfied the statute of frauds or even the most basic of contractual requirements” (Cousbelus v. Alexander). Given the criteria, we would be surprised to find any schedule of pooled mortgages which constitute valid assignment under MA law as described above. By focusing on an irrelevant or secondary subject Mr. Deutsch is diverting attention from the main subject – that the detail contained in the schedules of pooled mortgage loans is insuficient to establish assignment, and that there may not be any other "assignments" to speak of that can be legitimately transferred into the MBS. Because people have strong opinions about the validity of the assignments in blank, their attention is being diverted from the more important issue of the ability to find the true Mortgage holders, and if they do, the serious problem of altering the REMiC status of the MBS's. For this reason, Mr. Deutsch's comments are a Red Herring.

“…Where an assignment is confirmatory of an earlier, valid assignment made prior to the publication of notice and execution of the sale, that confirmatory assignment may be executed and recorded after the foreclosure…” The key word here is “valid”, and as we see from AG Coakley’s comments above, at no time where the assignments valid, either before or after the foreclosure. Entry into evidence, as Mr. Deutsch suggests has nothing to do with the validity of the assignments. In fact, what the SJC did say regarding the plaintiffs arguments to be the holders of the mortgages is: “…their reliance is misplaced because this proposition is contrary to G.L.c. 183, ss 21 and G.L.c. 244 ss 14 and their published claims to be the present holders of the mortgages were false.” Despite this, Mr. Deutsche added that his group was: “Pleased the court validated the use of the conveyance language in securitization documents as being sufficient to prove transfers of mortgages under the unique aspects of Massachusetts law.” and added: “The ASF is confident securitization transfers are valid and fully enforceable.”

|

| Posted: 12 Jan 2011 08:50 AM PST The 5 min. Forecast January 12, 2011 01:24 PM by Addison Wiggin - January 12, 2011 [LIST] [*] China, India go for gold: Frank Holmes on “the love trade” in emerging markets [*] $426 million into $10 billion? Patrick Cox on the awesome potential behind one “wealth quake” [*] Complacency rules... Jim Nelson on why the VIX is sure to rise, and a sure way to play it [*] “Clarify your gross assumption”... Readers unload on our Chinese correspondent, and call our letter to Harry Reid “a waste of time and effort” [/LIST] On the surface, our favorite yellow metal isn’t doing much this week. The spot price has moved within a tight range around $1,380. But just below... we sense something lurking. Retail buyers in China can’t get their hands on gold bars fast enough. The premium in Hong Kong, for example, has reached $3 an ounce over the spot price, a level last seen during the Panic of ‘08. “I don&rsqu... |

| Posted: 12 Jan 2011 08:24 AM PST by Addison Wiggin - January 12, 2011

On the surface, our favorite yellow metal isn’t doing much this week. The spot price has moved within a tight range around $1,380. But just below... we sense something lurking. On the surface, our favorite yellow metal isn’t doing much this week. The spot price has moved within a tight range around $1,380. But just below... we sense something lurking. Retail buyers in China can’t get their hands on gold bars fast enough. The premium in Hong Kong, for example, has reached $3 an ounce over the spot price, a level last seen during the Panic of ‘08. Retail buyers in China can’t get their hands on gold bars fast enough. The premium in Hong Kong, for example, has reached $3 an ounce over the spot price, a level last seen during the Panic of ‘08.“I don’t have any gold,” one dealer told Reuters yesterday. “Premiums are very high. Some say they have no stocks on hand.” Chalk it up to inflation -- officially at 5.1%, but probably double that -- and the run-up to the Lunar New Year. “The jewelry sector is gearing up,” another expert tells Reuters, “and giving gold bars as a gift has been getting very popular.”  Likewise, the first gold-oriented fund in China has had no trouble meeting its goal of raising $500 million. Lion Fund Management hung out its gold shingle barely six weeks ago, giving ordinary Chinese access to overseas gold ETFs for the first time. Likewise, the first gold-oriented fund in China has had no trouble meeting its goal of raising $500 million. Lion Fund Management hung out its gold shingle barely six weeks ago, giving ordinary Chinese access to overseas gold ETFs for the first time.In the limited space of funds allowing Chinese to invest overseas, this was the biggest offering in three years. Perhaps not a surprise for the world’s No. 2 consumer of gold.  Meanwhile, the world’s No. 1 consumer of gold likely set a record for imports last year. Final figures aren’t in yet, but Indian purchases totaled roughly 800 metric tons -- a massive increase from the previous year’s 557 tons, according to the World Gold Council. Meanwhile, the world’s No. 1 consumer of gold likely set a record for imports last year. Final figures aren’t in yet, but Indian purchases totaled roughly 800 metric tons -- a massive increase from the previous year’s 557 tons, according to the World Gold Council.Investment demand for bullion surged 73% in the year ended Sept. 30, says the Council’s Ajay Mitra. “Price is no longer a factor,” he adds, reinforcing a point we made here last week: Indian buyers no longer wait for a 10% pullback before backing up the truck. We have visited gold markets in Mumbai and Beijing over the past year and can attest to the irrational desire buyers have when they get near the stuff.  “There are two main drivers of gold demand,” says U.S. Global Investors chief and Vancouver favorite Frank Holmes, helping put the demand in perspective: “The Fear Trade and the Love Trade.” “There are two main drivers of gold demand,” says U.S. Global Investors chief and Vancouver favorite Frank Holmes, helping put the demand in perspective: “The Fear Trade and the Love Trade.”The Fear Trade is what we have in the West, “driven by negative real interest rates -- where inflation is greater than the nominal interest rate -- and deficit spending. Whenever you have negative real interest rates coupled with increased deficit spending, gold tends to rise in that country’s currency. “In the U.S., we’re in the middle of an extended period of negative real interest rates that will likely last through the year.”  By contrast, “The love trade is significant and unique to gold,” Frank continues. “People buy gold out of love and those in emerging markets are especially amorous of the metal. It is customary in most emerging countries to give gold as a gift to friends and relatives for birthdays, weddings, and to celebrate religious holidays. By contrast, “The love trade is significant and unique to gold,” Frank continues. “People buy gold out of love and those in emerging markets are especially amorous of the metal. It is customary in most emerging countries to give gold as a gift to friends and relatives for birthdays, weddings, and to celebrate religious holidays.“What is important to remember when looking at the history of gold is that in the 1970s, China, India and Russia were isolationists with no significant global economic footprint. The world’s population was 3 billion, and today we have witnessed an awakening of epic proportions. “These countries are growing with free market policies and massive infrastructure spending. In the 1970s, gold rose on the fear trade and the Cold War. Today, the world is significantly different and the love trade drives gold. “It’s impossible to predict where gold prices will be 12 months from now,” Frank concludes, “but we think gold prices could double over the next five years. This would mean roughly a 15% return if you compounded it annually. And that’s just the bullion. If you haven’t checked out Byron King’s report on ways you can still get rich with gold, he has a list of nine right here.  “At long last,” Patrick Cox wrote his Breakthrough Technology Alert readers yesterday, “we can begin to view the No. 1 cause of death -- aged hearts and vascular systems -- as a preventable disease. “At long last,” Patrick Cox wrote his Breakthrough Technology Alert readers yesterday, “we can begin to view the No. 1 cause of death -- aged hearts and vascular systems -- as a preventable disease.“The ability to restore the heart, vascular and immune systems to full youthful health, using the donors’ own cells, has so many enormous implications.” One of the tiny companies Patrick follows unveiled plans last week to accelerate the development of a revolutionary treatment for both heart disease and autoimmune disorders. How much will this breakthrough treatment cost? Patrick compares it favorably to a biotech darling of the recent past: “I don’t believe it will be more than Dendreon’s anti-cancer vaccine Provenge, which costs about $93,000 per customer. “Dendreon estimates $400 million in U.S. sales this year. If you divide total expected revenues by the cost of the therapy, that amounts to only 4,301 prostate cancer patients. Analysts are predicting sales of over a billion annually. That’s 10,752 patients buying a therapy that on average extends life by about four months. “Now think about the market for a nonsurgical cardiopulmonary therapy, delivered through transfusion, which could easily extend life by a decade. “Let’s pretend this firm charges $200,000 for the procedure, clearing $100,000 per procedure. Also, pretend that only 5% of the world’s high net worth individuals buy rejuvenated cardiopulmonary system every year. One clinic in Hong Kong could perform that many transfusions easily. “Regardless, that’s 100,000 procedures at a profit of $100,000 each, for a total profit of $10 billion a year.” All for a company with a market cap today of $426 million. No wonder Patrick sees this as one of the five “wealth quakes” coming in 2011. To learn more about all five, check out Patrick’s predictions for the year. Don’t hesitate; this presentation goes offline at midnight on Friday.  U.S. stocks are adding to yesterday’s gains, traders cheered by the news Portugal pulled off a bond issue successfully. The S&P 500 just topped 1,280. U.S. stocks are adding to yesterday’s gains, traders cheered by the news Portugal pulled off a bond issue successfully. The S&P 500 just topped 1,280. Canada’s TSX is also up for a second straight day, driven by acquisition news: Cliffs Natural Resources, the country’s largest iron producer, is buying out a smaller competitor, Consolidated Thompson. Canada’s TSX is also up for a second straight day, driven by acquisition news: Cliffs Natural Resources, the country’s largest iron producer, is buying out a smaller competitor, Consolidated Thompson.This is sweet news for readers of Mayer’s Special Situations. Chris recommended Consolidated Thompson in July 2009 at C$3.11 a share. Cliffs’ offer is for C$17.25 a share. That’s a 455% gain in just 18 months. Did you buy it? If so, we’d like to know. If you’re interested in Chris’s favorite special situations of the moment, he lays out the story on four of them in this presentation.  The Volatility Index is down over 3% this morning -- not to the ultra-complacent lows of last month, but as Chris would put it, “fear is still cheap.” The Volatility Index is down over 3% this morning -- not to the ultra-complacent lows of last month, but as Chris would put it, “fear is still cheap.”“As you’ll recall,” writes Lifetime Income Report’s Jim Nelson, “the VIX measures how much implied volatility investors foresee in the S&P 500 through the volume of puts on the index. “This is based on the idea that investors buy more puts on stocks when they think the stocks could fall. It’s the easiest way to hedge investments. So the higher the VIX, the more hedging there is on the S&P.” Jim sees a number of speed bumps facing the market this year. “The number of objections we often list — continued stubbornness in real estate, weak commercial financing, energy prices on the rise, the muni bond market’s ticking time bomb, etc. -- are just the start. “With the endless lists of potential mini-crises about to unfold in the next several months, we’re going to see investors begin hedging their bets. The VIX should fly.” Last year, Jim uncovered a one-of-a-kind way to play a rising VIX. And it has nothing to do with VIX-oriented ETFs, which do a notoriously awful job of tracking the movements of the index. Best of all, this one pays you a dividend; that’s right, you collect checks as market volatility takes off. Jim lays it all out in the current issue of Lifetime Income Report, released just yesterday. If you’re not yet a subscriber, here’s where to go.  After a week in which the Chinese notched a record buildup of forex reserves, test-flew a stealth fighter jet and completed the world’s longest bridge, what’s next? After a week in which the Chinese notched a record buildup of forex reserves, test-flew a stealth fighter jet and completed the world’s longest bridge, what’s next?They’re taking one more step toward making the renminbi a global currency. Starting today, the Bank of China is allowing U.S. firms to trade in renminbi. Heck, even individuals can open renminbi-denominated accounts (minimum balance: US$500). On first glance, there’s no real point. There is still something of a yuan-dollar peg; the yuan can move no more than 0.5% in a day. Standard Chartered figures the people’s currency might appreciate 6% this year. But the general manager of Bank of China’s New York branch makes it clear. Echoing a trend we first identified in the 2005 edition of Demise of the Dollar, Li Xiaojing explained, “We’re preparing for the day when renminbi becomes fully convertible.” Tim Geithner, call your office.  “I’ve been enjoying your letters...” “I’ve been enjoying your letters...”[And the inevitable ‘but’] “however, sweeping the Tea Party into the tragedy in nearby Tucson is a real reach and insult to [your readers]. There was NO reference by anyone to the Tea Party re the tragic events in Tucson. “Mein Kampf, The Communist Manifesto, etc., were among [Jared Loughner’s] reading. There wasn’t a scintilla of reference directly or indirectly to the Tea Party. I am shocked and disappointed. “You might care to clarify your gross assumption, which was totally ungrounded in fact.” The 5: We assume nothing about the mind of an assassin who’s clearly unhinged. But you missed our contributor’s point: To those on the outside, the Tea Party smacks of populism fueled by anger. He made the leap to violent ultra-nationalism from there. And suggests whether the association is accurate or not, we will see more violence in the future.  “I know you had the wisdom to say you didn’t necessarily agree with the ridiculous comment from China about the Arizona gunman and his (nonexistent) connections with the Tea Party. But you spread the lie, so you should also spread the truth. Here it is: “I know you had the wisdom to say you didn’t necessarily agree with the ridiculous comment from China about the Arizona gunman and his (nonexistent) connections with the Tea Party. But you spread the lie, so you should also spread the truth. Here it is:“A friend described him as decidedly ‘left-wing’ as recently as 2007. On YouTube, he flagged as a favorite a video of a person dressed as a terrorist burning the American flag. Only a lunatic or a leftist would do that. His favorite work was a staple of every left-wing bookshelf, The Communist Manifesto. “If we take the evidence as presented and not as the media and the left would have it presented, the gunman is clearly not of the right. More precisely, the shooter is neither left-wing nor right-wing. He is crazy and evil -- a word not used enough. “By the way, as an exit thought, the Tea Party movement won in November. Winners don’t go on shooting sprees.”  “Who cares what China thinks about our political system?” asks another. “We have no intention of allowing our system to deteriorate to the point that China has. “Who cares what China thinks about our political system?” asks another. “We have no intention of allowing our system to deteriorate to the point that China has.“For them to equate what a insane jerk did to a political view is just what a radical left-wing nutjob wants you to believe, I am dismayed you give such viral a platform.” The 5: You have no intention of letting the system deteriorate... how do you propose to stop it? For the record, it was one reader’s point of view. While he’s a high school teacher in Beijing, I don’t think he can be thought of as speaking for the entire Chinese nation. Having said that, what makes “their” point of view interesting is the $900 billion pile of U.S. debt the Chinese government holds... on top of the other $1.4 trillion pile of U.S. dollars.  “Addison’s letter to Congress is excellent, and I agree with every word. However...” “Addison’s letter to Congress is excellent, and I agree with every word. However...”[Here we go again.] “sending it to Harry Reid and most members of Congress is most likely a waste of time and effort. Too many in Congress only care about their next election, and the easy path is to give things to people ‘for free.’ “Since most people know there is no such thing as a free lunch, they fool people into believing they are entitled to these ‘free’ things, that they have earned them or paid for them, when the cost is just being passed on to others. “If all this spending results in a disaster, many politicians just see that as an opportunity to expand their power and influence. As Rahm Emanuel says, ‘Never let a serious crisis go to waste.’ “Nothing will really change until the people understand Addison’s message and recognize the promises of something for nothing and ‘entitlement’ for what they are, lies to buy votes and power. I applaud I.O.U.S.A., but wish it had been seen by more people. It should go to colleges and high schools. The 5: Amen. Cheers, Addison Wiggin The 5 Min. Forecast P.S.: Tomorrow, we hear from the attorneys representing both the kingdom of Spain and Odyssey Marine regarding the WikiLeaks cables that reveal a shifty deal proposed by the then-U.S. ambassador to Spain offering to turn over the coins Odyssey found in their ‘Black Swan’ shipwreck find in exchange for a painting (stolen by the Nazis), which now hangs in a museum in Madrid. The painting reportedly belonged to a California family with some weighty political connections in Washington. That said, we’re told the WikiLeaks cables will have no bearing on the court case currently in progress regarding the “ownership” of the $500 million cache. Uh, right. We’ll see. [Program Note: We’ve been granted an extension on our deadline to submit the film we’re making about the Black Swan treasure to the Tribeca Film Festival. This week remains a critical week in the development of this first festival cut, however. Wish us luck. We’ll continue to let you know how things develop.] |

| Where Gold, Bonds and Emerging Markets Converge Posted: 12 Jan 2011 08:23 AM PST Our narrative today begins with gold-buying in New York, then wanders past bond-selling in Lisbon and ends with some squiggles in Shanghai. First, the gold-buying… The precious metals rebounded yesterday – and are maintaining their elevated levels this morning. The reason, according to Bloomberg News, is that "Europe's debt crisis is spreading. Portuguese bond yields [are] rising to levels that may force the nation to follow Greece and Ireland in requesting a bailout from the European Union." Nonsense! Says Portugal's Prime Minister, Jose Socrates. "Portugal won't request any financial help, for the simple reason that it doesn't need it," the proud Prime Minister insists. "The government is doing its job and is doing it well." Hmmm… Portugal's soaring bond yields provide compelling testimony to the contrary. The Portuguese government may be doing part of its job well – like repairing cobblestone streets or boosting global cork sales – but it is clearly not doing a great job of managing the nation's finances. At last count, Portugal's budget deficit was brushing up against 10% of GDP. The government is promising to reduce that shortfall to a somewhat less terrible number over the next couple of years. But so far, bond investors are skeptical.

As recently as one year ago, Portugal's 10-year bonds paid a respectably low yield of 3.70%. But now that Portugal has joined the ranks of Europe's fiscally infirm nations, its bond yields are nearly twice as high. Portugal managed to sell a little bit of its debt this morning, but only because it offered a "junk bond" yield of 6.72%. (Your California editor could have securitized and sold his personal credit card debt at a lower rate of interest). Even so, the financial news outlets were quick to hail the Portuguese bond sale as "a success." But this "success" was more theatre than real life. The size of the auction – at a mere 599 million euros – was little more than a ribbon-cutting ceremony to show the world that Portugal is in okay shape after all. The auction was a success, only if one ignores the fact that the ECB has been aggressively buying Portuguese debt to suppress bond yields. Bear in mind also that this 599 million euro sale occurred in the context of chatter about Portugal receiving a 60 billion euro bailout from the ECB. The Portuguese government's finances may not be in dire straights just yet, but they are hardly in tip-top shape. Not surprisingly, Portuguese stocks have been slumping for the past few months (as have Spanish stocks). These lackluster stock market trends on the Iberian Peninsula are eerily similar to those of several major Emerging Markets. The goings on in these peripheral markets may not mean anything at all. On the other hand, they may mean a little something. In recent years, Emerging Market stocks and bonds – as the quintessential "risk on" assets – have tended to lead the financial markets of the Developed World – either higher or lower… Which brings us to those squiggles in Shanghai… The Shanghai Composite Index bottomed out in early November of 2008 – four months before the S&P 500 reached its ultimate low. Most of the other major Emerging Markets bottomed out at the same time as the Shanghai Composite and had established clear uptrends, even as the S&P 500 was tumbling to lower lows. As such, the Emerging Markets clearly led the Developed Markets out of the 2008-9 bear market.

Today, a completely opposite phenomenon may be unfolding. Emerging Markets have been weakening for several months, even as the Developed Markets have continued to new post-recovery highs. This recent divergence may not portend doom and gloom, but neither does it inspire confidence.

Net-net, there may be no relevant connection between the recent gold-buying in New York, bond-selling in Lisbon and squiggles in Shanghai. But if there were a connection, it would probably be that investors are slowly embracing the "risk off" trade. They are backing away from assets like Portuguese bonds and Chinese stocks. And in place of these "risk on" investments, they are buying gold, silver and other hard assets. Eric Fry Where Gold, Bonds and Emerging Markets Converge originally appeared in the Daily Reckoning. The Daily Reckoning, offers a uniquely refreshing, perspective on the global economy, investing, gold, stocks and today's markets. Its been called "the most entertaining read of the day." |

| Gold Daily and Silver Weekly Charts Posted: 12 Jan 2011 08:22 AM PST |

| China wants “positive” statement from US on dollar assets Posted: 12 Jan 2011 07:31 AM PST January 13, 2011 (Reuters) BEIJING — China would welcome assurance about the security of its financial assets in the United States, a senior diplomat said on Wednesday ahead of President Hu Jintao's visit next week, while playing down rifts between the two powers. … While Obama may press Hu on China's yuan currency controls, Chinese Vice Foreign Minister Cui Tiankai said Beijing had its own concerns about its big holdings of U.S. treasury debt. China has amassed the world's biggest stockpile of foreign exchange reserves at $2.85 trillion, an estimated two-thirds of which is invested in US assets. "Regarding the security of China's assets in the United States, if the US side can offer a positive statement on that then of course we'd welcome that, and it's an issue we're paying attention to," Cui told reporters. … China regularly seeks assurances on the security of its US investments before any formal high-level meetings with the United States.